OVERVIEW Indian Agriculture Agriculture Risks Crop Insurance Evolution

![National Agricultural Insurance Scheme [NAIS] (Government’s flagship Yield index Crop Insurance Program) • Introduced National Agricultural Insurance Scheme [NAIS] (Government’s flagship Yield index Crop Insurance Program) • Introduced](https://slidetodoc.com/presentation_image/08e79e16cb9473ed4ce2d5ff9b5bf3f0/image-10.jpg)

- Slides: 23

OVERVIEW • Indian Agriculture • Agriculture Risks • Crop Insurance: Evolution • Crop Insurance: Why Index insurance? • Crop Insurance: Key Products • Crop Insurance: How Products work? • Crop Insurance: Key Characteristics • Crop Insurance: Key Challenges • Crop Insurance: New Initiatives 1

Indian Agriculture 2

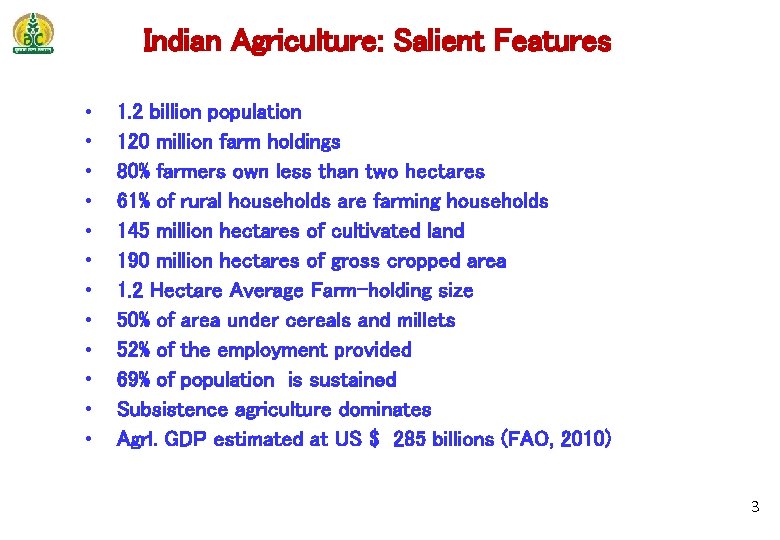

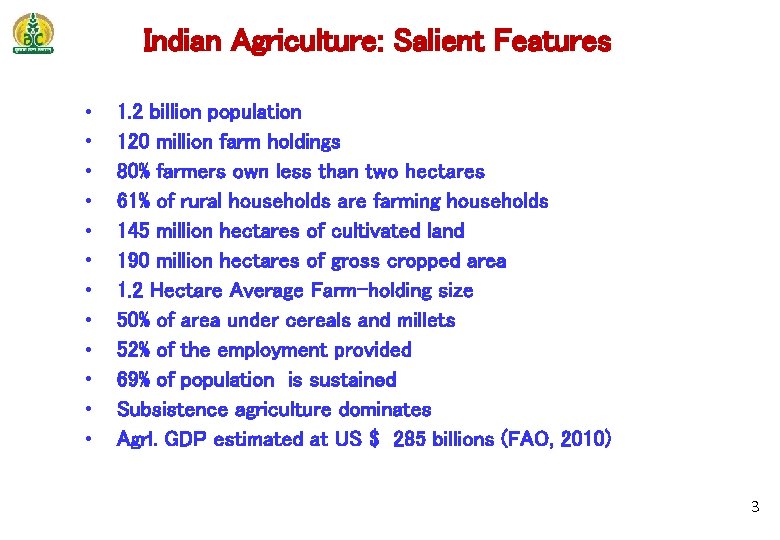

Indian Agriculture: Salient Features • • • 1. 2 billion population 120 million farm holdings 80% farmers own less than two hectares 61% of rural households are farming households 145 million hectares of cultivated land 190 million hectares of gross cropped area 1. 2 Hectare Average Farm-holding size 50% of area under cereals and millets 52% of the employment provided 69% of population is sustained Subsistence agriculture dominates Agrl. GDP estimated at US $ 285 billions (FAO, 2010) 3

