Risk Management of Shortterm Financing and Equipment Financing

- Slides: 53

短期融资及设备融资风险管理 Risk Management of Short-term Financing and Equipment Financing

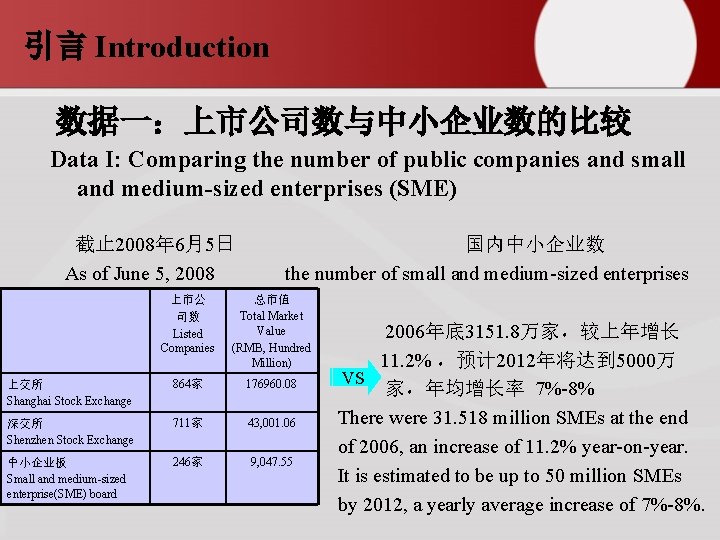

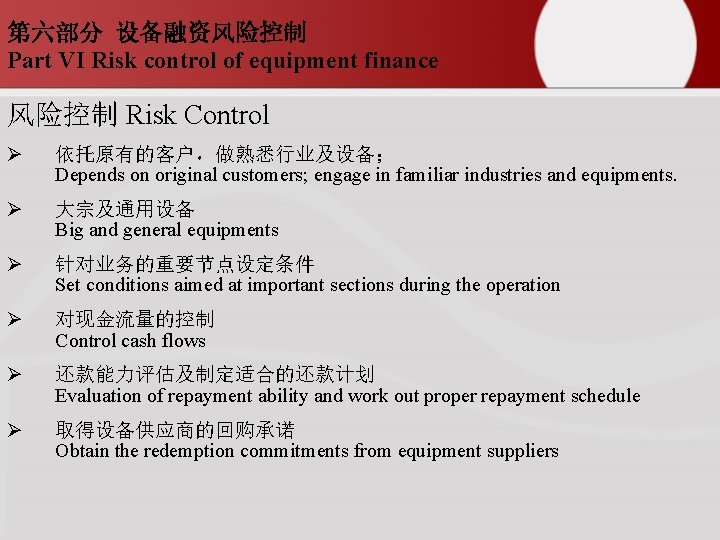

引言 Introduction 数据一:上市公司数与中小企业数的比较 Data I: Comparing the number of public companies and small and medium-sized enterprises (SME) 截止 2008年 6月5日 As of June 5, 2008 国内中小企业数 the number of small and medium-sized enterprises 上市公 司数 Listed Companies 总市值 Total Market Value (RMB, Hundred Million) 上交所 Shanghai Stock Exchange 864家 176960. 08 深交所 Shenzhen Stock Exchange 711家 43, 001. 06 中小企业板 Small and medium-sized enterprise(SME) board 246家 9, 047. 55 2006年底 3151. 8万家,较上年增长 11. 2% ,预计 2012年将达到 5000万 VS 家,年均增长率 7%-8% There were 31. 518 million SMEs at the end of 2006, an increase of 11. 2% year-on-year. It is estimated to be up to 50 million SMEs by 2012, a yearly average increase of 7%-8%.

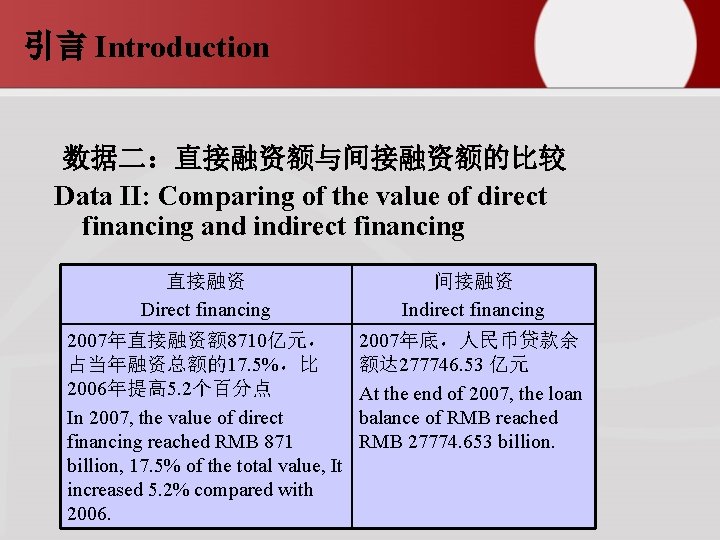

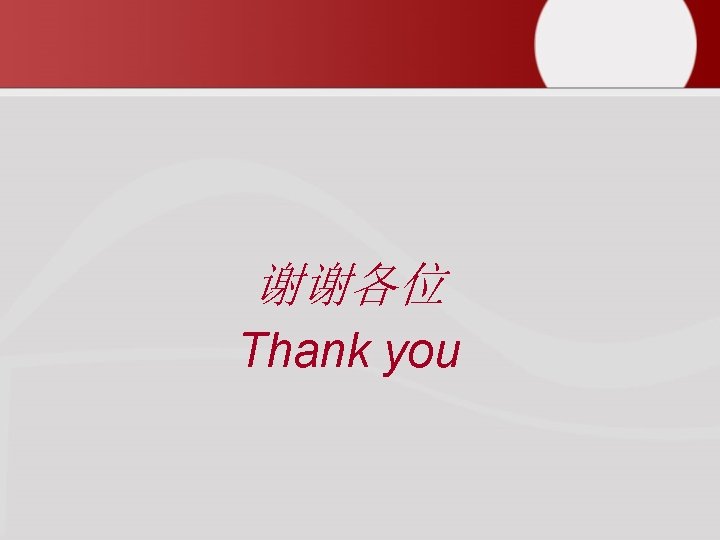

引言 Introduction 数据二:直接融资额与间接融资额的比较 Data II: Comparing of the value of direct financing and indirect financing 直接融资 Direct financing 间接融资 Indirect financing 2007年直接融资额 8710亿元, 占当年融资总额的17. 5%,比 2006年提高 5. 2个百分点 In 2007, the value of direct financing reached RMB 871 billion, 17. 5% of the total value, It increased 5. 2% compared with 2006. 2007年底,人民币贷款余 额达 277746. 53 亿元 At the end of 2007, the loan balance of RMB reached RMB 27774. 653 billion.

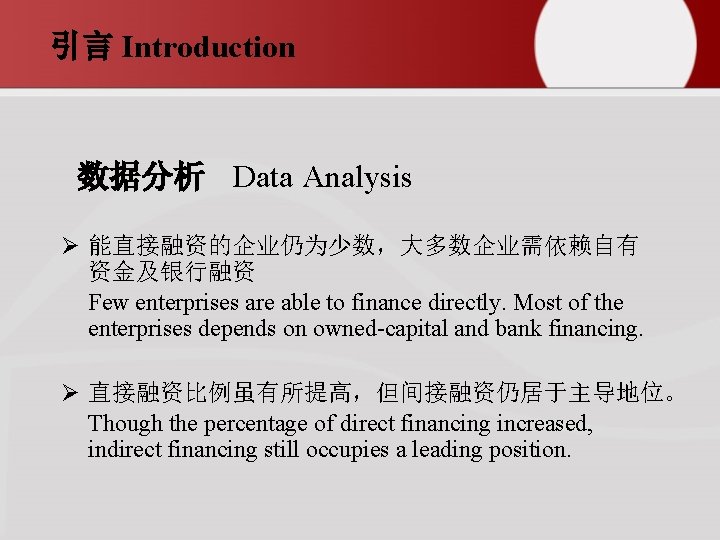

引言 Introduction 数据分析 Data Analysis Ø 能直接融资的企业仍为少数,大多数企业需依赖自有 资金及银行融资 Few enterprises are able to finance directly. Most of the enterprises depends on owned-capital and bank financing. Ø 直接融资比例虽有所提高,但间接融资仍居于主导地位。 Though the percentage of direct financing increased, indirect financing still occupies a leading position.

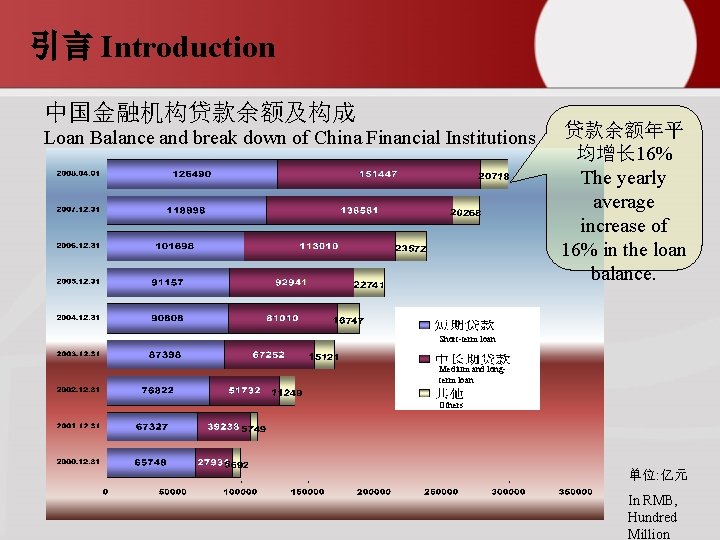

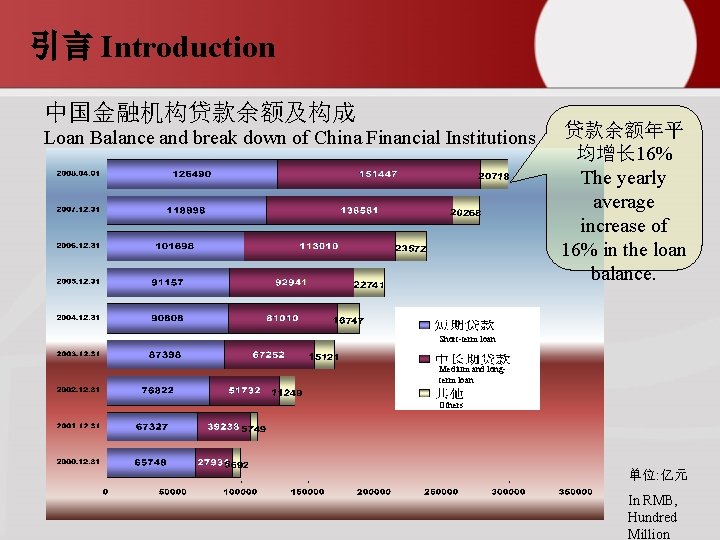

引言 Introduction 中国金融机构贷款余额及构成 Loan Balance and break down of China Financial Institutions 贷款余额年平 均增长 16% The yearly average increase of 16% in the loan balance. Short-term loan Medium and longterm loan Others 单位: 亿元 In RMB, Hundred Million

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 不基于单笔贸易的短期融资品种 The varieties of short-term financing products based on non-single trade transaction Ø 营运资金贷款 Working capital loan Ø 周转限额贷款 Revolving line of credit loan Ø 临时贷款 Temporary loan Ø 搭桥贷款 Bridge loan Ø 贷款承诺 Loan commitment

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 1、营运资金贷款 1. Working capital loan Ø 满足借款人日常经营中合理的连续使用需求 The borrower uses for normal business operations or to meet continuous need for capital Ø 未来综合收益和其他合法收入等作为还款来源 Future income and other legal income are the resources for repayment. Ø 可采用循环贷款方式,一次签约、多次提款、逐笔归还,循 环使用 It could be revolving loans. Sign contract once, draw down several times, repayment by transactions.

