Municipal Association of Victoria Local Government Reform Projects

- Slides: 24

Municipal Association of Victoria Local Government Reform Projects 2012 International Local Government and Asset Management Conference Ian Mann CT Management Group

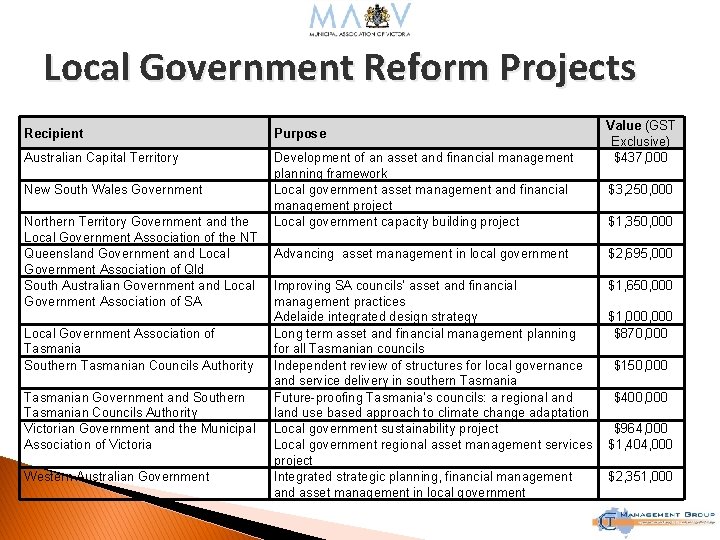

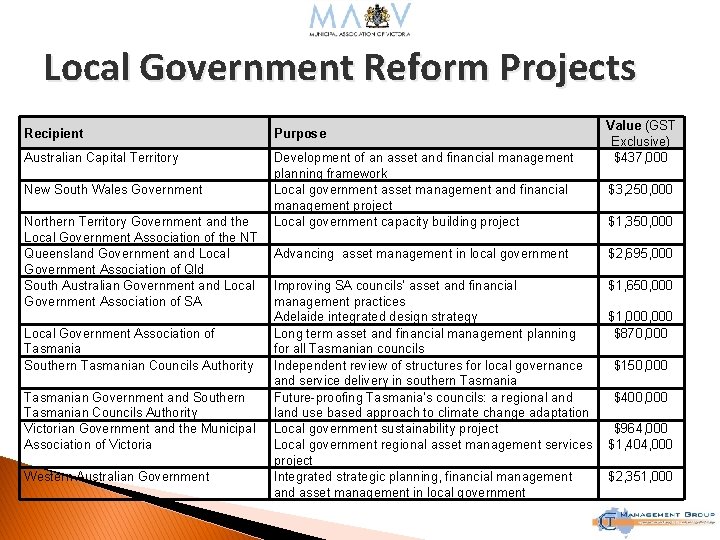

Local Government Reform Projects Recipient Purpose Australian Capital Territory Development of an asset and financial management planning framework Local government asset management and financial management project Local government capacity building project New South Wales Government Northern Territory Government and the Local Government Association of the NT Queensland Government and Local Government Association of Qld South Australian Government and Local Government Association of SA Local Government Association of Tasmania Southern Tasmanian Councils Authority Tasmanian Government and Southern Tasmanian Councils Authority Victorian Government and the Municipal Association of Victoria Western Australian Government Value (GST Exclusive) $437, 000 $3, 250, 000 $1, 350, 000 Advancing asset management in local government $2, 695, 000 Improving SA councils’ asset and financial management practices Adelaide integrated design strategy Long term asset and financial management planning for all Tasmanian councils Independent review of structures for local governance and service delivery in southern Tasmania Future-proofing Tasmania’s councils: a regional and land use based approach to climate change adaptation Local government sustainability project Local government regional asset management services project Integrated strategic planning, financial management and asset management in local government $1, 650, 000 $1, 000 $870, 000 $150, 000 $400, 000 $964, 000 $1, 404, 000 $2, 351, 000

Regional Asset Management Services Program � Objectives ◦ maximise the financial sustainability of Victoria’s regional councils to support continued provision of services to their communities over the long term by increasing collaboration between them; and ◦ increase councils’ ability to effectively manage their assets using more collaborative and efficient delivery models and improved asset management practices.

Program Delivery � Council visits � Regional workshops ◦ Support each Council ◦ Develop solutions – tools and templates � Web site ◦ Collect and disseminate information � 4, 900 hours of program delivery

Tools & Templates Asset Management Policy � Asset Management Strategy � Terms of Reference for an Asset Management Steering Committee � Asset Management Roles and Responsibilities Matrix � Asset Management Skills Matrix � Capitalisation and Valuation Policies (Work in progress) � Asset Management Plan Templates � Long Term Financial Plan asset forecasting criteria � Capital Works Evaluation Framework � Asset Categorisation Hierarchy � Asset Handover Process � Levels of Service Framework (Work in progress) � Community Consultation Guidelines (Work in progress) �

