Provisions in a nutshell Section Provisions Corresponding Rules

- Slides: 16

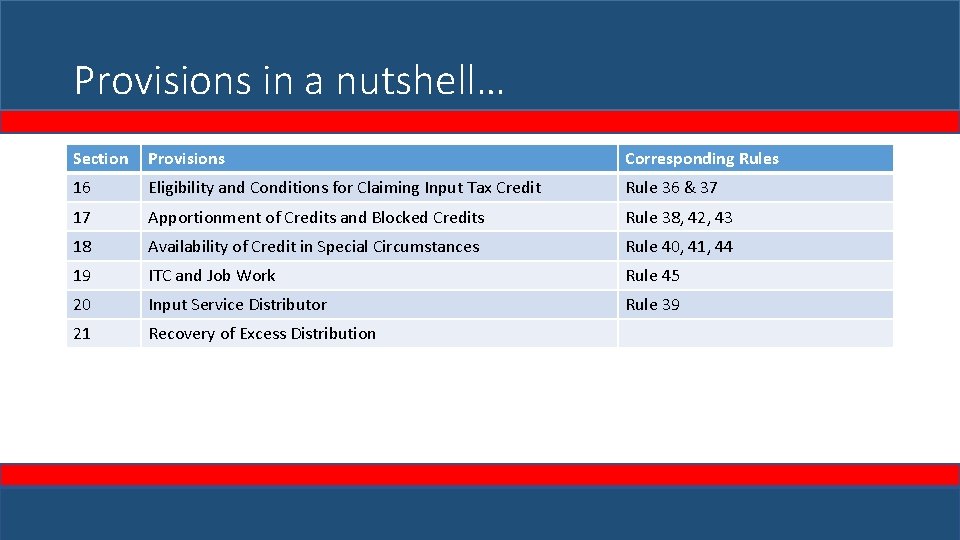

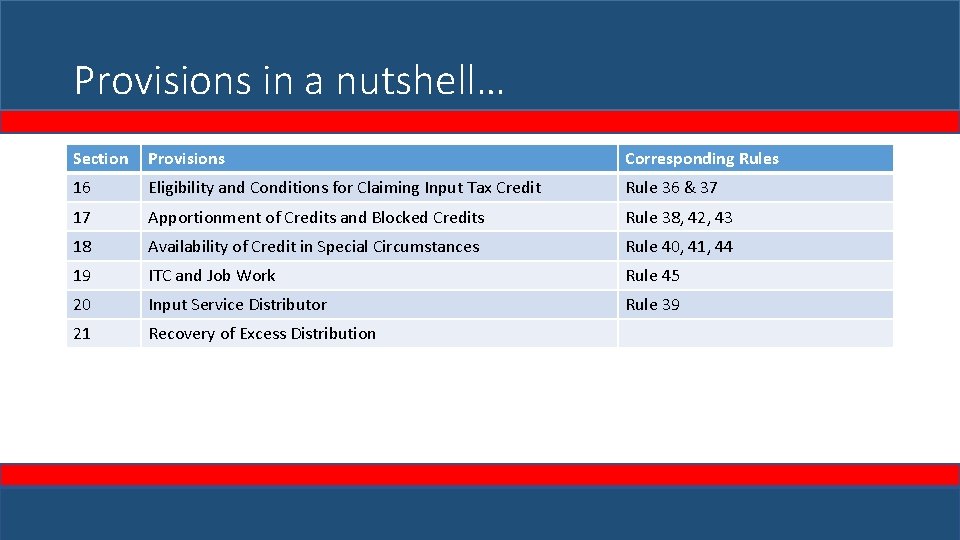

Provisions in a nutshell… Section Provisions Corresponding Rules 16 Eligibility and Conditions for Claiming Input Tax Credit Rule 36 & 37 17 Apportionment of Credits and Blocked Credits Rule 38, 42, 43 18 Availability of Credit in Special Circumstances Rule 40, 41, 44 19 ITC and Job Work Rule 45 20 Input Service Distributor Rule 39 21 Recovery of Excess Distribution

