Pure Competition and Monopolistic Competition Chapter 10 Pure

- Slides: 29

Pure Competition and Monopolistic Competition Chapter 10 • Pure competition is a standard against which other market structures are compared. The product is perfectly undifferentiated. • When there are many firms, but the product is differentiated, the market is monopolistically competitive. » This brand competition may involve advertising campaigns and large promotional expenditures to stress often minor distinctions among products 2005 South-Western Publishing Slide 1

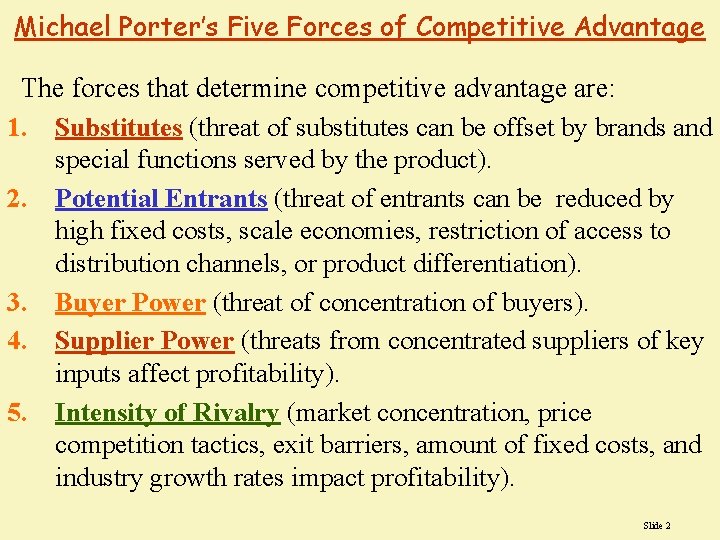

Michael Porter’s Five Forces of Competitive Advantage The forces that determine competitive advantage are: 1. Substitutes (threat of substitutes can be offset by brands and special functions served by the product). 2. Potential Entrants (threat of entrants can be reduced by high fixed costs, scale economies, restriction of access to distribution channels, or product differentiation). 3. Buyer Power (threat of concentration of buyers). 4. Supplier Power (threats from concentrated suppliers of key inputs affect profitability). 5. Intensity of Rivalry (market concentration, price competition tactics, exit barriers, amount of fixed costs, and industry growth rates impact profitability). Slide 2

