OPTIONS MEISTER Module 4 Determining Trade Parameters Trade

- Slides: 15

OPTIONS MEISTER Module 4 – Determining Trade Parameters

Trade Parameters • The previous modules have introduced the basics of options, basic concepts of probabilities and how they are derived from the use of standard deviation. • Future modules will introduce and go into detail on market conditions, parameters and execution of many different trading strategies. This module will focus on the basic building blocks of Probability Based Trading (PBT). • Those basic trading strategies are vertical credit spreads, both call side and put side. You will soon discover that variations of these basic setups are found in most of the trade strategies we use. • Let’s get started

Trade Parameters • Most trades are executed with 20 to 45 DTE. • We try to get trades on with 45 DTE because that has found to be the “sweet spot” for our strategies. Because we are managing winners by exiting at 25%, 50% or 75% of maximum profit we constantly need to replace those winners with new trades. For that reason we will continue to put trades on up until 20 DTE. But as we get close to 20 DTE it becomes increasingly challenging to find trades that qualify for us. • The IV Percentile or IV Rank (IVR) is > 50% • On basic vertical spreads we try to collect premium that is 1/3 of the width of the strikes: • $1. 00 width of strikes – collect. 33 • $2. 50 width of strikes – collect. 83 • $5. 00 width of strikes – collect 1. 67

Trade Selection Steps • Sort our watch list by IV Percentile • Look for candidates with IVP > 50% • Using TOS you can easily link the watch list to the chart • Quickly scroll through the list to look for stocks and ETF’s that in your opinion is they are extended either to the upside or to the downside • Identify potential trade candidates • Find potential trades that meet the short premium benchmark • Execute the trade

Sort Watch list by IVP • Watch list example:

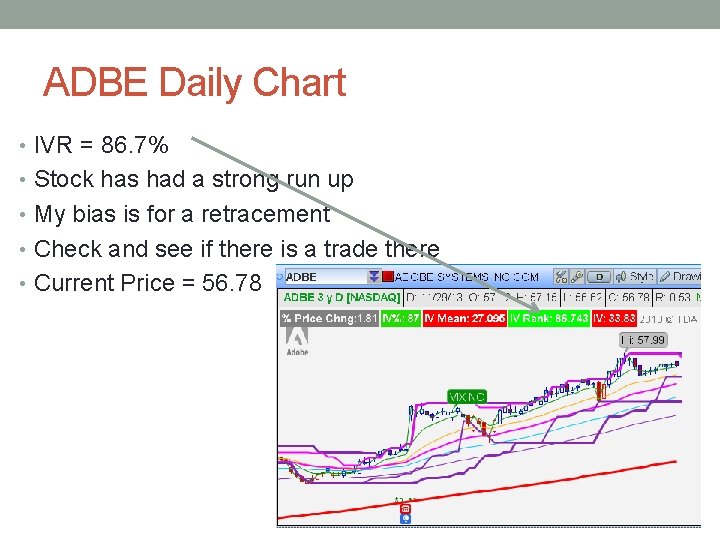

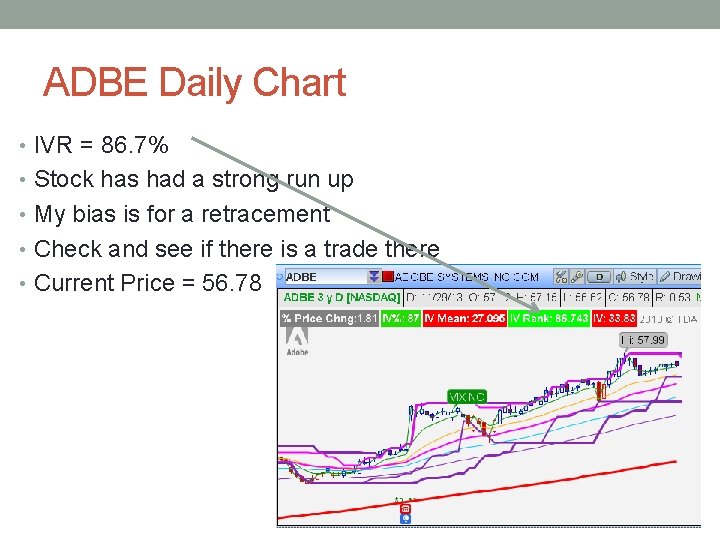

ADBE Daily Chart • IVR = 86. 7% • Stock has had a strong run up • My bias is for a retracement • Check and see if there is a trade there • Current Price = 56. 78

