Overview of Fair Labor Standards Act 29 USC

Overview of Fair Labor Standards Act 29 USC § 201, et. seq. SKYE SUH, PLC 32000 NORTHWESTERN HWY. , STE, 260, FARMINGTON HILLS, MICHIGAN 48334 www. SKYESUHPLC. com

State Laws • Ohio - Ohio Minimum Fair Wage Standards – Ohio Revised Code § 4111. 01, et. seq. • Michigan – Michigan Minimum Wage Act – MCL § 408. 381 § Both Ohio and Michigan mirror Federal Law (minor differences) § Courts may use parts of both State and Federal laws to provide greatest benefit to the employee

Legislative Intent • Enacted in 1938 to correct “. . . labor conditions detrimental to the maintenance of the minimum standard of living necessary for the health, efficiency, and general well-being of workers. . . ” • Designed and intended to be a broadly remedial and humanitarian statute • Congress intended FLSA to cover all employees, unless specifically EXCLUDED

United States Supreme Court “FLSA exemptions are to be narrowly construed against employers and are to be withheld except as to persons plainly and unmistakably within their terms and spirit. . ” Auer v. Robbins, 519 U. S. 452, (1997)

Fair Labor Standards Act What is covered under the FLSA? • Minimum Wage • Overtime Pay • Exemptions to Overtime Pay • Child Labor • Record Keeping Requirements • Timely Payment of Wages • Equal Pay

Fair Labor Standards Act What is not covered under the FLSA? • Maximum Hours Per Week • Required Meal Breaks • Shift Premiums • Vacation Pay • Sick Pay • Time Off • Scheduling

Fair Labor Standards Act (“FLSA”) • Minimum wage - $7. 25/hr. – Ohio - $7. 70/hr. – Michigan - $7. 40/hr. • Overtime compensation standards • No waiver permitted

Fair Labor Standards Act Overtime • One and one-half (1 -1/2) times employee’s “regular rate” for each “hour worked” over 40 hours in the “work week” • Work week - fixed and regularly occurring period of 168 hours - seven consecutive 24 -hour periods • Begin work week any day of week, any hour, but must stay consistent

Fair Labor Standards Act Administration and Enforcement of the Act • Back Pay • 2 year statute of limitations • Effect of willful violation (intentional violation of the FLSA) 3 year statute of limitations Liquidated damages (i. e. , double) Attorneys fees Civil penalties for repeated violations • Good faith defense (honest intention to comply) • One complaint can result in “wall-to-wall” investigation

Fair Labor Standards Act Exempt/Non-Exempt • Exemptions contained in 29 USC 213 • Limited exceptions to the FLSA minimum wage & overtime obligations exist for white-collar exemptions • Determination of whether a job is truly exempt is a question of fact (Job title is of only very, very minimal importance) • Burden of proving exemption is on employer

Fair Labor Standards Act Exempt/Non-Exempt Most common white-collar exemptions are: Executive, Administrative and Professional White-collar exemptions have three basic requirements in common: • Employee must perform work of an exempt nature • Employee must spend sufficient time performing exempt work so that such work is the employee’s primary duty; and • Employee must be paid compensation in a specified form (e. g. , salary basis or fee) and in at least a specified amount ($455 per week)

Fair Labor Standards Act Exempt/Non-Exempt Salary Basis Test • Requires that exempt white-collar employees regularly receive a predetermined salary (minimum $455. 00/week) on a weekly or less frequent basis; and • Employee must “receive his full salary for any week in which he performs any work without regard to the number of days or hours worked”; and • Predetermined amount cannot be reduced due to “variations in the quality or quantity of the work performed”; and • Except where expressly permitted by law, MNA may not make deduction from predetermined amount paid to exempt white-collar employees

Fair Labor Standards Act Exempt/Non-Exempt Permissible Deductions from exempt employee’s salary • During initial and final weeks of employment, can pay proportionate part of salary for time actually worked • Absence of one or more full days “for personal reasons, other than sickness or accident” • Absence of a day or more due to sickness or disability, pursuant to bona fide plan, policy or practice of making deductions from employee’s salary after sickness or disability leave has been exhausted • Intermittent leave under the Family Medical Leave Act • Penalty imposed “in good faith for infractions of safety rules of major significance” (include only those relating to the prevention of serious danger to the plant, or other employees)

Fair Labor Standards Act Exempt/Non-Exempt Impermissible Deductions from exempt employee’s salary • Deduction for absence occasioned by employer • Deduction for absence due to jury duty, attendance as a witness, or temporary military leave • Deduction for partial day absence • Disciplinary deduction - Exemption will be lost if employee is suspended without pay for a period less than one (1) week for violating ordinary rules that govern employee conduct

