Rethinking the Economies of SEE South Mediterranean Economies

- Slides: 26

Rethinking the Economies of SEE, South Mediterranean Economies and the Euro Area Debt Crisis in the Light of Turkish Experience Eray Yucel, Ph. D. , Economist, Central Bank of the Republic of Turkey 3 rd Bank of Greece Workshop on the Economies of Eastern Europe and Mediterranean Countries Athens, 18 May 2012 1

An Array of Crises • The 2008+ Global Financial Crisis – made a web of systemic problems visible – Underlined the importance of prudential policies and better regulations • Resolution of one crisis might make a separate set of systemic problems visible – the Greco-European debt crisis (or Eurozone/EZ debt crisis) • A solid understanding of vulnerabilities (exposures) is essential to draft recovery 2

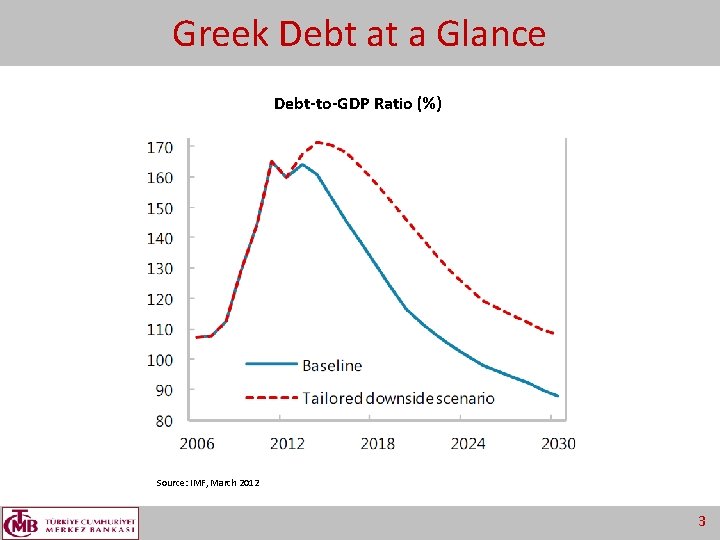

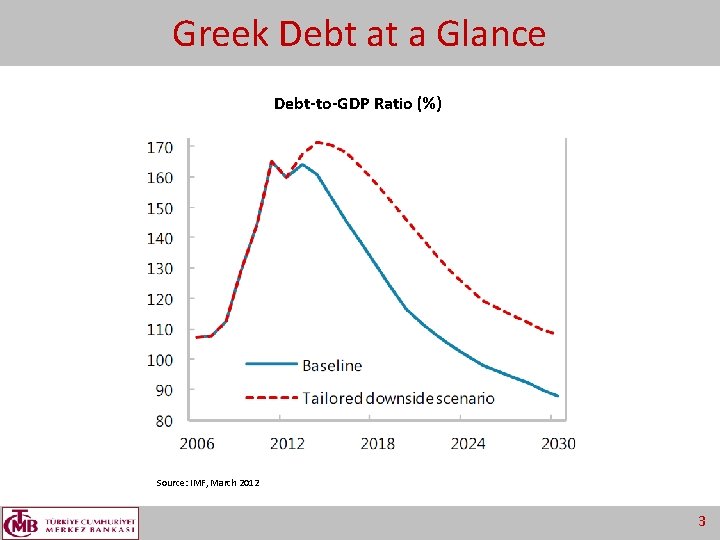

Greek Debt at a Glance Debt-to-GDP Ratio (%) Source: IMF, March 2012 3

Greek Debt at a Glance - II Ø Baseline Scenario 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 165. 3 159. 7 164. 0 160. 7 153 145. 2 137. 4 130. 3 123. 3 116. 5 Primary Surplus (% GDP) -2. 4 -1. 0 1. 8 4. 5 4. 8 4. 6 4. 5 Privatization Revenues (% GDP) 0. 5 1. 6 2. 1 2. 6 2. 1 Growth Rate of Real GDP (%) -6. 8 -4. 8 0. 0 2. 5 3. 1 3. 0 2. 8 2. 6 2. 5 2. 2 Public Debt (% GDP) Ø Alternative Scenario 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 165. 3 159. 3 167. 5 171. 4 170. 6 168. 0 162. 8 157. 5 151. 7 145. 7 Primary Surplus (% GDP) -2. 4 -1. 0 -0. 5 0. 0 1. 3 2. 5 4. 2 Privatization Revenues (% GDP) 0. 5 1. 0 1. 6 1. 7 1. 2 1. 3 Growth Rate of Real GDP(%) -6. 8 -5. 2 -1. 0 1. 6 2. 2 2. 3 2. 4 2. 3 Public Debt (% GDP) Source: IMF, March 2012 4

