Process Costing Chapter 4 Power Point Authors Susan

- Slides: 83

Process Costing Chapter 4 Power. Point Authors: Susan Coomer Galbreath, Ph. D. , CPA Charles W. Caldwell, D. B. A. , CMA Jon A. Booker, Ph. D. , CPA, CIA Cynthia J. Rooney, Ph. D. , CPA Copyright © 2015 Mc. Graw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of Mc. Graw-Hill Education.

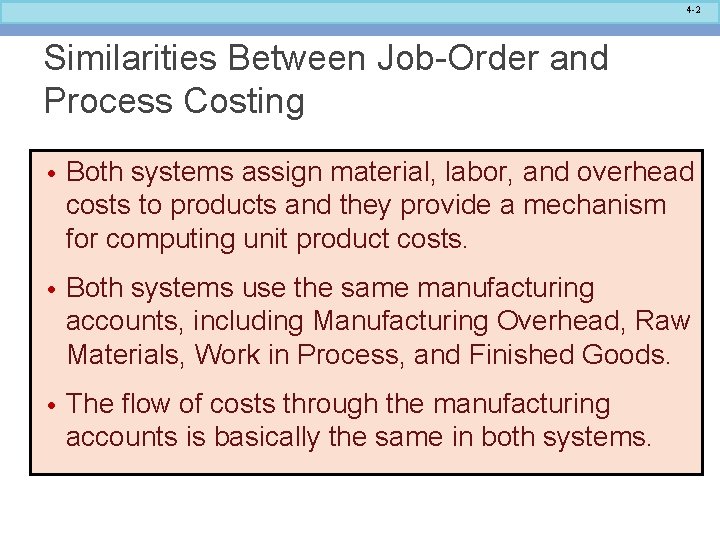

4 -2 Similarities Between Job-Order and Process Costing • Both systems assign material, labor, and overhead costs to products and they provide a mechanism for computing unit product costs. • Both systems use the same manufacturing accounts, including Manufacturing Overhead, Raw Materials, Work in Process, and Finished Goods. • The flow of costs through the manufacturing accounts is basically the same in both systems.

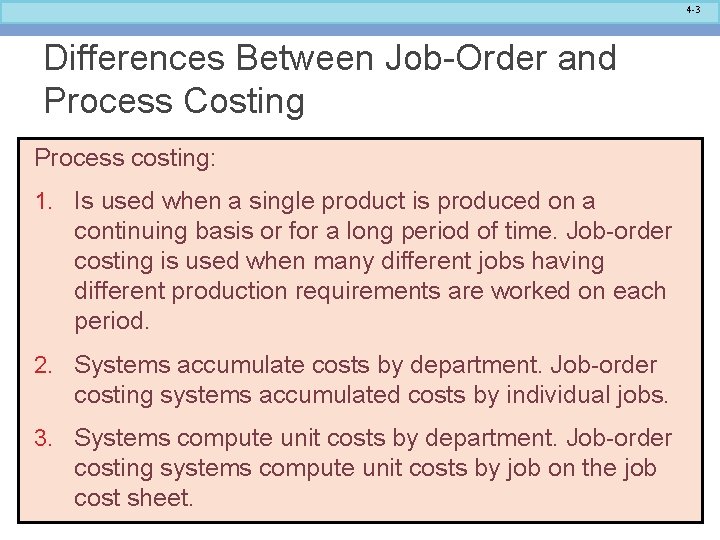

4 -3 Differences Between Job-Order and Process Costing Process costing: 1. Is used when a single product is produced on a continuing basis or for a long period of time. Job-order costing is used when many different jobs having different production requirements are worked on each period. 2. Systems accumulate costs by department. Job-order costing systems accumulated costs by individual jobs. 3. Systems compute unit costs by department. Job-order costing systems compute unit costs by job on the job cost sheet.

4 -4 Quick Check Process costing is used for products that are: a. Different and produced continuously. b. Similar and produced continuously. c. Individual units produced to customer specifications. d. Purchased from vendors.

4 -5 Quick Check Process costing is used for products that are: a. Different and produced continuously. b. Similar and produced continuously. c. Individual units produced to customer specifications. d. Purchased from vendors.

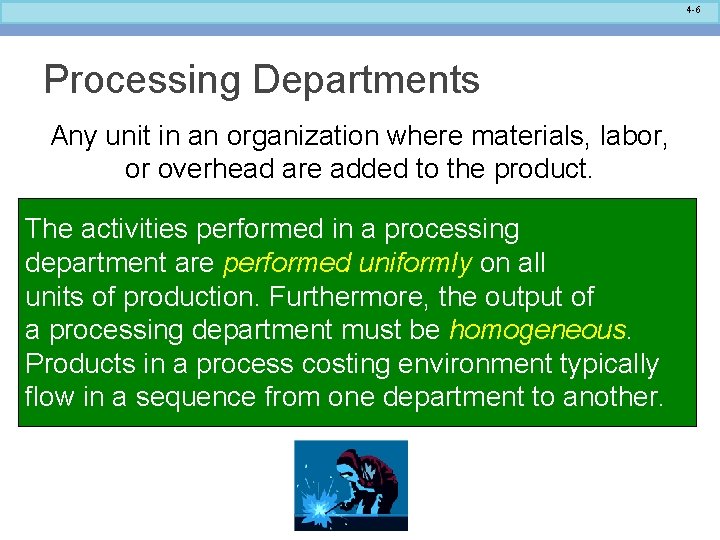

4 -6 Processing Departments Any unit in an organization where materials, labor, or overhead are added to the product. The activities performed in a processing department are performed uniformly on all units of production. Furthermore, the output of a processing department must be homogeneous. Products in a process costing environment typically flow in a sequence from one department to another.

4 -7 Learning Objective 1 Record the flow of materials, labor, and overhead through a process costing system.

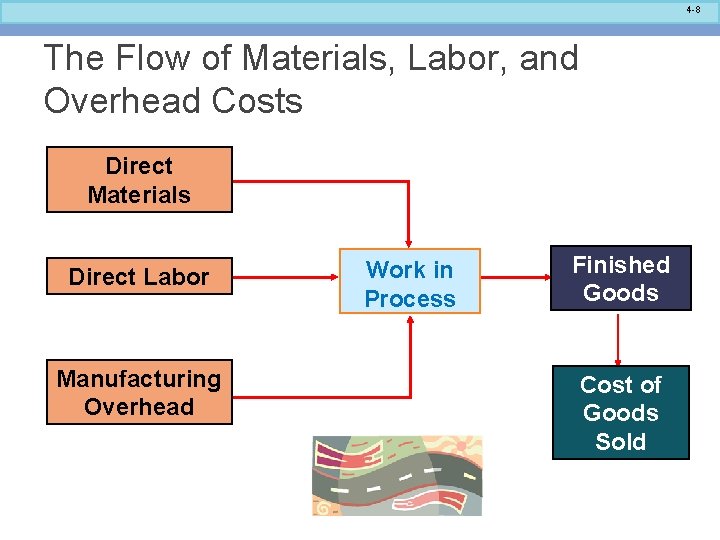

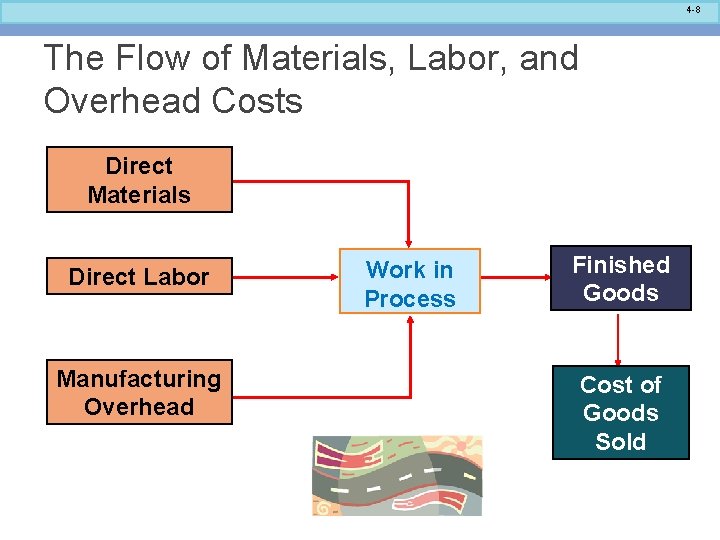

4 -8 The Flow of Materials, Labor, and Overhead Costs Direct Materials Direct Labor Manufacturing Overhead Work in Process Finished Goods Cost of Goods Sold

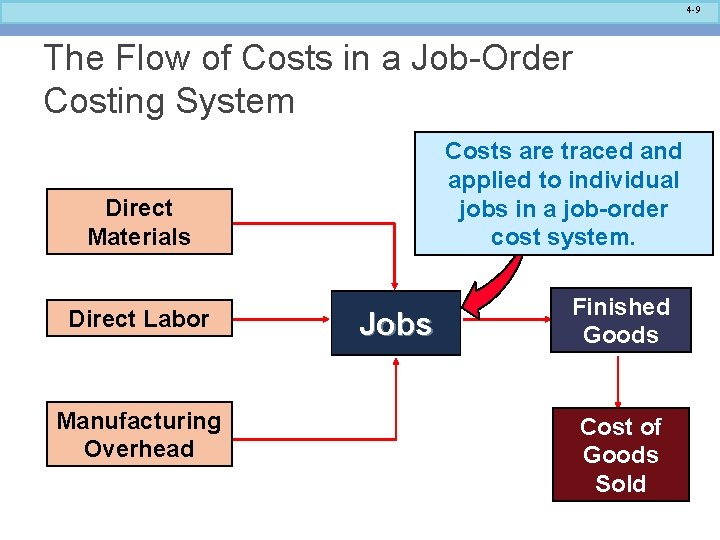

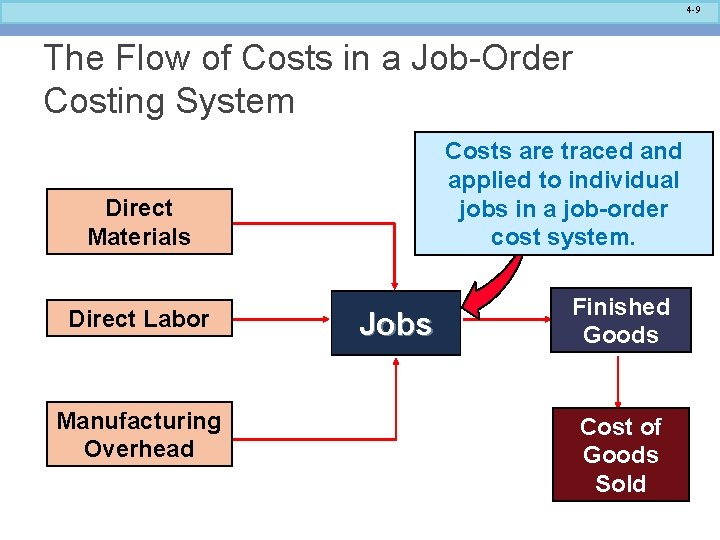

4 -9 The Flow of Costs in a Job-Order Costing System Costs are traced and applied to individual jobs in a job-order cost system. Direct Materials Direct Labor Manufacturing Overhead Jobs Finished Goods Cost of Goods Sold

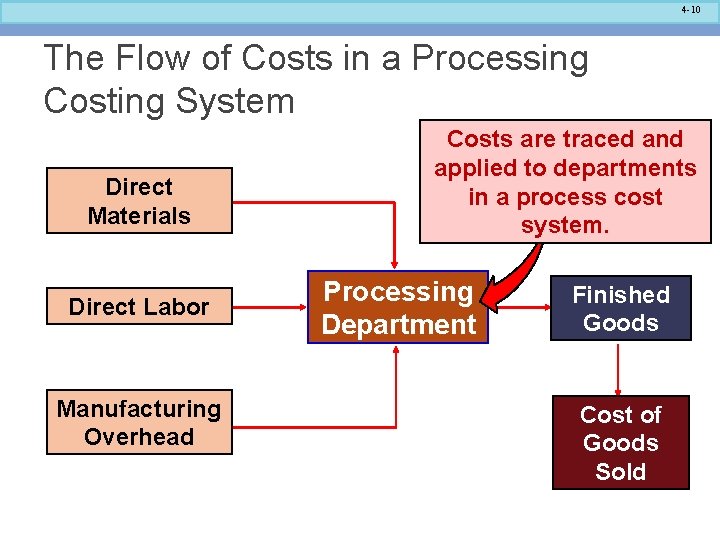

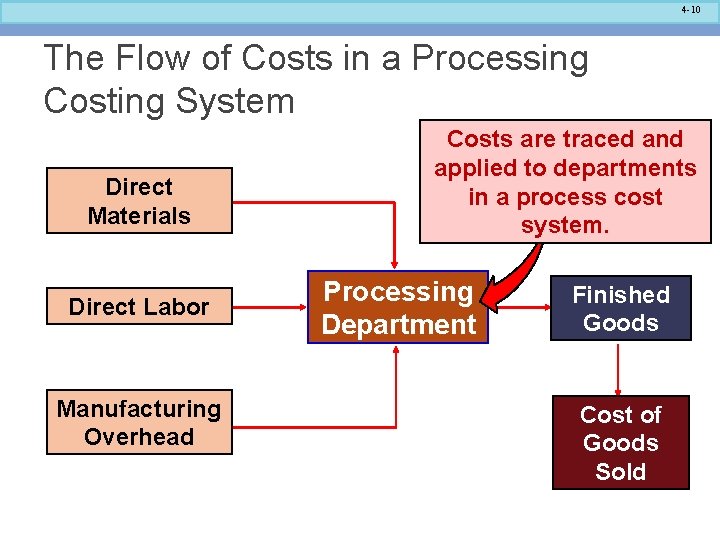

4 -10 The Flow of Costs in a Processing Costing System Direct Materials Direct Labor Manufacturing Overhead Costs are traced and applied to departments in a process cost system. Processing Department Finished Goods Cost of Goods Sold

4 -11 T-Account and Journal Entry Views of Process Cost Flows For purposes of this example, assume there are two processing departments – Departments A and B. We will use T-accounts and journal entries.