Does The Exemption Apply • The duties performed constitute the most pertinent test for determining whether one is an exempt employee excluded from coverage of the FLSA. Walling v. General Industries Co. , 330 U. S. 545 (1947) • Exemption to wage and hour provisions of the FLSA is to be applied only to those clearly and unmistakably within terms and spirit of exemption. Lyles v. K-Mart Corp. , M. D. Fla. 1981, 519 F. Supp. 756 (2008)

Fair Labor Standards Act Executive Exemption • To qualify for the executive employee exemption, all of the following tests must be met: – The employee’s primary duty must be managing the enterprise, or managing a customarily recognized department/subdivision; – The employee must customarily and regularly direct the work of at least two or more other full-time employees or their equivalent; and • The employee must have the authority to hire or fire other employees, or the employee’s suggestions and recommendations as to the hiring, firing, promotion or any other change of status of other employees must be given particular weight.

Fair Labor Standards Act Administrative Exemption • To qualify for the administrative employee exemption, all of the following tests must be met: – The employee’s primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers; and – The employee’s primary duty includes the exercise of discretion and independent judgment with respect to matters of significance. – Performing set administrative duties unlikely to qualify (i. e. bookkeeping, payroll, secretary).

Fair Labor Standards Act Administrative Exemption Important to Understand • Exemption for administrative employees is being defined in progressively narrower terms.

Fair Labor Standards Act Administrative Exemption “Exemptions, are to be narrowly construed against the employers seeking to assert them. The employer bears the burden of establishing the affirmative defense by a preponderance of the evidence, and the employer satisfies this burden only by providing “clear and affirmative evidence that the employee meets every requirement of an exemption. ” Orton v. Johnny’s Lunch Franchise, LLC, 668 F. 3 d 843, 847 (2012) United States 6 th Circuit Court of Appeals Decided February 21, 2012

Fair Labor Standards Act Professional Exemption To qualify for the learned professional employee exemption, all of the following tests must be met: • The employee’s primary duty must be the performance of work requiring advanced knowledge, defined as work which is predominantly intellectual in character and which includes work requiring the consistent exercise of discretion and judgment; • The advanced knowledge must be in a field of science or learning; and • The advanced knowledge must be customarily acquired by a prolonged course of specialized intellectual instruction.

Fair Labor Standards Act Professional Exemption To qualify for the creative professional employee exemption, all of the following tests must be met: • The employee’s primary duty must be the performance of work requiring invention, imagination, originality or talent in a recognized field of artistic or creative endeavor.

Fair Labor Standards Act Exempt/Non-Exempt • Administrative and professional employees must exercise independent judgment and discretion • Exercise of independent judgment and discretion means the ability and authority to make a decision of significance, relatively free of supervision • Independent judgment and discretion cannot be confused with the ability to work independently, use initiative or follow through

Fair Labor Standards Act Exempt/Non-Exempt – Primary Duty • Employee’s primary duty must be exempt in order to qualify as exempt • “Rule of thumb” is that “primary duty” means the major part, or more than 50% of the employee’s time • Regulations do not specify the period of time that should be used to determine when 50% applies

Fair Labor Standards Act Primary Duty “Primary duty, ” for purposes of determining whether an employee has management as her primary duty, as required for the employee to be subject to the executive-employee exemption from the FLSA's overtime requirements under the short test, does not mean the most time-consuming duty; it instead connotes the principal or chief, that is, the most important, duty performed by the employee. ” Thomas v. Speedway Super. America, LLC, 506 F. 3 d 496 (6 th Cir Ohio) 2007

Fair Labor Standards Act Exempt/Non-Exemption for Computer Occupation Professional Congress amended FLSA in 1990 to provide that certain computer occupations be included in the professional exemption: • • Intended to apply to employees highly skilled in computer systems analysis, programming, or related work in software functions Does not apply to those employees who manufacture, repair or maintain computer hardware Trainees and employees in entry-level positions will seldom qualify Must be compensated at a rate of not less than $27. 63 per hour

Fair Labor Standards Act Work Time Questions frequently arise as to whether time spent on various job-related activities - ranging from travel time and on-call time to meal period and sleep time - are compensable. This discussion will focus on the principles for deciding whether the time spent by an employee in activities such as these counts as hours worked.

Fair Labor Standards Act Work Time The term “work” is not defined in the FLSA The FLSA defines “employ” as “to suffer or permit to work” General proposition - Work week includes “all the time during which an employee is necessarily required to be on the employer’s premises, on duty or at a prescribed work place. ”

Fair Labor Standards Act Work Time “To suffer or permit to work” Time spent by an employee performing work not requested but suffered or permitted is generally seen as work time Put another way - time is compensable if expended for the employer’s benefit, controlled by employer, or allowed by employer

Fair Labor Standards Act Work Time Employer must compensate employees for unauthorized work that, even though prohibited, is performed with the knowledge & acquiescence of management. Key factual inquiry - whether employer knew or through use of reasonable diligence should have known that employee was performing work on its behalf.

