SAG Infotech Private Limited GenXD An Excise Software

- Slides: 27

SAG Infotech Private Limited Gen-XD : An Excise Software Now No more Exercise on Excise! Soft solutions for those who can’t afford to make errors.

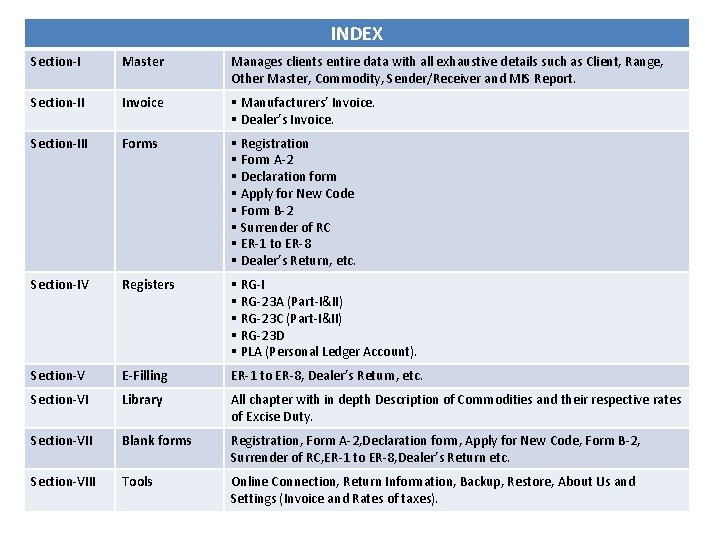

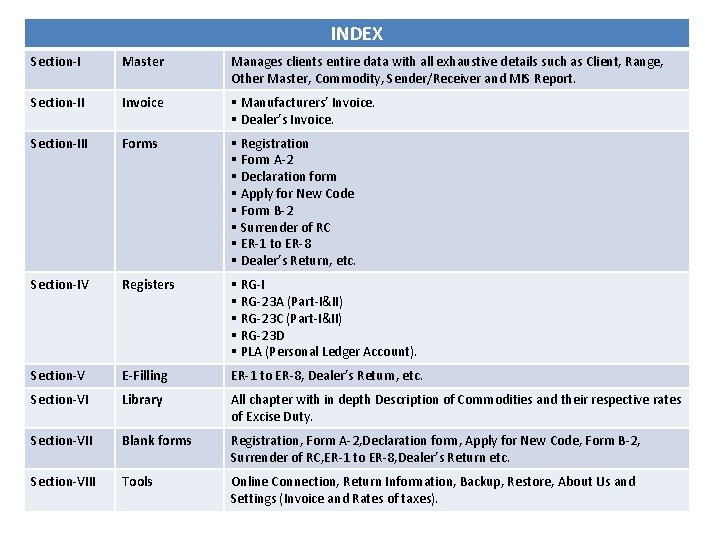

INDEX Section-I Master Manages clients entire data with all exhaustive details such as Client, Range, Other Master, Commodity, Sender/Receiver and MIS Report. Section-II Invoice § Manufacturers’ Invoice. § Dealer’s Invoice. Section-III Forms § Registration § Form A-2 § Declaration form § Apply for New Code § Form B-2 § Surrender of RC § ER-1 to ER-8 § Dealer’s Return, etc. Section-IV Registers § RG-I § RG-23 A (Part-I&II) § RG-23 C (Part-I&II) § RG-23 D § PLA (Personal Ledger Account). Section-V E-Filling ER-1 to ER-8, Dealer’s Return, etc. Section-VI Library All chapter with in depth Description of Commodities and their respective rates of Excise Duty. Section-VII Blank forms Registration, Form A-2, Declaration form, Apply for New Code, Form B-2, Surrender of RC, ER-1 to ER-8, Dealer’s Return etc. Section-VIII Tools Online Connection, Return Information, Backup, Restore, About Us and Settings (Invoice and Rates of taxes).

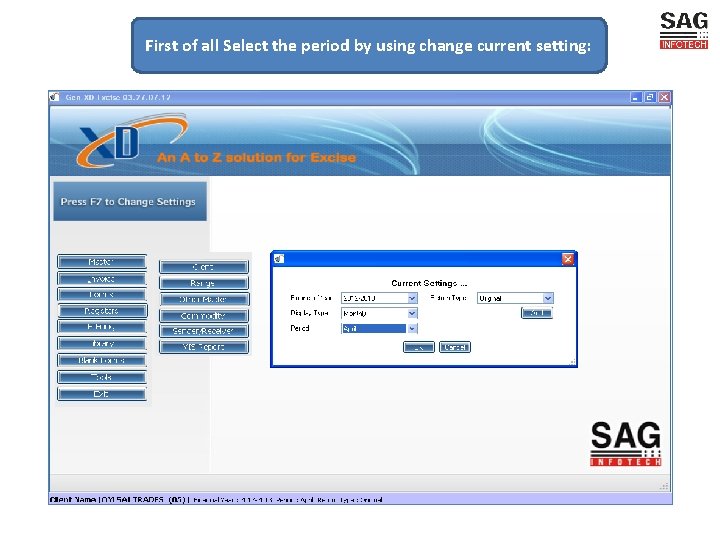

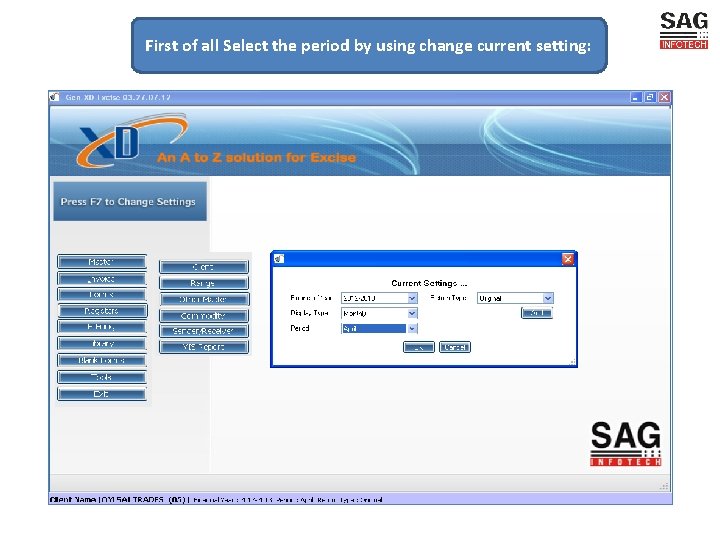

First of all Select the period by using change current setting:

