PURPOSE OF PAYROLL CERTIFICATION The Payroll Certification is

- Slides: 31

PURPOSE OF PAYROLL CERTIFICATION The Payroll Certification is an important tool for Fiscal Officers and/or Delegates. It’s purpose is to allow Fiscal Officers and/or Delegates to review pending payroll changes just prior to payday and allows an opportunity to correct mistakes before employees are paid. An automated internal process uses the Fiscal Officers and/or Delegates authorization for AIS transactions to view Banner payroll transactions. Fiscal Officers and/or Delegates should approve the Certification if each employee’s (including Graduate Assistants) pay is accurate AND charged to the proper account. The Certification should be disputed if there are incorrect pay amounts OR the labor account being charged is incorrect. The Certification process is not a Banner function. Information Technology Support (ITS) created the Certification process outside of the Banner system to help with payroll processing. NOTE: Certifications may be used for reporting purposes for external and internal auditors. 1

VIEWING THE PAYROLL CERTIFICATION If employees are missing from the certification, before the certification is disputed, please contact Payroll. If the new employee paperwork was not received by the Payroll cutoff date, the employee will not appear until the following payroll. In this case, the certification does not need to be disputed. When contacting Payroll by fax (650 -2696) or by e-mail about a disputed certification, please indicate which employee (name and Banner ID) is affected and provide a description of the issue. Payroll Certifications expire in 2 weeks. Certifications may be approved or disputed during the 2 week period. It is to the advantage of the employee, the department and the University, if corrections can be made in a timely fashion. NOTE: If Certifications are allowed to expire this is considered as an approved Certification by payroll. 2

VIEWING THE PAYROLL CERTIFICATION When Certifications are reviewed and responded to in a timely manner, Payroll can make the necessary corrections on the next available payroll. If certifications are disputed prior to the next payroll cutoff date (FA, SM, BW) corrections can be made. When a certification contains an overpayment situation and Payroll is contacted before the direct deposit tape is sent to the bank, the overpaid employee can be removed from the tape before the pay is sent to the bank. Transmission of the direct deposit tape occurs two days before the scheduled payday. If a termination occurs, please inform Payroll immediately. Payroll will accept the “Employment Termination Form” by fax (650 -2696) without the appropriate signatures to avoid an overpayment situation. The paper copy of the termination form must follow termination guidelines and acquire all appropriate signatures. A manual check can be prepared and available for the employee on the scheduled payday if partial pay is due. Manual checks are calculated by Payroll and processed by Accounts Payable. Manual checks cannot be deposited into an employee’s checking or savings account. Due to Accounts Payable recon schedule (the last two working days of the month), Manual checks cannot be processed on these days. NOTE: If the employee’s direct deposit is to multiple accounts please inform the employee of the recon schedule dates and the manual check process. 3

