New Approach to Health Care Coverage Retiree Choices

- Slides: 34

New Approach to Health Care Coverage Retiree Choices New Choices Better Value New Coverage Updated | 5/9/2012

What We’ll Cover Today • Benito Cachinero, SVP, HR, Du. Pont • Introducing Extend Health • Understanding Supplemental Medicare Insurance • Next Steps • Questions & Answers 2

Introducing Extend Health The Industry’s Largest Private Medicare Exchange

Who is Extend Health? • Independent company, dedicated to serving Medicareeligible retirees • Partner with 75+ health plan carriers to provide you coverage to fit your individual needs and budget • Objective and Trusted U. S. –based licensed benefit advisors • Focused on helping each participant make an informed and confident decision

Why Extend Health? • We are experienced in helping people just like you • Our services are provided at no cost to you

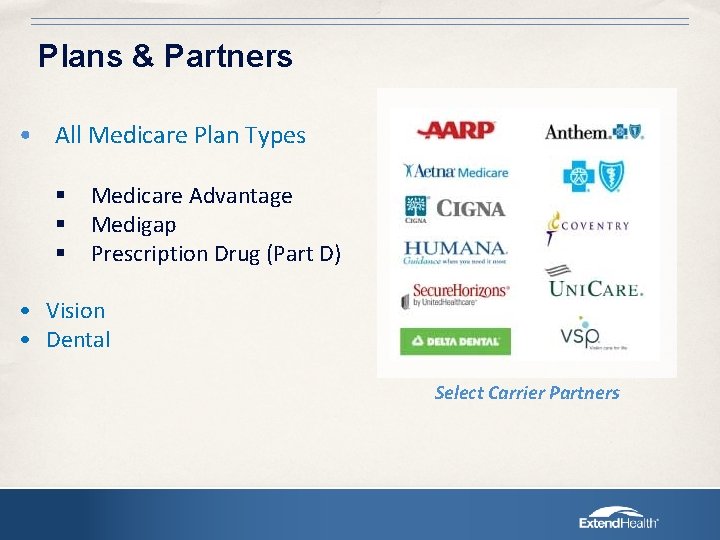

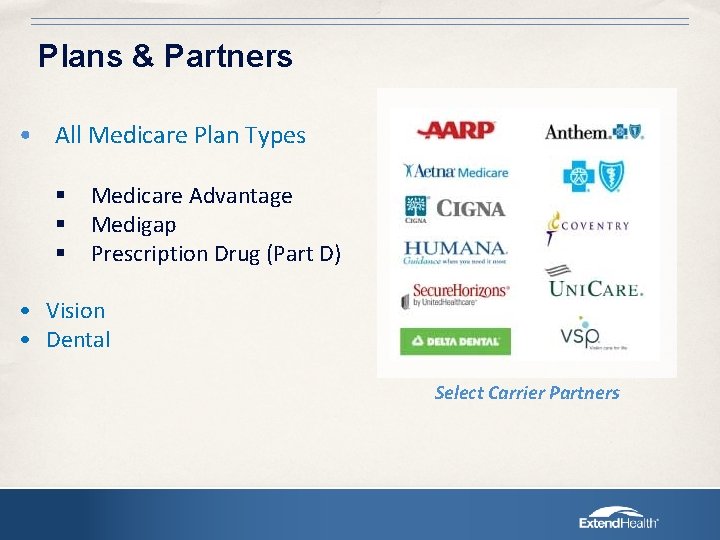

Plans & Partners • All Medicare Plan Types § § § Medicare Advantage Medigap Prescription Drug (Part D) • Vision • Dental Select Carrier Partners

OPTION 1: Medigap Plan + Part D Plan MEDIGAP PLAN PART D PLAN MEDIGAP (Medicare Supplement) A Medigap plan fills the “gaps” in original Medicare Part A and Part B coverage (i. e. , helps pay the difference between your costs and the amount original Medicare pays). These plans provide additional coverage for your doctor visits and hospital stays as well as other expenses not covered by original Medicare. PART D PLAN A Part D plan supplements Medigap to provide prescription drug coverage. These plans help pay for your prescription drug expenses. You will need to pay your first premium when you enroll…

OPTION 2: Medicare Advantage Plan with Prescription Drug Coverage (MAPD)* MEDICARE ADVANTAGE MAPD PLAN An MAPD plan provides an all-in-one plan which bundles your Part A, Part B and prescription drug coverage together with additional benefits. These plans provide coverage for your doctor visits, hospital stays, and prescription drug expenses. * Note that Medicare Advantage plans are generally network based plans

