SME INITIATIVE IN ROMANIA BUCHAREST 11 12 July

SME INITIATIVE IN ROMANIA BUCHAREST, 11 -12 July 2017

SME Initiative (1) q TO 3 – enhancing the competitiveness of SMEs q Investment priority 3 d – supporting the capacity of SMEs to grow in regional, national and international markets, and to engage in innovation processes q SO: improve SME access to finance by addressing challenges that banks face: Ø Covering 60% of losses for defaulted loans (with no cap at portfolio level), addresses credit risk and/or lack of collateral at the SME level Ø Providing capital relief to the banks due to the involvement of EIF (0% risk weighting on the guaranteed part of each loan under CRD IV), addresses regulatory capital scarcity at the banks’ level

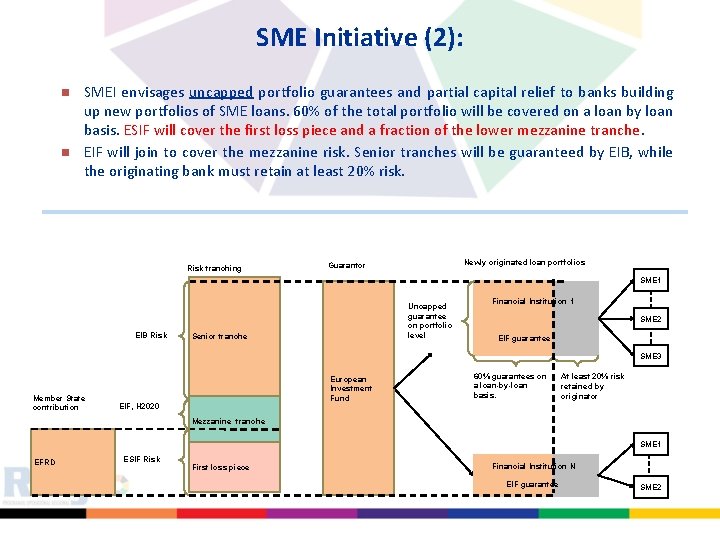

SME Initiative (2): n n SMEI envisages uncapped portfolio guarantees and partial capital relief to banks building up new portfolios of SME loans. 60% of the total portfolio will be covered on a loan by loan basis. ESIF will cover the first loss piece and a fraction of the lower mezzanine tranche. EIF will join to cover the mezzanine risk. Senior tranches will be guaranteed by EIB, while the originating bank must retain at least 20% risk. Risk tranching Newly originated loan portfolios Guarantor SME 1 EIB Risk Uncapped guarantee on portfolio level Senior tranche Financial Institution 1 SME 2 EIF guarantee SME 3 Member State contribution European Investment Fund EIF, H 2020 60% guarantees on a loan-by-loan basis. At least 20% risk retained by originator Mezzanine tranche SME 1 EFRD ESIF Risk First loss piece Financial Institution N EIF guarantee SME 2

SME Initiative (3): • Priority axes 1 – Increasing Romanian SMEs access to financing • OP budget – 100 mil. Euro (7 mil. Euro management costs and fees) • Result indicator – proportion of credit requests approved • No of estimated beneficiaries – 2500 of SMEs • Estimated leverage (for 60% of the defaulted loans per portfolio)– min 4

SME Initiative (4) q Memorandum of the Government: Participation of Romania in SME Initiative from ERDF allocation (8 July 2015) - 100 mil. Euro; q Modification of Partnership Agreement/Regional Operation Programme 2014 – 2020 in order to include the new OP; q The elaboration, negotiation and approval of SMEI OP (23. 03. 2016); q The signature of the Funding Agreement between Romania and EIF and of the Intercreditor Agreement between Romania, EIF, EIB and EC (20. 10. 2016); q First meeting of the Monitoring Committee and Investment Board (20. 10. 2016) ü Approval of the rules of procedures ü Approval the qualitative criteria for the call of expression of interest from banks q Launching the call of expression of interest to select financial intermediaries (21. 10. 2016) – deadline 31 March 2017

