Service Exports From India Scheme SEIS SERVICES EXPORTS

- Slides: 12

Service Exports From India Scheme (SEIS)

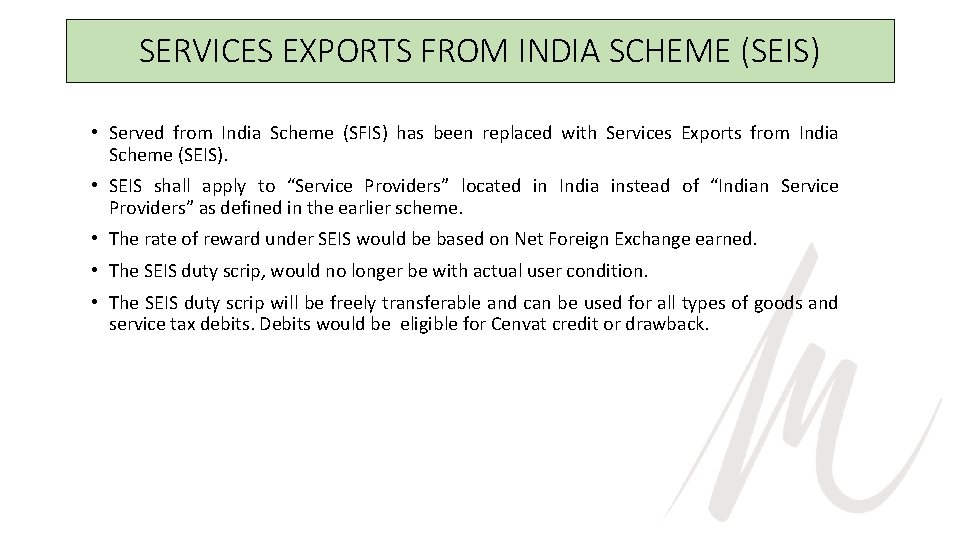

SERVICES EXPORTS FROM INDIA SCHEME (SEIS) • Served from India Scheme (SFIS) has been replaced with Services Exports from India Scheme (SEIS). • SEIS shall apply to “Service Providers” located in India instead of “Indian Service Providers” as defined in the earlier scheme. • The rate of reward under SEIS would be based on Net Foreign Exchange earned. • The SEIS duty scrip, would no longer be with actual user condition. • The SEIS duty scrip will be freely transferable and can be used for all types of goods and service tax debits. Debits would be eligible for Cenvat credit or drawback.

