REVISED SCHEDULE VI BALANCE SHEET AS PER COMPANIES

REVISED SCHEDULE VI BALANCE SHEET AS PER COMPANIES ACT 1956

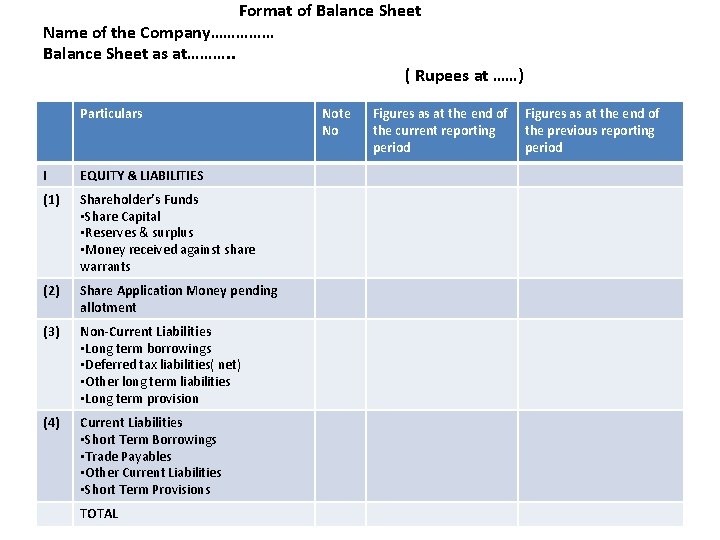

Format of Balance Sheet Name of the Company…………… Balance Sheet as at………. . ( Rupees at ……) Particulars I EQUITY & LIABILITIES (1) Shareholder’s Funds • Share Capital • Reserves & surplus • Money received against share warrants (2) Share Application Money pending allotment (3) Non-Current Liabilities • Long term borrowings • Deferred tax liabilities( net) • Other long term liabilities • Long term provision (4) Current Liabilities • Short Term Borrowings • Trade Payables • Other Current Liabilities • Short Term Provisions TOTAL Note No Figures as at the end of the current reporting period Figures as at the end of the previous reporting period

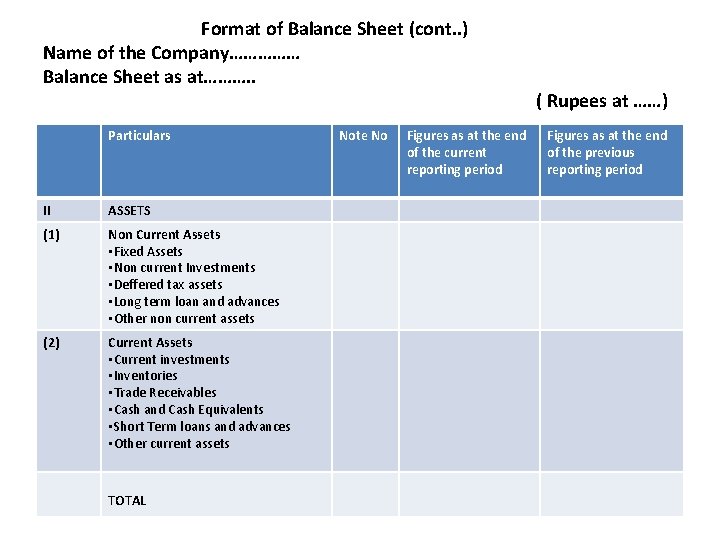

Format of Balance Sheet (cont. . ) Name of the Company…………… Balance Sheet as at………. . Particulars II ASSETS (1) Non Current Assets • Fixed Assets • Non current Investments • Deffered tax assets • Long term loan and advances • Other non current assets (2) Current Assets • Current investments • Inventories • Trade Receivables • Cash and Cash Equivalents • Short Term loans and advances • Other current assets TOTAL Note No Figures as at the end of the current reporting period ( Rupees at ……) Figures as at the end of the previous reporting period

