Our Confession ACT 110 Is EASY POP ACT

- Slides: 67

Our Confession ACT 110 Is EASY POP!

ACT 110 INTRODUCTION TO ACCOUNTING LECTURERS: TROY J. WISHART MARIA CHRISTY

Course Outline ACT 110 Introduction to Accounting COURSE DESCRIPTION AND AIMS: • The aim of this course is to expose students to the mechanics of financial accounting. In addition students would be introduced to the history and development of accounting, accounting concepts, principles and practices. • CREDIT HOURS: 4 hours – 3 hours Lecturers – 1 hour Tutorial

Course Outline ACT 110 Introduction to Accounting • DURATION OF COURSE: 15 WEEKS • COURSE CONTENT: • Week 1: History, relevance and development of accounting. (Relationships between accounting and other sciences) – Accounting concepts, conventions and principles. • Definition of accounting and other relevant terminologies.

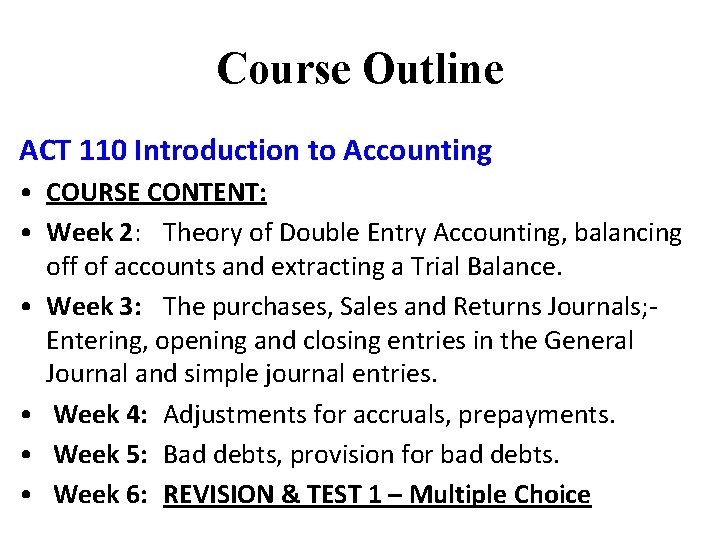

Course Outline ACT 110 Introduction to Accounting • COURSE CONTENT: • Week 2: Theory of Double Entry Accounting, balancing off of accounts and extracting a Trial Balance. • Week 3: The purchases, Sales and Returns Journals; - Entering, opening and closing entries in the General Journal and simple journal entries. • Week 4: Adjustments for accruals, prepayments. • Week 5: Bad debts, provision for bad debts. • Week 6: REVISION & TEST 1 – Multiple Choice

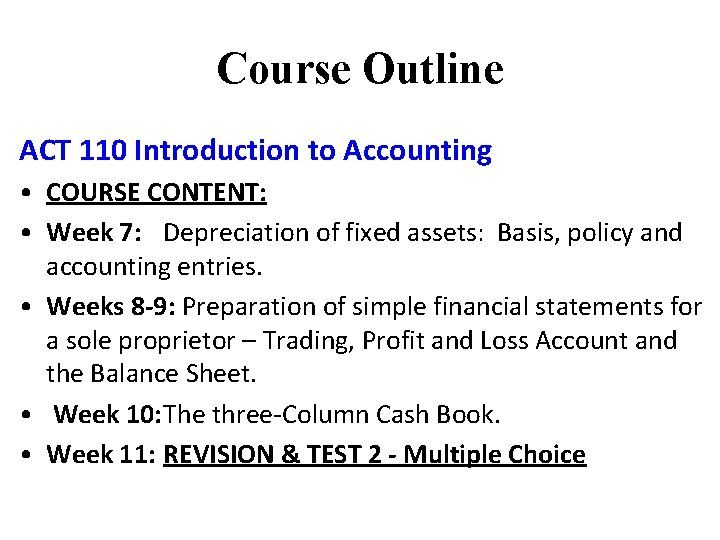

Course Outline ACT 110 Introduction to Accounting • COURSE CONTENT: • Week 7: Depreciation of fixed assets: Basis, policy and accounting entries. • Weeks 8 -9: Preparation of simple financial statements for a sole proprietor – Trading, Profit and Loss Account and the Balance Sheet. • Week 10: The three-Column Cash Book. • Week 11: REVISION & TEST 2 - Multiple Choice

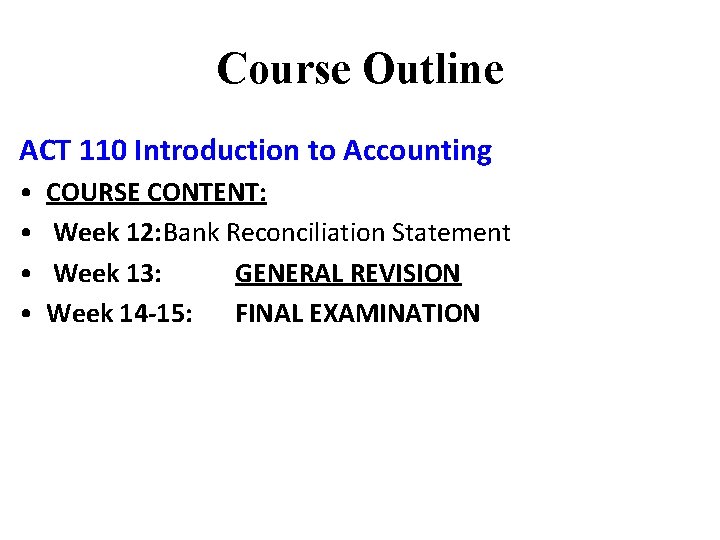

Course Outline ACT 110 Introduction to Accounting • • COURSE CONTENT: Week 12: Bank Reconciliation Statement Week 13: GENERAL REVISION Week 14 -15: FINAL EXAMINATION

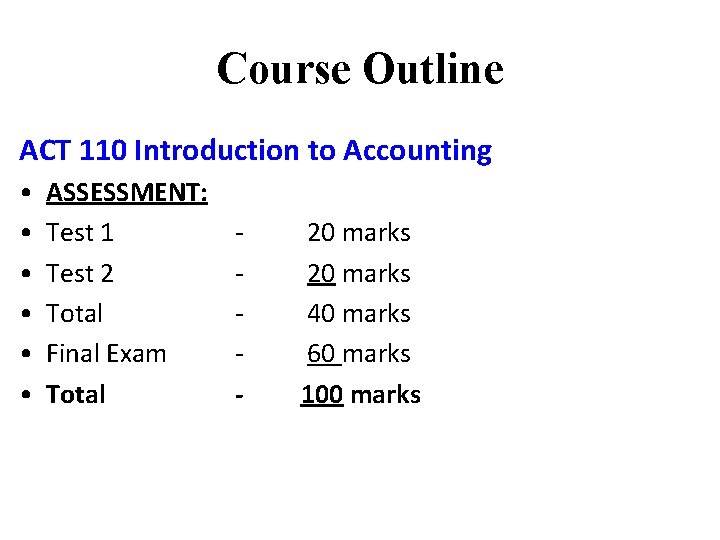

Course Outline ACT 110 Introduction to Accounting • • • ASSESSMENT: Test 1 Test 2 Total Final Exam Total 20 marks 40 marks 60 marks - 100 marks

