Pump Primer Define the term entrepreneur Explain the

- Slides: 33

Pump Primer • Define the term entrepreneur. • Explain the difference between sole proprietorship, partnership, & corporation.

Chapter 7: “Forms of Business Ownership” Business Organization By Focus: Institutions and Markets. National Council on Economic Education, New York, N. Y.

Objectives: • Define entrepreneur, sole proprietorship, partnership, & corporation • Compare the advantage and disadvantages of organizing a business as a corporation, partnership, or sole proprietorship. • Explain limited liability. • Describe the Scriptural principles that apply to Christians involvement in partnerships. • Define and describe two types of corporation • Explain the significance of stock to a corporation. • Give examples of laws and regulations that affect how corporations and other forms of businesses are formed and operate.

Entrepreneurship is the human resource that organizes labor, land, and capital. Ø An ability to take risks and coordinate the factors of production in order to produce a good or service for a profit. (Carper 97) Ø People such as: Ø Sam Walton – created Wal-Mart Ø Bill Gates – founded Microsoft Ø Michael Dell – established Dell Computers

Forms of Business Ownership An “entrepreneur determines what the market wishes to purchase; hires managers and workers, encourages their efforts, and leads them in performance that will be attended and applauded. ” Most important decision an entrepreneur must make is which form of business ownership they will use. (Carper 97)

Forms of Business Organizations Different legal forms of business organizations: 1) Corporations 2) Partnerships 3) Proprietorships They establish the legal rules and methods used to produce all of the goods and services that are sold to consumers in private markets.

Corporations Allow people to limit the economic risks they face in forming a business and make it easier to obtain financial capital when large investments in factories and equipment are necessary to take advantage of economies of scale. These advantages have contributed to the growth development of many large businesses in market economies, and to the overall level of production and income in those economies.

Corporations • Incorporation allows firms to accumulate sufficient financial capital to make large-scale investments and achieve economics of scale. • Incorporation also reduces the risk to investors by limiting stockholders’ liability to the value of their share of ownership in the corporation. (If one million shares are outstanding in a firm and you own 500, 000 shares, then you own one-half of the firm. ) – Two types of stock: preferred and common

Corporations • Two types of corporations: (1) Private corporation is one that is owned by private citizens (2) Public corporation, which is owned by the general public and managed by the government.

Corporation • S-Corporation are a different type of corporation. – Profits and losses are not taxed at the corporate level – Earnings are reported on the owner’s personal tax returns in much the same way as sole proprietorships and partnerships. – Limited to one class of stock and shareholders are limited in number and by U. S. residency. – Limited liability – Easier to raise capital and to transfer ownership – No corporate taxes, but have regulations just like a corporation.

Advantages of Corporation Limited Personal Financial Liability of Stockholders – “Stockholders have the advantage of risking only their investment in the firm. The firm’s creditors cannot touch the personal property of the shareholders. ” (Carper 104)

Advantages of Corporation Experienced Management and Specialized Employees • Large corporations are run by a board of directors, who are elected by votes of the stockholders. • “The board of directors represents the interest of the stockholders and usually is composed of people with experience in running other corporations. ” – “The board of directors appoints a Chief Executive Officer, or CEO – who serves as president of the corporation. ” (Carper 104)

Partnership • A partnership, or general partnership, is a business enterprise owned by two or more people. It is the least popular form of business ownership. • General partnership is a business firm owned by two or more people. (Carper 101)

Partnership Unlimited Personal Financial Liability is the greatest drawback to the partnership form of business ownership. – – – Each general partner is responsible to pay all obligations of the firm. Each partner is liable for all of the firm’s debts, but each general partner has the power to obligate the firm without the other partner’s knowledge. ” “General partnerships have the shortest life span of any form of business, due to dissolution of partnerships – death, withdrawal insanity, bankruptcy, or failure of one party to carry out certain responsibilities of the partnership. ” (Carper 101, 102)

Limited Partnership • In order to counter some of the biggest complaints of general partnership, the limited partnership was developed. • “Limited partnership is a business firm in which one investor has unlimited personal liability while another investor can lose only his investment in the firm. ” (Carper 102, 103)

Scripture and Partnerships • Specific rules for business partnerships are not mentioned directly in Scripture, but it does give us some general principles we may use when considering a partnership. • 2 Cor. 6: 14 speaks of not “being unequally yoked together with unbelievers” (Carper 102, 103)

Scripture and Partnerships • “Yoking” is considered any situation in which two or more people are tied together in a common endeavor, striving toward a common goal where one individual has the ability to influence, affect, or control the other. • An unbeliever in business strives mainly for increased profits, whereas, a believer ‘s main goal should be to magnify Jesus Christ.

Scripture and Partnerships • • Some believe scripture implies that a general partnership between two saved persons would even be unwise, because each would become a surety, or cosigner, for debts that the other may incur. Using Prov. 11: 15; 17: 18; 22: 26 -27 to support their reasoning. (Carper 102, 103)

Sole Proprietorships is a business operated by an individual or a married couple, without legal documents issued by the state government. Ø Might be run by a number of managers and/or employees. Ø Examples: a freelance photographer or writer, a crafts person who takes jobs on a contract basis, a salesperson who receives only commissions, or an independent contractor who isn't on an employer's regular payroll.

