Recognizing Opportunities and Generating Ideas Part II Diane

- Slides: 24

Recognizing Opportunities and Generating Ideas Part II Diane M. Sullivan (2007) Sections Modified from Barringer & Ireland’s (2006) Chapter 2

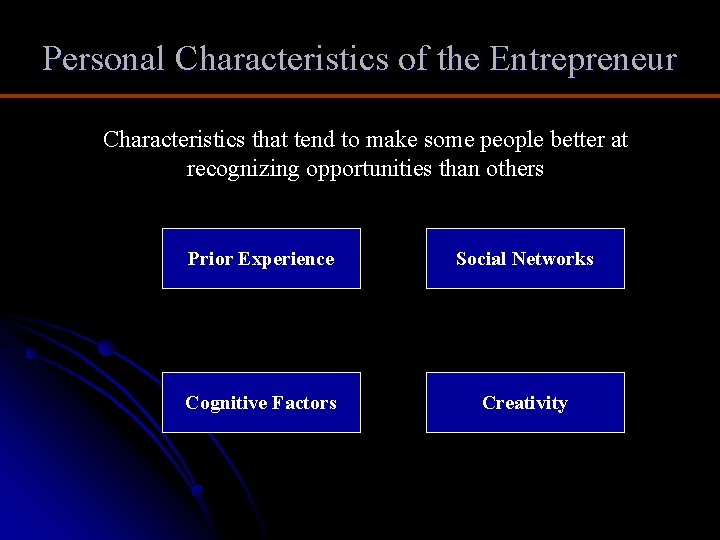

Personal Characteristics of the Entrepreneur Characteristics that tend to make some people better at recognizing opportunities than others Prior Experience Social Networks Cognitive Factors Creativity

Prior Industry Experience l Prior industry experience helps entrepreneurs recognize opportunities because An individual may spot a market niche that is underserved l Can build a network of social contacts who provide insights that lead to new opportunities l Technical term: The Corridor Principle l

Cognitive Factors Opportunity recognition may be an innate skill or cognitive process l Entrepreneurs may have a “sixth sense” so they see opportunities that others miss l l This “sixth sense” is called entrepreneurial alertness l The ability to notice things without engaging in deliberate search

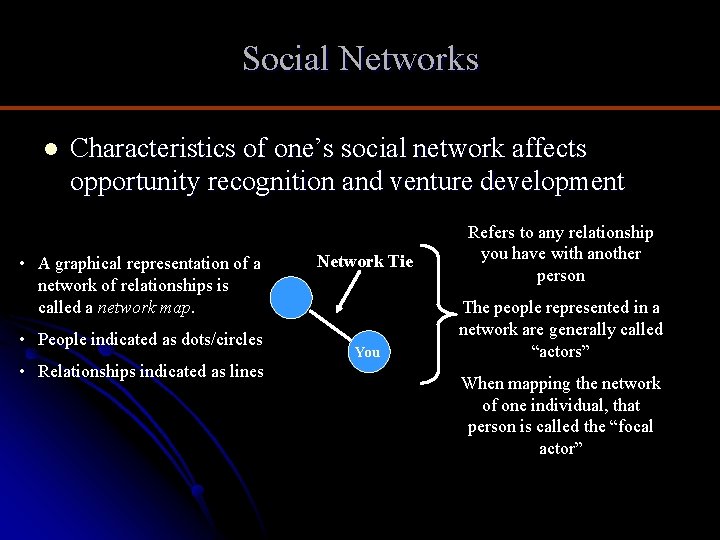

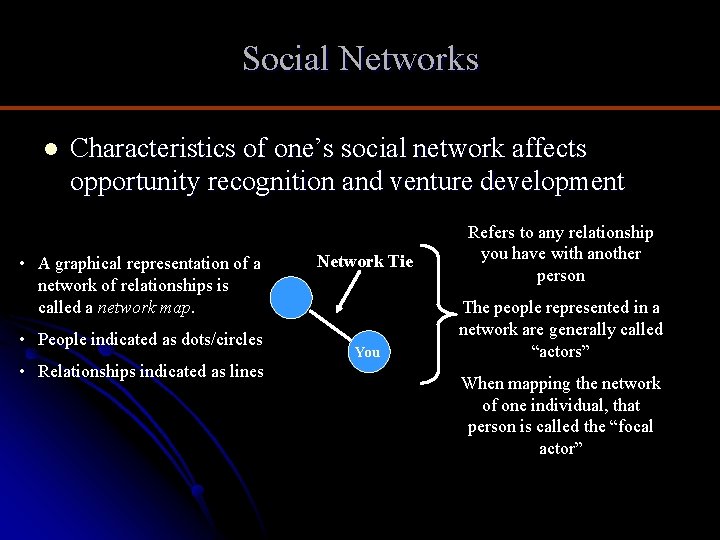

Social Networks l Characteristics of one’s social network affects opportunity recognition and venture development • A graphical representation of a network of relationships is called a network map. • People indicated as dots/circles • Relationships indicated as lines Network Tie You Refers to any relationship you have with another person The people represented in a network are generally called “actors” When mapping the network of one individual, that person is called the “focal actor”