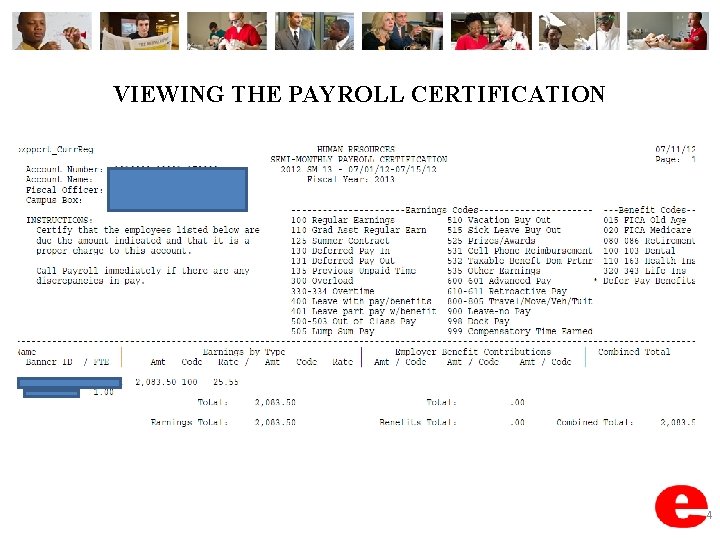

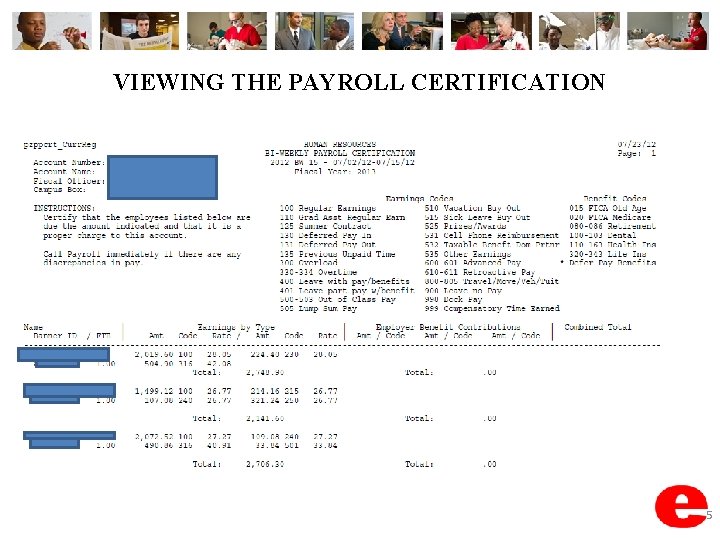

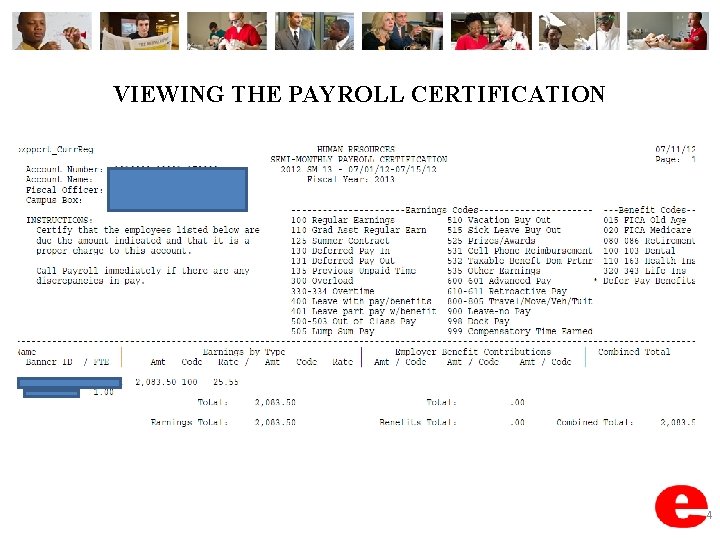

VIEWING THE PAYROLL CERTIFICATION 4

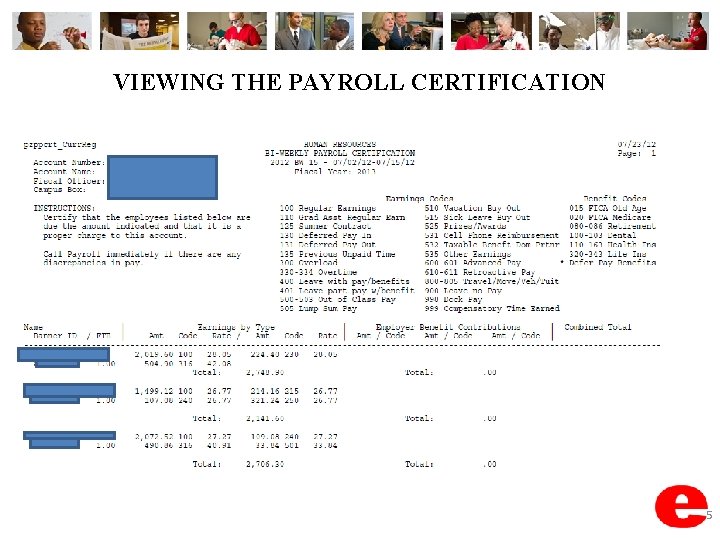

VIEWING THE PAYROLL CERTIFICATION 5

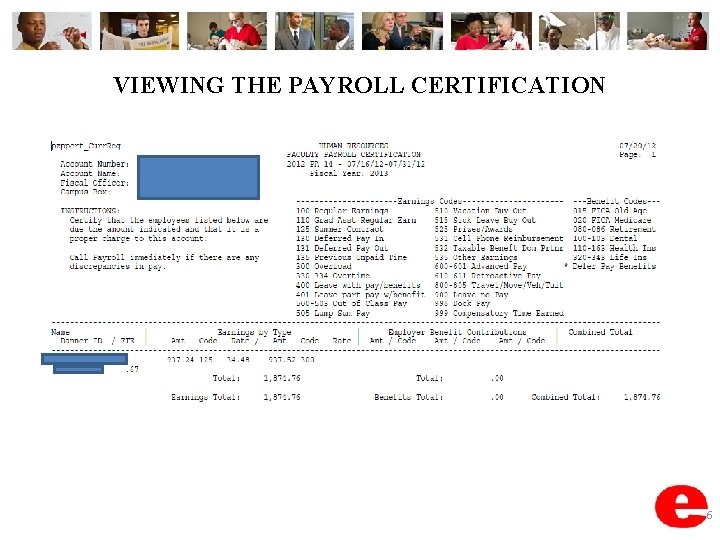

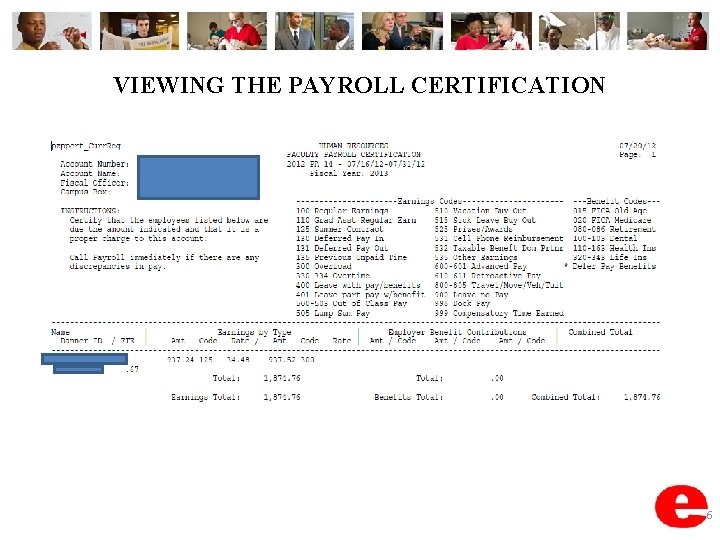

VIEWING THE PAYROLL CERTIFICATION 6

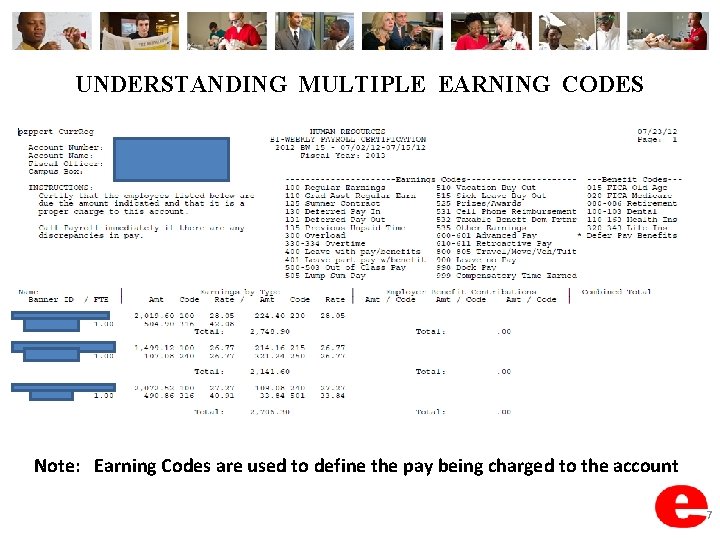

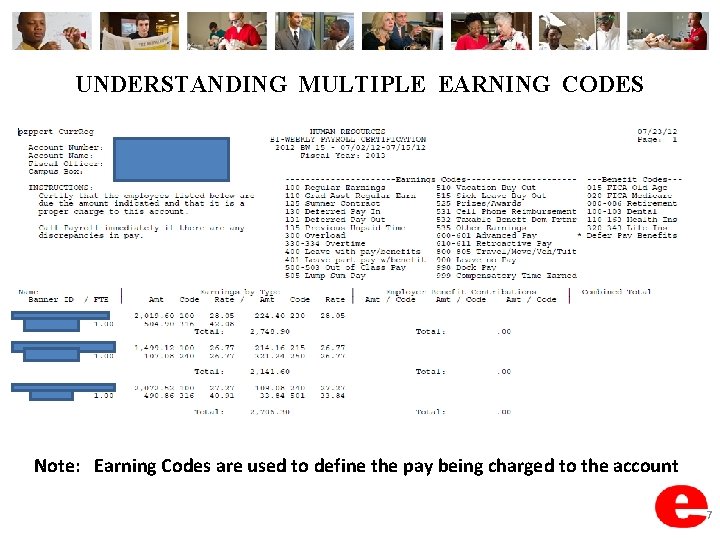

UNDERSTANDING MULTIPLE EARNING CODES Note: Earning Codes are used to define the pay being charged to the account 7

