Production Information Cost and Economic Organization Alchian A

- Slides: 10

Production, Information Cost, and Economic Organization Alchian, A. A. and H. Demsetz (1972), American Economic Review, 62: 777 -795 Prepared by: Enrique, Lihong, John, Jongkuk 1

Motivation Two important problems of a theory of economic organization To explain the conditions that determine whether the gains from specialization and cooperative production can better be obtained within an organization or across market Coase: Cost of using market Alchian and Demsetz (1972): monitoring cost under team production To explain the structure of the organization Existing view: power of fiat, authority, disciplinary action Alchian and Demsetz (1972): ordinary market contracting between any two people 2

Metering Problem The economic organization, through which input owners cooperate, will make better use of their comparative advantages to the extent that it facilitates the payment of rewards in accord with input productivity Two key demands placed on an economic organization Metering input productivity Metering rewards 3

Team Production Team production makes it difficult to meter input productivity and hence induces means of economizing on metering costs Team production will be used if it yields an output enough larger than the sum of separable productions to cover the costs of organizing and disciplining team members Each input owner will have more incentive to shirk when he works as part of a team since costs must be incurred to monitor each other Forms of organizing team production to lower the cost of detecting performance Market competition Specialization in monitoring 4

Theory of Firm Market competition Input owners who are not team members can offer, in return for a smaller share of the team’s rewards, to replace excessively shirking members Limitations of market competition 1) For this competition to be completely effective, new challengers for team membership must know where, and to what extent, shirking is a serious problem But, by definition, the detection of shirking by observing team output is costly for team production 2) In order to secure a place on the team, a new input owner must accept a smaller share of rewards But, his incentive to shirk would still be at least as great as the incentives of the replaced inputs 5

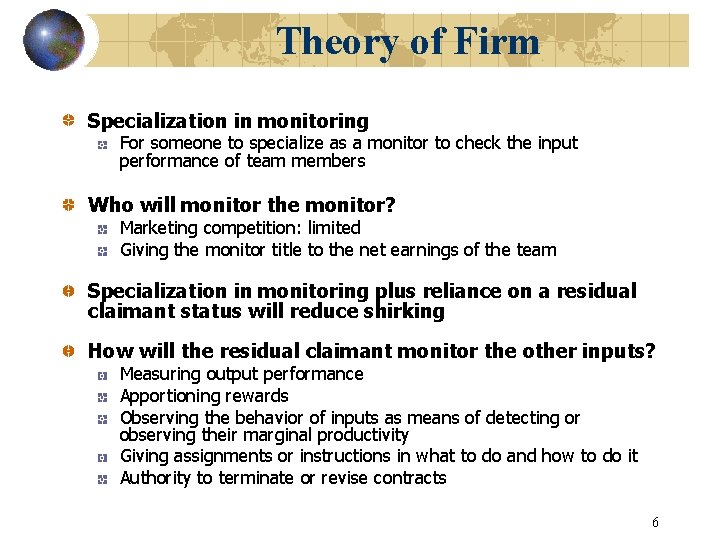

Theory of Firm Specialization in monitoring For someone to specialize as a monitor to check the input performance of team members Who will monitor the monitor? Marketing competition: limited Giving the monitor title to the net earnings of the team Specialization in monitoring plus reliance on a residual claimant status will reduce shirking How will the residual claimant monitor the other inputs? Measuring output performance Apportioning rewards Observing the behavior of inputs as means of detecting or observing their marginal productivity Giving assignments or instructions in what to do and how to do it Authority to terminate or revise contracts 6

