Recent Developments and Policy Implications for Port Modernization

- Slides: 25

Recent Developments and Policy Implications for Port Modernization in the Mediterranean Vincent F. Valentine Officer-in-Charge, Transport Section Division on Technology and Logistics Parliamentary Assembly of the Mediterranean 2013

Contents 1. 2. 3. 4. 5. Overview Infrastructure Funding UNCTAD’s Work Policy Implications

1. 1. Overview

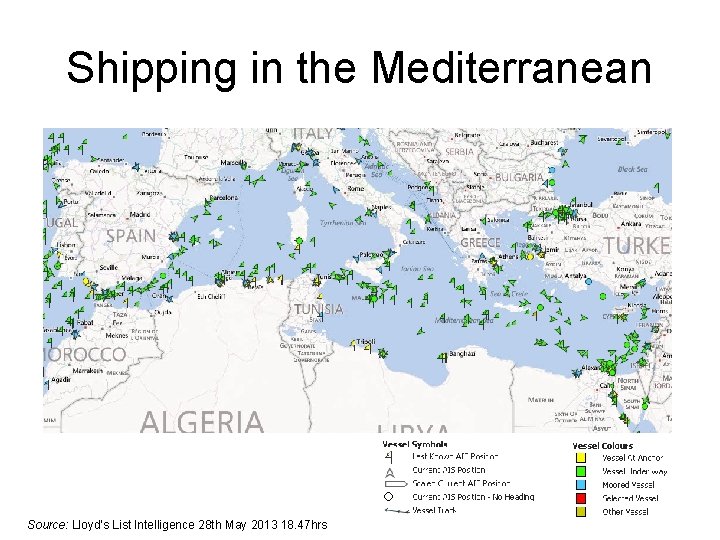

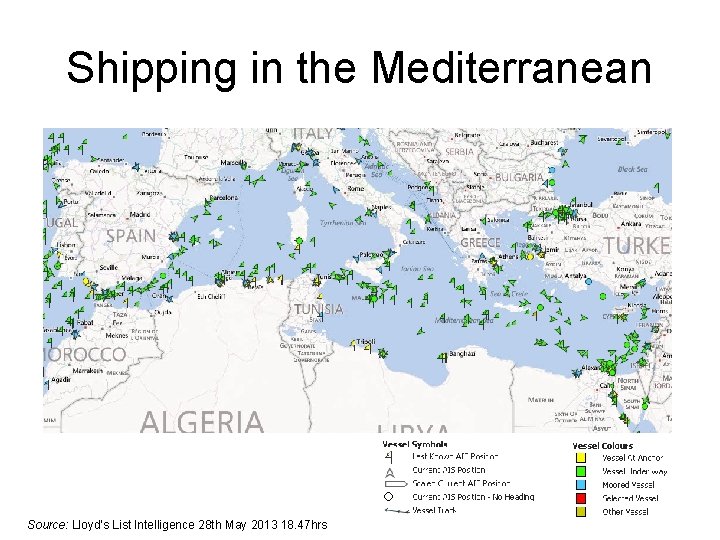

Shipping in the Mediterranean Source: Lloyd’s List Intelligence 28 th May 2013 18. 47 hrs