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 2、周转限额贷款 2. revolving line of credit loan Ø 满足借款人日常经营中确定产品用途项下的资金短缺 需求 Finance confirmed products in normal operation when borrower are short of capital Ø 以约定的、可预见的经营收入作为还款来源 The agreed predicted operating income is the repayment resource.

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 3、临时贷款 3. Temporary loan Ø 满足季节性或临时性的资金需求 To finance the seasonal or temporary capital needs. Ø 依据订单组织备货和生产 Preparing the material and production according to the order. Ø 以对应的产品(商品)销售收入和其他合法收入等作为还 款来源 The sales of relevant products and other legal income are the repayment resources.

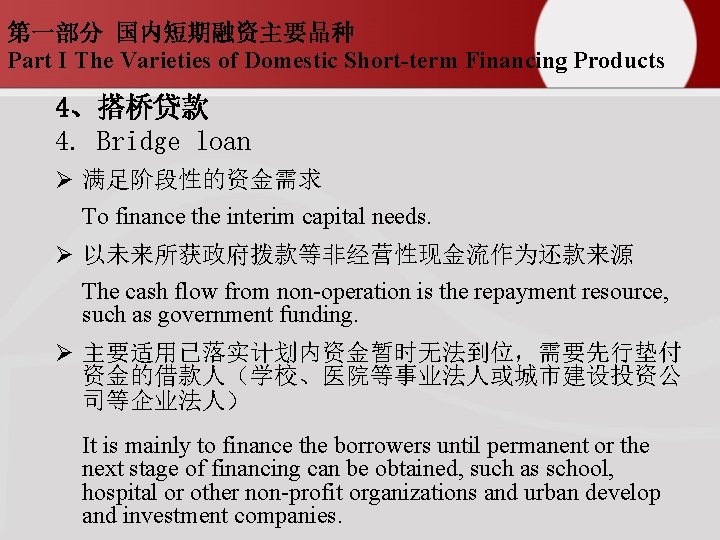

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 4、搭桥贷款 4. Bridge loan Ø 满足阶段性的资金需求 To finance the interim capital needs. Ø 以未来所获政府拨款等非经营性现金流作为还款来源 The cash flow from non-operation is the repayment resource, such as government funding. Ø 主要适用已落实计划内资金暂时无法到位,需要先行垫付 资金的借款人(学校、医院等事业法人或城市建设投资公 司等企业法人) It is mainly to finance the borrowers until permanent or the next stage of financing can be obtained, such as school, hospital or other non-profit organizations and urban develop and investment companies.

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 5、贷款承诺 5. Loan commitment Ø 满足借款人未来一定时期内或有的融资需求,向其出 具的具有法律约束力、允许其在需要时按照合同约定 条件提取贷款的信贷承诺 To meet the contingent financing needs in a certain period in the future, the a lender makes commitments that are contractual obligations for future funding to a borrower on specific terms in return for a fee Ø 为借款人提供信用支持(发行债券或商业票据、向第 三方融资、收购资产) Provide credit support to borrowers such as bonds, commercial paper, financing from a third party, acquiring assets, etc.

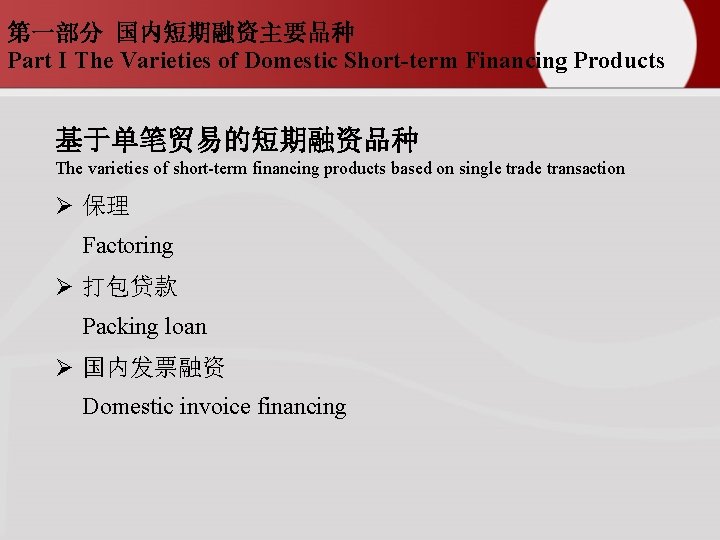

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 基于单笔贸易的短期融资品种 The varieties of short-term financing products based on single trade transaction Ø 保理 Factoring Ø 打包贷款 Packing loan Ø 国内发票融资 Domestic invoice financing

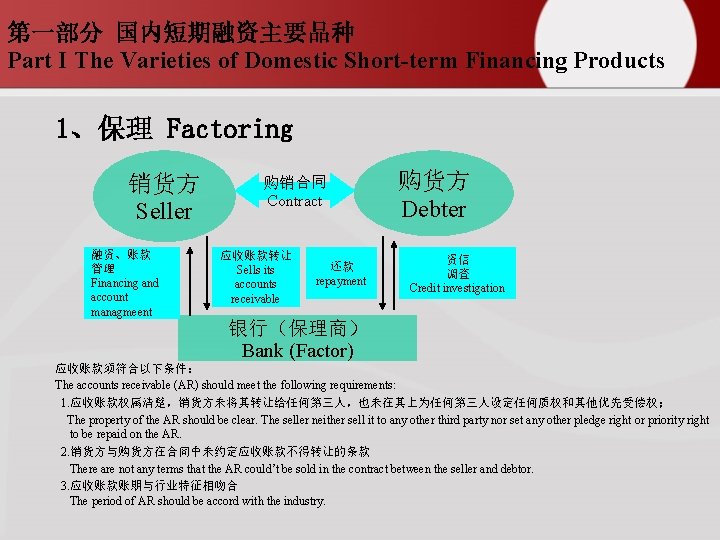

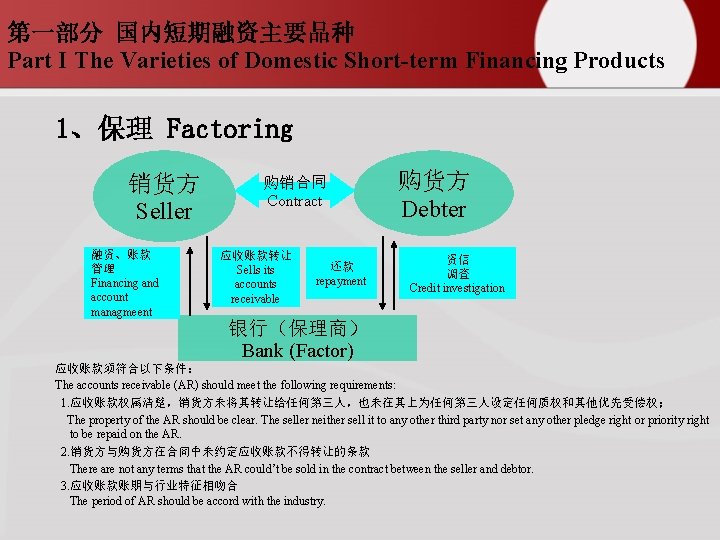

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 1、保理 Factoring 销货方 Seller 融资、账款 管理 Financing and account managmeent 购销合同 Contract 应收账款转让 Sells its accounts receivable 还款 repayment 购货方 Debter 资信 调查 Credit investigation 银行(保理商) Bank (Factor) 应收账款须符合以下条件: The accounts receivable (AR) should meet the following requirements: 1. 应收账款权属清楚,销货方未将其转让给任何第三人,也未在其上为任何第三人设定任何质权和其他优先受偿权; The property of the AR should be clear. The seller neither sell it to any other third party nor set any other pledge right or priority right to be repaid on the AR. 2. 销货方与购货方在合同中未约定应收账款不得转让的条款 There are not any terms that the AR could’t be sold in the contract between the seller and debtor. 3. 应收账款账期与行业特征相吻合 The period of AR should be accord with the industry.

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 2、打包贷款 2. Packing loan Ø 用于出口商装船前生产、收购、运输等费用的支出 provide support to export enterprise to finance the expenses of production, acquisition, transportation before shipping. Ø 出口商以收到的信用证项下的预期收汇款项作为还款来源 The predicted remittance under L/C from export enterprise is the repayment resource.

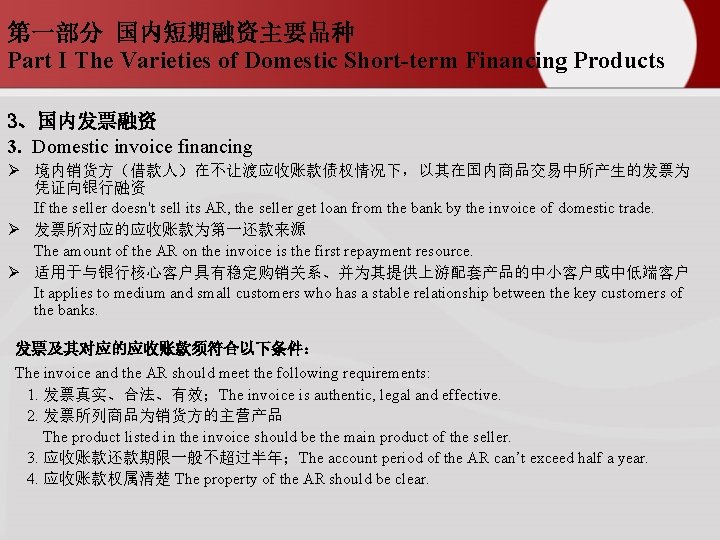

第一部分 国内短期融资主要品种 Part I The Varieties of Domestic Short-term Financing Products 3、国内发票融资 3. Domestic invoice financing Ø 境内销货方(借款人)在不让渡应收账款债权情况下,以其在国内商品交易中所产生的发票为 凭证向银行融资 If the seller doesn't sell its AR, the seller get loan from the bank by the invoice of domestic trade. Ø 发票所对应的应收账款为第一还款来源 The amount of the AR on the invoice is the first repayment resource. Ø 适用于与银行核心客户具有稳定购销关系、并为其提供上游配套产品的中小客户或中低端客户 It applies to medium and small customers who has a stable relationship between the key customers of the banks. 发票及其对应的应收账款须符合以下条件: The invoice and the AR should meet the following requirements: 1. 发票真实、合法、有效;The invoice is authentic, legal and effective. 2. 发票所列商品为销货方的主营产品 The product listed in the invoice should be the main product of the seller. 3. 应收账款还款期限一般不超过半年;The account period of the AR can’t exceed half a year. 4. 应收账款权属清楚 The property of the AR should be clear.