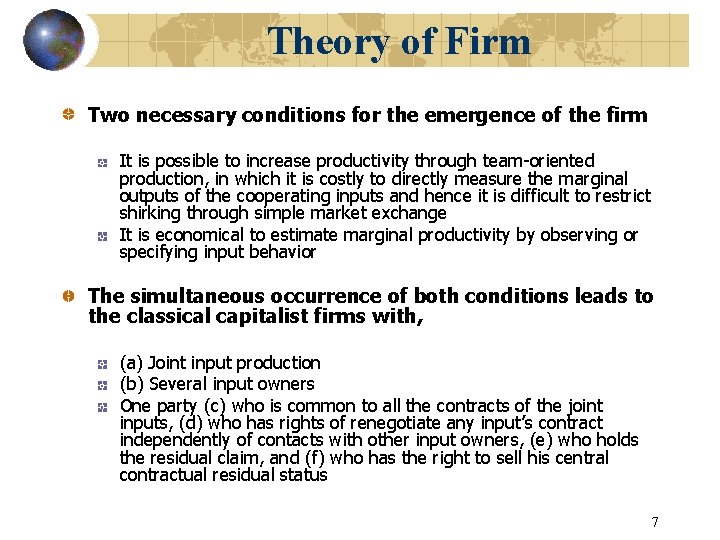

Theory of Firm Two necessary conditions for the emergence of the firm It is possible to increase productivity through team-oriented production, in which it is costly to directly measure the marginal outputs of the cooperating inputs and hence it is difficult to restrict shirking through simple market exchange It is economical to estimate marginal productivity by observing or specifying input behavior The simultaneous occurrence of both conditions leads to the classical capitalist firms with, (a) Joint input production (b) Several input owners One party (c) who is common to all the contracts of the joint inputs, (d) who has rights of renegotiate any input’s contract independently of contacts with other input owners, (e) who holds the residual claim, and (f) who has the right to sell his central contractual residual status 7