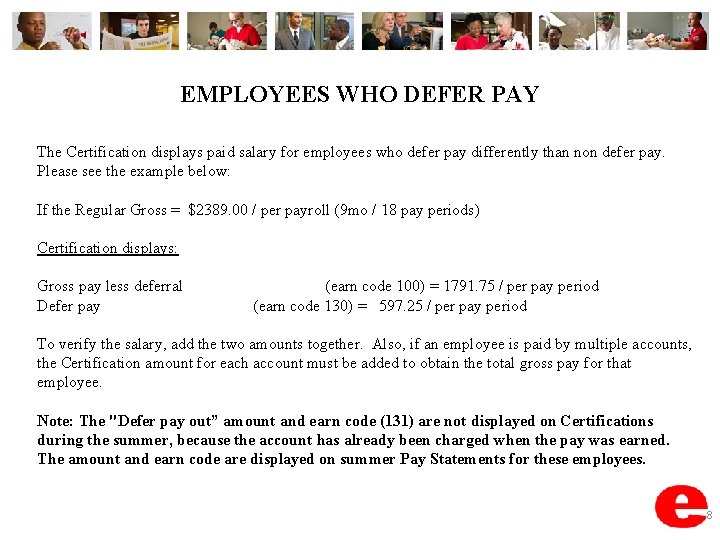

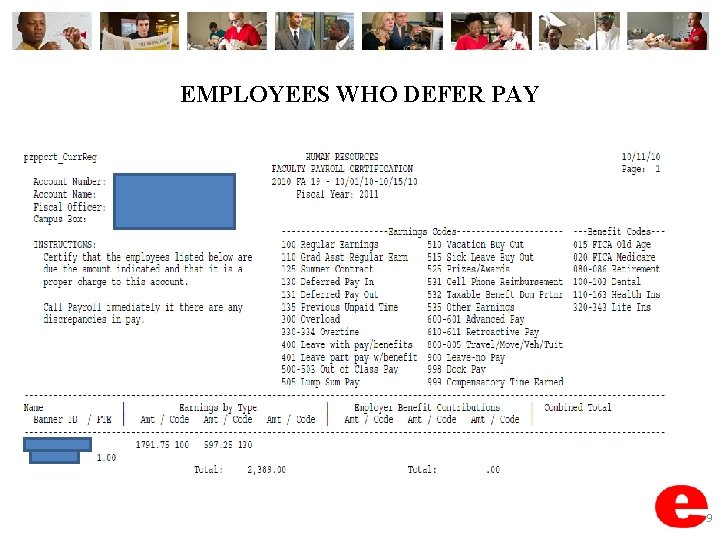

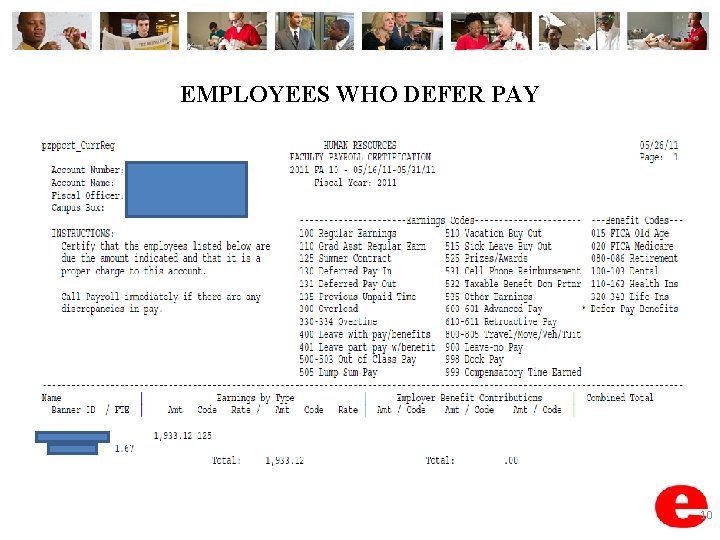

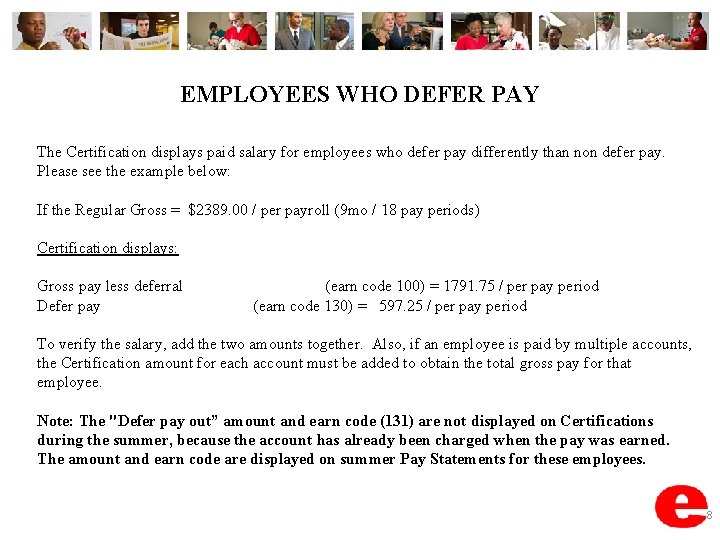

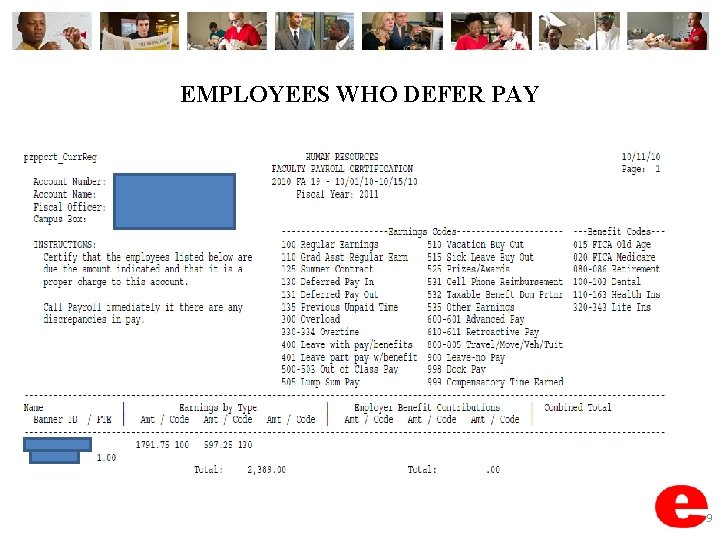

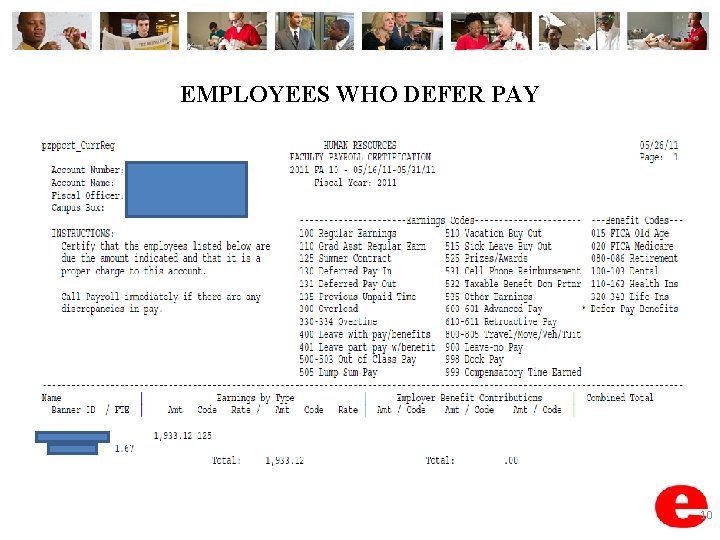

EMPLOYEES WHO DEFER PAY The Certification displays paid salary for employees who defer pay differently than non defer pay. Please see the example below: If the Regular Gross = $2389. 00 / per payroll (9 mo / 18 pay periods) Certification displays: Gross pay less deferral Defer pay (earn code 100) = 1791. 75 / per pay period (earn code 130) = 597. 25 / per pay period To verify the salary, add the two amounts together. Also, if an employee is paid by multiple accounts, the Certification amount for each account must be added to obtain the total gross pay for that employee. Note: The "Defer pay out” amount and earn code (131) are not displayed on Certifications during the summer, because the account has already been charged when the pay was earned. The amount and earn code are displayed on summer Pay Statements for these employees. 8