Fair Labor Standards Act Work Time • Duty of management to exercise control and see that work is not performed if it does not want it performed • Mere promulgation of rule against unauthorized work is not enough • Employer must make every effort to prevent employee from performing unauthorized work

Fair Labor Standards Act Work Time Mobis North America Employee Handbook: 2. 1. 1 “. . . Any hours worked more than the scheduled shift needs the approval of the Department Manager on a daily basis. . ” 2. 3 “Any overtime worked by the employee without their Sr. Manager/Manager’s approval will result in disciplinary action and possible non-payment of the overtime worked. ”

Fair Labor Standards Act Work Time You MAY discipline for working unauthorized overtime You MUST pay them for the overtime worked (at overtime rates)

Fair Labor Standards Act Rest Periods/Coffee Breaks • Not required under FLSA • If given, and under 20 minutes - must be counted as hours work, compensable • To be non-compensable - must be 30 minutes or more and completely relieved from duty

Fair Labor Standards Act Meal Periods • Typically must be 30 minutes or longer, employee is relieved of all duties and is free to leave work station • Employee need not be permitted to leave premises for meal period to be non-compensable • If office or factory worker is required to eat at desk or machine - working time • If meal period is frequently interrupted by calls to duty entire period is working time

Fair Labor Standards Act Preparing and Concluding Activities Showering and/or changing clothes - need not be compensated unless done at work site at employer’s request or required by nature of principal duties. Other endeavors performed for the benefit of employer which have been found to be compensable • Cleaning machines • Driving company truck to work site • Implementing of safety precautions • Sharpening tools Non-compensable activities • Riding to work site on bus provided for employees’ convenience • Arriving 2 -3 minutes early to relieve prior shift

Fair Labor Standards Act Training Generally, time spent attending employer-sponsored lectures, meetings and training programs is compensable. Exception if meet all of these criteria: • Attendance is outside of employee’s regular working hours • Attendance is in fact voluntary; • Course, lecture or meeting is not directly related to employee’s job; and • Employee does not perform productive work during attendance.

Fair Labor Standards Act Voluntary/Involuntary? Training is involuntary if: • It is required by the employer, or • If it is the employee’s understanding that the employee’s current job or employment would be adversely affected by not attending, or • If the employee is led to believe that his/her current job or employment would be adversely affected by not attending Where course was not required for current job, but successful completion could lead to higher salary - Court found training non-compensable.

Fair Labor Standards Act “Directly Related To” Training is directly related to job if it is designed to make employee handle job more effectively. Training to prepare employee for advancement or promotion is not “directly related, ” and therefore not compensable.

Fair Labor Standards Act Travel Time Whether or not travel is compensable depends on: • Employee’s activities during travel • Time during which travel takes place • Purpose of travel • Ordinary home-to-work travel is not compensable, absent a specific agreement to the contrary

Fair Labor Standards Act Travel Time Employee required to take a trip that keeps them away from home overnight • All time spent traveling during hours corresponding to employee’s normal working hours must be counted as working time. • Include travel hours on Saturdays, Sundays and holidays if correspond to normal working hours. • Meal periods may be excluded. • Enforcement policy - DOL does not consider time outside of regular working hours spent as a passenger traveling “work time”. • Travel time spent on special one-day trip to another city for employer’s benefit is compensable.

Fair Labor Standards Act What must be included in the “regular rate” • “Regular rate of pay” is the critical measure for calculating overtime • Overtime is calculated by the hour at 1 -1/2 times the “regular rate” • Regardless of how non-exempt employee is paid - by hour, salary, etc. - must convert amount to equivalent hourly rate from which overtime rate can be calculated

Fair Labor Standards Act What must be included in the “regular rate” Regular rate includes: • All hourly wages • Salary • Commissions • Shift differential • Standby compensation • Value of employer-provided meals and lodging • Bonuses which are based upon quantity or quality of work

Fair Labor Standards Act Bonuses Bonus payments are excluded from the regular rate if: “Both the fact that payment is to be made and the amount of the payment are determined at the sole discretion of the employer at or near the end of the period and not pursuant to any prior contract, agreement, or promise causing the employee to expect such payments regularly. ”

Fair Labor Standards Act Bonuses If employer gives up its discretion in any way - bonus must be included in regular rate of pay. Examples • Hiring bonus • Attendance bonus • Production bonus • Quality bonus • Other incentive bonus