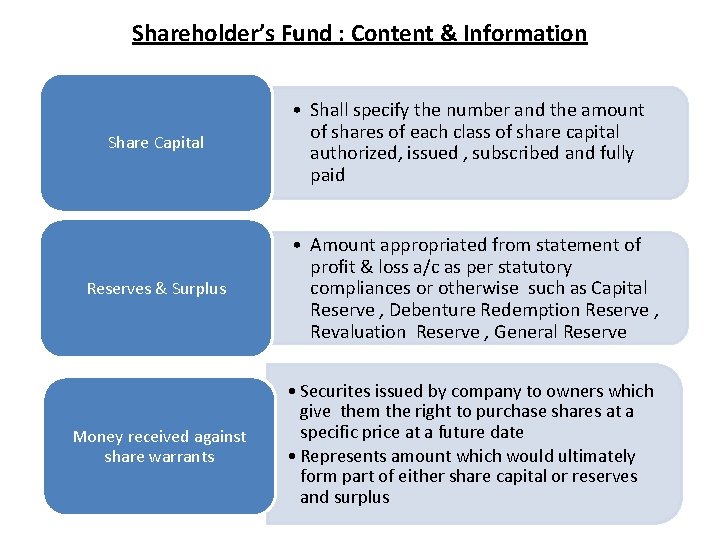

Shareholder’s Fund : Content & Information Share Capital • Shall specify the number and the amount of shares of each class of share capital authorized, issued , subscribed and fully paid Reserves & Surplus • Amount appropriated from statement of profit & loss a/c as per statutory compliances or otherwise such as Capital Reserve , Debenture Redemption Reserve , Revaluation Reserve , General Reserve Money received against share warrants • Securites issued by company to owners which give them the right to purchase shares at a specific price at a future date • Represents amount which would ultimately form part of either share capital or reserves and surplus

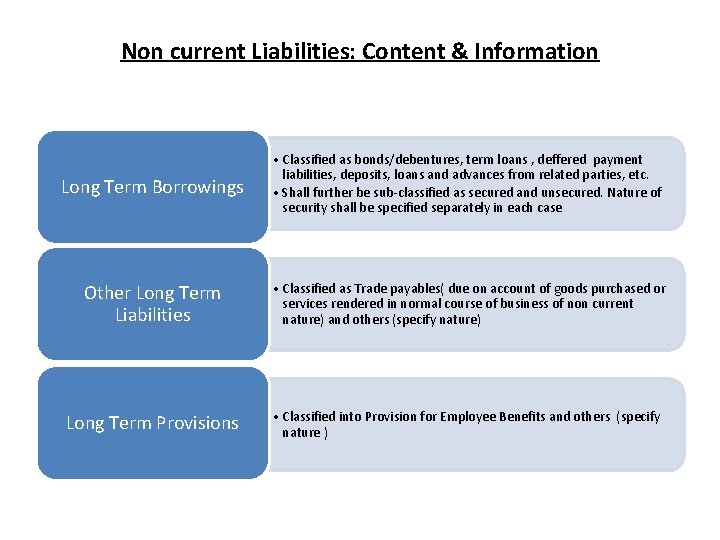

Non current Liabilities: Content & Information Long Term Borrowings • Classified as bonds/debentures, term loans , deffered payment liabilities, deposits, loans and advances from related parties, etc. • Shall further be sub-classified as secured and unsecured. Nature of security shall be specified separately in each case Other Long Term Liabilities • Classified as Trade payables( due on account of goods purchased or services rendered in normal course of business of non current nature) and others (specify nature) Long Term Provisions • Classified into Provision for Employee Benefits and others (specify nature )