EMPLOYEES WHO DEFER PAY 9

EMPLOYEES WHO DEFER PAY 10

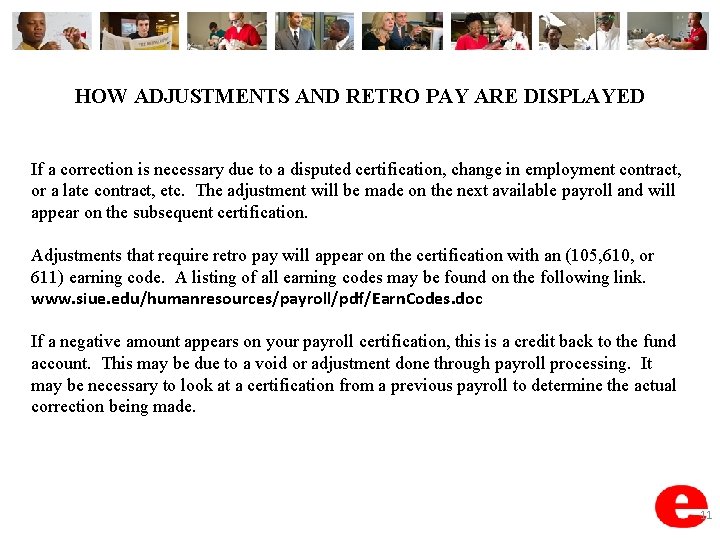

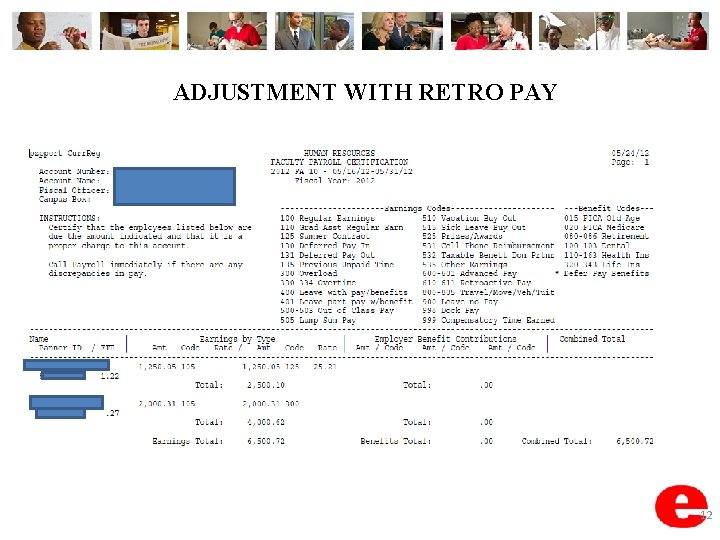

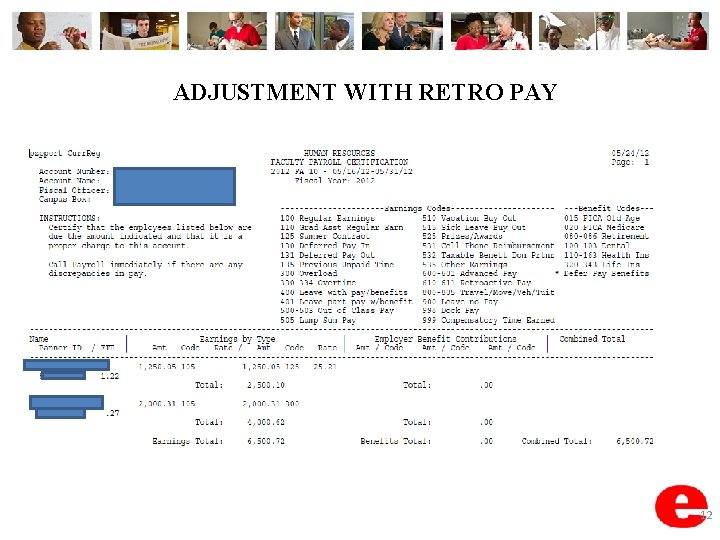

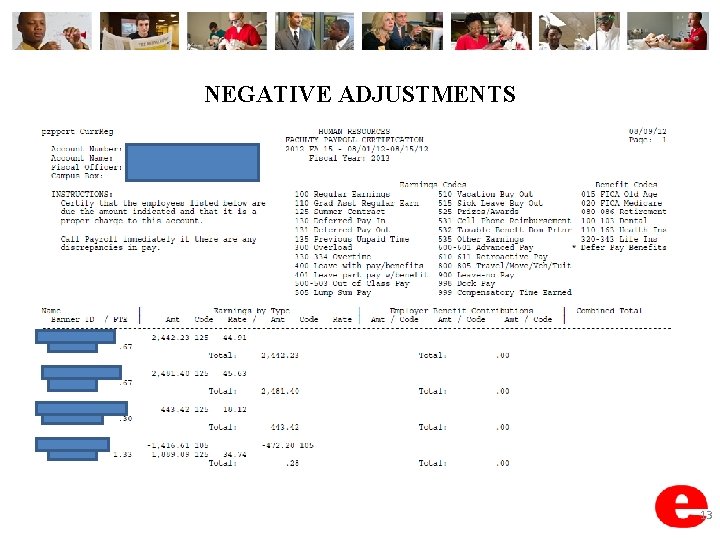

HOW ADJUSTMENTS AND RETRO PAY ARE DISPLAYED If a correction is necessary due to a disputed certification, change in employment contract, or a late contract, etc. The adjustment will be made on the next available payroll and will appear on the subsequent certification. Adjustments that require retro pay will appear on the certification with an (105, 610, or 611) earning code. A listing of all earning codes may be found on the following link. www. siue. edu/humanresources/payroll/pdf/Earn. Codes. doc If a negative amount appears on your payroll certification, this is a credit back to the fund account. This may be due to a void or adjustment done through payroll processing. It may be necessary to look at a certification from a previous payroll to determine the actual correction being made. 11

ADJUSTMENT WITH RETRO PAY 12

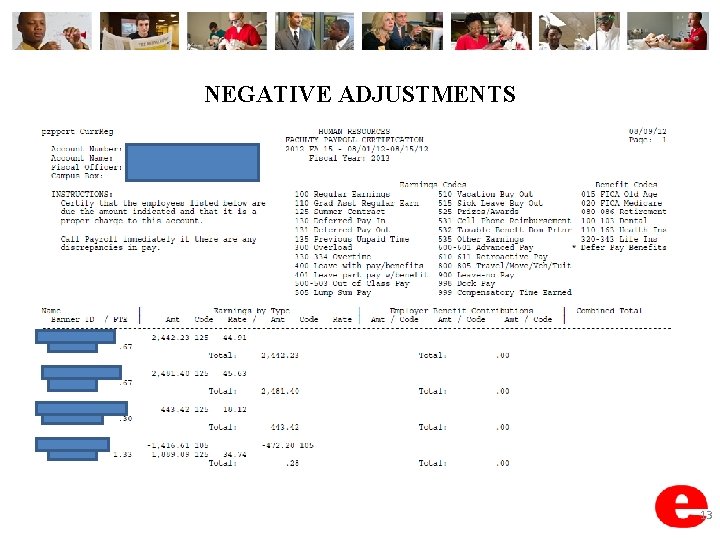

NEGATIVE ADJUSTMENTS 13

PAYROLL REDISTRIBUTION CERTIFICATION FOR PREVIOUS PAYROLLS The Payroll Redistribution certification only displays retroactive labor (and applicable benefits) that is redistributed between two or more accounts. The redistributions will be shown separately from current labor and benefits. Redistributions of labor (and applicable benefits) changes will be listed on the payroll in which the change was entered. The Payroll Redistribution Certification will display the current payroll on the first page and the second page will display the changes to any previous payrolls with each payroll identified (ex BW 5, FA 06 and SM 06 etc). 14

