Network Externalities What is a network externality When

- Slides: 24

Network Externalities • What is a network externality? – When a person buys a good or service, he becomes part of a network. – Thus the network increases in size. – The utility that people derive depends on the size of the network. – By joining I make everyone else in the network better off.

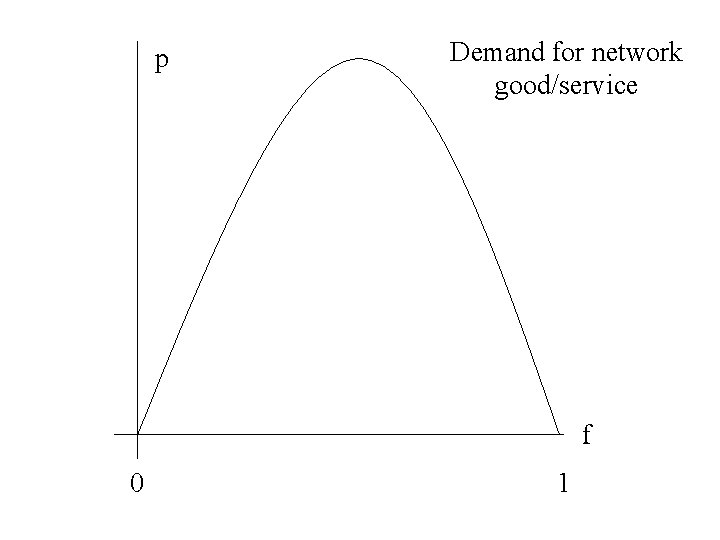

Model of Network Externalities • Demand for service depends on the size of the network. • Let Vi be consumer i’s maximum value for the product. • Consumer i will “join” the network if: Price < f*Vi where f is the fraction of the population that has “joined” the network.

Network Externalities, con’t • Assume that all consumers are uniformly distributed in terms of value from 0 to 100. • Then the percentage of the population with a value less than or equal to X is X/100 and the percentage with a value greater is (1 X/100). • Order all consumers based on their values from highest to lowest.

Network Externalities, con’t • To determine total demand at any price we need to find the “marginal” consumer, call him j, who is indifferent between joining the network and not joining it. – For this consumer price = f. Vj. • If this consumer is indifferent, all consumers with higher values will join and all consumers with lower values will not.

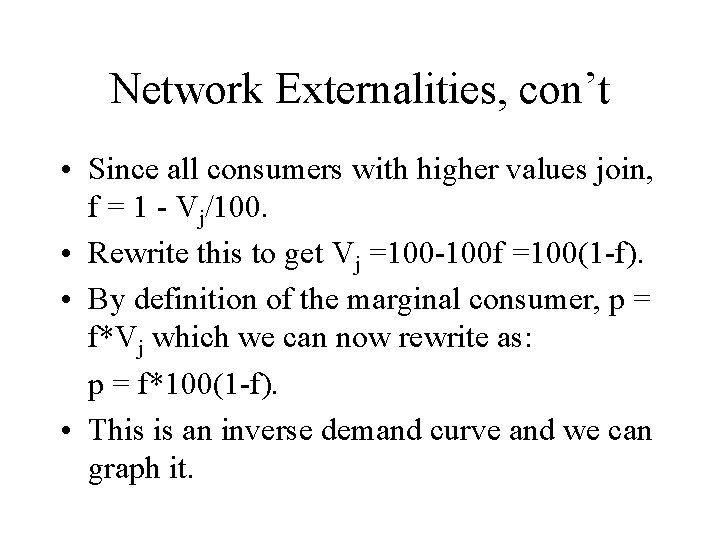

Network Externalities, con’t • Since all consumers with higher values join, f = 1 - Vj/100. • Rewrite this to get Vj =100 -100 f =100(1 -f). • By definition of the marginal consumer, p = f*Vj which we can now rewrite as: p = f*100(1 -f). • This is an inverse demand curve and we can graph it.

