Primary issuance techniques promoting secondary market development Example

- Slides: 16

Primary issuance techniques promoting secondary market development Example of the Hungarian Government Debt Management Agency (www. akk. hu) – stylized facts by Werner Riecke (werner. riecke@gmail. com)

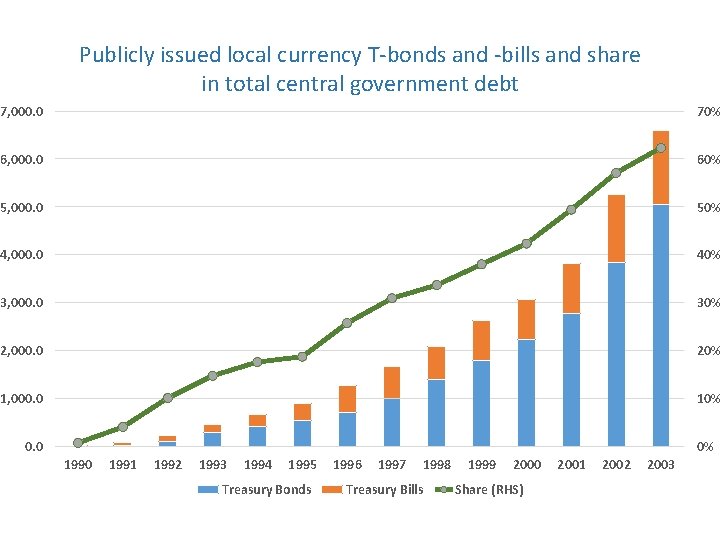

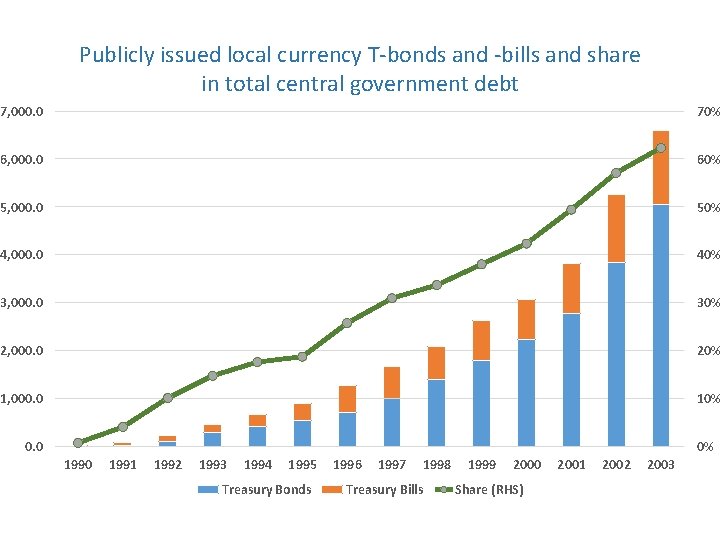

Publicly issued local currency T-bonds and -bills and share in total central government debt 7, 000. 0 70% 6, 000. 0 60% 5, 000. 0 50% 4, 000. 0 40% 3, 000. 0 30% 2, 000. 0 20% 1, 000. 0 10% 0. 0 0% 1990 1991 1992 1993 1994 1995 Treasury Bonds 1996 1997 1998 Treasury Bills 1999 2000 Share (RHS) 2001 2002 2003

The main guiding principles for government securities market development • Simplicity • Transparency • Liquidity