Agriculture Risks 4

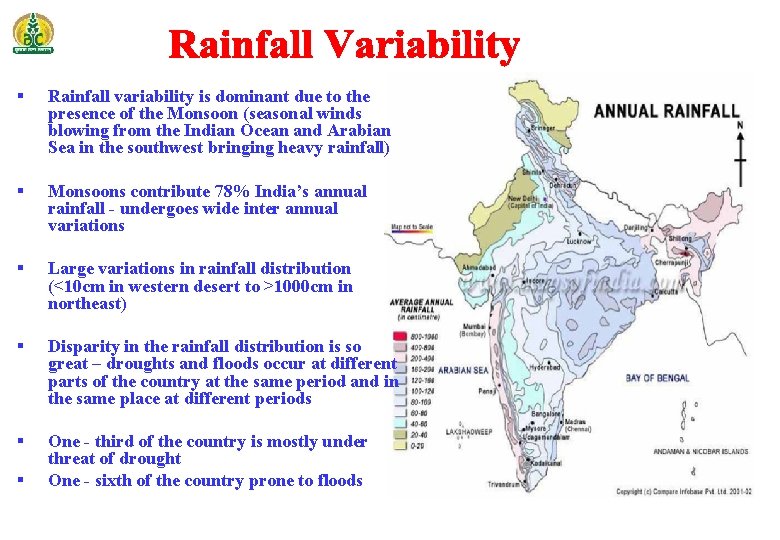

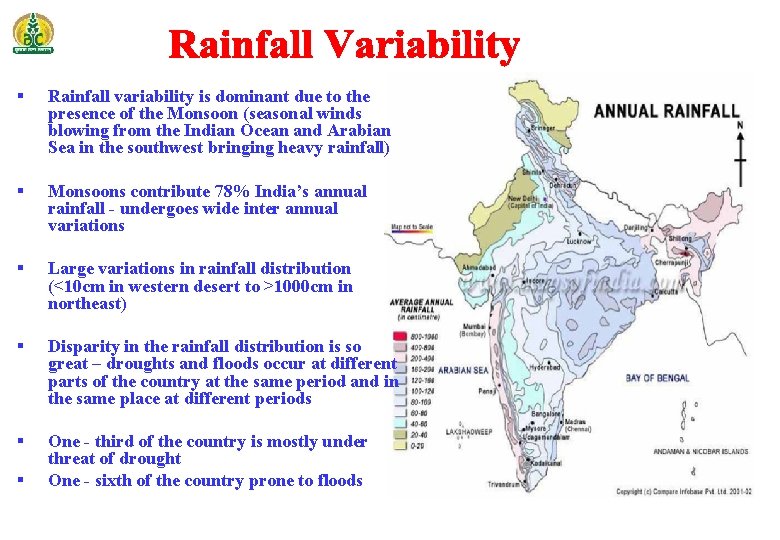

§ Rainfall variability is dominant due to the presence of the Monsoon (seasonal winds blowing from the Indian Ocean and Arabian Sea in the southwest bringing heavy rainfall) § Monsoons contribute 78% India’s annual rainfall - undergoes wide inter annual variations § Large variations in rainfall distribution (<10 cm in western desert to >1000 cm in northeast) § Disparity in the rainfall distribution is so great – droughts and floods occur at different parts of the country at the same period and in the same place at different periods § One - third of the country is mostly under threat of drought One - sixth of the country prone to floods §