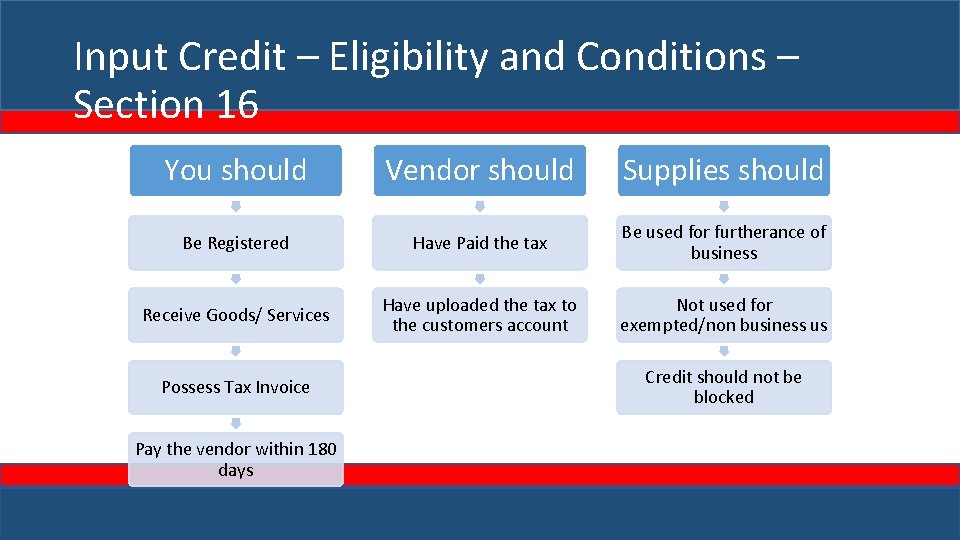

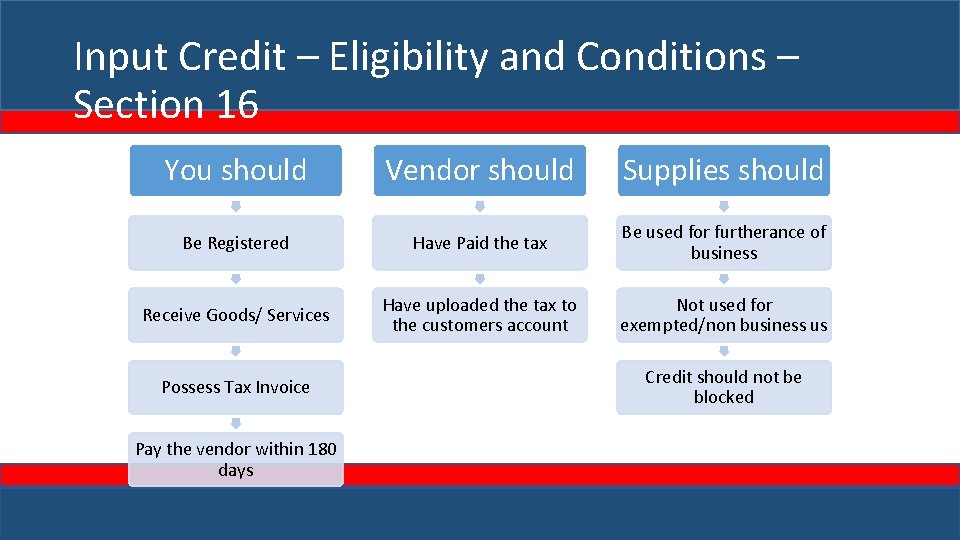

Input Credit – Eligibility and Conditions – Section 16 You should Vendor should Supplies should Be Registered Have Paid the tax Be used for furtherance of business Receive Goods/ Services Have uploaded the tax to the customers account Not used for exempted/non business us Possess Tax Invoice Pay the vendor within 180 days Credit should not be blocked

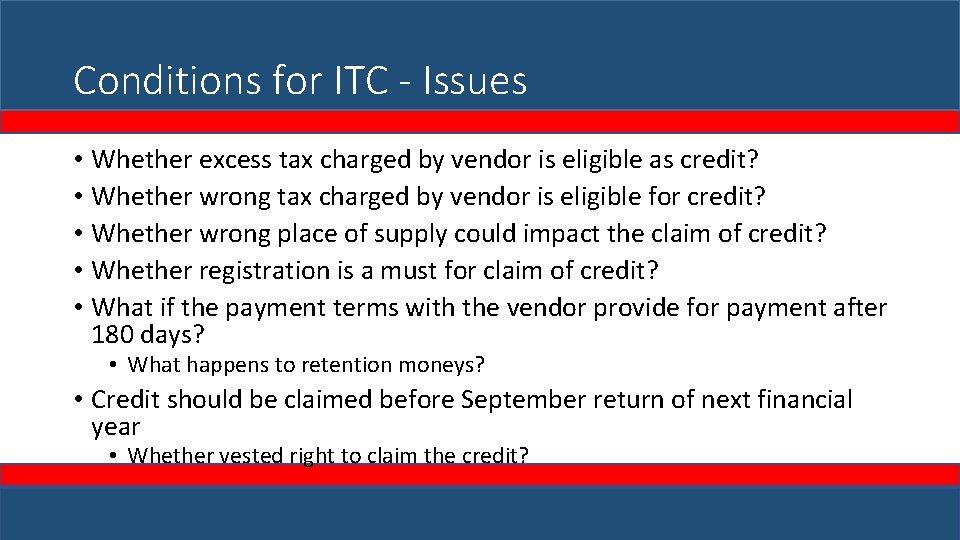

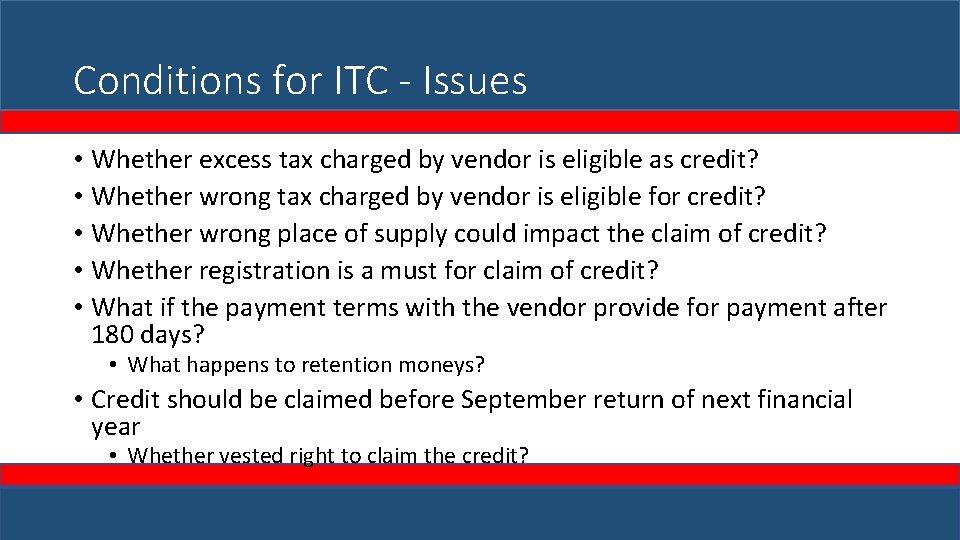

Conditions for ITC - Issues • Whether excess tax charged by vendor is eligible as credit? • Whether wrong tax charged by vendor is eligible for credit? • Whether wrong place of supply could impact the claim of credit? • Whether registration is a must for claim of credit? • What if the payment terms with the vendor provide for payment after 180 days? • What happens to retention moneys? • Credit should be claimed before September return of next financial year • Whether vested right to claim the credit?

