Performance Evaluation EMBA 5412 Fall 2010 Performance of

Performance Evaluation EMBA 5412 Fall 2010

Performance of what? o o Companies Divisions Products managers 2

Centralization - Decentralization o o o Total decentralization-minimum constraints and maximum freedom for managers at the lowest levels of an organization to make decisions Total centralization - maximum constraints and minimum freedom for managers at the lowest levels of an organization to make decisions A structure is chosen based on cost vs. benefit analysis 3

Decentralized Organizations o o substantial decision making authority the managers of subunits managers at lower levels of the organization free to make decisions Autonomy is the degree of freedom to make decisions. The greater the freedom, the greater the autonomy Usually some decentralized some centralized 4

Advantages of Decentralization o o o Provides better information to make decisions – at the local and top management levels Leads to gains from faster decision making quicker responses to changing circumstances Creates greater responsiveness to local needs Increases motivation of subunit managers Provides excellent training for future top-level executives Sharpens the focus of subunit managers 5

Disadvantages of Decentralization o o o Costly duplication of activities Lack of goal congruence Agency n n Management pursues personal goals Personal goals are incompatible with the company’s goals 6

Why Evaluate o o o A company evaluates subunits in order to decide if it should expand or contract them or change their operations A company evaluates subunit managers in order to motivate them to take actions that maximize the value of the firm Reasons for evaluating subunit managers: n n Identifies successful operations and areas needing improvement Influences the behavior of managers 7

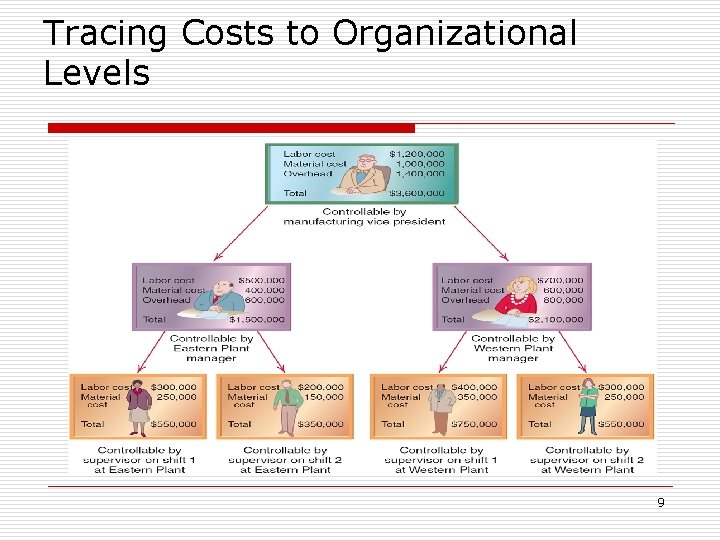

Responsibility Accounting and Performance Evaluation o o Responsibility accounting - managers responsible only for costs and revenues that they can control To implement responsibility accounting in a decentralized organization, costs and revenues are traced to the organizational level where they can be controlled 8

Tracing Costs to Organizational Levels 9

Types of responsibility centers o o Cost Center Revenue Center Profit Center Investment Center 10

Cost Centers o Subunit responsible for controlling costs but not responsible for generating revenue n o o Most service departments are cost centers (i. e. , janitorial, maintenance, computer services, production) Must provide service to company at a reasonable cost Evaluation based on comparison of budgeted or standard costs with actual costs 11

Profit Centers o o o Subunit responsible for generating revenues and controlling costs Goal is to maximize profit for the division n Performance can be evaluated in terms of profitability n Motivates managers to focus their attention on ways of maximizing profit A variety of methods are used to evaluate profitability n Current income compared to budgeted income n Current income compared to past income n Comparison with other profit centers, called relative performance evaluation 12

Investment Centers o o o Subunit responsible for generating revenue, controlling costs, and investing in assets Goal is to maximize return on investment Evaluation based on comparison with a benchmark, previous years, or other investment centers 13

Boyner Example o o o A wide range of products varying from cosmetics to sports, and from home appliances to kidswear are presented at 24 Boyner Stores all over Turkey in İstanbul, Ankara, Adana, Antalya, Bursa, İzmir, Trabzon, Mersin, Diyarbakır, Denizli and Konya. Women, Men, Kids and Shoes at each of the Discount Stores servicing the customers at 8 different locations all over Turkey Outlet centers and stores could be profit or investment centers Each store could be a revenue or profit center – depending how autonomous they are Accounting department and maintenance-cost centers 14

Study Break #1 o An investment center is responsible for: a. b. c. d. Investing in long term assets Controlling costs Generating revenues All of the above Answer: d. All of the above 15

Study Break #2 o Cost centers are often evaluated using: a. b. c. d. Variance analysis Operating margin Return on investment Residual income Answer: a. Variance analysis 16

Study Break #3 o Profit centers are often evaluated using: a. b. c. d. Investment turnover Income targets or profit budgets Return on investment Residual income Answer: b. Income targets or profit budgets 17

Accounting-Based Performance Measures o Requires a six-step design process: 1. 2. 3. 4. 5. 6. Choose Performance Measures that align with top management’s financial goals Choose the time horizon of each Performance Measure Choose a definition of the components in each Performance Measure Choose a measurement alternative for each Performance Measure Choose a target level of performance Choose the timing of feedback 18

Step 1: Choosing among Different Performance Measures o Four common measures of economic performance: 1. 2. 3. 4. o Return on Investment Residual Income Economic Value Added Return on Sales Selecting Subunit Operating Income as a metric is inappropriate since it obviously differs simply on the differing size of the subunits 19

Evaluating Investment Centers With ROI o o o ROI is a primary tool for evaluating the performance of investment centers = Investment Center Income Invested Capital Focuses management’s attention on income and level of investment Most popular metric for two reasons: n Blends all the ingredients of profitability (revenues, costs, and investment) into a single percentage n May be compared to other ROIs both inside and outside the firm Also called the Accounting Rate of Return (ARR) or the Accrual Accounting Rate of Return (AARR) 20

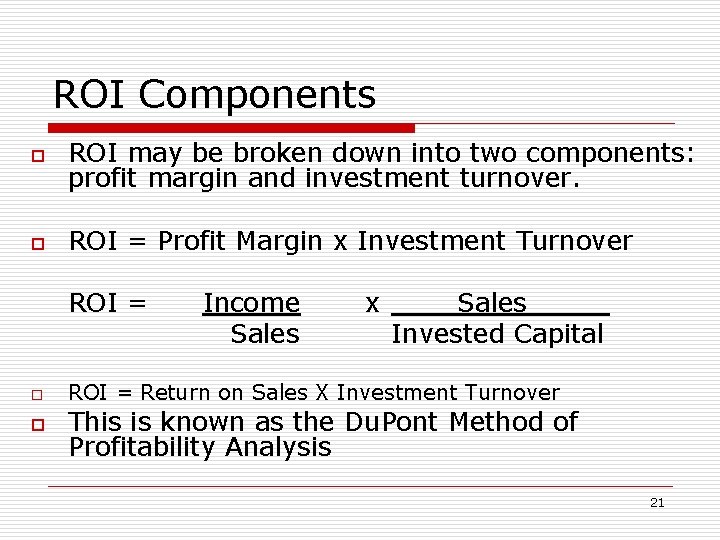

ROI Components o ROI may be broken down into two components: profit margin and investment turnover. o ROI = Profit Margin x Investment Turnover ROI = o o Income Sales x ____Sales_____ Invested Capital ROI = Return on Sales X Investment Turnover This is known as the Du. Pont Method of Profitability Analysis 21