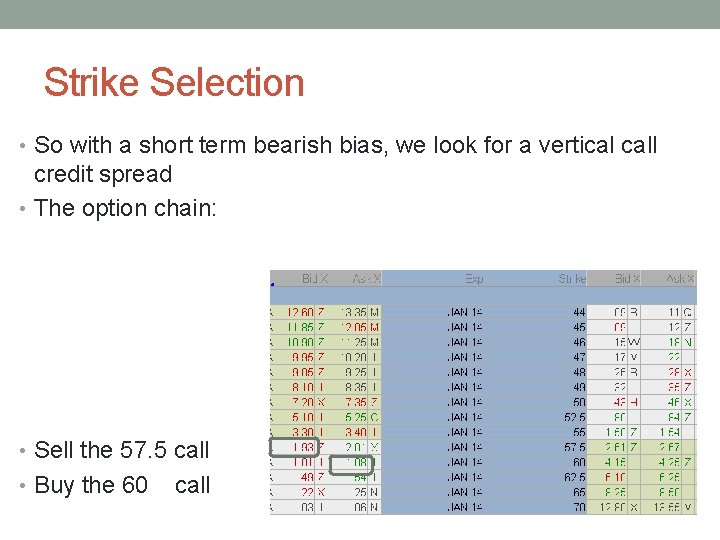

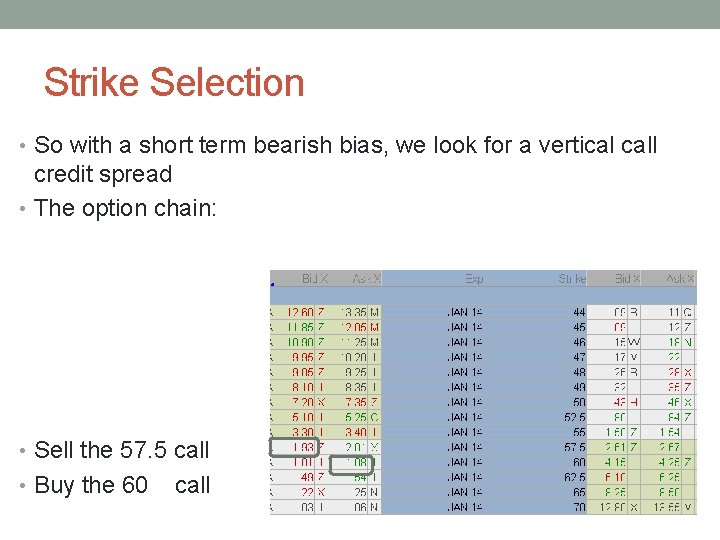

Strike Selection • So with a short term bearish bias, we look for a vertical call credit spread • The option chain: • Sell the 57. 5 call • Buy the 60 call