4 -12 Process Cost Flows: The Flow of Raw Materials (in T-account form) Raw Materials • Direct Materials Work in Process Department A • Direct Materials Work in Process Department B • Direct Materials

4 -13 Process Cost Flows: The Flow of Raw Materials (in journal entry form)

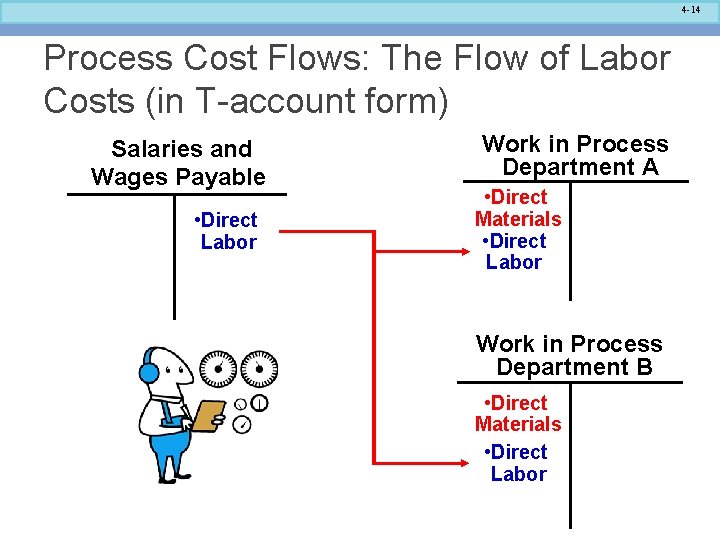

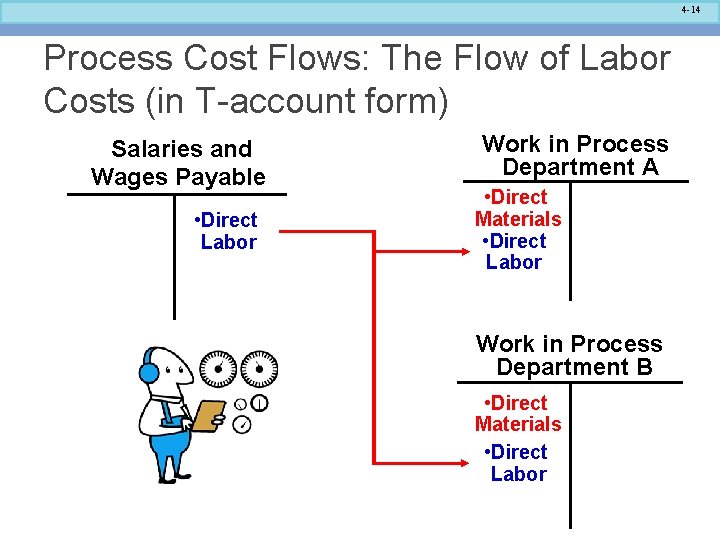

4 -14 Process Cost Flows: The Flow of Labor Costs (in T-account form) Salaries and Wages Payable • Direct Labor Work in Process Department A • Direct Materials • Direct Labor Work in Process Department B • Direct Materials • Direct Labor

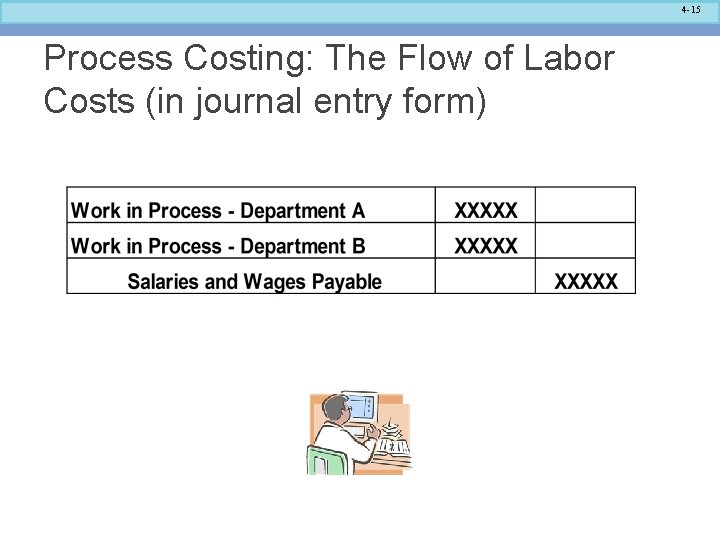

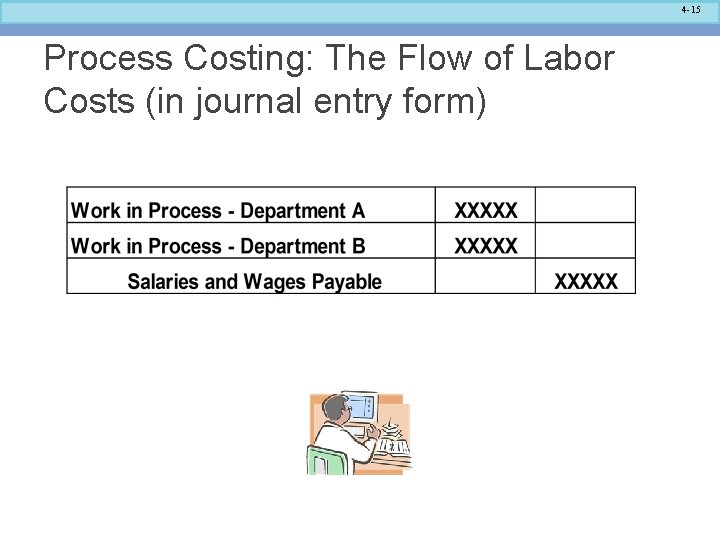

4 -15 Process Costing: The Flow of Labor Costs (in journal entry form)

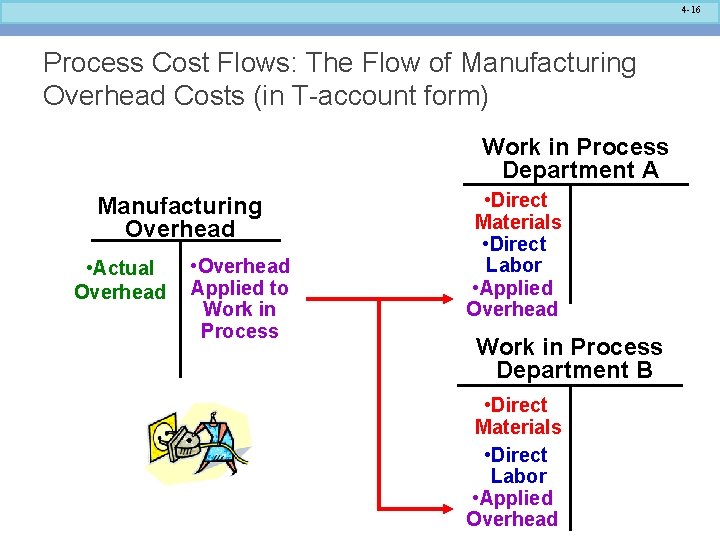

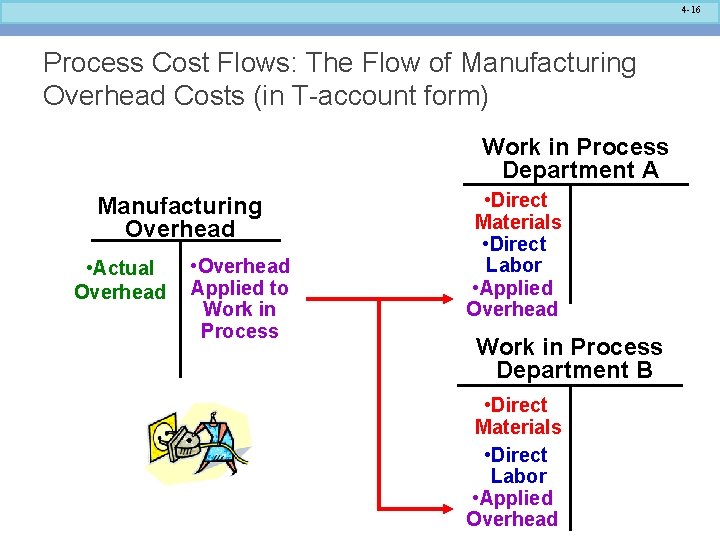

4 -16 Process Cost Flows: The Flow of Manufacturing Overhead Costs (in T-account form) Work in Process Department A Manufacturing Overhead • Actual Overhead • Overhead Applied to Work in Process • Direct Materials • Direct Labor • Applied Overhead Work in Process Department B • Direct Materials • Direct Labor • Applied Overhead

4 -17 Process Cost Flows: The Flow of Manufacturing Overhead Costs (in journal entry form)

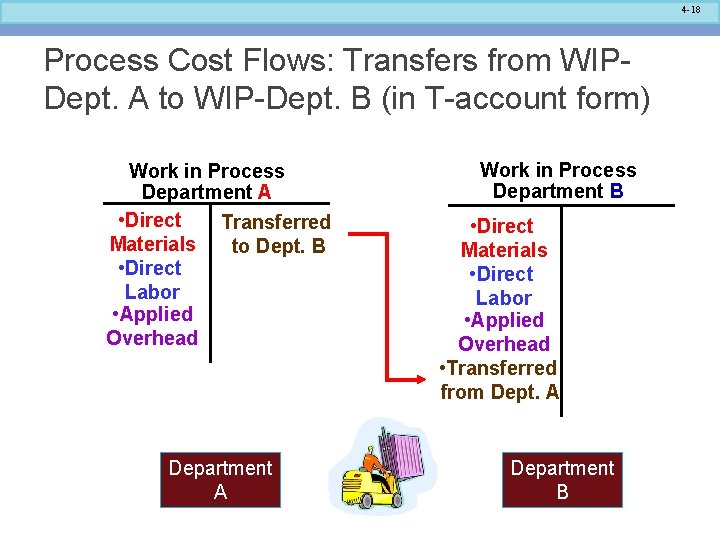

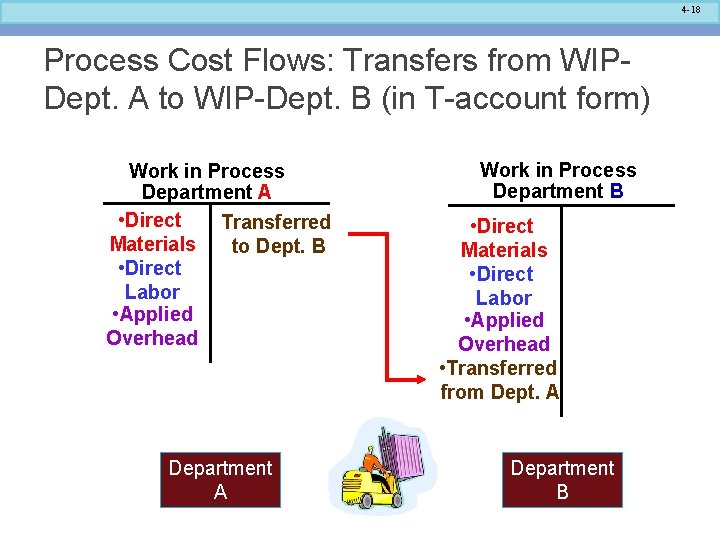

4 -18 Process Cost Flows: Transfers from WIPDept. A to WIP-Dept. B (in T-account form) Work in Process Department A • Direct Transferred Materials to Dept. B • Direct Labor • Applied Overhead Department A Work in Process Department B • Direct Materials • Direct Labor • Applied Overhead • Transferred from Dept. A Department B

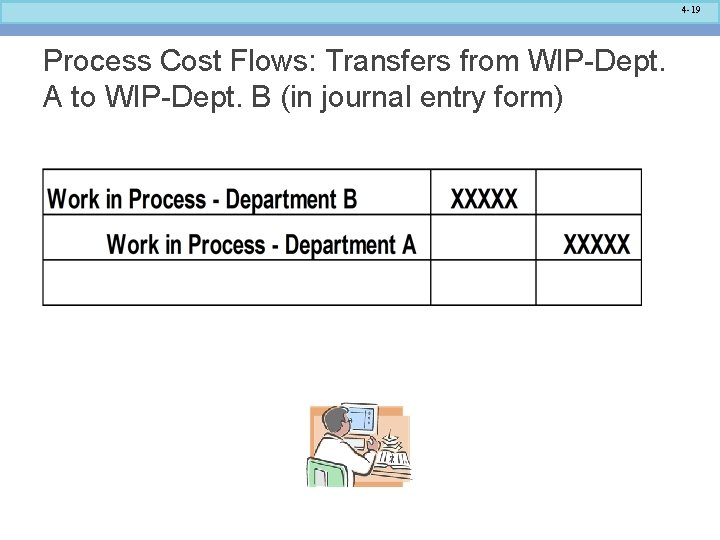

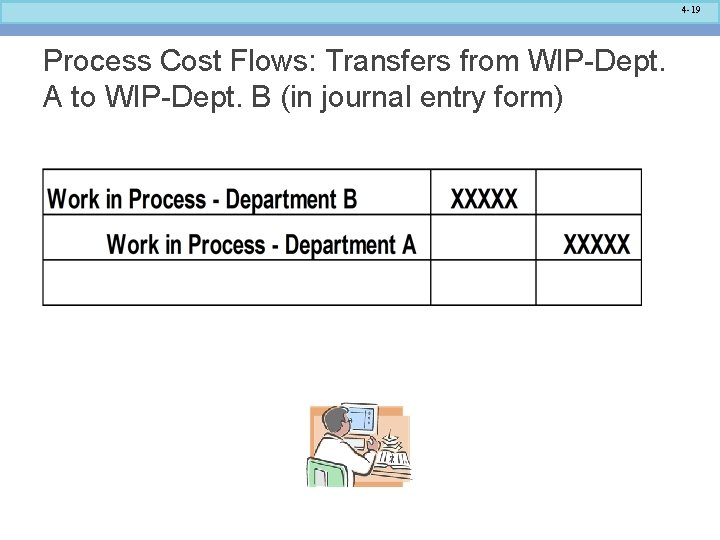

4 -19 Process Cost Flows: Transfers from WIP-Dept. A to WIP-Dept. B (in journal entry form)

4 -20 Process Cost Flows: Transfers from WIP-Dept. B to Finished Goods (in T-account form) Work in Process Department B • Direct • Cost of Materials Goods • Direct Manufactured Labor • Applied Overhead • Transferred from Dept. A Finished Goods • Cost of Goods Manufactured

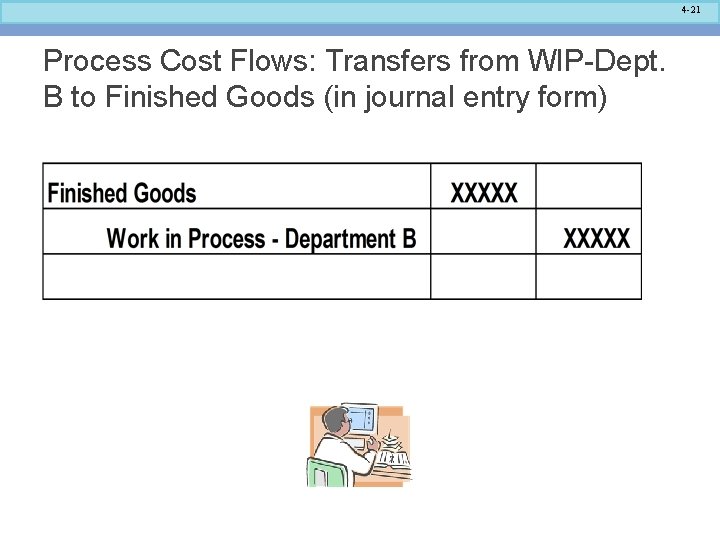

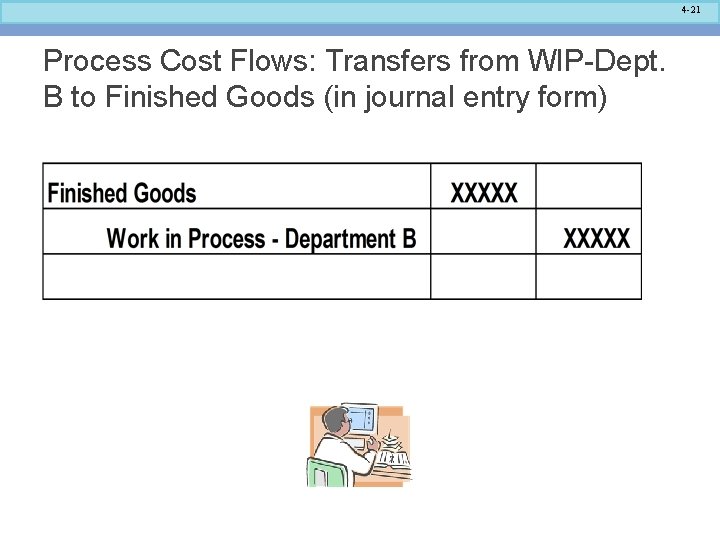

4 -21 Process Cost Flows: Transfers from WIP-Dept. B to Finished Goods (in journal entry form)