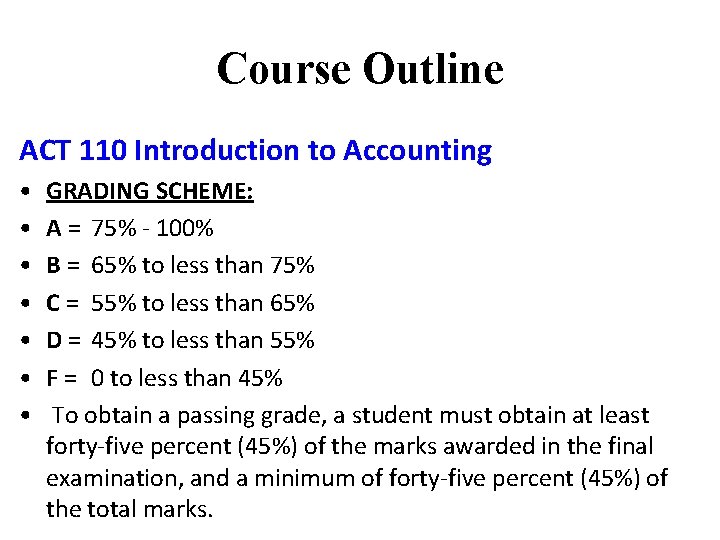

Course Outline ACT 110 Introduction to Accounting • • GRADING SCHEME: A = 75% - 100% B = 65% to less than 75% C = 55% to less than 65% D = 45% to less than 55% F = 0 to less than 45% To obtain a passing grade, a student must obtain at least forty-five percent (45%) of the marks awarded in the final examination, and a minimum of forty-five percent (45%) of the total marks.

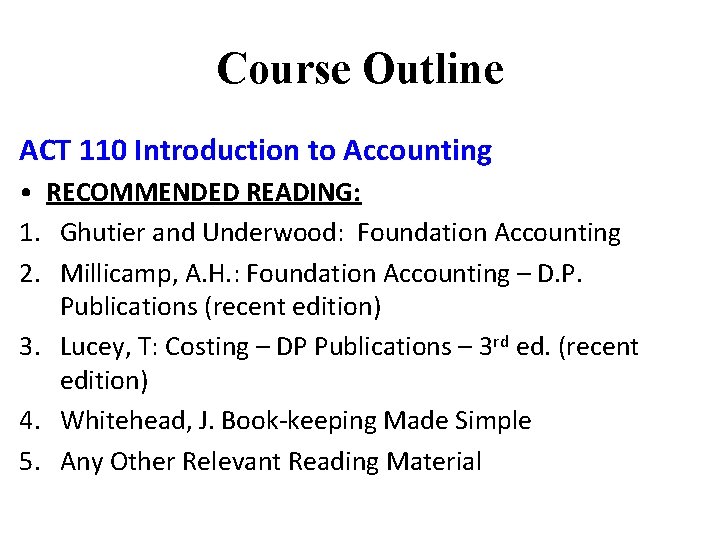

Course Outline ACT 110 Introduction to Accounting • RECOMMENDED READING: 1. Ghutier and Underwood: Foundation Accounting 2. Millicamp, A. H. : Foundation Accounting – D. P. Publications (recent edition) 3. Lucey, T: Costing – DP Publications – 3 rd ed. (recent edition) 4. Whitehead, J. Book-keeping Made Simple 5. Any Other Relevant Reading Material

Lecture Notes 1 History of Accounting

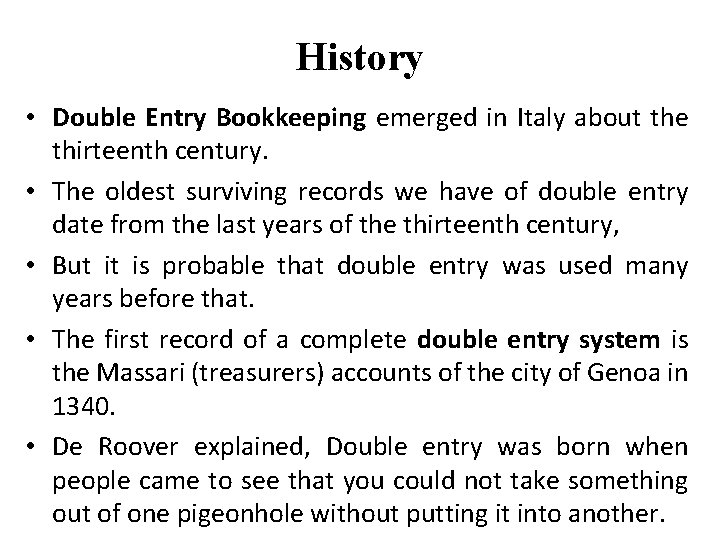

History • Double Entry Bookkeeping emerged in Italy about the thirteenth century. • The oldest surviving records we have of double entry date from the last years of the thirteenth century, • But it is probable that double entry was used many years before that. • The first record of a complete double entry system is the Massari (treasurers) accounts of the city of Genoa in 1340. • De Roover explained, Double entry was born when people came to see that you could not take something out of one pigeonhole without putting it into another.

History • Double Entry Bookkeeping emerged in Italy about the thirteenth century. • Luca Pacioli’s book Summa de Arithmetica Geometria Proportioni et Proportionalita (Review of Arithmetic, Geometry and Proportions) in 1944 is the first book on double entry bookkeeping to be published. • However, according to Peragallo the first person to write on double-entry was probably Benedetto Cotrugli, whose book was completed in 1458

Lecture Notes 1 Definition and Concepts

Definitions and Concepts Bookkeeping is the systematic recording of each relevant business transaction as it occurs. • The transactions are to be recorded in a particular or prescribed manner as is the norm or practice. • Only the business’s transactions are recorded, and therefore all personal transactions that have no relationship with the business are to be excluded. • The transactions are also to be recorded as they occur or in chronological order based on the date of the transactions.

Definitions and Concepts Accounting is the recording, classification, summarizing of transactions and events in a significant manner, which are of a financial nature and interpreting of the results thereof. • Recording includes such activities as writing up receipts and payment vouchers, as well as other source documents. (Journals and/or Day Books) • The transactions then have to be classified or categorize based on the nature of the transactions, and posted to the various accounts or under common heads. (Ledgers)

Definitions and Concepts Accounting • They are then summarized in accordance with generally accepted accounting practice. (Financial Statements) • A transaction is an external event involving a transfer or exchange between two or more entities, • An Event generally is the source or cause of changes in assets, liabilities and equity, which may be external or internal. • Accounting also involves the interpreting of the results and one of the Interpreting tools used include ratio analysis, which gives further meaning to the financial information.