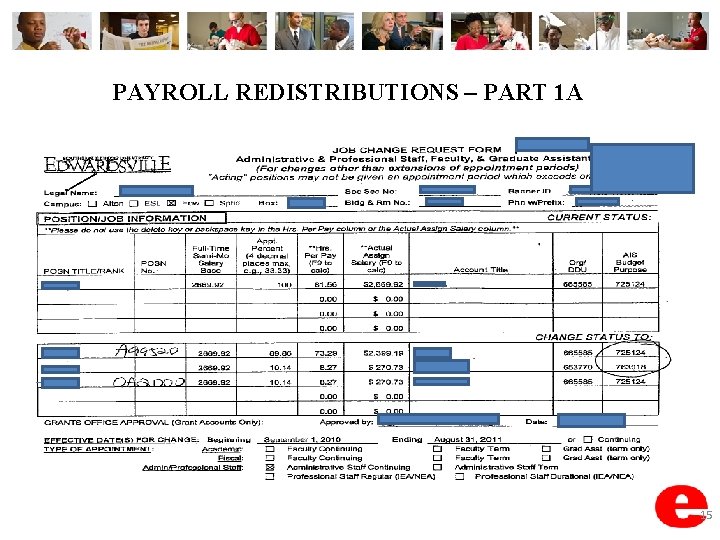

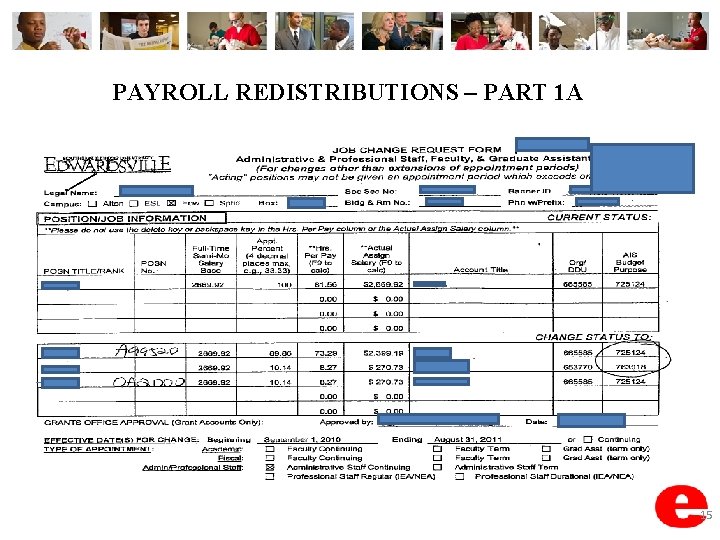

PAYROLL REDISTRIBUTIONS – PART 1 A 15

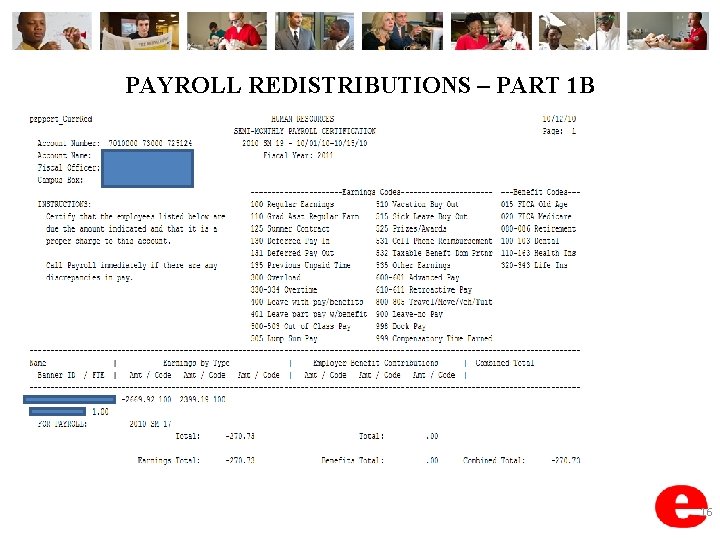

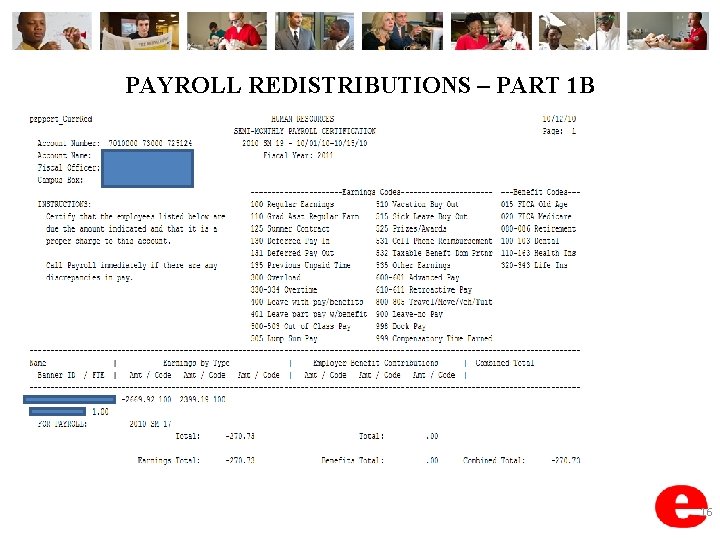

PAYROLL REDISTRIBUTIONS – PART 1 B 16

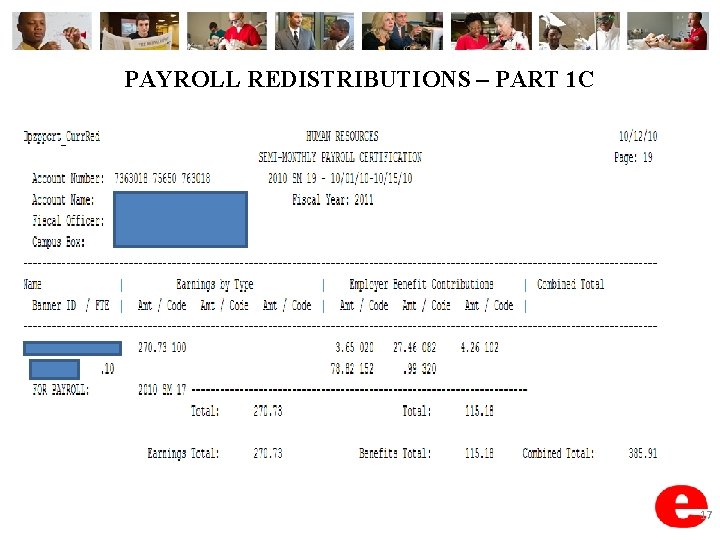

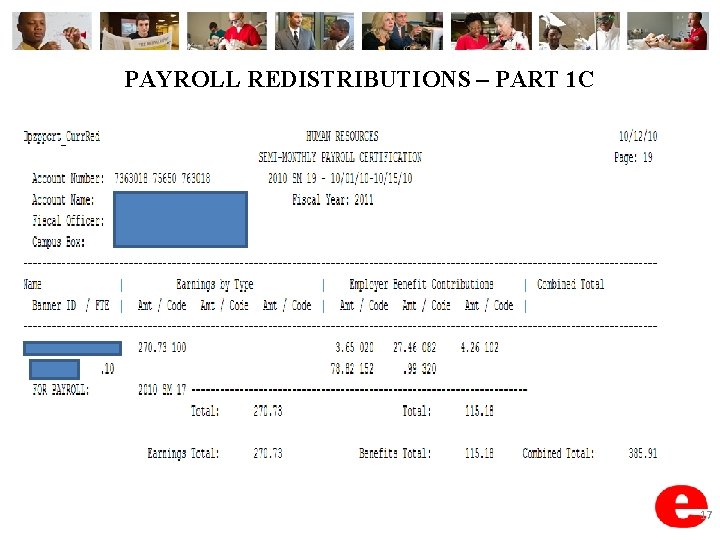

PAYROLL REDISTRIBUTIONS – PART 1 C 17

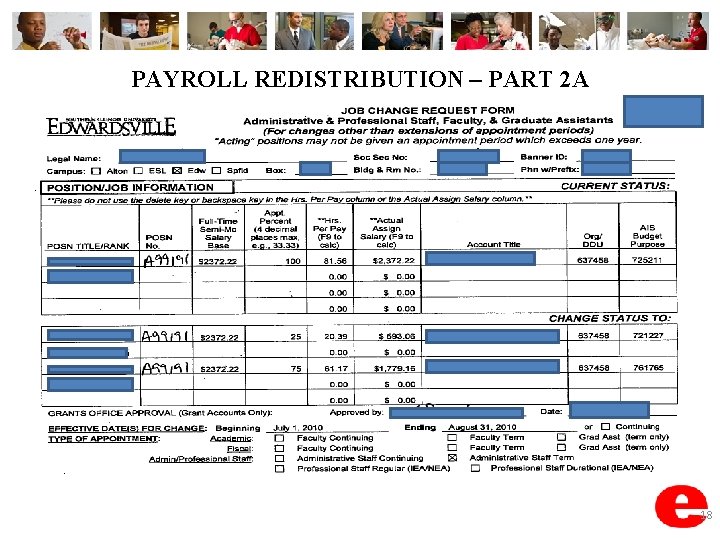

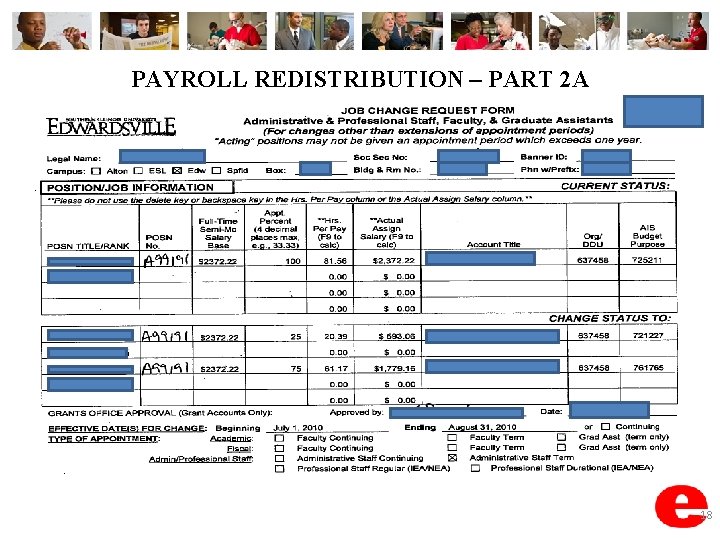

PAYROLL REDISTRIBUTION – PART 2 A 18

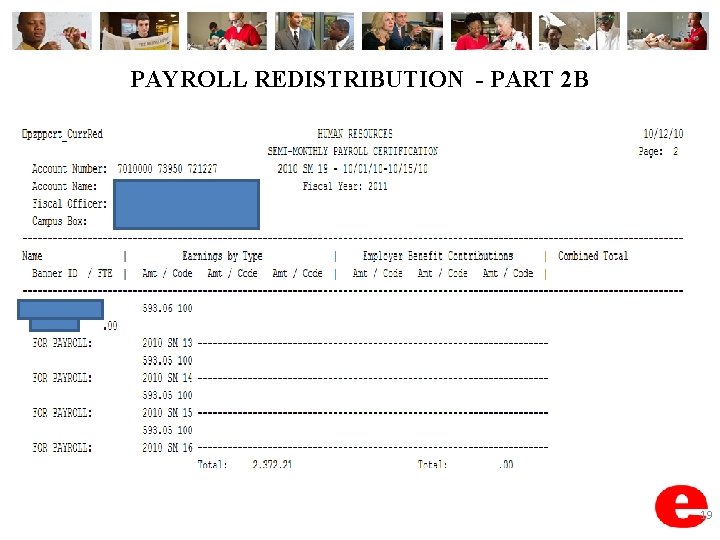

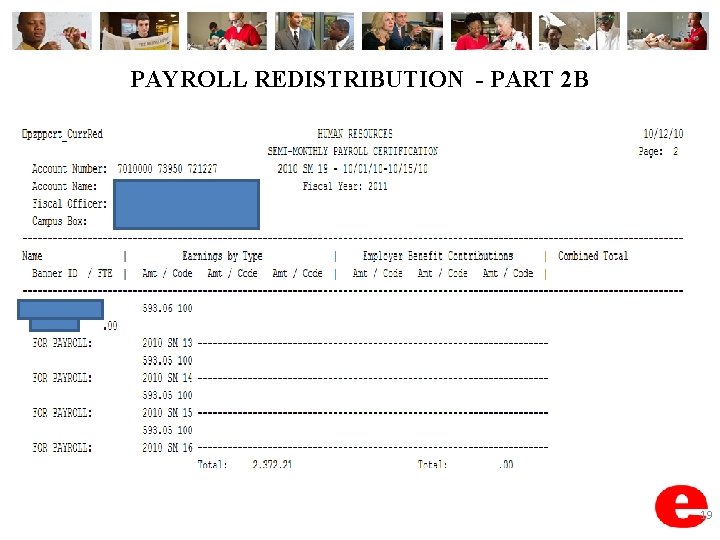

PAYROLL REDISTRIBUTION - PART 2 B 19

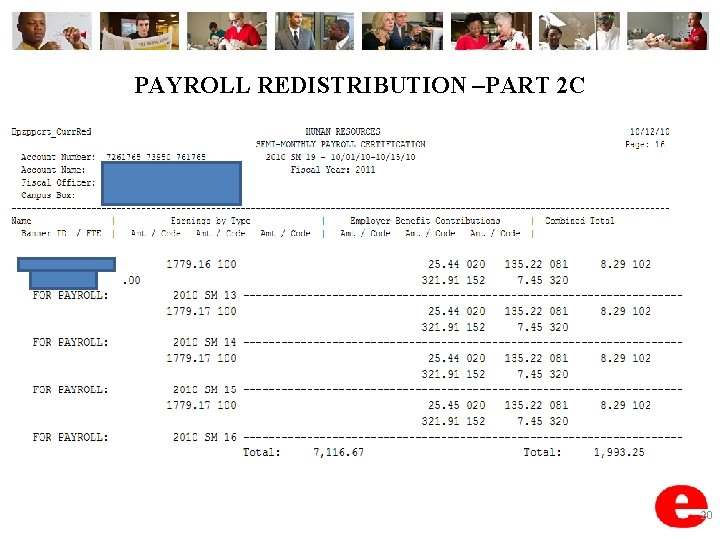

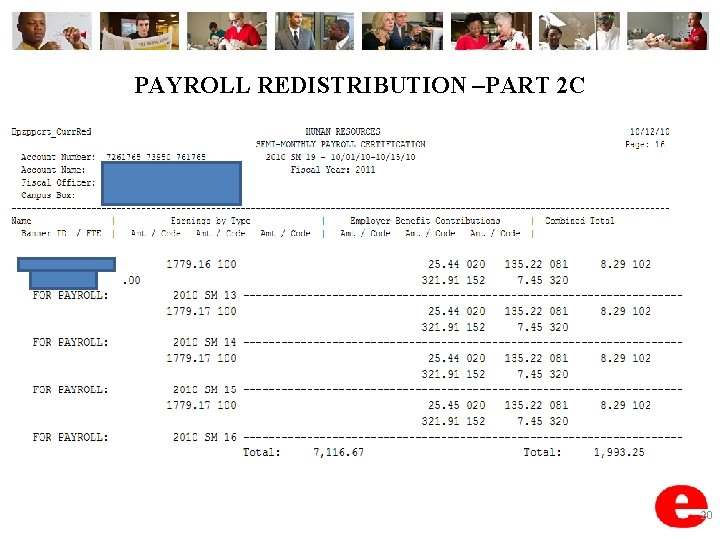

PAYROLL REDISTRIBUTION –PART 2 C 20

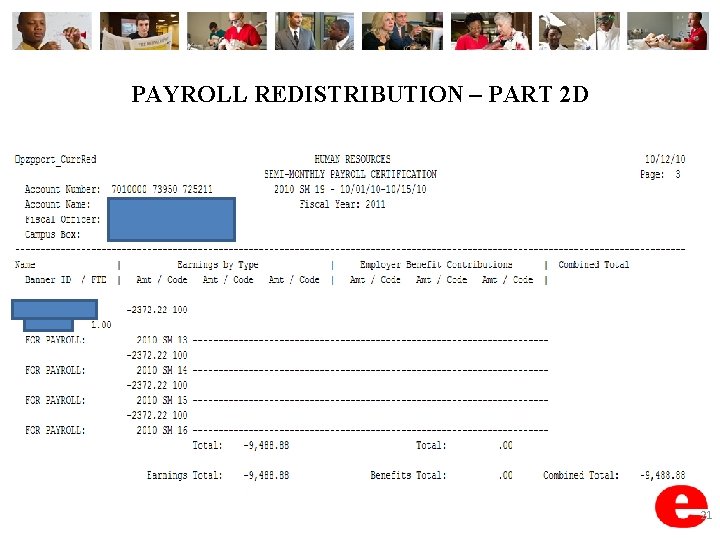

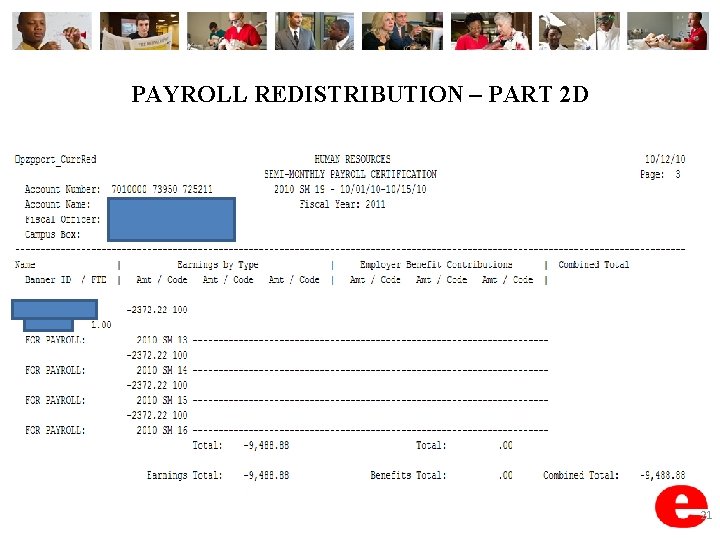

PAYROLL REDISTRIBUTION – PART 2 D 21

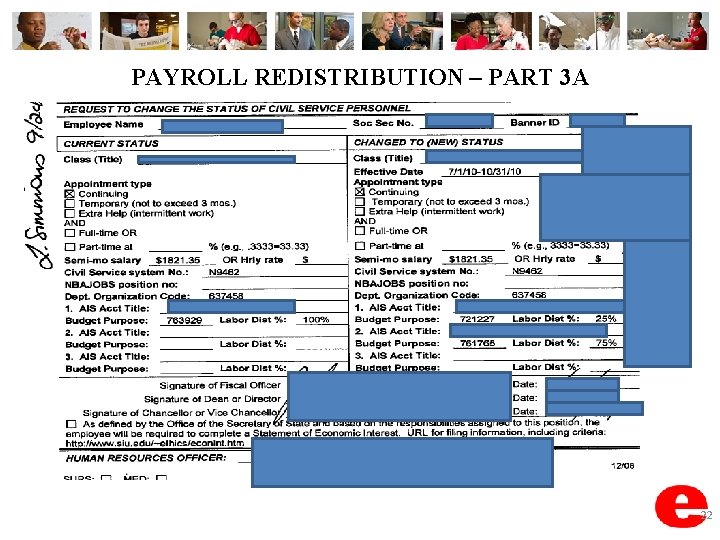

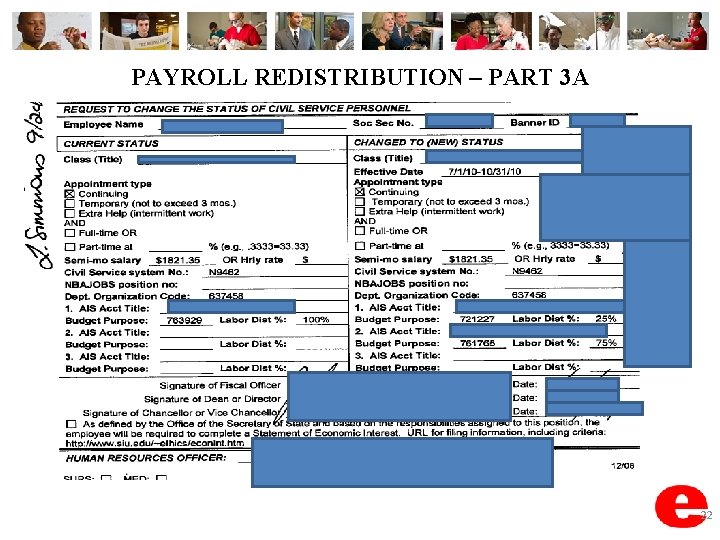

PAYROLL REDISTRIBUTION – PART 3 A 22

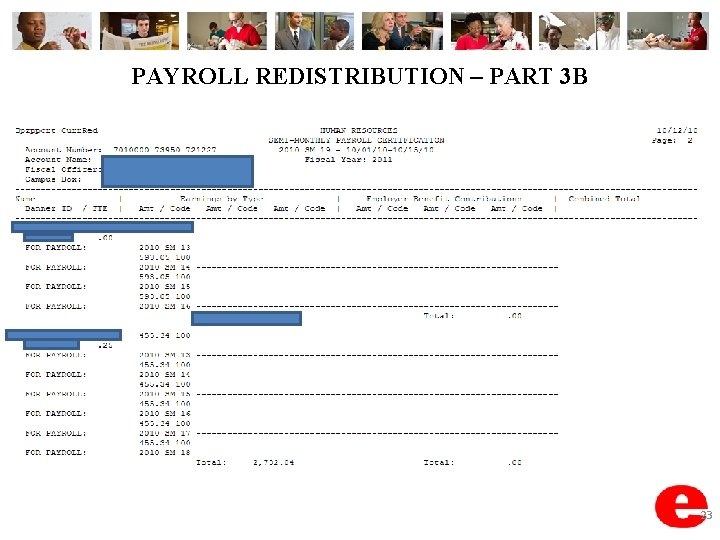

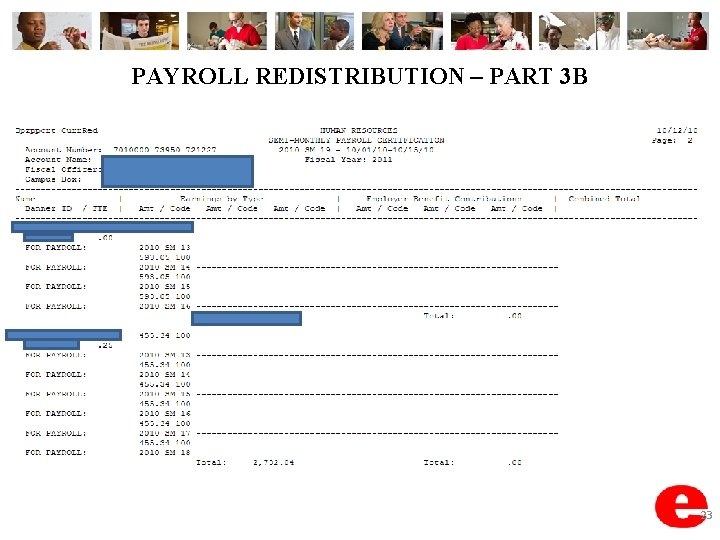

PAYROLL REDISTRIBUTION – PART 3 B 23

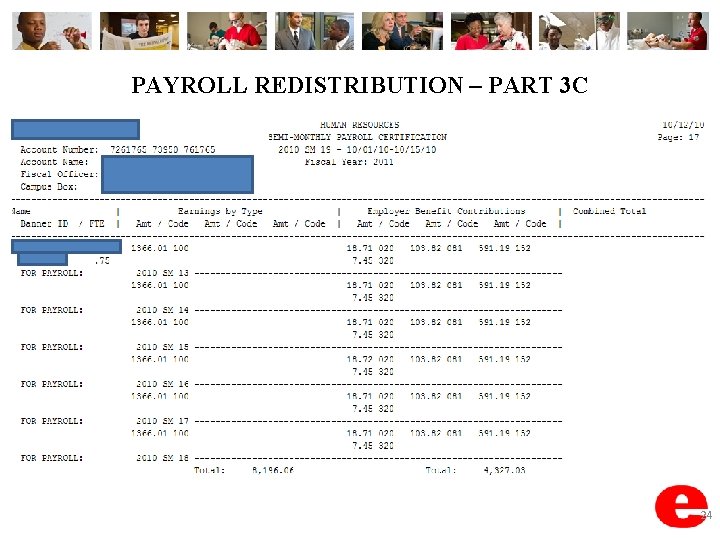

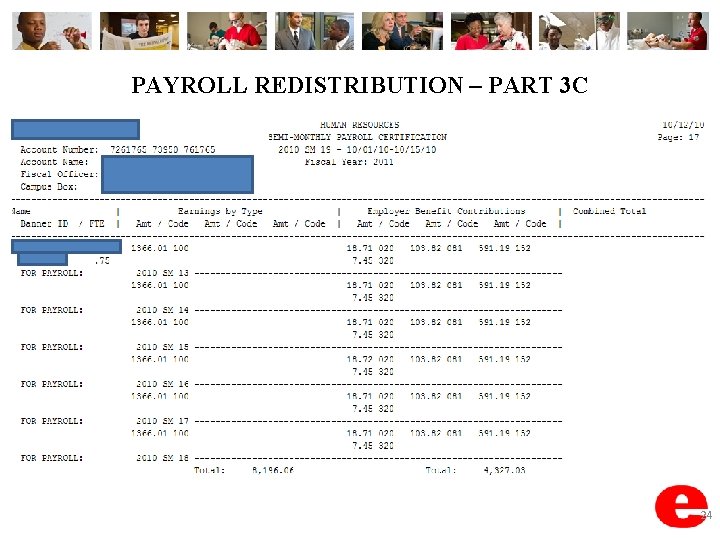