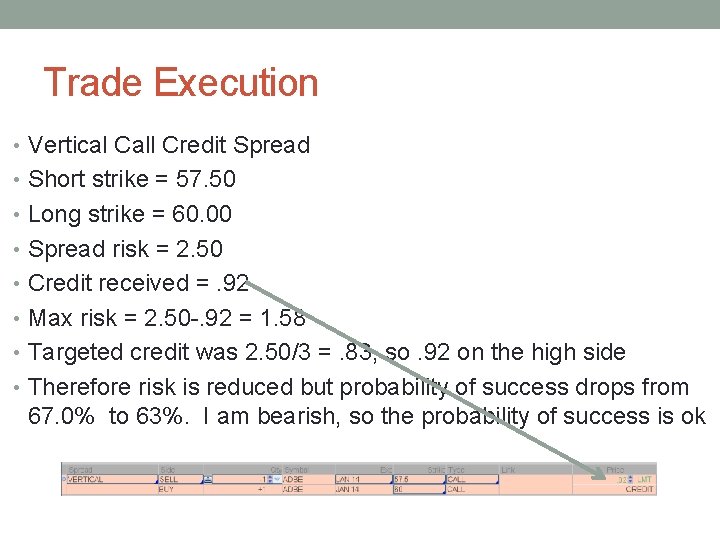

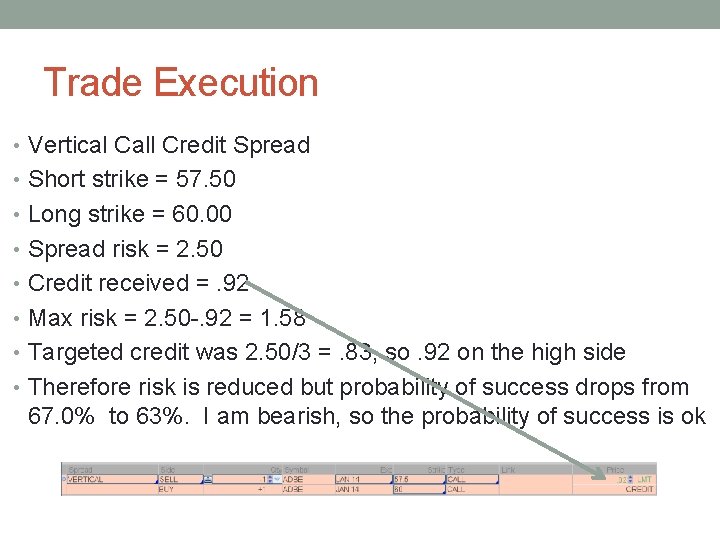

Trade Execution • Vertical Call Credit Spread • Short strike = 57. 50 • Long strike = 60. 00 • Spread risk = 2. 50 • Credit received =. 92 • Max risk = 2. 50 -. 92 = 1. 58 • Targeted credit was 2. 50/3 =. 83, so. 92 on the high side • Therefore risk is reduced but probability of success drops from 67. 0% to 63%. I am bearish, so the probability of success is ok

