Reinsurance Overview Ryan Couch Senior Reinsurance and Accounting

- Slides: 25

Reinsurance Overview Ryan Couch Senior Reinsurance and Accounting Policy Advisor National Association of Insurance Commissioners rcouch@naic. org

Reinsurance by Definition • Reinsurance is a contract of insurance whereby one insurer (reinsurer) agrees, for a portion of the premium, to indemnify another insurer (reinsured) for losses paid by the reinsured under insurance policies issued by the reinsured to its policyholders.

Elements of Reinsurance • Reinsurance is a form of insurance. • A reinsurance contract is an indemnity contract. • There are only two parties to the reinsurance contract – the reinsurer and the reinsured – both of whom are insurers, i. e. , entities empowered to insure. • The subject matter of a reinsurance contract is the insurance liability of the reinsured undertaken by it under insurance policies issued to its own policyholders.

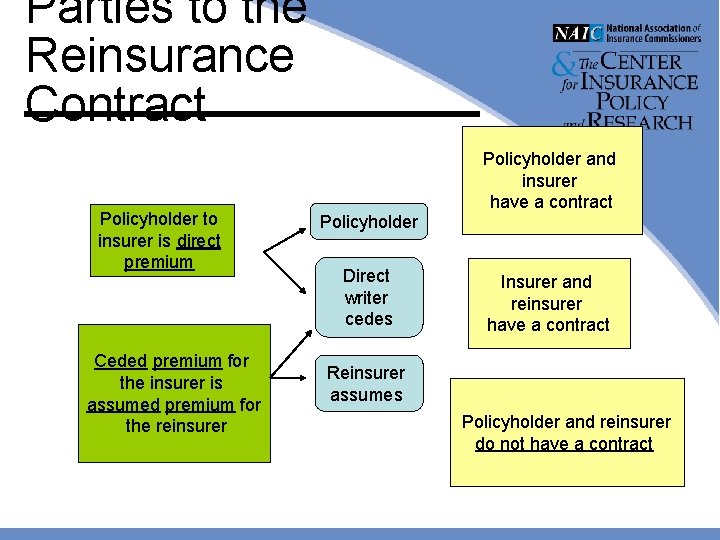

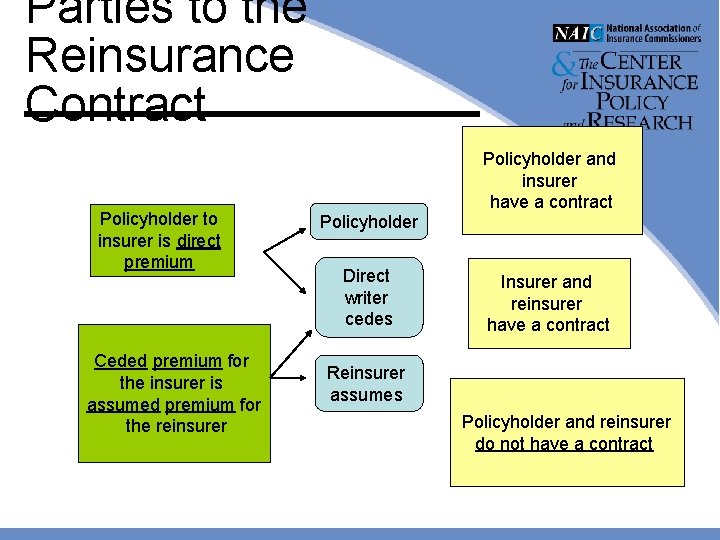

Parties to the Reinsurance Contract Policyholder to insurer is direct premium Ceded premium for the insurer is assumed premium for the reinsurer Policyholder Direct writer cedes Policyholder and insurer have a contract Insurer and reinsurer have a contract Reinsurer assumes Policyholder and reinsurer do not have a contract

What Reinsurance Does • Reinsurance redistributes the risk of loss incurred by the reinsured under its policies, according to its own business needs. • Reinsurance redistributes the premiums received by the reinsured, which now belong to the reinsured, according to its own business needs.

