Presentation On Foreign Exchange Meaning of Foreign Exchange

- Slides: 14

Presentation On Foreign Exchange

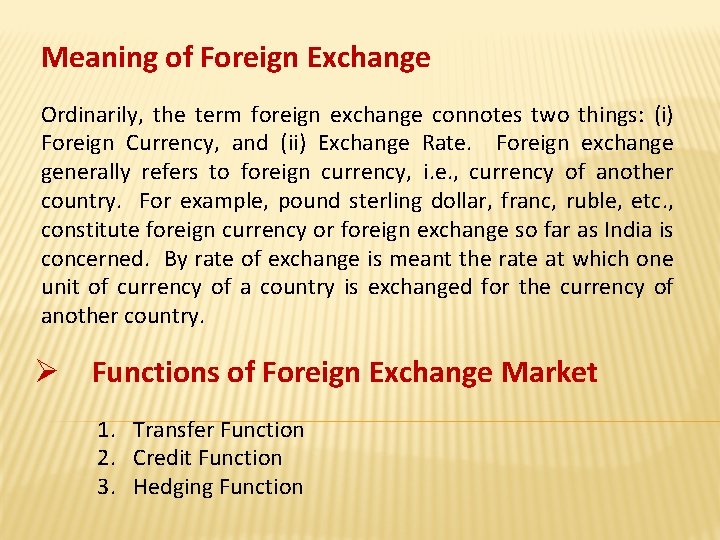

Meaning of Foreign Exchange Ordinarily, the term foreign exchange connotes two things: (i) Foreign Currency, and (ii) Exchange Rate. Foreign exchange generally refers to foreign currency, i. e. , currency of another country. For example, pound sterling dollar, franc, ruble, etc. , constitute foreign currency or foreign exchange so far as India is concerned. By rate of exchange is meant the rate at which one unit of currency of a country is exchanged for the currency of another country. Ø Functions of Foreign Exchange Market 1. Transfer Function 2. Credit Function 3. Hedging Function

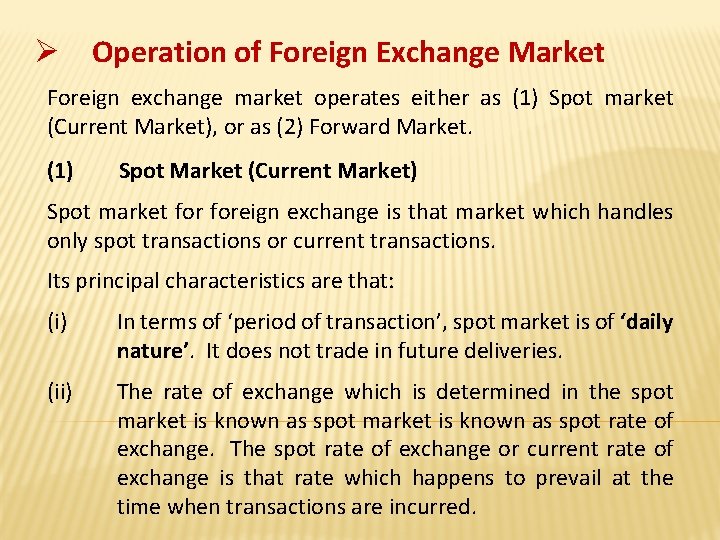

Ø Operation of Foreign Exchange Market Foreign exchange market operates either as (1) Spot market (Current Market), or as (2) Forward Market. (1) Spot Market (Current Market) Spot market foreign exchange is that market which handles only spot transactions or current transactions. Its principal characteristics are that: (i) In terms of ‘period of transaction’, spot market is of ‘daily nature’. It does not trade in future deliveries. (ii) The rate of exchange which is determined in the spot market is known as spot rate of exchange. The spot rate of exchange or current rate of exchange is that rate which happens to prevail at the time when transactions are incurred.

(2) Forward Market Forward market foreign exchange is that market which handles such transactions of foreign exchange as are meant for future delivery. Such transactions are signed today but are to materialise (or are to be honoured) on some future date. Principal characteristics of forward market are that: (i) It only caters to forward transactions; it does not deal with spot transactions in foreign exchange. (ii) It defines (or determines) forward exchange rate-the exchange rate at which forward transactions are to be honoured.

