Public Goods Microeconomics What is Marketing Principles of

Public Goods Microeconomics What is Marketing? Principles of Marketing

Externalities • Private markets offer an efficient way to put buyers and sellers together and determine what goods are produced, how they are produced, and who gets them • The effect of a market exchange on a third party who is outside or “external” to the exchange is called an externality. • Because externalities that occur in market transactions affect other parties beyond those involved, they are sometimes called spillovers. • Externalities can be negative or positive.

Public Goods Public goods have two defining characteristics: • Nonexcludable: it is costly or impossible to exclude someone from using the good • Non-rivalrous: when one person uses the public good, another can also use it

Public Goods and Positive Externalities • Public goods have positive externalities • But not all goods and services with positive externalities are public goods

Common Resources • Nonexcludable • Rivalrous • “Tragedy of the Commons” - no one individual has an incentive to protect that resource and responsibly harvest it

Free Rider Problem A free rider problem can arise, in which people have an incentive to let others pay for the public good and then to “free ride” on the purchases of others

Practice Question Why do free rider problems arise?

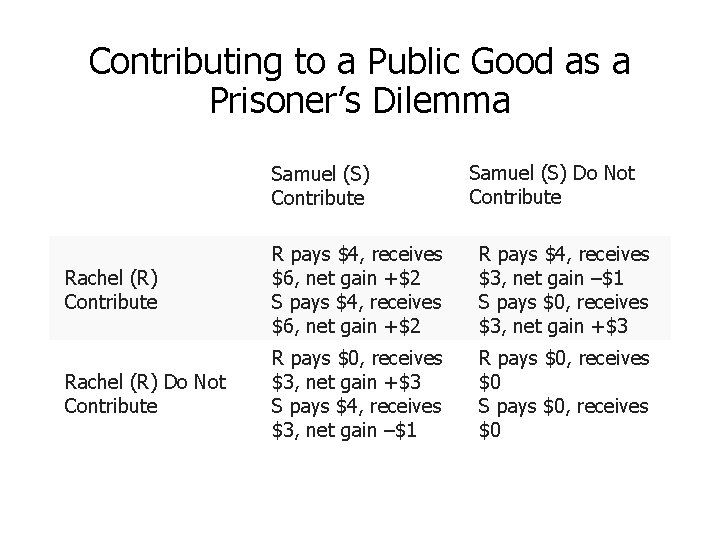

Contributing to a Public Good as a Prisoner’s Dilemma Samuel (S) Contribute Samuel (S) Do Not Contribute Rachel (R) Contribute R pays $4, receives $6, net gain +$2 S pays $4, receives $6, net gain +$2 R pays $4, receives $3, net gain –$1 S pays $0, receives $3, net gain +$3 Rachel (R) Do Not Contribute R pays $0, receives $3, net gain +$3 S pays $4, receives $3, net gain –$1 R pays $0, receives $0 S pays $0, receives $0

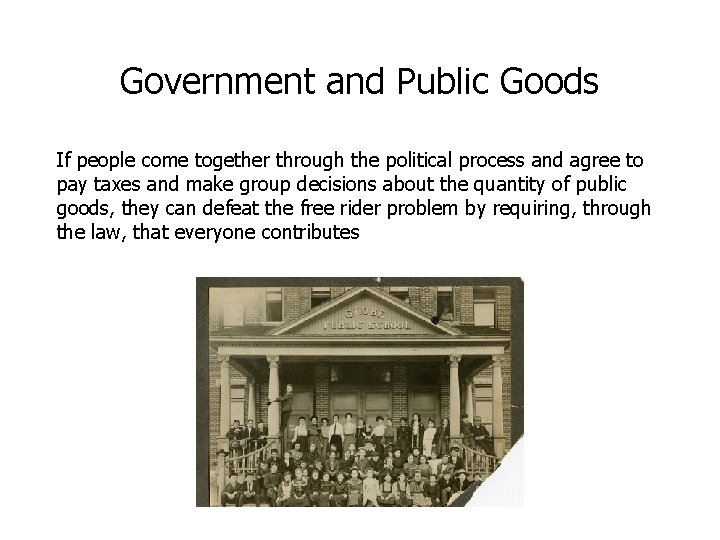

Government and Public Goods If people come together through the political process and agree to pay taxes and make group decisions about the quantity of public goods, they can defeat the free rider problem by requiring, through the law, that everyone contributes