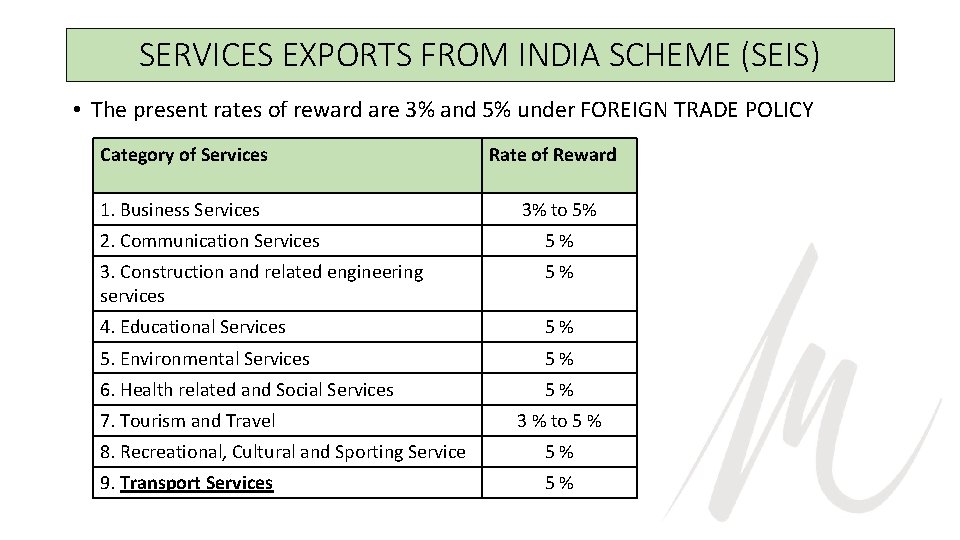

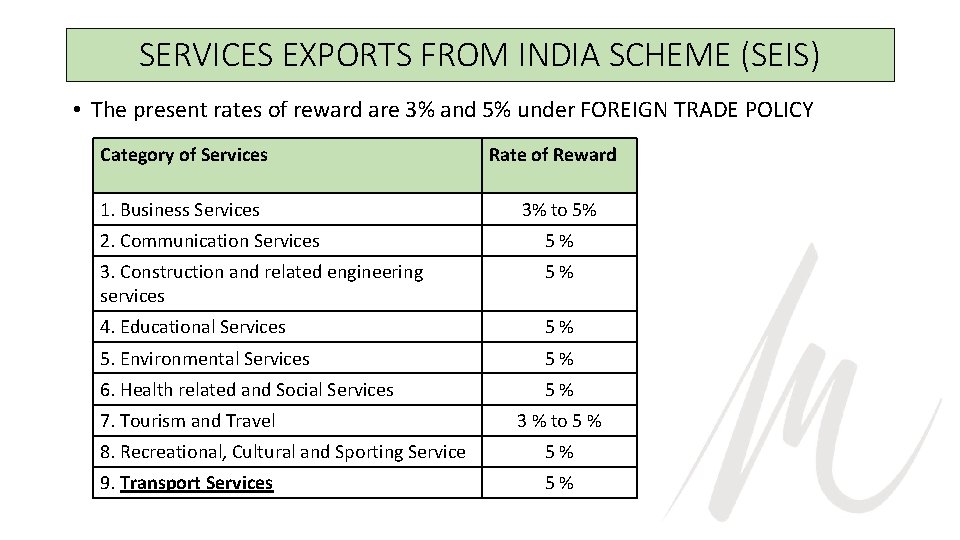

SERVICES EXPORTS FROM INDIA SCHEME (SEIS) • The present rates of reward are 3% and 5% under FOREIGN TRADE POLICY Category of Services 1. Business Services Rate of Reward 3% to 5% 2. Communication Services 5 % 3. Construction and related engineering services 5 % 4. Educational Services 5 % 5. Environmental Services 5 % 6. Health related and Social Services 5 % 7. Tourism and Travel 3 % to 5 % 8. Recreational, Cultural and Sporting Service 5 % 9. Transport Services 5 %

Eligibility • Service Providers of notified services, located in India and providing services in the manner as per Para 9. 51(i) Supply of a ‘service’ from India to any other country; (Mode 1 - Cross border trade) and Para 9. 51 (ii) Supply of a ‘service’ from India to service consumer(s) of any other country In India; (Mode 2 -Consumption abroad) of the FTP. • Service Provider should have minimum net foreign exchange earnings of US$ 15, 000 in preceding financial year. • For Individual Service Providers and sole proprietorship, minimum net foreign exchange earnings criteria would be US$ 10, 000 in preceding financial year. • Payment in Indian Rupees for service charges earned on specified services, shall be treated as deemed foreign exchange as per RBI guidelines (as per para 3. 08 c of FTP and App - 3 E). • Net Foreign Exchange Earnings for the scheme are defined as under: • Net Foreign Exchange = Gross Earnings of Foreign Exchange minus Total expenses/payment/remittances of Foreign Exchange by IEC holder, relating to service sector in the Financial year.

Eligibility • Exports from SEZ is entitle for SEIS benefit vide Notification No. 08 /2015 -2020 New Delhi, 4 th June , 2015 • If the IEC holder is a manufacturer of good as well as service provider, then the foreign exchange earnings and Total expenses/ payment / remittances shall be taken into account for service sector only. • Service Provider should have an active IEC to claim the reward.