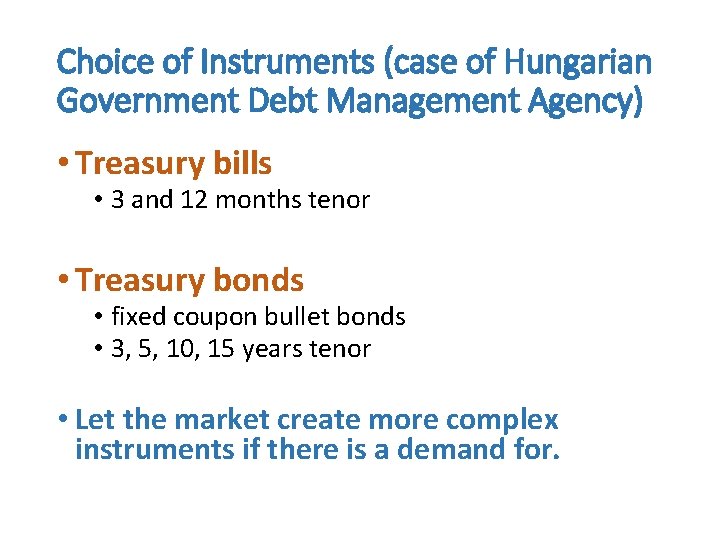

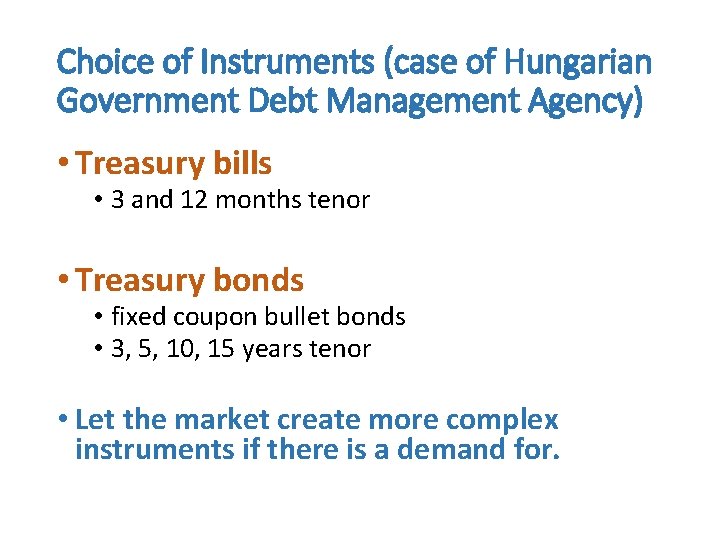

Choice of Instruments (case of Hungarian Government Debt Management Agency) • Treasury bills • 3 and 12 months tenor • Treasury bonds • fixed coupon bullet bonds • 3, 5, 10, 15 years tenor • Let the market create more complex instruments if there is a demand for.

