Options Topic 9 I Options A Definition The

- Slides: 45

Options Topic 9

I. Options A. Definition: The right to buy or sell a specific issue at a specified price (the exercise price) on or before a specified date regardless of what the market price of the security is on the date the option is exercised. n B. Call: The right to buy a security. n C. Put: The right to sell a security. n

I. Options (continued) n D. Option Writer • The person who writes the call or put and receives a premium. n E. Option Buyer • The person who buys the call or put and pays the premium.

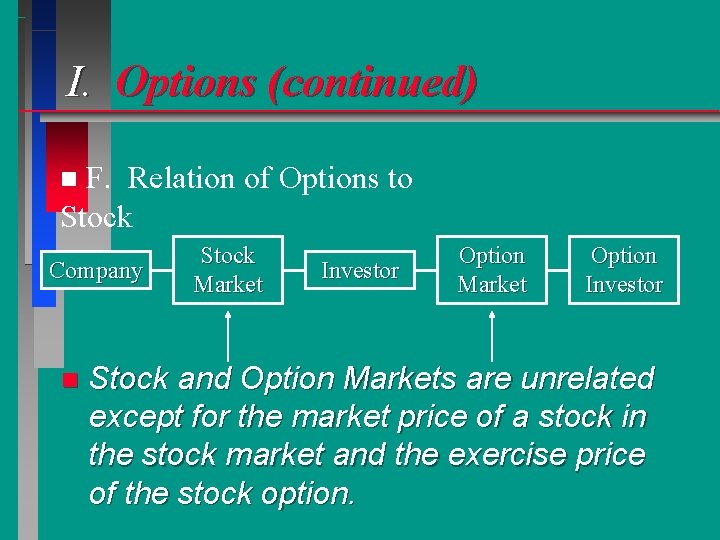

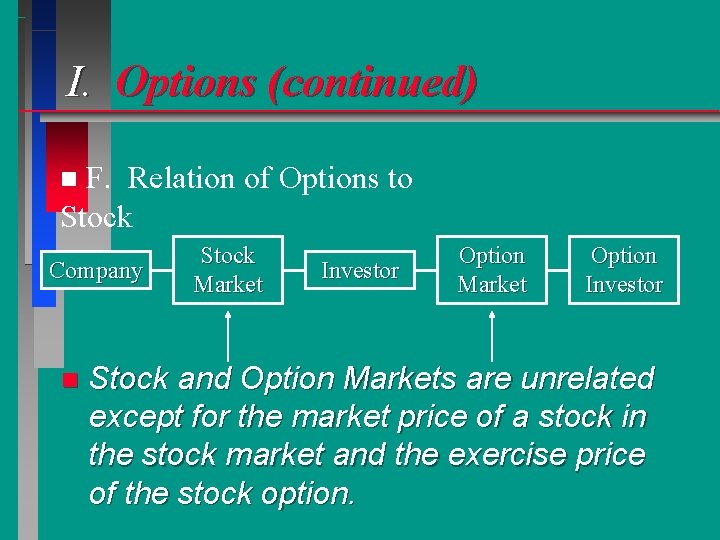

I. Options (continued) F. Relation of Options to Stock n Company n Stock Market Investor Option Market Option Investor Stock and Option Markets are unrelated except for the market price of a stock in the stock market and the exercise price of the stock option.

II. Investor Profit Profiles n Assume you bought 1 share of T. I. at $40. This is your profit profile given various assumptions about T. I. ’s future market price.

II. Investor Profit Profiles n A. Call Option Profit Graph of Buyer and Seller • Situation: Investor thinks a security will increase in price -- can buy security or a call option. If price declines, Investor has a capital loss in long position or loses his option premium when expired.

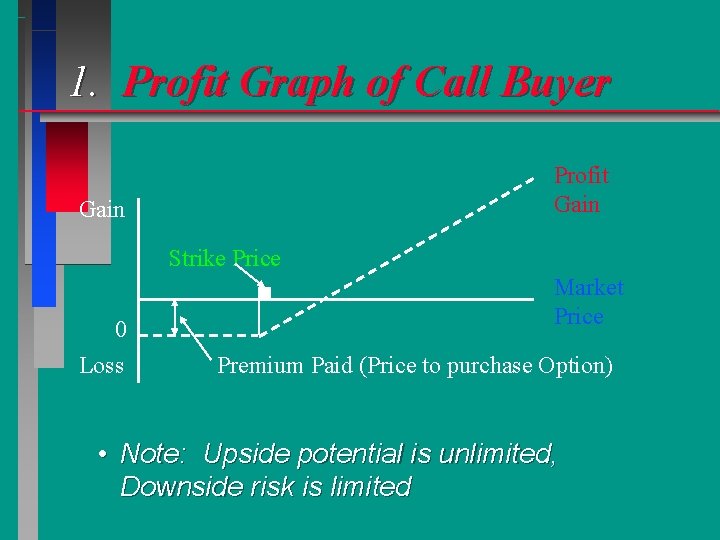

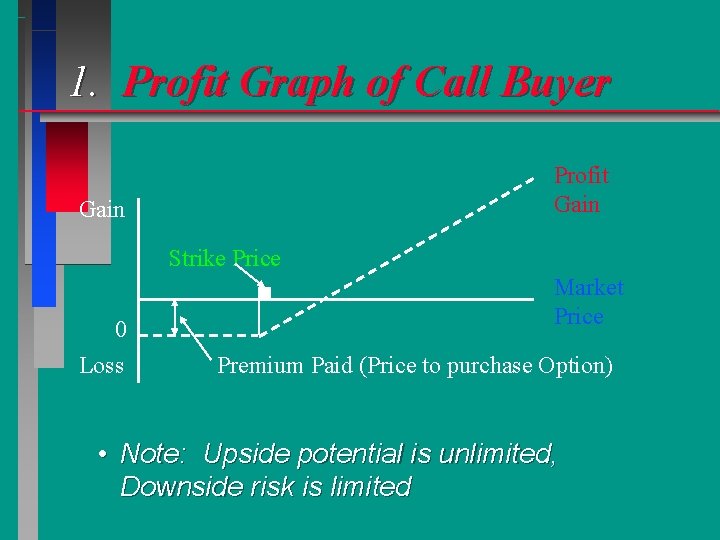

1. Profit Graph of Call Buyer Profit Gain Strike Price 0 Loss Market Price Premium Paid (Price to purchase Option) • Note: Upside potential is unlimited, Downside risk is limited