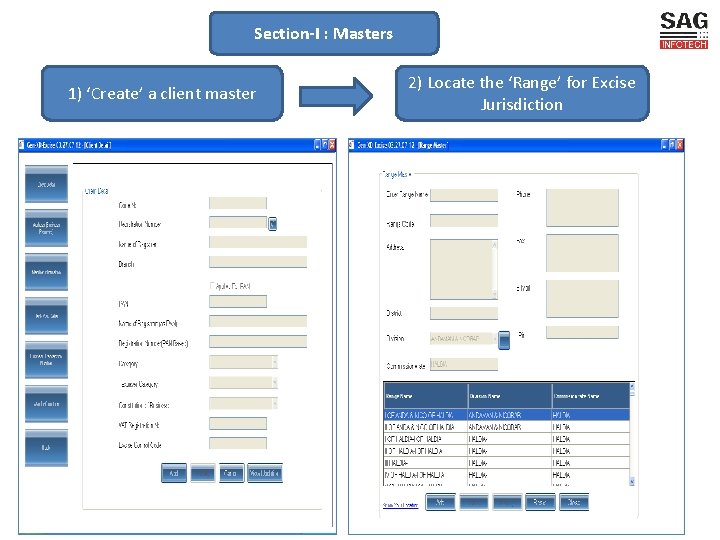

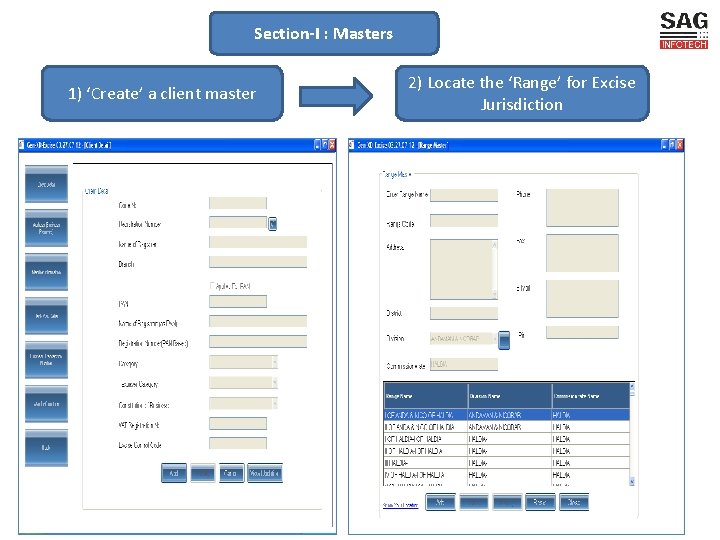

Section-I : Masters 1) ‘Create’ a client master 2) Locate the ‘Range’ for Excise Jurisdiction

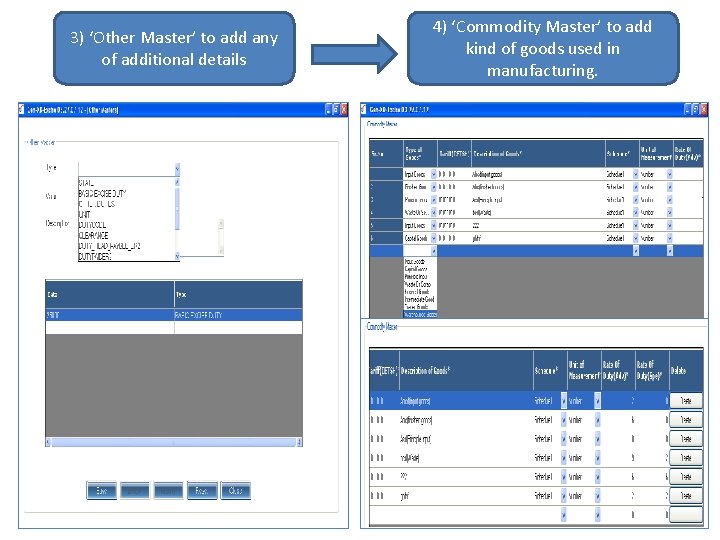

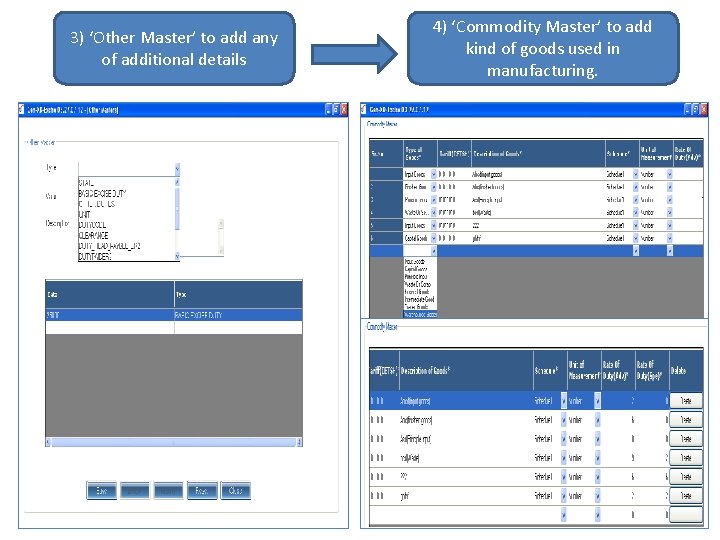

3) ‘Other Master’ to add any of additional details 4) ‘Commodity Master’ to add kind of goods used in manufacturing.

