Rail The Intermodal Connection Drew Glassman AVP Intermodal

- Slides: 15

Rail – The Intermodal Connection Drew Glassman, AVP Intermodal Marketing CSX Transportation 1

Holistic focus on controlling supply chain costs n Near-sourcing of manufacturing sites due to rising costs in Asia n Simplification and rebalancing of supply chain network design n Optimization software to improve efficiencies and streamline processes n Use of alternate transportation modes, including intermodal 2

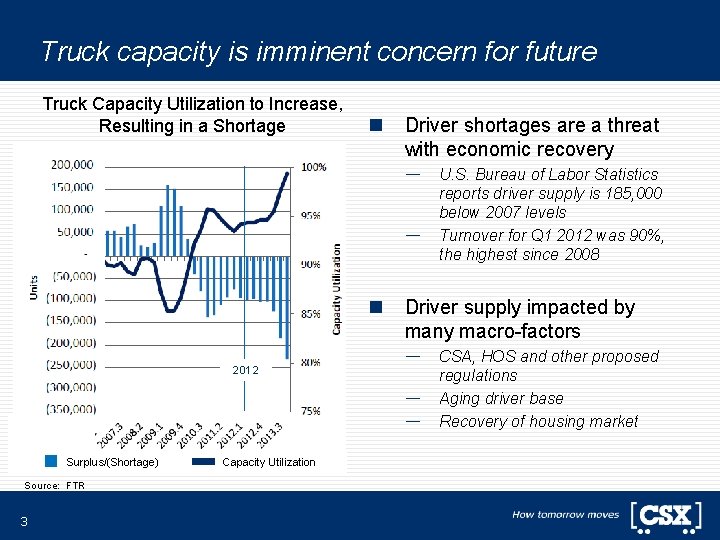

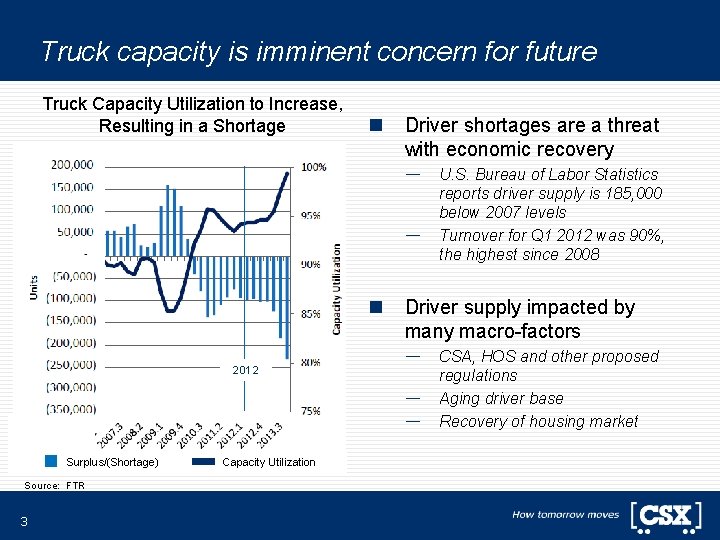

Truck capacity is imminent concern for future Truck Capacity Utilization to Increase, Resulting in a Shortage n Driver shortages are a threat with economic recovery — — n 2012 Driver supply impacted by many macro-factors — — — Surplus/(Shortage) Source: FTR 3 Capacity Utilization U. S. Bureau of Labor Statistics reports driver supply is 185, 000 below 2007 levels Turnover for Q 1 2012 was 90%, the highest since 2008 CSA, HOS and other proposed regulations Aging driver base Recovery of housing market