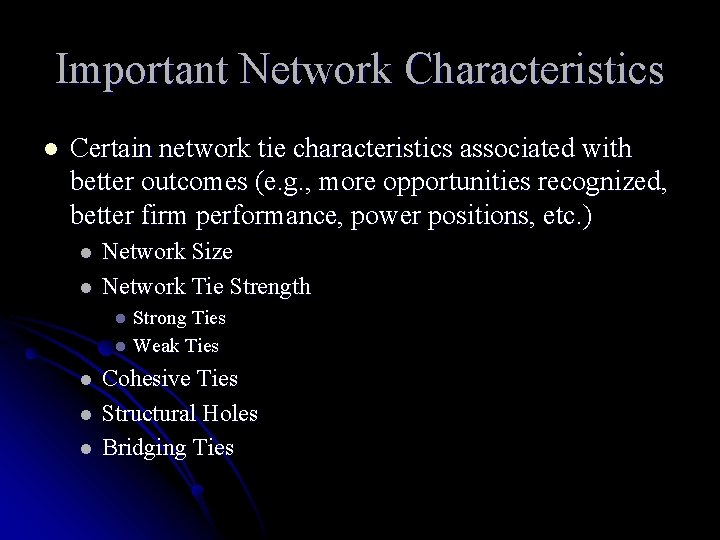

Important Network Characteristics l Certain network tie characteristics associated with better outcomes (e. g. , more opportunities recognized, better firm performance, power positions, etc. ) l l Network Size Network Tie Strength Strong Ties l Weak Ties l l Cohesive Ties Structural Holes Bridging Ties

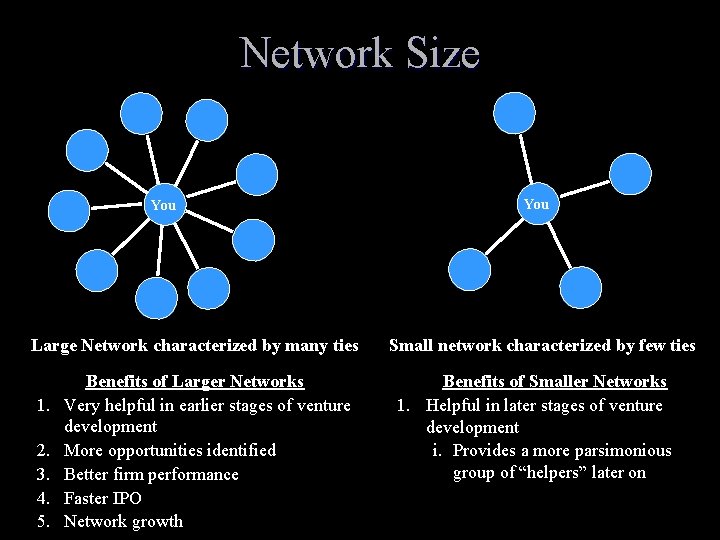

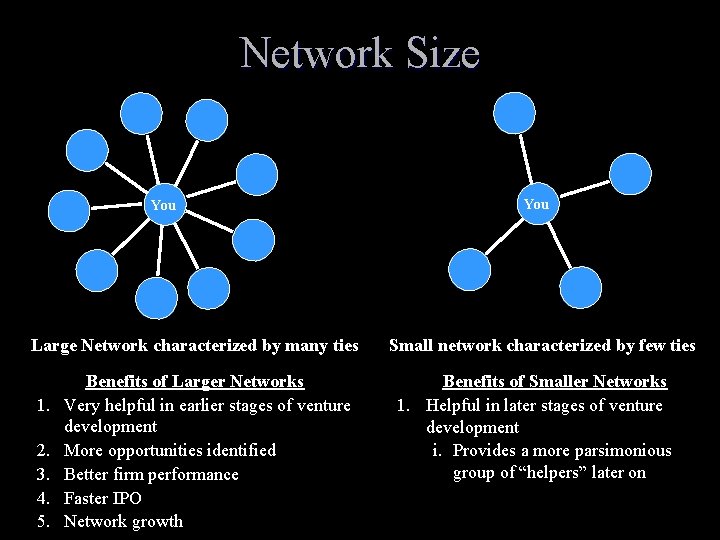

Network Size You Large Network characterized by many ties 1. 2. 3. 4. 5. Benefits of Larger Networks Very helpful in earlier stages of venture development More opportunities identified Better firm performance Faster IPO Network growth You Small network characterized by few ties Benefits of Smaller Networks 1. Helpful in later stages of venture development i. Provides a more parsimonious group of “helpers” later on