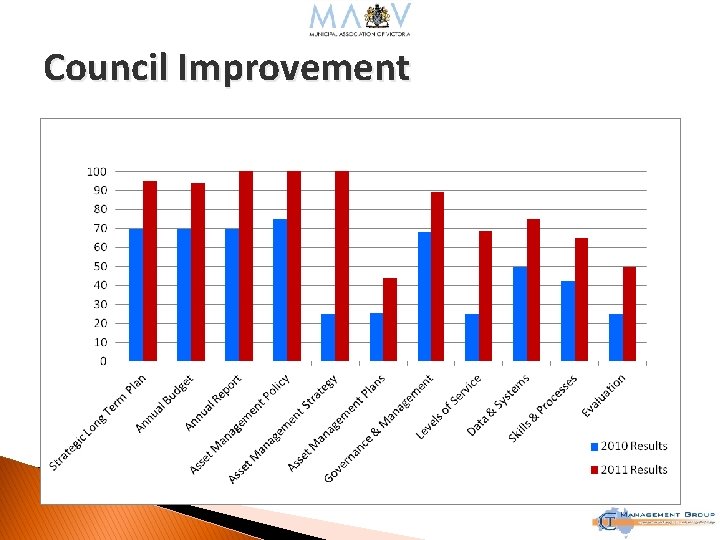

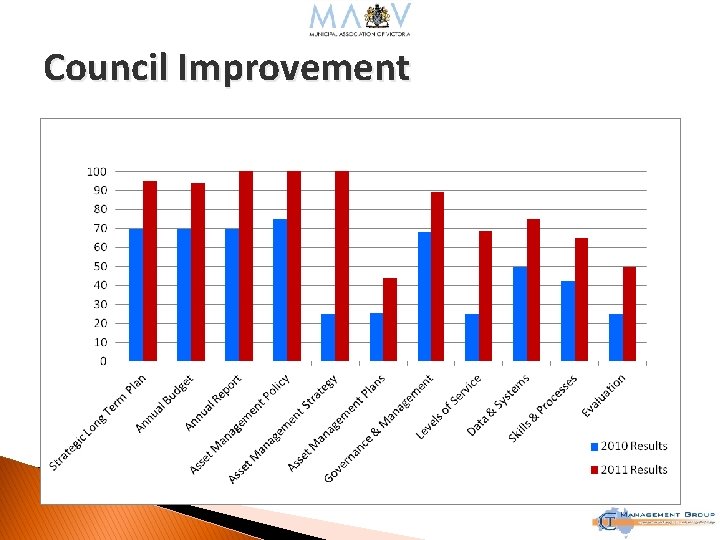

Council Improvement

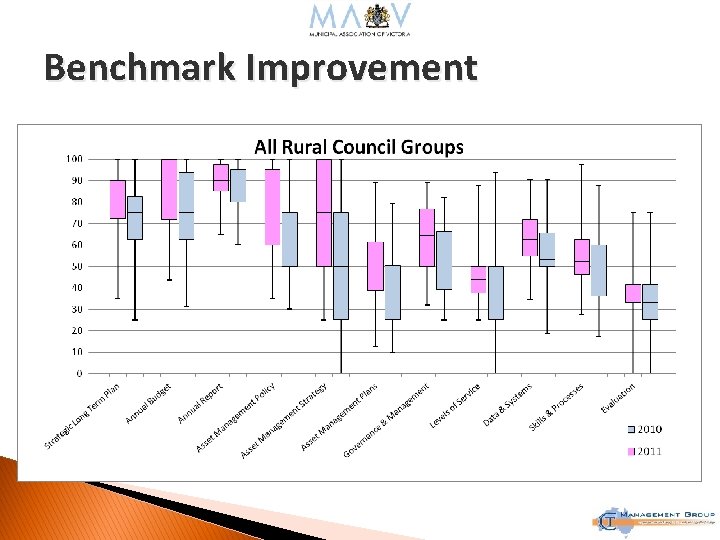

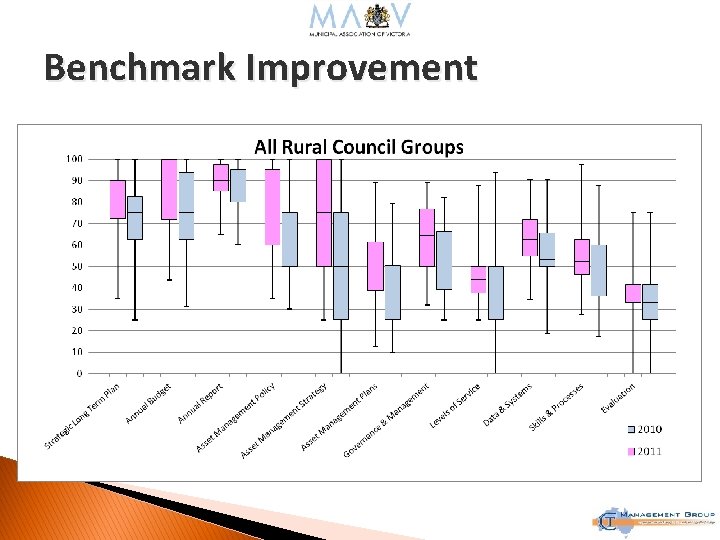

Benchmark Improvement

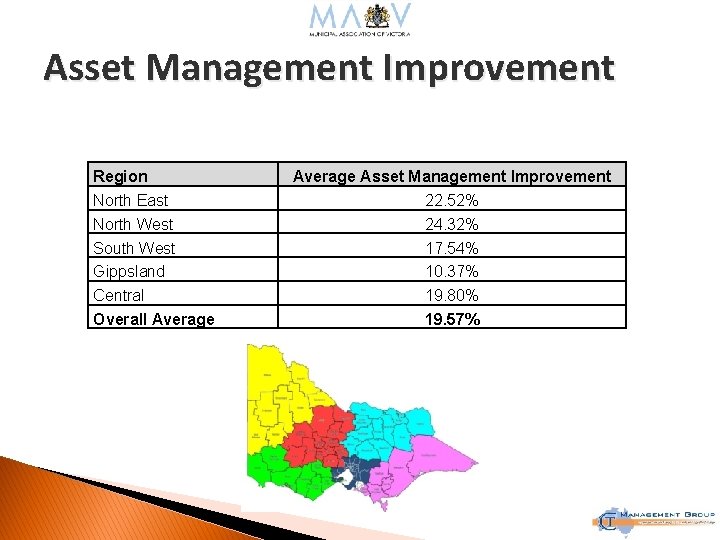

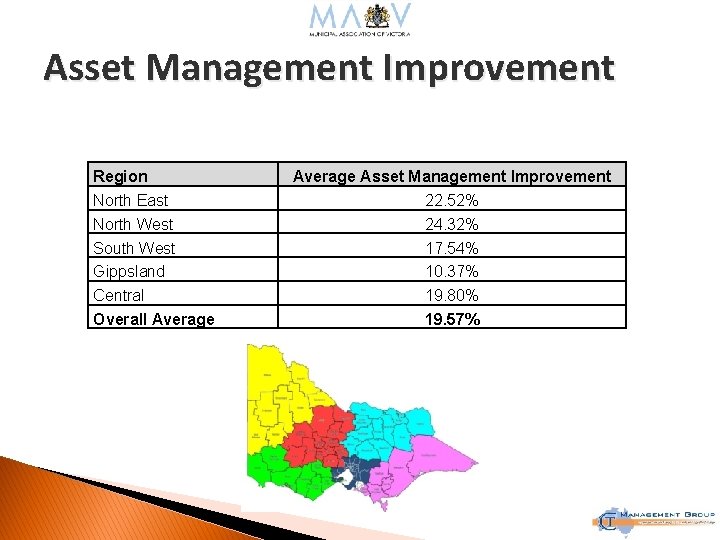

Asset Management Improvement Region North East North West South West Gippsland Central Overall Average Asset Management Improvement 22. 52% 24. 32% 17. 54% 10. 37% 19. 80% 19. 57%