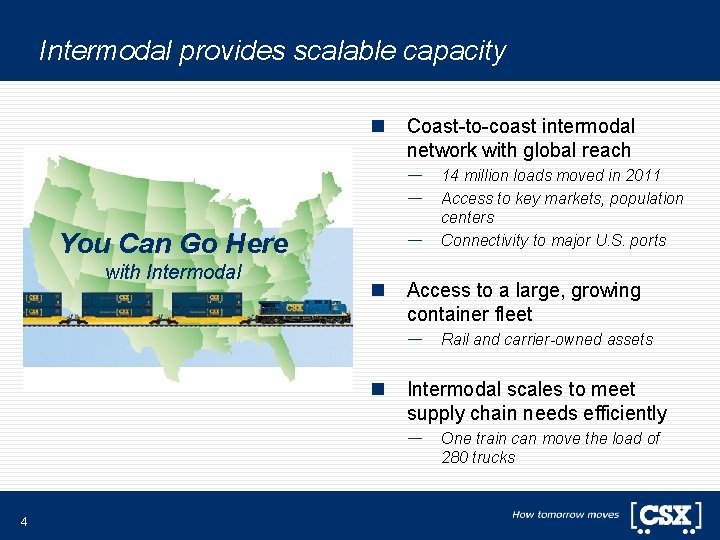

Intermodal provides scalable capacity n Coast-to-coast intermodal network with global reach — — You Can Go Here with Intermodal — n Access to a large, growing container fleet — n Rail and carrier-owned assets Intermodal scales to meet supply chain needs efficiently — 4 14 million loads moved in 2011 Access to key markets, population centers Connectivity to major U. S. ports One train can move the load of 280 trucks

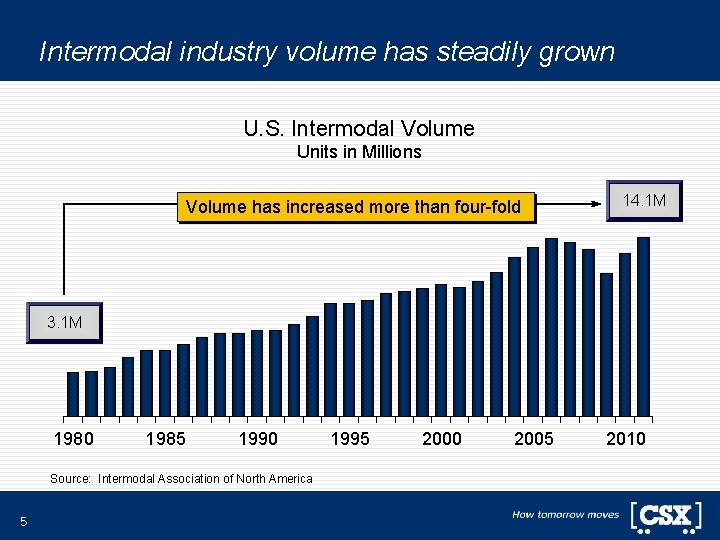

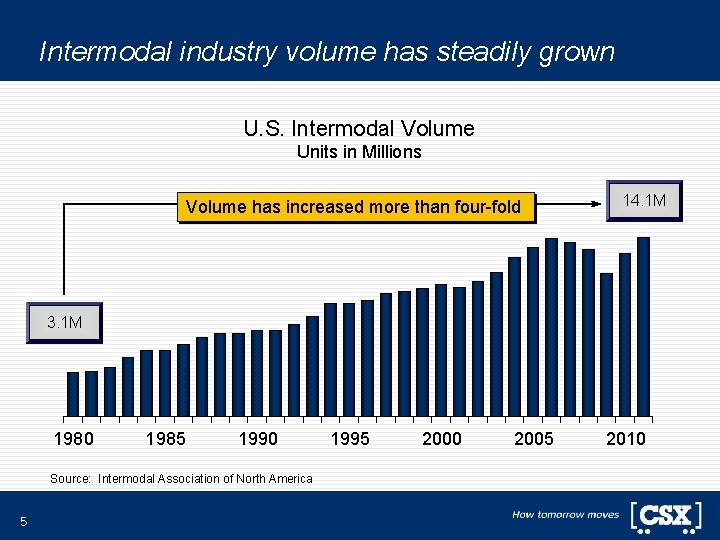

Intermodal industry volume has steadily grown U. S. Intermodal Volume Units in Millions Volume has increased more than four-fold 14. 1 M 3. 1 M 1980 1985 1990 Source: Intermodal Association of North America 5 1995 2000 2005 2010