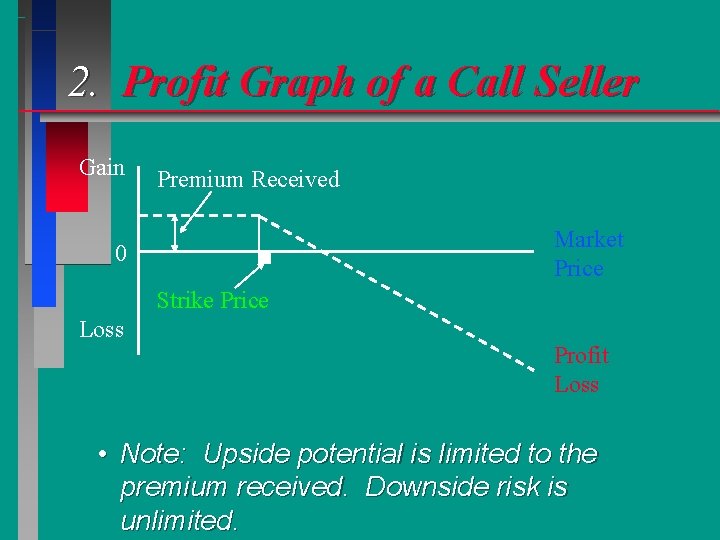

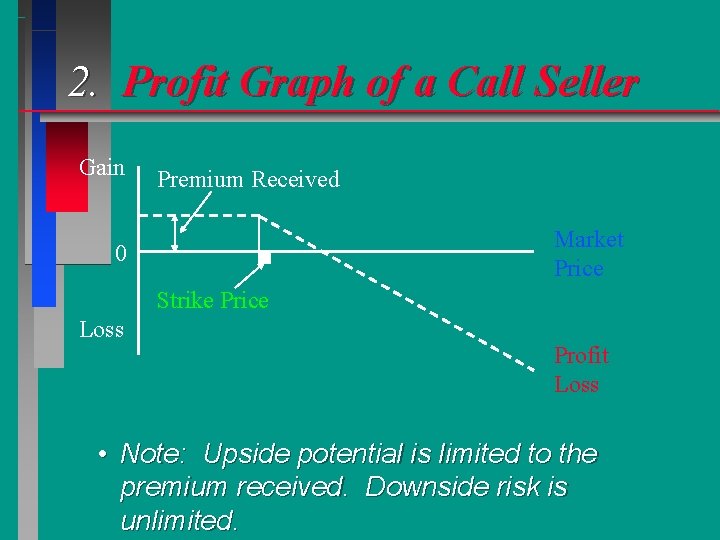

2. Profit Graph of a Call Seller Gain Premium Received Market Price 0 Strike Price Loss Profit Loss • Note: Upside potential is limited to the premium received. Downside risk is unlimited.

B. Put Option Profit Graph of Buyer and Seller n Situation: Investor thinks a security will decrease in price -- can short sell or buy a PUT option. If the security increases in price, the short position produces a capital loss and the option position produces a premium loss.

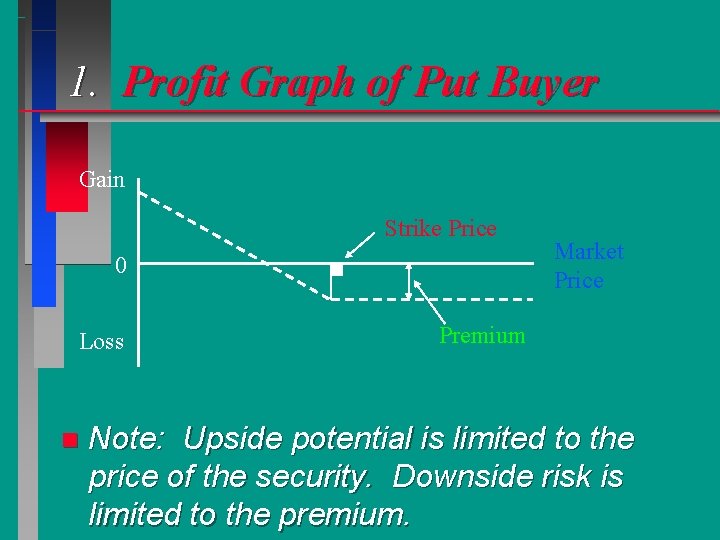

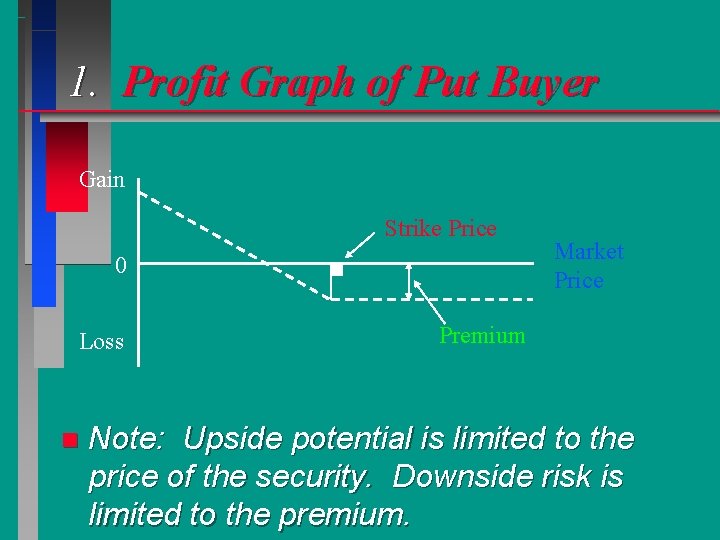

1. Profit Graph of Put Buyer Gain Strike Price 0 Loss n Market Price Premium Note: Upside potential is limited to the price of the security. Downside risk is limited to the premium.

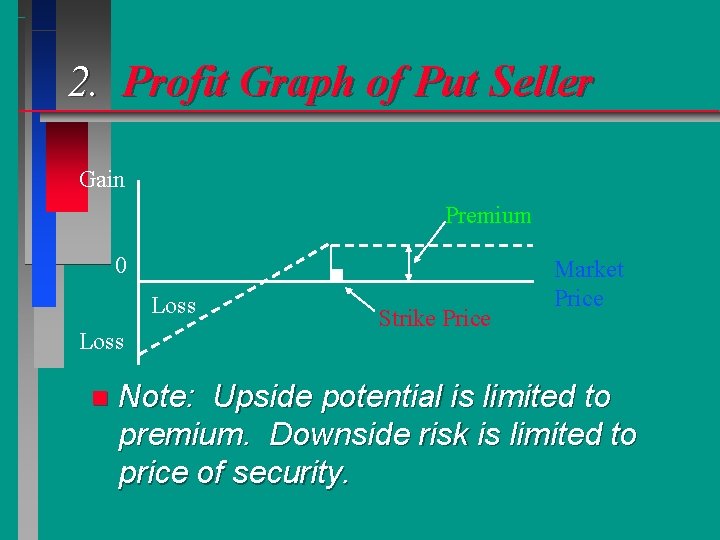

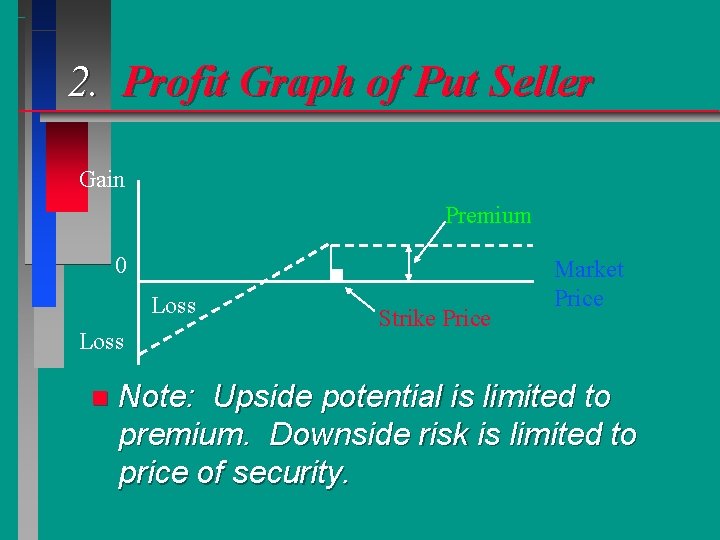

2. Profit Graph of Put Seller Gain Premium 0 Loss n Strike Price Market Price Note: Upside potential is limited to premium. Downside risk is limited to price of security.