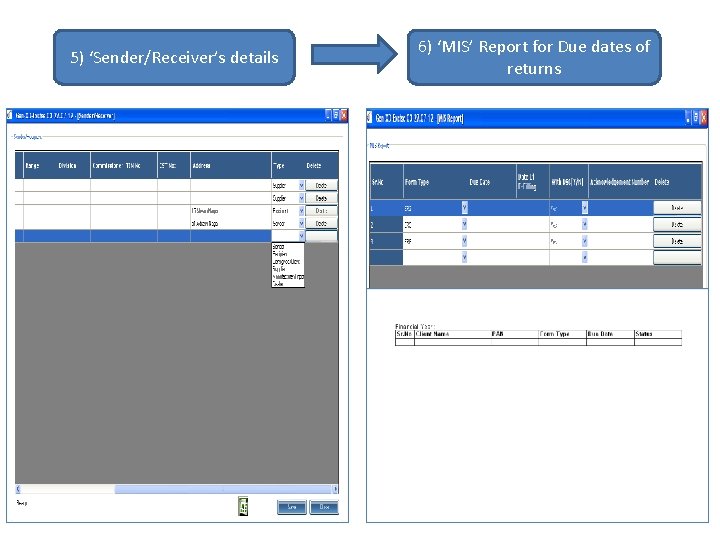

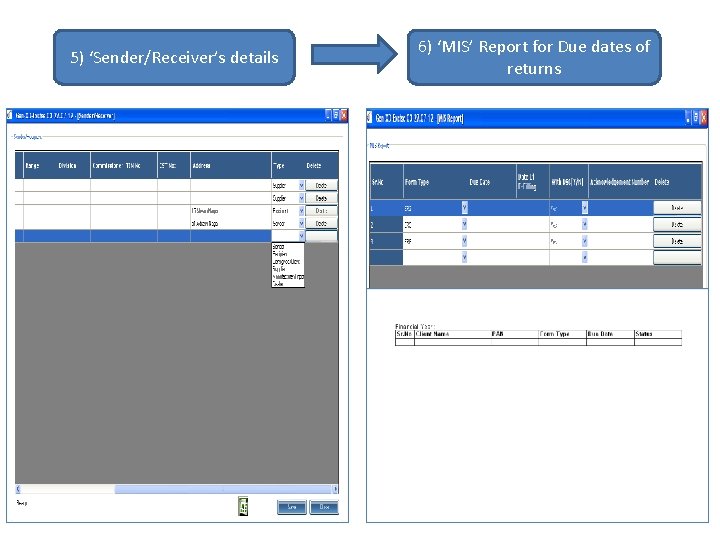

5) ‘Sender/Receiver’s details 6) ‘MIS’ Report for Due dates of returns

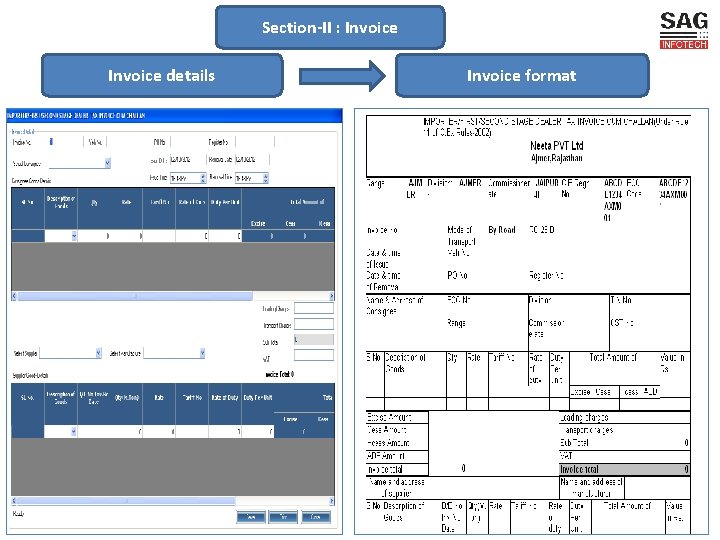

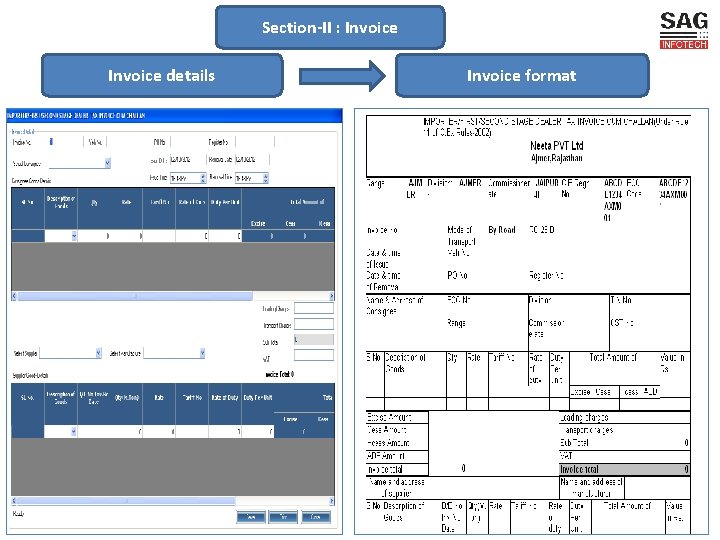

Section-II : Invoice details Invoice format

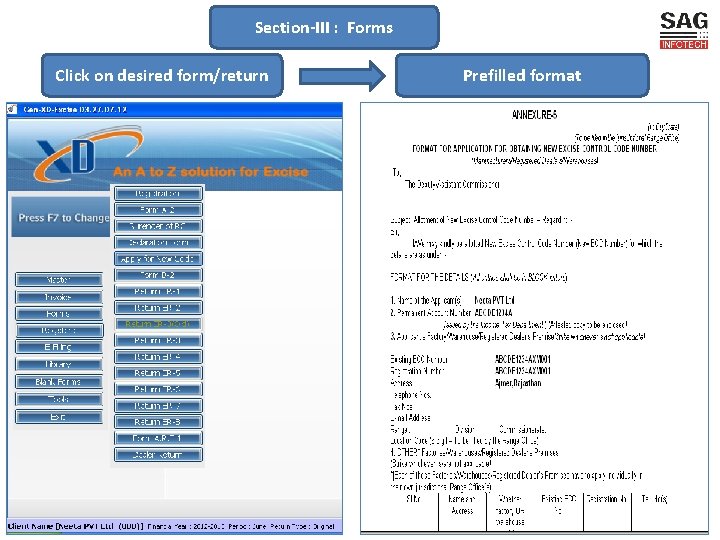

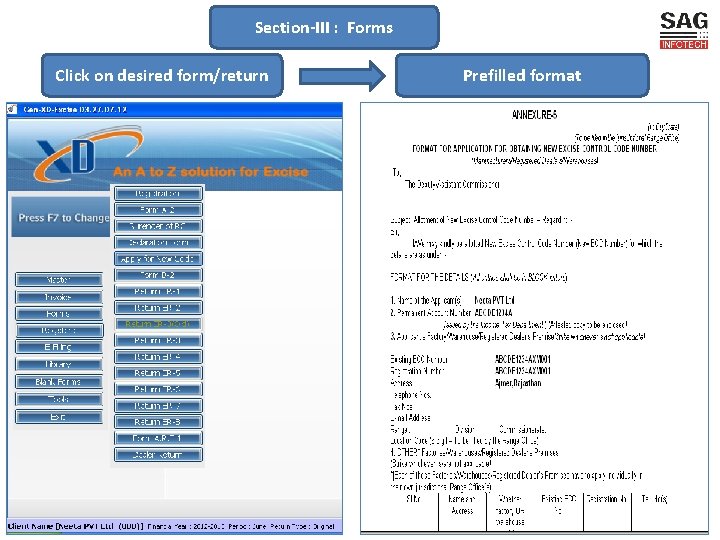

Section-III : Forms Click on desired form/return Prefilled format

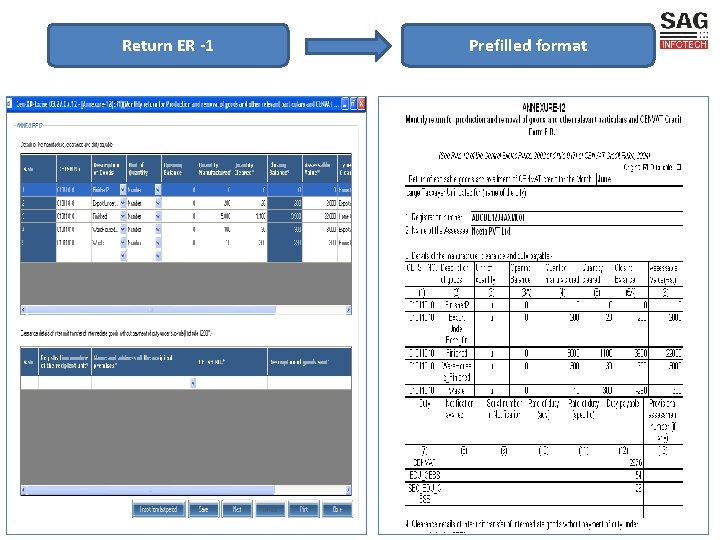

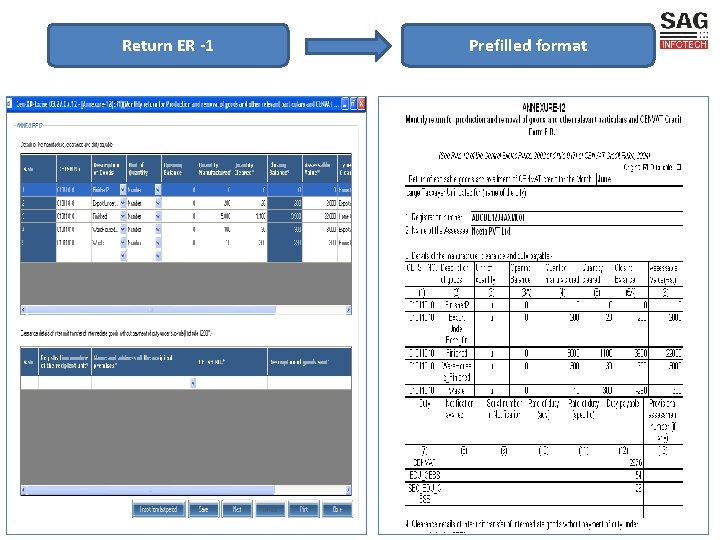