Sole Proprietorship • When deciding to grant a loan to a proprietor, the creditor, or lender, must determine the probability of whether the proprietorship will be in business long enough to repay the loan. (Carper 99)

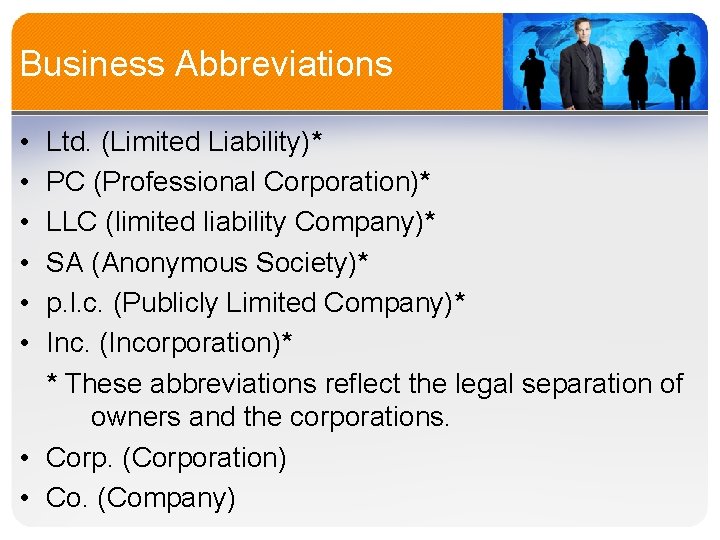

Business Abbreviations • • • Ltd. (Limited Liability)* PC (Professional Corporation)* LLC (limited liability Company)* SA (Anonymous Society)* p. l. c. (Publicly Limited Company)* Inc. (Incorporation)* * These abbreviations reflect the legal separation of owners and the corporations. • Corp. (Corporation) • Co. (Company)

Activity 1 • Break-up into groups of two or three. • Look over the list of companies and place them into the correct category of business types.

Activity 2 Using your textbook and lecture notes complete the chart with your partner(s). • Define the term, then list all of the advantages and disadvantages for each form of business.

Principal-Agent Model The principal-agent model describes the interaction between two individuals in a contractual relationship where the objectives of the two individuals may differ. The principal wants some action on the part of the agent, who has been hired to carry out this action.

Principal-Agent Model Agents are the individuals who act on behalf of others. (Ex. representatives for actors, singers, etc. ) Principals are the parties on whose behalf agents are acting. When agents and principals have different goals, it is often necessary or helpful to provide incentives that encourage agents to act in the best interest of principals.

Principal-Agent Model In many cases people represent others directly or indirectly, even though they are not called agents. • Union members elect shop stewards and bargaining committees to represent their interests, and politicians are elected or appointed to represent their constituents. • All employees of a business can be considered agents of firms’ owners, but especially top managers who make key decisions about investments and competitive strategies.

Incentives Problems often arise when the objective of the principal and the agent are different. It is important that managers (agents) have incentives to make decisions that are in the best interest of the owners (principals). One method firms use to provide these incentives is profit sharing. This gives the managers a stake (not direct ownership, unless it is a stock option) in the performance of the firm, and therefore stronger incentives to make decisions that are in the best interest of the owners. (Bonuses c/b tied to the level of profit the company generates. )

Activity 3 With your partner(s) look over the data in Activity 3. • One set of data shows the total number of businesses in the U. S. and the number that are organized as sole proprietorships, partnerships, corporations, and employment levels. • The other set of data shows the total sales revenue and profits generated by sole proprietorships, partnerships, and corporations. Discuss and answer the questions provided in Activity 4.

Review! • What is a sole proprietorship? A business operated by an individual or a married couple that has not been legally registered or registered as a partnership or corporation. • What is a partnership? A business operated by two or more people that has not been legally registered or recognized as a corporation. • What is a corporation? A business recognized by state government as a legal entity, separate from the shareholders who own it.

Review! • What are some advantages of operating a sole proprietorship? Freedom to enter and exit. Freedom from paying excessive Freedom from outside control. taxes. Freedom to retain information. Freedom from being an employee. • What are some disadvantages of operating a sole proprietorship? Unlimited personal financial liability. Limited management and employee skills. Limited availability of money.

Review! • What are some advantages of operating a partnership? Greater Management skills. Greater chance of keeping competent employees. Greater sources of financing. Ease of formation and freedom to manage. • What are some disadvantages of operating a partnership? Unlimited Personal financial liability. Uncertain life. Conflicts between partners.

Review! • What are some advantages of operating a corporation? Limited personal financial liability of stockholder. Experienced management and specialized employees. Continuous life. Ease in raising financial capital. • What are some disadvantages of operating a corporation? Higher taxes. Greater government regulations. Lack of secrecy. Impersonal and rigidity.

Works Cited Carper, Alan. Economics for Christian Schools. Greenville: Bob Jones University Press, 1998.