The Process Educate Evaluate/Enroll Manage

Education Getting Started Guide § Gather information § Current prescriptions and preferred physicians § Current coverage and health conditions* § Give us a call toll-free at 1 -855 -535 -7140 § Visit us online www. extendhealth. com/dupont * Pre-existing conditions will not limit your plan selection - except end-stage renal disease

Education Enrollment Guide • Prepare for your for enrollment discussion • Review Medicare basics • Appointment confirmation letter

Decision Support Tools • Help Me Choose • Prescription Profiler

Evaluate and Enroll Extend Health’s Benefit Advisors Hours of Operation Monday – Friday 8 a. m. – 9 p. m. Eastern Time • • • 100% domestic workforce Objective advocacy Neutral compensation Extend University Certified and appointed Average 43 Call Extend Health Toll-Free at 1 -855 -535 -7140

Enrollment Process § Benefit Advisors can discuss coverage options with anyone – need to speak to the participant to complete the enrollment § Once you have made a coverage selection, enrollment is conducted via telephone § 100% of calls are recorded

Medicare & You

Your Future Coverage Primary Coverage Medicare Parts A & B Additional Coverage (Your Choice) Medigap + Prescription Drug (PDP) or Medicare Advantage with Prescription Drug (MAPD) Optional Coverage (Your Choice) Dental and Vision

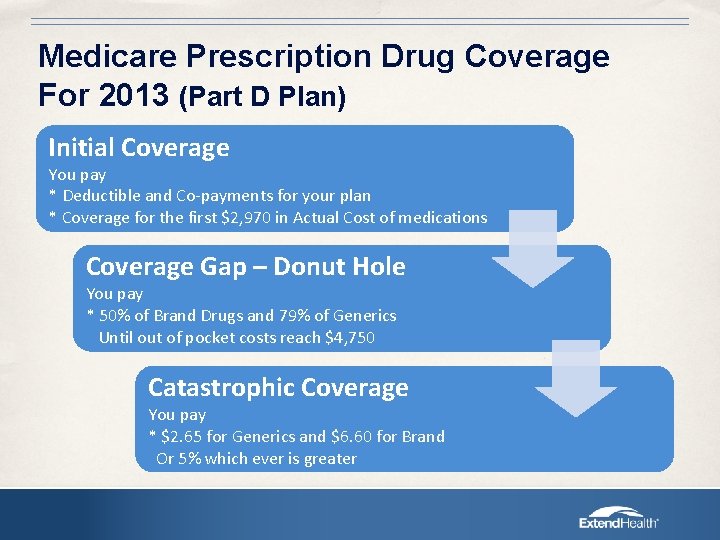

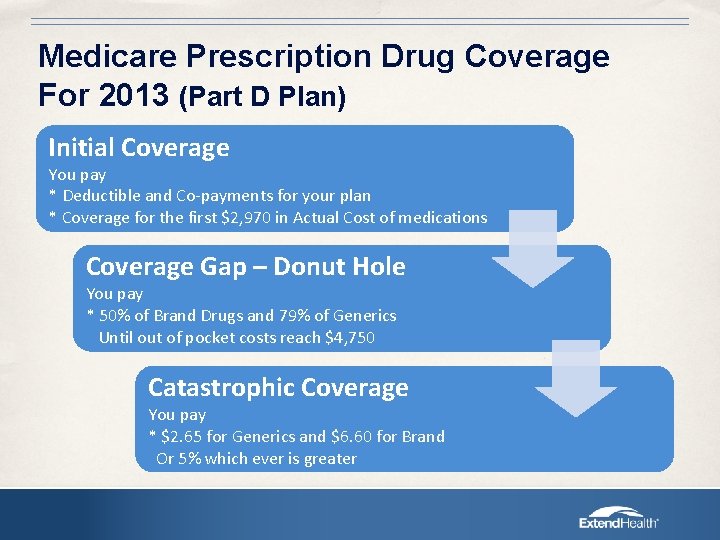

Medicare Prescription Drug Coverage For 2013 (Part D Plan) Initial Coverage You pay * Deductible and Co-payments for your plan * Coverage for the first $2, 970 in Actual Cost of medications Coverage Gap – Donut Hole You pay * 50% of Brand Drugs and 79% of Generics Until out of pocket costs reach $4, 750 Catastrophic Coverage You pay * $2. 65 for Generics and $6. 60 for Brand Or 5% which ever is greater