Definitions and Concepts Financial Statement • Statements that reflect the collection, tabulation and summarizing of the accounting data. • Financial statements include Profit and Loss Account, Balance Sheet, Cash Flow Statement, notes to the accounts and the Directors’ and Auditor’s reports.

Definitions and Concepts BALANCE SHEET The balance sheet is a financial statement of a person or business as at a particular date or time. • The balance sheet changes after each transaction, such as – One asset may increase while another will decrease – An asset may increase with a liability increasing to a similar extent, – An asset may decrease resulting in a liability decreasing to a similar degree.

Definitions and Concepts Balance Sheet • The balance sheet is prepared in a prescribed manner, with each item having a particular place in the statement. • Consecutive balance sheets can also be used to determine the performance of a business for the period between the balance sheets dates. • Some of the items found in the Balance Sheet are – Assets (Fixed and Current), Liabilities (Long-term and Current), Equity or Capital and Drawings

Definitions and Concepts Assets Probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events. • An economic benefit is expected from the action taken by the business in the future. • The item does not have to be owned by the business, but might be controlled by the business in such a way that it may be perceived by others to be owned. • The transaction or event must have occurred, not expected to occur. • Assets are therefore items or things owned by the business, as well as things controlled by the business.

Definitions and Concepts Fixed Assets These are assets that are held for use, rather than realization and which are intended to provide services or generate revenues over future accounting periods. • Fixed assets are items purchased by the business either to provide services or generate revenues over more than one accounting period. • If the item is purchased for resale it cannot be treated as a fixed asset. • Materiality (the significance of the value) is used to determine whether an item is a fixed asset and will be used for more than one accounting period.

Definitions and Concepts Current Assets Those assets, which are intended to be held within a period of one year and are expected to be exhausted in one operating cycle. • These are assets that are expected to be used up by the business during the next accounting period, or change their form during the next accounting period. • The operating cycle is the period of time it takes a firm to buy inputs, make or market a product and collects the cash from a customer. • Current assets relate to the next period.

Definitions and Concepts Liabilities Probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events. • The obligation must be currently existing or would have arisen from a past transaction. • Liabilities are amounts owed to third parties by the business. • A liability can be eliminated by giving up some assets or creating another liability.

Definitions and Concepts Current Liabilities • These are short-term debts or obligations, which are expected to be satisfied in one accounting period. • The portion of a long-term liability, which would be paid during the next accounting period, must be classified as current liabilities for the current reporting period.

Definitions and Concepts Equity • Equity or capital as it is commonly called is the amount owed to the owner by the business. • The residual interest in the assets of an entity that remains after deducting its liabilities. • The equity is the owner’s interest or the amount invested by the owner, as well as accumulated profits from period to period.

Definitions and Concepts Drawings • This is the withdrawal of cash or good by the proprietor from the business for his personal use. • Drawings reduce capital, which is the amount owing to the owners, and is usually a debit balance. • Drawings is subtracted from opening capital in the balance sheet.

Definitions and Concepts PROFIT & LOSS ACCOUNT • The profit and loss account is used to determine the performance of the business over a given period of time. • This account is part of the double entry system. • It shows the expenses and revenue incurred and earned during the period.

Definitions and Concepts Expenses • Expense is the value of assets given up or liability incurred or a combination of both during a period to generate revenue. Revenue • These are inflows or other enhancements of assets of an entity or settlement of liabilities, or a combination during a period.

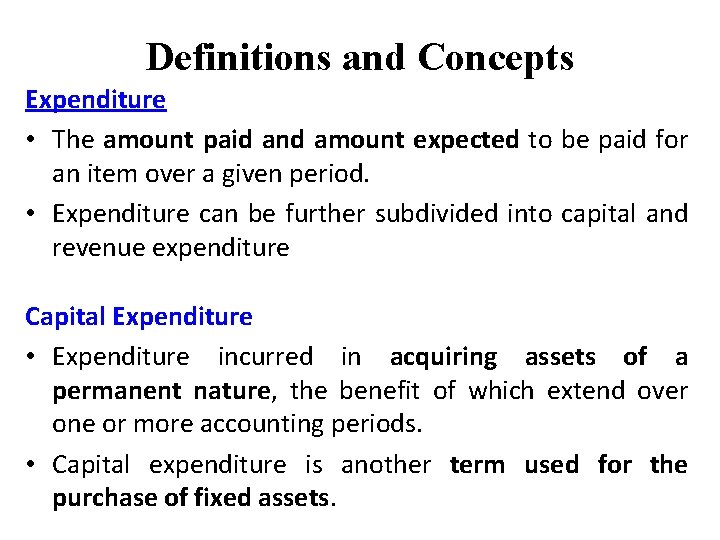

Definitions and Concepts Expenditure • The amount paid and amount expected to be paid for an item over a given period. • Expenditure can be further subdivided into capital and revenue expenditure Capital Expenditure • Expenditure incurred in acquiring assets of a permanent nature, the benefit of which extend over one or more accounting periods. • Capital expenditure is another term used for the purchase of fixed assets.

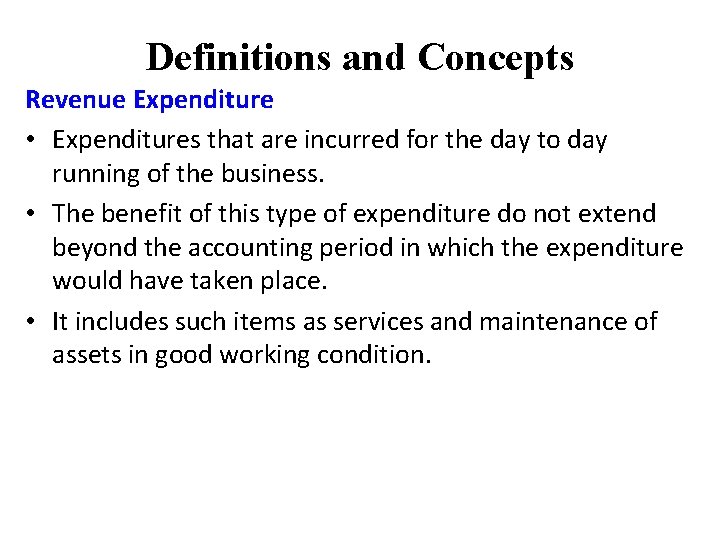

Definitions and Concepts Revenue Expenditure • Expenditures that are incurred for the day to day running of the business. • The benefit of this type of expenditure do not extend beyond the accounting period in which the expenditure would have taken place. • It includes such items as services and maintenance of assets in good working condition.

