Optimal Risk Selection Using Cat Models Lixin Zeng

- Slides: 22

Optimal Risk Selection Using Cat Models Lixin Zeng, Ph. D. CAS Seminar on Funding of Catastrophe Risks Providence RI October 17, 2000 Thinking beyond The Box

Optimal Risk Selection Outline n Use and Misuse of Cat Model n Optimal Risk Selection n Example 2

Optimal Risk Selection What a Cat Model Tells Us n Loss Probability Distribution - n Expected Loss Probable Maximum Loss (a. k. a. Value at Risk) Relative Value - Deal A is riskier than Deal B Correlation: Constructing a Portfolio with High Return on Risk Capital 3

Optimal Risk Selection Great! Cat Problem Solved? n Underwriting Decisions n Rate Making n Reinsurance Purchasing n Securitization 4

Optimal Risk Selection What’s Inside a Cat Model n State-of-the-Art Science in Meteorology and Seismology n Lack of Consensus in Scientific Community on Key Issues n Engineering Experts’ Opinions for Structure Damage n Best Guesses Given Limited Data and Modeling n Computation Hurdles vs. Convergence n Modern Simulation Technology 5

Optimal Risk Selection User’s Responsibilities n Understand Key Assumptions n Appreciate Sources of Uncertainty n Independent Model Evaluation n Integrate Multiple Models 6

Optimal Risk Selection What’s a Cat Model Good For? n Relative (Not Absolute) Indicators n Differentiate Good and Bad Risks/Areas n Risk Selection n Portfolio Optimization 7

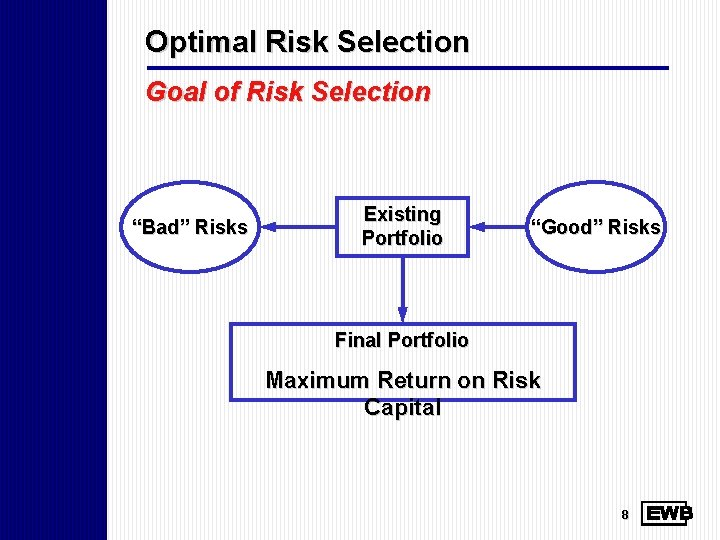

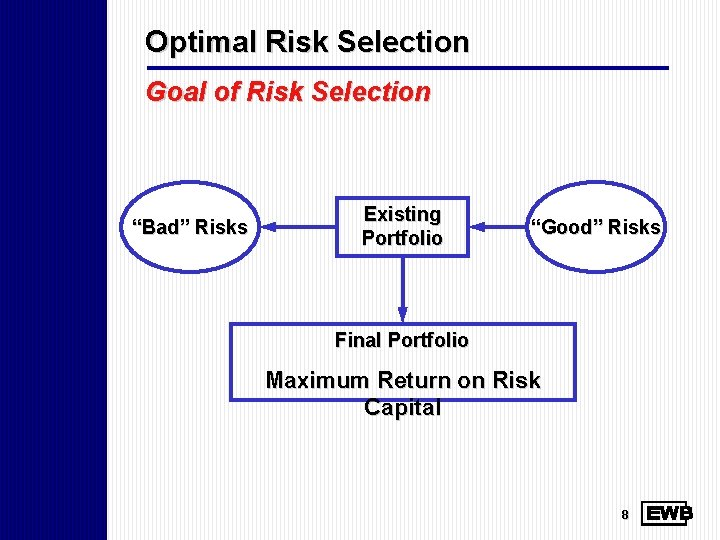

Optimal Risk Selection Goal of Risk Selection “Bad” Risks Existing Portfolio “Good” Risks Final Portfolio Maximum Return on Risk Capital 8

