Real Estate Investment Trust Wong Yee Han Roni

- Slides: 30

Real Estate Investment Trust 房地產投資信託基金 Wong Yee Han, Roni Tsang Pui Yee, Polly Kwok Chi Keung, Rex Yeung Tat Chung, Angus (043102) (043112) (043126) (043097)

Agenda • Introduction of REIT • Example of REIT – The Link • Comparison of different REIT in HK • Evaluation and Recommendations • Conclusion Roni Wong

Introduction of REIT Roni Wong

What is Real Estate Investment trust (REIT)? • collective investment scheme in a portfolio of income-generating real property • Manager distributes all / almost of net income holders • Annual or semi-annual basis Roni Wong

What is Real Estate Investment trust (REIT)? (con’t) • Investor buy / sell through a stock exchange • REIT do not redeem investors interests • Long term income yield • not for capital appreciation on resale Roni Wong

Advantages • Realize and redeploy capital investment asset become more liquidate • Regular income • Invest in an asset class which is difficult to access • Remove double taxation Roni Wong

Example of REIT – The Link 領匯房地產投資信託基金 Polly Tsang

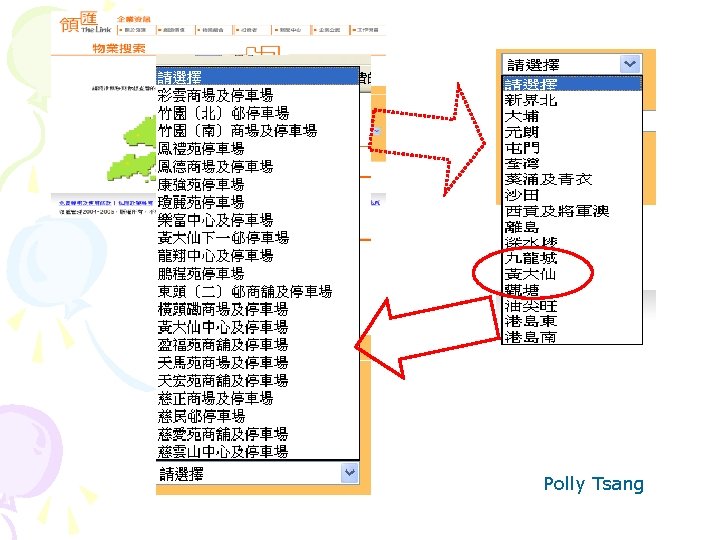

Background • Stock code: 823 • invests in 180 retail and carpark facilities • one million sq. m of retail space and around 80, 000 carpark spaces • 40% of people lived near the Link REIT properties Polly Tsang

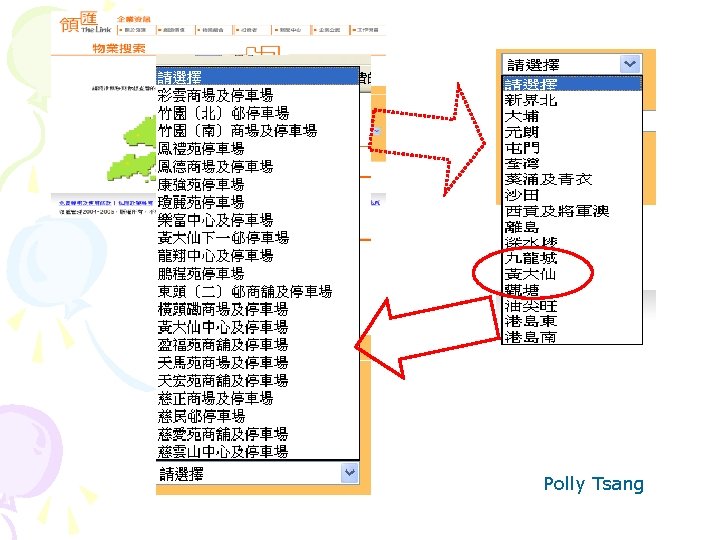

Polly Tsang

Investment strategies • invest in properties for the long-term • focus on sustainable-income producing properties with the potential for long-term income and capital growth • maintain a large and geographically diversified portfolio Polly Tsang