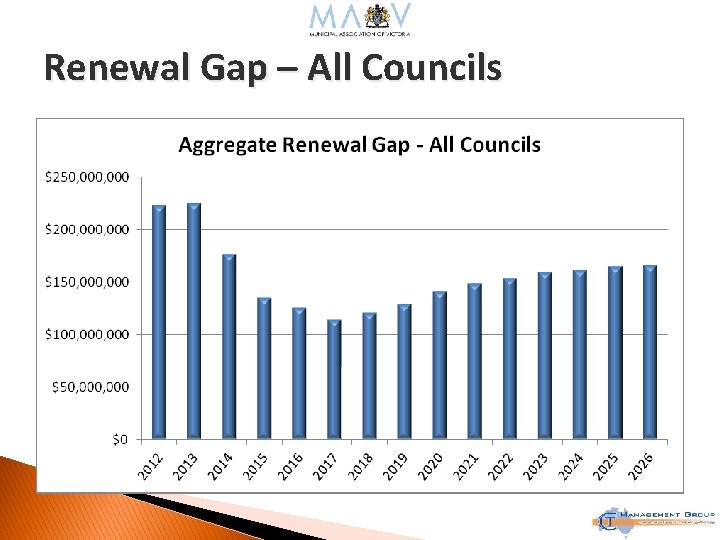

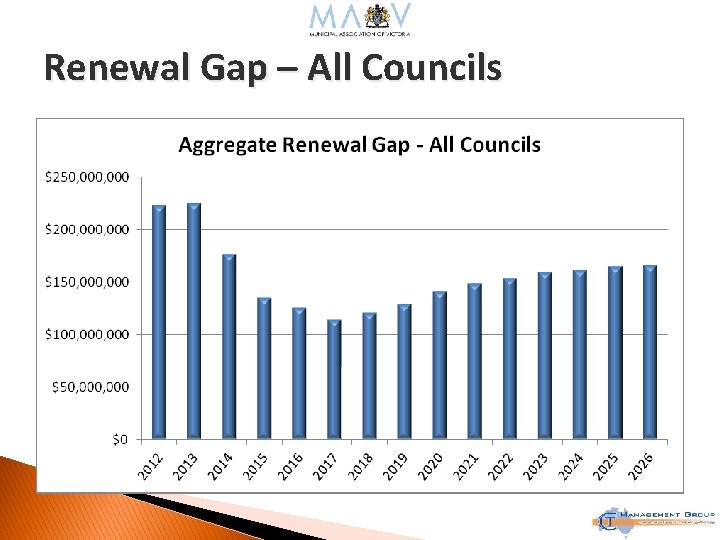

Renewal Gap – All Councils

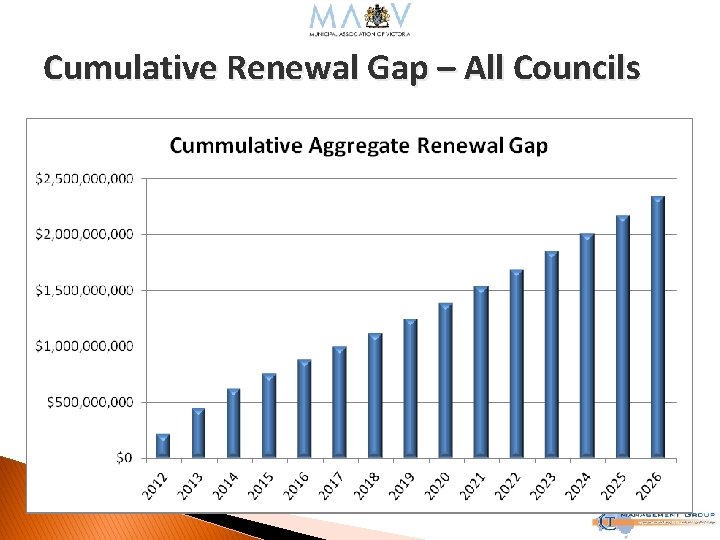

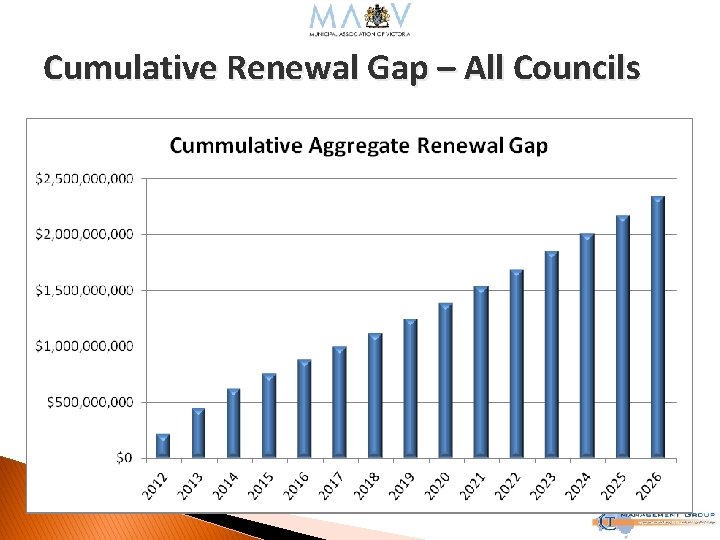

Cumulative Renewal Gap – All Councils

Local Government Sustainability � Objectives ◦ maximise councils’ financial sustainability to support continued provision of services to their communities over the long term; and ◦ increase councils’ ability to effectively manage their current and future performance using a consistent ‘whole of council’ perspective which brings together their financial and asset management operations for reporting and management purposes.

LGS - Program Delivery � Strategic Analysis ◦ Council visits ◦ Self Assessment ◦ Assessment Report � Strategic Review ◦ Financial Analysis - Historical ◦ Strategic Report ◦ Long Term Financial Plan assistance