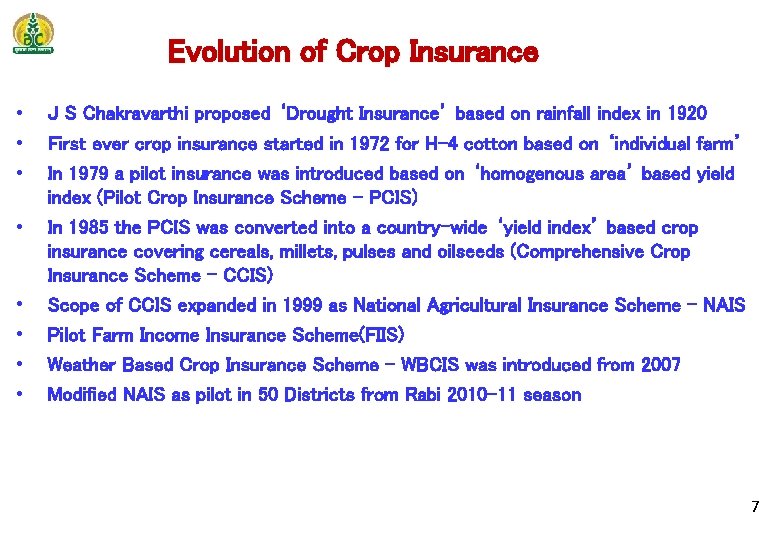

India Crop Insurance: History 6

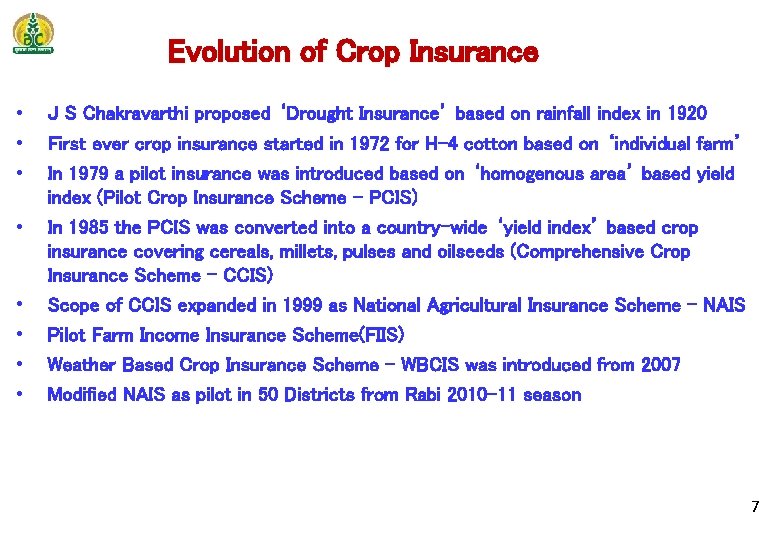

Evolution of Crop Insurance • • J S Chakravarthi proposed ‘Drought Insurance’ based on rainfall index in 1920 First ever crop insurance started in 1972 for H-4 cotton based on ‘individual farm’ In 1979 a pilot insurance was introduced based on ‘homogenous area’ based yield index (Pilot Crop Insurance Scheme – PCIS) In 1985 the PCIS was converted into a country-wide ‘yield index’ based crop insurance covering cereals, millets, pulses and oilseeds (Comprehensive Crop Insurance Scheme – CCIS) Scope of CCIS expanded in 1999 as National Agricultural Insurance Scheme – NAIS Pilot Farm Income Insurance Scheme(FIIS) Weather Based Crop Insurance Scheme – WBCIS was introduced from 2007 Modified NAIS as pilot in 50 Districts from Rabi 2010 -11 season 7

