Royalty Account There are some special rights over

- Slides: 25

Royalty Account

• There are some special rights over something which are possessed by some person • For ex: - A author has an exclusive copywriter over the work or his writing in the form of a book. When these rightes give to some other person on lease basis for some consideration there come into existence a royalty agreement

ROYALITY AGREEMENT : - It is an agreement between the two parties , i. e. , the person who gives out his special rights and the person who takes out the special right on lease for a consideration. .

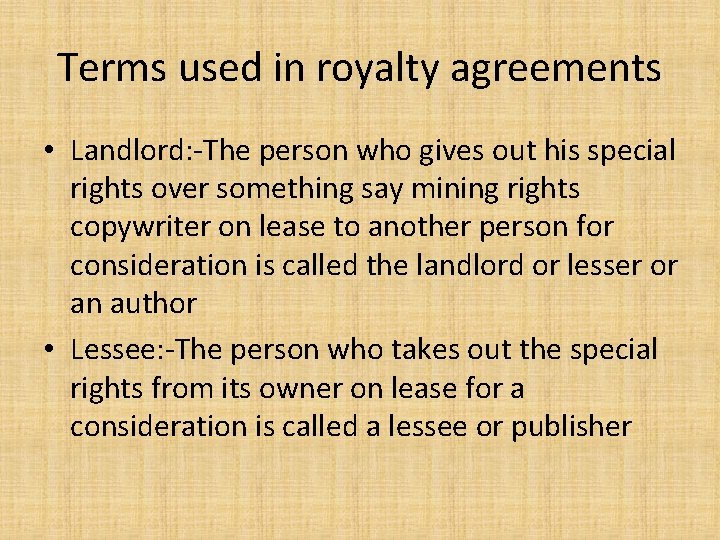

Terms used in royalty agreements • Landlord: -The person who gives out his special rights over something say mining rights copywriter on lease to another person for consideration is called the landlord or lesser or an author • Lessee: -The person who takes out the special rights from its owner on lease for a consideration is called a lessee or publisher

• Royalty: -Royalty is a periodical payment based on output or sales for the use of a certain assets or right like mine, copyright or patent to its owner. Types of Royalties Mining Royalty Copyright Royalty Patent Royalty

• Minimum (dead or fixed) rent: -Minimum amount received by landlord or lesser on production or sales In a particular period. • Short working: -The excess of minimum rent over actual royalty calculated on the basis of output or sales is termed as short working. • Ground rent: -It is the fixed yearly or half yearly rent payable by the lessee to the landlord in addition to minimum rent. • Right of recouping short working: -The right of getting back the excess payment made by the lessee In earlier years.

• Recoupment of short working: - It means the recovery of short working of the previous years out of surplus royalty of subsequent yearly. The following condition can be there for recoupment of short workings: a) Short working are recouped when there is surplus i. e. , excess of royalty over minimum rent. b) Recoupment of short working is to be done within the agreed period as given in the agreement. c) If short working could not be recouped within the agreed period, it will be transferred to profit & loss account in the year in which the right of recoupment is lost.

Accounting Entries In the books of the lessee • When there are no royalties in a year a) If minimum rent is not opened Shortworkings Account Dr. To ladlord’s Account b) If minimum rent is opened (1) Minimum rent account Dr. To landlord account (2) Shortworkings account Dr. To minimum rent account

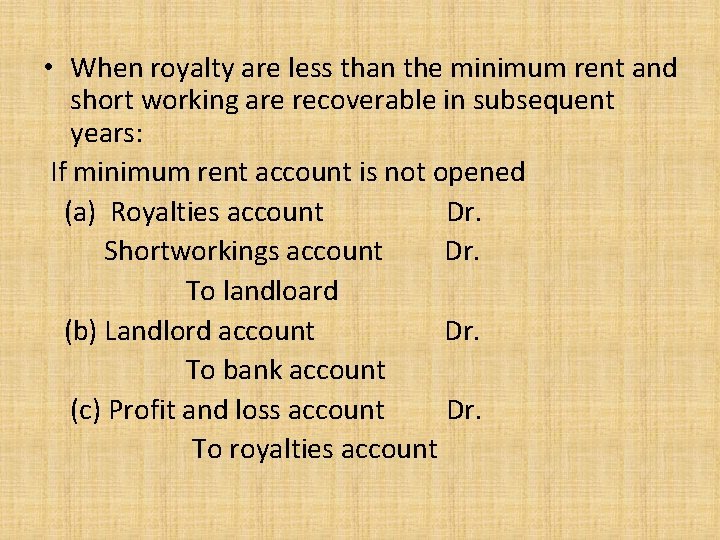

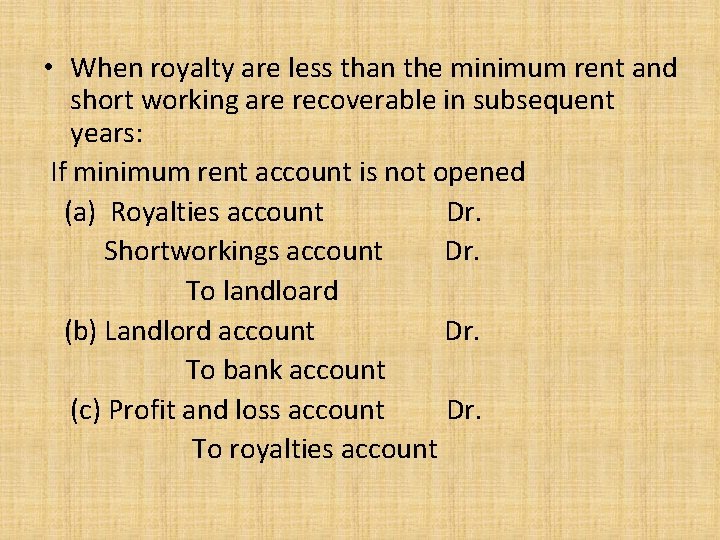

• When royalty are less than the minimum rent and short working are recoverable in subsequent years: If minimum rent account is not opened (a) Royalties account Dr. Shortworkings account Dr. To landloard (b) Landlord account Dr. To bank account (c) Profit and loss account Dr. To royalties account