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 短期资金授信相关风险 The credit risks of short-term capital Ø债务主体风险 debtor risk Ø市场风险 market risk Ø业务风险 operation risk Ø政策风险 policy risk Ø担保风险 guarantee risk Ø银行管理风险 bank management risk

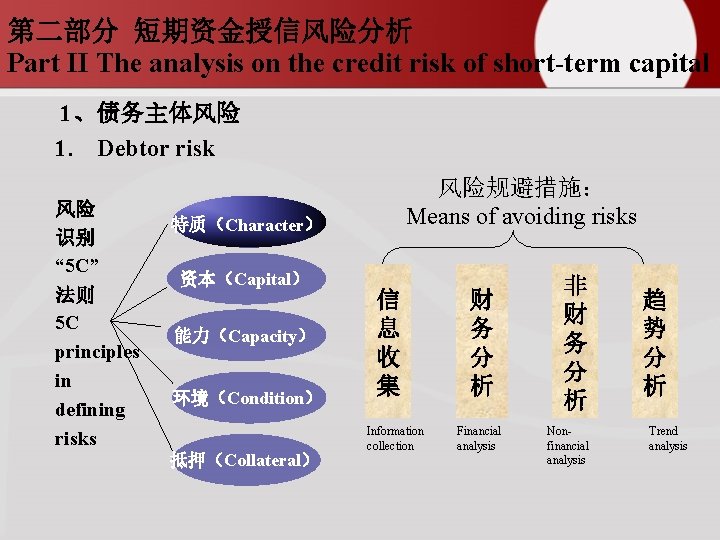

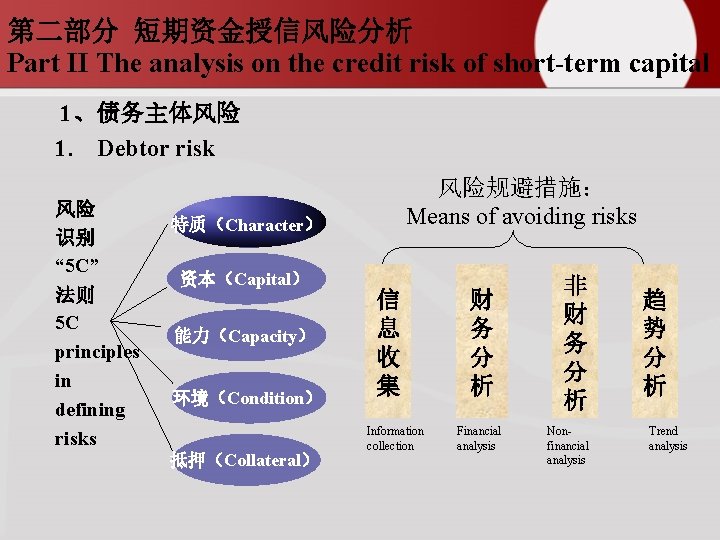

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 1、债务主体风险 1. Debtor risk 风险 识别 “ 5 C” 法则 5 C principles in defining risks 风险规避措施: Means of avoiding risks 特质(Character) 资本(Capital) 能力(Capacity) 环境(Condition) 抵押(Collateral) 信 息 收 集 Information collection 财 务 分 析 Financial analysis 非 财 务 分 析 Nonfinancial analysis 趋 势 分 析 Trend analysis

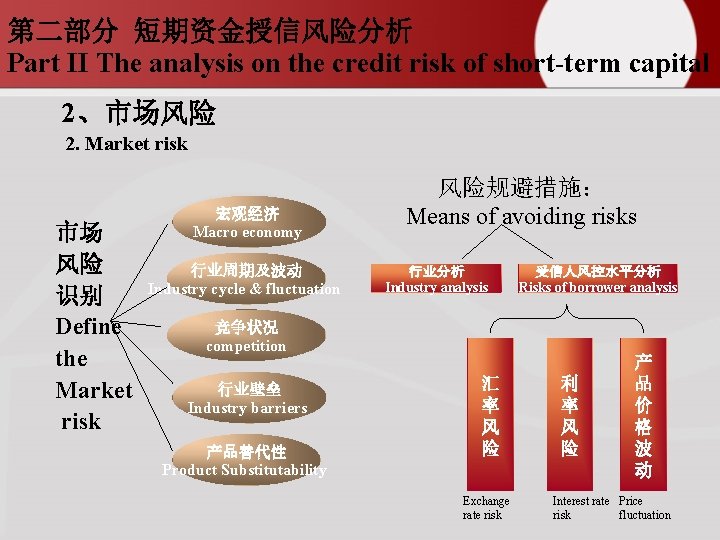

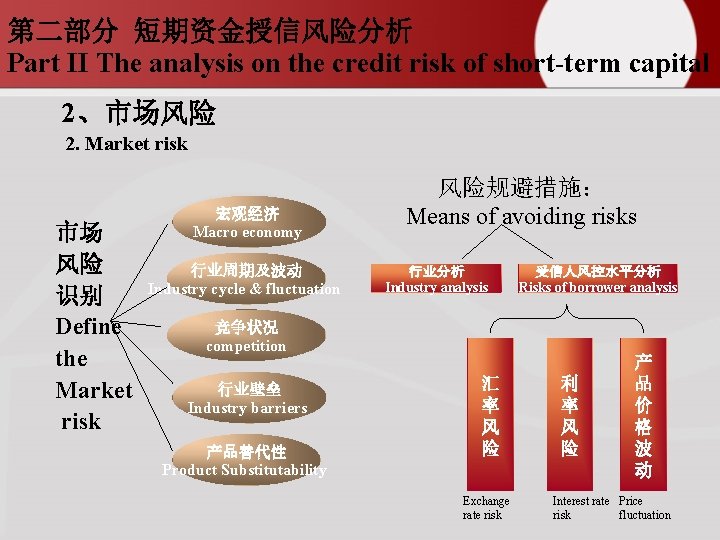

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 2、市场风险 2. Market risk 市场 风险 识别 Define the Market risk 宏观经济 Macro economy 行业周期及波动 Industry cycle & fluctuation 风险规避措施: Means of avoiding risks 行业分析 Industry analysis 受信人风控水平分析 Risks of borrower analysis 竞争状况 competition 行业壁垒 Industry barriers 产品替代性 Product Substitutability 汇 率 风 险 Exchange rate risk 利 率 风 险 产 品 价 格 波 动 Interest rate Price risk fluctuation

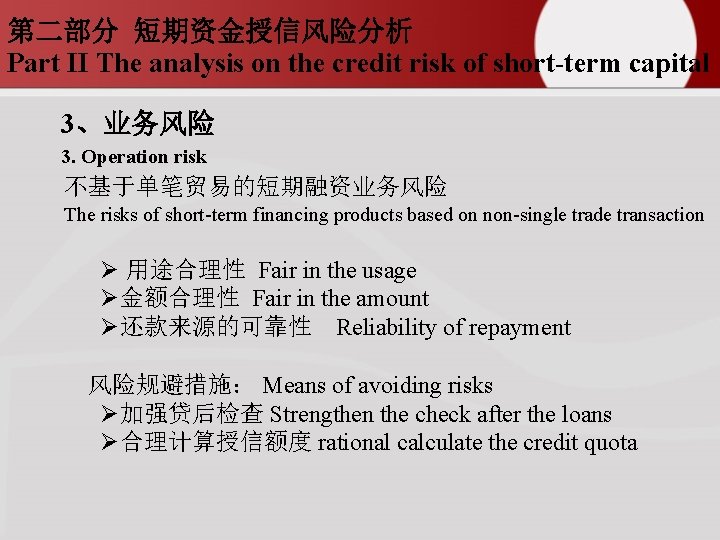

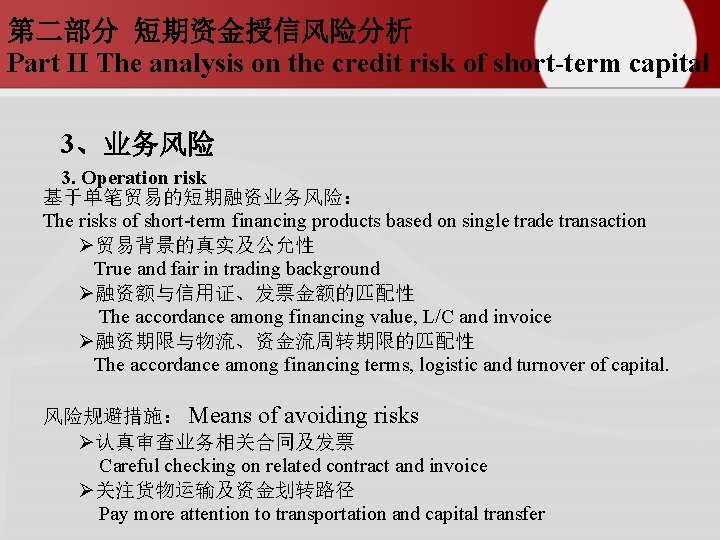

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 3、业务风险 3. Operation risk 不基于单笔贸易的短期融资业务风险 The risks of short-term financing products based on non-single trade transaction Ø 用途合理性 Fair in the usage Ø金额合理性 Fair in the amount Ø还款来源的可靠性 Reliability of repayment 风险规避措施: Means of avoiding risks Ø加强贷后检查 Strengthen the check after the loans Ø合理计算授信额度 rational calculate the credit quota

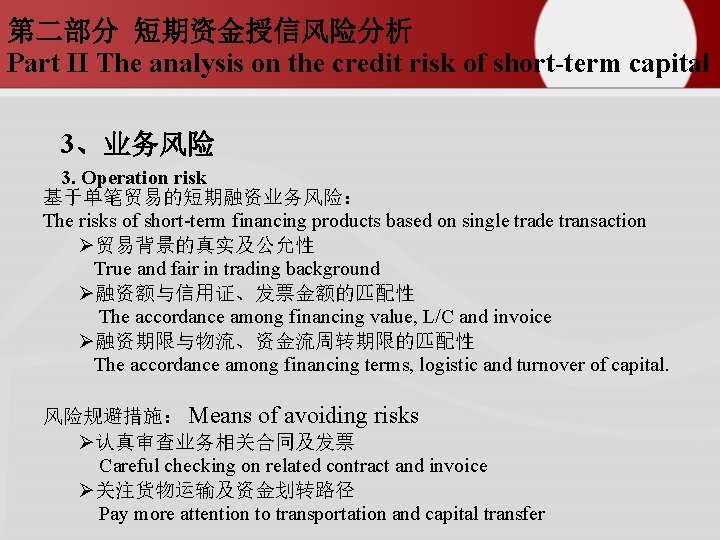

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 3、业务风险 3. Operation risk 基于单笔贸易的短期融资业务风险: The risks of short-term financing products based on single trade transaction Ø贸易背景的真实及公允性 True and fair in trading background Ø融资额与信用证、发票金额的匹配性 The accordance among financing value, L/C and invoice Ø融资期限与物流、资金流周转期限的匹配性 The accordance among financing terms, logistic and turnover of capital. 风险规避措施: Means of avoiding risks Ø认真审查业务相关合同及发票 Careful checking on related contract and invoice Ø关注货物运输及资金划转路径 Pay more attention to transportation and capital transfer