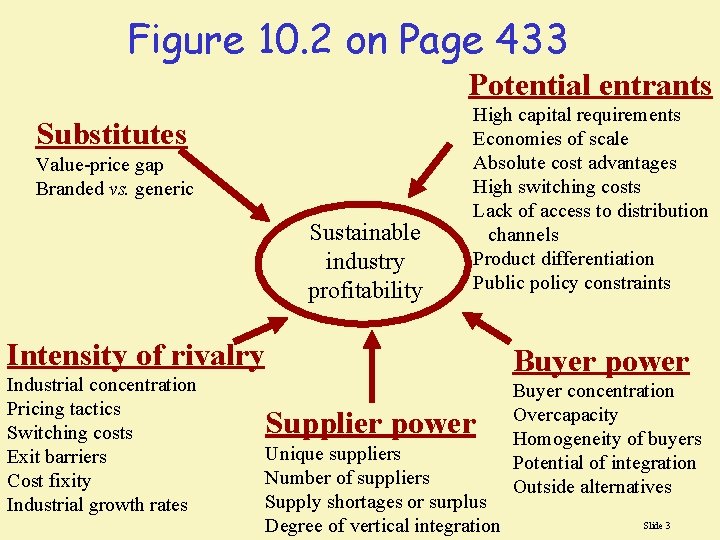

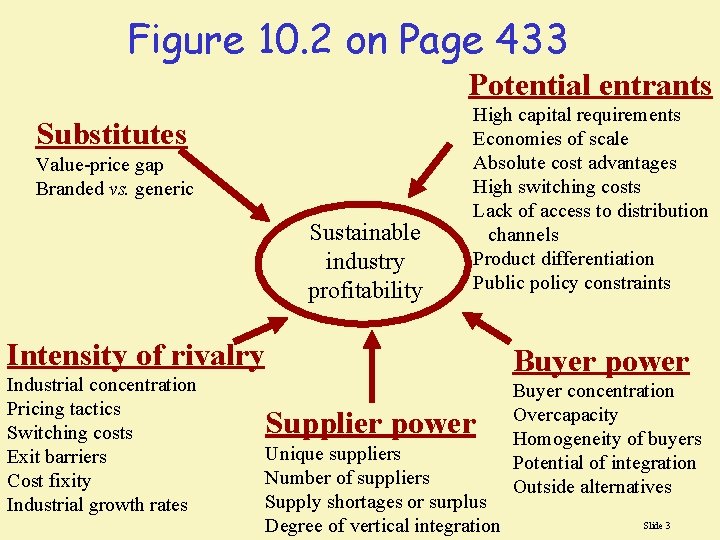

Figure 10. 2 on Page 433 Potential entrants Substitutes Value-price gap Branded vs. generic Sustainable industry profitability High capital requirements Economies of scale Absolute cost advantages High switching costs Lack of access to distribution channels Product differentiation Public policy constraints Intensity of rivalry Industrial concentration Pricing tactics Switching costs Exit barriers Cost fixity Industrial growth rates Buyer power Supplier power Unique suppliers Number of suppliers Supply shortages or surplus Degree of vertical integration Buyer concentration Overcapacity Homogeneity of buyers Potential of integration Outside alternatives Slide 3

What Went Wrong With Xerox? • After inventing chemical paper copiers, Xerox enjoyed 15% growth rates in the 1960 s and 70’s. • As their patents expired, new rivals such as Ricoh and Cannon aimed their copiers at smaller businesses and smaller volume users. • Xerox continued to build all parts in-house and suffered from serious price competition. Xerox’s strategy led to erosion of its once dominant status to that of an also-ran. Slide 4

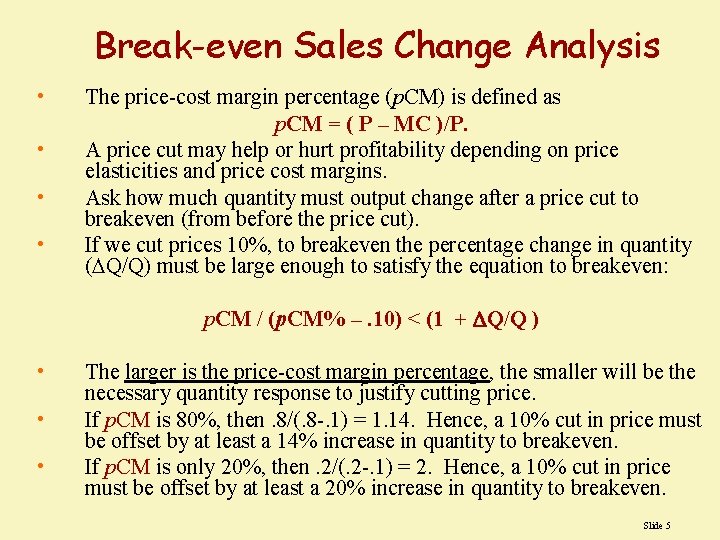

Break-even Sales Change Analysis • • The price-cost margin percentage (p. CM) is defined as p. CM = ( P – MC )/P. A price cut may help or hurt profitability depending on price elasticities and price cost margins. Ask how much quantity must output change after a price cut to breakeven (from before the price cut). If we cut prices 10%, to breakeven the percentage change in quantity (DQ/Q) must be large enough to satisfy the equation to breakeven: p. CM / (p. CM% –. 10) < (1 + DQ/Q ) • • • The larger is the price-cost margin percentage, the smaller will be the necessary quantity response to justify cutting price. If p. CM is 80%, then. 8/(. 8 -. 1) = 1. 14. Hence, a 10% cut in price must be offset by at least a 14% increase in quantity to breakeven. If p. CM is only 20%, then. 2/(. 2 -. 1) = 2. Hence, a 10% cut in price must be offset by at least a 20% increase in quantity to breakeven. Slide 5