Fair Labor Standards Act Compensatory Time Off Very Limited: • 1 -1/2 hour off for each hour worked in excess of 40 • Same work week – no exceptions even at request of the employee • No banking

Ongoing Claim • Ohio Division and Wage & Hour has determined that an employee was improperly paid straight time for overtime hours. – Initial determination was that employee was is owed $10, 192. 03 – Response filed that employee was only due $4, 209 • Limited by 2 year “look back” period • Safe Harbor Policy was in effect • Miscalculation of overtime hours • Paid salary for 45 hour per week, includes 5 hours overtime

Ongoing Claims- Current Status • Ohio Division and Wage & Hour has responded that only two year period was applicable. – Initial determination was that employee was is owed $10, 192. 03 – Response filed that employee was only due $4, 209 • Limited by 2 year “look back” period - Accepted • Safe Harbor Policy was in effect - Likely To Be Rejected • Miscalculation of overtime hours - Under Review • Paid for 45 hour per week - Under Review

Corrective Action 1. Review Salaried Employee’s Job Duties and divide into three categories. a) Clearly Exempt Employees – Department heads, shift leaders, etc. b) Possibly Exempt Employees – Lower level administrative staff, secretaries, etc. c) Probably Non-Exempt Employees – All remaining salaried employees.

Clearly Exempt Employees • Employees classified as “Clearly Exempt” need to have no further remedial actions taken. • No back overtime is due to these employees.

Determine If Employee Is Exempt • Review job descriptions; • Compare Job Descriptions with actual work performed – Are described duties performed – Do they perform additional duties not listed – Is the majority of the Employee’s work non-manual directly related to management policies or business operations. • Apply “short test” – Does Employee Exercise Discretion and Independent Judgment? – Does the Employee manage 2 or more employees? • If no to both of these questions, then the employee is non-exempt.

Determine If Employee Is Exempt Exercise Discretion And Independent Judgment • Factors to consider: – Does the employee advise senior level employees on policy, actions and critical decisions? – Does the employee work without constant supervision and direction of superiors? – Does the employee have the authority to make some decisions without the approval of senior management?

Robinson-Smith v. Geico Insurance U. S. Court of Appeals District of Columbia • Most recent case determining/affirming the requirements of Executive - Administrative Exemption. • Three prong test: – Employee makes more than $455. 00 – Employee’s primary duty must be administrative in nature – Employee “customarily and regularly” exercises discretion

If Employee Is Found To Be Non-Exempt • Review payroll records for past two years (Statute of Limitations) – Examine weekly time to calculate if overtime is owed – Determine projected overtime amount – Prepare settlement offer (reduced amount based upon reduction factors multiplied by percentage for prompt payment) (Confidential Attorney Client Communications)

If Employee Is Found To Be Non-Exempt • Theories to reduce liability: – Safe Harbor/Fluctuating Work Week Policy • Utilize salary amount divided by number of hours worked to determine hourly wage on a week by week basis • Calculate overtime based upon revised hourly wage. (Confidential Attorney Client Communications)