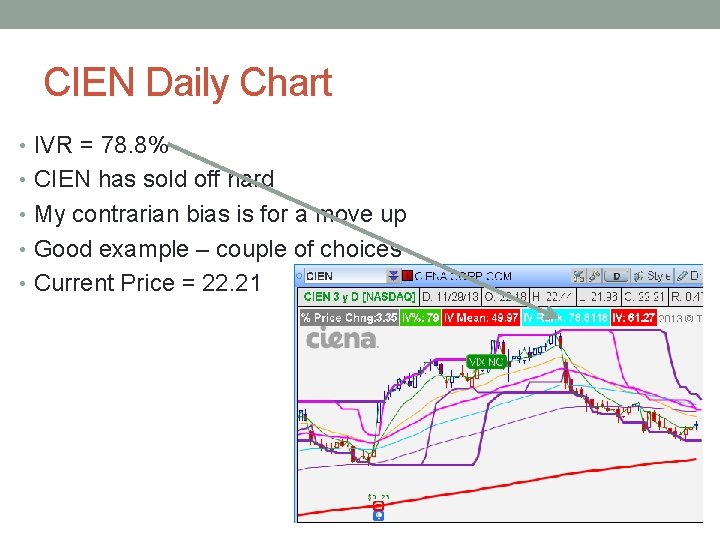

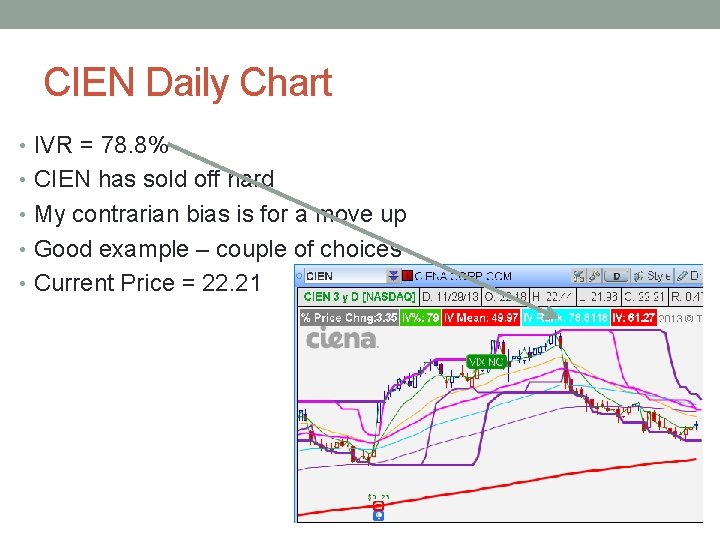

CIEN Daily Chart • IVR = 78. 8% • CIEN has sold off hard • My contrarian bias is for a move up • Good example – couple of choices • Current Price = 22. 21

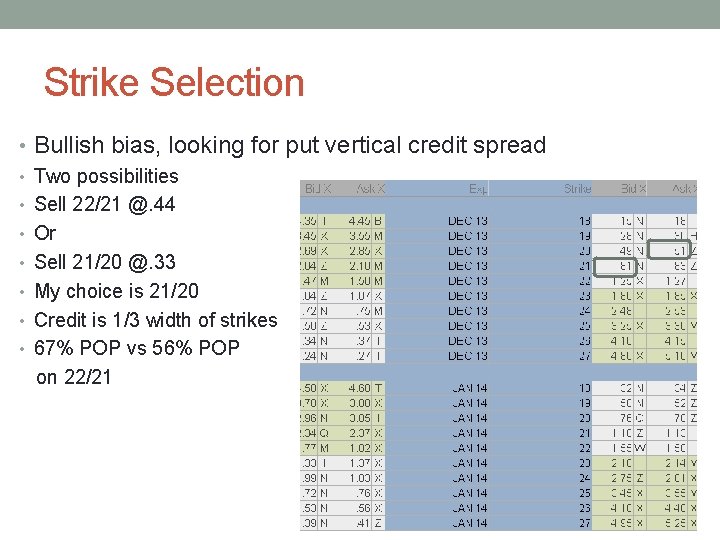

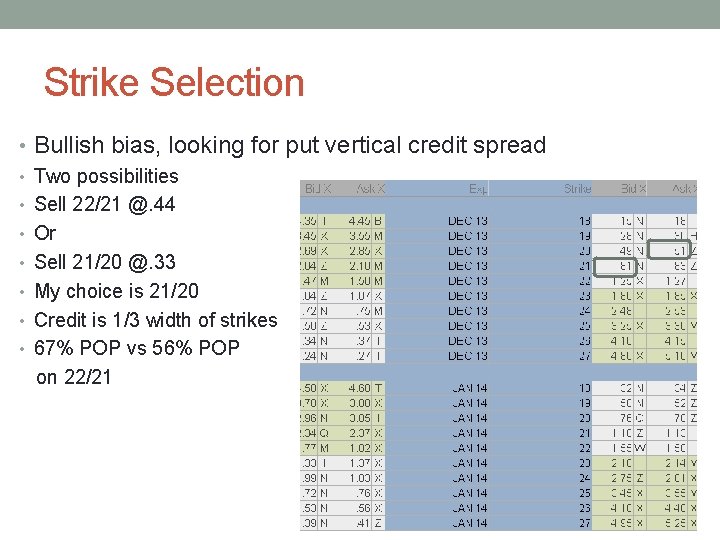

Strike Selection • Bullish bias, looking for put vertical credit spread • Two possibilities • Sell 22/21 @. 44 • Or • Sell 21/20 @. 33 • My choice is 21/20 • Credit is 1/3 width of strikes • 67% POP vs 56% POP on 22/21

