Reconciling Net Income to CFO using the Indirect

![Rearrange to focus on Cash from Operations (CFO) [Cash Collections - decreases in A/R] Rearrange to focus on Cash from Operations (CFO) [Cash Collections - decreases in A/R]](https://slidetodoc.com/presentation_image_h2/56a89c7219daf49063e70251eb951a5d/image-10.jpg)

- Slides: 10

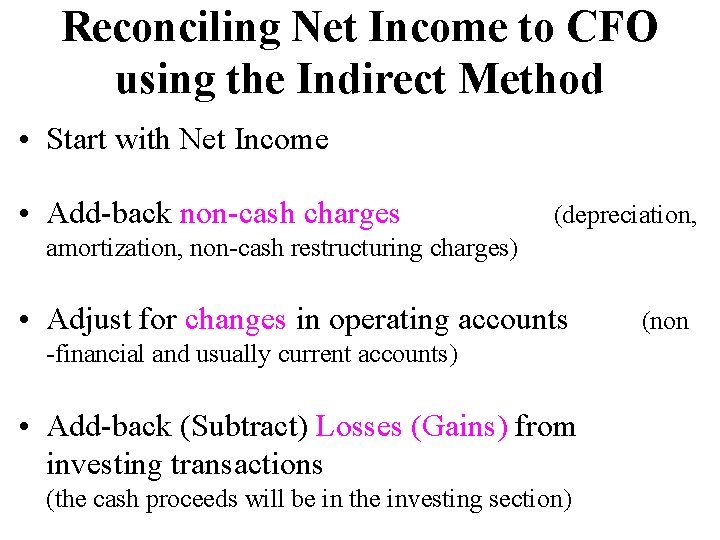

Reconciling Net Income to CFO using the Indirect Method • Start with Net Income • Add-back non-cash charges (depreciation, amortization, non-cash restructuring charges) • Adjust for changes in operating accounts -financial and usually current accounts) • Add-back (Subtract) Losses (Gains) from investing transactions (the cash proceeds will be in the investing section) (non

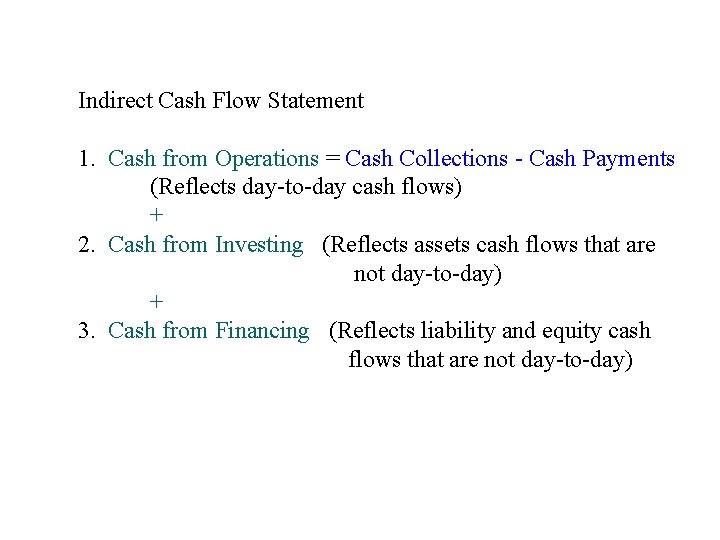

Indirect Cash Flow Statement 1. Cash from Operations = Cash Collections - Cash Payments (Reflects day-to-day cash flows) + 2. Cash from Investing (Reflects assets cash flows that are not day-to-day) + 3. Cash from Financing (Reflects liability and equity cash flows that are not day-to-day)