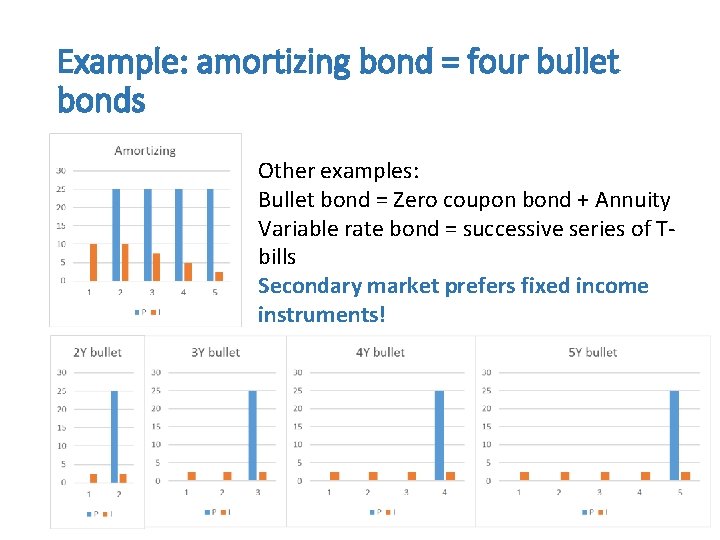

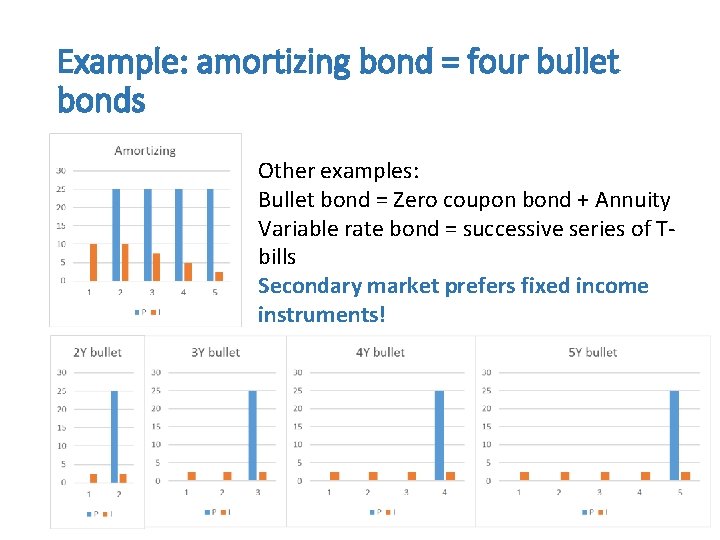

Example: amortizing bond = four bullet bonds Other examples: Bullet bond = Zero coupon bond + Annuity Variable rate bond = successive series of Tbills Secondary market prefers fixed income instruments!

Transparency • Regular Issuance • Primary placement through auctions • Publication of the auction calendar • Refrain from private placements • Refrain from captive measures • Use of re-openings and buy backs (also through auctions) – later on switching auctions

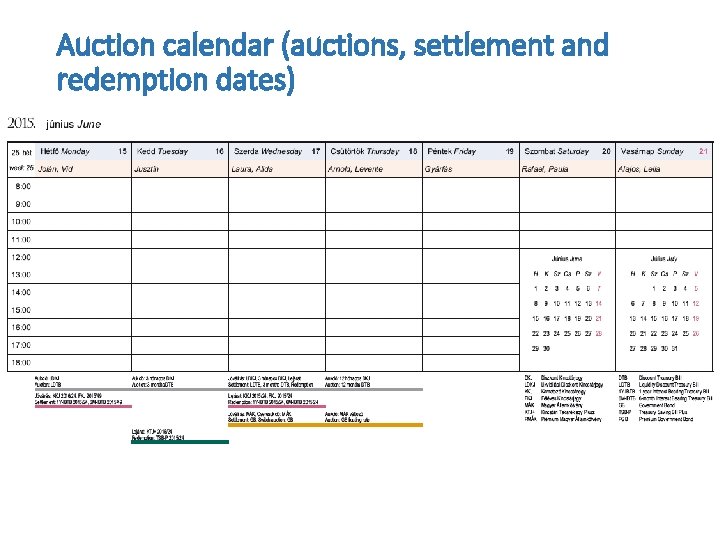

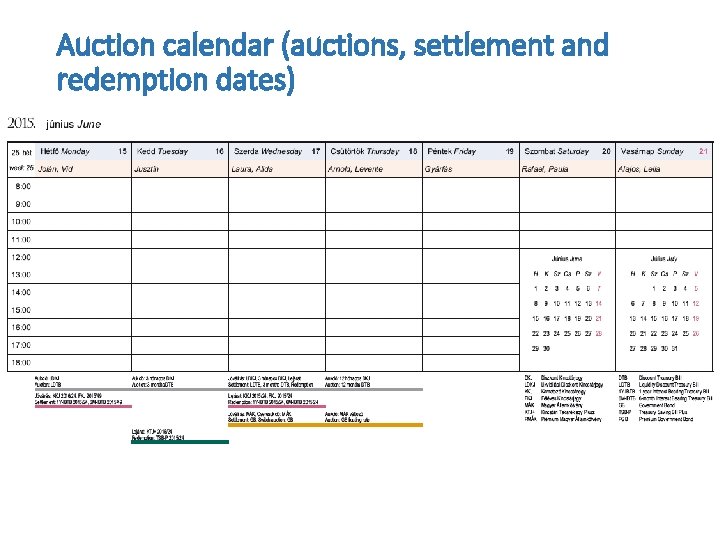

Auction calendar (auctions, settlement and redemption dates)

