Section 2 The Allowance Method What Youll Learn

- Slides: 10

Section 2 The Allowance Method What You’ll Learn = The concept of matching uncollectible accounts with revenue. = The allowance method of accounting for uncollectible accounts. = How to record the adjustment for uncollectible accounts on the work sheet. = How to record estimated uncollectible amounts on the financial statements.

Section 2 The Allowance Method (cont'd. ) What You’ll Learn (cont'd. ) = How to journalize the adjusting entry for uncollectible accounts. = How write off an uncollectible account receivable using the allowance method. = How to record the collection of an account written off by the allowance.

Section 2 The Allowance Method (cont'd. ) Why It’s Important The allowance method of accounting for uncollectible accounts conforms to the matching principle. Key Terms = allowance method = book value of accounts receivable

Section 2 The Allowance Method (cont'd. ) Matching Uncollectible Accounts Expense with Revenue = One of the fundamental principles of accounting is that revenue should be matched with the expenses incurred in generating that revenue. = This means that expenses incurred to earn revenue should be deducted in the same period in which the revenue is recorded. = The uncollectible accounts expense should be reported in the year in which the sale takes place.

Section 2 The Allowance Method (cont'd. ) The Allowance Method = Matches the estimated uncollectible accounts expense with sales made during the same period. = At the end of the period, an estimate is made of the amount of uncollectible accounts that will result from the sales made during the period.

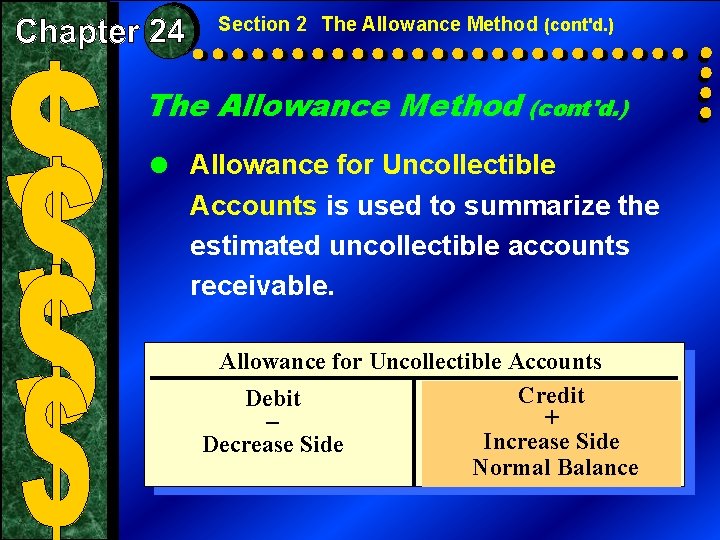

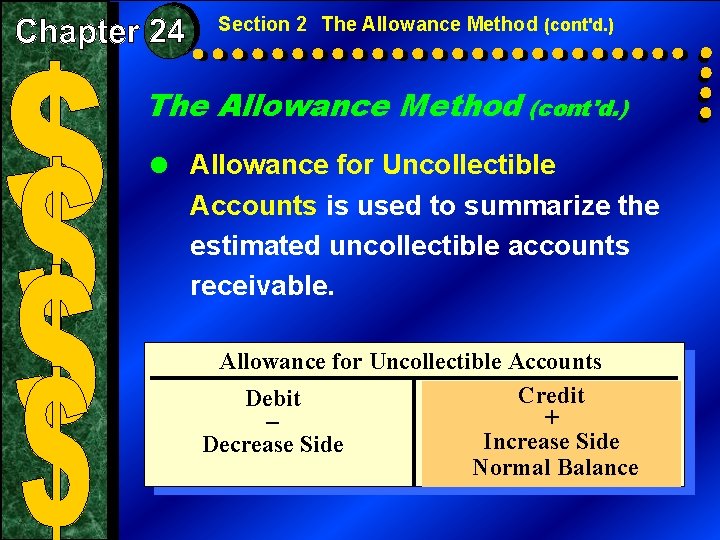

Section 2 The Allowance Method (cont'd. ) = Allowance for Uncollectible Accounts is used to summarize the estimated uncollectible accounts receivable. Allowance for Uncollectible Accounts Credit Debit + – Increase Side Decrease Side Normal Balance