What Reinsurance Does Not Do • Reinsurance is not banking – It is not the lending of money, though it can have the same effect. • Reinsurance is not a security. • Reinsurance does not: – Convert an uninsurable risk into an insurable risk – Make loss either more or less likely to happen – Make a loss either greater or lesser in magnitude – Convert bad business into good business

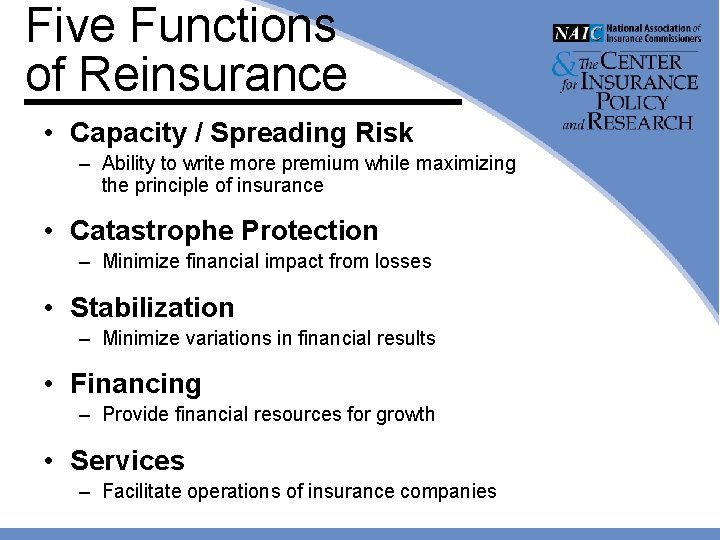

Five Functions of Reinsurance • Capacity / Spreading Risk – Ability to write more premium while maximizing the principle of insurance • Catastrophe Protection – Minimize financial impact from losses • Stabilization – Minimize variations in financial results • Financing – Provide financial resources for growth • Services – Facilitate operations of insurance companies

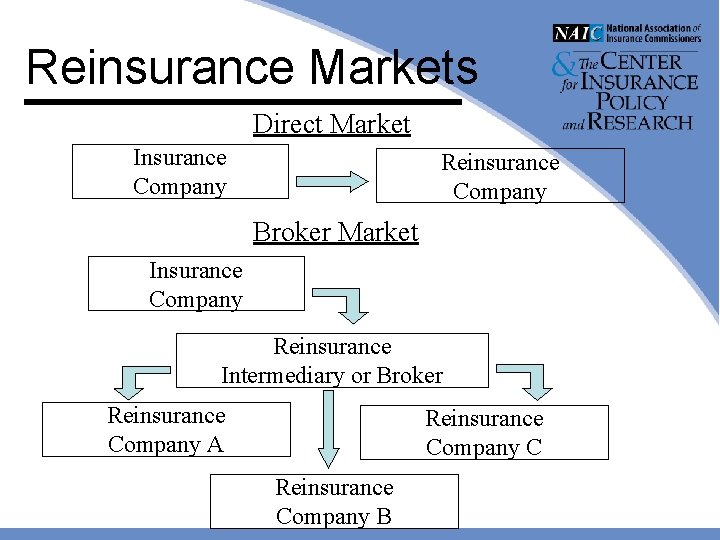

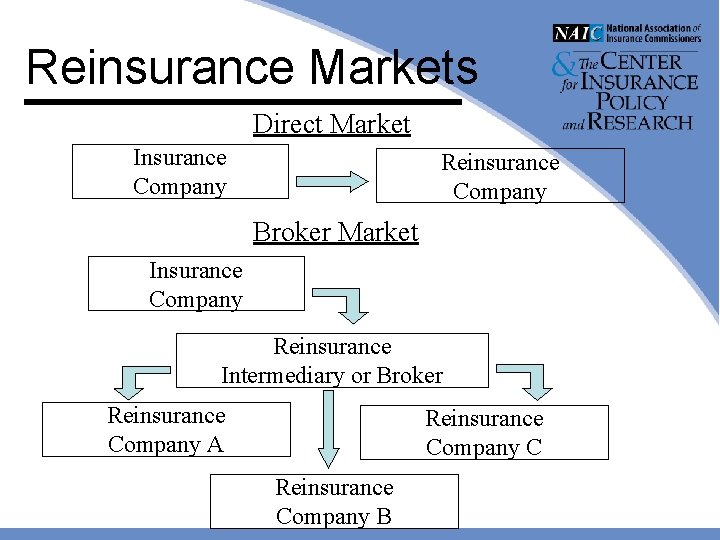

Reinsurance Markets Direct Market Insurance Company Reinsurance Company Broker Market Insurance Company Reinsurance Intermediary or Broker Reinsurance Company A Reinsurance Company C Reinsurance Company B