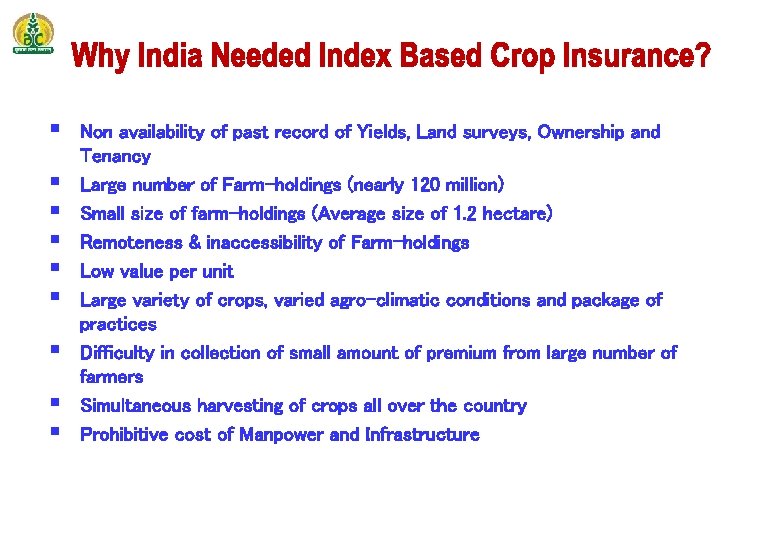

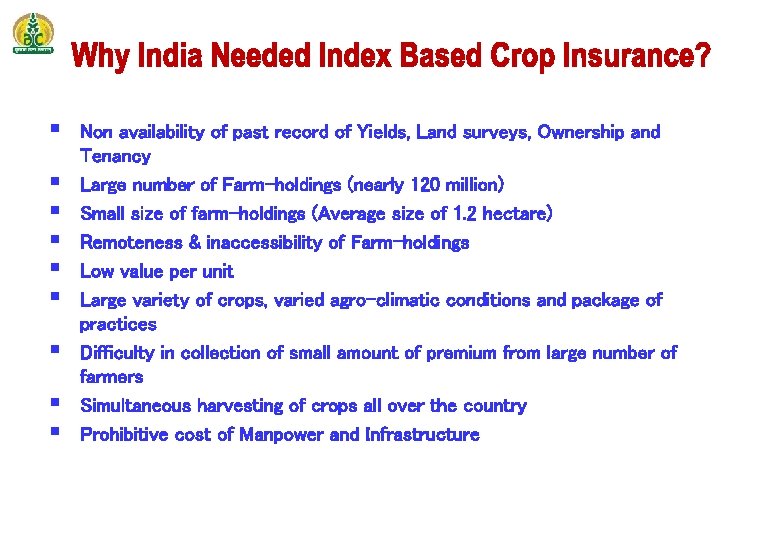

§ § § § § Non availability of past record of Yields, Land surveys, Ownership and Tenancy Large number of Farm-holdings (nearly 120 million) Small size of farm-holdings (Average size of 1. 2 hectare) Remoteness & inaccessibility of Farm-holdings Low value per unit Large variety of crops, varied agro-climatic conditions and package of practices Difficulty in collection of small amount of premium from large number of farmers Simultaneous harvesting of crops all over the country Prohibitive cost of Manpower and Infrastructure

![National Agricultural Insurance Scheme NAIS Governments flagship Yield index Crop Insurance Program Introduced National Agricultural Insurance Scheme [NAIS] (Government’s flagship Yield index Crop Insurance Program) • Introduced](https://slidetodoc.com/presentation_image/08e79e16cb9473ed4ce2d5ff9b5bf3f0/image-10.jpg)

National Agricultural Insurance Scheme [NAIS] (Government’s flagship Yield index Crop Insurance Program) • Introduced in 1999 and presently in operation countrywide • Homogenous Area approach and Area-Yield Guarantee • Available to all Farmers - compulsory for borrowing & optional for non-borrowing • Covers Food crops, Oilseeds & Annual Commercial / Horticultural Crops • Indemnity levels vary from 60% to 90% of past average yield • Sum Insured - Loan amount to 150% of value of Yield • Premium rates § Food crops & Oilseeds – ranges from 1. 5% to 3. 5% § Annual Commercial / Horticultural Crops – Actuarial • Indemnities exceeding Premium for food crops & oilseeds are borne by the Government • Being Implemented in 25 States & 2 Union Territories • Covers more than 35 different crops each during Kharif and Rabi 9