The Relevant Market Concept • A market is a group of economic agents that interact in a buyer-seller relationship. The number and size of the buyers and sellers affect the nature of that relationship. • A popular measure of concentration is the percentage of an industry comprised of the top 4 firms. Similarly, the market share held by the top 4 buyers is a popular measure of buyer concentration. • The relationship among firms is affected by: a. the number of firms and their relative sizes. b. whether the product is differentiated or standardized. c. whether decisions by firms are independent or coordinated (collusion). Slide 6

A Continuum of Market Structures: Competition Pure Competition assumes: 1. 2. 3. 4. a very large number of buyers and sellers homogeneous product (standardized) complete knowledge of all relevant market information free entry and exit (no barriers) These assumptions imply several things about competitive markets, including price equals marginal cost. Slide 7

A Continuum of Market Structures: Monopoly assumes: 1. 2. 3. 4. Only one firm in the market area Low cross price elasticity with other products. No interdependence with other competitors. Substantial entry barriers These assumptions imply several things about monopolies, including that the monopoly price is well above marginal cost. Monopoly is discussed in full in Chapter 11. Slide 8

A Continuum of Market Structures: Monopolistic Competition Monopolistic competition assumes: 1. 2. 3. 4. A large number of firms, some of which may be dominant in size Differentiated products Independent decision making by individual firms Easy entry and exit These assumptions imply several things about monopolistic competition, including that the price in the long run is equal to average cost. Slide 9

A Continuum of Market Structures: Oligopoly assumes: 1. 2. 3. Only a few firms in the market area Products may be differentiated or undifferentiated There is a large degree of interdependence with other competitors These assumptions imply several things about monopolies, including that the monopoly price is well above marginal cost. Chapter 12 discusses oligopoly markets. Slide 10

Price-Output Determination Under Pure Competition Competitive firms attempt to maximize profits. Competitive firms cannot charge more than the market price of others, since their product is identical to all others. Hence, competitive firms are price takers. Total revenue, TR, is P·Q, where price is given. Therefore, marginal revenue, MR, is price, P. Profit is total revenue minus total cost = TR - TC). Slide 11