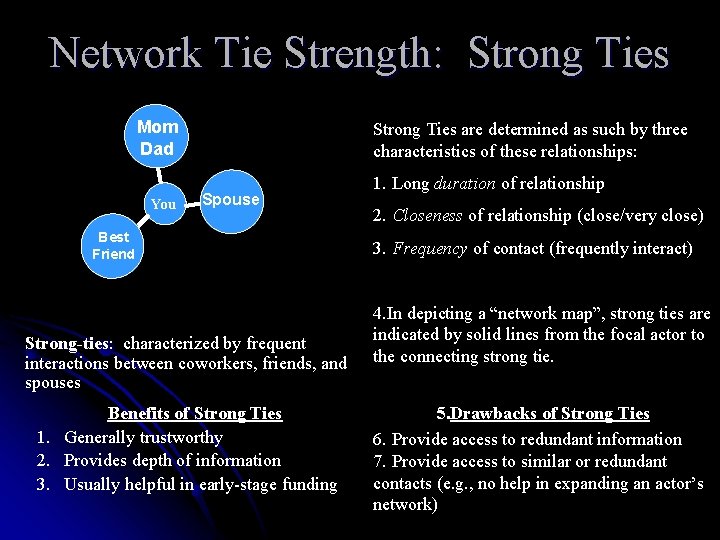

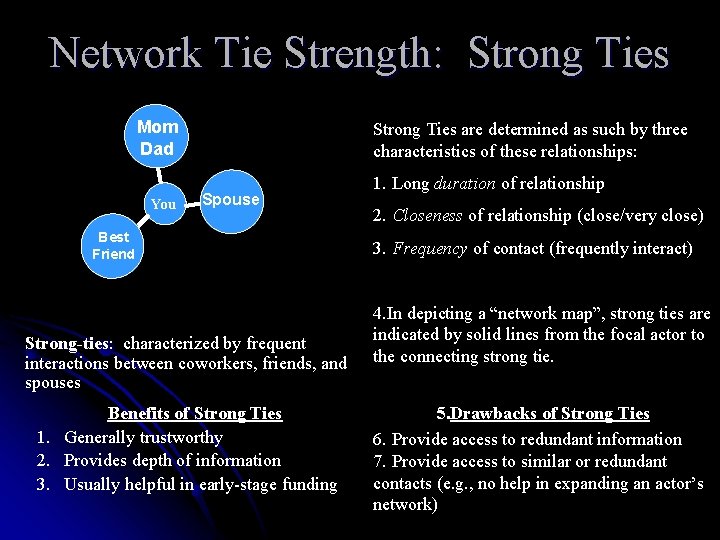

Network Tie Strength: Strong Ties Mom Dad You Strong Ties are determined as such by three characteristics of these relationships: Spouse Best Friend Strong-ties: characterized by frequent interactions between coworkers, friends, and spouses Benefits of Strong Ties 1. Generally trustworthy 2. Provides depth of information 3. Usually helpful in early-stage funding 1. Long duration of relationship 2. Closeness of relationship (close/very close) 3. Frequency of contact (frequently interact) 4. In depicting a “network map”, strong ties are indicated by solid lines from the focal actor to the connecting strong tie. 5. Drawbacks of Strong Ties 6. Provide access to redundant information 7. Provide access to similar or redundant contacts (e. g. , no help in expanding an actor’s network)

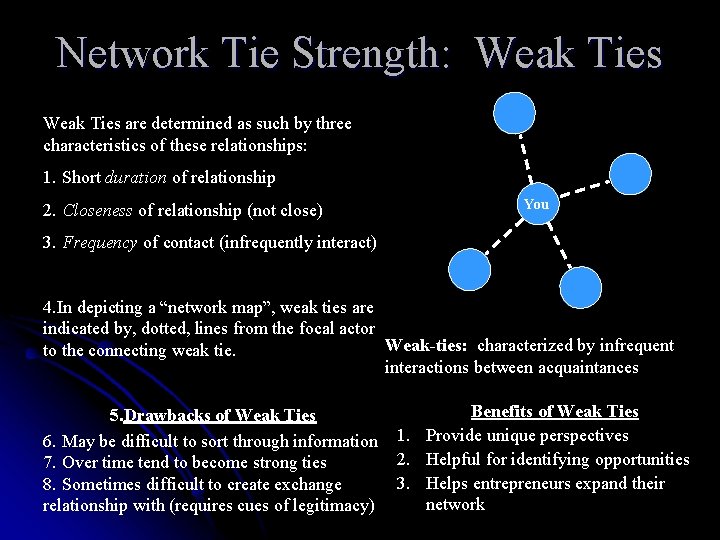

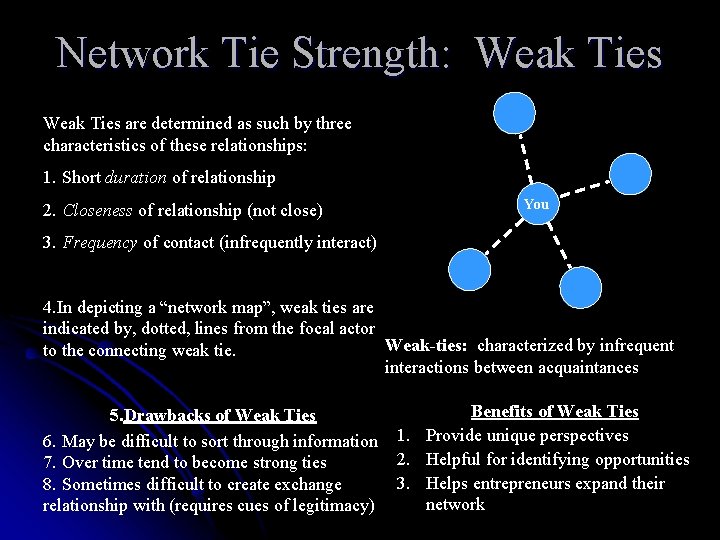

Network Tie Strength: Weak Ties are determined as such by three characteristics of these relationships: 1. Short duration of relationship 2. Closeness of relationship (not close) You 3. Frequency of contact (infrequently interact) 4. In depicting a “network map”, weak ties are indicated by, dotted, lines from the focal actor Weak-ties: characterized by infrequent to the connecting weak tie. interactions between acquaintances 5. Drawbacks of Weak Ties 6. May be difficult to sort through information 7. Over time tend to become strong ties 8. Sometimes difficult to create exchange relationship with (requires cues of legitimacy) Benefits of Weak Ties 1. Provide unique perspectives 2. Helpful for identifying opportunities 3. Helps entrepreneurs expand their network