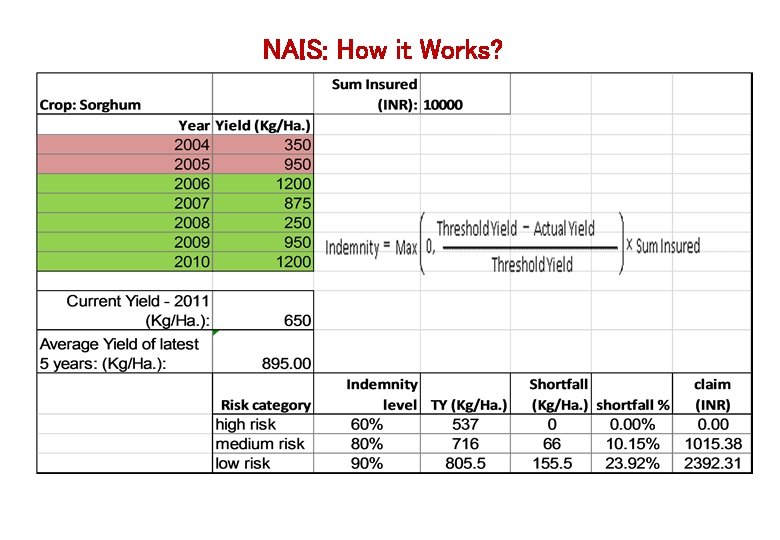

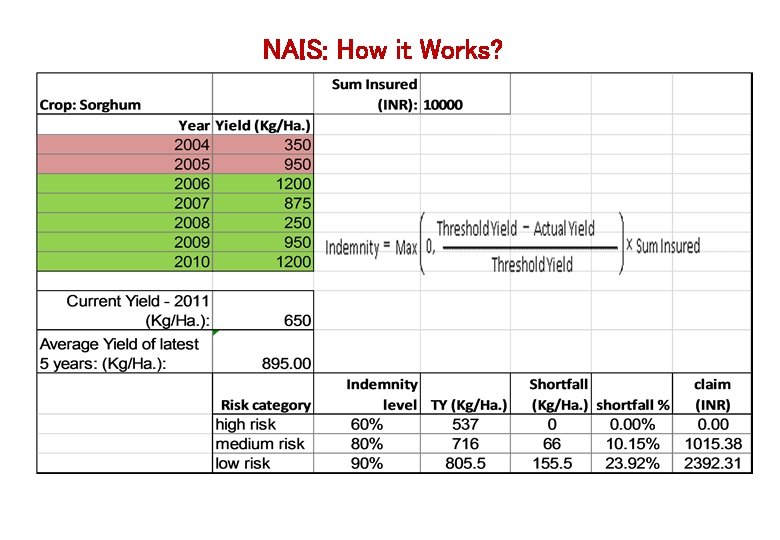

NAIS: How it Works?