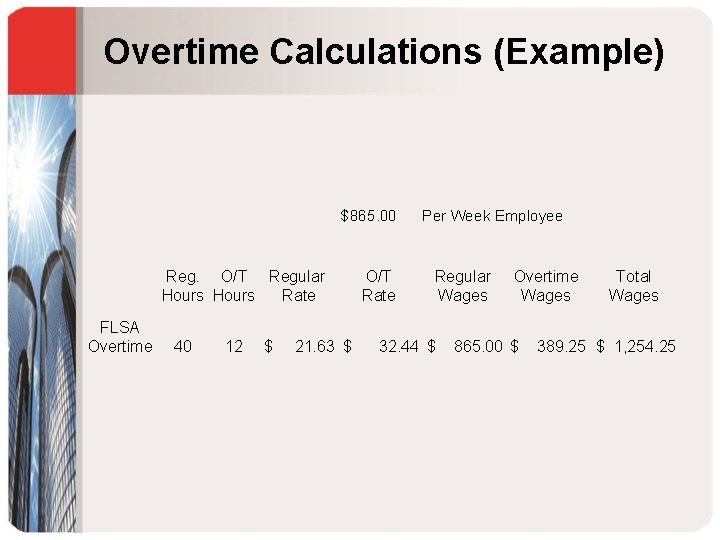

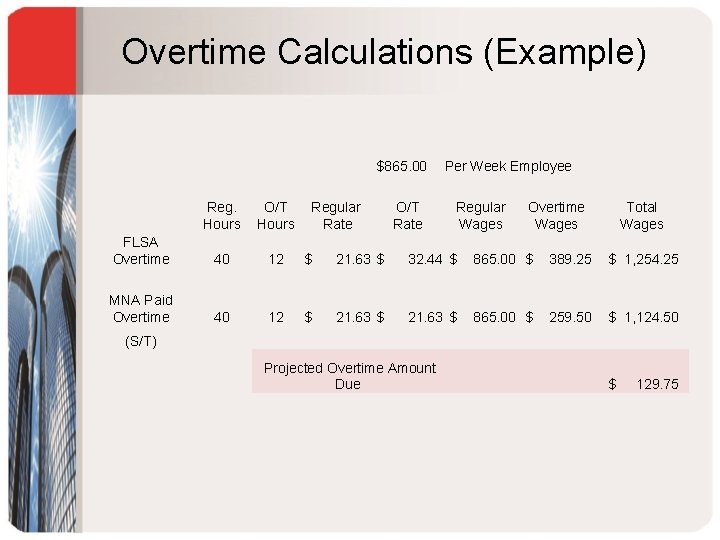

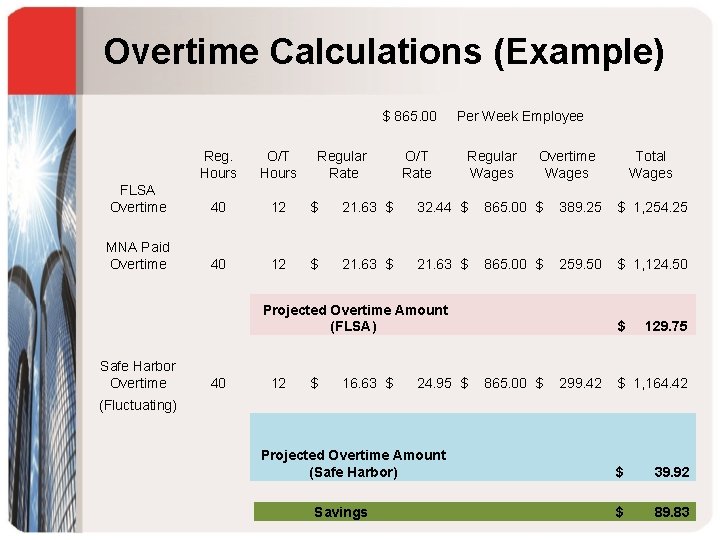

Overtime Calculations (Example) $865. 00 Reg. O/T Regular Hours Rate FLSA Overtime 40 12 $ 21. 63 $ O/T Rate Per Week Employee Regular Wages 32. 44 $ Overtime Wages 865. 00 $ Total Wages 389. 25 $ 1, 254. 25

Overtime Calculations (Example) $865. 00 Regular Rate O/T Rate Per Week Employee Reg. Hours O/T Hours Regular Wages Overtime Wages Total Wages FLSA Overtime 40 12 $ 21. 63 $ 32. 44 $ 865. 00 $ 389. 25 $ 1, 254. 25 MNA Paid Overtime 40 12 $ 21. 63 $ 865. 00 $ 259. 50 $ 1, 124. 50 (S/T) Projected Overtime Amount Due $ 129. 75

Overtime Calculations (Example) $ 865. 00 Regular Rate O/T Rate Per Week Employee Reg. Hours O/T Hours Regular Wages Overtime Wages FLSA Overtime 40 12 $ 21. 63 $ 32. 44 $ 865. 00 $ 389. 25 $ 1, 254. 25 MNA Paid Overtime 40 12 $ 21. 63 $ 865. 00 $ 259. 50 $ 1, 124. 50 Projected Overtime Amount (FLSA) Safe Harbor Overtime 40 12 $ 16. 63 $ 24. 95 $ Total Wages $ 865. 00 $ 299. 42 129. 75 $ 1, 164. 42 (Fluctuating) Projected Overtime Amount (Safe Harbor) Savings $ 39. 92 $ 89. 83

Safe Harbor Policy • Safe Harbor Policy permitted by FLSA • Provides: – Protection for employer who incorrectly pays or takes improper deduction – A Complaint Procedure for Employees – A Review Process – A Demonstration of Employer’s intent to comply with FLSA (to avoid double damages) • Inadvertent and Improper Deductions must be remedied immediately

Safe Harbor Policy/Fluctuating Workweek • Fluctuating Workweek allows employer to limit overtime of salaried employee • Conditions: – Employee must expressly agree to the fluctuating workweek – Employee must understand the payment plan exists – Not necessary that employee understands the calculations

Fluctuating Workweek • Employee is paid a set amount for the work week • Overtime is calculated as follows: – Divide Weekly Pay by the number of hours worked in the week, establishing an hourly pay rate for that week – Multiply hours over 40 by the weekly hourly pay rate and divide by 2 – The resulting amount is the overtime to be paid. – Employee can never be paid less than minimum wage Only applies to salaried non-exempt employees