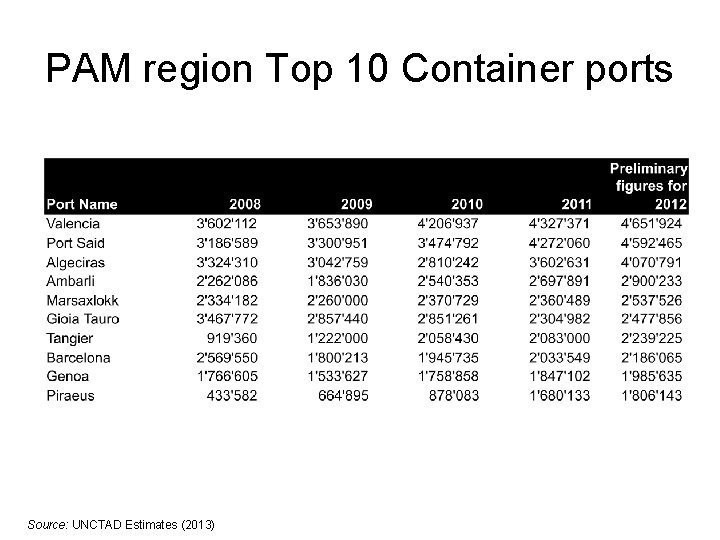

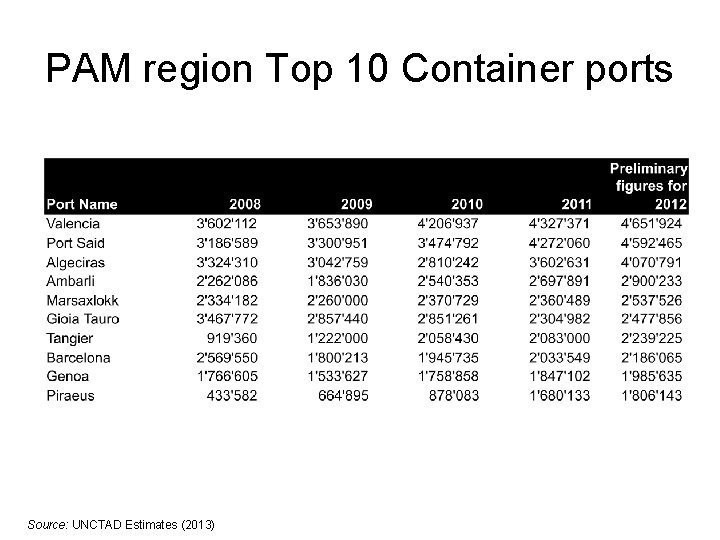

PAM region Top 10 Container ports Source: UNCTAD Estimates (2013)

