Operations Management Chapter 4 Forecasting Power Point presentation

![Correlation Coefficient y y n. Sxy - Sx. Sy r= 2 - (Sx)2][n. Sy Correlation Coefficient y y n. Sxy - Sx. Sy r= 2 - (Sx)2][n. Sy](https://slidetodoc.com/presentation_image/1f5b569f4d1a2c7bc7870d8c22890914/image-100.jpg)

- Slides: 113

Operations Management Chapter 4 – Forecasting Power. Point presentation to accompany Heizer/Render Principles of Operations Management, 7 e Operations Management, 9 e © 2008 Prentice Hall, Inc. 4–

Outline þ Global Company Profile: Disney World þ What Is Forecasting? þ Forecasting Time Horizons þ The Influence of Product Life Cycle þ Types Of Forecasts © 2008 Prentice Hall, Inc. 4– 2

Outline – Continued þ The Strategic Importance of Forecasting þ Human Resources þ Capacity þ Supply Chain Management þ Seven Steps in the Forecasting System © 2008 Prentice Hall, Inc. 4– 3

Outline – Continued þ Forecasting Approaches þ Overview of Qualitative Methods þ Overview of Quantitative Methods © 2008 Prentice Hall, Inc. 4– 4

Outline – Continued þ Time-Series Forecasting þ þ þ Decomposition of a Time Series Naive Approach Moving Averages Exponential Smoothing with Trend Adjustment þ Trend Projections þ Seasonal Variations in Data þ Cyclical Variations in Data © 2008 Prentice Hall, Inc. 4– 5

Outline – Continued þ Associative Forecasting Methods: Regression and Correlation Analysis þ Using Regression Analysis for Forecasting þ Standard Error of the Estimate þ Correlation Coefficients for Regression Lines þ Multiple-Regression Analysis © 2008 Prentice Hall, Inc. 4– 6

Outline – Continued þ Monitoring and Controlling Forecasts þ Adaptive Smoothing þ Focus Forecasting þ Forecasting In The Service Sector © 2008 Prentice Hall, Inc. 4– 7

Learning Objectives When you complete this chapter you should be able to : þ Understand the three time horizons and which models apply for each use þ Explain when to use each of the four qualitative models þ Apply the naive, moving average, exponential smoothing, and trend methods © 2008 Prentice Hall, Inc. 4– 8

Learning Objectives When you complete this chapter you should be able to : þ Compute three measures of forecast accuracy þ Develop seasonal indexes þ Conduct a regression and correlation analysis þ Use a tracking signal © 2008 Prentice Hall, Inc. 4– 9

Forecasting at Disney World þ Global portfolio includes parks in Hong Kong, Paris, Tokyo, Orlando, and Anaheim þ Revenues are derived from people – how many visitors and how they spend their money þ Daily management report contains only the forecast and actual attendance at each park © 2008 Prentice Hall, Inc. 4 – 10

Forecasting at Disney World þ Disney generates daily, weekly, monthly, annual, and 5 -year forecasts þ Forecast used by labor management, maintenance, operations, finance, and park scheduling þ Forecast used to adjust opening times, rides, shows, staffing levels, and guests admitted © 2008 Prentice Hall, Inc. 4 – 11

Forecasting at Disney World þ 20% of customers come from outside the USA þ Economic model includes gross domestic product, cross-exchange rates, arrivals into the USA þ A staff of 35 analysts and 70 field people survey 1 million park guests, employees, and travel professionals each year © 2008 Prentice Hall, Inc. 4 – 12

Forecasting at Disney World þ Inputs to the forecasting model include airline specials, Federal Reserve policies, Wall Street trends, vacation/holiday schedules for 3, 000 school districts around the world þ Average forecast error for the 5 -year forecast is 5% þ Average forecast error for annual forecasts is between 0% and 3% © 2008 Prentice Hall, Inc. 4 – 13

What is Forecasting? þ Process of predicting a future event þ Underlying basis of all business decisions ? ? þ Production þ Inventory þ Personnel þ Facilities © 2008 Prentice Hall, Inc. 4 – 14

Forecasting Time Horizons þ Short-range forecast þ Up to 1 year, generally less than 3 months þ Purchasing, job scheduling, workforce levels, job assignments, production levels þ Medium-range forecast þ 3 months to 3 years þ Sales and production planning, budgeting þ Long-range forecast þ 3+ years þ New product planning, facility location, research and development © 2008 Prentice Hall, Inc. 4 – 15

Distinguishing Differences þ Medium/long range forecasts deal with more comprehensive issues and support management decisions regarding planning and products, plants and processes þ Short-term forecasting usually employs different methodologies than longer-term forecasting þ Short-term forecasts tend to be more accurate than longer-term forecasts © 2008 Prentice Hall, Inc. 4 – 16

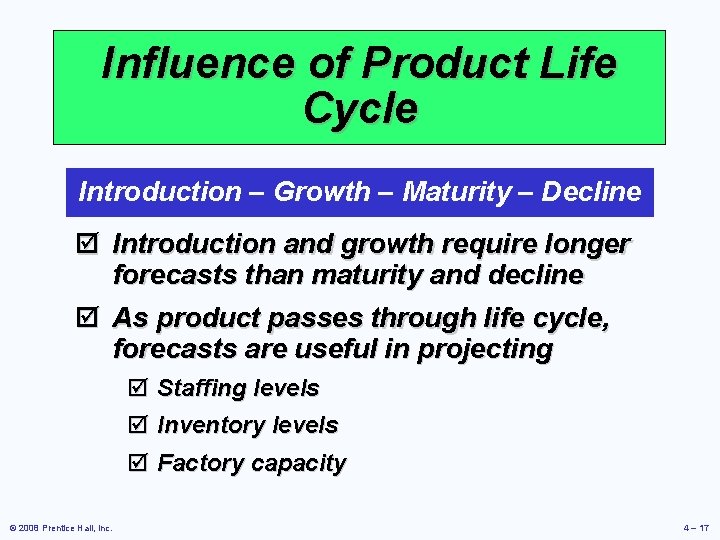

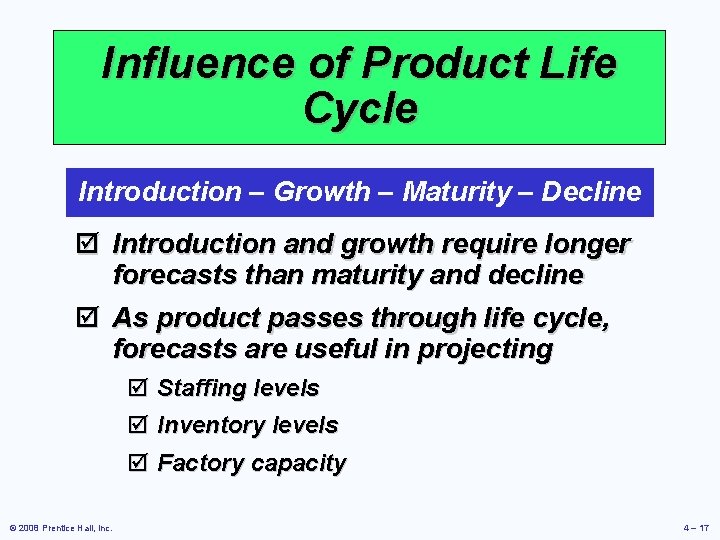

Influence of Product Life Cycle Introduction – Growth – Maturity – Decline þ Introduction and growth require longer forecasts than maturity and decline þ As product passes through life cycle, forecasts are useful in projecting þ Staffing levels þ Inventory levels þ Factory capacity © 2008 Prentice Hall, Inc. 4 – 17

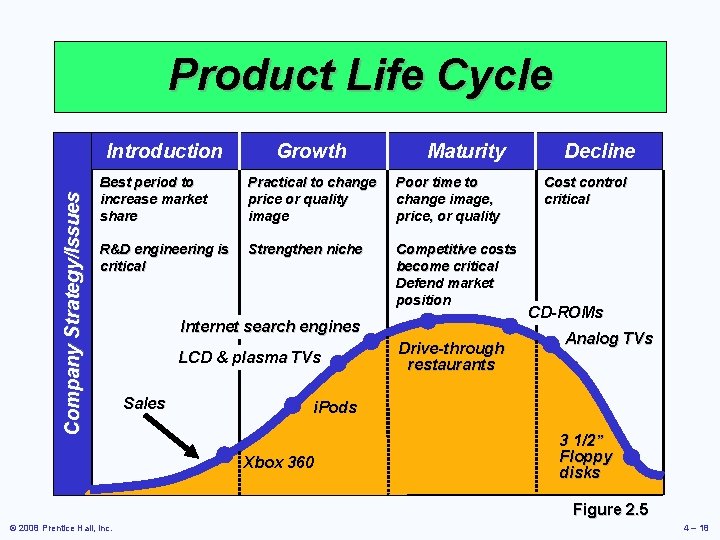

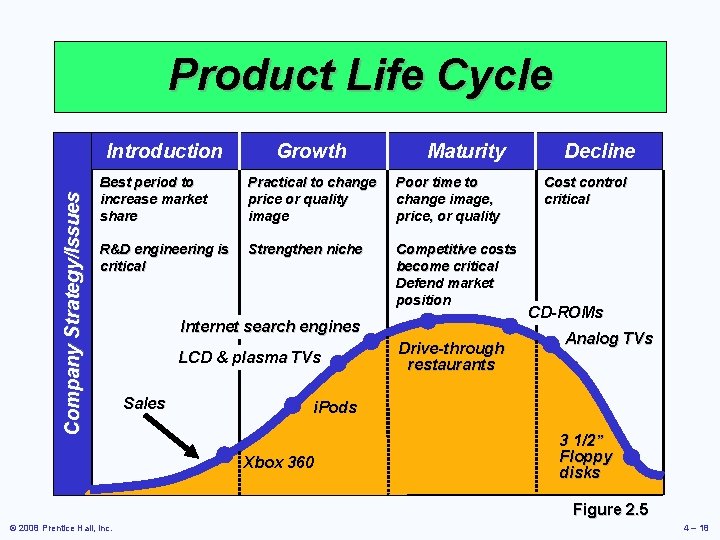

Product Life Cycle Company Strategy/Issues Introduction Growth Maturity Best period to increase market share Practical to change price or quality image Poor time to change image, price, or quality R&D engineering is critical Strengthen niche Competitive costs become critical Defend market position Internet search engines LCD & plasma TVs Sales Drive-through restaurants Decline Cost control critical CD-ROMs Analog TVs i. Pods Xbox 360 3 1/2” Floppy disks Figure 2. 5 © 2008 Prentice Hall, Inc. 4 – 18

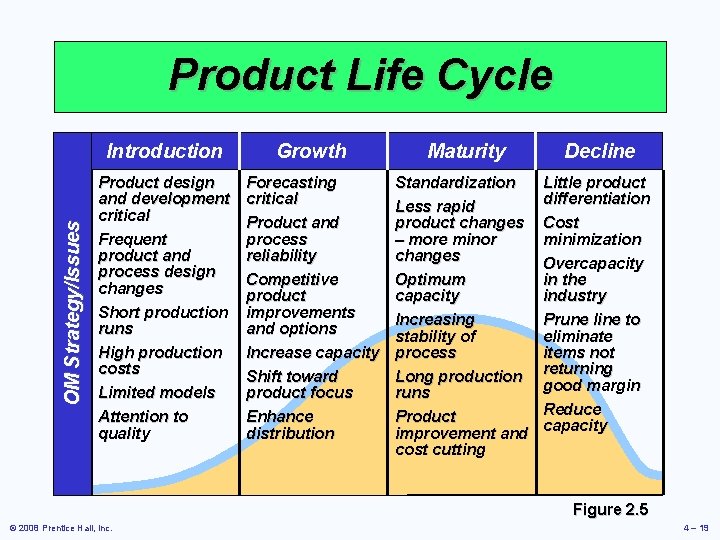

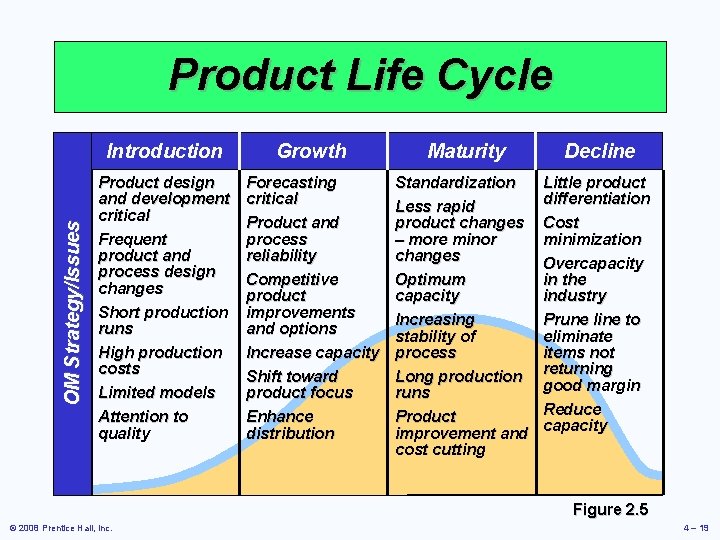

OM Strategy/Issues Product Life Cycle Introduction Growth Maturity Decline Product design and development critical Frequent product and process design changes Short production runs High production costs Limited models Attention to quality Forecasting critical Product and process reliability Competitive product improvements and options Increase capacity Shift toward product focus Enhance distribution Standardization Less rapid product changes – more minor changes Optimum capacity Increasing stability of process Long production runs Product improvement and cost cutting Little product differentiation Cost minimization Overcapacity in the industry Prune line to eliminate items not returning good margin Reduce capacity Figure 2. 5 © 2008 Prentice Hall, Inc. 4 – 19

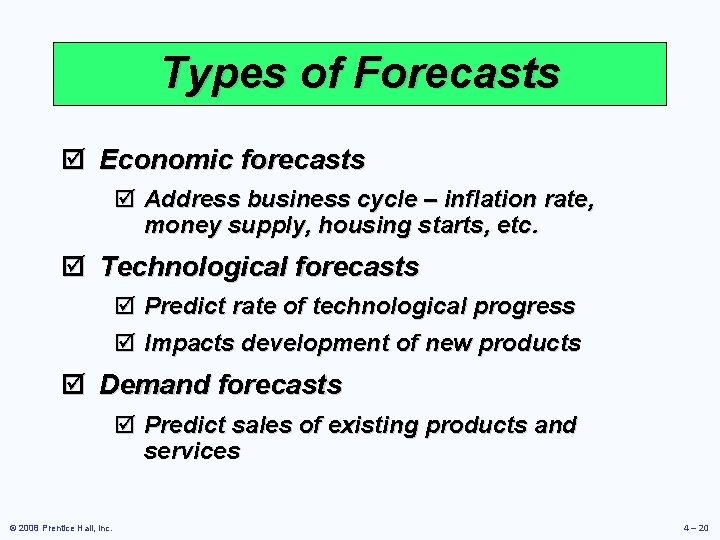

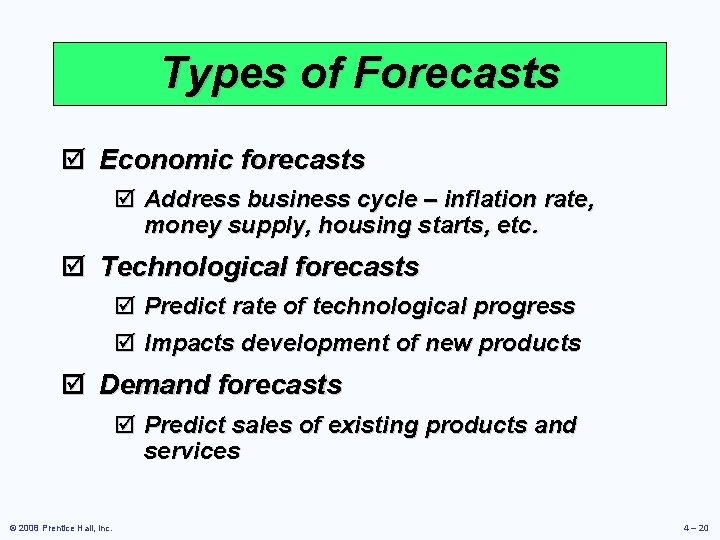

Types of Forecasts þ Economic forecasts þ Address business cycle – inflation rate, money supply, housing starts, etc. þ Technological forecasts þ Predict rate of technological progress þ Impacts development of new products þ Demand forecasts þ Predict sales of existing products and services © 2008 Prentice Hall, Inc. 4 – 20

Strategic Importance of Forecasting þ Human Resources – Hiring, training, laying off workers þ Capacity – Capacity shortages can result in undependable delivery, loss of customers, loss of market share þ Supply Chain Management – Good supplier relations and price advantages © 2008 Prentice Hall, Inc. 4–

Seven Steps in Forecasting þ Determine the use of the forecast þ Select the items to be forecasted þ Determine the time horizon of the forecast þ Select the forecasting model(s) þ Gather the data þ Make the forecast þ Validate and implement results © 2008 Prentice Hall, Inc. 4 – 22

The Realities! þ Forecasts are seldom perfect þ Most techniques assume an underlying stability in the system þ Product family and aggregated forecasts are more accurate than individual product forecasts © 2008 Prentice Hall, Inc. 4–

Forecasting Approaches Qualitative Methods þ Used when situation is vague and little data exist þ New products þ New technology þ Involves intuition, experience þ e. g. , forecasting sales on Internet © 2008 Prentice Hall, Inc. 4 – 24

Forecasting Approaches Quantitative Methods þ Used when situation is ‘stable’ and historical data exist þ þ Existing products Current technology þ Involves mathematical techniques þ e. g. , forecasting sales of color televisions © 2008 Prentice Hall, Inc. 4 – 25

Overview of Qualitative Methods þ Jury of executive opinion þ Pool opinions of high-level experts, sometimes augment by statistical models þ Delphi method þ Panel of experts, queried iteratively © 2008 Prentice Hall, Inc. 4 – 26

Overview of Qualitative Methods þ Sales force composite þ Estimates from individual salespersons are reviewed for reasonableness, then aggregated þ Consumer Market Survey þ Ask the customer © 2008 Prentice Hall, Inc. 4 – 27

Jury of Executive Opinion þ Involves small group of high-level experts and managers þ Group estimates demand by working together þ Combines managerial experience with statistical models þ Relatively quick þ ‘Group-think’ disadvantage © 2008 Prentice Hall, Inc. 4 – 28

Sales Force Composite þ Each salesperson projects his or her sales þ Combined at district and national levels þ Sales reps know customers’ wants þ Tends to be overly optimistic © 2008 Prentice Hall, Inc. 4 – 29

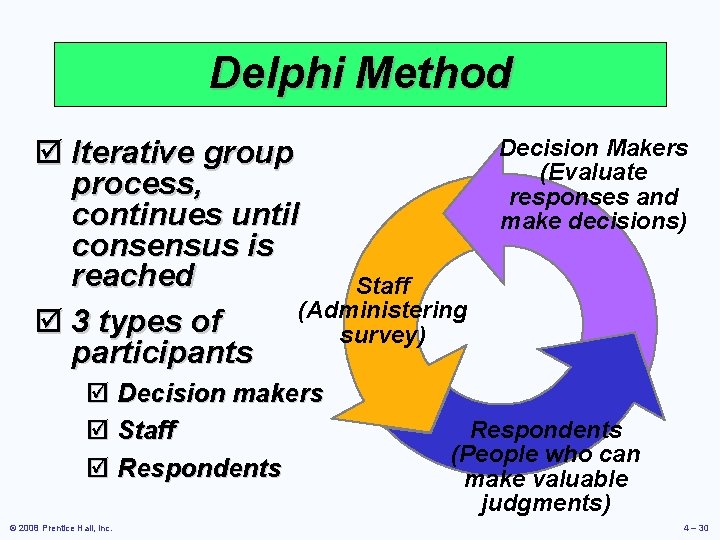

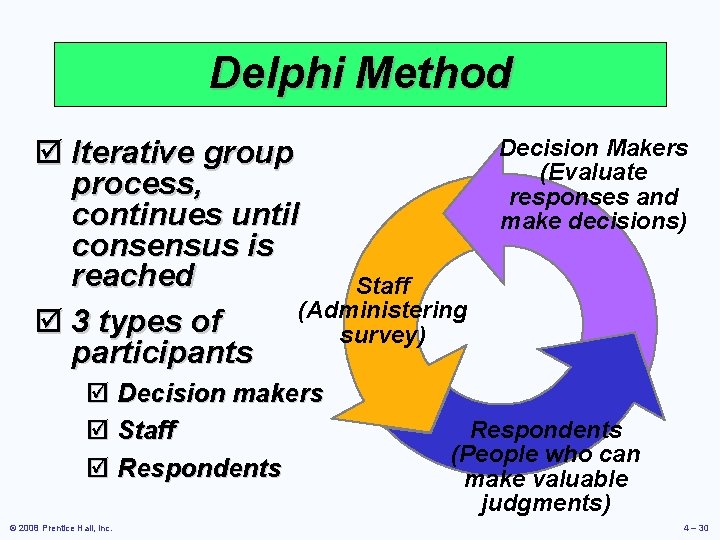

Delphi Method þ Iterative group process, continues until consensus is reached Staff (Administering þ 3 types of survey) participants þ Decision makers þ Staff þ Respondents © 2008 Prentice Hall, Inc. Decision Makers (Evaluate responses and make decisions) Respondents (People who can make valuable judgments) 4 – 30

Consumer Market Survey þ Ask customers about purchasing plans þ What consumers say, and what they actually do are often different þ Sometimes difficult to answer © 2008 Prentice Hall, Inc. 4 – 31

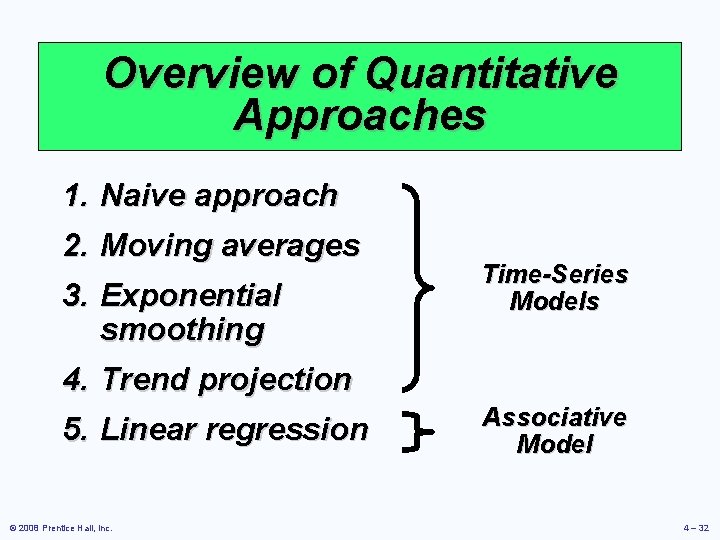

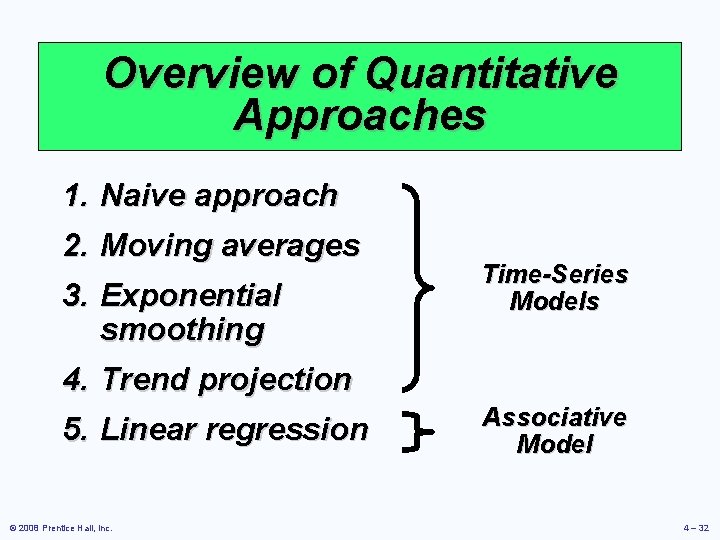

Overview of Quantitative Approaches 1. Naive approach 2. Moving averages 3. Exponential smoothing 4. Trend projection 5. Linear regression © 2008 Prentice Hall, Inc. Time-Series Models Associative Model 4 – 32

Time Series Forecasting þ Set of evenly spaced numerical data þ Obtained by observing response variable at regular time periods þ Forecast based only on past values, no other variables important þ Assumes that factors influencing past and present will continue influence in future © 2008 Prentice Hall, Inc. 4 – 33

Time Series Components Trend Cyclical Seasonal Random © 2008 Prentice Hall, Inc. 4 – 34

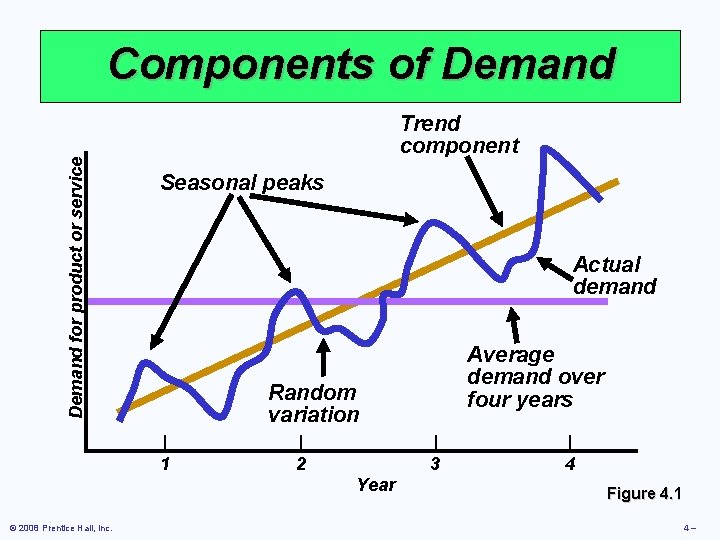

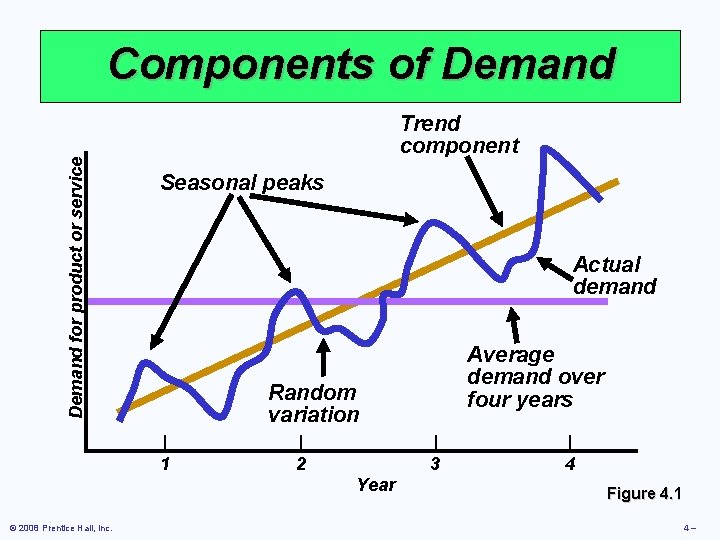

Demand for product or service Components of Demand Trend component Seasonal peaks Actual demand Random variation | 1 | 2 | 3 Year © 2008 Prentice Hall, Inc. Average demand over four years | 4 Figure 4. 1 4–