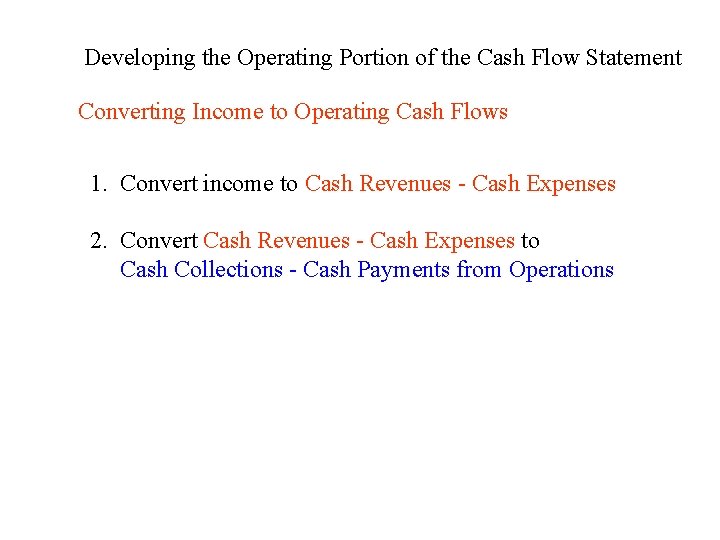

Developing the Operating Portion of the Cash Flow Statement Converting Income to Operating Cash Flows 1. Convert income to Cash Revenues - Cash Expenses 2. Convert Cash Revenues - Cash Expenses to Cash Collections - Cash Payments from Operations

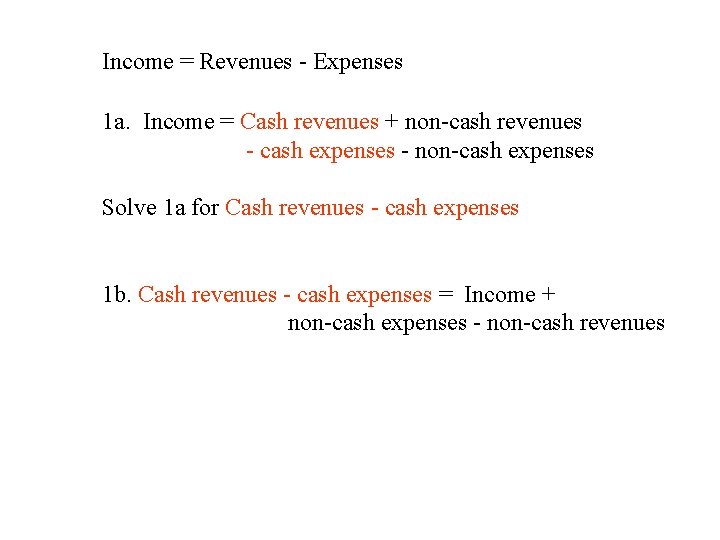

Income = Revenues - Expenses 1 a. Income = Cash revenues + non-cash revenues - cash expenses - non-cash expenses Solve 1 a for Cash revenues - cash expenses 1 b. Cash revenues - cash expenses = Income + non-cash expenses - non-cash revenues

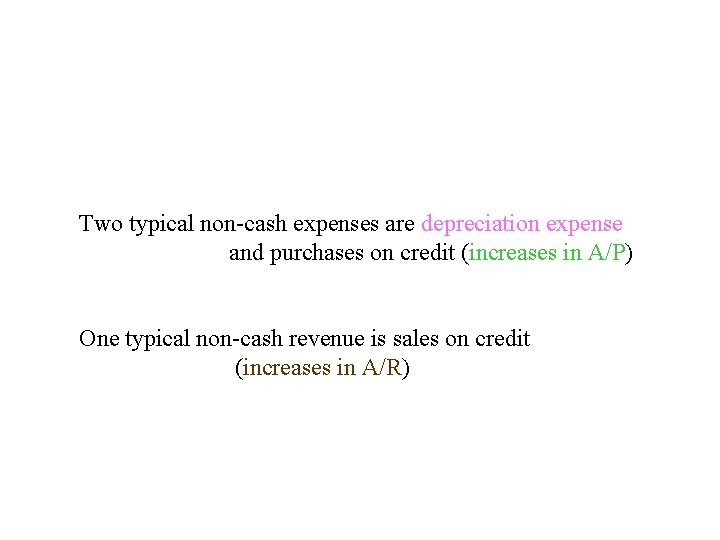

Two typical non-cash expenses are depreciation expense and purchases on credit (increases in A/P) One typical non-cash revenue is sales on credit (increases in A/R)