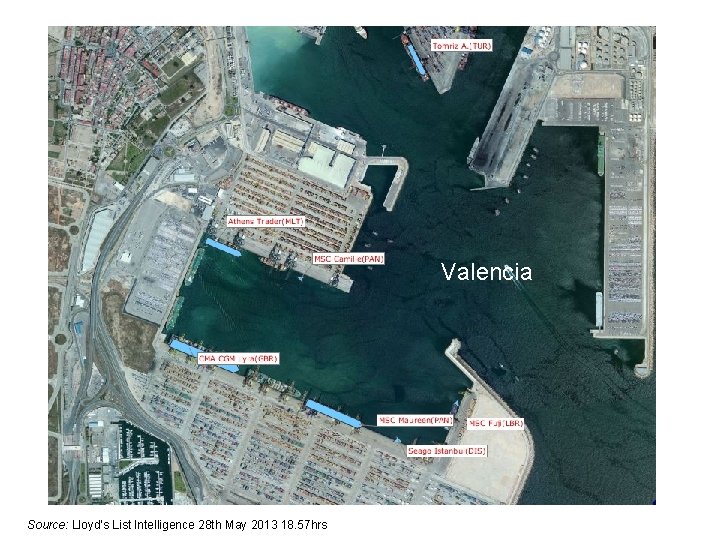

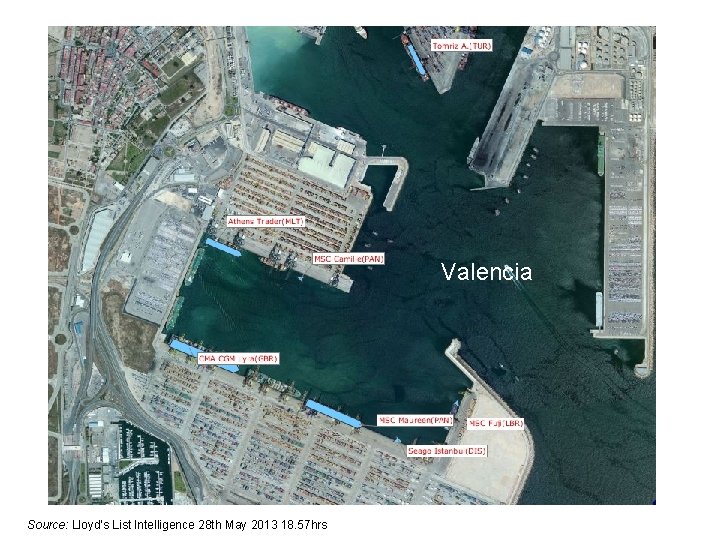

Valencia Source: Lloyd’s List Intelligence 28 th May 2013 18. 57 hrs

PAM region - Port Throughput Source: UNCTAD (2013) Review of Maritime Transport Forthcoming

1. 2. Infrastructure

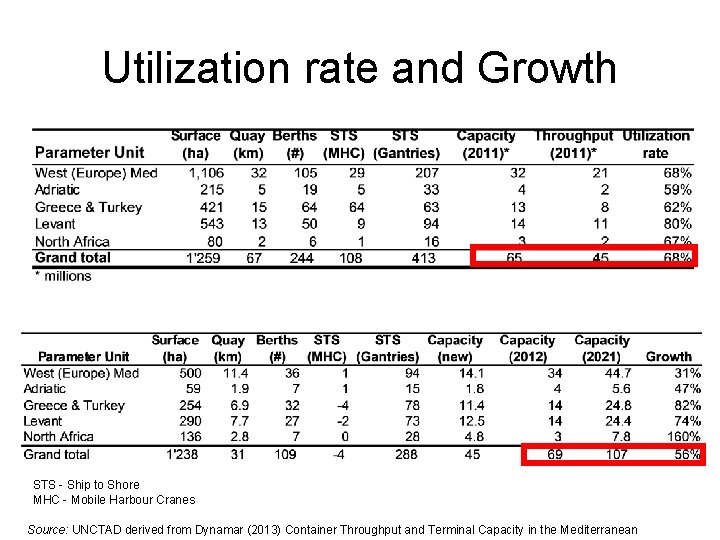

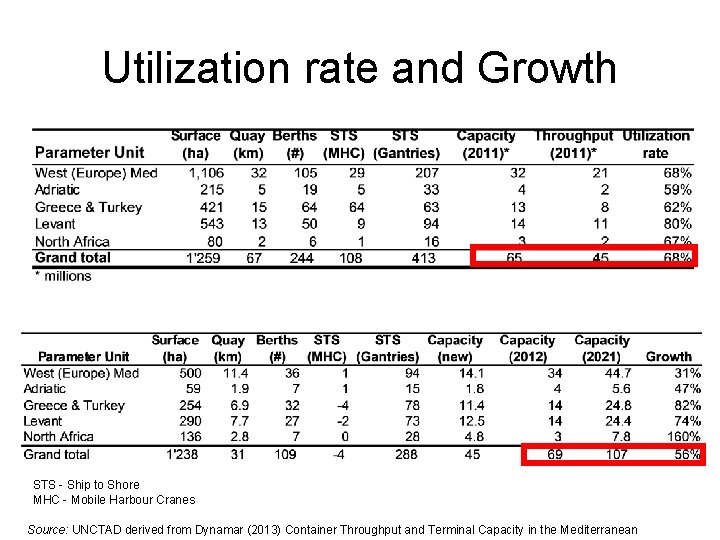

Utilization rate and Growth STS - Ship to Shore MHC - Mobile Harbour Cranes Source: UNCTAD derived from Dynamar (2013) Container Throughput and Terminal Capacity in the Mediterranean

