PERS Education and Retirement Planning Welcome The Oregon

- Slides: 32

PERS Education and Retirement Planning Welcome ! The Oregon Public Service Retirement Plan (OPSRP) Updated: 4/22/08

Disclaimer n Information may change as the result of administrative, legislative or judicial decisions.

Today’s Agenda n OPSRP n n n Administration Components Membership Retirement Eligibility Individual Account Program Member resources

OPSRP: Effective August 29, 2003 n n Established by legislature For new employees hired “on or after” August 29, 2003

OPSRP Administration n n Administered by the PERS Board The Oregon Investment Council n Invests OPSRP assets as part of the PERS fund

Benefits: Two components of OPSRP n n Pension Program: a defined benefit plan based on salary and service time AND Individual Account Program: a defined contribution plan

OPSRP Pension Program n n n Funded by your employer Employer must make contributions necessary to fund the Pension Program Employer contribution rate determined by PERS

OPSRP Pension Program n n At retirement, provides lifetime pension benefit For general service member with 30 years of service (25 years for P & F) retiring at normal retirement age n Will provide approx. 45 percent of your final average salary at retirement

Membership Requirements n Hired into a qualifying position Position that normally requires 600 hours of work in a calendar year Completes six full calendar months of work in waiting time period n n Waiting time period cannot be interrupted by more than 30 consecutive workdays Membership is established

Your Responsibilities n n Important that PERS has up-to-date accurate information to send you member annual statements Throughout your career, it’s your responsibility to ensure your employer always has your correct personal information n Employer sends PERS this information

Vesting n Vested in pension when: n n Member reaches normal retirement age, or Member completes five years of qualifying service n n Five years need not be consecutive Before becoming vested… n Five consecutive years of less than 600 hrs/year causes loss of any prior vesting service

Active Member Benefits n n Disability benefit Death benefit

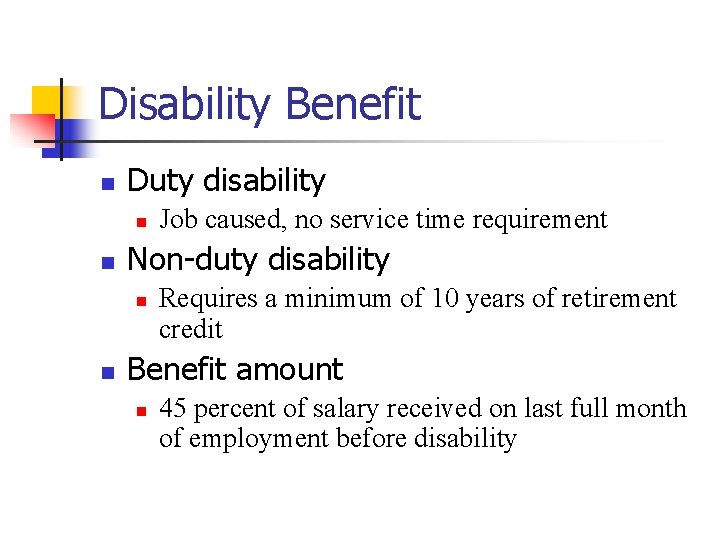

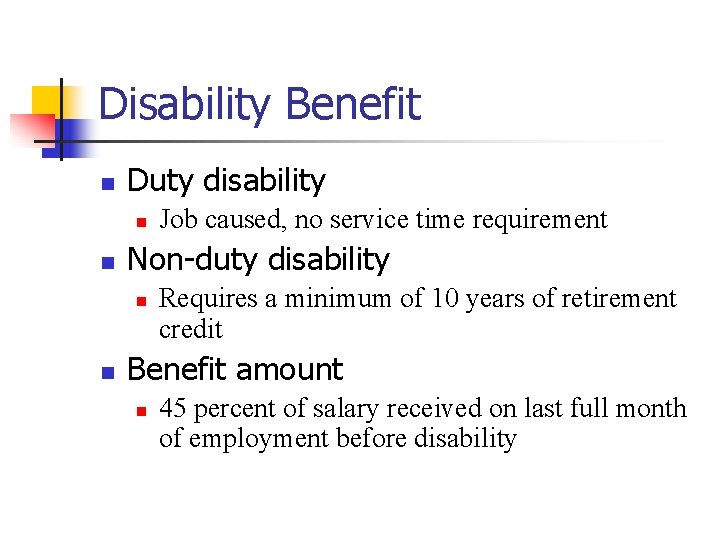

Disability Benefit n Duty disability n n Non-duty disability n n Job caused, no service time requirement Requires a minimum of 10 years of retirement credit Benefit amount n 45 percent of salary received on last full month of employment before disability