Health Reimbursement Arrangement (HRA)

What Is An HRA? • Tax-advantaged account used to reimburse you for eligible health care expenses • You must meet Du. Pont’s eligibility requirements to qualify for HRA • Your HRA funds will be available January 1, 2013

Who is Eligible? § You are eligible for a Health Reimbursement Arrangement (HRA) account if Du. Pont currently helps you pay for the cost of your group plan § You received information on your HRA in your announcement package from Du. Pont § You and your eligible spouse/dependent(s) will have a joint account

Your HRA amount § If you have Medical, Rx and Dental coverage or just Medical and Dental from Du. Pont TODAY* you’ll receive $1, 400 annual allocation (prorated based on the retirees pension adjustment factor) § Participants enrolled in a medical only plan TODAY* will receive $1, 200 annual allocation (prorated based on the retirees pension adjustment factor) § Participants enrolled in dental only TODAY* will receive $200 annual allocation (prorated based on the retirees pension adjustment factor) § You must enroll in a plan through Extend Health in order to qualify for your HRA. § Extend Health Benefits Advisors will confirm your HRA amount when you speak with them. *You must maintain coverage through 12/31/2012

Health Reimbursement Arrangement (HRA) § HRA Enrollment Kit ØInitial batch mailed in late December ØOngoing will be mailed prior to beginning of month coverage begins ØConfirms HRA amount ØDescribes eligible expenses ØIncludes claim and direct deposit request form ØReminder how to use HRA, where to get support, reminder of dedicated toll-free line

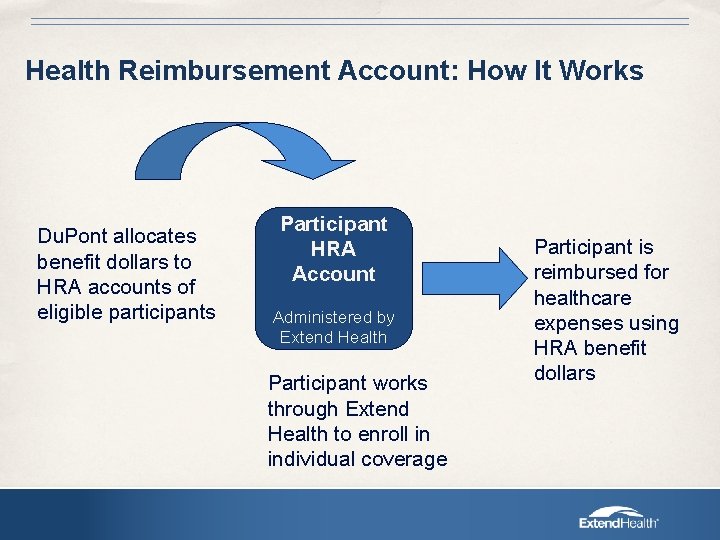

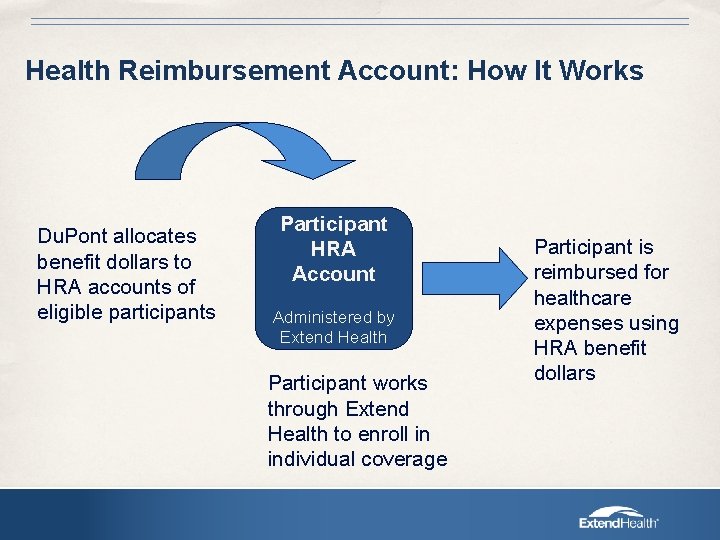

Health Reimbursement Account: How It Works Du. Pont allocates benefit dollars to HRA accounts of eligible participants Participant HRA Account Administered by Extend Health Participant works through Extend Health to enroll in individual coverage Participant is reimbursed for healthcare expenses using HRA benefit dollars