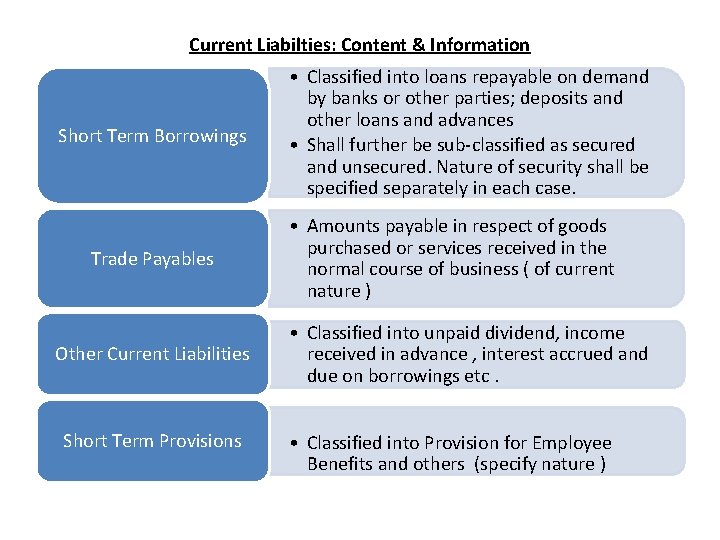

Current Liabilties: Content & Information Short Term Borrowings Trade Payables Other Current Liabilities Short Term Provisions • Classified into loans repayable on demand by banks or other parties; deposits and other loans and advances • Shall further be sub-classified as secured and unsecured. Nature of security shall be specified separately in each case. • Amounts payable in respect of goods purchased or services received in the normal course of business ( of current nature ) • Classified into unpaid dividend, income received in advance , interest accrued and due on borrowings etc. • Classified into Provision for Employee Benefits and others (specify nature )

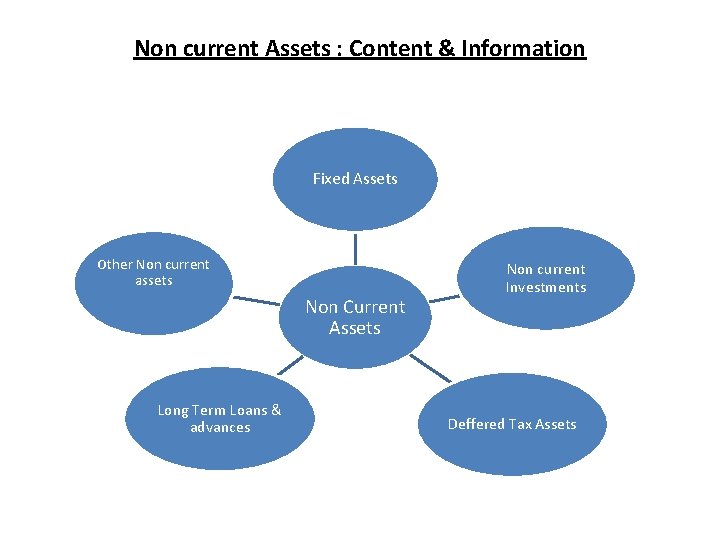

Non current Assets : Content & Information Fixed Assets Other Non current assets Non Current Assets Long Term Loans & advances Non current Investments Deffered Tax Assets

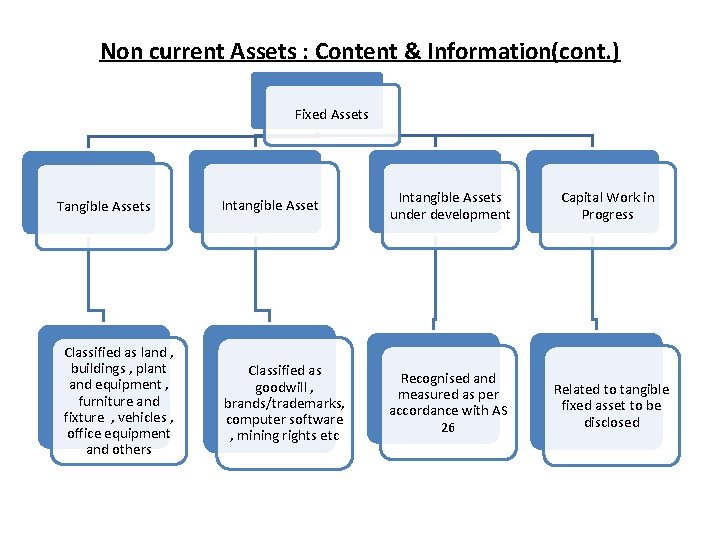

Non current Assets : Content & Information(cont. ) Fixed Assets Tangible Assets Classified as land , buildings , plant and equipment , furniture and fixture , vehicles , office equipment and others Intangible Assets under development Capital Work in Progress Classified as goodwill , brands/trademarks, computer software , mining rights etc Recognised and measured as per accordance with AS 26 Related to tangible fixed asset to be disclosed

Non current Assets : Content & Information(cont. ) Non-current Investment Long Term Loans and Advances Other non-current assets • Shall be classified as trade investments and other investments and further classified as investment property , investment in equity instruments , preference shares , government securities , bonds , debentures etc. • Shall be classifies as capital advances , security deposits , loans and advances related to other parties. • Shall be Further classified into secured , considered good; unsecured , considered good or doubtful • Shall be classified as long term trade receivables or others. • Shall be Further classified into secured , considered good; unsecured , considered good or doubtful