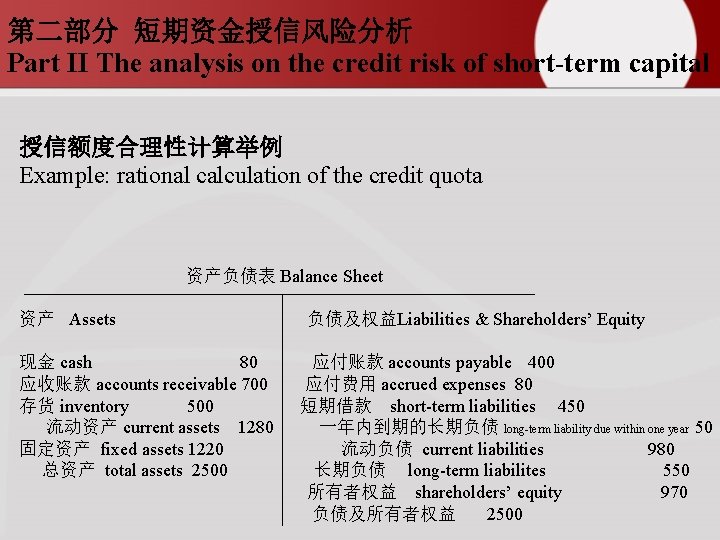

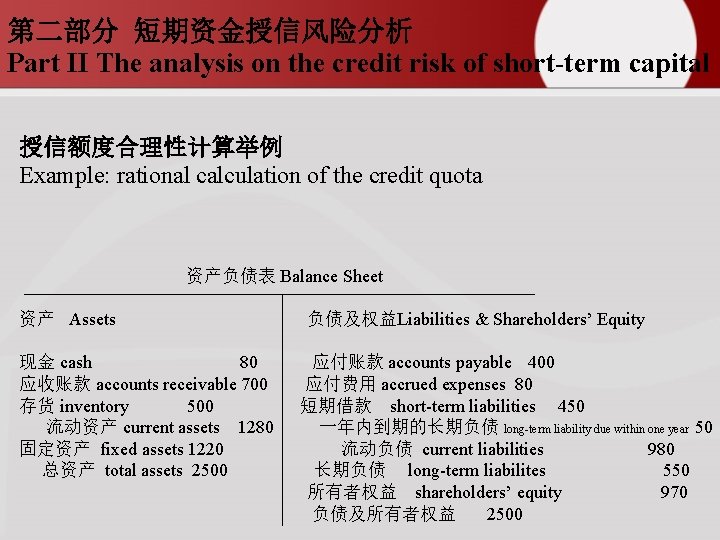

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 授信额度合理性计算举例 Example: rational calculation of the credit quota 资产负债表 Balance Sheet 资产 Assets 现金 cash 80 应收账款 accounts receivable 700 存货 inventory 500 流动资产 current assets 1280 固定资产 fixed assets 1220 总资产 total assets 2500 负债及权益Liabilities & Shareholders’ Equity 应付账款 accounts payable 400 应付费用 accrued expenses 80 短期借款 short-term liabilities 450 一年内到期的长期负债 long-term liability due within one year 50 流动负债 current liabilities 980 长期负债 long-term liabilites 550 所有者权益 shareholders’ equity 970 负债及所有者权益 2500

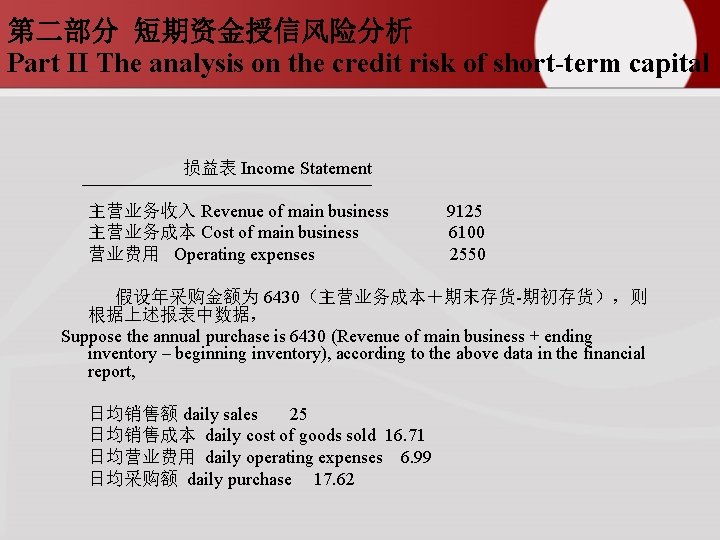

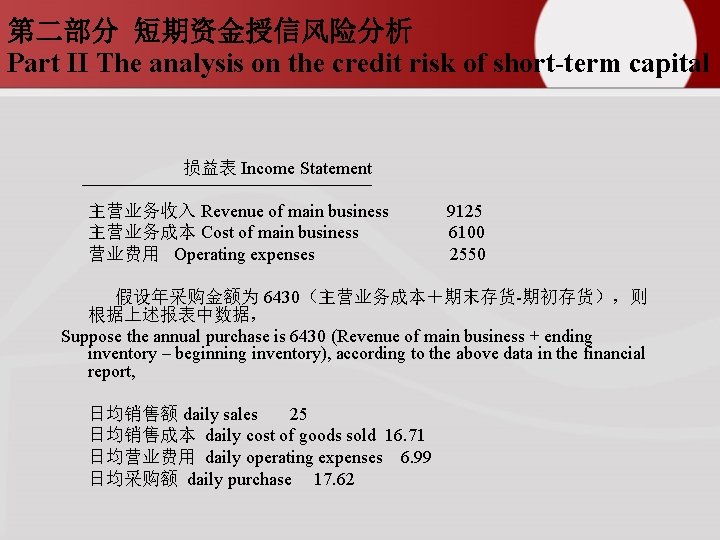

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 损益表 Income Statement 主营业务收入 Revenue of main business 主营业务成本 Cost of main business 营业费用 Operating expenses 9125 6100 2550 假设年采购金额为 6430(主营业务成本+期末存货-期初存货),则 根据上述报表中数据, Suppose the annual purchase is 6430 (Revenue of main business + ending inventory – beginning inventory), according to the above data in the financial report, 日均销售额 daily sales 25 日均销售成本 daily cost of goods sold 16. 71 日均营业费用 daily operating expenses 6. 99 日均采购额 daily purchase 17. 62

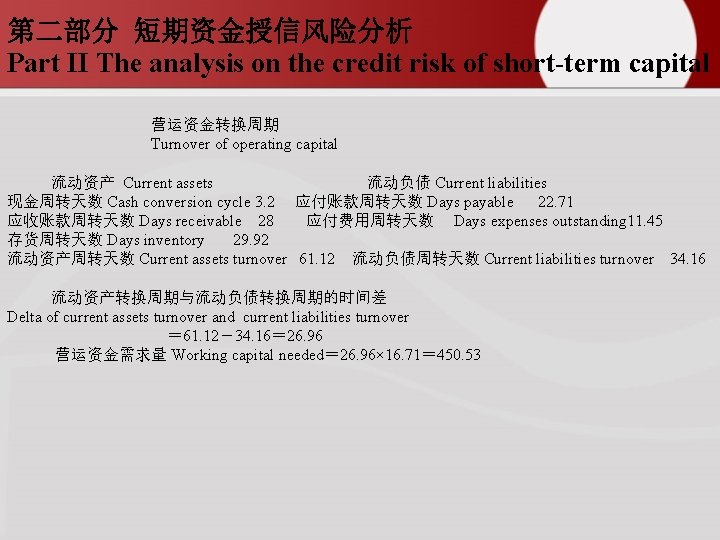

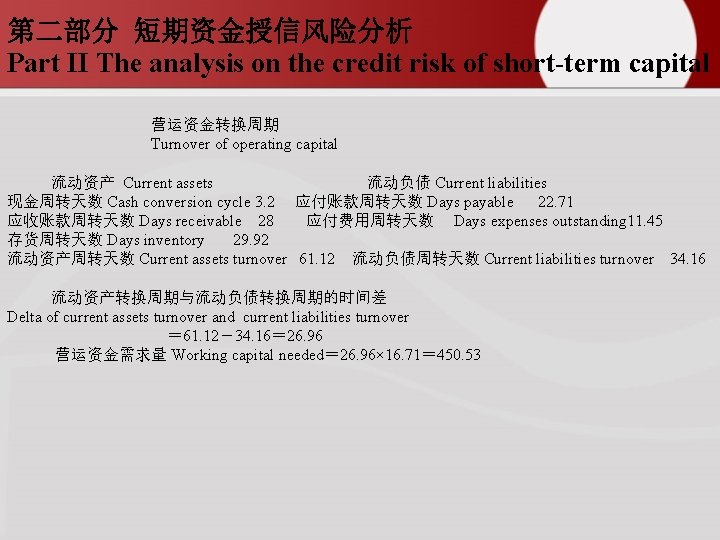

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 营运资金转换周期 Turnover of operating capital 流动资产 Current assets 流动负债 Current liabilities 现金周转天数 Cash conversion cycle 3. 2 应付账款周转天数 Days payable 22. 71 应收账款周转天数 Days receivable 28 应付费用周转天数 Days expenses outstanding 11. 45 存货周转天数 Days inventory 29. 92 流动资产周转天数 Current assets turnover 61. 12 流动负债周转天数 Current liabilities turnover 34. 16 流动资产转换周期与流动负债转换周期的时间差 Delta of current assets turnover and current liabilities turnover = 61. 12-34. 16= 26. 96 营运资金需求量 Working capital needed= 26. 96× 16. 71= 450. 53

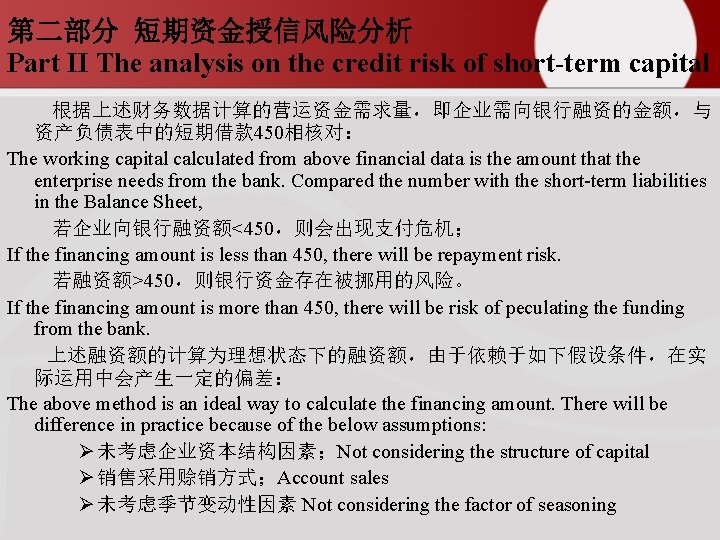

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 根据上述财务数据计算的营运资金需求量,即企业需向银行融资的金额,与 资产负债表中的短期借款 450相核对: The working capital calculated from above financial data is the amount that the enterprise needs from the bank. Compared the number with the short-term liabilities in the Balance Sheet, 若企业向银行融资额<450,则会出现支付危机; If the financing amount is less than 450, there will be repayment risk. 若融资额>450,则银行资金存在被挪用的风险。 If the financing amount is more than 450, there will be risk of peculating the funding from the bank. 上述融资额的计算为理想状态下的融资额,由于依赖于如下假设条件,在实 际运用中会产生一定的偏差: The above method is an ideal way to calculate the financing amount. There will be difference in practice because of the below assumptions: Ø 未考虑企业资本结构因素;Not considering the structure of capital Ø 销售采用赊销方式;Account sales Ø 未考虑季节变动性因素 Not considering the factor of seasoning

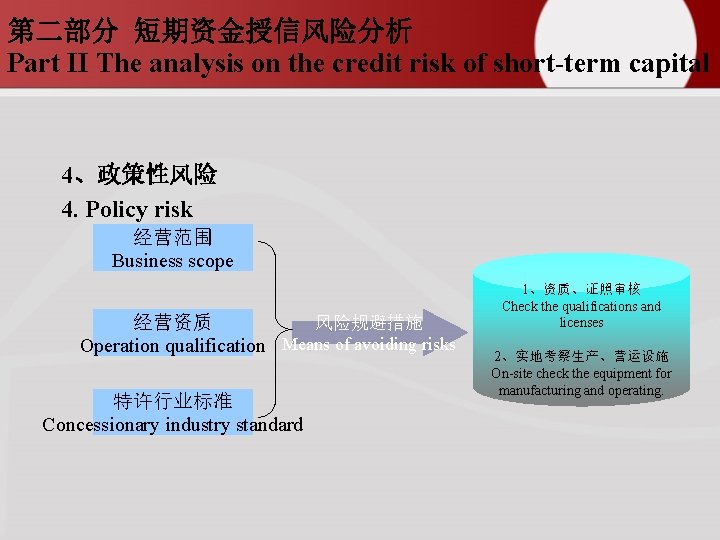

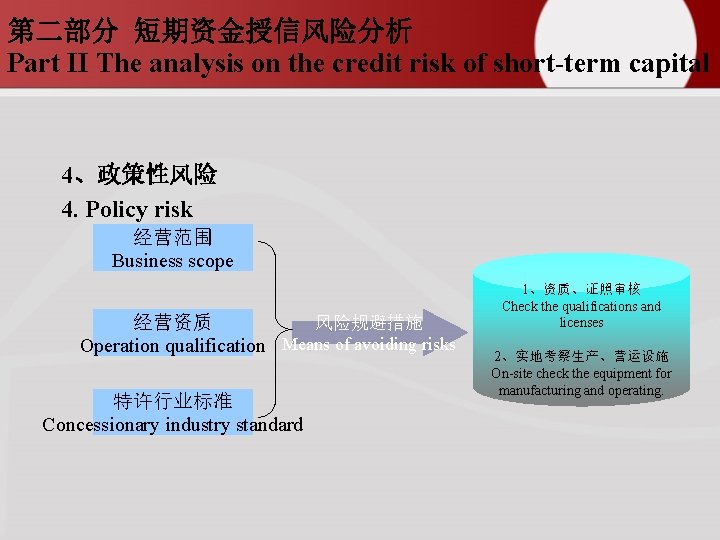

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 4、政策性风险 4. Policy risk 经营范围 Business scope 经营资质 风险规避措施 Operation qualification Means of avoiding risks 特许行业标准 Concessionary industry standard 1、资质、证照审核 Check the qualifications and licenses 2、实地考察生产、营运设施 On-site check the equipment for manufacturing and operating.

