PHILIPPINE MANUFACTURING INDUSTRY ROADMAP and GLOBAL VALUE CHAINS

PHILIPPINE MANUFACTURING INDUSTRY ROADMAP and GLOBAL VALUE CHAINS Rafaelita M. Aldaba Ateneo de Manila University Professional Schools, Rockwell, Makati City November 12, 2014 1

Outline Objective: implications of GVCs on the growth & development of PH manufacturing • Global Value Chains • Manufacturing Performance • Philippine Manufacturing Industry Roadmap • Services Vision and Strategy • Future Implications 2

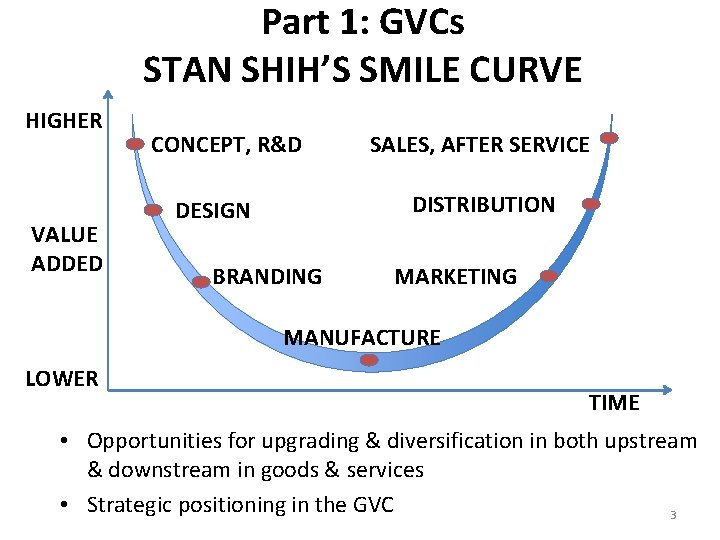

Part 1: GVCs STAN SHIH’S SMILE CURVE HIGHER VALUE ADDED CONCEPT, R&D SALES, AFTER SERVICE DISTRIBUTION DESIGN BRANDING MARKETING MANUFACTURE LOWER TIME • Opportunities for upgrading & diversification in both upstream & downstream in goods & services • Strategic positioning in the GVC 3

Distribution of value for Iphone Cost of inputs materials 22% Cost of inputs Chinanon-China labor 2% labor 3% Apple profits 58% Source: Kraemer et al 2011 Unidentified profits 5% S. Korea profits Japan profits Taiwan EUprofits 5% 0% Non-Apple 0% 1% US profits 2% • GVCs require high quality services embodied in production & increasingly outsourced • US (Apple) captures 58. 5% of Iphone sales price • Korea: 5% • Japan: 0. 5%; China: 1. 8% • Most value: product design, software development, product management, marketing & other high wage functions kept by Apple 4 • Trend: dispersion of functions

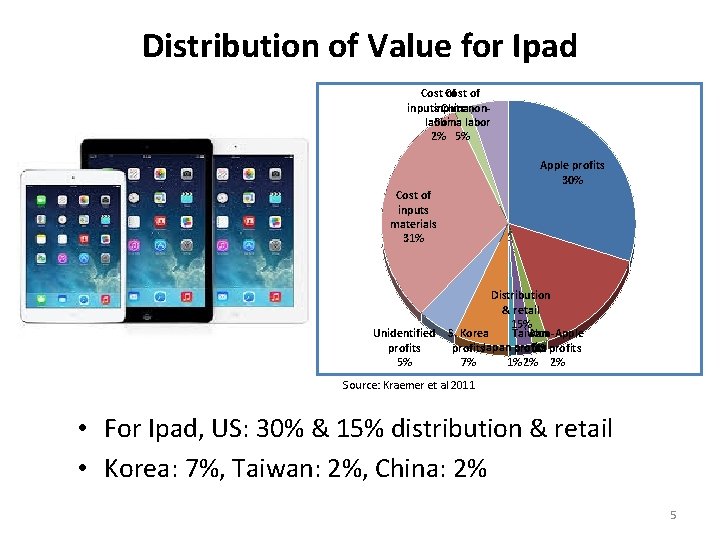

Distribution of Value for Ipad Cost of of inputs Chinanonlabor China labor 2% 5% Apple profits 30% Cost of inputs materials 31% Unidentified profits 5% Distribution & retail 15% S. Korea Taiwan Non-Apple profits. Japan profits US profits 1% 2% 2% 7% Source: Kraemer et al 2011 • For Ipad, US: 30% & 15% distribution & retail • Korea: 7%, Taiwan: 2%, China: 2% 5