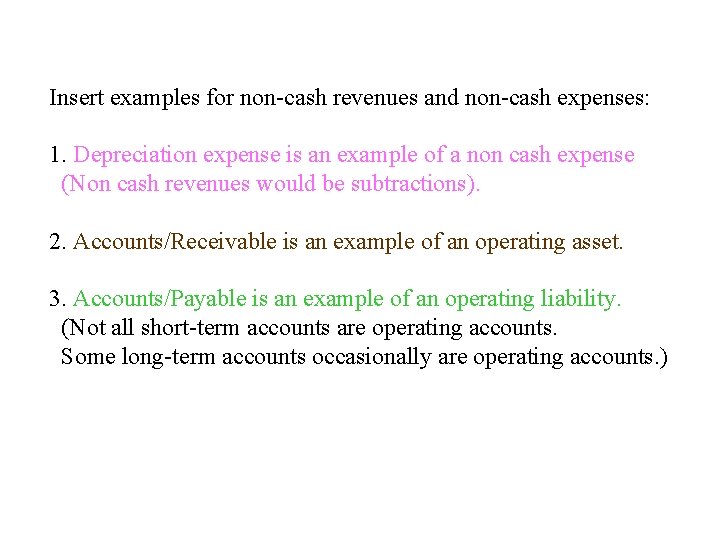

Insert examples for non-cash revenues and non-cash expenses: 1. Depreciation expense is an example of a non cash expense (Non cash revenues would be subtractions). 2. Accounts/Receivable is an example of an operating asset. 3. Accounts/Payable is an example of an operating liability. (Not all short-term accounts are operating accounts. Some long-term accounts occasionally are operating accounts. )