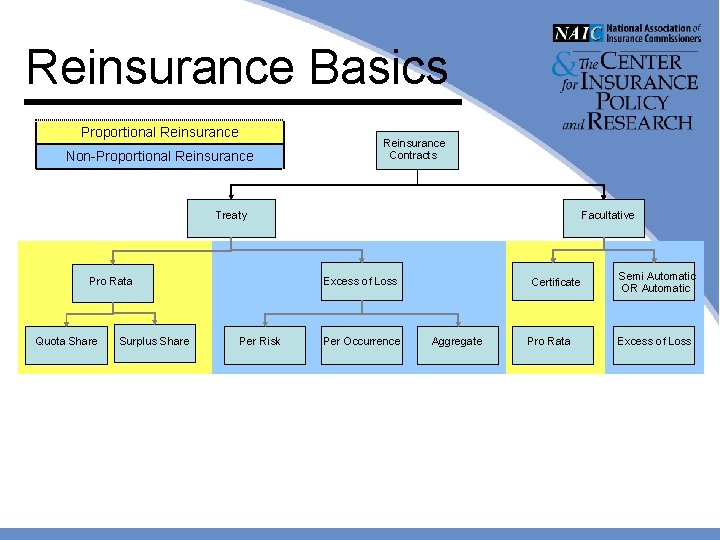

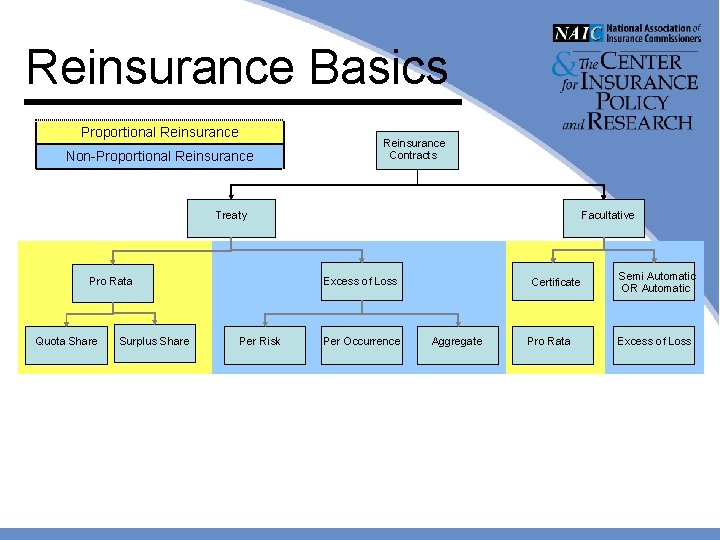

Reinsurance Basics Proportional Reinsurance Non-Proportional Reinsurance Contracts Treaty Pro Rata Quota Share Surplus Share Facultative Excess of Loss Per Risk Per Occurrence Certificate Aggregate Pro Rata Semi Automatic OR Automatic Excess of Loss