Auto Global Value Chain FUNCTION R&D & DESIGN MATERIAL SUPPLY COST FOR AUTOMAKERS Low to Low: <10% High: 40 -70% medium : 10% Material Standardizers (R&D, model design. Toyota, Honda, etc. ) PARTS ASSEMBLY MARKETING SOURCING INTEGRATION & SERVICES Component specialists suppliers Glass, rubber, plastic, steel, textile, electronics Body panels, mechanical & electrical Wheels, tires, seats, engines, transmission Low: <10% Medium to high: 20% Distributor Integrators 1 st tier Assemblers Exporter 6

Global auto production network Source: Toyota Motor Corporation • Toyota’s IMV Project: transmission (Phils. & India), diesel engine (Thai), gas engine (Indonesia) 7

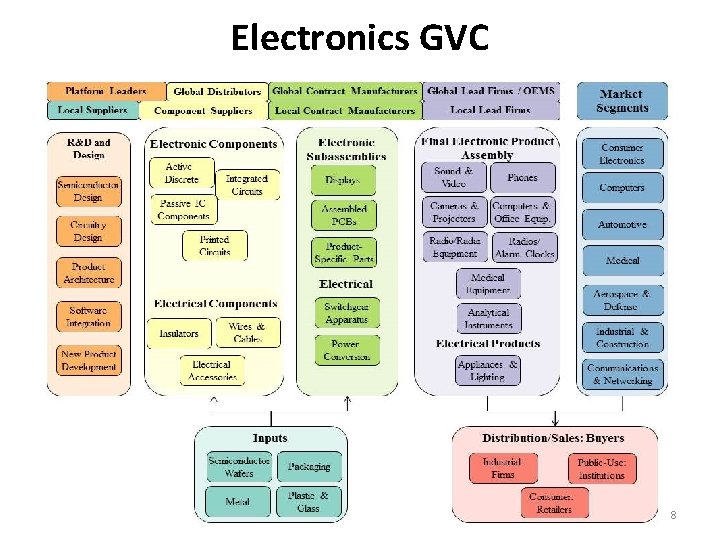

Electronics GVC 8

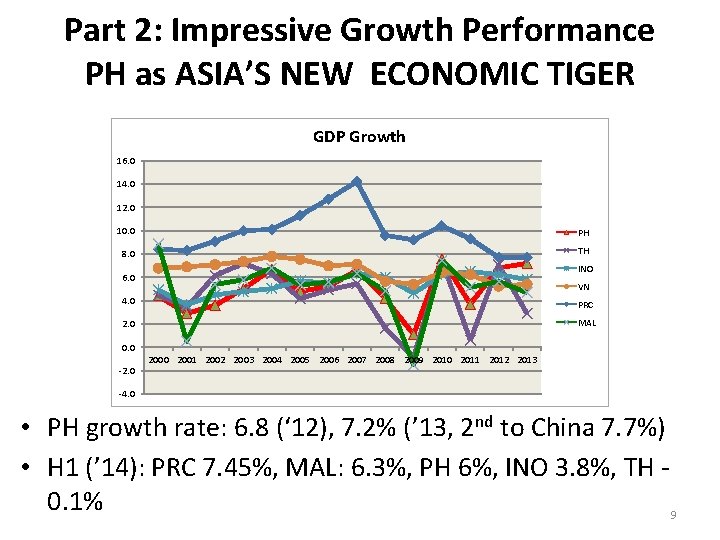

Part 2: Impressive Growth Performance PH as ASIA’S NEW ECONOMIC TIGER GDP Growth 16. 0 14. 0 12. 0 10. 0 PH 8. 0 TH INO 6. 0 VN 4. 0 PRC 2. 0 MAL 0. 0 -2. 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 -4. 0 • PH growth rate: 6. 8 (‘ 12), 7. 2% (’ 13, 2 nd to China 7. 7%) • H 1 (’ 14): PRC 7. 45%, MAL: 6. 3%, PH 6%, INO 3. 8%, TH 0. 1% 9