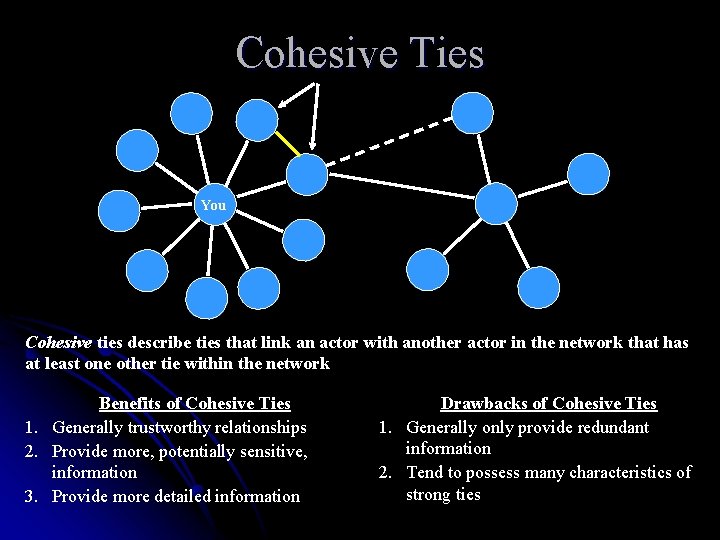

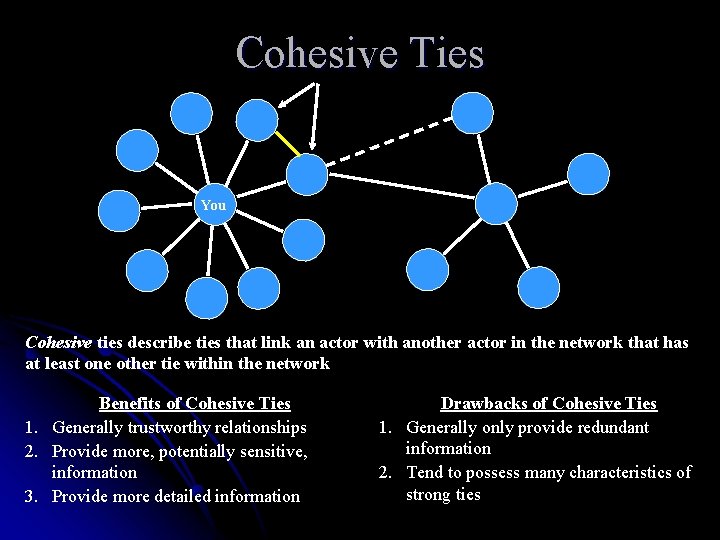

Cohesive Ties You Cohesive ties describe ties that link an actor with another actor in the network that has at least one other tie within the network Benefits of Cohesive Ties 1. Generally trustworthy relationships 2. Provide more, potentially sensitive, information 3. Provide more detailed information Drawbacks of Cohesive Ties 1. Generally only provide redundant information 2. Tend to possess many characteristics of strong ties

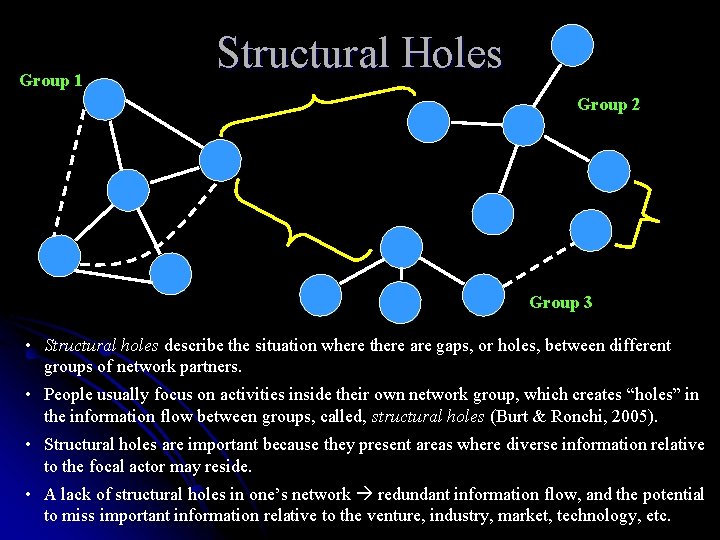

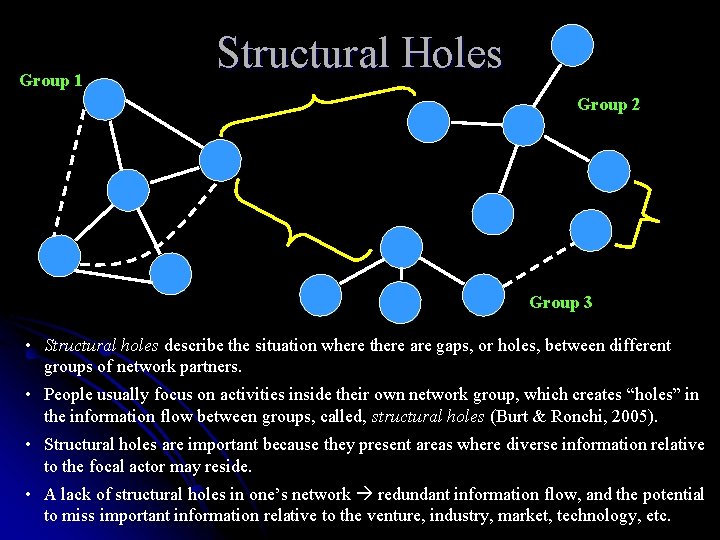

Group 1 Structural Holes Group 2 Group 3 • Structural holes describe the situation where there are gaps, or holes, between different groups of network partners. • People usually focus on activities inside their own network group, which creates “holes” in the information flow between groups, called, structural holes (Burt & Ronchi, 2005). • Structural holes are important because they present areas where diverse information relative to the focal actor may reside. • A lack of structural holes in one’s network redundant information flow, and the potential to miss important information relative to the venture, industry, market, technology, etc.