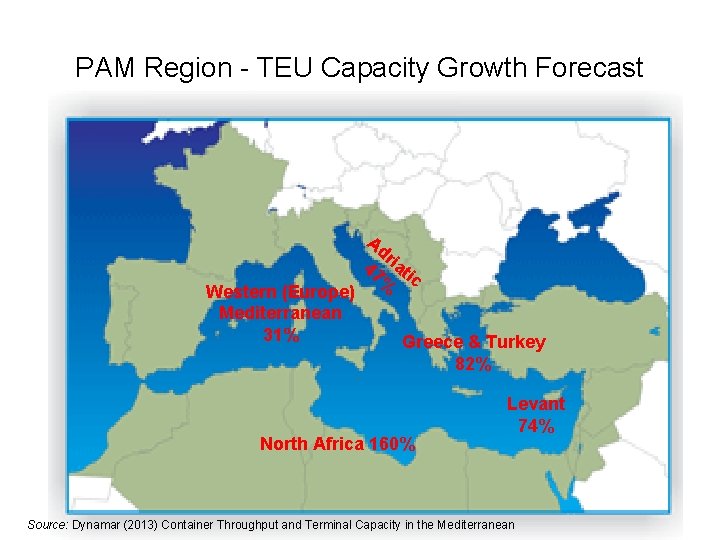

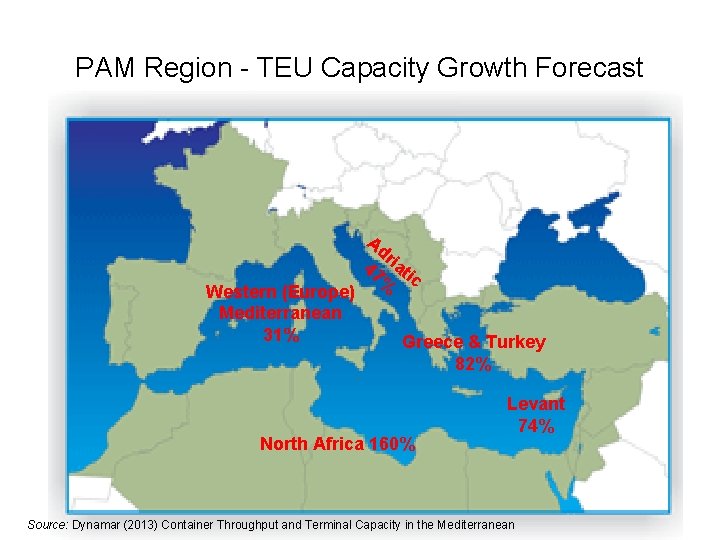

PAM Region - TEU Capacity Growth Forecast Western (Europe) Mediterranean 31% Ad r 47 iati % c Greece & Turkey 82% North Africa 160% Levant 74% Source: Dynamar (2013) Container Throughput and Terminal Capacity in the Mediterranean