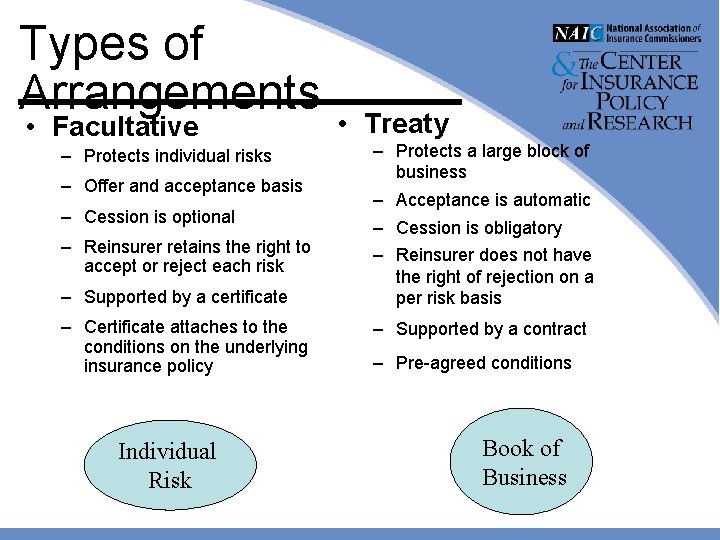

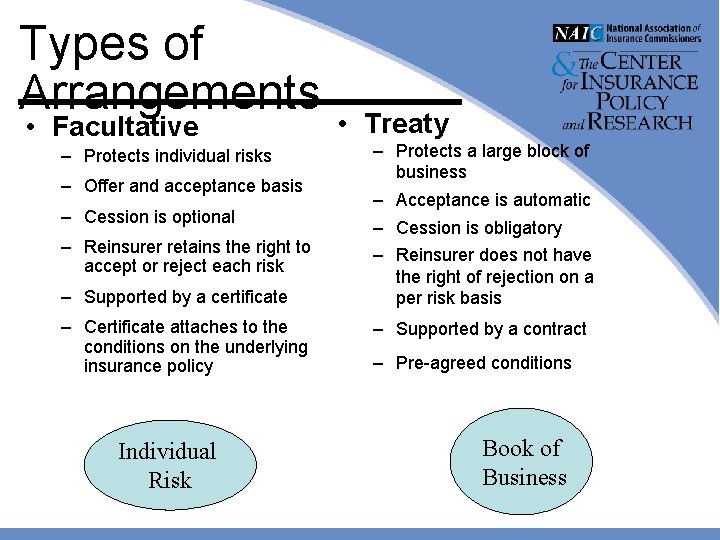

Types of Arrangements • Facultative – Protects individual risks – Offer and acceptance basis – Cession is optional – Reinsurer retains the right to accept or reject each risk – Supported by a certificate – Certificate attaches to the conditions on the underlying insurance policy Individual Risk • Treaty – Protects a large block of business – Acceptance is automatic – Cession is obligatory – Reinsurer does not have the right of rejection on a per risk basis – Supported by a contract – Pre-agreed conditions Book of Business

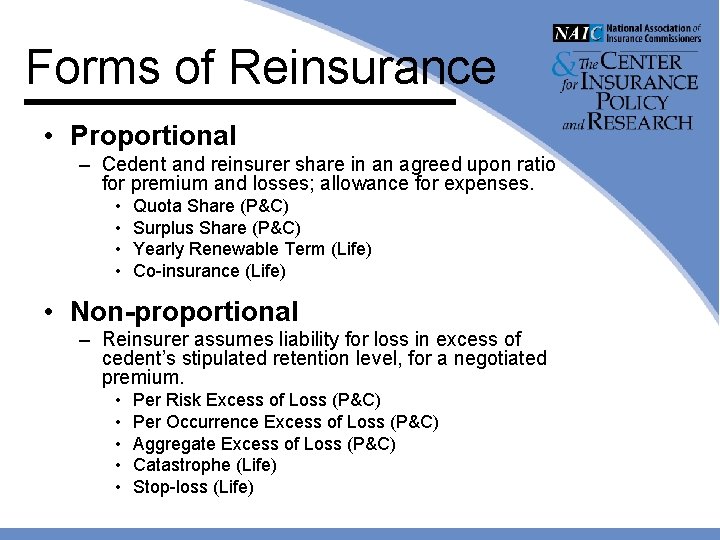

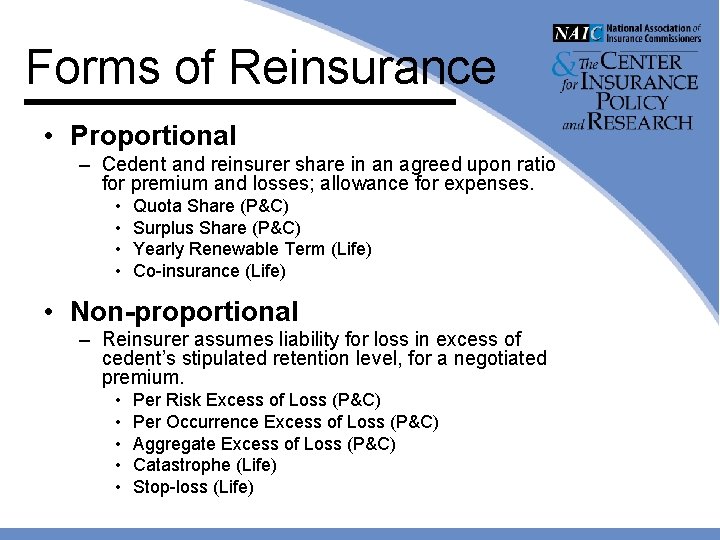

Forms of Reinsurance • Proportional – Cedent and reinsurer share in an agreed upon ratio for premium and losses; allowance for expenses. • • Quota Share (P&C) Surplus Share (P&C) Yearly Renewable Term (Life) Co-insurance (Life) • Non-proportional – Reinsurer assumes liability for loss in excess of cedent’s stipulated retention level, for a negotiated premium. • • • Per Risk Excess of Loss (P&C) Per Occurrence Excess of Loss (P&C) Aggregate Excess of Loss (P&C) Catastrophe (Life) Stop-loss (Life)

Prospective vs. Retroactive • Prospective Agreement – Covers future insurable events – Uses traditional reinsurance accounting • Retroactive Agreement – Covers past insurable events – Uses retroactive reinsurance accounting

Transfer of Risk • Reinsurance Accounting (net of reinsurance basis) – Agreement is prospective in nature – Agreement transfers a significant amount of underwriting and timing risk to the reinsurer • Retroactive Accounting – Agreement is retroactive in nature – Agreement transfers a significant amount of underwriting and timing risk to the reinsurer • Deposit Accounting – Prospective or retroactive agreement that does not meet risk transfer requirements

Nine-Month Rule • If a contract is not finalized within nine months it is presumed to be retroactive. • Nine-month rule does not apply to: – – Facultative reinsurance Contracts signed by lead reinsurer Business from non-affiliated alien ceding companies Documents with companies in liquidation

Annual Statement Schedule F • All U. S. domiciled insurers and reinsurers must file quarterly and annual financial statements with the NAIC. • Schedule F is the reinsurance schedule for P&C entities; it includes 8 parts. • Part 1 – Assumed Reinsurance – Requires all U. S. domiciled entities to report any premium assumptions and claims information on both affiliated or unaffiliated business as of year-end. • Part 2 – Premium Portfolios Effected or Cancelled During Current Year – Requires all U. S. domiciled entities to report any portfolios or cancellations of reinsurance.