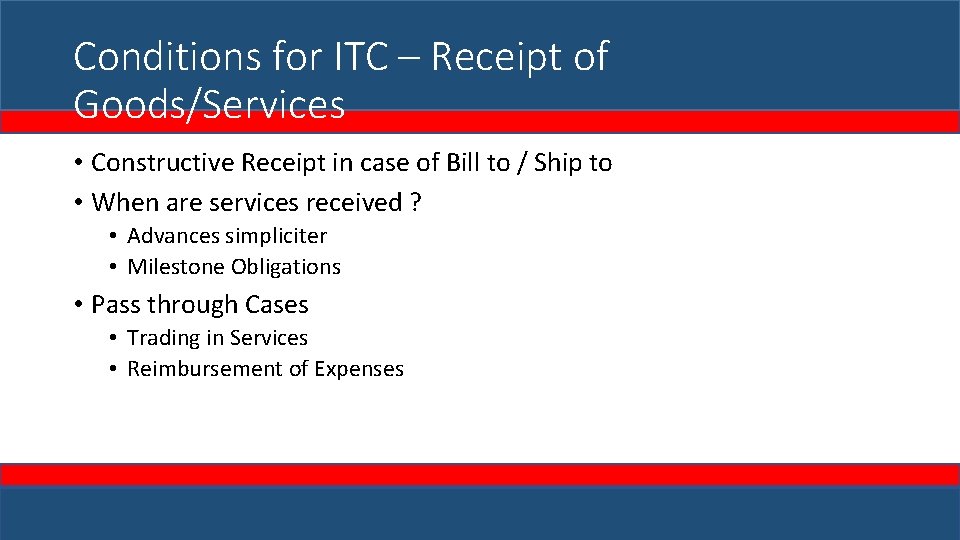

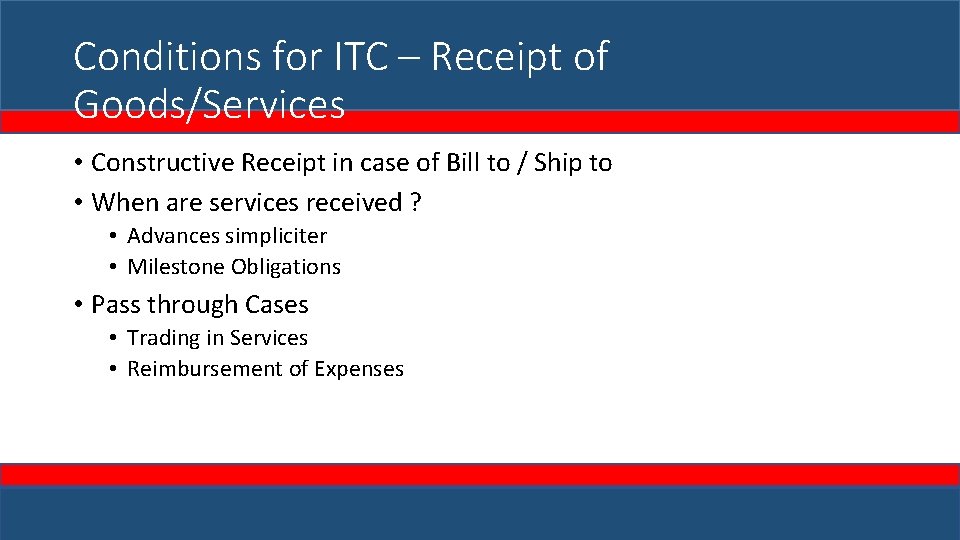

Conditions for ITC – Receipt of Goods/Services • Constructive Receipt in case of Bill to / Ship to • When are services received ? • Advances simpliciter • Milestone Obligations • Pass through Cases • Trading in Services • Reimbursement of Expenses

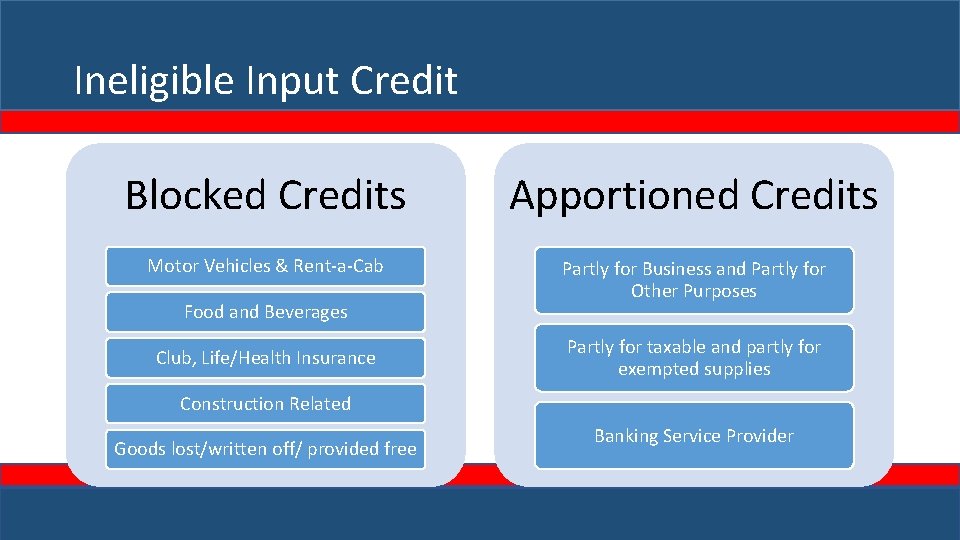

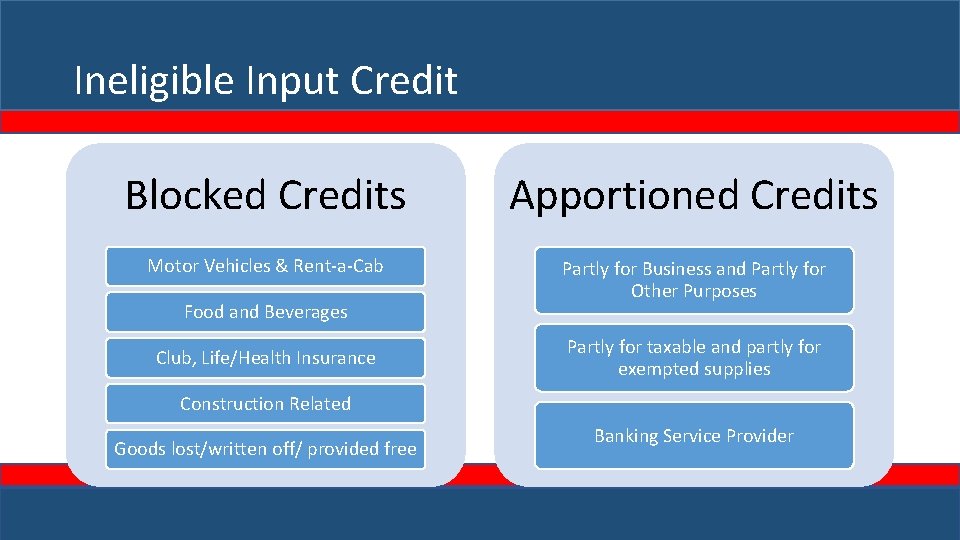

Ineligible Input Credit Blocked Credits Apportioned Credits Motor Vehicles & Rent-a-Cab Partly for Business and Partly for Other Purposes Food and Beverages Club, Life/Health Insurance Partly for taxable and partly for exempted supplies Construction Related Goods lost/written off/ provided free Banking Service Provider