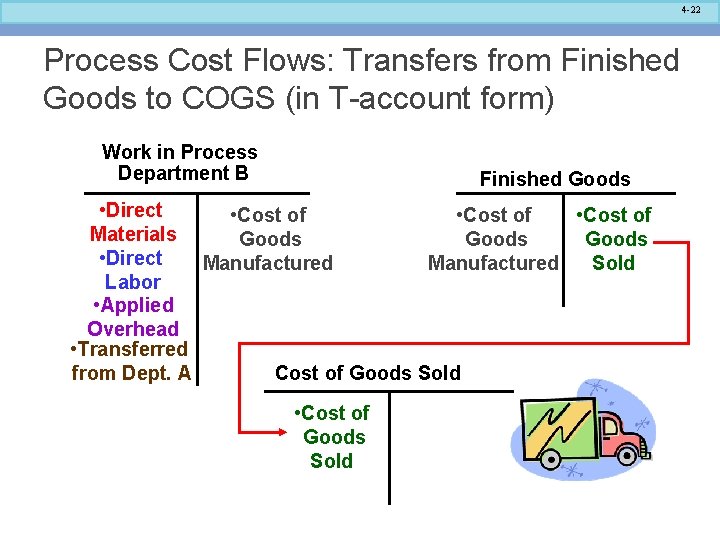

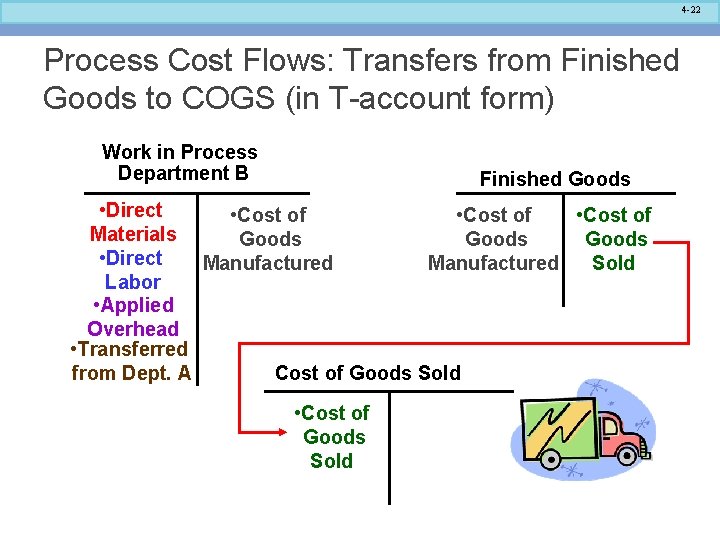

4 -22 Process Cost Flows: Transfers from Finished Goods to COGS (in T-account form) Work in Process Department B Finished Goods • Direct • Cost of Materials Goods • Direct Manufactured Sold Labor • Applied Overhead • Transferred Cost of Goods Sold from Dept. A • Cost of Goods Sold

4 -23 Process Cost Flows: Transfers from Finished Goods to COGS (in journal entry form)

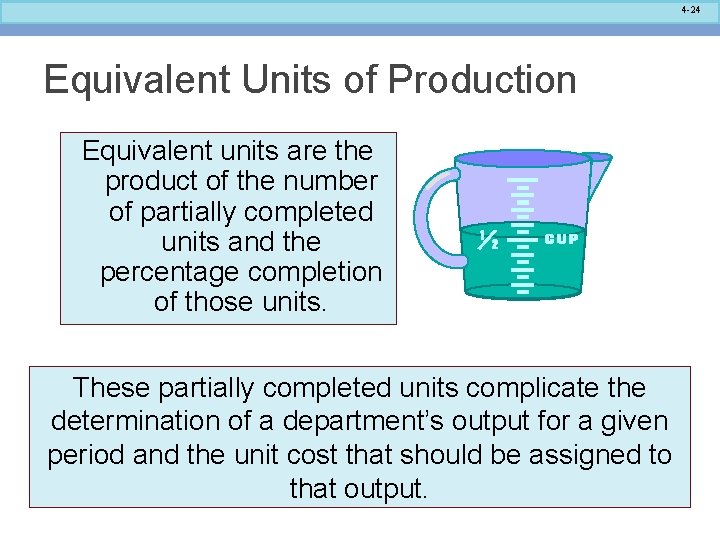

4 -24 Equivalent Units of Production Equivalent units are the product of the number of partially completed units and the percentage completion of those units. These partially completed units complicate the determination of a department’s output for a given period and the unit cost that should be assigned to that output.

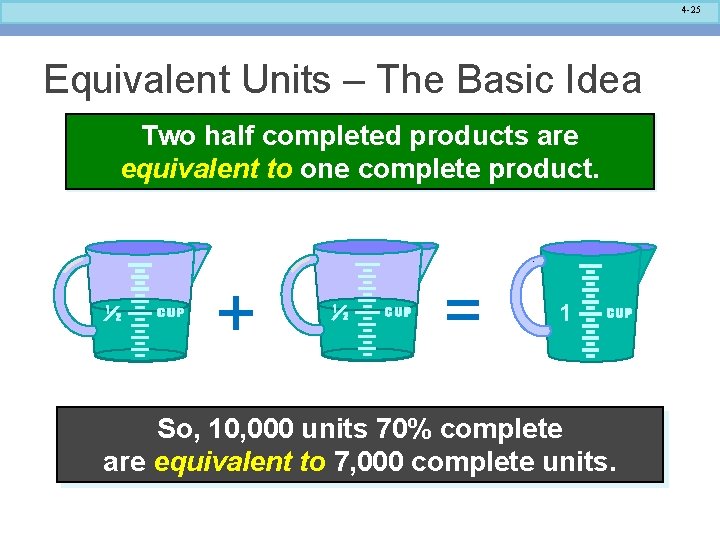

4 -25 Equivalent Units – The Basic Idea Two half completed products are equivalent to one complete product. + = 1 So, 10, 000 units 70% complete are equivalent to 7, 000 complete units.

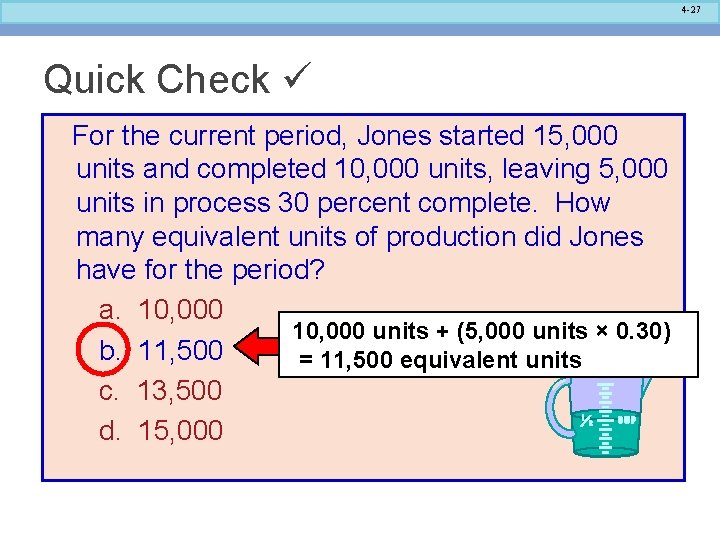

4 -26 Quick Check For the current period, Jones started 15, 000 units and completed 10, 000 units, leaving 5, 000 units in process 30 percent complete. How many equivalent units of production did Jones have for the period? a. 10, 000 b. 11, 500 c. 13, 500 d. 15, 000

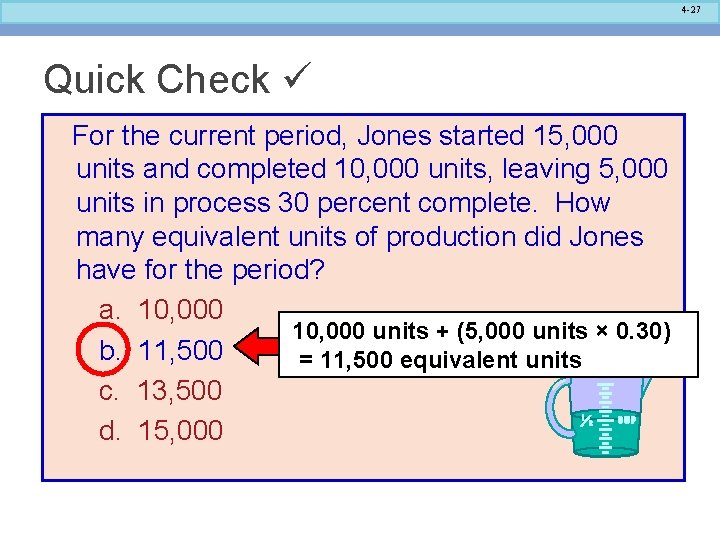

4 -27 Quick Check For the current period, Jones started 15, 000 units and completed 10, 000 units, leaving 5, 000 units in process 30 percent complete. How many equivalent units of production did Jones have for the period? a. 10, 000 units + (5, 000 units × 0. 30) b. 11, 500 = 11, 500 equivalent units c. 13, 500 d. 15, 000

4 -28 Calculating Equivalent Units Equivalent units can be calculated two ways: The First-In, First-Out Method – FIFO is covered in the appendix to this chapter. The Weighted-Average Method – This method will be covered in the main portion of the chapter.

4 -29 Learning Objective 2 Compute the equivalent units of production using the weightedaverage method.

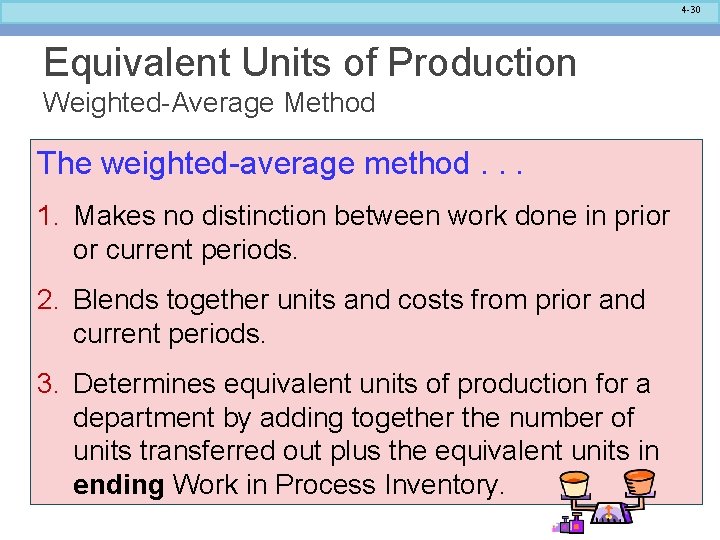

4 -30 Equivalent Units of Production Weighted-Average Method The weighted-average method. . . 1. Makes no distinction between work done in prior or current periods. 2. Blends together units and costs from prior and current periods. 3. Determines equivalent units of production for a department by adding together the number of units transferred out plus the equivalent units in ending Work in Process Inventory.

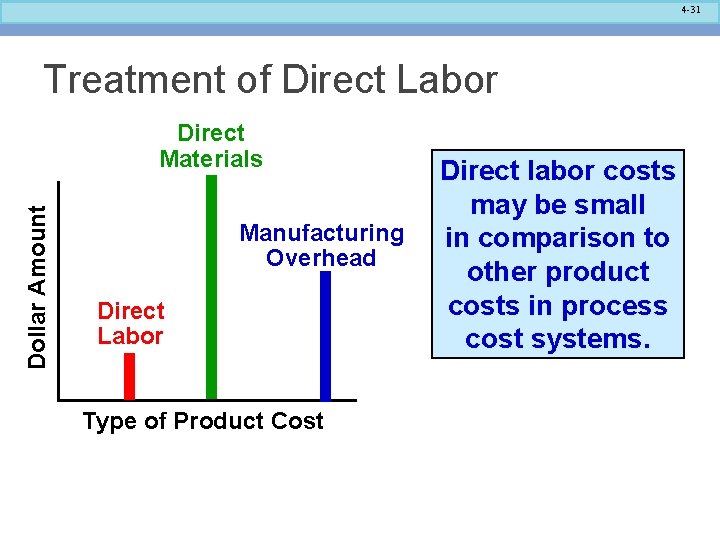

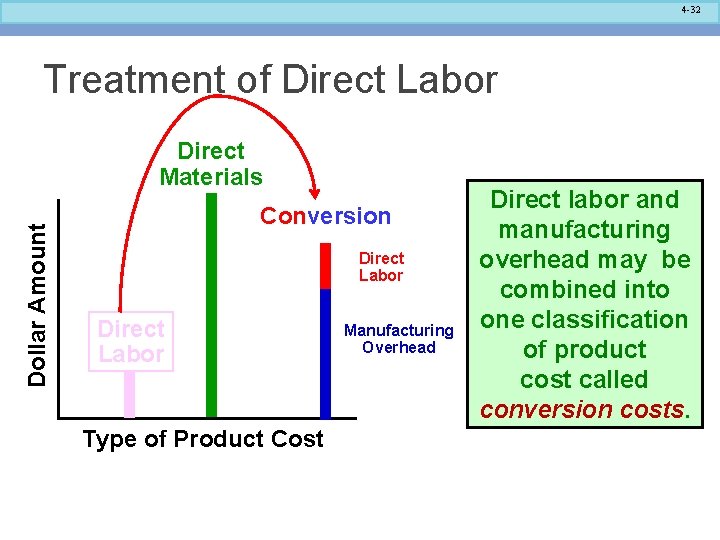

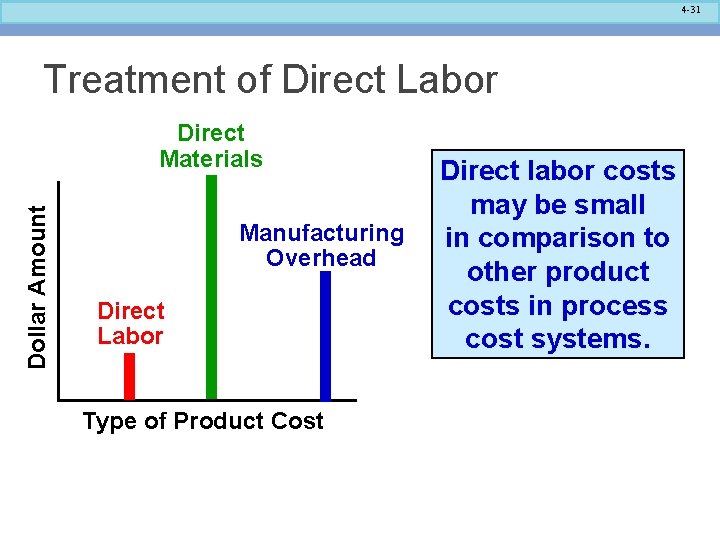

4 -31 Treatment of Direct Labor Dollar Amount Direct Materials Manufacturing Overhead Direct Labor Type of Product Cost Direct labor costs may be small in comparison to other product costs in process cost systems.