Optimal Risk Selection Return on Risk Capital (RORC) n Return - n Risk Capital - - n Cat premium minus expected cat loss Probable maximum loss (or value at risk) Expected policy holder deficit Loss standard deviation Applicable to Both Individual Risks and Portfolios 9

Optimal Risk Selection RORC: Definition n A Simple Definition Cat Premium - Expected Cat Loss Cat X-Year PML n Different Definitions - Financial strength Risk tolerance etc. 10

Optimal Risk Selection Identify “Bad” Individual Risks An Individual Risk Is the Worst in a Portfolio if (1) It has the lowest RORC among all risks (2) Removing it will increase the portfolio’s RORC the most vs. removing any other individual risk The right answer: (1) or (2)? 11

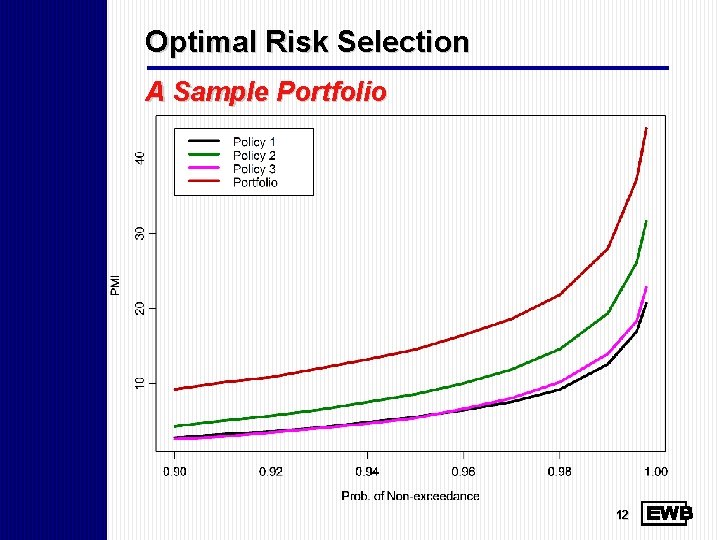

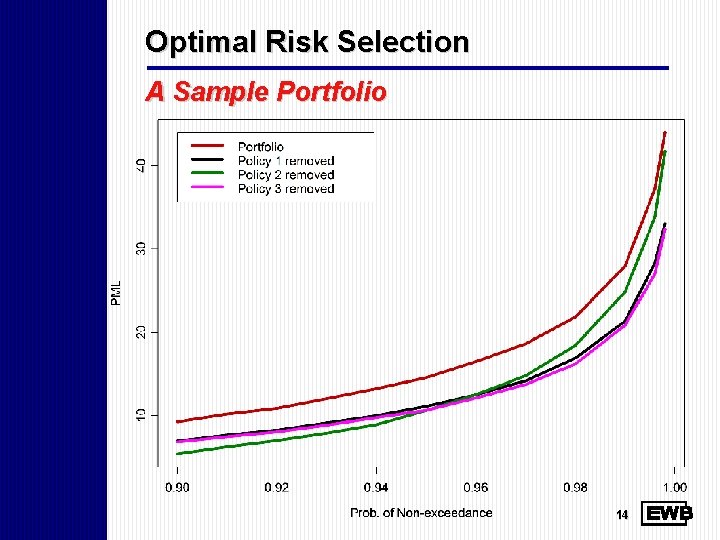

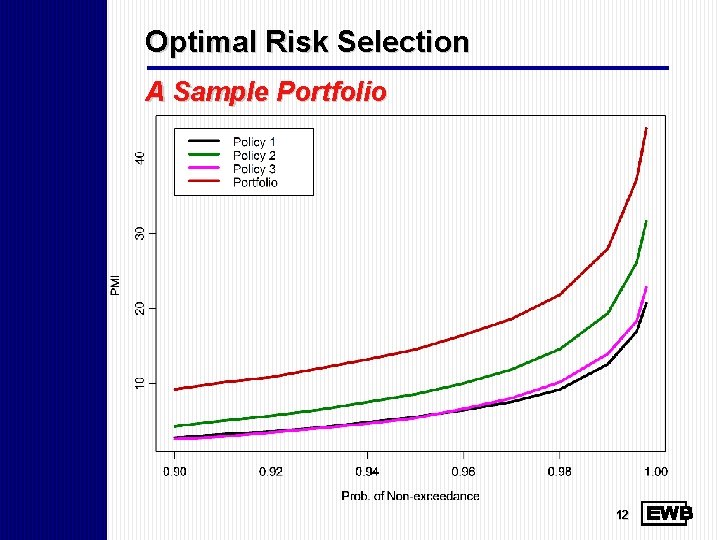

Optimal Risk Selection A Sample Portfolio 12

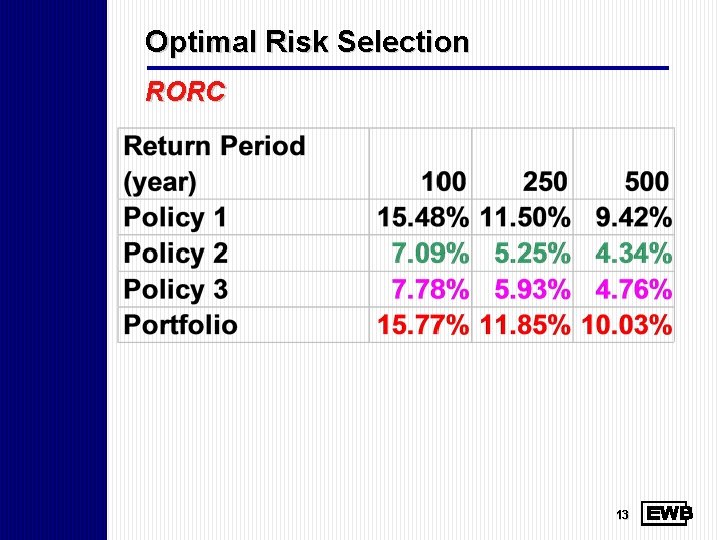

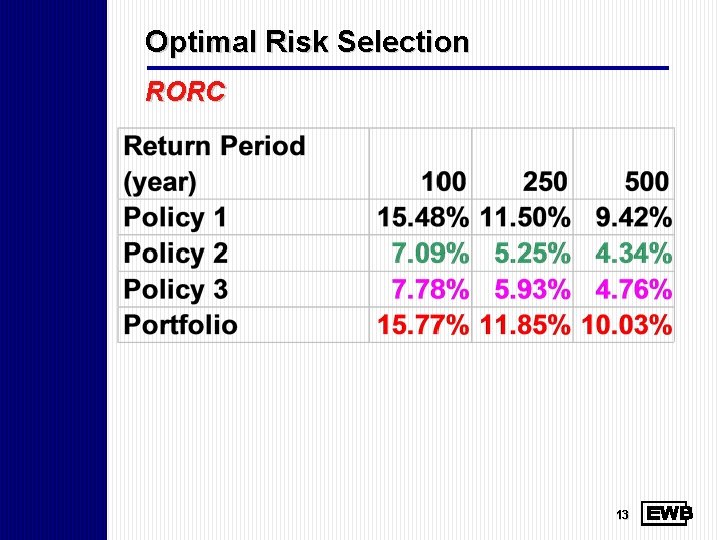

Optimal Risk Selection RORC 13

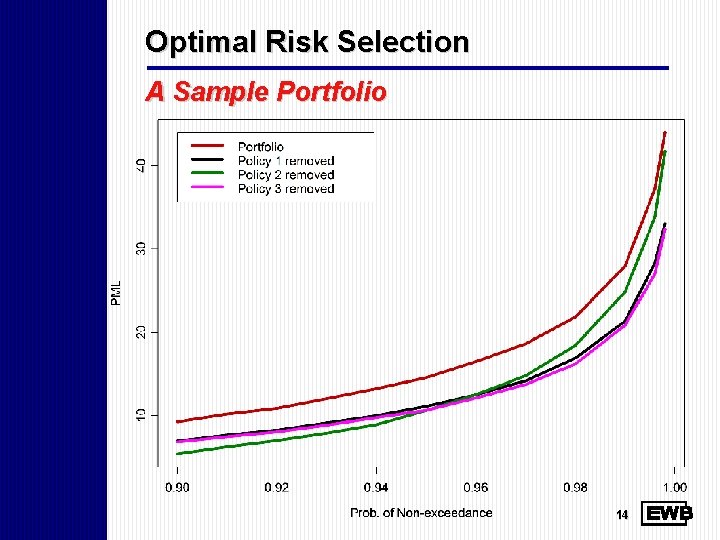

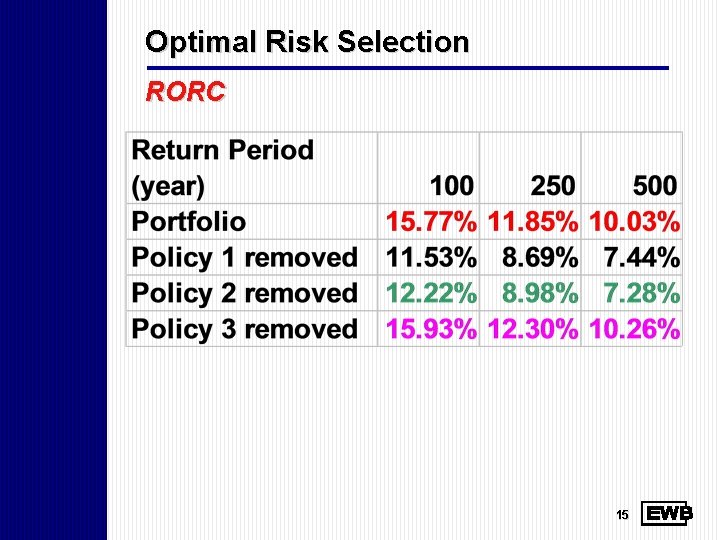