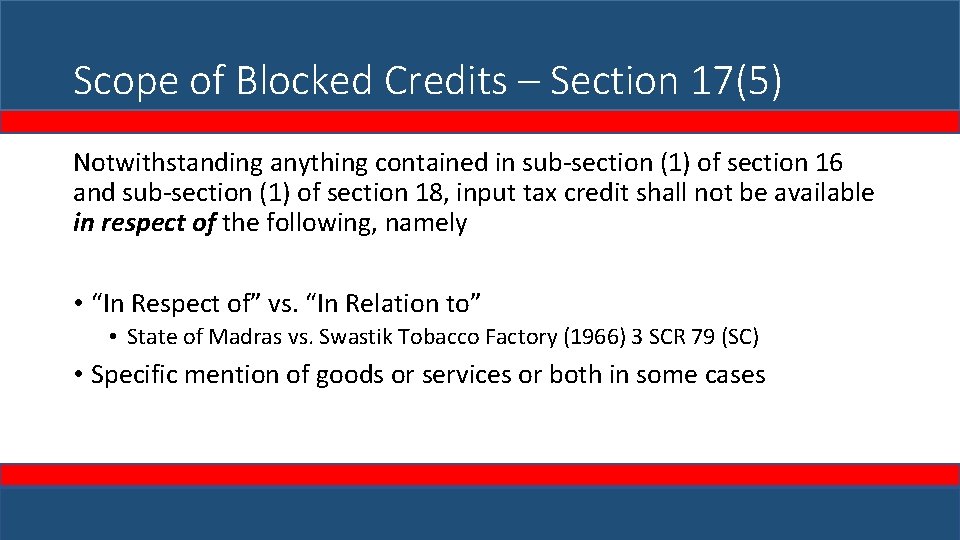

Scope of Blocked Credits – Section 17(5) Notwithstanding anything contained in sub-section (1) of section 16 and sub-section (1) of section 18, input tax credit shall not be available in respect of the following, namely • “In Respect of” vs. “In Relation to” • State of Madras vs. Swastik Tobacco Factory (1966) 3 SCR 79 (SC) • Specific mention of goods or services or both in some cases

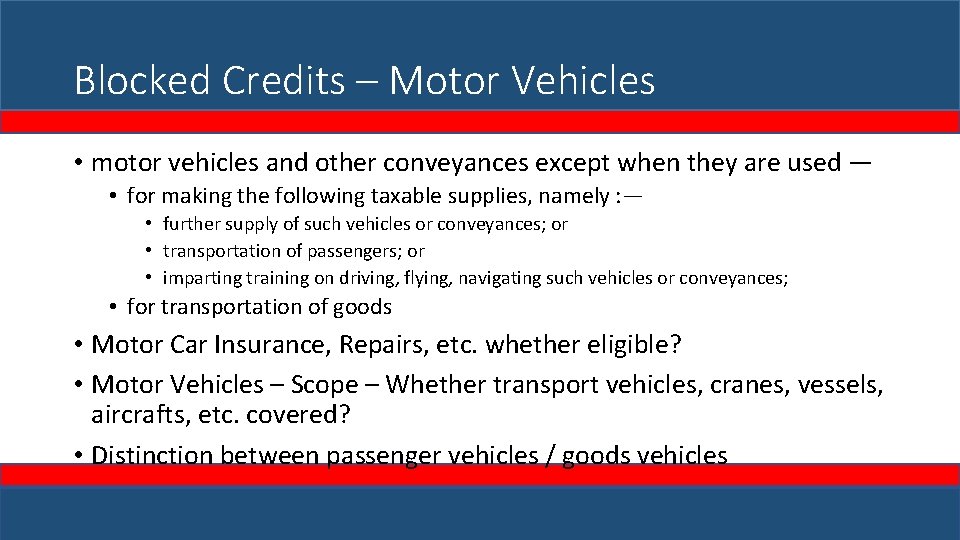

Blocked Credits – Motor Vehicles • motor vehicles and other conveyances except when they are used — • for making the following taxable supplies, namely : — • further supply of such vehicles or conveyances; or • transportation of passengers; or • imparting training on driving, flying, navigating such vehicles or conveyances; • for transportation of goods • Motor Car Insurance, Repairs, etc. whether eligible? • Motor Vehicles – Scope – Whether transport vehicles, cranes, vessels, aircrafts, etc. covered? • Distinction between passenger vehicles / goods vehicles

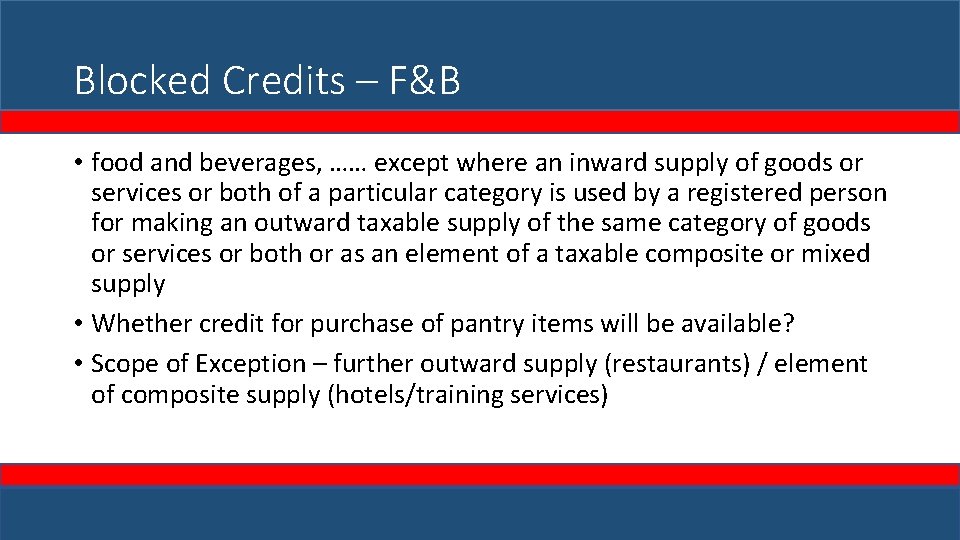

Blocked Credits – F&B • food and beverages, …… except where an inward supply of goods or services or both of a particular category is used by a registered person for making an outward taxable supply of the same category of goods or services or both or as an element of a taxable composite or mixed supply • Whether credit for purchase of pantry items will be available? • Scope of Exception – further outward supply (restaurants) / element of composite supply (hotels/training services)

