Slide 27 1 Chapter 27 Earnings Per Share

- Slides: 41

Slide 27. 1 Chapter 27 Earnings Per Share

Slide 27. 2 Objectives By the end of the chapter, you should be able to: • define earnings per share and the PE ratio; • comment critically on the PE ratio of an enterprise in comparison with the industry average; • calculate the basic and diluted earnings per share.

Slide 27. 3 Investor Ratios Investor ratios The market price and performance of a company’s shares indicate what investors think of a company. l Market price: l l ¡ ¡ l the price people are willing to buy and sell the shares of a company for. Includes information about how investors see the potential risk and return connected with owning a part of the company. Companies are diverse: they have different numbers of issued shares, differing levels of profits and dividends, differing activities/industries and differing future prospects.

Slide 27. 4 Investor Ratios l To get the necessary information to enable an investment decision to be made, the following ratios need to be considered: earnings per share ¡ price/earnings ratio ¡ dividend per share ¡ dividend yield ¡ dividend cover ¡ net tangible asset backing per share. ¡

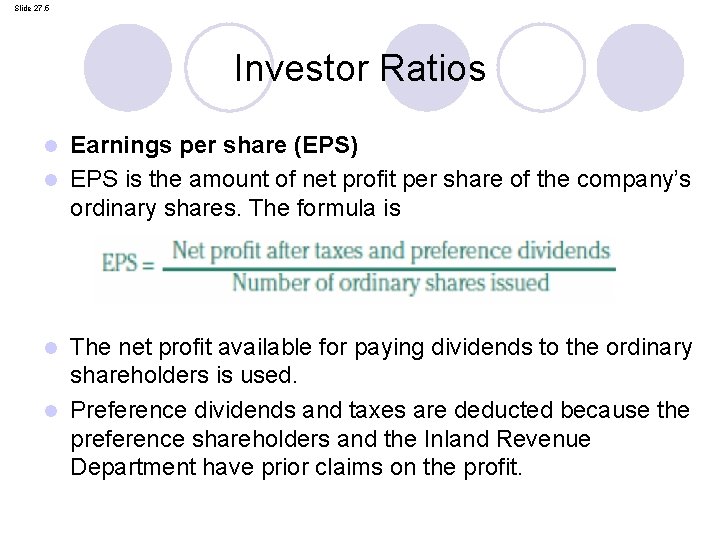

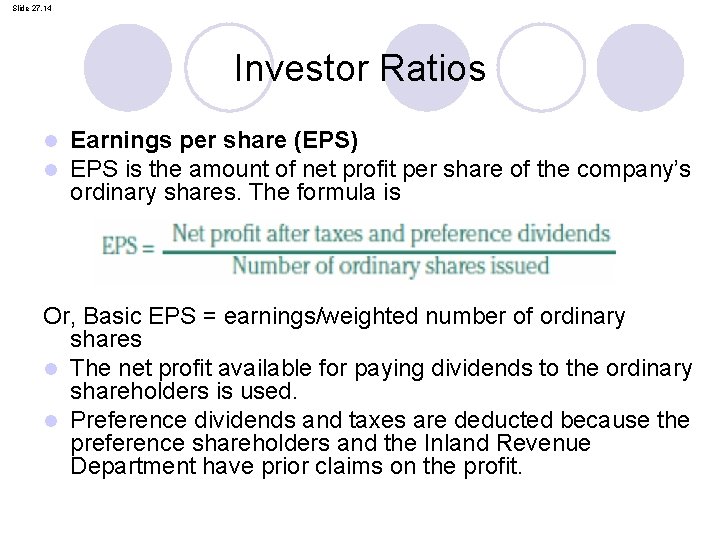

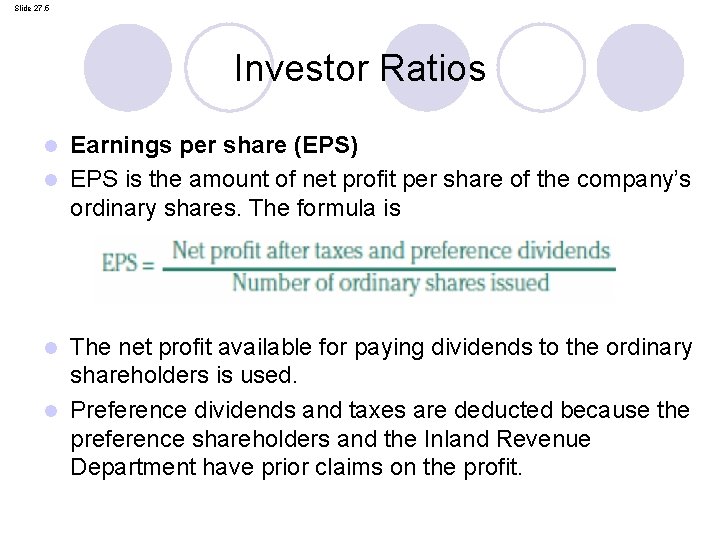

Slide 27. 5 Investor Ratios Earnings per share (EPS) l EPS is the amount of net profit per share of the company’s ordinary shares. The formula is l The net profit available for paying dividends to the ordinary shareholders is used. l Preference dividends and taxes are deducted because the preference shareholders and the Inland Revenue Department have prior claims on the profit. l

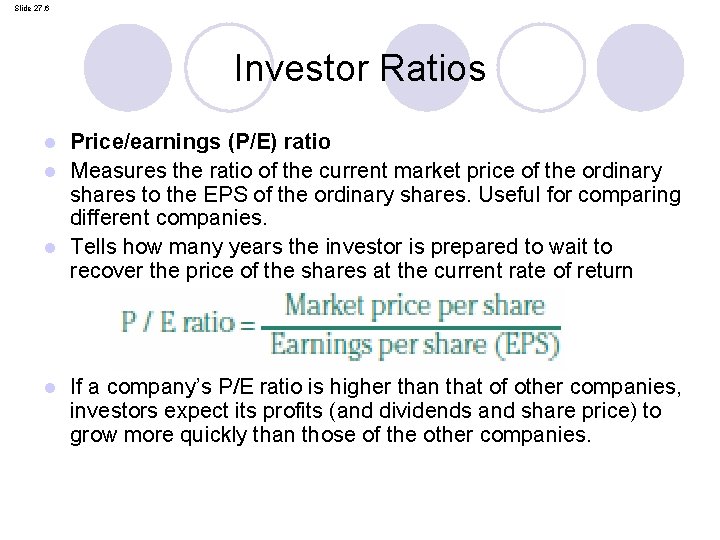

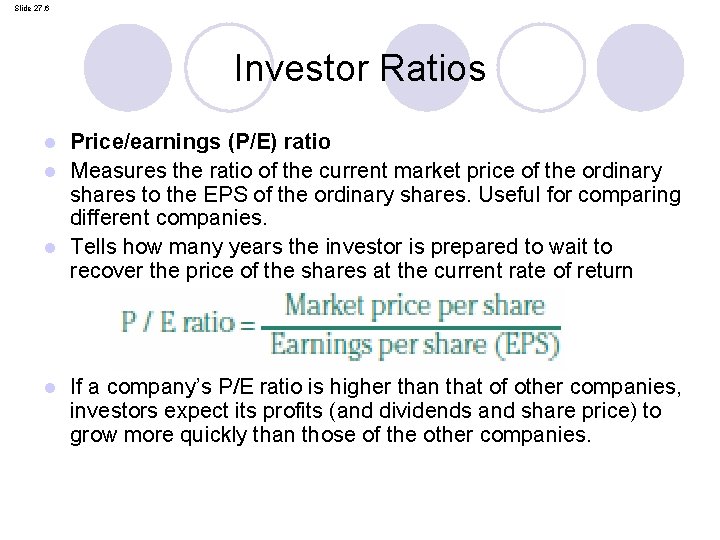

Slide 27. 6 Investor Ratios Price/earnings (P/E) ratio l Measures the ratio of the current market price of the ordinary shares to the EPS of the ordinary shares. Useful for comparing different companies. l Tells how many years the investor is prepared to wait to recover the price of the shares at the current rate of return l l If a company’s P/E ratio is higher than that of other companies, investors expect its profits (and dividends and share price) to grow more quickly than those of the other companies.

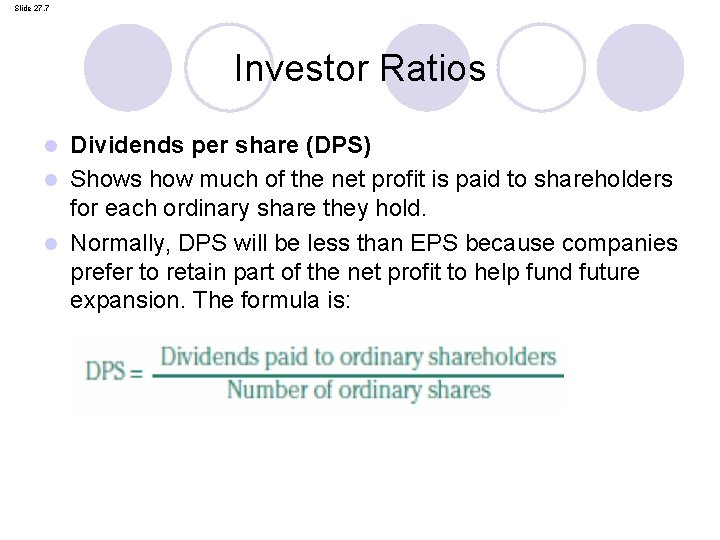

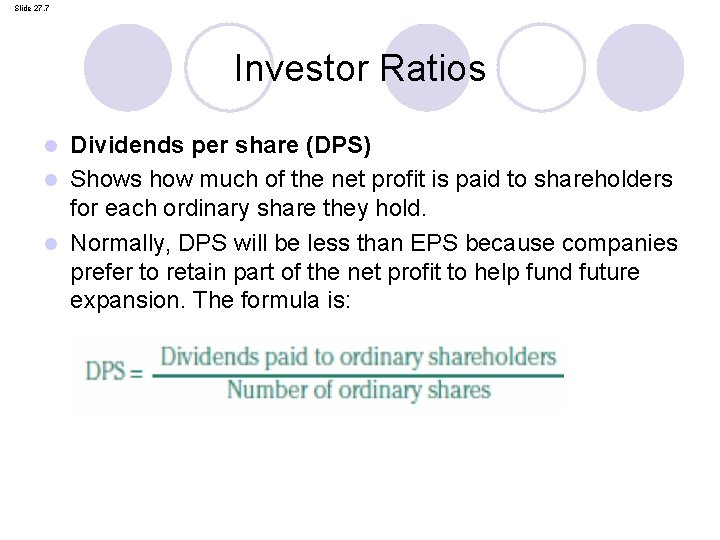

Slide 27. 7 Investor Ratios Dividends per share (DPS) l Shows how much of the net profit is paid to shareholders for each ordinary share they hold. l Normally, DPS will be less than EPS because companies prefer to retain part of the net profit to help fund future expansion. The formula is: l