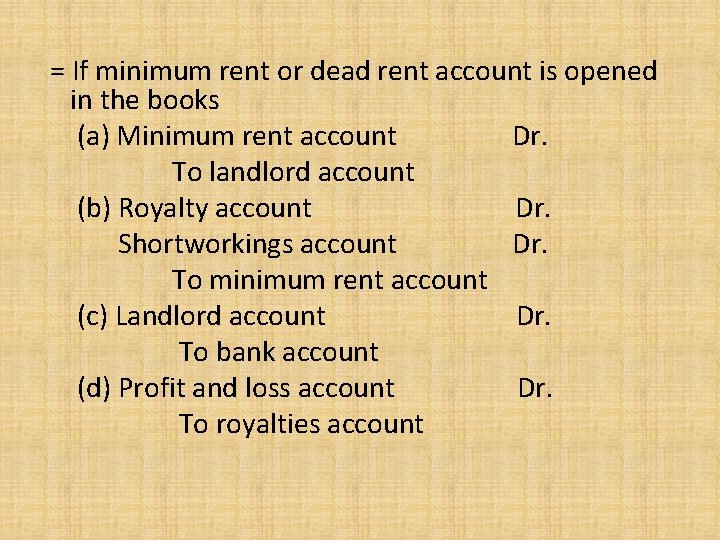

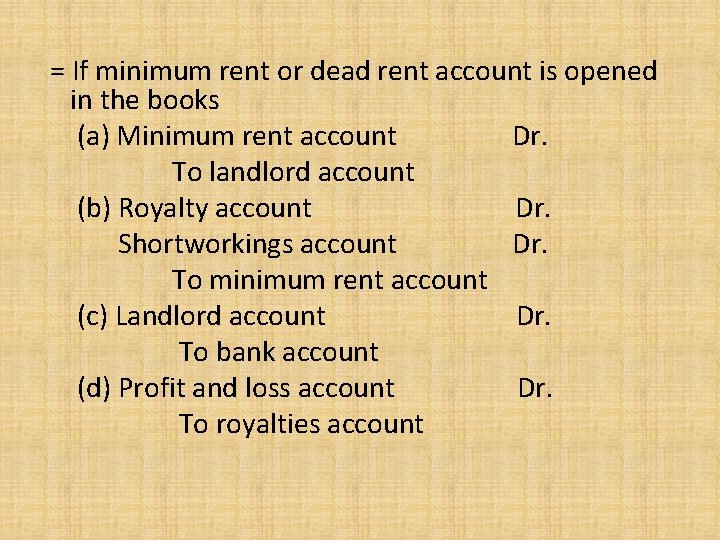

= If minimum rent or dead rent account is opened in the books (a) Minimum rent account Dr. To landlord account (b) Royalty account Dr. Shortworkings account Dr. To minimum rent account (c) Landlord account Dr. To bank account (d) Profit and loss account Dr. To royalties account