Optimal Risk Selection A Sample Portfolio 14

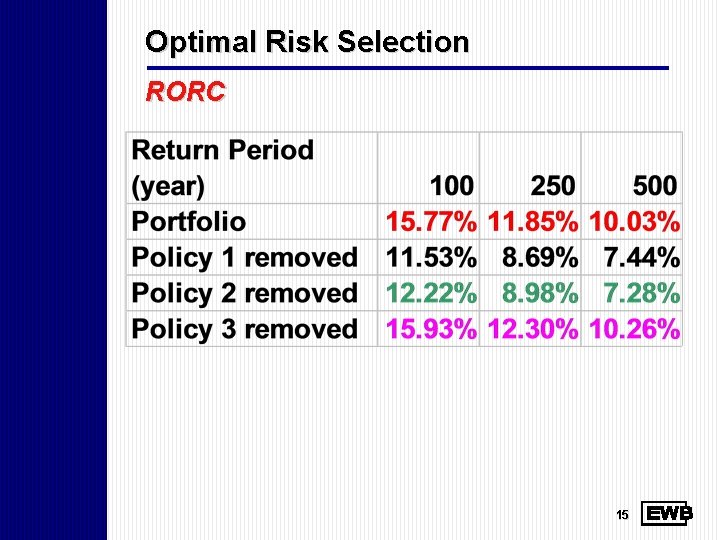

Optimal Risk Selection RORC 15

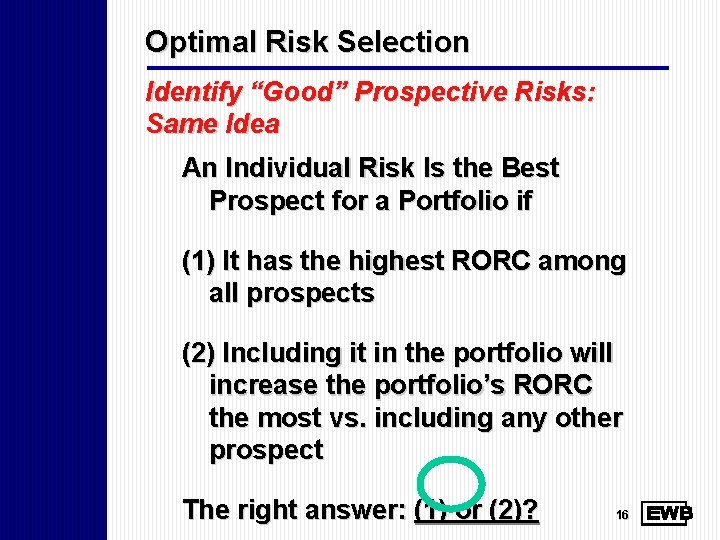

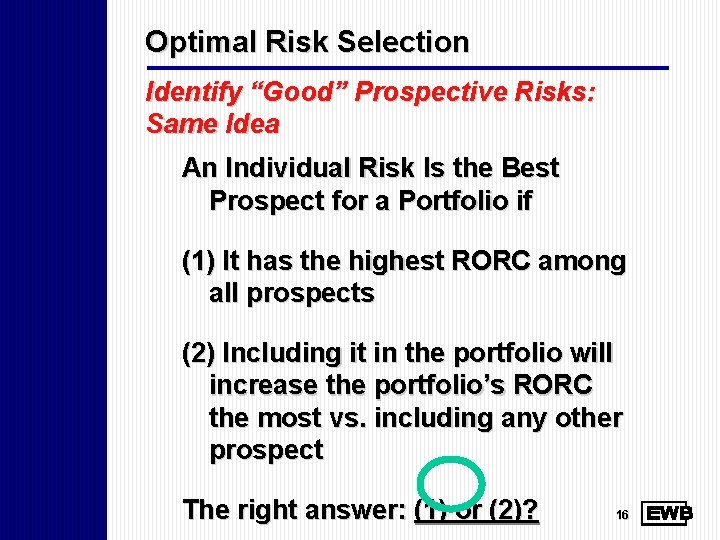

Optimal Risk Selection Identify “Good” Prospective Risks: Same Idea An Individual Risk Is the Best Prospect for a Portfolio if (1) It has the highest RORC among all prospects (2) Including it in the portfolio will increase the portfolio’s RORC the most vs. including any other prospect The right answer: (1) or (2)? 16