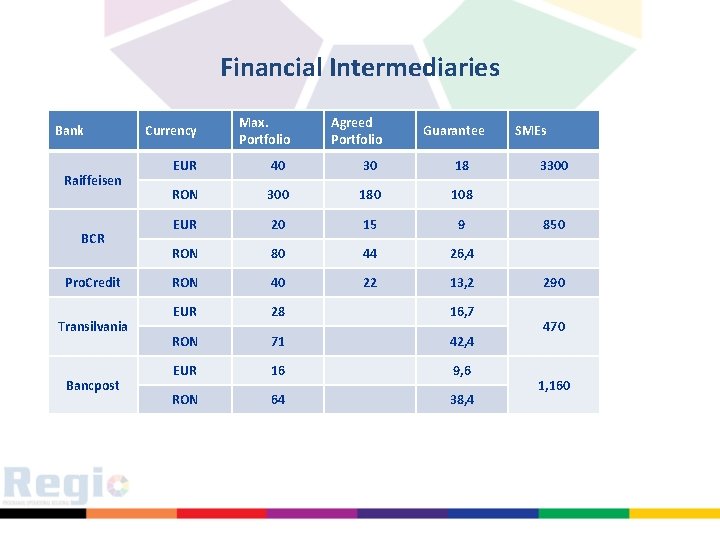

SME Initiative(5) q Payments made from national funds until MA accreditation ü first payment request: 74. 052 mil euro (90. 000 euro management costs and fees) ü second payment request: 19. 038 mil. euro q Designing and approval of de minimis scheme (April 2017) – applicable until 31. 12. 2020 q Designation process: still pending the MA accreditation q Signing of the first operational contract – 5 May 2017. q Second meeting of the Monitoring Committee and Investment Board (20. 06. 2016) ü First AIR approval q Signature event with all the financial intermediaries selected – 21 June 2017: Signed: Raiffeisen Bank (RON si EUR), BCR (RON si EUR), Pro. Credit (RON), Banca Transilvania (RON si EUR), Banc. Post (RON si EUR) Pre-selected, signature pending: ING (RON si EUR), Libra Bank (RON si EUR), BRD (RON)

Financial Intermediaries Bank Raiffeisen BCR Pro. Credit Transilvania Bancpost Currency Max. Portfolio Agreed Portfolio Guarantee EUR 40 30 18 RON 300 180 108 EUR 20 15 9 RON 80 44 26, 4 RON 40 22 13, 2 EUR 28 16, 7 RON 71 42, 4 EUR 16 9, 6 RON 64 38, 4 SMEs 3300 850 290 470 1, 160

Issues to be clarified (1) q Decision CE 660/2014 includes formula for calculating de Gross Grant Equivalent (GGE), that allow ex-ante determination of the state aid amount (at the signature of the financing contract) ü Granted state aid will be reported once, at the signature of the financing contract q Competition Council – according to Regulation 1407/2013, reporting of the state aid must be made each time the SMEs make an reimbursement to the Financial Intermediaries, based on the eligible financing contracts ü In this case, the formula for GGE in the Decision 660/2014 could need to be modified in order to include a discount rate q Correspondence with DG COMP

Issues to be clarified (2) q Reg. AS – state aid register: data on all the state aid granted in Romania to all beneficiaries q according to art. 29 from Regas Regulation, all the state aid must be reported both, when is granted and when is paid q pending issues: q the frequency of Regas reporting or other possibilities (data base interconnection) q Recovery of the illegal state aid

Future activities q Successfully closure of the MA designation process q Initiating the reimbursement from the EC and payment back of the amounts borrowed from the Ministry of Public Finance q Clarifying the issues related to monitoring, reporting and recovery of the state aid q Product Launching – loans availability on the market (FI) q monitoring the implementation of the Operational Agreements with Financial Intermediaries ( commonly with EIF)

Thank you! Ministry of Regional Development, Public Administration and European Funds The Managing Authority for the SMEI Tel: 0372 11 1661, Fax: 0372 111 630 email: madalina. istrate@mdrap. ro

- Slides: 11