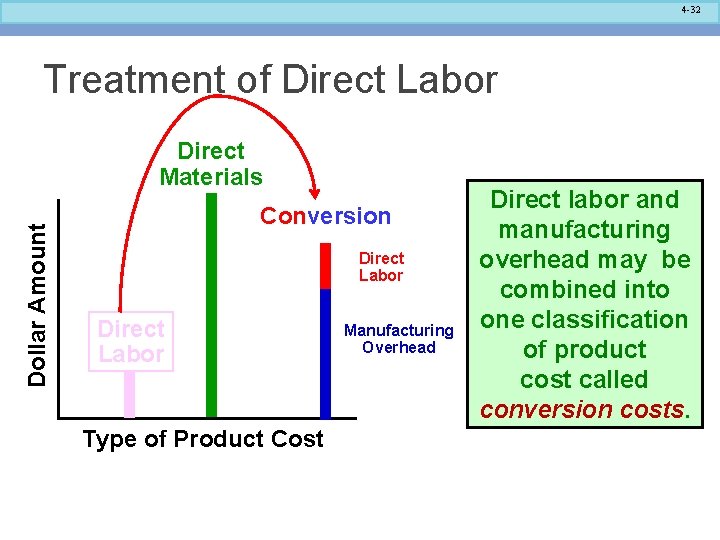

4 -32 Treatment of Direct Labor Dollar Amount Direct Materials Conversion Direct Labor Type of Product Cost Manufacturing Overhead Direct labor and manufacturing overhead may be combined into one classification of product cost called conversion costs.

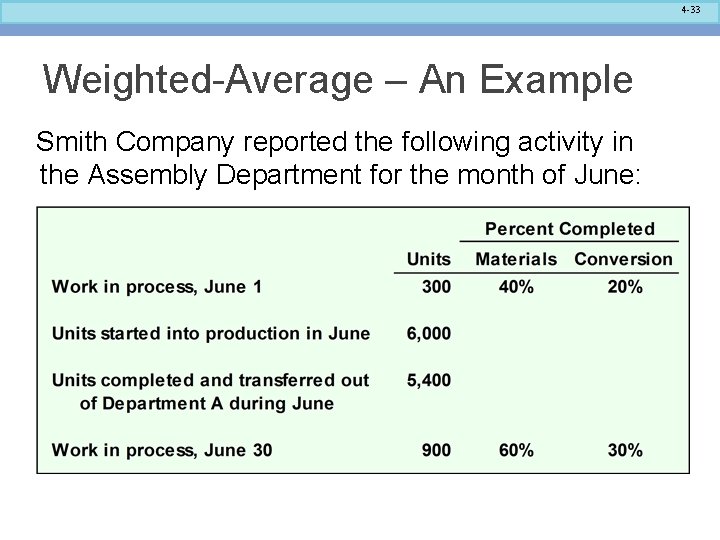

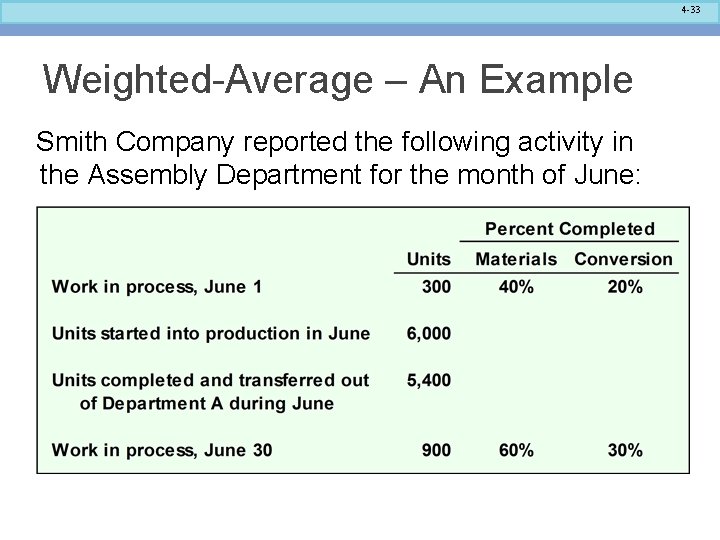

4 -33 Weighted-Average – An Example Smith Company reported the following activity in the Assembly Department for the month of June:

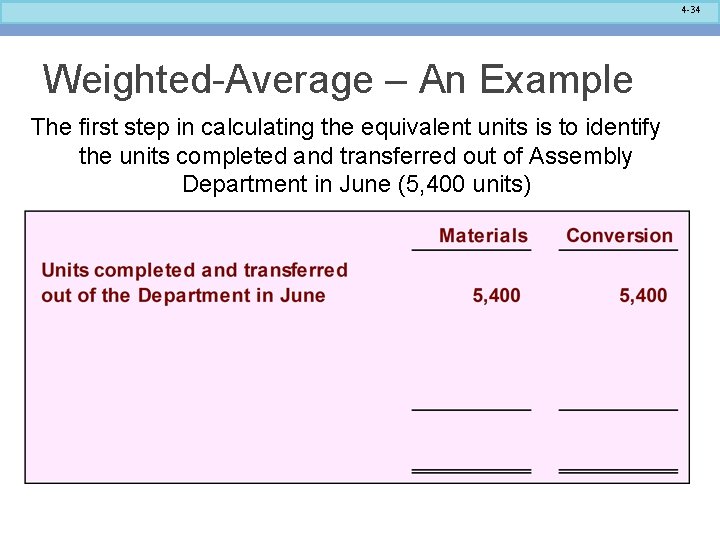

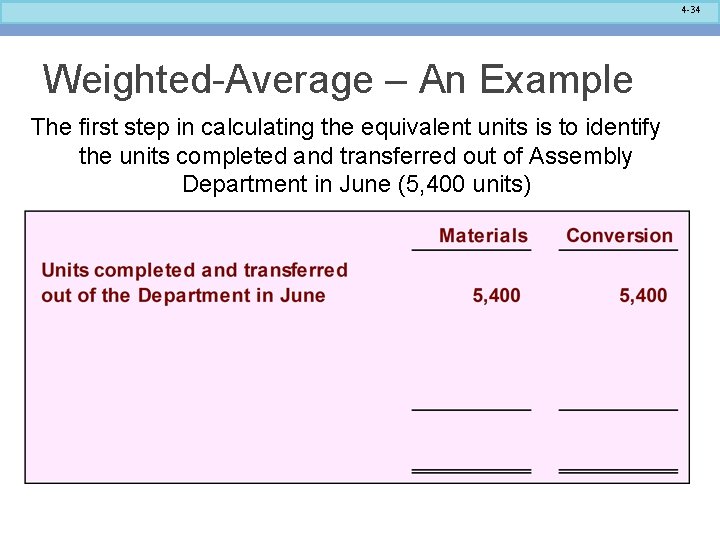

4 -34 Weighted-Average – An Example The first step in calculating the equivalent units is to identify the units completed and transferred out of Assembly Department in June (5, 400 units)

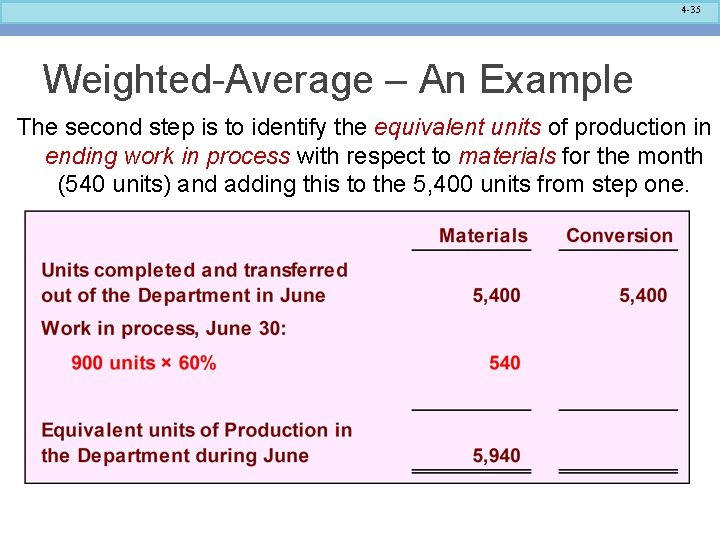

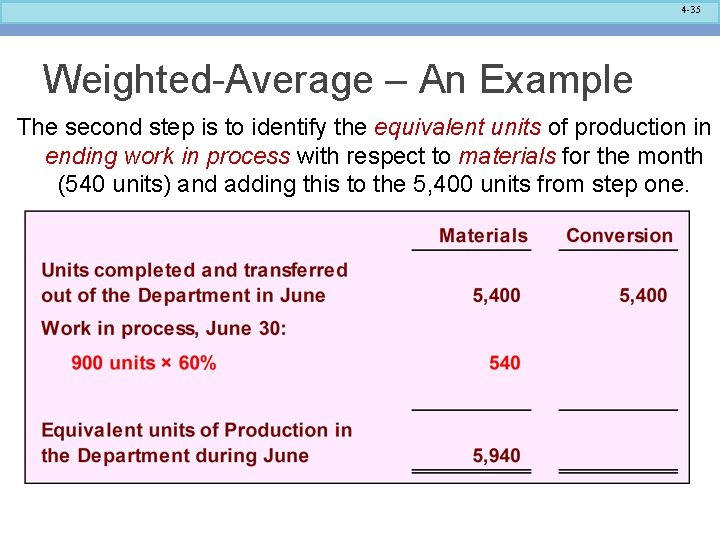

4 -35 Weighted-Average – An Example The second step is to identify the equivalent units of production in ending work in process with respect to materials for the month (540 units) and adding this to the 5, 400 units from step one.

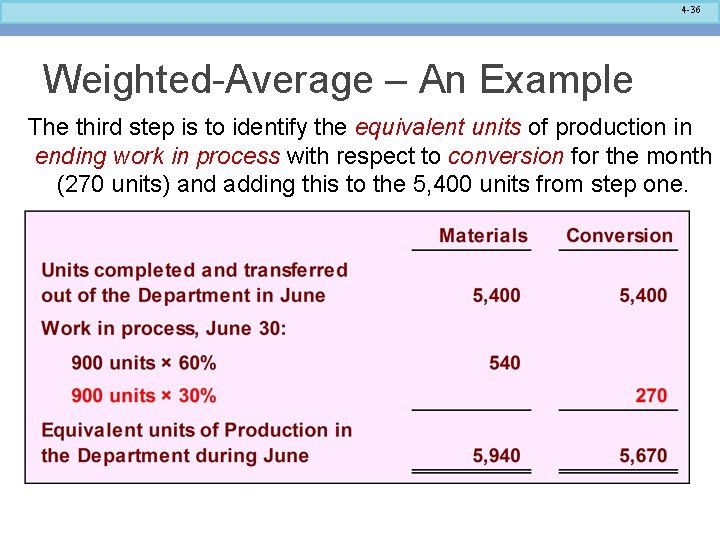

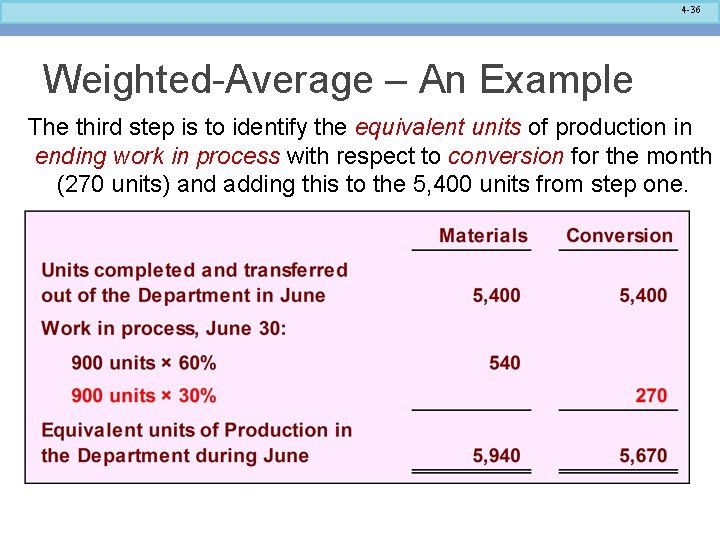

4 -36 Weighted-Average – An Example The third step is to identify the equivalent units of production in ending work in process with respect to conversion for the month (270 units) and adding this to the 5, 400 units from step one.

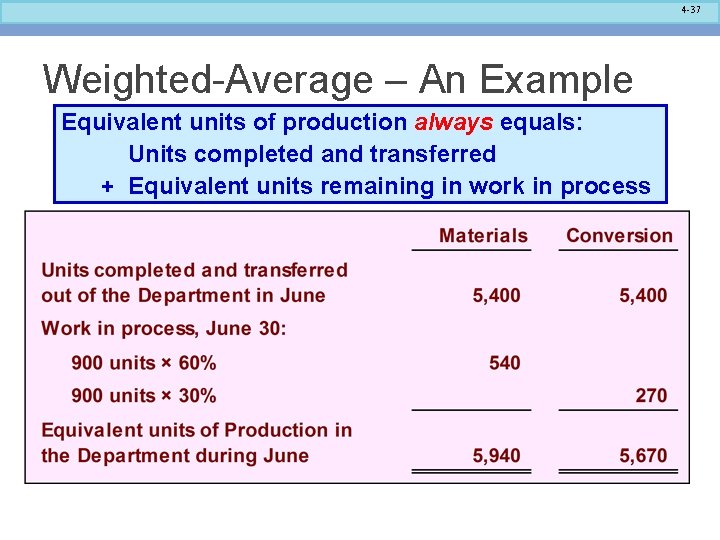

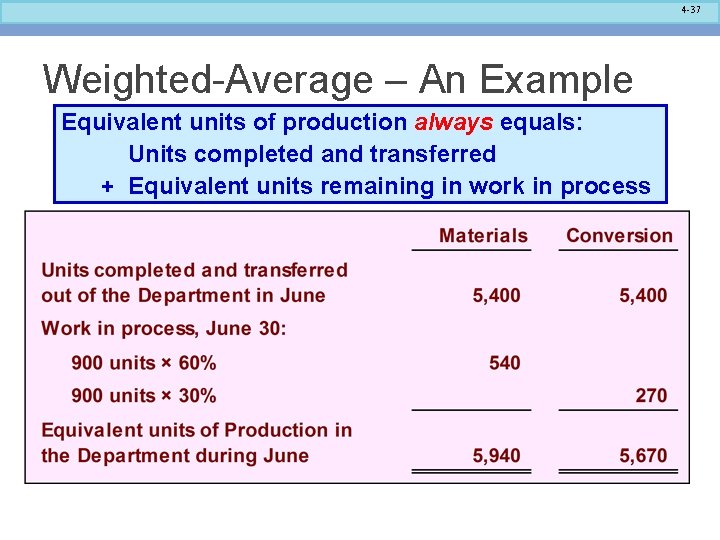

4 -37 Weighted-Average – An Example Equivalent units of production always equals: Units completed and transferred + Equivalent units remaining in work in process

4 -38 Weighted-Average – An Example Materials Beginning Work in Process 300 Units 40% Complete 6, 000 Units Started 5, 100 Units Started and Completed 5, 400 Units Completed 540 Equivalent Units 5, 940 Equivalent units of production Ending Work in Process 900 Units 60% Complete 900 × 60%