p Demand for network good/service f 0 1

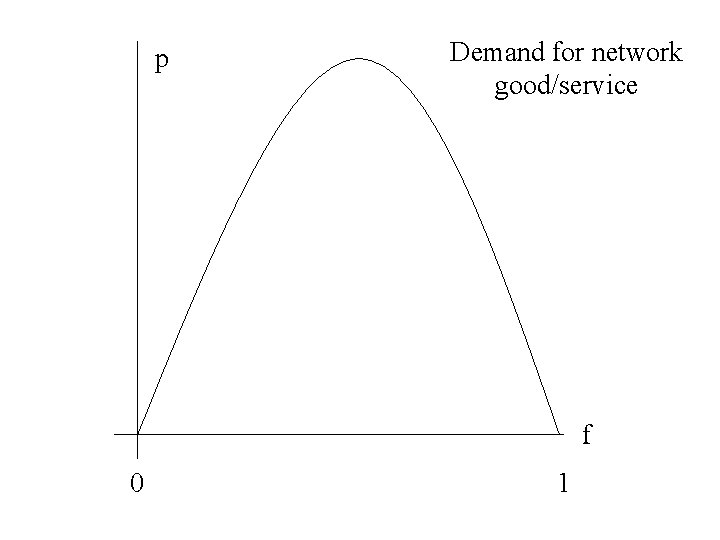

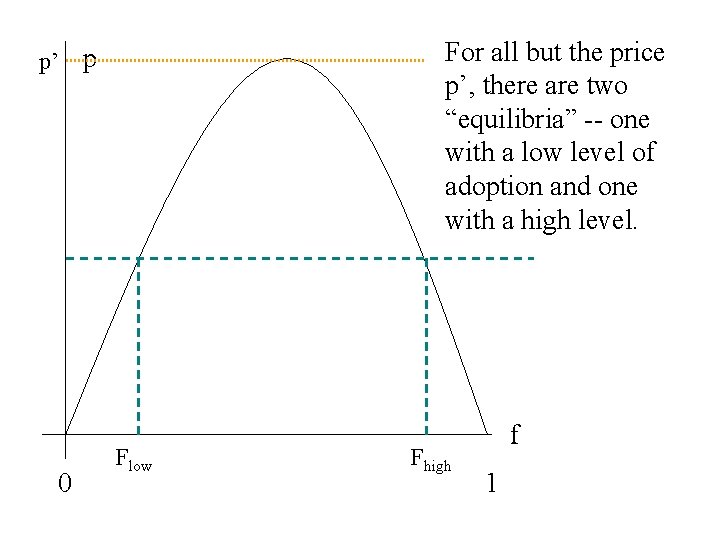

For all but the price p’, there are two “equilibria” -- one with a low level of adoption and one with a high level. p’ p 0 Flow Fhigh f 1

Network Externalities, con’t • Although there are two “equilibria” for each price, the low price equilibrium is unstable because any small increase in subscribers or decrease in price will increase the number of subscribers and move us to the high equilibrium. • So what price should the monopolist set?

Network Externalities, con’t • Assume the market is a monopoly. • Assume the MC of adding a subscriber is 0. • Total profit = pf. N = f 100(1 -f)f. N = 100 Nf 2 100 Nf 3. • Take derivative of profit w. r. t. f (which the monopolist controls indirectly through price) to get 100 N 2 f - 100 N 3 f 2 = 100 N(2 f 3 f 2). • Setting equal to 0, we get that f =0 or f =2/3.

Network Externalities, con’t • Since f*=0 implies profits of 0, f* = 2/3 must be optimal. • Of course, with different marginal costs, the answer would be different. • Since p = f 100 (1 -f), p = 2/3*100(1/3) =200/9 = 22.

Network Externalities, con’t • So how does the monopolist get the network started? • Once the network gets started, consumers with high values will buy, increasing the size of the network, causing more consumers to buy, causing the network to grow, and so on. • But no one wants to be the first to sign up.

