Slide 22 1 Chapter 22 Accounting for Groups

- Slides: 32

Slide 22. 1 Chapter 22 Accounting for Groups at the Date of Acquisition

Slide 22. 2 Main purpose The main purpose of this chapter is to explain the reasons for preparing consolidated financial statements at the date of acquisition and to show to prepare such statements.

Slide 22. 3 Objectives By the end of this chapter, you should be able to: • explain the need for consolidated financial statements; • define the meaning of IFRS 10 terms ‘control’ and ‘subsidiary’; • prepare consolidated accounts at the date of acquisition and calculate goodwill for a wholly-owned subsidiary; • explain the treatment of goodwill; • account for non-controlling interests under the two options available in IFRS 3; • understand the need for fair value adjustments and prepare consolidated financial statements reflecting such adjustments.

Slide 22. 4 Accounting for groups at date of acquisition • Definition of a group under IFRS 10 • Definition of control: – rights to variable returns – ability to affect those returns – through power over the investee • Reasons for preparing consolidated accounts.

Slide 22. 5 Definition of a group • One enterprise controls another enterprise – Directly – Indirectly.

Slide 22. 6 Control considerations l Control assumed if > 50% of voting rights l Control may exist where < 50%.

Slide 22. 7 Control may exist where < 50% voting rights l Agreement with other investors gives power over > 50% l Power over financial and operating policies by an agreement l Power to appoint or remove majority of board members l Power to cast the majority of votes at a board meeting.

Slide 22. 8 Reasons for preparing consolidated accounts l Because many corporations have controlling interests in other business entities, financial statements for the parent company alone can be misleading. For this reason, parent companies are legally required to prepare consolidated financial statements that include data about the financial performance of subsidiaries l Prevent ¡ ¡ ¡ manipulation Inflating sales by selling within the group More meaningful EPS figure Better measurement of management performance using ROCE.

Slide 22. 9 Alternative methods of preparing consolidated accounts l The purchase method ¡ Fair value of parent company’s investment ¡ Fair value of identifiable net assets in subsidiary ¡ Difference is goodwill l Pooling of interests method ¡ No longer permitted under IFRS 3.

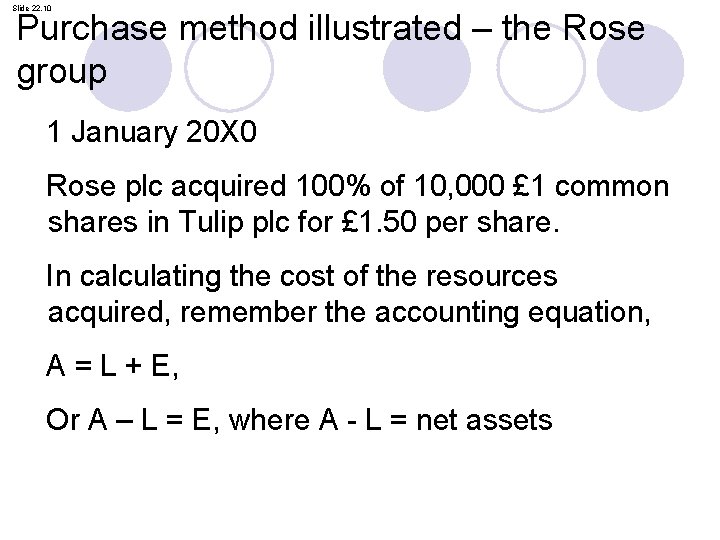

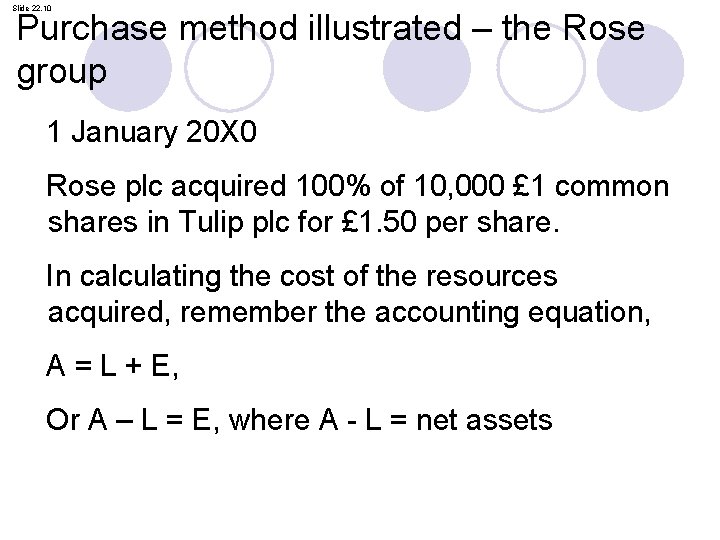

Slide 22. 10 Purchase method illustrated – the Rose group 1 January 20 X 0 Rose plc acquired 100% of 10, 000 £ 1 common shares in Tulip plc for £ 1. 50 per share. In calculating the cost of the resources acquired, remember the accounting equation, A = L + E, Or A – L = E, where A - L = net assets

Slide 22. 11 The Rose group statement of financial position on acquisition £ £ £ Rose has bought the Equity in Tulip, which is represented by Tulip’s net assets. l Tulip’s equity is £ 14, 000, and the amount paid was 10, 000 x £ 1. 50 = £ 15, 000 l