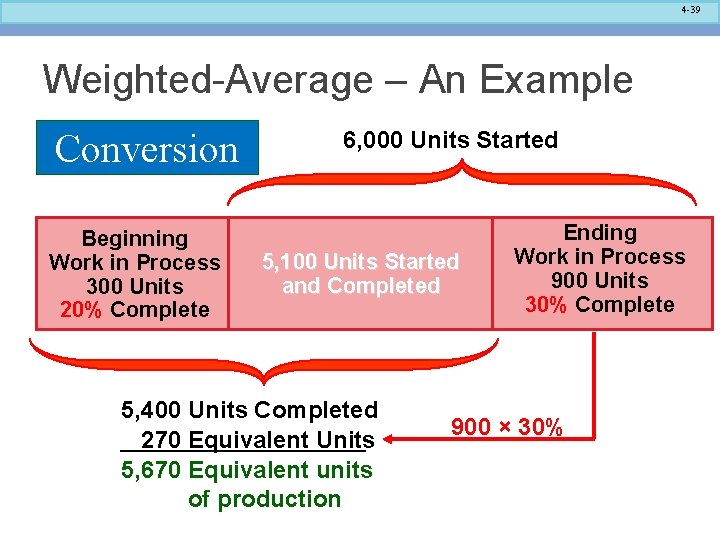

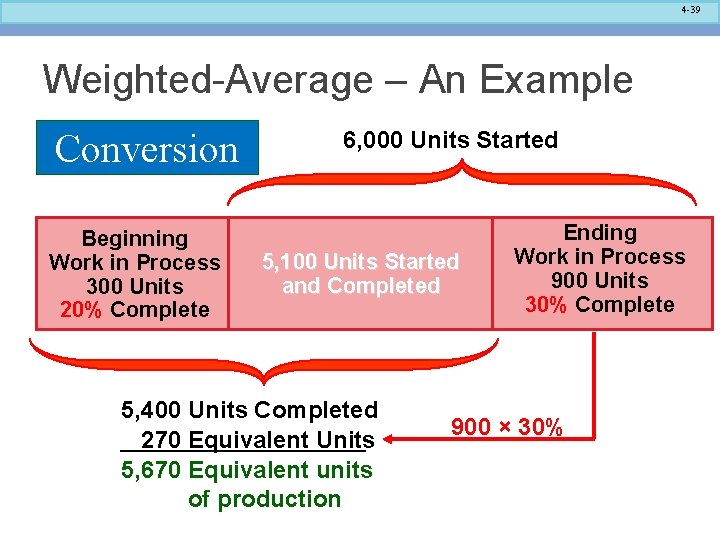

4 -39 Weighted-Average – An Example Conversion Beginning Work in Process 300 Units 20% Complete 6, 000 Units Started 5, 100 Units Started and Completed 5, 400 Units Completed 270 Equivalent Units 5, 670 Equivalent units of production Ending Work in Process 900 Units 30% Complete 900 × 30%

4 -40 Learning Objective 3 Compute the cost per equivalent unit using the weighted-average method.

4 -41 Compute and Apply Costs Beginning Work in Process Inventory: 400 units Materials: 40% complete $ 6, 119 Conversion: 20% complete $ 3, 920 Production started during June Production completed during June Costs added to production in June Materials cost Conversion cost Ending Work in Process Inventory: Materials: 60% complete Conversion: 30% complete 6, 000 units 5, 400 units $ 118, 621 $ 81, 130 900 units

4 -42 Compute and Apply Costs The formula for computing the cost per equivalent unit is: Cost per equivalent = unit Cost of beginning Work in Process + Cost added during Inventory the period Equivalent units of production

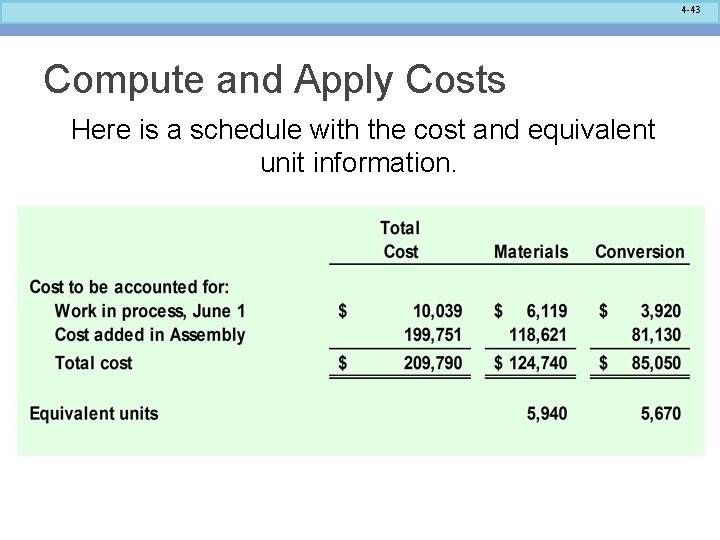

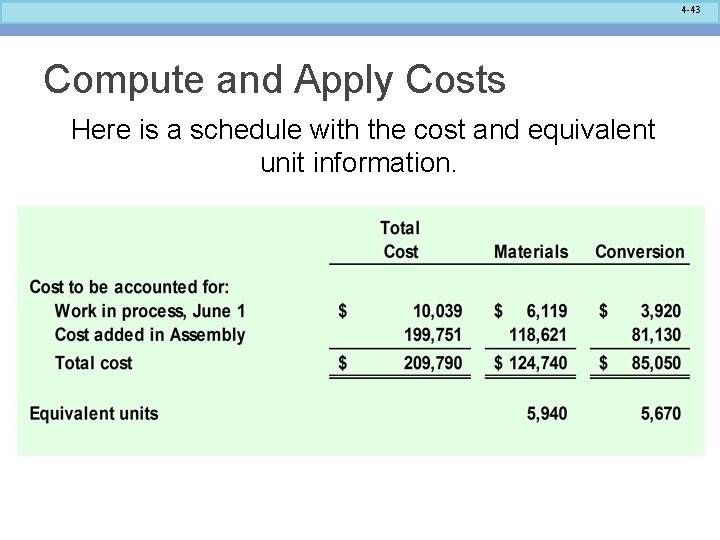

4 -43 Compute and Apply Costs Here is a schedule with the cost and equivalent unit information.

4 -44 Compute and Apply Costs Here is a schedule with the cost and equivalent unit information. $124, 740 ÷ 5, 940 units = $21. 00 $85, 050 ÷ 5, 670 units = $15. 00 Cost per equivalent unit = $21. 00 + $15. 00 = $36. 00

4 -45 Learning Objective 4 Assign costs to units using the weightedaverage method.

