Random Walk Model Random Walk Model One of

![Intel Closing Prices [6/16/97 -6/12/00] Intel Closing Prices [6/16/97 -6/12/00]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-11.jpg)

![Intel Closing Prices [Original Series] Intel Closing Prices [Original Series]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-12.jpg)

![Intel Closing Prices [First Differenced Series] Intel Closing Prices [First Differenced Series]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-13.jpg)

![Intel Closing Prices [Original Series] H 0: The series is random H 1: The Intel Closing Prices [Original Series] H 0: The series is random H 1: The](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-14.jpg)

![Intel Closing Prices [Original Series] Intel Closing Prices [Original Series]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-15.jpg)

![Intel Closing Prices [Original Series] Test for Randomness of original series Intel Closing Prices Intel Closing Prices [Original Series] Test for Randomness of original series Intel Closing Prices](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-16.jpg)

![Intel Closing Prices [Original Series] The (second) test counts the number of times the Intel Closing Prices [Original Series] The (second) test counts the number of times the](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-17.jpg)

![Intel Closing Prices [Original Series] Thus the [original] series for Intel Closing Prices is Intel Closing Prices [Original Series] Thus the [original] series for Intel Closing Prices is](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-18.jpg)

![Intel Closing Prices [First Differenced Series] H 0: The series is random H 1: Intel Closing Prices [First Differenced Series] H 0: The series is random H 1:](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-19.jpg)

![Intel Closing Prices [First Differenced Series] Intel Closing Prices [First Differenced Series]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-20.jpg)

![Intel Closing Prices [First Differenced Series] Test for Randomness of first difference (DIFF) Intel Intel Closing Prices [First Differenced Series] Test for Randomness of first difference (DIFF) Intel](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-21.jpg)

![Intel Closing Prices [First Differenced Series] The (second) test counts the number of times Intel Closing Prices [First Differenced Series] The (second) test counts the number of times](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-22.jpg)

![Intel Closing Prices [First Differenced Series] Thus the [first differenced] series for Intel Closing Intel Closing Prices [First Differenced Series] Thus the [first differenced] series for Intel Closing](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-23.jpg)

![Intel Closing Prices Thus, for Intel Closing Prices [6/16/97 -6/12/00] Ø The series (Intel Intel Closing Prices Thus, for Intel Closing Prices [6/16/97 -6/12/00] Ø The series (Intel](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-24.jpg)

- Slides: 27

Random Walk Model

Random Walk Model One of the simplest models, yet the random walk model is widely used in the area of finance. A common and serious departure from random behavior is called a random walk.

Random Walk Model By definition, a series is said to follow a random walk if the first differences are random.

Random Walk Model By definition, a series is said to follow a random walk if the first differences are random. What is meant by first differences is the difference from one observation to the next.

Random Walk Model Think about the process of walking to class. You have a set goal, you are achieving an objective. However, while walking you use a sequence of stumbling, unpredictable steps, the difference between each step has no “rhyme or reason. ”

Random Walk Model In a random walk model, the series itself is not random. However, its differences—the changes from one period to the next—are random. This type of behavior is typical of stock price data.