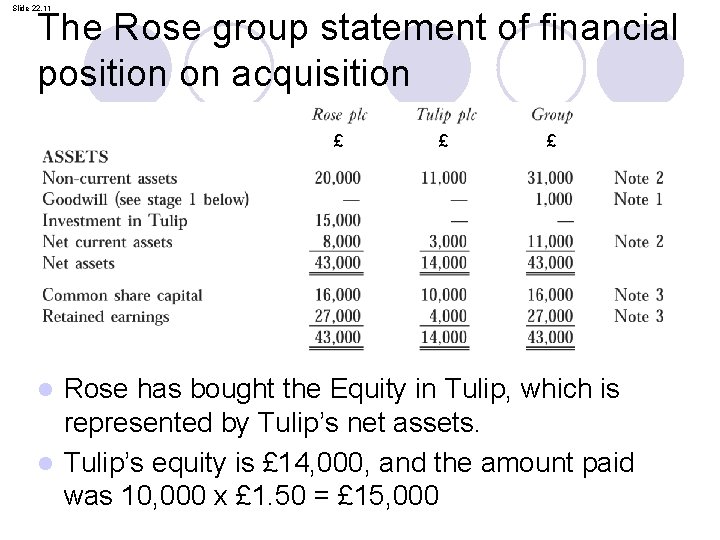

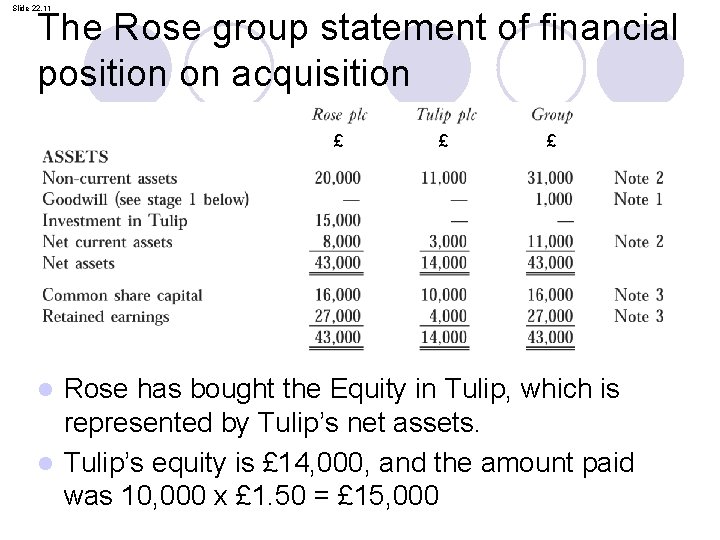

Slide 22. 12 The Rose group statement of financial position on acquisition (Continued) £ £ £