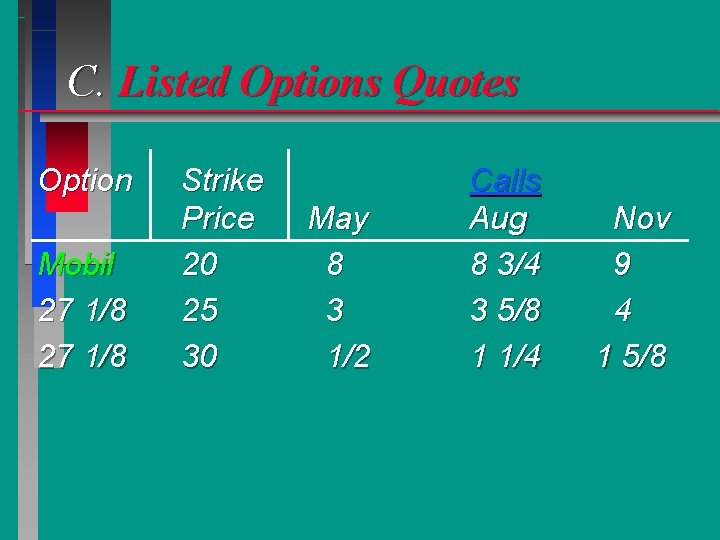

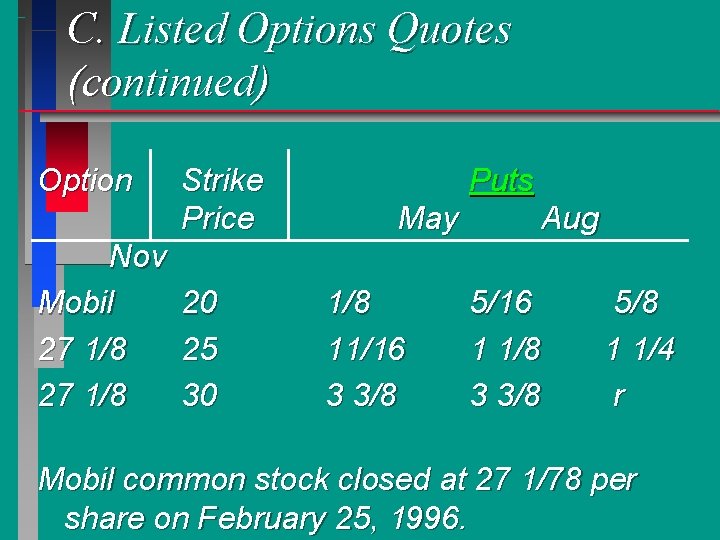

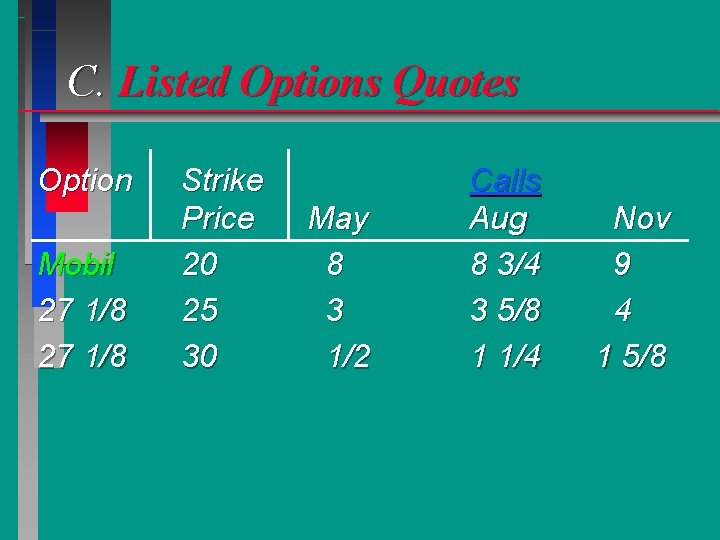

C. Listed Options Quotes Option Mobil 27 1/8 Strike Price 20 25 30 May 8 3 1/2 Calls Aug 8 3/4 3 5/8 1 1/4 Nov 9 4 1 5/8

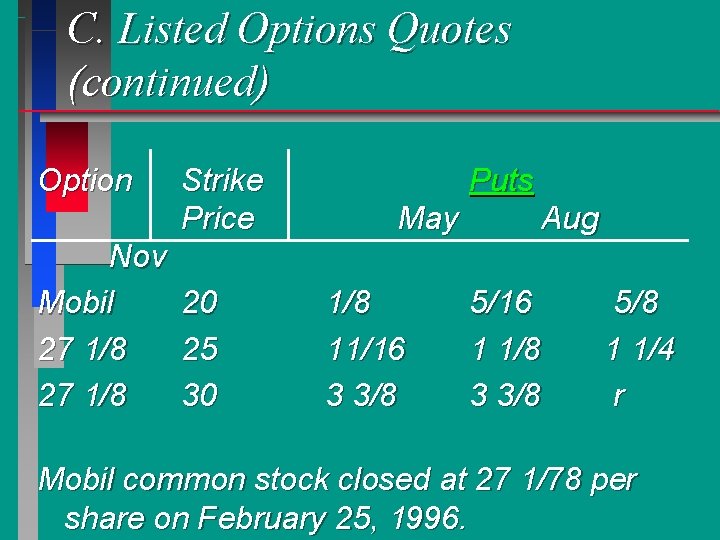

C. Listed Options Quotes (continued) Option Nov Mobil 27 1/8 Strike Price 20 25 30 Puts May 1/8 11/16 3 3/8 Aug 5/16 1 1/8 3 3/8 5/8 1 1/4 r Mobil common stock closed at 27 1/78 per share on February 25, 1996.

D. Option Premiums n 1. Option premium is the price an option buyer must pay for the right and the price an option writer receives for selling the right.

D. Option Premiums (continued) n 2. Affected by • a. The Security Price – Premiums are directly related to the relative magnitude of the security price since the risk of price change is a function of the price. – Example: Stock A: P = $100 Stock B: P = $10 – Loss potential as a result of changes in security price is greater for Stock A and hence, the option writer will require a greater premium.

D. Option Premiums (continued) • b. Length of Option Life: • 3, 6, 9 months • Longer term options on the same security are riskier since the probability of adverse price changes increases with time. Higher premiums compensate the seller for this greater risk.

D. Option Premiums (continued) • c. Variability of Returns – The greater the past variability of return on the security, the more likely that the option will be exercised. Greater return variability translates into greater option risk, for which, the writer wants to be compensated for.