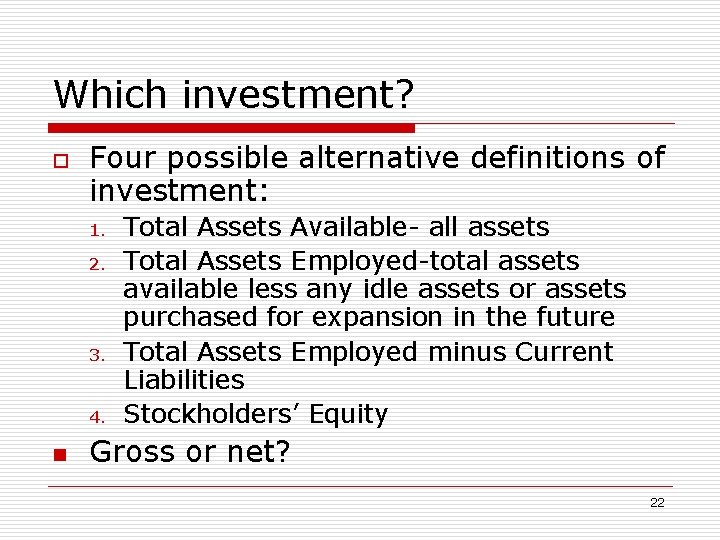

Which investment? o Four possible alternative definitions of investment: 1. 2. 3. 4. n Total Assets Available- all assets Total Assets Employed-total assets available less any idle assets or assets purchased for expansion in the future Total Assets Employed minus Current Liabilities Stockholders’ Equity Gross or net? 22

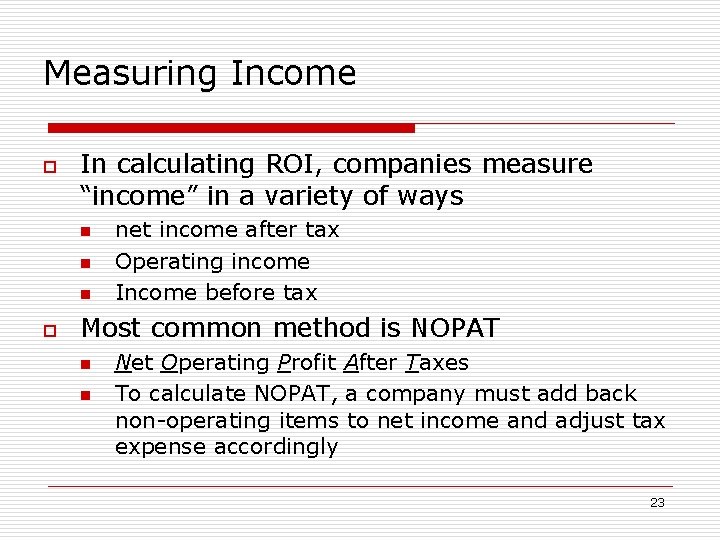

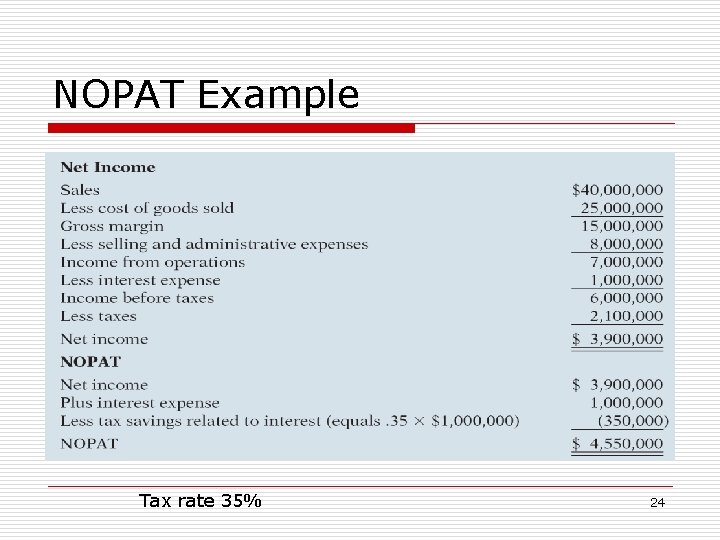

Measuring Income o In calculating ROI, companies measure “income” in a variety of ways n n n o net income after tax Operating income Income before tax Most common method is NOPAT n n Net Operating Profit After Taxes To calculate NOPAT, a company must add back non-operating items to net income and adjust tax expense accordingly 23

NOPAT Example Tax rate 35% 24

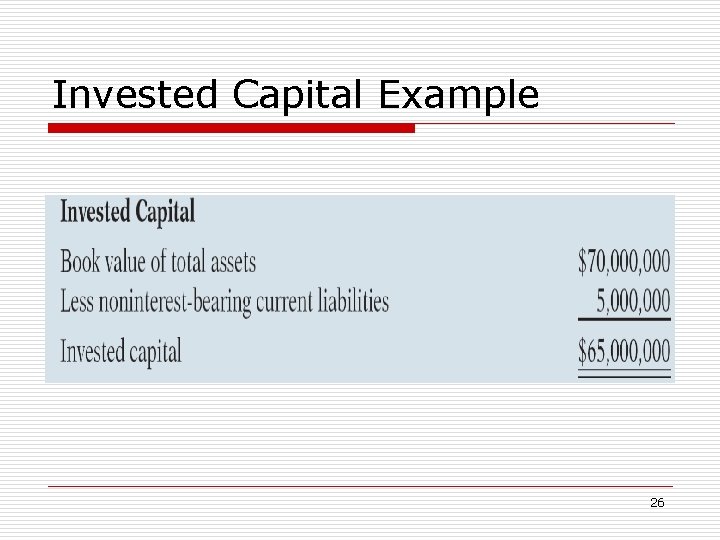

Measuring Income and Invested Capital for ROI o o In calculating ROI, companies measure “invested capital” in a variety of ways Approach used here: Total assets less non-interest-bearing current liabilities 25

Invested Capital Example 26

ROI – France, Germany, and Japan 27

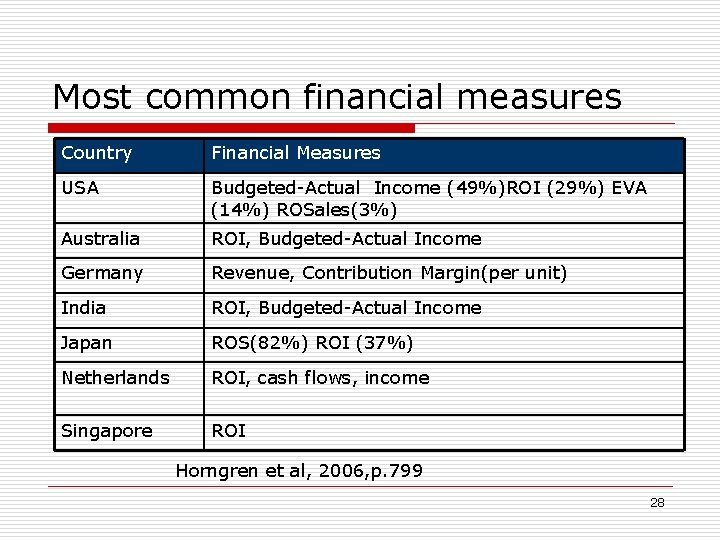

Most common financial measures Country Financial Measures USA Budgeted-Actual Income (49%)ROI (29%) EVA (14%) ROSales(3%) Australia ROI, Budgeted-Actual Income Germany Revenue, Contribution Margin(per unit) India ROI, Budgeted-Actual Income Japan ROS(82%) ROI (37%) Netherlands ROI, cash flows, income Singapore ROI Horngren et al, 2006, p. 799 28

Return on Sales (ROS) o o Return on Sales is simply income divided by sales Simple to compute, and widely understood 29

Example Exercise #1 o o Davenport Mills is a division of Iowa Woolen Products, Inc. For the most recent year, Davenport had net income of $16, 000. Included in income was interest expense of $1, 300, 000. The operation’s tax rate is 40%. Total assets of Davenport Mills are $225, 000, current liabilities are $45, 000, and $30, 000 of the current liabilities are noninterest-bearing. Calculate NOPAT, invested capital, and ROI. 30