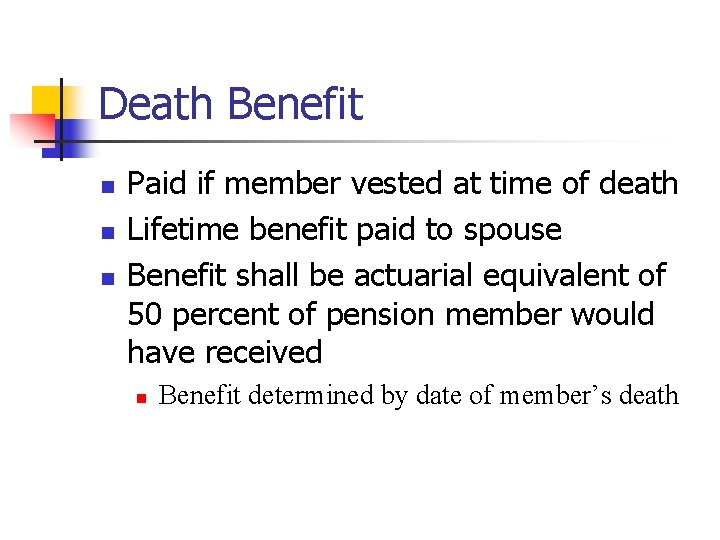

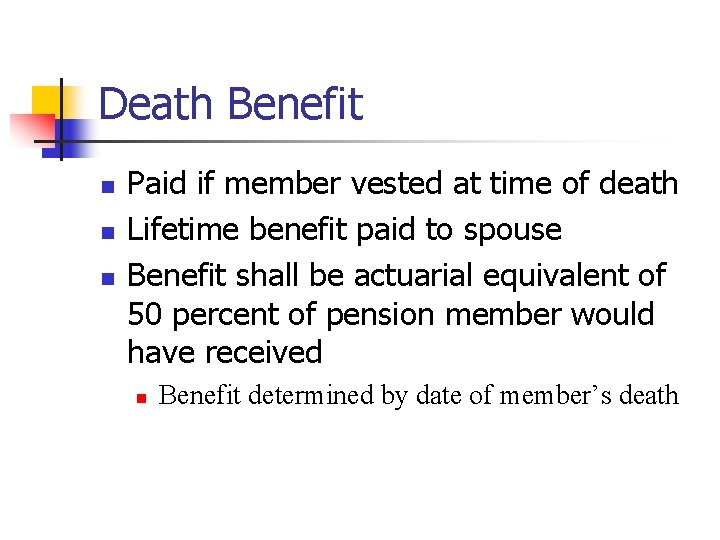

Death Benefit n n n Paid if member vested at time of death Lifetime benefit paid to spouse Benefit shall be actuarial equivalent of 50 percent of pension member would have received n Benefit determined by date of member’s death