Investment strategies (con’t) • convenience-based retail properties primarily serving the basic consumer needs of the residents of the adjacent housing estates and other visitors • carparks serving the tenants and customers of the retail properties and the residents of the surrounding • neighborhoods and other visitors Polly Tsang

Dividend Distribution • no less than 90% of total distributable income • not less than HK$0. 6176 • 21 December 2006 - 32. 81 HK cents • 30 August 2006 - 21. 81 HK cents Polly Tsang

Advantages • Certainty as to business focus • A policy to distribute of an amount equivalent to 100% of total distributable income • Financial and operating transparency Polly Tsang

Comparison of different REITs in Hong Kong Link REIT(領匯房產基金, 823) Gzi REIT(越秀房產信託基金, 405) Champion REIT(冠君產業信託, 2778) Prosperity REIT(泓富產業信託, 808) Rex Kwok

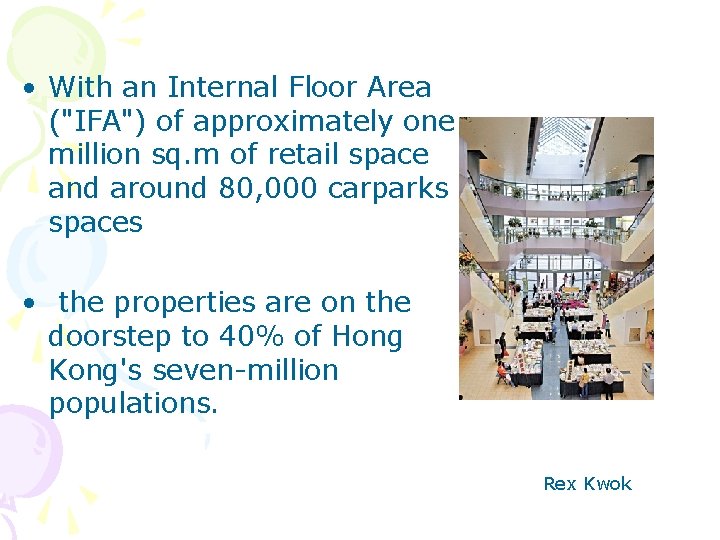

Link REIT--- invests in 180 retail and carparks facilities Rex Kwok

• With an Internal Floor Area ("IFA") of approximately one million sq. m of retail space and around 80, 000 carparks spaces • the properties are on the doorstep to 40% of Hong Kong's seven-million populations. Rex Kwok

Gzi REIT---consists of commercial properties located in Guangzhou 1. White Horse Units 2. Fortune Plaza Units 3. City Development Plaza Units 4. Victory Plaza Units Rex Kwok

The overall occupancy of the 4 properties improved to over 90% • White Horse Building is maintained at 100% • Fortune Plaza at approximately 90. 2% • City Development Plaza at approximately 92. 6% • Victory Plaza at 100% Rex Kwok

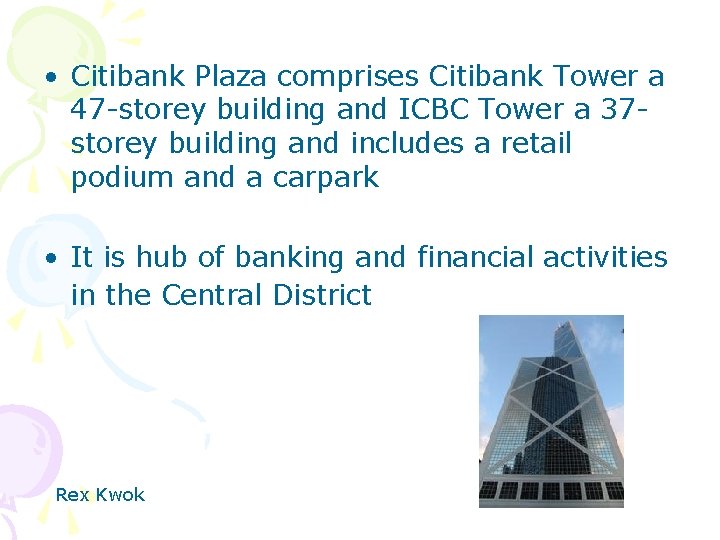

Champion REIT--formed primarily to office and retail properties in Hong Kong • Comprises 91. 5% of the Gross Rentable Area of Citibank Plaza and substantially all of the parking spaces at Citibank Plaza. Rex Kwok