Return ER -1 Prefilled format

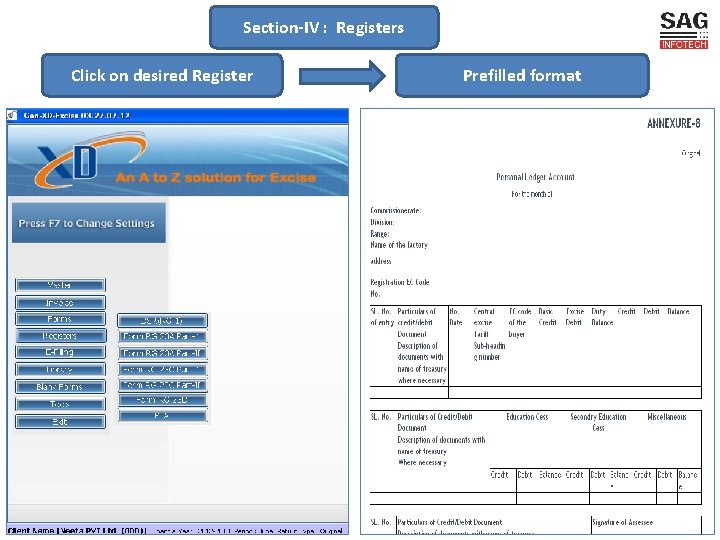

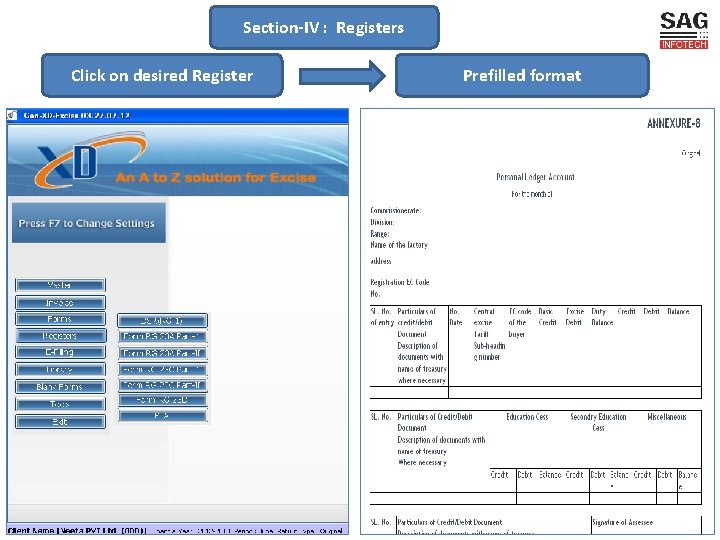

Section-IV : Registers Click on desired Register Prefilled format

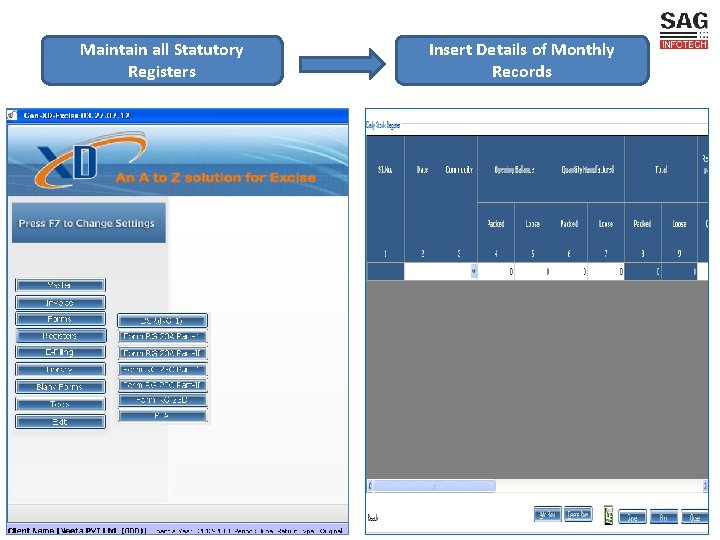

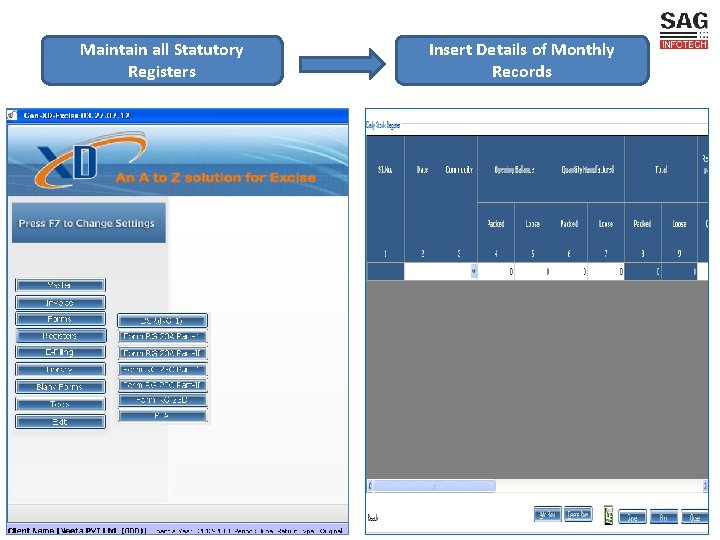

Maintain all Statutory Registers Insert Details of Monthly Records

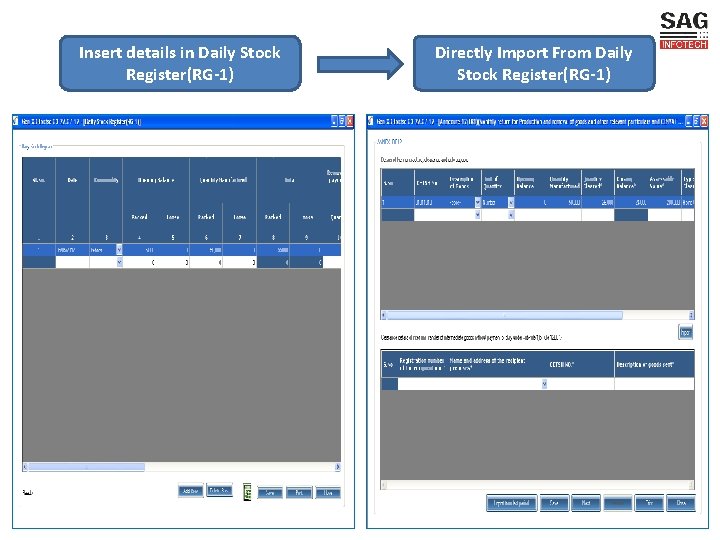

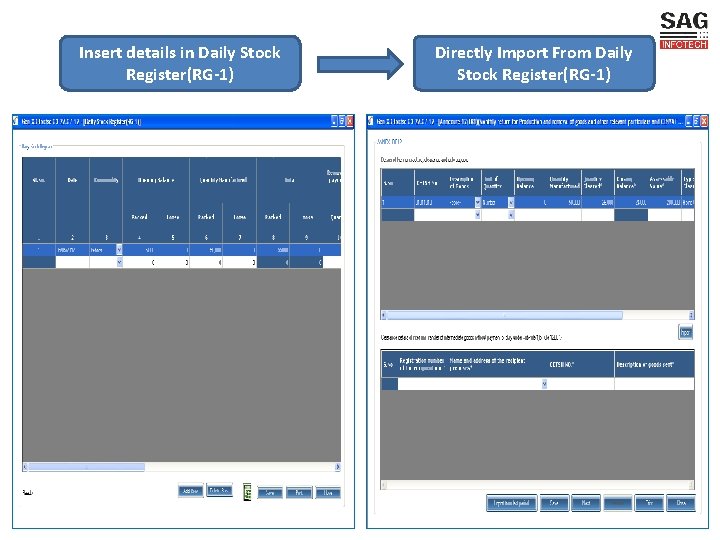

Insert details in Daily Stock Register(RG-1) Directly Import From Daily Stock Register(RG-1)