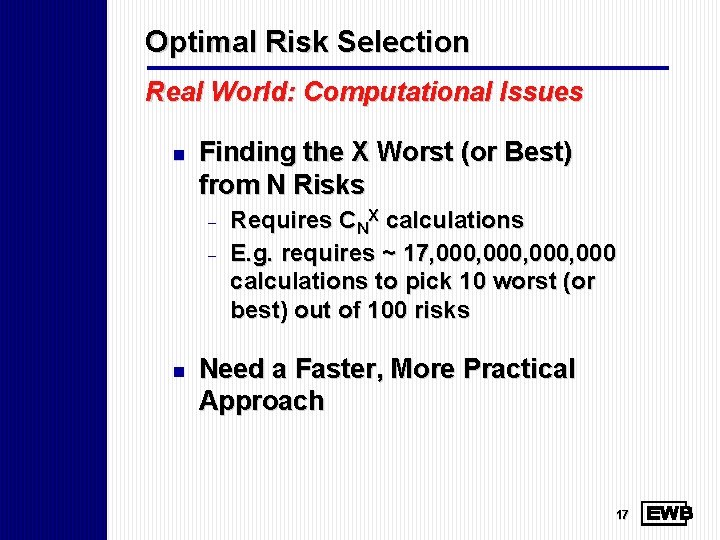

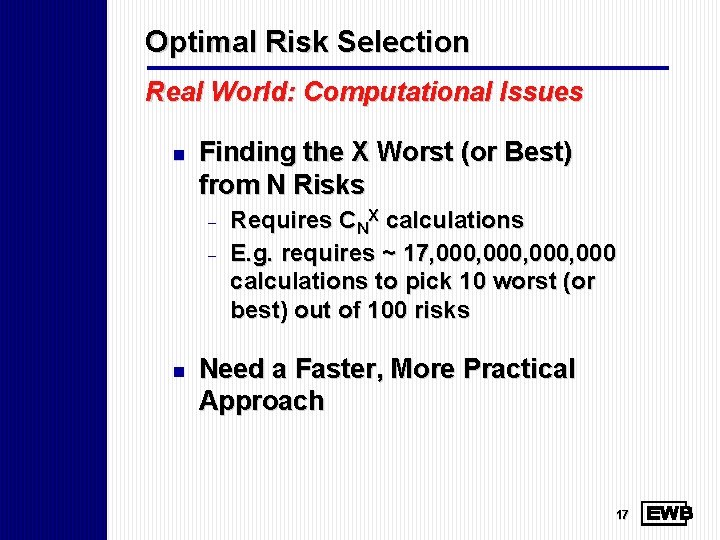

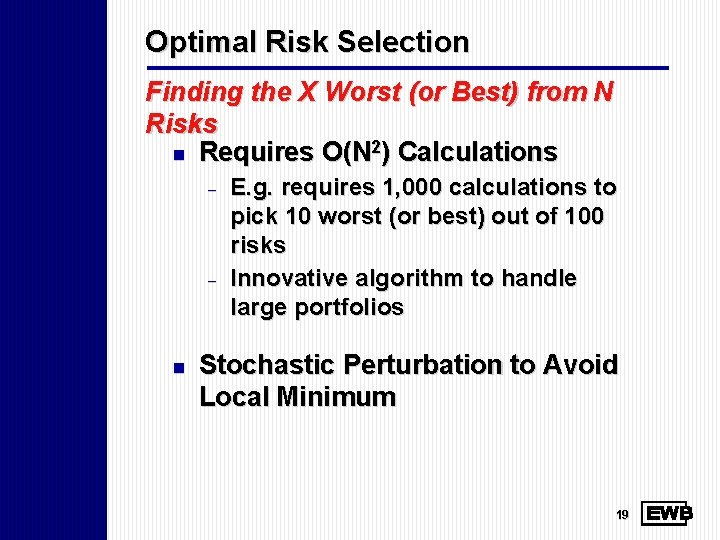

Optimal Risk Selection Real World: Computational Issues n Finding the X Worst (or Best) from N Risks - n Requires CNX calculations E. g. requires ~ 17, 000, 000 calculations to pick 10 worst (or best) out of 100 risks Need a Faster, More Practical Approach 17

