Productivity policy Rupert Harrison Productivity policy RD tax

- Slides: 19

Productivity policy Rupert Harrison

Productivity policy • R&D tax credits • The National Employer Training Programme • The Barker review of land use planning

R&D tax credits • July 2005 consultation • ‘Enhancing the R&D tax credit’ • PBR 2005 • Initial response and administrative changes • Budget 2006 • Further structural enhancements?

R&D tax credits • Largest single policy initiative aimed at increasing private sector innovation • SME tax credit (since 2000): £ 264 m in 2004 -05 • Large companies credit (since 2002): £ 440 m p. a. ? • Both allow companies to deduct more than 100% of current R&D expenditure from taxable profits • SME credit is more generous and includes payable credit for firms with no taxable profits

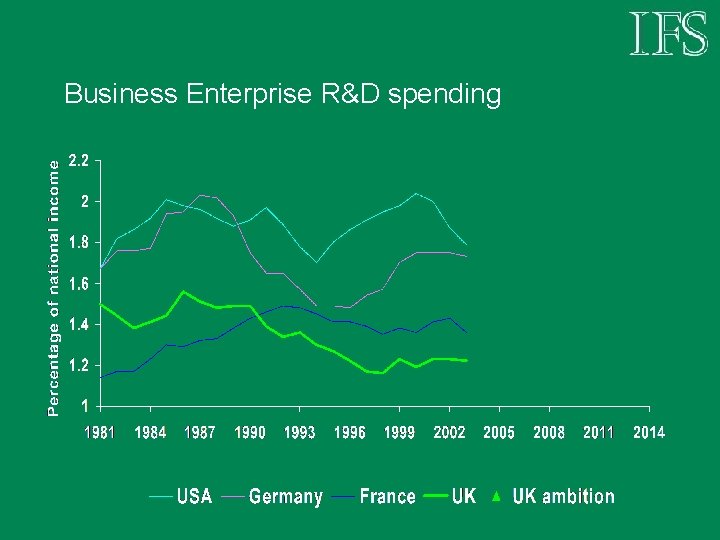

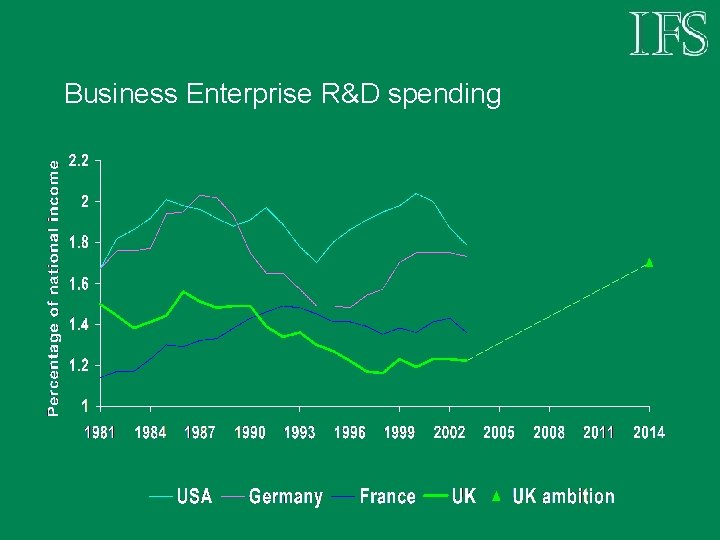

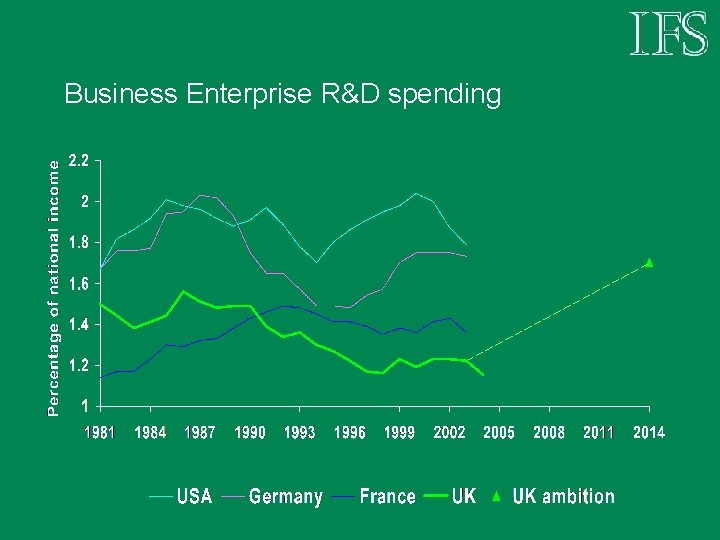

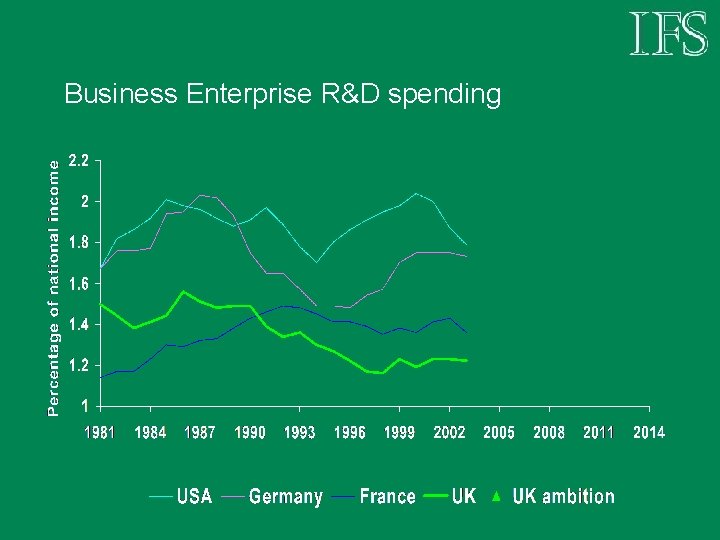

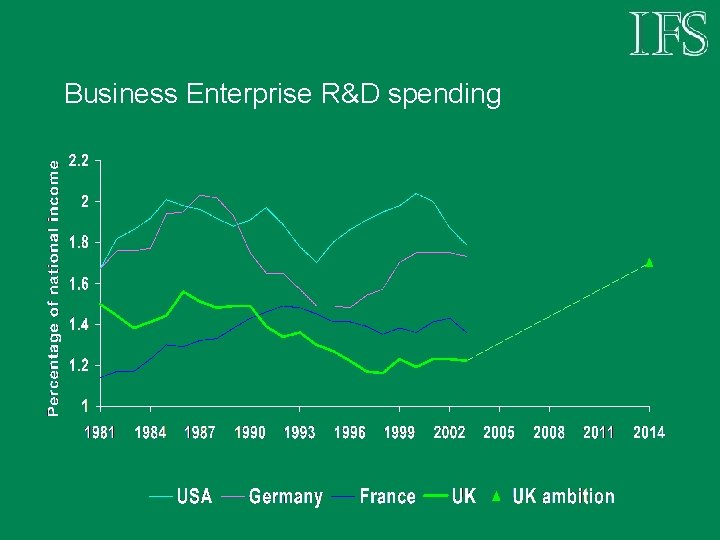

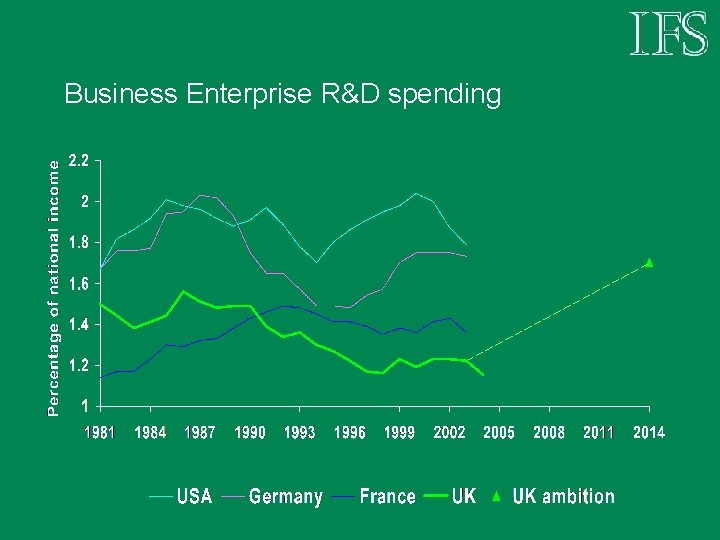

Business Enterprise R&D spending

Business Enterprise R&D spending

Business Enterprise R&D spending

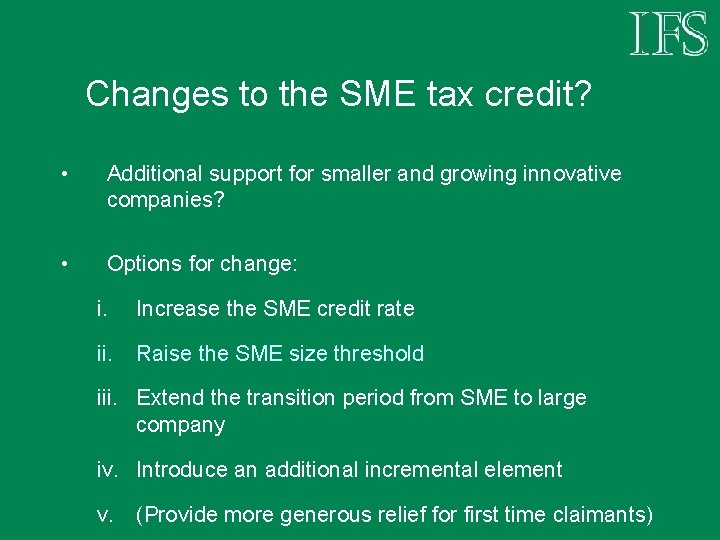

Changes to the SME tax credit? • Additional support for smaller and growing innovative companies? • Options for change: i. Increase the SME credit rate ii. Raise the SME size threshold iii. Extend the transition period from SME to large company iv. Introduce an additional incremental element v. (Provide more generous relief for first time claimants)

Changes to the SME tax credit? • Additional support for smaller and growing innovative companies? • Options for change: i. Increase the SME credit rate ii. Raise the SME size threshold iii. Extend the transition period from SME to large company iv. Introduce an additional incremental element v. (Provide more generous relief for first time claimants)

Changes to the SME tax credit? • Additional support for smaller and growing innovative companies? • Options for change: i. Increase the SME credit rate ii. Raise the SME size threshold iii. Extend the transition period from SME to large company iv. Introduce an additional incremental element v. (Provide more generous relief for first time claimants)