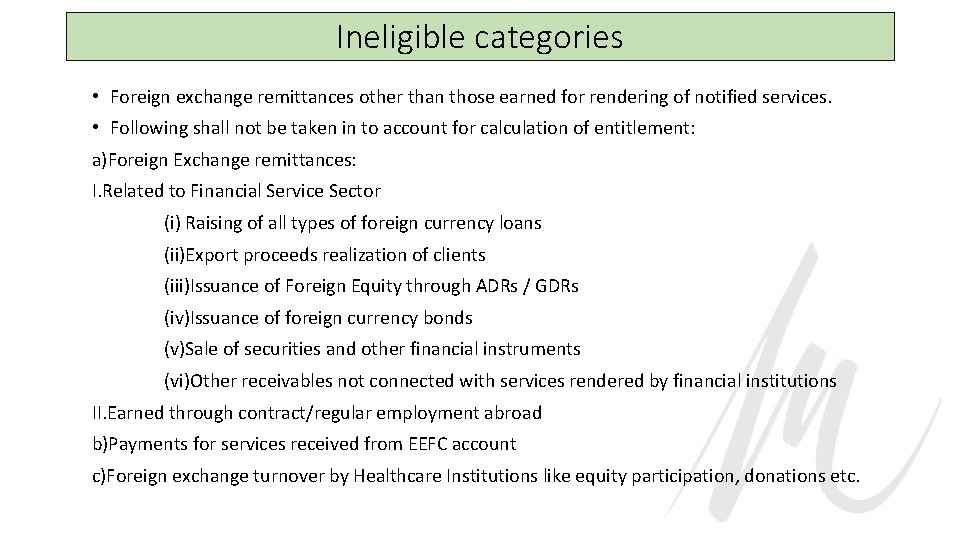

Ineligible categories • Foreign exchange remittances other than those earned for rendering of notified services. • Following shall not be taken in to account for calculation of entitlement: a)Foreign Exchange remittances: I. Related to Financial Service Sector (i) Raising of all types of foreign currency loans (ii)Export proceeds realization of clients (iii)Issuance of Foreign Equity through ADRs / GDRs (iv)Issuance of foreign currency bonds (v)Sale of securities and other financial instruments (vi)Other receivables not connected with services rendered by financial institutions II. Earned through contract/regular employment abroad b)Payments for services received from EEFC account c)Foreign exchange turnover by Healthcare Institutions like equity participation, donations etc.

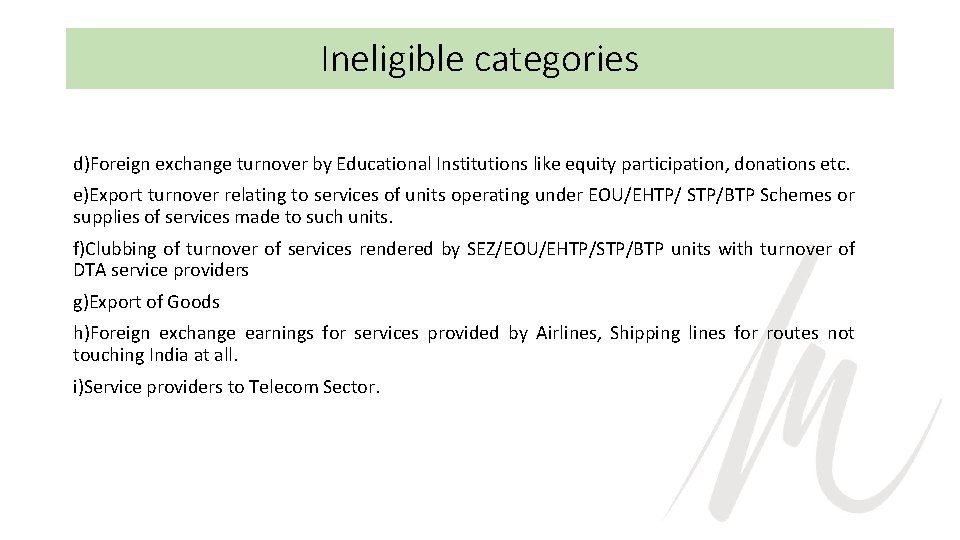

Ineligible categories d)Foreign exchange turnover by Educational Institutions like equity participation, donations etc. e)Export turnover relating to services of units operating under EOU/EHTP/ STP/BTP Schemes or supplies of services made to such units. f)Clubbing of turnover of services rendered by SEZ/EOU/EHTP/STP/BTP units with turnover of DTA service providers g)Export of Goods h)Foreign exchange earnings for services provided by Airlines, Shipping lines for routes not touching India at all. i)Service providers to Telecom Sector.