Trend Component þ Persistent, overall upward or downward pattern þ Changes due to population, technology, age, culture, etc. þ Typically several years duration © 2008 Prentice Hall, Inc. 4 – 36

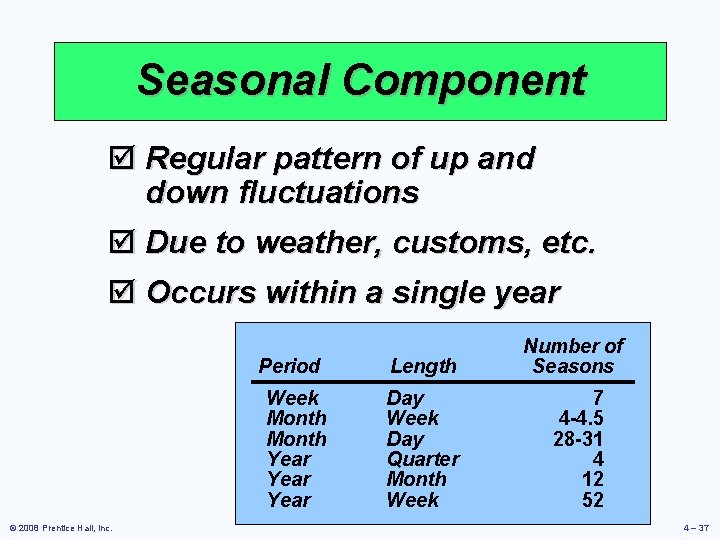

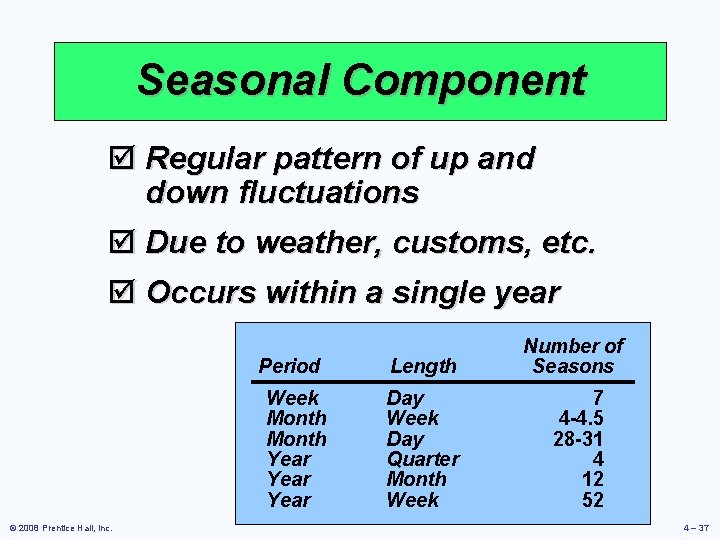

Seasonal Component þ Regular pattern of up and down fluctuations þ Due to weather, customs, etc. þ Occurs within a single year © 2008 Prentice Hall, Inc. Period Length Number of Seasons Week Month Year Day Week Day Quarter Month Week 7 4 -4. 5 28 -31 4 12 52 4 – 37

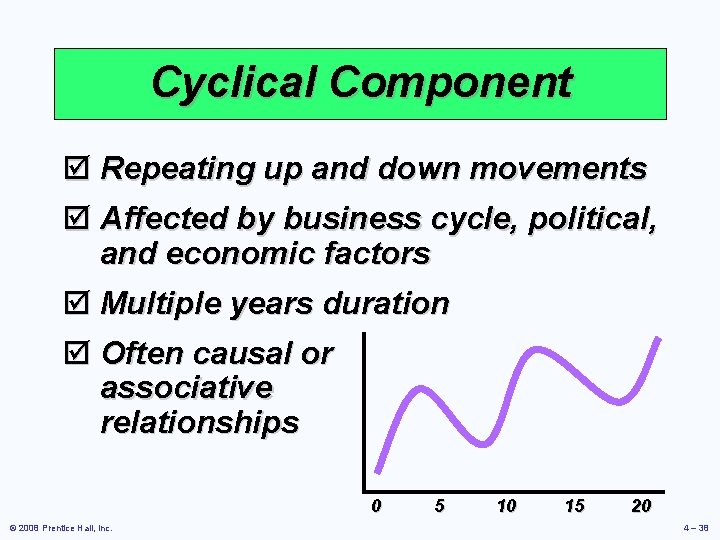

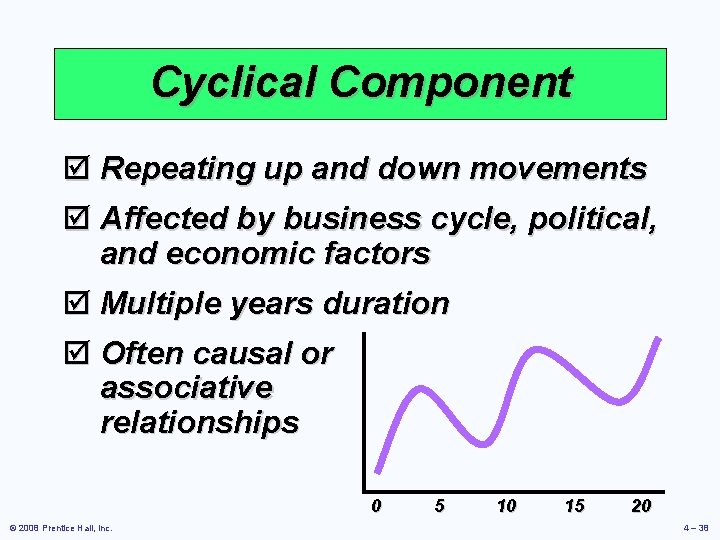

Cyclical Component þ Repeating up and down movements þ Affected by business cycle, political, and economic factors þ Multiple years duration þ Often causal or associative relationships 0 © 2008 Prentice Hall, Inc. 5 10 15 20 4 – 38

Random Component þ Erratic, unsystematic, ‘residual’ fluctuations þ Due to random variation or unforeseen events þ Short duration and nonrepeating M © 2008 Prentice Hall, Inc. T W T F 4 – 39

Naive Approach þ Assumes demand in next period is the same as demand in most recent period þ e. g. , If January sales were 68, then February sales will be 68 þ Sometimes cost effective and efficient þ Can be good starting point © 2008 Prentice Hall, Inc. 4 – 40

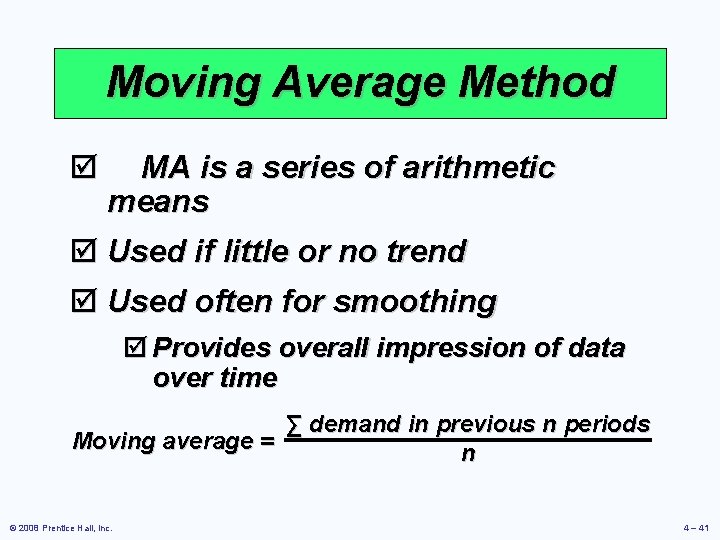

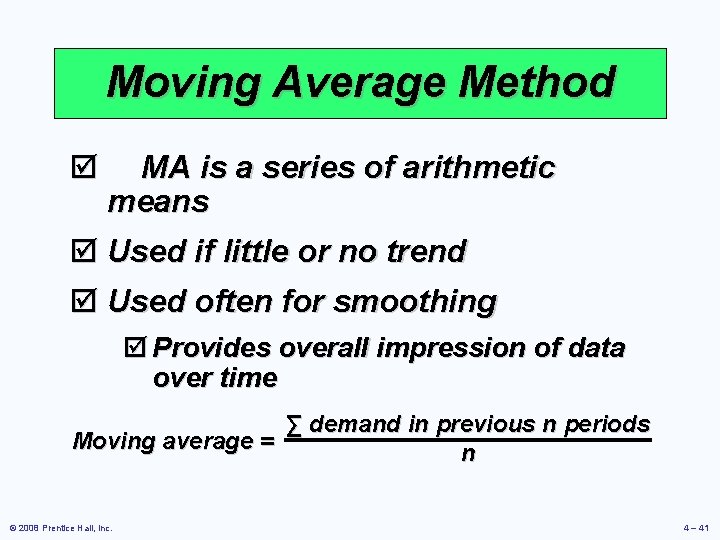

Moving Average Method þ MA is a series of arithmetic means þ Used if little or no trend þ Used often for smoothing þ Provides overall impression of data over time ∑ demand in previous n periods Moving average = n © 2008 Prentice Hall, Inc. 4 – 41

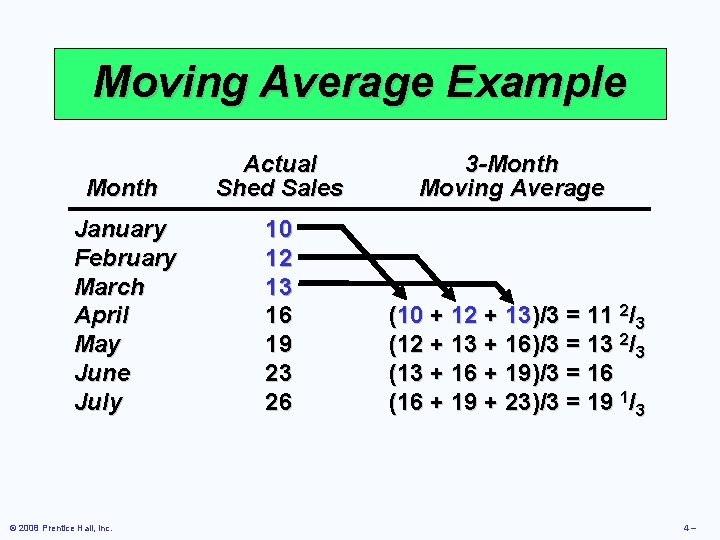

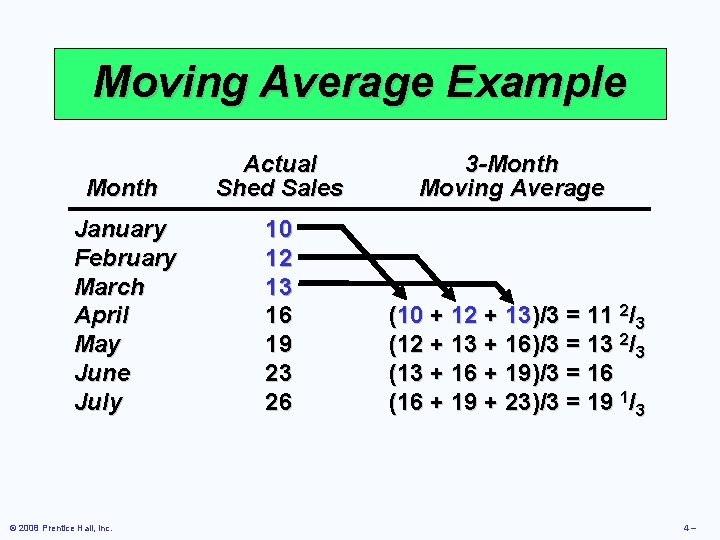

Moving Average Example Month Actual Shed Sales 3 -Month Moving Average January February March April May June July 10 12 13 16 19 23 26 (10 + 12 + 13)/3 = 11 2/3 (12 + 13 + 16)/3 = 13 2/3 (13 + 16 + 19)/3 = 16 (16 + 19 + 23)/3 = 19 1/3 © 2008 Prentice Hall, Inc. 4–

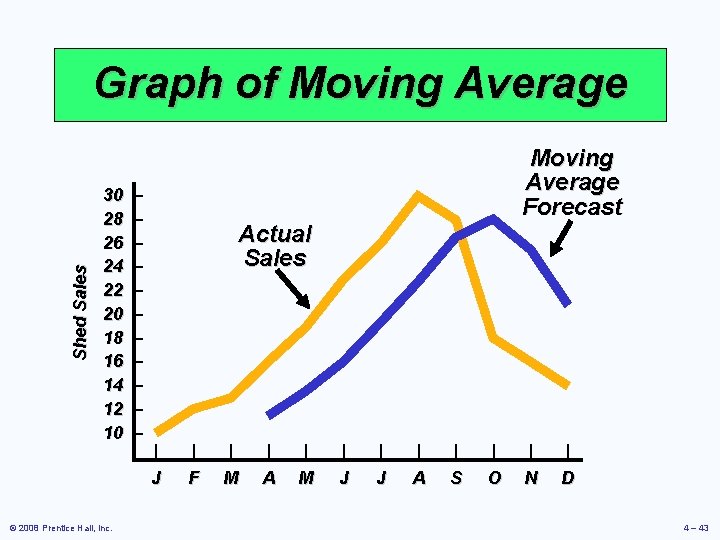

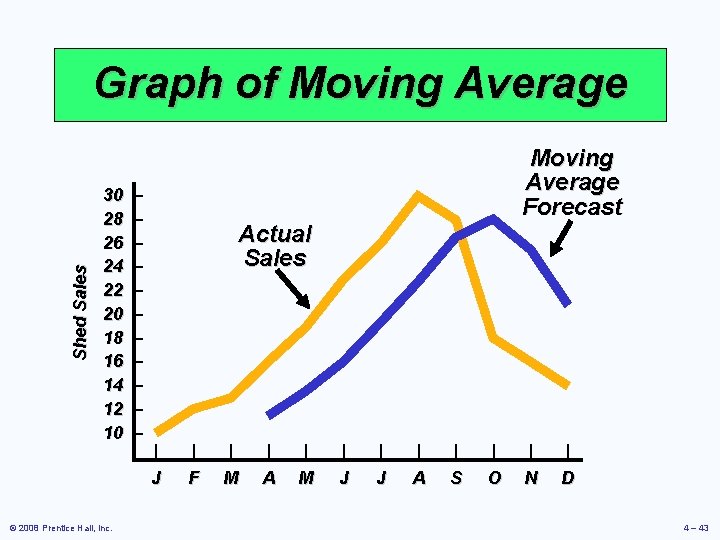

Shed Sales Graph of Moving Average 30 28 26 24 22 20 18 16 14 12 10 © 2008 Prentice Hall, Inc. – – – Moving Average Forecast Actual Sales | | | J F M A M J J A S O N D 4 – 43

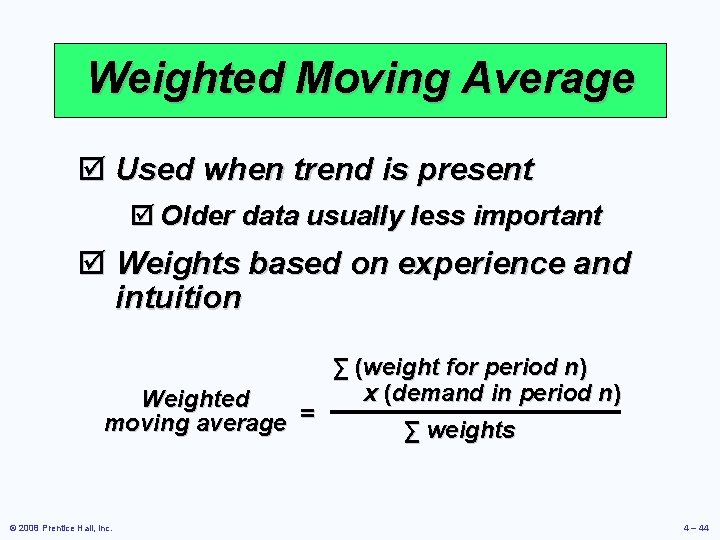

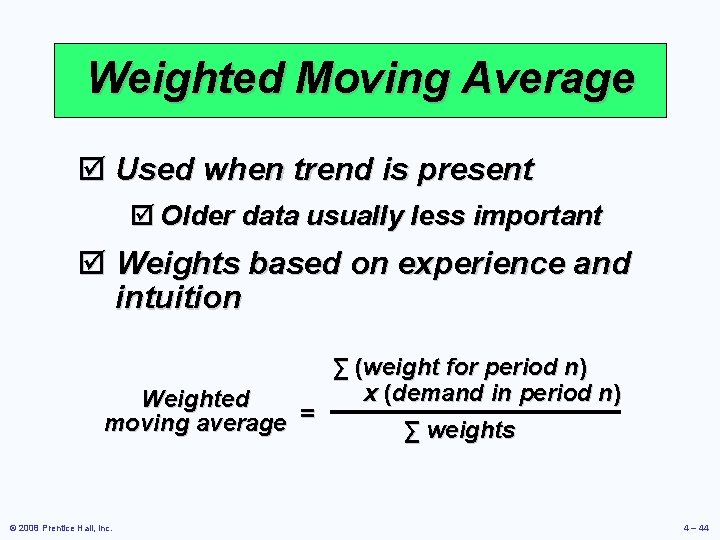

Weighted Moving Average þ Used when trend is present þ Older data usually less important þ Weights based on experience and intuition Weighted moving average = © 2008 Prentice Hall, Inc. ∑ (weight for period n) x (demand in period n) ∑ weights 4 – 44

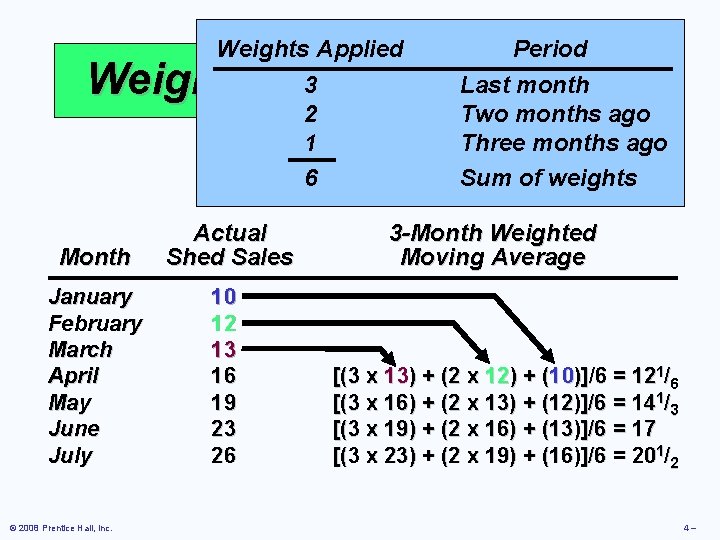

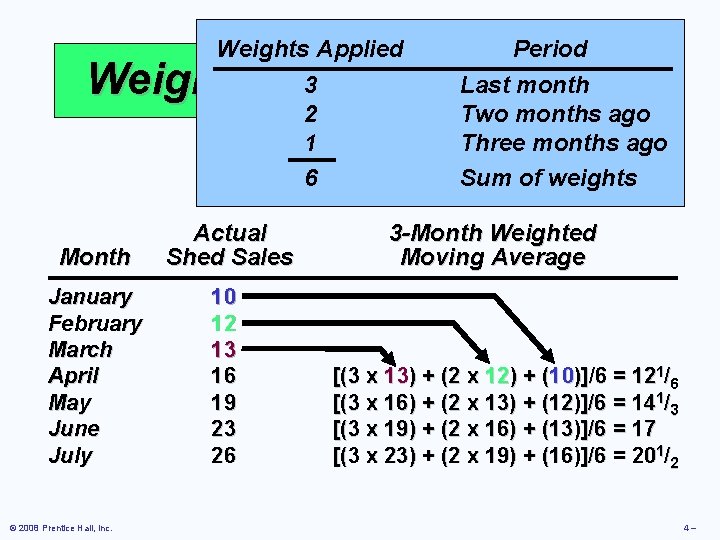

Weights Applied 3 2 1 6 Period Last month Two months ago Three months ago Sum of weights Weighted Moving Average Month Actual Shed Sales January February March April May June July 10 12 13 16 19 23 26 © 2008 Prentice Hall, Inc. 3 -Month Weighted Moving Average [(3 x 13) + (2 x 12) + (10)]/6 = 121/6 [(3 x 16) + (2 x 13) + (12)]/6 = 141/3 [(3 x 19) + (2 x 16) + (13)]/6 = 17 [(3 x 23) + (2 x 19) + (16)]/6 = 201/2 4–

Potential Problems With Moving Average þ Increasing n smooths the forecast but makes it less sensitive to changes þ Do not forecast trends well þ Require extensive historical data © 2008 Prentice Hall, Inc. 4 – 46

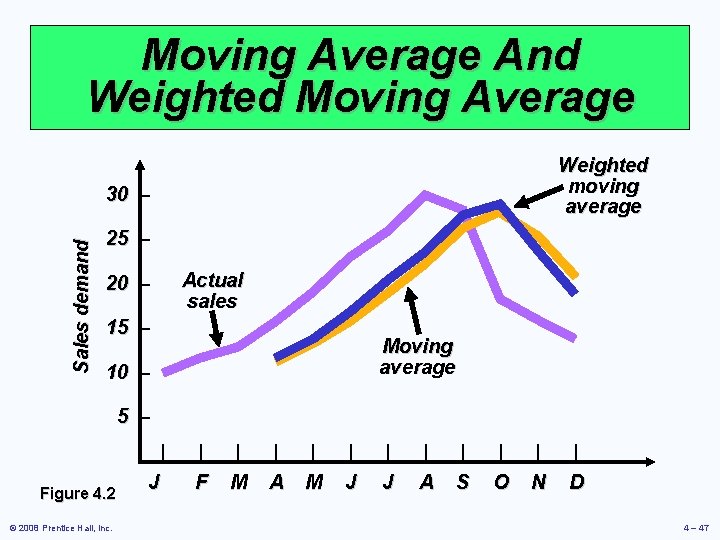

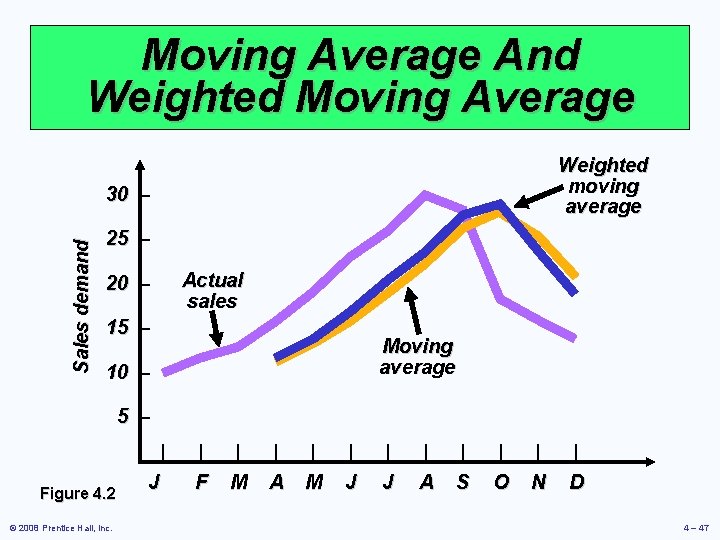

Moving Average And Weighted Moving Average Weighted moving average Sales demand 30 – 25 – Actual sales 20 – 15 – Moving average 10 – 5 – | Figure 4. 2 © 2008 Prentice Hall, Inc. J | F | M | A | M | J | A | S | O | N | D 4 – 47

Exponential Smoothing þ Form of weighted moving average þ Weights decline exponentially þ Most recent data weighted most þ Requires smoothing constant ( ) þ Ranges from 0 to 1 þ Subjectively chosen þ Involves little record keeping of past data © 2008 Prentice Hall, Inc. 4 – 48

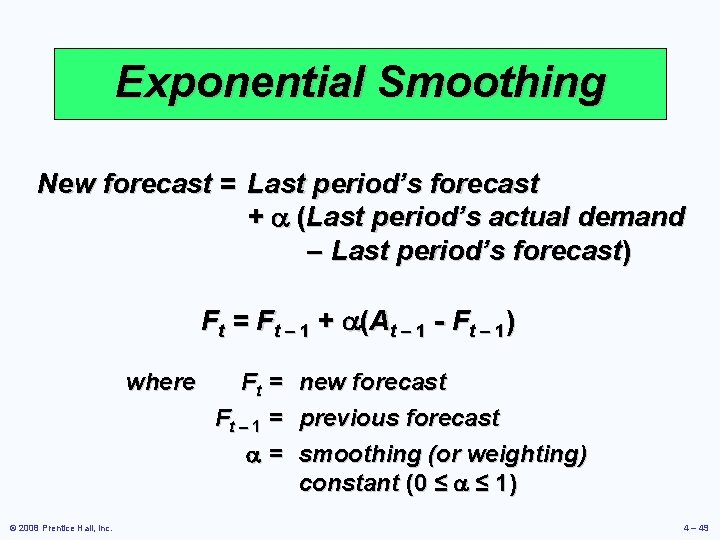

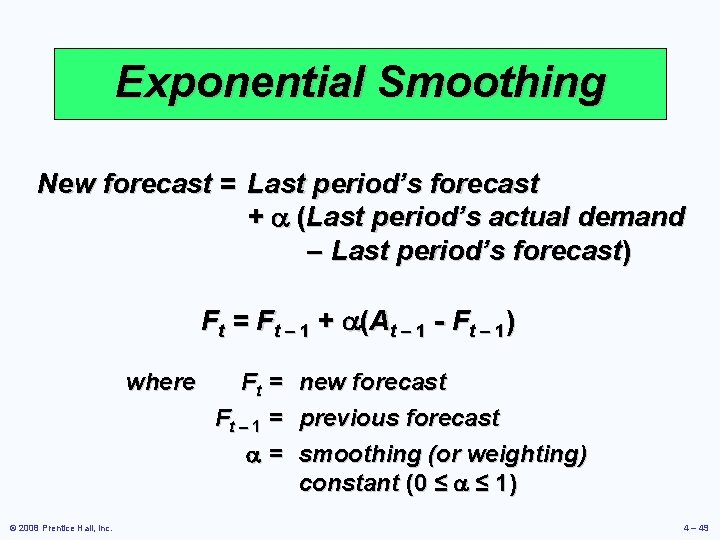

Exponential Smoothing New forecast = Last period’s forecast + (Last period’s actual demand – Last period’s forecast) F t = F t – 1 + (A t – 1 - F t – 1 ) where © 2008 Prentice Hall, Inc. Ft = new forecast Ft – 1 = previous forecast = smoothing (or weighting) constant (0 ≤ ≤ 1) 4 – 49