Annual Statement Schedule F • Part 3 – Ceded Reinsurance – Requires all U. S. domiciled entities to report the ceded reinsurance to both authorized and unauthorized reinsurers, their recoverable balances, forms of collateral, and reserves. • Part 4 – Aging of Ceded Reinsurance – Summary of ceded reinsurance recoverables and their respective days past due, if any. • Part 5 – Provision For Unauthorized Reinsurance – Reporting of collateral for unauthorized reinsurance business and the provision calculation for the uncollateralized portion of unauthorized reinsurance.

Annual Statement Schedule F • Part 6 – Provision for Overdue Authorized Reinsurance – Provision calculation for authorized reinsurance recoverables past 90 days overdue. • Part 7 – Provision for Overdue Reinsurance – Requires all U. S. domiciled entities to report any portfolios or cancellations of reinsurance. • Part 8 – Restatement of Balance Sheet to Identify Net Credit For Reinsurance • Schedule S is the reinsurance schedule for Life/Health entities; similar to Schedule F, but only has 6 parts

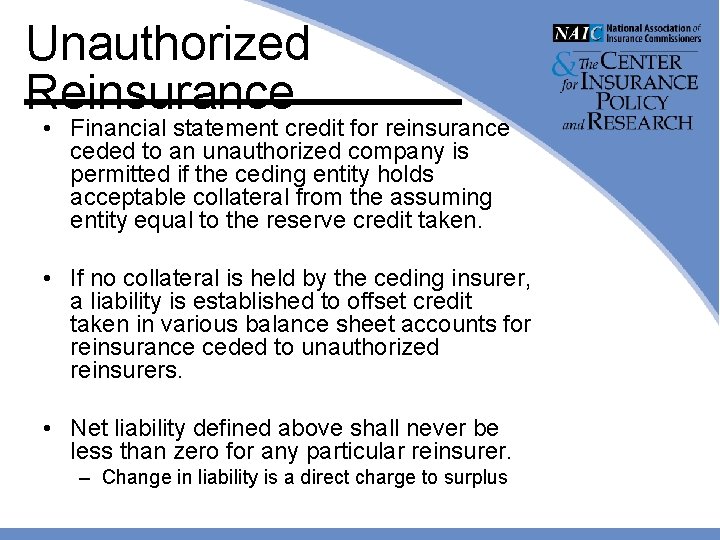

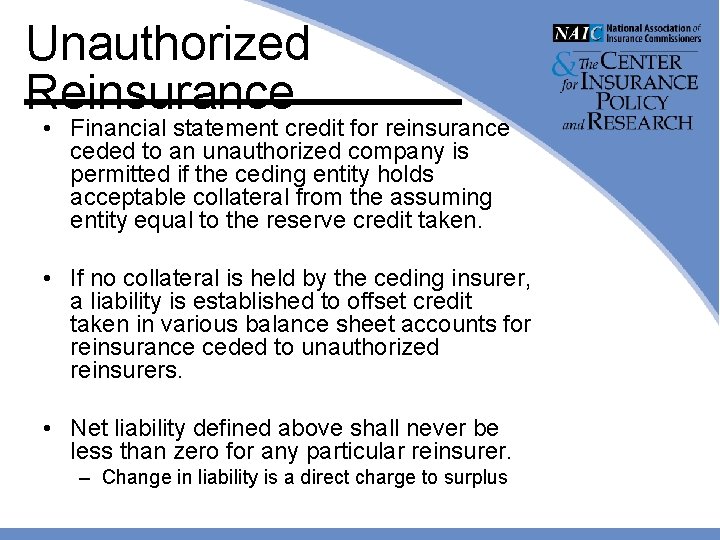

Unauthorized Reinsurance • Authorized Reinsurer: – Licensed in the same state of domicile as the ceding company; or – Accredited by the domiciliary insurance department of the ceding company; or – Domiciled and licensed in a state with substantially similar credit for reinsurance laws as the ceding company’s domicile; or – Maintains a multi-beneficiary trust in the U. S. • If the reinsurer is not authorized, or is not approved, the reinsurance is “unauthorized”. • Under the NAIC model law, a U. S. ceding company must hold collateral in order to take financial statement credit for reinsurance ceded to an unauthorized reinsurer.