Example Exercise #1 Solution o NOPAT = Net income + interest expense (1 - tax rate) = $16, 000 + $1, 300, 000 (1 -. 40) = $16, 780, 000 o Invested Capital = Total assets - noninterest-bearing current liabilities = $225, 000 - $30, 000 = $195, 000 31

Example Exercise #1 Solution o ROI = NOPAT ÷ Invested capital = $16, 780, 000 ÷ $195, 000 = 86. 05% 32

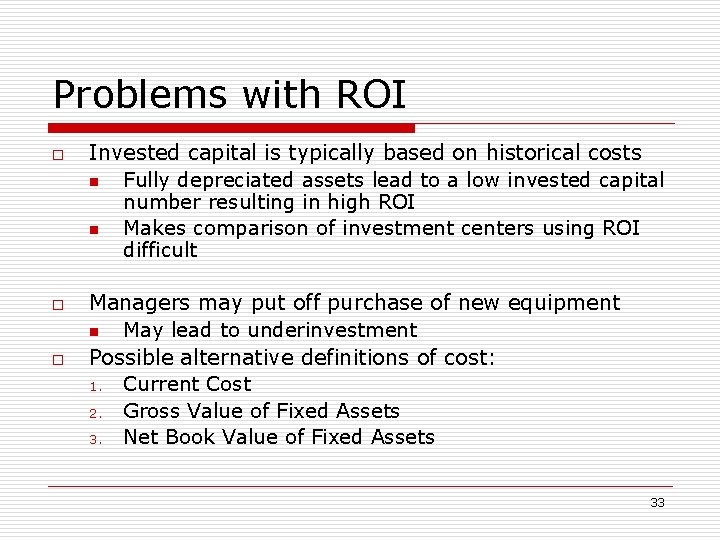

Problems with ROI o o o Invested capital is typically based on historical costs n Fully depreciated assets lead to a low invested capital number resulting in high ROI n Makes comparison of investment centers using ROI difficult Managers may put off purchase of new equipment n May lead to underinvestment Possible alternative definitions of cost: 1. Current Cost 2. Gross Value of Fixed Assets 3. Net Book Value of Fixed Assets 33

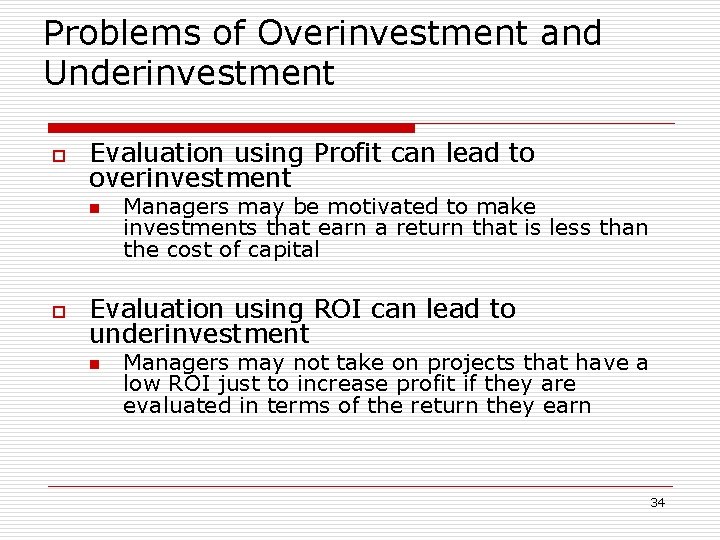

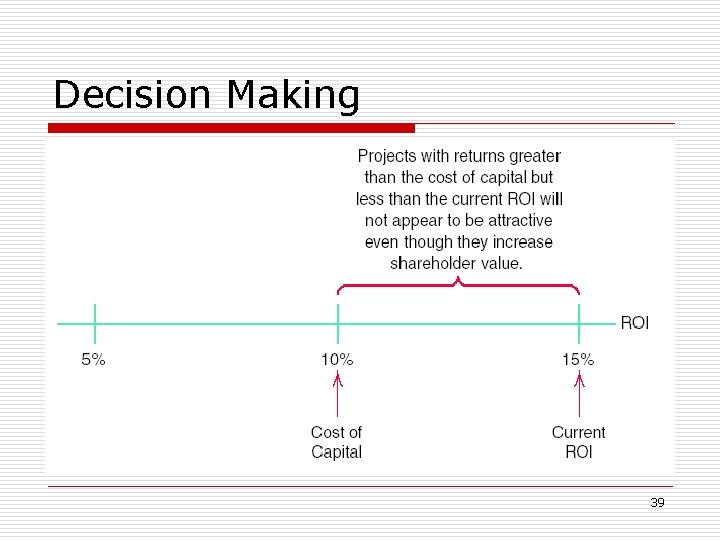

Problems of Overinvestment and Underinvestment o Evaluation using Profit can lead to overinvestment n o Managers may be motivated to make investments that earn a return that is less than the cost of capital Evaluation using ROI can lead to underinvestment n Managers may not take on projects that have a low ROI just to increase profit if they are evaluated in terms of the return they earn 34

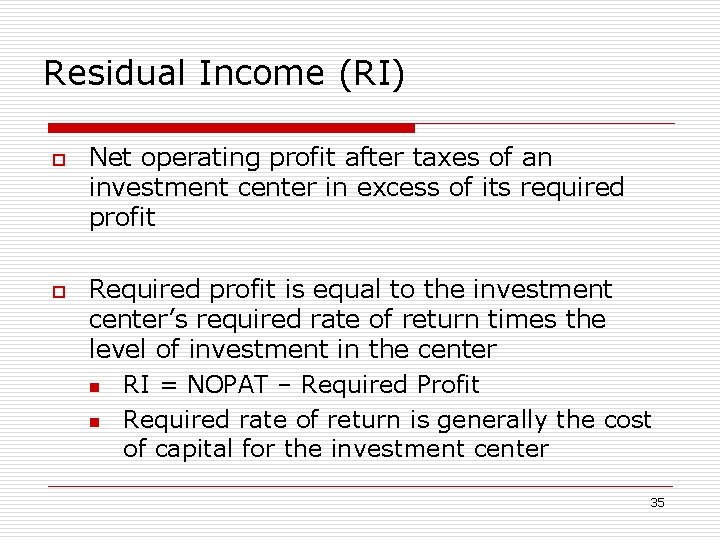

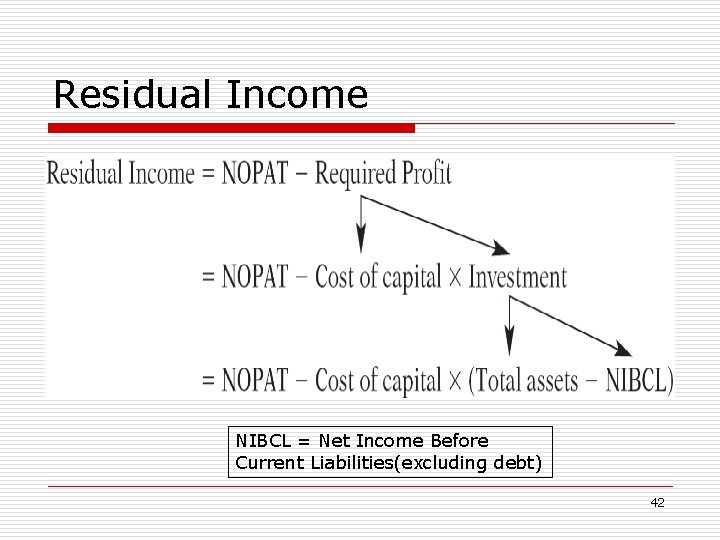

Residual Income (RI) o o Net operating profit after taxes of an investment center in excess of its required profit Required profit is equal to the investment center’s required rate of return times the level of investment in the center n RI = NOPAT – Required Profit n Required rate of return is generally the cost of capital for the investment center 35