PAYROLL REDISTRIBUTION – PART 3 C 24

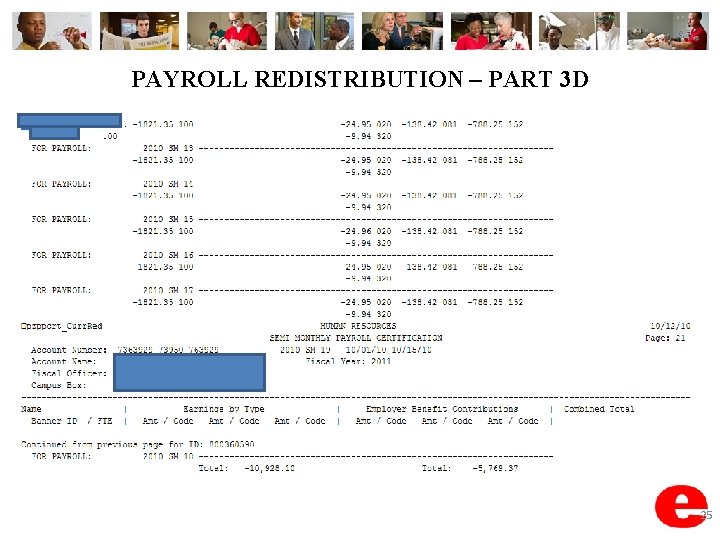

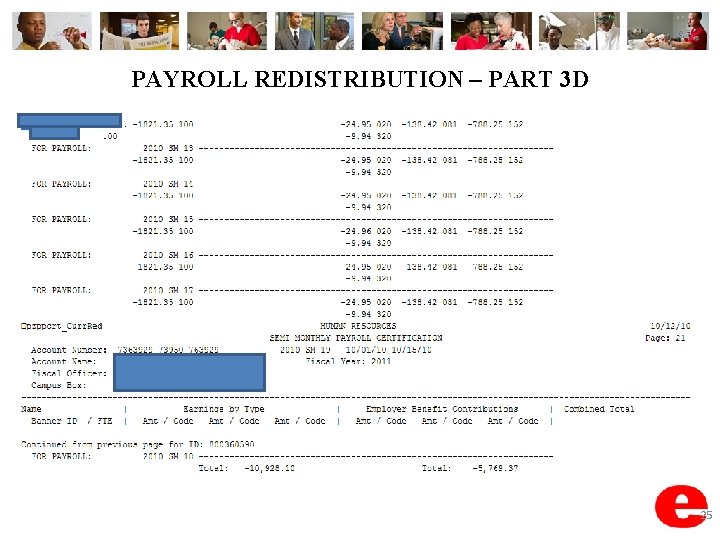

PAYROLL REDISTRIBUTION – PART 3 D 25

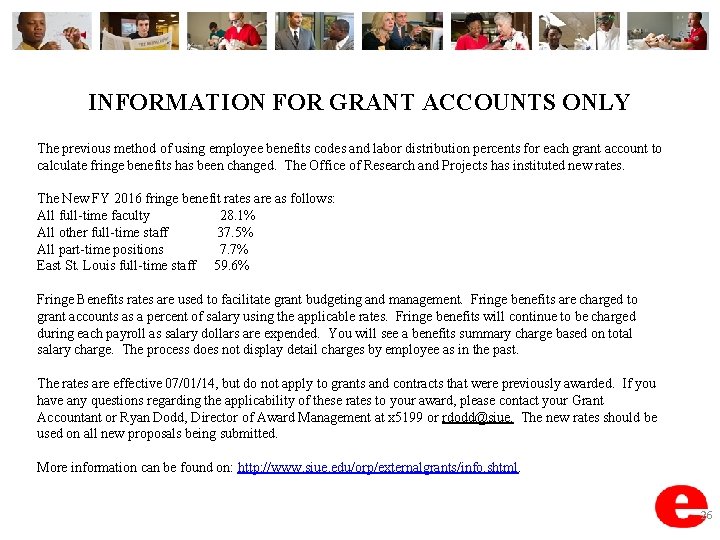

INFORMATION FOR GRANT ACCOUNTS ONLY The previous method of using employee benefits codes and labor distribution percents for each grant account to calculate fringe benefits has been changed. The Office of Research and Projects has instituted new rates. The New FY 2016 fringe benefit rates are as follows: All full-time faculty 28. 1% All other full-time staff 37. 5% All part-time positions 7. 7% East St. Louis full-time staff 59. 6% Fringe Benefits rates are used to facilitate grant budgeting and management. Fringe benefits are charged to grant accounts as a percent of salary using the applicable rates. Fringe benefits will continue to be charged during each payroll as salary dollars are expended. You will see a benefits summary charge based on total salary charge. The process does not display detail charges by employee as in the past. The rates are effective 07/01/14, but do not apply to grants and contracts that were previously