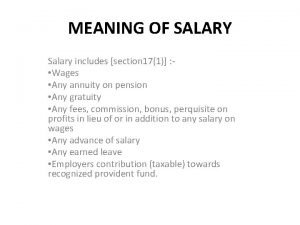

SALARY PERQUISITES PERQUISITES Section 172 Us 171 Salary

![PERQUISITES [Section 17(2)] U/s 17(1) 'Salary' includes the value of any perquisite allowed or PERQUISITES [Section 17(2)] U/s 17(1) 'Salary' includes the value of any perquisite allowed or](https://slidetodoc.com/presentation_image_h2/5322ef53abd816f9ed3638f5a384c808/image-2.jpg)

- Slides: 21

SALARY PERQUISITES

![PERQUISITES Section 172 Us 171 Salary includes the value of any perquisite allowed or PERQUISITES [Section 17(2)] U/s 17(1) 'Salary' includes the value of any perquisite allowed or](https://slidetodoc.com/presentation_image_h2/5322ef53abd816f9ed3638f5a384c808/image-2.jpg)

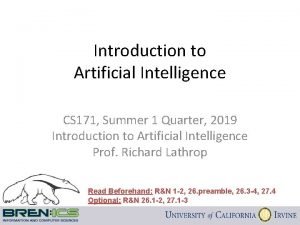

PERQUISITES [Section 17(2)] U/s 17(1) 'Salary' includes the value of any perquisite allowed or amenity provided by employer to employee. . Perquisite simply means any casual emolument attached to an office. Dictionary defines perquisite as "any casual emolument, fee or profit attached to an office or position, in addition to salary or wages".

Perquisites may be given in a variety of forms: Under section 17(2) perquisites are of the following types : - (i) The value of rent-free accommodation provided to the assessee by his employer [Sec. 17(2)(i)] : (ii) The value of any concession in the matter of rent respecting any accommodation provided to the assessee by his employer [Sec. 17(2) (ii)]: (iii) The value of any benefit or amenity granted or provided free of cost or at concessional rate in any case [Sec. 17(2)(iii)] : (iv) Any sum paid by the employee in respect of any obligation which, but for such payment would have been payable by the employee [Sec. 17(2)(iv)] :

(v) Any sum payable by the employer, whether directly through a fund, other than a recognized provident fund [Sec. (2)(v)] : (vi) The value of any specified security or sweat equity shares allotted or transferred directly or indirectly, by the employer or former employer, free of cost or at concessional rate to the assessee [Sec. 17(2)(vi)] : (vii) The amount of any contribution to an approved superannuation fund by the employer in respect of the assessee, to the extent it exceeds Rs. 1, 000; and [Section 17(2)(vii)] (viii) The value of any other fringe benefit or amenity as may be prescribed. [Sec. 17(2)(viii)] provided that nothing in his clause shall apply to: 1. the value of any medical treatment provided to an employ or any other member of his family

2. Any sum paid by the employer in respect of any expenditure actually incurred by the employee on his medical treatment or of any member of his family 3. Any portion of the premium paid by an employer in relation to an employee 4. Any sum paid by an employer in respect of any premium paid by an employee 5. any sum paid by an employer in respect of any expenditure actually incurred by an employee Etc

TAXABILITY OF PERQUISITES TYPES OF PERKS Perks can be divided into three categories A. Perks exempted for all employees ; B. Perks taxable for all employees ; C. Perks taxable only for specified employees.

A. Exempted From Tax Value of following benefits is not added in salary income : A-1. Free medical facilities or reimbursement of medical expenditure : Exemption under this section shall be allowed for treatment of self, wife, dependent children, dependent parents and dependent brothers and sisters. A-2. Free refreshment supplied by employer to its employees during office hours in office premises except free meals is Fully exempted. A-3. Free meals given at remote area or offshore installation shall be Fully exempted.