Greek Debt Problem • Involves widespread participation of EZ countries • Resolution is not straightforward – Commitment issues – Political uncertainties • Healthy functioning of euro system • Uncertainties regarding each country • Even the baseline scenario requires commitment to an ambitious set of targets • Still a high degree of uncertainty after resolution – Resolution of Greek debt might unveil other countries’ embedded problems 5

In this presentation… • An account from an outsider’s angle of view – Southeast European economies – South Mediterranean economies – The EZ debt crisis • For each, the Turkish experience might yield useful insights 6

Southeast European Economies • Assessments of different –yet interrelated– types of exposures are fundamental • Mostly pertaining to short-to-medium term performance/crisis prevention – Trade integration – Equity market integration – Credit market ties • A longer term view, though, might require further assessment of socio-demographic factors 7

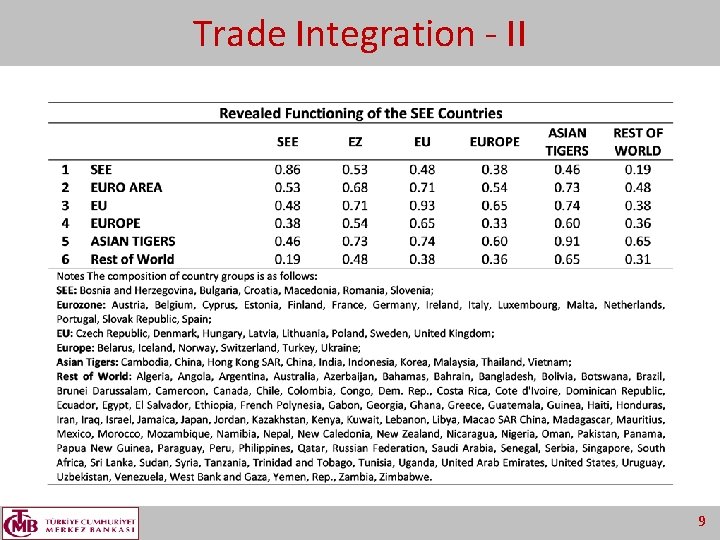

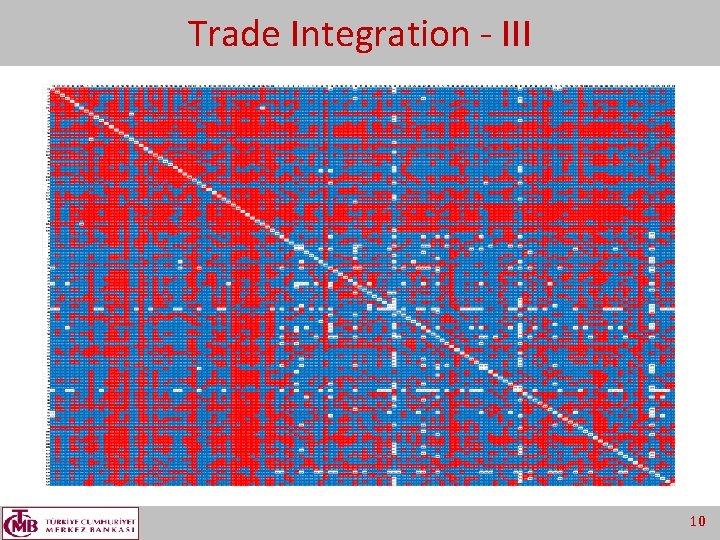

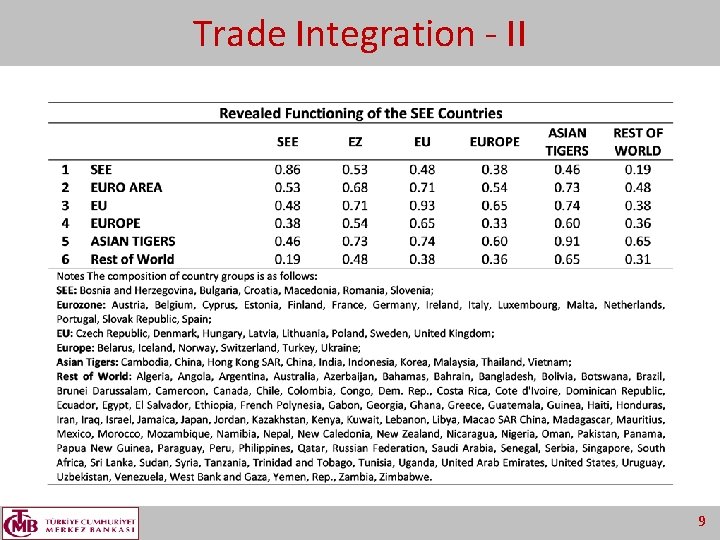

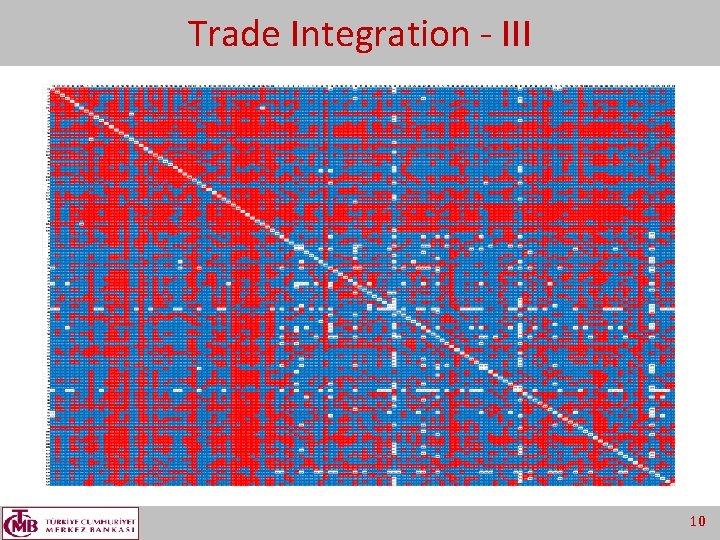

Trade Integration • Gravity Analysis: Dataset for 130 countries and 48 years – Fixed effects estimates extracted from the gravity equation • If (+) “above” average trade ties • If (-) “below” average trade ties – Simply counting the positive fixed effect estimates and measuring trade intensity relative to the average of the dataset 8