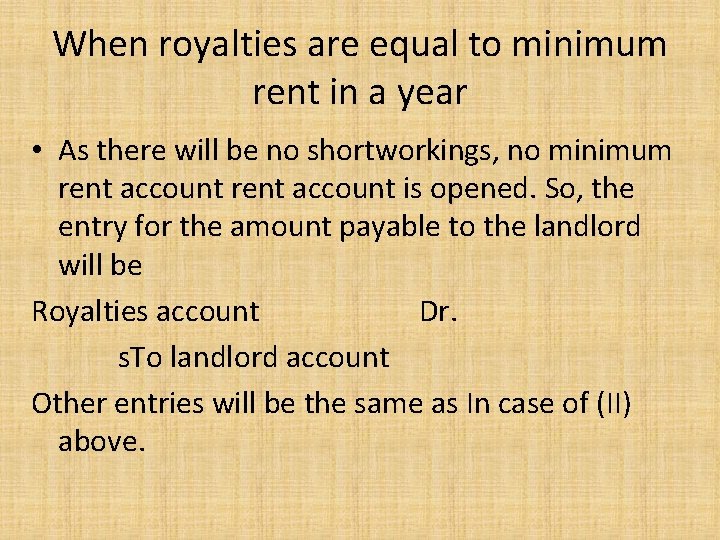

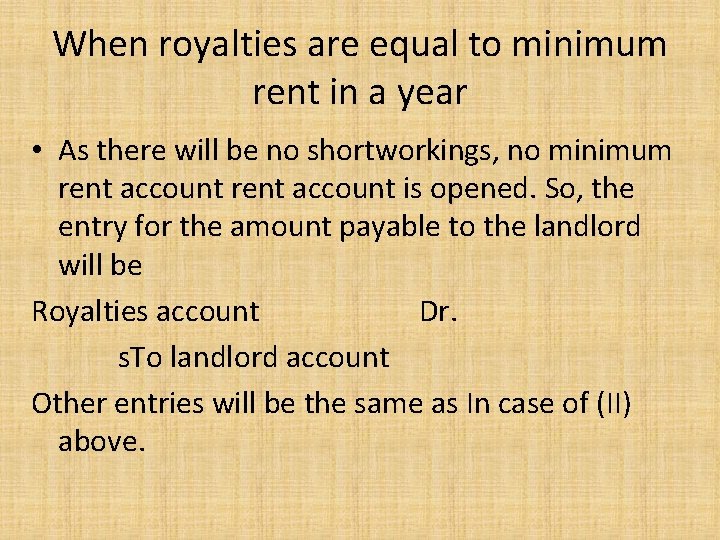

When royalties are equal to minimum rent in a year • As there will be no shortworkings, no minimum rent account is opened. So, the entry for the amount payable to the landlord will be Royalties account Dr. s. To landlord account Other entries will be the same as In case of (II) above.

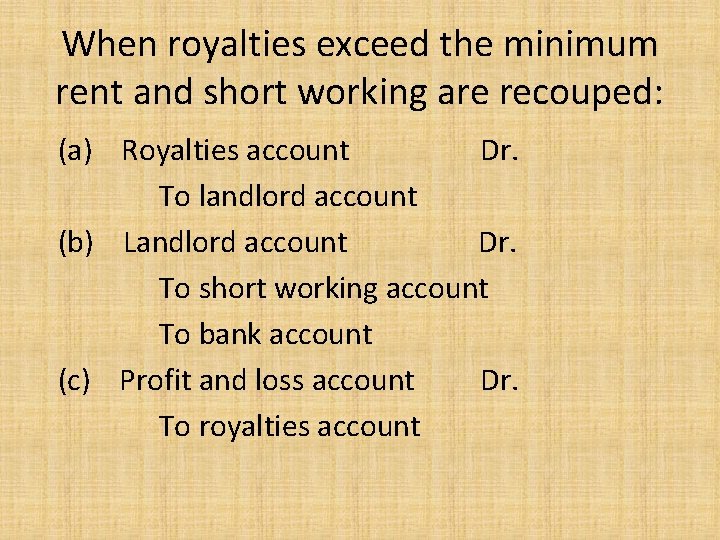

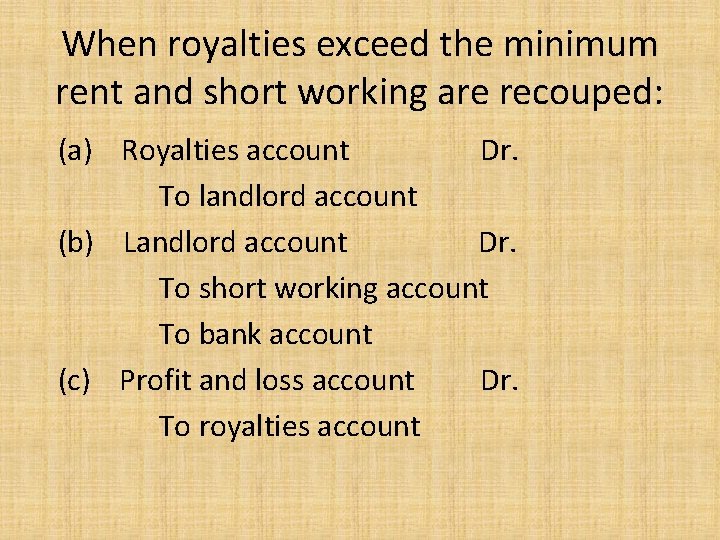

When royalties exceed the minimum rent and short working are recouped: (a) Royalties account Dr. To landlord account (b) Landlord account Dr. To short working account To bank account (c) Profit and loss account Dr. To royalties account

Stoppage of work due to Strike/Lockout/Accident etc. Whenever there is stoppage of work due to abnormal reasons as strike, lockout, accident or for any other reason, the minimum rent is required to the adjustment as provided for in the agreement. Such agreement may have the following arrangements:

1) Non-application of the condition of minimum rent: In such a case the clause of minimum rent is not applied. Actual royalties will discharge all rental obligations. There will not be any short working or surplus.

2) Reduction In the amount of minimum rent: - If there is any clause in the areement, regarding in the amount of minimum rent, it can take the following form: a) Minimum rent is reduced proportionately to the length of the stoppage of work during the relevant year. b) Minimum rent can be reduced by a fixed percentage or by a fixed amount in the year of stoppage.

ACCOUNTS TO BE PREPARED : - 1) 2) 3) 4) 5) 6) Analytical table Royalty account Short workings account Minimum rent account Landlords account Lessee’s account