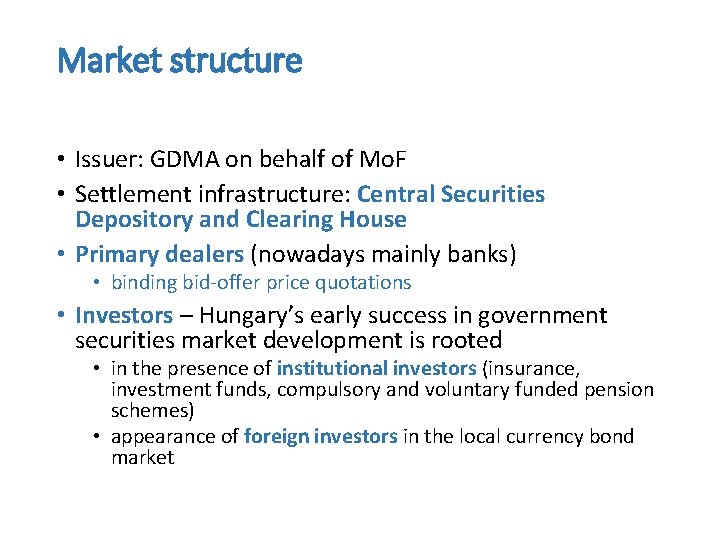

Market structure • Issuer: GDMA on behalf of Mo. F • Settlement infrastructure: Central Securities Depository and Clearing House • Primary dealers (nowadays mainly banks) • binding bid-offer price quotations • Investors – Hungary’s early success in government securities market development is rooted • in the presence of institutional investors (insurance, investment funds, compulsory and voluntary funded pension schemes) • appearance of foreign investors in the local currency bond market