A-4. Free recreational facilities provided by employer to its employees is Fully exempted. A-5. Provision of telephones including mobile phones given by the employer to employee to facilitate the business of the employer is Fully exempted. A-6. Free education which is provided by employer from its own resources who is engaged in such business provided value of such benefit does not exceed Rs. 1, 000 p. m. per child is Fully exempted. A-7. Cost of refresher course attended by employee met by employer. In case employer meets expenditure of higher education or training whether in India or abroad is Fully exempted.

A-8. Any rent-free residential accommodation to Judges of High Court or Supreme Court is Fully exempted. A-9. Goods sold by an employer to his employees at concessional rate. The amount of concession given is Fully exempted. A-10. Free ration received by members of armed forces is Fully exempted. A-11. Perquisites allowed by Govt. to its employees posted abroad is Fully exempted. A-12. Rent free house given to an officer of Parliament, a Union Minister and leader of opposition in Parliament is Fully exempted.

A-13. Conveyance facilities to Judges of Supreme Court and High court is Fully exempted. A-14. Free conveyance provided by employer to employees for going to or coming from place of employment is Fully exempted. A-15. Any amount contributed by employer towards pension or deferred annuity scheme is Fully exempted. A-16. Employer's contribution to staff group insurance scheme is Fully exempted. A-17. Computers, laptops given to [no transferred] an employee for official/personal use is Fully exempted. A-18. Transfer of a moveable asset [computer, car or electronic items] without consideration to an employee after such asset has been used by the employer for more than 10 years is Fully exempted.

A-19. Accident insurance premium paid by employer for his own benefit. In such case premium is paid for an insurance whose benefit is to accrue to the employee, it will be taxable is Fully exempted. A-20. Interest free loan (a) In case total amount of all loans taken by an employee from his employer does not exceed Rs. 20, 000 is Fully exempted. (b) In case loan is taken for any other purpose and rate of interest is equal to or higher than the rate prescribed by SBI on 1 -4 -2013 is Fully exempted. A-21. Income tax on perquisites if paid by employer is Fully exempted. A-22. Any unauthorized use of a benefit is Fully exempted.

B. PERKS TAXABLE FOR ALL EMPLOYESS B-1 RENT FREE HOUSE [Section 17(2)(i) Rule 3(1) as amended by notification no. 94/2009 dated 18 -122009] Before calculating the value of rent free house, following information is collected: 1. Nature of Employment 2. place where rent free house is provided 3. Meaning of accommodation 4. Nature of accommodation 5. Meaning of salary

B-2 In case accommodations is provided as concessional accommodation [Section 17(2)(i) Rule 3(1) as amended by notification no. 94/2009 dated 1812 -2009] Accommodation AT CONCESSIONAL RENT MEANS that employer has given a house to his employees for which he is charging a part of the rent and thus employee is enjoying a perquisite. B-3 Obligation of employee met by employer [Section 17(2)(iv)] In case of any of the following payments are made by employer these are fully taxable these are: (a) Gas & Electricity bills (b) Education of Children Bills

( c) Income tax Professional tax ( d) salary of domestic servants B-4. Sum payable by the Employer directly or through a fund to effect an assurance/an annuity [Section 17(2)(v)] Any sum payable by the employer for employees shall be treated as perk to employee if: (a) The amount is payable by the employer to effect the assurance on the life of the assessee or (b) The amount is payable by the employer to effect a contract for annuity for employee

B-5 Any specified security or sweat equity shares allotted or transferred to employee [Section 17(2)(vi)] The value of any specified security or sweat equity shares allotted or transferred by the employer or former employer of the employee either free of cost or at concessional rate shall be treated as perk to employee. Such transfer to employee may be direct or indirect. B-6 Contribution to an approved superannuation fund by the employer [Section 17(2)(vii)] The amount of any contribution made by an employer to an approved superannuation fund in

to the employee to the extent it exceeds Rs 1, 000 B-7 Value of any other prescribed fringe benefits or amenities [Section 17(2)(vii)] The followings benefits or amenities have been prescribed: B-7 -1 Interest free or concessional loan from employer B-7 -2 Valuation of perk in respect of Travelling, Touring , Accommodation B-7 -3 Food & Beverages Facility B-7 -4 Valuation of Perquisite in respect of gift voucher or Token B-7 -5 Valuation of Perquisite in respect of Credit Card B-7 -6 Valuation of Perquisite in respect of Club Facility B-7 -7 Use of moveable assets B-7 -8 Transfer of Moveable assets to the Employee