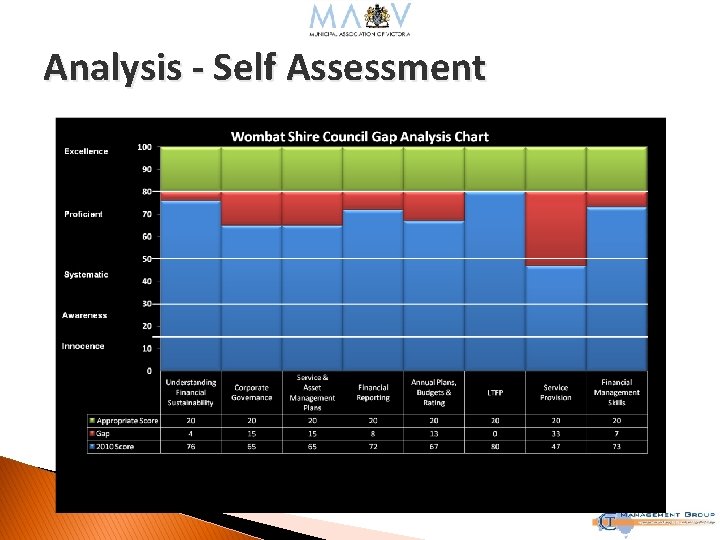

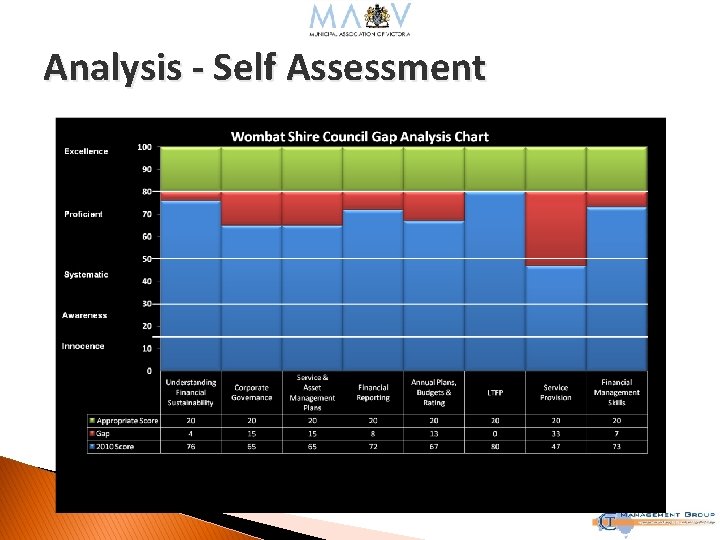

Analysis - Self Assessment

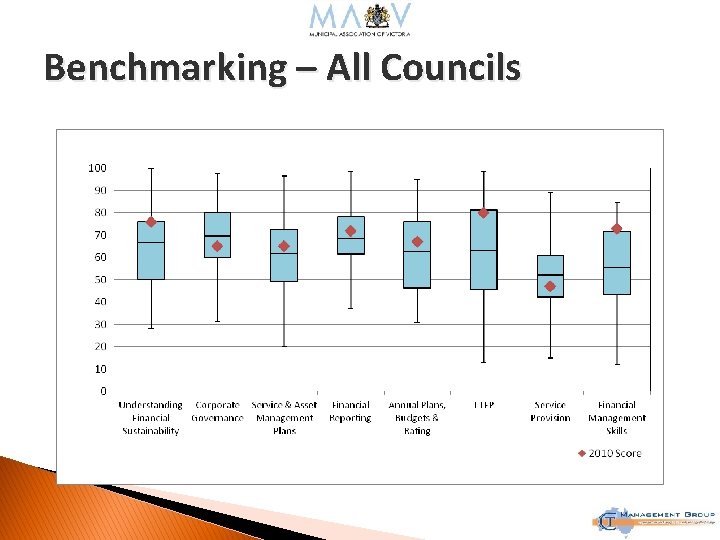

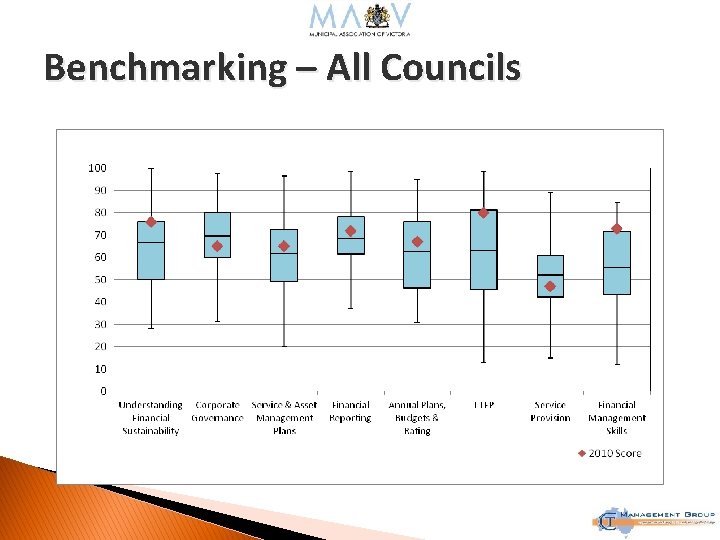

Benchmarking – All Councils

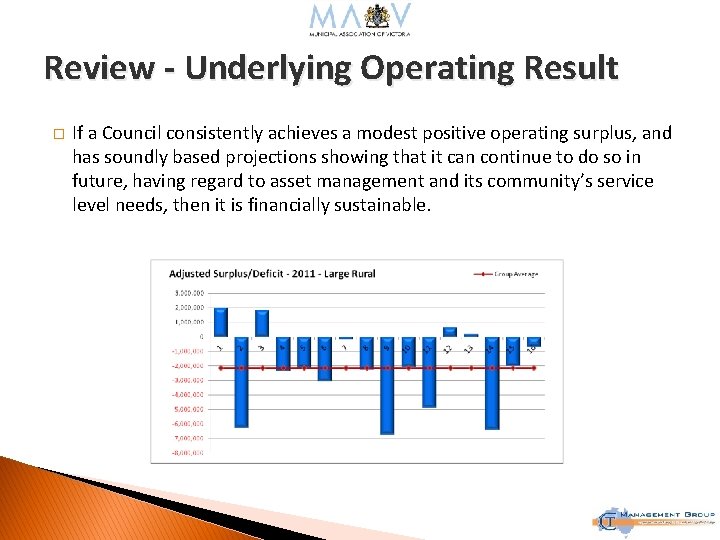

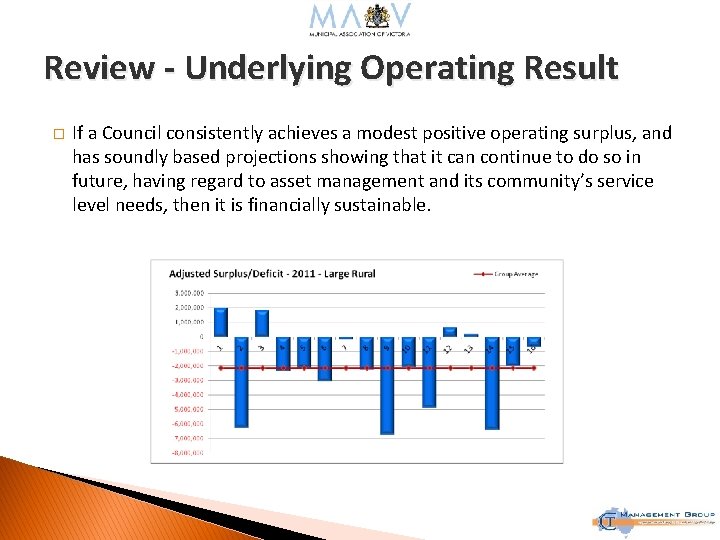

Review - Underlying Operating Result � If a Council consistently achieves a modest positive operating surplus, and has soundly based projections showing that it can continue to do so in future, having regard to asset management and its community’s service level needs, then it is financially sustainable.