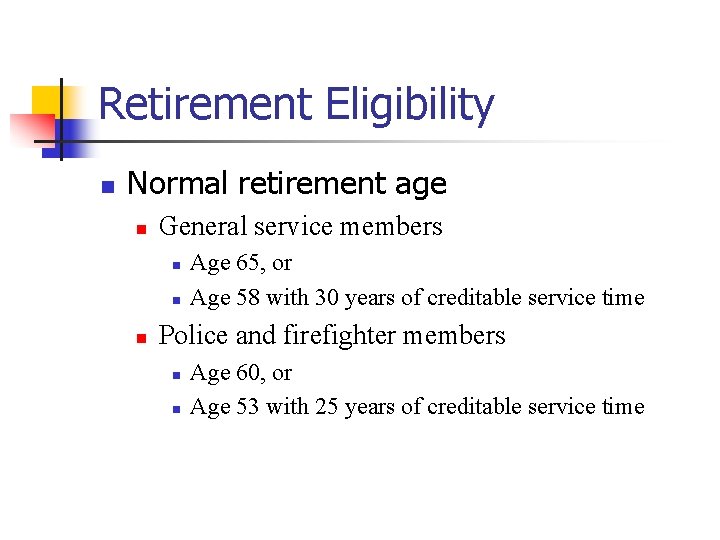

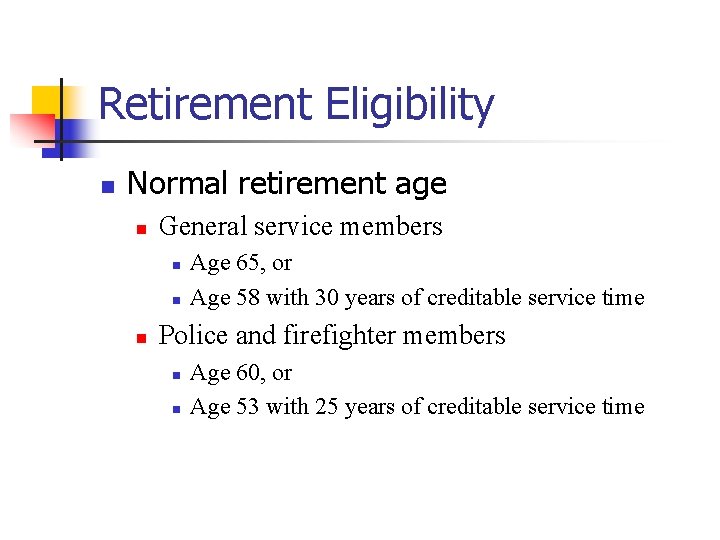

Retirement Eligibility n Normal retirement age n General service members n n n Age 65, or Age 58 with 30 years of creditable service time Police and firefighter members n n Age 60, or Age 53 with 25 years of creditable service time

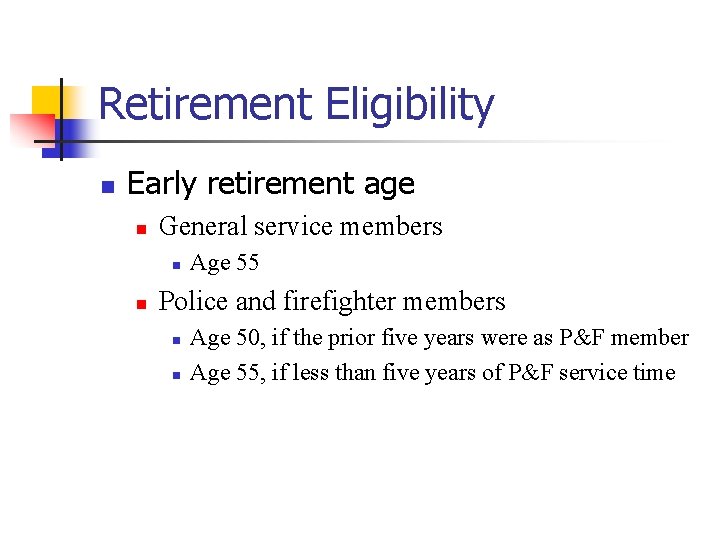

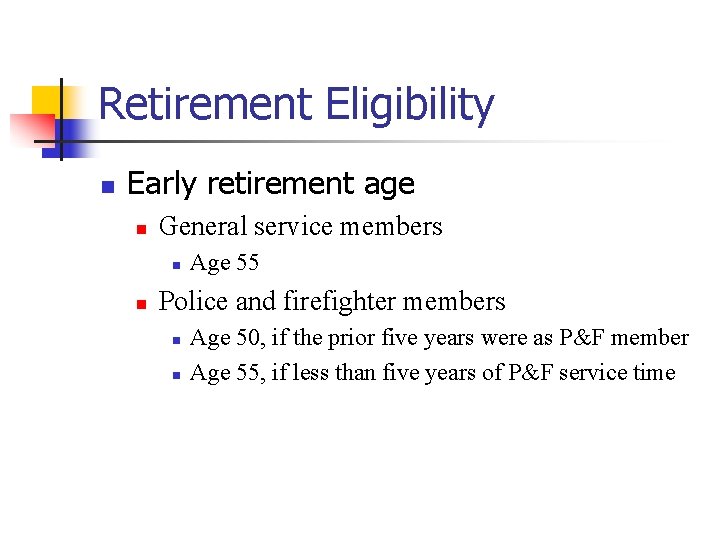

Retirement Eligibility n Early retirement age n General service members n n Age 55 Police and firefighter members n n Age 50, if the prior five years were as P&F member Age 55, if less than five years of P&F service time