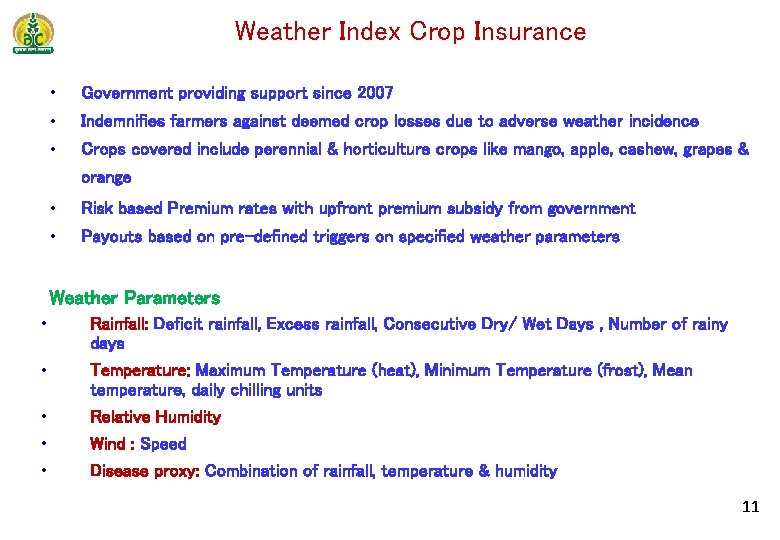

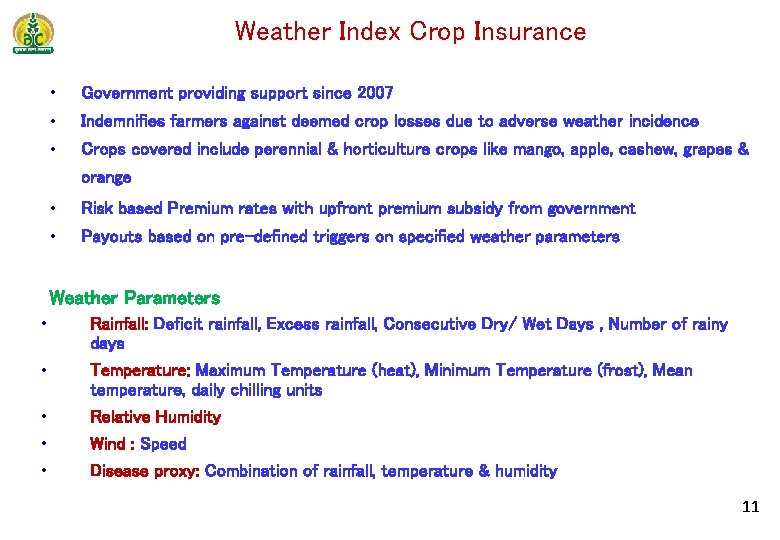

Weather Index Crop Insurance • Government providing support since 2007 • Indemnifies farmers against deemed crop losses due to adverse weather incidence • Crops covered include perennial & horticulture crops like mango, apple, cashew, grapes & orange • Risk based Premium rates with upfront premium subsidy from government • Payouts based on pre-defined triggers on specified weather parameters Weather Parameters • • • Rainfall: Deficit rainfall, Excess rainfall, Consecutive Dry/ Wet Days , Number of rainy days Temperature: Maximum Temperature (heat), Minimum Temperature (frost), Mean temperature, daily chilling units Relative Humidity Wind : Speed Disease proxy: Combination of rainfall, temperature & humidity 11