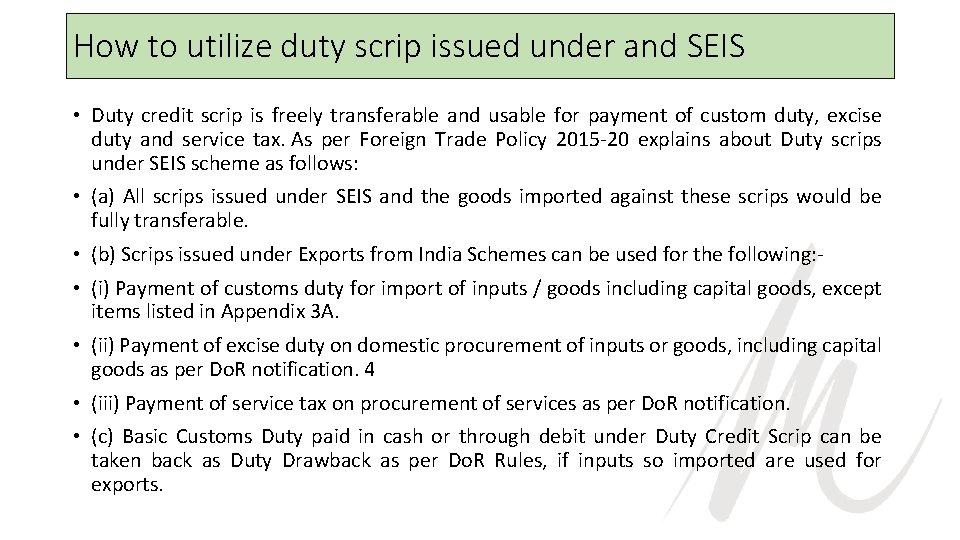

How to utilize duty scrip issued under and SEIS • Duty credit scrip is freely transferable and usable for payment of custom duty, excise duty and service tax. As per Foreign Trade Policy 2015 -20 explains about Duty scrips under SEIS scheme as follows: • (a) All scrips issued under SEIS and the goods imported against these scrips would be fully transferable. • (b) Scrips issued under Exports from India Schemes can be used for the following: • (i) Payment of customs duty for import of inputs / goods including capital goods, except items listed in Appendix 3 A. • (ii) Payment of excise duty on domestic procurement of inputs or goods, including capital goods as per Do. R notification. 4 • (iii) Payment of service tax on procurement of services as per Do. R notification. • (c) Basic Customs Duty paid in cash or through debit under Duty Credit Scrip can be taken back as Duty Drawback as per Do. R Rules, if inputs so imported are used for exports.