Network Externalities, con’t • Even for the consumer with the highest value to want to buy, the network must be of a certain minimum size f’ defined by p* = f’ 100. • Rewritten, f’ = p*/100 = 22. 22%. • Once the network gets to f’, the network will grow until it reaches the equilibrium of 2/3.

Network Externalities and Standardization • With network externalities, there will be a few large networks instead of several small ones. • Will there be only one, or will there be competing networks? • Two factors to consider: – With only one network, there is less product differentiation, so competition will be more intense. – But a larger network bestows more benefits on users, thus increasing willingness to pay and price. • Depending on which effect is larger, there are three separate “games” which firms may play.

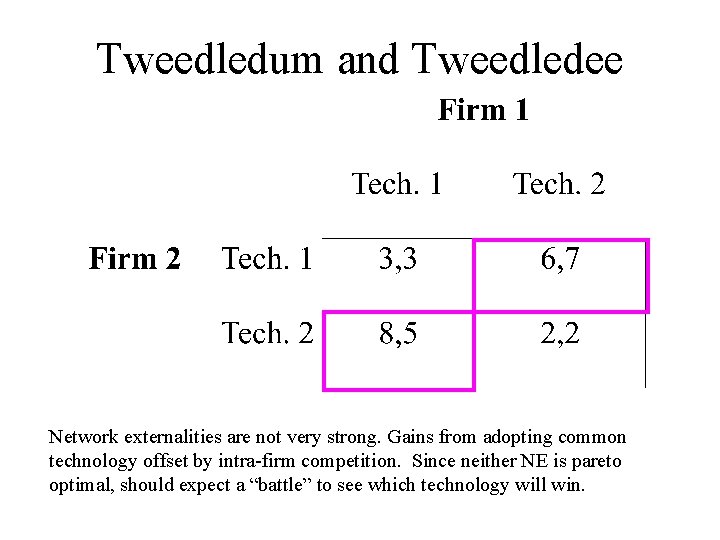

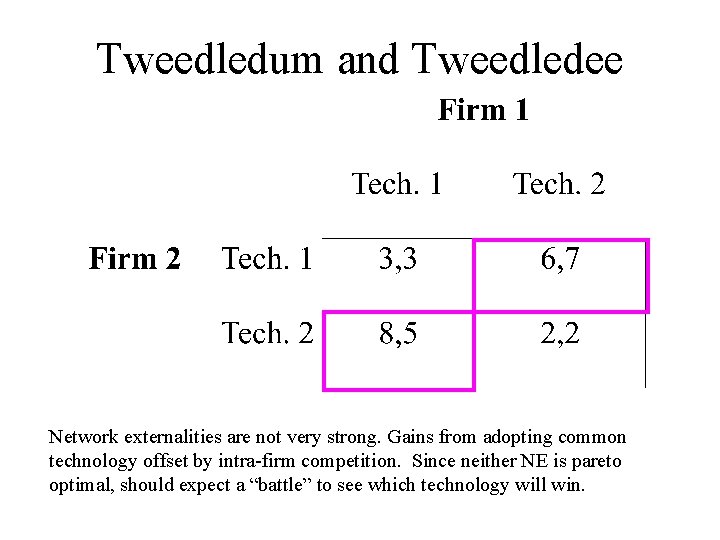

Tweedledum and Tweedledee Network externalities are not very strong. Gains from adopting common technology offset by intra-firm competition. Since neither NE is pareto optimal, should expect a “battle” to see which technology will win.

Tweedledum and Tweedledee, con’t • Types of possible battles to establish dominant technology: – Intense price competition to get the lead and the bigger network. – Attract suppliers of complements (software, games) to increase consumer’s value of joining network. – Product preannouncement to let people know what is coming (Windows 95). – Commitments to maintain low prices in the long run (cheap upgrades). • Results in these markets not predetermined, i. e. they are path dependent.