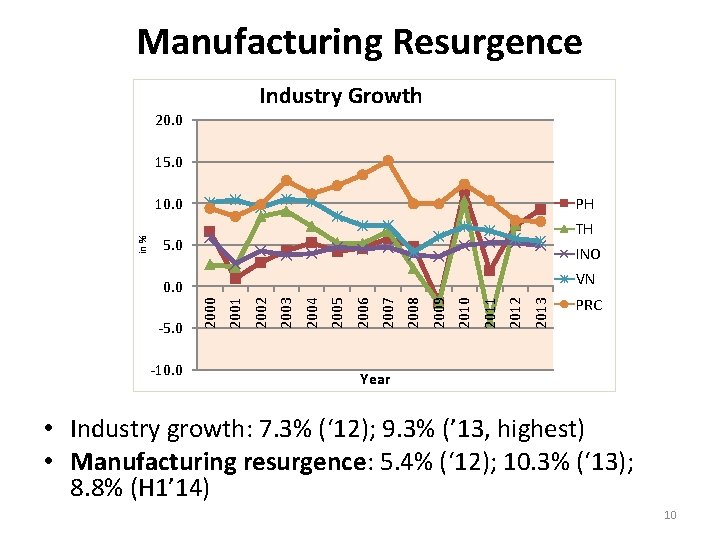

Manufacturing Resurgence Industry Growth 20. 0 15. 0 in % 10. 0 PH TH 5. 0 INO VN -10. 0 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 -5. 0 2000 0. 0 PRC Year • Industry growth: 7. 3% (‘ 12); 9. 3% (’ 13, highest) • Manufacturing resurgence: 5. 4% (‘ 12); 10. 3% (‘ 13); 8. 8% (H 1’ 14) 10

WHAT MAKES PH DIFFERENT Market Opportunities • Growing market & middle class: demographic sweet spot Labor • Young, English speaking, highly trainable workforce • Moderate wage increases Operating Environment • Strong macroeconomic fundamentals • Political stability, business/consumer confidence Policy Focus • New Industrial Policy & a more pro-active Government • Industry programs to support manufacturing resurgence • Philippine Economic Zone Authority, Board of Investments, Subic, Clark: investment facilitation, investor care Improved competitiveness ranking (World Economic Forum) • Rank #52 in 2014 -15 from rank #59 11

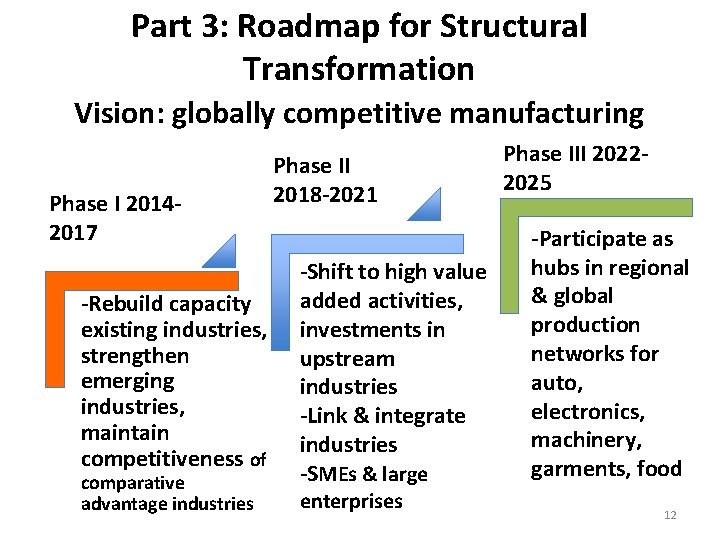

Part 3: Roadmap for Structural Transformation Vision: globally competitive manufacturing Phase I 20142017 -Rebuild capacity existing industries, strengthen emerging industries, maintain competitiveness of comparative advantage industries Phase II 2018 -2021 -Shift to high value added activities, investments in upstream industries -Link & integrate industries -SMEs & large enterprises Phase III 20222025 -Participate as hubs in regional & global production networks for auto, electronics, machinery, garments, food 12