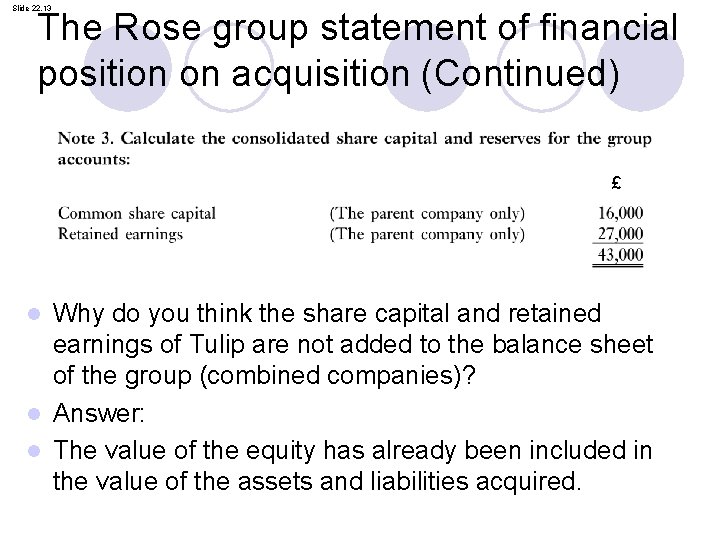

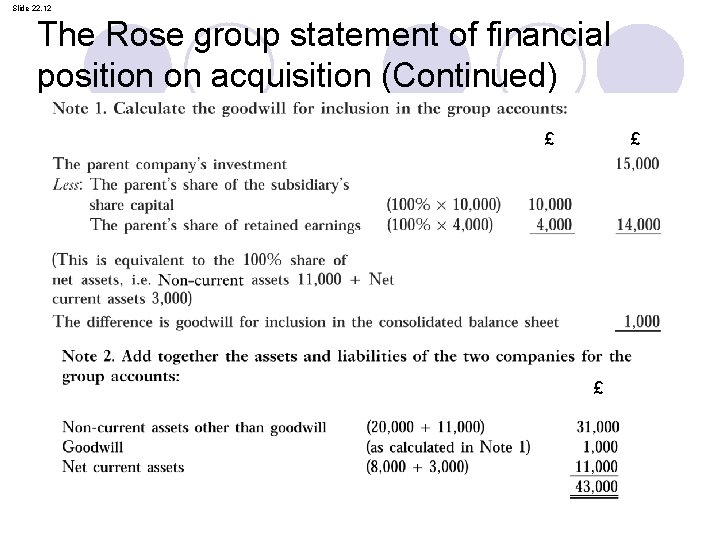

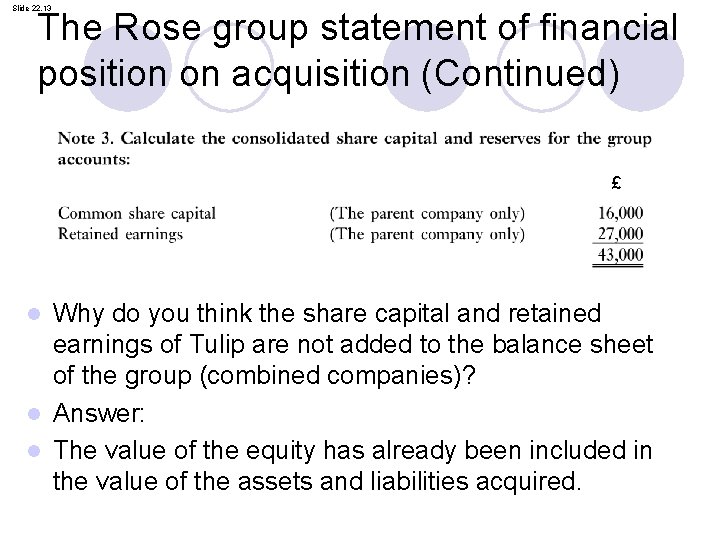

Slide 22. 13 The Rose group statement of financial position on acquisition (Continued) £ Why do you think the share capital and retained earnings of Tulip are not added to the balance sheet of the group (combined companies)? l Answer: l The value of the equity has already been included in the value of the assets and liabilities acquired. l

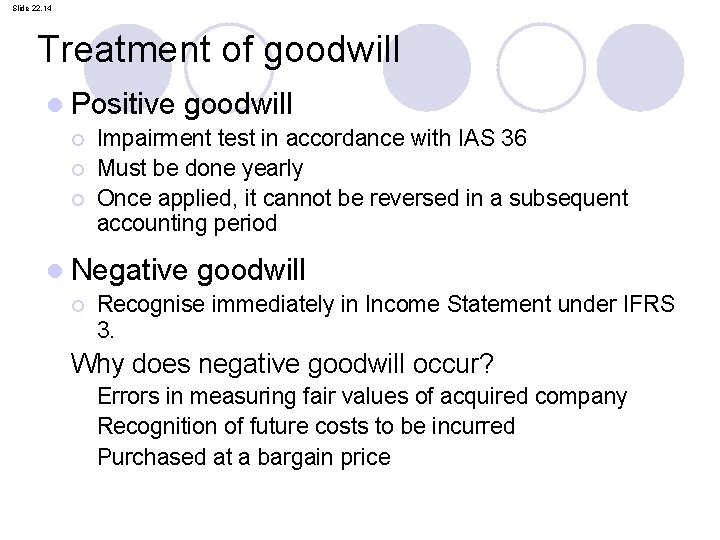

Slide 22. 14 Treatment of goodwill l Positive ¡ ¡ ¡ goodwill Impairment test in accordance with IAS 36 Must be done yearly Once applied, it cannot be reversed in a subsequent accounting period l Negative ¡ goodwill Recognise immediately in Income Statement under IFRS 3. Why does negative goodwill occur? Errors in measuring fair values of acquired company Recognition of future costs to be incurred Purchased at a bargain price

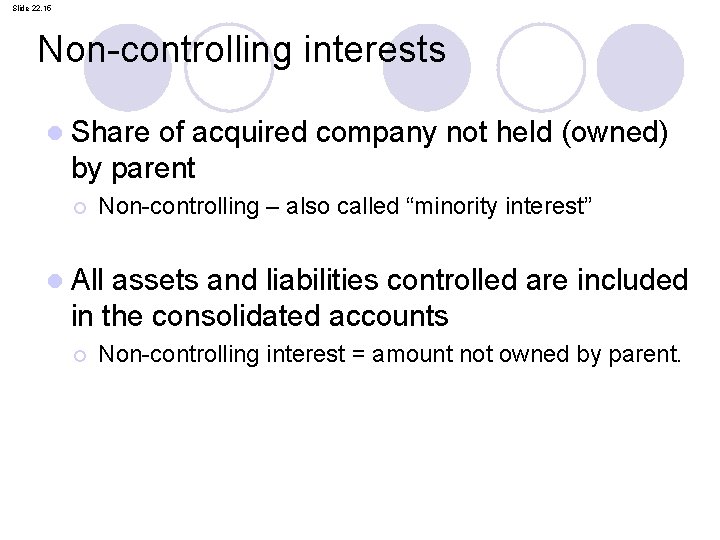

Slide 22. 15 Non-controlling interests l Share of acquired company not held (owned) by parent ¡ Non-controlling – also called “minority interest” l All assets and liabilities controlled are included in the consolidated accounts ¡ Non-controlling interest = amount not owned by parent.

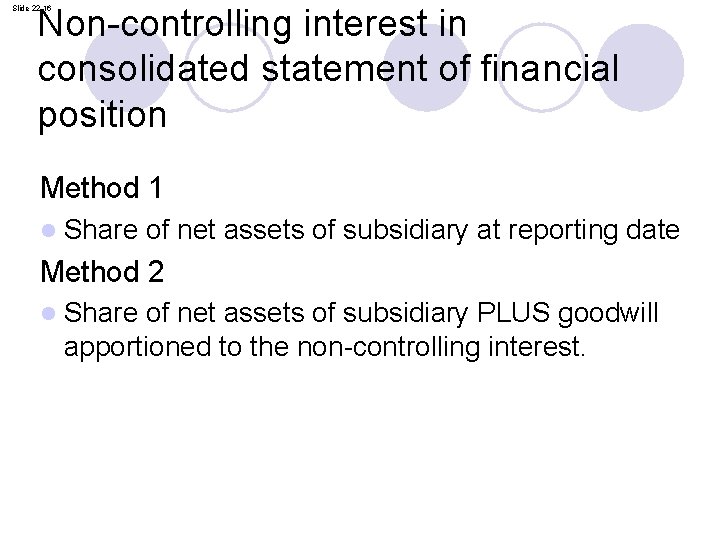

Non-controlling interest in consolidated statement of financial position Slide 22. 16 Method 1 l Share of net assets of subsidiary at reporting date Method 2 l Share of net assets of subsidiary PLUS goodwill apportioned to the non-controlling interest.