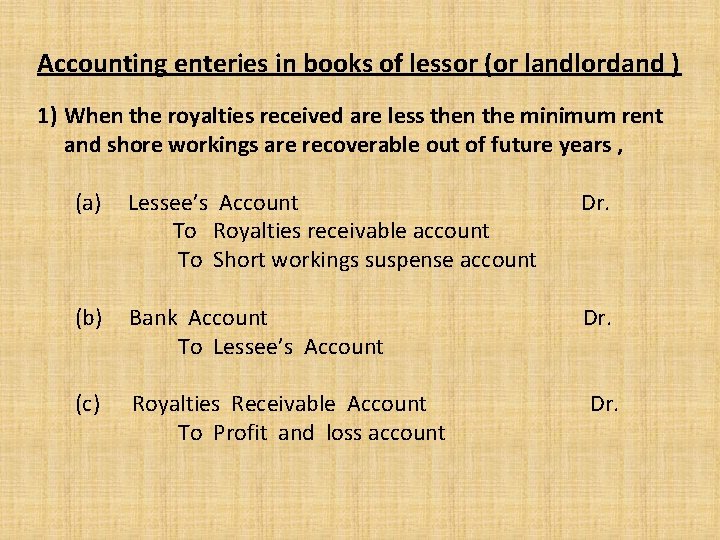

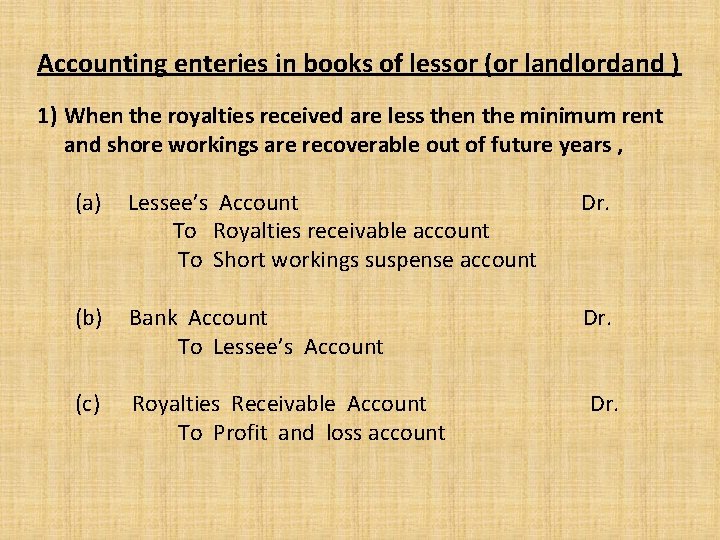

Accounting enteries in books of lessor (or landlordand ) 1) When the royalties received are less then the minimum rent and shore workings are recoverable out of future years , (a) Lessee’s Account To Royalties receivable account To Short workings suspense account Dr. (b) Bank Account To Lessee’s Account Dr. (c) Royalties Receivable Account To Profit and loss account Dr.

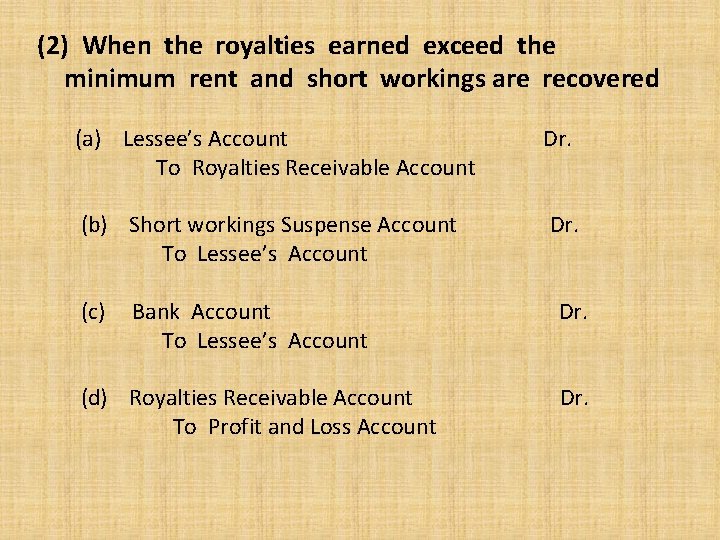

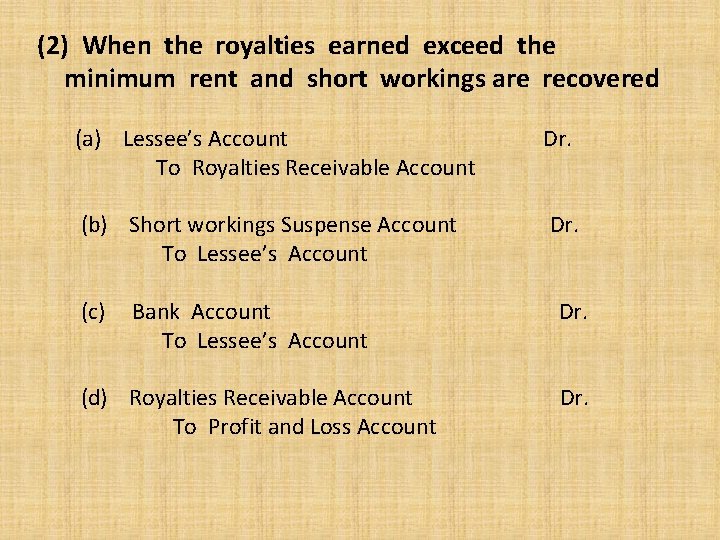

(2) When the royalties earned exceed the minimum rent and short workings are recovered (a) Lessee’s Account To Royalties Receivable Account Dr. (b) Short workings Suspense Account To Lessee’s Account Dr. (c) Bank Account To Lessee’s Account (d) Royalties Receivable Account To Profit and Loss Account Dr.