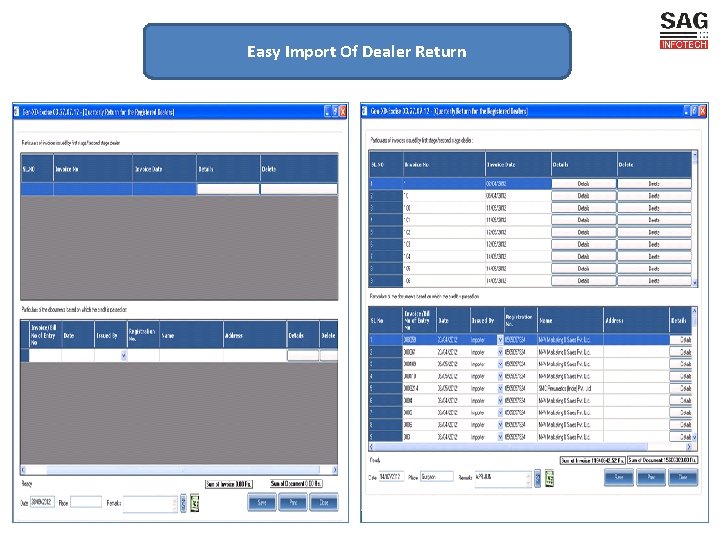

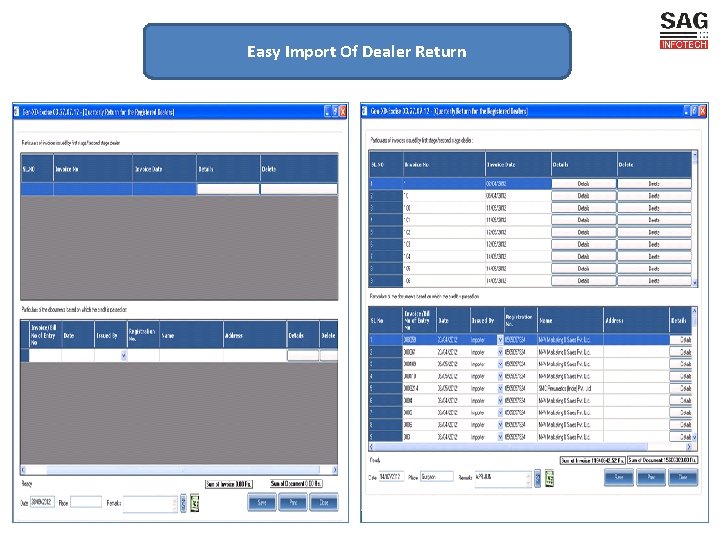

Easy Import Of Dealer Return

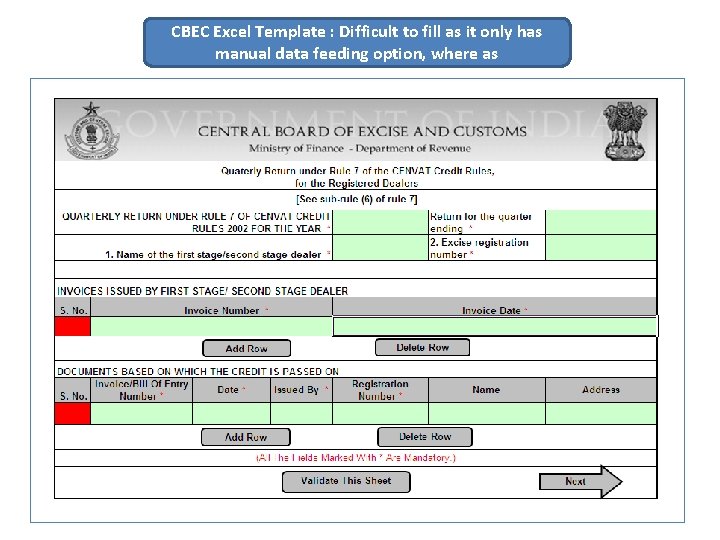

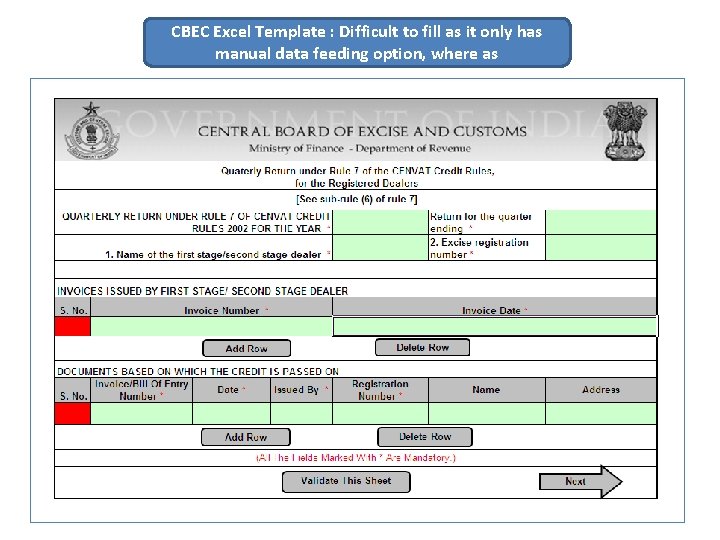

CBEC Excel Template : Difficult to fill as it only has manual data feeding option, where as

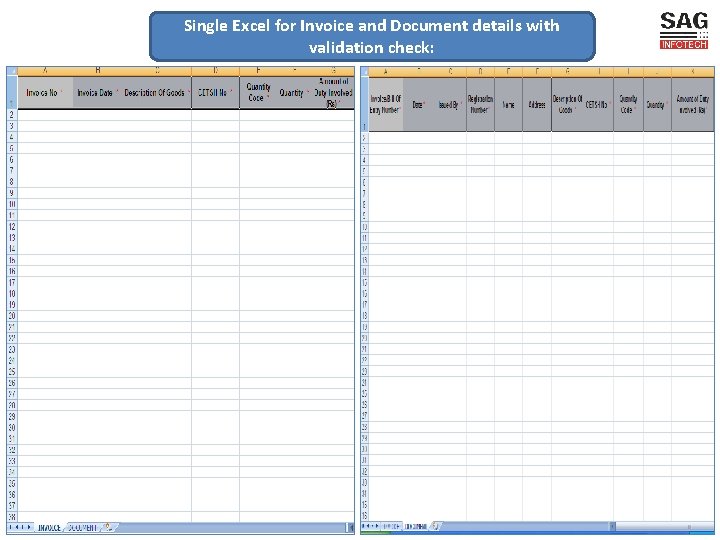

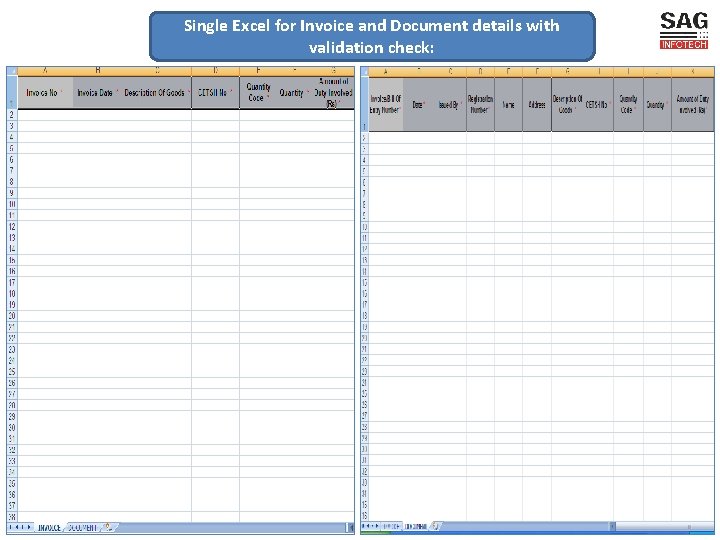

Single Excel for Invoice and Document details with validation check:

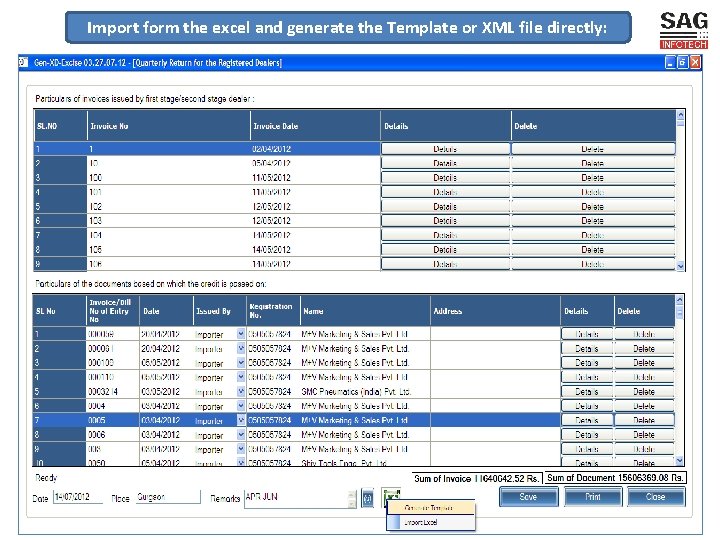

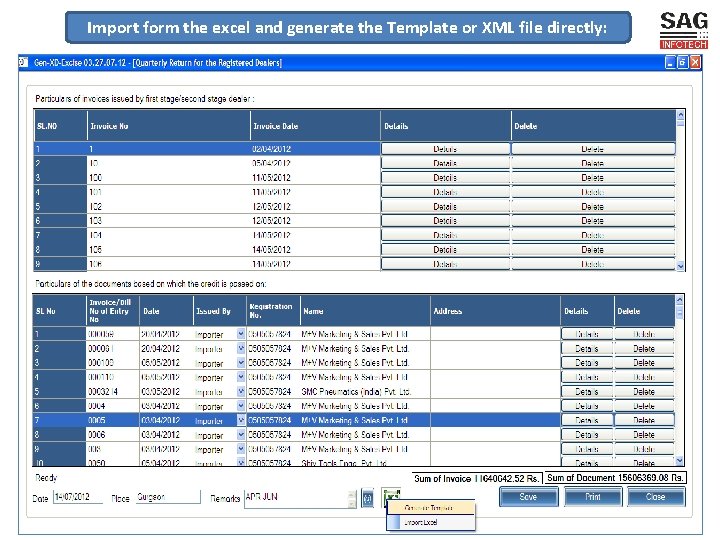

Import form the excel and generate the Template or XML file directly:

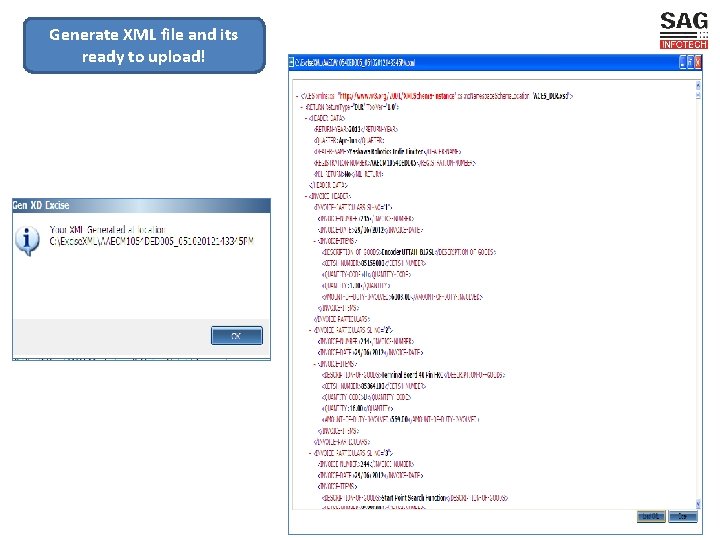

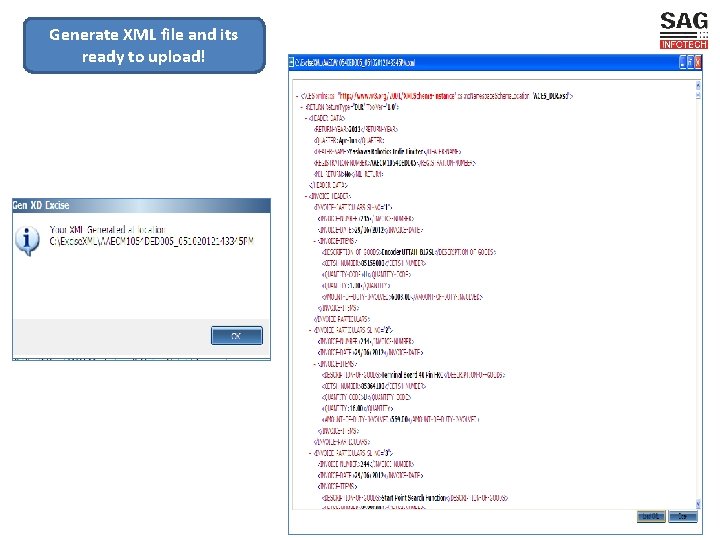

Generate XML file and its ready to upload!

