Risk Aversion and Optimal Reserve Prices in First

- Slides: 11

Risk Aversion and Optimal Reserve Prices in First and Second-Price Auctions Audrey Hu University of Amsterdam Stephen A. Matthews University of Pennsylvania Liang Zou University of Amsterdam

The Benchmark Model ¡ Ex ante symmetric buyers l l ¡ An indivisible object for sale to n potential risk-neutral buyers Buyers’ values are independently drawn ex ante from the same distribution F Main results (e. g. Myerson 1981) l l Revenue (payoff) equivalence Optimal reserve price is the same in the standard auctions

Extension to Risk-Averse Buyers ¡ Under the same reserve price: l l Higher revenue in FPA than in SPA (Holt 1980, Maskin and Riley 1984) Buyers’ preference differs from the seller (Matthews 1987) ¡ DARA buyers prefer SPA ¡ IARA buyers prefer FPA ¡ CARA buyers are indifferent

The Present Model ¡ Both the seller and the buyers are risk-averse l l l ¡ Private value v [L, H] Buyers have the same utility function u. B The seller has the utility function u. S , and reservation value v 0 ≥ L Endogenize the reserve price

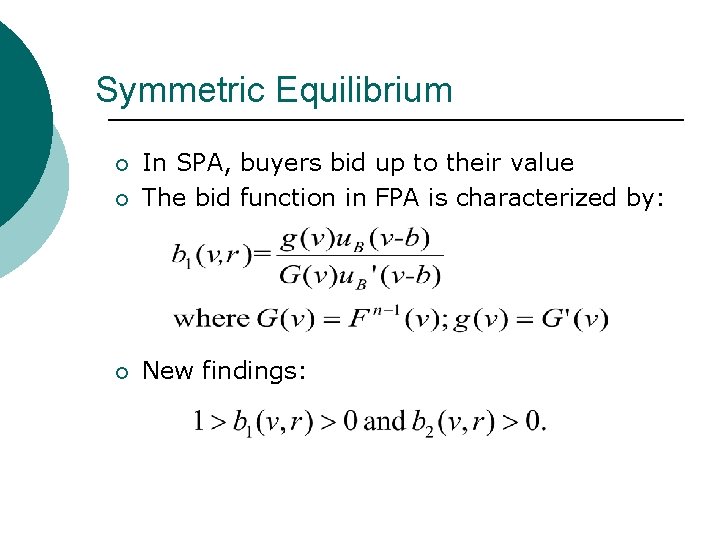

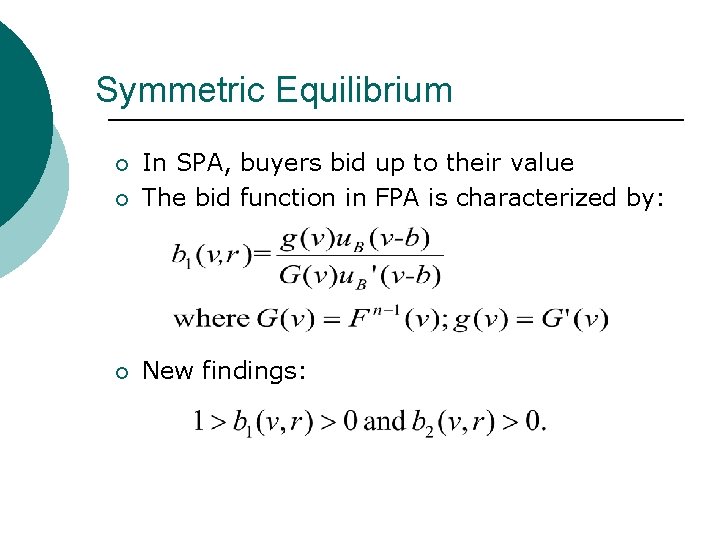

Symmetric Equilibrium ¡ In SPA, buyers bid up to their value The bid function in FPA is characterized by: ¡ New findings: ¡