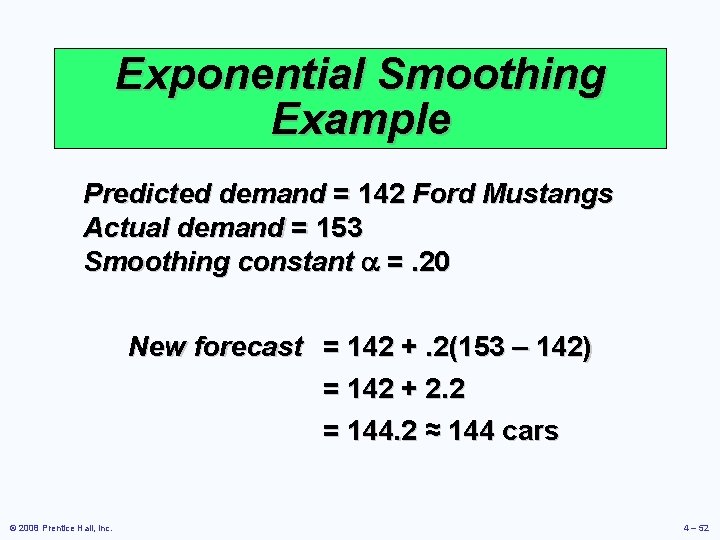

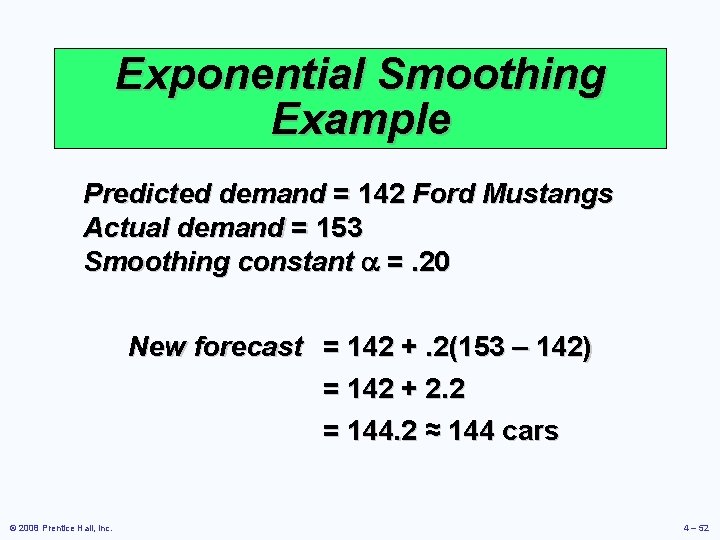

Exponential Smoothing Example Predicted demand = 142 Ford Mustangs Actual demand = 153 Smoothing constant =. 20 © 2008 Prentice Hall, Inc. 4 – 50

Exponential Smoothing Example Predicted demand = 142 Ford Mustangs Actual demand = 153 Smoothing constant =. 20 New forecast = 142 +. 2(153 – 142) © 2008 Prentice Hall, Inc. 4 – 51

Exponential Smoothing Example Predicted demand = 142 Ford Mustangs Actual demand = 153 Smoothing constant =. 20 New forecast = 142 +. 2(153 – 142) = 142 + 2. 2 = 144. 2 ≈ 144 cars © 2008 Prentice Hall, Inc. 4 – 52

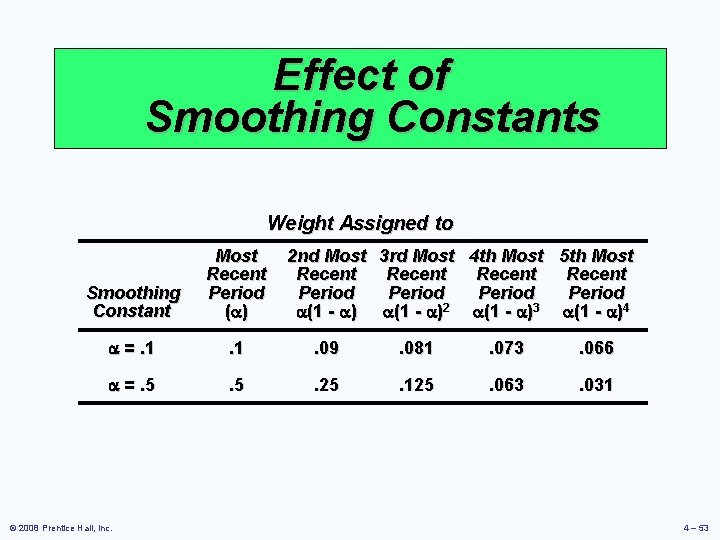

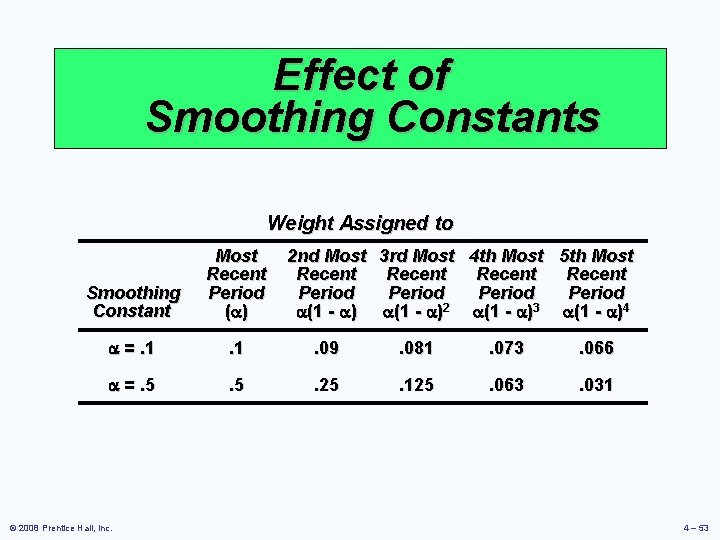

Effect of Smoothing Constants Weight Assigned to Smoothing Constant Most Recent Period ( ) =. 1 . 09 . 081 . 073 . 066 =. 5 . 25 . 125 . 063 . 031 © 2008 Prentice Hall, Inc. 2 nd Most 3 rd Most 4 th Most 5 th Most Recent Period 2 3 (1 - )4 4 – 53

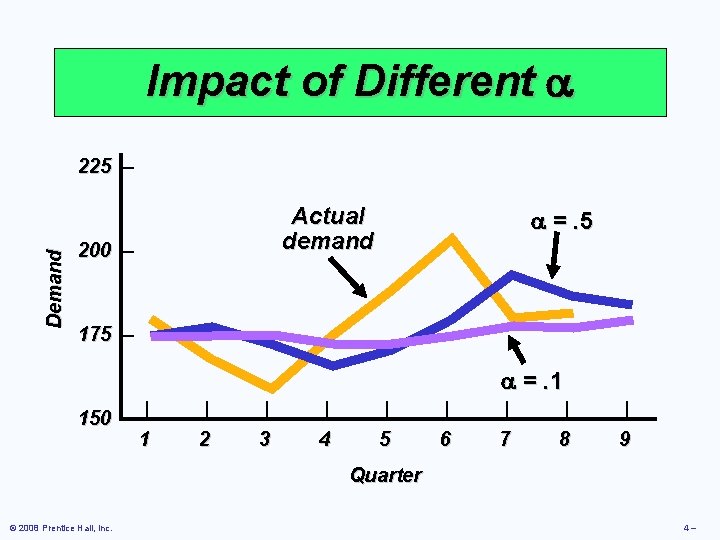

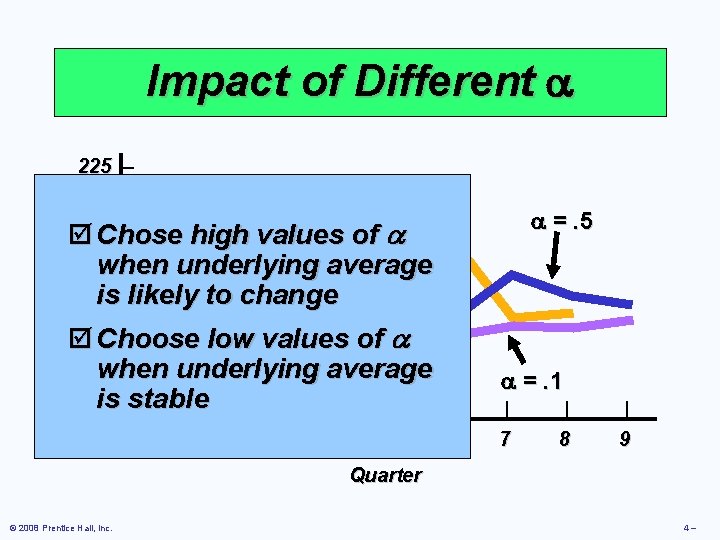

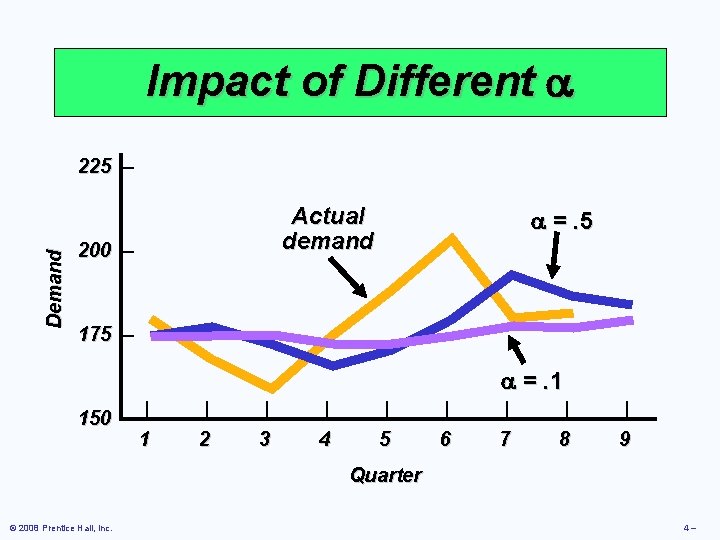

Impact of Different Demand 225 – Actual demand 200 – =. 5 175 – =. 1 150 – | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 Quarter © 2008 Prentice Hall, Inc. 4–

Impact of Different Demand 225 – Actual þ Chose high values of demand 200 – =. 5 when underlying average is likely to change 175 – þ Choose low values of when underlying average is stable | | | 150 – 1 2 3 4 5 =. 1 | 6 | 7 | 8 | 9 Quarter © 2008 Prentice Hall, Inc. 4–

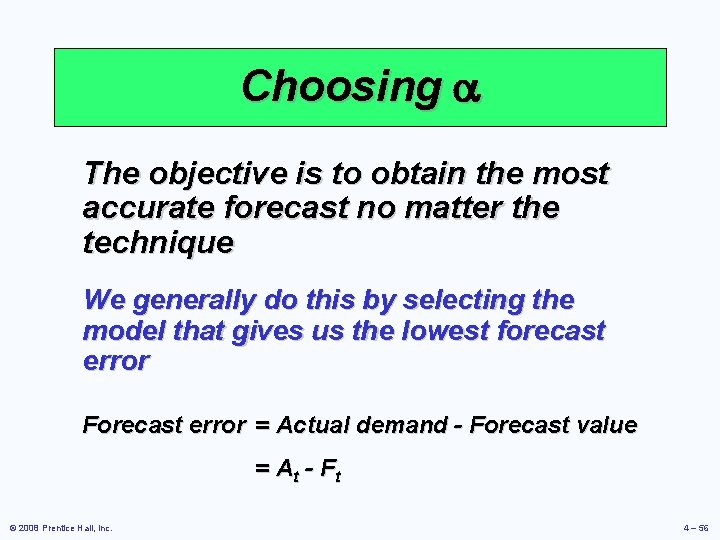

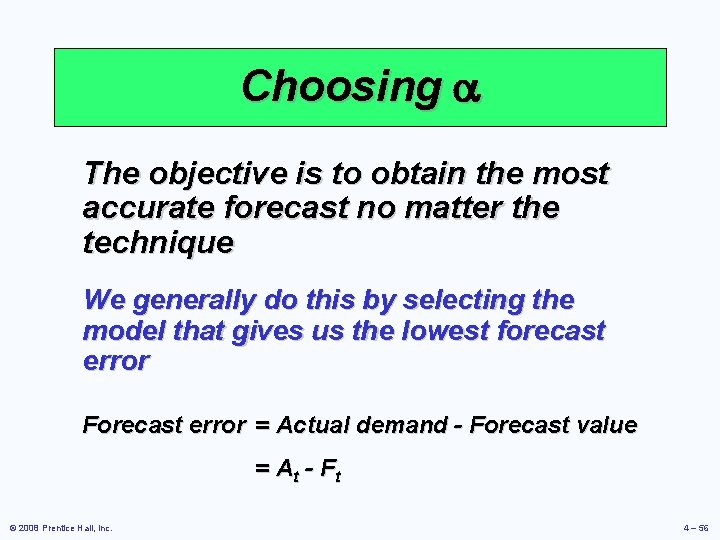

Choosing The objective is to obtain the most accurate forecast no matter the technique We generally do this by selecting the model that gives us the lowest forecast error Forecast error = Actual demand - Forecast value = At - Ft © 2008 Prentice Hall, Inc. 4 – 56

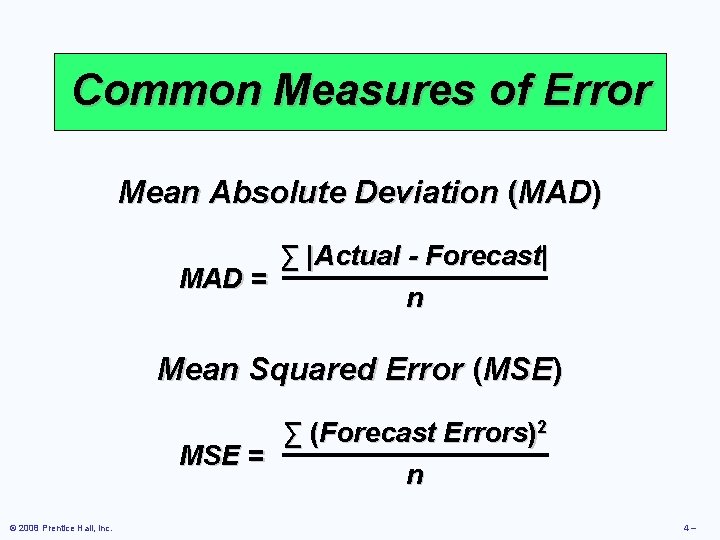

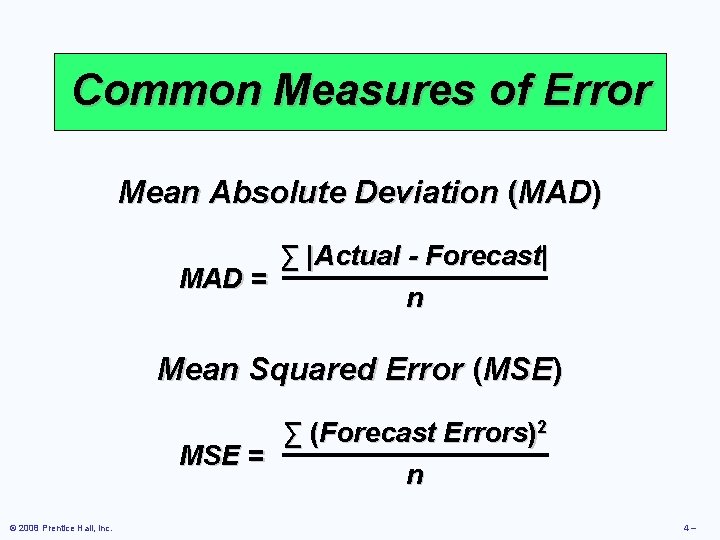

Common Measures of Error Mean Absolute Deviation (MAD) ∑ |Actual - Forecast| MAD = n Mean Squared Error (MSE) ∑ (Forecast Errors)2 MSE = n © 2008 Prentice Hall, Inc. 4–

Common Measures of Error Mean Absolute Percent Error (MAPE) n MAPE = © 2008 Prentice Hall, Inc. ∑ 100|Actuali - Forecasti|/Actuali i=1 n 4–

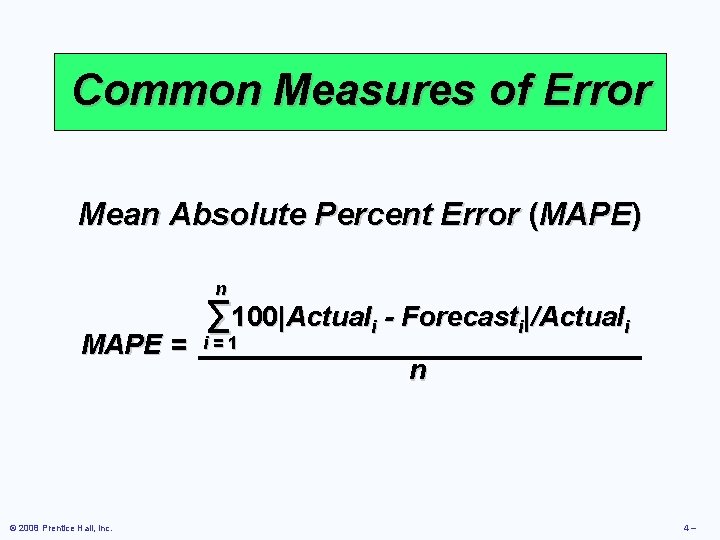

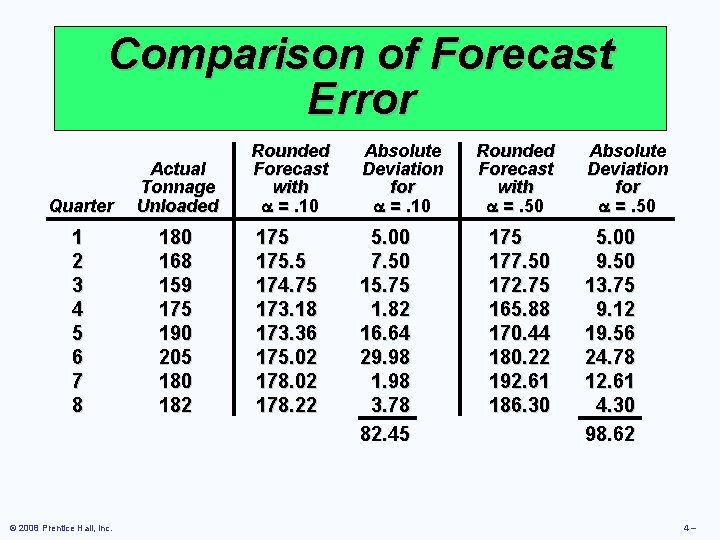

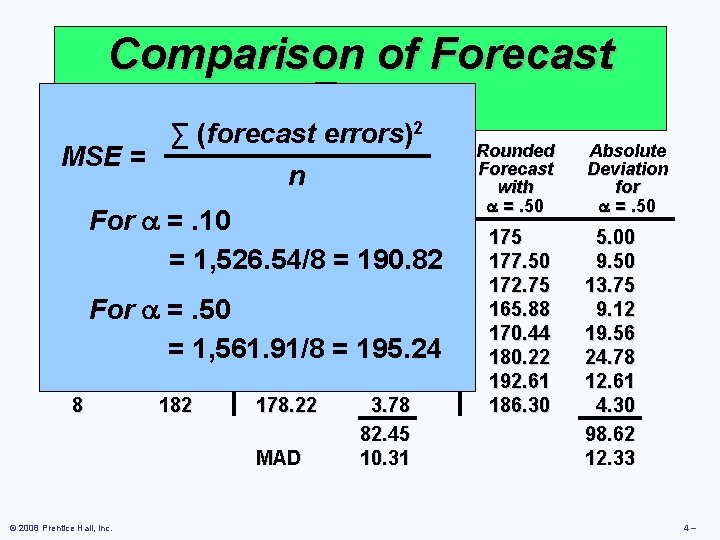

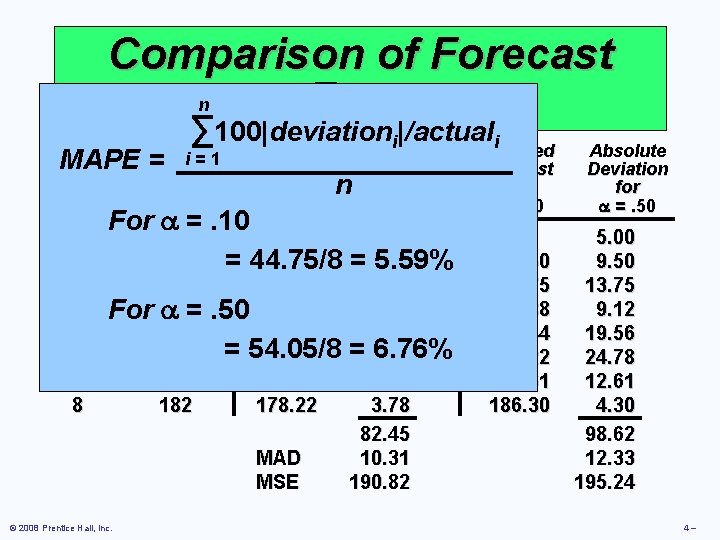

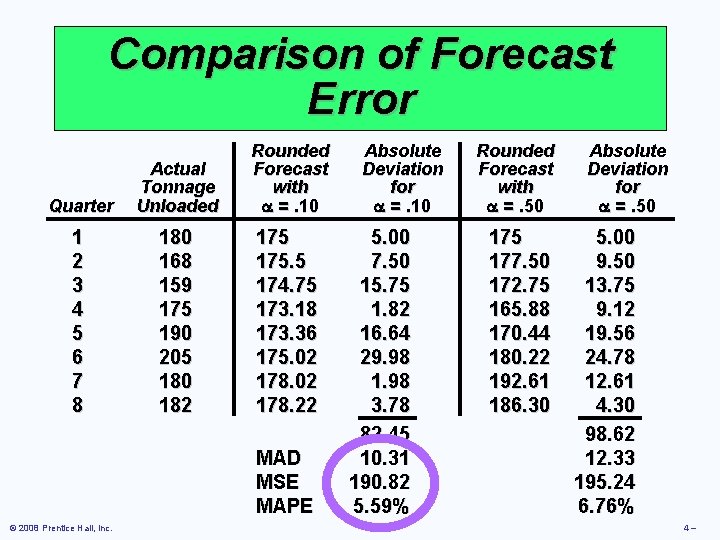

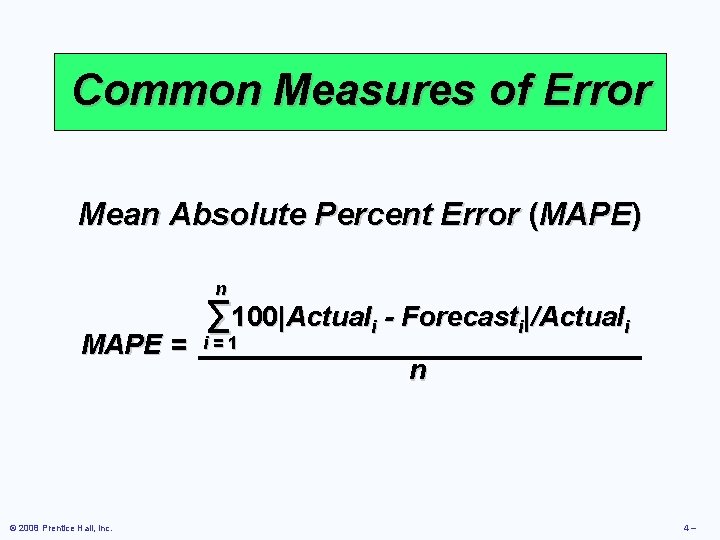

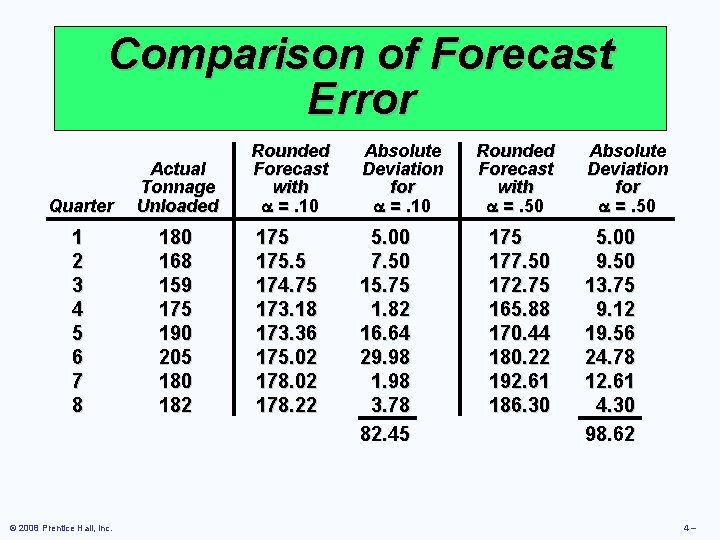

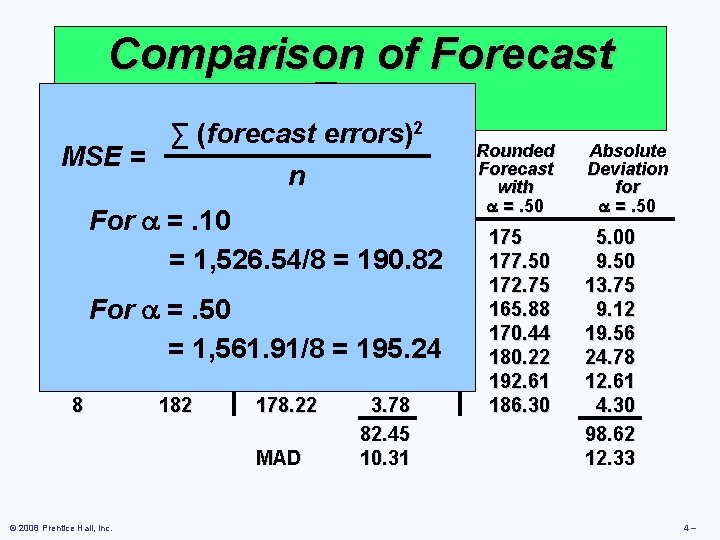

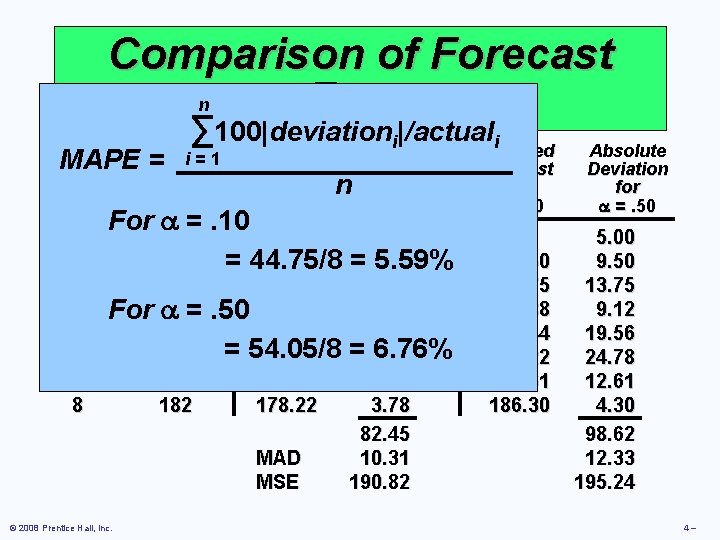

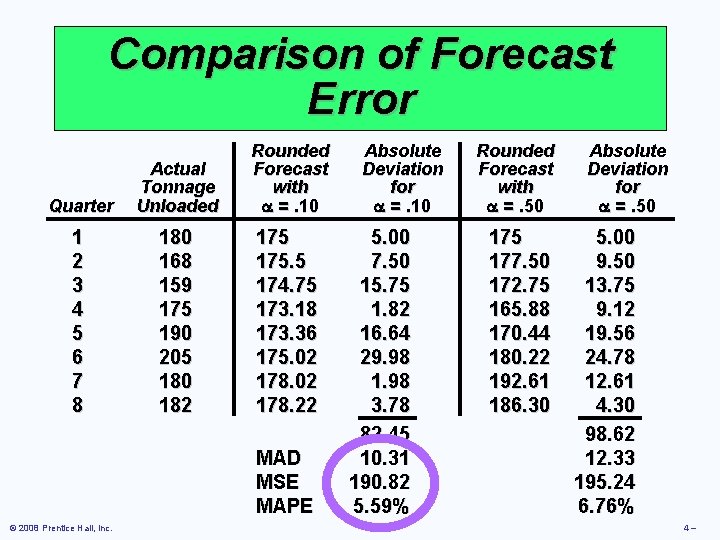

Comparison of Forecast Error Quarter Actual Tonnage Unloaded Rounded Forecast with =. 10 Absolute Deviation for =. 10 1 2 3 4 5 6 7 8 180 168 159 175 190 205 180 182 175. 5 174. 75 173. 18 173. 36 175. 02 178. 22 5. 00 7. 50 15. 75 1. 82 16. 64 29. 98 1. 98 3. 78 82. 45 © 2008 Prentice Hall, Inc. Rounded Forecast with =. 50 175 177. 50 172. 75 165. 88 170. 44 180. 22 192. 61 186. 30 Absolute Deviation for =. 50 5. 00 9. 50 13. 75 9. 12 19. 56 24. 78 12. 61 4. 30 98. 62 4–