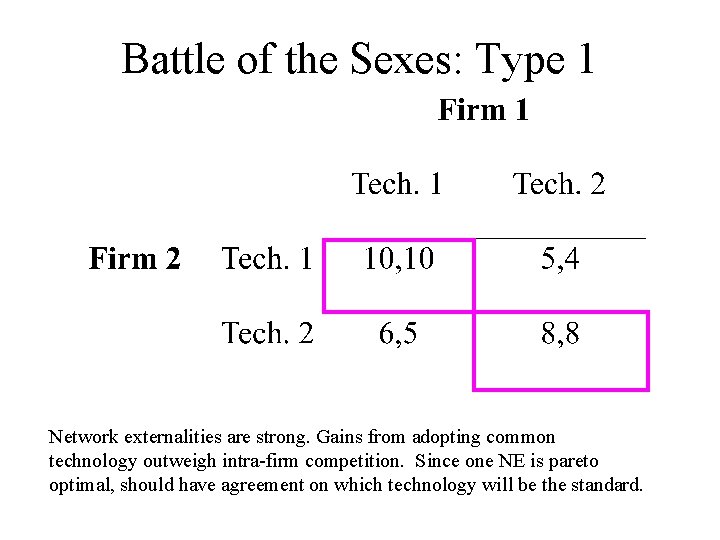

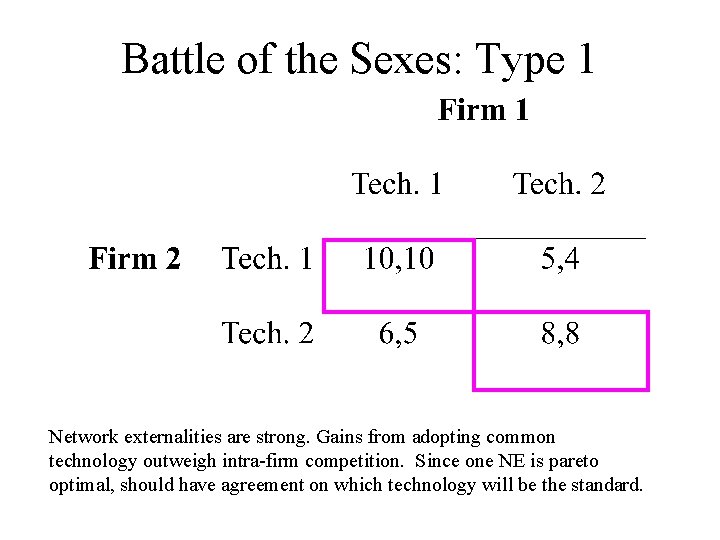

Battle of the Sexes: Type 1 Network externalities are strong. Gains from adopting common technology outweigh intra-firm competition. Since one NE is pareto optimal, should have agreement on which technology will be the standard.