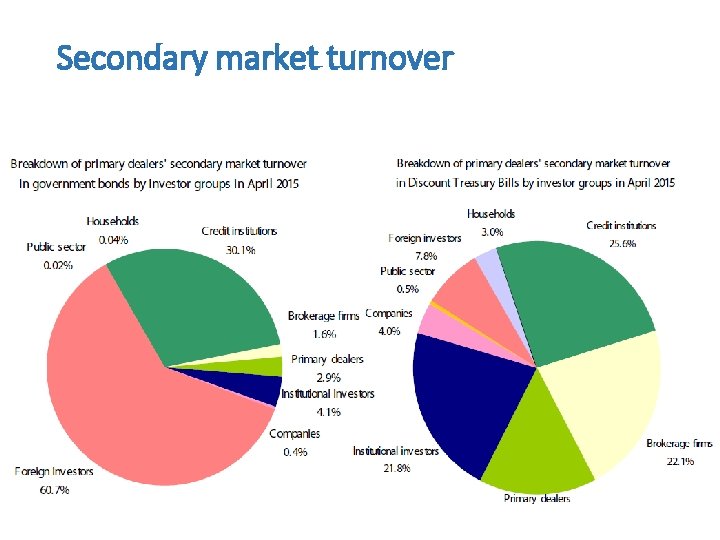

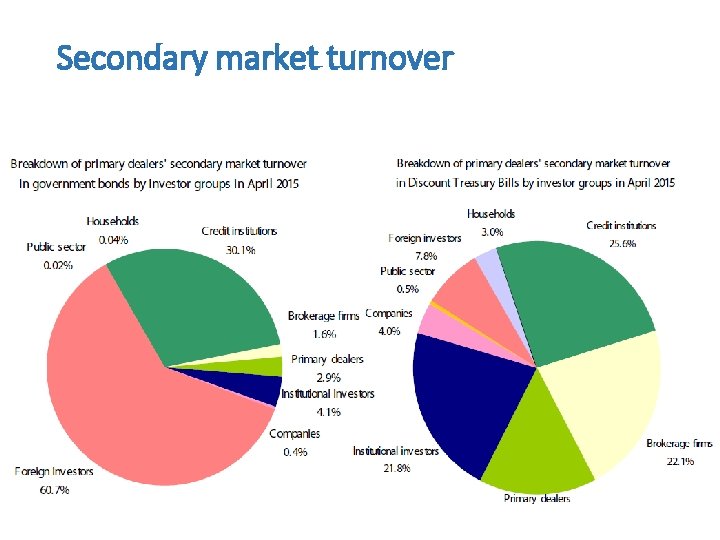

Secondary market turnover

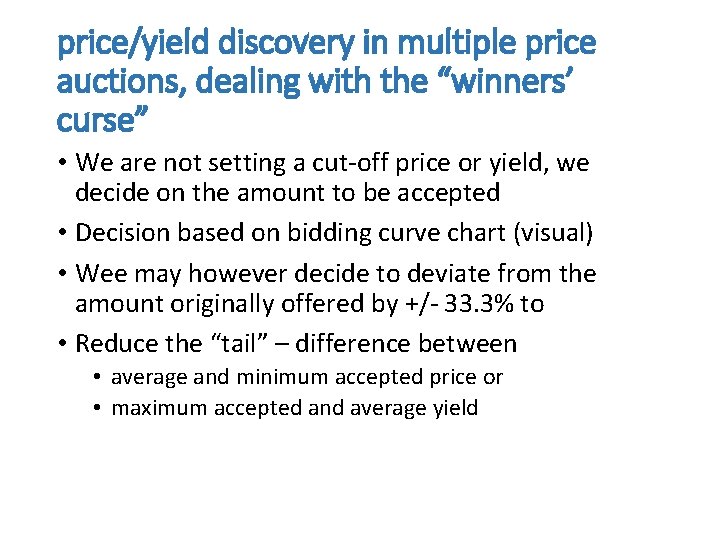

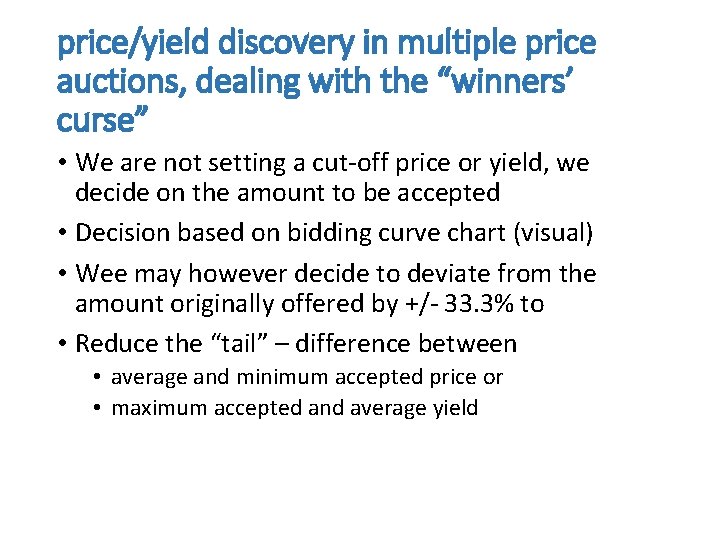

price/yield discovery in multiple price auctions, dealing with the “winners’ curse” • We are not setting a cut-off price or yield, we decide on the amount to be accepted • Decision based on bidding curve chart (visual) • Wee may however decide to deviate from the amount originally offered by +/- 33. 3% to • Reduce the “tail” – difference between • average and minimum accepted price or • maximum accepted and average yield