• Citibank Plaza comprises Citibank Tower a 47 -storey building and ICBC Tower a 37 storey building and includes a retail podium and a carpark • It is hub of banking and financial activities in the Central District Rex Kwok

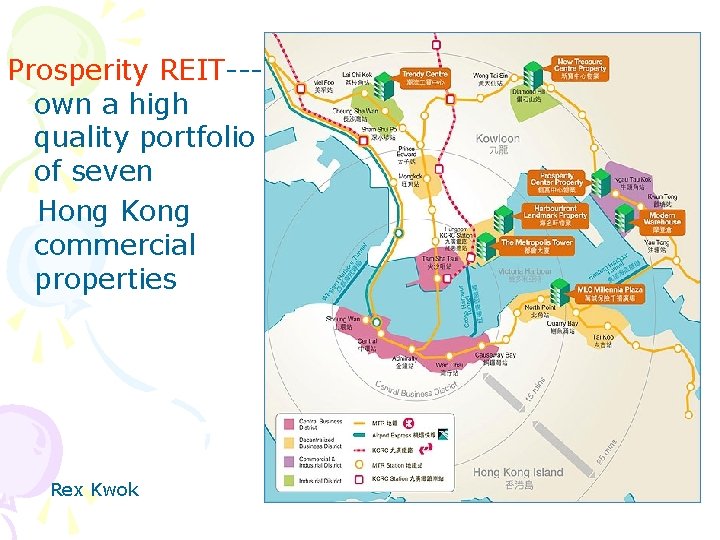

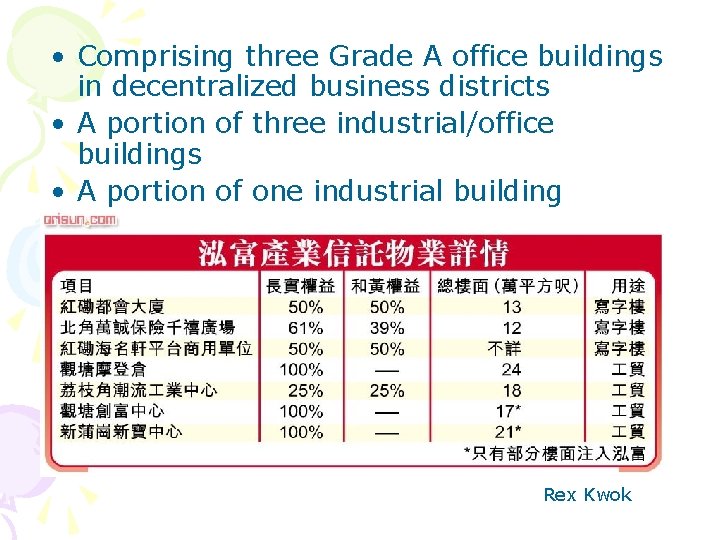

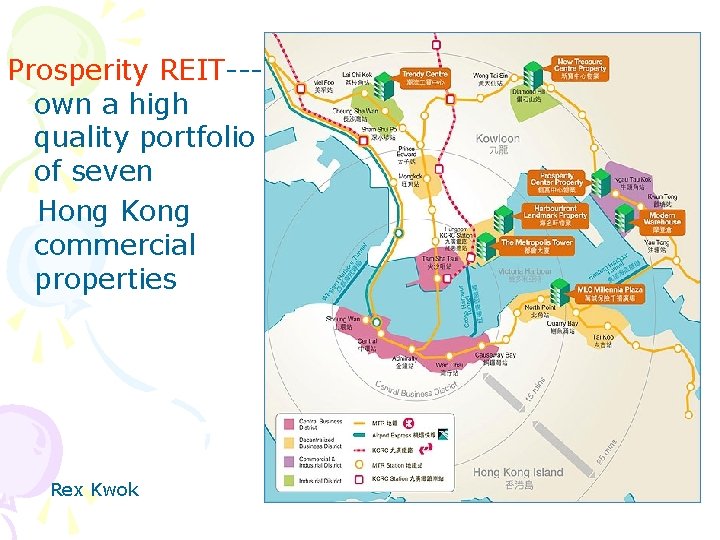

Prosperity REIT--own a high quality portfolio of seven Hong Kong commercial properties Rex Kwok