Changes to the SME tax credit? • Additional support for smaller and growing innovative companies? • Options for change: i. Increase the SME credit rate ii. Raise the SME size threshold iii. Extend the transition period from SME to large company iv. Introduce an additional incremental element v. (Provide more generous relief for first time claimants)

Changes to the SME tax credit? • Additional support for smaller and growing innovative companies? • Options for change: i. Increase the SME credit rate ii. Raise the SME size threshold iii. Extend the transition period from SME to large company iv. Introduce an additional incremental element v. (Provide more generous relief for first time claimants)

Changes to the SME tax credit? • Additional support for smaller and growing innovative companies? • Options for change: i. Increase the SME credit rate ii. Raise the SME size threshold iii. Extend the transition period from SME to large company iv. Introduce an additional incremental element v. (Provide more generous relief for first time claimants)

Changes to the SME tax credit? • None of the options is without potential drawbacks • Any change is likely to increase uncertainty and/or complexity • Given the long-term nature of R&D investment decisions, policy stability is particularly desirable • No change may well be the best option

Employer-Provided Training • PBR 2005 confirmed the launch of the National Employer Training Programme (“Train to Gain”) • Training for low-skill employees: • • Free training to basic skill qualification or Level 2 • Paid time off for training during working hours • Employers with <50 employees get wage compensation £ 268 m in 2006 -07 and £ 437 m in 2007 -08

Employer-Provided Training • • Why intervene in employer-provided training? • Transferable skills (if employees unable to pay) • Information failures • Firms (especially small ones) may be credit constrained • Equity considerations But little evidence that Level 2’s lead to higher wages (some evidence for employer-provided)

