Renewable Energy Massachusetts LLC Partnerships for Solar Energy

Renewable Energy Massachusetts LLC Partnerships for Solar Energy Development 2010 1

Introduction of Renewable Energy Massachusetts n A Massachusetts Team: The REM team is from Massachusetts, understands the terrain of our state, and seeks to use Massachusetts resources as we build solar facilities in the Commonwealth n Direct Ownership Stake: Together with our partners, REM finances, owns and operates solar facilities for positive long-term results n Legal Counsel: Mintz Levin, our Boston-based law firm, has substantial clean energy and tax expertise n Environmental Advisor: Steve Barrett, HMMH’s Director of Clean Energy, has over 15 years of renewable energy siting and environmental experience 2

REM Goals n Advance Massachusetts’ Green Communities Act - Goal of 400 MW Solar installed in MA this decade n Build 2 MW solar facilities in partnership with MA municipal-owned light departments (MLDs) n Obtain an acceptable rate of return for our equity investment n Realize the promise of local, distributed energy n Deliver power at prices near parity with traditional energy sources 3

REM Management & Advisory Team n Experienced and Tested Team: Combined 140 -Year Professional Track Record n Brian Kopperl, CEO & co-founder – Over 20 years business and law professional experience. Co-founder and Chief Investment Officer, Pegasus Investments, a Boston firm that he co-led for over a decade from seed $3 mm portfolio to a peak of $450 mm of public equity investments managed for Smith Barney, Deutsche Bank and other institutions. Proven startup entrepreneur and project management, including the sale of a privately held vision care company and equity private placement for a biotechnology company. Corporate and securities law attorney Pillsbury Winthrop LLP, San Francisco. Law staff of Judge Rymer, 9 th Circuit U. S. Court of Appeals. JD & Law Review, UCLA. Harvard Kennedy School MPA. n Bob Knowles, COO & co-founder – Over 20 years business experience. Sales, marketing and business development expertise. Significant startup experience as co-founder of Little Point Corp. and Neighbor Corp. , both innovative consumer product companies that were successfully sold. Most recently, business development director for Project Adventure, Inc. , Beverly, MA, an $11 mm fee-for-service nonprofit. Ohio Wesleyan BA. n Bob Mc. Dermott, co-founder & advisor - Following his 26 -year career in financial services, the last 12 years of which he served as Managing Director and head of Sales and Trading in Boston for CIBC, Bob in 2008 formed ECO Investments to invest in the renewable energy space. In 2009, Bob founded the Boston office and began directing the public equity investment operations of Rafferty Capital. BA and now a trustee, Southern New Hampshire University. n Paul Kopperl, advisor & investor - Co-founder and President, Pegasus Investments, Boston, following Paul's previous, lengthy investment banking career with Goldman Sachs, Kidder Peabody and Delano & Kopperl, Inc. , a corporate financial advisory and private equity firm he led for 27 years. Paul is a Trustee and member of the Executive and Finance Committees of the Dana-Farber Cancer Institute. Former lecturer, U. S. Military Academy, West Point. Trustee, Williamstown Theater. Harvard Business School MBA. n Ed Brakeman, advisor only - Managing Director, Bain Capital, LLC, Boston, an affiliation Ed has maintained since 1988, first in private equity investments and then as co-founder in 1996 of Bain Capital’s public equity investment business, Brookside Capital. Active philanthropic roles currently with Tenacity, African Leadership Academy, and Girls and Boys Town. Ed has known Brian Kopperl for over 30 years and 4 advises REM on company strategy. Stanford University MBA.

Massachusetts: A Good Solar Market n MA = among the most expensive energy prices in the United States n ~40% MA electricity = fueled by volatile natural gas n MA solar capacity factors = 13 -15% (~ 75% of CA solar yield) Mass. Maritime Academy PV Arrays, Bourne, Massachusetts 5

Solar Proven in Massachusetts Site Factor PV Size AC-k. Wh Capacity (DC-rated) (2009 full year) Brockton, MA (35˚ pitch) 14. 69% Brockton Brightfield 465 k. W 598, 582 Lowell, MA (10˚pitch) 64. 8 k. W 76, 004 Hannaford Market 13. 39% Newton, MA (35˚ pitch)46. 8 k. W 59, 864 Chapman Construction 14. 60% Brockton, MA REM-MA Solar (35˚pitch) 2, 000 KW 13. 5% Proposed Site Est. 2, 370, 000 (AC k. Wh) Each site = Real-Time Data at Fat Spaniel. com 6

Basic Solar Site Needs Site Requirements: Flat (<5% grade), south-facing, un-shaded & close to grid Size: 2 MW system requires 12 -14 acres of land (depending on shading and grading) Security: Fencing and other appropriate security measures needed 7

Solar Value Proposition n I. No Capital Costs to Our Customers - Instead, customers enter a long-term power purchase agreement n II. Valuable Peak Power Generated - Peak power can cost utilities 300% or more compared to non-peak hours - Daylight Hours = 56. 7% of 500 most expensive peak energy hours each year (Source: NE-ISO day-ahead spot market electricity prices, 2005 -09) - Distributed solar facilities save municipal power customers expensive and fast-rising peak energy costs (forward capacity and regional transmission) n III. Transmission Loss Avoidance Distributed solar facilities suffer minimal transmission loss, compared to 10% loss factors for energy delivered via NE-ISO regional grid 8