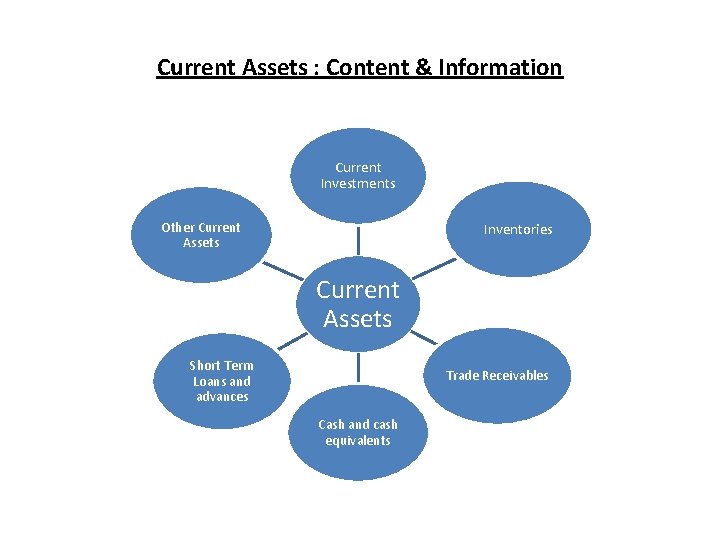

Current Assets : Content & Information Current Investments Other Current Assets Inventories Current Assets Short Term Loans and advances Trade Receivables Cash and cash equivalents

Current Assets : Content & Information (cont) Current Investments • Shall be classified as trade investments and other investments and further classified as investment property, investment in equity instruments, preference shares, government, securities , bonds, debentures, etc Inventories • Shall be classified as raw material , work in progress , finished goods , stock in trade , stores and spares , loose tools , etc • Mode of valuation should be stated Trade Receivables • Treated as current if it is expected to be realised within 12 months from the balance sheet date or within the operating cycle of the business , whichever is longer. • Shall be Further classified into secured , considered good; unsecured , considered good or doubtful

Current Assets : Content & Information (cont) Cash and Cash Equivalents • Shall be classified into bank balances, cheques , drafts on hand , cash on hand , short term highly liquid investments , other etc Short Term Loans and Advances • Shall be classifies into loans and advances to related parties and others( specifying nature ) • Shall be Further classified into secured , considered good; unsecured , considered good or doubtful Other Current Assets • Covers residuary current assets that do not fall into the any of the other current asset categories such as interest accrued on investments

REVISED SCHEDULE VI STATEMENT OF PROFIT & LOSS AS PER COMPANIES ACT 1956

STATEMENT OF PROFIT & LOSS • Ministry of Corporate Affairs has revised schedule VI which comprises of Profit & Loss Account and Balance Sheet. • The name of Profit & Loss account has been changed to Statement of Profit & Loss.