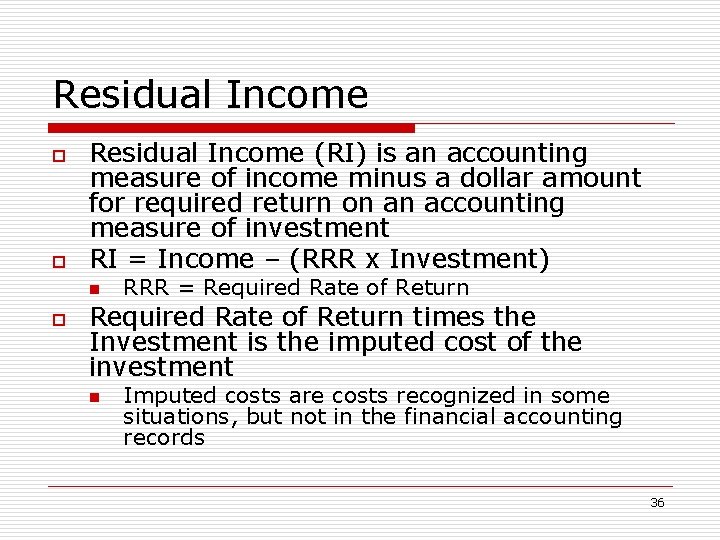

Residual Income o o Residual Income (RI) is an accounting measure of income minus a dollar amount for required return on an accounting measure of investment RI = Income – (RRR x Investment) n o RRR = Required Rate of Return times the Investment is the imputed cost of the investment n Imputed costs are costs recognized in some situations, but not in the financial accounting records 36

Example Exercise #2 o Using the same information as in Example Exercise #1, calculate the residual income if the company’s cost of capital is 10%. 37

Example Exercise #2 Solution o Residual Income = NOPAT – (Cost of Capital x Invested Capital) = $16, 780, 000 – (10% x $195, 000) = ($2, 720, 000) 38

Decision Making 39

Economic Value Added (EVA) o EVA is residual income adjusted for accounting distortions that arise from GAAP n n o A performance measure approach to solving overinvestment and underinvestment problems Advantage is that managers are less tempted to cut those costs that distort income under GAAP For example, under GAAP research and development costs are expensed, but the costs benefits future periods n Thus, under EVA research and development is capitalized and amortized over future periods 40

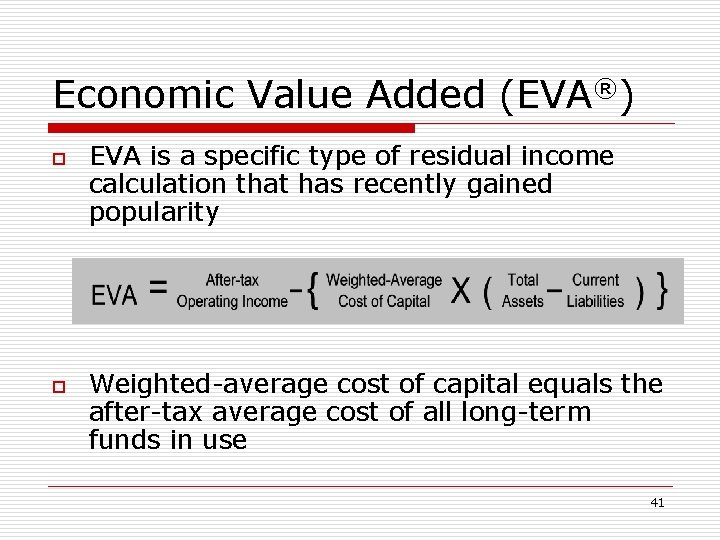

Economic Value Added (EVA®) o o EVA is a specific type of residual income calculation that has recently gained popularity Weighted-average cost of capital equals the after-tax average cost of all long-term funds in use 41

Residual Income NIBCL = Net Income Before Current Liabilities(excluding debt) 42

Study Break #4 o Use of profit as a performance measure: a. b. c. d. May lead to overinvestment in assets Is appropriate for an investment center Is appropriate as long as profit is calculated using GAAP Encourages managers to finance operations with debt rather than equity Answer: a. May lead to overinvestment in assets 43

Study Break #5 o Investment centers are often evaluated using: a. b. c. d. Standard cost variances Return on investment Residual income/EVA Both b and c Answer: d. Both b and c 44

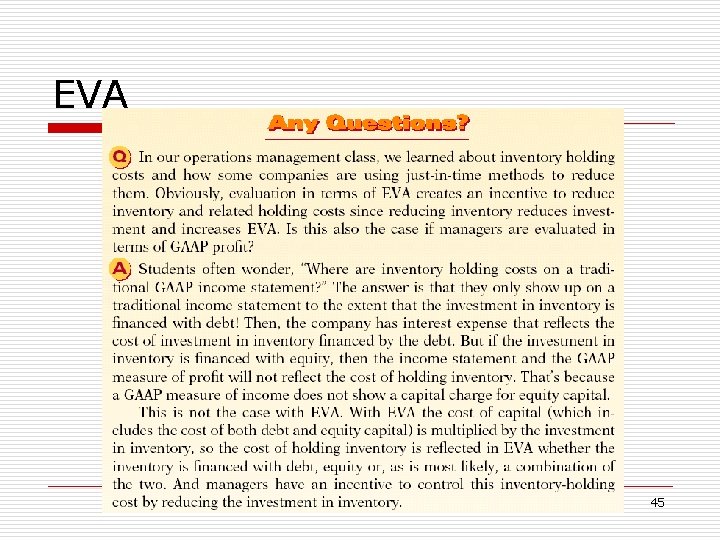

EVA 45

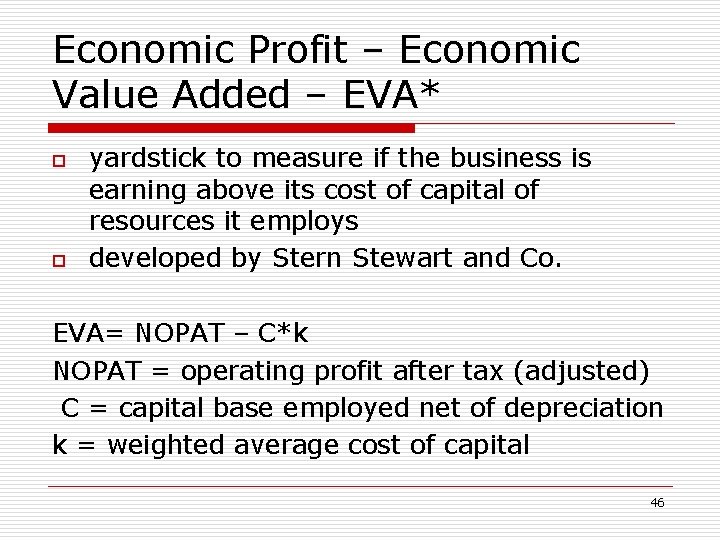

Economic Profit – Economic Value Added – EVA* o o yardstick to measure if the business is earning above its cost of capital of resources it employs developed by Stern Stewart and Co. EVA= NOPAT – C*k NOPAT = operating profit after tax (adjusted) C = capital base employed net of depreciation k = weighted average cost of capital 46

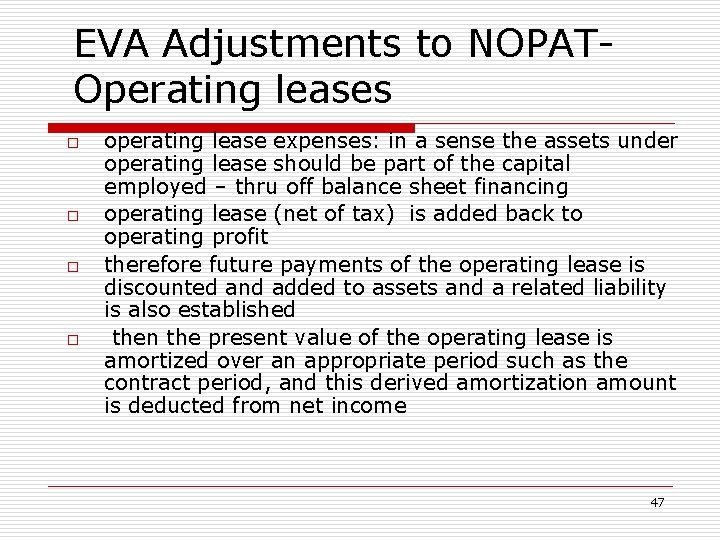

EVA Adjustments to NOPATOperating leases o o operating lease expenses: in a sense the assets under operating lease should be part of the capital employed – thru off balance sheet financing operating lease (net of tax) is added back to operating profit therefore future payments of the operating lease is discounted and added to assets and a related liability is also established then the present value of the operating lease is amortized over an appropriate period such as the contract period, and this derived amortization amount is deducted from net income 47