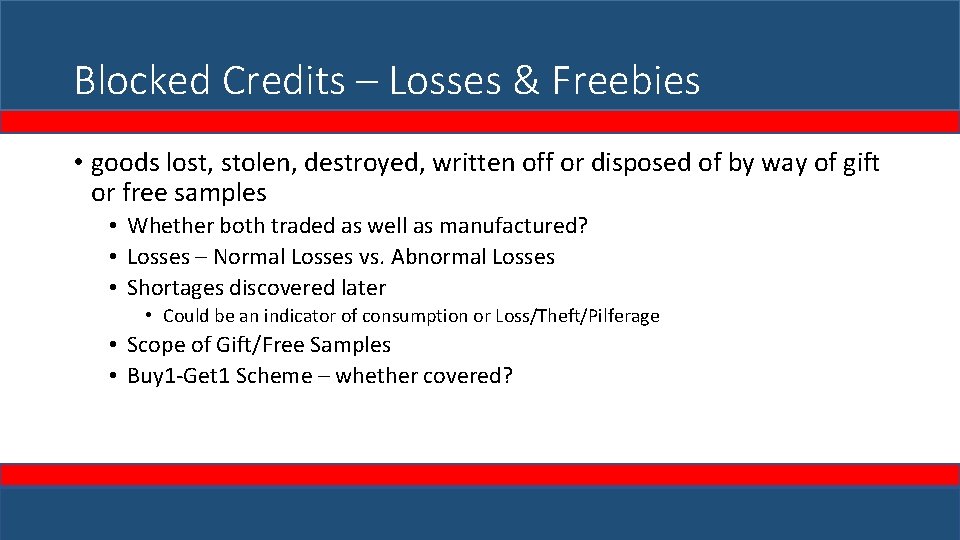

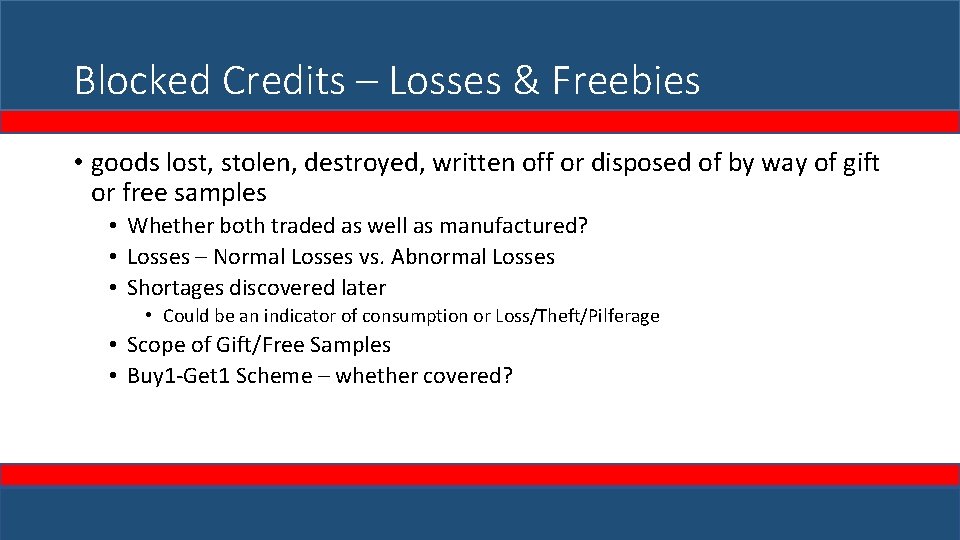

Blocked Credits – Losses & Freebies • goods lost, stolen, destroyed, written off or disposed of by way of gift or free samples • Whether both traded as well as manufactured? • Losses – Normal Losses vs. Abnormal Losses • Shortages discovered later • Could be an indicator of consumption or Loss/Theft/Pilferage • Scope of Gift/Free Samples • Buy 1 -Get 1 Scheme – whether covered?