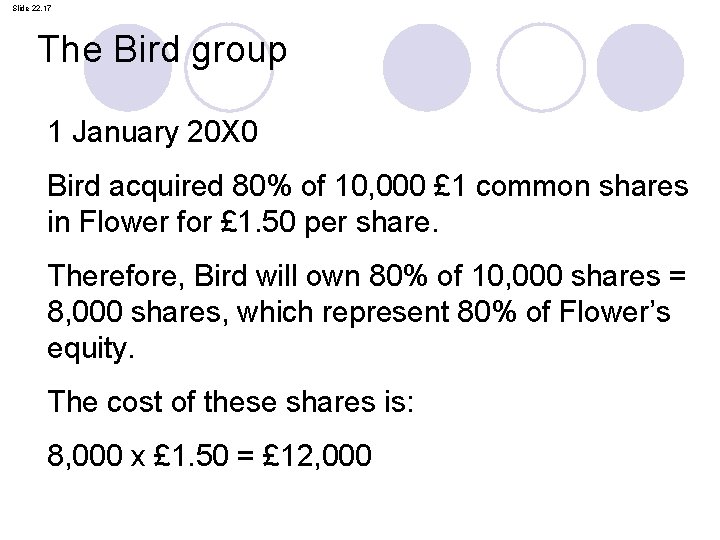

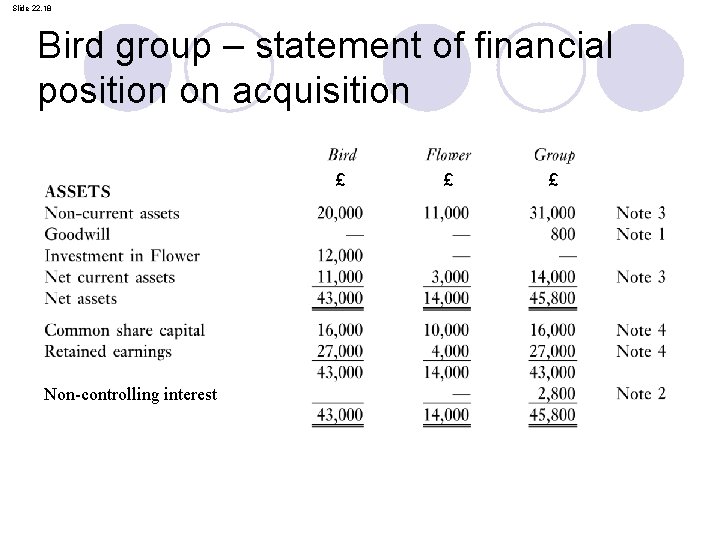

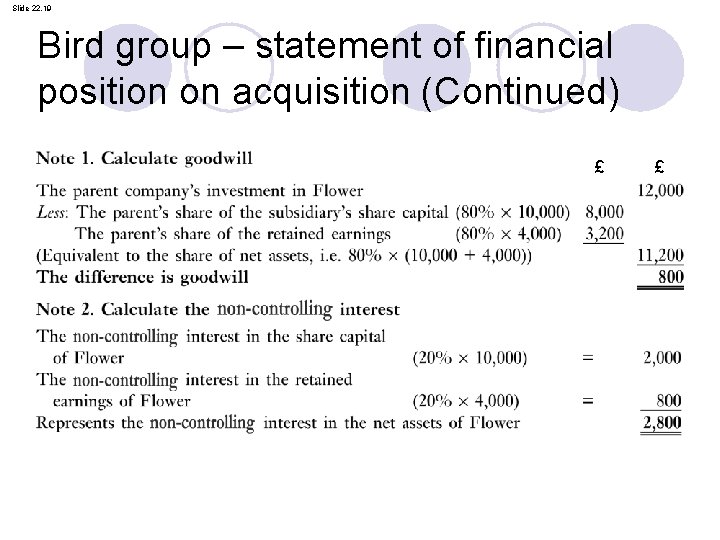

Slide 22. 17 The Bird group 1 January 20 X 0 Bird acquired 80% of 10, 000 £ 1 common shares in Flower for £ 1. 50 per share. Therefore, Bird will own 80% of 10, 000 shares = 8, 000 shares, which represent 80% of Flower’s equity. The cost of these shares is: 8, 000 x £ 1. 50 = £ 12, 000