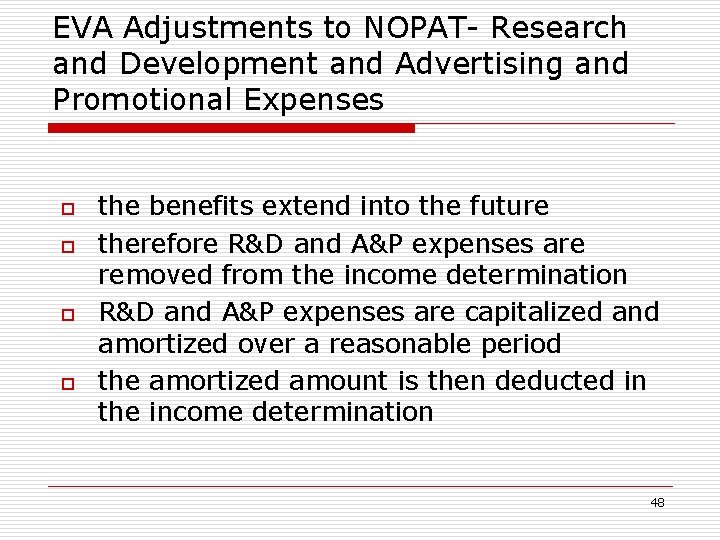

EVA Adjustments to NOPAT- Research and Development and Advertising and Promotional Expenses o o the benefits extend into the future therefore R&D and A&P expenses are removed from the income determination R&D and A&P expenses are capitalized and amortized over a reasonable period the amortized amount is then deducted in the income determination 48

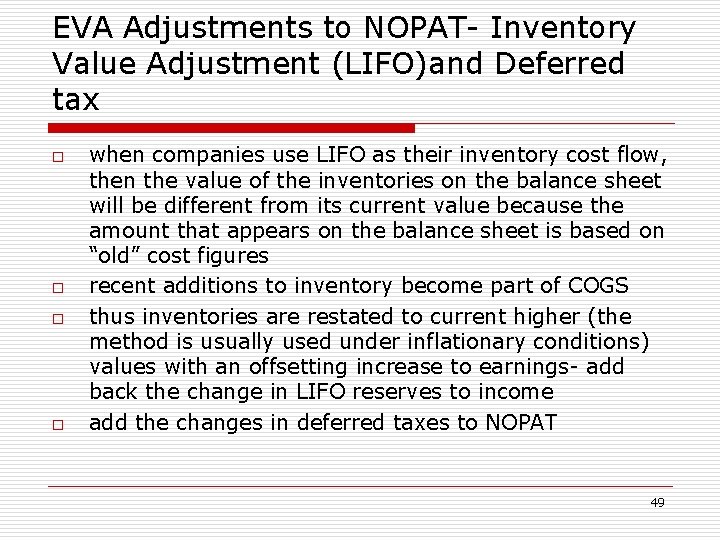

EVA Adjustments to NOPAT- Inventory Value Adjustment (LIFO)and Deferred tax o o when companies use LIFO as their inventory cost flow, then the value of the inventories on the balance sheet will be different from its current value because the amount that appears on the balance sheet is based on “old” cost figures recent additions to inventory become part of COGS thus inventories are restated to current higher (the method is usually used under inflationary conditions) values with an offsetting increase to earnings- add back the change in LIFO reserves to income add the changes in deferred taxes to NOPAT 49

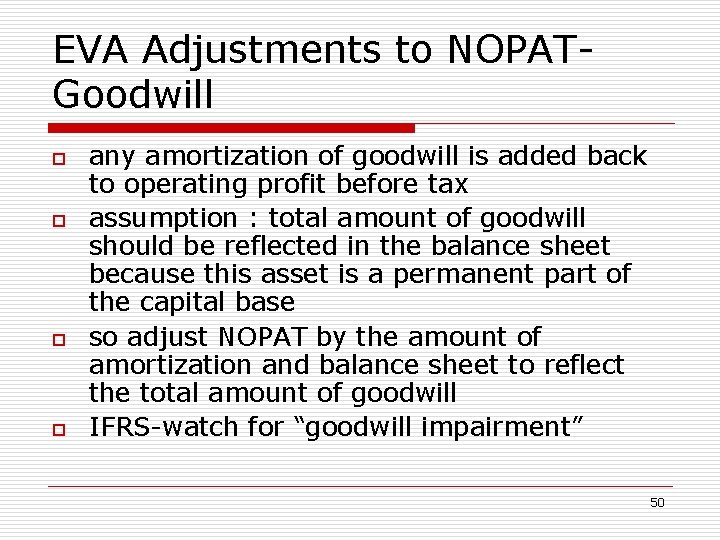

EVA Adjustments to NOPATGoodwill o o any amortization of goodwill is added back to operating profit before tax assumption : total amount of goodwill should be reflected in the balance sheet because this asset is a permanent part of the capital base so adjust NOPAT by the amount of amortization and balance sheet to reflect the total amount of goodwill IFRS-watch for “goodwill impairment” 50

EVA Adjustments to Capital Base o Non-operating assets: such assets should be excluded from the capital base because they are not used in generation of earnings 51

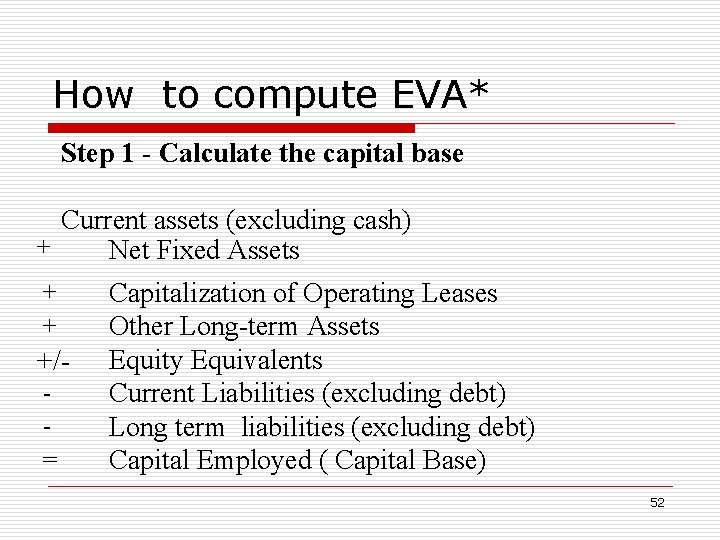

How to compute EVA* Step 1 - Calculate the capital base Current assets (excluding cash) + Net Fixed Assets + + +/= Capitalization of Operating Leases Other Long-term Assets Equity Equivalents Current Liabilities (excluding debt) Long term liabilities (excluding debt) Capital Employed ( Capital Base) 52