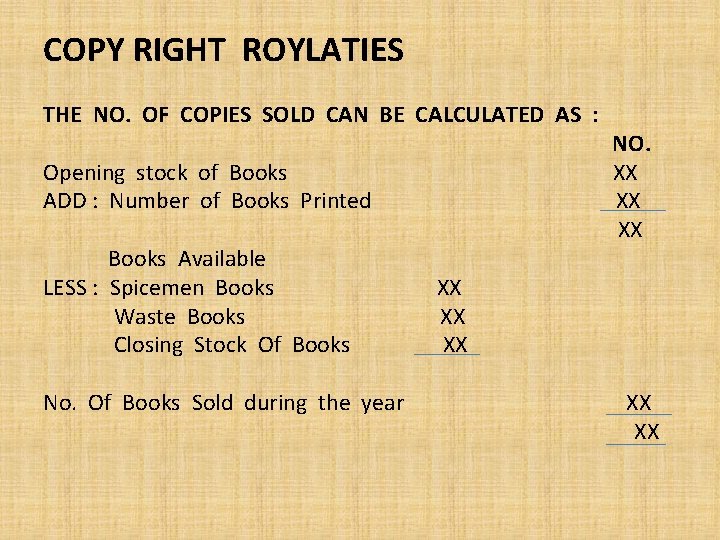

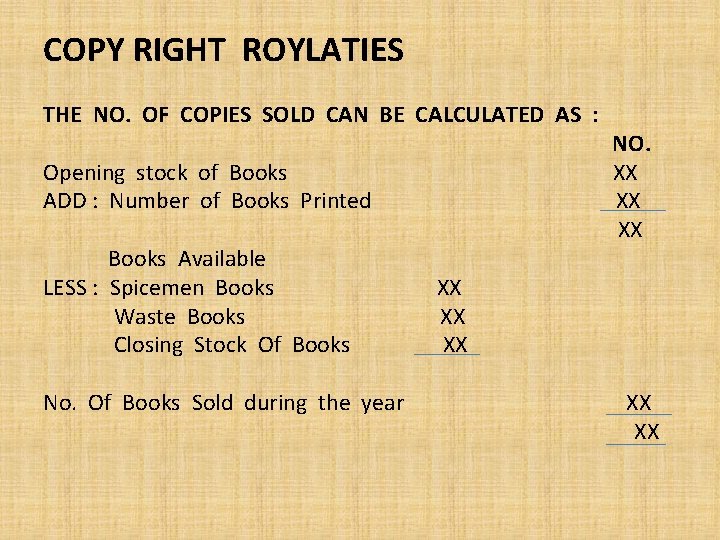

COPY RIGHT ROYLATIES THE NO. OF COPIES SOLD CAN BE CALCULATED AS : Opening stock of Books ADD : Number of Books Printed Books Available LESS : Spicemen Books Waste Books Closing Stock Of Books No. Of Books Sold during the year NO. XX XX

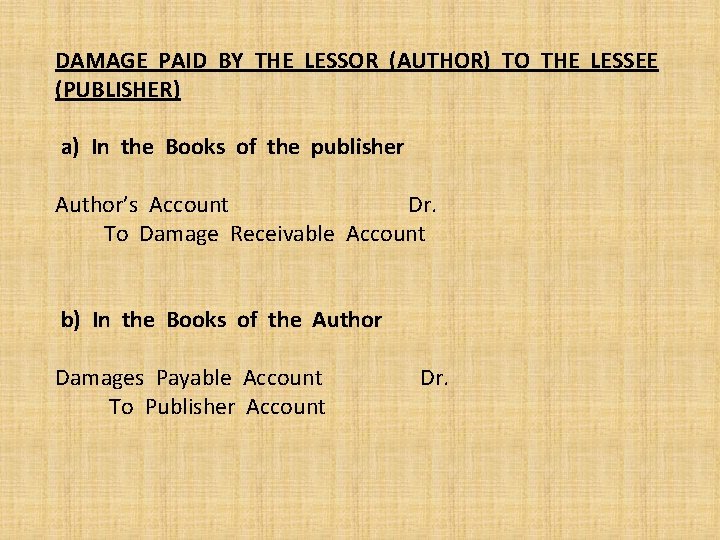

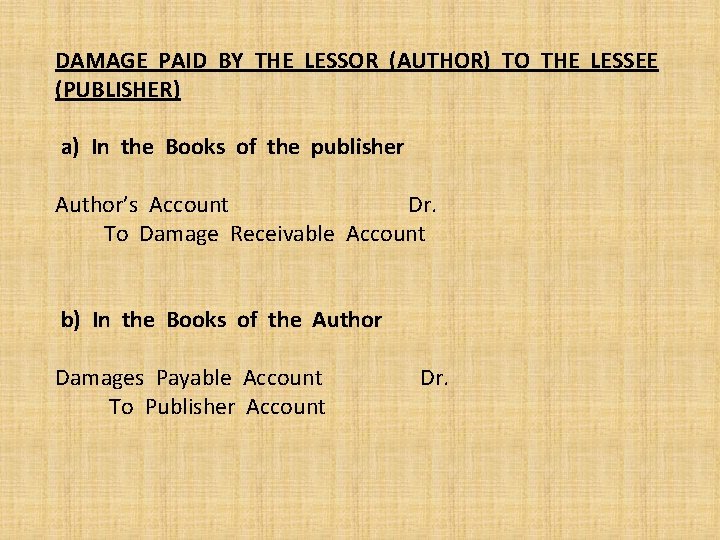

DAMAGE PAID BY THE LESSOR (AUTHOR) TO THE LESSEE (PUBLISHER) a) In the Books of the publisher Author’s Account Dr. To Damage Receivable Account b) In the Books of the Author Damages Payable Account To Publisher Account Dr.