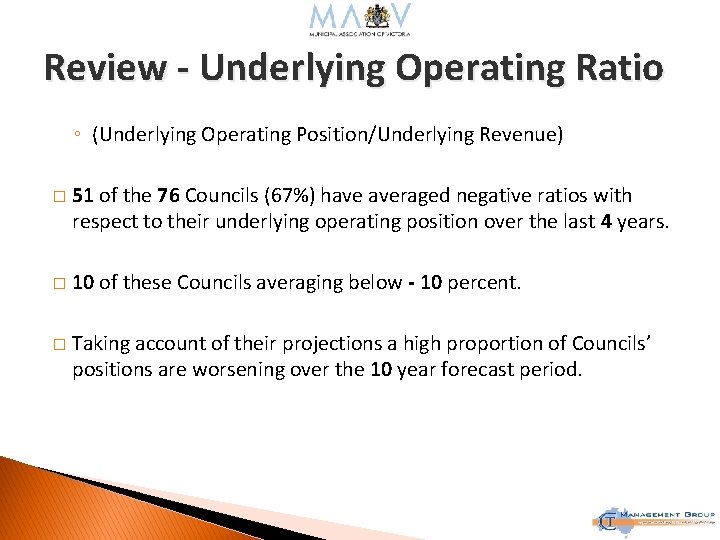

Review - Underlying Operating Ratio ◦ (Underlying Operating Position/Underlying Revenue) � 51 of the 76 Councils (67%) have averaged negative ratios with respect to their underlying operating position over the last 4 years. � 10 of these Councils averaging below - 10 percent. � Taking account of their projections a high proportion of Councils’ positions are worsening over the 10 year forecast period.

Review - Depreciation � Councils are the custodians of over $28. 2 billion of infrastructure and other assets. � Accounting Standards ◦ define depreciation as ‘the systematic allocation of the depreciable amount of an asset over its useful life’-(AASB 116). ◦ require that depreciation methods reflect “the pattern in which the asset’s future economic benefits are expected to be consumed. ” � For most Councils, depreciation is amongst the largest expenditure item.

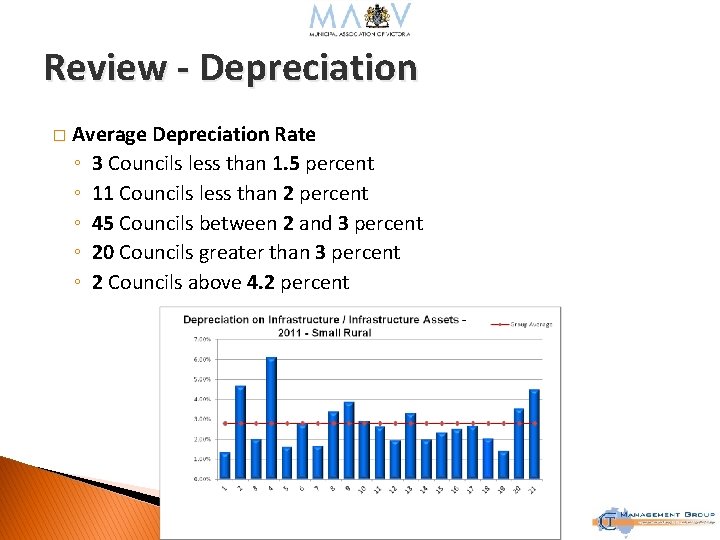

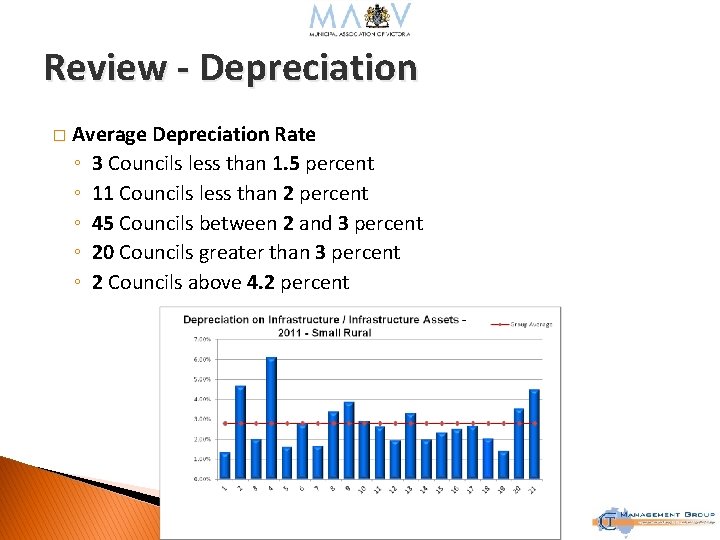

Review - Depreciation � Average Depreciation Rate ◦ 3 Councils less than 1. 5 percent ◦ 11 Councils less than 2 percent ◦ 45 Councils between 2 and 3 percent ◦ 20 Councils greater than 3 percent ◦ 2 Councils above 4. 2 percent