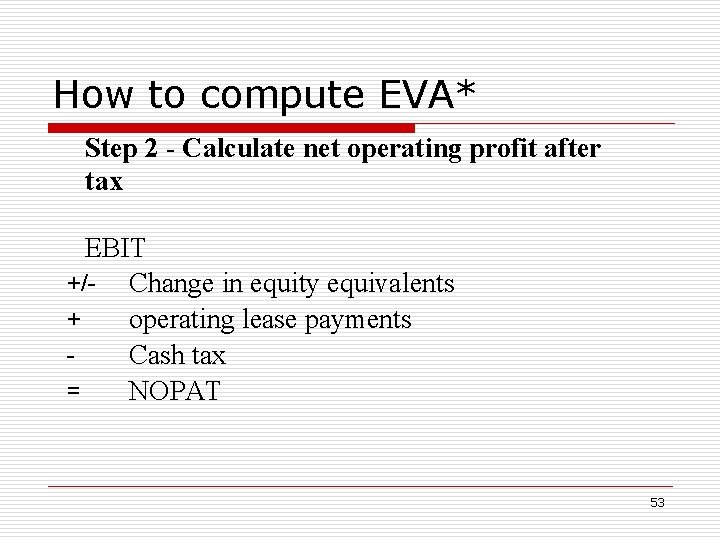

How to compute EVA* Step 2 - Calculate net operating profit after tax EBIT +/- Change in equity equivalents + operating lease payments Cash tax = NOPAT 53

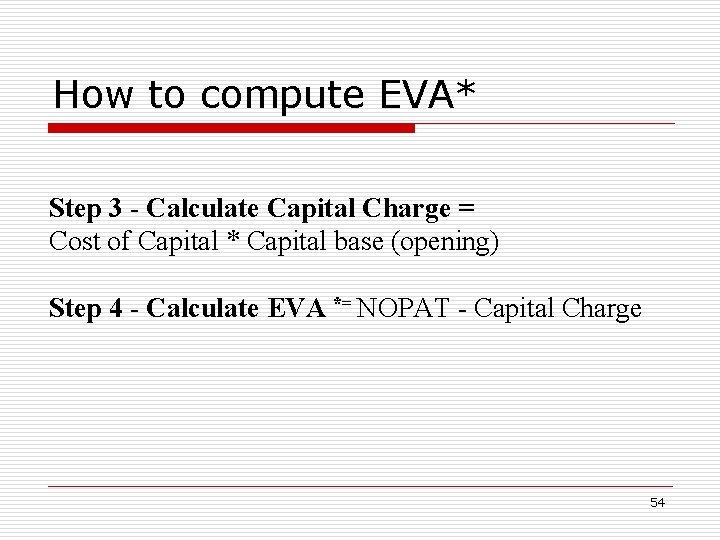

How to compute EVA* Step 3 - Calculate Capital Charge = Cost of Capital * Capital base (opening) Step 4 - Calculate EVA *= NOPAT - Capital Charge 54