Arguments in favour of Fixed Rate of Exhcnage (i) (iii) (iv) (vi) Encourage to International Trade Economic Development End of Speculation Suitable for Currency Areas Internal Stability Encouragement to Capital Formation Arguments against Fixed Rate of Exchange (i) (iii) (iv) (vi) Not very Helpful in Promoting International Trade Not Real Rate of Exchange No Elimination of Speculation Not Necessary for Particular Currency Areas Not Necessary for Long term Capital Flow International Crisis

Arguments in favour of Flexible Rate of Exchange (i) Possibility of Independent Economic Policy (ii) Full Employment Situation (iii) Regulation of Imports and Exports (iv) Application of the Theory of Demand Supply (v) Improvement in the Balance of Payments (vi) Increase in International Liquidity (vii) Helpful in making Monetary Policy Effective Arguments against Flexible Rate of Exchange (i) (iii) (iv) (vi) Causes Uncertainty Encourages Speculation Discourages Long-term Foreign Investment Causes Inflation Deprives Stability Impractical

Determination of Equilibrium Rate of Exchange 1. Determination of Fixed Rate of Exchange : It is determined by the government who alone is competent to change it. Prior to 1930, when Gold Standard was prevalent in many countries of the world, rate of exchange depended on the quantity of gold contained in the standard money of the country, e. g. dollar in case of America and pound in case of England. If American government fixed the price of one dollar as eqaul to 1 gram of gold and government of England fixed the price of one pound as equal to 4 grams. 2. Determination of Flexible Rate of Exchange : Flexible rate of exchange is not determined by the government. It is determined by the demand for and supply of different currencies in the foreign exchange market. In other words, it is determined by the market forces, like the price of any other commodity. The market where foreign currencies are demanded and supplied is called foreign exchange market.

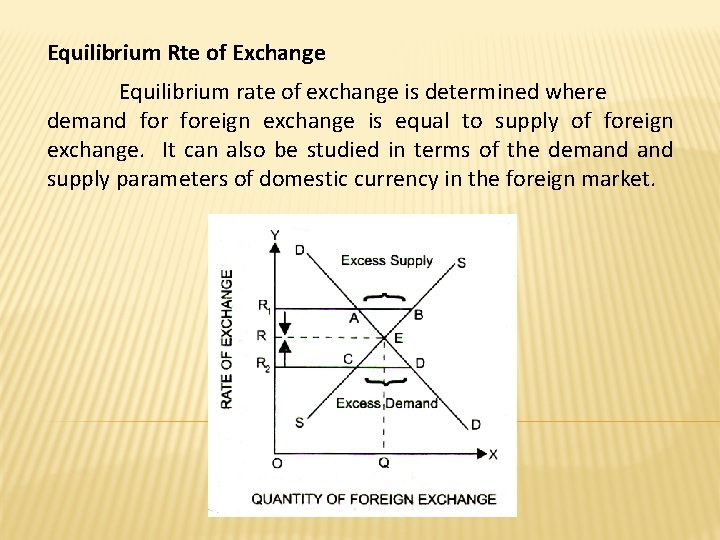

Demand for Foreign Exchange Foreign exchange is demanded for several purposes, i. e. , to pay for import of goods and services, to pay for loans and investments abroad, etc. There is an inverse relation between demand foreign currency and rate of exchange. Supply of Foreign Exchange Supply of foreign exchange is also governed by several factors, like exports to foreign countries, loans and investment from abroad, etc. Ordinarily, supply of foreign exchange and rate of exchange are directly related. With rise in the exchange, supply of foreign exchange increases and with fall in the rate of exchange, supply of foreign exchange decreases. Hence, supply curve of foreign exchange is an upward sloping (positive) curve.