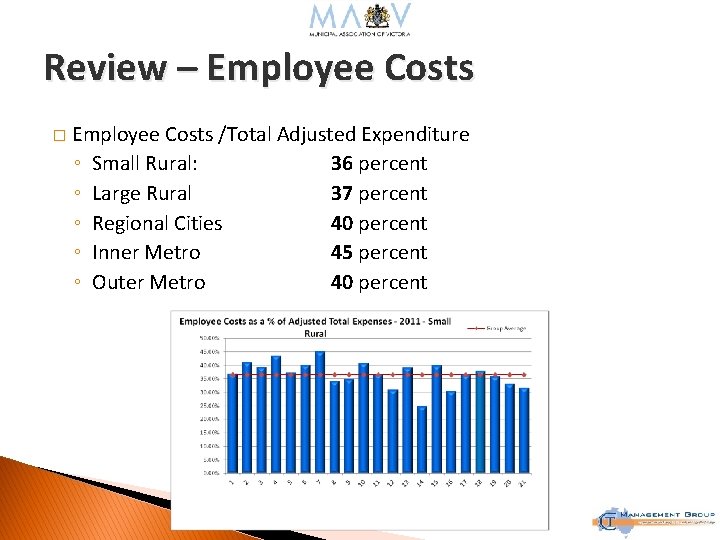

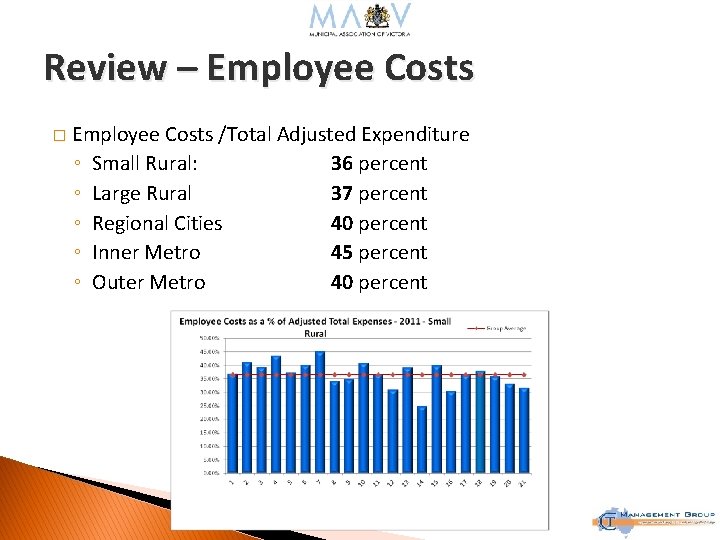

Review – Employee Costs � Employee Costs /Total Adjusted Expenditure ◦ Small Rural: 36 percent ◦ Large Rural 37 percent ◦ Regional Cities 40 percent ◦ Inner Metro 45 percent ◦ Outer Metro 40 percent

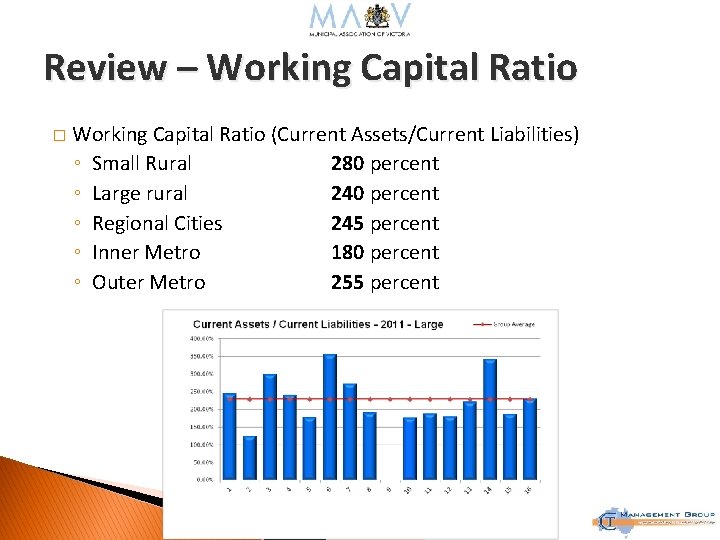

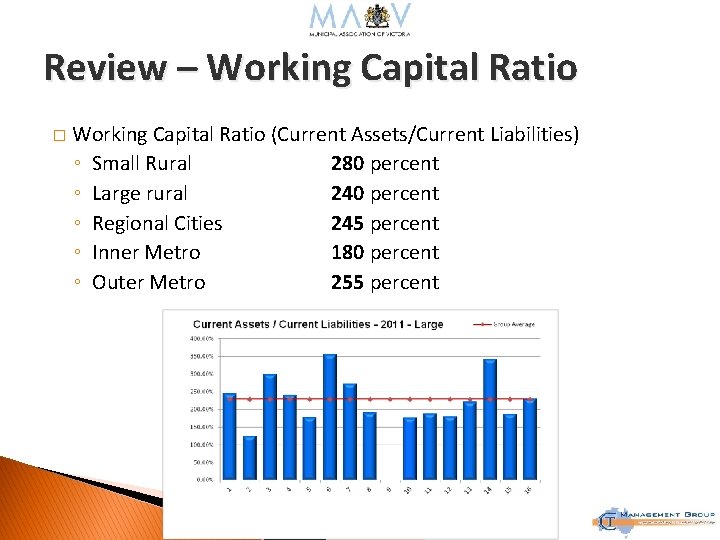

Review – Working Capital Ratio � Working Capital Ratio (Current Assets/Current Liabilities) ◦ Small Rural 280 percent ◦ Large rural 240 percent ◦ Regional Cities 245 percent ◦ Inner Metro 180 percent ◦ Outer Metro 255 percent