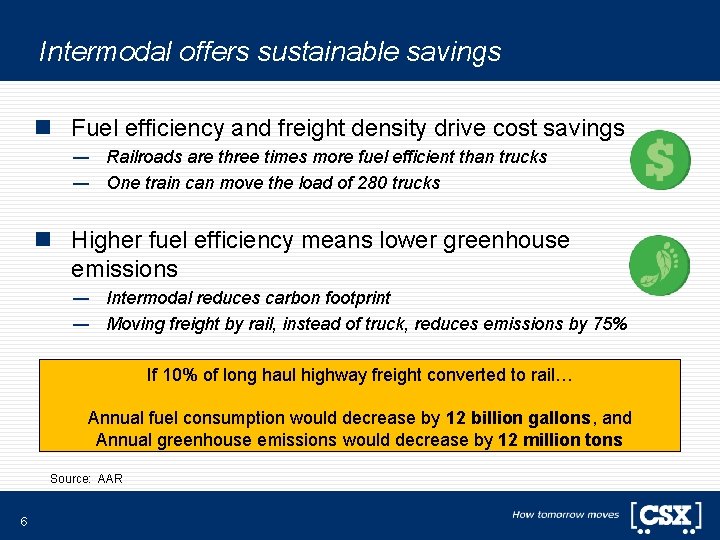

Intermodal offers sustainable savings n Fuel efficiency and freight density drive cost savings — Railroads are three times more fuel efficient than trucks — One train can move the load of 280 trucks n Higher fuel efficiency means lower greenhouse emissions — Intermodal reduces carbon footprint — Moving freight by rail, instead of truck, reduces emissions by 75% If 10% of long haul highway freight converted to rail… Annual fuel consumption would decrease by 12 billion gallons, and Annual greenhouse emissions would decrease by 12 million tons Source: AAR 6

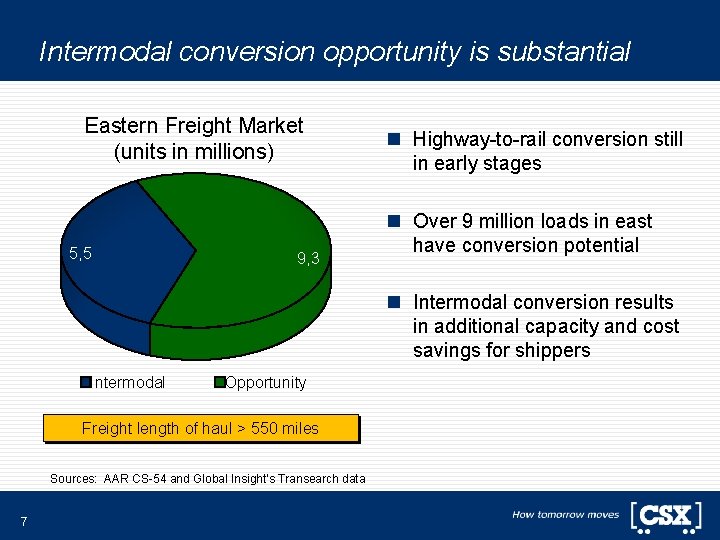

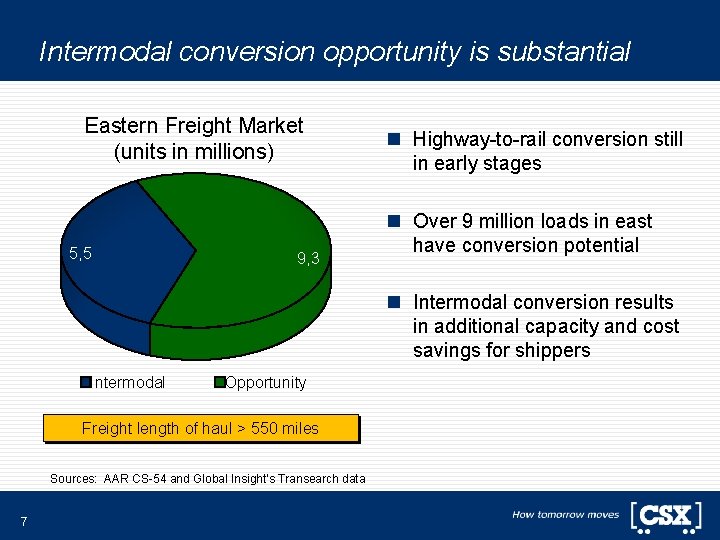

Intermodal conversion opportunity is substantial Eastern Freight Market (units in millions) 5, 5 9, 3 n Highway-to-rail conversion still in early stages n Over 9 million loads in east have conversion potential n Intermodal conversion results in additional capacity and cost savings for shippers Intermodal Opportunity Freight length of haul > 550 miles Sources: AAR CS-54 and Global Insight’s Transearch data 7