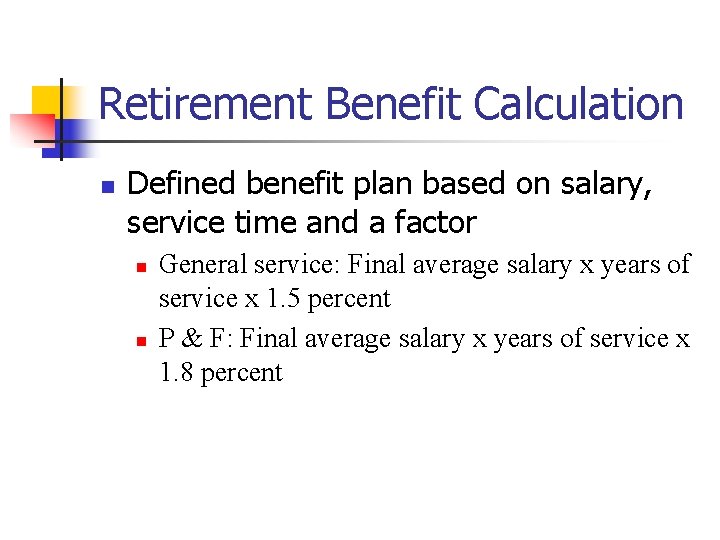

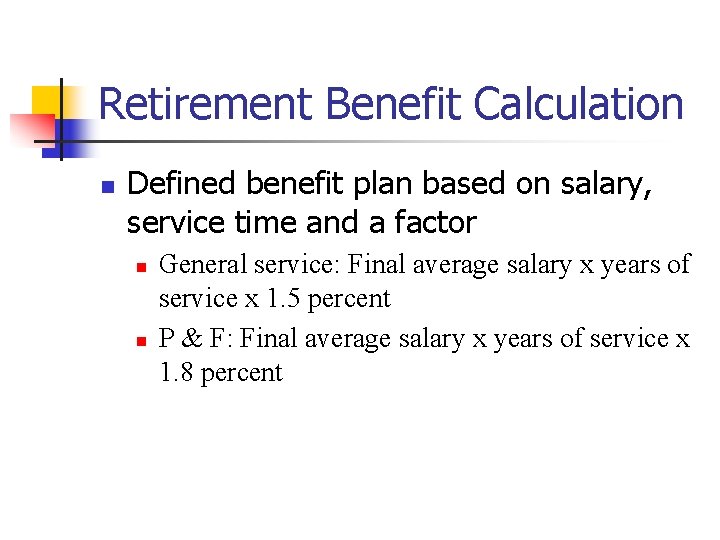

Retirement Benefit Calculation n Defined benefit plan based on salary, service time and a factor n n General service: Final average salary x years of service x 1. 5 percent P & F: Final average salary x years of service x 1. 8 percent