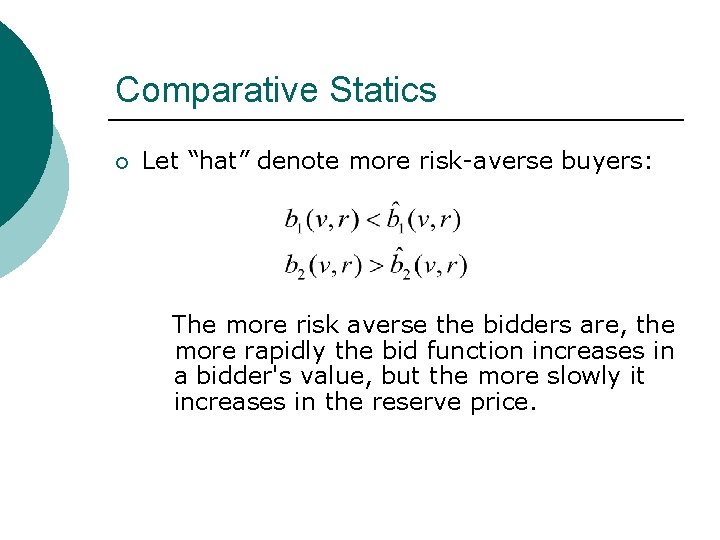

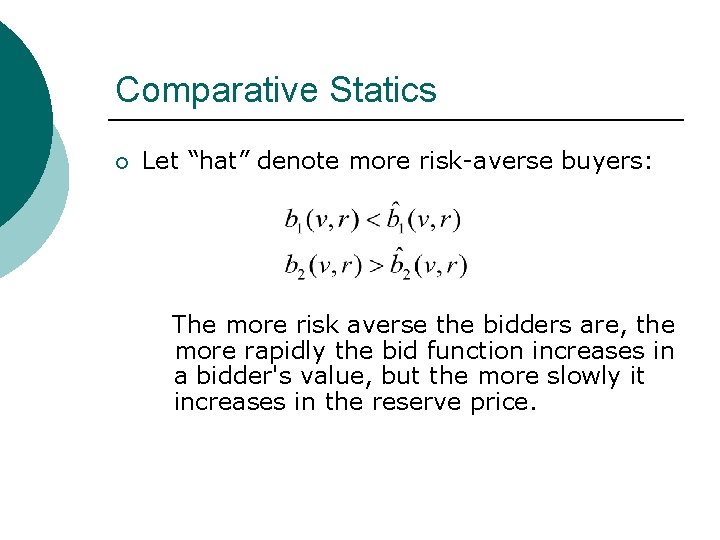

Comparative Statics ¡ Let “hat” denote more risk-averse buyers: The more risk averse the bidders are, the more rapidly the bid function increases in a bidder's value, but the more slowly it increases in the reserve price.