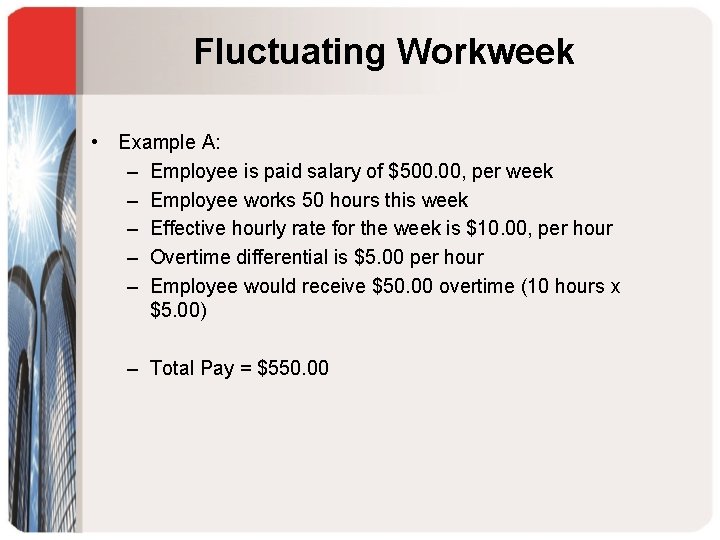

Fluctuating Workweek • Example A: – Employee is paid salary of $500. 00, per week – Employee works 50 hours this week – Effective hourly rate for the week is $10. 00, per hour – Overtime differential is $5. 00 per hour – Employee would receive $50. 00 overtime (10 hours x $5. 00) – Total Pay = $550. 00

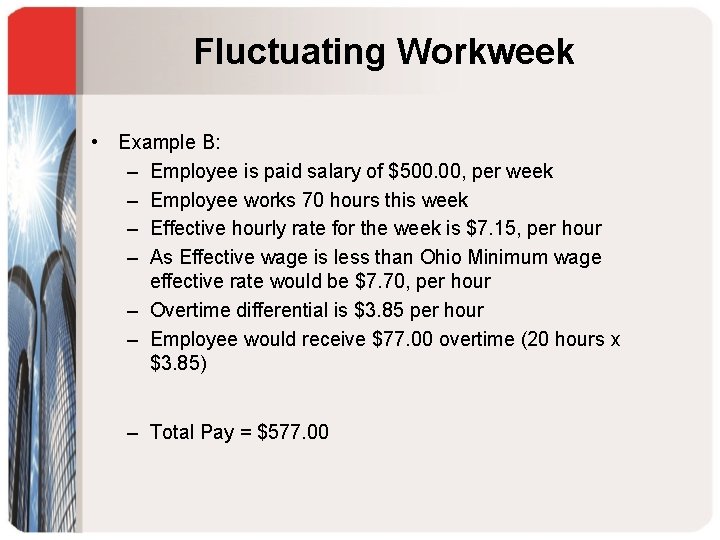

Fluctuating Workweek • Example B: – Employee is paid salary of $500. 00, per week – Employee works 70 hours this week – Effective hourly rate for the week is $7. 15, per hour – As Effective wage is less than Ohio Minimum wage effective rate would be $7. 70, per hour – Overtime differential is $3. 85 per hour – Employee would receive $77. 00 overtime (20 hours x $3. 85) – Total Pay = $577. 00

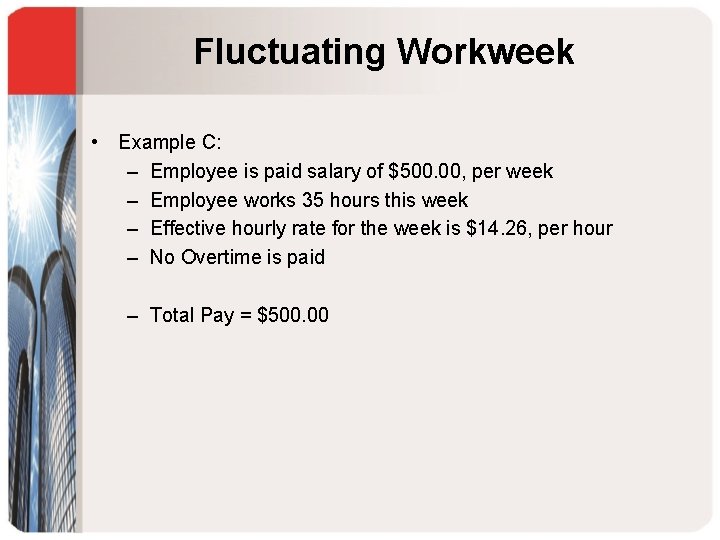

Fluctuating Workweek • Example C: – Employee is paid salary of $500. 00, per week – Employee works 35 hours this week – Effective hourly rate for the week is $14. 26, per hour – No Overtime is paid – Total Pay = $500. 00