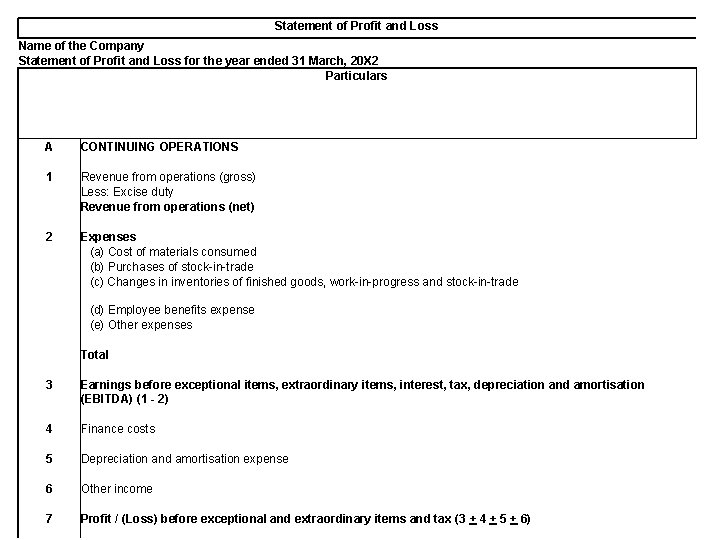

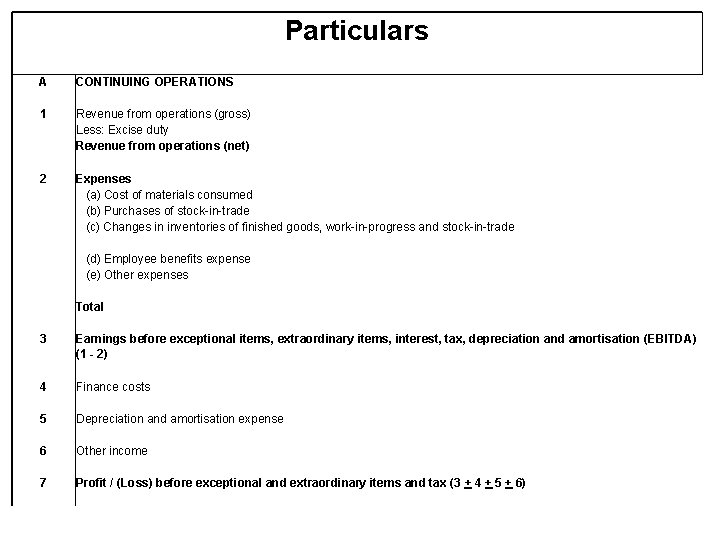

Statement of Profit and Loss Name of the Company Statement of Profit and Loss for the year ended 31 March, 20 X 2 Particulars A CONTINUING OPERATIONS 1 Revenue from operations (gross) Less: Excise duty Revenue from operations (net) 2 Expenses (a) Cost of materials consumed (b) Purchases of stock-in-trade (c) Changes in inventories of finished goods, work-in-progress and stock-in-trade (d) Employee benefits expense (e) Other expenses Total 3 Earnings before exceptional items, extraordinary items, interest, tax, depreciation and amortisation (EBITDA) (1 - 2) 4 Finance costs 5 Depreciation and amortisation expense 6 Other income 7 Profit / (Loss) before exceptional and extraordinary items and tax (3 + 4 + 5 + 6)

Particulars A CONTINUING OPERATIONS 1 Revenue from operations (gross) Less: Excise duty Revenue from operations (net) 2 Expenses (a) Cost of materials consumed (b) Purchases of stock-in-trade (c) Changes in inventories of finished goods, work-in-progress and stock-in-trade (d) Employee benefits expense (e) Other expenses Total 3 Earnings before exceptional items, extraordinary items, interest, tax, depreciation and amortisation (EBITDA) (1 - 2) 4 Finance costs 5 Depreciation and amortisation expense 6 Other income 7 Profit / (Loss) before exceptional and extraordinary items and tax (3 + 4 + 5 + 6)

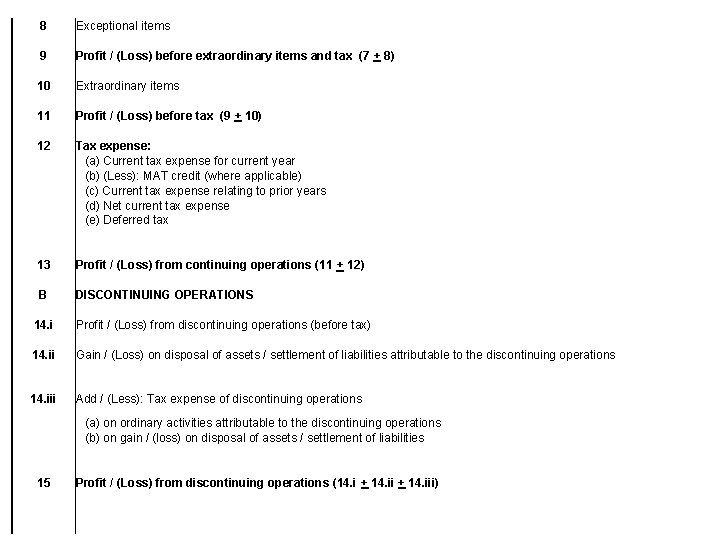

8 Exceptional items 9 Profit / (Loss) before extraordinary items and tax (7 + 8) 10 Extraordinary items 11 Profit / (Loss) before tax (9 + 10) 12 Tax expense: (a) Current tax expense for current year (b) (Less): MAT credit (where applicable) (c) Current tax expense relating to prior years (d) Net current tax expense (e) Deferred tax 13 Profit / (Loss) from continuing operations (11 + 12) B DISCONTINUING OPERATIONS 14. i Profit / (Loss) from discontinuing operations (before tax) 14. ii Gain / (Loss) on disposal of assets / settlement of liabilities attributable to the discontinuing operations 14. iii Add / (Less): Tax expense of discontinuing operations (a) on ordinary activities attributable to the discontinuing operations (b) on gain / (loss) on disposal of assets / settlement of liabilities 15 Profit / (Loss) from discontinuing operations (14. i + 14. iii)