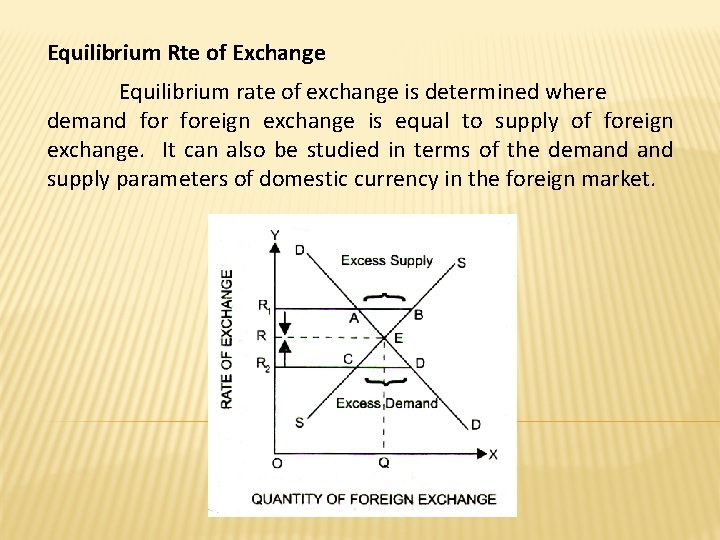

Equilibrium Rte of Exchange Equilibrium rate of exchange is determined where demand foreign exchange is equal to supply of foreign exchange. It can also be studied in terms of the demand supply parameters of domestic currency in the foreign market.

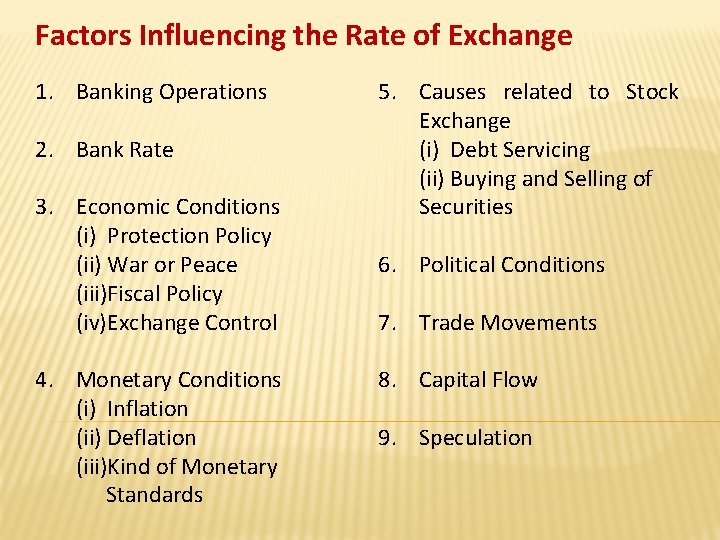

Factors Influencing the Rate of Exchange 1. Banking Operations 2. Bank Rate 3. Economic Conditions (i) Protection Policy (ii) War or Peace (iii)Fiscal Policy (iv)Exchange Control 4. Monetary Conditions (i) Inflation (ii) Deflation (iii)Kind of Monetary Standards 5. Causes related to Stock Exchange (i) Debt Servicing (ii) Buying and Selling of Securities 6. Political Conditions 7. Trade Movements 8. Capital Flow 9. Speculation

Purchasing Power Parity Theory of Exchange Rate Determination Rate of exchange under inconvertible paper currency is determined by purchasing power parity theory. According to this theory, rate of exchange in such countries is determined by the ratio of the purchasing power of their respective currencies. Definition According to Gustav Cassel, “The rate of exchange between two currencies must stand essentially on the quotient of the internal purchasing power of these currencies. ”