D. Option Premiums (continued) • d. Exercise Price – 1. In-the-Money: Call exercise price is below the current market price. – 2. At-the-Money: Call exercise price is equal to the current market price. – 3. Out-the-Money: Call exercise price is above the current market price. – Relation between Call Premium and Exercise Price:

E. Option Trading Strategies n 1. Buying Call Options • a. Buying to achieve leverage – The price of a call of 100 shares is significantly lower than buying the shares outright. – Example: IBM sells at $50/share and a $50 call costs $5/share. The Investor can buy the call for $500 instead of the shares for $5, 000. If IBM goes to $60, the value of the option is $1000. – Return on option: $1000/$500 = 200% – Return on stock purchase: $1000/$5000 = 20%

E. Option Trading Strategies (continued) • b. Buying call options to limit risk – Investor dislikes the risk of buying IBM and watching it go down in value. Therefore, Investor purchases IBM 50 call at $5 and puts remaining $ in risk-free securities. Hence, given the same $5, 000, the Investor buys call and puts $4, 500 into R securities. – Example: If IBM goes to $60, the Investor can buy or exercise the option to net $1, 000 plus interest from R investment. If IBM stays at $50 or falls below, the investor has lost his option premium which is partly offset by interest income.

E. Option Trading Strategies (continued) • c. Buying call option to hedge short stock position – Investor believes IBM will decline. Investor sells IBM short to obtain total profit potential but he is exposed to unlimited loss from stock price increase. The Investor buys a call to eliminate loss.

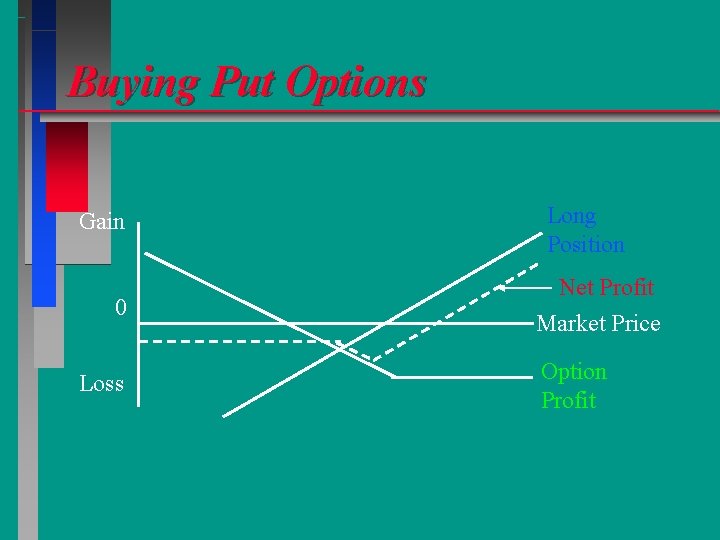

E. Option Trading Strategies (continued) n 2. Put Option Strategies • a. Buying Put options for leverage and limited risk – Investor anticipates significant decrease in the stock price but does not have the margin money for a short sale, and does not want to be exposed to unlimited risk of stock price increases. Investor buys a put. – NOTE: Stock price must decline enough to break even.

E. Option Trading Strategies (continued) • b. Buying Put options to hedge against a stock price decline – Investor holds IBM and has already taken a paper profit. Investor believes IBM will go higher and would like to participate in upside without risking a loss on paper profit. Buys a put. If price goes up, the potential is only diminished by the cost of the put, whereas the paper profits are protected by the put and decreased only by the put price.

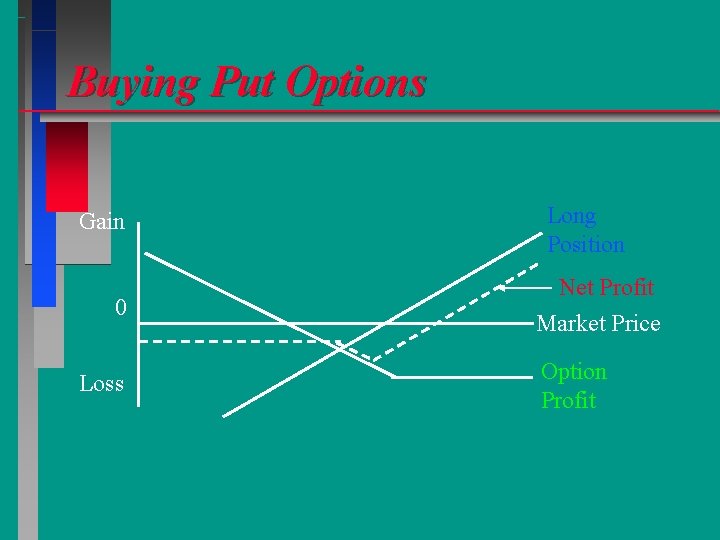

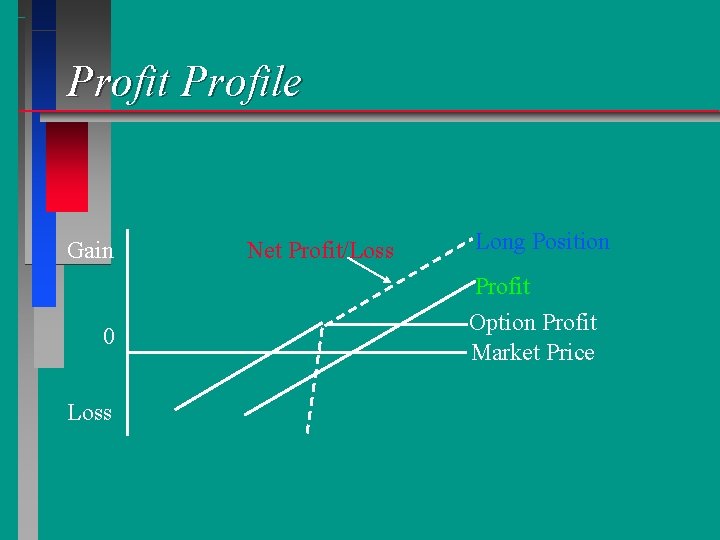

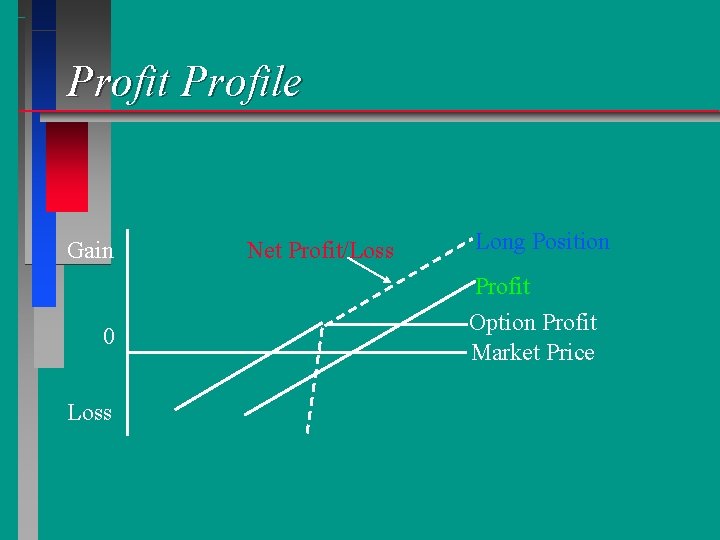

Buying Put Options Gain 0 Loss Long Position Net Profit Market Price Option Profit

E. Option Trading Strategies (continued) n 3. Option Writing Strategies • Definition: An investor holds 100 shares of IBM. Writes 2 calls and receives the option call premiums. One option is covered and the other is naked.