Our Confession ACT 110 Is EASY POP! We are more than Conquerors

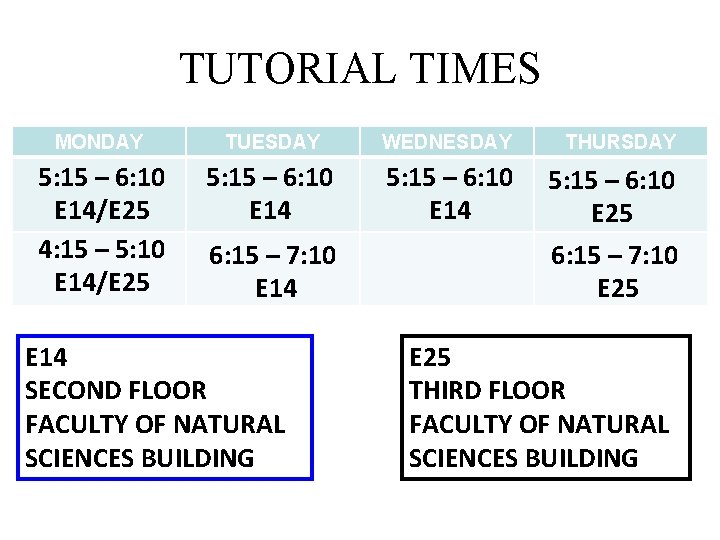

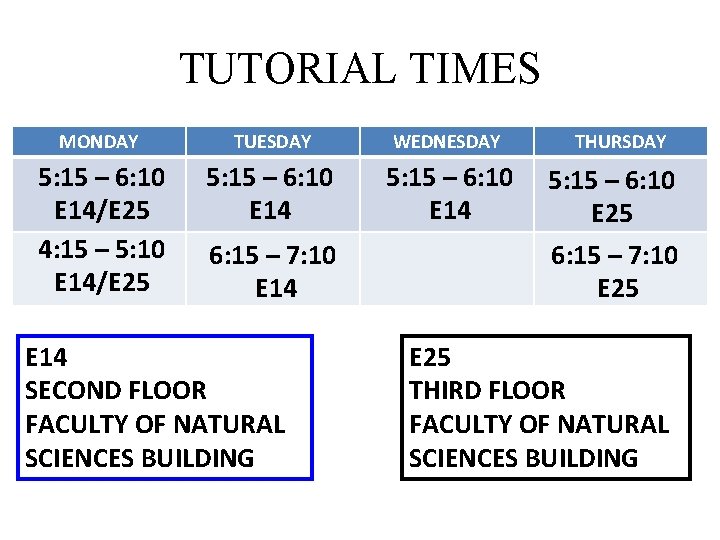

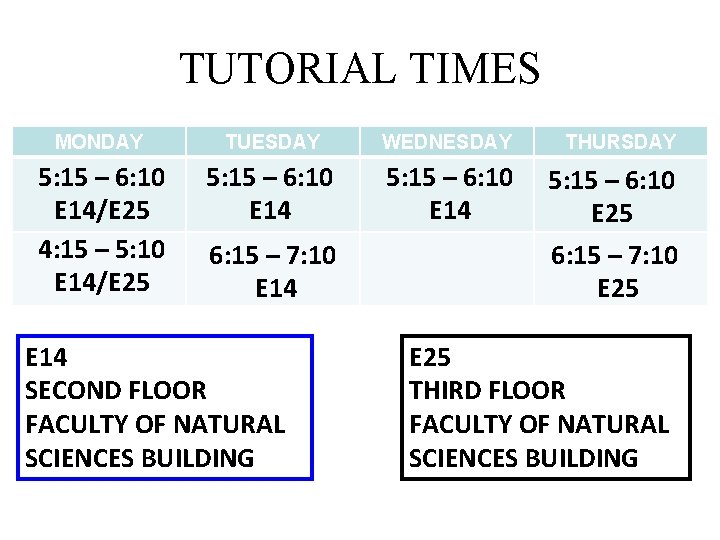

TUTORIAL TIMES MONDAY TUESDAY WEDNESDAY THURSDAY 5: 15 – 6: 10 E 14/E 25 4: 15 – 5: 10 E 14/E 25 5: 15 – 6: 10 E 14 5: 15 – 6: 10 E 25 6: 15 – 7: 10 E 14 SECOND FLOOR FACULTY OF NATURAL SCIENCES BUILDING E 25 THIRD FLOOR FACULTY OF NATURAL SCIENCES BUILDING

Lecture Notes 1 Definition and Concepts Cont’d

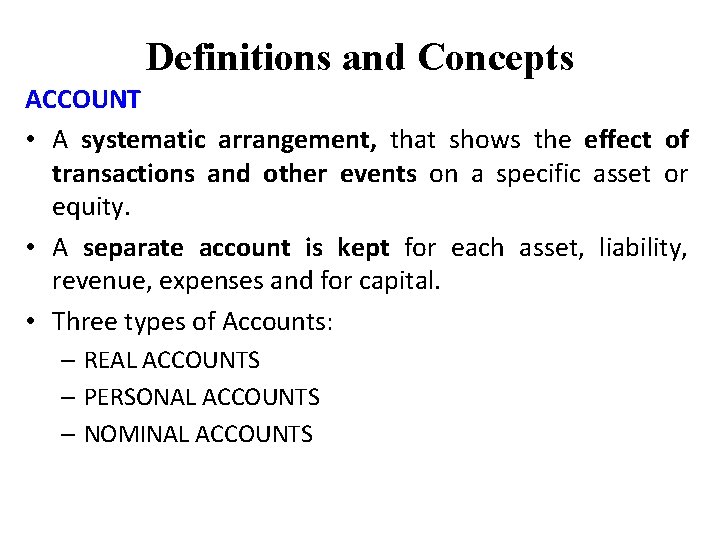

Definitions and Concepts ACCOUNT • A systematic arrangement, that shows the effect of transactions and other events on a specific asset or equity. • A separate account is kept for each asset, liability, revenue, expenses and for capital. • Three types of Accounts: – REAL ACCOUNTS – PERSONAL ACCOUNTS – NOMINAL ACCOUNTS

