Pricing NoNegativeEquity Guarantee for Equity Release Products under

- Slides: 34

Pricing No-Negative-Equity. Guarantee for Equity Release Products under a Jump ARMA-GARCH Model Presenter: Sharon Yang Co-authors: Chuang-Chang Jr-Wei Huang National Central University, Taiwan 2020/9/30 1

Outline n Introduction. n Investigation of House Price Return Dynamics With Jumps. n Valuation Framework for No-Negative-Equity-Guarantee. n Numerical Analysis. n Conclusion. 2020/9/30 2

Introduction 2020/9/30 3

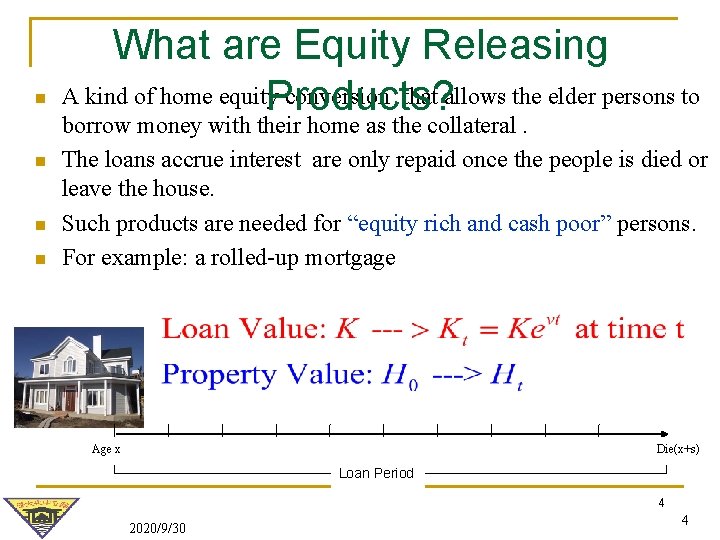

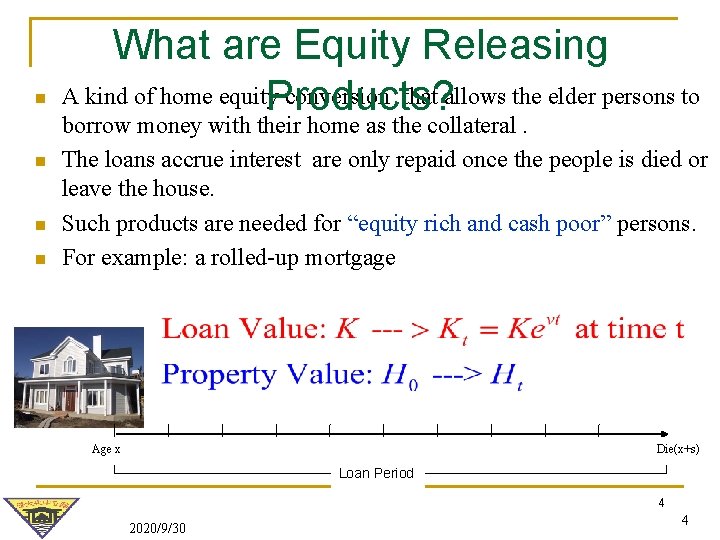

n n What are Equity Releasing A kind of home equity conversion that allows the elder persons to Products? borrow money with their home as the collateral. The loans accrue interest are only repaid once the people is died or leave the house. Such products are needed for “equity rich and cash poor” persons. For example: a rolled-up mortgage Age x Die(x+s) Loan Period 4 2020/9/30 4