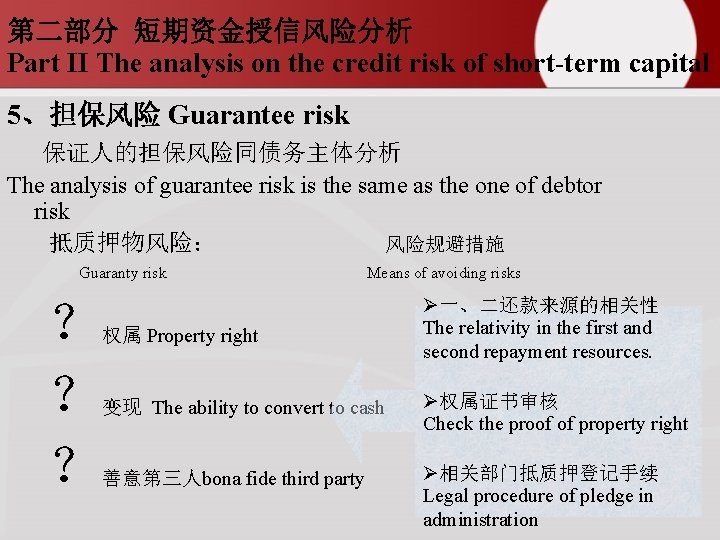

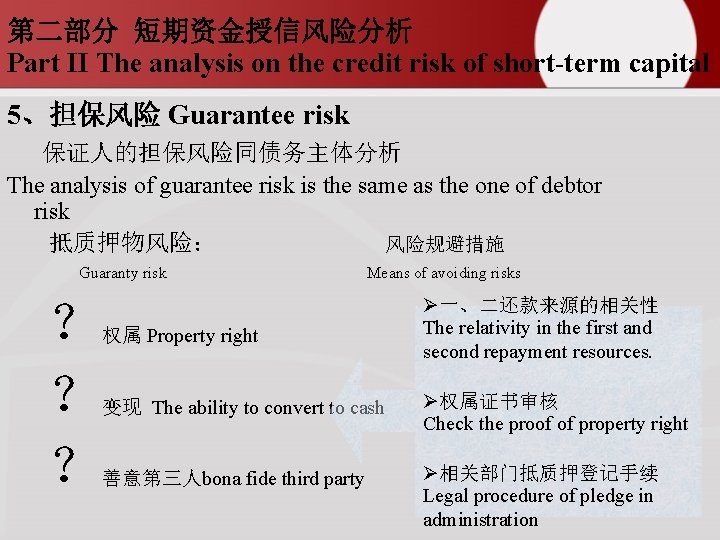

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 5、担保风险 Guarantee risk 保证人的担保风险同债务主体分析 The analysis of guarantee risk is the same as the one of debtor risk 抵质押物风险: 风险规避措施 Guaranty risk Means of avoiding risks 权属 Property right Ø一、二还款来源的相关性 The relativity in the first and second repayment resources. 变现 The ability to convert to cash Ø权属证书审核 Check the proof of property right 善意第三人bona fide third party Ø相关部门抵质押登记手续 Legal procedure of pledge in administration ? ? ?

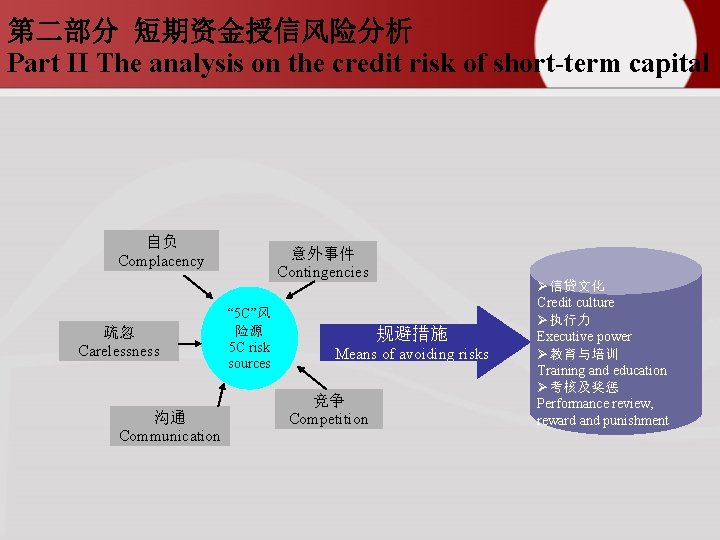

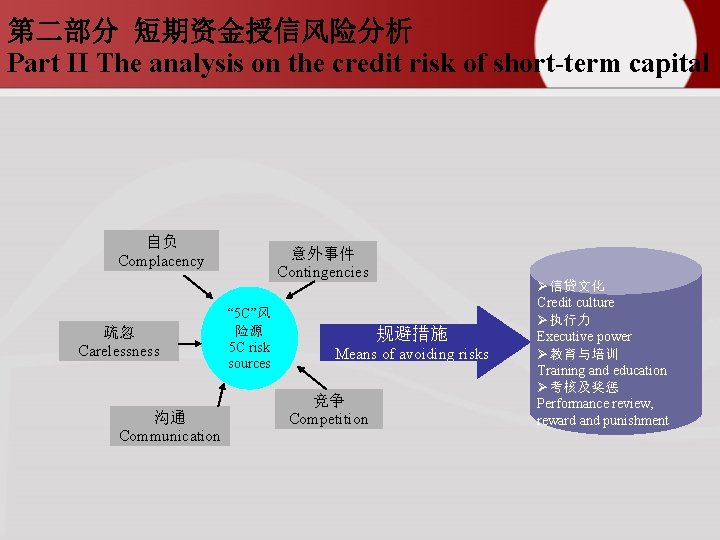

第二部分 短期资金授信风险分析 Part II The analysis on the credit risk of short-term capital 自负 Complacency 疏忽 Carelessness 沟通 Communication 意外事件 Contingencies “ 5 C”风 险源 5 C risk sources 规避措施 Means of avoiding risks 竞争 Competition Ø信贷文化 Credit culture Ø执行力 Executive power Ø教育与培训 Training and education Ø考核及奖惩 Performance review, reward and punishment

第三部分 短期资金授信风险控制 Part III The control on the credit risk of short-term capital 风险敞口控制 Control of risk exposure Ø 对单一客户、行业、地域设定最高额限制。 Set top limitation to single customer, industry and region. Ø 风险敞口根据客户、行业、地域的风险度水平及银行 股权资本对风险的保障程度而定。 Risk exposure depends on the risks of customers, industries and regions as well as the stock equity of the banks.

第三部分 短期资金授信风险控制 Part III The control on the credit risk of short-term capital 贷款风险评级 Ranking of the loan risk Ø 分析客户及贷款的特征 Analyze the features of the customers and the loans Ø 评估违约的可能性及预期损失。 Evaluate the possibilities of breach and estimated loss Ø 定性与定量分析 Qualitative and quantitative analysis

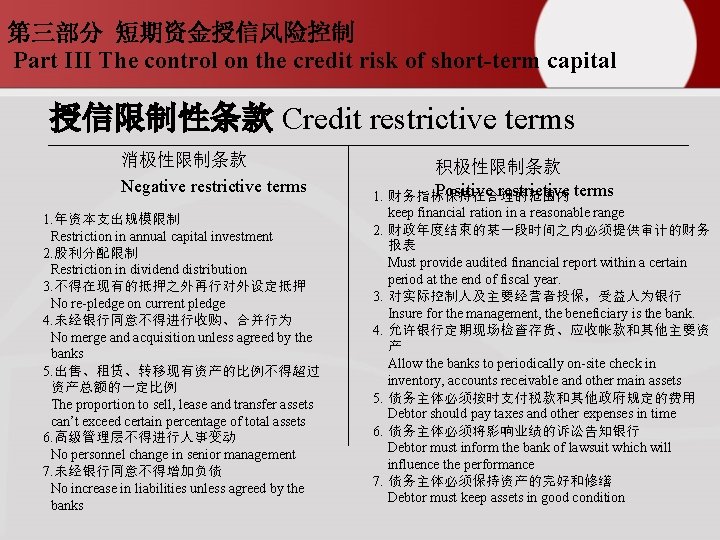

第三部分 短期资金授信风险控制 Part III The control on the credit risk of short-term capital 授信限制性条款 Credit restrictive terms 消极性限制条款 Negative restrictive terms 1. 年资本支出规模限制 Restriction in annual capital investment 2. 股利分配限制 Restriction in dividend distribution 3. 不得在现有的抵押之外再行对外设定抵押 No re-pledge on current pledge 4. 未经银行同意不得进行收购、合并行为 No merge and acquisition unless agreed by the banks 5. 出售、租赁、转移现有资产的比例不得超过 资产总额的一定比例 The proportion to sell, lease and transfer assets can’t exceed certain percentage of total assets 6. 高级管理层不得进行人事变动 No personnel change in senior management 7. 未经银行同意不得增加负债 No increase in liabilities unless agreed by the banks 积极性限制条款 Positive restrictive terms 1. 财务指标保持在合理的范围内 keep financial ration in a reasonable range 2. 财政年度结束的某一段时间之内必须提供审计的财务 报表 Must provide audited financial report within a certain period at the end of fiscal year. 3. 对实际控制人及主要经营者投保,受益人为银行 Insure for the management, the beneficiary is the bank. 4. 允许银行定期现场检查存货、应收帐款和其他主要资 产 Allow the banks to periodically on-site check in inventory, accounts receivable and other main assets 5. 债务主体必须按时支付税款和其他政府规定的费用 Debtor should pay taxes and other expenses in time 6. 债务主体必须将影响业绩的诉讼告知银行 Debtor must inform the bank of lawsuit which will influence the performance 7. 债务主体必须保持资产的完好和修缮 Debtor must keep assets in good condition