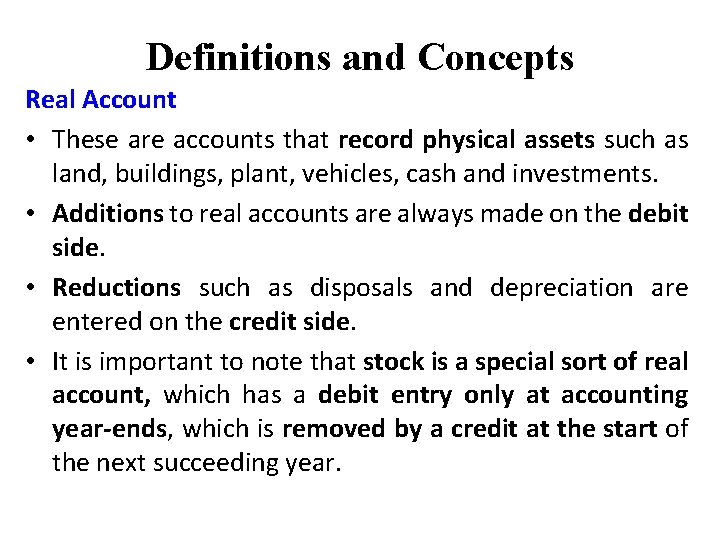

Definitions and Concepts Real Account • These are accounts that record physical assets such as land, buildings, plant, vehicles, cash and investments. • Additions to real accounts are always made on the debit side. • Reductions such as disposals and depreciation are entered on the credit side. • It is important to note that stock is a special sort of real account, which has a debit entry only at accounting year-ends, which is removed by a credit at the start of the next succeeding year.

Definitions and Concepts Personal Account • These accounts show the dealings with and the balances due to or from persons or institutions. • Transactions that increase the amount due to a person by the enterprise are entered on the credit side. • Transactions that reduce the amount due to a creditor are entered on the debit side of the creditor’s account. • Transactions that increase the amount due from a person to the business are entered on the debit side of that person’s account.

Definitions and Concepts Personal Account • Transactions that reduce the amount due from a person to a business are entered on the credit side of that person's account. • The capital account is also a personal account. • It is the account of the proprietor. • Profit is credited as it increases the sum due to the proprietor and drawings and losses are debited as they reduce the amount due.

Definitions and Concepts Personal Account • The cash book is an example of a personal account. • It deals with the balance due to or from the bank. • Receipts (payments into the bank), goes on debit side and payments (cheques drawn) goes on the credit side. • It should be noted that we are talking about the bank account in the cash book, and not the cash account which is also found in the cash book.

Definitions and Concepts Nominal Account • These accounts accumulate the data required for the trading and profit and loss accounts. • They are temporary accounts that are transferred to the Trading and Profit and Loss account at the end of the period. • Example – Revenue, Expenses, Sales, Purchases, Stock. • While real and personal accounts are placed in the Balance Sheet, nominal accounts are placed in the Trading and Profit and Loss account.

Definitions and Concepts LOSSES • Decrease in equity (net assets) from peripheral or incidental transactions of an entity. • Other transactions and other events and circumstances affecting the entity during a period, except those that result from revenue or investment by owners. GAINS • Increase in equity (net assets) from peripheral or incidental transaction of an entity • Other transactions and other events and circumstances affecting the entity during a period, except those that result from revenue or investment by owners.

Definitions and Concepts Goodwill • An intangible asset representing the value of the whole business in excess of the combined individual value of tangible assets, which it is made up of. • Goodwill is incapable of realisation separately from the business as a whole, and is the value of a business as a whole from the value of its separate net asset.

Definitions and Concepts Depreciation • This is the measure of the wearing out, consumption or other reductions in the useful economic life of a fixed asset, whether arising from use, passage of time or obsolescence. • Depreciation has nothing to do with the valuation of assets, though it affects the value of assets. • It is the allocation of cost of fixed assets over the assets useful life. • Obsolescence is the ending of an asset’s useful life for reasons other than deterioration. • Obsolescence is caused by new technology.

Definitions and Concepts PROVISION • An amount retained as reasonably necessary for the purpose of providing for any liability or loss which is either likely to be incurred, or certain to be incurred, but uncertain as to amount or as to the date on which it will arise. NET REALIZABLE VALUE • The actual or estimated selling price of an asset less all further costs to completion, and all costs to be incurred in the marketing, selling and distribution.

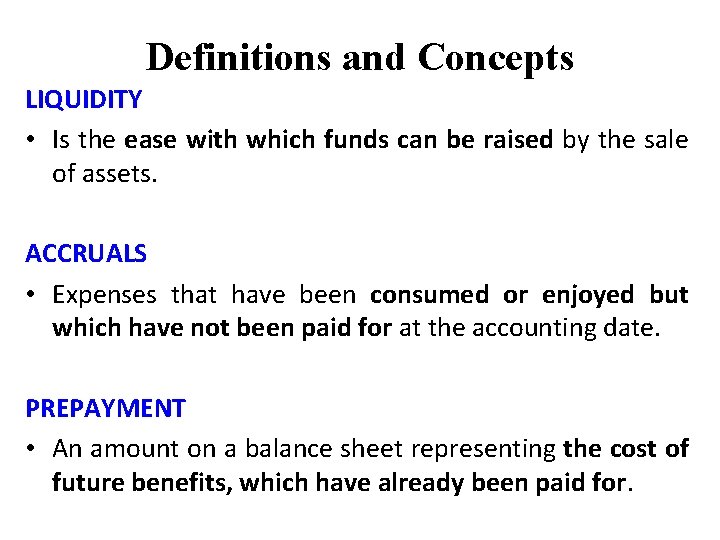

Definitions and Concepts LIQUIDITY • Is the ease with which funds can be raised by the sale of assets. ACCRUALS • Expenses that have been consumed or enjoyed but which have not been paid for at the accounting date. PREPAYMENT • An amount on a balance sheet representing the cost of future benefits, which have already been paid for.

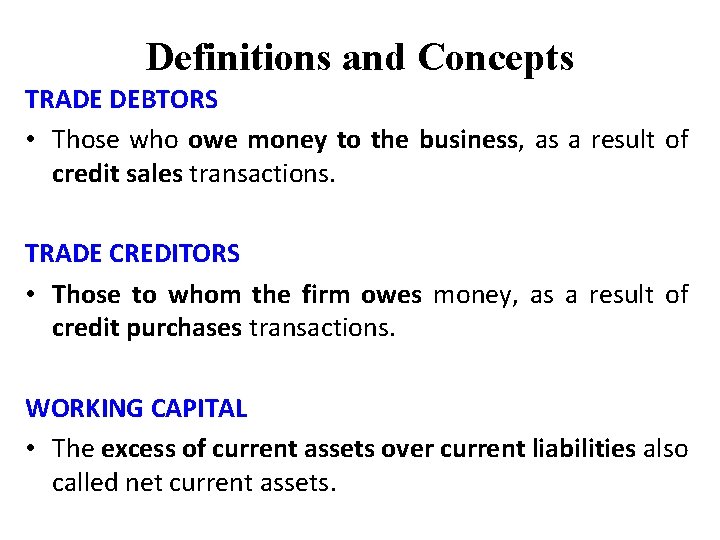

Definitions and Concepts TRADE DEBTORS • Those who owe money to the business, as a result of credit sales transactions. TRADE CREDITORS • Those to whom the firm owes money, as a result of credit purchases transactions. WORKING CAPITAL • The excess of current assets over current liabilities also called net current assets.