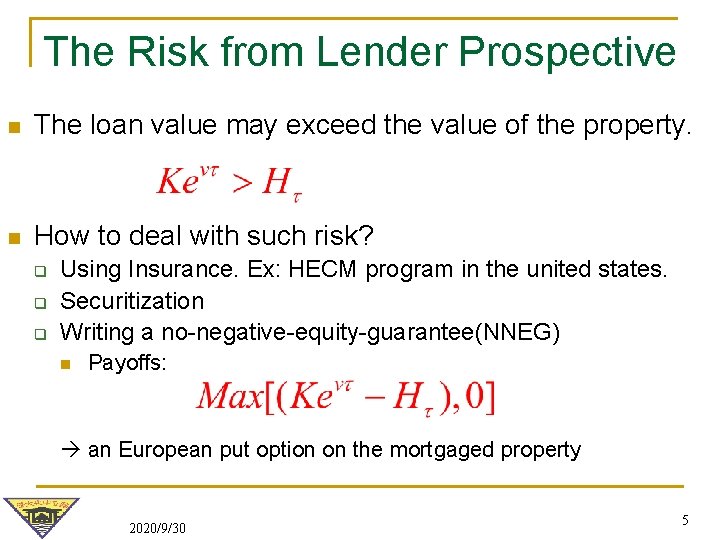

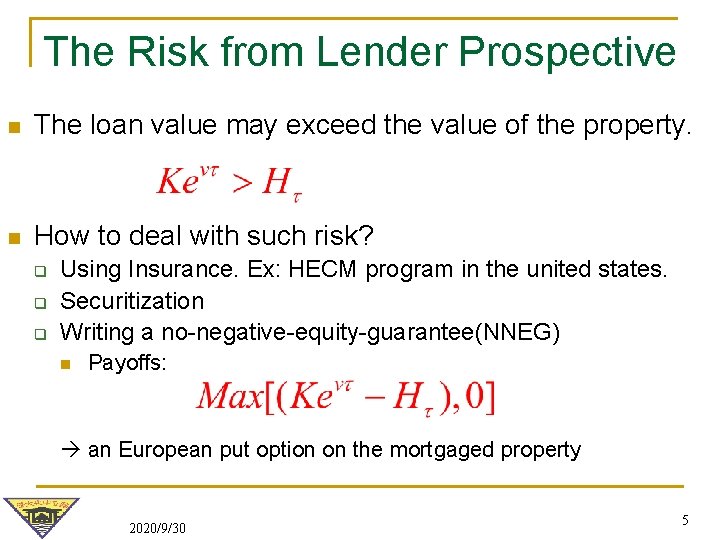

The Risk from Lender Prospective n The loan value may exceed the value of the property. n How to deal with such risk? q q q Using Insurance. Ex: HECM program in the united states. Securitization Writing a no-negative-equity-guarantee(NNEG) n Payoffs: an European put option on the mortgaged property 2020/9/30 5

Purpose of this study Can Black & Sholes option pricing formula apply to value NNEG? No! n We built up a general framework which considers the dynamics of the house price return with jumps. n 2020/9/30 6

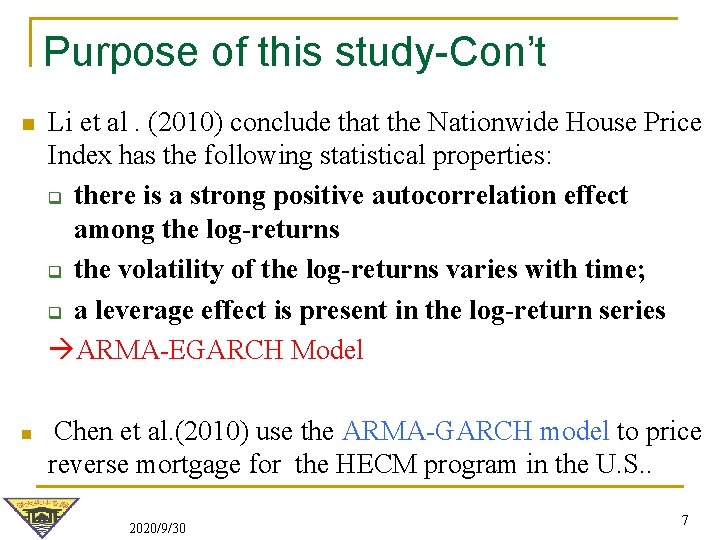

Purpose of this study-Con’t n n Li et al. (2010) conclude that the Nationwide House Price Index has the following statistical properties: q there is a strong positive autocorrelation effect among the log-returns q the volatility of the log-returns varies with time; q a leverage effect is present in the log-return series ARMA-EGARCH Model Chen et al. (2010) use the ARMA-GARCH model to price reverse mortgage for the HECM program in the U. S. . 2020/9/30 7