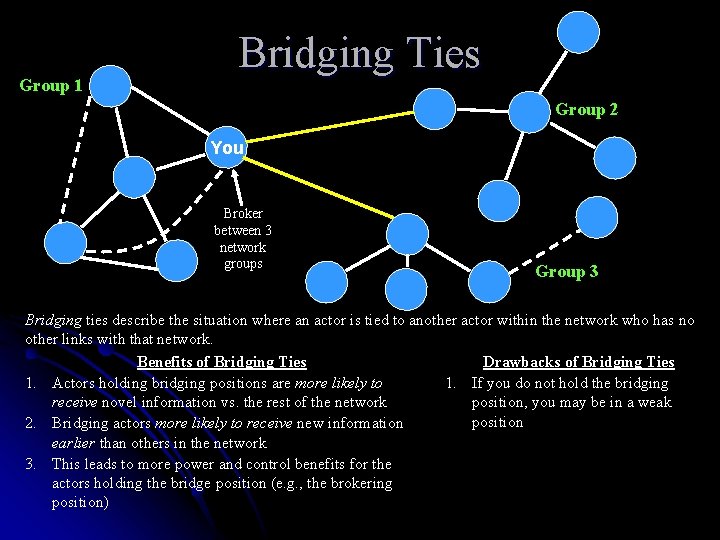

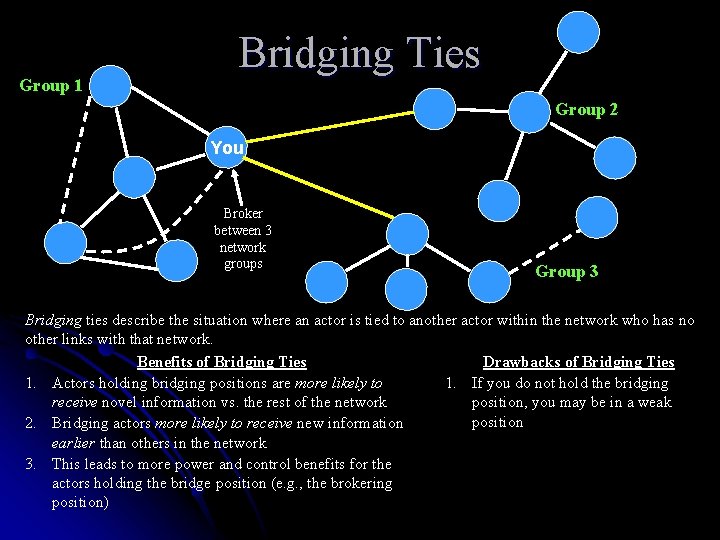

Group 1 Bridging Ties Group 2 You Broker between 3 network groups Group 3 Bridging ties describe the situation where an actor is tied to another actor within the network who has no other links with that network. Benefits of Bridging Ties Drawbacks of Bridging Ties 1. Actors holding bridging positions are more likely to 1. If you do not hold the bridging receive novel information vs. the rest of the network position, you may be in a weak position 2. Bridging actors more likely to receive new information earlier than others in the network 3. This leads to more power and control benefits for the actors holding the bridge position (e. g. , the brokering position)

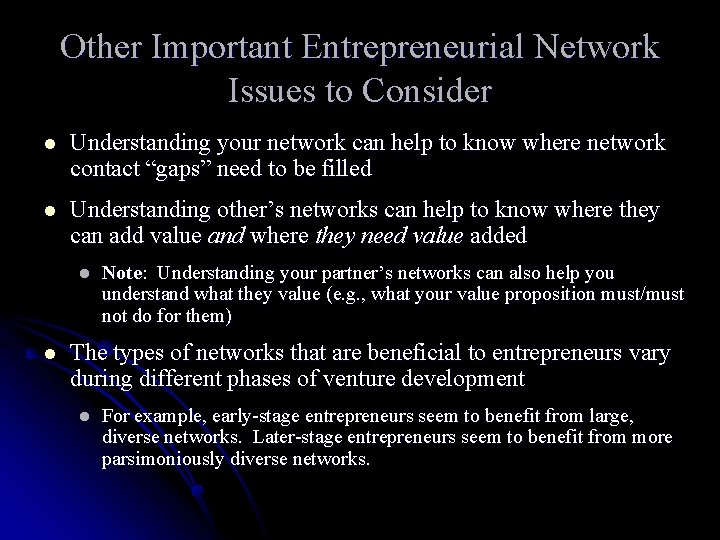

Other Important Entrepreneurial Network Issues to Consider l Understanding your network can help to know where network contact “gaps” need to be filled l Understanding other’s networks can help to know where they can add value and where they need value added l l Note: Understanding your partner’s networks can also help you understand what they value (e. g. , what your value proposition must/must not do for them) The types of networks that are beneficial to entrepreneurs vary during different phases of venture development l For example, early-stage entrepreneurs seem to benefit from large, diverse networks. Later-stage entrepreneurs seem to benefit from more parsimoniously diverse networks.