Our Confession ACT 110 Is EASY POP! Because We Study to Show Ourselves Approved!

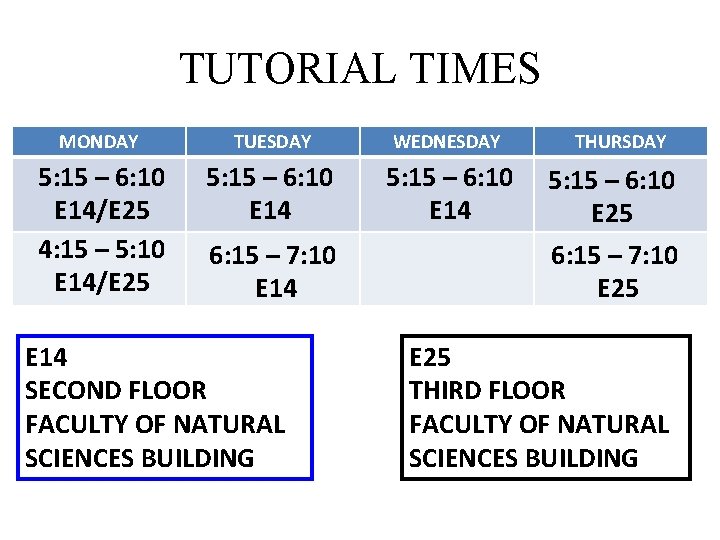

TUTORIAL TIMES MONDAY TUESDAY WEDNESDAY THURSDAY 5: 15 – 6: 10 E 14/E 25 4: 15 – 5: 10 E 14/E 25 5: 15 – 6: 10 E 14 5: 15 – 6: 10 E 25 6: 15 – 7: 10 E 14 SECOND FLOOR FACULTY OF NATURAL SCIENCES BUILDING E 25 THIRD FLOOR FACULTY OF NATURAL SCIENCES BUILDING

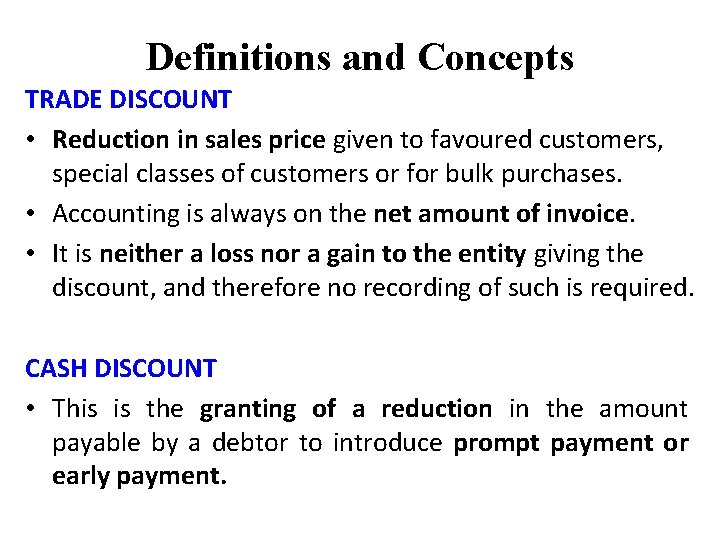

Definitions and Concepts TRADE DISCOUNT • Reduction in sales price given to favoured customers, special classes of customers or for bulk purchases. • Accounting is always on the net amount of invoice. • It is neither a loss nor a gain to the entity giving the discount, and therefore no recording of such is required. CASH DISCOUNT • This is the granting of a reduction in the amount payable by a debtor to introduce prompt payment or early payment.

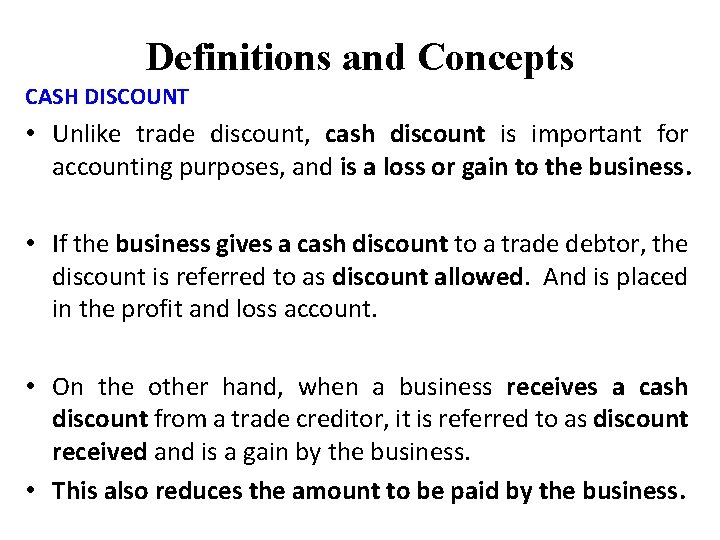

Definitions and Concepts CASH DISCOUNT • Unlike trade discount, cash discount is important for accounting purposes, and is a loss or gain to the business. • If the business gives a cash discount to a trade debtor, the discount is referred to as discount allowed. And is placed in the profit and loss account. • On the other hand, when a business receives a cash discount from a trade creditor, it is referred to as discount received and is a gain by the business. • This also reduces the amount to be paid by the business.

Definitions and Concepts TRADING STOCK • Trading goods that were not sold at a particular date or time are referred to as trading stock. CONSUMABLE STOCK • Those items that were intended to be consumed (used up) during the accounting period, but have not been exhausted at the end of the accounting period.

Lecture Notes 1 Accounting Concepts

Accounting Concepts • Accounting concepts are assumptions under which financial accounts of a business enterprise are prepared. • • • Accruals Consistency Prudence Going Concern Substance Over Form Materiality Business Entity Money Measurement Cost Realization Dual Aspect

Accounting Concepts ACCRUAL • Revenue and cost are accrued, that is recognised as they are earned or incurred (and not as money is received or paid), and recorded in the financial statements of the periods to which they relate. CONSISTENCY • It is assumed that accounting policies are consistent from one period to another, and there is consistency of accounting treatment of like items within each accounting period.

Accounting Concepts PRUDENCE • Revenue and profit are not anticipated but are recognised by inclusion in the profit and loss account only when realised in the form either of cash or of other assets, • Provision is made for all known liabilities (expenses and losses), whether the amount of these is known with certainty or is a best estimate in the light of the information available.

Accounting Concepts GOING CONCERN • The enterprise is normally viewed as a going concern, that is, as continuing in operation for the foreseeable future. • It is assumed that the enterprise has neither the intention nor the necessity of liquidation or of curtailing materially the scale of its operations. SUBSTANCE OVER FORM • Transactions and other events should be accounted for and presented in accordance with their substance and financial reality and not merely with their legal form.