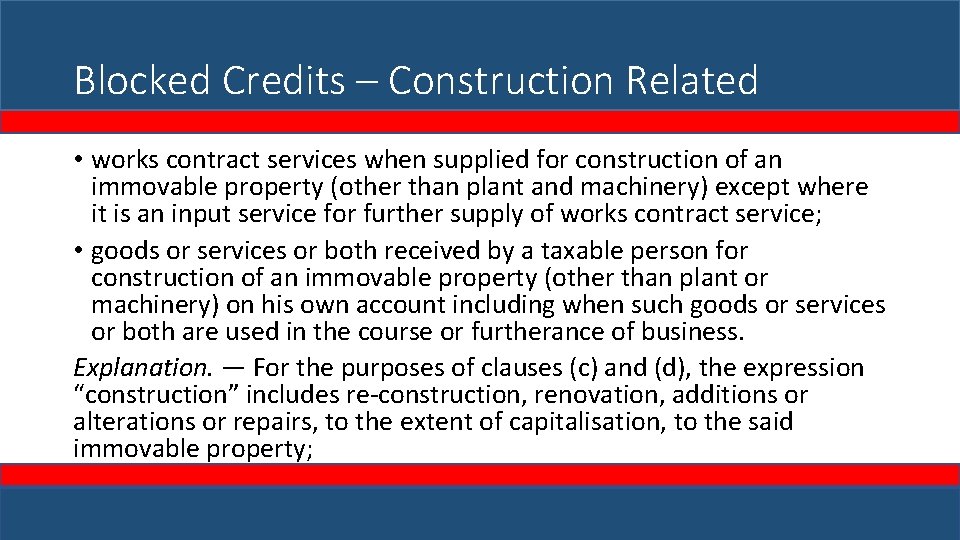

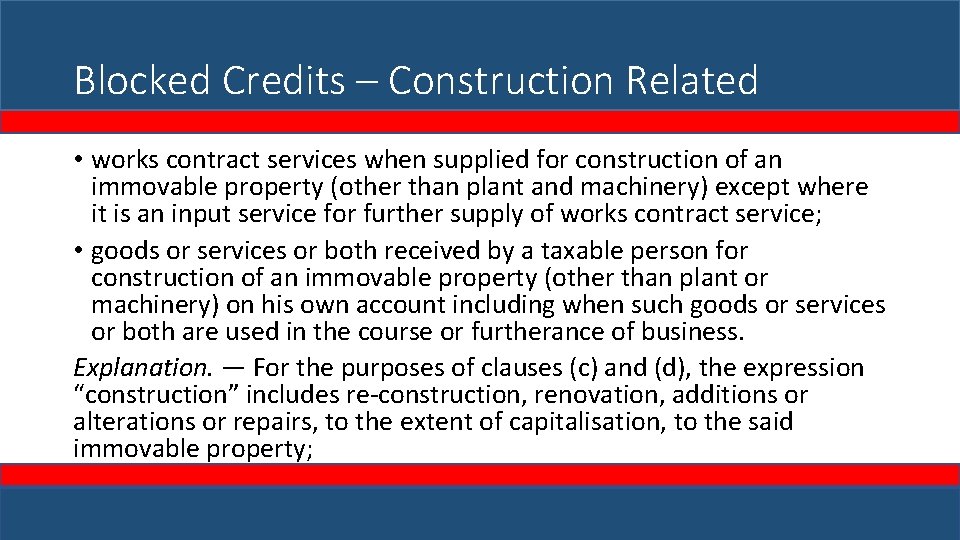

Blocked Credits – Construction Related • works contract services when supplied for construction of an immovable property (other than plant and machinery) except where it is an input service for further supply of works contract service; • goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business. Explanation. — For the purposes of clauses (c) and (d), the expression “construction” includes re-construction, renovation, additions or alterations or repairs, to the extent of capitalisation, to the said immovable property;

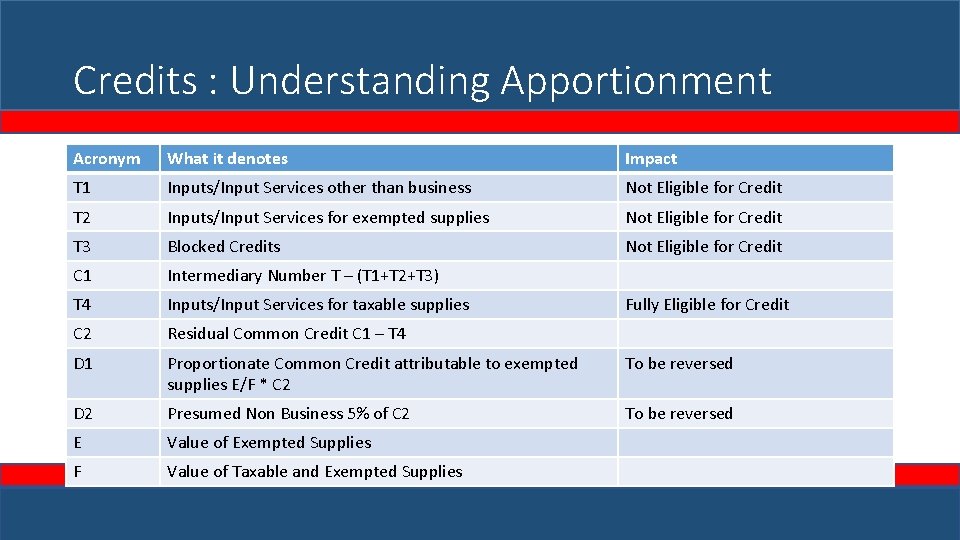

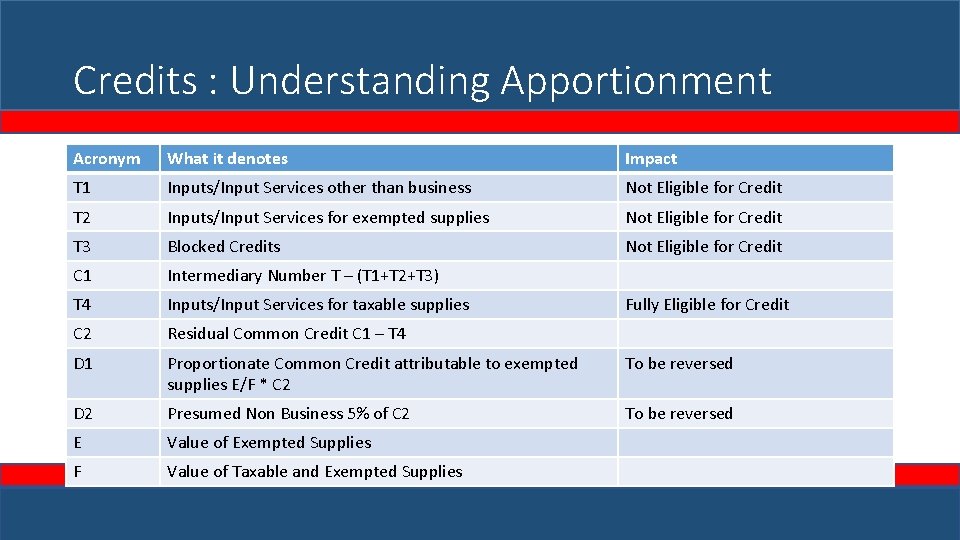

Credits : Understanding Apportionment Acronym What it denotes Impact T 1 Inputs/Input Services other than business Not Eligible for Credit T 2 Inputs/Input Services for exempted supplies Not Eligible for Credit T 3 Blocked Credits Not Eligible for Credit C 1 Intermediary Number T – (T 1+T 2+T 3) T 4 Inputs/Input Services for taxable supplies C 2 Residual Common Credit C 1 – T 4 D 1 Proportionate Common Credit attributable to exempted supplies E/F * C 2 To be reversed D 2 Presumed Non Business 5% of C 2 To be reversed E Value of Exempted Supplies F Value of Taxable and Exempted Supplies Fully Eligible for Credit

