Own Funds and Proportionality EBA Proportionality Workshop Own

“Own Funds” and Proportionality: EBA Proportionality Workshop Own Funds Session 22 nd October 2013 Christian Lajoie

AGENDA o Proportionality: a challenge for regulation o The “own funds” case § Own funds requirements • Pillar 1 • Pillar 2 • Pillar 3 § o o Own funds definition Proportionality: a natural component of supervision Conclusions 2

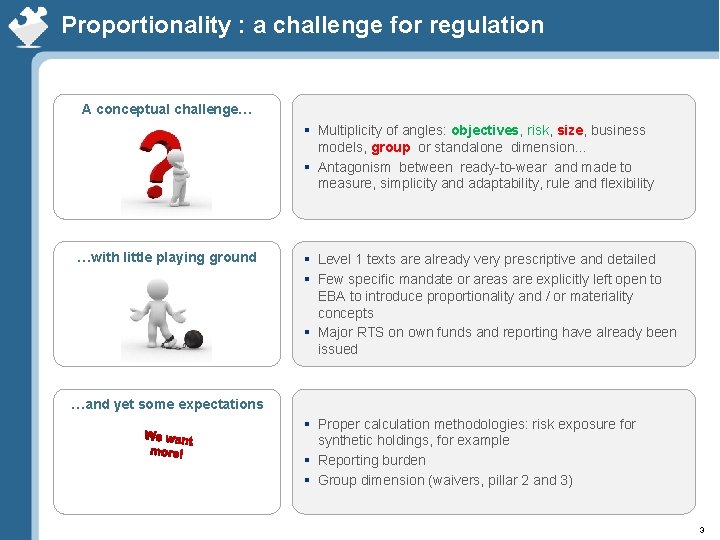

Proportionality : a challenge for regulation A conceptual challenge… § Multiplicity of angles: objectives, risk, size, business models, group or standalone dimension… § Antagonism between ready-to-wear and made to measure, simplicity and adaptability, rule and flexibility …with little playing ground § Level 1 texts are already very prescriptive and detailed § Few specific mandate or areas are explicitly left open to EBA to introduce proportionality and / or materiality concepts § Major RTS on own funds and reporting have already been issued …and yet some expectations § Proper calculation methodologies: risk exposure for synthetic holdings, for example § Reporting burden § Group dimension (waivers, pillar 2 and 3) 3

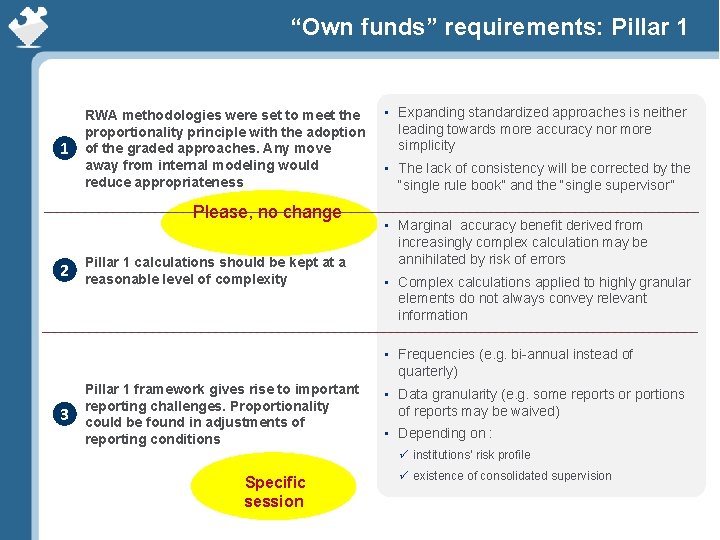

“Own funds” requirements: Pillar 1 • 1 RWA methodologies were set to meet the proportionality principle with the adoption of the graded approaches. Any move away from internal modeling would reduce appropriateness Please, no change • 2 Pillar 1 calculations should be kept at a reasonable level of complexity • Expanding standardized approaches is neither leading towards more accuracy nor more simplicity • The lack of consistency will be corrected by the “single rule book” and the “single supervisor” • Marginal accuracy benefit derived from increasingly complex calculation may be annihilated by risk of errors • Complex calculations applied to highly granular elements do not always convey relevant information • Frequencies (e. g. bi-annual instead of quarterly) • 3 Pillar 1 framework gives rise to important reporting challenges. Proportionality could be found in adjustments of reporting conditions • Data granularity (e. g. some reports or portions of reports may be waived) • Depending on : ü institutions’ risk profile Specific session ü existence of consolidated supervision

“Own funds” requirements: Pillar 2 q Pillar 2 is typically the chosen field for proportionality or appropriateness. It has been construed as such q EBA should thus refrain to issue overly prescriptive “one size fits all” standards or guidelines with respect to Pillar 2. Its role is rather to elaborate tools and methodologies for the benefit of the supervisor community q The “Group” dimension should be accepted as a possible risk mitigating factor, depending on the group’s own structure and business organisation Is it relevant to expect a subsidiary representing 0, 06% of the RWA of a 1 st tier banking group to produce “reverse stress tests” as part of its usual Pillar 2 process ? o Group diversification as well as specific risk management are truly improving the subsidiary risk profiles. A stand alone approach is not appropriate in many case. o Group level ICAAPs should be taken into account by Supervisors when they consider subsidiaries’ Pillar 2 approaches. 5.

“Own funds” definition o Level 1 texts are already very prescriptive o Mandates given to EBA are narrow, particularly as far as proportionality is concerned o Definitive draft RTS have already been issued and significant proportionality issues raised by stakeholders were a level 1 text matter: § Proportionality should not be tackled by additional complexity. On the contrary, proportionality to stakes should contribute to reduce this complexity, for example deduction rule for own shares and participations in financial institutions indirectly held in the banking book (The contemplated structure based approach is a commendable attempt but a simple threshold in % of own funds would be more effective) o Q&A process is most probably the best way to address remaining issues 6.

Proportionality: a naturel component of supervision q An efficient supervision should be able to use information to identify material risk areas in order to concentrate on relevant issues. Expert judgement and qualitative analysis are key in such a process q A purely or mainly quantitative approach may be detrimental to an effective supervision q The EBA should consider as a duty to assess the NCA’s supervisory burden on institutions with the view to maintain proportionality between means and results 7.

Conclusions § Proportionality is already considered by the current regulation, including “own funds”. Going further is just using common sense for implementation and supervision § Regulators have been working for more than 5 years to overhaul the regulatory framework (which was not enforced when the crisis occurred). It is time to stabilize, implement and supervise smartly. Æ Stabilizing through a straightforward, unique and perfect single rule book. This is the responsibility of the EBA on the basis of the CRD Æ Implementing regulation in good faith and complying with its intent. This is the duty of banks. Æ Supervising with independence, courage, flexibility and consistency. This is the responsibility of the BCE and Bo. E. § There is no need nor efficiency to tackle with proportionality through additional regulation, at least as far as “own funds” are concerned 8

- Slides: 8