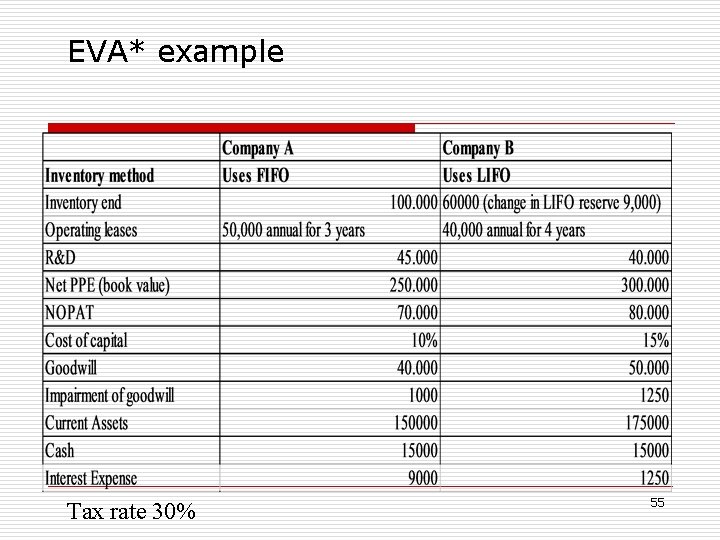

EVA* example Tax rate 30% 55

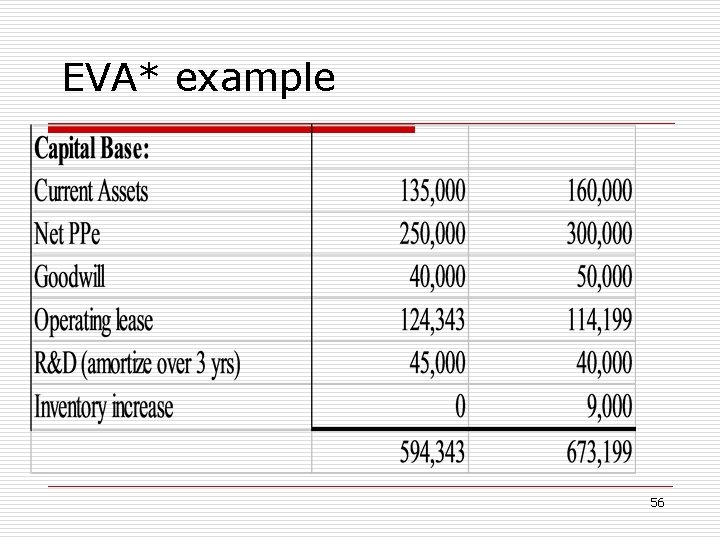

EVA* example 56

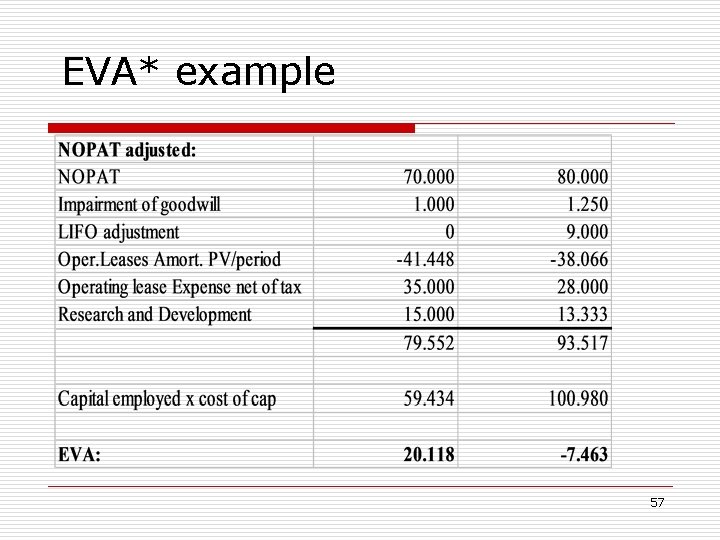

EVA* example 57

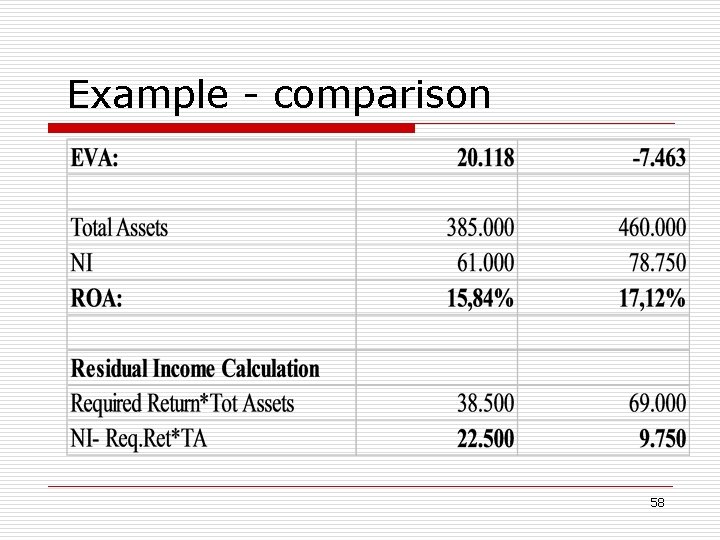

Example - comparison 58

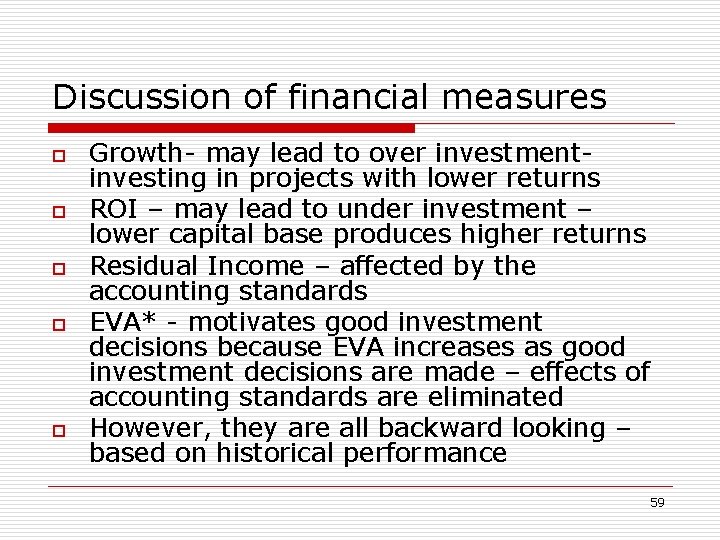

Discussion of financial measures o o o Growth- may lead to over investmentinvesting in projects with lower returns ROI – may lead to under investment – lower capital base produces higher returns Residual Income – affected by the accounting standards EVA* - motivates good investment decisions because EVA increases as good investment decisions are made – effects of accounting standards are eliminated However, they are all backward looking – based on historical performance 59

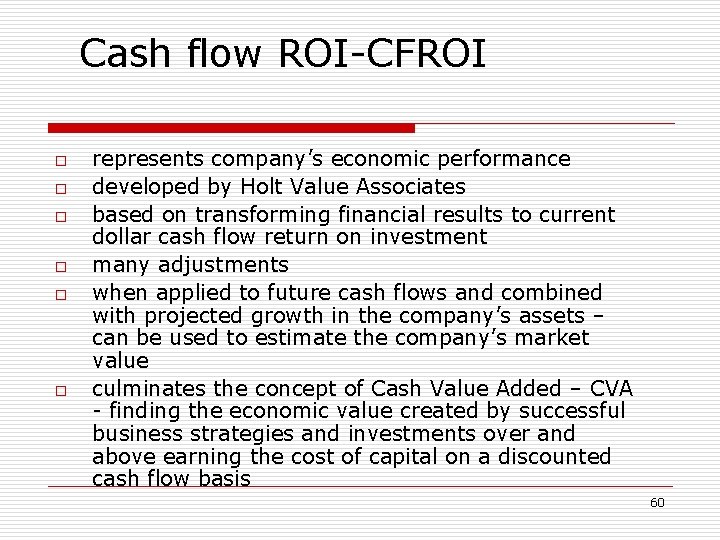

Cash flow ROI-CFROI o o o represents company’s economic performance developed by Holt Value Associates based on transforming financial results to current dollar cash flow return on investment many adjustments when applied to future cash flows and combined with projected growth in the company’s assets – can be used to estimate the company’s market value culminates the concept of Cash Value Added – CVA - finding the economic value created by successful business strategies and investments over and above earning the cost of capital on a discounted cash flow basis 60

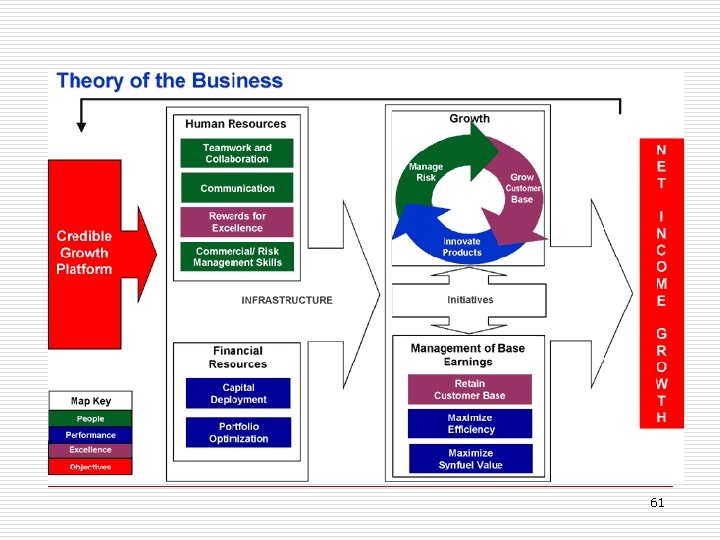

61

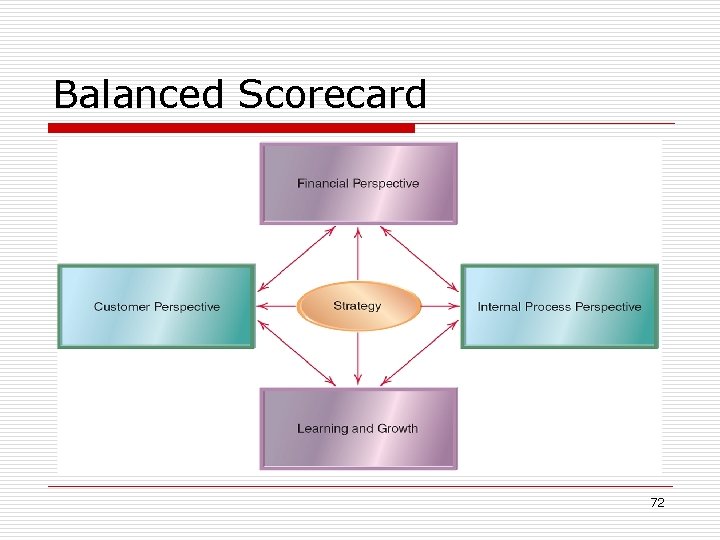

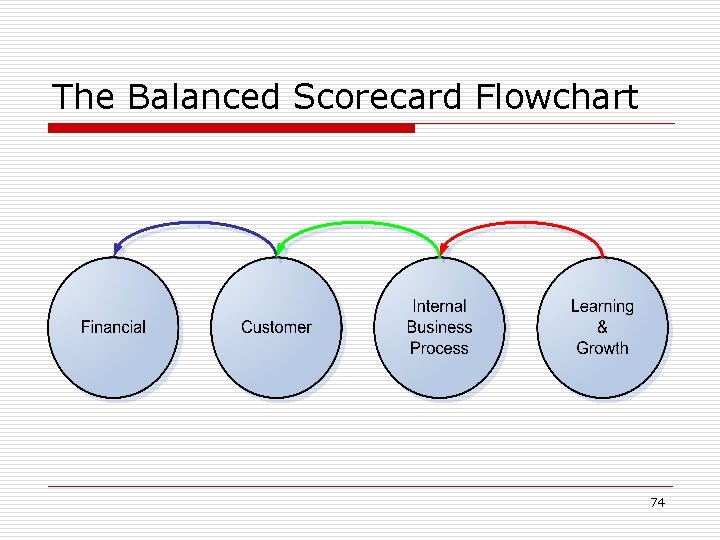

Financial and Nonfinancial Measures o Firms are increasingly presenting financial and nonfinancial performance measures for their subunits in a Balanced Scorecard, and it’s four perspectives: 1. 2. 3. 4. Financial Customer Internal Business Process Learning and Growth 62

Balanced Scorecard Flow o o Firms assume that improvements in learning and growth will lead to improvements in internal business processes Improvements in the internal business processes will lead to improvements in the customer and financial perspectives 63

The Balanced Scorecard o o The balanced scorecard translates an organization’s mission and strategy into a set of performance measures that provides the framework for implementing its strategy It is called the balanced scorecard because it balances the use of financial and nonfinancial performance measures to evaluate performance 64

Balanced Scorecard Perspectives 1. 2. 3. 4. Financial Customer Internal Business Perspective Learning and Growth 65

The Financial Perspective o o o Evaluates the profitability of the strategy Uses the most objective measures in the scorecard The other three perspectives eventually feed back into this dimension 66