Other Ways to Provide Public Goods • Someone else pays ie. Radio supported by advertisers • Use social pressure to fundraise for non-profit organizations

Why Invest in Human Capital? The positive externalities to education typically include: • better health outcomes for the population • lower levels of crime • a cleaner environment • a more stable, democratic government. Education clearly benefits the person who receives it, but a society where most people have a good level of education provides positive externalities for all

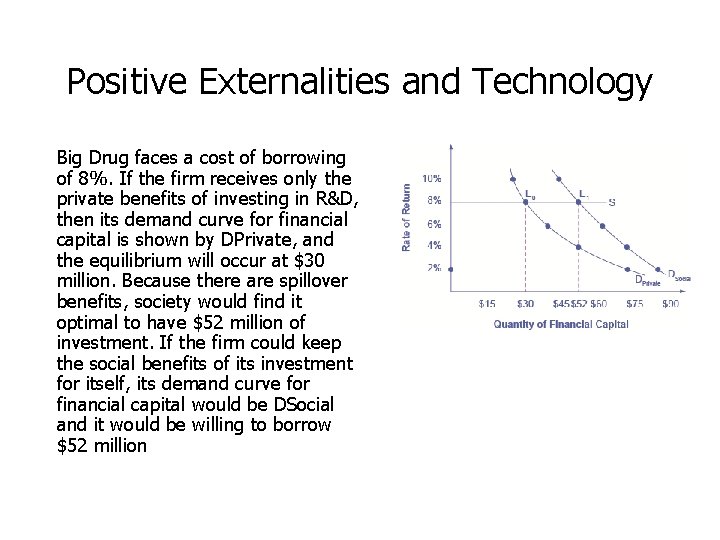

Positive Externalities and Technology Big Drug faces a cost of borrowing of 8%. If the firm receives only the private benefits of investing in R&D, then its demand curve for financial capital is shown by DPrivate, and the equilibrium will occur at $30 million. Because there are spillover benefits, society would find it optimal to have $52 million of investment. If the firm could keep the social benefits of its investment for itself, its demand curve for financial capital would be DSocial and it would be willing to borrow $52 million

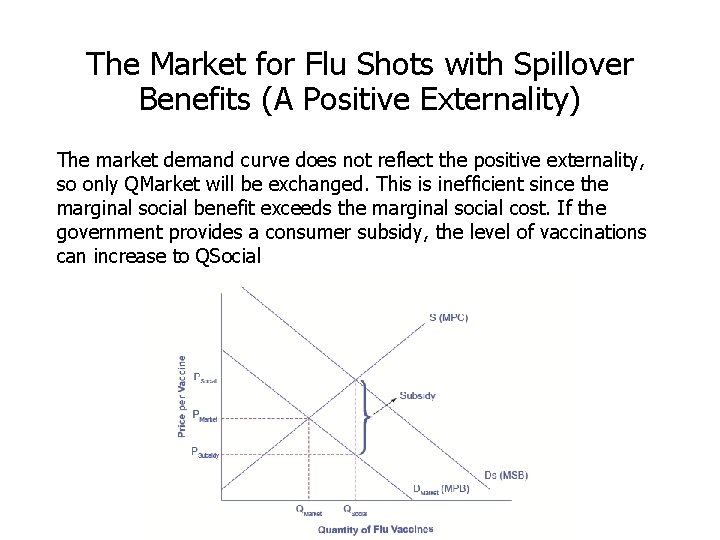

The Market for Flu Shots with Spillover Benefits (A Positive Externality) The market demand curve does not reflect the positive externality, so only QMarket will be exchanged. This is inefficient since the marginal social benefit exceeds the marginal social cost. If the government provides a consumer subsidy, the level of vaccinations can increase to QSocial