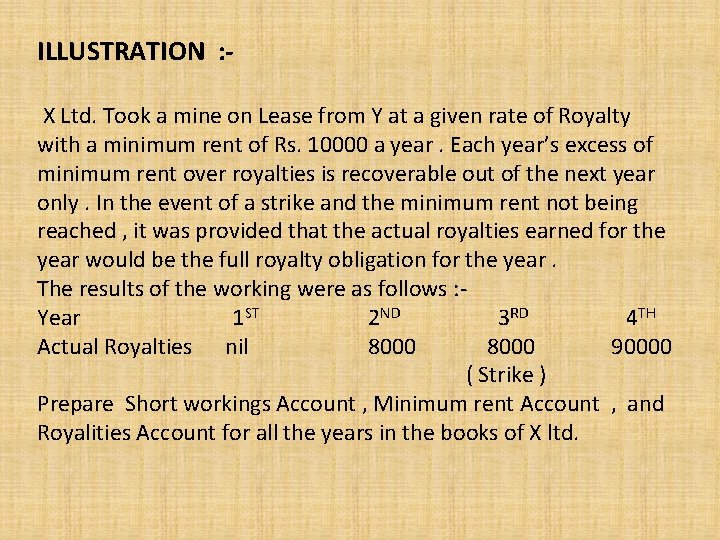

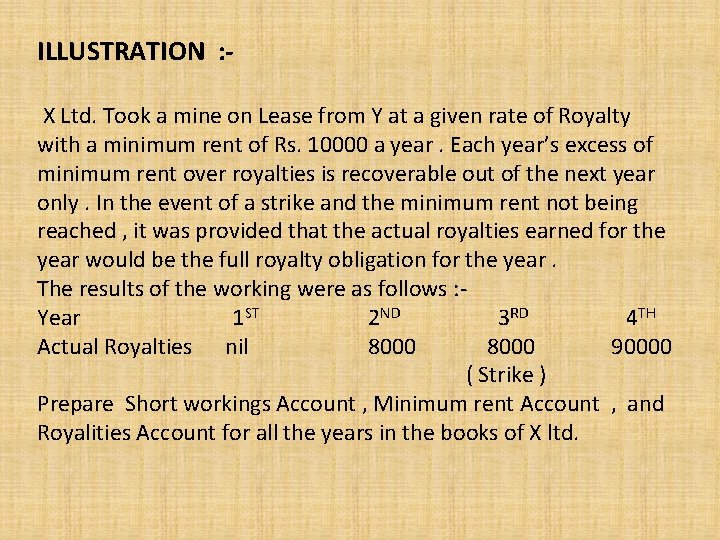

ILLUSTRATION : X Ltd. Took a mine on Lease from Y at a given rate of Royalty with a minimum rent of Rs. 10000 a year. Each year’s excess of minimum rent over royalties is recoverable out of the next year only. In the event of a strike and the minimum rent not being reached , it was provided that the actual royalties earned for the year would be the full royalty obligation for the year. The results of the working were as follows : Year 1 ST 2 ND 3 RD 4 TH Actual Royalties nil 8000 90000 ( Strike ) Prepare Short workings Account , Minimum rent Account , and Royalities Account for all the years in the books of X ltd.

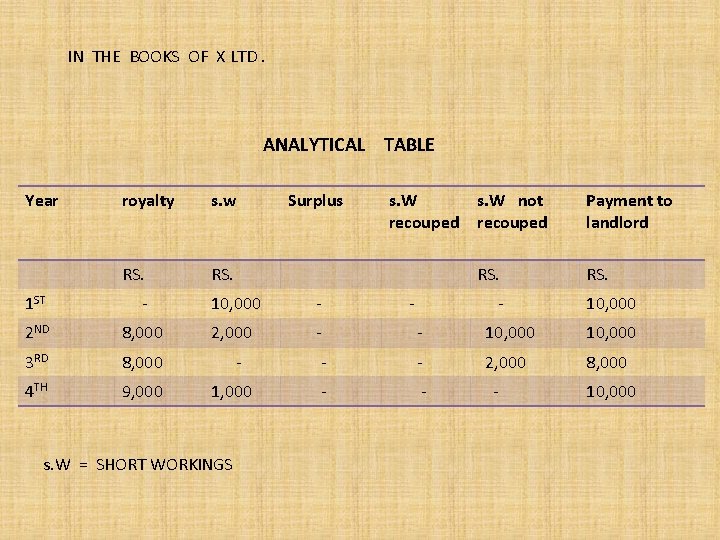

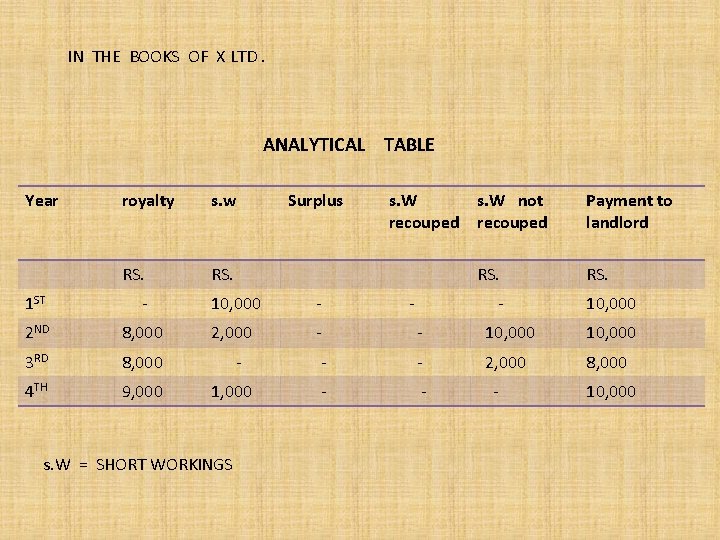

IN THE BOOKS OF X LTD. ANALYTICAL TABLE Year royalty s. w RS. Surplus s. W not recouped RS. - 10, 000 - 2 ND 8, 000 2, 000 - - 10, 000 3 RD 8, 000 - - 2, 000 8, 000 4 TH 9, 000 - - 1, 000 s. W = SHORT WORKINGS - RS. 1 ST - - Payment to landlord - 10, 000