awarded. If you have any questions regarding the applicability of these rates to your award, please contact your Grant Accountant or Ryan Dodd, Director of Award Management at x 5199 or rdodd@siue. The new rates should be used on all new proposals being submitted. More information can be found on: http: //www. siue. edu/orp/externalgrants/info. shtml. 26

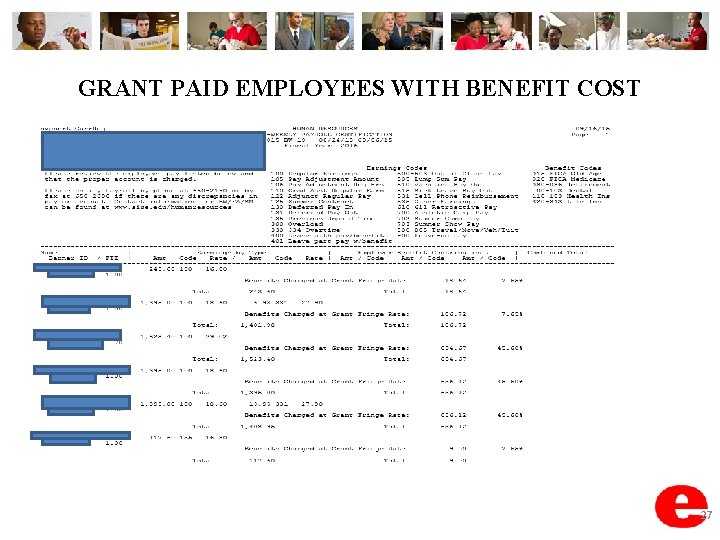

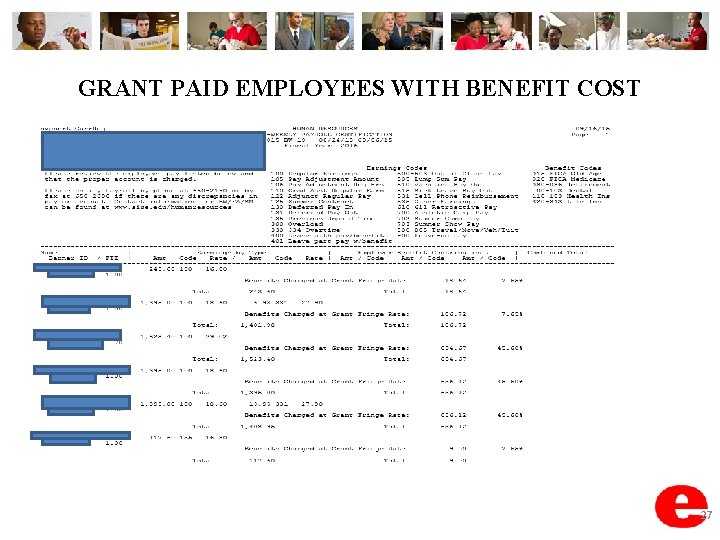

GRANT PAID EMPLOYEES WITH BENEFIT COST 27

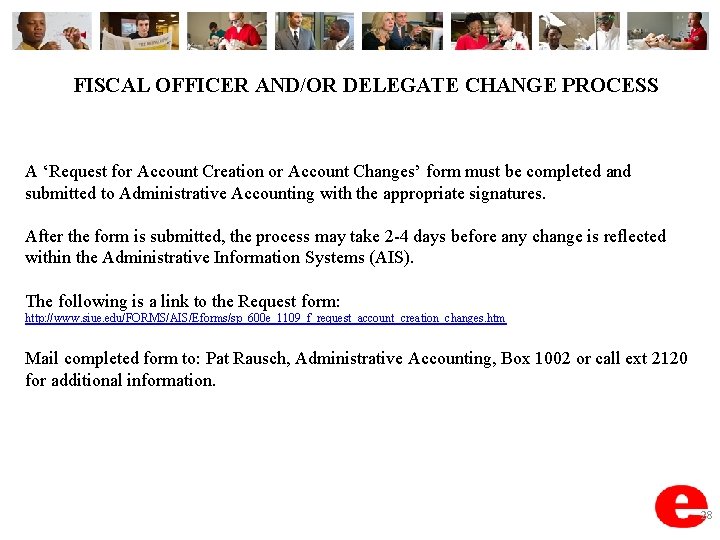

FISCAL OFFICER AND/OR DELEGATE CHANGE PROCESS A ‘Request for Account Creation or Account Changes’ form must be completed and submitted to Administrative Accounting with the appropriate signatures. After the form is submitted, the process may take 2 -4 days before any change is reflected within the Administrative Information Systems (AIS). The following is a link to the Request form: http: //www. siue. edu/FORMS/AIS/Eforms/sp_600 e_1109_f_request_account_creation_changes. htm Mail completed form to: Pat Rausch, Administrative Accounting, Box 1002 or call ext 2120 for additional information. 28

PREVIOUS FISCAL YEAR CERTIFICATION (STATE LAPSE PERIOD) During the two month State Lapse Period (July 1 – Aug 31), changes may be made to State Accounts for the previous fiscal year. These changes will appear on the Previous Fiscal Year Certification. Fiscal Officers and/or Delegates may submit payroll changes such as, (Changes of Assignments/Job Change Request Forms/Retroactive adjustments/Change of Status Forms/Retroactive Adjustments/Memos and Payments) to state accounts for the previous fiscal year during the State Lapse Period. All changes must be submitted to payroll by the scheduled cut-off dates. Any changes received after cut-off will be posted on the current fiscal year certification. Future announcements and reminders will list scheduled cut-off dates for each payroll type. 29

PREVIOUS FISCAL YEAR CERTIFICATION (STATE LAPSE PERIOD) 30

Who can I call for help? For assistance, contact the Payroll Department in the Office of Human Resources at 618 -650 -2190 or by e-mail at payrollhr@siue. edu. For additional information, please view the Payroll website which has links to the Certification Guidelines, Overview and FAQ’s at http: //www. siue. edu/humanresources/payroll/index. shtml.