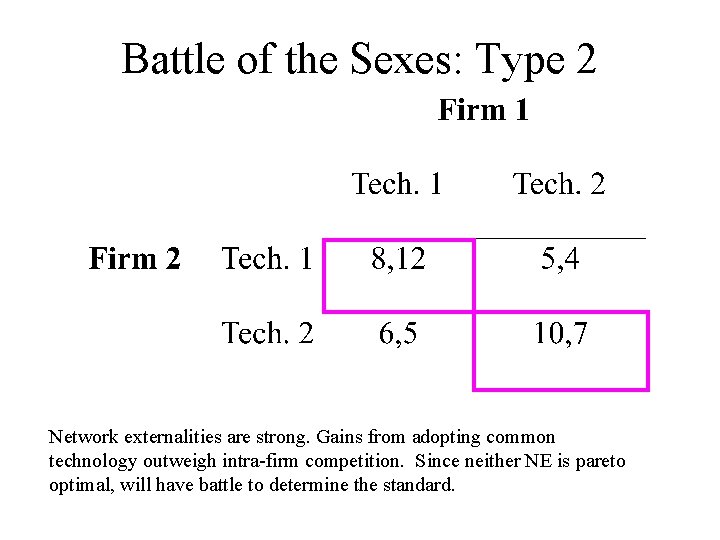

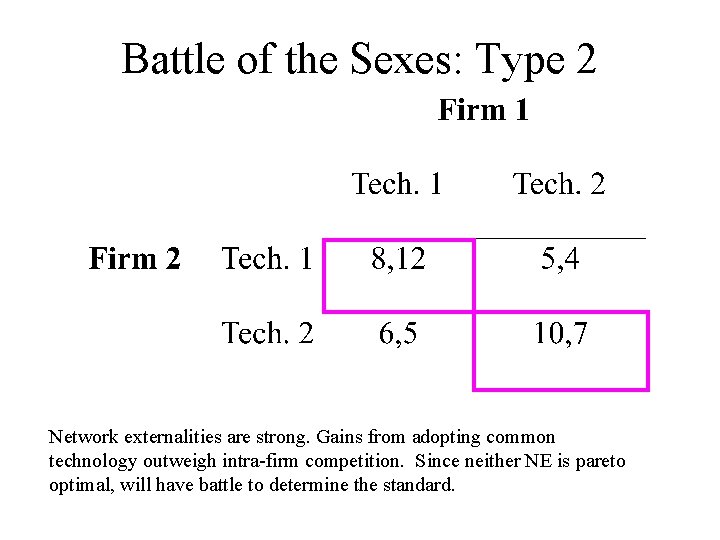

Battle of the Sexes: Type 2 Network externalities are strong. Gains from adopting common technology outweigh intra-firm competition. Since neither NE is pareto optimal, will have battle to determine the standard.

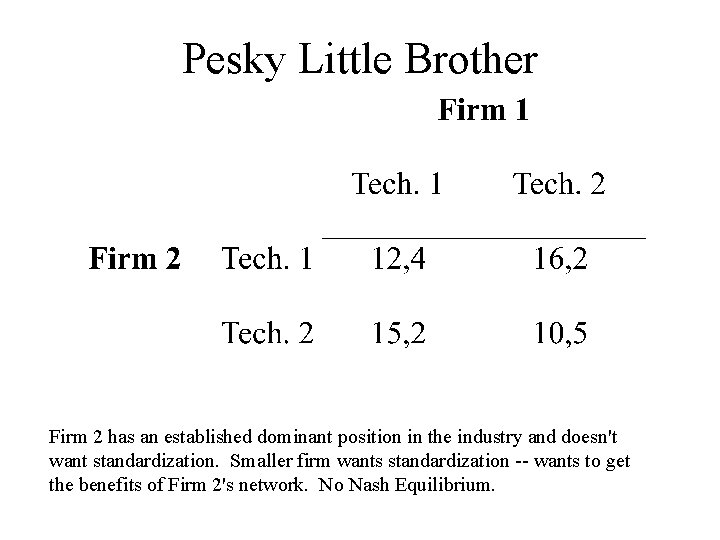

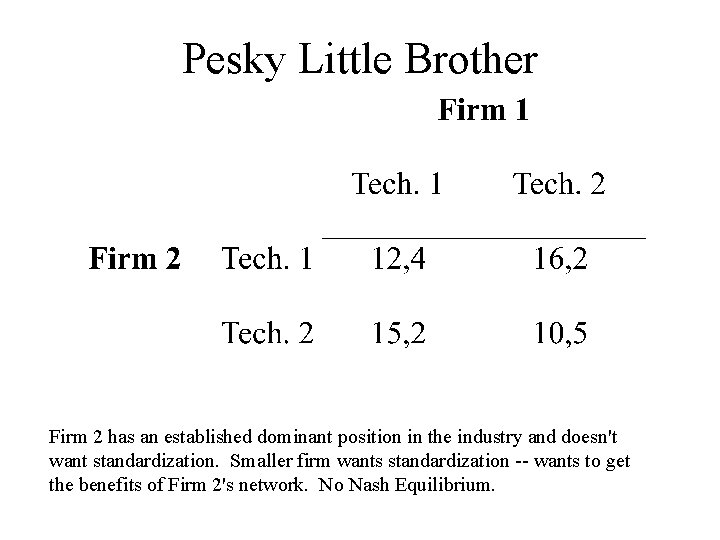

Pesky Little Brother Firm 2 has an established dominant position in the industry and doesn't want standardization. Smaller firm wants standardization -- wants to get the benefits of Firm 2's network. No Nash Equilibrium.