Creativity l l l Creativity is the process of generating a novel AND useful idea. Opportunity recognition may be, at least in part, a creative process. Per the text, for an individual, the creative process can be broken down into five stages (next slide)

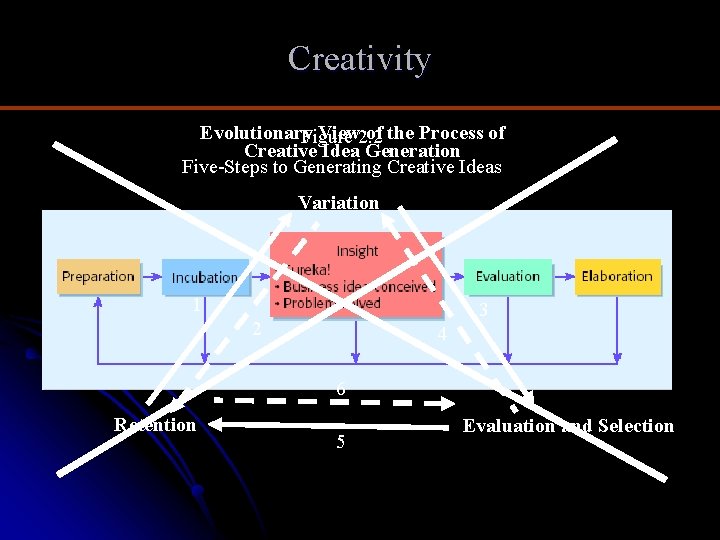

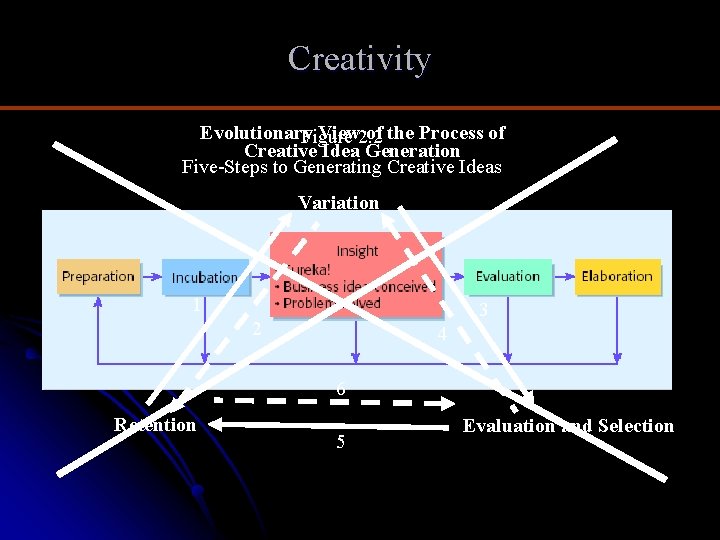

Creativity Evolutionary View 2. 2 of the Process of Figure Creative Idea Generation Five-Steps to Generating Creative Ideas Variation 1 3 2 4 6 Retention 5 Evaluation and Selection

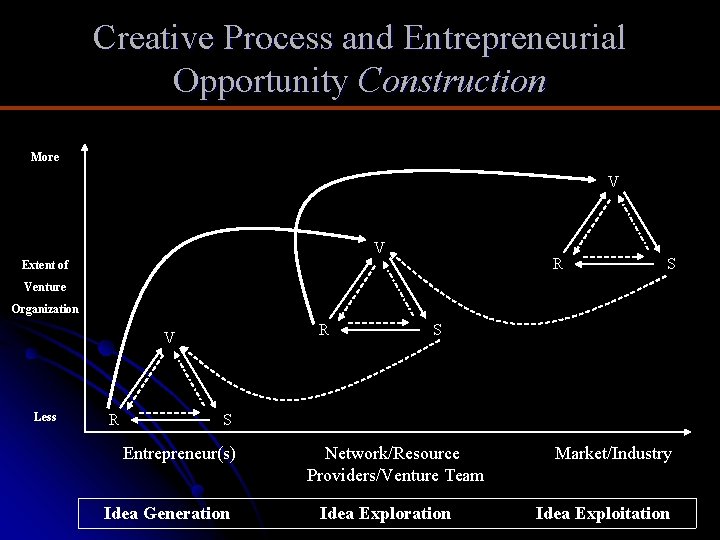

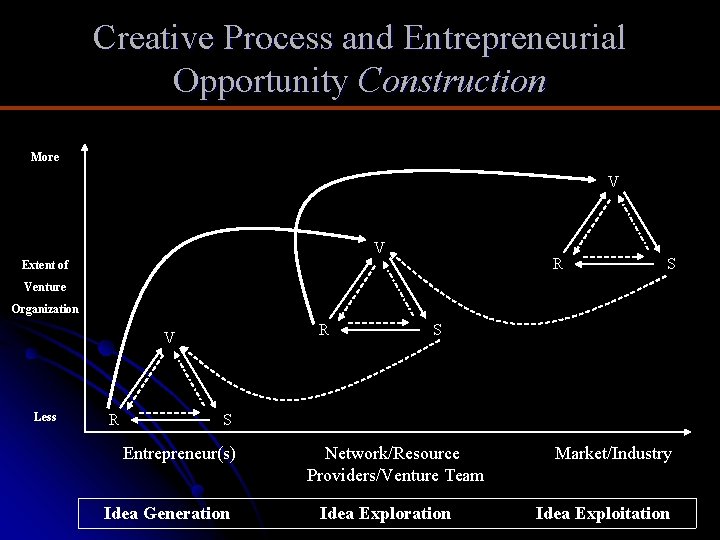

Creative Process and Entrepreneurial Opportunity Construction More V V R Extent of S Venture Organization R V Less R S S Entrepreneur(s) Idea Generation Network/Resource Providers/Venture Team Idea Exploration Market/Industry Idea Exploitation