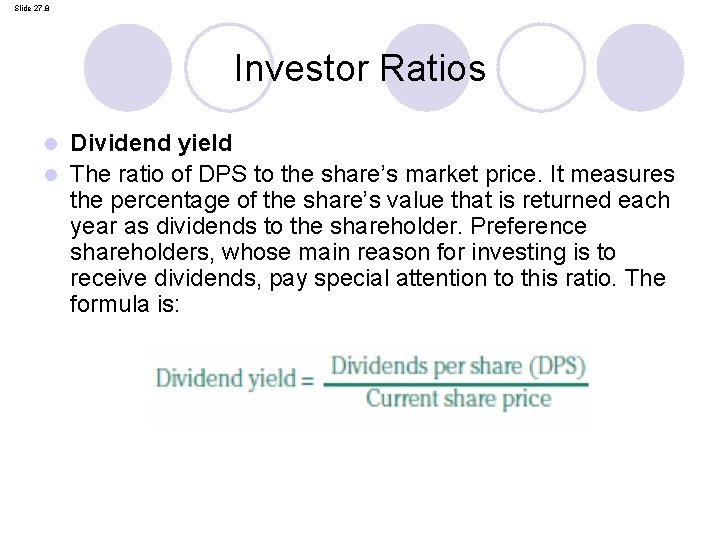

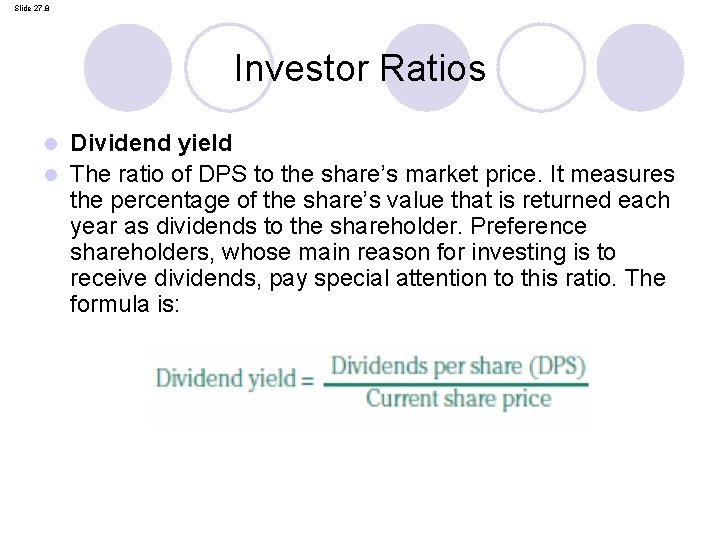

Slide 27. 8 Investor Ratios Dividend yield l The ratio of DPS to the share’s market price. It measures the percentage of the share’s value that is returned each year as dividends to the shareholder. Preference shareholders, whose main reason for investing is to receive dividends, pay special attention to this ratio. The formula is: l

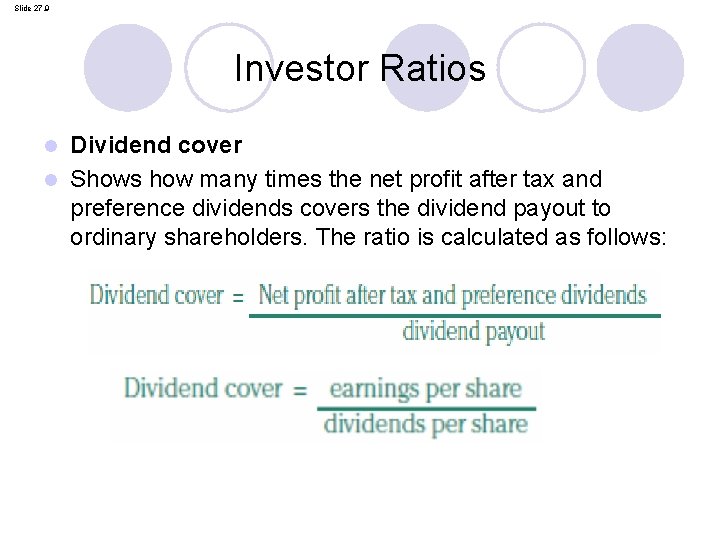

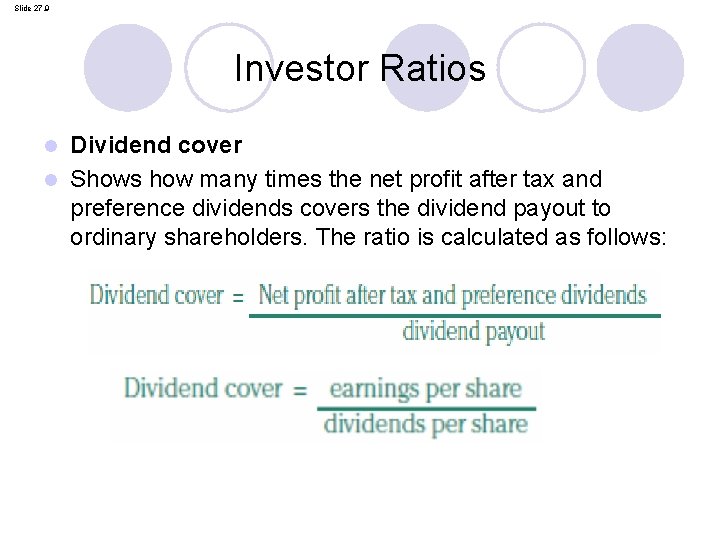

Slide 27. 9 Investor Ratios Dividend cover l Shows how many times the net profit after tax and preference dividends covers the dividend payout to ordinary shareholders. The ratio is calculated as follows: l

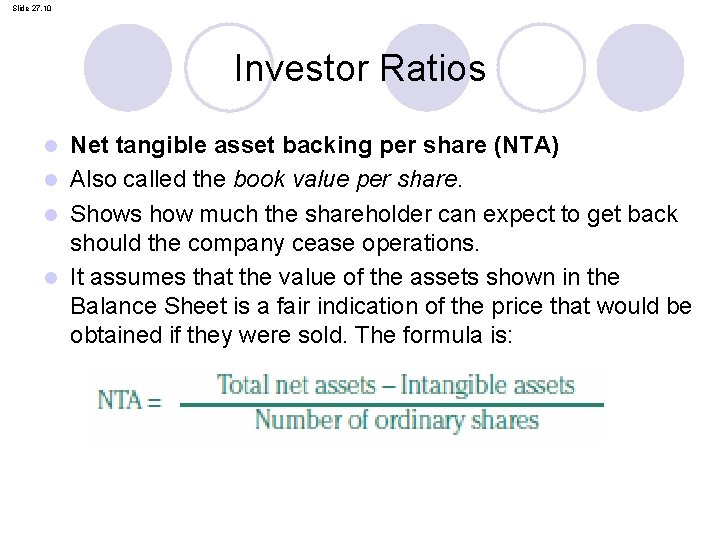

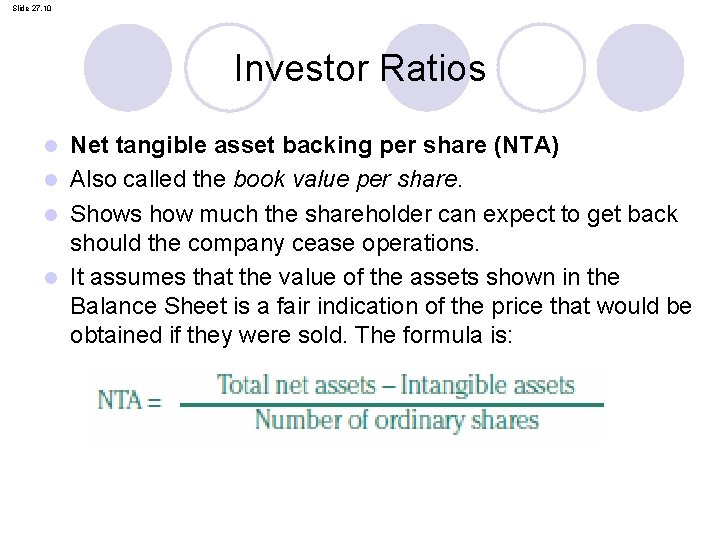

Slide 27. 10 Investor Ratios Net tangible asset backing per share (NTA) l Also called the book value per share. l Shows how much the shareholder can expect to get back should the company cease operations. l It assumes that the value of the assets shown in the Balance Sheet is a fair indication of the price that would be obtained if they were sold. The formula is: l