The Customer Perspective o Identifies targeted customer and market segments and measures the company’s success in these segments 67

The Internal Business Prospective o o Focuses on internal operations that create value for customers that, in turn, furthers the financial perspective by increasing shareholder value Includes three subprocesses: 1. 2. 3. Innovation Operations Post-sales service 68

The Learning and Growth Perspective o Identifies the capabilities the organization must excel at to achieve superior internal processes that create value for customers and shareholders 69

Balanced Scorecard Set of performance measures constructed for four dimensions of performance n Financial o n Customer o n Examines the company’s success in meeting customer expectations Internal Processes o n Critical measures even if they are backward looking Examines the company’s success in improving critical business processes Learning and Growth o Examines the company’s success in improving its ability to adapt, innovate, and grow 70

Balanced Scorecard o o o Company develops three to five performance measures for each dimension Measures should be tied to company strategy Balance among the dimensions is critical 71

Balanced Scorecard 72

How Balance is Achieved in a Balanced Scorecard o o o Performance is assessed across a balanced set of dimensions Balance quantitative measures with qualitative measures There is a balance of backwardlooking measures and forward-looking measures 73

The Balanced Scorecard Flowchart 74

Balanced Scorecard Implementation o o Must have commitment and leadership from top management Must be communicated to all employees 75

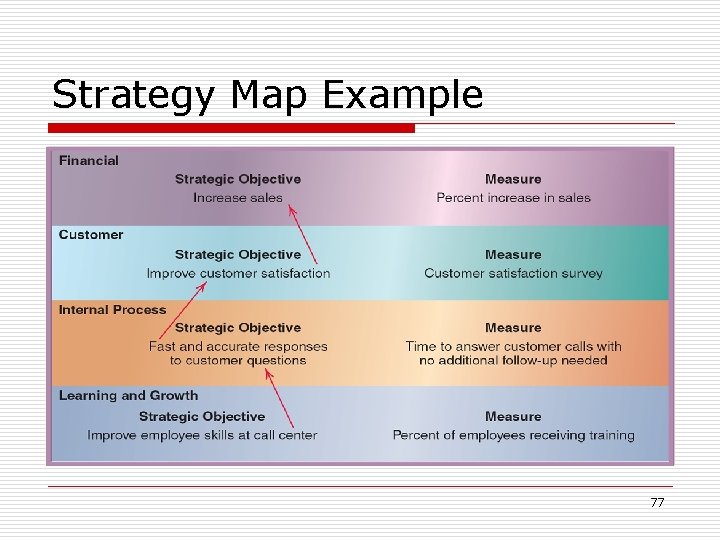

Developing a Strategy Map for a Balanced Scorecard o A strategy map is a diagram of the relationships of the strategic objectives across the four dimensions o Used to test the soundness of the strategy o Identifies how strategy is linked to measures on the scorecard o Communicates strategic objectives to employees 76

Strategy Map Example 77

Features of a Good Balanced Scorecard o o Tells the story of a firm’s strategy, articulating a sequence of cause-and-effect relationships: the links among the various perspectives that describe how strategy will be implemented Helps communicate the strategy to all members of the organization by translating the strategy into a coherent and linked set of understandable and measurable operational targets 78

Keys to a Successful Balanced Scorecard o o o Targets n For each measure, there should be a target so managers know what they are expected to achieve Initiatives n For each measure, the company must identify actions that will be taken to achieve the target Responsibility n A particular employee must be given responsibility and held accountable for successfully implementing each initiative Funding n Initiatives must be funded appropriately Top Management Support n It is crucial to have the full support of top management 79

Features of a Good Balanced Scorecard o Must motivate managers to take actions that eventually result in improvements in financial performance n o o Predominately applies to for-profit entities, but has some application to not-for-profit entities as well Limits the number of measures, identifying only the most critical ones Highlights less-than-optimal tradeoffs that managers may make when they fail to consider operational and financial measures together 80

Balanced Scorecard Implementation Pitfalls o o o Managers should not assume the cause-and-effect linkages are precise: they are merely hypotheses Managers should not seek improvements across all of the measures all of the time Managers should not use only objective measures: subjective measures are important as well 81

Balanced Scorecard Implementation Pitfalls o o o Managers must include both costs and benefits of initiatives placed in the balanced scorecard: costs are often overlooked Managers should not ignore nonfinancial measures when evaluating employees Managers should not use too many measures 82

Distinction between Managers and Organization Units o The performance evaluation of a manager should be distinguished from the performance evaluation of that manager’s subunit, such as a division of the company 83

The Trade-Off: Creating Incentives vs. Imposing Risk o An inherent trade-off exists between creating incentives and imposing risk n n An incentive should be some reward for performance An incentive may create an environment in which suboptimal behavior may occur: the goals of the firm are sacrificed in order to meet a manager’s personal goals 84

Moral Hazard o Moral Hazard describes situations in which an employee prefers to exert less effort (or report distorted information) compared with the effort (or accurate information) desired by the owner because the employee’s effort (or the validity of the reported information) cannot be accurately monitored and enforced 85

Intensity of Incentives o Intensity of Incentives – how large the incentive component of a manager’s compensation is relative to their salary component 86

Preferred Performance Measures o o Preferred Performance Measures are those that are sensitive to or change significantly with the manager’s performance They do not change much with changes in factors that are beyond the manager’s control They motivate the manager as well as limit the manager’s exposure to risk, reducing the cost of providing incentives May include Benchmarking 87

Preferred Performance Measures o o Preferred Performance Measures are those that are sensitive to or change significantly with the manager’s performance They do not change much with changes in factors that are beyond the manager’s control They motivate the manager as well as limit the manager’s exposure to risk, reducing the cost of providing incentives May include Benchmarking 88

Performance Measures at the Individual Activity Level o Two issues when evaluating performance at the individual activity level: 1. 2. Designing performance measures for activities that require multiple tasks Designing performance measures for activities done in teams 89

Compensation for Multiple Tasks o If the employer wants an employee to focus on multiple tasks of a job, then the employer must measure and compensate performance on each of those tasks 90

Team-Based Compensation o o o Companies use teams extensively for problem solving Teams achieve better results than individual employees acting alone Companies must reward individuals on a team based on team performance 91

Executive Compensation Plans o Based on both financial and nonfinancial performance measures, and include a mix of: n n n o Base Salary Annual Incentives, such as cash bonuses Long-Run Incentives, such as stock options Well-designed plans use a compensation mix that balances risk (the effect of uncontrollable factors on the performance measure, and hence compensation) with short-run and long-run incentives to achieve the firm’s goals 92

Step 2: Choosing the Time Horizon of the Performance Measures o o o Multiple periods of evaluation are sometimes appropriate ROI, RI, EVA, and ROS all basically evaluate one period of time ROI, RI, EVA, and ROS may all be adapted to evaluate multiple periods of time 93

Step 3: Choosing Alternative Definitions for Performance Measures o Four possible alternative definitions of investment: 1. 2. 3. 4. Total Assets Available Total Assets Employed minus Current Liabilities Stockholders’ Equity 94

Step 4: Choosing Measurement Alternatives for Performance Measures o Possible alternative definitions of cost: 1. 2. 3. Current Cost Gross Value of Fixed Assets Net Book Value of Fixed Assets 95

Step 5: Choosing Target Levels of Performance o o Historically driven targets used to set target goals Goal may include a Continuous Improvement component 96

Step 6: Choosing the Timing of the Feedback o Timing of feedback depends on: n n n How critical the information is for the success of the organization The specific level of management receiving the feedback The sophistication of the organization’s information technology 97

Performance Measurement in Multinational Companies o Additional Difficulties faced by Multinational Companies: n n The economic, legal, political, social, and cultural environments differ significantly across countries Governments in some countries may impose controls and limit selling prices of a company’s products Availability of materials and skilled labor, as well as costs of materials, labor, and infrastructure may differ across countries Divisions operating in different countries account for their performance in different currencies 98

99

- Slides: 99