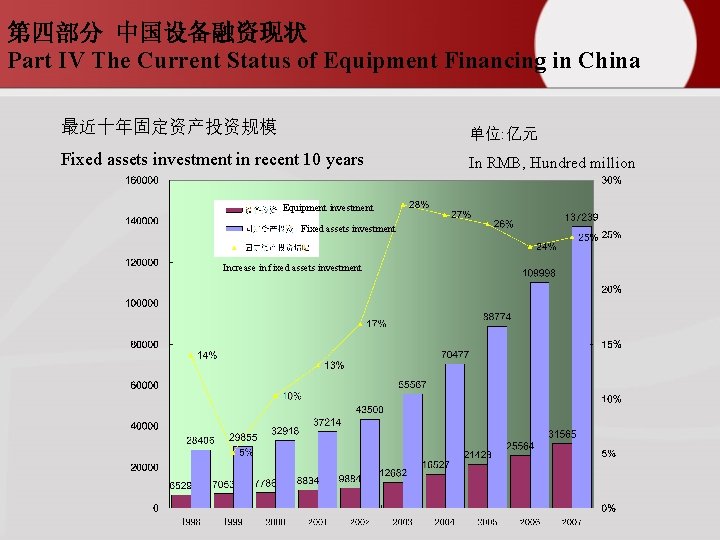

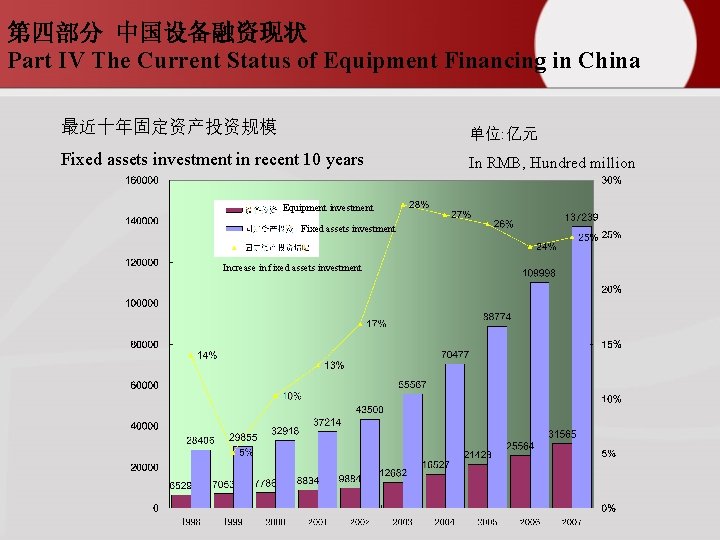

第四部分 中国设备融资现状 Part IV The Current Status of Equipment Financing in China 最近十年固定资产投资规模 单位: 亿元 Fixed assets investment in recent 10 years In RMB, Hundred million Equipment investment Fixed assets investment Increase in fixed assets investment

第四部分 中国设备融资现状 Your Logo Part IV The Current Status of Equipment Financing in China 设备融资的方式 Methods of equipment finance Ø 租赁 Leasing Ø 分期付款 Pay by installment Ø 银行(抵押)贷款 Mortgage Ø 出口买方信贷 Export buyers’ credit

第四部分 中国设备融资现状 Your Logo Part IV The Current Status of Equipment Financing in China 设备融资所能覆盖的设备种类 Equipment category under equipment finance Ø 飞机 Aircraft Ø 船舶 Ship Ø 营运车辆 Business vehicles Ø 程机械 Engineering machinery Ø 医疗设备 Medical equipment Ø 成套大型设备 large complete - set equipment

第四部分 中国设备融资现状 Part IV The Current Status of Equipment Financing in China 提供设备融资的主体 Equipment Finance Principal Parts 设备制造商 Equipment Manufacturer 租赁公司 Leasing Company 商业银行 Commercial Bank

第四部分 中国设备融资现状 Part IV The Current Status of Equipment Financing in China 设备制造商 Equipment manufacturer 问题:Questions Ø 占用自身经营性现金流量 Use its own operating cash flow Ø 信用风险难以控制 Difficult to control the credit risk Ø 首付比例高、期限短不利于用户资金安排 High down payment, short term which is not convenient for client to arrange the capital 改善途径: Means of improvement Ø 成立融资租赁公司 Set up financial leasing company Ø 与银行合作开展银行按揭 Cooperate with the banks for mortgage loan

第四部分 中国设备融资现状 Part IV The Current Status of Equipment Financing in China 租赁公司 Leasing company 中国租赁行业现状 Current status of leasing industry in China Ø 业务规模小 Small business scale Ø 信用环境有待改善 Credit environment needs improving Ø 缺乏法律和税收等政策支持 short of policy support such as law and tax, etc.

第四部分 中国设备融资现状 Part IV The Current Status of Equipment Financing in China 商业银行 Commercial bank 对设备买方、卖方及租赁公司进行融资 Finance among equipment seller, buyer and leasing company.

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank Ø 信贷 Credit loan Ø 成立金融租赁公司 Set up financial leasing company Ø 财务顾问服务 Financial consultant service Ø 代理信托产品发行 Agent to issue trust fund

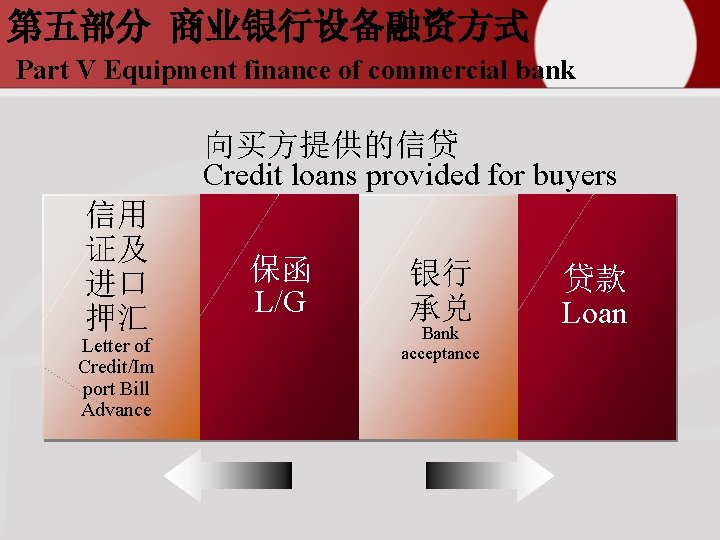

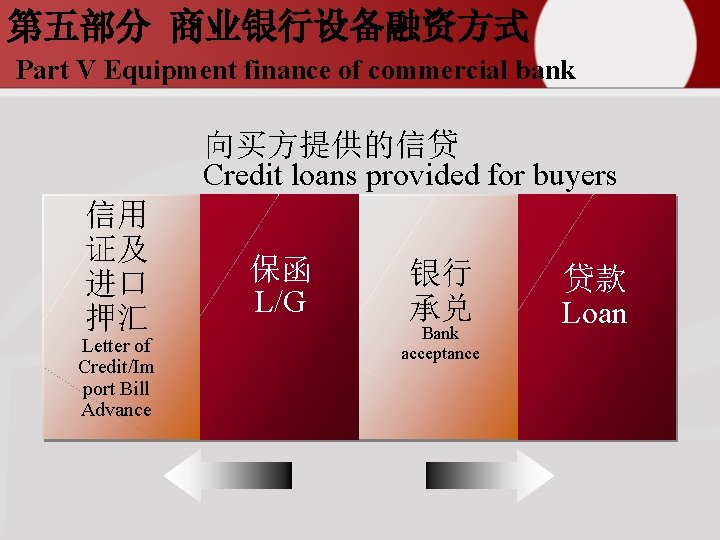

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 向买方提供的信贷 Credit loans provided for buyers 信用 证及 进口 押汇 Letter of Credit/Im port Bill Advance 保函 L/G 银行 承兑 Bank acceptance 贷款 Loan

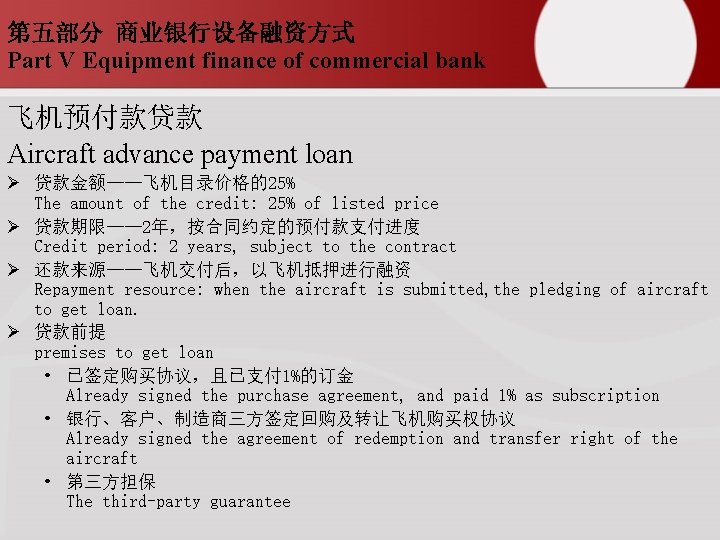

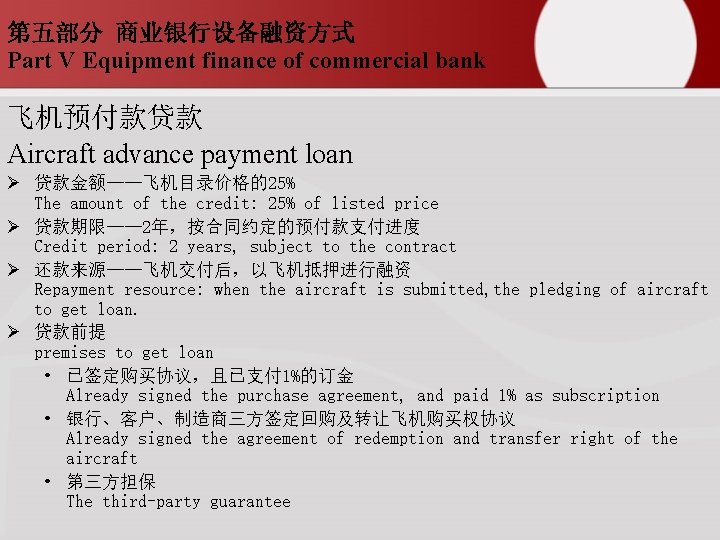

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 飞机预付款贷款 Aircraft advance payment loan Ø 贷款金额——飞机目录价格的25% The amount of the credit: 25% of listed price Ø 贷款期限—— 2年,按合同约定的预付款支付进度 Credit period: 2 years, subject to the contract Ø 还款来源——飞机交付后,以飞机抵押进行融资 Repayment resource: when the aircraft is submitted, the pledging of aircraft to get loan. Ø 贷款前提 premises to get loan • 已签定购买协议,且已支付 1%的订金 Already signed the purchase agreement, and paid 1% as subscription • 银行、客户、制造商三方签定回购及转让飞机购买权协议 Already signed the agreement of redemption and transfer right of the aircraft • 第三方担保 The third-party guarantee

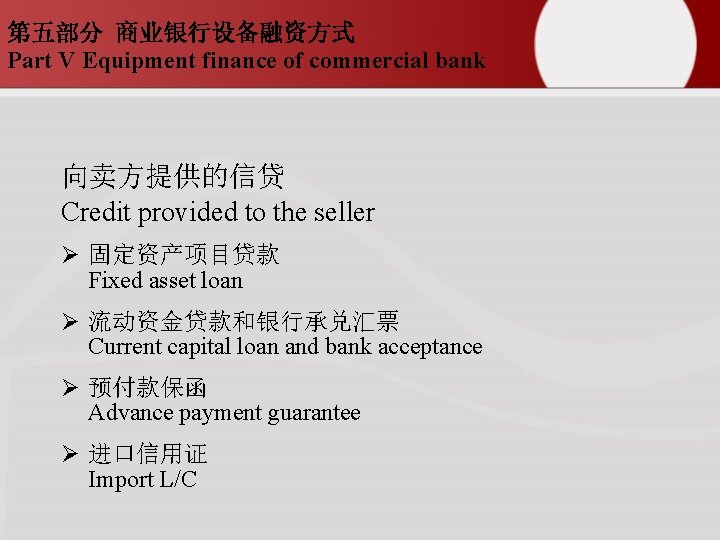

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 向卖方提供的信贷 Credit provided to the seller Ø 固定资产项目贷款 Fixed asset loan Ø 流动资金贷款和银行承兑汇票 Current capital loan and bank acceptance Ø 预付款保函 Advance payment guarantee Ø 进口信用证 Import L/C