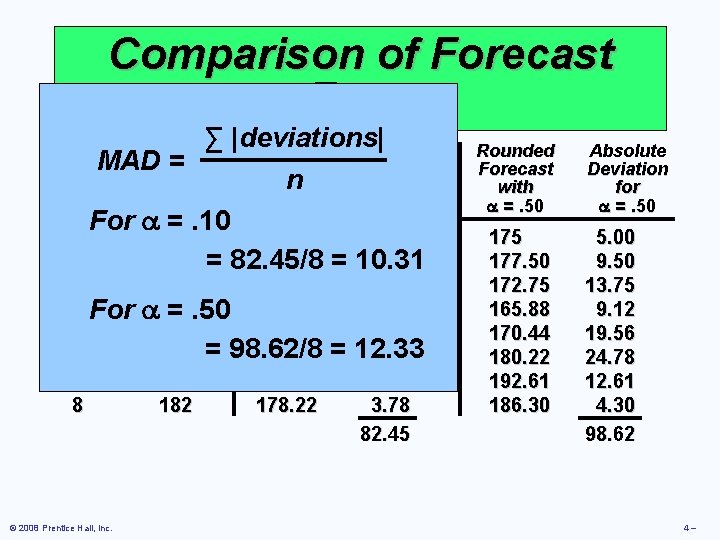

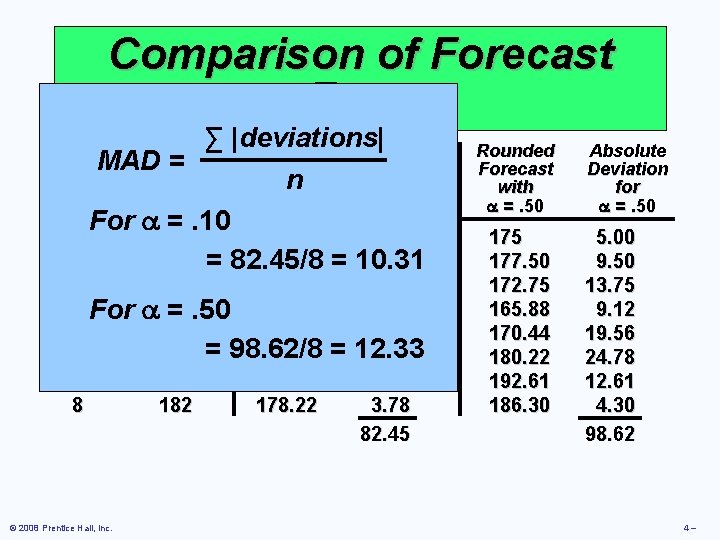

Comparison of Forecast Error ∑ |deviations| Rounded Absolute MADActual = Quarter Tonnage Unloaded Forecast n with =. 10 Deviation for =. 10 For 180 =. 10 175 5. 00 168 = 82. 45/8 175. 5 = 10. 31 7. 50 1 2 3 4 For 5 6 7 8 © 2008 Prentice Hall, Inc. 159 174. 75 175 =. 50 173. 18 190 173. 36 205 = 98. 62/8 175. 02 180 178. 02 182 178. 22 = 15. 75 1. 82 16. 64 12. 33 29. 98 1. 98 3. 78 82. 45 Rounded Forecast with =. 50 175 177. 50 172. 75 165. 88 170. 44 180. 22 192. 61 186. 30 Absolute Deviation for =. 50 5. 00 9. 50 13. 75 9. 12 19. 56 24. 78 12. 61 4. 30 98. 62 4–

Comparison of Forecast Error 2 ∑ (forecast errors) Rounded Absolute MSE = Actual Quarter Tonnage Unloaded Rounded Forecast n with =. 10 Absolute Deviation for =. 10 For 180 =. 10 175 5. 00 168 175. 5 = 190. 82 7. 50 = 1, 526. 54/8 1 2 3 4 For 5 6 7 8 159 174. 75 175 =. 50 173. 18 190 173. 36 = 1, 561. 91/8 205 175. 02 180 178. 02 182 178. 22 MAD © 2008 Prentice Hall, Inc. = 15. 75 1. 82 16. 64 195. 24 29. 98 1. 98 3. 78 82. 45 10. 31 Rounded Forecast with =. 50 175 177. 50 172. 75 165. 88 170. 44 180. 22 192. 61 186. 30 Absolute Deviation for =. 50 5. 00 9. 50 13. 75 9. 12 19. 56 24. 78 12. 61 4. 30 98. 62 12. 33 4–

Comparison of Forecast n Error ∑ 100|deviation |/actuali i Rounded Absolute Rounded i=1 MAPE = Actual Quarter 1 2 3 4 5 6 7 8 Tonnage Unloaded Forecast with =. 10 n Deviation for =. 10 For 180 =. 10 175 5. 00 168 175. 5 = 44. 75/8 = 7. 50 5. 59% 159 For 175 = 190 205 180 182 174. 75. 50 173. 18 173. 36 = 54. 05/8 175. 02 178. 22 MAD MSE © 2008 Prentice Hall, Inc. 15. 75 1. 82 16. 64 =29. 98 6. 76% 1. 98 3. 78 82. 45 10. 31 190. 82 Forecast with =. 50 175 177. 50 172. 75 165. 88 170. 44 180. 22 192. 61 186. 30 Absolute Deviation for =. 50 5. 00 9. 50 13. 75 9. 12 19. 56 24. 78 12. 61 4. 30 98. 62 12. 33 195. 24 4–

Comparison of Forecast Error Quarter Actual Tonnage Unloaded Rounded Forecast with =. 10 1 2 3 4 5 6 7 8 180 168 159 175 190 205 180 182 175. 5 174. 75 173. 18 173. 36 175. 02 178. 22 MAD MSE MAPE © 2008 Prentice Hall, Inc. Absolute Deviation for =. 10 5. 00 7. 50 15. 75 1. 82 16. 64 29. 98 1. 98 3. 78 82. 45 10. 31 190. 82 5. 59% Rounded Forecast with =. 50 175 177. 50 172. 75 165. 88 170. 44 180. 22 192. 61 186. 30 Absolute Deviation for =. 50 5. 00 9. 50 13. 75 9. 12 19. 56 24. 78 12. 61 4. 30 98. 62 12. 33 195. 24 6. 76% 4–

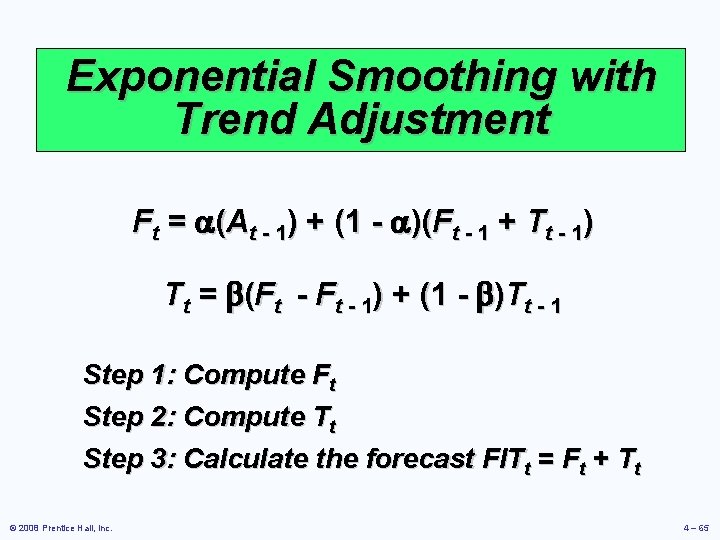

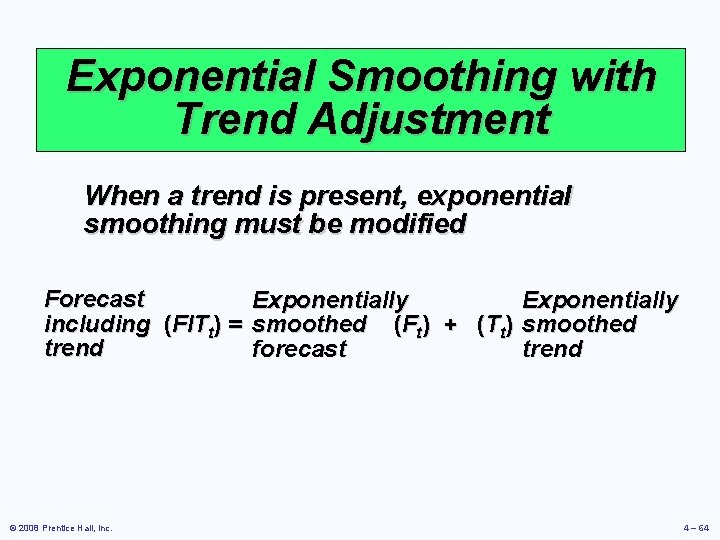

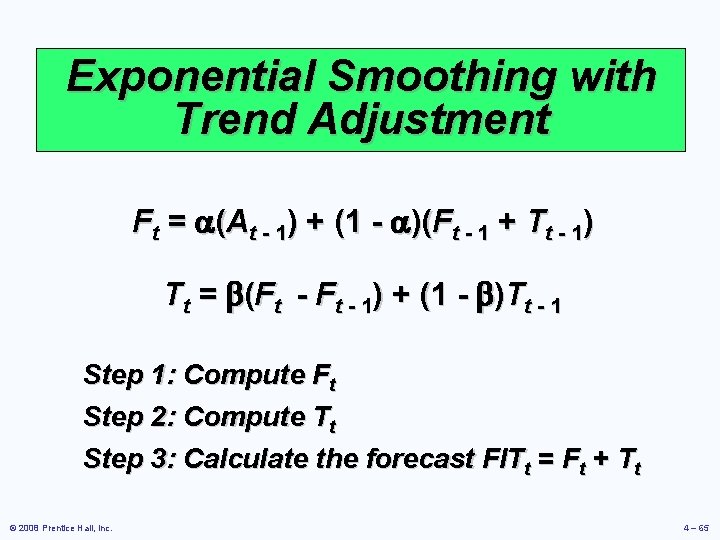

Exponential Smoothing with Trend Adjustment When a trend is present, exponential smoothing must be modified Forecast including (FITt) = trend © 2008 Prentice Hall, Inc. Exponentially smoothed (Ft) + (Tt) forecast Exponentially smoothed trend 4 – 64

Exponential Smoothing with Trend Adjustment Ft = (At - 1) + (1 - )(Ft - 1 + Tt - 1) Tt = (Ft - 1) + (1 - )Tt - 1 Step 1: Compute Ft Step 2: Compute Tt Step 3: Calculate the forecast FITt = Ft + Tt © 2008 Prentice Hall, Inc. 4 – 65

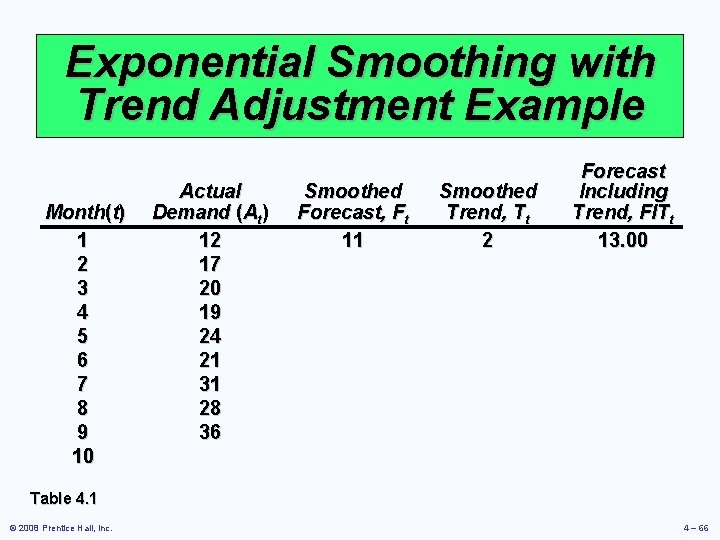

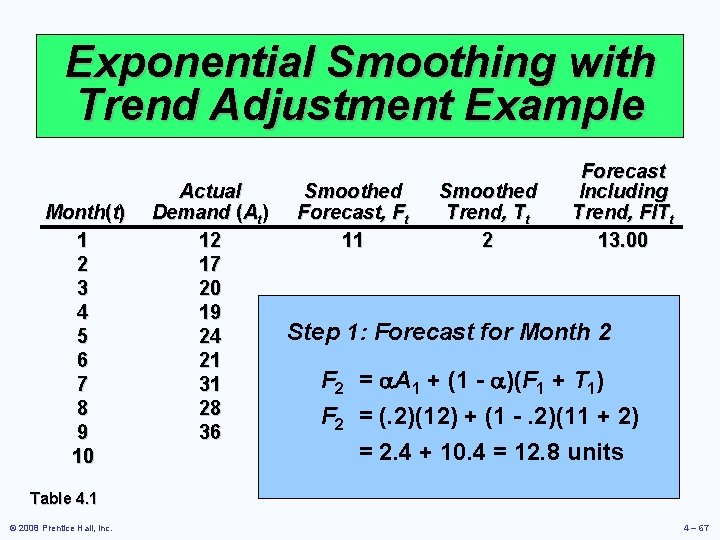

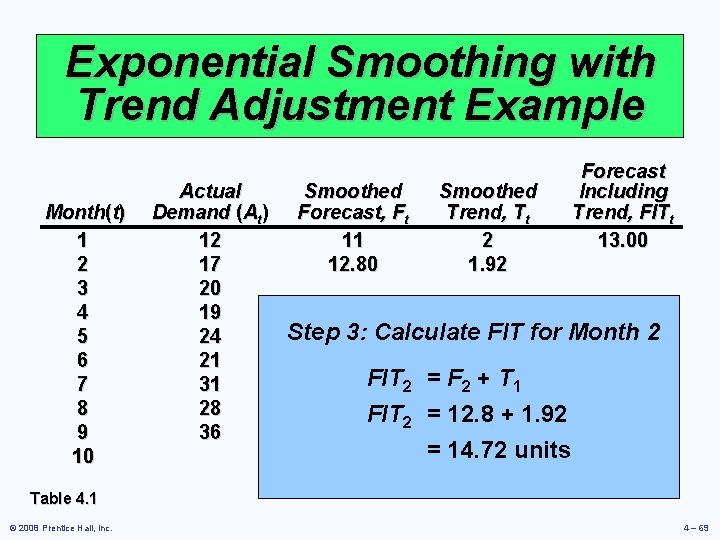

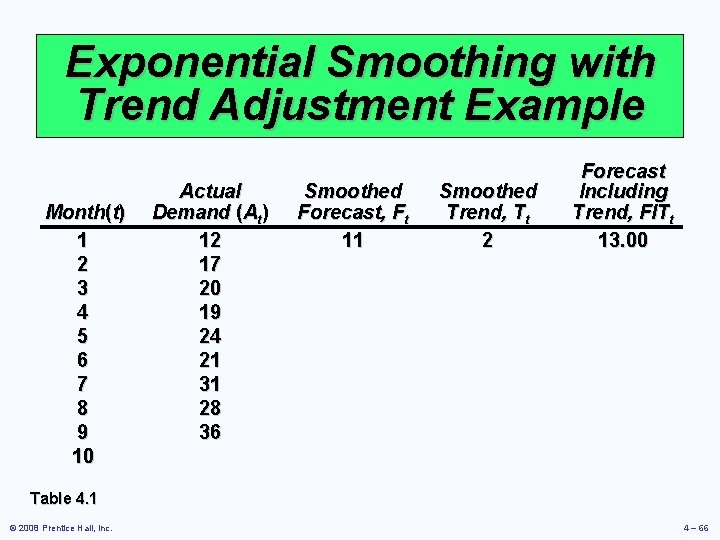

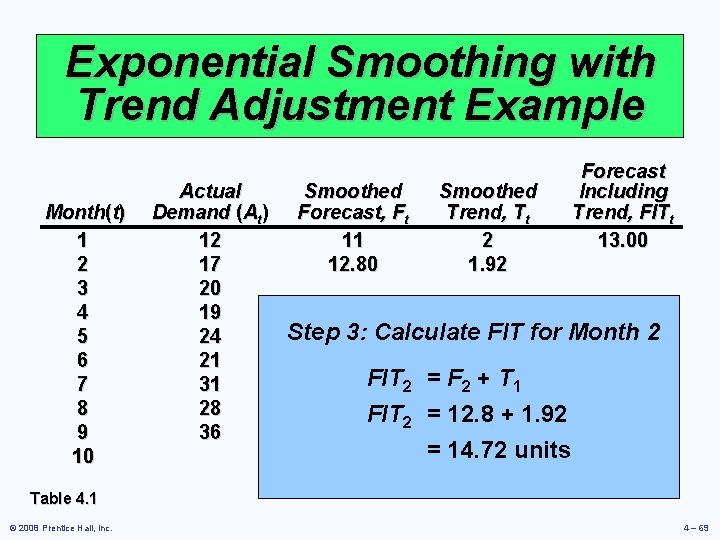

Exponential Smoothing with Trend Adjustment Example Month(t) 1 2 3 4 5 6 7 8 9 10 Actual Demand (At) 12 17 20 19 24 21 31 28 36 Smoothed Forecast, Ft 11 Smoothed Trend, Tt 2 Forecast Including Trend, FITt 13. 00 Table 4. 1 © 2008 Prentice Hall, Inc. 4 – 66

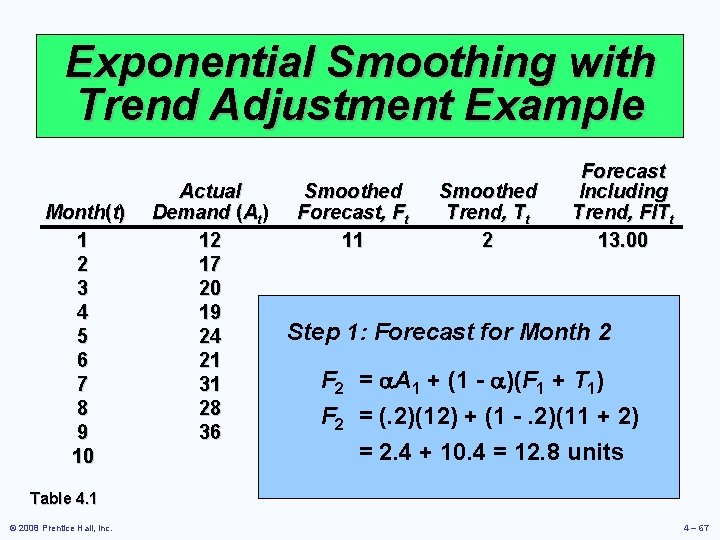

Exponential Smoothing with Trend Adjustment Example Month(t) 1 2 3 4 5 6 7 8 9 10 Actual Demand (At) 12 17 20 19 24 21 31 28 36 Smoothed Forecast, Ft 11 Smoothed Trend, Tt 2 Forecast Including Trend, FITt 13. 00 Step 1: Forecast for Month 2 F 2 = A 1 + (1 - )(F 1 + T 1) F 2 = (. 2)(12) + (1 -. 2)(11 + 2) = 2. 4 + 10. 4 = 12. 8 units Table 4. 1 © 2008 Prentice Hall, Inc. 4 – 67

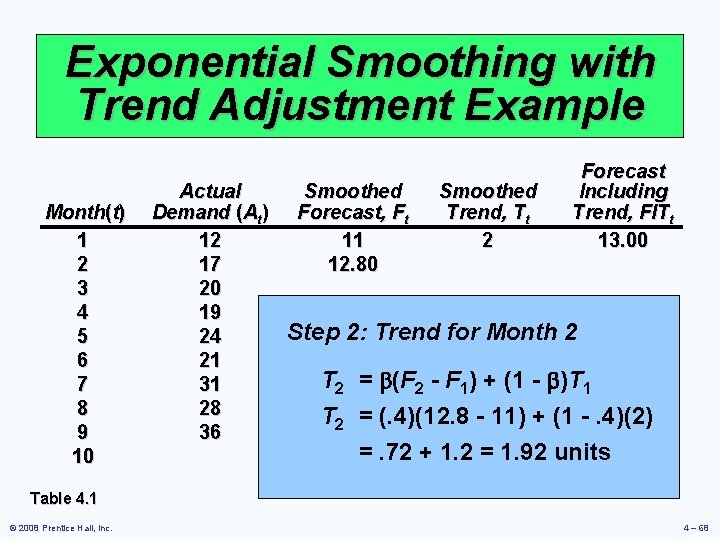

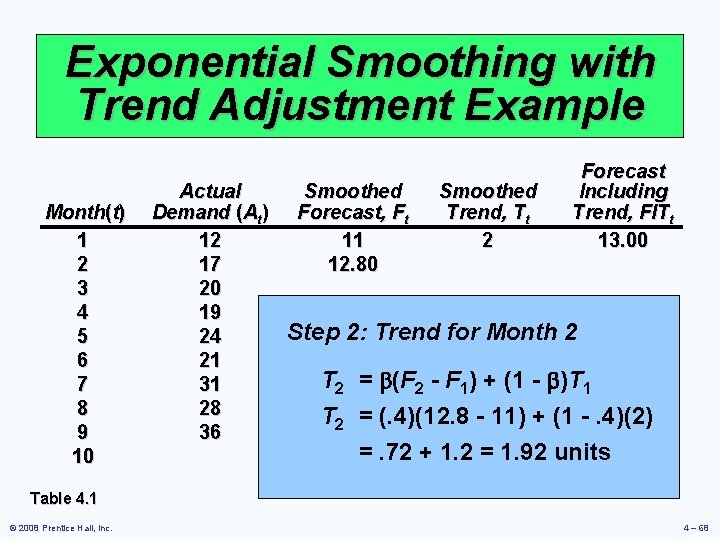

Exponential Smoothing with Trend Adjustment Example Month(t) 1 2 3 4 5 6 7 8 9 10 Actual Demand (At) 12 17 20 19 24 21 31 28 36 Smoothed Forecast, Ft 11 12. 80 Smoothed Trend, Tt 2 Forecast Including Trend, FITt 13. 00 Step 2: Trend for Month 2 T 2 = (F 2 - F 1) + (1 - )T 1 T 2 = (. 4)(12. 8 - 11) + (1 -. 4)(2) =. 72 + 1. 2 = 1. 92 units Table 4. 1 © 2008 Prentice Hall, Inc. 4 – 68

Exponential Smoothing with Trend Adjustment Example Month(t) 1 2 3 4 5 6 7 8 9 10 Actual Demand (At) 12 17 20 19 24 21 31 28 36 Smoothed Forecast, Ft 11 12. 80 Smoothed Trend, Tt 2 1. 92 Forecast Including Trend, FITt 13. 00 Step 3: Calculate FIT for Month 2 FIT 2 = F 2 + T 1 FIT 2 = 12. 8 + 1. 92 = 14. 72 units Table 4. 1 © 2008 Prentice Hall, Inc. 4 – 69

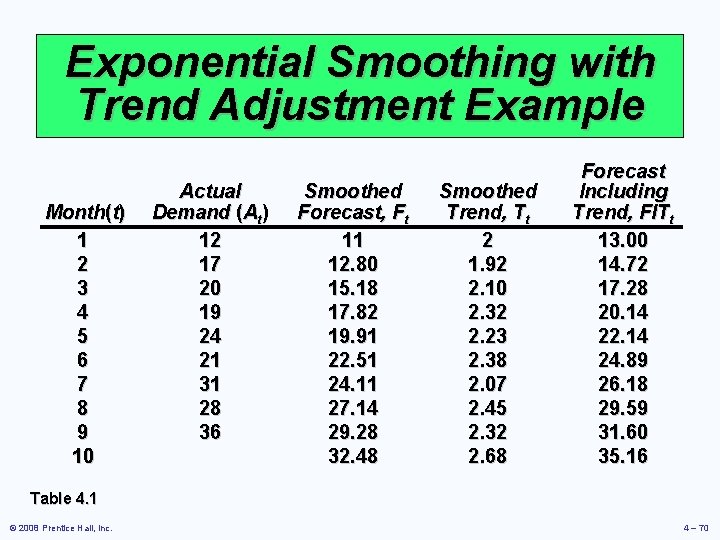

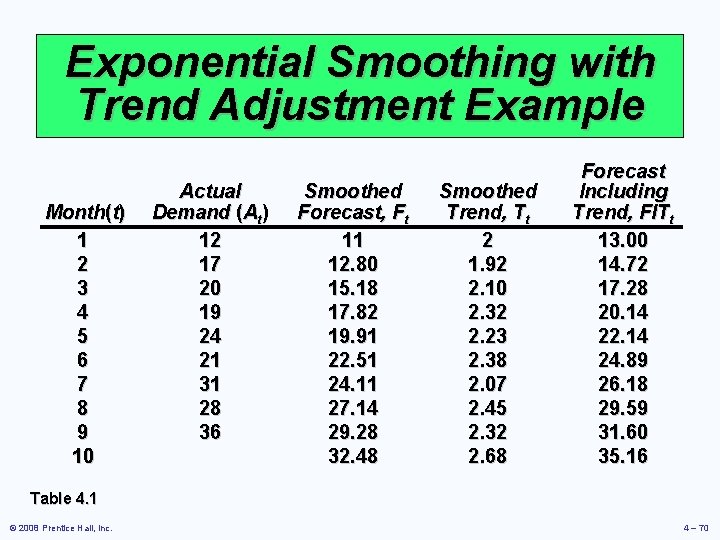

Exponential Smoothing with Trend Adjustment Example Month(t) 1 2 3 4 5 6 7 8 9 10 Actual Demand (At) 12 17 20 19 24 21 31 28 36 Smoothed Forecast, Ft 11 12. 80 15. 18 17. 82 19. 91 22. 51 24. 11 27. 14 29. 28 32. 48 Smoothed Trend, Tt 2 1. 92 2. 10 2. 32 2. 23 2. 38 2. 07 2. 45 2. 32 2. 68 Forecast Including Trend, FITt 13. 00 14. 72 17. 28 20. 14 22. 14 24. 89 26. 18 29. 59 31. 60 35. 16 Table 4. 1 © 2008 Prentice Hall, Inc. 4 – 70

