Payment Systems Collection of Checks and Final Payment

- Slides: 17

Payment Systems Collection of Checks and Final Payment

Basic concepts Governing Law?

Basic concepts Governing Law? An overlapping State (UCC) and federal law (Regulation CC) and in some cases private agreement (Clearinghouse rules and bilateral agreements)

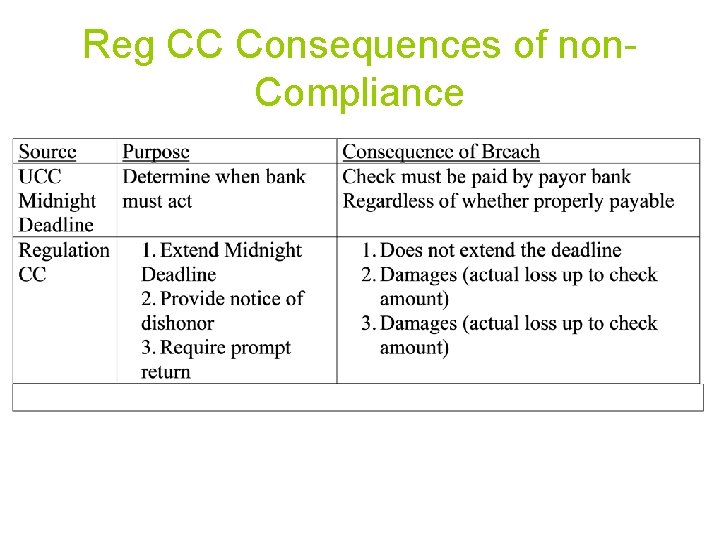

Basic concepts • UCC governs the timing of giving provisional and final settlements and deadline for refusing to pay a check (Midnight Deadline). • Regulation CC – Extends Midnight Deadline in some cases – Imposes independent obligation to notify of dishonor and return check within timeframes.

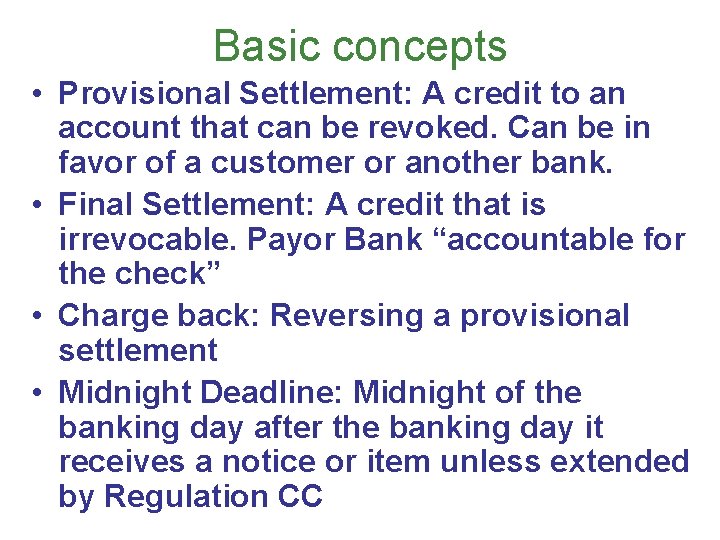

Basic concepts • Provisional Settlement: A credit to an account that can be revoked. Can be in favor of a customer or another bank. • Final Settlement: A credit that is irrevocable. Payor Bank “accountable for the check” • Charge back: Reversing a provisional settlement • Midnight Deadline: Midnight of the banking day after the banking day it receives a notice or item unless extended by Regulation CC

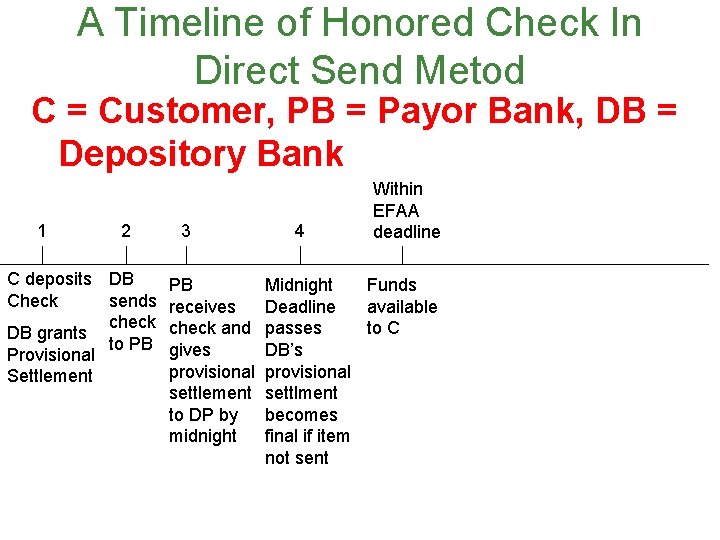

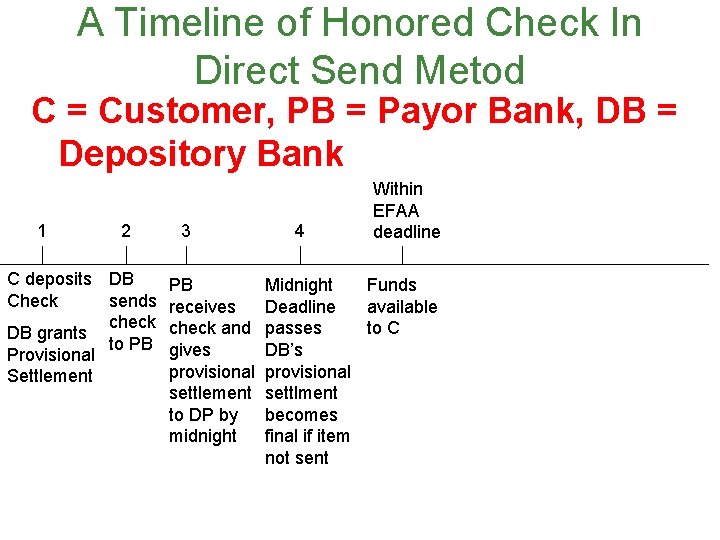

A Timeline of Honored Check In Direct Send Metod C = Customer, PB = Payor Bank, DB = Depository Bank 1 2 C deposits DB Check sends check DB grants to PB Provisional Settlement 3 PB receives check and gives provisional settlement to DP by midnight 4 Within EFAA deadline Midnight Funds Deadline available passes to C DB’s provisional settlment becomes final if item not sent