Negative Externality: Pollution

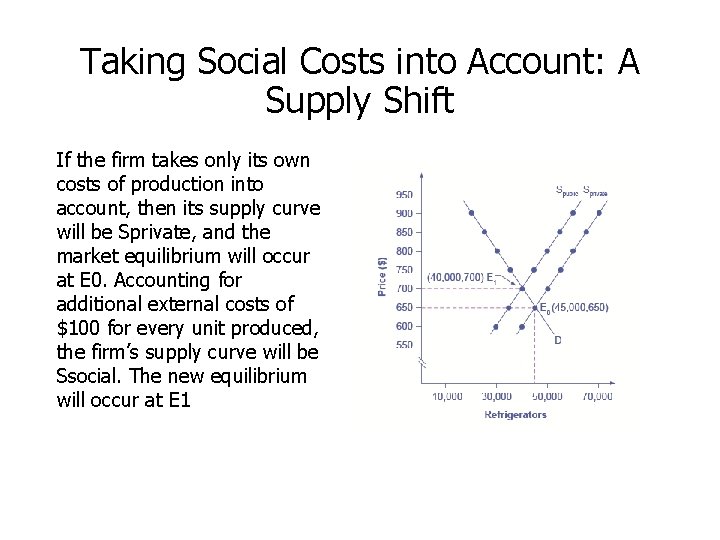

Taking Social Costs into Account: A Supply Shift If the firm takes only its own costs of production into account, then its supply curve will be Sprivate, and the market equilibrium will occur at E 0. Accounting for additional external costs of $100 for every unit produced, the firm’s supply curve will be Ssocial. The new equilibrium will occur at E 1

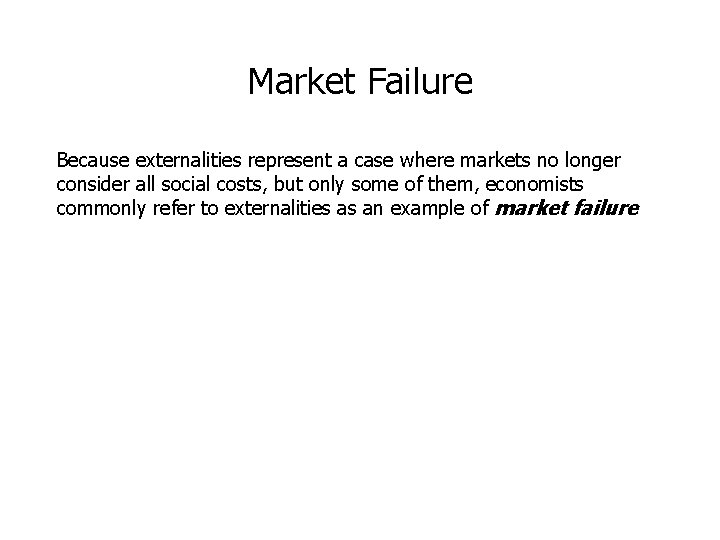

Market Failure Because externalities represent a case where markets no longer consider all social costs, but only some of them, economists commonly refer to externalities as an example of market failure