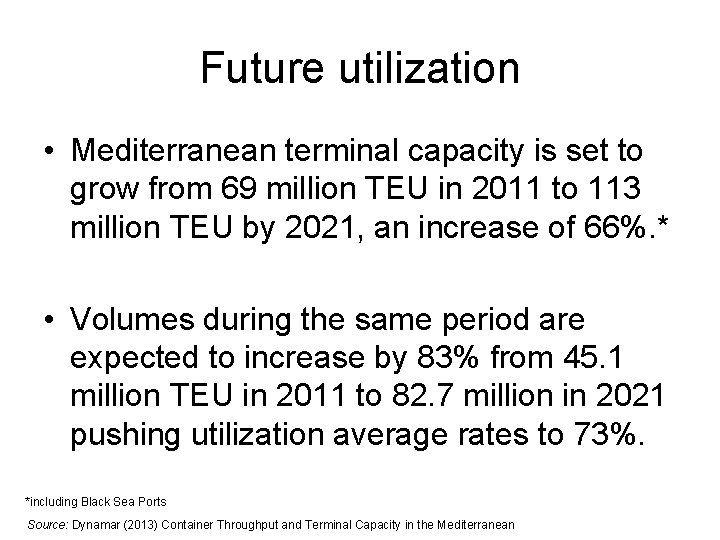

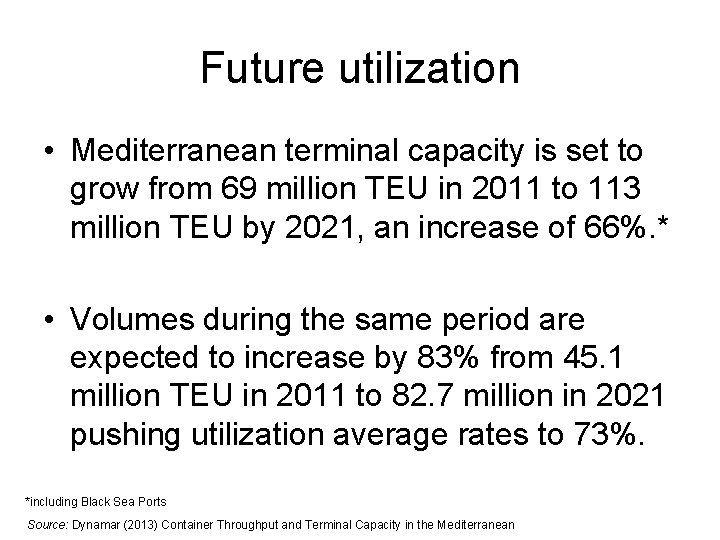

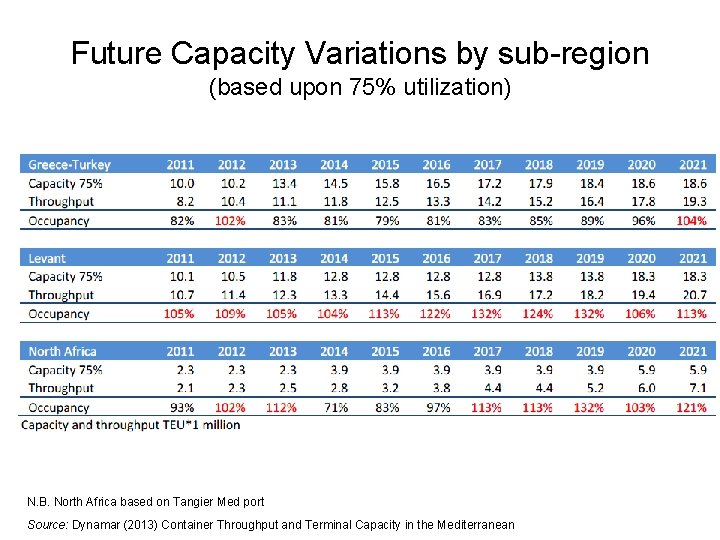

Future utilization • Mediterranean terminal capacity is set to grow from 69 million TEU in 2011 to 113 million TEU by 2021, an increase of 66%. * • Volumes during the same period are expected to increase by 83% from 45. 1 million TEU in 2011 to 82. 7 million in 2021 pushing utilization average rates to 73%. *including Black Sea Ports Source: Dynamar (2013) Container Throughput and Terminal Capacity in the Mediterranean

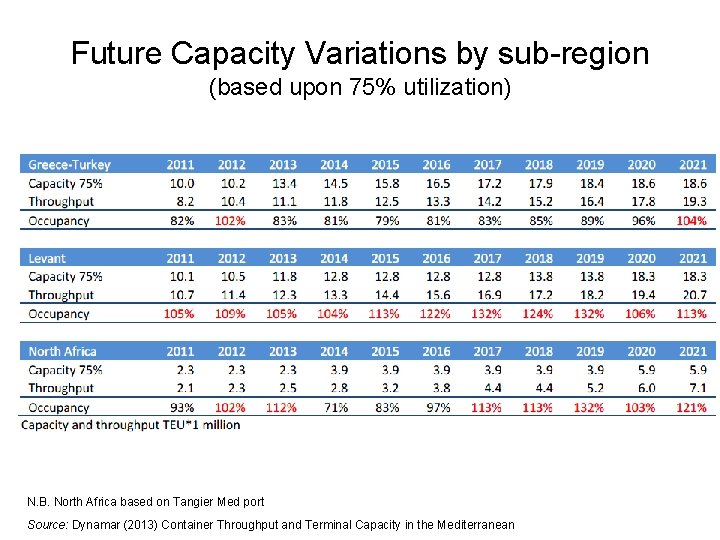

Future Capacity Variations by sub-region (based upon 75% utilization) N. B. North Africa based on Tangier Med port Source: Dynamar (2013) Container Throughput and Terminal Capacity in the Mediterranean