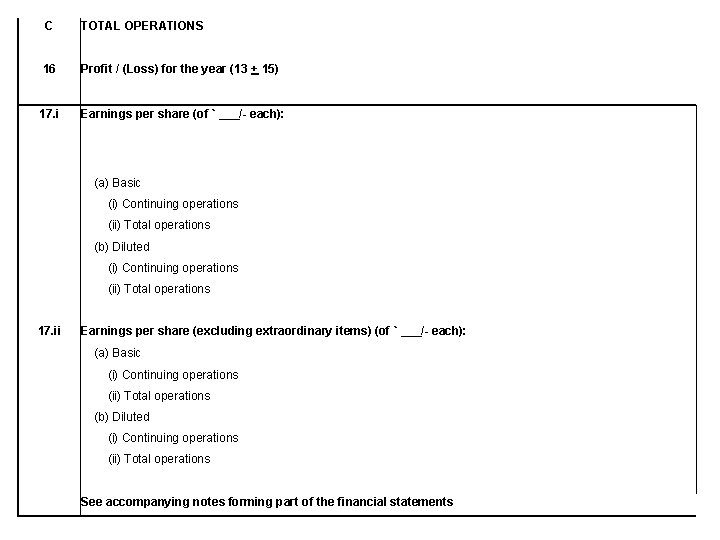

C TOTAL OPERATIONS 16 Profit / (Loss) for the year (13 + 15) 17. i Earnings per share (of ` ___/- each): (a) Basic (i) Continuing operations (ii) Total operations (b) Diluted (i) Continuing operations (ii) Total operations 17. ii Earnings per share (excluding extraordinary items) (of ` ___/- each): (a) Basic (i) Continuing operations (ii) Total operations (b) Diluted (i) Continuing operations (ii) Total operations See accompanying notes forming part of the financial statements

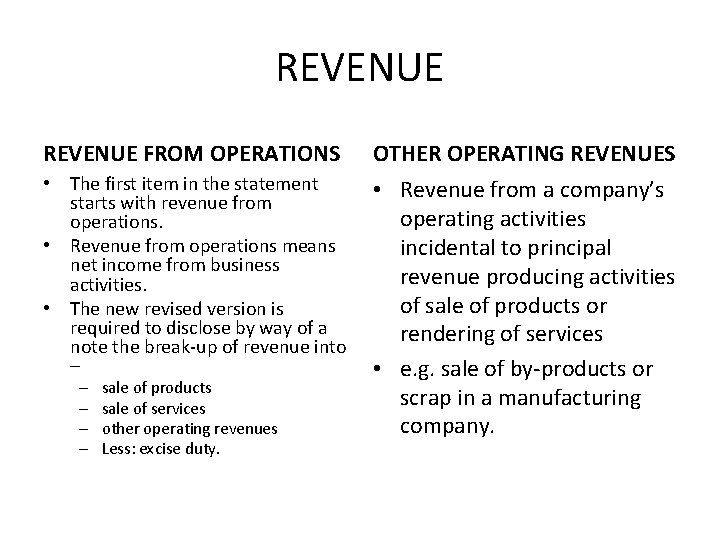

REVENUE FROM OPERATIONS OTHER OPERATING REVENUES • The first item in the statement starts with revenue from operations. • Revenue from operations means net income from business activities. • The new revised version is required to disclose by way of a note the break-up of revenue into – • Revenue from a company’s operating activities incidental to principal revenue producing activities of sale of products or rendering of services • e. g. sale of by-products or scrap in a manufacturing company. – – sale of products sale of services other operating revenues Less: excise duty.