Purpose of this study-Con’t n We consider a jump model that incorporate both autocorrelation effect and volatility cluster. a Jump ARMA-GARCH Model 2020/9/30 8

An Investigation of House Price Return Dynamics with Jumps 2020/9/30 9

Jumps in House Price Returns? n According to the quarterly data from 1952 to 2008, it can show that the quarterly housing price changed more than three standard deviations. 2020/9/30 10

Jumps in House. Price or Equity Returns ? Chen et al. (2009) study U. S. mortgage insurance premium using n Merton jump diffusion process for house price returns. n Merton (1976) build a jump diffusion model with a continuous-time basis. 2020/9/30 11

Jumps in House Price or Equity Returns ? n Kou (2002) also considers the leptokurtic feature and proposes a double exponential jump-diffusion model. The return distribution of assets may have a higher peak and two (asymmetric) heavier tails than those of the normal distribution. 2020/9/30 12

Jumps in House Price or Equity Returns ? n Chan and Maheu (2002) and Duan et al. (2006, 2007) both examine the jump effect with equity returns under a GARCH model q Dynamic jumps in return v. s. Constant jumps in both returns and volatility. 2020/9/30 13

Jumps in House Price or Equity Returns ? n Chan and Maheu (2002) q Dynamic jumps in return 2020/9/30 14

Jumps in House Price or Equity Returns ? n Duan et al. (2006, 2007) q Constant jumps in both returns and volatility. 2020/9/30 15

Jumps in House Price or Equity Returns ? n We extend Chan and Maheu (2002) to consider the dynamic jump effect with house price returns under an ARMA-GARCH model and develop a framework for pricing the NNEG. 2020/9/30 16

ARMA-GARCH Model follows an ARMA process. follows a GARCH process. 2020/9/30 17

Dynamic Jump ARMA-GARCH Model The case for a dynamic jump: 2020/9/30 18

A Comparison of Model Fitting Model Selection, 1953 Q 4~2008 Q 4 Model Log-Likelihood AIC BIC Geometric Brownian Motion 499. 1072 -4. 5192 -4. 4883 ARMA-GARCH 567. 8156 -5. 4861 -5. 2542 ARMA-EGARCH 586. 4799 -5. 4871 -5. 2303 Merton Jump 516. 2469 -4. 6477 -4. 5706 Double Exponential Jump 506. 3450 -4. 5481 -4. 4555 Constant Jump ARMAGARCH 592. 8361 -5. 6193 -5. 3149 Dynamic Jump ARMAGARCH 607. 5076 -5. 6512 -5. 3014 Diffusion 2020/9/30 19

A Comparison of Model Fitting Model Selection, 1958 Q 4~2008 Q 4 Model Log-Likelihood AIC BIC Geometric Brownian Motion 448. 9902 -4. 4699 -4. 4369 ARMA-GARCH 498. 4404 -5. 3309 -5. 0791 ARMA-EGARCH 505. 4725 -5. 2110 -4. 9395 Merton Jump 465. 1300 -4. 6013 -4. 5188 Double Exponential Jump 452. 3087 -4. 4907 -4. 4061 Constant Jump ARMAGARCH 519. 8619 -5. 3594 -5. 0330 Dynamic Jump ARMAGARCH 522. 0326 -5. 3817 -5. 0016 Diffusion 2020/9/30 20

A Comparison of Model Fitting Model Selection, 1968 Q 4~2008 Q 4 Model Log-Likelihood AIC BIC Geometric Brownian Motion 343. 6102 -4. 2701 -4. 2317 ARMA-GARCH 405. 9601 -5. 2722 -4. 9021 ARMA-EGARCH 397. 5060 -5. 0637 -4. 7417 Merton Jump 345. 2055 -4. 2526 -4. 1565 Double Exponential Jump 345. 4001 -4. 2425 -4. 1272 Constant Jump ARMAGARCH 415. 0801 -5. 3314 -4. 9211 Dynamic Jump ARMAGARCH 416. 0165 -5. 3679 -4. 9124 Diffusion 2020/9/30 21

The Valuation Framework for No. Negative-Equity-Guarantee 2020/9/30 22

Pricing No Negative Equity Guarantee Let us define the following notation: n K : the amount of loan advanced at time zero; n : the value of the mortgaged property at time t; n r : the constant risk-free interest rate; n v: the roll-up interest rate; n g : the rental yield; n : the average delay in time from the point of home exit until the actual sale of the property. 2020/9/30 23