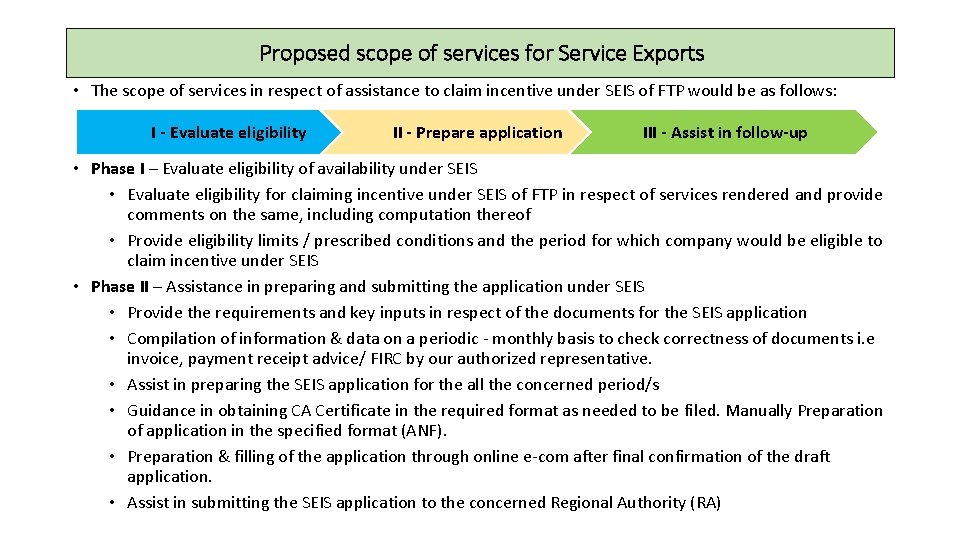

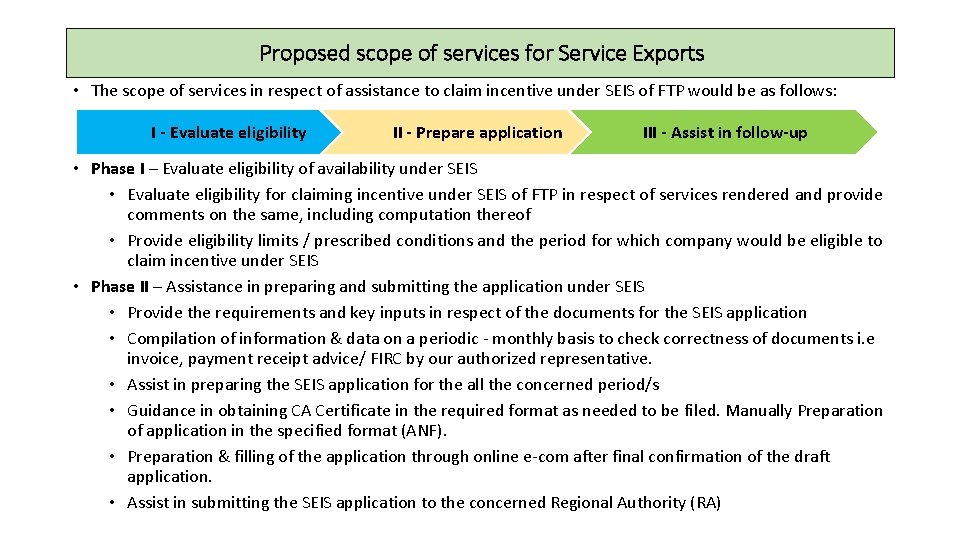

Proposed scope of services for Service Exports • The scope of services in respect of assistance to claim incentive under SEIS of FTP would be as follows: I - Evaluate eligibility II - Prepare application III - Assist in follow-up • Phase I – Evaluate eligibility of availability under SEIS • Evaluate eligibility for claiming incentive under SEIS of FTP in respect of services rendered and provide comments on the same, including computation thereof • Provide eligibility limits / prescribed conditions and the period for which company would be eligible to claim incentive under SEIS • Phase II – Assistance in preparing and submitting the application under SEIS • Provide the requirements and key inputs in respect of the documents for the SEIS application • Compilation of information & data on a periodic - monthly basis to check correctness of documents i. e invoice, payment receipt advice/ FIRC by our authorized representative. • Assist in preparing the SEIS application for the all the concerned period/s • Guidance in obtaining CA Certificate in the required format as needed to be filed. Manually Preparation of application in the specified format (ANF). • Preparation & filling of the application through online e-com after final confirmation of the draft application. • Assist in submitting the SEIS application to the concerned Regional Authority (RA)