Trends Average (159 countries) Source: UNCTAD Liner Shipping Connectivity Index – RMT various years

3. Funding

Sources of International and Regional Funding

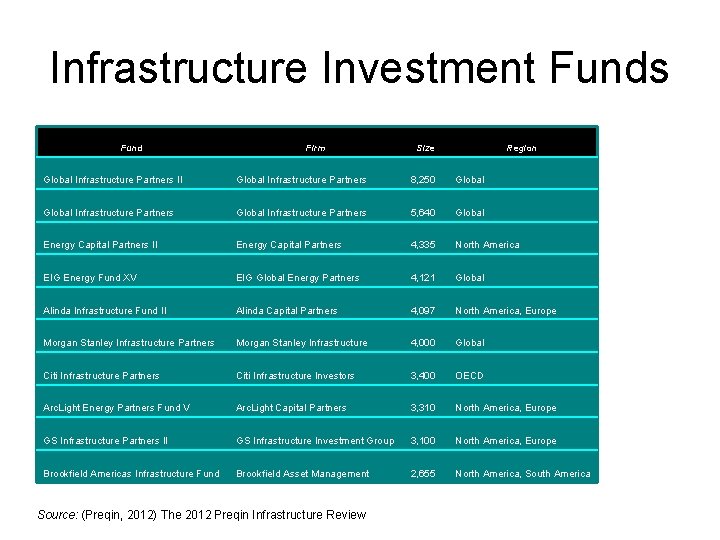

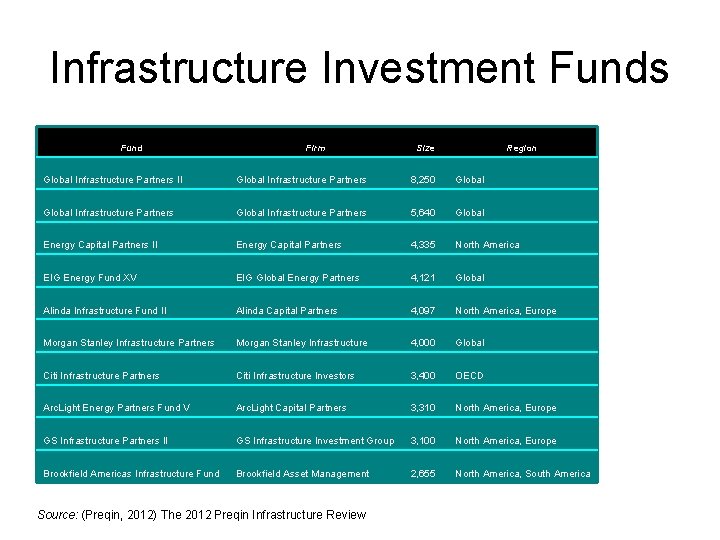

Infrastructure Investment Funds Fund Firm Size Region Global Infrastructure Partners II Global Infrastructure Partners 8, 250 Global Infrastructure Partners 5, 640 Global Energy Capital Partners II Energy Capital Partners 4, 335 North America EIG Energy Fund XV EIG Global Energy Partners 4, 121 Global Alinda Infrastructure Fund II Alinda Capital Partners 4, 097 North America, Europe Morgan Stanley Infrastructure Partners Morgan Stanley Infrastructure 4, 000 Global Citi Infrastructure Partners Citi Infrastructure Investors 3, 400 OECD Arc. Light Energy Partners Fund V Arc. Light Capital Partners 3, 310 North America, Europe GS Infrastructure Partners II GS Infrastructure Investment Group 3, 100 North America, Europe Brookfield Americas Infrastructure Fund Brookfield Asset Management 2, 655 North America, South America Source: (Preqin, 2012) The 2012 Preqin Infrastructure Review