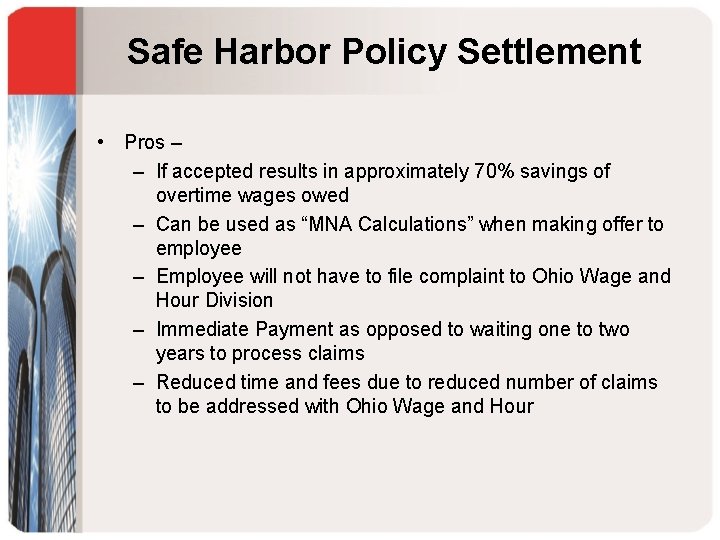

Safe Harbor Policy Settlement • Pros – – If accepted results in approximately 70% savings of overtime wages owed – Can be used as “MNA Calculations” when making offer to employee – Employee will not have to file complaint to Ohio Wage and Hour Division – Immediate Payment as opposed to waiting one to two years to process claims – Reduced time and fees due to reduced number of claims to be addressed with Ohio Wage and Hour

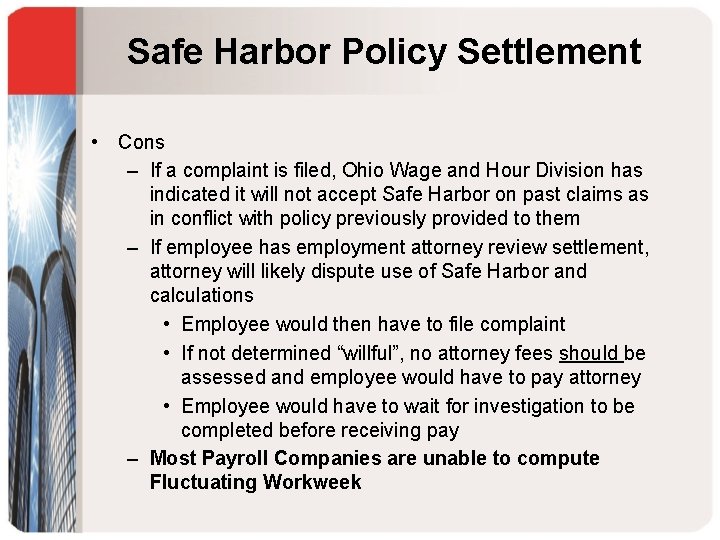

Safe Harbor Policy Settlement • Cons – If a complaint is filed, Ohio Wage and Hour Division has indicated it will not accept Safe Harbor on past claims as in conflict with policy previously provided to them – If employee has employment attorney review settlement, attorney will likely dispute use of Safe Harbor and calculations • Employee would then have to file complaint • If not determined “willful”, no attorney fees should be assessed and employee would have to pay attorney • Employee would have to wait for investigation to be completed before receiving pay – Most Payroll Companies are unable to compute Fluctuating Workweek