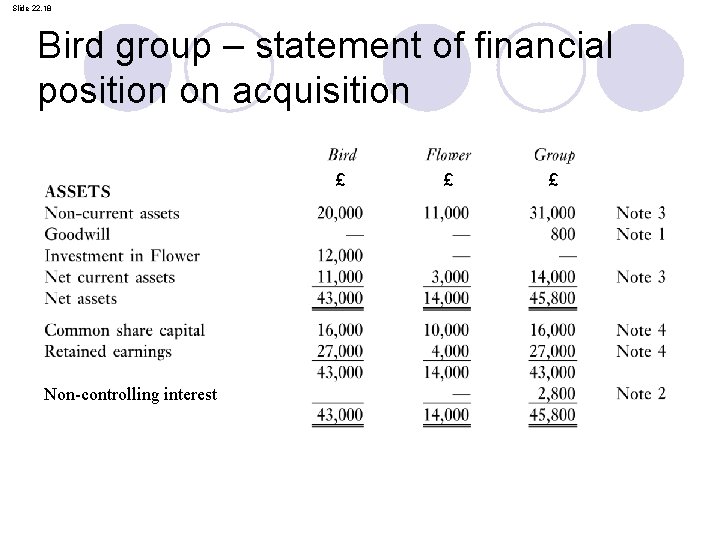

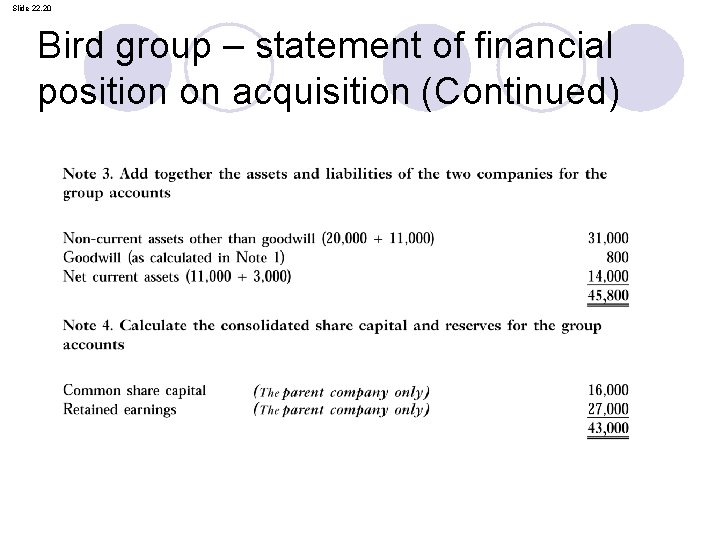

Slide 22. 18 Bird group – statement of financial position on acquisition £ Non-controlling interest £ £

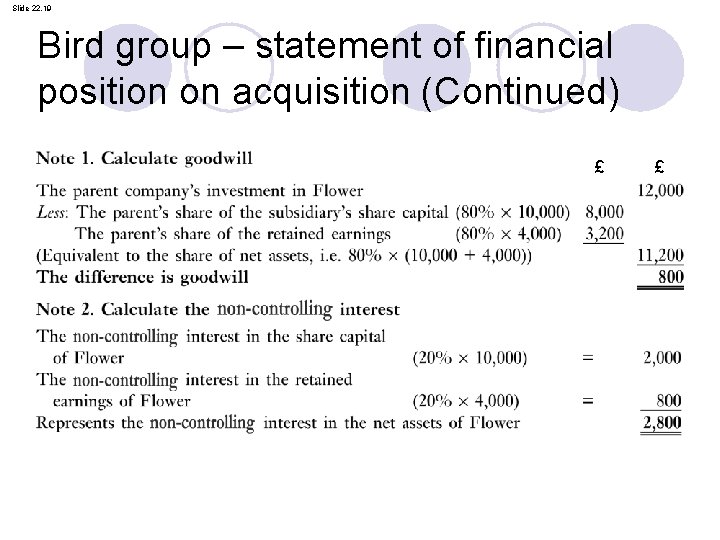

Slide 22. 19 Bird group – statement of financial position on acquisition (Continued) £ £

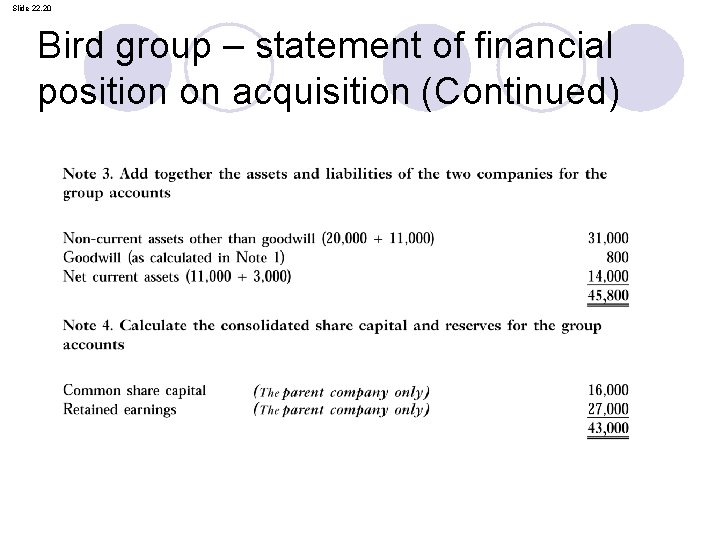

Slide 22. 20 Bird group – statement of financial position on acquisition (Continued)

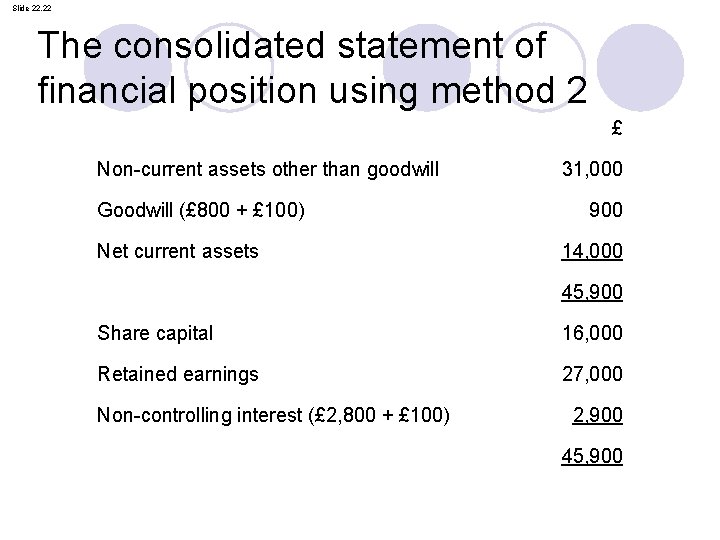

Slide 22. 21 Non-controlling interest using method 2 If using Method 2 to measure the non-controlling interest, we need to know the fair value of the noncontrolling interest in the subsidiary at the date of acquisition. Let us assume in this case that this fair value is £ 2, 900 l Goodwill that is attributed to the non-controlling interest is as follows: l Fair value of non-controlling interest at date of acquisition £ 2, 900 20% (the share attributable to the non-controlling interest) of the (2, 800) net assets at the date of acquisition (£ 14, 000) Attributable goodwill 100