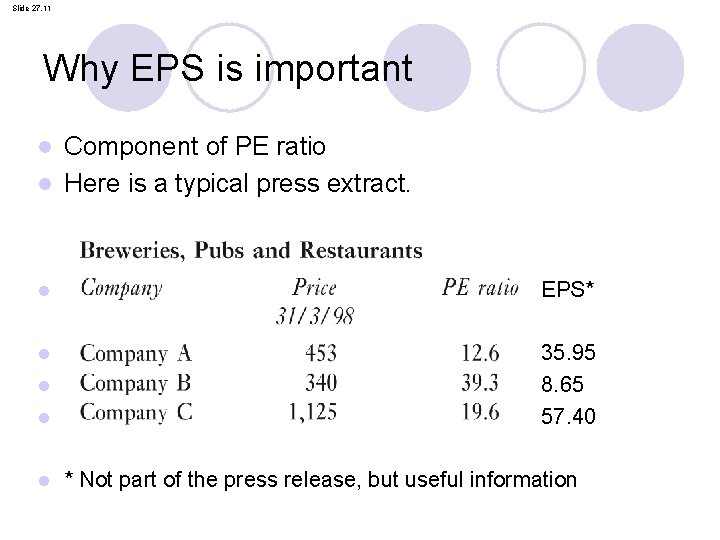

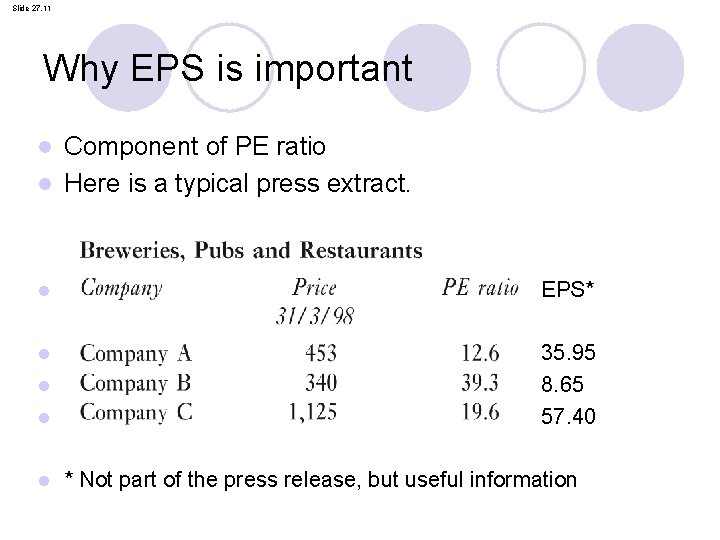

Slide 27. 11 Why EPS is important Component of PE ratio l Here is a typical press extract. l l EPS* l 35. 95 8. 65 57. 40 l l l * Not part of the press release, but useful information

Slide 27. 12 Factors that affect the PE ratio l Investors’ confidence ¡ International scene ¡ National economy ¡ Industry sector. – external influences

Slide 27. 13 Factors that affect the PE ratio (Continued) Investors’ confidence – external influences l Current year’s performance ¡ Potential changes and possible future implication l Management change • replacing failing • recruiting successful l High growth prospects – high PE ratio l Poor growth prospects – high PE if takeover likely.

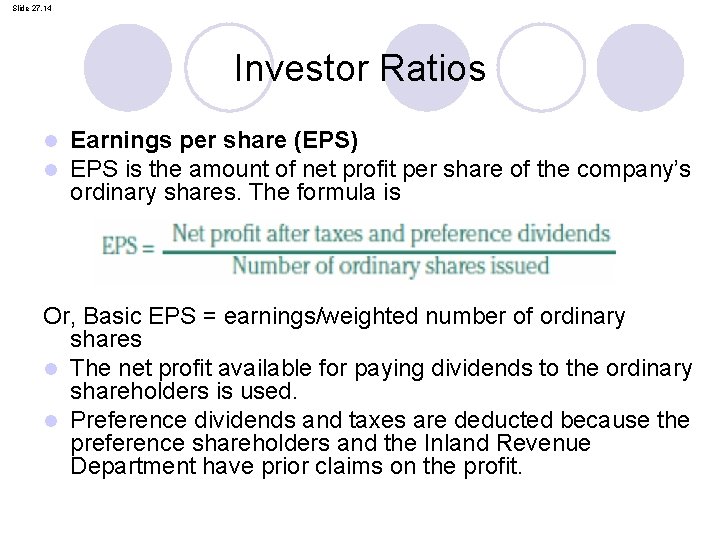

Slide 27. 14 Investor Ratios l l Earnings per share (EPS) EPS is the amount of net profit per share of the company’s ordinary shares. The formula is Or, Basic EPS = earnings/weighted number of ordinary shares l The net profit available for paying dividends to the ordinary shareholders is used. l Preference dividends and taxes are deducted because the preference shareholders and the Inland Revenue Department have prior claims on the profit.

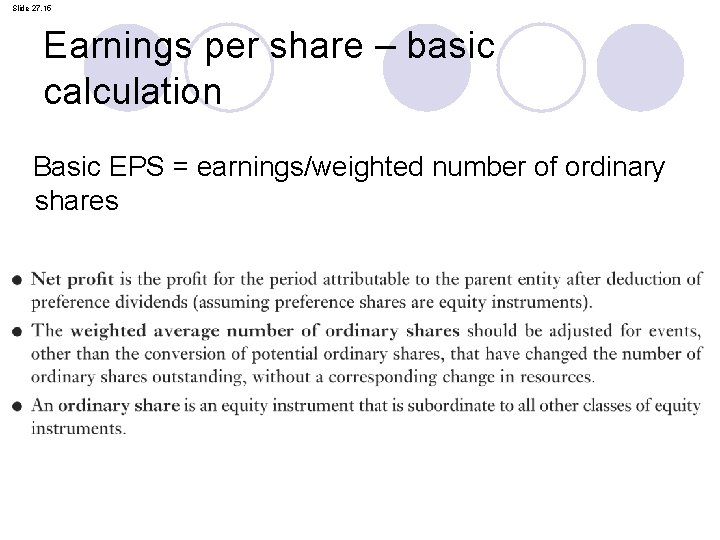

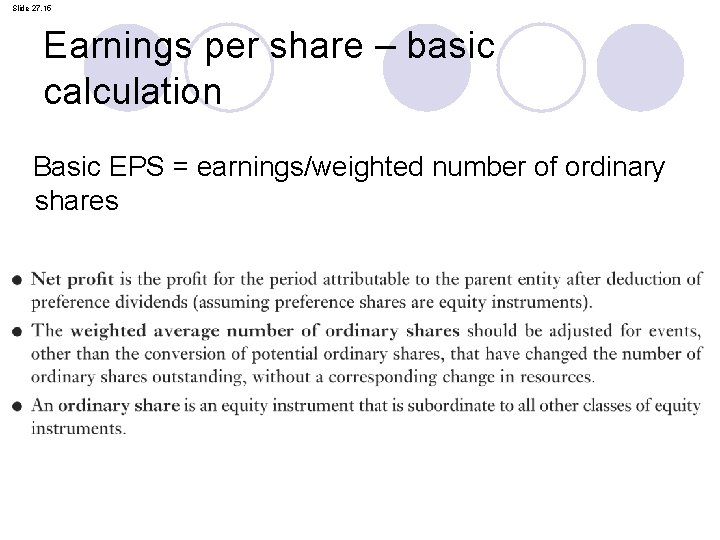

Slide 27. 15 Earnings per share – basic calculation Basic EPS = earnings/weighted number of ordinary shares

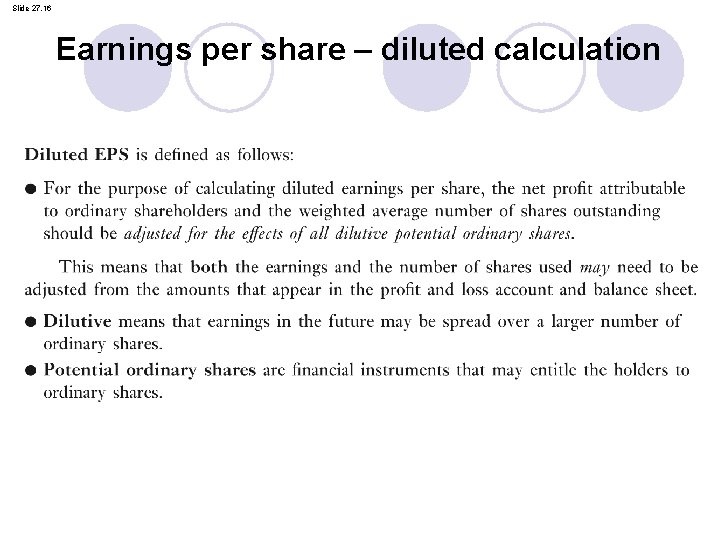

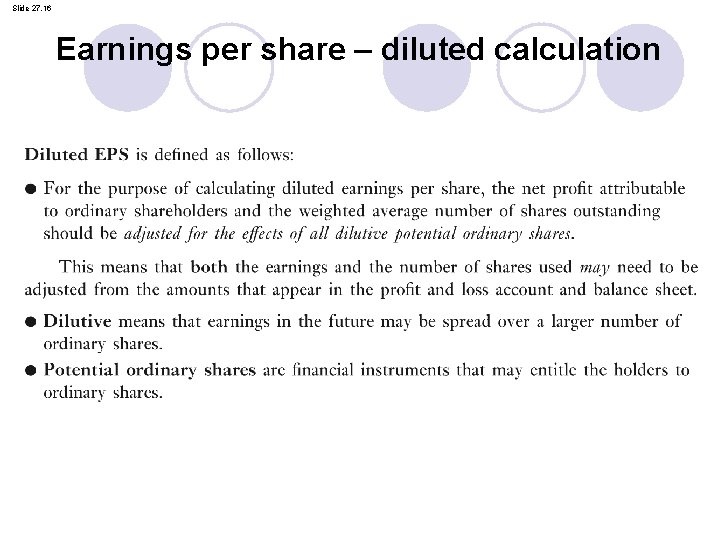

Slide 27. 16 Earnings per share – diluted calculation

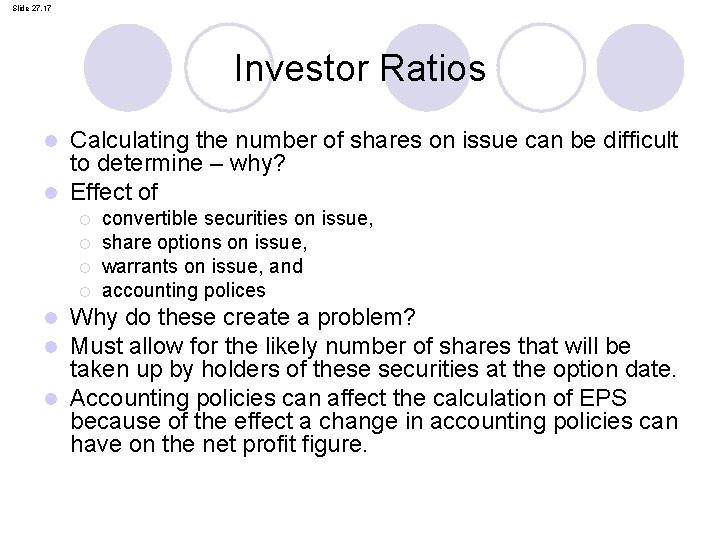

Slide 27. 17 Investor Ratios Calculating the number of shares on issue can be difficult to determine – why? l Effect of l ¡ ¡ convertible securities on issue, share options on issue, warrants on issue, and accounting polices Why do these create a problem? Must allow for the likely number of shares that will be taken up by holders of these securities at the option date. l Accounting policies can affect the calculation of EPS because of the effect a change in accounting policies can have on the net profit figure. l l