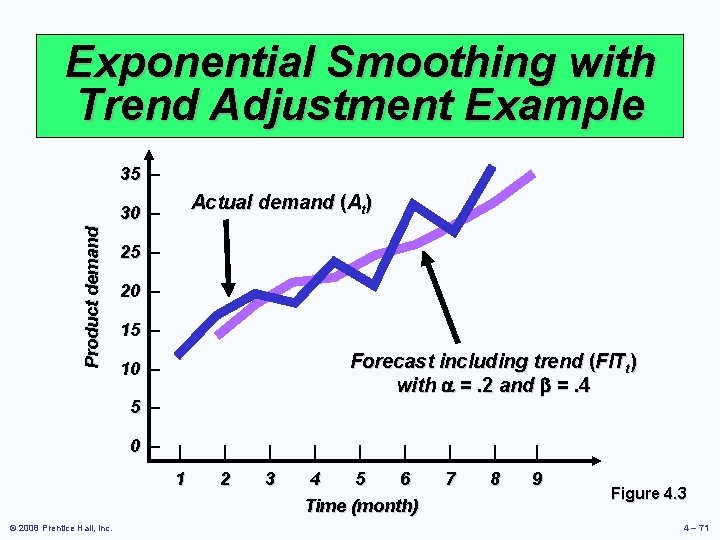

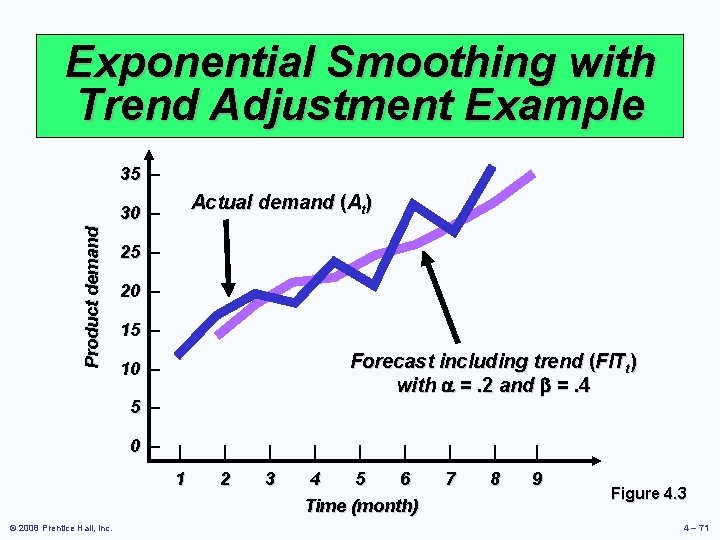

Exponential Smoothing with Trend Adjustment Example 35 – Actual demand (At) Product demand 30 – 25 – 20 – 15 – Forecast including trend (FITt) with =. 2 and =. 4 10 – 5 – © 2008 Prentice Hall, Inc. 0 – | | | 1 2 3 | | | 4 5 6 Time (month) | | | 7 8 9 Figure 4. 3 4 – 71

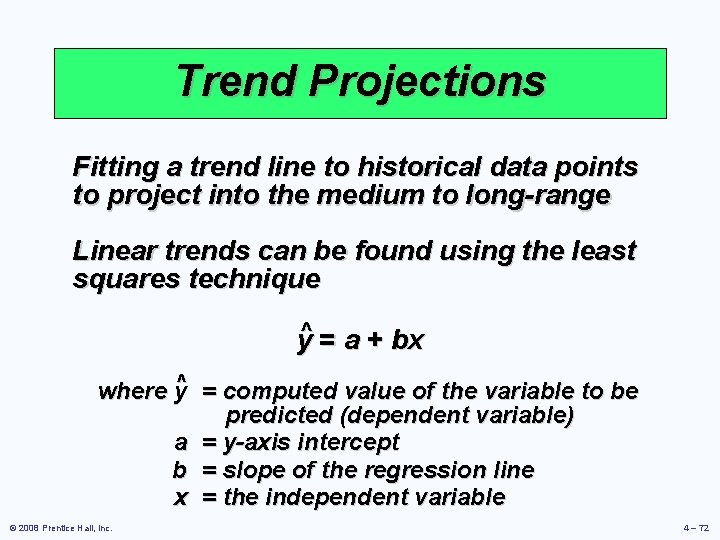

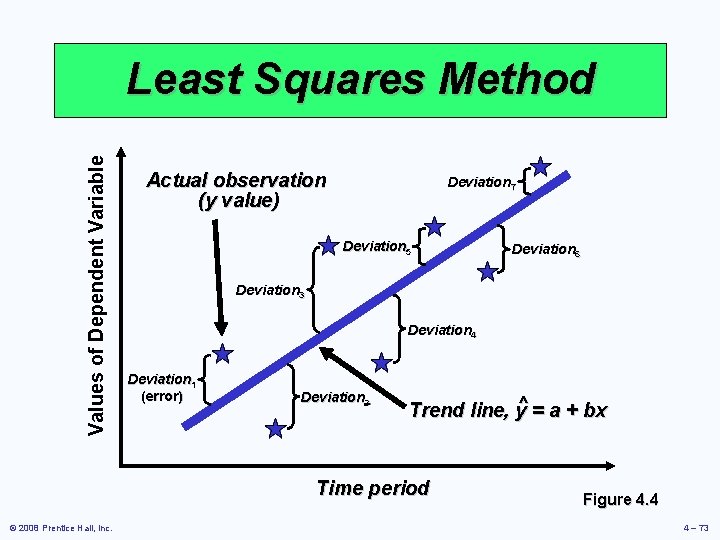

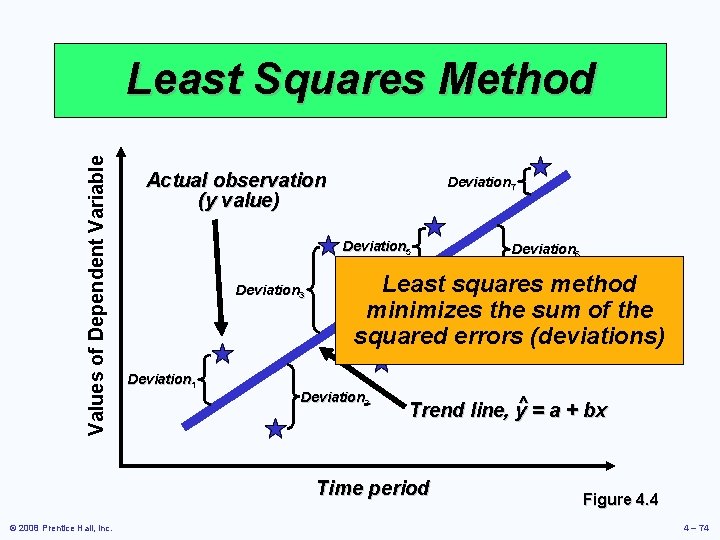

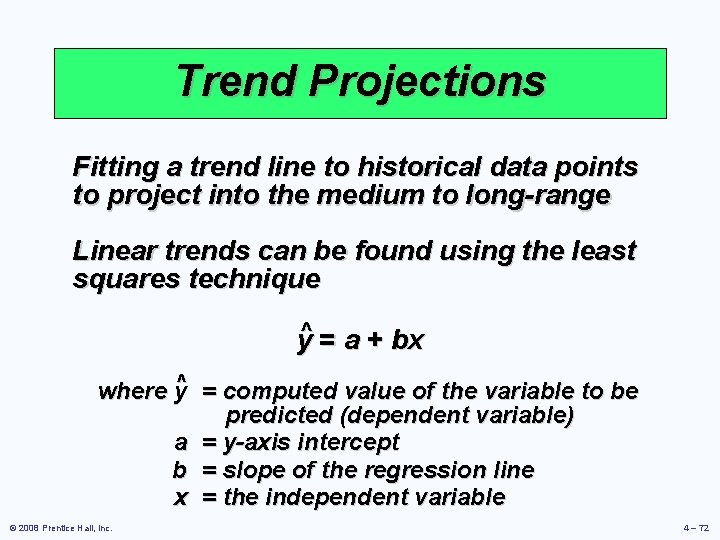

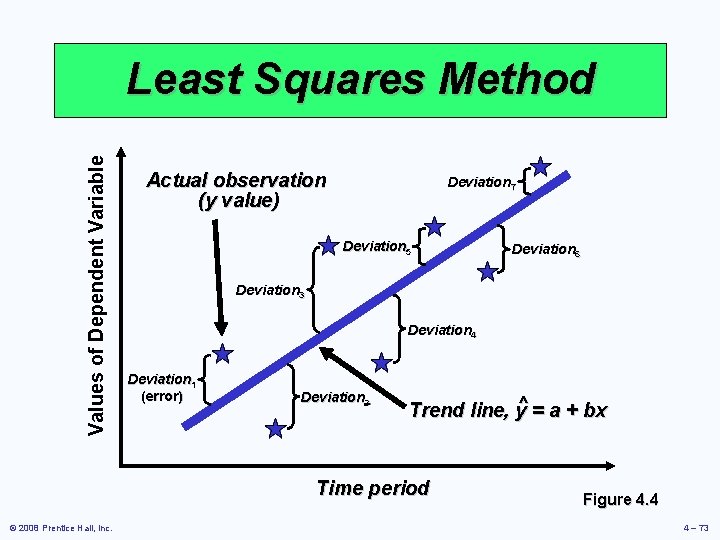

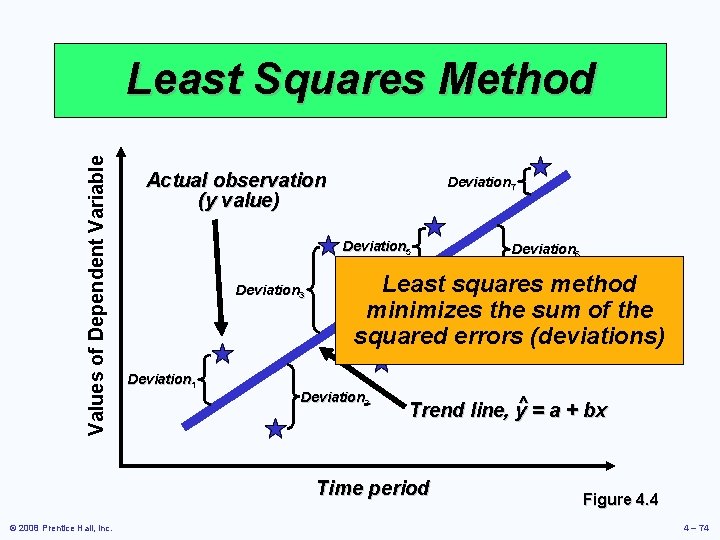

Trend Projections Fitting a trend line to historical data points to project into the medium to long-range Linear trends can be found using the least squares technique y^ = a + bx where y^ = computed value of the variable to be predicted (dependent variable) a = y-axis intercept b = slope of the regression line x = the independent variable © 2008 Prentice Hall, Inc. 4 – 72

Values of Dependent Variable Least Squares Method Actual observation (y value) Deviation 7 Deviation 5 Deviation 3 Deviation 4 Deviation 1 (error) Deviation 2 Trend line, y^ = a + bx Time period © 2008 Prentice Hall, Inc. Deviation 6 Figure 4. 4 4 – 73

Values of Dependent Variable Least Squares Method Actual observation (y value) Deviation 7 Deviation 5 Deviation 3 Least squares method minimizes the sum of the Deviation squared errors (deviations) 4 Deviation 1 Deviation 2 Trend line, y^ = a + bx Time period © 2008 Prentice Hall, Inc. Deviation 6 Figure 4. 4 4 – 74

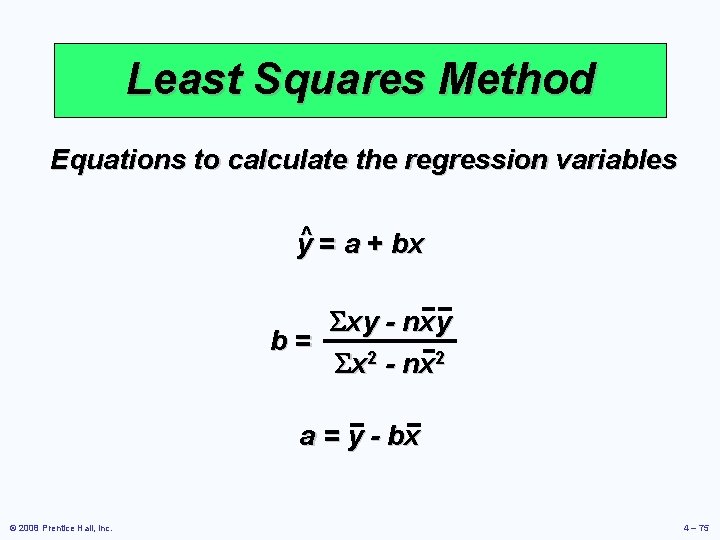

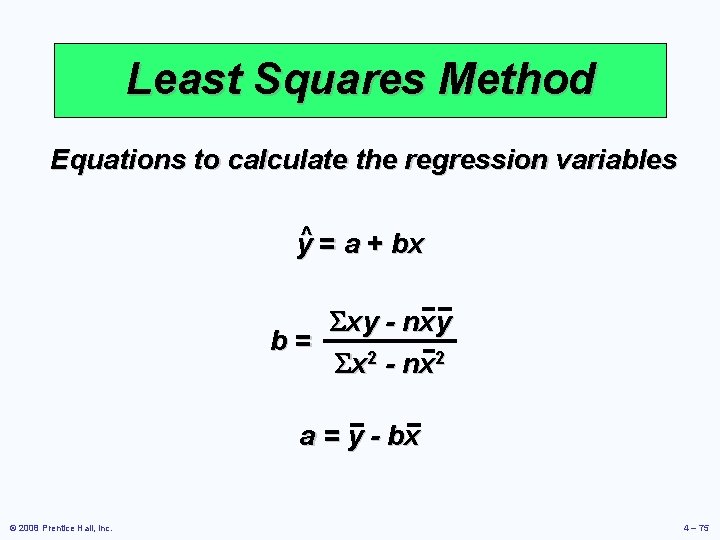

Least Squares Method Equations to calculate the regression variables y^ = a + bx Sxy - nxy b= Sx 2 - nx 2 a = y - bx © 2008 Prentice Hall, Inc. 4 – 75

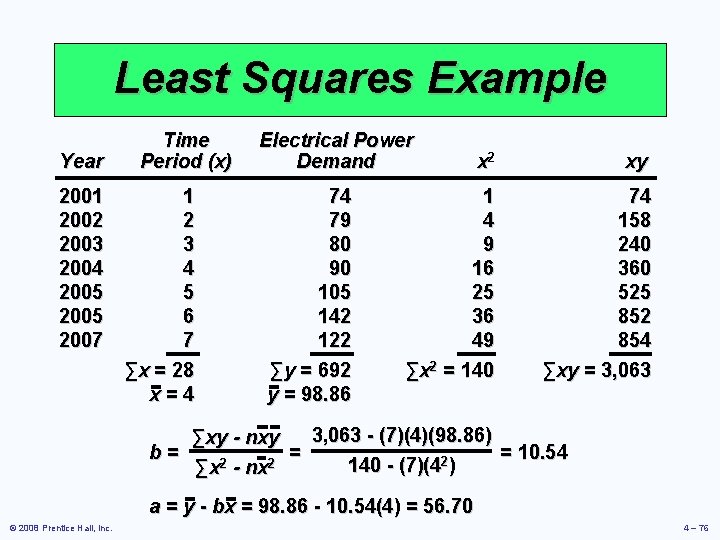

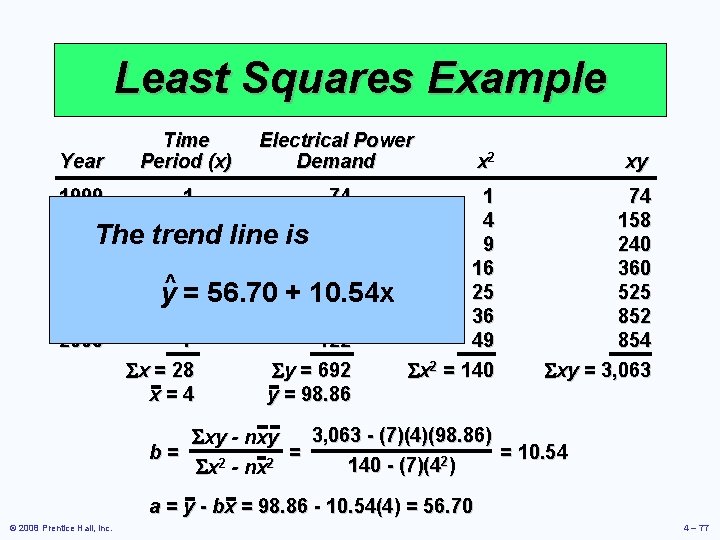

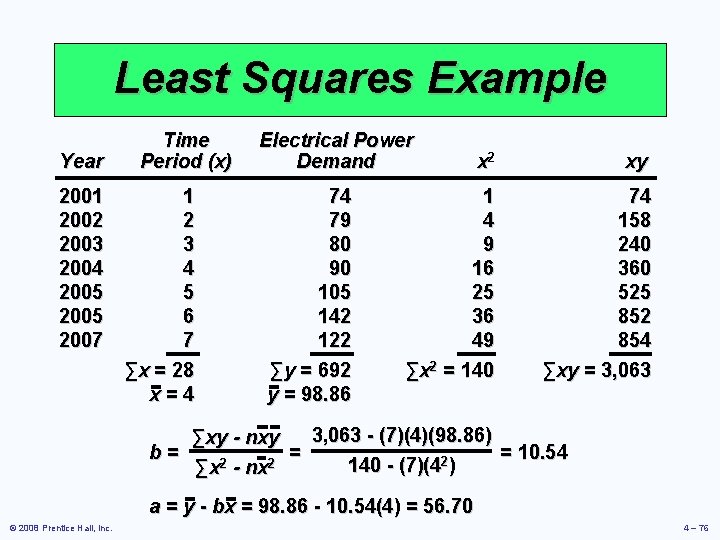

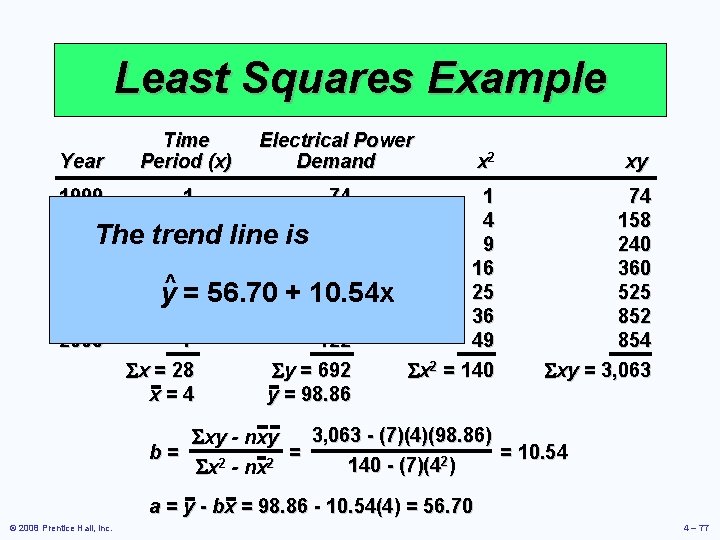

Least Squares Example Year 2001 2002 2003 2004 2005 2007 Time Period (x) 1 2 3 4 5 6 7 ∑x = 28 x=4 Electrical Power Demand 74 79 80 90 105 142 122 ∑y = 692 y = 98. 86 x 2 xy 1 4 9 16 25 36 49 ∑x 2 = 140 74 158 240 360 525 852 854 ∑xy = 3, 063 - (7)(4)(98. 86) ∑xy - nxy b= = = 10. 54 2 2 2 140 - (7)(4 ) ∑x - nx a = y - bx = 98. 86 - 10. 54(4) = 56. 70 © 2008 Prentice Hall, Inc. 4 – 76

Least Squares Example Year Time Period (x) Electrical Power Demand x 2 xy 1999 1 74 1 2000 2 79 4 line is 80 2001 The trend 3 9 2002 4 90 16 2003 105 25 y^ 5= 56. 70 + 10. 54 x 2004 6 142 36 2005 7 122 49 Sx = 28 Sy = 692 Sx 2 = 140 x=4 y = 98. 86 74 158 240 360 525 852 854 Sxy = 3, 063 - (7)(4)(98. 86) Sxy - nxy b= = = 10. 54 2 2 2 140 - (7)(4 ) Sx - nx a = y - bx = 98. 86 - 10. 54(4) = 56. 70 © 2008 Prentice Hall, Inc. 4 – 77

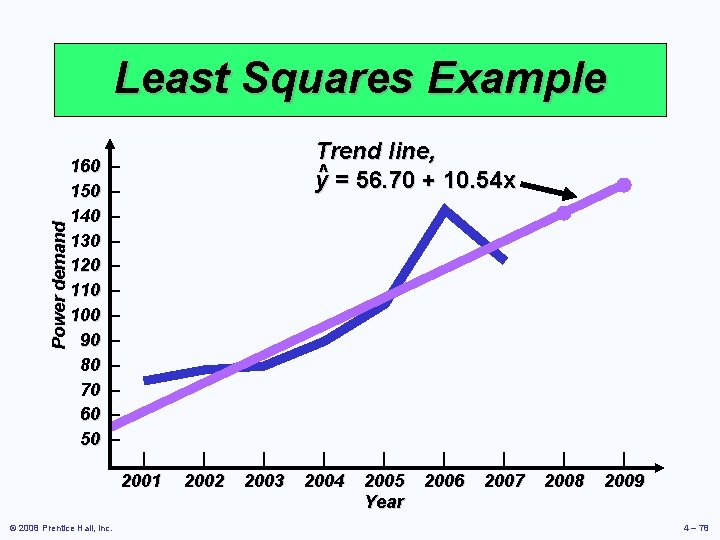

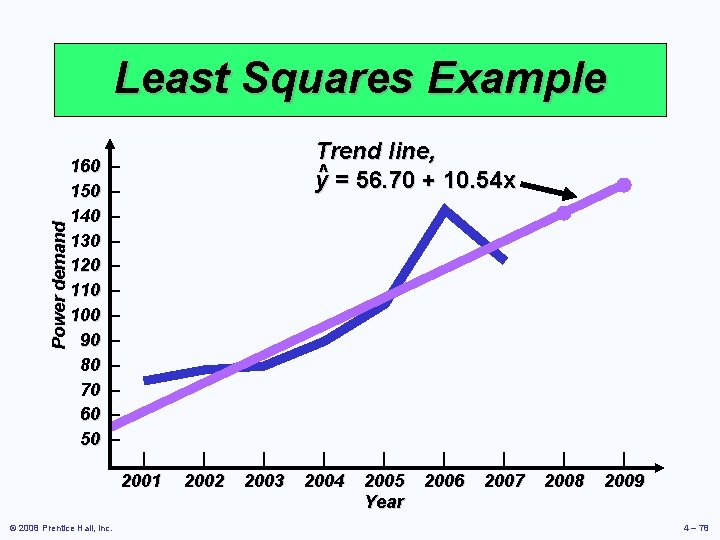

Power demand Least Squares Example 160 150 140 130 120 110 100 90 80 70 60 50 – – – © 2008 Prentice Hall, Inc. Trend line, y^ = 56. 70 + 10. 54 x | 2001 | 2002 | 2003 | 2004 | 2005 Year | 2006 | 2007 | 2008 | 2009 4 – 78

Seasonal Variations In Data The multiplicative seasonal model can adjust trend data for seasonal variations in demand © 2008 Prentice Hall, Inc. 4 – 80

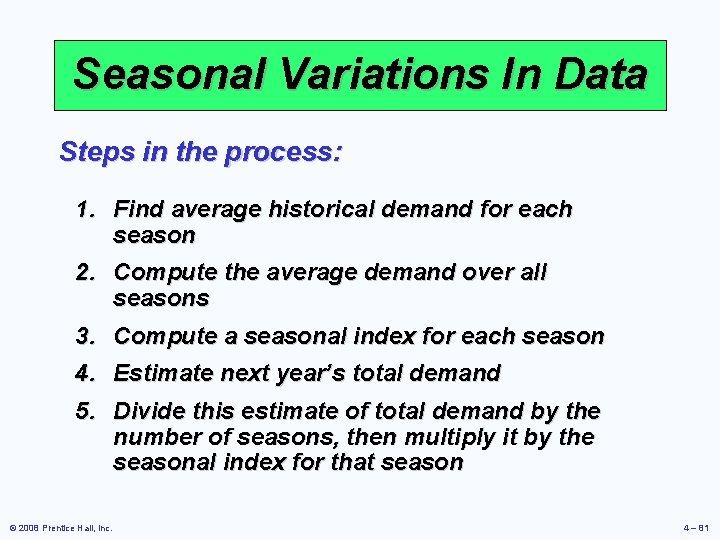

Seasonal Variations In Data Steps in the process: 1. Find average historical demand for each season 2. Compute the average demand over all seasons 3. Compute a seasonal index for each season 4. Estimate next year’s total demand 5. Divide this estimate of total demand by the number of seasons, then multiply it by the seasonal index for that season © 2008 Prentice Hall, Inc. 4 – 81