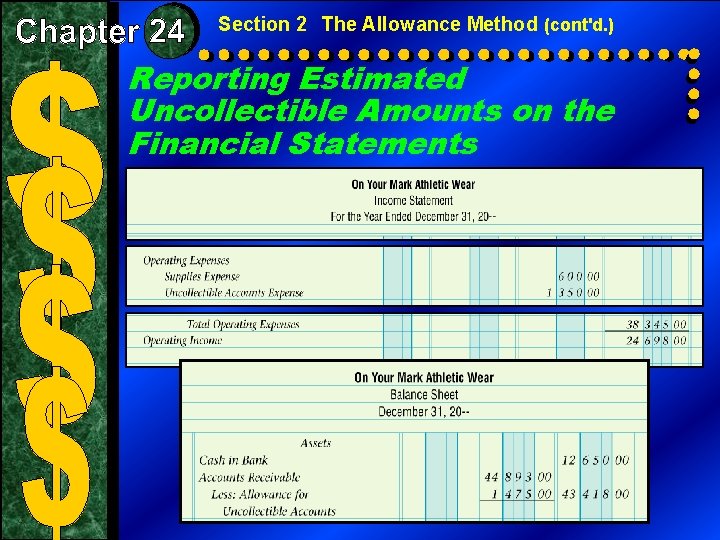

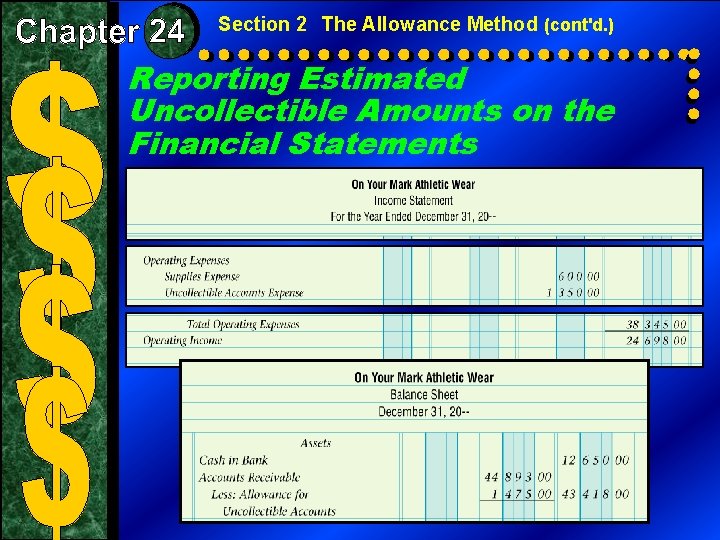

Section 2 The Allowance Method (cont'd. ) Reporting Estimated Uncollectible Amounts on the Financial Statements