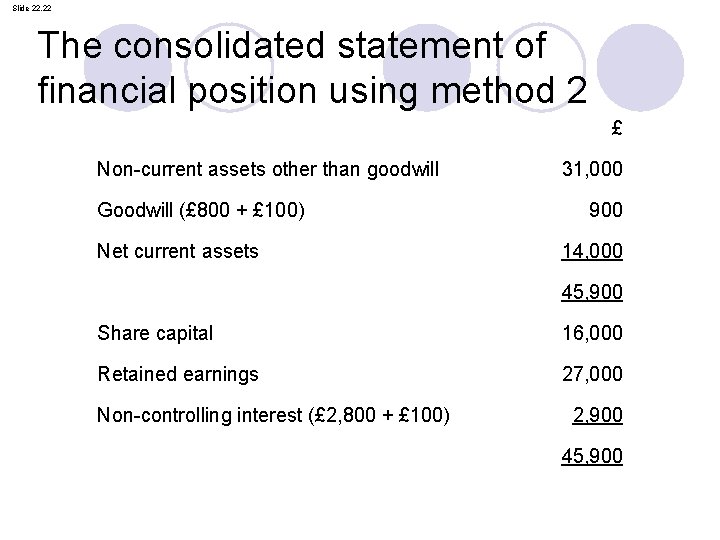

Slide 22. 22 The consolidated statement of financial position using method 2 £ Non-current assets other than goodwill Goodwill (£ 800 + £ 100) Net current assets 31, 000 900 14, 000 45, 900 Share capital 16, 000 Retained earnings 27, 000 Non-controlling interest (£ 2, 800 + £ 100) 2, 900 45, 900

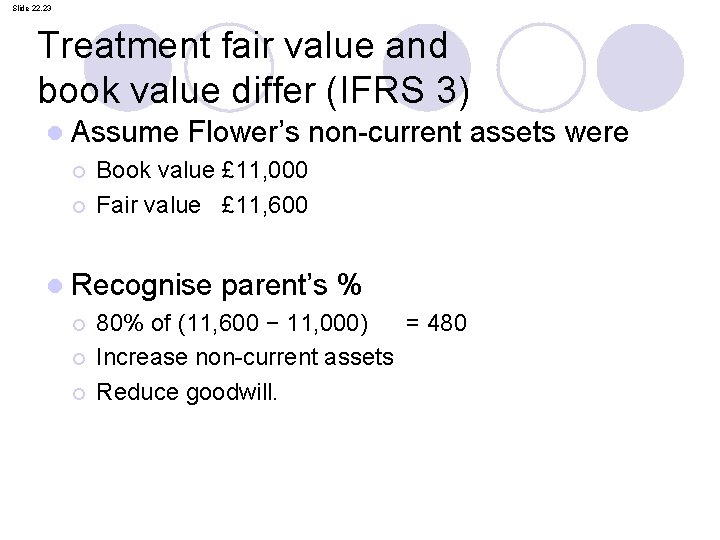

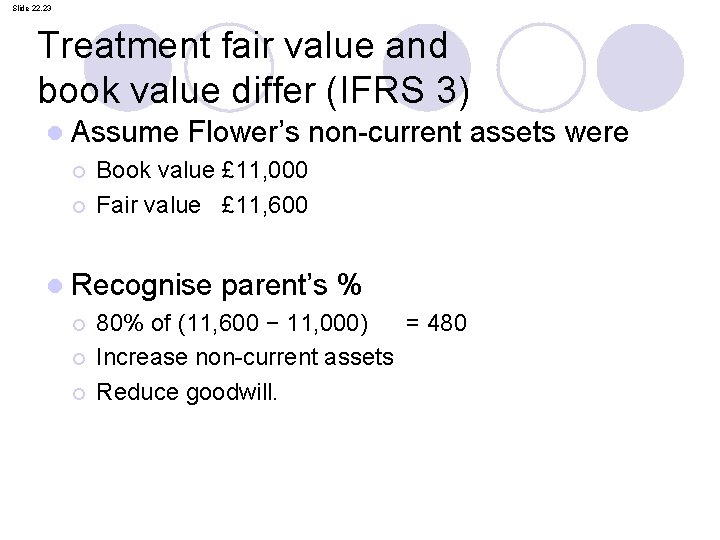

Slide 22. 23 Treatment fair value and book value differ (IFRS 3) l Assume Flower’s non-current ¡ Book value £ 11, 000 ¡ Fair value £ 11, 600 l Recognise parent’s % ¡ 80% of (11, 600 − 11, 000) = 480 ¡ Increase non-current assets ¡ Reduce goodwill. assets were