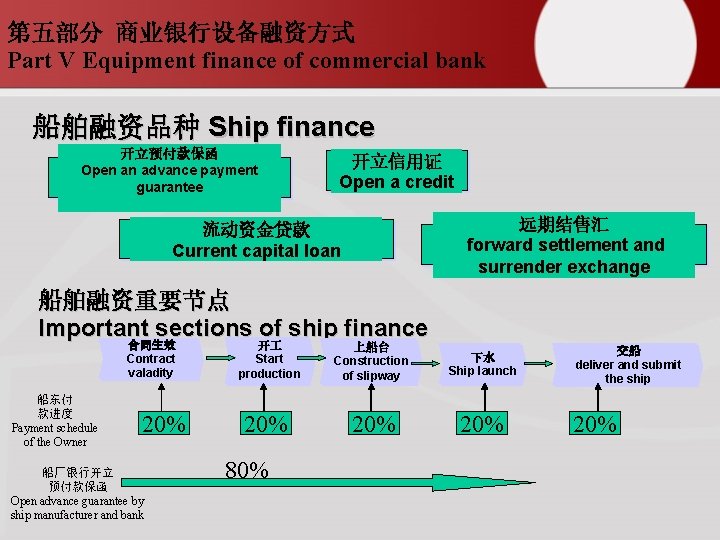

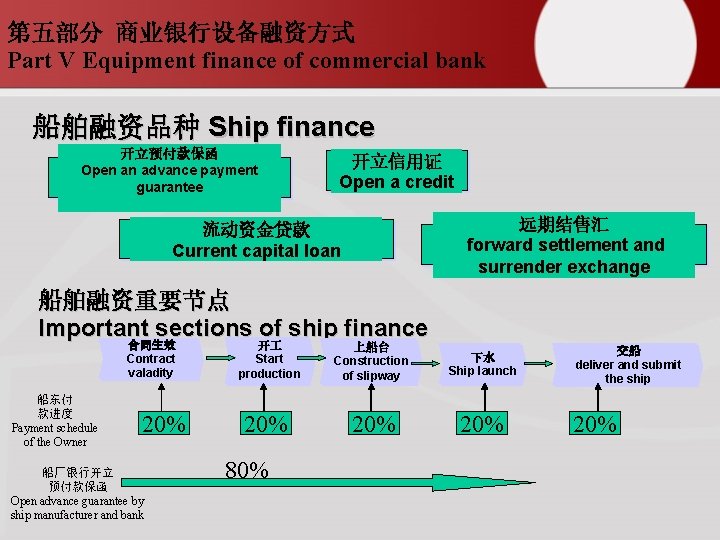

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 船舶融资品种 Ship finance 开立预付款保函 Open an advance payment guarantee 开立信用证 Open a credit 远期结售汇 forward settlement and surrender exchange 流动资金贷款 Current capital loan 船舶融资重要节点 Important sections of ship finance 合同生效 Contract valadity 船东付 款进度 Payment schedule of the Owner 20% 船厂银行开立 预付款保函 Open advance guarantee by ship manufacturer and bank 开 Start production 上船台 Construction of slipway 下水 Ship launch 20% 20% 80% 交船 deliver and submit the ship 20%

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 向租赁公司融资 Financing from leasing company • 应租赁的受让 Leasing tranfer • 流动资金贷款 Current capital loan • 按揭贷款 Mortgage loan • 提供担保 Provide guarantee

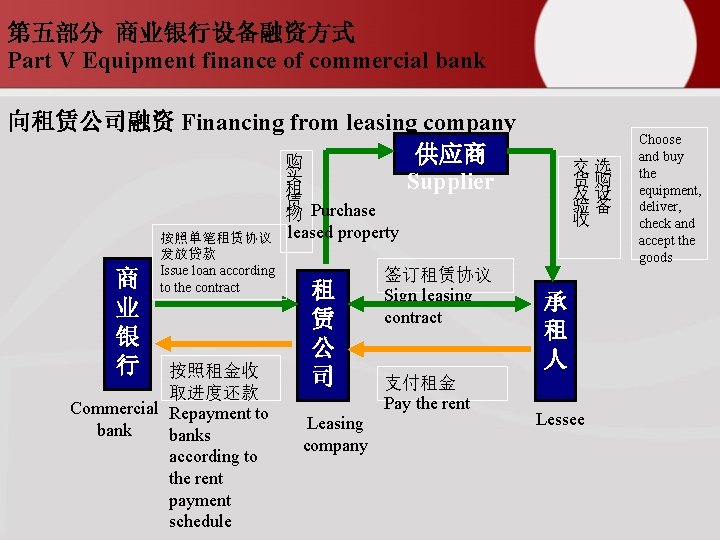

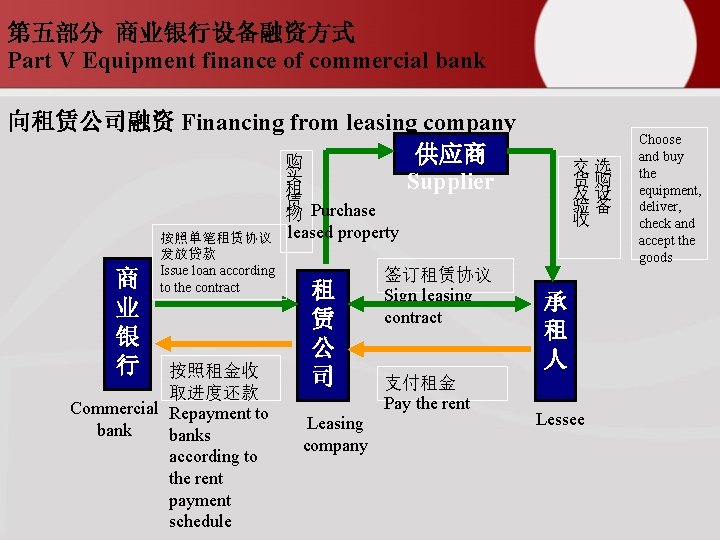

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 向租赁公司融资 Financing from leasing company 供应商 购 买 Supplier 租 商 业 银 行 按照单笔租赁协议 发放贷款 Issue loan according to the contract 按照租金收 取进度还款 Commercial Repayment to banks according to the rent payment schedule 交选 货购 及设 验备 收 赁 物 Purchase leased property 租 赁 公 司 Leasing company 签订租赁协议 Sign leasing contract 支付租金 Pay the rent 承 租 人 Lessee Choose and buy the equipment, deliver, check and accept the goods

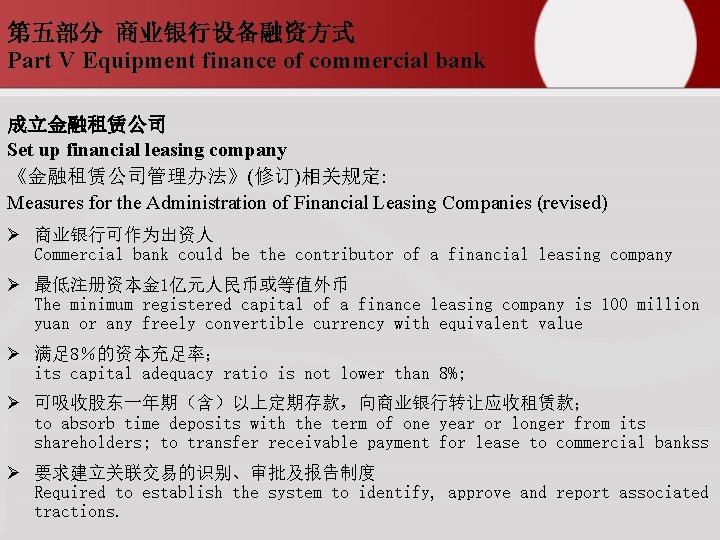

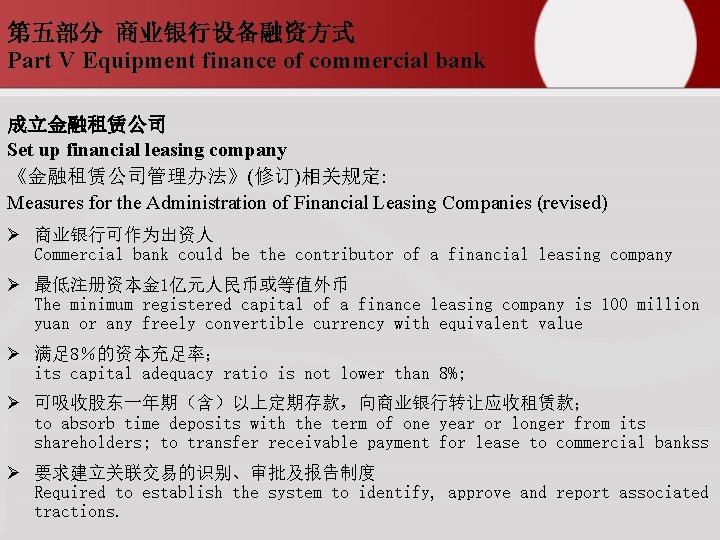

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 成立金融租赁公司 Set up financial leasing company 《金融租赁公司管理办法》(修订)相关规定: Measures for the Administration of Financial Leasing Companies (revised) Ø 商业银行可作为出资人 Commercial bank could be the contributor of a financial leasing company Ø 最低注册资本金 1亿元人民币或等值外币 The minimum registered capital of a finance leasing company is 100 million yuan or any freely convertible currency with equivalent value Ø 满足 8%的资本充足率; its capital adequacy ratio is not lower than 8%; Ø 可吸收股东一年期(含)以上定期存款,向商业银行转让应收租赁款; to absorb time deposits with the term of one year or longer from its shareholders; to transfer receivable payment for lease to commercial bankss Ø 要求建立关联交易的识别、审批及报告制度 Required to establish the system to identify, approve and report associated tractions.