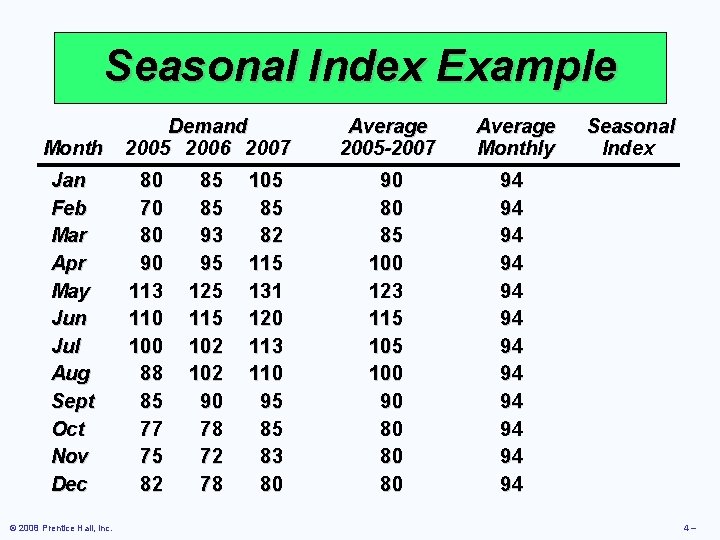

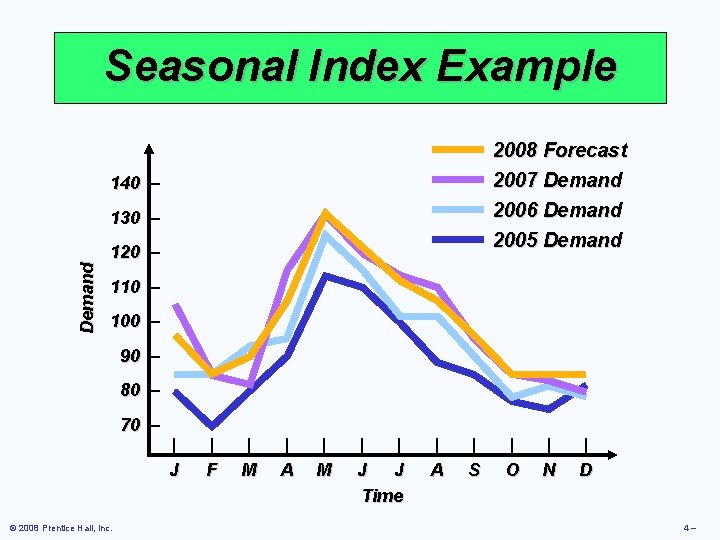

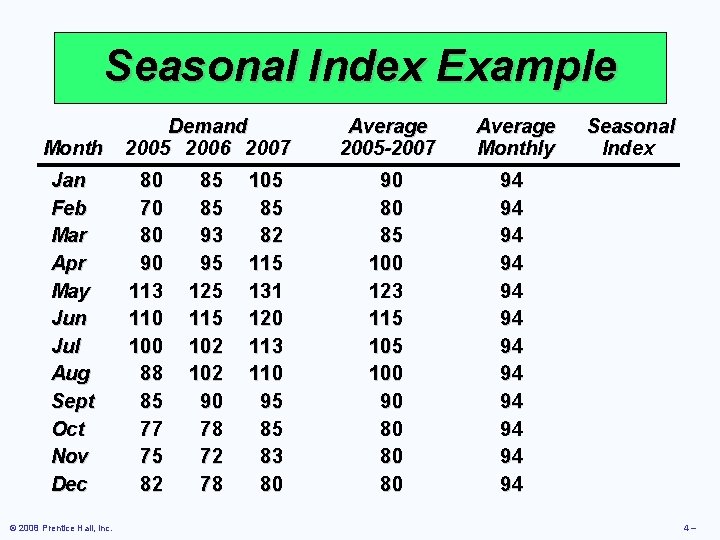

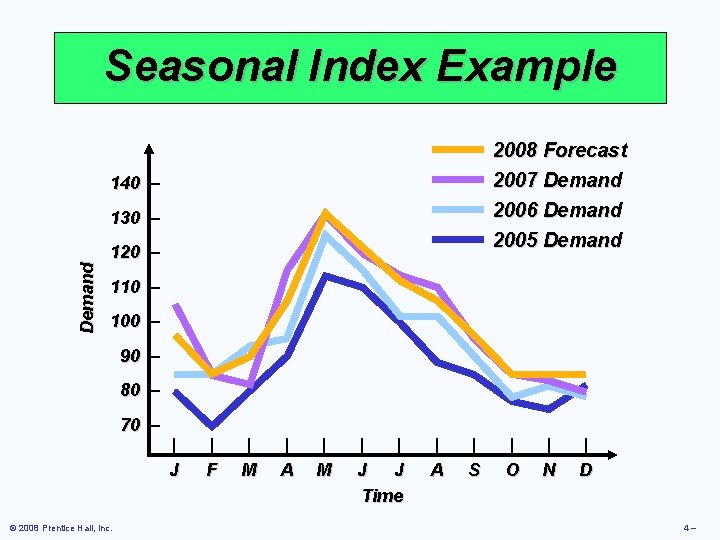

Seasonal Index Example Month Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec © 2008 Prentice Hall, Inc. Demand 2005 2006 2007 80 70 80 90 113 110 100 88 85 77 75 82 85 85 93 95 125 115 102 90 78 72 78 105 85 82 115 131 120 113 110 95 85 83 80 Average 2005 -2007 Average Monthly 90 80 85 100 123 115 100 90 80 80 80 94 94 94 Seasonal Index 4–

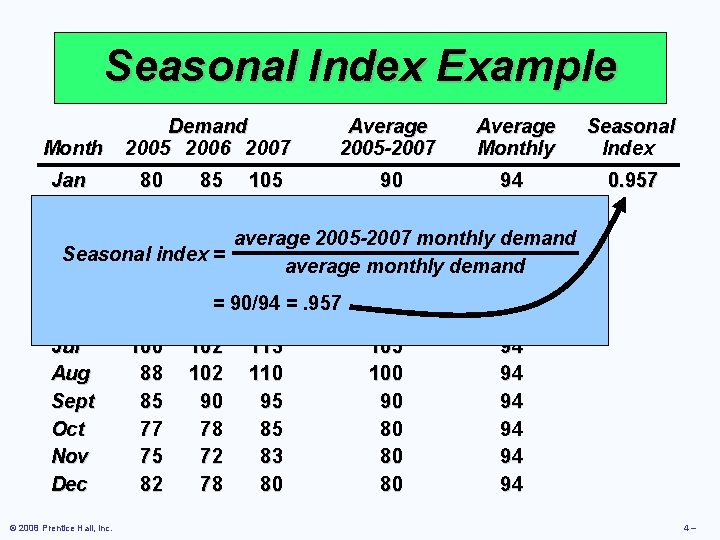

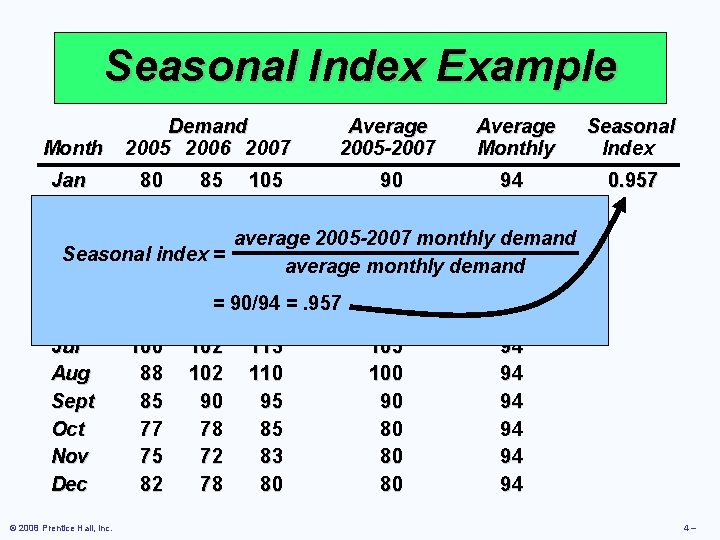

Seasonal Index Example Month Demand 2005 2006 2007 Average 2005 -2007 Average Monthly Jan 80 85 105 90 94 Feb 70 85 85 80 94 Mar 80 93 average 82 85 monthly demand 94 2005 -2007 Seasonal 90 index 95= 115 Apr 100 94 average monthly demand May 113 125 131 123 94 = 90/94 =. 957 Jun 110 115 120 115 94 Jul 100 102 113 105 94 Aug 88 102 110 100 94 Sept 85 90 94 Oct 77 78 85 80 94 Nov 75 72 83 80 94 Dec 82 78 80 80 94 © 2008 Prentice Hall, Inc. Seasonal Index 0. 957 4–

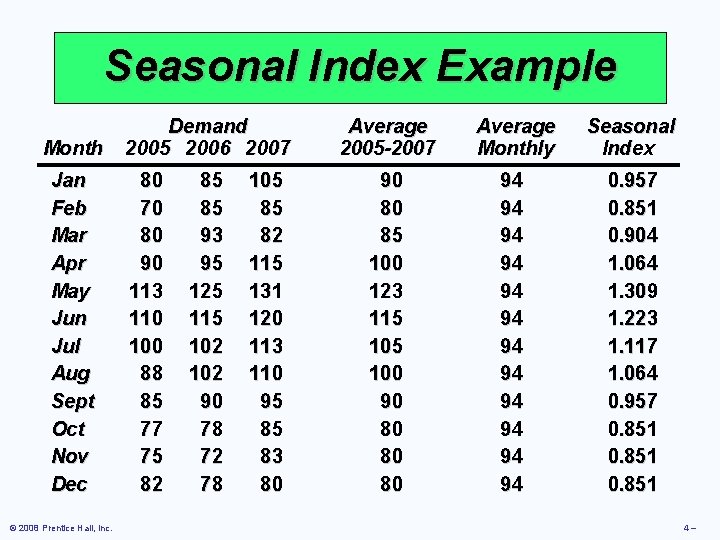

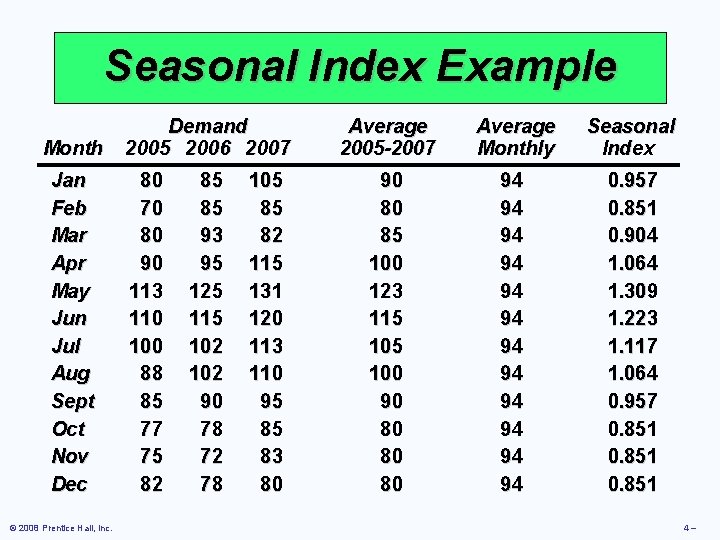

Seasonal Index Example Month Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec © 2008 Prentice Hall, Inc. Demand 2005 2006 2007 80 70 80 90 113 110 100 88 85 77 75 82 85 85 93 95 125 115 102 90 78 72 78 105 85 82 115 131 120 113 110 95 85 83 80 Average 2005 -2007 Average Monthly Seasonal Index 90 80 85 100 123 115 100 90 80 80 80 94 94 94 0. 957 0. 851 0. 904 1. 064 1. 309 1. 223 1. 117 1. 064 0. 957 0. 851 4–

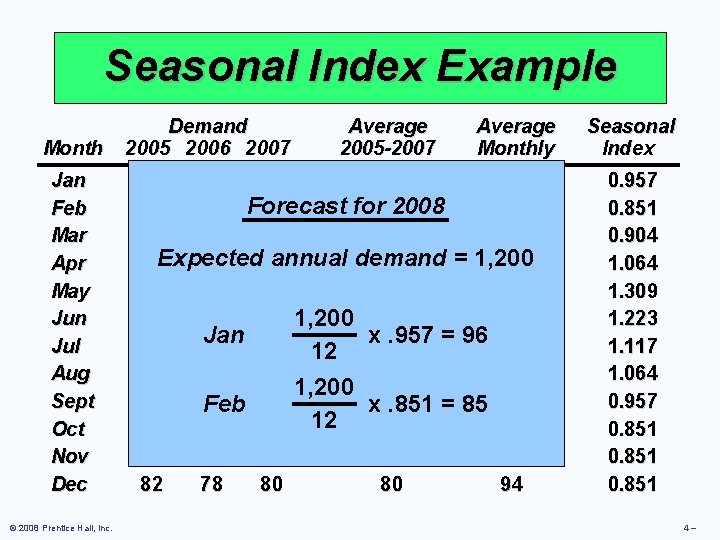

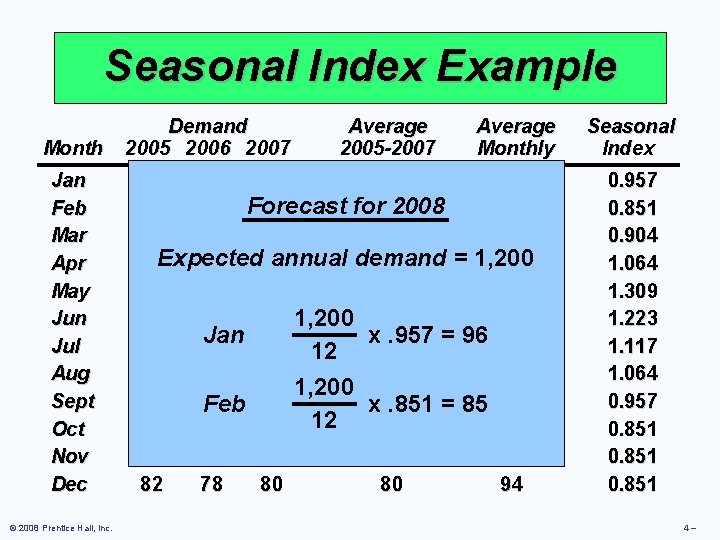

Seasonal Index Example Month Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec © 2008 Prentice Hall, Inc. Demand 2005 2006 2007 Average 2005 -2007 Average Monthly 80 85 105 90 94 for 802008 70 85 Forecast 85 94 80 93 82 85 94 annual demand = 1, 200 90 Expected 95 115 100 94 113 125 131 123 94 110 115 120 1, 200 115 94 Jan 113 x. 957 = 96 94 100 102 105 12 88 102 110 100 94 1, 200 85 90 Feb 95 x 90. 851 = 85 94 77 78 85 12 80 94 75 72 83 80 94 82 78 80 80 94 Seasonal Index 0. 957 0. 851 0. 904 1. 064 1. 309 1. 223 1. 117 1. 064 0. 957 0. 851 4–

Seasonal Index Example 2008 Forecast 2007 Demand 2006 Demand 2005 Demand 140 – Demand 130 – 120 – 110 – 100 – 90 – 80 – 70 – © 2008 Prentice Hall, Inc. | J | F | M | A | M | | J J Time | A | S | O | N | D 4–

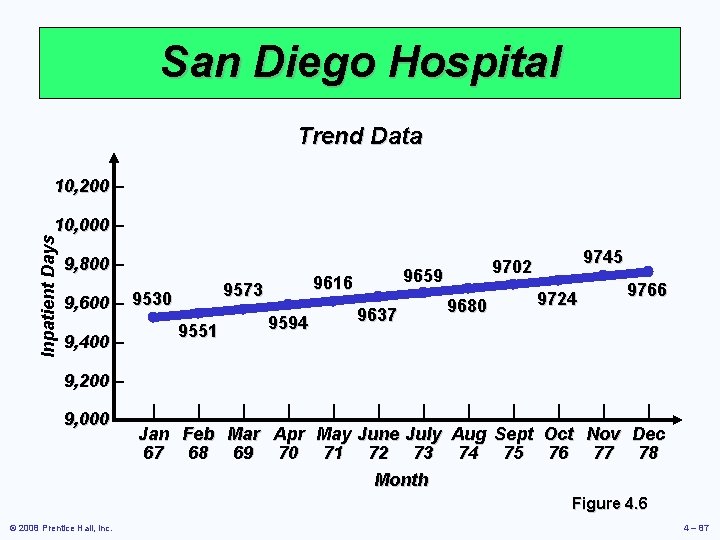

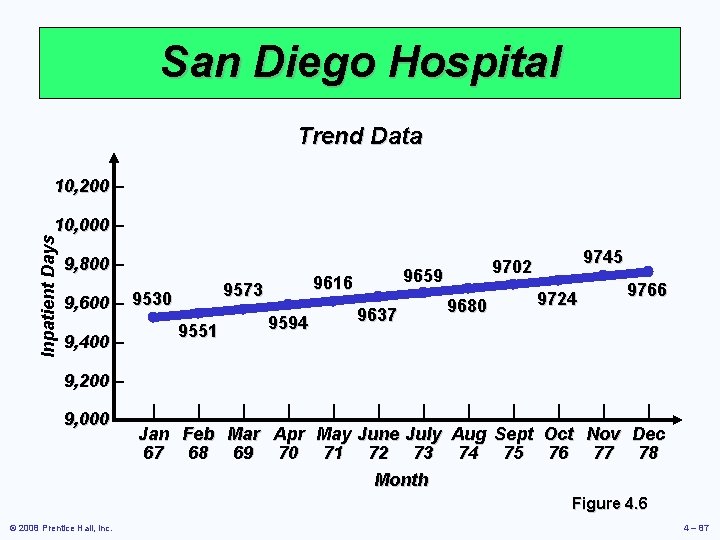

San Diego Hospital Trend Data 10, 200 – Inpatient Days 10, 000 – 9, 800 – 9573 9, 600 – 9530 9, 400 – 9551 9659 9616 9594 9637 9745 9702 9680 9724 9766 9, 200 – 9, 000 – | | | Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec 67 68 69 70 71 72 73 74 75 76 77 78 Month Figure 4. 6 © 2008 Prentice Hall, Inc. 4 – 87

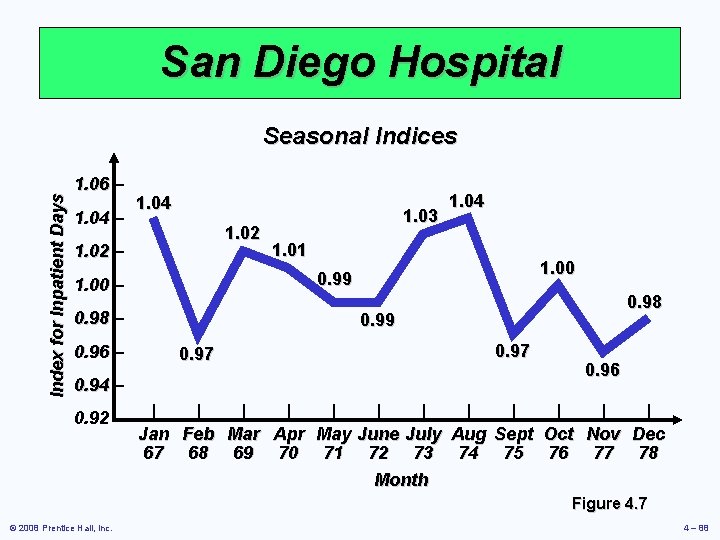

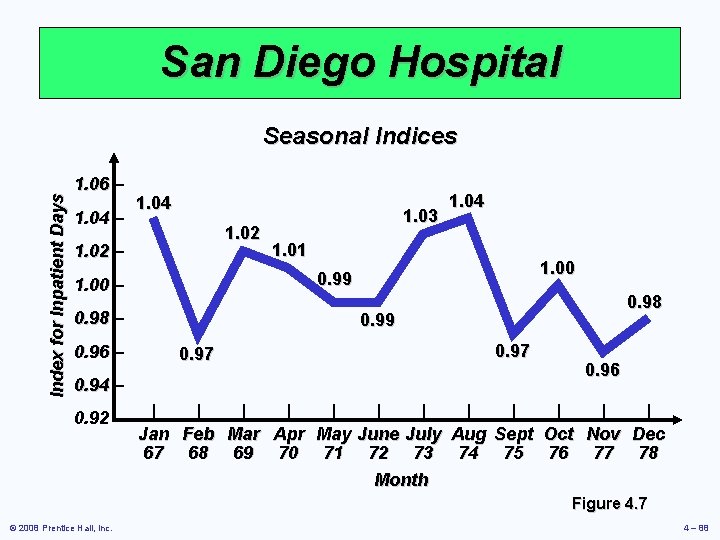

San Diego Hospital Index for Inpatient Days Seasonal Indices 1. 06 – 1. 04 1. 02 – 0. 98 – 0. 94 – 0. 92 – 1. 01 1. 00 0. 99 1. 00 – 0. 96 – 1. 03 1. 04 0. 98 0. 99 0. 97 0. 96 | | | Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec 67 68 69 70 71 72 73 74 75 76 77 78 Month Figure 4. 7 © 2008 Prentice Hall, Inc. 4 – 88

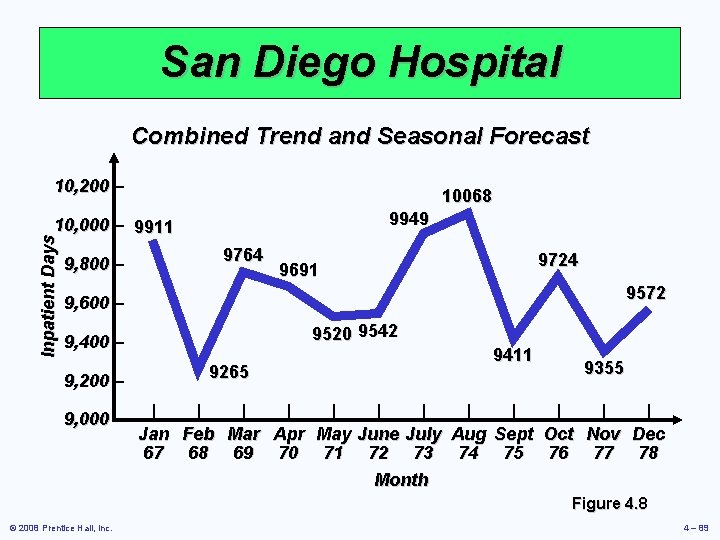

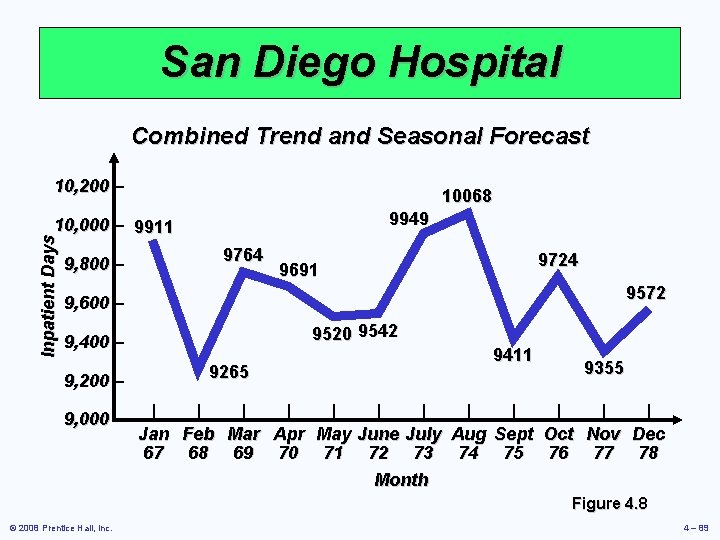

San Diego Hospital Combined Trend and Seasonal Forecast 10, 200 – 10068 9949 Inpatient Days 10, 000 – 9911 9, 800 – 9764 9724 9691 9572 9, 600 – 9520 9542 9, 400 – 9, 200 – 9, 000 – 9265 9411 9355 | | | Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec 67 68 69 70 71 72 73 74 75 76 77 78 Month Figure 4. 8 © 2008 Prentice Hall, Inc. 4 – 89

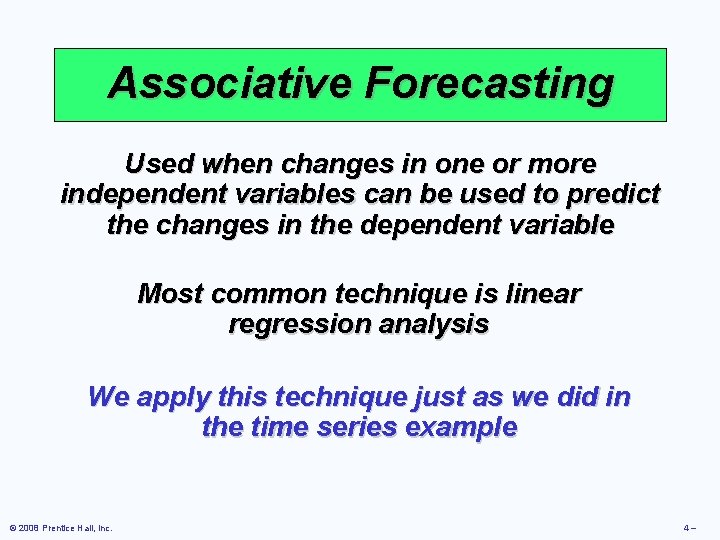

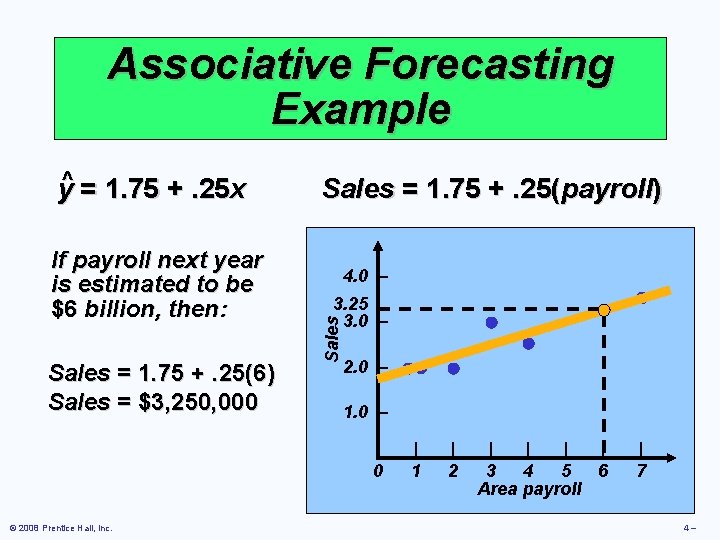

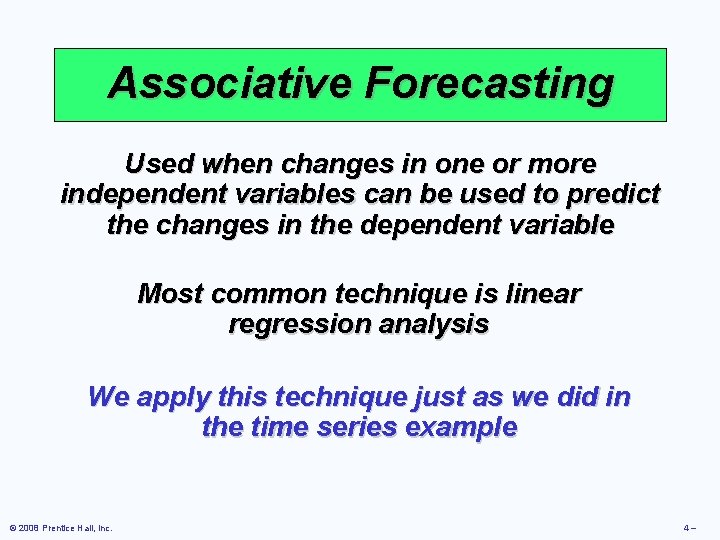

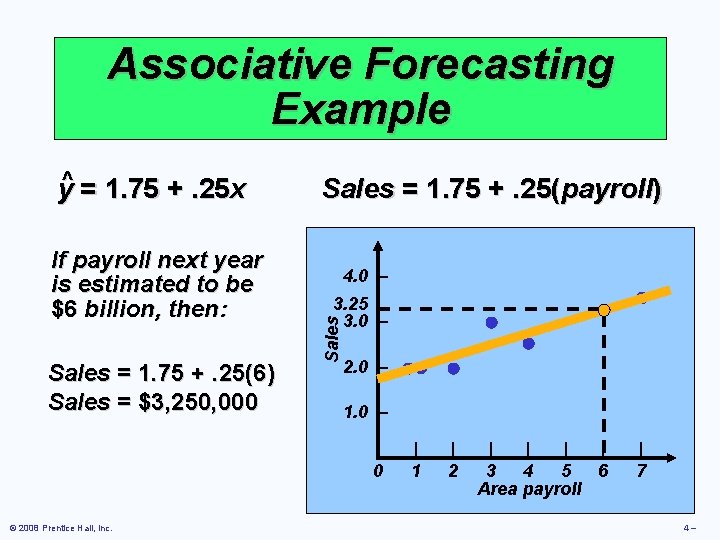

Associative Forecasting Used when changes in one or more independent variables can be used to predict the changes in the dependent variable Most common technique is linear regression analysis We apply this technique just as we did in the time series example © 2008 Prentice Hall, Inc. 4–