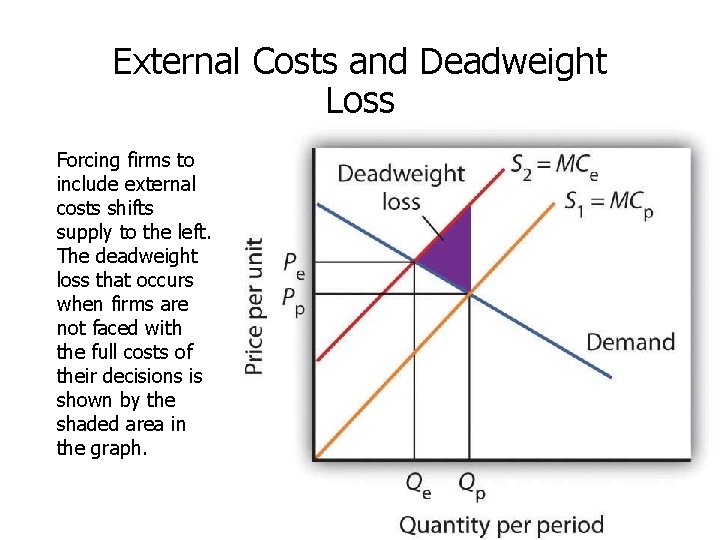

External Costs and Deadweight Loss Forcing firms to include external costs shifts supply to the left. The deadweight loss that occurs when firms are not faced with the full costs of their decisions is shown by the shaded area in the graph.

Government Options in Addressing Market Failure • Command control regulation specifies how much pollution could be emitted and imposes penalties if that limit is exceeded. Other command control regulations require the installation of certain equipment to reduce pollution • Market-oriented tools

Command Control Regulation Pro Con • highly successful in protecting and cleaning up the U. S. environment • no incentive to improve the quality of the environment beyond the standard set by the law • Inflexible – all firms face the same law no matter how efficient or inefficient it would be for them to follow it • subject to compromises in the political process. Existing firms lobby to turn stricter environmental standards into barriers to entry

Clean Air and Water Cost Benefit Government economists have estimated that U. S. firms may pay more than $200 billion per year to comply with federal environmental laws. (1) people may stay healthier and live longer (2) certain industries that rely on clean air and water, such as farming, fishing, and tourism, may benefit (3) property values may be higher (4) people may simply enjoy a cleaner environment in a way that does not need to involve a market transaction

Is it worth it? • A middle-range estimate of the health and other benefits from cleaner air was $22 trillion—about 44 times higher than the costs • A more recent study by the EPA estimated that the environmental benefits to Americans from the Clean Air Act will exceed their costs by a margin of four to one • What is a human life worth?