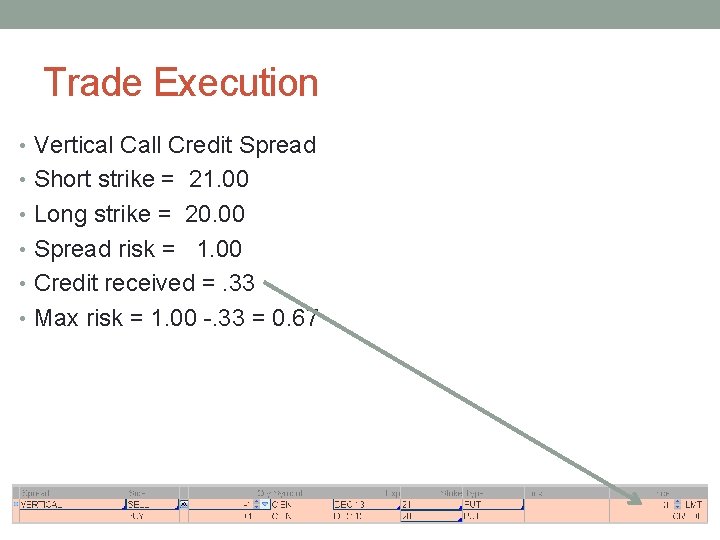

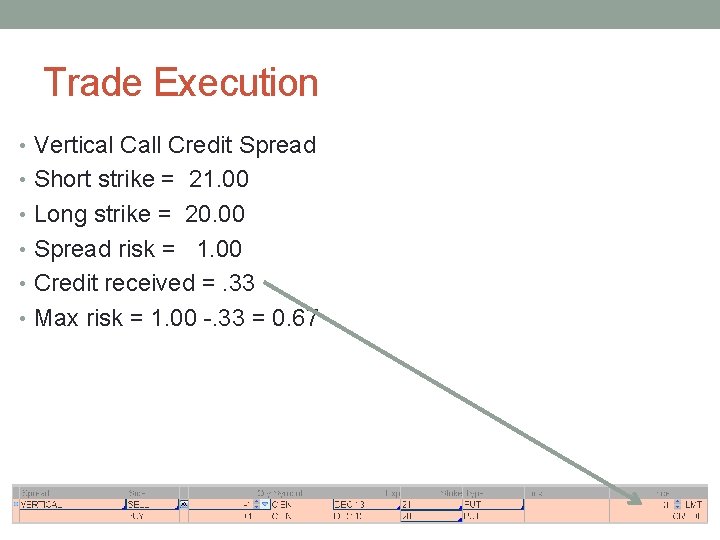

Trade Execution • Vertical Call Credit Spread • Short strike = 21. 00 • Long strike = 20. 00 • Spread risk = 1. 00 • Credit received =. 33 • Max risk = 1. 00 -. 33 = 0. 67