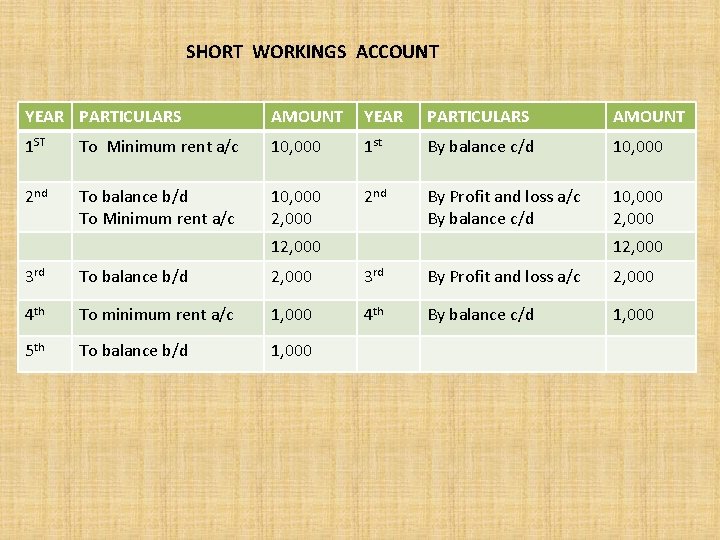

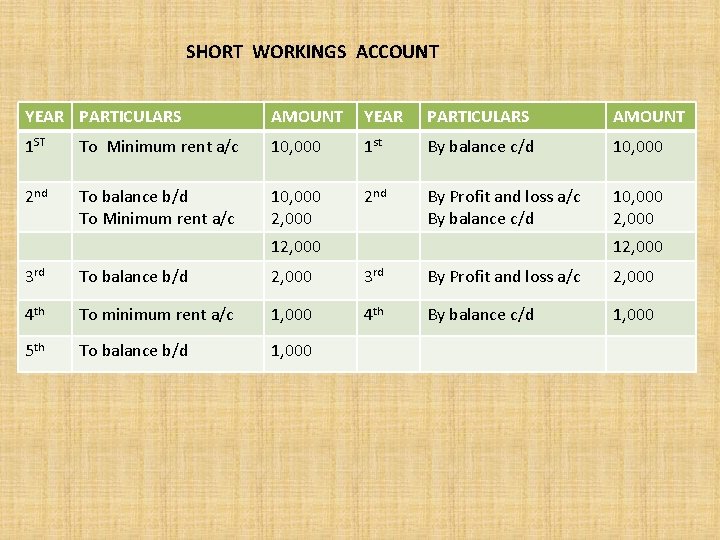

SHORT WORKINGS ACCOUNT YEAR PARTICULARS AMOUNT 1 ST To Minimum rent a/c 10, 000 1 st By balance c/d 10, 000 2 nd To balance b/d To Minimum rent a/c 10, 000 2 nd By Profit and loss a/c By balance c/d 10, 000 2, 000 12, 000 3 rd To balance b/d 2, 000 3 rd By Profit and loss a/c 2, 000 4 th To minimum rent a/c 1, 000 4 th By balance c/d 1, 000 5 th To balance b/d 1, 000