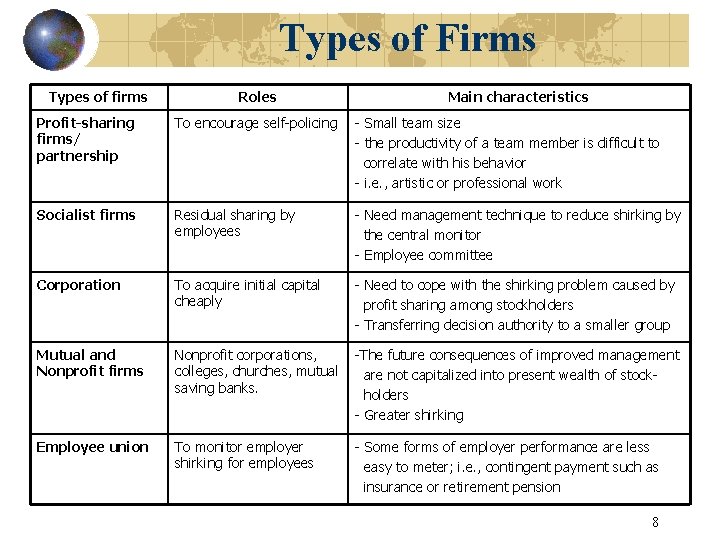

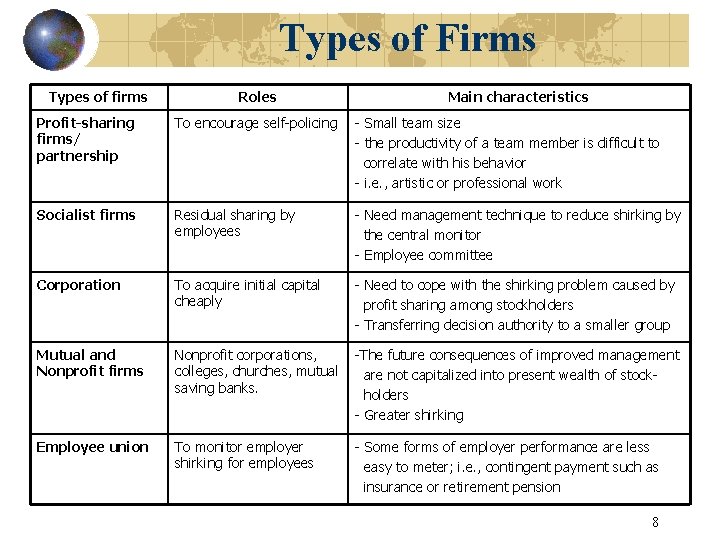

Types of Firms Types of firms Roles Main characteristics Profit-sharing firms/ partnership To encourage self-policing - Small team size - the productivity of a team member is difficult to correlate with his behavior - i. e. , artistic or professional work Socialist firms Residual sharing by employees - Need management technique to reduce shirking by the central monitor - Employee committee Corporation To acquire initial capital cheaply - Need to cope with the shirking problem caused by profit sharing among stockholders - Transferring decision authority to a smaller group Mutual and Nonprofit firms Nonprofit corporations, colleges, churches, mutual saving banks. -The future consequences of improved management are not capitalized into present wealth of stockholders - Greater shirking Employee union To monitor employer shirking for employees - Some forms of employer performance are less easy to meter; i. e. , contingent payment such as insurance or retirement pension 8

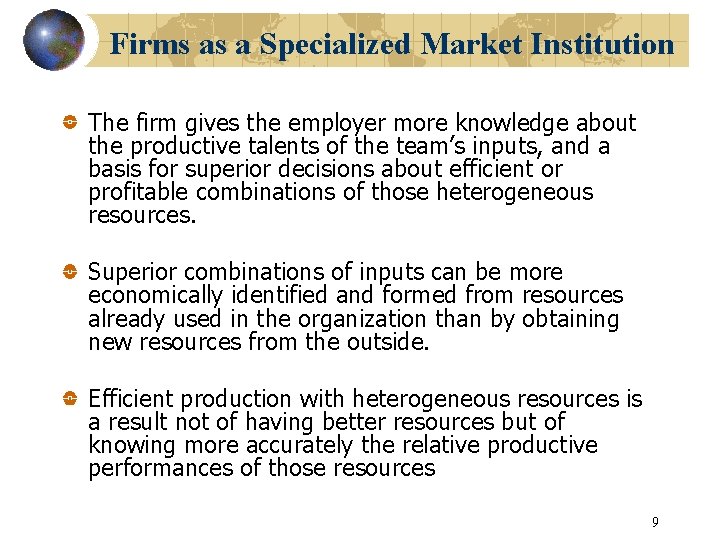

Firms as a Specialized Market Institution The firm gives the employer more knowledge about the productive talents of the team’s inputs, and a basis for superior decisions about efficient or profitable combinations of those heterogeneous resources. Superior combinations of inputs can be more economically identified and formed from resources already used in the organization than by obtaining new resources from the outside. Efficient production with heterogeneous resources is a result not of having better resources but of knowing more accurately the relative productive performances of those resources 9

Conclusions The classical firm is a contractual structure between input owners (employees) and central agent (employer). The contractual structure arises as a means of enhancing efficient organization of team production. As a consequence of the flow of information to the central agent, the firm takes on the characteristic of an efficient market in that information about the productive characteristics of a large set of specific inputs is now more cheaply available. Inputs compete with each other within and via a firm rather than solely across markets as conventionally conceived. The firm is a device for enhancing competition among sets of input resources as well as a device for more efficiently rewarding the inputs. The firm can be considered a privately owned market; if so, we could consider the firm and the ordinary market as competing types of markets. 10

Production, information costs, and economic organization

Production, information costs, and economic organization Production information costs and economic organization

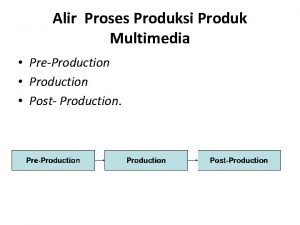

Production information costs and economic organization Diagram alir proses produksi

Diagram alir proses produksi Prof. meier and baldwin

Prof. meier and baldwin Cost and production analysis

Cost and production analysis Theory of production cost

Theory of production cost Production analysis

Production analysis Point by point compare and contrast

Point by point compare and contrast Economic growth vs economic development

Economic growth vs economic development Lesson 2 our economic choices

Lesson 2 our economic choices Economic region of production diagram

Economic region of production diagram