Trade Integration - II 9

Trade Integration - III 10

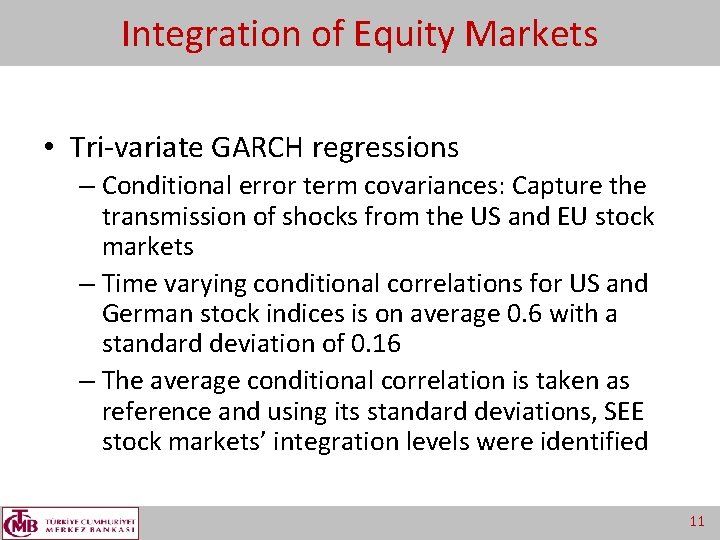

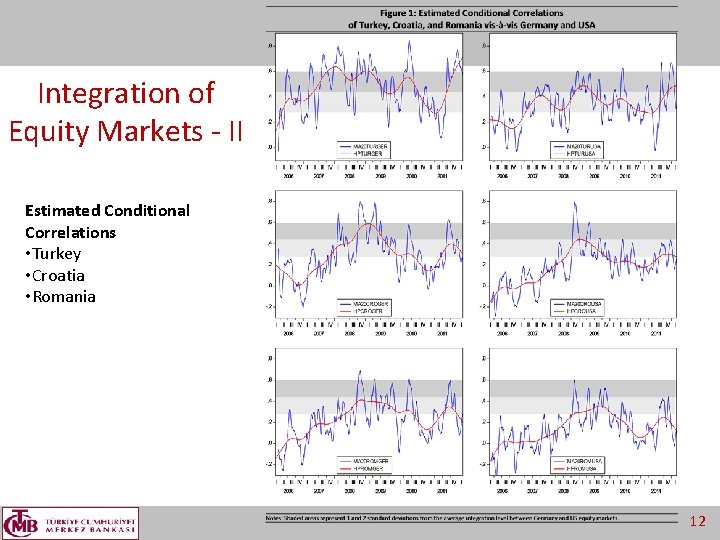

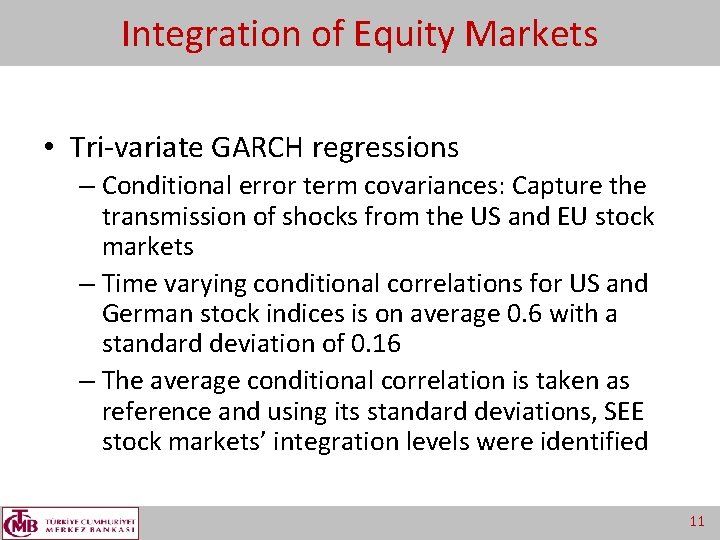

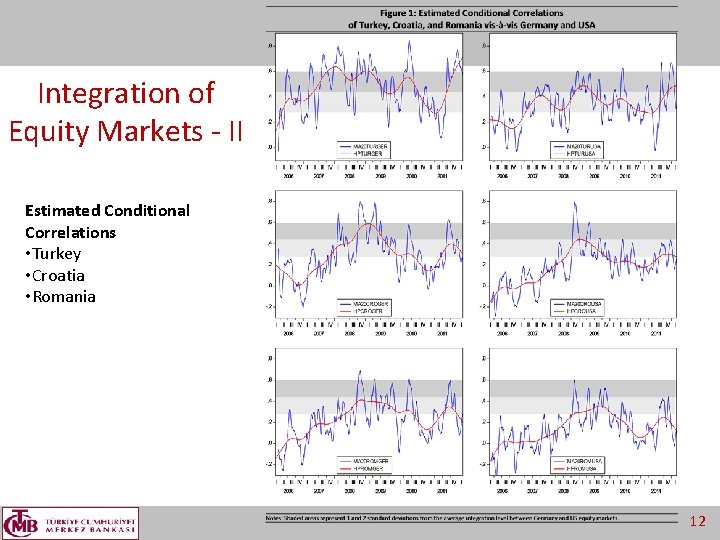

Integration of Equity Markets • Tri-variate GARCH regressions – Conditional error term covariances: Capture the transmission of shocks from the US and EU stock markets – Time varying conditional correlations for US and German stock indices is on average 0. 6 with a standard deviation of 0. 16 – The average conditional correlation is taken as reference and using its standard deviations, SEE stock markets’ integration levels were identified 11

Integration of Equity Markets - II Estimated Conditional Correlations • Turkey • Croatia • Romania 12

Integration of Equity Markets - III Estimated Conditional Correlations • Bulgaria • Macedonia • Slovenia 13