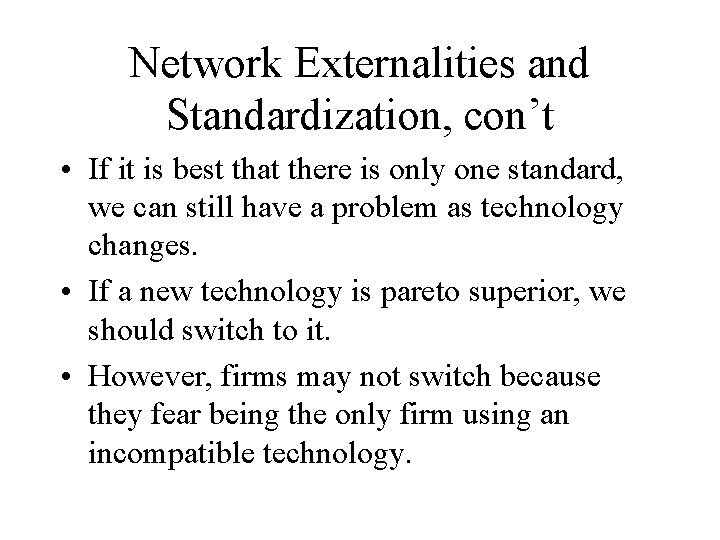

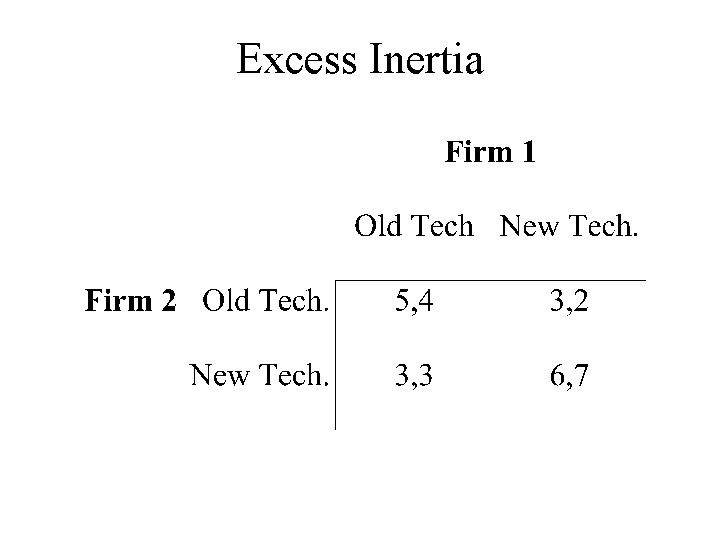

Network Externalities and Standardization, con’t • If it is best that there is only one standard, we can still have a problem as technology changes. • If a new technology is pareto superior, we should switch to it. • However, firms may not switch because they fear being the only firm using an incompatible technology.