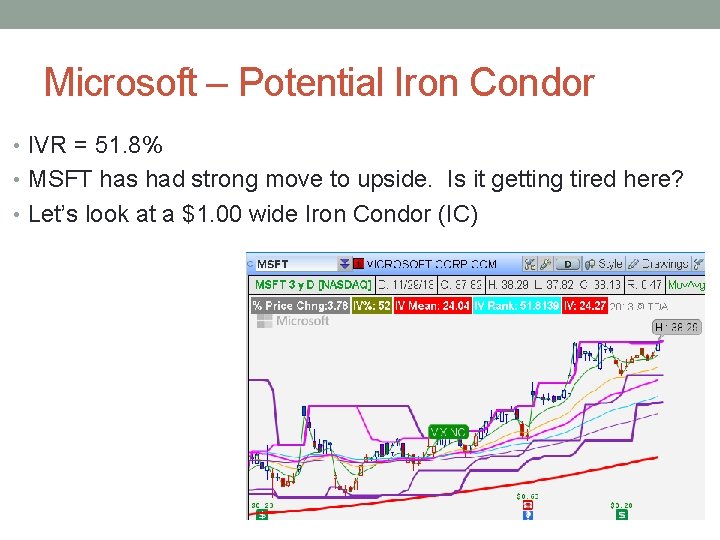

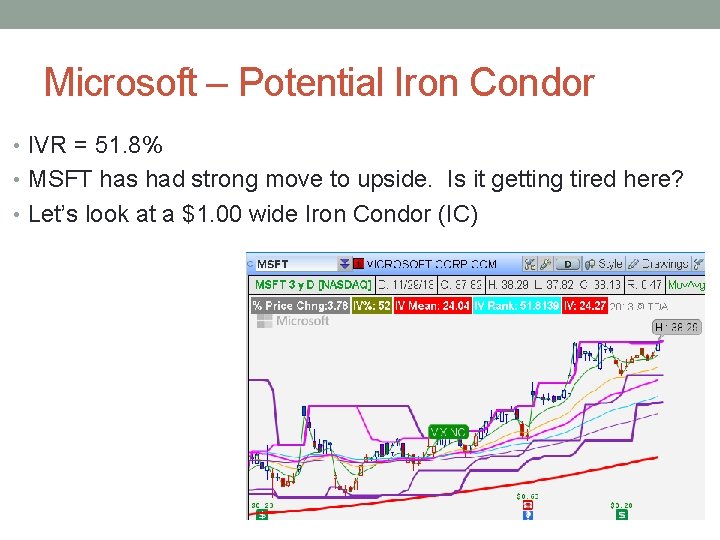

Microsoft – Potential Iron Condor • IVR = 51. 8% • MSFT has had strong move to upside. Is it getting tired here? • Let’s look at a $1. 00 wide Iron Condor (IC)

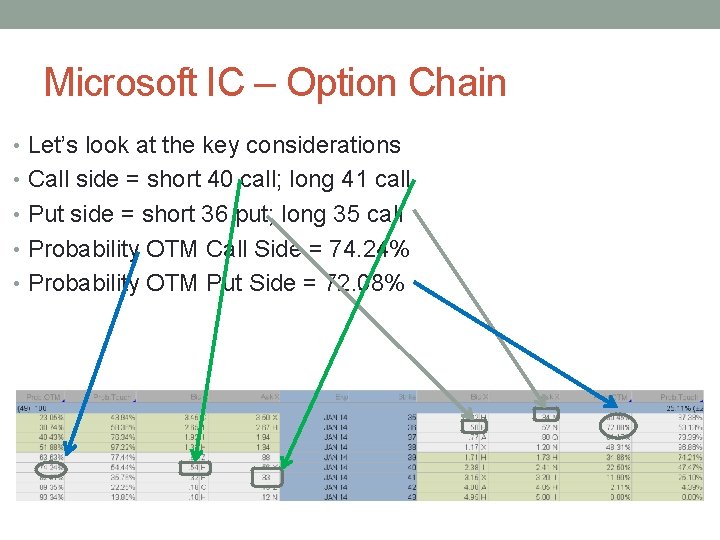

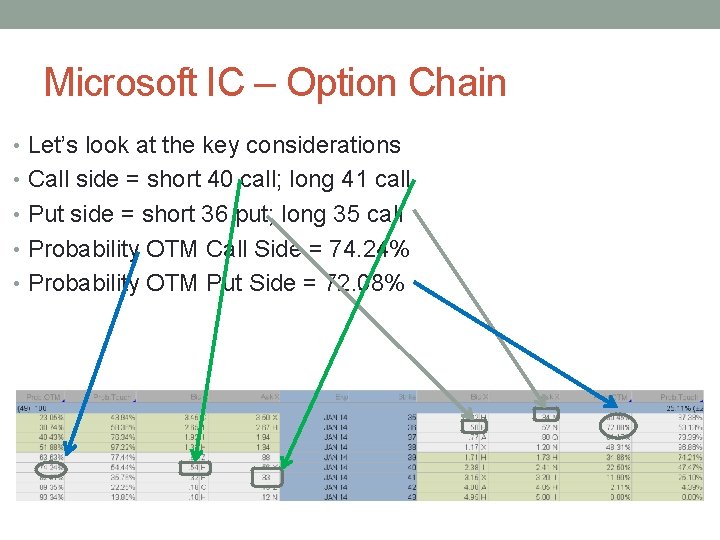

Microsoft IC – Option Chain • Let’s look at the key considerations • Call side = short 40 call; long 41 call • Put side = short 36 put; long 35 call • Probability OTM Call Side = 74. 24% • Probability OTM Put Side = 72. 08%