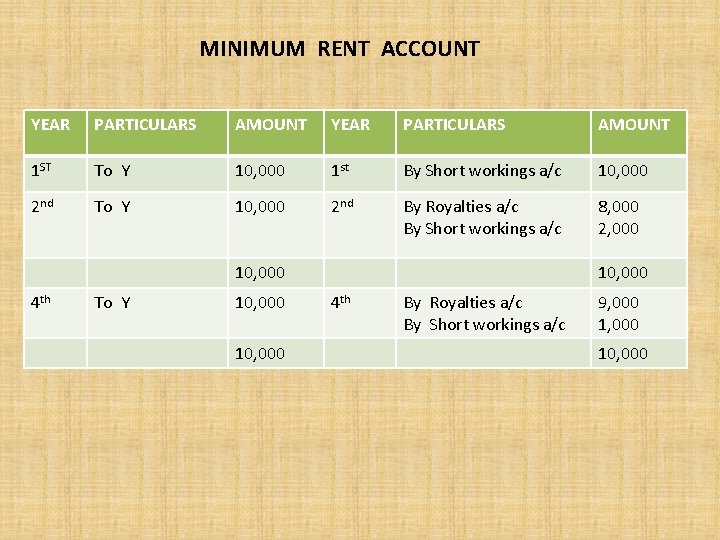

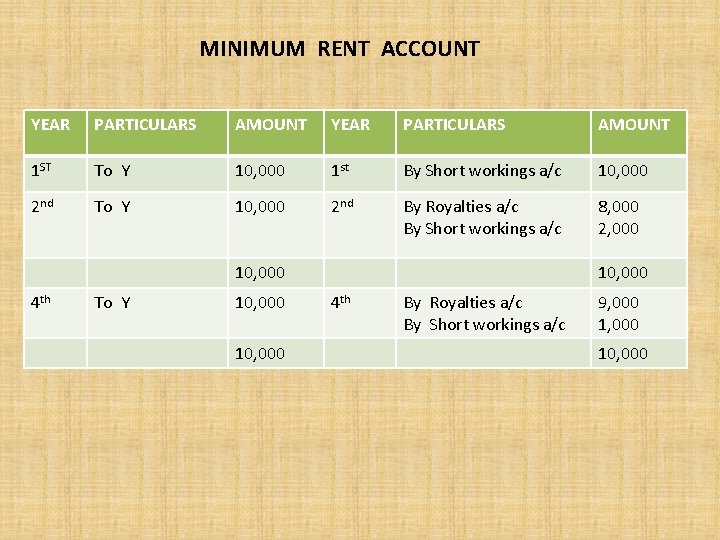

MINIMUM RENT ACCOUNT YEAR PARTICULARS AMOUNT 1 ST To Y 10, 000 1 st By Short workings a/c 10, 000 2 nd To Y 10, 000 2 nd By Royalties a/c By Short workings a/c 8, 000 2, 000 10, 000 4 th To Y 10, 000 4 th By Royalties a/c By Short workings a/c 9, 000 10, 000

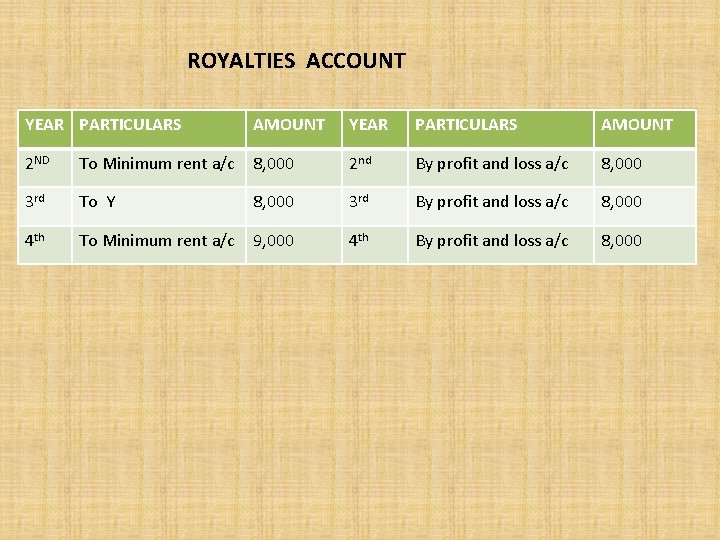

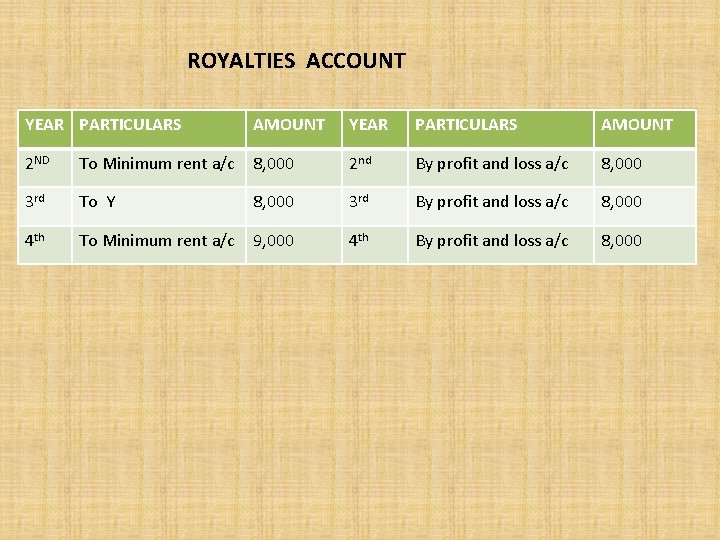

ROYALTIES ACCOUNT YEAR PARTICULARS AMOUNT 2 ND To Minimum rent a/c 8, 000 2 nd By profit and loss a/c 8, 000 3 rd To Y 8, 000 3 rd By profit and loss a/c 8, 000 4 th To Minimum rent a/c 9, 000 4 th By profit and loss a/c 8, 000

Insidan region jh

Insidan region jh Short workings are recouped when there is *

Short workings are recouped when there is * Royalty payable on an output basis is debited to

Royalty payable on an output basis is debited to Dr and cr rules

Dr and cr rules Some any farkı

Some any farkı Demonstrativos

Demonstrativos Positive vs negative rights

Positive vs negative rights Riparian rights vs littoral rights

Riparian rights vs littoral rights Conclusion of rights

Conclusion of rights Legal rights and moral rights

Legal rights and moral rights Positive and negative rights

Positive and negative rights Negative rights vs positive rights

Negative rights vs positive rights Positive rights vs negative rights

Positive rights vs negative rights Positive rights and negative rights

Positive rights and negative rights Accounts payable worksheets

Accounts payable worksheets 3 errors that affect the trial balance

3 errors that affect the trial balance Trading profit and loss account

Trading profit and loss account What is a secondhand account

What is a secondhand account Irrevocable rights to some limited use of another's land

Irrevocable rights to some limited use of another's land Parental rights over child's health

Parental rights over child's health If a company uses a special payroll bank account:

If a company uses a special payroll bank account: They say it only takes a little faith to move a mountain

They say it only takes a little faith to move a mountain Sometimes you win some sometimes you lose some

Sometimes you win some sometimes you lose some Icecream countable or uncountable

Icecream countable or uncountable Force and motion

Force and motion Some say the world will end in fire some say in ice

Some say the world will end in fire some say in ice