Pricing No Negative Equity Guarantee n Assuming the person dies in the middle of the year Considering the delaying time Payoff n Valuation n n 2020/9/30 24

Pricing No Negative Equity Guarantee The value of P under measure Q can be obtained using conditional Esscher transform. 2020/9/30 25

Pricing No Negative Equity Guarantee Under the risk-neutral measure Q, the return processes of and to n characterize the jump ARMA(s, m)-GARCH(p, q) model become n Special Case: Constant Jump 2020/9/30 26

Pricing No Negative Equity Guarantee n Black and Sholes n Merton Jump 2020/9/30 27

Making Numerical Analysis 2020/9/30 28

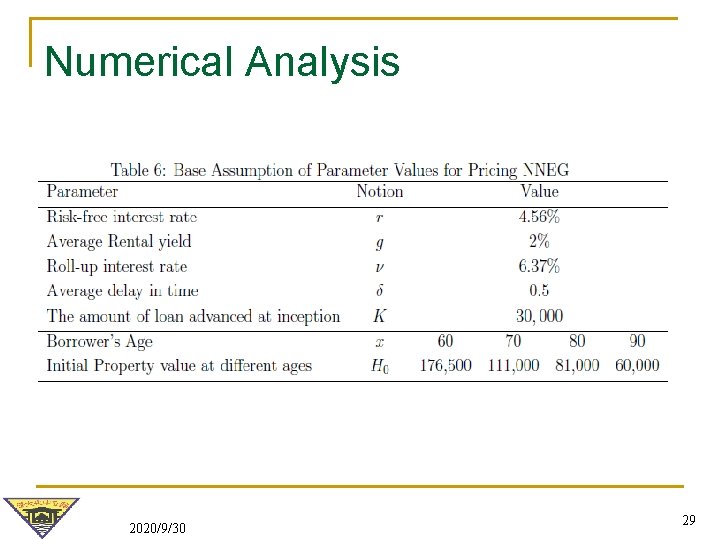

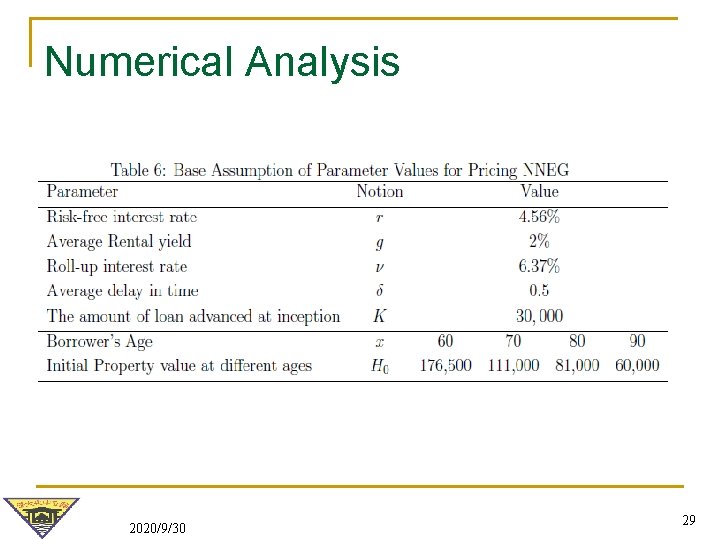

Numerical Analysis 2020/9/30 29

Numerical Analysis 2020/9/30 30

Numerical Analysis 2020/9/30 31

Conclusion n This article contributes to the literature in the following ways. ü ü Dynamic Jump ARMA-GARCH model can better capture the dynamics of house price return. The estimation of the proposed jump ARMA-GARCH model is carried out and presents a better fitting result compared with various house price return models proposed in the literature. 2020/9/30 32

Conclusion n This article contributes to the literature in the following ways. ü ü The risk neutral pricing framework for the jump ARMA-GARCH model is derived using the conditional Esscher transform technique. Numerical result shows that incorporating the jump effect in house price returns is important for pricing NNEG. 2020/9/30 33

The End. Thanks! 2020/9/30 34