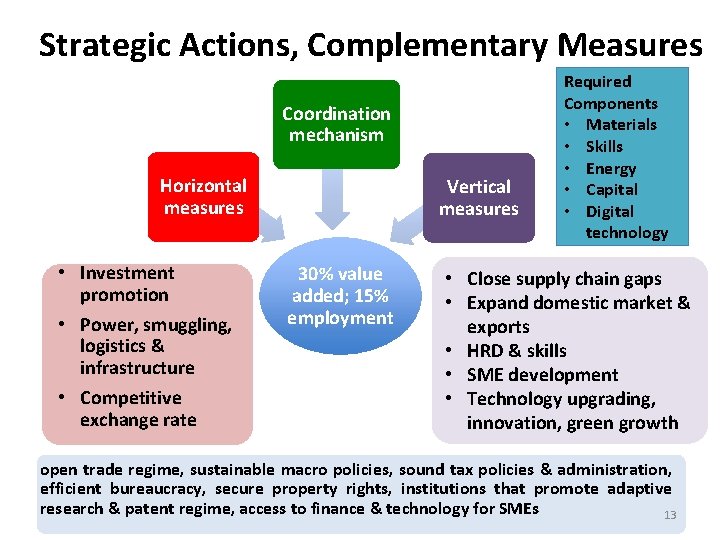

Strategic Actions, Complementary Measures Coordination mechanism Horizontal measures • Investment promotion • Power, smuggling, logistics & infrastructure • Competitive exchange rate Vertical measures 30% value added; 15% employment Required Components • Materials • Skills • Energy • Capital • Digital technology • Close supply chain gaps • Expand domestic market & exports • HRD & skills • SME development • Technology upgrading, innovation, green growth open trade regime, sustainable macro policies, sound tax policies & administration, efficient bureaucracy, secure property rights, institutions that promote adaptive research & patent regime, access to finance & technology for SMEs 13

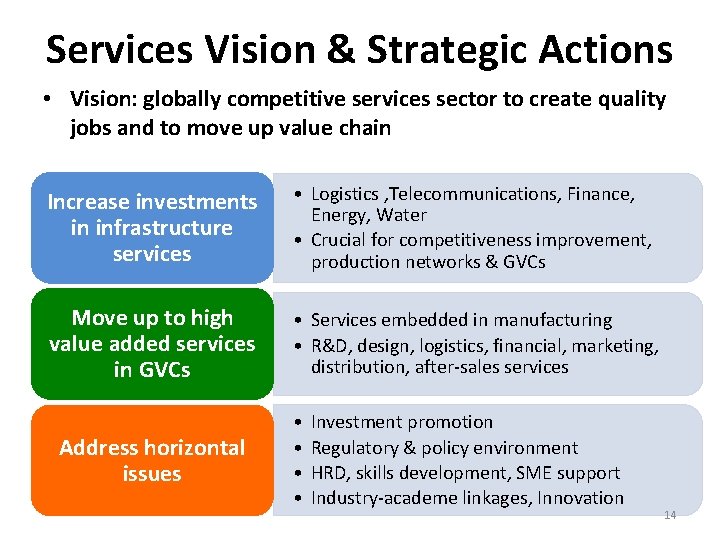

Services Vision & Strategic Actions • Vision: globally competitive services sector to create quality jobs and to move up value chain Increase investments in infrastructure services • Logistics , Telecommunications, Finance, Energy, Water • Crucial for competitiveness improvement, production networks & GVCs Move up to high value added services in GVCs • Services embedded in manufacturing • R&D, design, logistics, financial, marketing, distribution, after-sales services Address horizontal issues • • Investment promotion Regulatory & policy environment HRD, skills development, SME support Industry-academe linkages, Innovation 14

Manufacturing: Comparative Advantage • Motor vehicle • Engineered Products – Motor vehicle: body panel stamping, engines, transmissions, transaxle, large injection molded parts – E-vehicles: controller assembly, motor, battery, charging stations – Shipbuilding & Aerospace: parts & components • Chemicals: oleochemicals, petrochemicals & derivatives, chlor-alkali • Auto electronics, LED, solar, office equipment, communication radar, Electronic Data Processing, office equipment, consumer electronics • Virgin pulp paper • Copper wires & copper wire rods • Basic iron & steel products, long steel products, flat hot/cold rolled products • Tool & die: simple, compound, & progressive dies for metal stamping & forging; molds for die casting, plastic injection or blow molding; jigs & fixtures for metal cutting & forging • Food Processing/Manufacturing 15

Services: Comparative Advantage • Pool of skilled workers: main source of strength • Current comparative advantage : IT-BPM • Potential comparative advantage § Creative/knowledge-based services § Services embedded in manufacturing § Medical tourism, Tourism & travel related § Educational, recreational, cultural & sporting § Aircraft maintenance, repair, &overhaul § Ship repair § Distribution (retail, franchising) § Construction & engineering § Transport support q Energy, Public infrastructure & logistics, Public Private Partnership projects 16