Slide 27. 18 Limitations of EPS as performance measure l Based on historical earnings l No account of inflation ¡ Real growth differing from apparent growth l Inter-company ¡ ¡ comparison adversely affected Management choice over accounting policies Changes in capital structure.

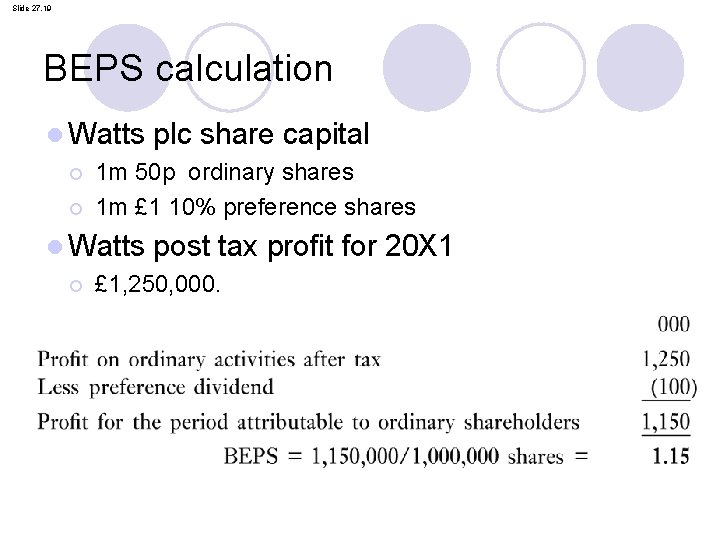

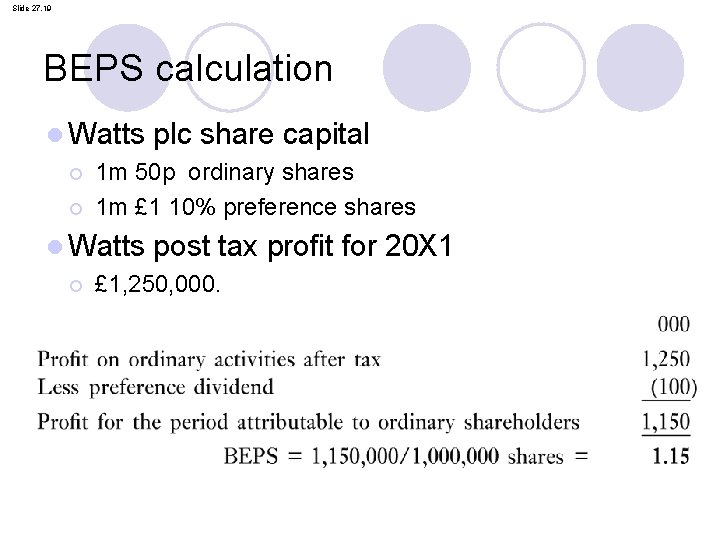

Slide 27. 19 BEPS calculation l Watts plc share capital ¡ 1 m 50 p ordinary shares ¡ 1 m £ 1 10% preference shares l Watts post tax ¡ £ 1, 250, 000. profit for 20 X 1

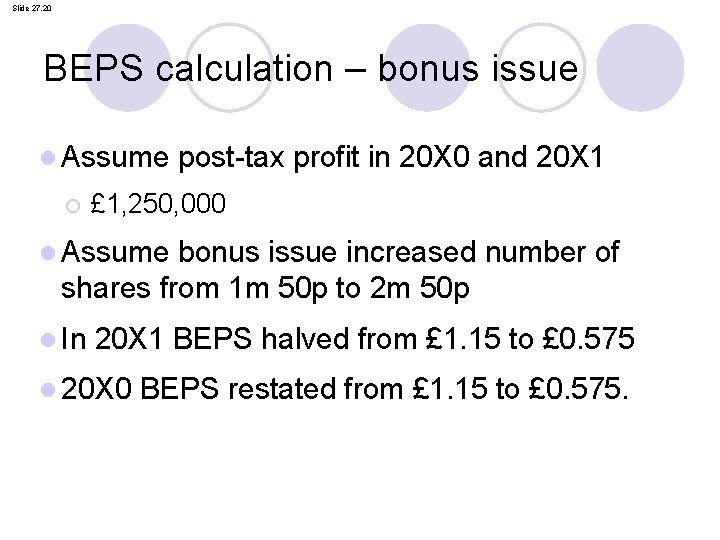

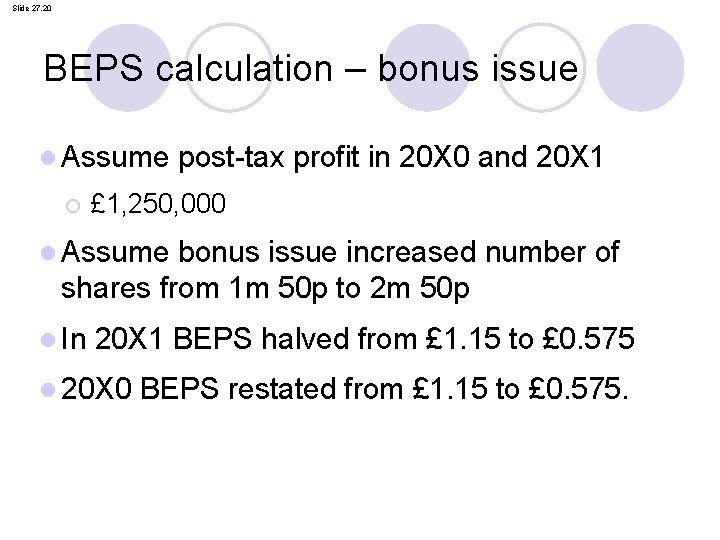

Slide 27. 20 BEPS calculation – bonus issue l Assume ¡ post-tax profit in 20 X 0 and 20 X 1 £ 1, 250, 000 l Assume bonus issue increased number of shares from 1 m 50 p to 2 m 50 p l In 20 X 1 BEPS halved from £ 1. 15 to £ 0. 575 l 20 X 0 BEPS restated from £ 1. 15 to £ 0. 575.

Slide 27. 21 BEPS calculation – share splits l Treated l Affects l Aim same way as a bonus issue both current and previous year is to avoid appearance of a fall compared to previous year.

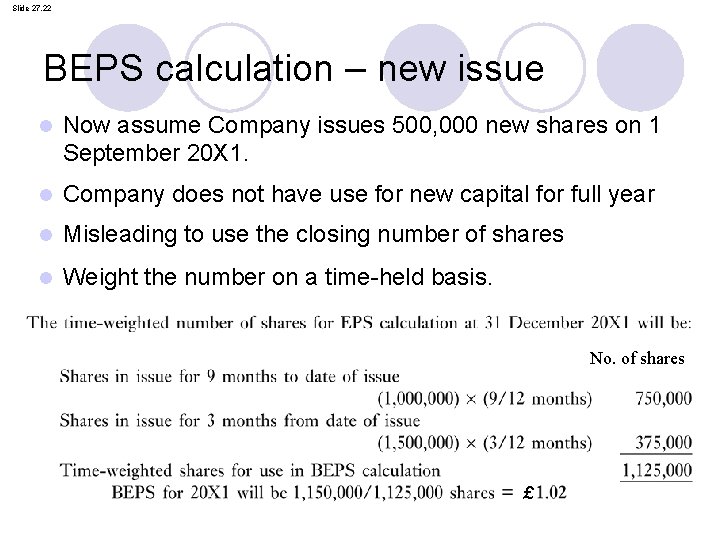

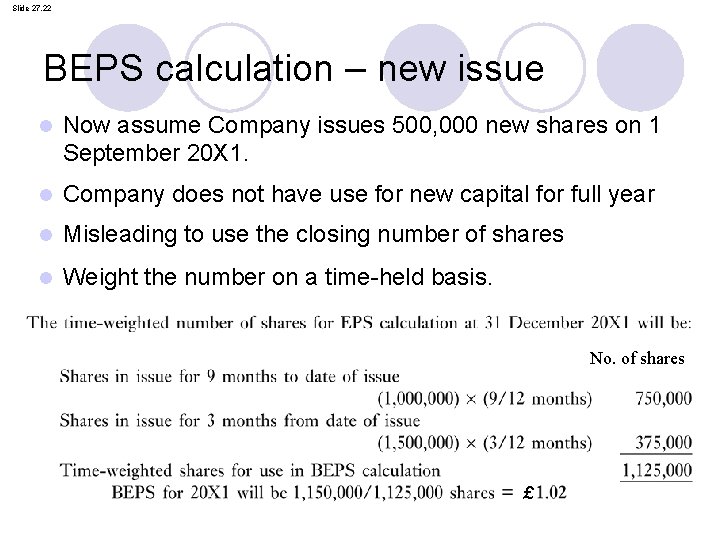

Slide 27. 22 BEPS calculation – new issue l Now assume Company issues 500, 000 new shares on 1 September 20 X 1. l Company does not have use for new capital for full year l Misleading to use the closing number of shares l Weight the number on a time-held basis. No. of shares £