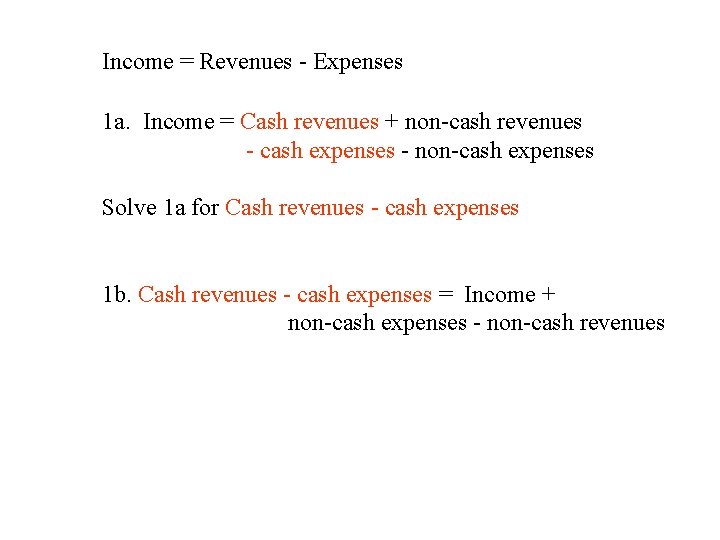

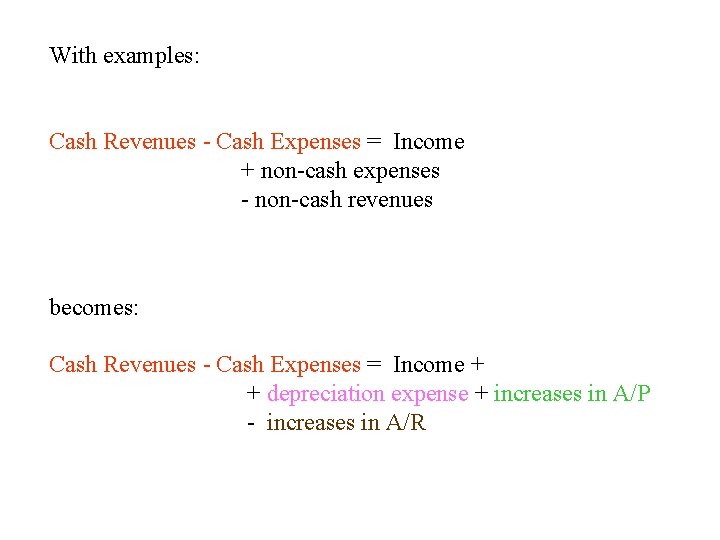

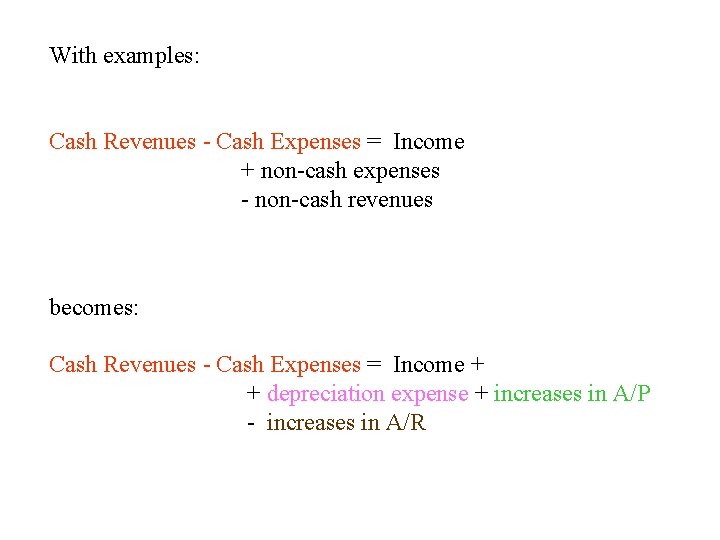

With examples: Cash Revenues - Cash Expenses = Income + non-cash expenses - non-cash revenues becomes: Cash Revenues - Cash Expenses = Income + + depreciation expense + increases in A/P - increases in A/R

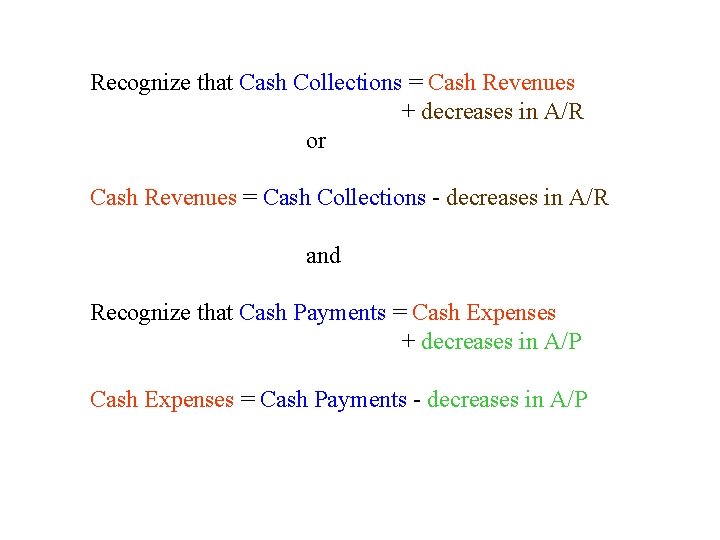

Recognize that Cash Collections = Cash Revenues + decreases in A/R or Cash Revenues = Cash Collections - decreases in A/R and Recognize that Cash Payments = Cash Expenses + decreases in A/P Cash Expenses = Cash Payments - decreases in A/P