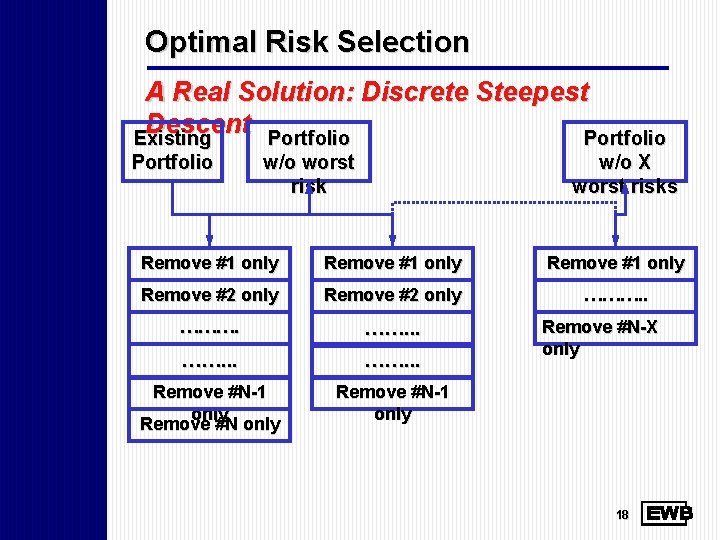

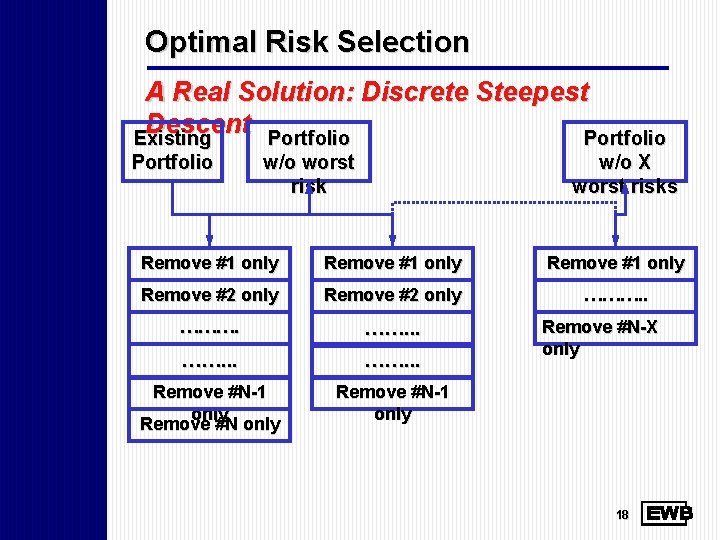

Optimal Risk Selection A Real Solution: Discrete Steepest Descent Portfolio Existing Portfolio w/o worst risk w/o X worst risks Remove #1 only Remove #2 only ………. . . Remove #N-1 only Remove #N-X only 18