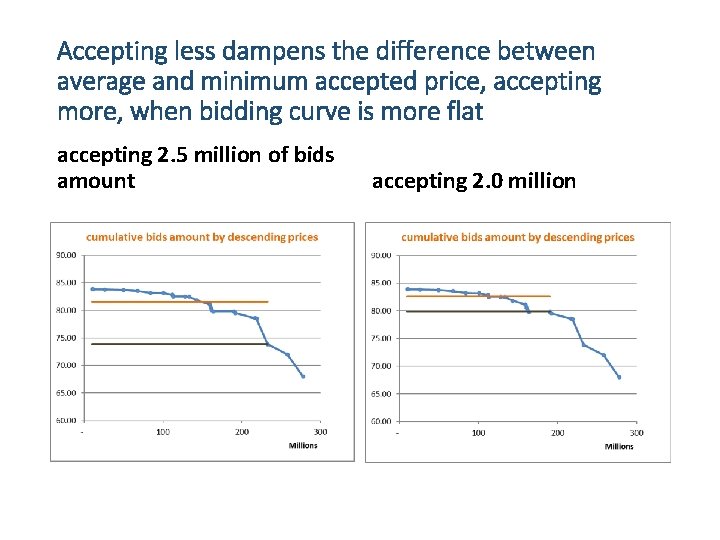

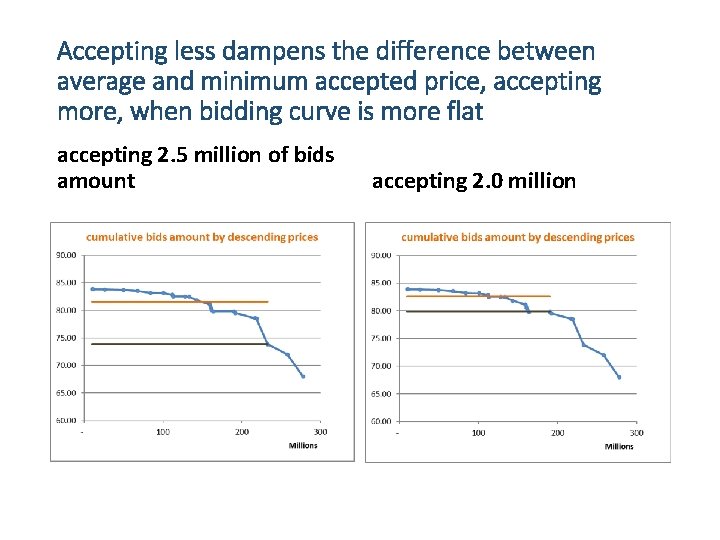

Accepting less dampens the difference between average and minimum accepted price, accepting more, when bidding curve is more flat accepting 2. 5 million of bids amount accepting 2. 0 million