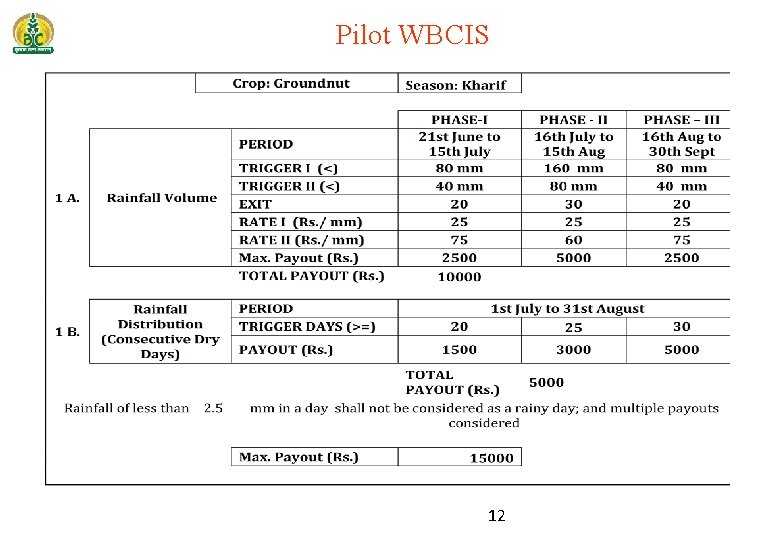

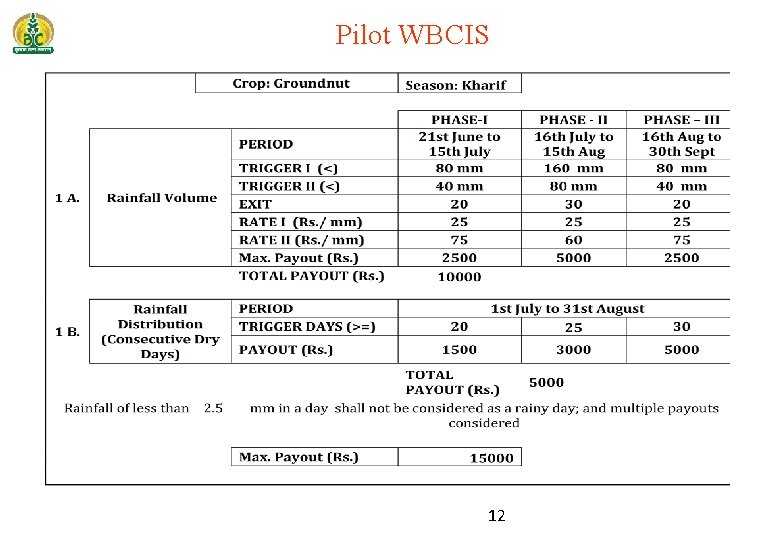

Pilot WBCIS 12

Modified Yield Index Insurance 13

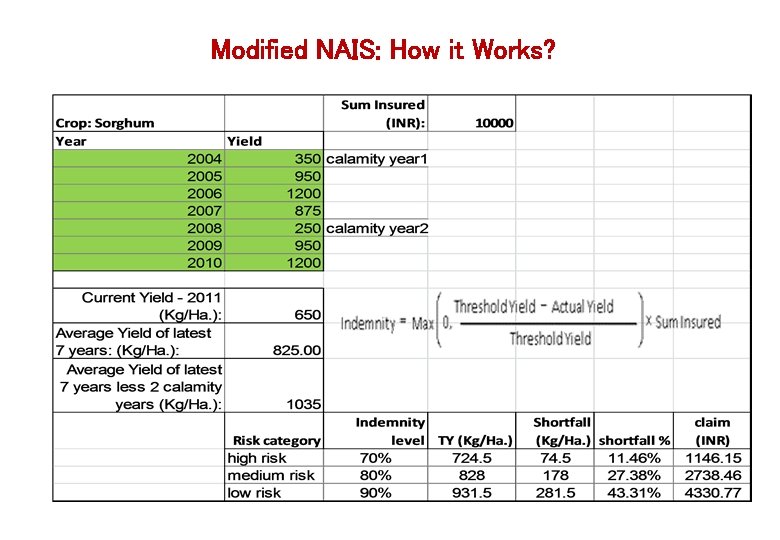

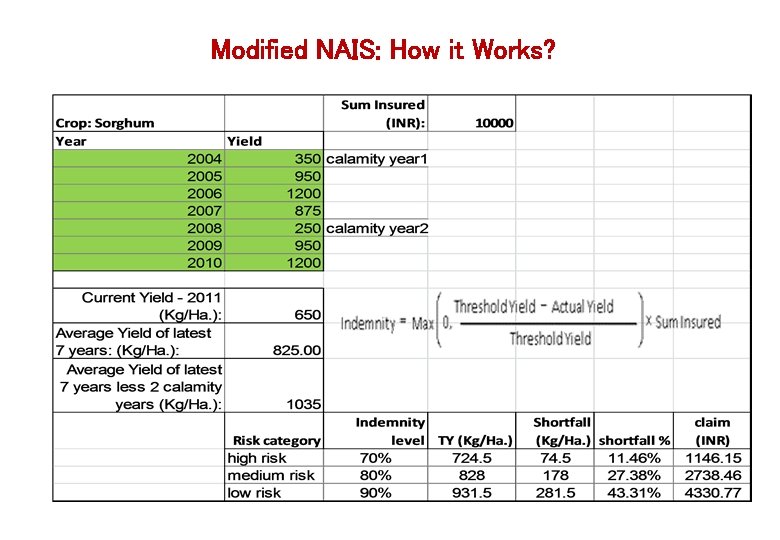

Modified NAIS: How it Works?