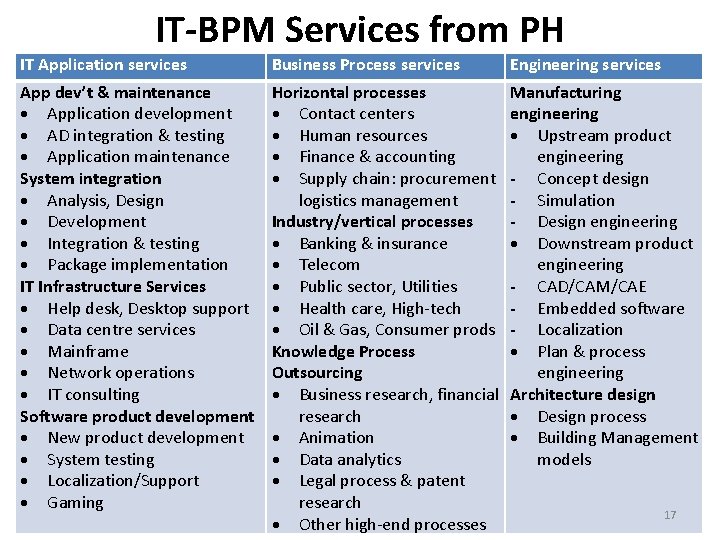

IT-BPM Services from PH IT Application services Business Process services Engineering services App dev’t & maintenance Application development AD integration & testing Application maintenance System integration Analysis, Design Development Integration & testing Package implementation IT Infrastructure Services Help desk, Desktop support Data centre services Mainframe Network operations IT consulting Software product development New product development System testing Localization/Support Gaming Horizontal processes Contact centers Human resources Finance & accounting Supply chain: procurement logistics management Industry/vertical processes Banking & insurance Telecom Public sector, Utilities Health care, High-tech Oil & Gas, Consumer prods Knowledge Process Outsourcing Business research, financial research Animation Data analytics Legal process & patent research Other high-end processes Manufacturing engineering Upstream product engineering - Concept design - Simulation - Design engineering Downstream product engineering - CAD/CAM/CAE - Embedded software - Localization Plan & process engineering Architecture design Design process Building Management models 17

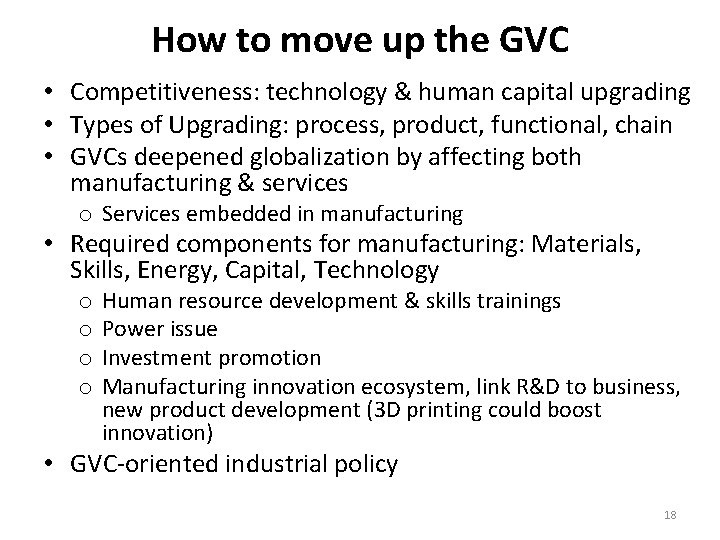

How to move up the GVC • Competitiveness: technology & human capital upgrading • Types of Upgrading: process, product, functional, chain • GVCs deepened globalization by affecting both manufacturing & services o Services embedded in manufacturing • Required components for manufacturing: Materials, Skills, Energy, Capital, Technology o o Human resource development & skills trainings Power issue Investment promotion Manufacturing innovation ecosystem, link R&D to business, new product development (3 D printing could boost innovation) • GVC-oriented industrial policy 18

With or without AEC, we need to pursue a new industrial policy to make our industries competitive and create an environment conducive to private sector development. This could lead to more investments, increased competition, more innovation, increased productivity, sustainable & inclusive growth, & more & better jobs! THANK YOU! 19

- Slides: 19