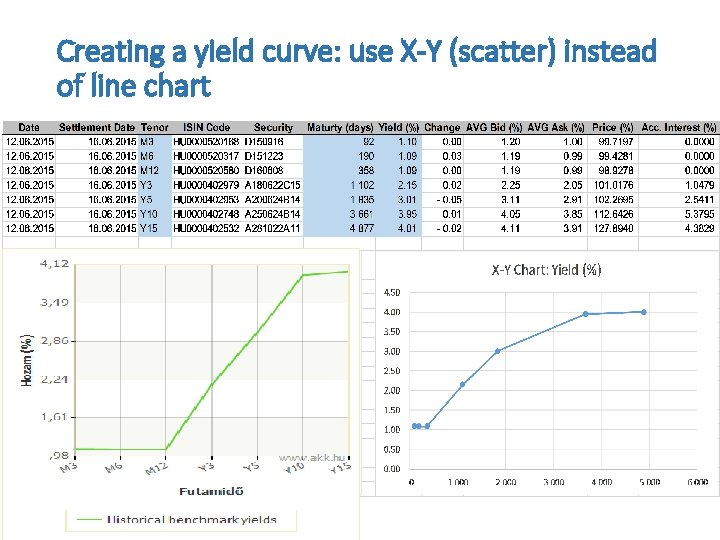

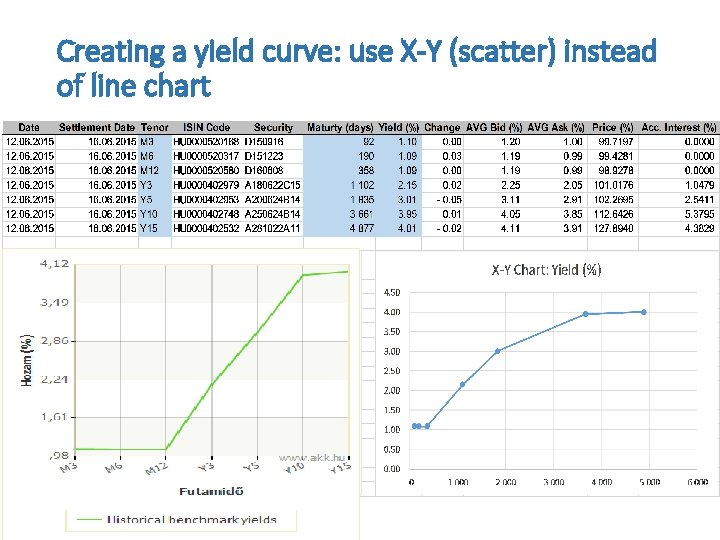

Creating a yield curve: use X-Y (scatter) instead of line chart

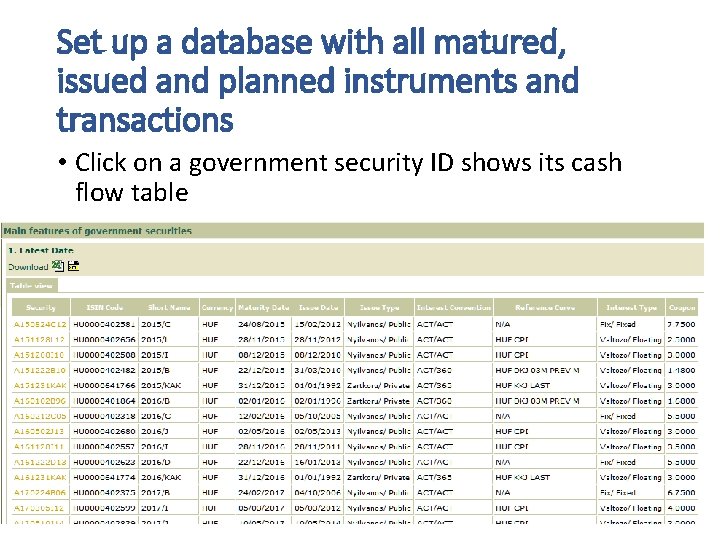

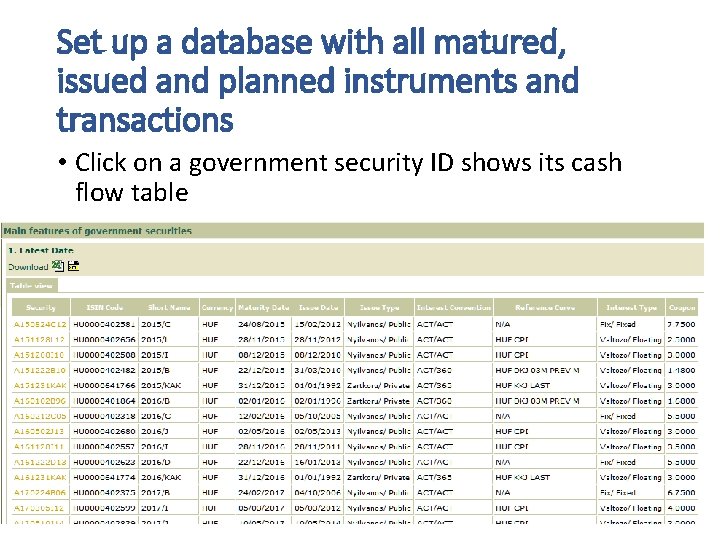

Set up a database with all matured, issued and planned instruments and transactions • Click on a government security ID shows its cash flow table