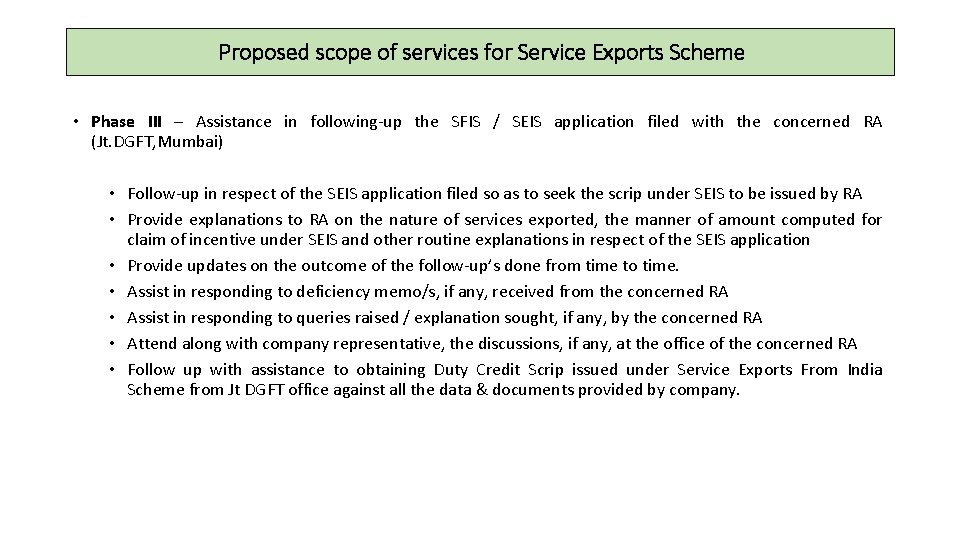

Proposed scope of services for Service Exports Scheme • Phase III – Assistance in following-up the SFIS / SEIS application filed with the concerned RA (Jt. DGFT, Mumbai) • Follow-up in respect of the SEIS application filed so as to seek the scrip under SEIS to be issued by RA • Provide explanations to RA on the nature of services exported, the manner of amount computed for claim of incentive under SEIS and other routine explanations in respect of the SEIS application • Provide updates on the outcome of the follow-up’s done from time to time. • Assist in responding to deficiency memo/s, if any, received from the concerned RA • Assist in responding to queries raised / explanation sought, if any, by the concerned RA • Attend along with company representative, the discussions, if any, at the office of the concerned RA • Follow up with assistance to obtaining Duty Credit Scrip issued under Service Exports From India Scheme from Jt DGFT office against all the data & documents provided by company.

Consultancy fees • Our Charges for Consultancy Services : • We believe that the essence of building a relationship is the quality of service and expertise that we provide. Our fees are based on the value added viable solutions we provide and the estimated time to be expended having regard to the level of experience of the staff concerned. In view of our long-term relationship, an effort has been made to keep our fees at a reasonable level consistent with our commitment to maintain the applicable technical and professional standards. • Therefore, we will quote our fees after completion of Phase-I i. e. evaluating, understanding and quantifying the claim.

Thanks & Regards, Prepared by FOR MADHU CORPORATE SERVICES PVT. LTD. 3 -B, Ganga Vihar, 94, Kazi Sayed Street, Mumbai-400 003 Tel - 2342 2710, 43470150/1 Fax - 2343 5774 Cell # AKASH – 99209 75047 KRUNAL - 98922 06171 Visit Us at www. madhuconsultancy. com "Save Paper, Don't print this e-mail unless it's really necessary , Think before printing" Every 3000 sheets of paper cost us a tree

Service export from india scheme

Service export from india scheme 3 domain scheme and 5 kingdom scheme

3 domain scheme and 5 kingdom scheme Scheme stata

Scheme stata Florida department of financial regulation

Florida department of financial regulation Unidad educativa seis de octubre de ventanas

Unidad educativa seis de octubre de ventanas Uno dos tres cuatro cinco seis siete ocho nueve diez

Uno dos tres cuatro cinco seis siete ocho nueve diez Seis sombreros para pensar ejemplos practicos

Seis sombreros para pensar ejemplos practicos Beta.seis.org login

Beta.seis.org login Jorge martn

Jorge martn Sombrero blanco de edward de bono

Sombrero blanco de edward de bono Deceos

Deceos Poliedro convexo com 36 hastes e 27 esferas

Poliedro convexo com 36 hastes e 27 esferas El exceso del doble de un número sobre 25

El exceso del doble de un número sobre 25