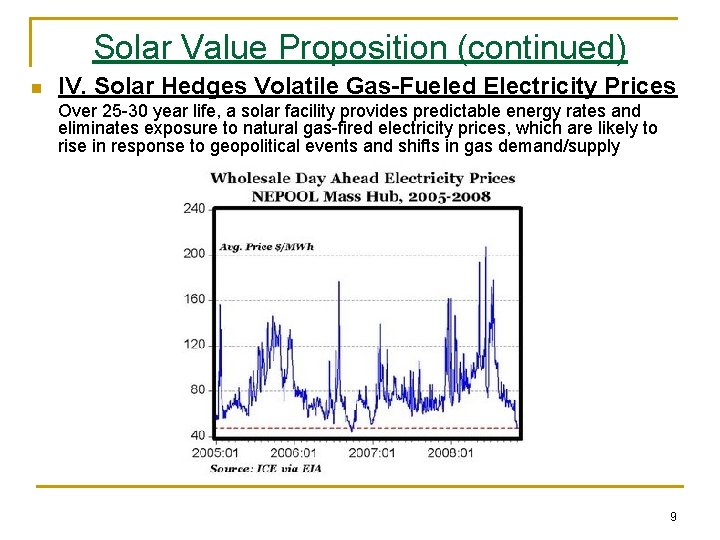

Solar Value Proposition (continued) n IV. Solar Hedges Volatile Gas-Fueled Electricity Prices Over 25 -30 year life, a solar facility provides predictable energy rates and eliminates exposure to natural gas-fired electricity prices, which are likely to rise in response to geopolitical events and shifts in gas demand/supply 9

n n Powerful Federal Incentive: 30% ITC Grant Overview: 2009 American Recovery Act converted Investment Tax Credit (ITC) into a cash grant equal to 30% of project costs paid to owners of newly installed, U. S. -sited renewable energy facilities Eligibility: Grant may be paid to any U. S. taxpayer owner, including LLC or other passthrough entity (provided no government or nonprofit partners) Deadline: “Significant construction” required by Dec. 31, 2010: defined by U. S. Treasury as at least 5% of project cost expended & non-refundable. Grant Payment: 30% project cost paid in cash by U. S. Treasury within 60 days of electric service 10

Powerful State Incentive: MA Solar. RECs n Overview: MA DOER authorizes 400 MW of solar facilities to n n n sell Solar-RECs for cash to MA load serving entities Solar-REC Non-Compliance Penalty: DOER 2010 penalty rate in 2010 at $0. 60/k. Wh Solar-REC Fixed Price Auction: Each new solar facility retains the option to sell its unsold Solar-RECs each year-end at a DOER auction for a fixed price of $0. 285/k. Wh. Solar. RECs purchased at auction have compliance value for the 2 -3 years following auction Anticipated Solar-REC Value: Solar-RECs sold in the market are expected to be priced between the penalty rate ($0. 60/k. Wh in 2010) and the DOER auction price Creating a Greener Energy Future for the Commonwealth ($0. 285/k. Wh) 11

MA Solar-RECs (continued) n n n Timing: Program launched Jan. 1, 2010 Solar-REC Eligibility: Any solar facility sited anywhere in MA, including MLD territories, may sell Solar-RECs Solar-REC Program Duration: Between 13 and 18 years (program wrap-up tied to speed of MA solar build-out) Program Stability: Annual program cost of $150200 mm at maturity is borne by all MA rate-payers, but remains a small fraction of the roughly $8 billion MA annual electric bill Market-Driven Program: Solar-RECs involve no fiscal cost to the MA state government 12

Solar’s Environmental Benefits Increasingly Valuable n Future Federal Climate Legislation would impose a cost of carbon and raise the price of coal and natural gas -fired electricity n Solar project retains future right to sell carbon offsets instead of Solar-RECs n A 2 MW solar facility eliminates over 50 million lbs. of CO 2 over system lifetime n Equal to removing 300 cars (at 7, 100 lbs C 02/year) from road (source: Solar. Buzz Feb 2009) 13

Solar’s Secure Cash Flow Supports Project Debt n Long-Term Power Purchase Agreement (PPA) with set annual rate escalation provides the revenue base needed to support targeted debt repayment n Solar-REC Revenues from sale to large Investor-Owned Utilities (NStar, National Grid, etc. ) whose expenses are reimbursed by ratepayers n Federal Investment Tax Credit (ITC) Grant pays 30% of total project cost in cash within 60 days of electric service, thereby reducing project capital costs n Strong Collateral: Installed PV system with long-term PPA contract, site control, and all operating permits provides durable collateral for project debt 14

No Securities Offering Made; Additional Information No Offering. Nothing in this presentation is intended to be an offer to sell or a solicitation of an offer to purchase any security or investment product. Additional Information. Parties wishing to learn more about the REM solar development model, please contact: Bob Knowles, COO of REM 617. 650. 3557 BKnowles@REMenergyco. com 15

- Slides: 15