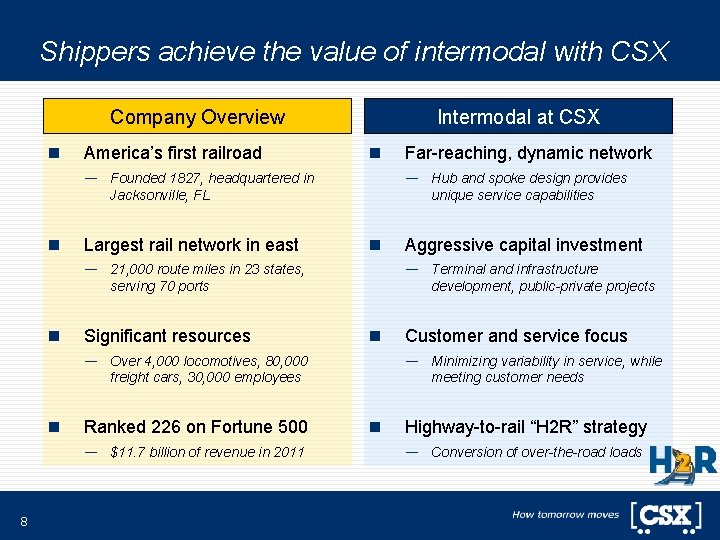

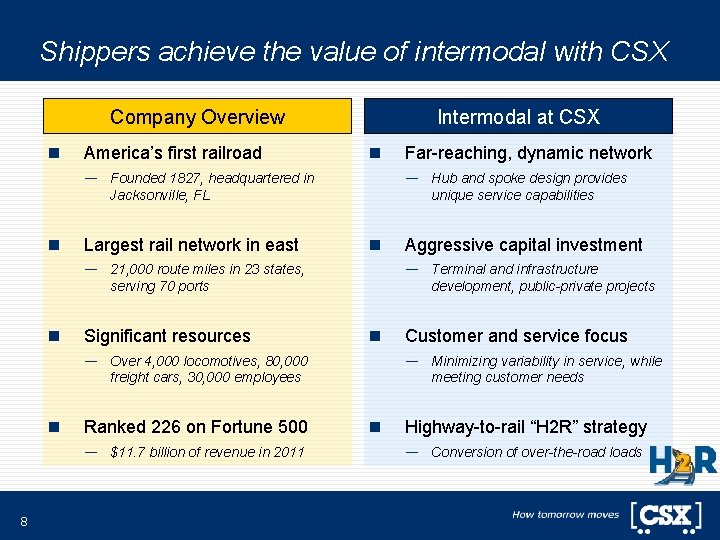

Shippers achieve the value of intermodal with CSX Company Overview n America’s first railroad Intermodal at CSX n — Founded 1827, headquartered in Jacksonville, FL n Largest rail network in east — Hub and spoke design provides unique service capabilities n — 21, 000 route miles in 23 states, serving 70 ports n Significant resources Ranked 226 on Fortune 500 — $11. 7 billion of revenue in 2011 8 Aggressive capital investment — Terminal and infrastructure development, public-private projects n — Over 4, 000 locomotives, 80, 000 freight cars, 30, 000 employees n Far-reaching, dynamic network Customer and service focus — Minimizing variability in service, while meeting customer needs n Highway-to-rail “H 2 R” strategy — Conversion of over-the-road loads