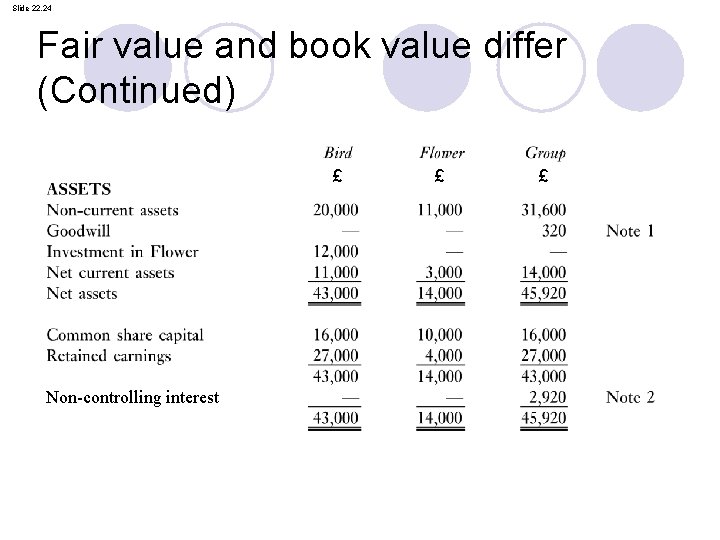

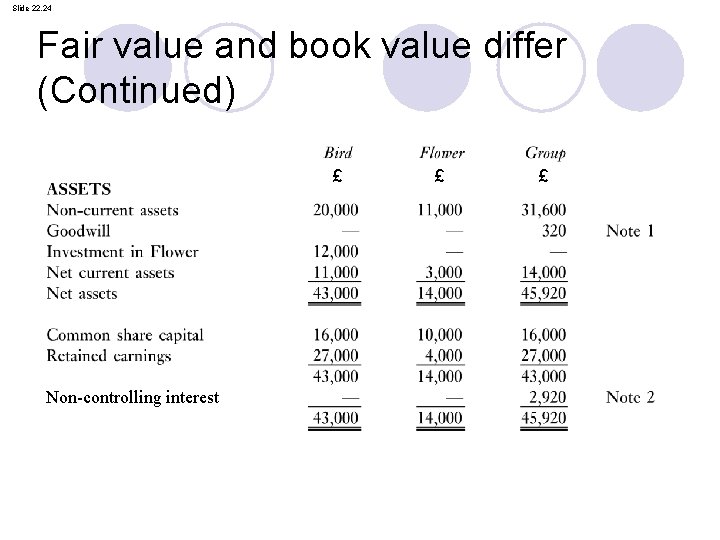

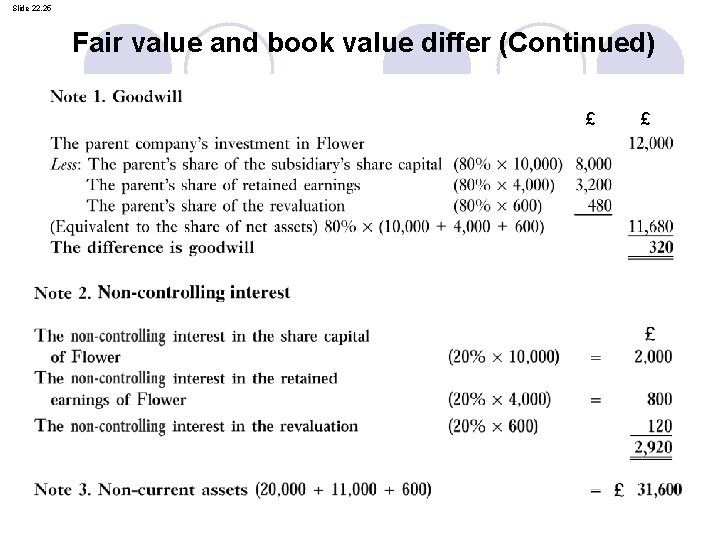

Slide 22. 24 Fair value and book value differ (Continued) £ Non-controlling interest £ £