E. Option Trading Strategies n 4. Writing Call Options Strategies • a. Writing covered calls – Investor owns 100 shares of IBM ($50) and writes a call at $55 to earn a greater return than the stock alone. Investor earns D = $1. 00 plus $5. 00 on the call. Return is $6. 00 plus any capital gains. – Disadvantage: if price goes above $55, the upside is limited to $6. 00. – Note: Covered call also provides limited protection to writer against price decline. Price can decline to $45 ($50 -Premium) before writer experiences paper loss.

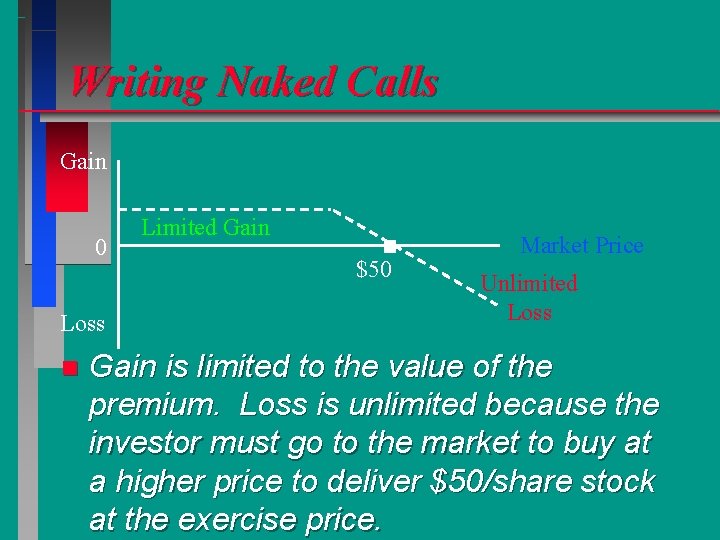

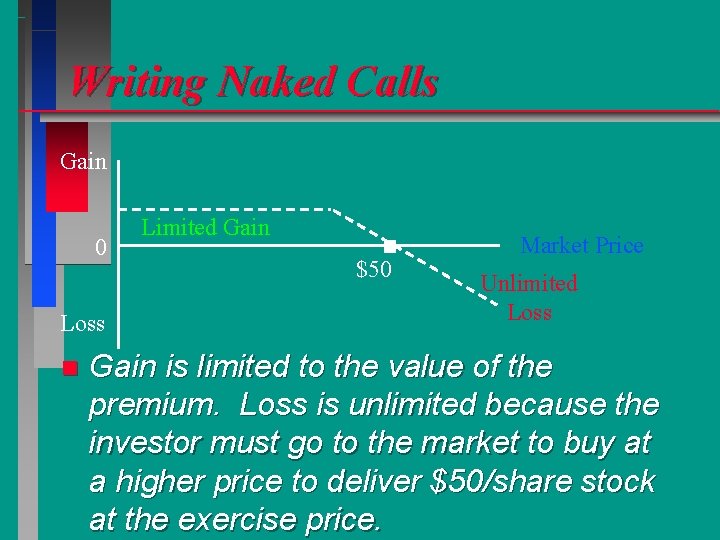

E. Option Trading Strategies • b. Writing naked calls • Investor writes a call on IBM and receives a premium income without owning the security.

Writing Naked Calls Gain 0 Loss n Limited Gain $50 Market Price Unlimited Loss Gain is limited to the value of the premium. Loss is unlimited because the investor must go to the market to buy at a higher price to deliver $50/share stock at the exercise price.

E. Option Trading Strategies (continued) n 5. Writing Put Option Strategies • a. Writing Puts for Premium Income – Investor expects the price of the stock he holds to increase. Therefore, he can write a covered put to increase income. The only risk is that the stock falls below current market price.

Profit Profile Gain 0 Loss Net Profit/Loss Long Position Profit Option Profit Market Price

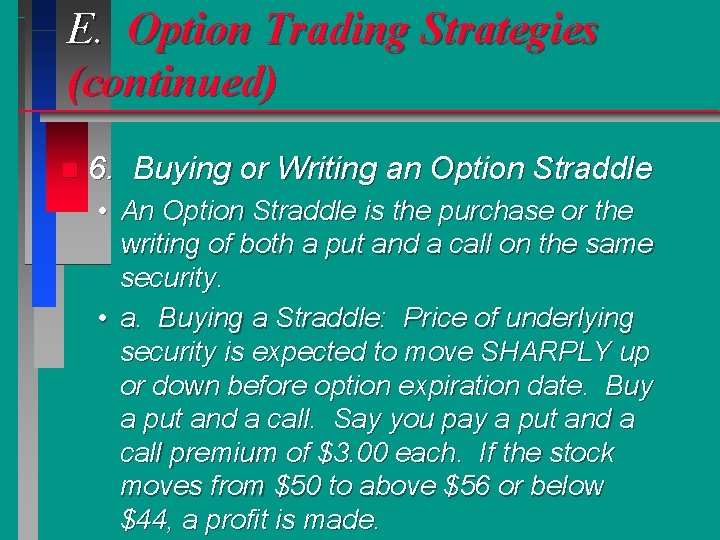

E. Option Trading Strategies (continued) n 6. Buying or Writing an Option Straddle • An Option Straddle is the purchase or the writing of both a put and a call on the same security. • a. Buying a Straddle: Price of underlying security is expected to move SHARPLY up or down before option expiration date. Buy a put and a call. Say you pay a put and a call premium of $3. 00 each. If the stock moves from $50 to above $56 or below $44, a profit is made.

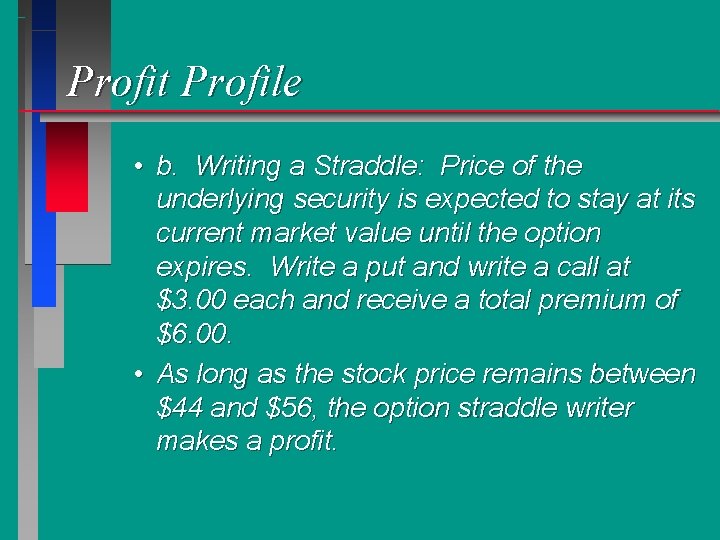

Profit Profile • b. Writing a Straddle: Price of the underlying security is expected to stay at its current market value until the option expires. Write a put and write a call at $3. 00 each and receive a total premium of $6. 00. • As long as the stock price remains between $44 and $56, the option straddle writer makes a profit.