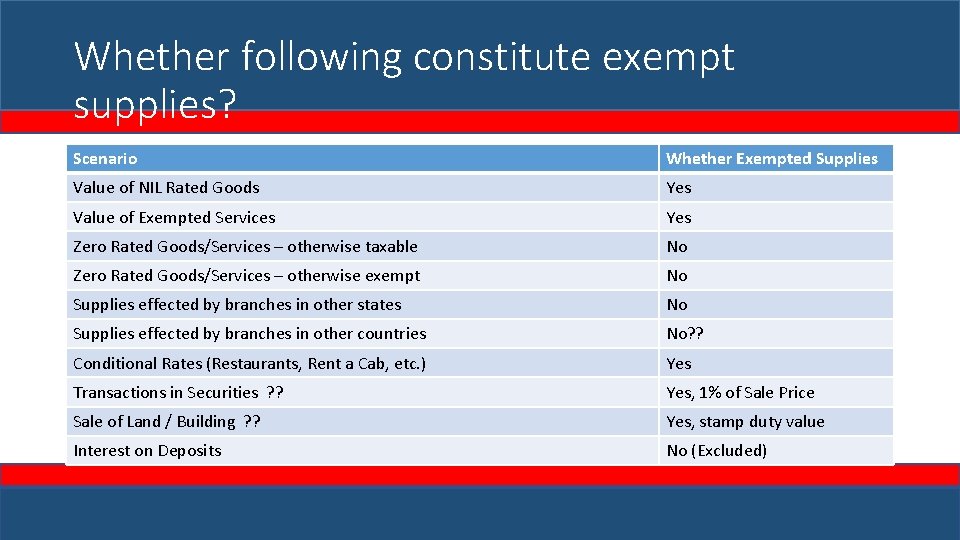

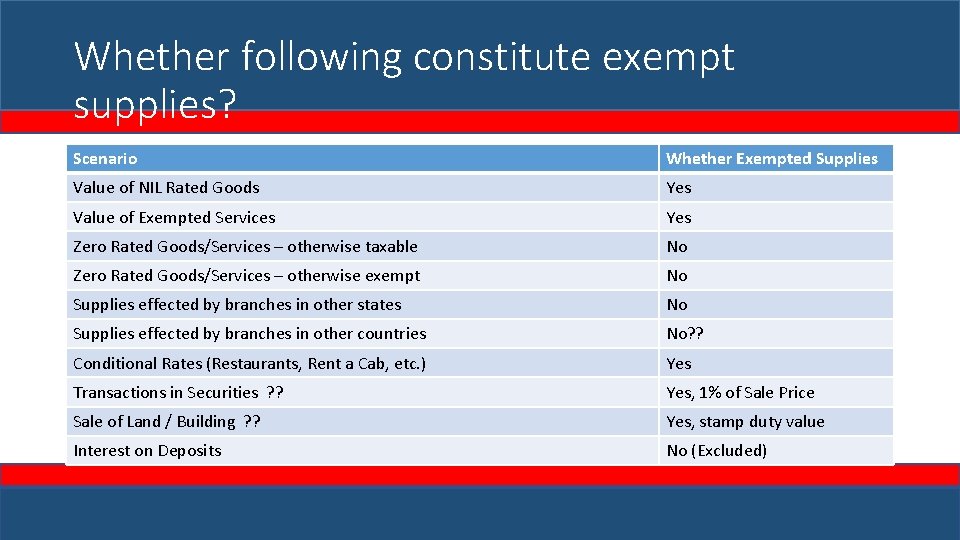

Whether following constitute exempt supplies? Scenario Whether Exempted Supplies Value of NIL Rated Goods Yes Value of Exempted Services Yes Zero Rated Goods/Services – otherwise taxable No Zero Rated Goods/Services – otherwise exempt No Supplies effected by branches in other states No Supplies effected by branches in other countries No? ? Conditional Rates (Restaurants, Rent a Cab, etc. ) Yes Transactions in Securities ? ? Yes, 1% of Sale Price Sale of Land / Building ? ? Yes, stamp duty value Interest on Deposits No (Excluded)