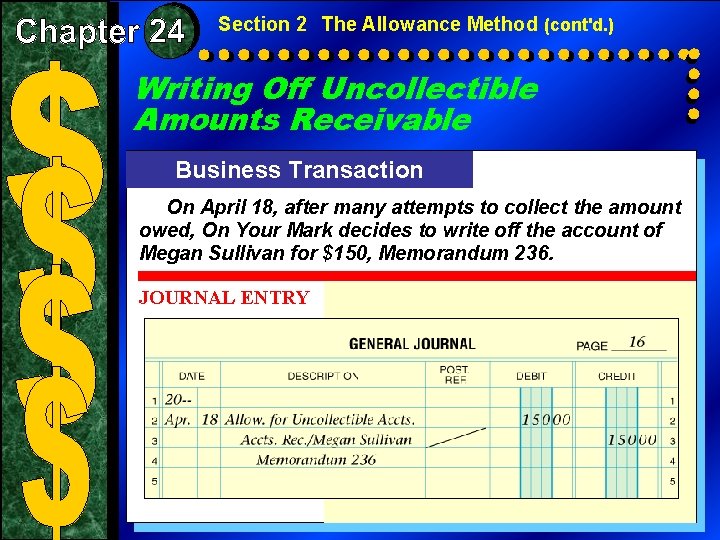

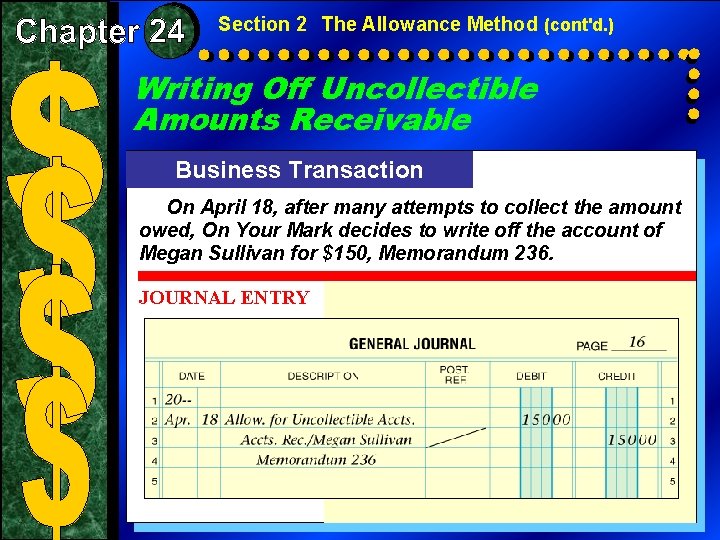

Section 2 The Allowance Method (cont'd. ) Writing Off Uncollectible Amounts Receivable Business Transaction On April 18, after many attempts to collect the amount owed, On Your Mark decides to write off the account of Megan Sullivan for $150, Memorandum 236. JOURNAL ENTRY

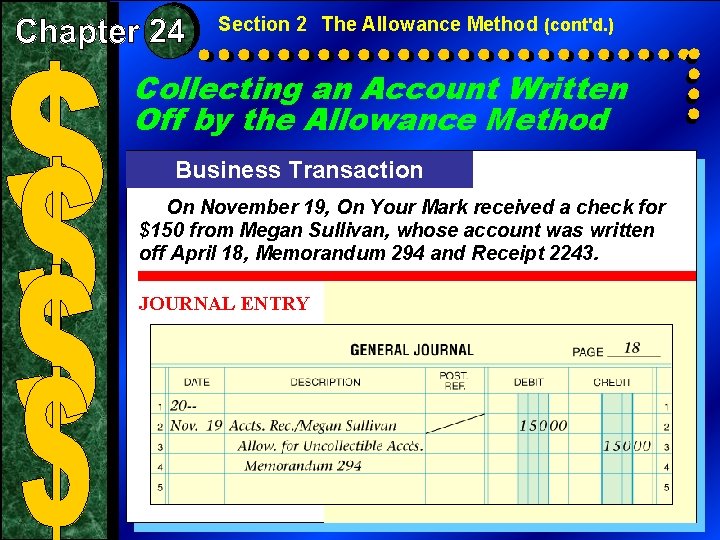

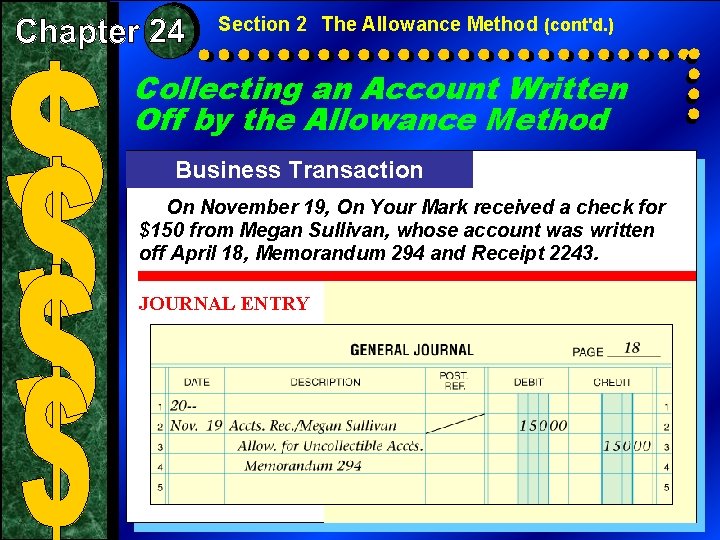

Section 2 The Allowance Method (cont'd. ) Collecting an Account Written Off by the Allowance Method Business Transaction On November 19, On Your Mark received a check for $150 from Megan Sullivan, whose account was written off April 18, Memorandum 294 and Receipt 2243. JOURNAL ENTRY

Section 2 The Allowance Method (cont'd. ) Check Your Understanding Explain the use of the allowance method of accounting for uncollectible accounts.