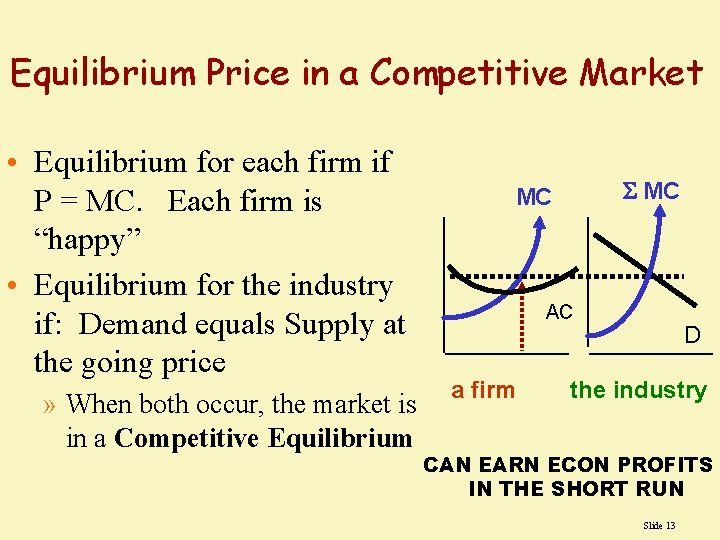

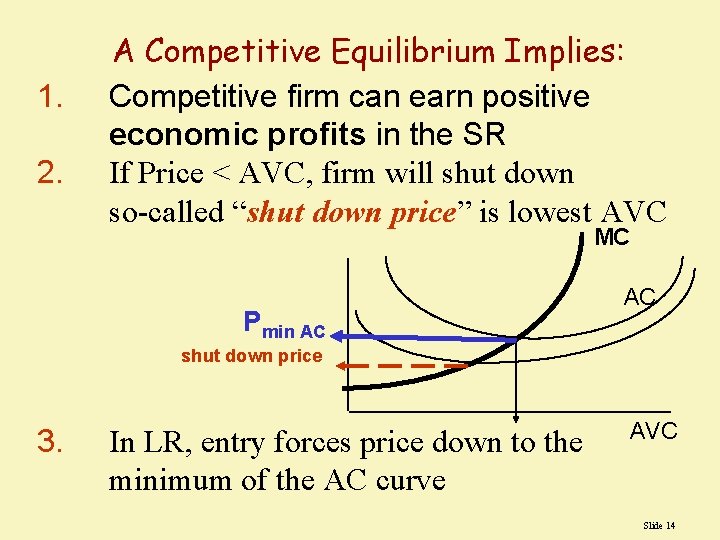

Profit maximization implies that each firm produces an output where Price = Marginal Cost (P = MC). » To produce more than this quantity implies that P < MC, which is not the most profitable decision. » To produce less than where P=MC, implies that P > MC, and the firm could increase profits by expanding output. • In short run, a competitive firm may earn economic profits. • In long run, entry pushes price down to the minimum point of the average cost curve, so that economic profits are zero. Slide 12

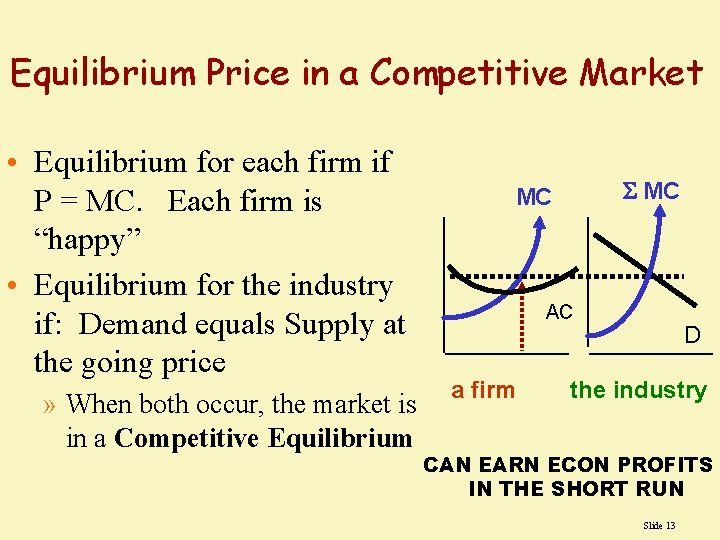

Equilibrium Price in a Competitive Market • Equilibrium for each firm if P = MC. Each firm is “happy” • Equilibrium for the industry if: Demand equals Supply at the going price » When both occur, the market is in a Competitive Equilibrium MC AC a firm D the industry CAN EARN ECON PROFITS IN THE SHORT RUN Slide 13

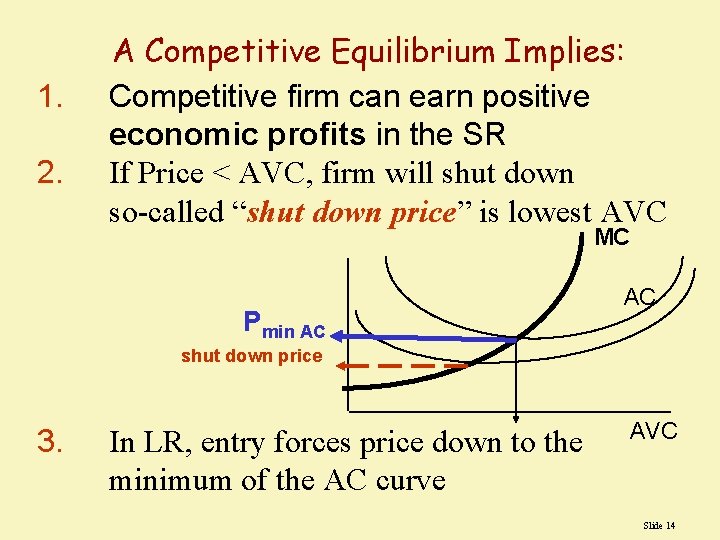

1. 2. A Competitive Equilibrium Implies: Competitive firm can earn positive economic profits in the SR If Price < AVC, firm will shut down so-called “shut down price” is lowest AVC MC Pmin AC AC shut down price 3. In LR, entry forces price down to the minimum of the AC curve AVC Slide 14