A Timeline of Dishonored non local $3000 Check In Direct Send Metod C = Customer, PB = Payor Bank, DB = Depository Bank Within 1 2 C deposits DB Check sends check DB grants to PB Provisional Settlement 3 PB receives check and gives provisional settlement to DP by midnight 4 EFAA deadline Before Funds Midnight available Deadline to C passes PB sends check back to DB 5 PB must send CC Notice by 4: 00 7 Check sent by a method which would have DB normally receive by 4: 00 8 DB recharges C by midnight (or later)

Methods of Final Payment of a Check • Direct payment over the counter at a payor bank • Direct send from Depository to Payor Bank • Through an intermediary collecting bank • Through a clearing house • Through the Federal Reserve System

Methods of Payment of a Check • Payment over the counter • Statute or private agreement does not give a right to revoke a settlment • Failure to meet the midnight deadline

Ways of Satisfying the Reg CC Return Rule • Two Day/Four Day Rule • Forward Collection Test

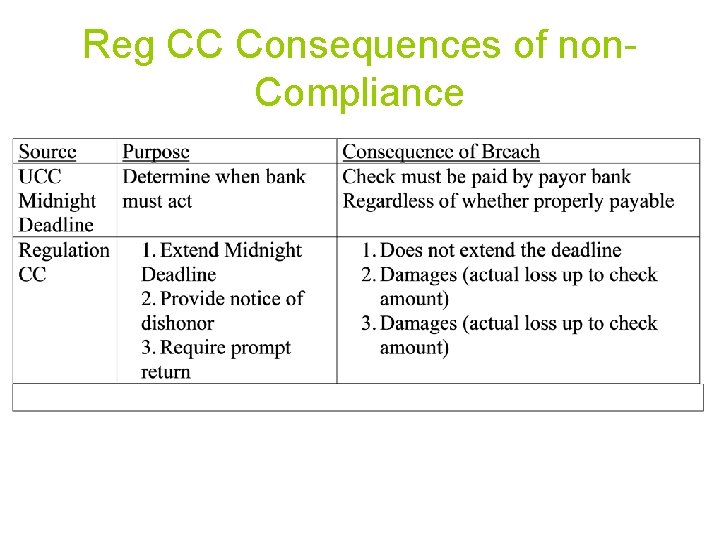

Reg CC Consequences of non. Compliance

§ 4 -215. Final Payment of Item by Payor Bank; When Provisional Debits and Credits Become Final; When Certain Credits Become Available for Withdrawal. (a) An item is finally paid by a payor bank when the bank has first done any of the following: (1) paid the item in cash; (2) settled for the item without having a right to revoke the settlement under statute, clearing-house rule, or agreement; or (3) made a provisional settlement for the item and failed to revoke the settlement in the time and manner permitted by statute, clearing-house rule, or agreement.

§ 4 -301. Posting; Recovery of Payment by Return of Items; Time of Dishonor; Return of Items by Payor Bank. (a) If a payor bank settles for a demand item other than a documentary draft presented otherwise than for immediate payment over the counter before midnight of the banking day of receipt, the payor bank may revoke the settlement and recover the settlement if, before it has made final payment and before its midnight deadline, it (1) returns the item; (2) returns an image of the item, if the party to which the return is made has entered into an agreement to accept an image as a return of the item and the image is returned in accordance with that agreement; or (3) sends a record providing notice of dishonor or nonpayment if the item is unavailable for return.

§ 4 -302. Payor's Bank Responsibility for Late Return of Item. (a) If an item is presented to and received by a payor bank, the bank is accountable for the amount of: (1) a demand item, other than a documentary draft, whether properly payable or not, if the bank, in any case in which it is not also the depositary bank, retains the item beyond midnight of the banking day of receipt without settling for it or, whether or not it is also the depositary bank, does not pay or return the item or send notice of dishonor until after its midnight deadline; or

4 -301 (d) An item is returned: (1) as to an item presented through a clearing house, when it is delivered to the presenting or last collecting bank or to the clearing house or is sent or delivered in accordance with clearinghouse rules; or (2) in all other cases, when it is sent or delivered to the bank's customer or transferor or pursuant to instructions.

Regulation CC Extension of Midnight Deadline 229. 30 c) Extension of deadline. The deadline for return or notice of nonpayment under the U. C. C. or Regulation J (12 CFR part 210), or § 229. 36(f)(2) is extended to the time of dispatch of such return or notice of nonpayment where a paying bank uses a means of delivery that would ordinarily result in receipt by the bank to which it is sent-(1) On or before the receiving bank's next banking day following the otherwise applicable deadline by the earlier of the close of that banking day or a cutoff hour of 2 p. m. or later set by the receiving bank under U. C. C. 4108, for all deadlines other than those described in paragraph (c)(2) of this section; this deadline is extended further if a paying bank uses a highly expeditious means of transportation, even if this means of transportation would ordinarily result in delivery after the receiving bank's next cutoff hour or banking day referred to above; or