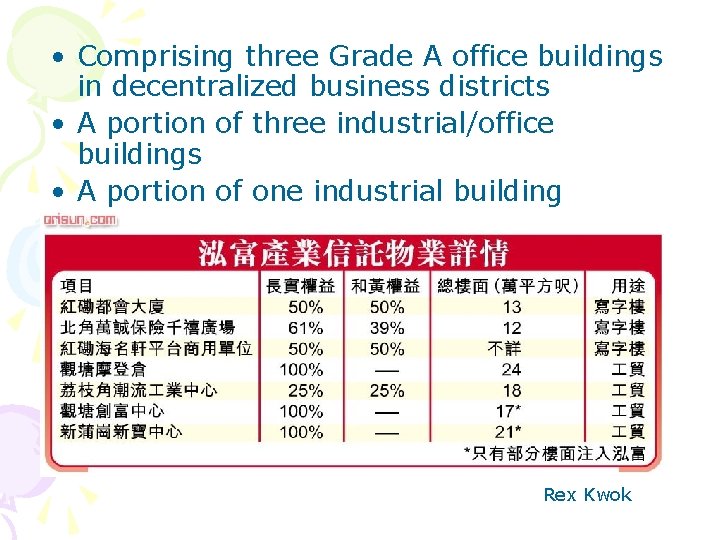

• Comprising three Grade A office buildings in decentralized business districts • A portion of three industrial/office buildings • A portion of one industrial building Rex Kwok

Discussion According to their different portfolio of properties, which REITs will you subscribe and why? Rex Kwok

Evaluation and Recommendations Angus Yeung

Evaluation • Market scale is large • Low quality of capital • Underdeveloped supervision structure • Lack of experience of fund managers • Unclear investment strategies Angus Yeung

Recommendations 1) Redevelop the assets (Shopping mall, Carparks, Estates) Capital quality and rent level of private properties 2) Human resources management Training and learning from other countries (eg, USA, Singapore) Angus Yeung

Recommendations (con’t) 3) Investment strategies For business Focus on SME or large companies Benefit to properties Adjust the interest rate Angus Yeung

Conclusion • REIT will become more popular • The market scale will increase to 60% • Active in financial market

Q&A

THE END

Denver real estate investment associations

Denver real estate investment associations Cash flow pro

Cash flow pro Serat wulangreh kedadean saka saka

Serat wulangreh kedadean saka saka Real homes real estate

Real homes real estate Lay yee wah

Lay yee wah Wu jieh yee

Wu jieh yee Joanne dean

Joanne dean Juniper wan optimization

Juniper wan optimization Dr ooi phaik yee

Dr ooi phaik yee Lay yee wah

Lay yee wah Shaking vs seizure

Shaking vs seizure 761

761 Roni avissar

Roni avissar Murder mystery party pasta passion and pistols

Murder mystery party pasta passion and pistols Roni kastaman

Roni kastaman Rice a roni flavors ranked

Rice a roni flavors ranked Fixed investment and inventory investment

Fixed investment and inventory investment Parvest diversified dynamic

Parvest diversified dynamic Dunedin smaller companies

Dunedin smaller companies Northern trust charitable trust

Northern trust charitable trust Real estate finance fundamentals

Real estate finance fundamentals Difference between riparian and littoral rights

Difference between riparian and littoral rights Florida real estate principles practices & law 43rd edition

Florida real estate principles practices & law 43rd edition Unlimited funding for real estate

Unlimited funding for real estate Real estate risk management fee

Real estate risk management fee Free real estate powerpoint templates

Free real estate powerpoint templates Social media plan for real estate

Social media plan for real estate Norm miller real estate

Norm miller real estate Urban economics and real estate markets

Urban economics and real estate markets Real estate case study examples

Real estate case study examples Real estate adalah

Real estate adalah