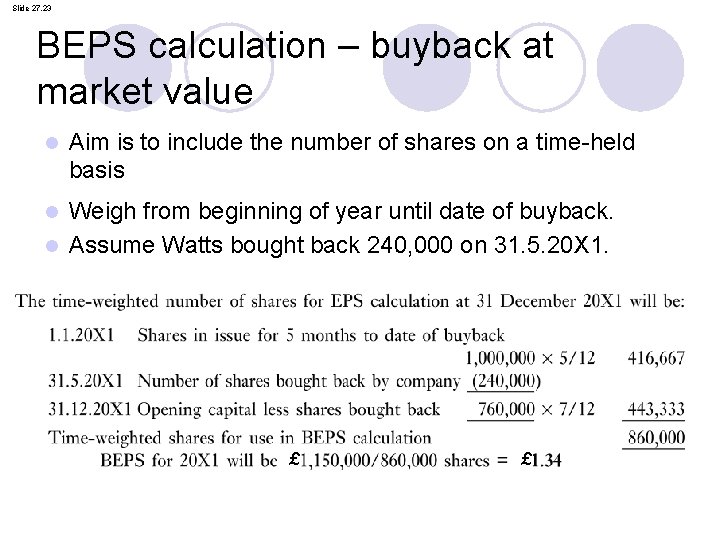

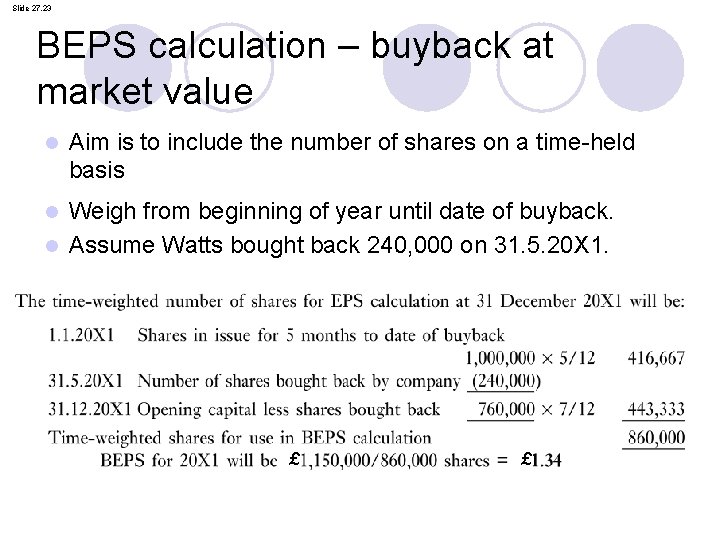

Slide 27. 23 BEPS calculation – buyback at market value l Aim is to include the number of shares on a time-held basis Weigh from beginning of year until date of buyback. l Assume Watts bought back 240, 000 on 31. 5. 20 X 1. l £ £

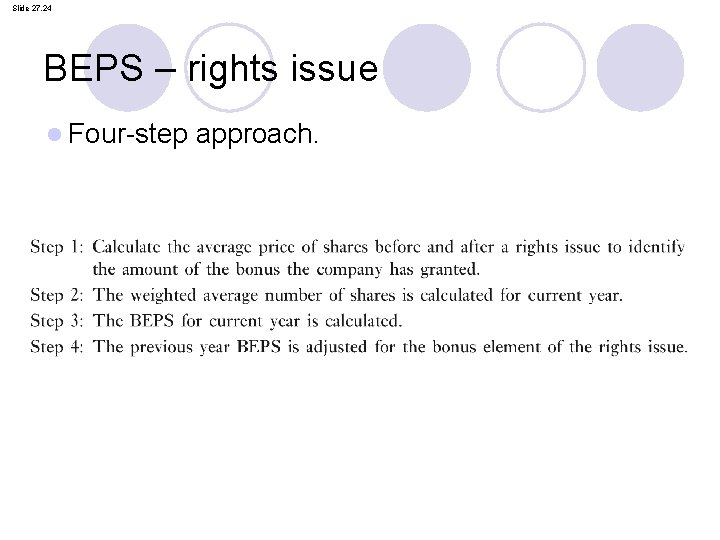

Slide 27. 24 BEPS – rights issue l Four-step approach.

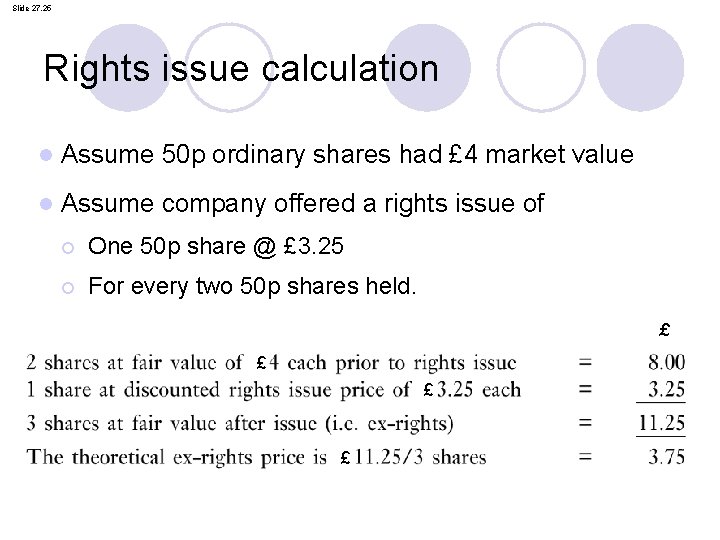

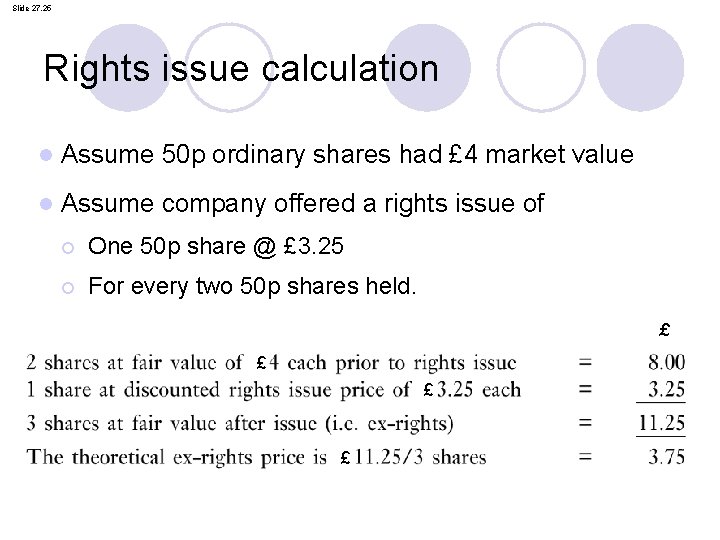

Slide 27. 25 Rights issue calculation l Assume 50 p ordinary shares had £ 4 market value l Assume company offered a rights issue of ¡ One 50 p share @ £ 3. 25 ¡ For every two 50 p shares held. £ £

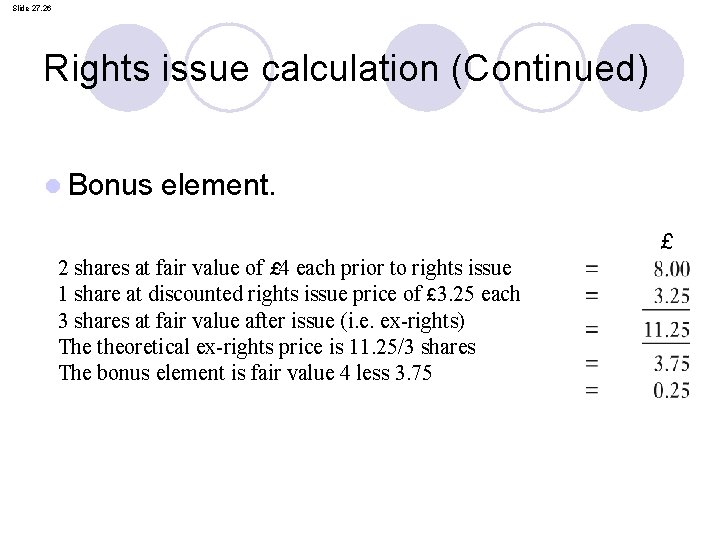

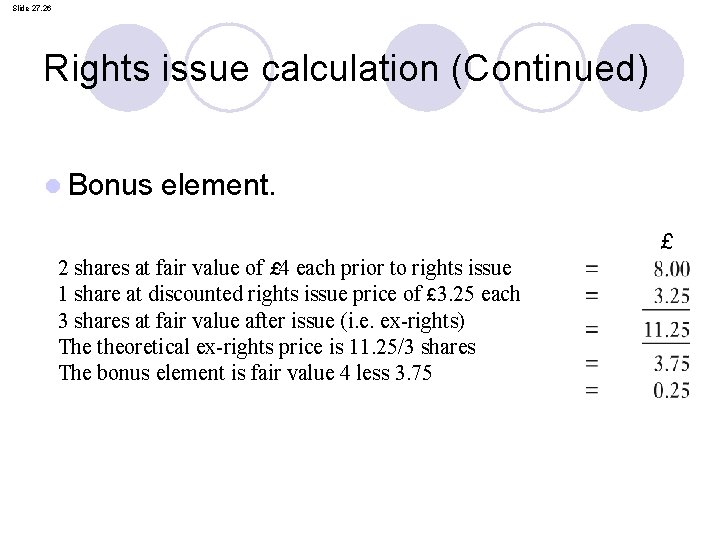

Slide 27. 26 Rights issue calculation (Continued) l Bonus element. £ 2 shares at fair value of £ 4 each prior to rights issue 1 share at discounted rights issue price of £ 3. 25 each 3 shares at fair value after issue (i. e. ex-rights) The theoretical ex-rights price is 11. 25/3 shares The bonus element is fair value 4 less 3. 75