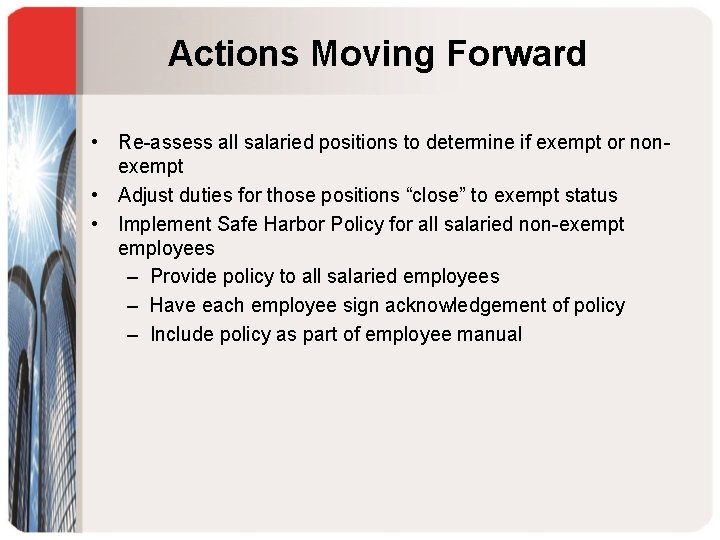

Actions Moving Forward • Re-assess all salaried positions to determine if exempt or nonexempt • Adjust duties for those positions “close” to exempt status • Implement Safe Harbor Policy for all salaried non-exempt employees – Provide policy to all salaried employees – Have each employee sign acknowledgement of policy – Include policy as part of employee manual

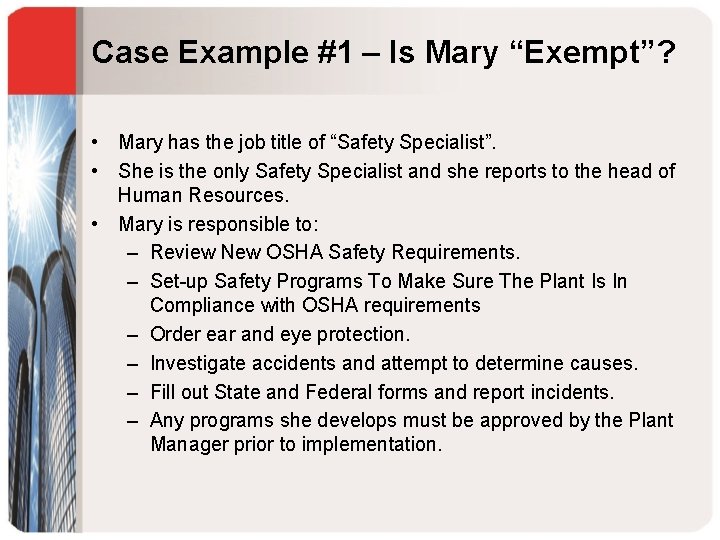

Case Example #1 – Is Mary “Exempt”? • Mary has the job title of “Safety Specialist”. • She is the only Safety Specialist and she reports to the head of Human Resources. • Mary is responsible to: – Review New OSHA Safety Requirements. – Set-up Safety Programs To Make Sure The Plant Is In Compliance with OSHA requirements – Order ear and eye protection. – Investigate accidents and attempt to determine causes. – Fill out State and Federal forms and report incidents. – Any programs she develops must be approved by the Plant Manager prior to implementation.

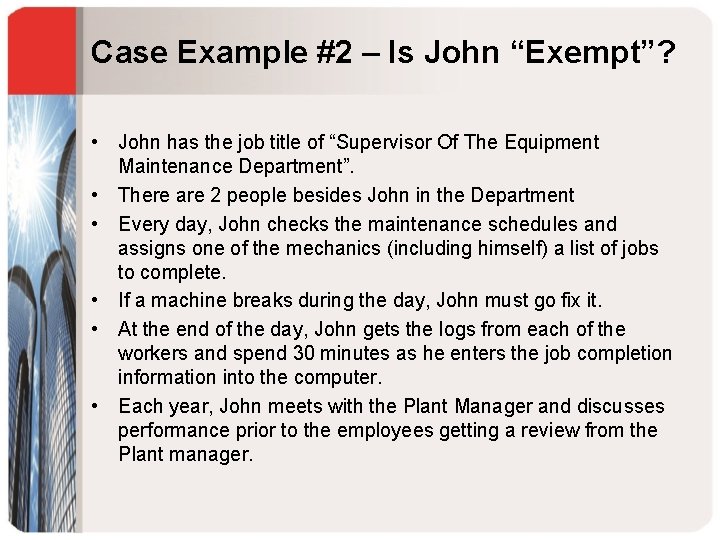

Case Example #2 – Is John “Exempt”? • John has the job title of “Supervisor Of The Equipment Maintenance Department”. • There are 2 people besides John in the Department • Every day, John checks the maintenance schedules and assigns one of the mechanics (including himself) a list of jobs to complete. • If a machine breaks during the day, John must go fix it. • At the end of the day, John gets the logs from each of the workers and spend 30 minutes as he enters the job completion information into the computer. • Each year, John meets with the Plant Manager and discusses performance prior to the employees getting a review from the Plant manager.

Thank you. Q&A SKYE SUH, PLC 32000 Northwestern Hwy. , Suite 260 Farmington Hills, Michigan 48334 Tel. 248. 932. 8844 /Fax 248. 932. 6355 www. SKYESUHPLC. com

- Slides: 69