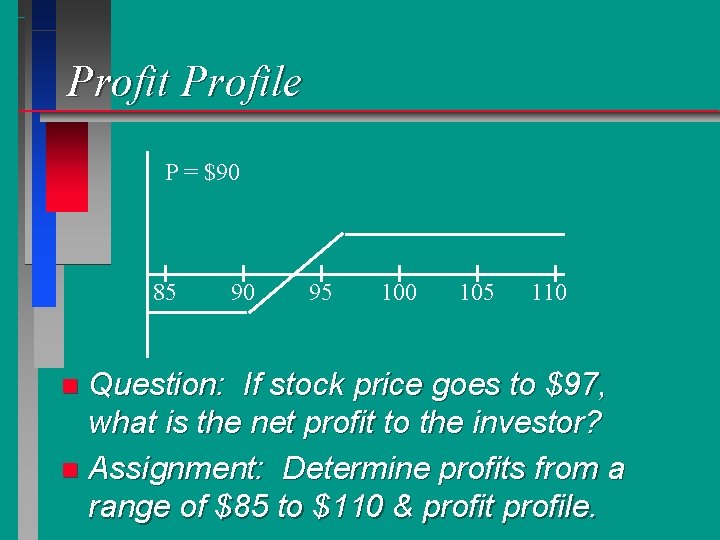

F. Other Option Strategies n 1. Bull Spread • Buying a call and selling a call with a higher strike price • Examples: – 1. Buy call with $90 SP • Premium = $5 – 2. Sell a call with $95 SP • Premium = $2

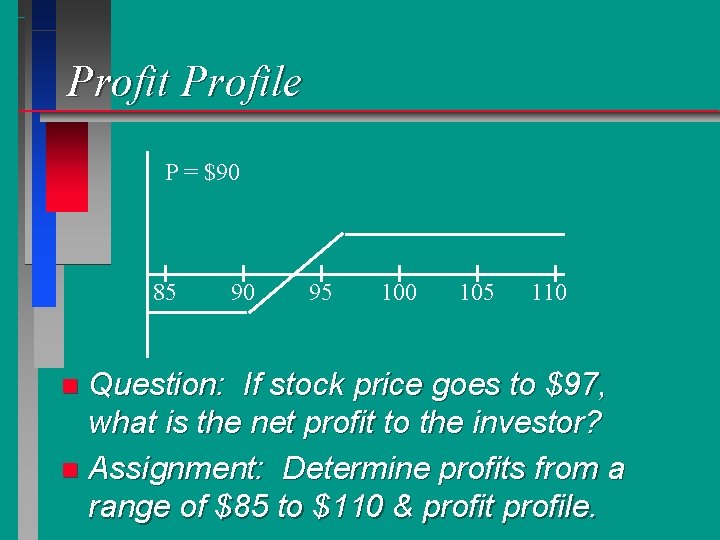

Profit Profile P = $90 85 90 95 100 105 110 Question: If stock price goes to $97, what is the net profit to the investor? n Assignment: Determine profits from a range of $85 to $110 & profit profile. n

F. Other Option Strategies (continued) n 2. Bear Spread • Buy a put option and sell a put with a lower strike price • Examples: – 1. Buy a put with $110 SP • Premium = $5 – 2. Sell put with $105 SP • Premium = $2

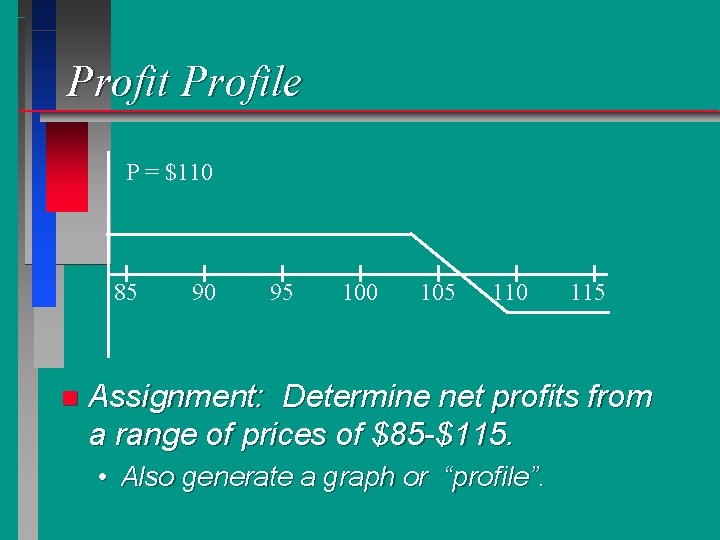

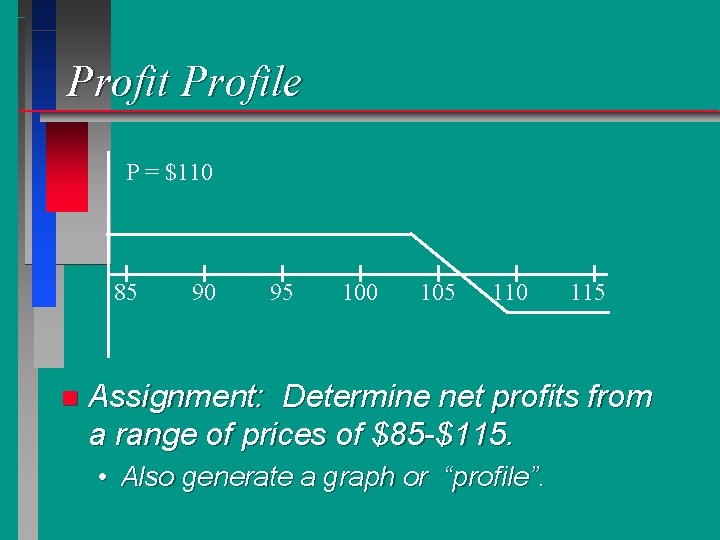

Profit Profile P = $110 85 n 90 95 100 105 110 115 Assignment: Determine net profits from a range of prices of $85 -$115. • Also generate a graph or “profile”.