Unauthorized Reinsurance • Financial statement credit for reinsurance ceded to an unauthorized company is permitted if the ceding entity holds acceptable collateral from the assuming entity equal to the reserve credit taken. • If no collateral is held by the ceding insurer, a liability is established to offset credit taken in various balance sheet accounts for reinsurance ceded to unauthorized reinsurers. • Net liability defined above shall never be less than zero for any particular reinsurer. – Change in liability is a direct charge to surplus

NAIC Reinsurance Task Force • History of the U. S. Reinsurance Collateral Debate • 2008 Reinsurance Regulatory Modernization Framework • 2009 Reinsurance Regulatory Modernization Act – proposed federal legislation, but not enacted

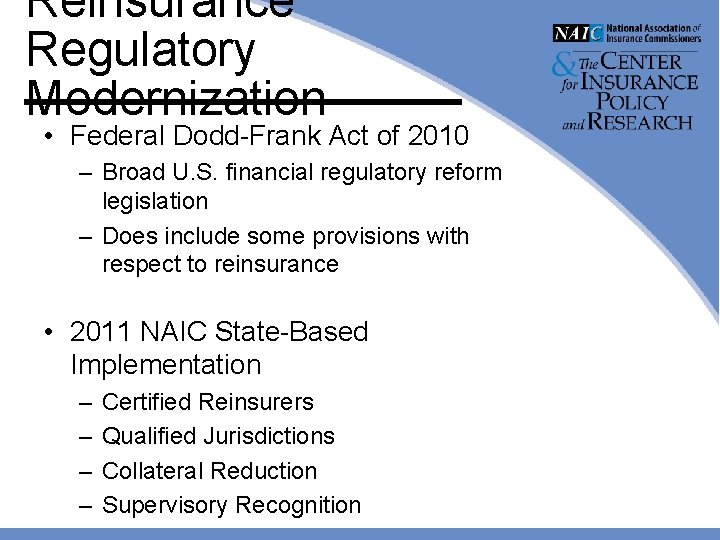

Reinsurance Regulatory Modernization • Federal Dodd-Frank Act of 2010 – Broad U. S. financial regulatory reform legislation – Does include some provisions with respect to reinsurance • 2011 NAIC State-Based Implementation – – Certified Reinsurers Qualified Jurisdictions Collateral Reduction Supervisory Recognition

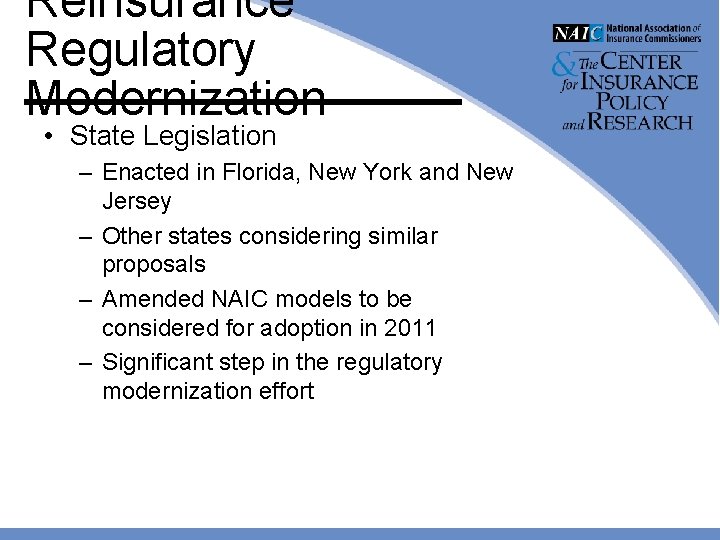

Reinsurance Regulatory Modernization • State Legislation – Enacted in Florida, New York and New Jersey – Other states considering similar proposals – Amended NAIC models to be considered for adoption in 2011 – Significant step in the regulatory modernization effort

Top Global Reinsurance Groups ‘ 09 Rank* Group Name 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. Swiss Re Munich Re Berkshire Hathaway** Hannover Re Lloyd’s of London*** SCOR RGA Reins Co Transatlantic Partner Re London Reins Group Everest Re XL Capital Korean Re**** Mapfre Odyssey Re ‘ 08 Rank ‘ 08 Reinsurance Premiums Written (U. S. $ millions) 1 2 3 4 5 6 8 9 12 7 10 13 11 16 15 $29, 212 $28, 820 $12, 827 $11, 446 $9, 114 $8, 185 $5, 839 $4, 423 $4, 028 $3, 696 $3, 678 $2, 951 $2, 946 $2, 507 $2, 295 * Rank based on prior year third-party gross premiums written. Excluded are state-sponsored reinsurers. **Gross premiums written are estimated by A. M. Best using publicly available financial filings. ***Lloyds premiums are all inclusive. GPW for certain groups within the rankings may also include Lloyd’s Syndicate GPW when applicable. ****Year-end is March 31, 2008 Source: A. M. Best Co.