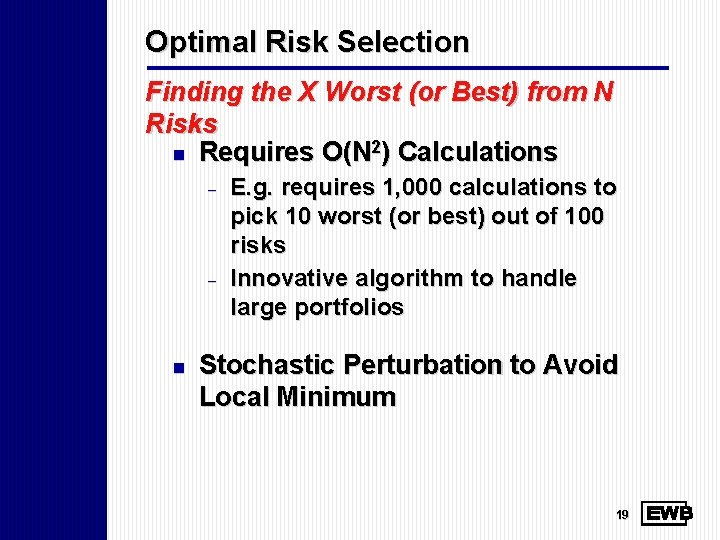

Optimal Risk Selection Finding the X Worst (or Best) from N Risks n Requires O(N 2) Calculations - - n E. g. requires 1, 000 calculations to pick 10 worst (or best) out of 100 risks Innovative algorithm to handle large portfolios Stochastic Perturbation to Avoid Local Minimum 19

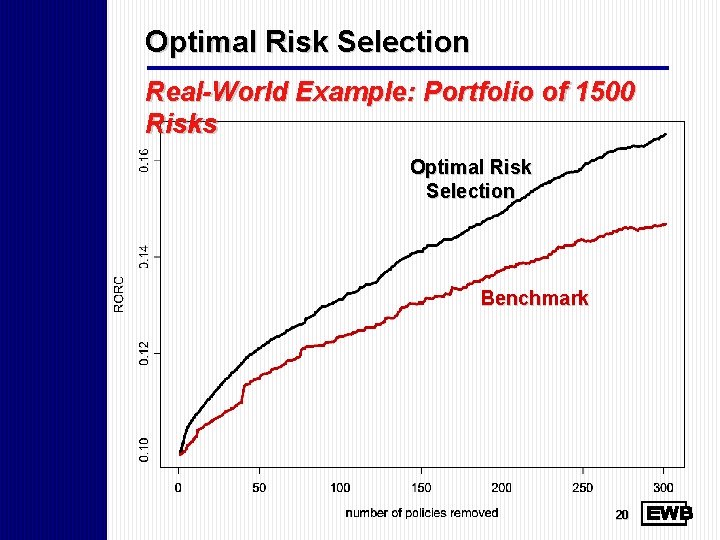

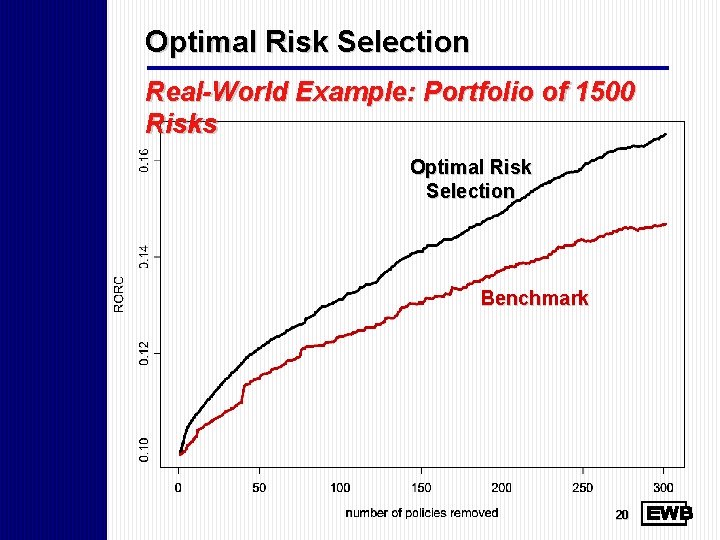

Optimal Risk Selection Real-World Example: Portfolio of 1500 Risks Optimal Risk Selection Benchmark 20

Optimal Risk Selection Cautions n Cat Model Relative Bias - n Geographical and structural Usually less than absolute bias But cannot be ignored Use of a Single Point on the PML Curve - Potentially misleading 21

Optimal Risk Selection Conclusions n Cat Model - n Relative indications more credible than absolute values Portfolio Optimization - - One of the best uses of cat models Cat model relative bias must be evaluated and understood 22