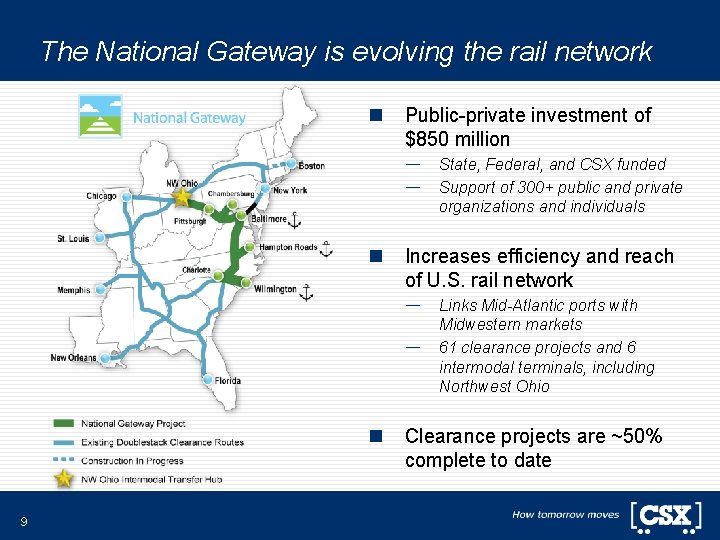

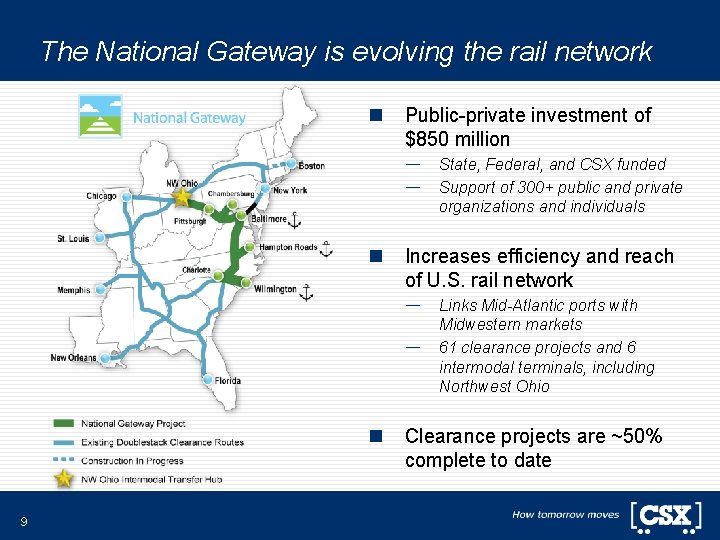

The National Gateway is evolving the rail network n Public-private investment of $850 million — — n Increases efficiency and reach of U. S. rail network — — n 9 State, Federal, and CSX funded Support of 300+ public and private organizations and individuals Links Mid-Atlantic ports with Midwestern markets 61 clearance projects and 6 intermodal terminals, including Northwest Ohio Clearance projects are ~50% complete to date