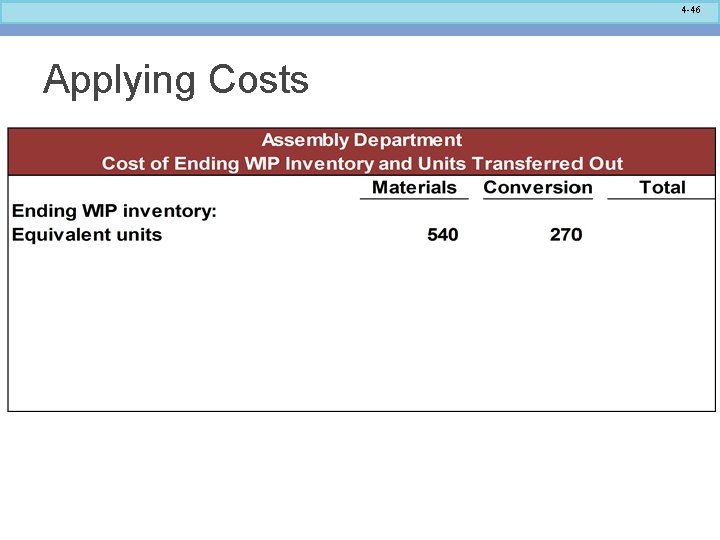

4 -46 Applying Costs

4 -47 Applying Costs

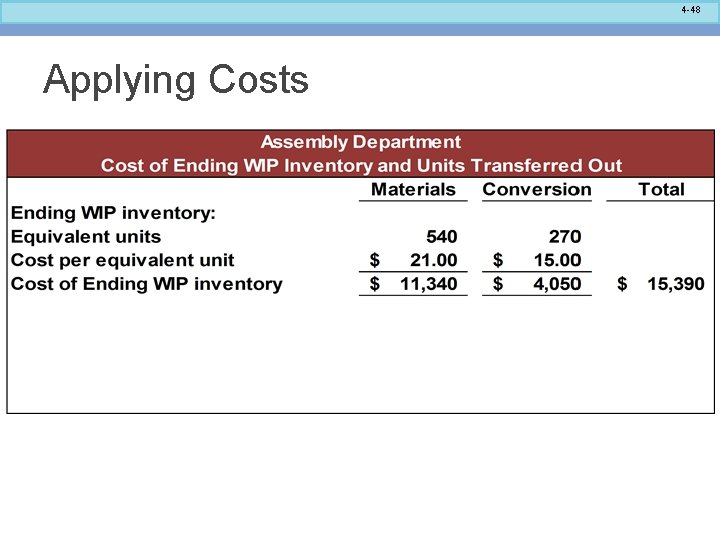

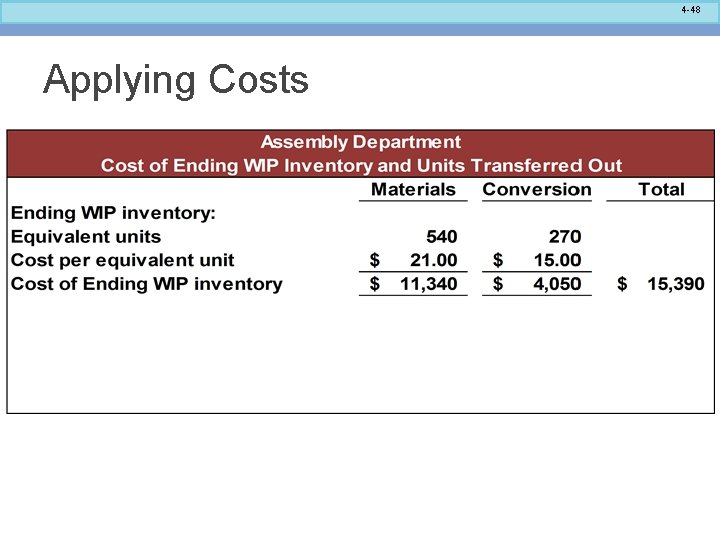

4 -48 Applying Costs

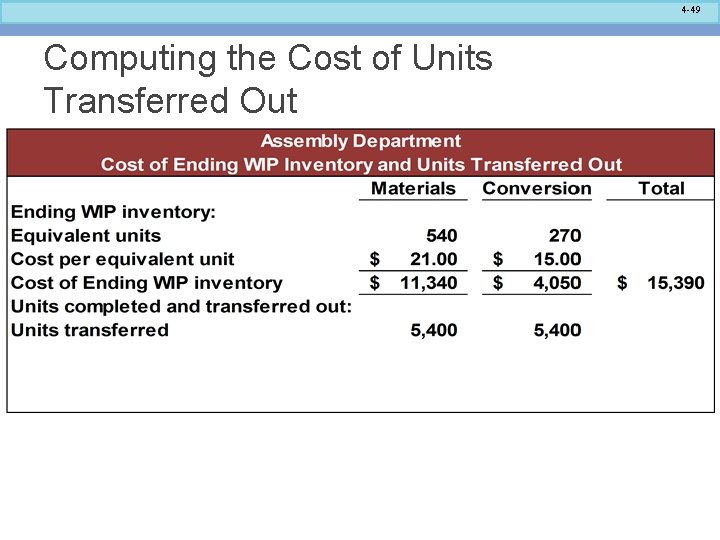

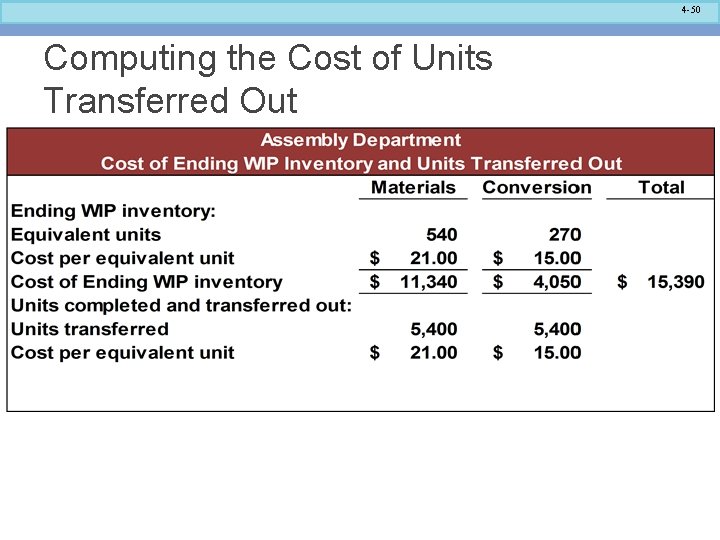

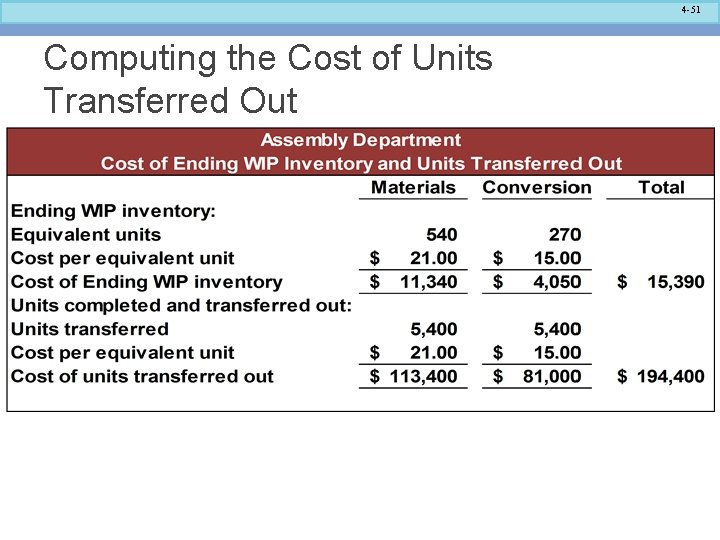

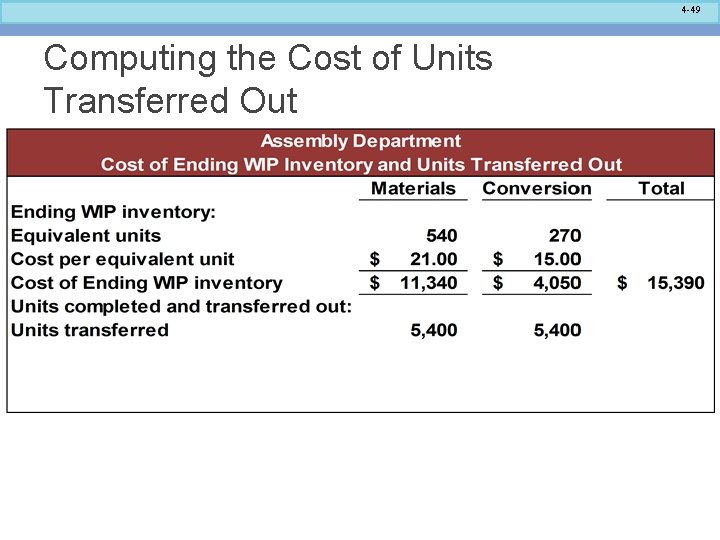

4 -49 Computing the Cost of Units Transferred Out

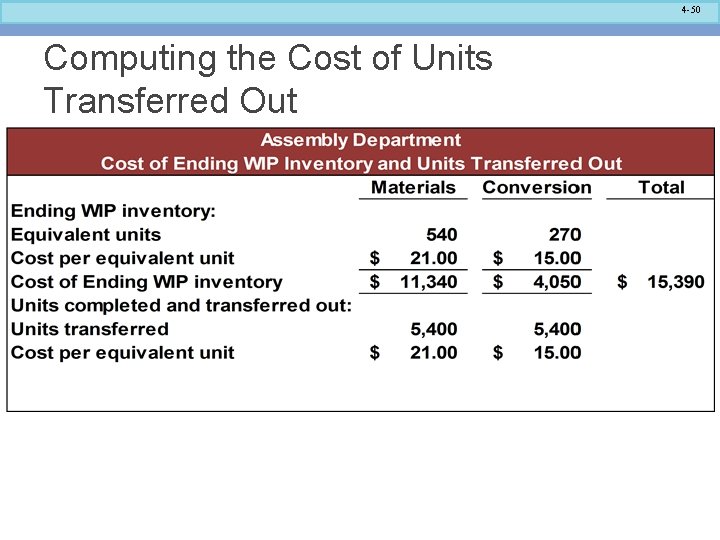

4 -50 Computing the Cost of Units Transferred Out

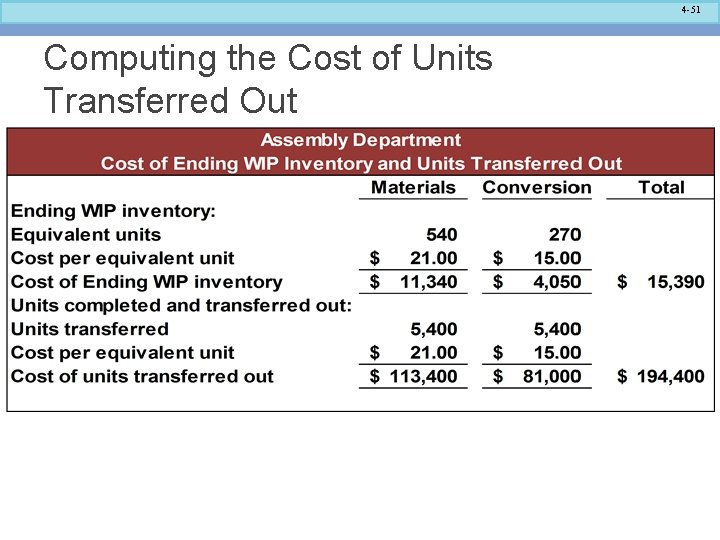

4 -51 Computing the Cost of Units Transferred Out

4 -52 Learning Objective 5 Prepare a cost reconciliation report.

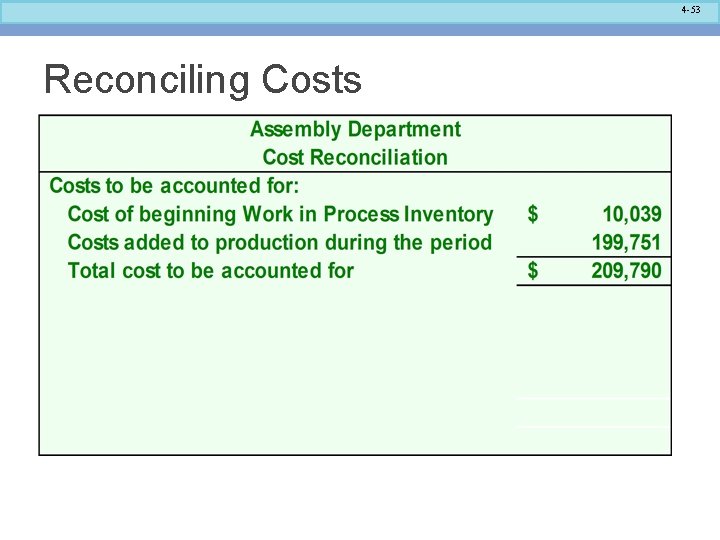

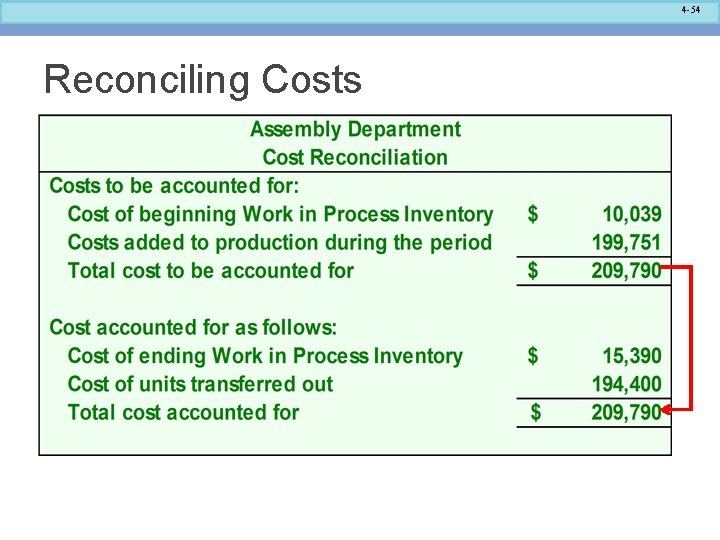

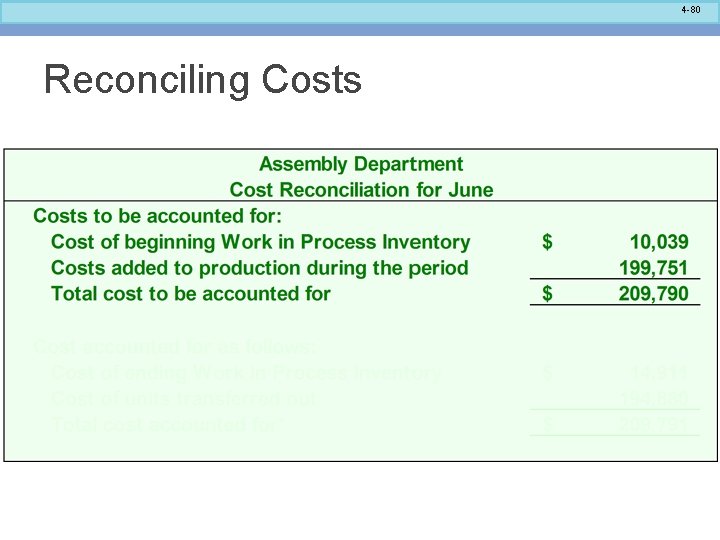

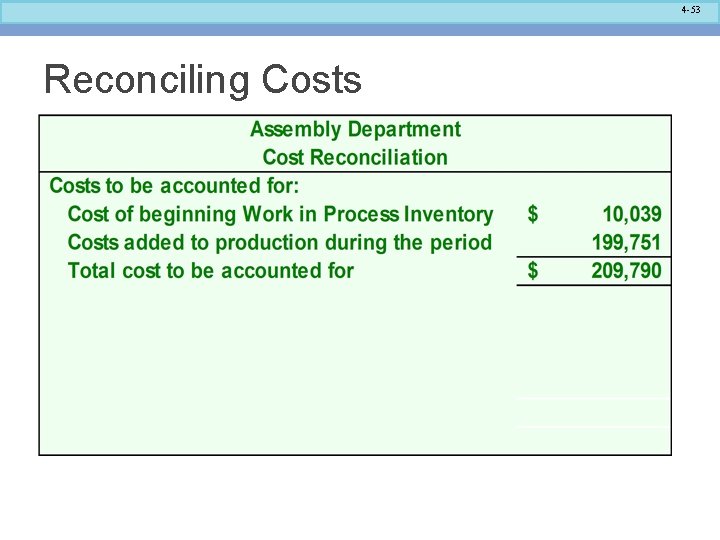

4 -53 Reconciling Costs

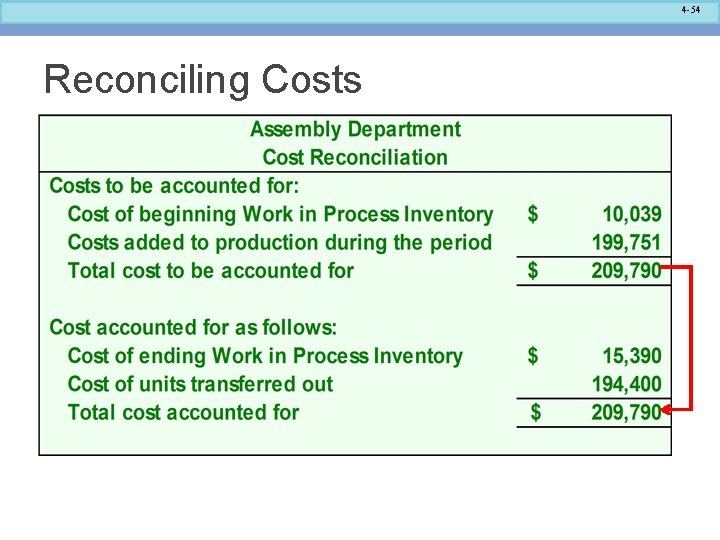

4 -54 Reconciling Costs

4 -55 Operation Costing Operation cost is a hybrid of job-order and process costing because it possesses attributes of both approaches. Operation costing is commonly used when batches of many different products pass through the same processing department.

4 -56 End of Chapter 4

FIFO Method Appendix 4 A Power. Point Authors: Susan Coomer Galbreath, Ph. D. , CPA Charles W. Caldwell, D. B. A. , CMA Jon A. Booker, Ph. D. , CPA, CIA Cynthia J. Rooney, Ph. D. , CPA Copyright © 2015 Mc. Graw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of Mc. Graw-Hill Education.

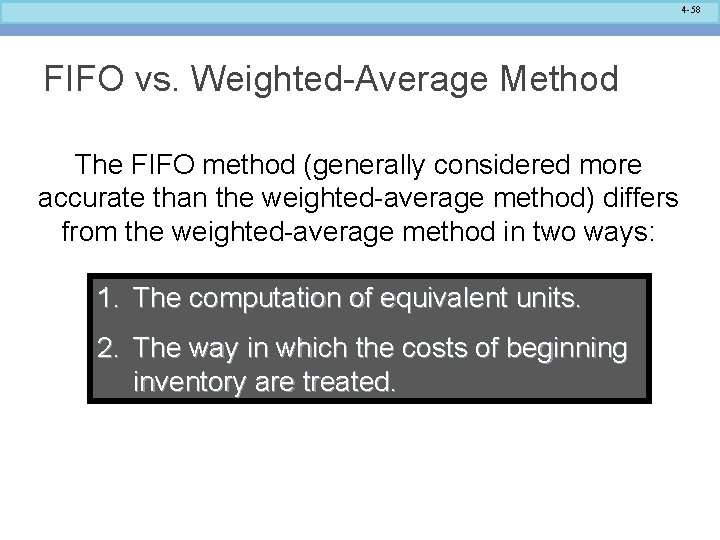

4 -58 FIFO vs. Weighted-Average Method The FIFO method (generally considered more accurate than the weighted-average method) differs from the weighted-average method in two ways: 1. The computation of equivalent units. 2. The way in which the costs of beginning inventory are treated.

4 -59 Learning Objective 6 Compute the equivalent units of production using the FIFO method.

4 -60 Equivalent Units – FIFO Method Let’s revisit the Smith Company example. Here is information concerning the Assembly Department for the month of June.

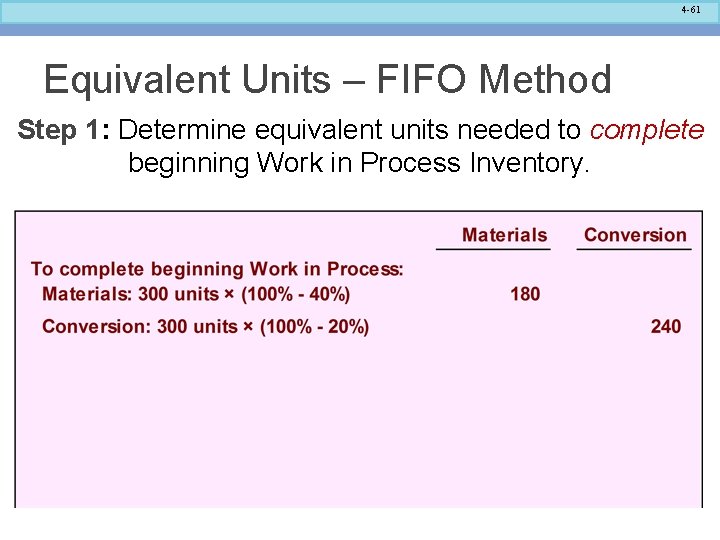

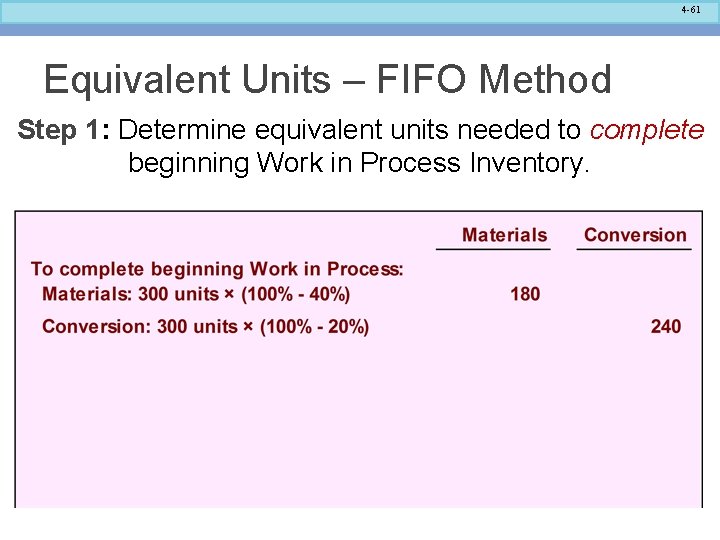

4 -61 Equivalent Units – FIFO Method Step 1: Determine equivalent units needed to complete beginning Work in Process Inventory.

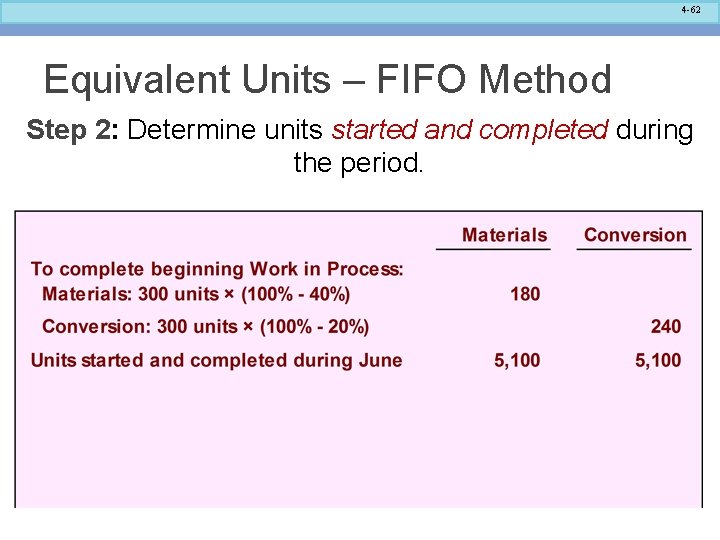

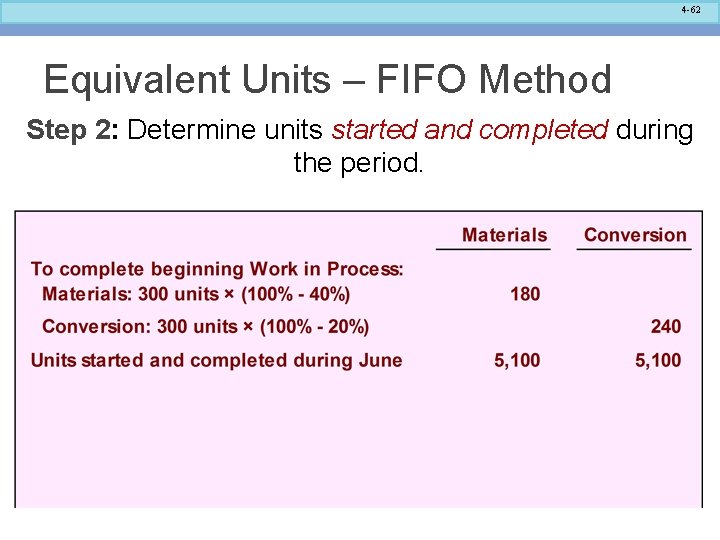

4 -62 Equivalent Units – FIFO Method Step 2: Determine units started and completed during the period.