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 五家商业银行成立金融租赁公司, 多家银行筹备 5 commercial banks set up financial leasing company. Several banks are in preparation. 银行 Bank 金融租赁公司 Financial leasing company 建设银行 China Construction Bank of China 商银行 Industrial and Commercial Bank of China 交通银行 Bank of Communications 建信金融租� 公司 Jianxin Financial Leasing Company 民生银行 China Minsheng Banking Corp. Ltd 注册资本 Register capital 45亿元 RMB 4. 5 Billion 股东 Shareholder 建�� 行占 75. 1% CCB: 75. 1% 美国� 行占 24. 9% Bank of America: 24. 9% � 金融租� 公司 20亿元 商� 行独�� 立 Gongyin Financial Leasing RMB 2 billion Wholly owned by ICBC Company 交� 金融租� 公司 Jiaoyin Financial Leasing Company 民生金融租� 公司 Minsheng Financial Leasing Company 20亿元 交通� 行独�� 立 RMB 2 billion Wholly owned by Bank of Communications 32亿元 RMB 3. 2 billion 民生� 行占 81. 25% CMBC: 81. 25% 天津保税区投� 公司占 18. 75% Tianjin FTZ (free trade zone) Investment Co. , Ltd. : 18. 75% 招商金融租� 公司 20亿元 招商银行独资设立 招商银行 Merchants Financial Leasing China Merchants Bank RMB 2 billion Wholly owned by CMB Company

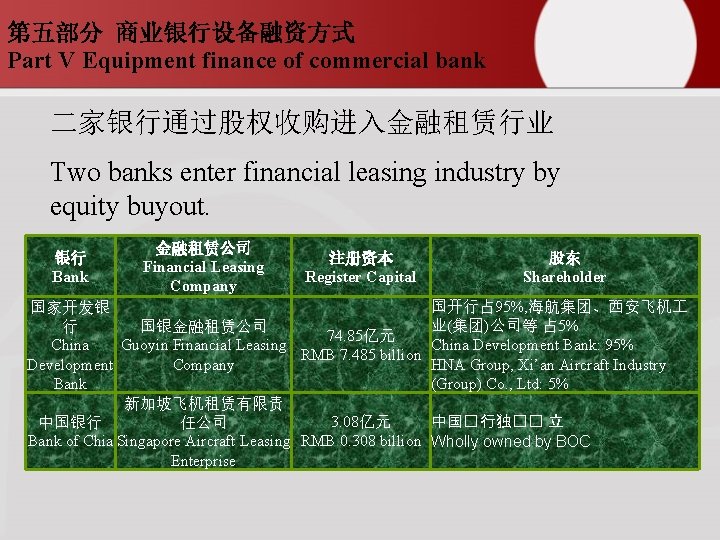

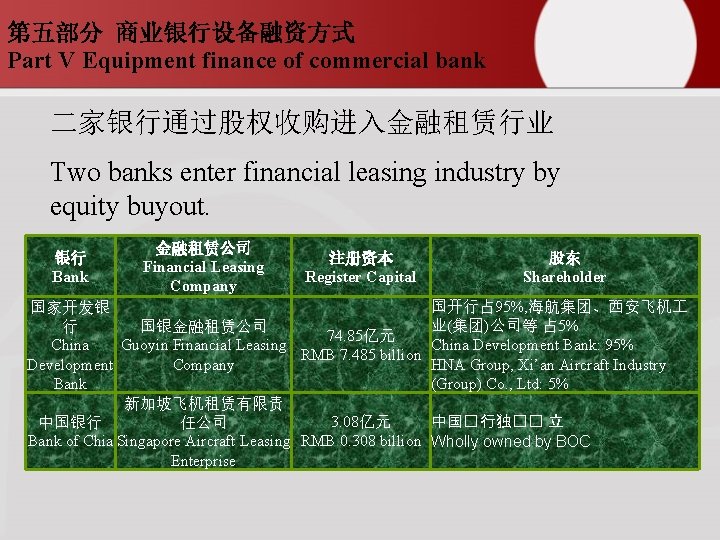

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 二家银行通过股权收购进入金融租赁行业 Two banks enter financial leasing industry by equity buyout. 银行 Bank 金融租赁公司 Financial Leasing Company 注册资本 Register Capital 国家开发银 行 国银金融租赁公司 74. 85亿元 China Guoyin Financial Leasing RMB 7. 485 billion Development Company Bank 新加坡飞机租赁有限责 3. 08亿元 任公司 中国银行 Bank of Chia Singapore Aircraft Leasing RMB 0. 308 billion Enterprise 股东 Shareholder 国开行占 95%, 海航集团、西安飞机 业(集团)公司等 占 5% China Development Bank: 95% HNA Group, Xi’an Aircraft Industry (Group) Co. , Ltd: 5% 中国� 行独�� 立 Wholly owned by BOC

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 财务顾问 Financial consultant 提供达到以下目的的融资方案 Provided financing proposal to meet below purposes Ø 针对个性化融资需求 focus on customized financing needs Ø 降低融资成本 reduce the cost of financing Ø 控制融资风险 control the financing risk Ø 改善财务结构 Improve the financial structure

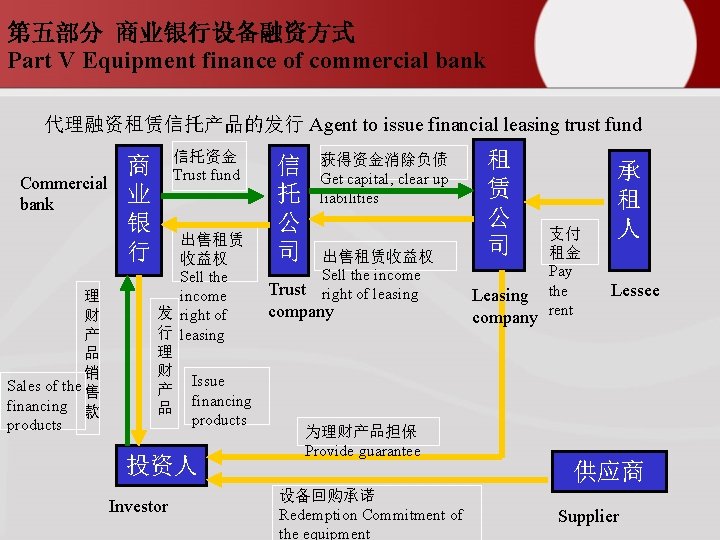

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 融资租赁信托产品的发行 Issue financial leasing trust fund Ø 商业银行与信托公司合作密切 close cooperation between commercial banks and trust companies Ø 以信托资金为融资租赁提供资金可行 Flexibility of providing financial leasing by trust fund

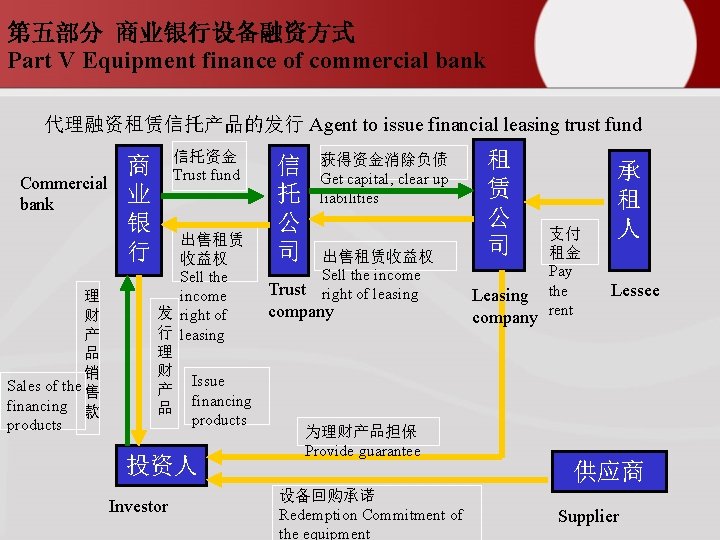

第五部分 商业银行设备融资方式 Part V Equipment finance of commercial bank 代理融资租赁信托产品的发行 Agent to issue financial leasing trust fund Commercial bank 理 财 产 品 销 Sales of the 售 financing 款 products 商 业 银 行 信托资金 Trust fund 信 托 公 司 获得资金消除负债 Get capital, clear up liabilities 出售租赁收益权 Sell the income Sell the Trust right of leasing income company 发 right of 行 leasing 理 财 Issue 产 financing 品 products 为理财产品担保 Provide guarantee 投资人 Investor 租 赁 公 司 支付 租金 Pay Leasing the company rent 承 租 人 Lessee 供应商 设备回购承诺 Redemption Commitment of the equipment Supplier

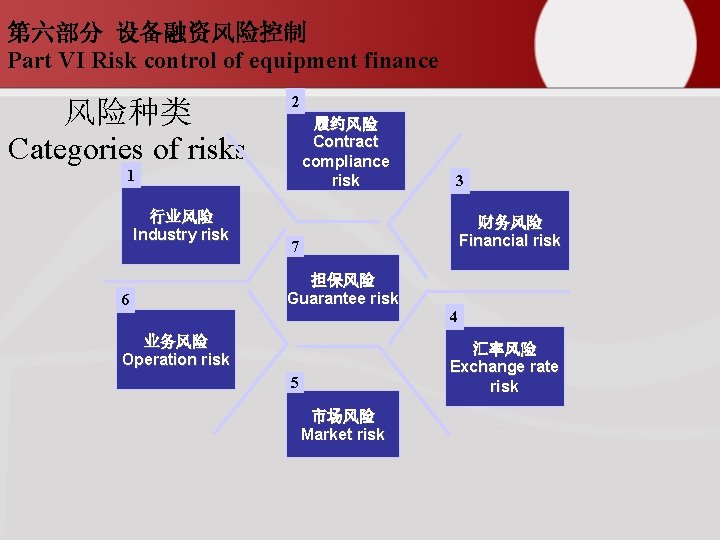

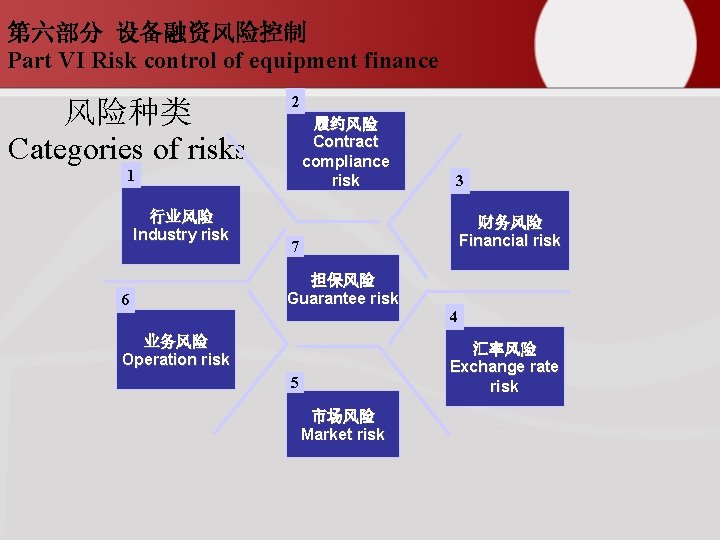

第六部分 设备融资风险控制 Part VI Risk control of equipment finance 风险种类 Categories of risks 2 履约风险 Contract compliance risk 1 行业风险 Industry risk 6 3 财务风险 Financial risk 7 担保风险 Guarantee risk 4 业务风险 Operation risk 汇率风险 Exchange rate risk 5 市场风险 Market risk

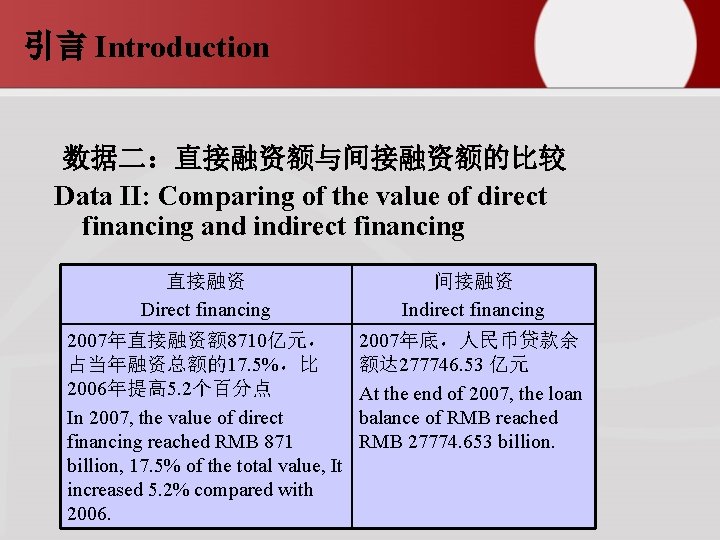

第六部分 设备融资风险控制 Part VI Risk control of equipment finance 风险控制 Risk Control Ø 依托原有的客户,做熟悉行业及设备; Depends on original customers; engage in familiar industries and equipments. Ø 大宗及通用设备 Big and general equipments Ø 针对业务的重要节点设定条件 Set conditions aimed at important sections during the operation Ø 对现金流量的控制 Control cash flows Ø 还款能力评估及制定适合的还款计划 Evaluation of repayment ability and work out proper repayment schedule Ø 取得设备供应商的回购承诺 Obtain the redemption commitments from equipment suppliers

谢谢各位 Thank you