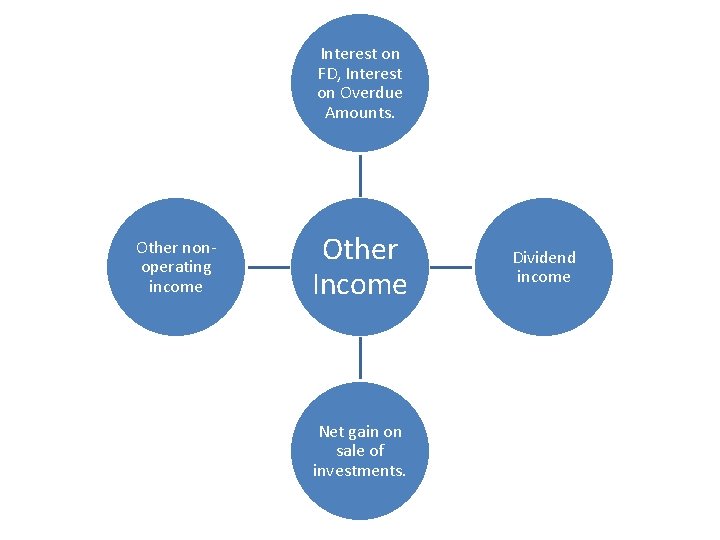

Interest on FD, Interest on Overdue Amounts. Other nonoperating income Other Income Net gain on sale of investments. Dividend income

EXPENSES

COST OF MATERIALS CONSUMED & PURCHASE OF STOCK IN TRADE • The revised Schedule requires separate disclosure of (i) cost of materials consumed, (ii) purchases of stock-in-trade and (iii) change in inventories of finished goods, workin-progress and stock in trade on the face of the statement of profit and loss. • Raw Material Consumed = Opening Stock of RM + Purchases of RM – Closing Stock of RM • Change in Inventory is the difference of Closing and Opening Stock of FG, WIP and SIT.

Employee Benefits Expenses • Salaries and wages • Contribution to provident and other funds • Expense on Employee Stock Option Scheme (ESOP) and Employee Stock Purchase Plan (ESPP) • Staff welfare expenses

Finance Costs • Interest expense • Other borrowing costs • Applicable net gain/loss on foreign currency transactions and translation. • Interest Expense includes Interest on Deb, Interest on Borrowings from Banks. • Other Borrowing Costs include project finance charges, loan processing charges etc.

Depreciation & Ammortization • Depreciation is an expense which arises due to the regular usage of the assets • Amortization refers to the writing off the cost of intangible assets like patents, copy rights etc. which have entitlements to use for a specified period of time. Commission on Sales • separate disclosure would be required if the amount exceeds one percent of turnover or INR 1, 000, whichever is higher.

Other Expenses Ø Consumption of stores and spare parts Ø Power and fuel Ø Rent Ø Repairs to buildings Ø Repairs to machinery Ø Insurance Ø Rates and taxes, excluding taxes on income Ø Miscellaneous expenses.

EXCEPTIONAL NATURE When items of income and expense within profit or loss from ordinary activities are of such size, nature or incidence that their disclosure is relevant to explain the performance of the enterprise for the period, the nature and amount of such items should be disclosed separately. ’

Extraordinary Items • The revised Schedule requires ‘extraordinary items’ to be distinguished from ‘exceptional items’ and shown separately on the face of the statement of profit and loss. For Eg: – Attachment of property – Loss of property due to earthquake.

Tax Expense Current tax (MAT) payable Less: MAT credit entitlement Net Current tax liability XX (XX) XX §MAT refers to Minimum Alternate tax. §This was introduced to make sure that the companies having large profits and declaring substantial dividends to the shareholders, but who were not contributing to the government by way of corporate tax, by taking the advantage of various incentives provided in the Income Tax Act, pay a fixed % of book profit as MAT

Profit/(loss) from Discontinuing Operations • The disclosure requirements of AS 24, Discontinuing Operations, including the amount of pre-tax profit or loss from ordinary activities attributable to the discontinuing operation, and the income tax expense related thereto to be disclosed on the face of the Statement should be complied with.

Earnings per Equity Share • Basic and diluted earnings per share, computed in accordance with AS 20, Earnings Per Share, should be disclosed on the face of the statements of profit and loss. In this regard, it is relevant to note that AS 20 requires the nominal value of equity shares to be disclosed ‘along with the earnings per share figures’; hence, the same would also need to be disclosed on the face.

- Slides: 31