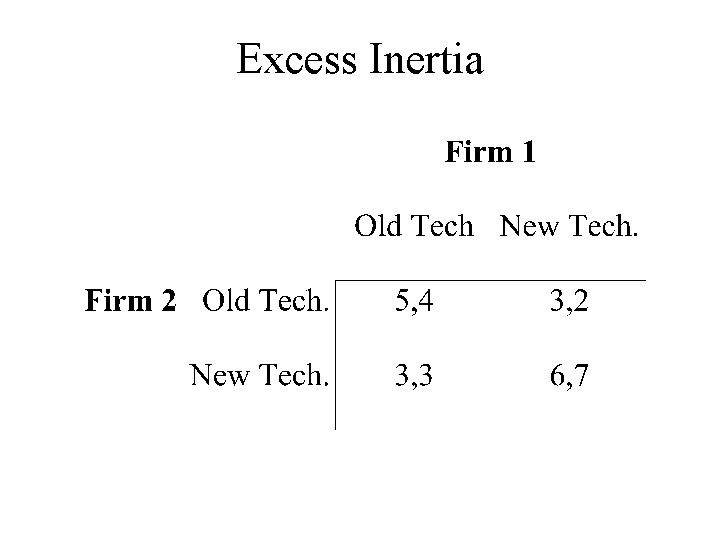

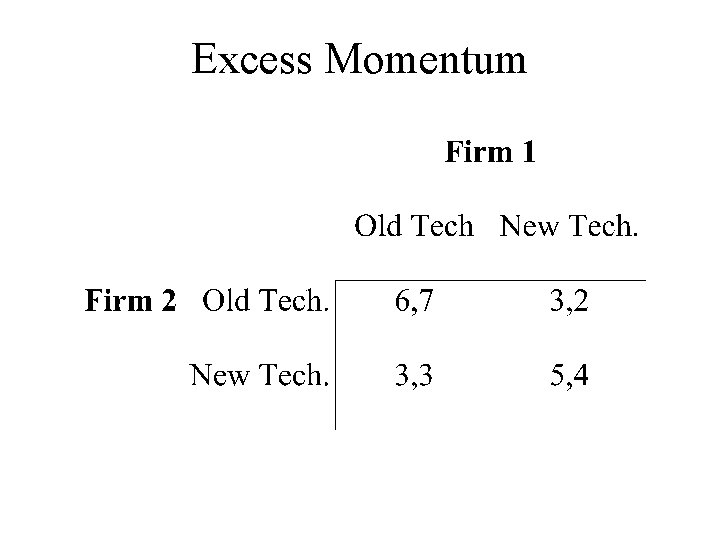

Excess Inertia

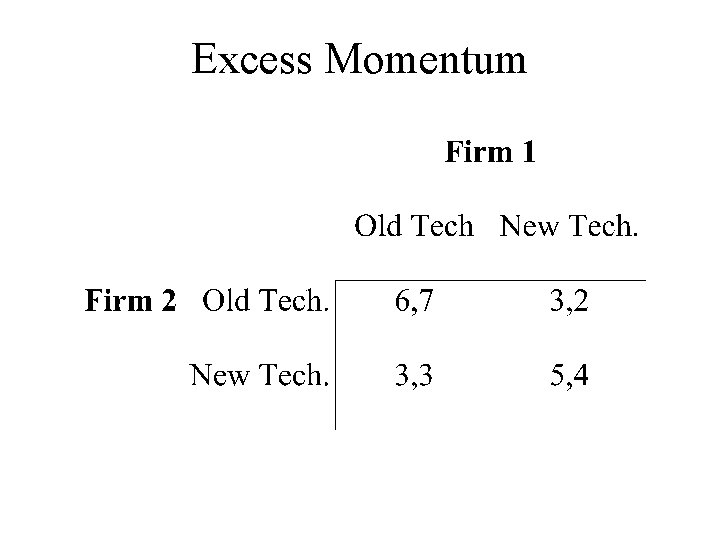

Network Externalities and Standardization, con’t • On the other hand, it could be that the old technology is pareto superior • In this case, we may get excess momentum, that is firms may switch because they fear being the only firm not using the new technology.

Excess Momentum

Network Externalities and Standardization, con’t • When introducing a technology, firms can adopt an “evolutionary” or “revolutionary” strategy. – Evolutionary: Make the technology “backwards compatible” so that people can easily switch from an older technology to your technology. – Revolutionary: Make the technology “backwards incompatible”.

Network Externalities and Standardization, con’t • With two firms and two possible strategies, get three types of “wars”. – Rival Evolution: Both firms have new technologies that are backward compatible, just not with each other. (DVDs and Divx both play CDs but not each others’ disks. ) – Evolution vs. Revolution: One technology is backwards compatible, the other is not. – Rival Revolution: Both new technologies are backwards incompatible. (Nintendo vs. Play Station. )