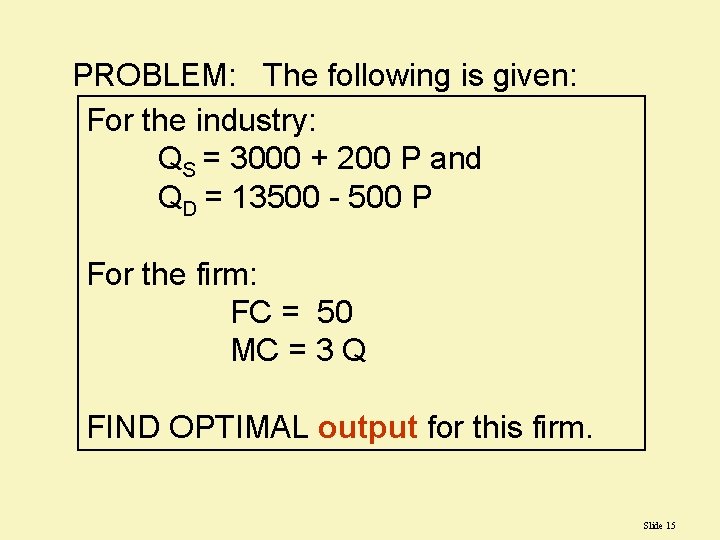

PROBLEM: The following is given: For the industry: QS = 3000 + 200 P and QD = 13500 - 500 P For the firm: FC = 50 MC = 3 Q FIND OPTIMAL output for this firm. Slide 15

Answer: Find equilibrium price. Set D = S we see 3, 000 + 200 P = 13, 500 - 500 P. This implies: 10, 500 / 700 = P = $15. At this price, the firm produces where P = MC, so 15 = 3 Q Q=5 Slide 16

Monopolistic Competition • Monopolistic Competition » MARKET STRUCTURE • Many Firms and Many Buyers • Easy Entry & Exit • PRODUCT DIFFERENTIATION ! ! ! • Historical Background » Joan Robinson “Economics of Imperfect Competition, ” 1933 » Edward Chamberlin, “Theory of Monopolistic Competition, 1933 • Small Groups & Large Groups Product Differentiation Among Gas Stations Slide 17

Product Differentiation • Differentiation occurs when consumers perceive that a product differs from its competition on any physical or nonphysical characteristic, including price. • Examples: restaurants, dealer-owned gas stations, Video rental stores, book & convenience stores, etc. • Assumptions of the Model: » Large number of firms » Differentiated Product » Conditions of Cost and Demand are Similar » Easy Entry & Exit Slide 18