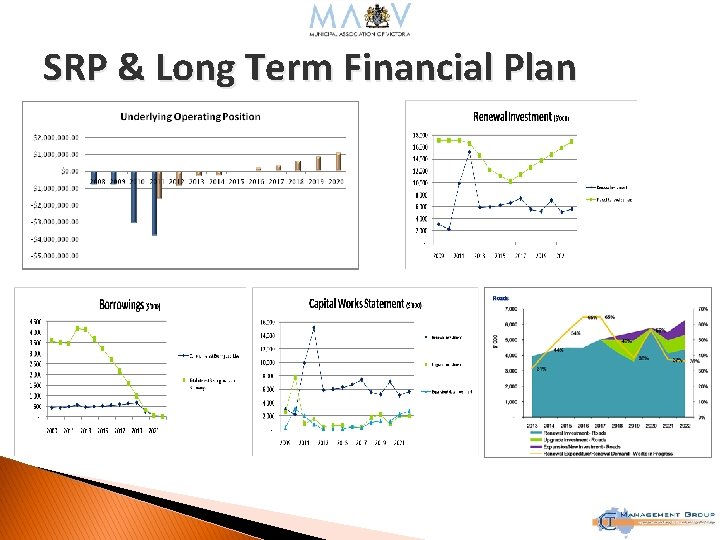

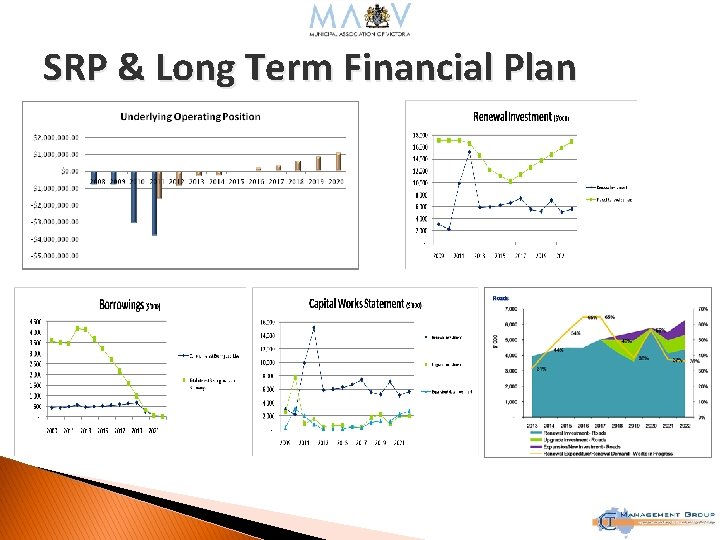

SRP & Long Term Financial Plan

LGS - Findings Underlying Operating Position 1. a) b) In many Councils the underlying operating position is in decline with growing deficits or minimal change. Operating deficits are creating the need to defer and under spend on renewal of infrastructure creating additional renewal backlog Working Capital 2. a) High correlation between Councils with high working capital levels and low delivery of the annual capital works program

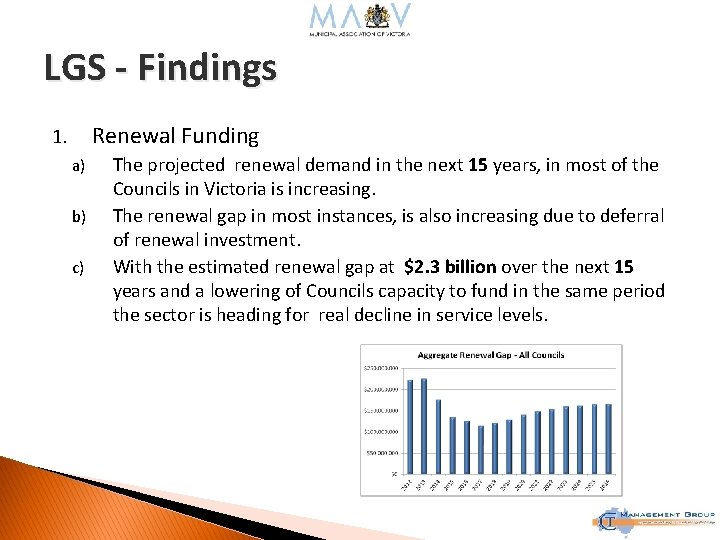

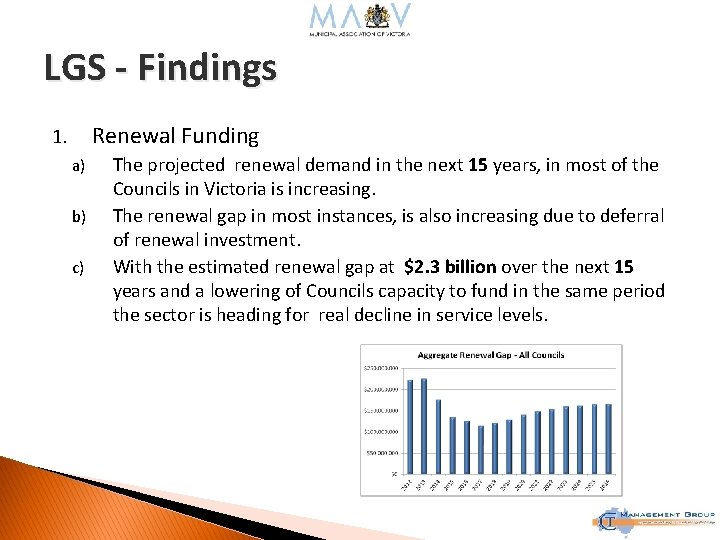

LGS - Findings Renewal Funding 1. a) b) c) The projected renewal demand in the next 15 years, in most of the Councils in Victoria is increasing. The renewal gap in most instances, is also increasing due to deferral of renewal investment. With the estimated renewal gap at $2. 3 billion over the next 15 years and a lowering of Councils capacity to fund in the same period the sector is heading for real decline in service levels.

End Ian Mann Director CT Management Group Mob: 0429 941 435 Email: ianm@ctman. com. au CT Management Group 152 Lt Malop Street PO Box 1374 Geelong 3220 Ph: (03) 5221 2566