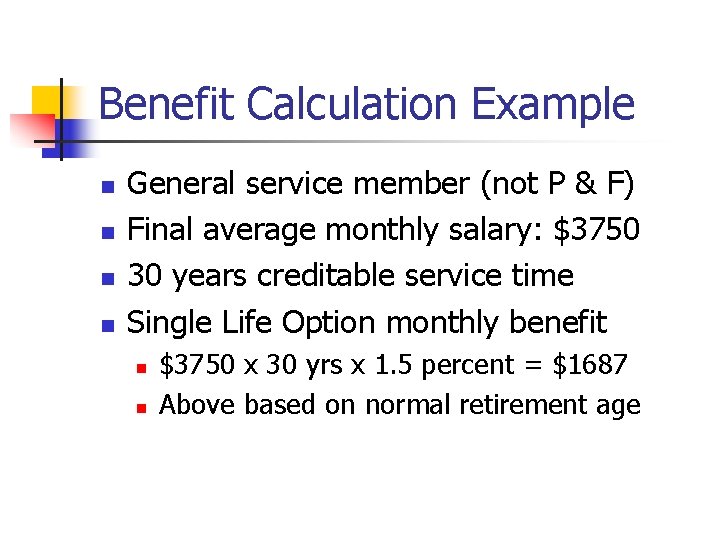

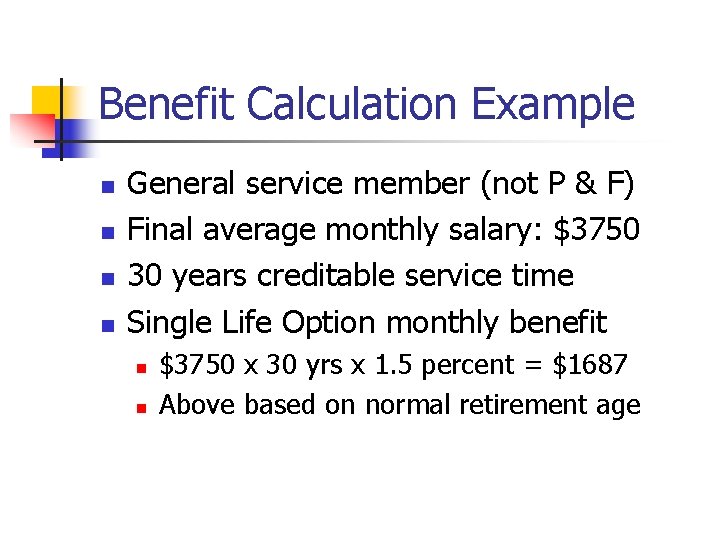

Benefit Calculation Example n n General service member (not P & F) Final average monthly salary: $3750 30 years creditable service time Single Life Option monthly benefit n n $3750 x 30 yrs x 1. 5 percent = $1687 Above based on normal retirement age

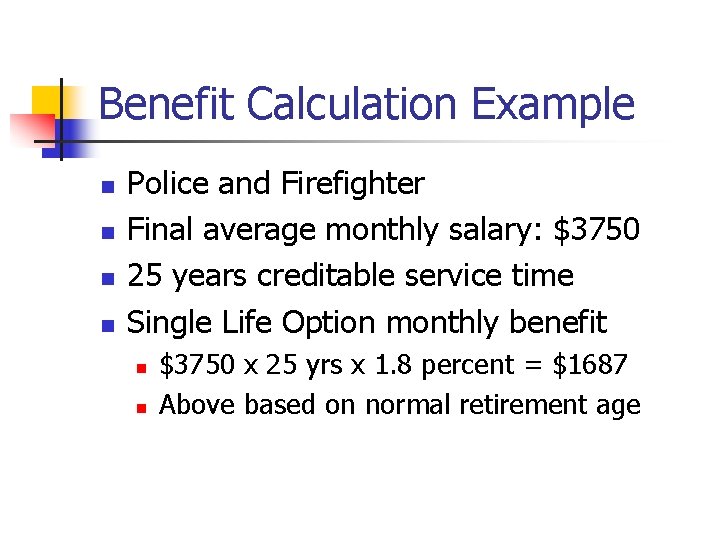

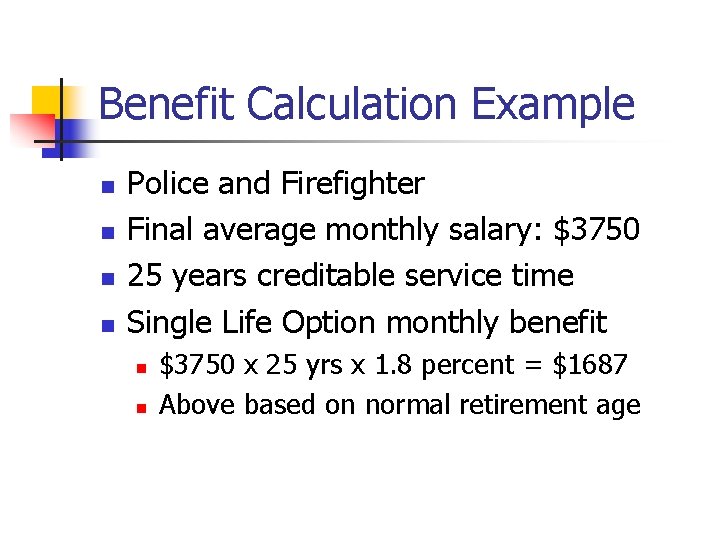

Benefit Calculation Example n n Police and Firefighter Final average monthly salary: $3750 25 years creditable service time Single Life Option monthly benefit n n $3750 x 25 yrs x 1. 8 percent = $1687 Above based on normal retirement age