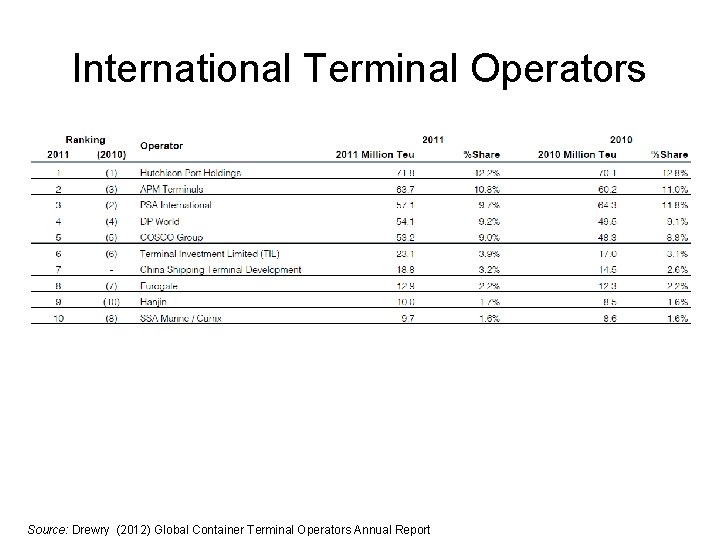

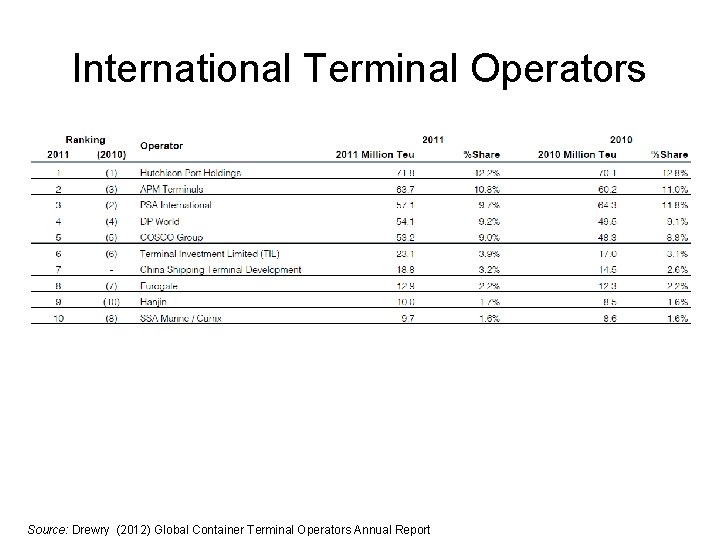

International Terminal Operators Source: Drewry (2012) Global Container Terminal Operators Annual Report