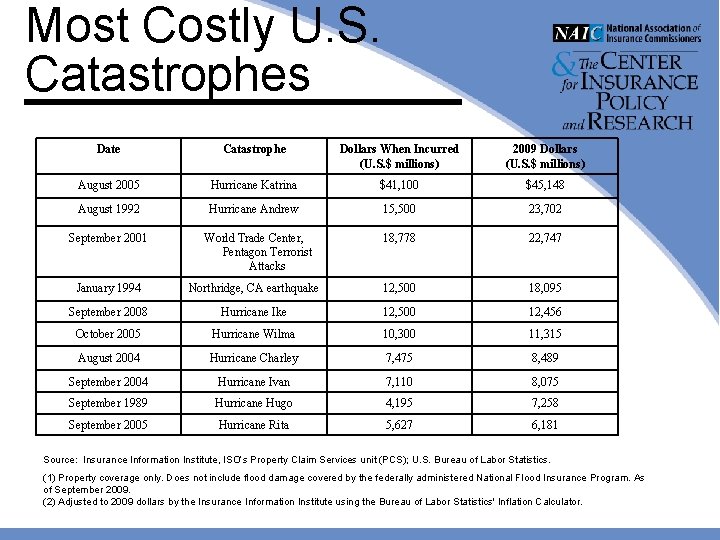

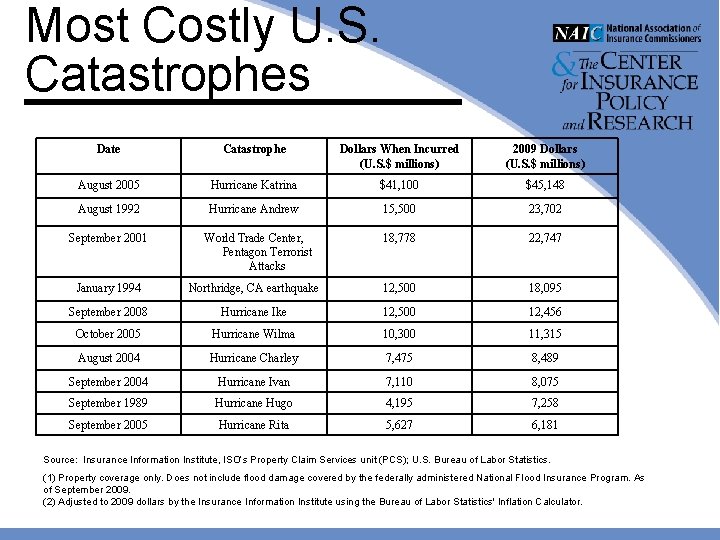

Most Costly U. S. Catastrophes Date Catastrophe Dollars When Incurred (U. S. $ millions) 2009 Dollars (U. S. $ millions) August 2005 Hurricane Katrina $41, 100 $45, 148 August 1992 Hurricane Andrew 15, 500 23, 702 18, 778 22, 747 September 2001 World Trade Center, Pentagon Terrorist Attacks January 1994 Northridge, CA earthquake 12, 500 18, 095 September 2008 Hurricane Ike 12, 500 12, 456 October 2005 Hurricane Wilma 10, 300 11, 315 August 2004 Hurricane Charley 7, 475 8, 489 September 2004 Hurricane Ivan 7, 110 8, 075 September 1989 Hurricane Hugo 4, 195 7, 258 September 2005 Hurricane Rita 5, 627 6, 181 Source: Insurance Information Institute, ISO’s Property Claim Services unit (PCS); U. S. Bureau of Labor Statistics. (1) Property coverage only. Does not include flood damage covered by the federally administered National Flood Insurance Program. As of September 2009. (2) Adjusted to 2009 dollars by the Insurance Information Institute using the Bureau of Labor Statistics' Inflation Calculator.