Accounting Concepts BUSINESS ENTITY • Only transactions that affect the firm are recorded in the firm’s books, and do not extend to personal resources of the proprietor. • The only attempt to show the transaction affects the owners of a business, is limited to showing how their capital in the firm is affected. MONEY MEASUREMENT • Accounting is only concern with those facts that can be measure in monetary terms with a fair degree of objectivity.

Accounting Concepts COST • Assets are normally shown at cost price, and this is the basis for assessing the future usage of the assets. REALIZATION • Profits are taken into account when they are earned, that is when the goods or services are passed to the customer and he incurs liability from them.

Accounting Concepts DUAL ASPECT • This states that there are two aspects of accounting, one represented by the assets of the business and the other by the claims against them. • These two aspects are always equal to each other. • Double entry is the name given to the method of recording the transactions so that the dual aspect concept is upheld.

Lecture Notes 1 The Accounting Equation

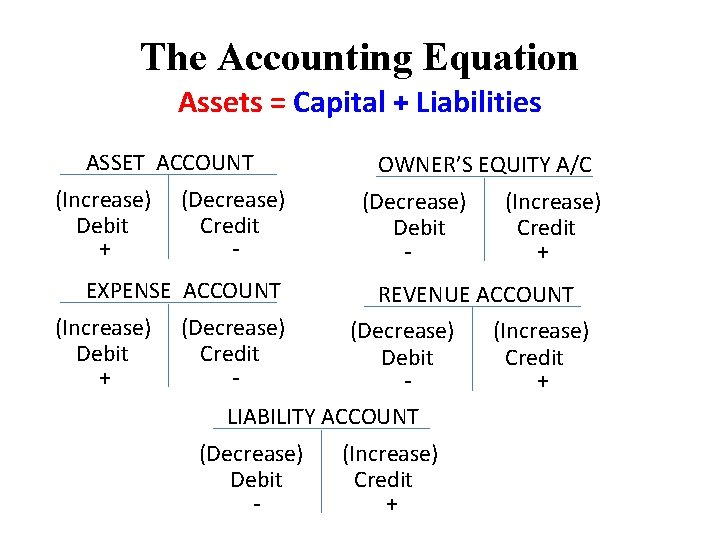

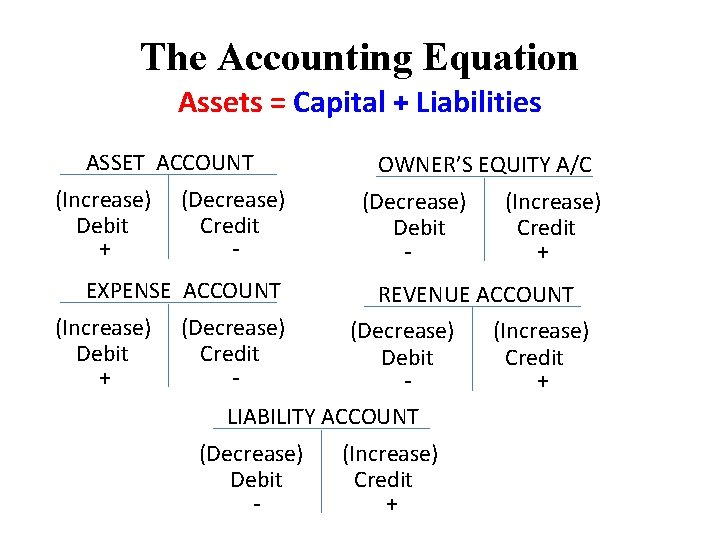

The Accounting Equation Assets = Capital + Liabilities ASSET ACCOUNT (Increase) (Decrease) Debit Credit + EXPENSE ACCOUNT (Increase) (Decrease) Debit Credit + - OWNER’S EQUITY A/C (Decrease) Debit - REVENUE ACCOUNT (Decrease) Debit - LIABILITY ACCOUNT (Decrease) Debit - (Increase) Credit +

Lecture Notes 1 Double Entry Theory

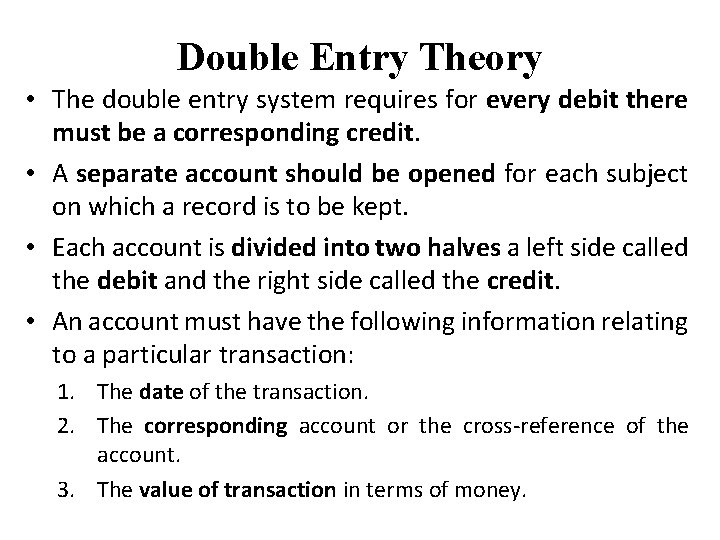

Double Entry Theory • The double entry system requires for every debit there must be a corresponding credit. • A separate account should be opened for each subject on which a record is to be kept. • Each account is divided into two halves a left side called the debit and the right side called the credit. • An account must have the following information relating to a particular transaction: 1. The date of the transaction. 2. The corresponding account or the cross-reference of the account. 3. The value of transaction in terms of money.

Lecture Notes 1 Exercises

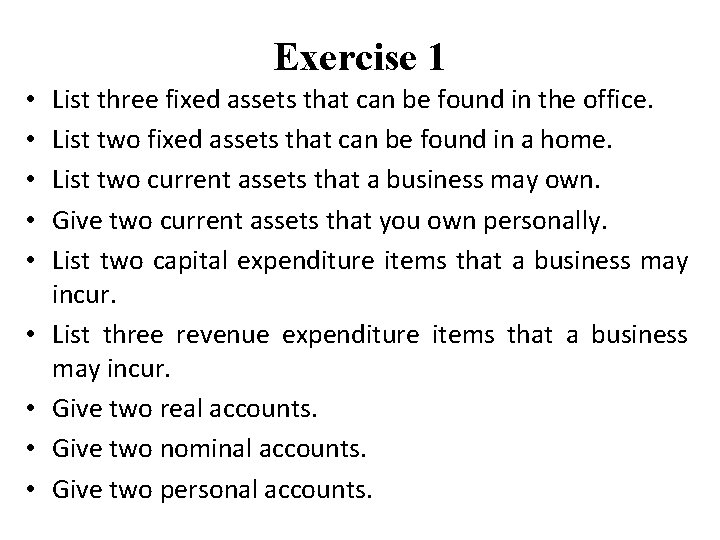

Exercise 1 • • • List three fixed assets that can be found in the office. List two fixed assets that can be found in a home. List two current assets that a business may own. Give two current assets that you own personally. List two capital expenditure items that a business may incur. List three revenue expenditure items that a business may incur. Give two real accounts. Give two nominal accounts. Give two personal accounts.