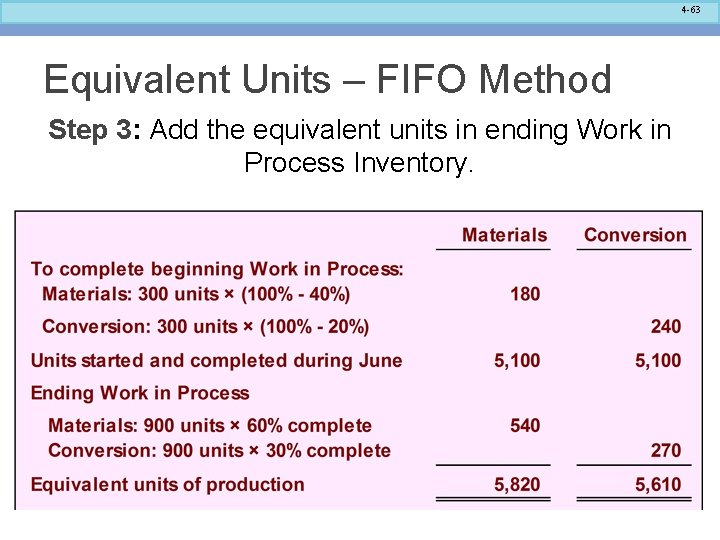

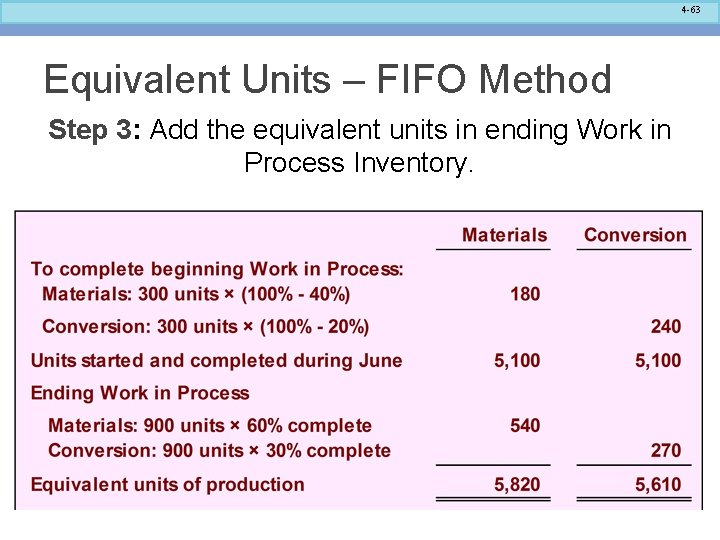

4 -63 Equivalent Units – FIFO Method Step 3: Add the equivalent units in ending Work in Process Inventory.

4 -64 FIFO Example Materials Beginning Work in Process 300 Units 40% Complete 300 × 60% 6, 000 Units Started 5, 100 Units Started and Completed 180 Equivalent Units 5, 100 Units Completed 540 Equivalent Units 5, 820 Equivalent units of production Ending Work in Process 900 Units 60% Complete 900 × 60%

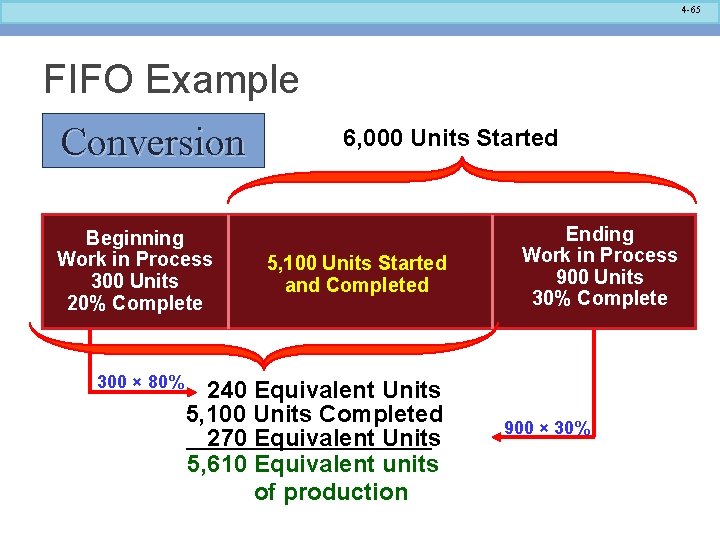

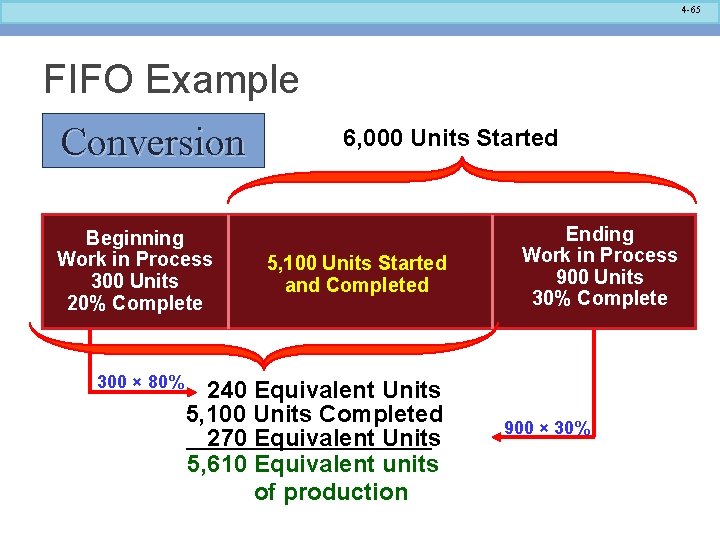

4 -65 FIFO Example Conversion Beginning Work in Process 300 Units 20% Complete 300 × 80% 6, 000 Units Started 5, 100 Units Started and Completed 240 Equivalent Units 5, 100 Units Completed 270 Equivalent Units 5, 610 Equivalent units of production Ending Work in Process 900 Units 30% Complete 900 × 30%

4 -66 Equivalent Units: Weighted-Average vs. FIFO As shown below, the equivalent units in beginning inventory are subtracted from the equivalent units of production per the weighted-average method to obtain the equivalent units of production under the FIFO method.

4 -67 Learning Objective 7 Compute the cost per equivalent unit using the FIFO method.

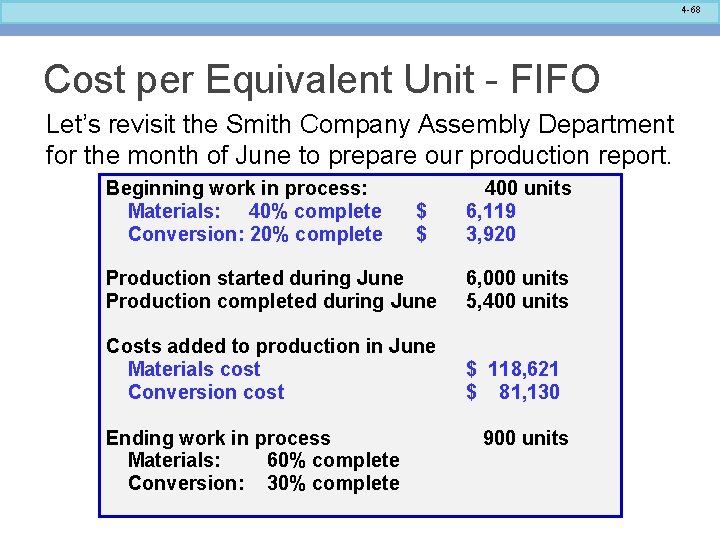

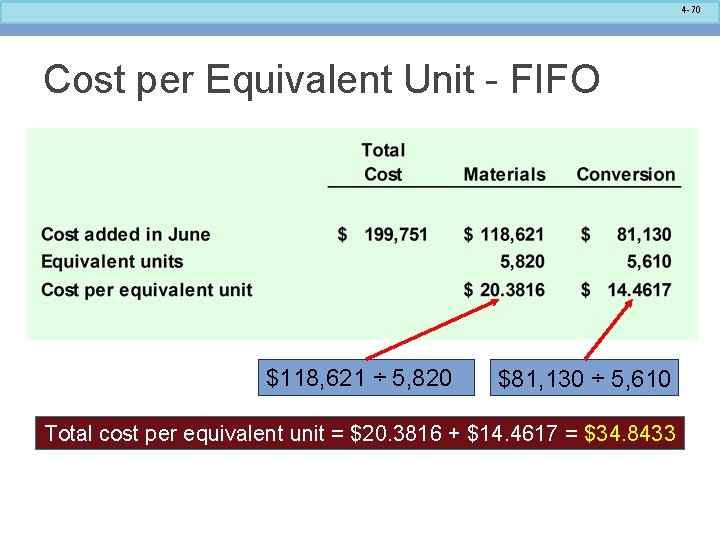

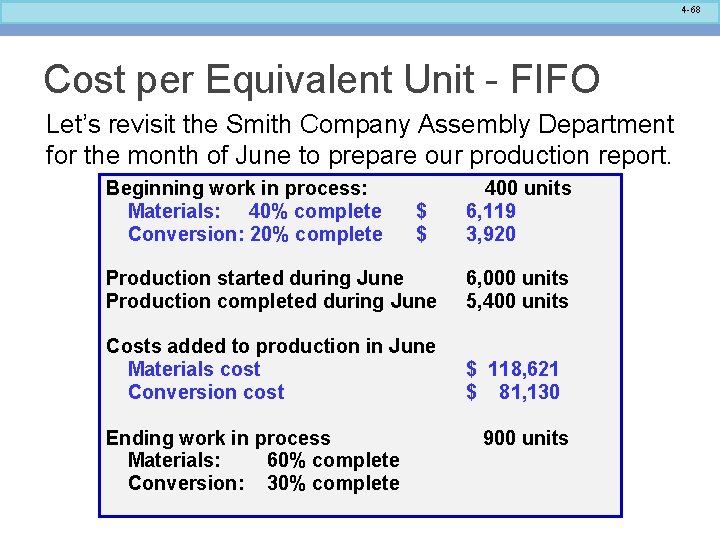

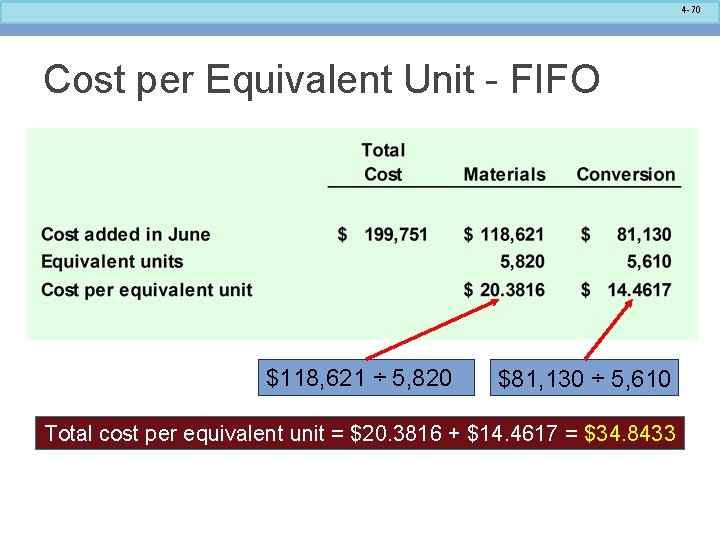

4 -68 Cost per Equivalent Unit - FIFO Let’s revisit the Smith Company Assembly Department for the month of June to prepare our production report. Beginning work in process: Materials: 40% complete Conversion: 20% complete $ $ 400 units 6, 119 3, 920 Production started during June Production completed during June 6, 000 units 5, 400 units Costs added to production in June Materials cost Conversion cost $ 118, 621 $ 81, 130 Ending work in process Materials: 60% complete Conversion: 30% complete 900 units

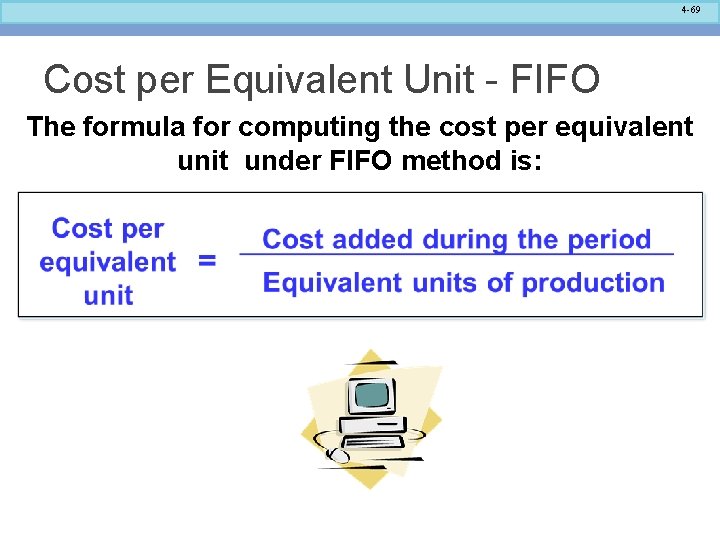

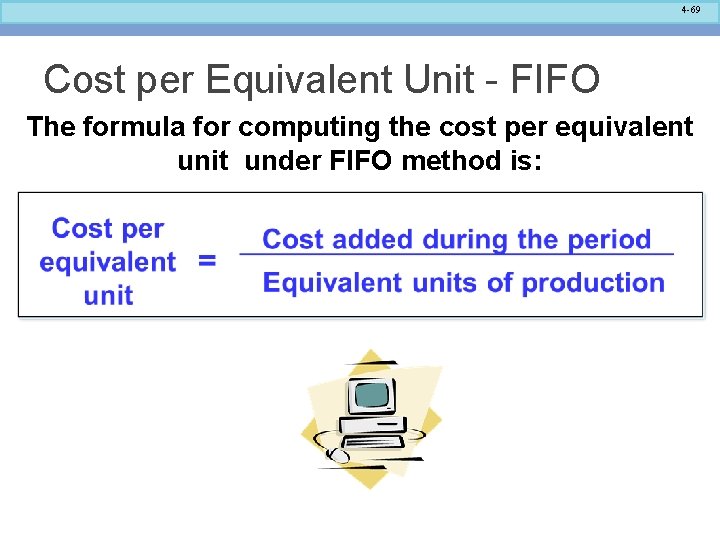

4 -69 Cost per Equivalent Unit - FIFO The formula for computing the cost per equivalent unit under FIFO method is:

4 -70 Cost per Equivalent Unit - FIFO $118, 621 ÷ 5, 820 $81, 130 ÷ 5, 610 Total cost per equivalent unit = $20. 3816 + $14. 4617 = $34. 8433

4 -71 Learning Objective 8 Assign costs to units using the FIFO method.