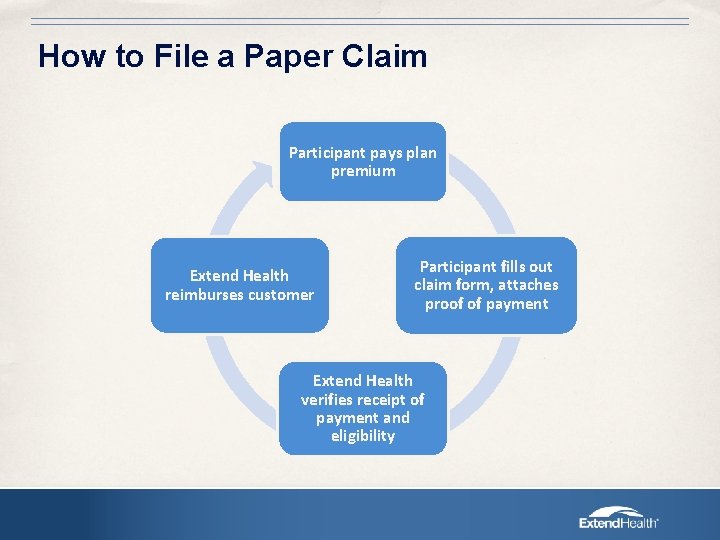

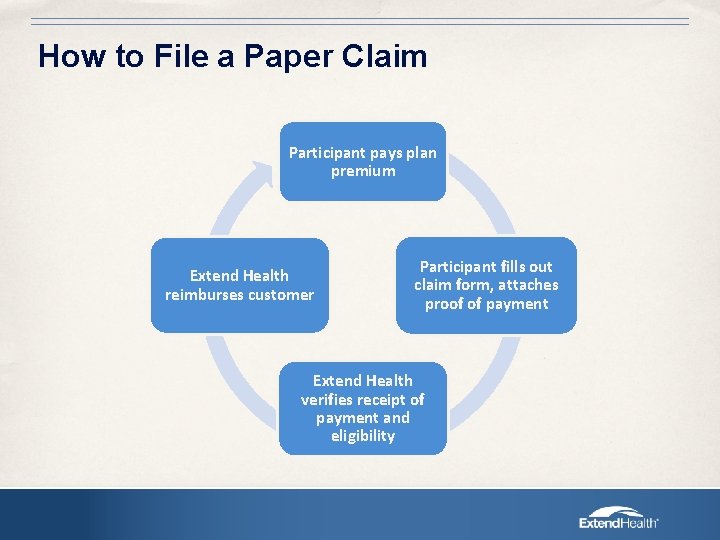

How to File a Paper Claim Participant pays plan premium Extend Health reimburses customer Participant fills out claim form, attaches proof of payment Extend Health verifies receipt of payment and eligibility