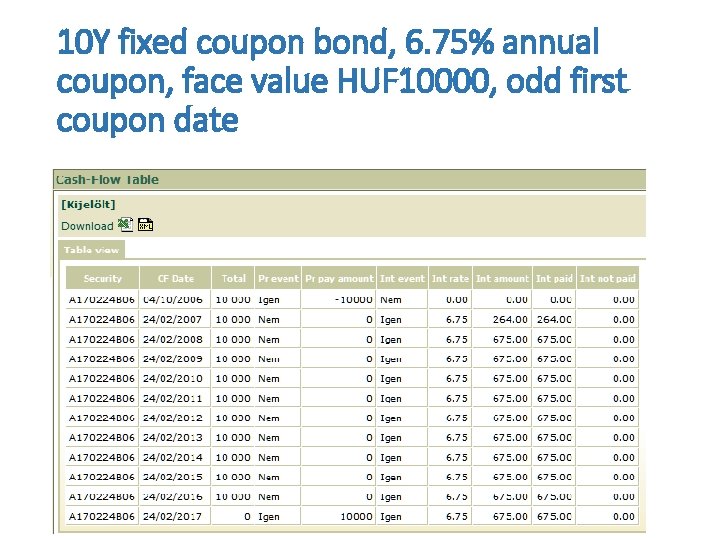

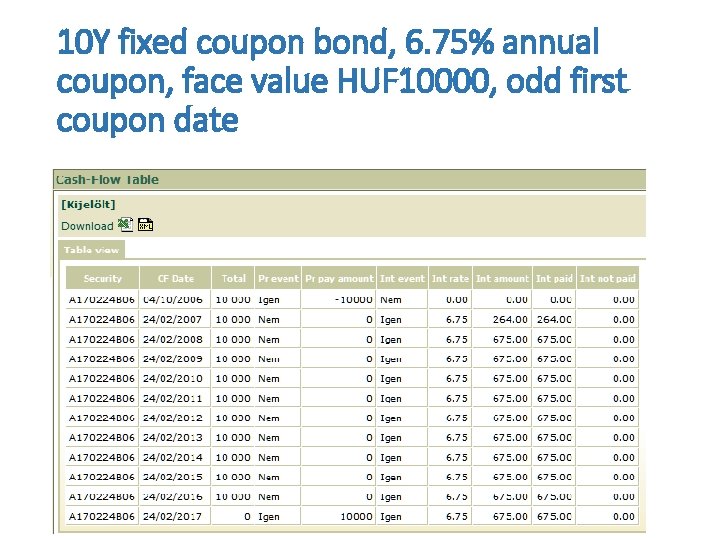

10 Y fixed coupon bond, 6. 75% annual coupon, face value HUF 10000, odd first coupon date

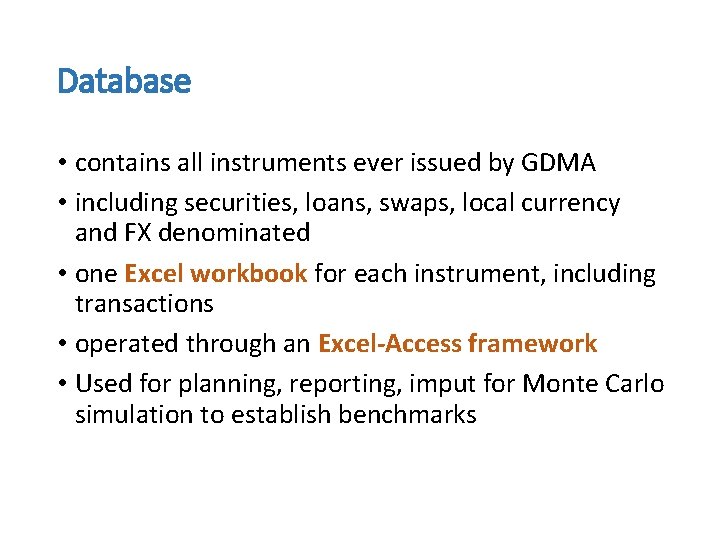

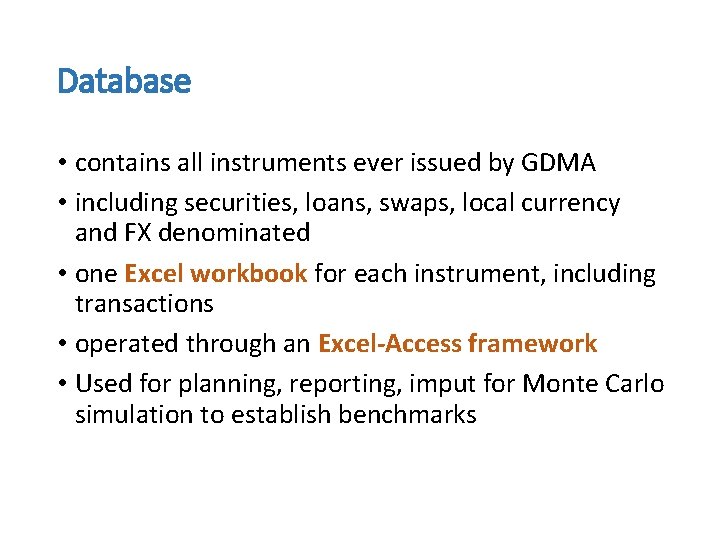

Database • contains all instruments ever issued by GDMA • including securities, loans, swaps, local currency and FX denominated • one Excel workbook for each instrument, including transactions • operated through an Excel-Access framework • Used for planning, reporting, imput for Monte Carlo simulation to establish benchmarks

AKK is exclusively responsible for managing Central Government’s debt. Public debt and external debt data compiled by central bank – national Bank of Hungary Thank you for your attention. Werner Riecke