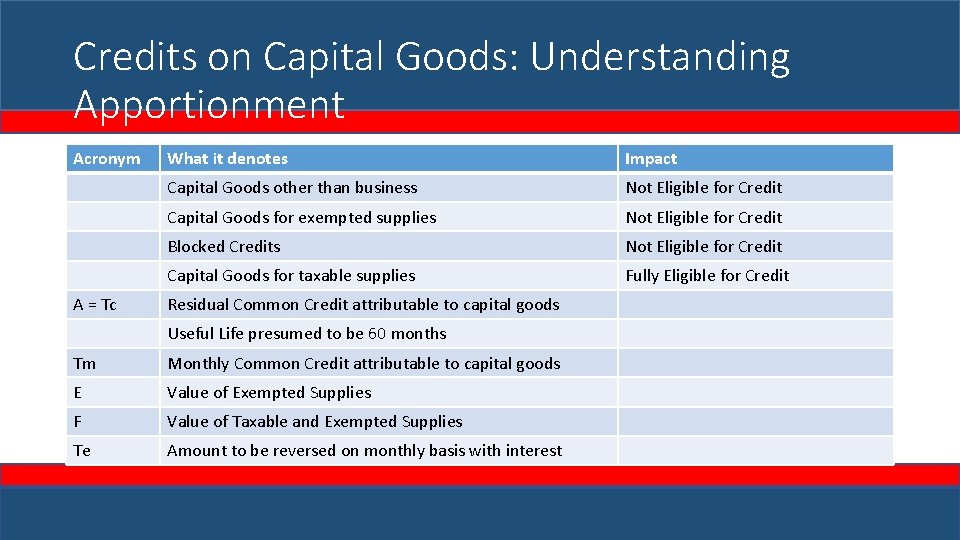

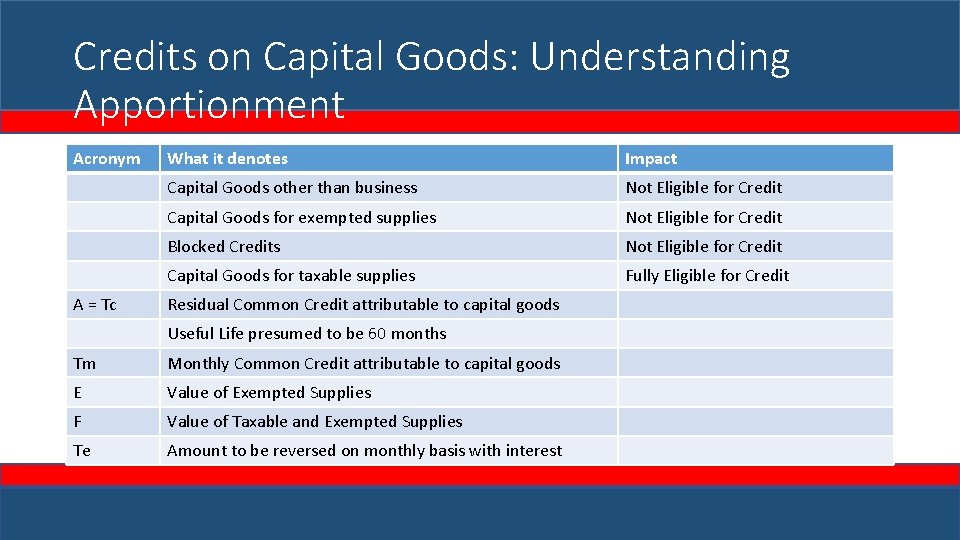

Credits on Capital Goods: Understanding Apportionment Acronym A = Tc What it denotes Impact Capital Goods other than business Not Eligible for Credit Capital Goods for exempted supplies Not Eligible for Credit Blocked Credits Not Eligible for Credit Capital Goods for taxable supplies Fully Eligible for Credit Residual Common Credit attributable to capital goods Useful Life presumed to be 60 months Tm Monthly Common Credit attributable to capital goods E Value of Exempted Supplies F Value of Taxable and Exempted Supplies Te Amount to be reversed on monthly basis with interest

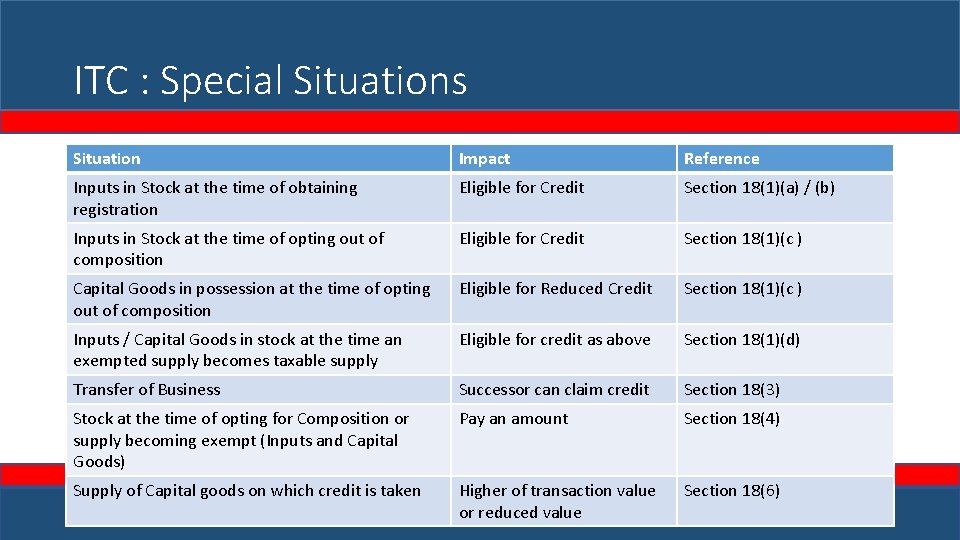

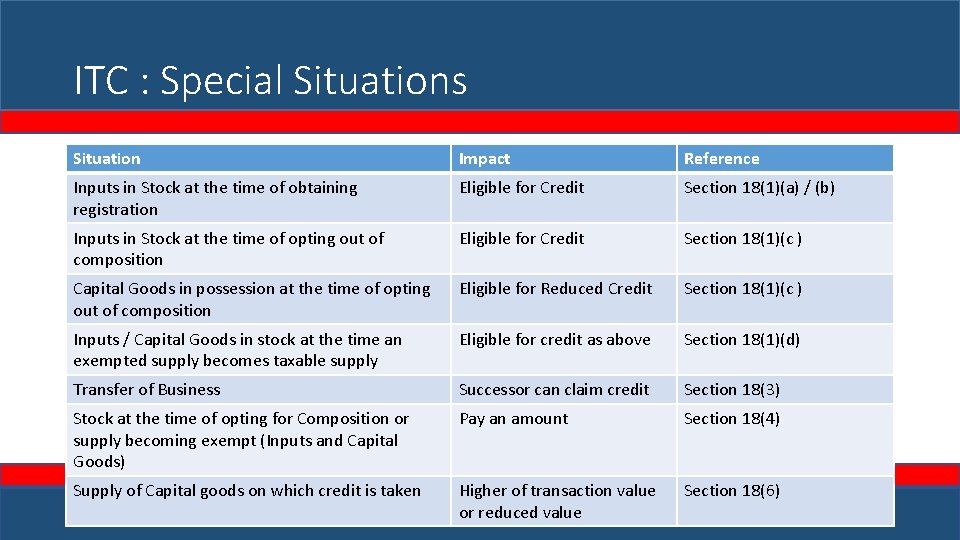

ITC : Special Situations Situation Impact Reference Inputs in Stock at the time of obtaining registration Eligible for Credit Section 18(1)(a) / (b) Inputs in Stock at the time of opting out of composition Eligible for Credit Section 18(1)(c ) Capital Goods in possession at the time of opting out of composition Eligible for Reduced Credit Section 18(1)(c ) Inputs / Capital Goods in stock at the time an exempted supply becomes taxable supply Eligible for credit as above Section 18(1)(d) Transfer of Business Successor can claim credit Section 18(3) Stock at the time of opting for Composition or supply becoming exempt (Inputs and Capital Goods) Pay an amount Section 18(4) Supply of Capital goods on which credit is taken Higher of transaction value or reduced value Section 18(6)