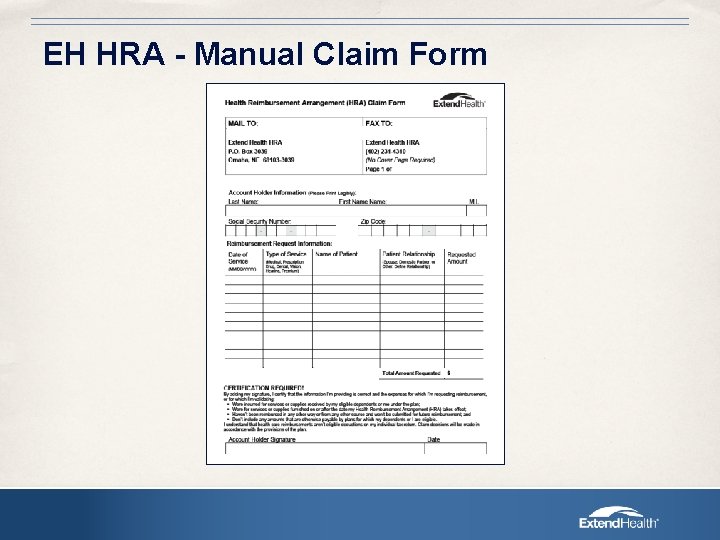

EH HRA - Manual Claim Form

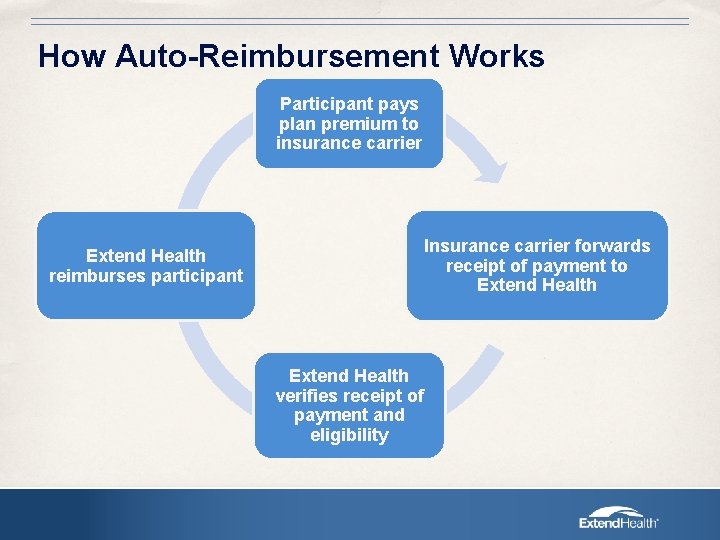

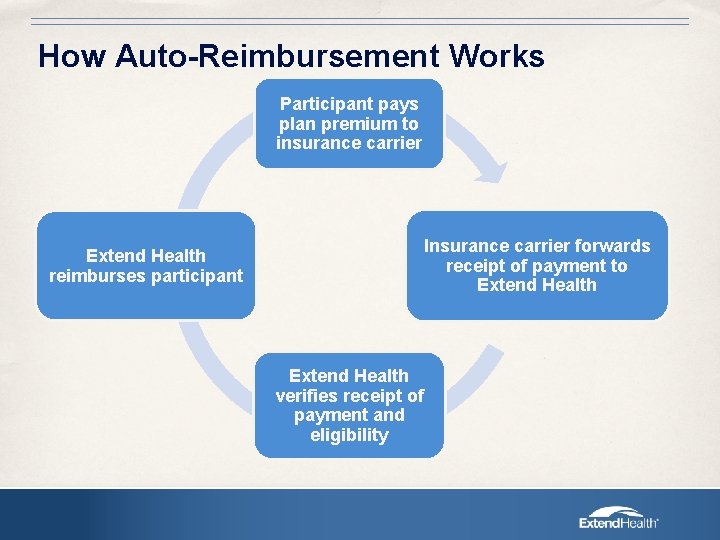

How Auto-Reimbursement Works Participant pays plan premium to insurance carrier Insurance carrier forwards receipt of payment to Extend Health reimburses participant Extend Health verifies receipt of payment and eligibility

What is Auto-Reimbursement? § Auto-Reimbursement (AR) allows retirees to be automatically reimbursed for monthly medical and prescription premiums without submitting a claim form or receipt § Auto-reimbursement only applies to premiums paid, not out-ofpocket expenses like copayments, deductibles, coinsurance § AR is NOT available on all plans § Due to the timing of Auto-Reimbursement files AR is usually not the fastest way to get a reimbursement