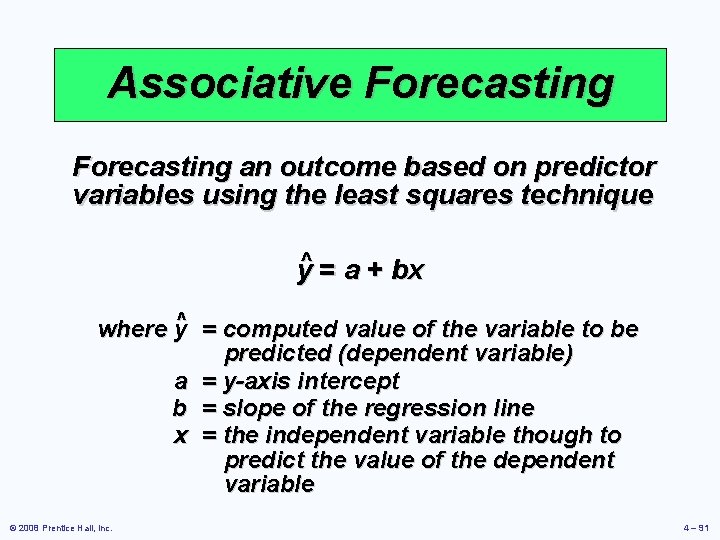

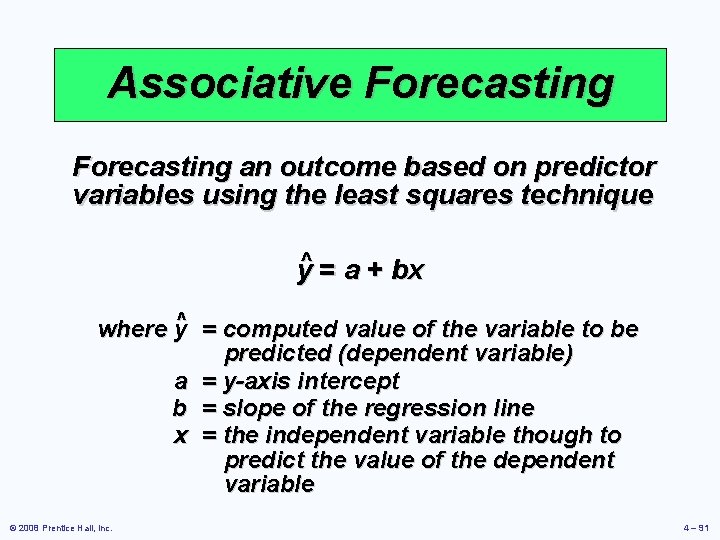

Associative Forecasting an outcome based on predictor variables using the least squares technique y^ = a + bx where y^ = computed value of the variable to be predicted (dependent variable) a = y-axis intercept b = slope of the regression line x = the independent variable though to predict the value of the dependent variable © 2008 Prentice Hall, Inc. 4 – 91

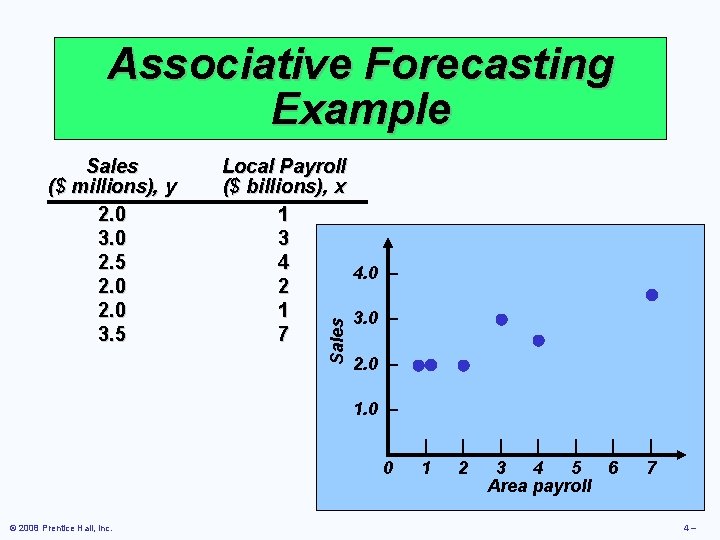

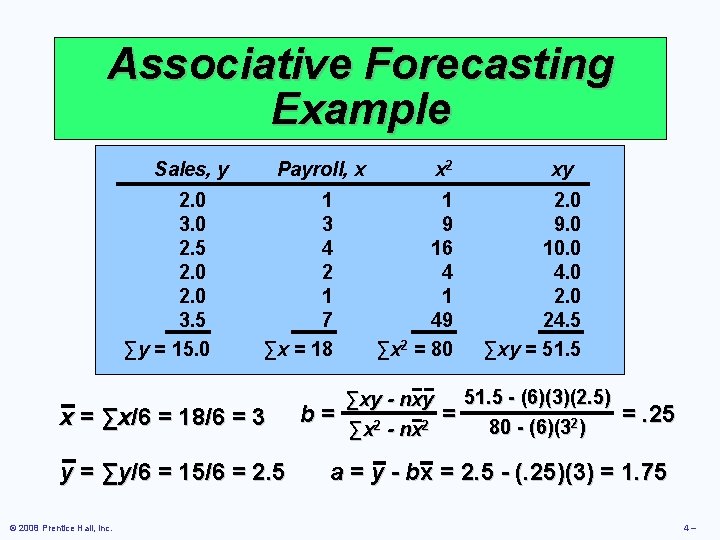

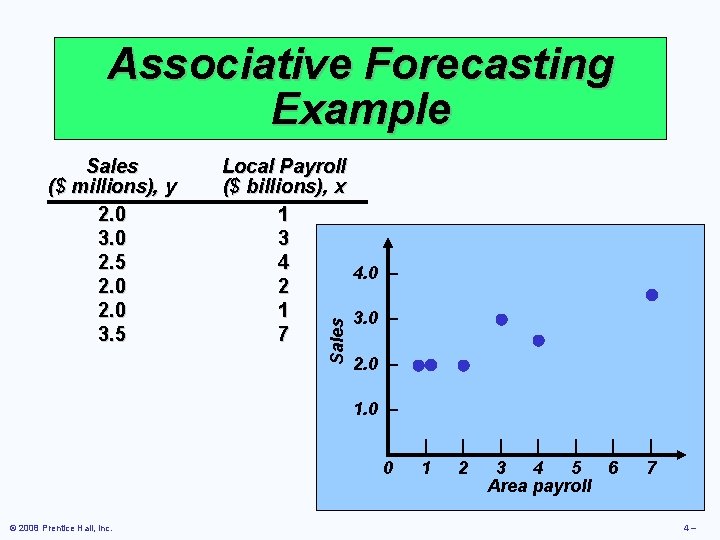

Associative Forecasting Example Local Payroll ($ billions), x 1 3 4 4. 0 – 2 1 3. 0 – 7 Sales ($ millions), y 2. 0 3. 0 2. 5 2. 0 3. 5 2. 0 – 1. 0 – 0 © 2008 Prentice Hall, Inc. | 1 | 2 | | 3 4 5 6 Area payroll | 7 4–

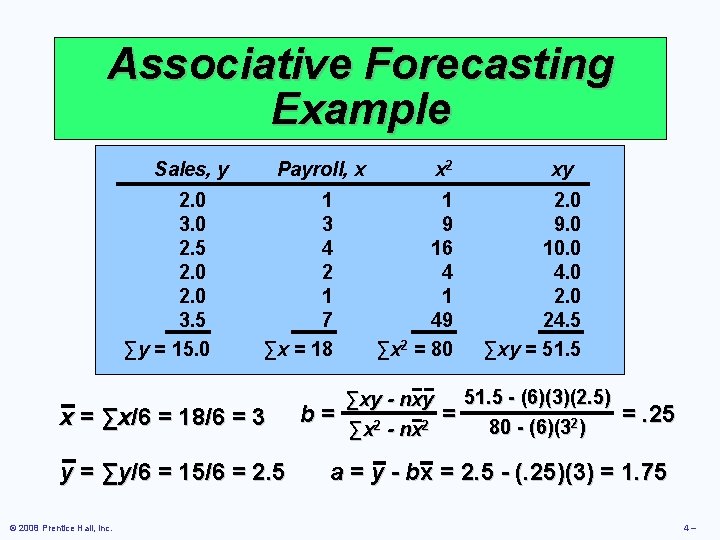

Associative Forecasting Example Sales, y 2. 0 3. 0 2. 5 2. 0 3. 5 ∑y = 15. 0 Payroll, x 1 3 4 2 1 7 ∑x = 18 x = ∑x/6 = 18/6 = 3 y = ∑y/6 = 15/6 = 2. 5 © 2008 Prentice Hall, Inc. b= x 2 1 9 16 4 1 49 ∑x 2 = 80 ∑xy - nxy ∑x 2 - nx 2 = xy 2. 0 9. 0 10. 0 4. 0 24. 5 ∑xy = 51. 5 - (6)(3)(2. 5) 80 - (6)(32) =. 25 a = y - bx = 2. 5 - (. 25)(3) = 1. 75 4–

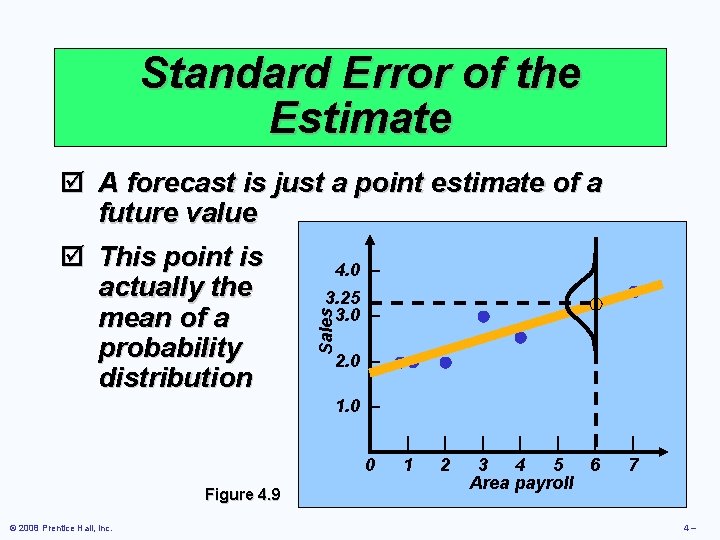

Associative Forecasting Example If payroll next year is estimated to be $6 billion, then: Sales = 1. 75 +. 25(6) Sales = $3, 250, 000 Sales = 1. 75 +. 25(payroll) 4. 0 – 3. 25 3. 0 – Sales y^ = 1. 75 +. 25 x 2. 0 – 1. 0 – 0 © 2008 Prentice Hall, Inc. | 1 | 2 | | 3 4 5 6 Area payroll | 7 4–

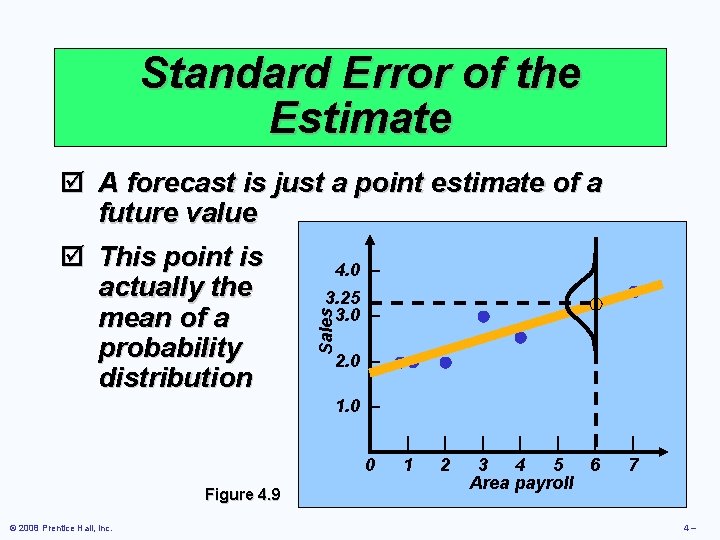

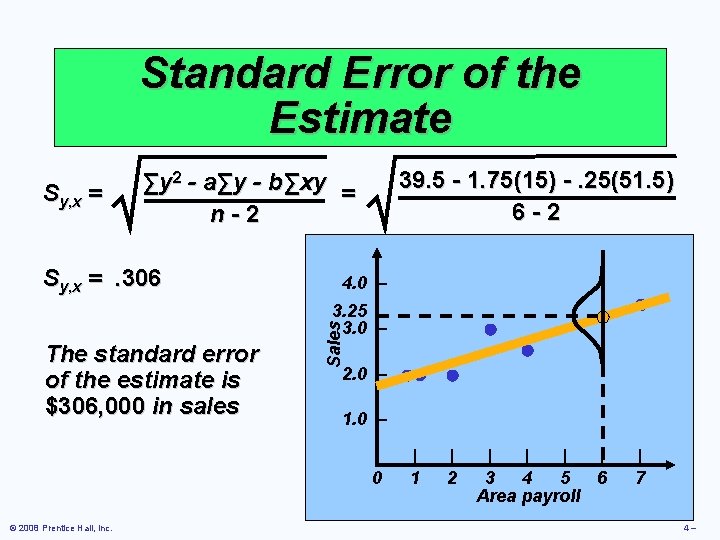

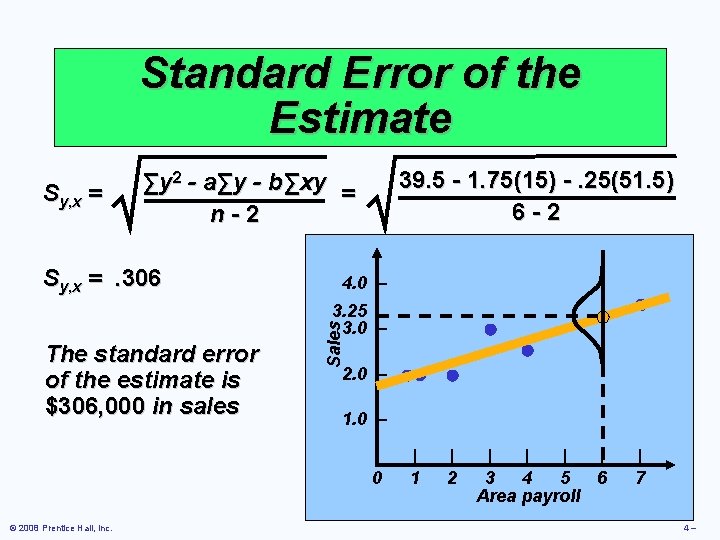

Standard Error of the Estimate Sales þ A forecast is just a point estimate of a future value þ This point is 4. 0 – actually the 3. 25 3. 0 – mean of a probability 2. 0 – distribution 1. 0 – 0 Figure 4. 9 © 2008 Prentice Hall, Inc. | 1 | 2 | | 3 4 5 6 Area payroll | 7 4–

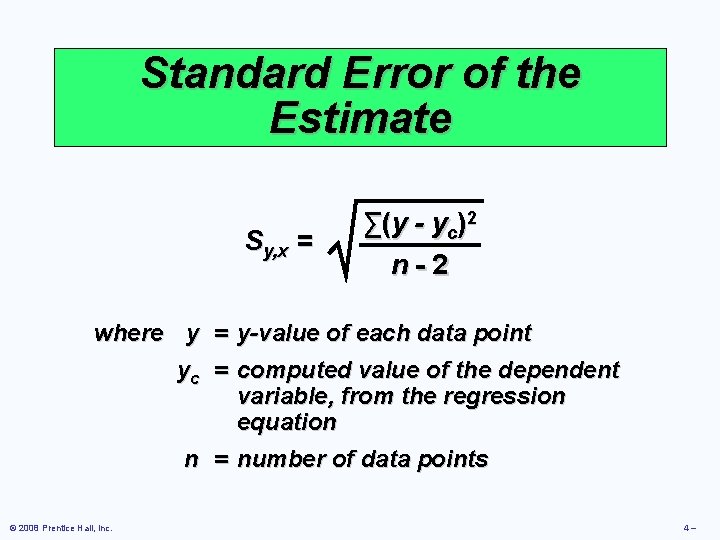

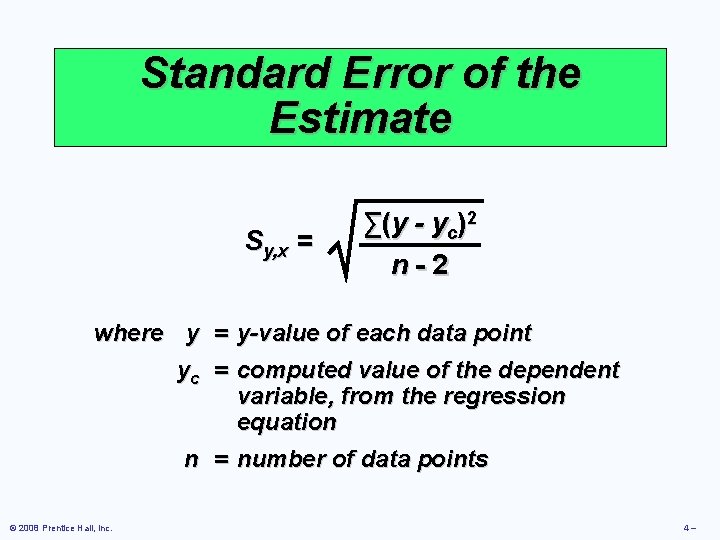

Standard Error of the Estimate Sy, x = ∑ (y - y c )2 n-2 where y = y-value of each data point yc = computed value of the dependent variable, from the regression equation n = number of data points © 2008 Prentice Hall, Inc. 4–

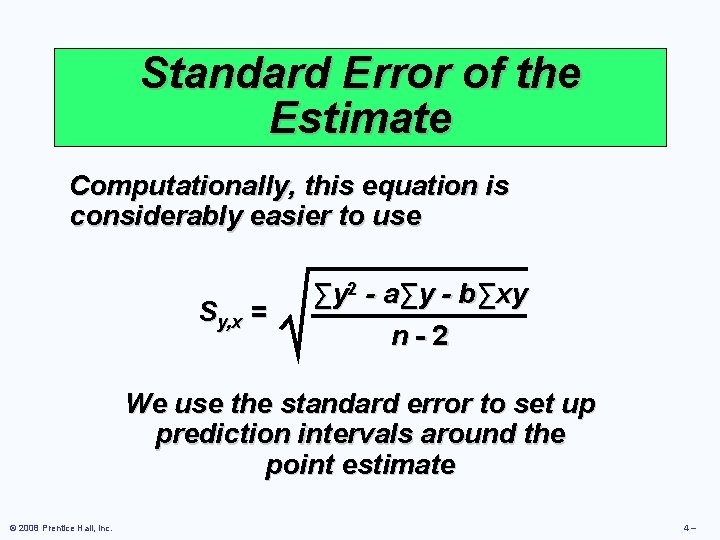

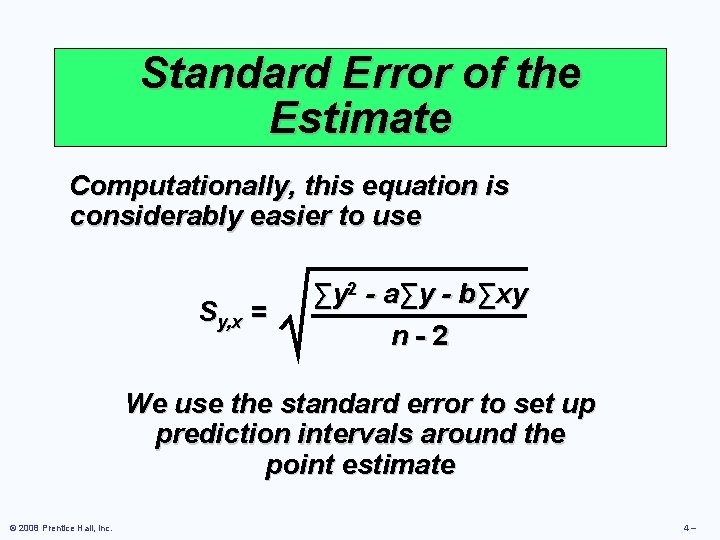

Standard Error of the Estimate Computationally, this equation is considerably easier to use Sy, x = ∑y 2 - a∑y - b∑xy n-2 We use the standard error to set up prediction intervals around the point estimate © 2008 Prentice Hall, Inc. 4–

Standard Error of the Estimate Sy, x = 39. 5 - 1. 75(15) -. 25(51. 5) 6 -2 ∑y 2 - a∑y - b∑xy = n-2 Sy, x =. 306 4. 0 – The standard error of the estimate is $306, 000 in sales Sales 3. 25 3. 0 – 2. 0 – 1. 0 – 0 © 2008 Prentice Hall, Inc. | 1 | 2 | | 3 4 5 6 Area payroll | 7 4–

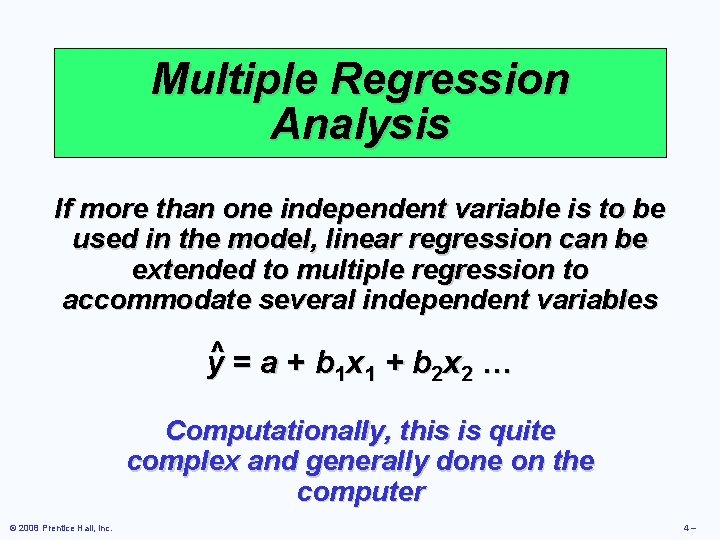

Correlation þ How strong is the linear relationship between the variables? þ Correlation does not necessarily imply causality! þ Coefficient of correlation, r, measures degree of association þ Values range from -1 to +1 © 2008 Prentice Hall, Inc. 4 – 99

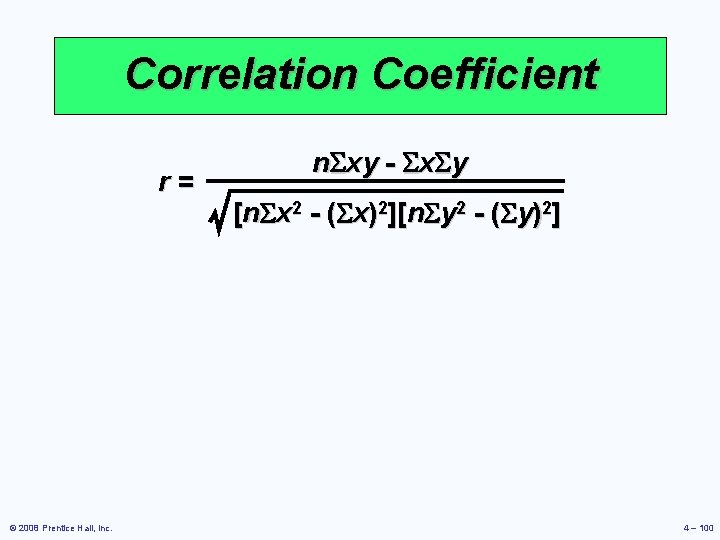

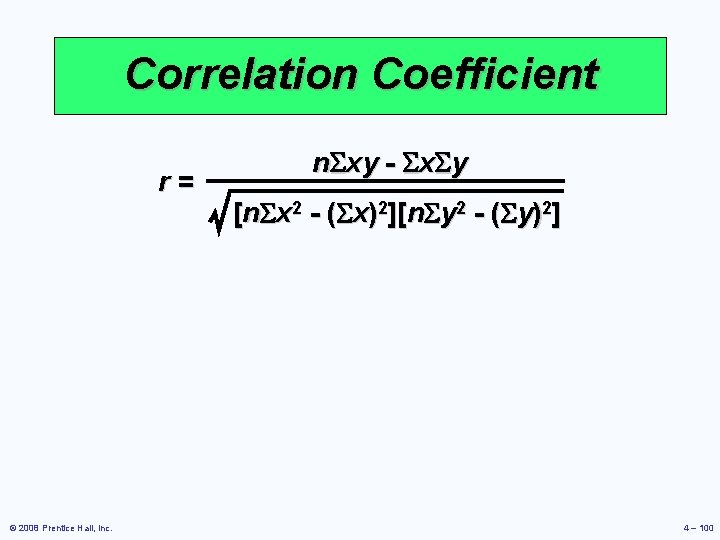

Correlation Coefficient r= © 2008 Prentice Hall, Inc. n. Sxy - Sx. Sy [n. Sx 2 - (Sx)2][n. Sy 2 - (Sy)2] 4 – 100

![Correlation Coefficient y y n Sxy Sx Sy r 2 Sx2n Sy Correlation Coefficient y y n. Sxy - Sx. Sy r= 2 - (Sx)2][n. Sy](https://slidetodoc.com/presentation_image/1f5b569f4d1a2c7bc7870d8c22890914/image-100.jpg)

Correlation Coefficient y y n. Sxy - Sx. Sy r= 2 - (Sx)2][n. Sy 2 - (Sy)2] [ n S x (a) Perfect positive x (b) Positive correlation: r = +1 x correlation: 0<r<1 y y (c) No correlation: r=0 © 2008 Prentice Hall, Inc. x (d) Perfect negative x correlation: r = -1 4 – 101