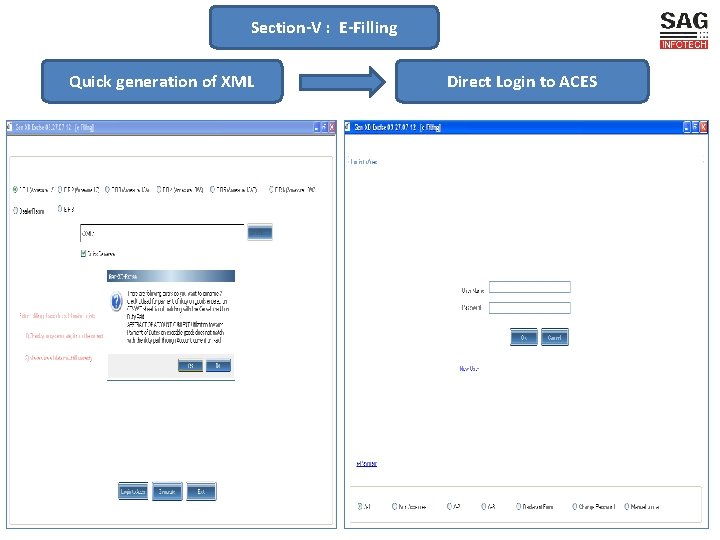

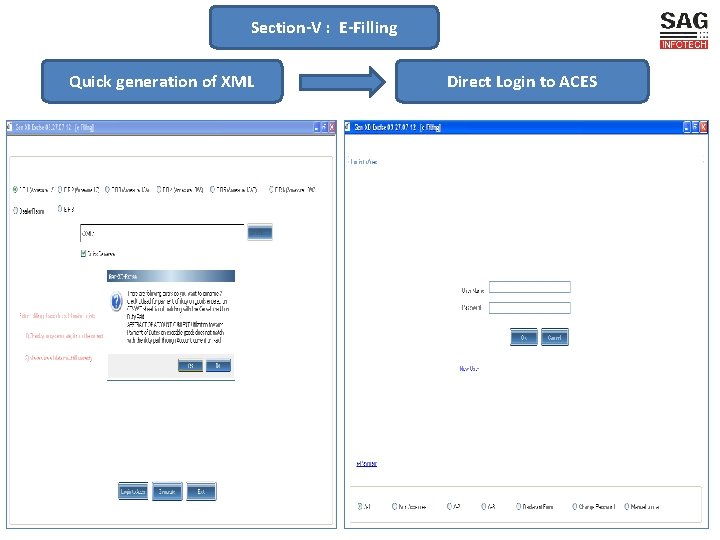

Section-V : E-Filling Quick generation of XML Direct Login to ACES

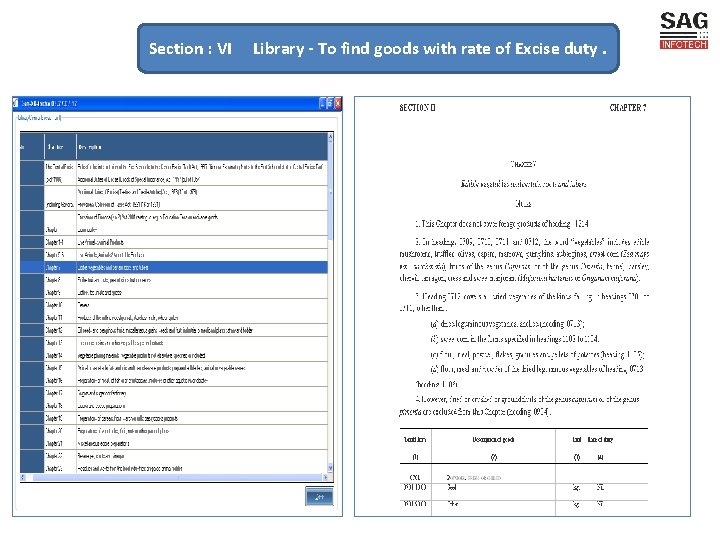

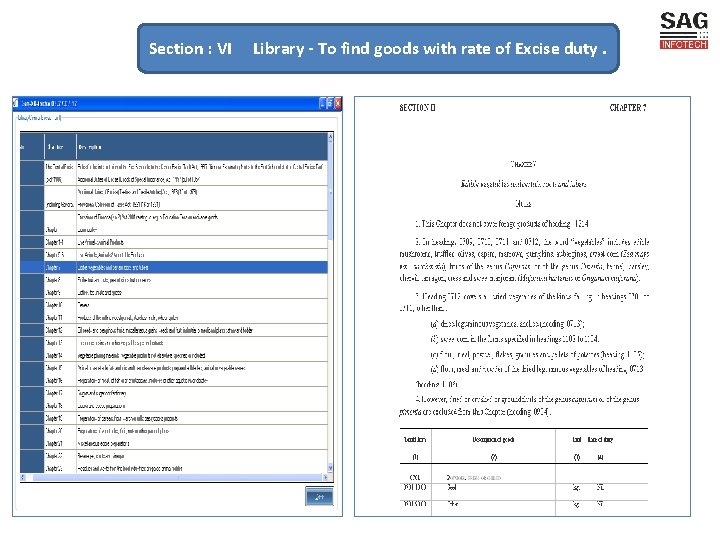

Section : VI Library - To find goods with rate of Excise duty.