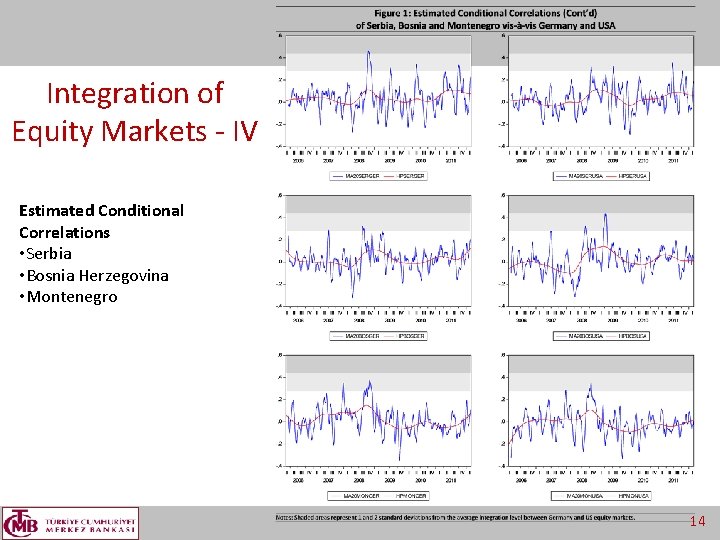

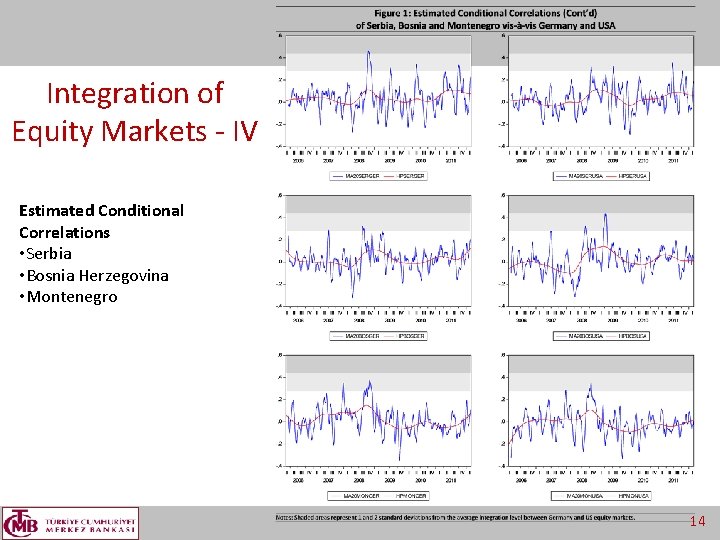

Integration of Equity Markets - IV Estimated Conditional Correlations • Serbia • Bosnia Herzegovina • Montenegro 14

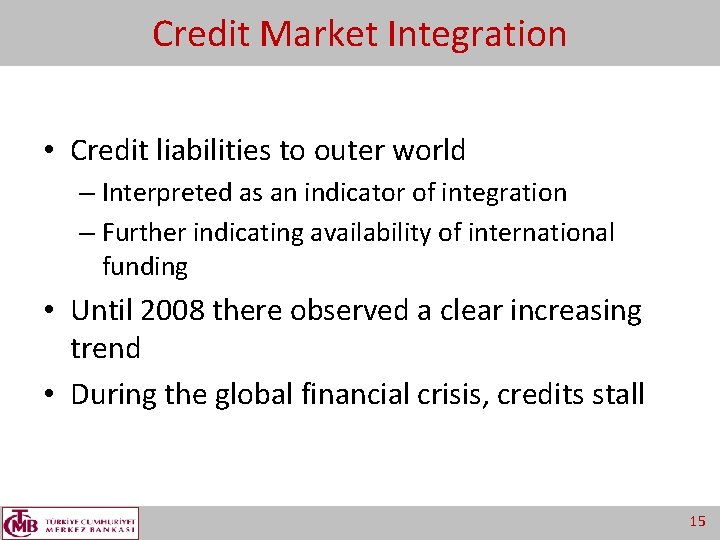

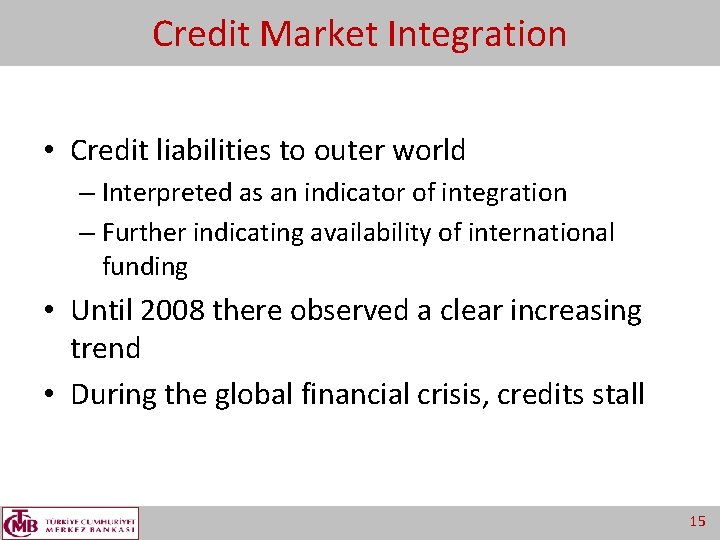

Credit Market Integration • Credit liabilities to outer world – Interpreted as an indicator of integration – Further indicating availability of international funding • Until 2008 there observed a clear increasing trend • During the global financial crisis, credits stall 15