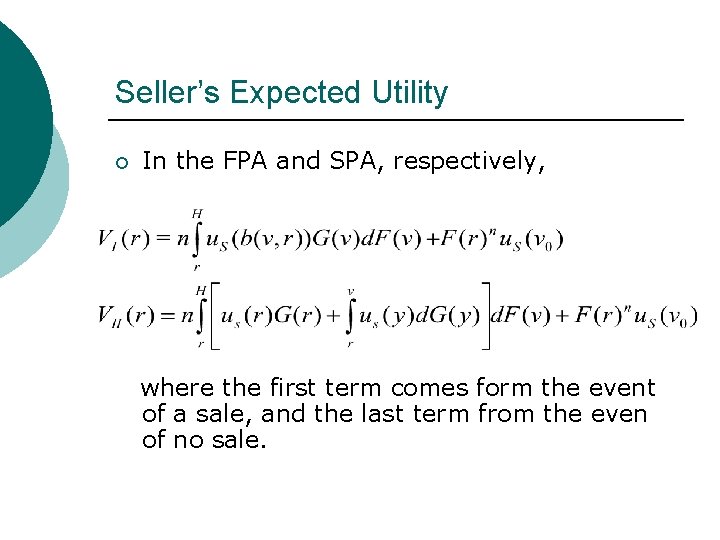

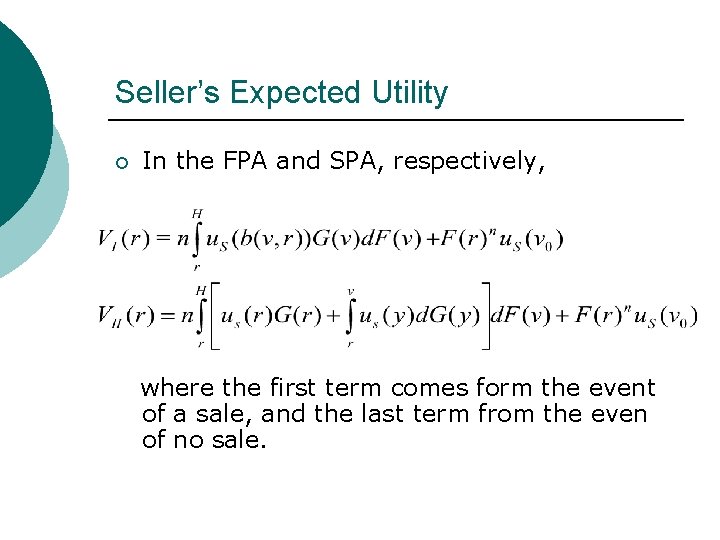

Seller’s Expected Utility ¡ In the FPA and SPA, respectively, where the first term comes form the event of a sale, and the last term from the even of no sale.

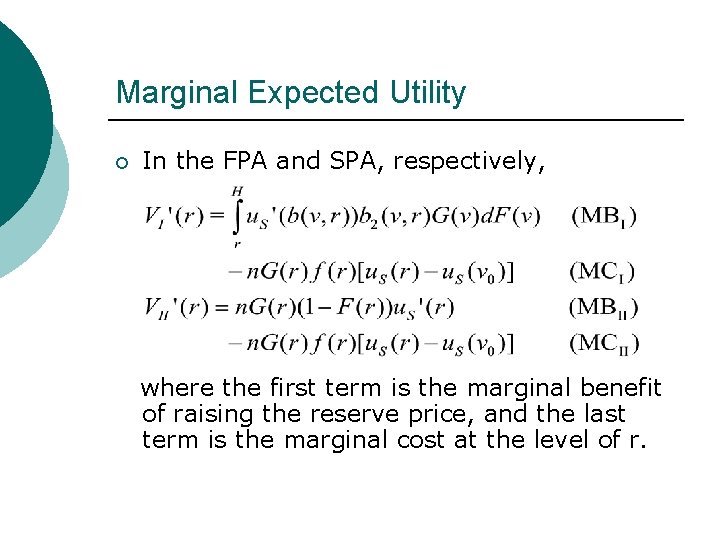

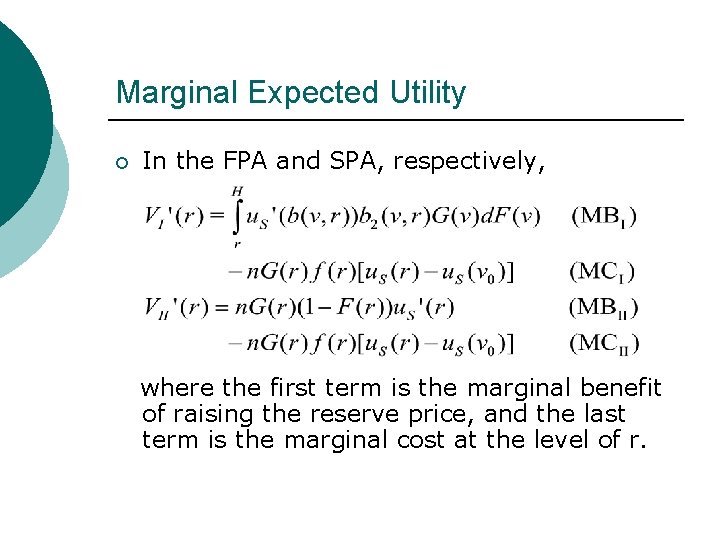

Marginal Expected Utility ¡ In the FPA and SPA, respectively, where the first term is the marginal benefit of raising the reserve price, and the last term is the marginal cost at the level of r.