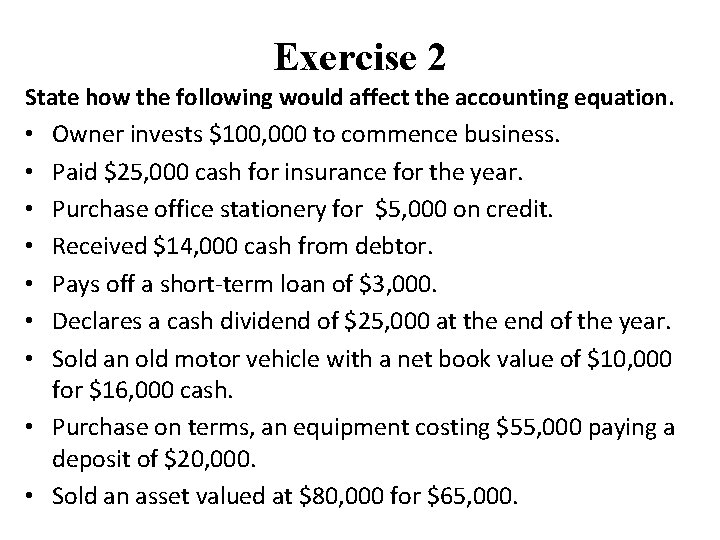

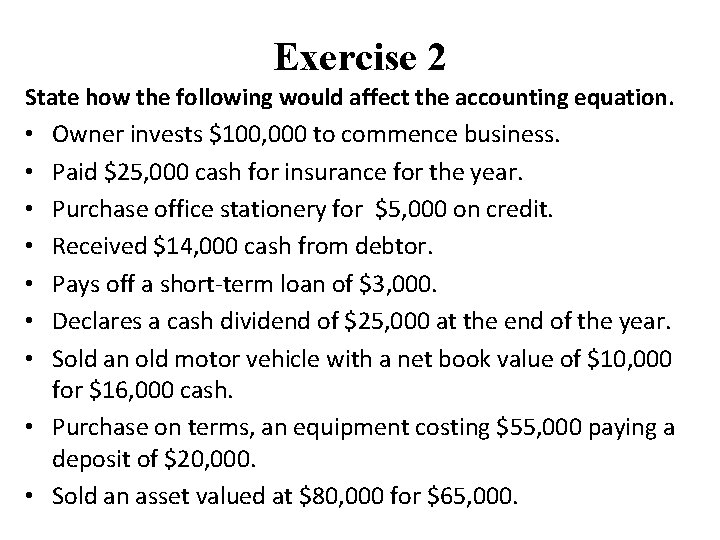

Exercise 2 State how the following would affect the accounting equation. • Owner invests $100, 000 to commence business. • Paid $25, 000 cash for insurance for the year. • Purchase office stationery for $5, 000 on credit. • Received $14, 000 cash from debtor. • Pays off a short-term loan of $3, 000. • Declares a cash dividend of $25, 000 at the end of the year. • Sold an old motor vehicle with a net book value of $10, 000 for $16, 000 cash. • Purchase on terms, an equipment costing $55, 000 paying a deposit of $20, 000. • Sold an asset valued at $80, 000 for $65, 000.

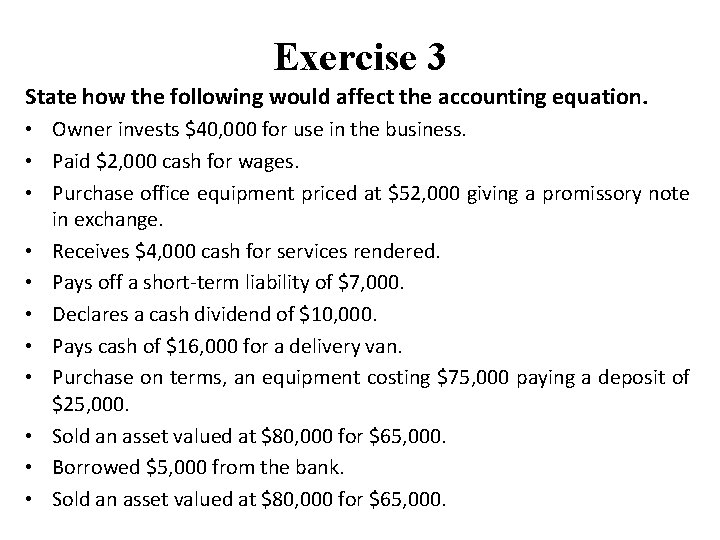

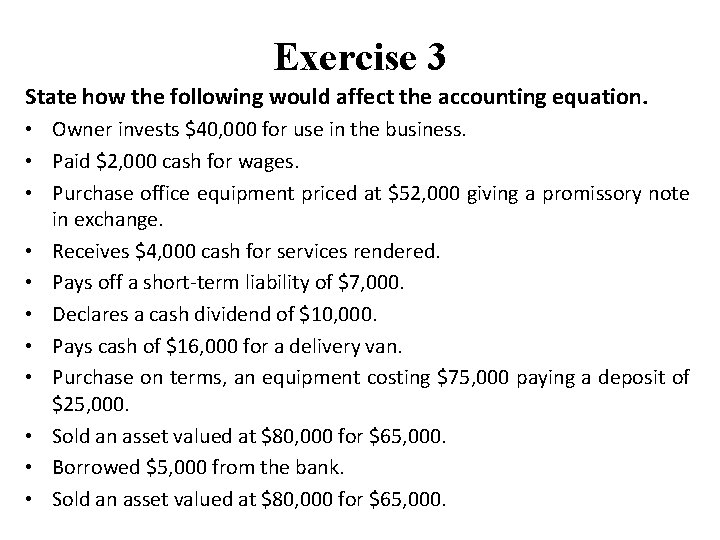

Exercise 3 State how the following would affect the accounting equation. • Owner invests $40, 000 for use in the business. • Paid $2, 000 cash for wages. • Purchase office equipment priced at $52, 000 giving a promissory note in exchange. • Receives $4, 000 cash for services rendered. • Pays off a short-term liability of $7, 000. • Declares a cash dividend of $10, 000. • Pays cash of $16, 000 for a delivery van. • Purchase on terms, an equipment costing $75, 000 paying a deposit of $25, 000. • Sold an asset valued at $80, 000 for $65, 000. • Borrowed $5, 000 from the bank. • Sold an asset valued at $80, 000 for $65, 000.