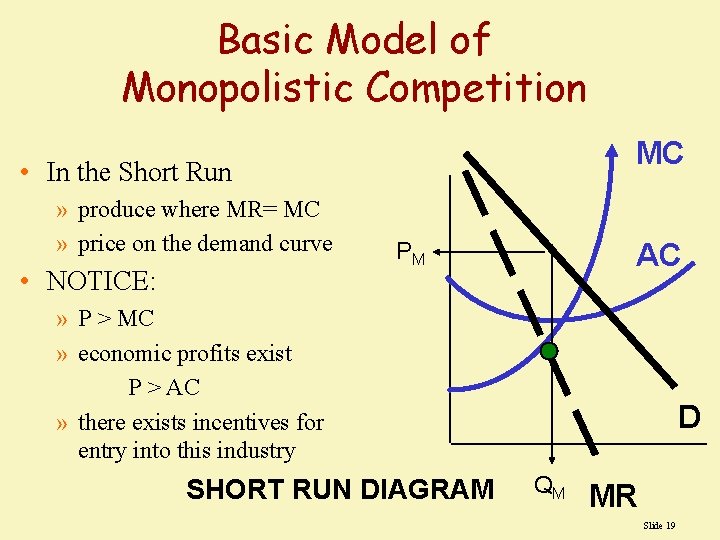

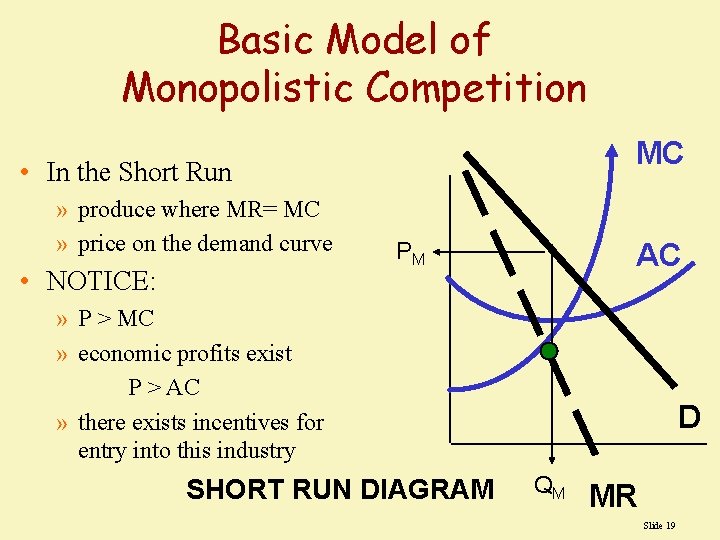

Basic Model of Monopolistic Competition MC • In the Short Run » produce where MR= MC » price on the demand curve • NOTICE: AC PM » P > MC » economic profits exist P > AC » there exists incentives for entry into this industry SHORT RUN DIAGRAM D QM MR Slide 19