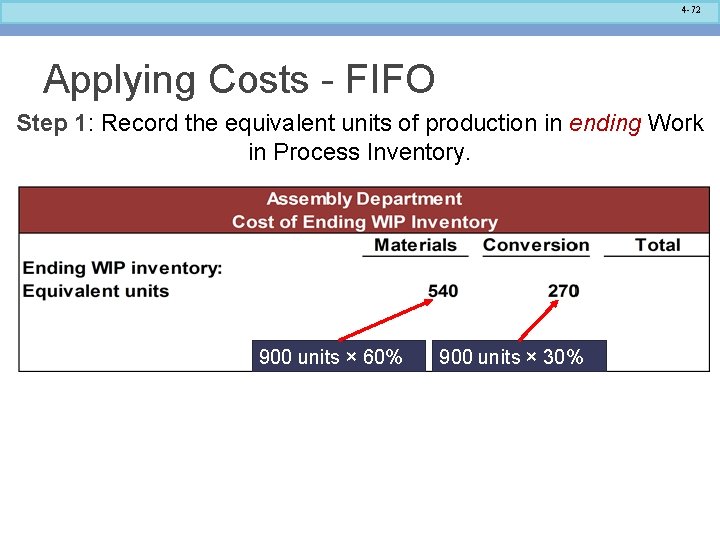

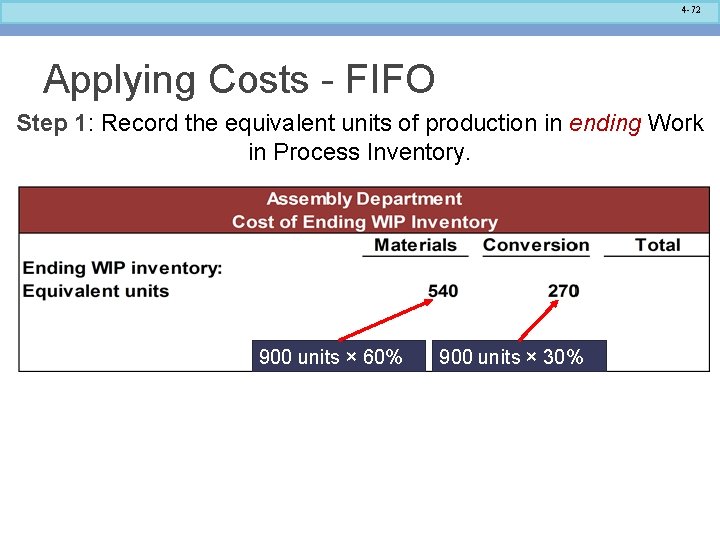

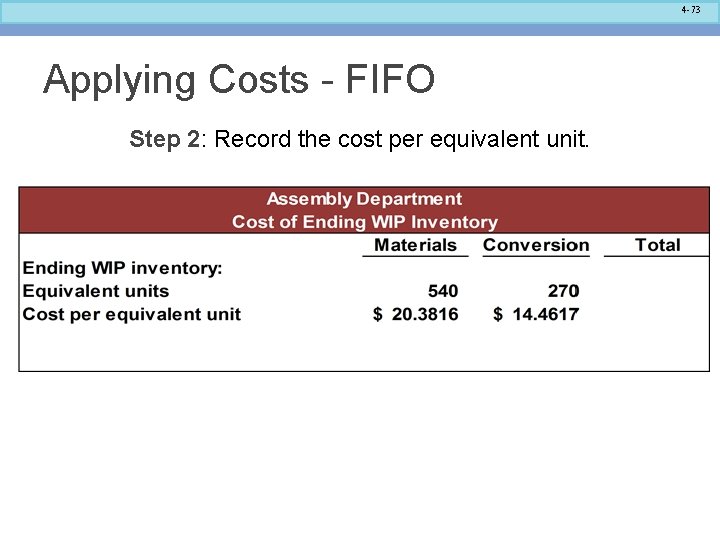

4 -72 Applying Costs - FIFO Step 1: Record the equivalent units of production in ending Work in Process Inventory. 900 units × 60% 900 units × 30%

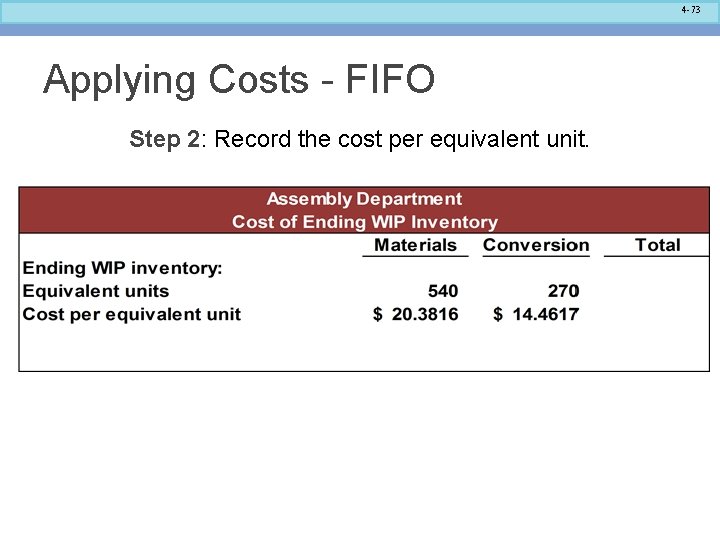

4 -73 Applying Costs - FIFO Step 2: Record the cost per equivalent unit.

4 -74 Applying Costs - FIFO Step 3: Compute the cost of ending Work in Process Inventory. 540 × $20. 3816 270 × 14. 4617

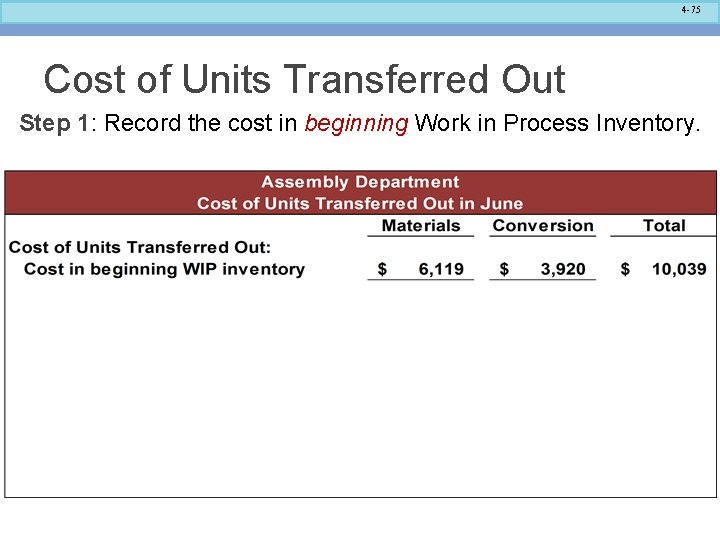

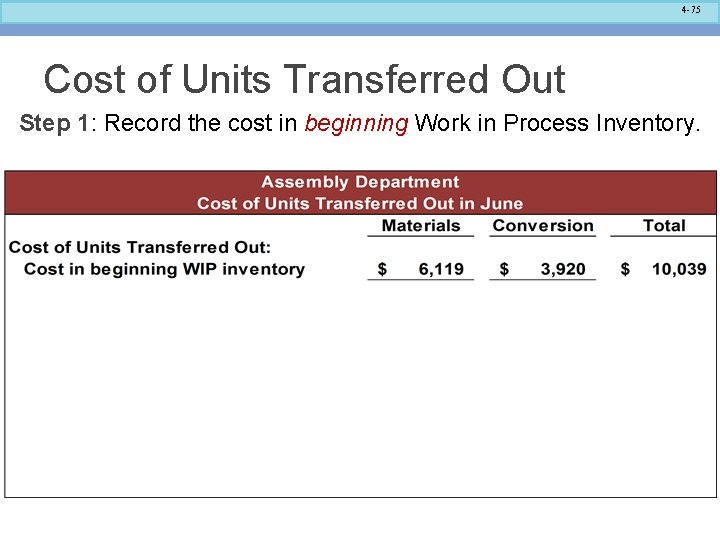

4 -75 Cost of Units Transferred Out Step 1: Record the cost in beginning Work in Process Inventory.

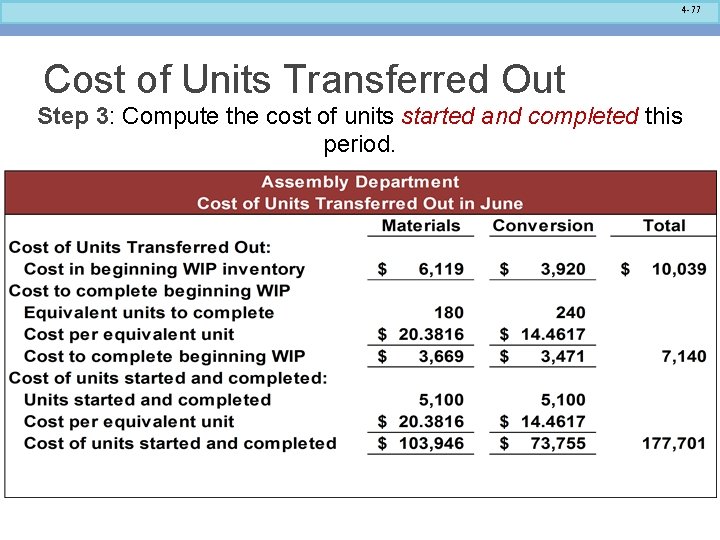

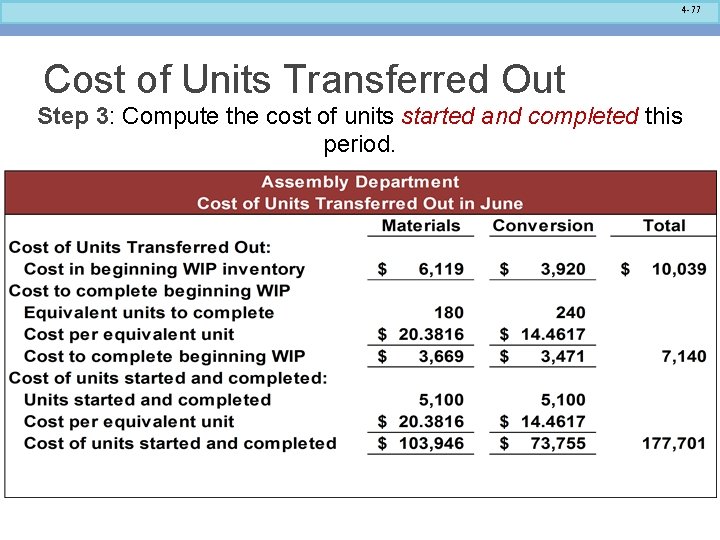

4 -76 Cost of Units Transferred Out Step 2: Compute the cost to complete the units in beginning Work in Process Inventory.

4 -77 Cost of Units Transferred Out Step 3: Compute the cost of units started and completed this period.

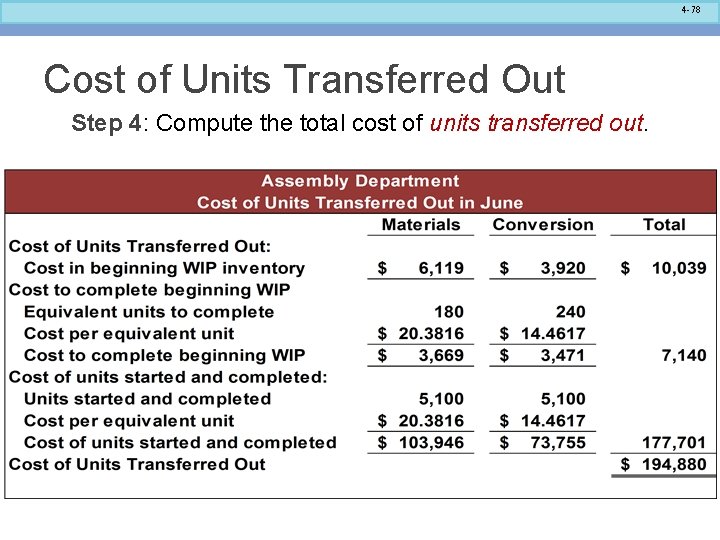

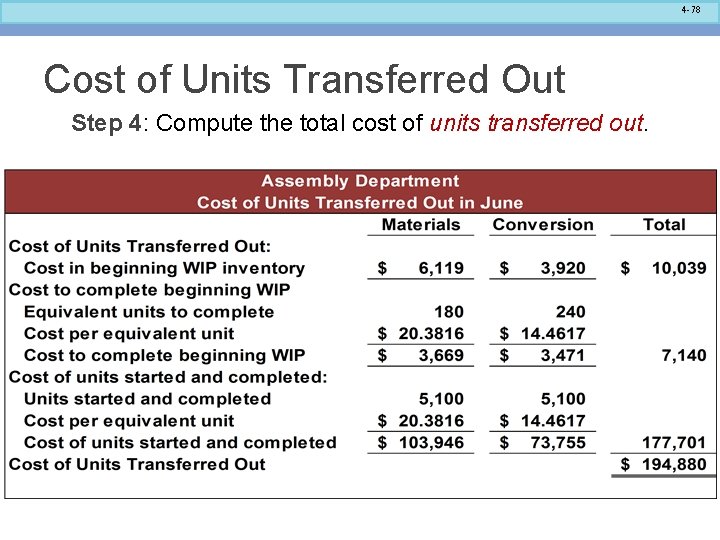

4 -78 Cost of Units Transferred Out Step 4: Compute the total cost of units transferred out.

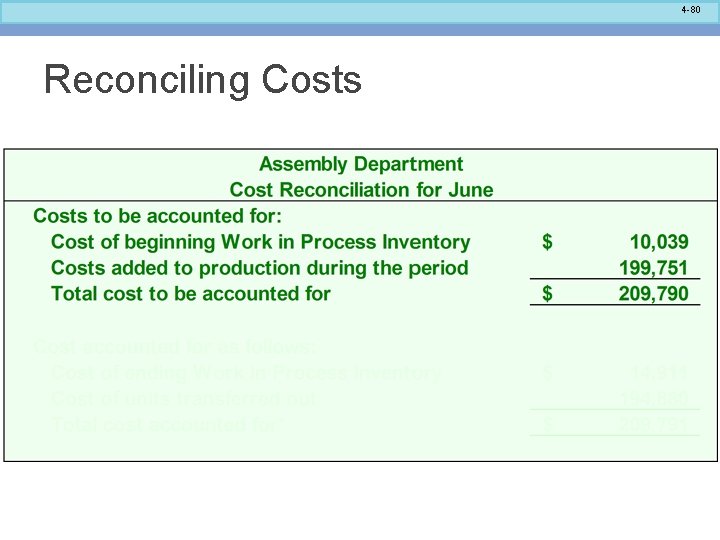

4 -79 Learning Objective 9 Prepare a cost reconciliation report using the FIFO method.

4 -80 Reconciling Costs

4 -81 Reconciling Costs * $1 rounding error.

4 -82 A Comparison of Costing Methods In a lean production environment, FIFO and weighted-average methods yield similar unit costs. When considering cost control, FIFO is superior to weighted-average because it does not mix costs of the current period with costs of the prior period.

4 -83 End of Appendix 4 A