4. UNCTAD’s Work

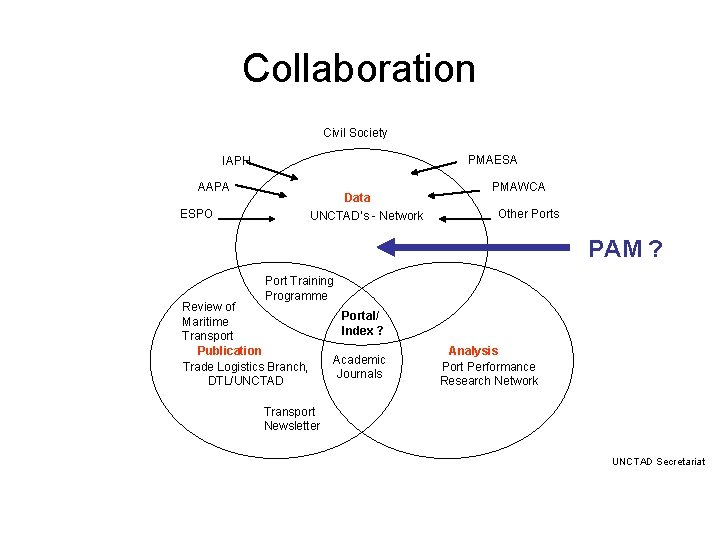

Collaboration Civil Society PMAESA IAPH AAPA Data UNCTAD’s - Network ESPO PMAWCA Other Ports PAM ? Port Training Programme Review of Maritime Transport Publication Trade Logistics Branch, DTL/UNCTAD Portal/ Index ? Academic Journals Analysis Port Performance Research Network Transport Newsletter UNCTAD Secretariat

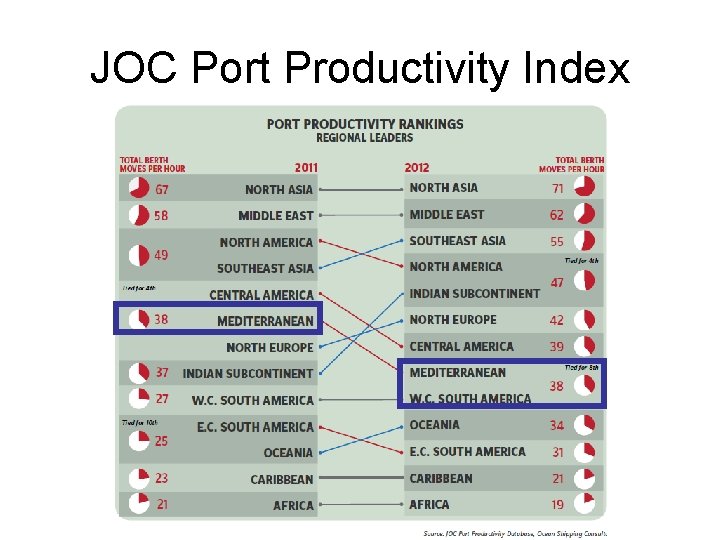

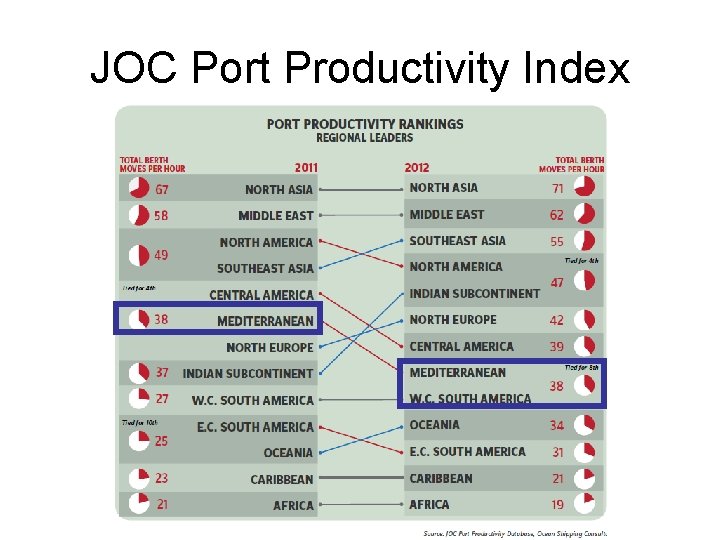

JOC Port Productivity Index

Challenges Changing Trade Patterns Bigger Customer $ CO 2 Emissions

5. Policy Implications

Policy Implications Governments need to find funding for port improvements (infra & superstructures) in a sustainable way so that future maintenance costs are easy to raise. Increased attention to port benchmarking means industry will play a greater role in monitor efficiency. Environmental concerns are fundamental to any development plan whether it be reporting, adaption or mitigation.

Main Sources Dynamar Drewry UNCTAD