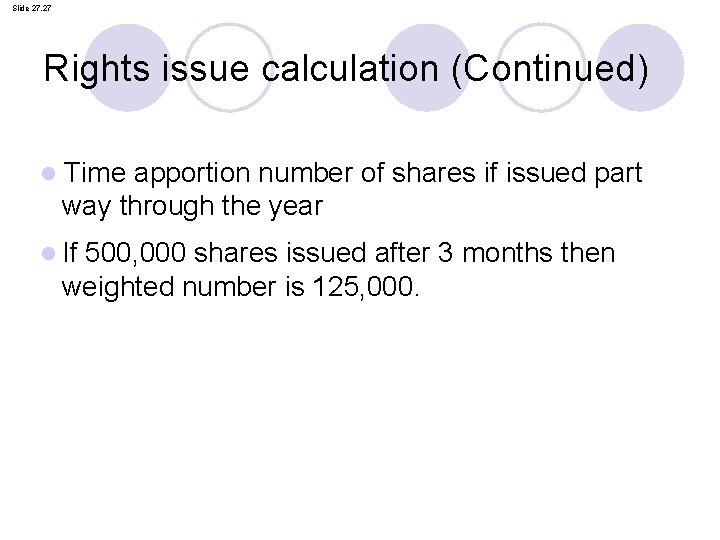

Slide 27. 27 Rights issue calculation (Continued) l Time apportion number of shares if issued part way through the year l If 500, 000 shares issued after 3 months then weighted number is 125, 000.

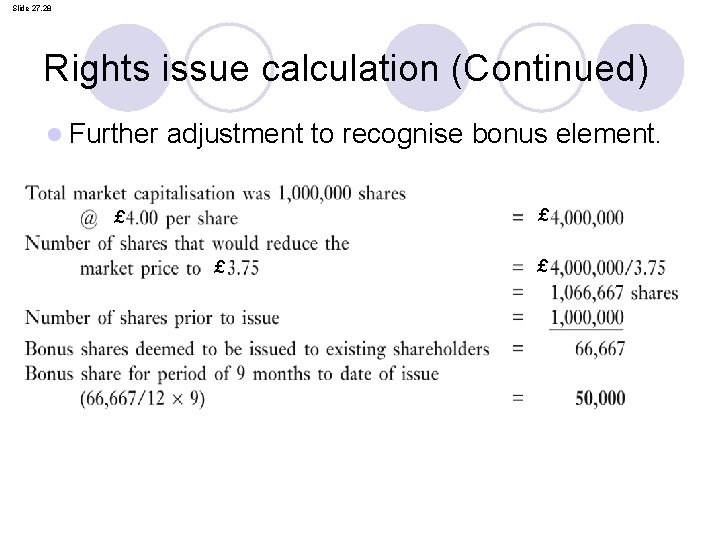

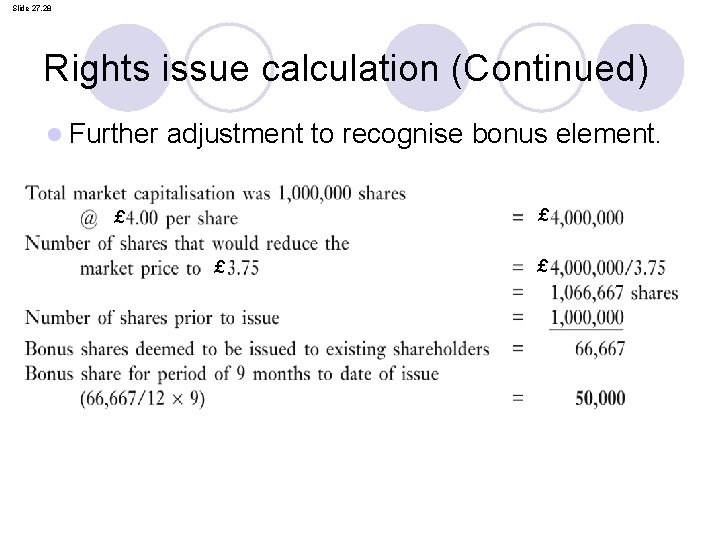

Slide 27. 28 Rights issue calculation (Continued) l Further adjustment to recognise bonus element. £ £

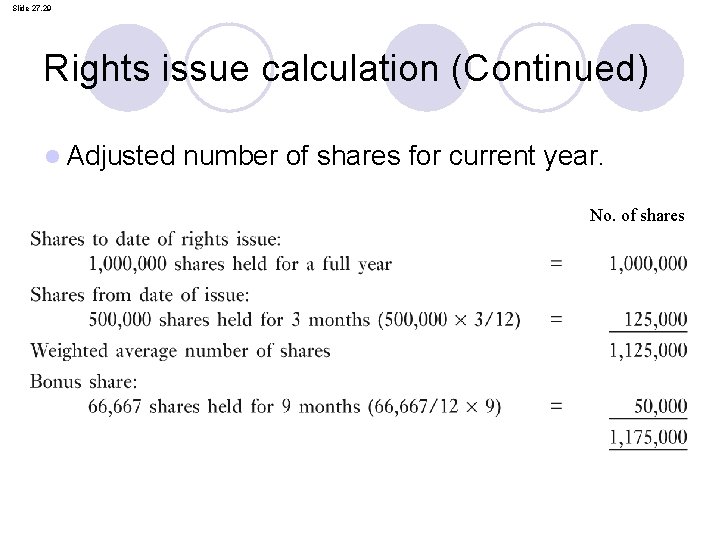

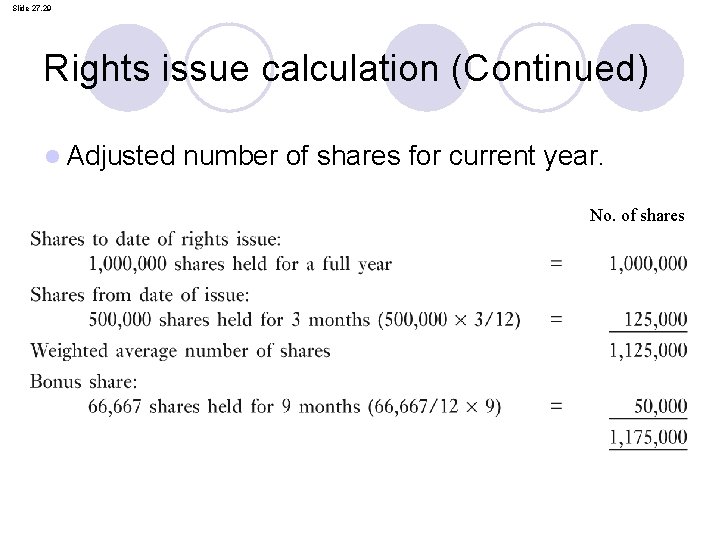

Slide 27. 29 Rights issue calculation (Continued) l Adjusted number of shares for current year. No. of shares

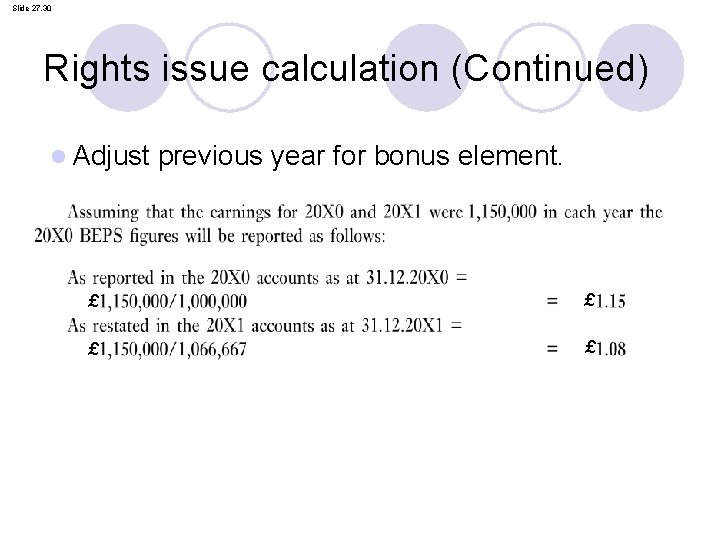

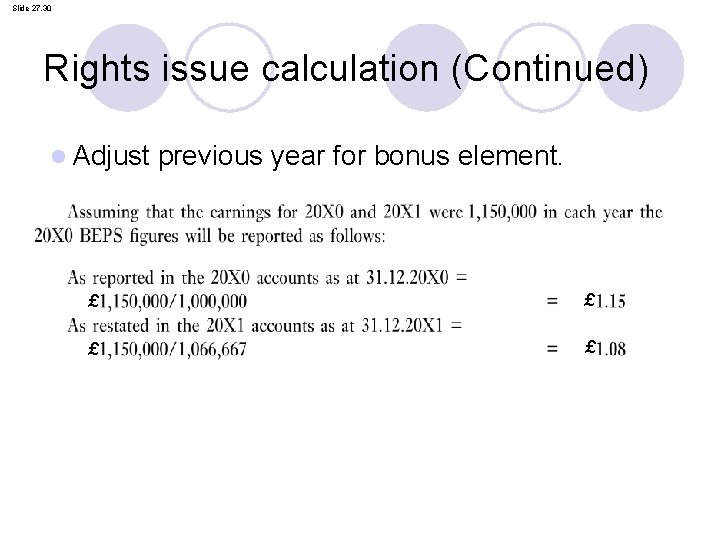

Slide 27. 30 Rights issue calculation (Continued) l Adjust previous year for bonus element. £ £

Slide 27. 31 Diluted EPS Dilution may arise from: l Convertible bonds l Convertible preference shares l Share options l Share warrants. l STOP HERE!