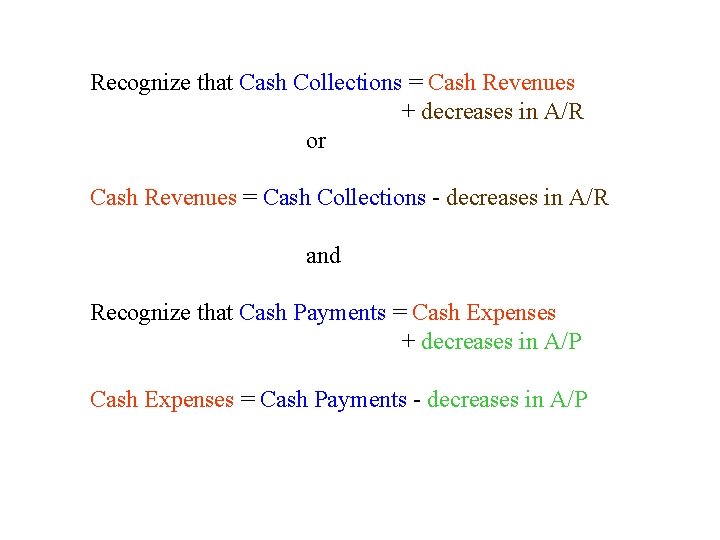

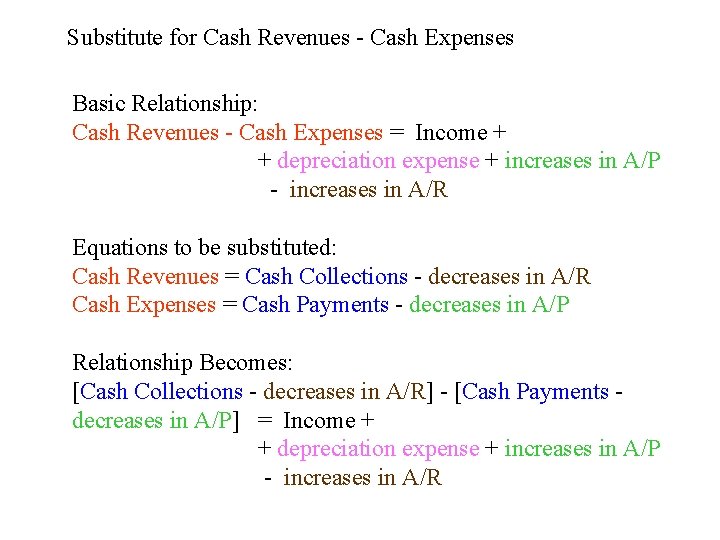

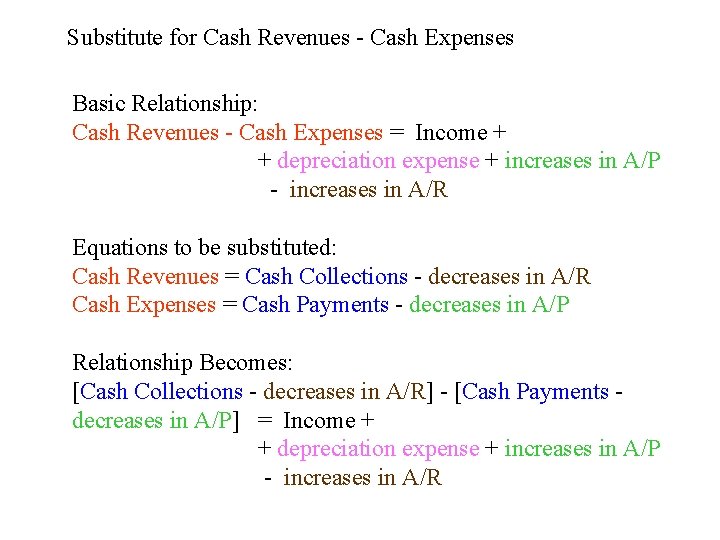

Substitute for Cash Revenues - Cash Expenses Basic Relationship: Cash Revenues - Cash Expenses = Income + + depreciation expense + increases in A/P - increases in A/R Equations to be substituted: Cash Revenues = Cash Collections - decreases in A/R Cash Expenses = Cash Payments - decreases in A/P Relationship Becomes: [Cash Collections - decreases in A/R] - [Cash Payments decreases in A/P] = Income + + depreciation expense + increases in A/P - increases in A/R

![Rearrange to focus on Cash from Operations CFO Cash Collections decreases in AR Rearrange to focus on Cash from Operations (CFO) [Cash Collections - decreases in A/R]](https://slidetodoc.com/presentation_image_h2/56a89c7219daf49063e70251eb951a5d/image-10.jpg)

Rearrange to focus on Cash from Operations (CFO) [Cash Collections - decreases in A/R] - [Cash Payments - decreases in A/P] = Income + + depreciation expense + increases in A/P - increases in A/R becomes CFO or [Cash Collections - Cash Payments] = Income + depreciation expense +decreases in A/R - increases in A/R + increases in A/P - decreases in A/P or CFO or [Cash Collections - Cash Payments] = Income + depreciation expense - in A/R + in A/P