Employer-Provided Training • Evaluation of first year of Employer Training Pilots • Small positive effect on take-up of training • Proportion of eligible employers providing training increased from around 8% to around 8½% • Suggests 85 -90% ‘deadweight’ and 10 -15% additional • High deadweight possibly to be expected • Only focused on first year effects – participation has increased over time

Employer-Provided Training • • Evidence for effectiveness in improving the UK’s productivity performance is not very strong so far • Some limited evidence of positive returns to Level 2’s • Evaluation of first year of Employer Training Pilots found small effects on take-up of training National roll-out will make it difficult to evaluate the impact of NETP on take-up of training

Conclusions • R&D tax credits may provide value for money, but impact on total R&D is likely to be relatively small • Effectiveness of NETP will depend on both increasing training and returns to that training • The impact of both schemes on productivity is likely to be small compared to: • Overall education and skill levels • The general investment climate • Other factors, e. g. regulation, competition

Images of harrison bergeron

Images of harrison bergeron Direct tax and indirect tax

Direct tax and indirect tax Ralphs annual income is about $32 000

Ralphs annual income is about $32 000 Rupert brooke biography

Rupert brooke biography War poets themes

War poets themes Rupert sodl

Rupert sodl Rupert leitner

Rupert leitner Rupert neudeck gesamtschule

Rupert neudeck gesamtschule Angie rupert

Angie rupert Polyimide

Polyimide Guy leschziner

Guy leschziner Rupert neudeck gesamtschule

Rupert neudeck gesamtschule Rupert gatti

Rupert gatti Rupert neblett

Rupert neblett Raşitik rozary

Raşitik rozary Harrison bergeron questions

Harrison bergeron questions Harrison bergeron questions

Harrison bergeron questions William henry harrison

William henry harrison Summary of harrison bergeron

Summary of harrison bergeron Reuven harrison

Reuven harrison