Next Steps

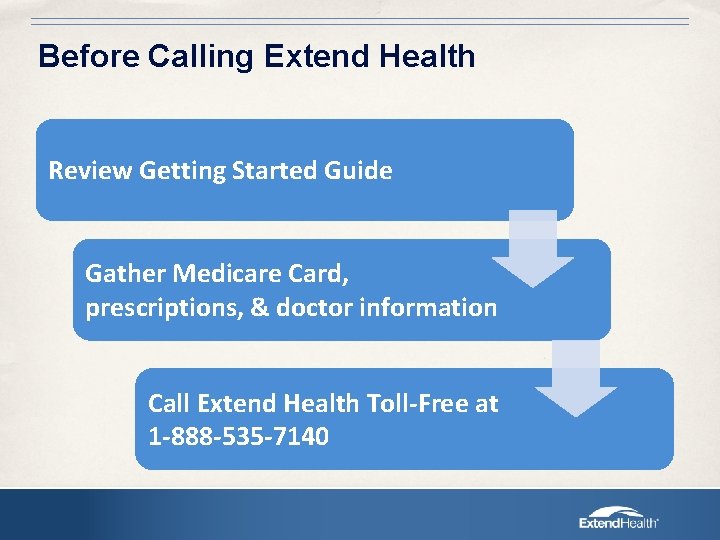

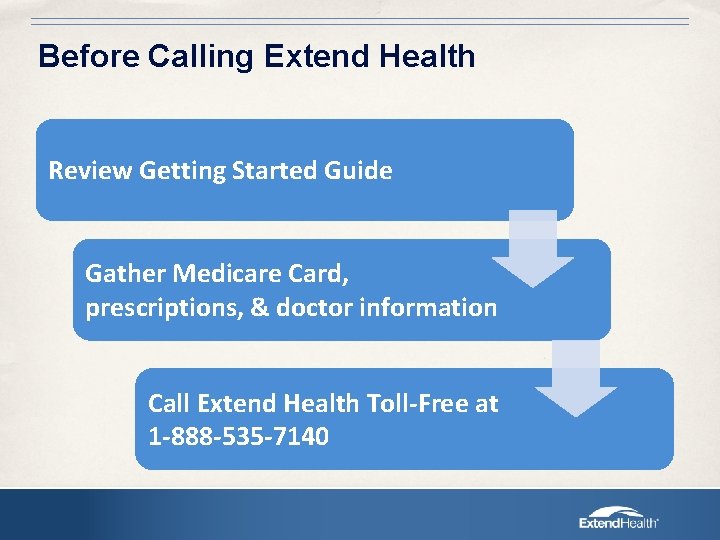

Before Calling Extend Health Review Getting Started Guide Gather Medicare Card, prescriptions, & doctor information Call Extend Health Toll-Free at 1 -888 -535 -7140

Post Enrollment Customer Service • Advocacy and support services: — Toll Free number to contact Extend Health representative — Direct support for claims issues, appeals and network questions • Renewal process – ability to pick new coverage for future years – not locked into this year’s coverage choice forever — Enrollment elections are generally for a one year period • Ongoing enrollment services as retiree or spouse turns age 65

Retirees or Covered Spouses Who Are Not Yet Eligible for Medicare • Dependents who are not yet eligible for Medicare do not need to take any action at this time • Du. Pont-sponsored group programs for pre-Medicare retirees and eligible spouses remain available • Once you or your spouse/dependents become eligible for Medicare, you will have access to the new individual program, including enrollment support offered through Extend Health 32

What You Need To Do Action required by current participants in Du. Pont-sponsored group coverage! • Enroll in Medicare Part B if not already enrolled • Contact Extend Health • Call 855 -535 -7140 • Schedule a meeting with a benefit advisor • Learn more about the individual coverage options available to you • Benefit advisors available: q Monday through Friday (Tip! Call on Thursday or Friday, and not on Monday morning) q 8: 00 a. m. to 9: 00 p. m. Eastern Time 33

Questions & Answers

Intel retiree organization

Intel retiree organization Local 237 prescription plan

Local 237 prescription plan Epeople oncor

Epeople oncor Www.oncorretirees.com

Www.oncorretirees.com Citgo retiree benefits

Citgo retiree benefits 8776441774

8776441774 Sears retiree website

Sears retiree website Eib retiree portal

Eib retiree portal Multifaceted approach to health care

Multifaceted approach to health care Comprehensive primary health care approach

Comprehensive primary health care approach Tertiary level of care

Tertiary level of care New-old approach to creating new ventures

New-old approach to creating new ventures Health and social care values unit 2

Health and social care values unit 2 Obamacare is new health care

Obamacare is new health care Universal health coverage in tamil

Universal health coverage in tamil Dimensions of universal health coverage

Dimensions of universal health coverage Dimensions of universal health coverage

Dimensions of universal health coverage Indiana health coverage programs

Indiana health coverage programs Health and social care component 3

Health and social care component 3 Community health choices waiver

Community health choices waiver Better choices better health sd

Better choices better health sd Food choices and human health

Food choices and human health Difference between virtual circuit and datagram networks

Difference between virtual circuit and datagram networks Cognitive approach vs behavioral approach

Cognitive approach vs behavioral approach Waterfall approach in international marketing

Waterfall approach in international marketing Multiple approach avoidance

Multiple approach avoidance Bandura's reciprocal determinism

Bandura's reciprocal determinism What is research approach

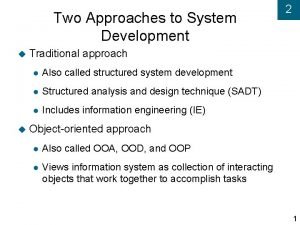

What is research approach Traditional approach vs object oriented approach

Traditional approach vs object oriented approach Tony wagner's seven survival skills

Tony wagner's seven survival skills Primary care a collaborative approach

Primary care a collaborative approach Word power: a new approach for content analysis

Word power: a new approach for content analysis A new approach to cross-modal multimedia retrieval

A new approach to cross-modal multimedia retrieval A whole new approach

A whole new approach New approach directives

New approach directives