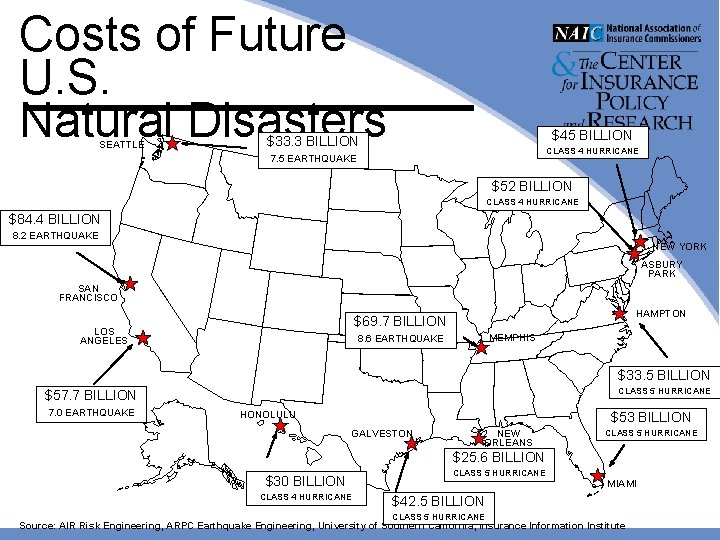

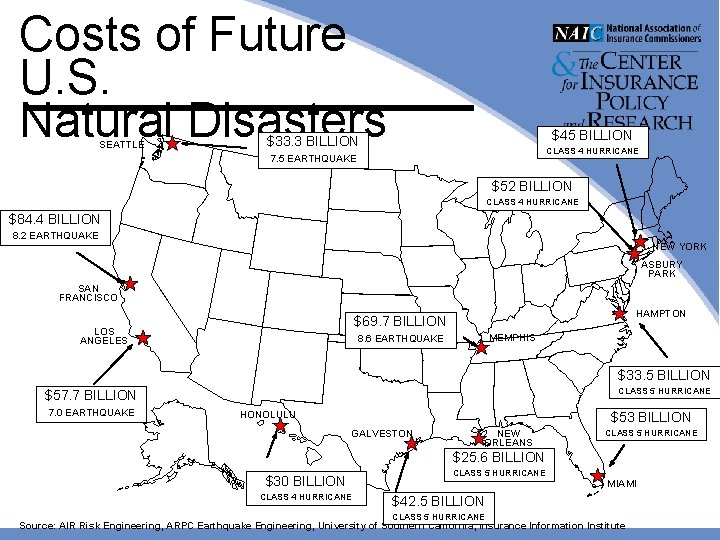

Costs of Future U. S. Natural Disasters SEATTLE $45 BILLION $33. 3 BILLION CLASS 4 HURRICANE 7. 5 EARTHQUAKE $52 BILLION CLASS 4 HURRICANE $84. 4 BILLION 8. 2 EARTHQUAKE NEW YORK ASBURY PARK SAN FRANCISCO HAMPTON $69. 7 BILLION LOS ANGELES MEMPHIS 8. 6 EARTHQUAKE $33. 5 BILLION CLASS 5 HURRICANE $57. 7 BILLION 7. 0 EARTHQUAKE HONOLULU $53 BILLION GALVESTON NEW ORLEANS CLASS 5 HURRICANE $25. 6 BILLION $30 BILLION CLASS 4 HURRICANE CLASS 5 HURRICANE MIAMI $42. 5 BILLION CLASS 5 HURRICANE Source: AIR Risk Engineering, ARPC Earthquake Engineering, University of Southern California, Insurance Information Institute

Retroactive reinsurance accounting

Retroactive reinsurance accounting Reinsurance accounting basics

Reinsurance accounting basics Brian couch attorney hyden ky

Brian couch attorney hyden ky One point perspective box

One point perspective box Couch rodzajnik

Couch rodzajnik Couch career.com

Couch career.com Couch drill

Couch drill Technology integration planning model diagram

Technology integration planning model diagram Finger couch

Finger couch Cancer stick kenning meaning

Cancer stick kenning meaning What does non literal mean

What does non literal mean Kenninga

Kenninga Tiffany couch

Tiffany couch Couch careers

Couch careers Couch potato figurative language

Couch potato figurative language Facultative reinsurance

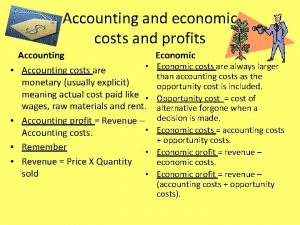

Facultative reinsurance Introduction to computerized accounting

Introduction to computerized accounting Overview of government accounting

Overview of government accounting Steps of accounting process

Steps of accounting process Treaty reinsurance

Treaty reinsurance Types of reinsurance

Types of reinsurance Facultative reinsurance

Facultative reinsurance Facultative reinsurance

Facultative reinsurance Sava reinsurance company

Sava reinsurance company Milli re

Milli re Buckeye reinsurance

Buckeye reinsurance