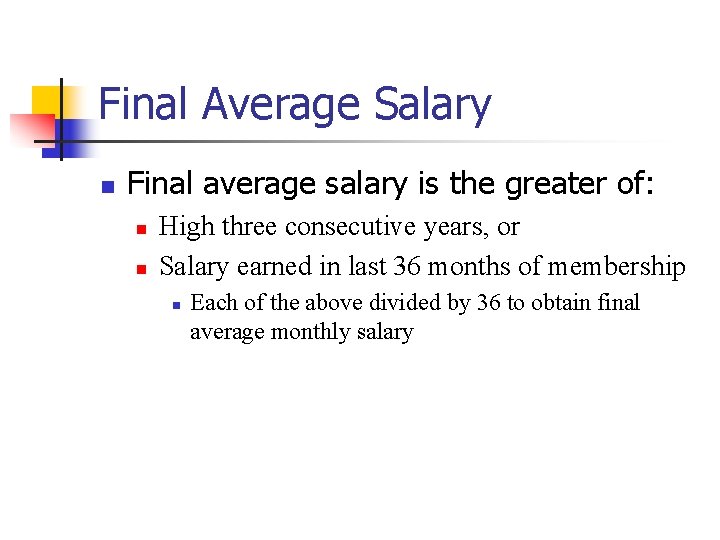

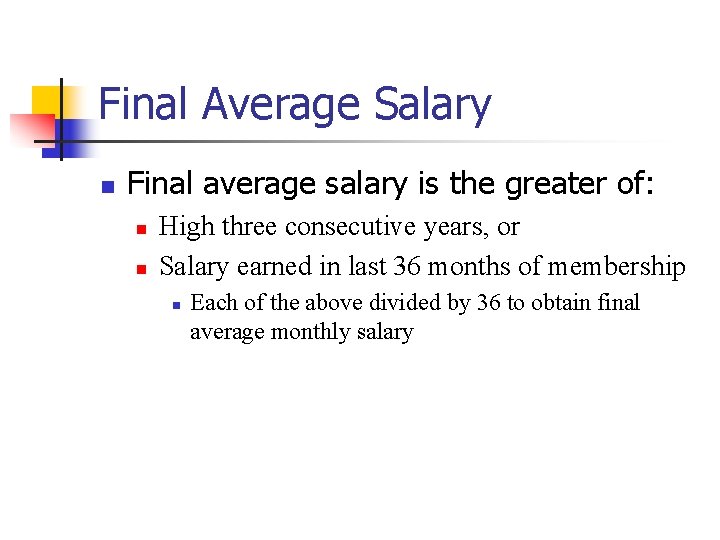

Final Average Salary n Final average salary is the greater of: n n High three consecutive years, or Salary earned in last 36 months of membership n Each of the above divided by 36 to obtain final average monthly salary

Years of Service n n No credit for a year with less than 600 hours of service Upon completion of waiting time, eligible employee becomes member, receives credit at that point for waiting time period

Retirement: Option Choices n Normal retirement benefit n n n Single Life Option Paid in lifetime monthly installments Early retirement benefit n Reduced pension

Survivorship Options n n Pension for retired member’s lifetime and same amount for beneficiary’s lifetime Pension for retired member’s lifetime and one-half that amount for beneficiary’s lifetime

Lump-sum payout n If monthly pension for member or beneficiary totals $200 or less n Paid as actuarial equivalent lump-sum

Working After Retirement n Pension benefits stop upon reemployment in a qualifying position n n Qualifying position: 600 hours in a calendar year Subsequent retirements n n Member can choose any retirement option The pension will be recalculated

Individual Account Program n n Member must contribute 6% salary contribution whether employer “picks up” contribution or not Oregon Investment Council provides investment oversight for IAP and OPSRP pension funds

IAP and Member Contributions § Contributions beginning January 1, 2004 n to IAP member account has earnings/losses until last dollar paid out to inactive or retired member

IAP and Death Benefits n n Member’s account paid to beneficiary If married member n Must be paid to spouse n n Unless otherwise designated with form If no named beneficiary n n n Paid to spouse, or Children, or Estate

IAP Distributions n Inactive member (withdrawal) n n OPSRP retiree (retirement) n n Lump sum, or Installments over 5 -10 -15 -20 year periods, or Anticipated Life Span Option Can receive IAP distributions only after separation from OPSRP covered employment

Planning for the Future n Save more for retirement n 457 deferred compensation plans n The Oregon Savings Growth Plan n Other employer sponsored 457 plans Qualified employer plans n n n http: //oregon. gov/PERS/OSGP 403(b) for education employees 401(k) for some local government employees Earnings accumulate tax-deferred

Member Resources n n Websites and E-mail link for PERS website n PERS: http: //oregon. gov/PERS n https: //iap. csplans. com Toll-free telephone number n PERS/OPSRP n 1 -888 -320 -7377 or 503 -598 -7377

Questions?