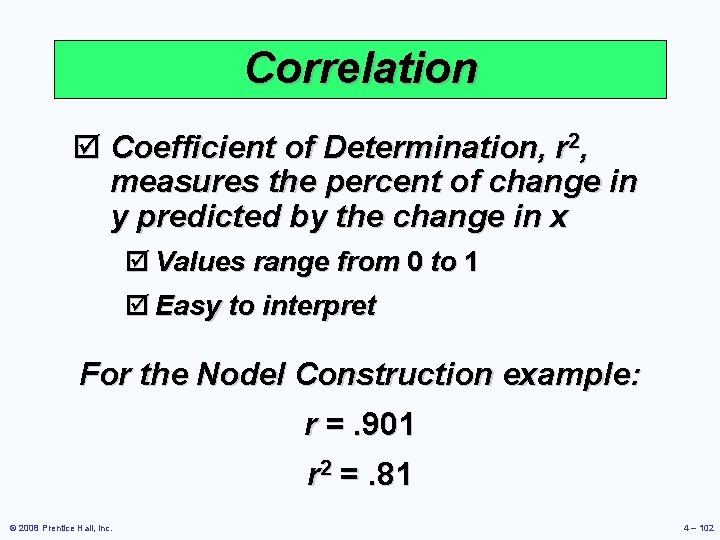

Correlation þ Coefficient of Determination, r 2, measures the percent of change in y predicted by the change in x þ Values range from 0 to 1 þ Easy to interpret For the Nodel Construction example: r =. 901 r 2 =. 81 © 2008 Prentice Hall, Inc. 4 – 102

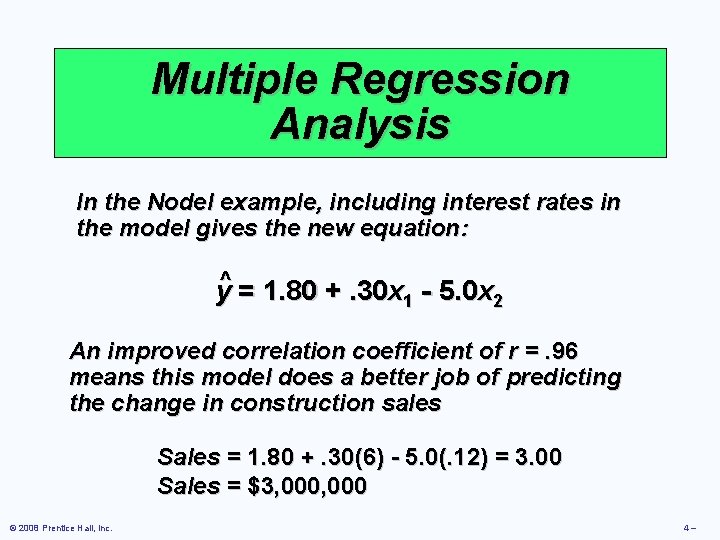

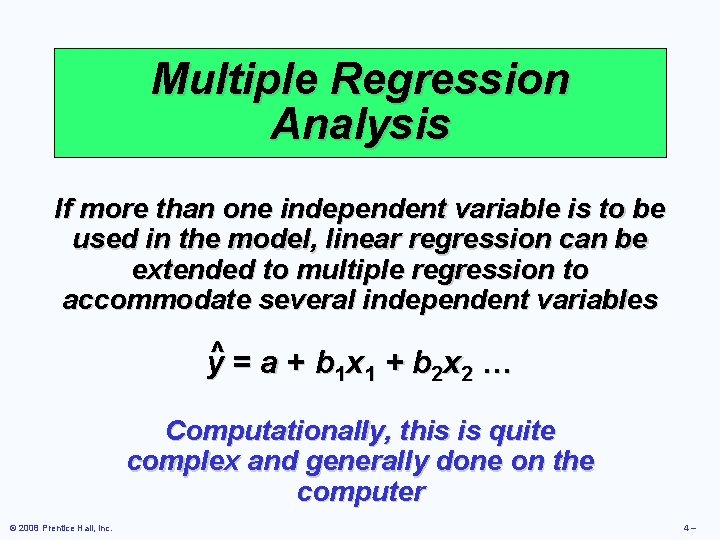

Multiple Regression Analysis If more than one independent variable is to be used in the model, linear regression can be extended to multiple regression to accommodate several independent variables y^ = a + b 1 x 1 + b 2 x 2 … Computationally, this is quite complex and generally done on the computer © 2008 Prentice Hall, Inc. 4–

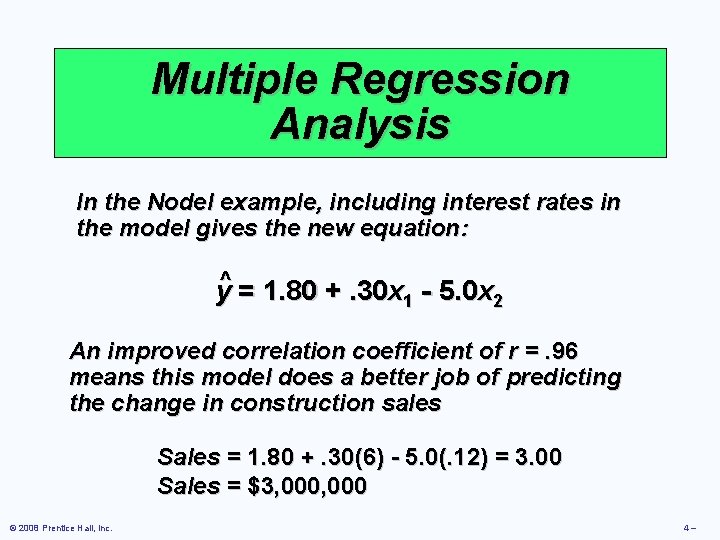

Multiple Regression Analysis In the Nodel example, including interest rates in the model gives the new equation: y^ = 1. 80 +. 30 x 1 - 5. 0 x 2 An improved correlation coefficient of r =. 96 means this model does a better job of predicting the change in construction sales Sales = 1. 80 +. 30(6) - 5. 0(. 12) = 3. 00 Sales = $3, 000 © 2008 Prentice Hall, Inc. 4–

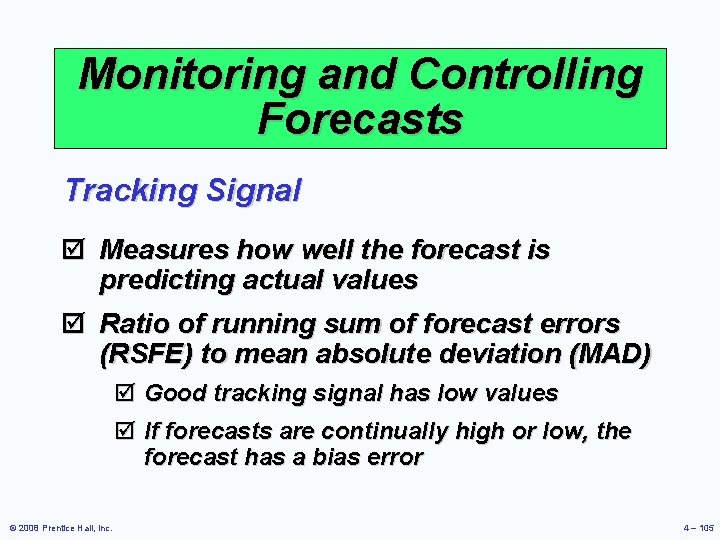

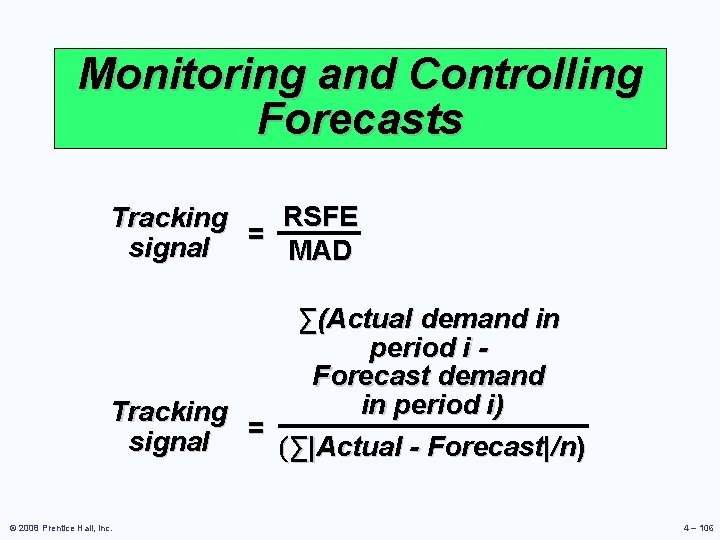

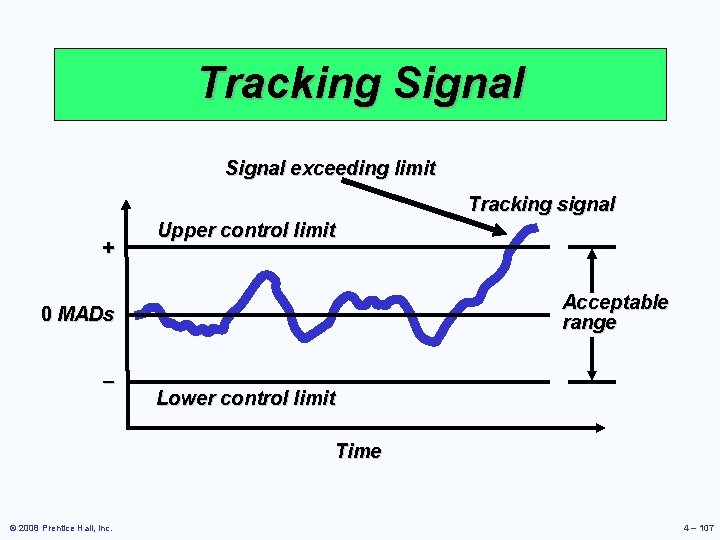

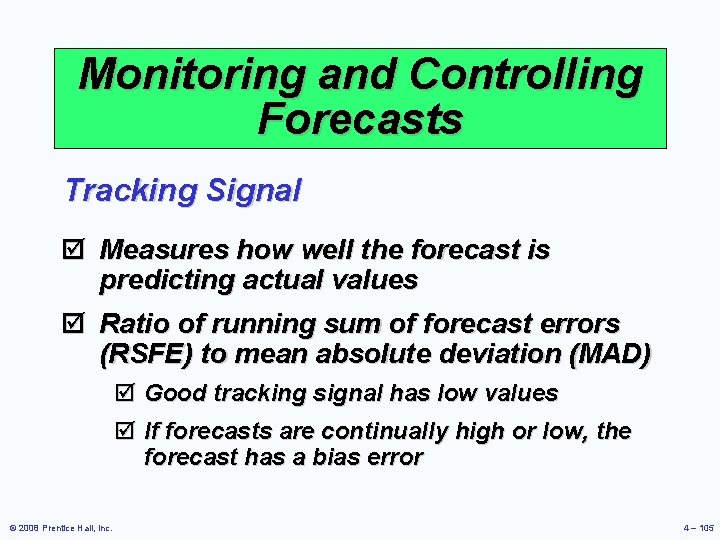

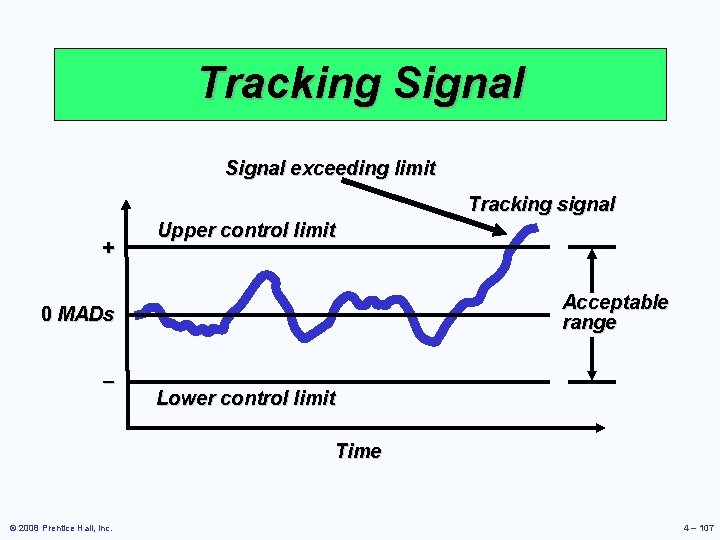

Monitoring and Controlling Forecasts Tracking Signal þ Measures how well the forecast is predicting actual values þ Ratio of running sum of forecast errors (RSFE) to mean absolute deviation (MAD) þ Good tracking signal has low values þ If forecasts are continually high or low, the forecast has a bias error © 2008 Prentice Hall, Inc. 4 – 105

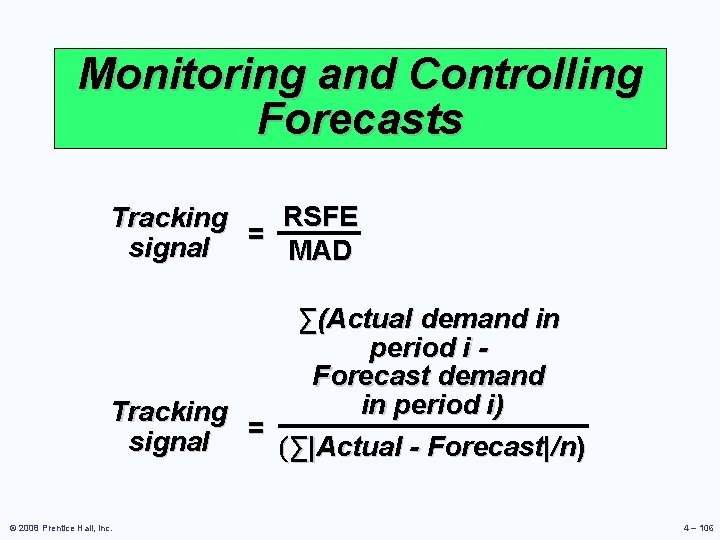

Monitoring and Controlling Forecasts RSFE Tracking = signal MAD ∑(Actual demand in period i Forecast demand in period i) Tracking = signal (∑|Actual - Forecast|/n) © 2008 Prentice Hall, Inc. 4 – 106

Tracking Signal exceeding limit Tracking signal + Upper control limit Acceptable range 0 MADs – Lower control limit Time © 2008 Prentice Hall, Inc. 4 – 107

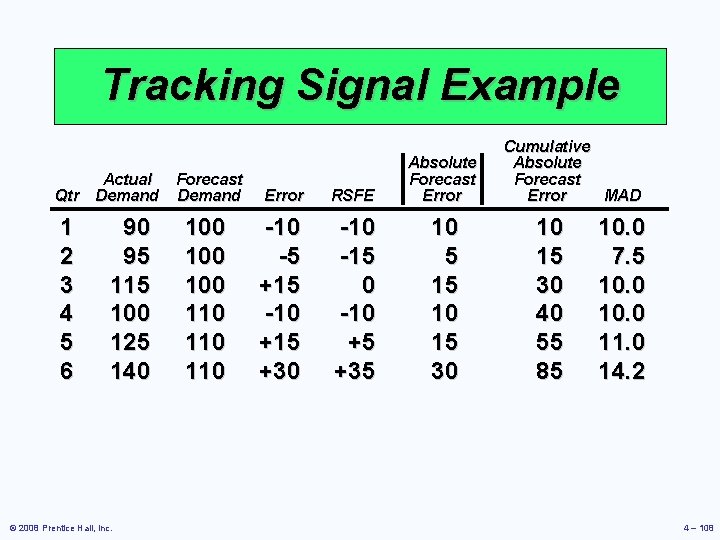

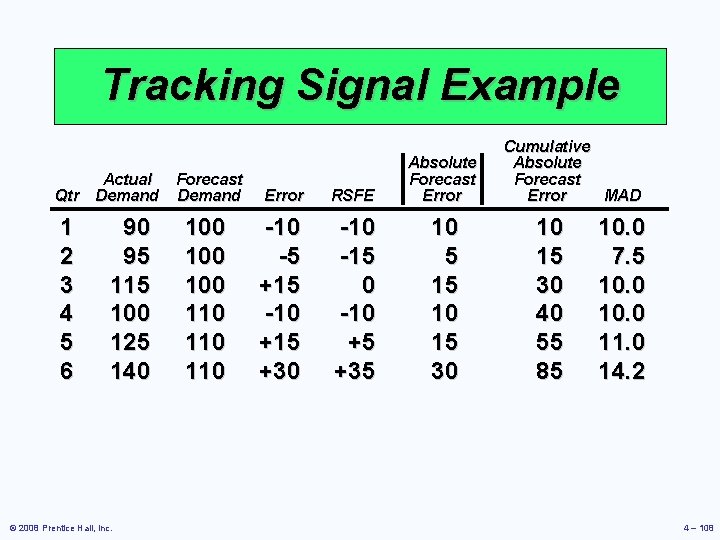

Tracking Signal Example Actual Qtr Demand 1 2 3 4 5 6 90 95 115 100 125 140 © 2008 Prentice Hall, Inc. Forecast Demand Error RSFE Absolute Forecast Error 100 100 110 110 -5 +15 -10 +15 +30 -15 0 -10 +5 +35 10 5 15 10 15 30 Cumulative Absolute Forecast Error MAD 10 15 30 40 55 85 10. 0 7. 5 10. 0 11. 0 14. 2 4 – 108

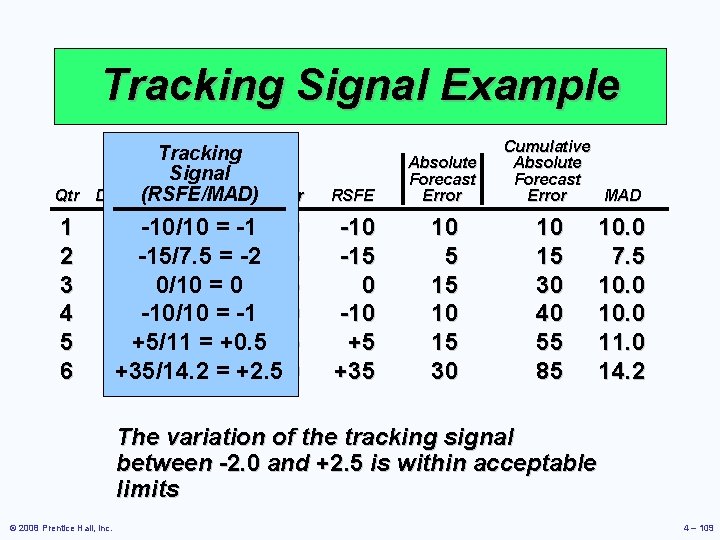

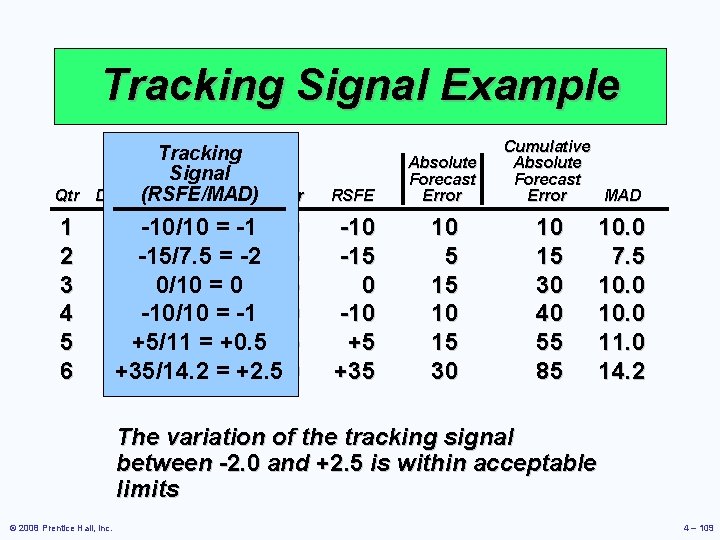

Tracking Signal Example Qtr 1 2 3 4 5 6 Tracking Actual Signal Forecast (RSFE/MAD) Demand Error RSFE Absolute Forecast Error 90 -10/10 100= -1 -10 95 -15/7. 5 100= -2 -5 115 0/10 100 = 0 +15 100 -10/10 110= -1 -10 125 +5/11110 = +0. 5+15 140 +35/14. 2 110= +2. 5 +30 -15 0 -10 +5 +35 10 5 15 10 15 30 Cumulative Absolute Forecast Error MAD 10 15 30 40 55 85 10. 0 7. 5 10. 0 11. 0 14. 2 The variation of the tracking signal between -2. 0 and +2. 5 is within acceptable limits © 2008 Prentice Hall, Inc. 4 – 109

Adaptive Forecasting It’s possible to use the computer to continually monitor forecast error and adjust the values of the and coefficients used in exponential smoothing to continually minimize forecast error This technique is called adaptive smoothing © 2008 Prentice Hall, Inc. 4–

Focus Forecasting Developed at American Hardware Supply, focus forecasting is based on two principles: 1. Sophisticated forecasting models are not always better than simple ones 2. There is no single technique that should be used for all products or services This approach uses historical data to test multiple forecasting models for individual items The forecasting model with the lowest error is then used to forecast the next demand © 2008 Prentice Hall, Inc. 4–

Forecasting in the Service Sector þ Presents unusual challenges þ Special need for short term records þ Needs differ greatly as function of industry and product þ Holidays and other calendar events þ Unusual events © 2008 Prentice Hall, Inc. 4 – 112

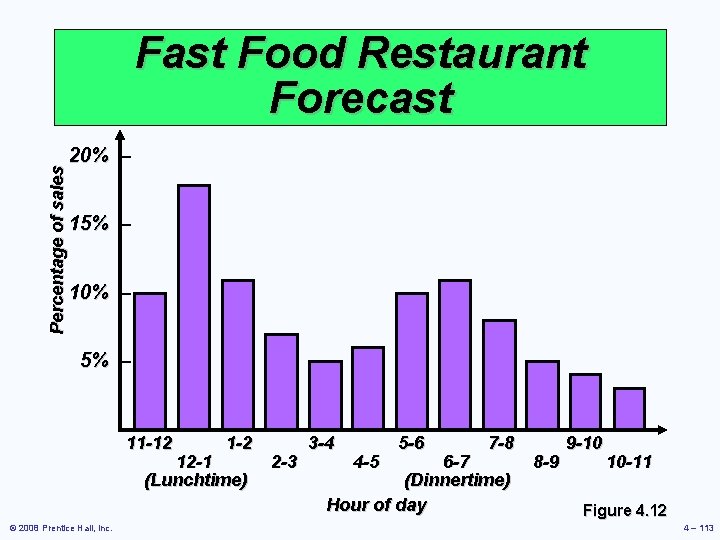

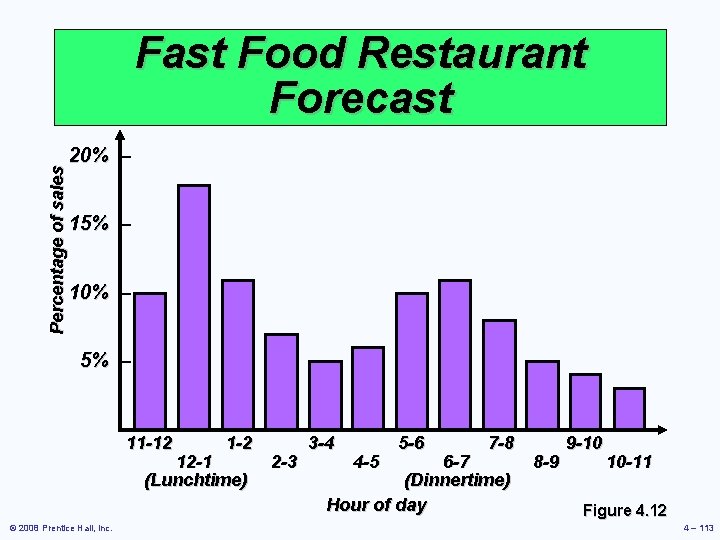

Percentage of sales Fast Food Restaurant Forecast 20% – 15% – 10% – 5% – 11 -12 1 -2 12 -1 (Lunchtime) © 2008 Prentice Hall, Inc. 2 -3 3 -4 4 -5 5 -6 7 -8 6 -7 (Dinnertime) Hour of day 8 -9 9 -10 10 -11 Figure 4. 12 4 – 113

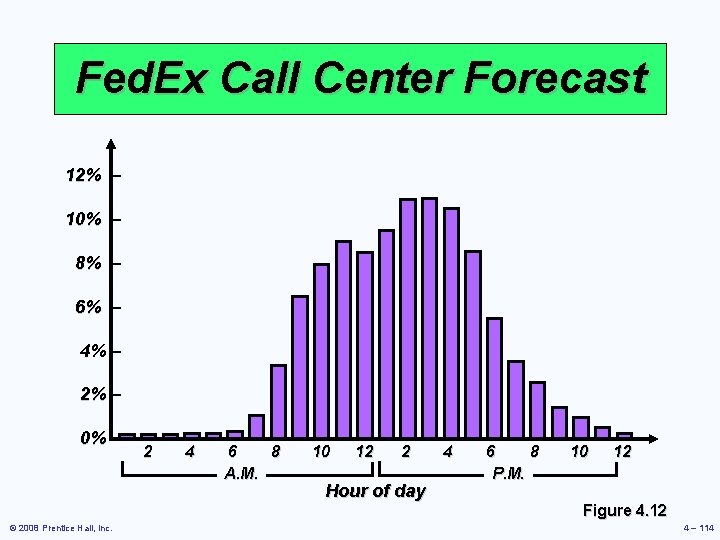

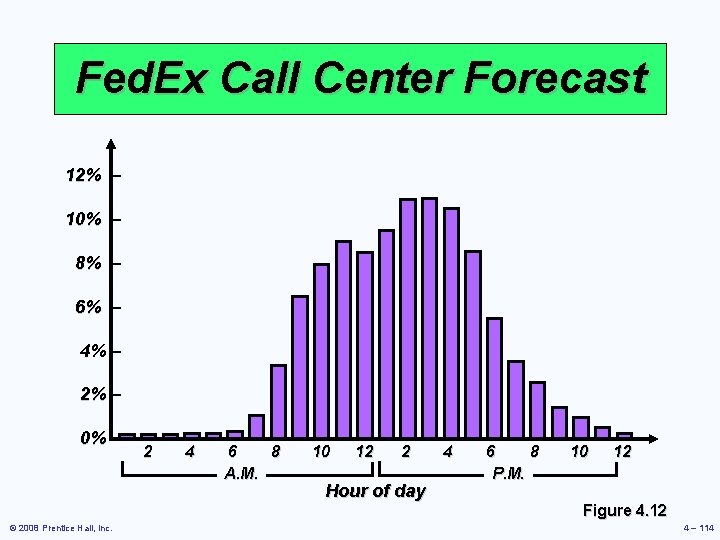

Fed. Ex Call Center Forecast 12% – 10% – 8% – 6% – 4% – 2% – 0% – © 2008 Prentice Hall, Inc. 2 4 6 8 A. M. 10 12 2 Hour of day 4 6 8 P. M. 10 12 Figure 4. 12 4 – 114