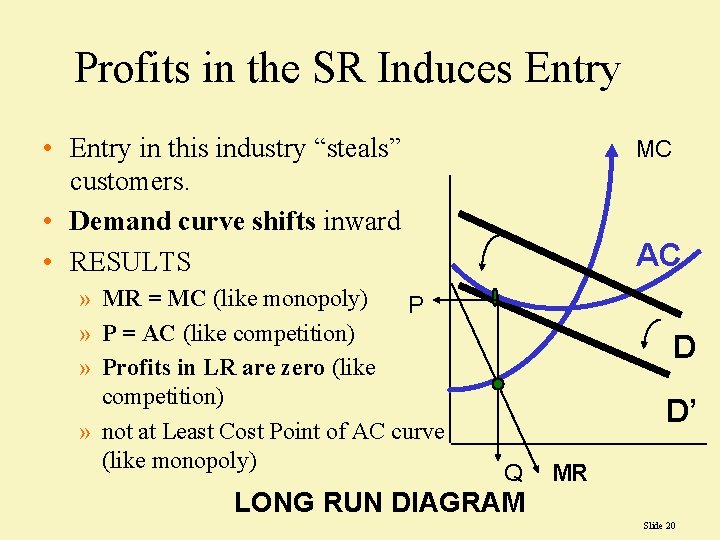

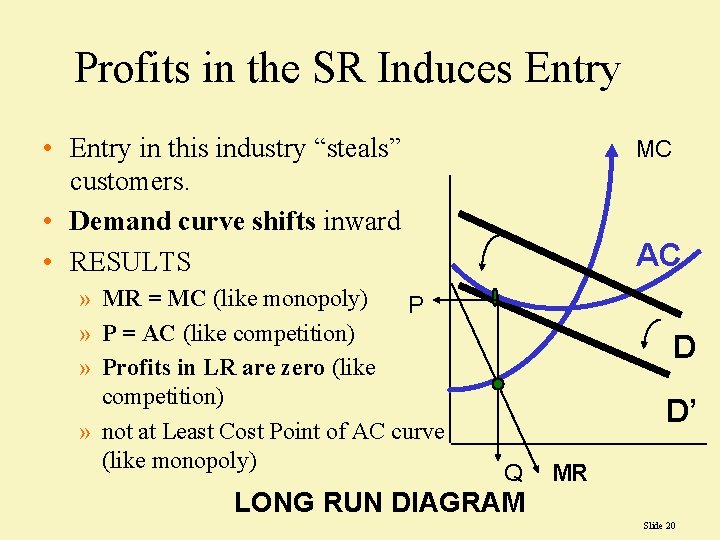

Profits in the SR Induces Entry • Entry in this industry “steals” customers. • Demand curve shifts inward • RESULTS » MR = MC (like monopoly) P » P = AC (like competition) » Profits in LR are zero (like competition) » not at Least Cost Point of AC curve (like monopoly) MC AC D D’ Q MR LONG RUN DIAGRAM Slide 20

Properties of Monopolistic Competition • Inefficient Production » EXCESS CAPACITY • not at least cost point of AC curve » Could Avoid Excess Capacity by JOINTLY PRODUCING at the same plant • Kroger Salt & Morton Salt at same plant • Sears’ Kenmore and Whirlpool built at same factory. • Does the expectation of zero profits in the future stifle innovation? • Is there too much product differentiation? Slide 21

Selling and Promotional Expenses • Suppose that the price is determined outside of the model, as with liquor prices in some States. • We will expand promotional activities until the extra profit associated with the activity equals the extra cost of the promotion. • This decision rule for Optimal Advertising is when: Contribution Margin = Marginal Cost of Advertising or P – MC = k • DA/DQ • or expand advertising whenever (P – MC)( DQ/DA) > k • where, contribution (P – MC) is the marginal profit contribution of an additional sale, and the marginal cost of advertising is ( k • DA/DQ). Slide 22

Example • To sell one more unit of output will cost the price of the added message, k, divided by the marginal product of a dollar of advertising (DQ/DA). • If a radio message costs $1000, and if that message yields 5 new items sold, then the marginal cost of advertising is $200, ($1000 /marginal product of advertising). • If it costs $200 to sell one more car (MCA=$200), and if the contribution of another car sold is $300 to profits, then we should expand promotional expenses. Slide 23

What Went Wrong With Amazon. com • Stocks only 1, 000 books but displays 2. 5 million • Barnes & Noble and Borders are profitable, but Amazon didn’t earn a profit • Classic example of a business with low barriers to entry • Internet buyers are very price conscience, as they can shop multiple sites with My. Simon. com and others Slide 24

Competitive Markets Under Asymmetric Information • Used car: who knows what about it? • Asymmetric Information -- unequal or dissimilar knowledge among market participants. • Incomplete Information -- uncertain knowledge of payoffs, choices, or types of opponents a market player faces. Slide 25

Search Goods versus Experience Goods • Search goods are products or services whose quality is best detected through a market search. • Experience goods are products and services whose quality is undetected when purchased. • Warranties and firm reputations are used to assure quality. • But if someone is selling his or her car, isn't it likely that the car is no good? Is it a lemon? » This is an explanation why used car prices are so much lower than new car prices. • If one firm defrauds customers, how do the reputable firms signal that they are NOT like the fraudulent firm? Slide 26