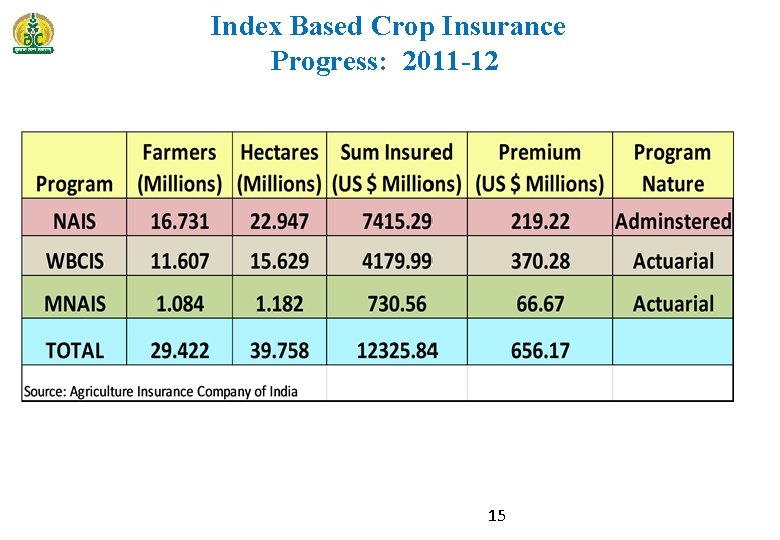

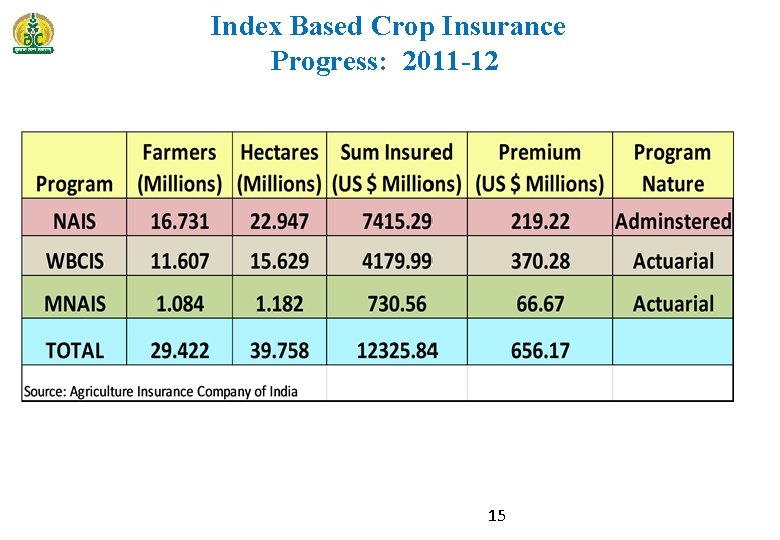

Index Based Crop Insurance Progress: 2011 -12 15

India Crop Insurance: Key Characteristics 16

Key Features of Implementation • Credit linkage, and mandatory for borrowing farmers • Risk covered is based n production cost (safety-net) • Credit institutions also finance the premium (in addition to crop loan) • Insurance acts as collateral, and lending agencies have the first lien on claim • Minimal distribution costs • Claims process is automated • Yield estimation is done by the provincial government agencies , and based on ‘single series’ • Weather product uses crop modeling inputs • Weather data comes from both public as well as private data providers • Extension activities and awareness programs are also organized by the government • Private insurance providers are allowed for actuarially priced programs, and enjoy • same level of support as AIC Government provides for about 2/3 rd cot of the program 17

Key Challenges • Basis risk • Issues of financial literacy • Un-realistic expectation– high frequency payouts to sustain interest • Crop Insurance Vs Other Subsidy programs • Technically Complex Products (weather index) • Climate Change & Seasonal Forecasts • Yield estimates prone to manipulation risk 18

Some Solutions… • Yield audit system • Weather data standardization and integration • Technical Support Unit (TSU) & product bench-marking • Financial literacy and consumer education • Micro-insurance agents • On-line portal • Information interface for stakeholders 19

India Crop Insurance: New Initiatives 20

Weather index: 1. Index + 2. Double-Trigger product 3. Savings linked (Loyalty Discount) based product 4. TOPS based weather data generation Yield index: 1. GPS enabled cell phones to audit yield estimation 2. Satellite imagery based area estimation and crop health reporting 3. Remote Sensing based Information and Insurance for Crops in Emerging Economies (RIICE)