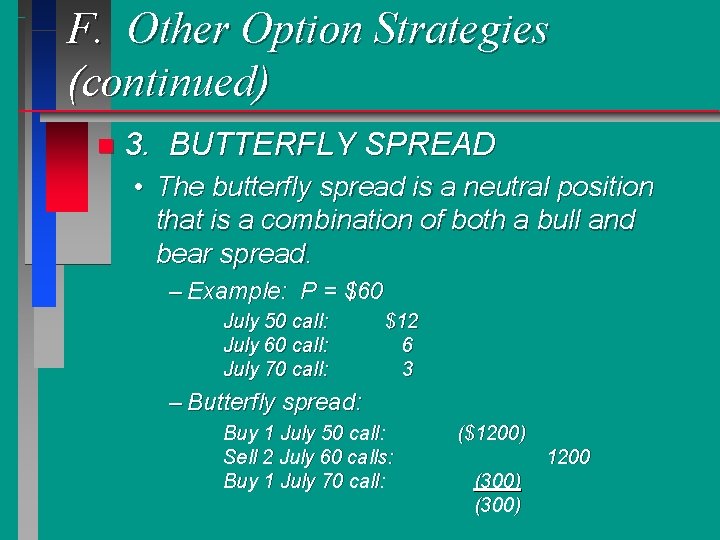

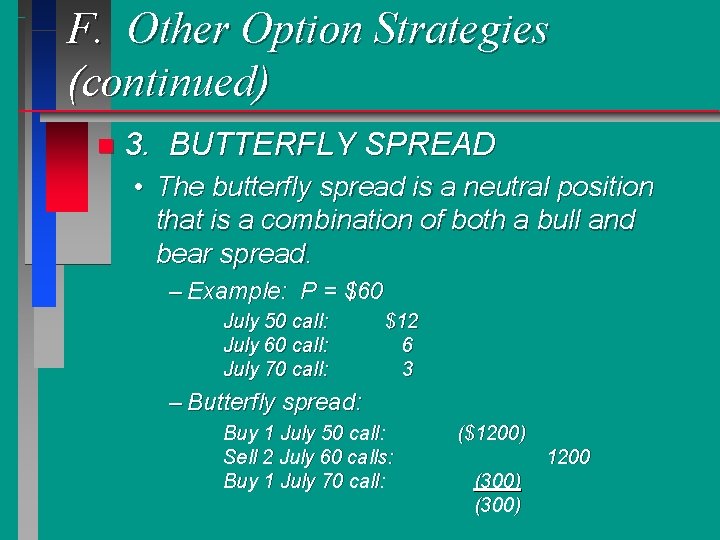

F. Other Option Strategies (continued) n 3. BUTTERFLY SPREAD • The butterfly spread is a neutral position that is a combination of both a bull and bear spread. – Example: P = $60 July 50 call: July 60 call: July 70 call: $12 6 3 – Butterfly spread: Buy 1 July 50 call: Sell 2 July 60 calls: Buy 1 July 70 call: ($1200) 1200 (300)

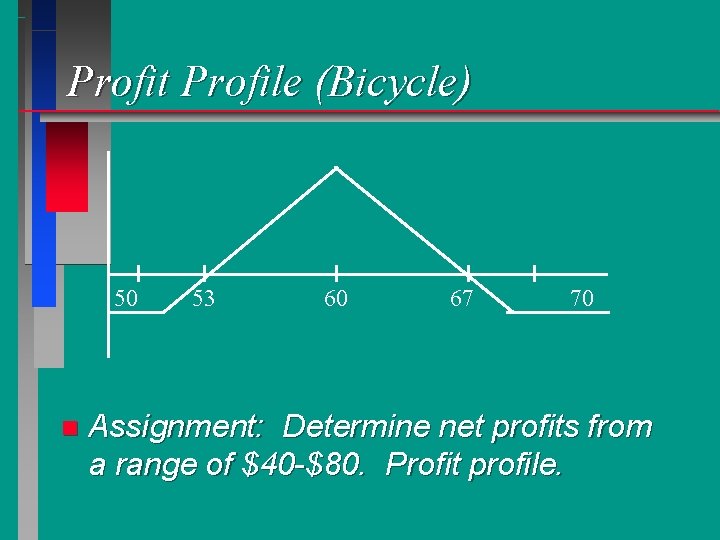

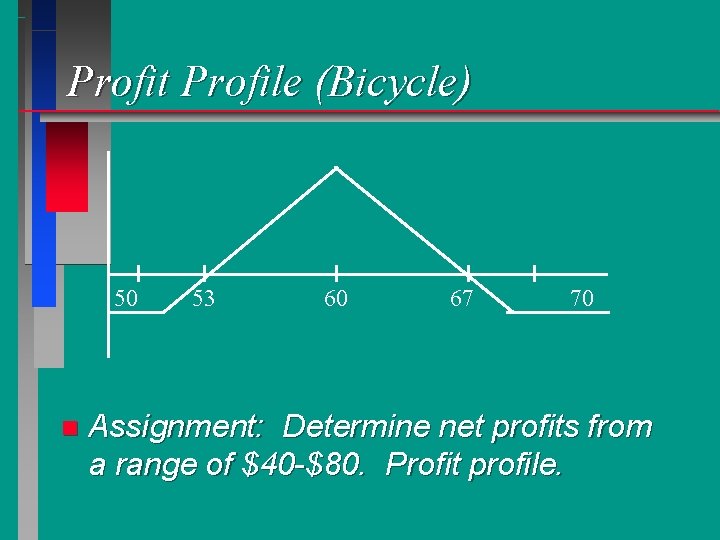

Profit Profile (Bicycle) 50 n 53 60 67 70 Assignment: Determine net profits from a range of $40 -$80. Profit profile.

F. Other Option Strategies (continued) n 4. Calendar or Time Spread • Involves the sale of one option and the simultaneous purchase of a more distant option, both with the same strike price.

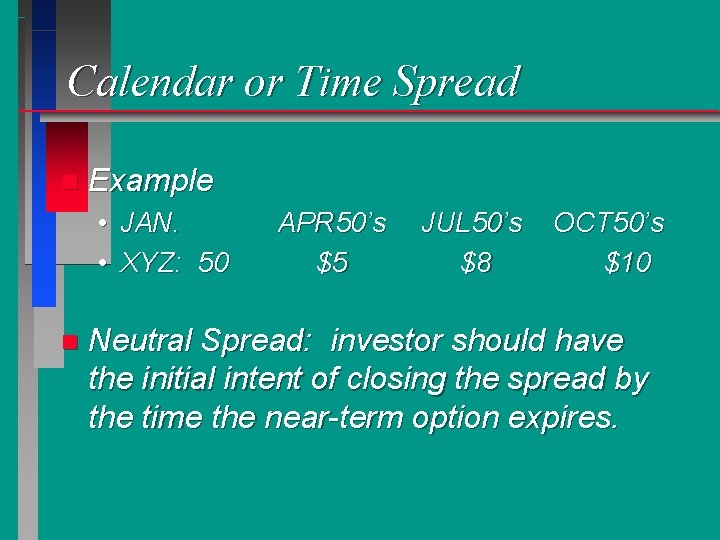

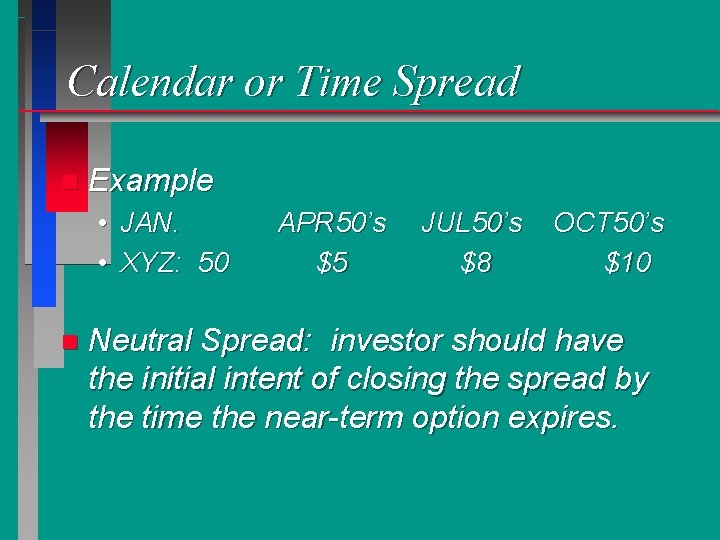

Calendar or Time Spread n Example • JAN. • XYZ: 50 n APR 50’s $5 JUL 50’s $8 OCT 50’s $10 Neutral Spread: investor should have the initial intent of closing the spread by the time the near-term option expires.