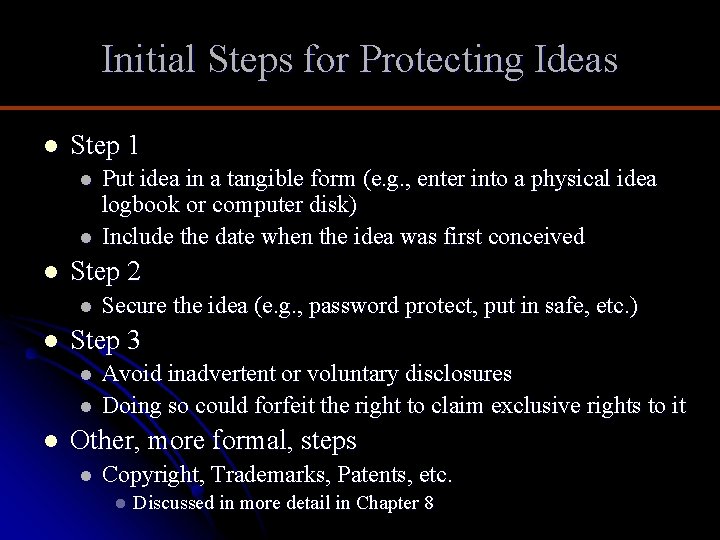

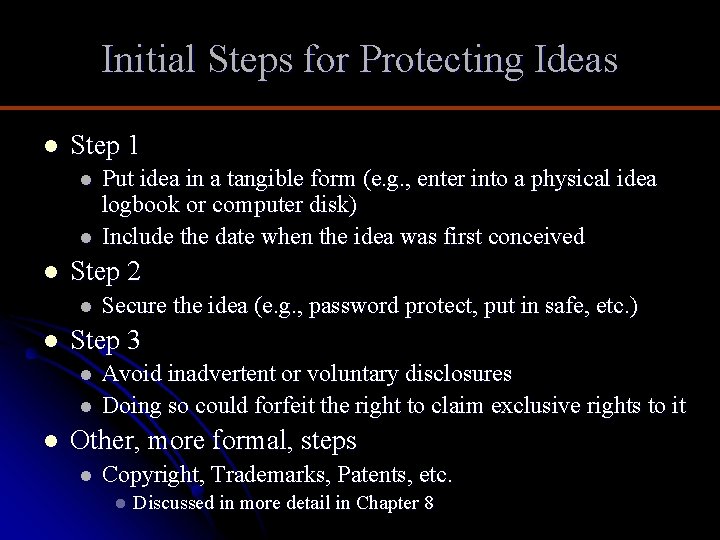

Initial Steps for Protecting Ideas l Step 1 l l l Step 2 l l Secure the idea (e. g. , password protect, put in safe, etc. ) Step 3 l l l Put idea in a tangible form (e. g. , enter into a physical idea logbook or computer disk) Include the date when the idea was first conceived Avoid inadvertent or voluntary disclosures Doing so could forfeit the right to claim exclusive rights to it Other, more formal, steps l Copyright, Trademarks, Patents, etc. l Discussed in more detail in Chapter 8

Evaluating Entrepreneurial Opportunities Relative to an Industry’s Structure Diane M. Sullivan (2007)

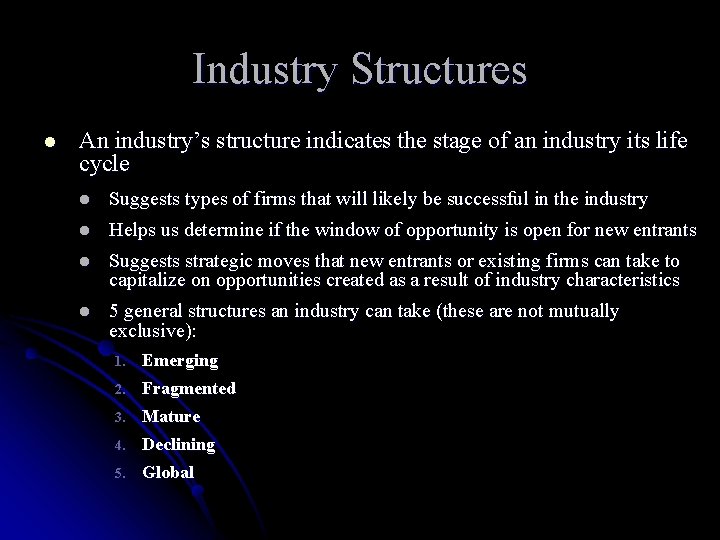

Industry Structures l An industry’s structure indicates the stage of an industry its life cycle l Suggests types of firms that will likely be successful in the industry l Helps us determine if the window of opportunity is open for new entrants l Suggests strategic moves that new entrants or existing firms can take to capitalize on opportunities created as a result of industry characteristics l 5 general structures an industry can take (these are not mutually exclusive): 1. Emerging 2. Fragmented 3. Mature 4. Declining 5. Global