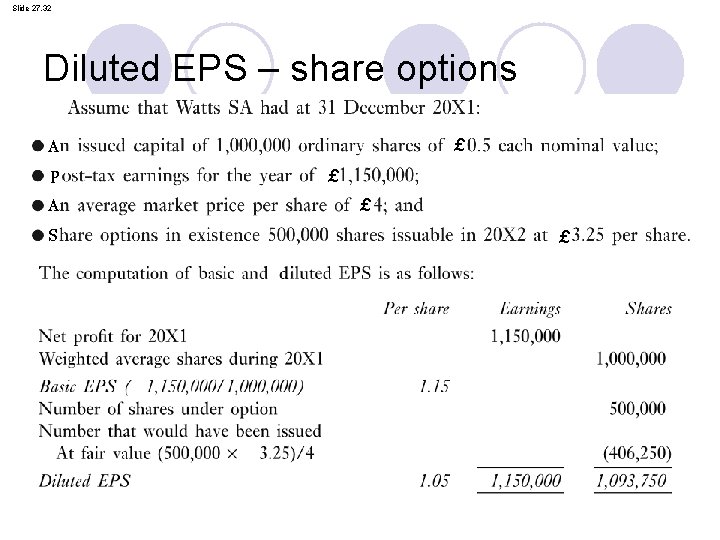

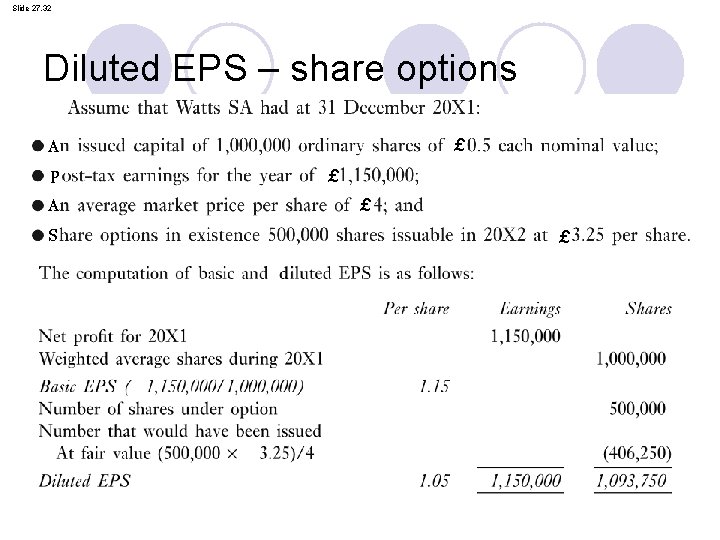

Slide 27. 32 Diluted EPS – share options £ A P A S £ £ £

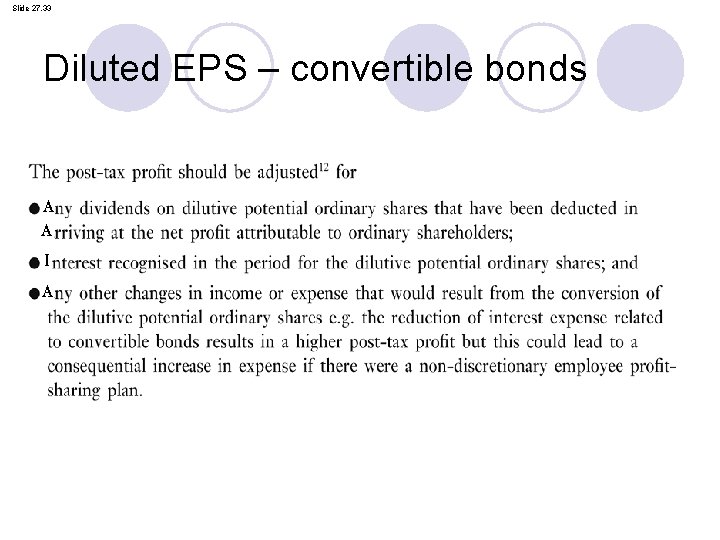

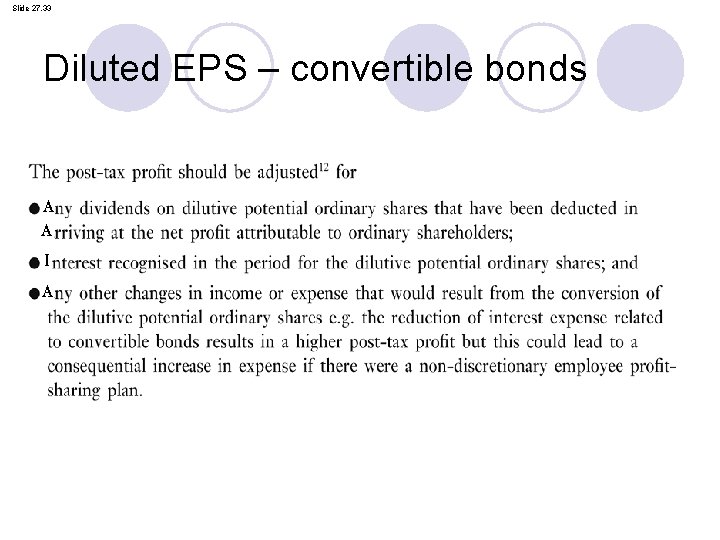

Slide 27. 33 Diluted EPS – convertible bonds A A I A

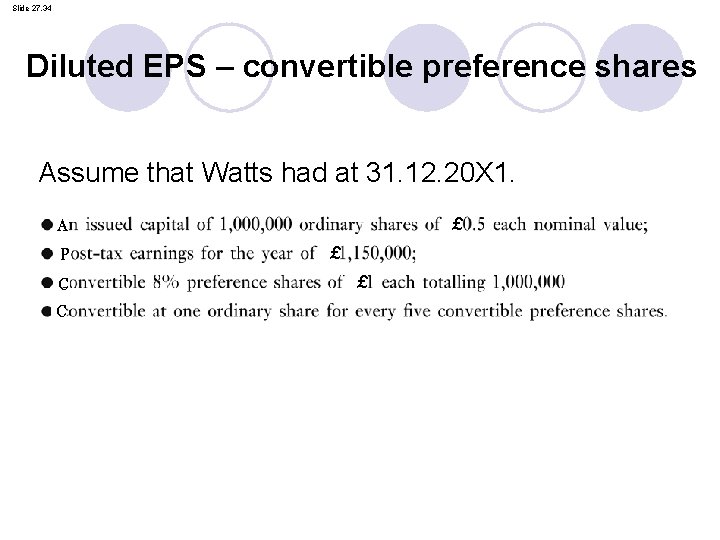

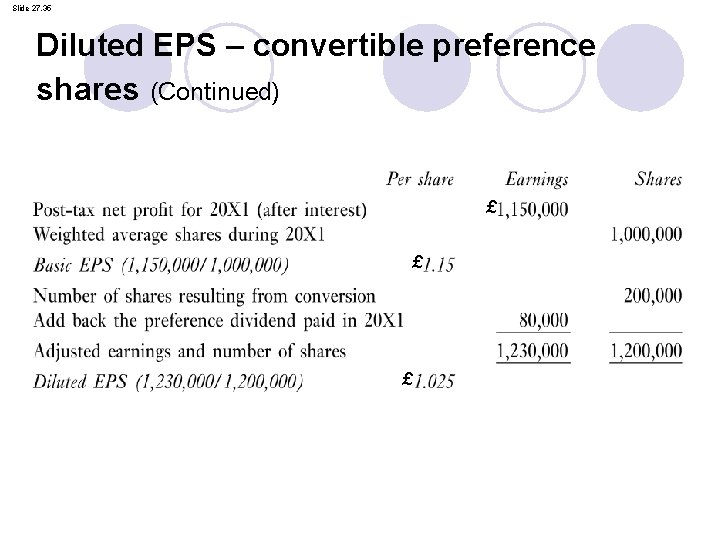

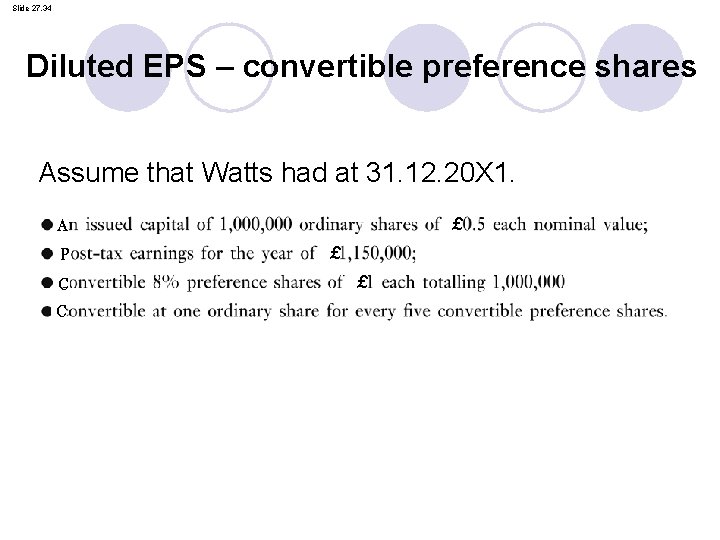

Slide 27. 34 Diluted EPS – convertible preference shares Assume that Watts had at 31. 12. 20 X 1. £ A P C C £ £