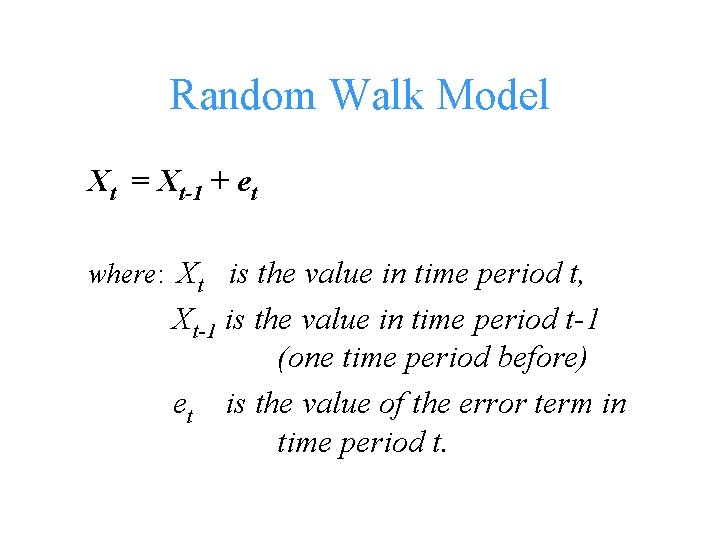

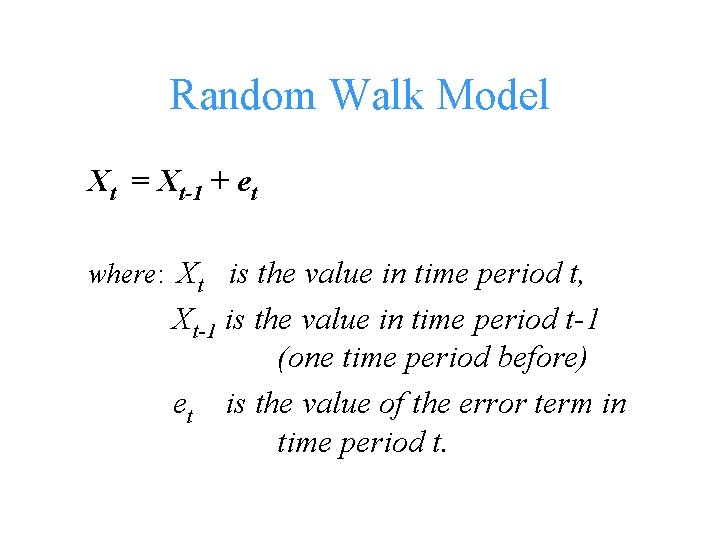

Random Walk Model Xt = Xt-1 + et where: Xt is the value in time period t, Xt-1 is the value in time period t-1 (one time period before) et is the value of the error term in time period t.

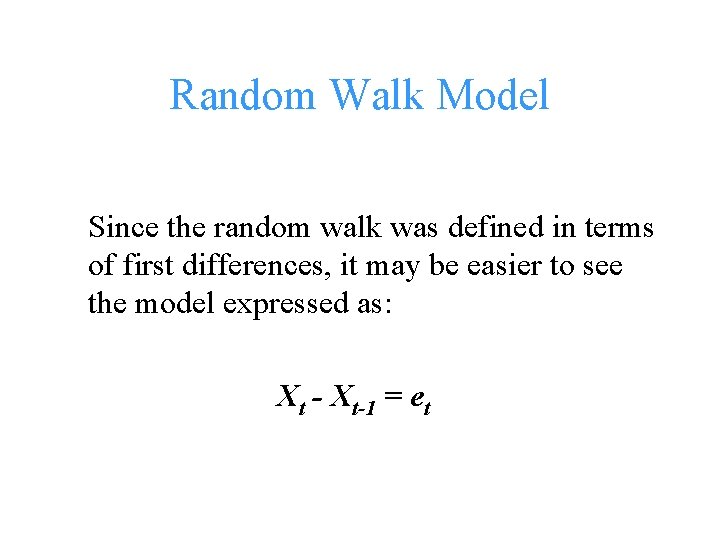

Random Walk Model Since the random walk was defined in terms of first differences, it may be easier to see the model expressed as: Xt - Xt-1 = et

Random Walk Model When the original series is changed to a first differences series, the series is transformed. When an x-value is changed to a z-score by the formula [(x- )/ ], the original data was transformed from an x-value to a z-score.

Why Transform a Series? • Forecast future trends to aid in decision making • If series follows random walk, original series offers little or no insights • May need to analyze first differenced series

![Intel Closing Prices 61697 61200 Intel Closing Prices [6/16/97 -6/12/00]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-11.jpg)

Intel Closing Prices [6/16/97 -6/12/00]

![Intel Closing Prices Original Series Intel Closing Prices [Original Series]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-12.jpg)

Intel Closing Prices [Original Series]

![Intel Closing Prices First Differenced Series Intel Closing Prices [First Differenced Series]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-13.jpg)

Intel Closing Prices [First Differenced Series]

![Intel Closing Prices Original Series H 0 The series is random H 1 The Intel Closing Prices [Original Series] H 0: The series is random H 1: The](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-14.jpg)

Intel Closing Prices [Original Series] H 0: The series is random H 1: The series is not random Note: The use of [original] in Notes for Data Analysis is for emphasis only. . . “original” is not generally used when stating the null and alternate hypotheses.