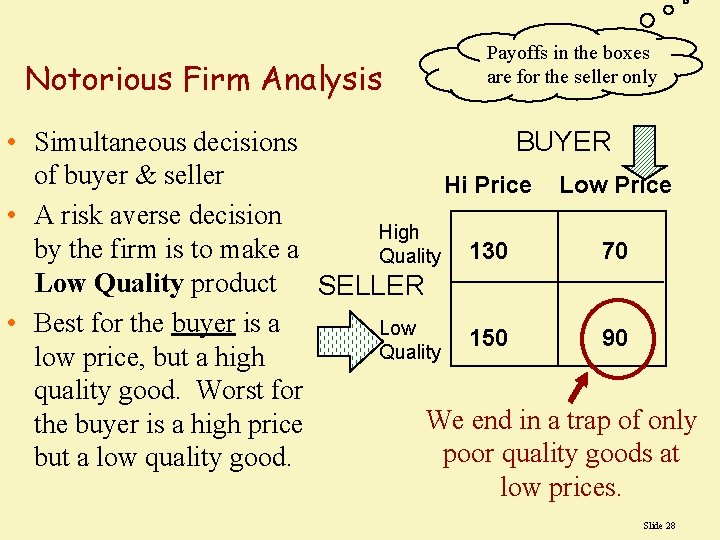

Adverse Selection and the Notorious Firm • Suppose that a firm may decide to produce a High Quality or Low Quality product, and the buyer may decide to offer a High Price or a Low Price. • Since the firm fears that if it offers a High Quality product but that buyers only offer a Low Price, they only produce Low Quality products and receive Low Prices. • This is the problem of adverse selection Slide 27

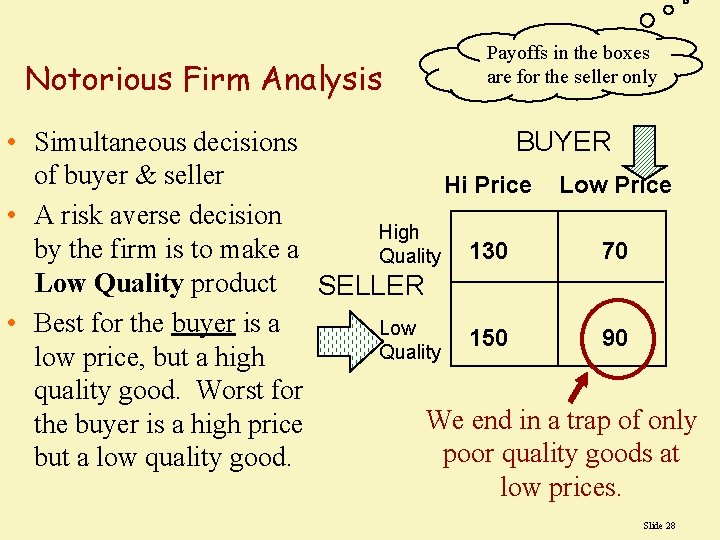

Notorious Firm Analysis Payoffs in the boxes are for the seller only • Simultaneous decisions BUYER of buyer & seller Hi Price Low Price • A risk averse decision High by the firm is to make a 70 Quality 130 Low Quality product SELLER • Best for the buyer is a Low 150 90 Quality low price, but a high quality good. Worst for We end in a trap of only the buyer is a high price poor quality goods at but a low quality good. low prices. Slide 28

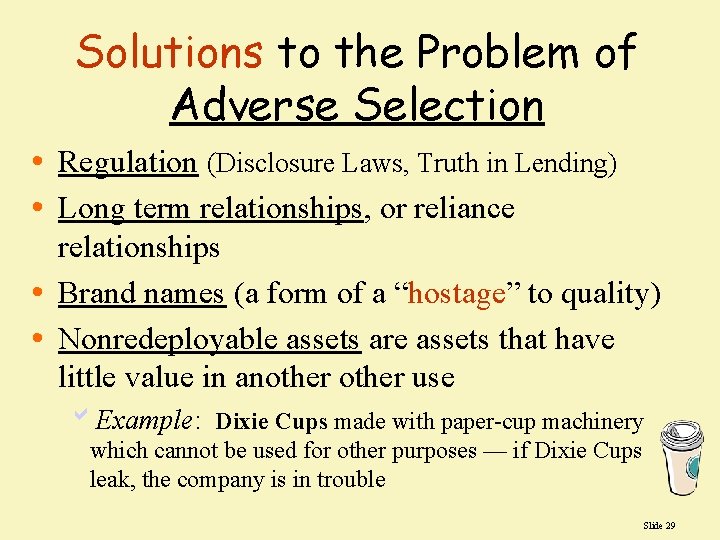

Solutions to the Problem of Adverse Selection • Regulation (Disclosure Laws, Truth in Lending) • Long term relationships, or reliance relationships • Brand names (a form of a “hostage” to quality) • Nonredeployable assets are assets that have little value in another use b. Example: Dixie Cups made with paper-cup machinery which cannot be used for other purposes — if Dixie Cups leak, the company is in trouble Slide 29