C. Perks taxable in specified cases only Meaning of specified employee A) if he is director of the company or B) he has substantial in interest in the affairs of the company i. e. He hold at least 20 per of the voting power (equity shares) in the company C) his monetary annual salary income is more than Rs. 50, 000 p. a. salary for this purpose means all what he gets in cash from One employer or more than one employer if he works for more than One employer simultaneously whether full time or part time and is taxable the head salary

C-1 Valuation of perquisite of motor Car on any Automotive Conveyance (RULE 3(2) In case of employer had provided a car or any other vehicle for the private use of the employee or any other member of his family it is a perquisite which is taxable in the hands of the employee provided he? she is a employee of a specified category. The valuation of Perk shall be made as under : 1. Motor car is owned or hired by employer and its running and maintenance expenses are met or reimbursed by employer. a) car is fully used in the performance of official duties of the employee b) car is fully used for personal a private or family purpose of the employee c) Car is used partly in the performance of duties and partly for private or personal purposes

2. Car is owned by employee but its running and maintenance expenses are met or reimbursed by employer. 3. where the employee owns any other automotive conveyance but the actual running and maintenance expensive are met or reimbursed by employer. C-2 Perquisite of Free domestic servants In case employer has provided the free service of a sweeper, a watchman or a personal attendant , taxable value of his type of perquisite shall be the actual cost to the employer i. e. salary etc value of perk { amount spent by employer} - {amount charged by employer from employee}

C-3 Perquisite in respect of free gas electricity energy water supply rule 3(4) In case employer has purchased gas electric energy or water supply from outside agency the taxable value of perk shall be equal to the amount paid by employer to outside agency. value of perk= (amount spend by employer)-(amount charged by employer} C-4 Free educational facilities to children of employee household 1: Payment or reimbursement of fess of School College: in case school or college fees of family member of employee is aid by employer directly to school or college or fee paid by the employee is reimbursed by employer it is a taxable perquisite whether employee is specified or non specified.

2: Educational facilities in school or college maintained by employer In case school etc is run by employer and free educational facilities given to children of employee the perk is calculated: a)free educational facilities to employees own children b)free education facilities to any member of employee household c. 5 FACALITY OF FREE CONSESSIONAL PRIVATE JOURNEY TO ANA EMPLOYEE BY THE EMPLOYER ENGAGGED IN THE CARRIAGE OF PASSENGERS OR GOODSCRULE 3(6) value of perk= {normal freight or fare - {amount charged chargeable from public } recovered from e employee}

172+172+283+283

172+172+283+283 Movable assets

Movable assets Perquisites in income tax

Perquisites in income tax Pg 171

Pg 171 29052007

29052007 The verbs salir decir and venir p 155 answers

The verbs salir decir and venir p 155 answers Nonlinear pricing strategies

Nonlinear pricing strategies Ai 171

Ai 171 Ai 171

Ai 171 Tax allowance meaning

Tax allowance meaning Informasiya prosesleri

Informasiya prosesleri 171 nomreli mekteb

171 nomreli mekteb Decret 171/2015

Decret 171/2015 Dot

Dot Cs 171 uci

Cs 171 uci 171 in binary

171 in binary 171 nomreli mekteb

171 nomreli mekteb 171 sayli mekteb

171 sayli mekteb Subnet mask kelas b

Subnet mask kelas b Phys 172

Phys 172 172,16,0,1

172,16,0,1 Ping 172

Ping 172