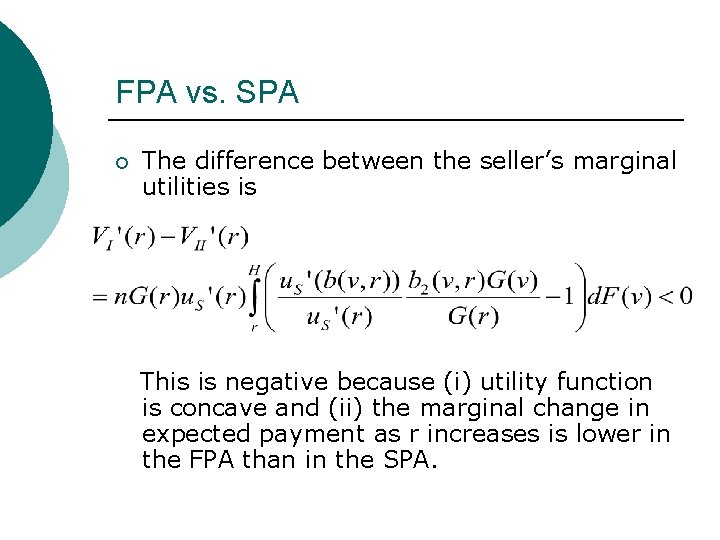

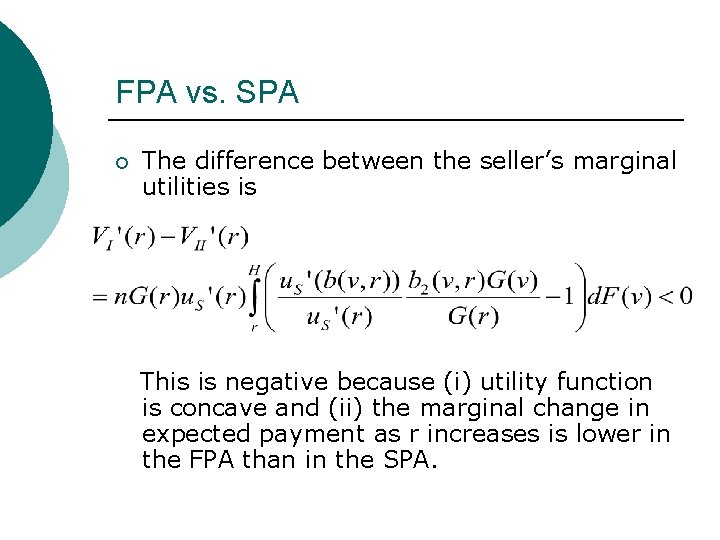

FPA vs. SPA ¡ The difference between the seller’s marginal utilities is This is negative because (i) utility function is concave and (ii) the marginal change in expected payment as r increases is lower in the FPA than in the SPA.

Main Results ¡ The seller's optimal reserve price decreases in his own risk aversion, and more so in the FPA. ¡ The seller's optimal reserve price in the FPA (not in the SPA) decreases in the buyers' risk aversion. ¡ At the interim stage, FPA is preferred by all buyer types in a lower interval, as well as by the seller.

Efficiency Implications ¡ Both the seller’s and the buyers’ risk aversion can be a disguised blessing in terms of ex post efficiency. (Higher risk aversion leads to higher probability of a sale. ) ¡ The seller and buyers with CARA or IARA always prefer the FPA to the SPA. At least some of the DARA buyers (with low values) also prefer the FPA. In these cases FPA Pareto dominates SPA.