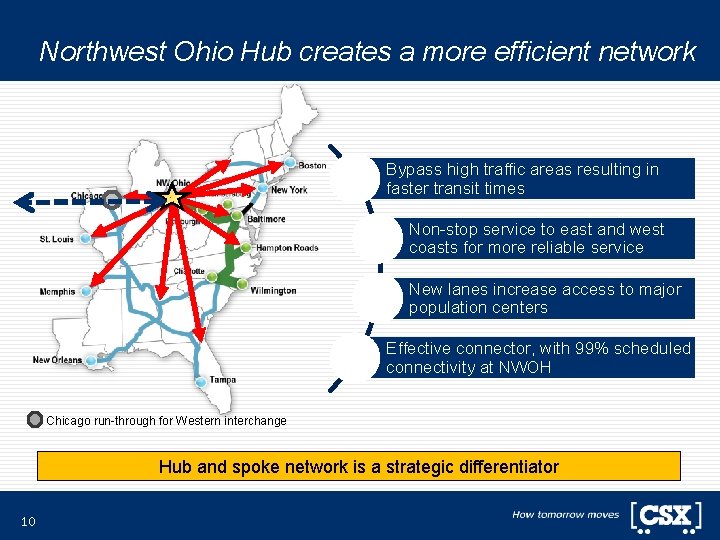

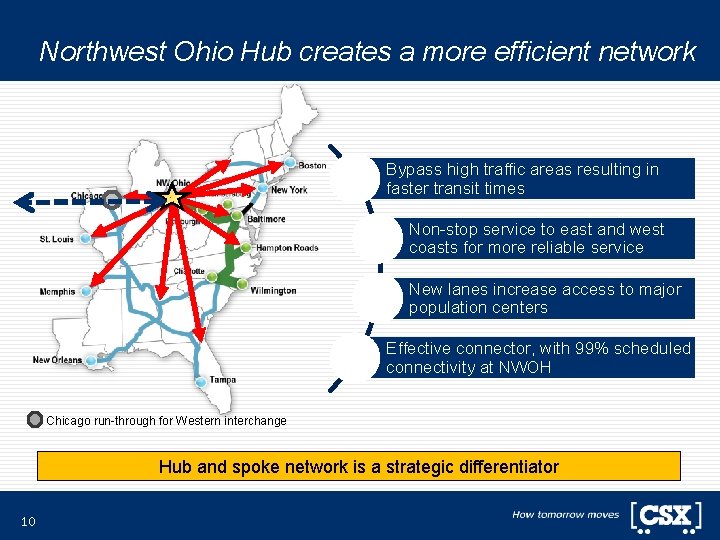

Northwest Ohio Hub creates a more efficient network Bypass high traffic areas resulting in faster transit times Non-stop service to east and west coasts for more reliable service New lanes increase access to major population centers Effective connector, with 99% scheduled connectivity at NWOH Chicago run-through for Western interchange Hub and spoke network is a strategic differentiator 10

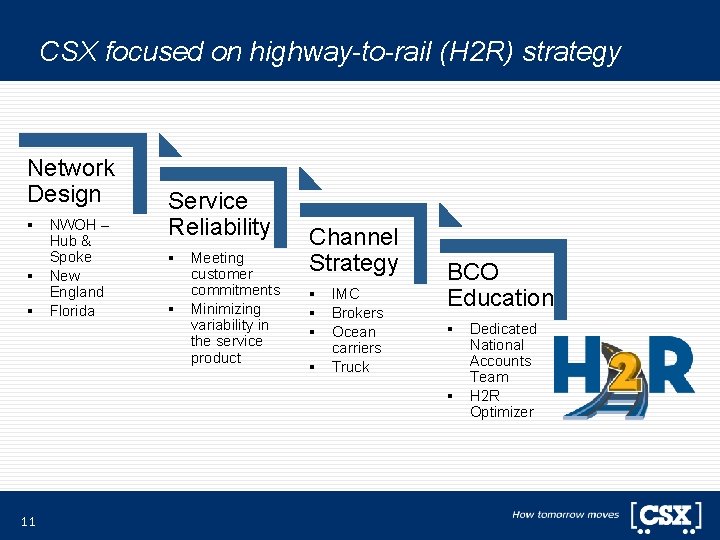

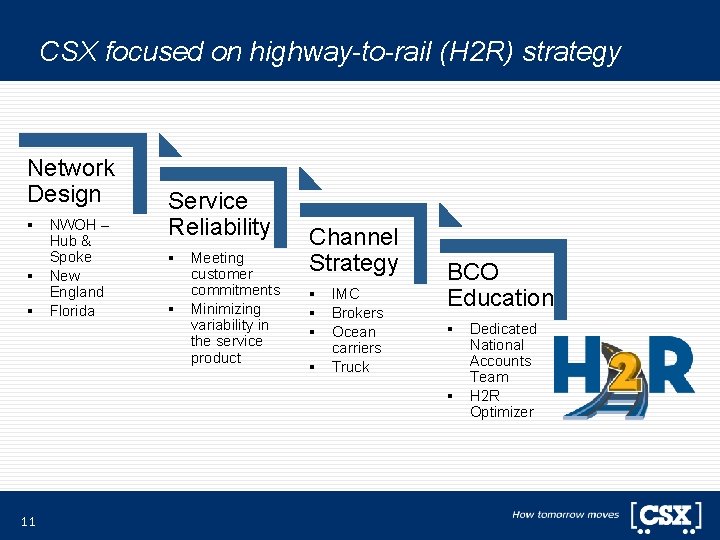

CSX focused on highway-to-rail (H 2 R) strategy Network Design § NWOH – Hub & Spoke § New England § Florida 11 Service Reliability § Meeting customer commitments § Minimizing variability in the service product Channel Strategy § IMC § Brokers § Ocean carriers § Truck BCO Education § Dedicated National Accounts Team § H 2 R Optimizer