Credit Market Integration - II 16

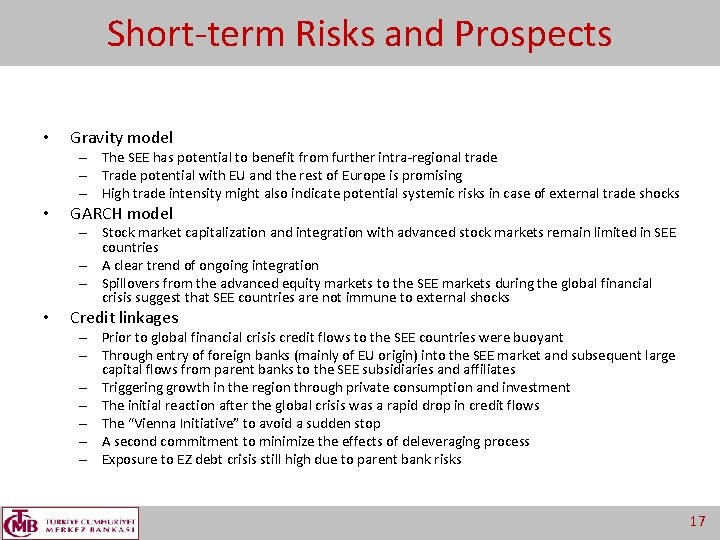

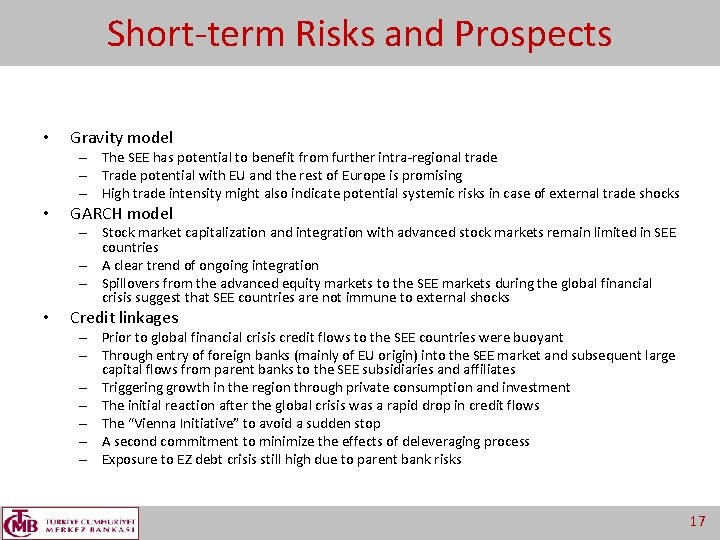

Short-term Risks and Prospects • Gravity model – The SEE has potential to benefit from further intra-regional trade – Trade potential with EU and the rest of Europe is promising – High trade intensity might also indicate potential systemic risks in case of external trade shocks • GARCH model – Stock market capitalization and integration with advanced stock markets remain limited in SEE countries – A clear trend of ongoing integration – Spillovers from the advanced equity markets to the SEE markets during the global financial crisis suggest that SEE countries are not immune to external shocks • Credit linkages – Prior to global financial crisis credit flows to the SEE countries were buoyant – Through entry of foreign banks (mainly of EU origin) into the SEE market and subsequent large capital flows from parent banks to the SEE subsidiaries and affiliates – Triggering growth in the region through private consumption and investment – The initial reaction after the global crisis was a rapid drop in credit flows – The “Vienna Initiative” to avoid a sudden stop – A second commitment to minimize the effects of deleveraging process – Exposure to EZ debt crisis still high due to parent bank risks 17