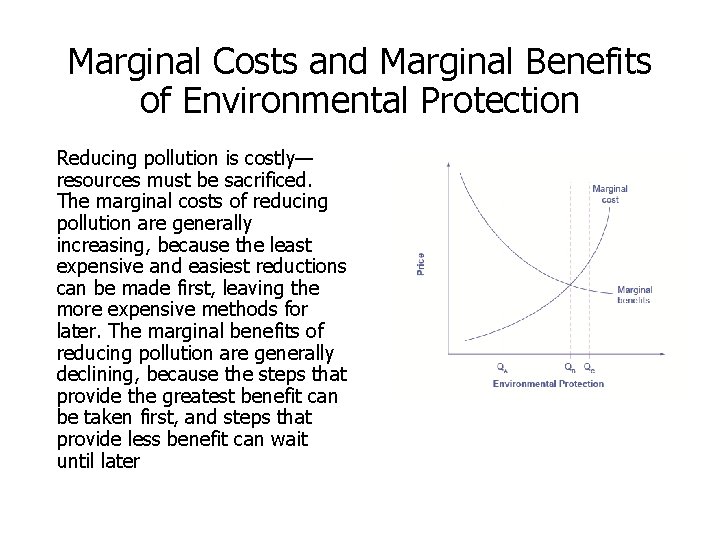

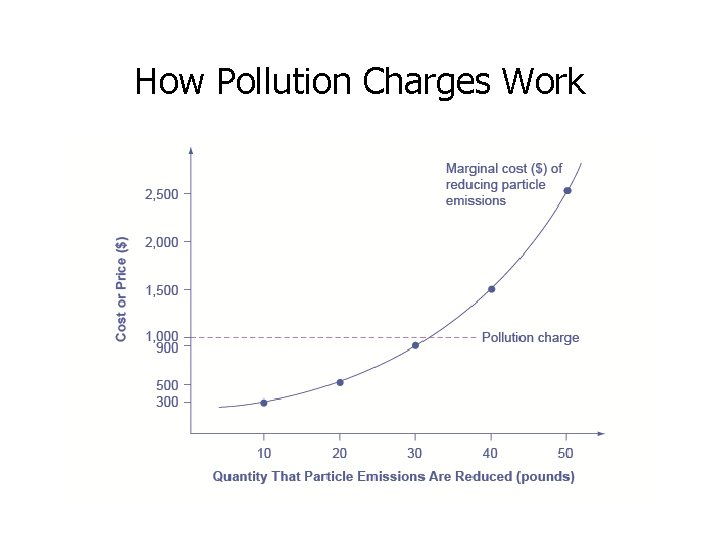

Marginal Costs and Marginal Benefits of Environmental Protection Reducing pollution is costly— resources must be sacrificed. The marginal costs of reducing pollution are generally increasing, because the least expensive and easiest reductions can be made first, leaving the more expensive methods for later. The marginal benefits of reducing pollution are generally declining, because the steps that provide the greatest benefit can be taken first, and steps that provide less benefit can wait until later

Practice Question How might the marginal costs and benefits graph explain the difference between the analysis of the Clean Air Act suggesting that benefits were 44 times higher than costs and the more recent study showing that benefits are 4 times higher than costs?

How Governments Can Encourage Innovation • Well-designed intellectual property laws • Government spending on research and development • Tax breaks for research and development • Cooperative research

Market-Oriented Environmental Tools • A pollution charge is a tax imposed on the quantity of pollution that a firm emits • Marketable permit program • Better defined property rights

How Pollution Charges Work

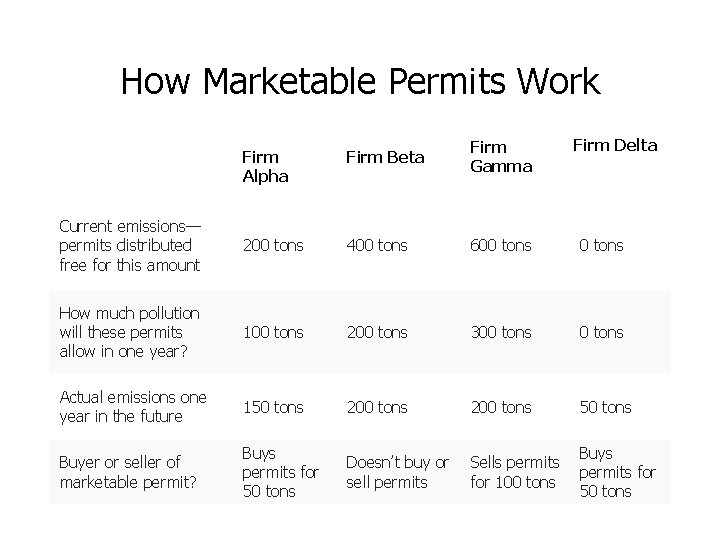

How Marketable Permits Work Firm Delta Firm Alpha Firm Beta Firm Gamma Current emissions— permits distributed free for this amount 200 tons 400 tons 600 tons How much pollution will these permits allow in one year? 100 tons 200 tons 300 tons Actual emissions one year in the future 150 tons 200 tons 50 tons Buyer or seller of marketable permit? Buys permits for 50 tons Doesn’t buy or sell permits Sells permits for 100 tons Buys permits for 50 tons

How Effective are Market-oriented Tools? The advantage of market-oriented environmental tools is not that they reduce pollution by more or less, but because of their incentives and flexibility, they can achieve any desired reduction in pollution at a lower cost to society

Quick Review • What is the difference between public and private goods? • What are free riders? • What are positive and negative externalities? What are some examples of each? • How effective are government policies to lessen negative externalities? • How does the government promote positive externalities? • How do market-based solutions affect negative externalities?

- Slides: 29