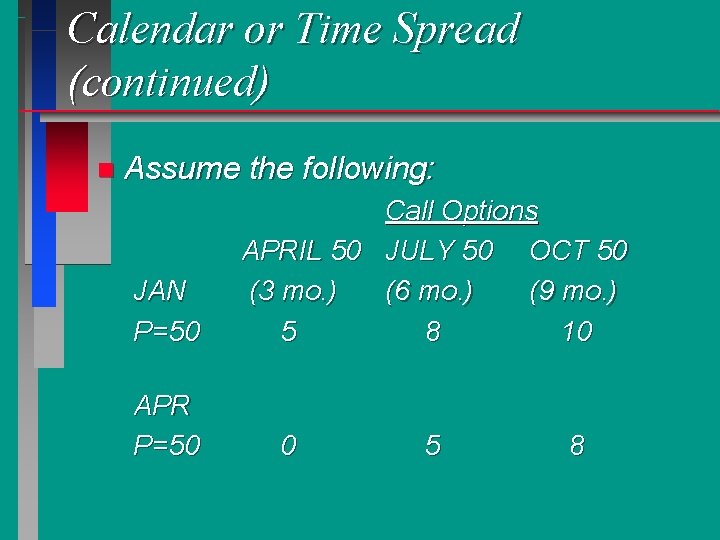

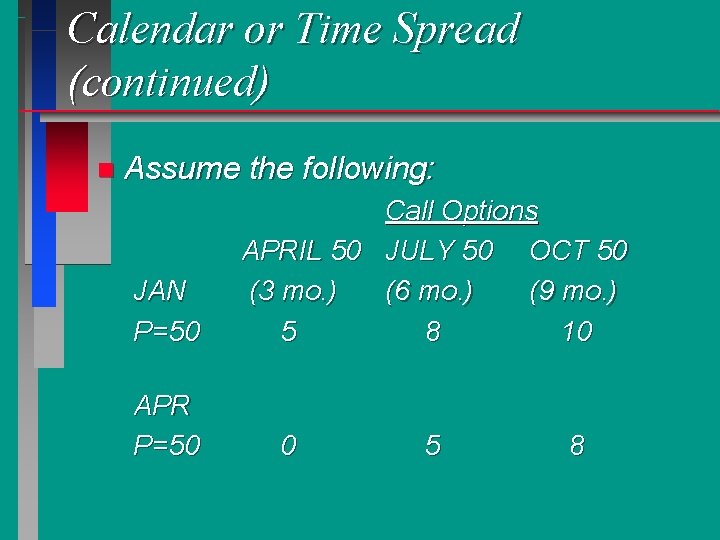

Calendar or Time Spread (continued) n Assume the following: JAN P=50 APR P=50 Call Options APRIL 50 JULY 50 OCT 50 (3 mo. ) (6 mo. ) (9 mo. ) 5 8 10 0 5 8

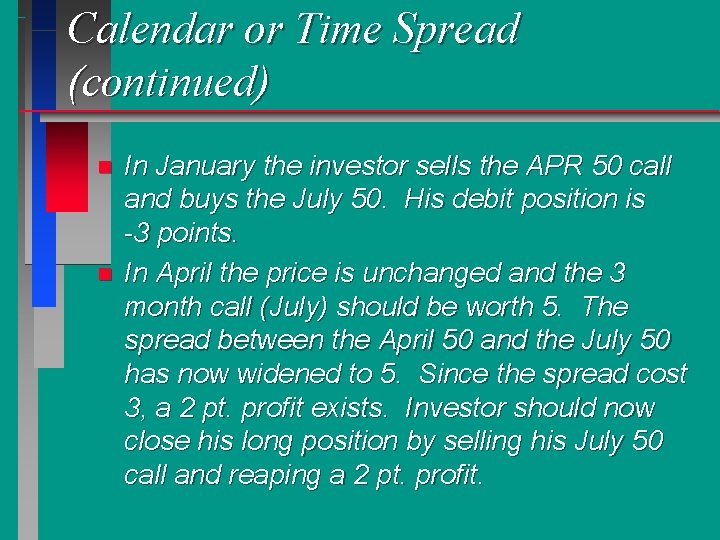

Calendar or Time Spread (continued) n n In January the investor sells the APR 50 call and buys the July 50. His debit position is -3 points. In April the price is unchanged and the 3 month call (July) should be worth 5. The spread between the April 50 and the July 50 has now widened to 5. Since the spread cost 3, a 2 pt. profit exists. Investor should now close his long position by selling his July 50 call and reaping a 2 pt. profit.

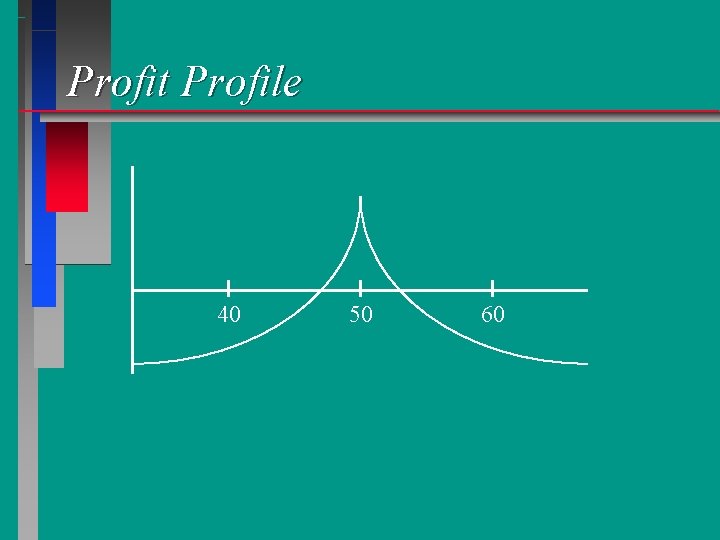

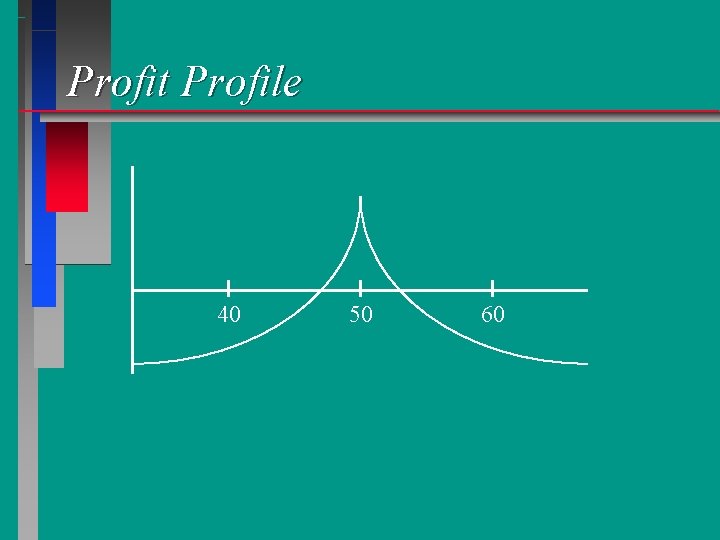

Profit Profile 40 50 60

Bullish Calendar Spread Investor sells the near-term call and buys a longer-term call when the underlying stock is some distance below the SP of the calls. n Feature of low dollar investment and large potential profit. Example: XYZ: $45 in Jan. n Sell April 50 for $1 Buy July 50 for $1 1/2

Bullish Calendar Spread (continued) n Investor wants 2 things to happen: • 1. Near-term call expires worthless • 2. Stock price must rise by the time July call expires n Assume price goes to 52 b/w April & July. Investor nets 1 1/2 pts. How?