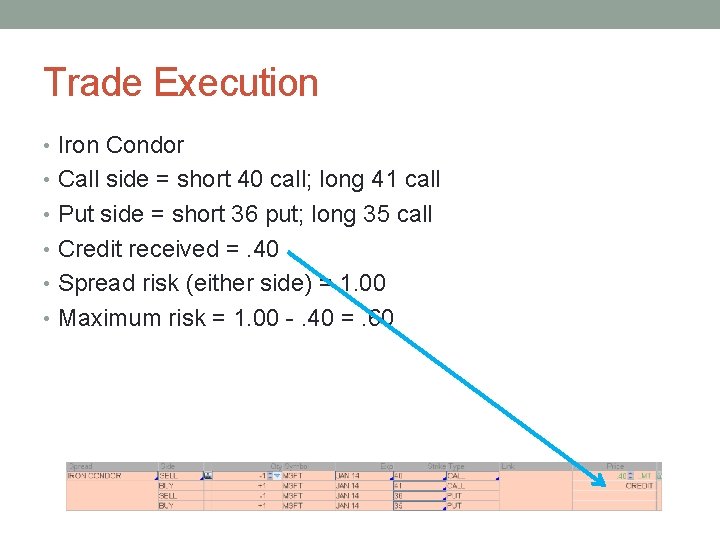

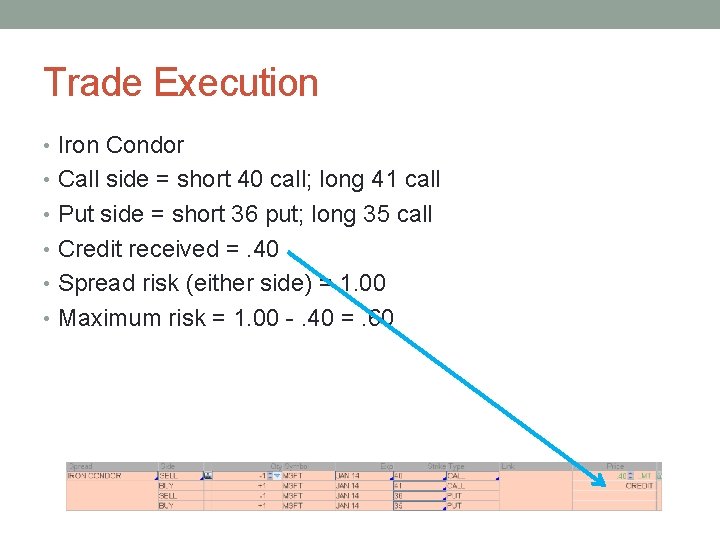

Trade Execution • Iron Condor • Call side = short 40 call; long 41 call • Put side = short 36 put; long 35 call • Credit received =. 40 • Spread risk (either side) = 1. 00 • Maximum risk = 1. 00 -. 40 =. 60

PBT Keys • The trades that were illustrated in the previous slides are the basic building blocks of PBT • Call credit spread (CCS) • Put credit spread (PCS) • CCS + PCS = Iron Condor • There are many trading strategies that will be introduced to you in future • • modules It is paramount that the trader have a concrete understanding of these strategies for a solid foundation on which to build. The trader must be proficient in finding, evaluating, order execution and exit strategy on these strategies before moving forward with more advanced versions. Take all the time you require to learn these trades. These three strategies alone, can provide you with above average returns by following the trade parameters outlined in this module. Step by step of many trade examples will be posted and updated on the website so you can follow real trades. This will expedite your understanding.