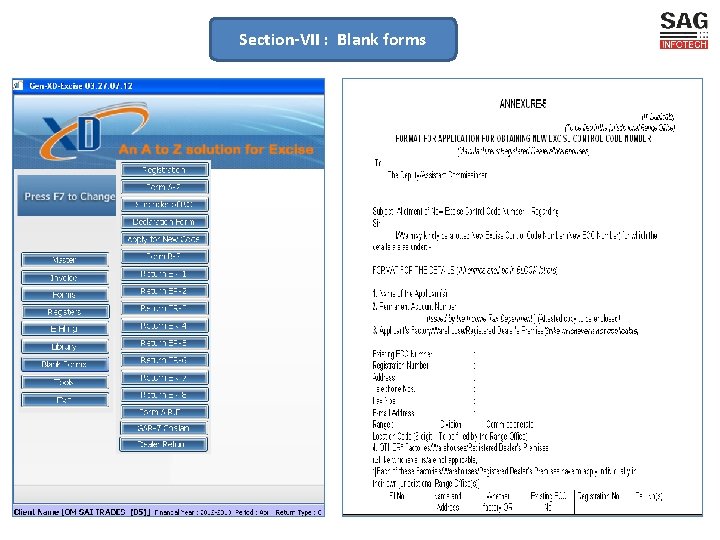

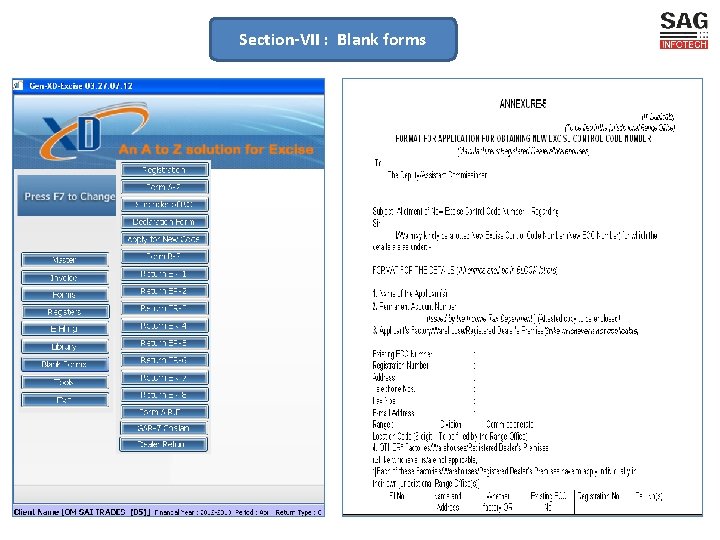

Section-VII : Blank forms

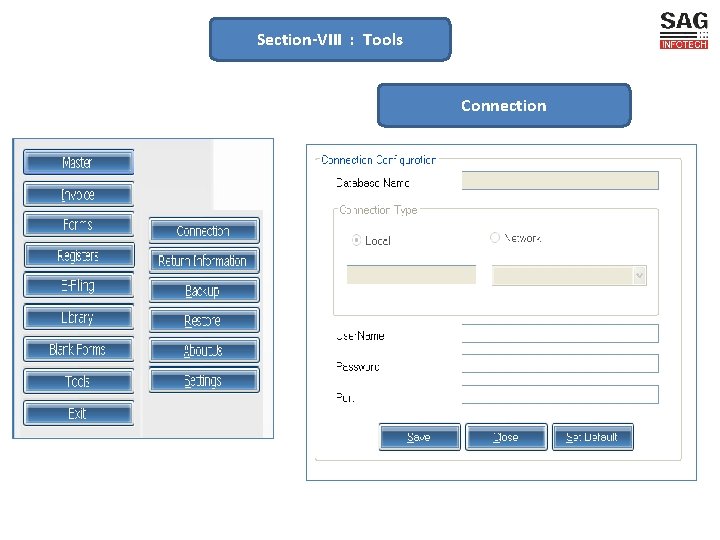

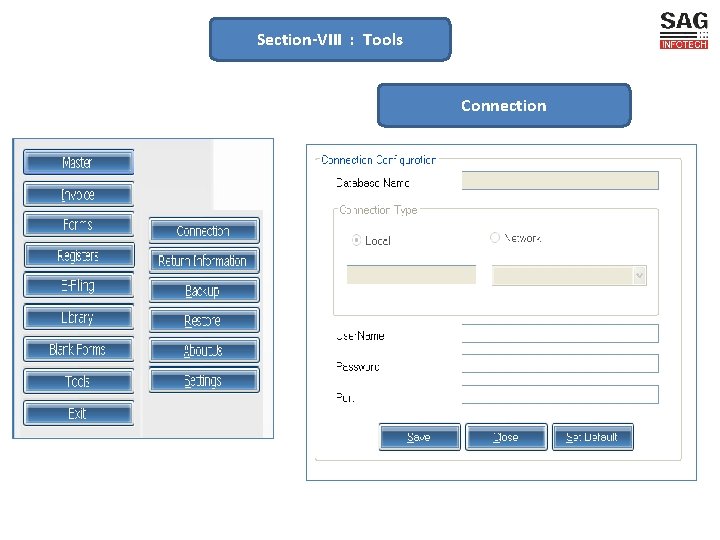

Section-VIII : Tools Connection

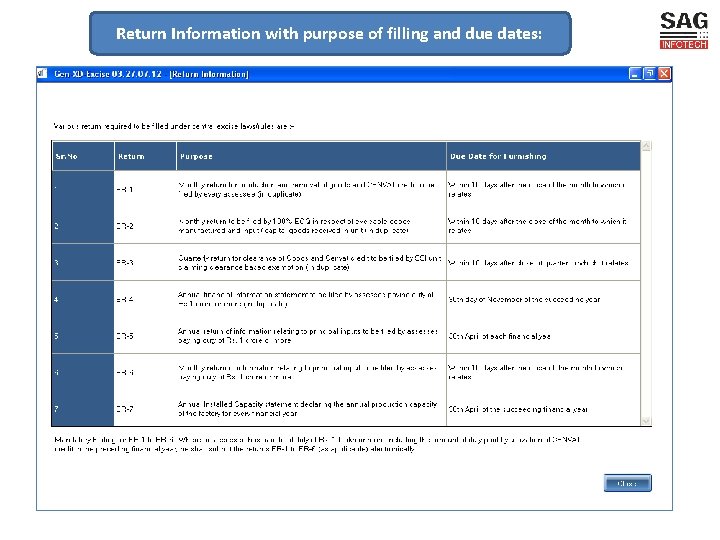

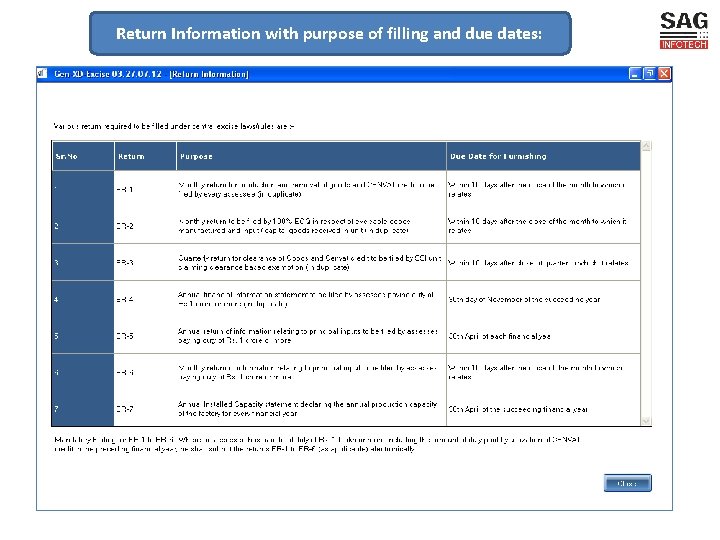

Return Information with purpose of filling and due dates:

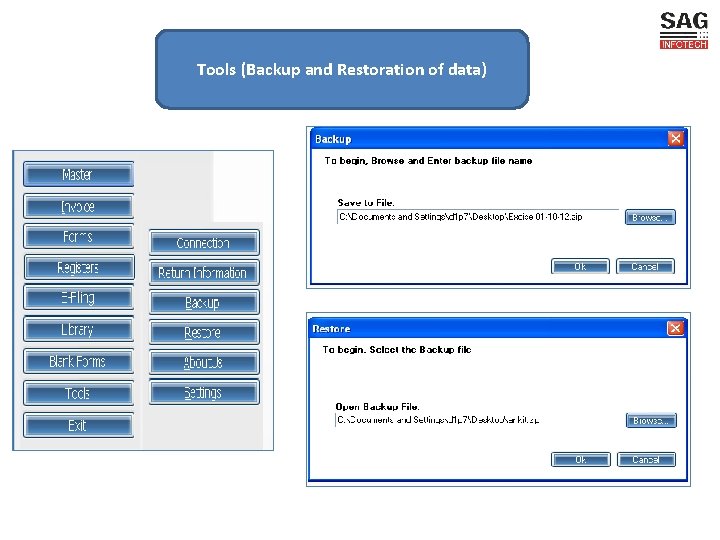

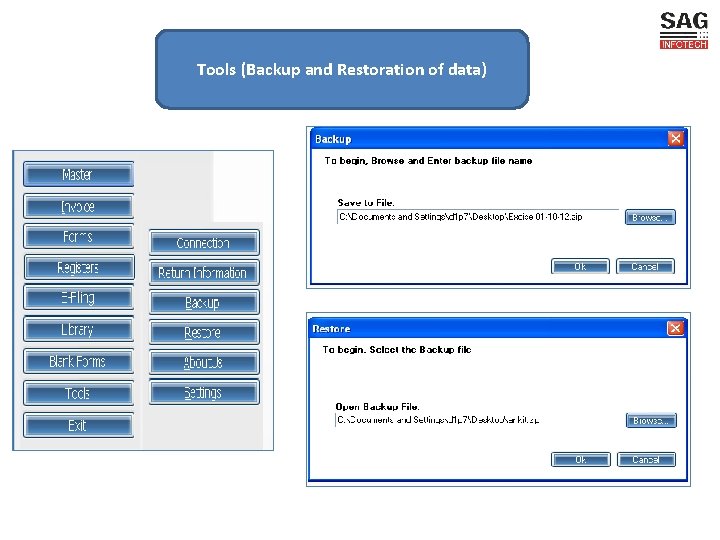

Tools (Backup and Restoration of data)

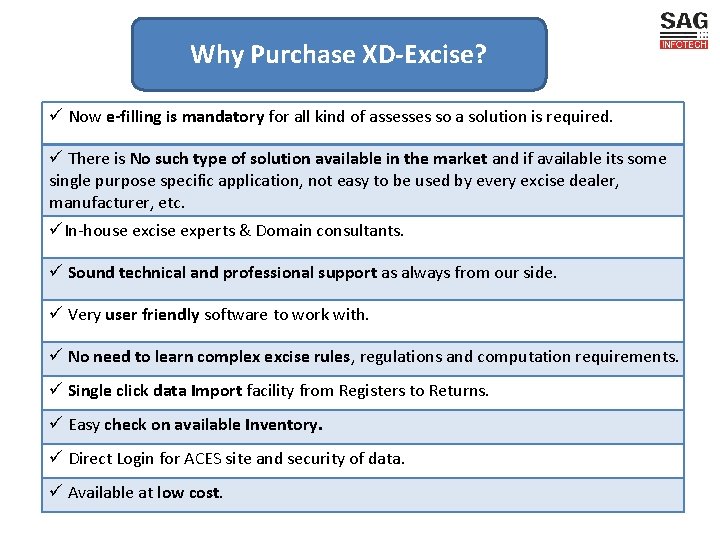

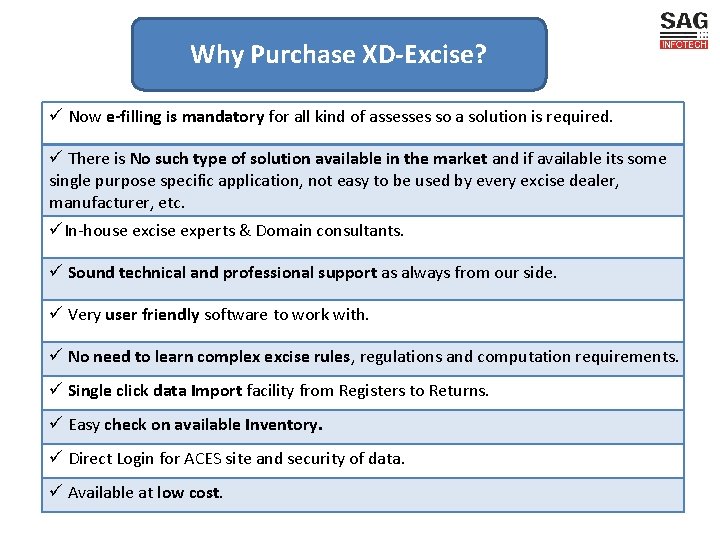

Why Purchase XD-Excise? ü Now e-filling is mandatory for all kind of assesses so a solution is required. ü There is No such type of solution available in the market and if available its some single purpose specific application, not easy to be used by every excise dealer, manufacturer, etc. üIn-house excise experts & Domain consultants. ü Sound technical and professional support as always from our side. ü Very user friendly software to work with. ü No need to learn complex excise rules, regulations and computation requirements. ü Single click data Import facility from Registers to Returns. ü Easy check on available Inventory. ü Direct Login for ACES site and security of data. ü Available at low cost.

Who can be our prospective customers? Chartered Accountants Excise Tax practitioners Direct production companies/houses. Excise Dealers Manufactures (Medium-Small. Micro Enterprises)

Thank you for your Valuable time. We assure you the best Services. Corporate Office Plot No 495, Above Bank of Baroda, Raja Park Gali No 5, Near AC Market, Raja Park, Jaipur - 302004 (Raj. ) State : Rajasthan Country : India Phone : 0141 -4072000 (60 Line) Email : info@saginfotech. com Website: http: //saginfotech. com Also contact for OUTSOURCING work by Our Professionals.