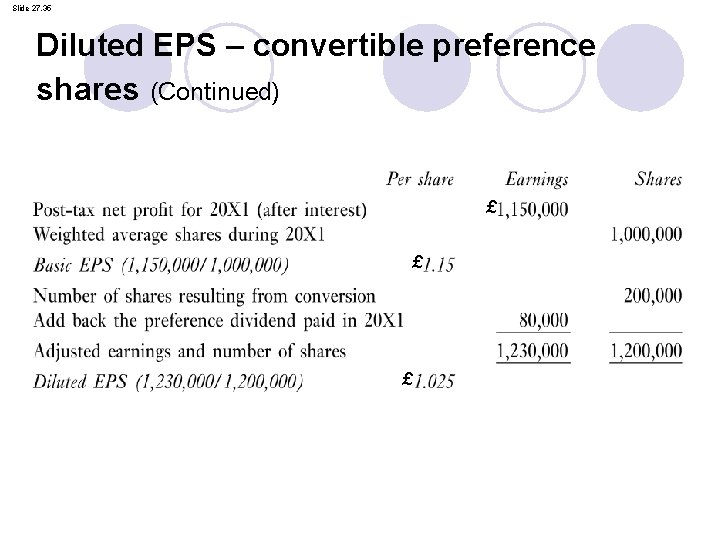

Slide 27. 35 Diluted EPS – convertible preference shares (Continued) £ £ £

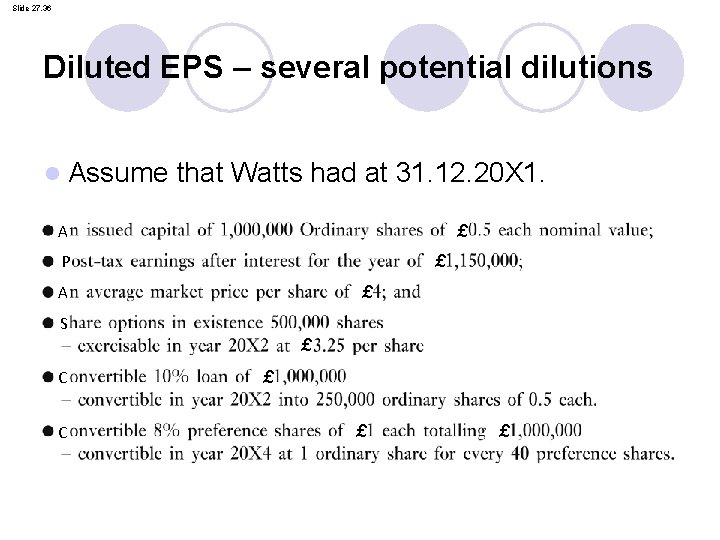

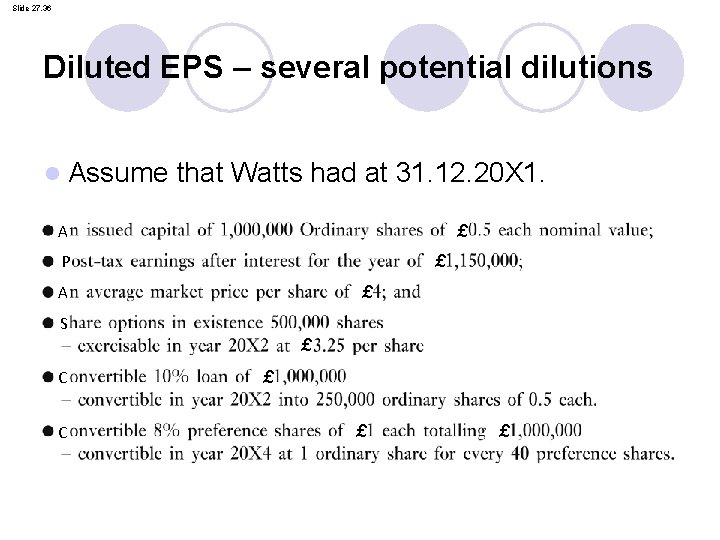

Slide 27. 36 Diluted EPS – several potential dilutions l Assume that Watts had at 31. 12. 20 X 1. £ A P £ £ A S £ C C £ £ £

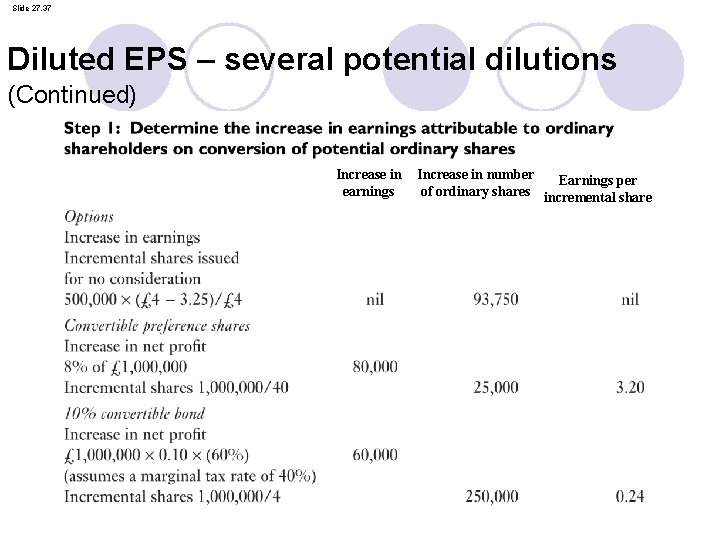

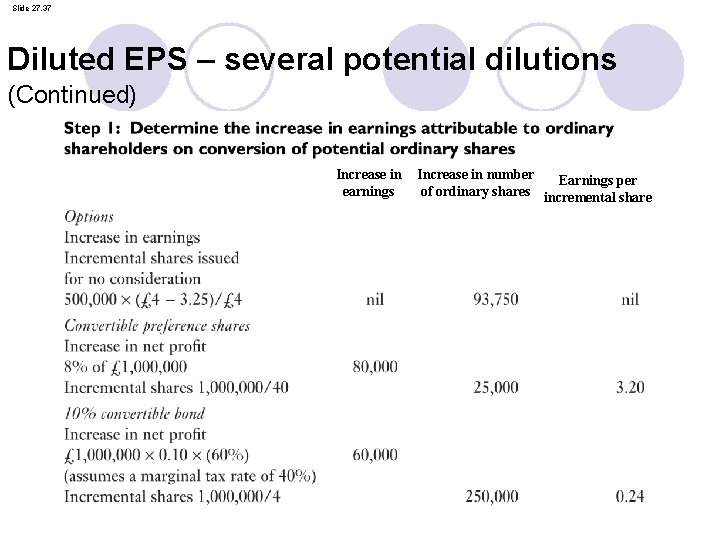

Slide 27. 37 Diluted EPS – several potential dilutions (Continued) Increase in earnings Increase in number Earnings per of ordinary shares incremental share

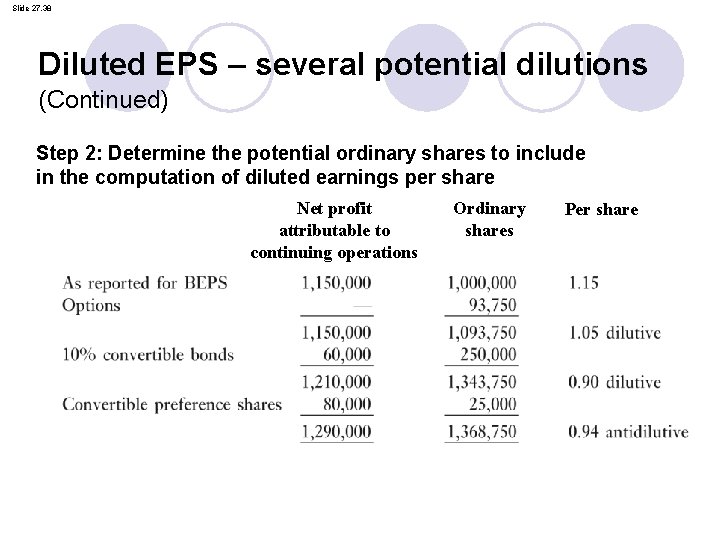

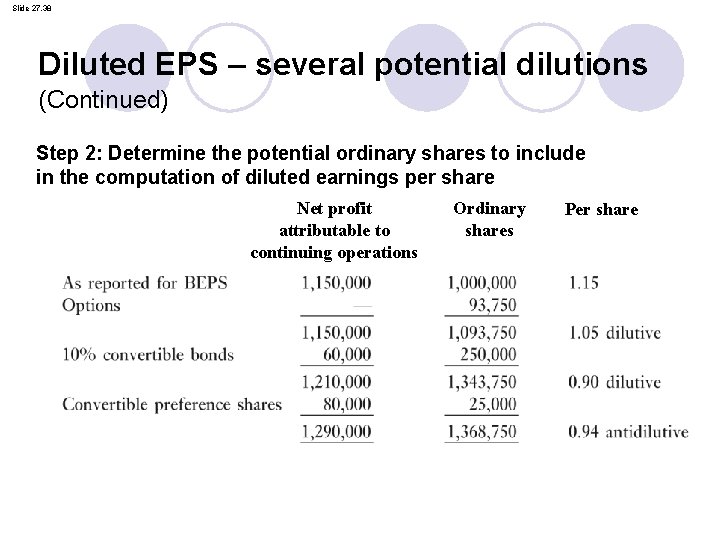

Slide 27. 38 Diluted EPS – several potential dilutions (Continued) Step 2: Determine the potential ordinary shares to include in the computation of diluted earnings per share Net profit attributable to continuing operations Ordinary shares Per share

Slide 27. 39 Discussion questions l Explain the limitation of EPS as a performance measure l Explain why a rights issue requires an adjustment with EPS of previous year l Explain what you understand by anti-dilutive.

Slide 27. 40 Review questions 1. Explain: (i) Basic earnings per share (ii) Fully diluted earnings per share (iii) Potential ordinary shares and (iv) Limitation of EPS as a performance measure 2. Why are issues at full market value treated differently from rights issues?

Slide 27. 41 Review questions (Continued) Income smoothing describes the management practice of maintaining a steady profit figure (a) Explain why managers might wish to smooth the earnings figure. Give three examples of how they might achieve this (b) It has been suggested that debt creditors are most at risk from income smoothing by the managers. Discuss why this should be so 7. In connection with IAS 33 Earnings per Share: (a) Define the profit used to calculate basic and diluted EPS (b) Explain the relationship between EPS and the price/earnings (P/E) ratio. Why may the P/E ratio be considered important as a stock market indicator? 6.