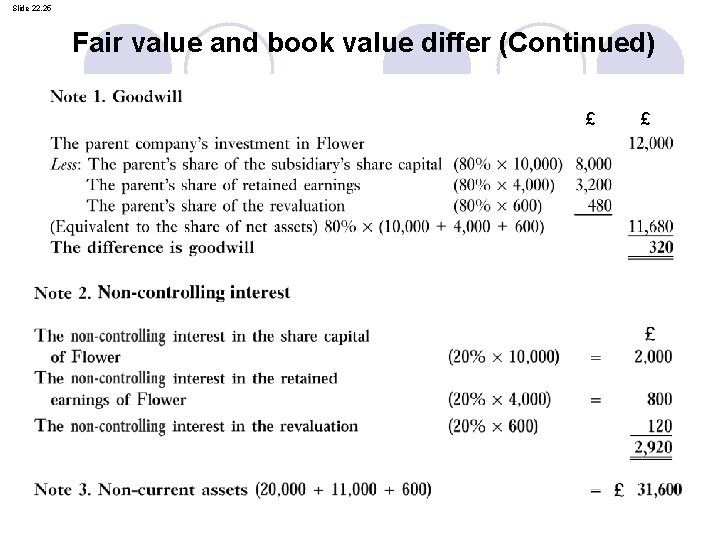

Slide 22. 25 Fair value and book value differ (Continued) £ £

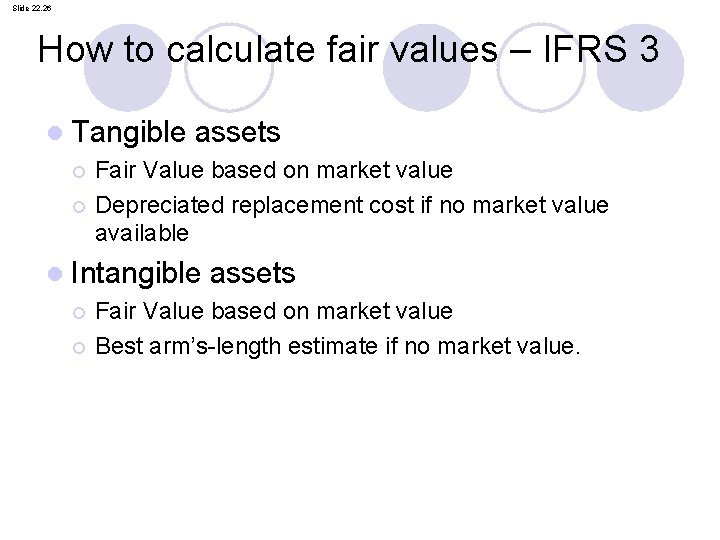

Slide 22. 26 How to calculate fair values – IFRS 3 l Tangible assets ¡ Fair Value based on market value ¡ Depreciated replacement cost if no market value available l Intangible assets ¡ Fair Value based on market value ¡ Best arm’s-length estimate if no market value.

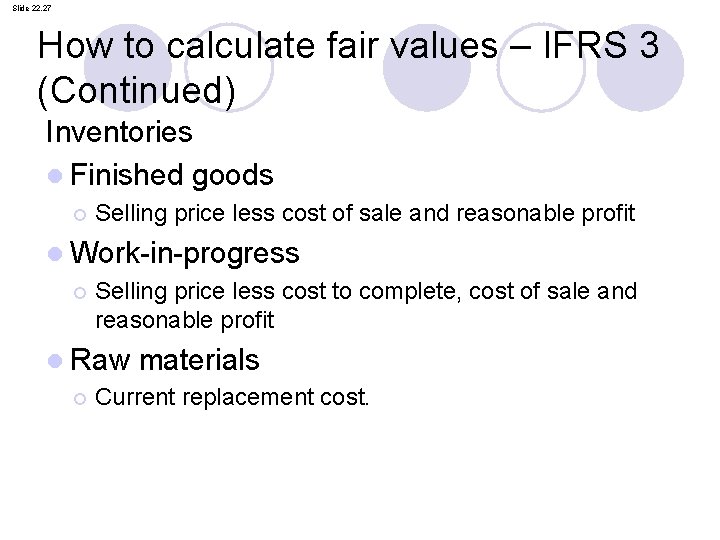

Slide 22. 27 How to calculate fair values – IFRS 3 (Continued) Inventories l Finished goods ¡ Selling price less cost of sale and reasonable profit l Work-in-progress ¡ Selling price less cost to complete, cost of sale and reasonable profit l Raw materials ¡ Current replacement cost.

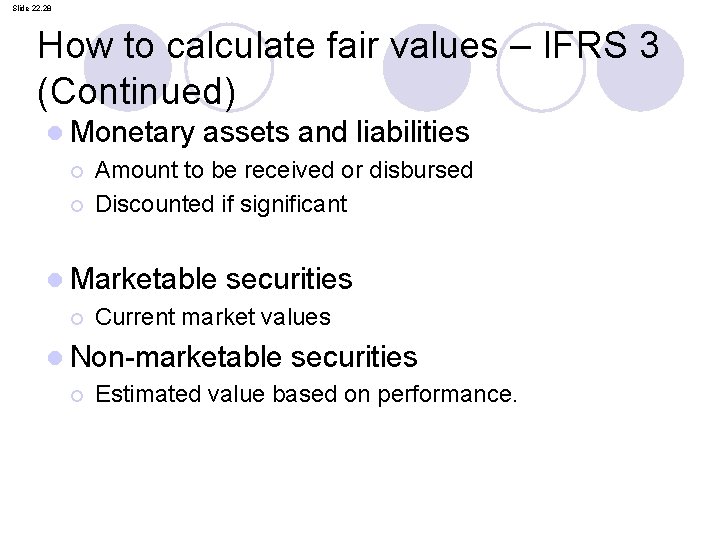

Slide 22. 28 How to calculate fair values – IFRS 3 (Continued) l Monetary assets and liabilities ¡ Amount to be received or disbursed ¡ Discounted if significant l Marketable securities ¡ Current market values l Non-marketable securities ¡ Estimated value based on performance.

Slide 22. 29 IFRS 13 Fair Value Measurement l price in an orderly transaction l between market participants.

Slide 22. 30 Review questions 1. Explain how negative goodwill may arise and its accounting treatment. 2. Explain how the fair value is calculated for: • • • Tangible non-current assets Inventories Monetary assets. 3. Explain why only the net assets of the subsidiary and not those of the parent are adjusted to fair value at the date of acquisition for the purpose of consolidated accounts.

Slide 22. 31 Review questions (Continued) 4. Coil SA/NV is a company incorporated under the laws of Belgium. Its accounts are IAS compliant. It states in its 2003 accounts (in accordance with IAS 27, para. 13): Principles of consolidation The consolidated Financial statements include all subsidiaries which are controlled by the Parent Company, unless such control is assumed to be temporary or due to long-term restrictions significantly impairing a subsidiary’s ability to transfer funds to the Parent Company. Required: Discuss whether these are acceptable reasons for excluding a subsidiary from the consolidated financial statements under the revised IAS 27.

Slide 22. 32 Review questions (Continued) 6. Parent plc acquired Son plc at the beginning of the year. At the end of the year there were intangible asset reported in the Consolidated accounts for the value of a domain name and customer lists. These assets did not appear in either the Parent or Son’s Statements of Financial Position. Required: Discuss why assets only appear in the consolidated accounts.