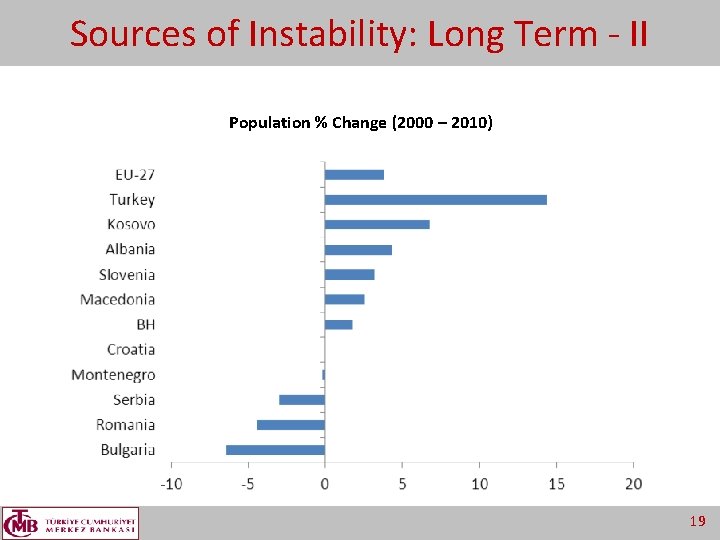

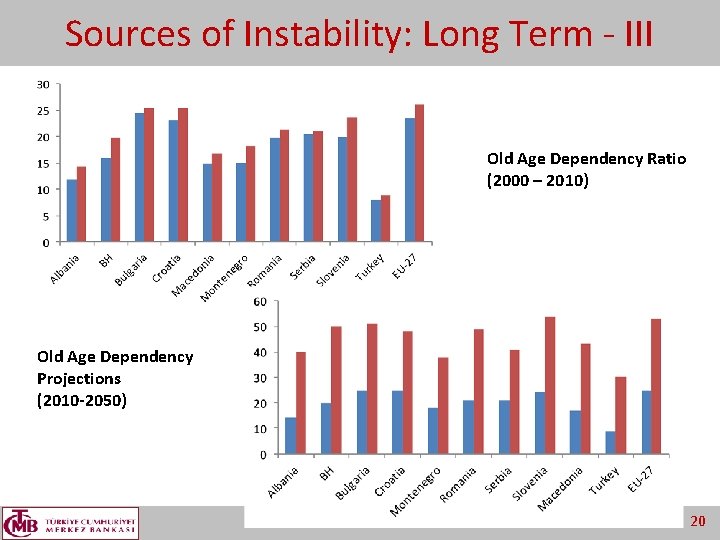

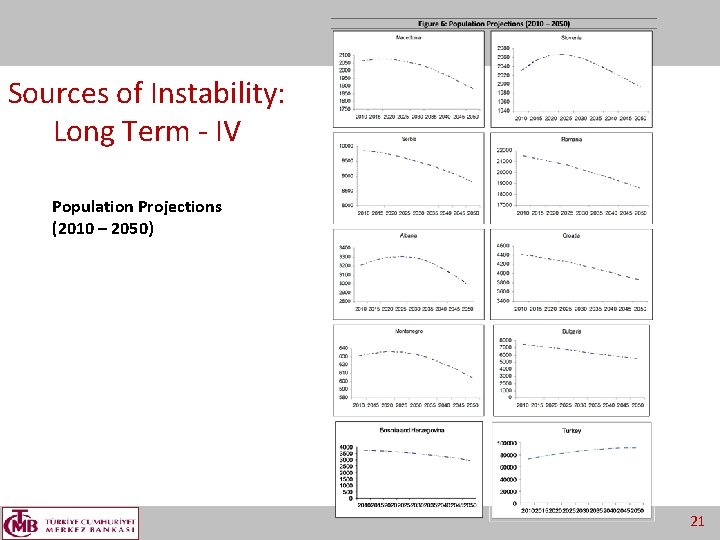

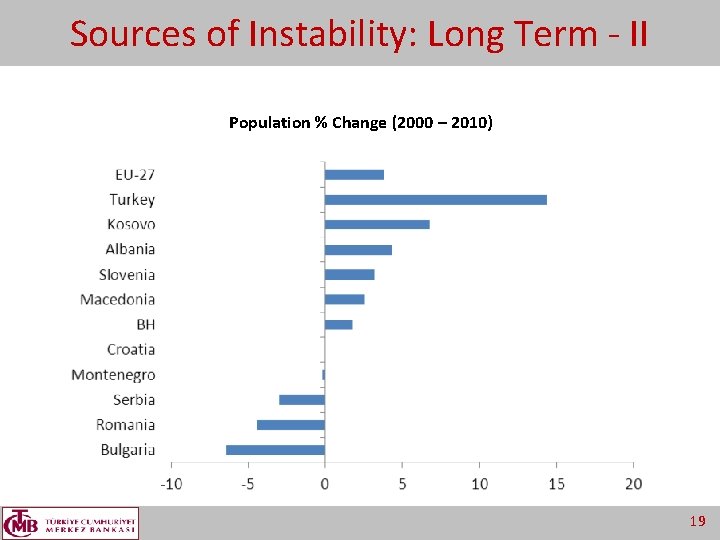

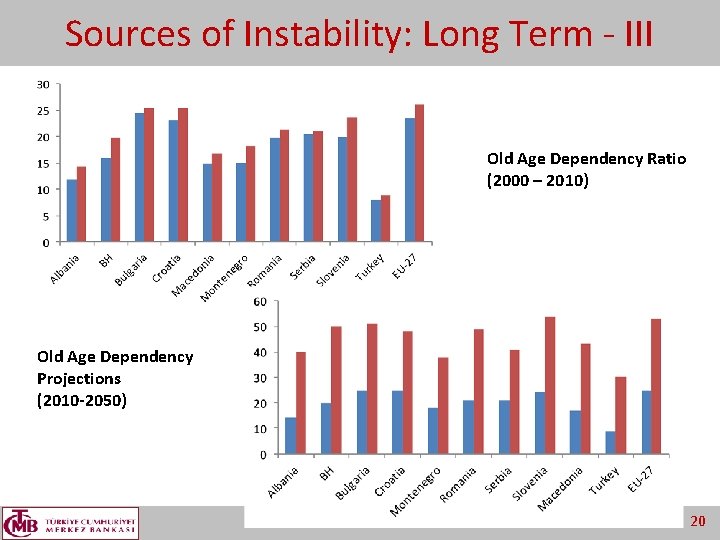

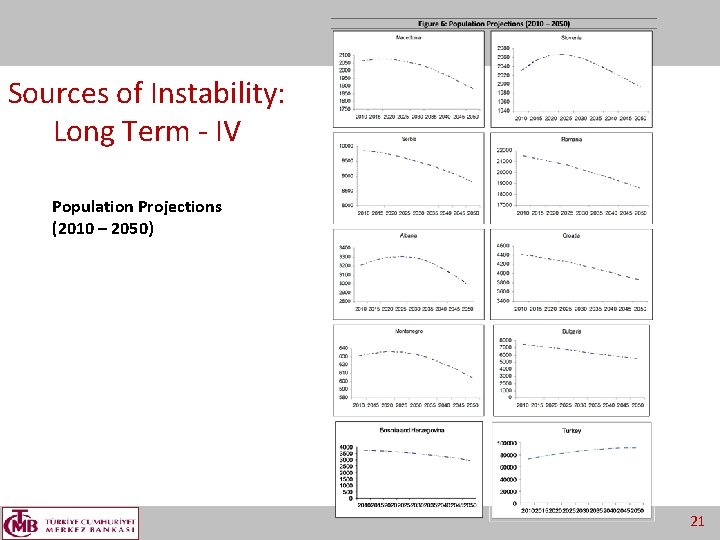

Sources of Instability: Long Term • Main demographic trends are crucial to understand the macroeconomic trends of the future – Pace of population growth – Old age dependency: Ratio of population aged above 65 to the working population 18

Sources of Instability: Long Term - II Population % Change (2000 – 2010) 19

Sources of Instability: Long Term - III Old Age Dependency Ratio (2000 – 2010) Old Age Dependency Projections (2010 -2050) 20

Sources of Instability: Long Term - IV Population Projections (2010 – 2050) 21

Setting up a Strategy for SEE • Short term macroeconomic imbalances and financial vulnerabilities – Short term stabilization efforts • Long term instabilities – Structural solutions • • Increase competitiveness, diversify export markets and products Secure a stable flow of remittances Labor market reforms Ageing and migration policies Innovation and technological development Support private sector initiatives Attract FDI • For both, the EU accession perspective might provide wellstructured guidance 22

South Mediterranean Economies • A multi-faceted problem – Liberalization • Higher degree of private sector orientation – Improving polity • Elevated democratic demands • Both requires or both are equivalent to – Wisely ordered reforms and commitment • Measures to avoid reform fatigue – Improved institutional capacity • Rethinking about the term “institution” 23

The EZ Debt Crisis • Turkish experience of debt – Issues of fiscal dominance – Post-2001 changes • Policy design based on updated priorities • Commitment – Private sector orientation • Internalization of risks improved hedging capacity • Istanbul Approach: mirroring balance sheets of nonfinancial corporations and banks 24

Summing Up • Thinking out of the box • “Go by the book, but be the author” strategy might perform well under certain circumstances • Collaboration at an institutional level – Exchange of experiences: higher pace of capacity building 25

Rethinking the Economies of SEE, South Mediterranean Economies and the Euro Area Debt Crisis in the Light of Turkish Experience Eray Yucel, Ph. D. , Economist, Central Bank of the Republic of Turkey 3 rd Bank of Greece Workshop on the Economies of Eastern Europe and Mediterranean Countries Athens, 18 May 2012 26