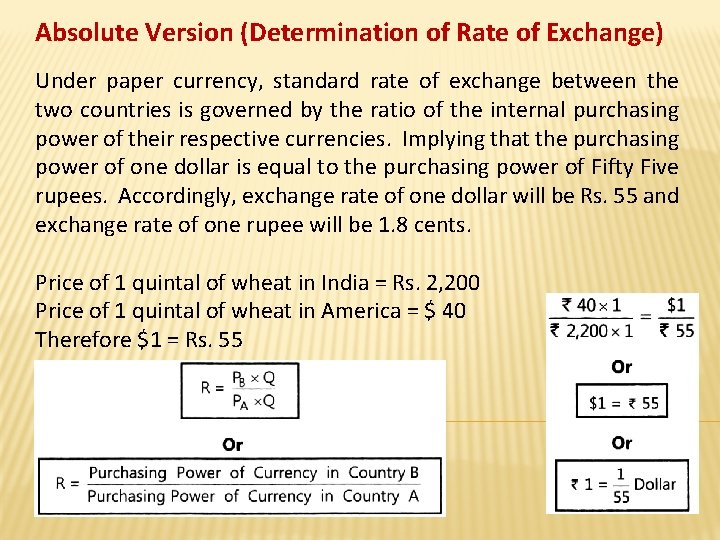

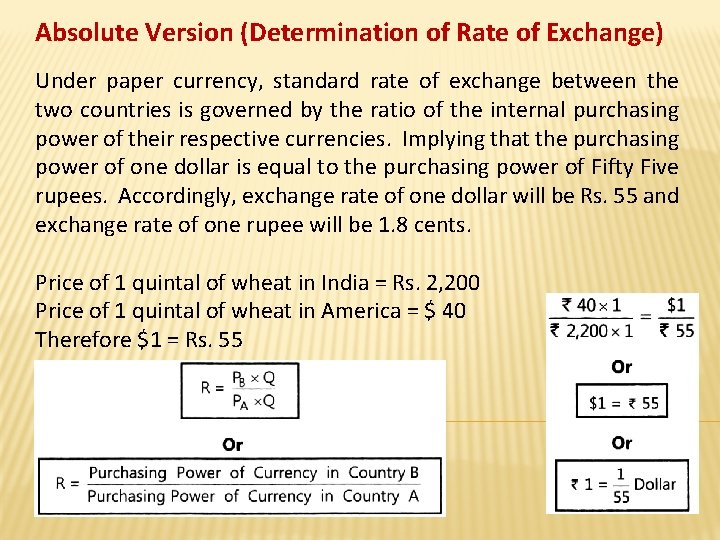

Absolute Version (Determination of Rate of Exchange) Under paper currency, standard rate of exchange between the two countries is governed by the ratio of the internal purchasing power of their respective currencies. Implying that the purchasing power of one dollar is equal to the purchasing power of Fifty Five rupees. Accordingly, exchange rate of one dollar will be Rs. 55 and exchange rate of one rupee will be 1. 8 cents. Price of 1 quintal of wheat in India = Rs. 2, 200 Price of 1 quintal of wheat in America = $ 40 Therefore $1 = Rs. 55

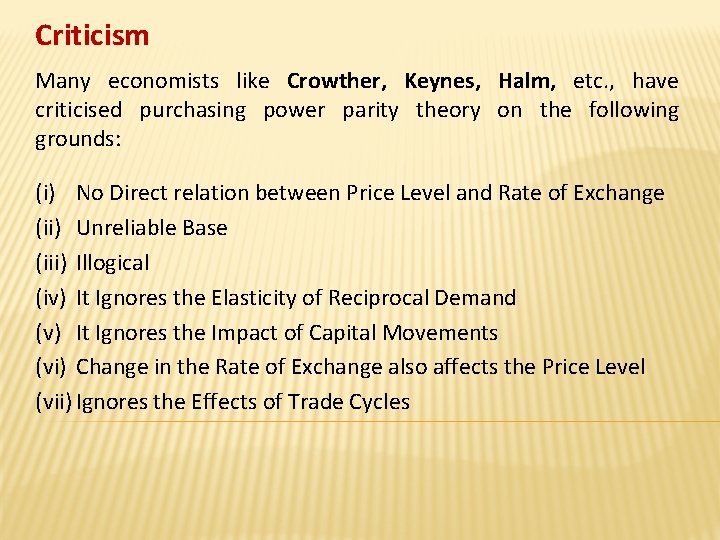

Criticism Many economists like Crowther, Keynes, Halm, etc. , have criticised purchasing power parity theory on the following grounds: (i) No Direct relation between Price Level and Rate of Exchange (ii) Unreliable Base (iii) Illogical (iv) It Ignores the Elasticity of Reciprocal Demand (v) It Ignores the Impact of Capital Movements (vi) Change in the Rate of Exchange also affects the Price Level (vii) Ignores the Effects of Trade Cycles

Thank You

Foreign exchange market presentation

Foreign exchange market presentation Too foreign for home

Too foreign for home Fx process

Fx process Bbr and bsr meaning

Bbr and bsr meaning Foreign exchange shifters

Foreign exchange shifters 4 forex shifters

4 forex shifters Kinds of foreign exchange market

Kinds of foreign exchange market Foreign exchange accounting

Foreign exchange accounting Objective of foreign exchange market

Objective of foreign exchange market Xlri jamshedpur student exchange program

Xlri jamshedpur student exchange program 4 shifters of foreign exchange

4 shifters of foreign exchange Unit 5 international trade

Unit 5 international trade Foreign exchange transaction regulation korea

Foreign exchange transaction regulation korea Hsbc forex rates

Hsbc forex rates Market structure in forex

Market structure in forex