Highway-to-rail continues to drive industry growth n Intermodal offers a transportation alternative with scalable capacity and sustainable savings advantages n The value of intermodal rail only beginning to be realized; great potential remains n CSX dedicated to understanding transportation needs and developing intermodal solutions 12

Appendix 14

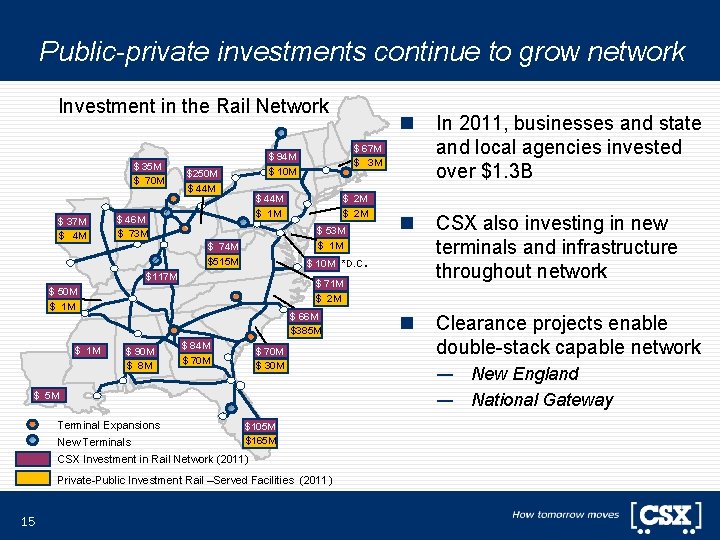

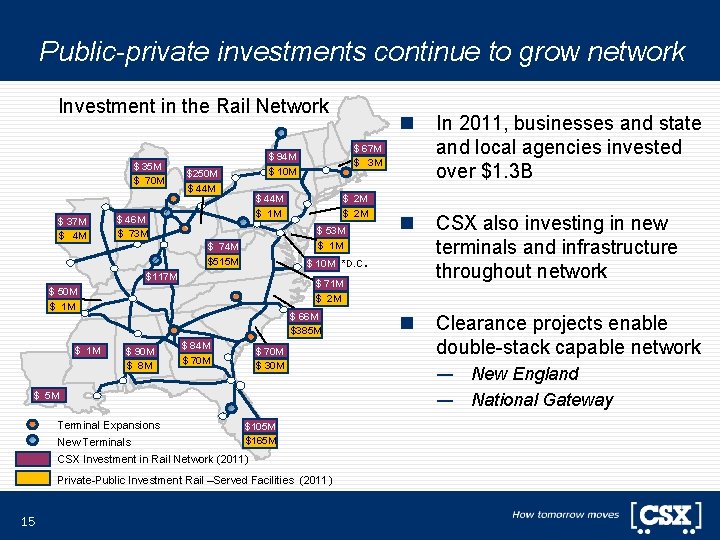

Public-private investments continue to grow network Investment in the Rail Network $ 35 M $ 70 M $ 37 M $ 44 M $ 1 M $ 46 M $ 73 M $ 10 M *D. C $117 M $ 66 M $385 M $ 90 M $ 84 M $ 70 M $ 30 M $ 5 M Terminal Expansions New Terminals $105 M $165 M CSX Investment in Rail Network (2011) Private-Public Investment Rail –Served Facilities (2011) 15 n CSX also investing in new terminals and infrastructure throughout network n Clearance projects enable double-stack capable network . $ 71 M $ 2 M $ 50 M $ 1 M $ 2 M $ 53 M $ 1 M $ 74 M $515 M In 2011, businesses and state and local agencies invested over $1. 3 B $ 67 M $ 3 M $ 94 M $ 10 M $250 M $ 44 M n — New England — National Gateway