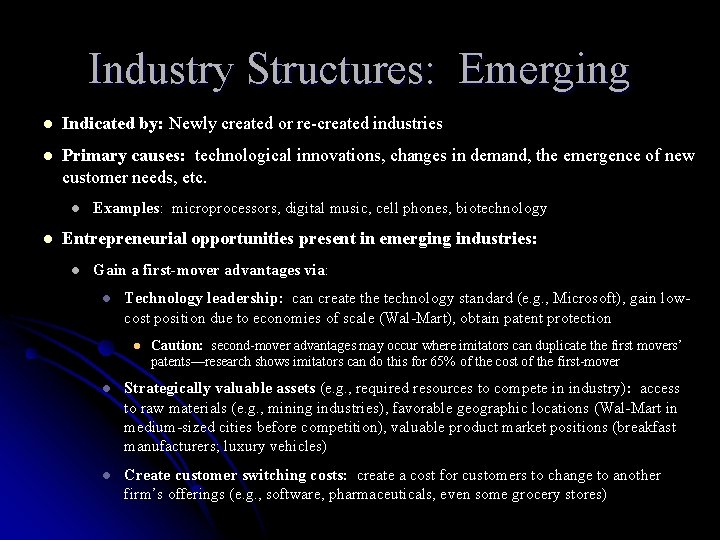

Industry Structures: Emerging l Indicated by: Newly created or re-created industries l Primary causes: technological innovations, changes in demand, the emergence of new customer needs, etc. l l Examples: microprocessors, digital music, cell phones, biotechnology Entrepreneurial opportunities present in emerging industries: l Gain a first-mover advantages via: l Technology leadership: can create the technology standard (e. g. , Microsoft), gain lowcost position due to economies of scale (Wal-Mart), obtain patent protection l Caution: second-mover advantages may occur where imitators can duplicate the first movers’ patents—research shows imitators can do this for 65% of the cost of the first-mover l Strategically valuable assets (e. g. , required resources to compete in industry): access to raw materials (e. g. , mining industries), favorable geographic locations (Wal-Mart in medium-sized cities before competition), valuable product market positions (breakfast manufacturers; luxury vehicles) l Create customer switching costs: create a cost for customers to change to another firm’s offerings (e. g. , software, pharmaceuticals, even some grocery stores)

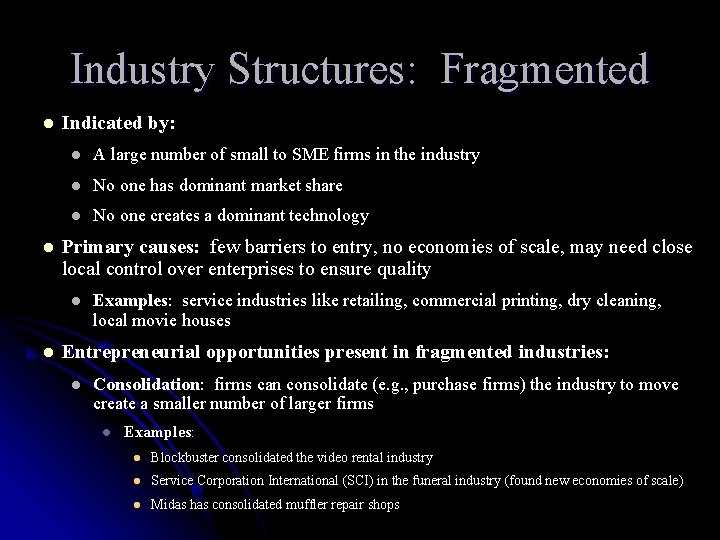

Industry Structures: Fragmented l l Indicated by: l A large number of small to SME firms in the industry l No one has dominant market share l No one creates a dominant technology Primary causes: few barriers to entry, no economies of scale, may need close local control over enterprises to ensure quality l l Examples: service industries like retailing, commercial printing, dry cleaning, local movie houses Entrepreneurial opportunities present in fragmented industries: l Consolidation: firms can consolidate (e. g. , purchase firms) the industry to move create a smaller number of larger firms l Examples: l Blockbuster consolidated the video rental industry l Service Corporation International (SCI) in the funeral industry (found new economies of scale) l Midas has consolidated muffler repair shops

Industry Structures: Mature l l Indicated by: l Slowing industry growth l Development of repeat customers l Slowing of production capacity l Slowdown in new product/service introductions l Increased international competition l Overall reduction in profitability of firms in industry Primary causes: technology diffusion, reduction in innovation rate l l Examples: fast food; motor oil, large discount retailers; laundry detergents, kitchen appliances Entrepreneurial opportunities present in mature industries: l Product refinement: focus on extending/improving current products and technologies (e. g. , additives to motor oil, more concentrated laundry detergents; front-loading washing machines; Silk Soymilk) l Investment in service quality: increase customer service quality (e. g. , restaurant industry and the casual dining segment—Applebee's; Chili's—versus fast-food service) l Process innovation: activities used to design, product and sell products/services (e. g. , US automobile industry; Dell and supply-chain management in PC industry)

Industry Structures: Declining l Indicated by: An industry that has experienced an absolute decline in unit sales over a sustained period of time. l l Examples: Traditional video rental industry; US defense industry after the Cold War in the 1980 s Entrepreneurial opportunities present in declining industries: l Market Leadership: wait out shakeout period; facilitate shakeout by purchasing competitors’ product lines, then try to gain majority of market share (e. g. , Martin Marietta in defense industry acquiring GE’s aerospace business—then merged with Lockheed to become Lockheed Martin) l Market Niche: reduce scope of operations and focus on narrow segments in industry (e. g. , Polaroid with instant photography) l Harvest: long, systematic, phased withdrawal from industry while extracting as much value as possible l Divestment: quickly withdraw from industry after industry decline pattern is established so no additional costs incurred (e. g. , can sell product lines to competitors)

Industry Structures: Global l Indicated l by: industry experiencing significant international sales Examples: athletic shoes; internet auctions; fast food l Entrepreneurial opportunities present in global industries: l Pursue Multidomestic Strategy: customize product/service offerings per each market’s specific needs/wants (fast food; e. Bay) l Pursue Global Strategy: approach each market with the same offerings (e. g. , Nike) l Determine which strategy appropriate by similarity of consumers’ tastes across markets