![Intel Closing Prices Original Series Intel Closing Prices [Original Series]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-15.jpg)

Intel Closing Prices [Original Series]

![Intel Closing Prices Original Series Test for Randomness of original series Intel Closing Prices Intel Closing Prices [Original Series] Test for Randomness of original series Intel Closing Prices](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-16.jpg)

Intel Closing Prices [Original Series] Test for Randomness of original series Intel Closing Prices [6/16/97 -6/12/00] Runs up and down -------------Number of runs up and down = 76 Expected number of runs = 104. 333 p-value = 1. 16648 E-7

![Intel Closing Prices Original Series The second test counts the number of times the Intel Closing Prices [Original Series] The (second) test counts the number of times the](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-17.jpg)

Intel Closing Prices [Original Series] The (second) test counts the number of times the sequence rose or fell. The number of such runs equals 76, as compared to an expected value of 104. 333 if the sequence were random. Since the p-value for this test is less than 0. 05, we can reject H 0: The series is random at the 95% confidence level.

![Intel Closing Prices Original Series Thus the original series for Intel Closing Prices is Intel Closing Prices [Original Series] Thus the [original] series for Intel Closing Prices is](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-18.jpg)

Intel Closing Prices [Original Series] Thus the [original] series for Intel Closing Prices is not random. [In a random walk model, the series itself is not random. ]

![Intel Closing Prices First Differenced Series H 0 The series is random H 1 Intel Closing Prices [First Differenced Series] H 0: The series is random H 1:](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-19.jpg)

Intel Closing Prices [First Differenced Series] H 0: The series is random H 1: The series is not random Note: Use of [first differenced] in Notes for Data Analysis is for emphasis only. . . “first differenced” is not generally used when stating the null and alternate hypotheses.

![Intel Closing Prices First Differenced Series Intel Closing Prices [First Differenced Series]](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-20.jpg)

Intel Closing Prices [First Differenced Series]

![Intel Closing Prices First Differenced Series Test for Randomness of first difference DIFF Intel Intel Closing Prices [First Differenced Series] Test for Randomness of first difference (DIFF) Intel](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-21.jpg)

Intel Closing Prices [First Differenced Series] Test for Randomness of first difference (DIFF) Intel Closing Prices [6/16/97 -6/12/00] Runs up and down -------------Number of runs up and down = 99 Expected number of runs = 104. 333 p-value = 0. 357469

![Intel Closing Prices First Differenced Series The second test counts the number of times Intel Closing Prices [First Differenced Series] The (second) test counts the number of times](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-22.jpg)

Intel Closing Prices [First Differenced Series] The (second) test counts the number of times the sequence rose or fell. The number of such runs equals 99, as compared to an expected value of 104. 333 if the sequence were random. Since the p-value for this test is greater than 0. 05, we can not reject H 0: The series is random at the 95% or higher confidence level.

![Intel Closing Prices First Differenced Series Thus the first differenced series for Intel Closing Intel Closing Prices [First Differenced Series] Thus the [first differenced] series for Intel Closing](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-23.jpg)

Intel Closing Prices [First Differenced Series] Thus the [first differenced] series for Intel Closing Prices is random. [… its differences—the changes from one period to the next—are random. ]

![Intel Closing Prices Thus for Intel Closing Prices 61697 61200 Ø The series Intel Intel Closing Prices Thus, for Intel Closing Prices [6/16/97 -6/12/00] Ø The series (Intel](https://slidetodoc.com/presentation_image_h2/30d829ec43c218ef9ee516e3bead74eb/image-24.jpg)

Intel Closing Prices Thus, for Intel Closing Prices [6/16/97 -6/12/00] Ø The series (Intel Closing Prices) is not random. Ø However, its differences—the changes from one period to the next—are random. Ø Intel Closing Prices behavior typical of stock price data…that is, the series is a random walk model.

Questions?

ANOVA