MSc in Actuarial Science MSc in Actuarial Management

- Slides: 45

MSc in Actuarial Science MSc in Actuarial Management MSc in Insurance & Risk Management

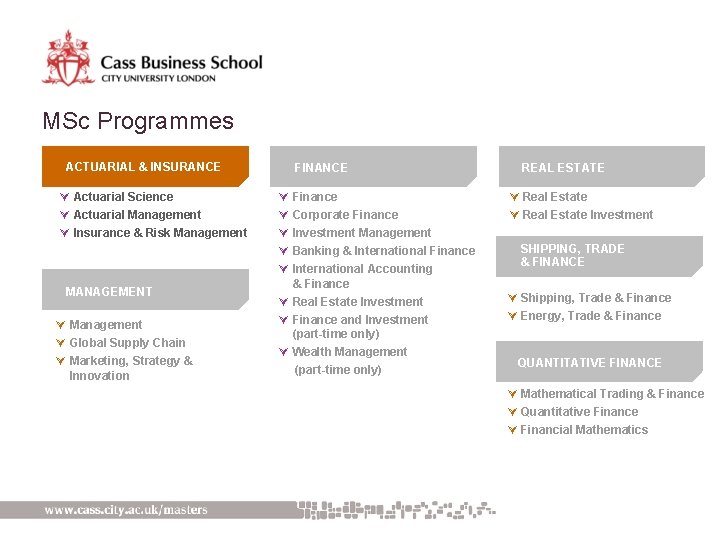

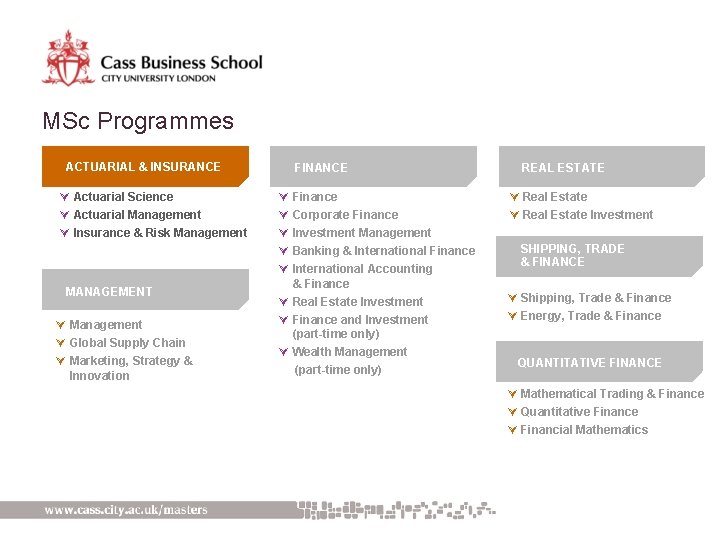

MSc Programmes ACTUARIAL & INSURANCE Ú Actuarial Science Ú Actuarial Management Ú Insurance & Risk Management MANAGEMENT Ú Management Ú Global Supply Chain Ú Marketing, Strategy & Innovation FINANCE Ú Finance Ú Corporate Finance Ú Investment Management Ú Banking & International Finance Ú International Accounting & Finance Ú Real Estate Investment Ú Finance and Investment (part-time only) Ú Wealth Management (part-time only) REAL ESTATE Ú Real Estate Investment SHIPPING, TRADE & FINANCE Ú Shipping, Trade & Finance Ú Energy, Trade & Finance QUANTITATIVE FINANCE Ú Mathematical Trading & Finance Ú Quantitative Finance Ú Financial Mathematics

Why choose Cass Business School? Ú International reputation Ú Qualified actuaries on teaching staff Ú Professional exemptions Ú World-class facilities Ú Excellent teaching assessment Ú Cass rated second in world for research in insurance Ú Excellent careers service

MSc in Actuarial Science Dr Douglas Wright, Presenter Dr Iqbal Owadally, Course Director Eva Matiaskova, Admissions Officer

Professional links Ú Staple Inn Actuarial Society Ú Reception for students at Institute of Actuaries Ú Annual students’ lecture Ú Careers events and professional development

Who should apply MSc in Actuarial Science (AS) is suitable for Ú Actuarial trainees who are at an early stage of their training Ú Prospective entrants to the actuarial profession

MSc in Actuarial Science Ú Offers eight Core Technical subjects of of Actuarial Profession (CT 1 -CT 8) Ú Minimum of 5 CT subjects required Ú MSc = 5 CTs + 5 Short Electives or Ú MSc = 5 CTs + 1 Short Elective + Project

Core technical subjects Ú CT 1 – Financial Mathematics Ú CT 2 – Finance and Financial Reporting Ú CT 3 – Probability & Mathematical Statistics Ú CT 4 – Modelling Ú CT 5 – Contingencies Ú CT 6 – Statistical Methods Ú CT 7 – Business Economics Ú CT 8 – Financial Economics

Professional exemptions Ú Course is accredited by the UK Institute and Faculty of Actuaries Ú Students scoring at least 65% as an average in their actuarial subjects are eligible for exemptions from that group of subjects Ú Exemptions are also awarded on a subject by subject basis for students not meeting the accreditation requirements

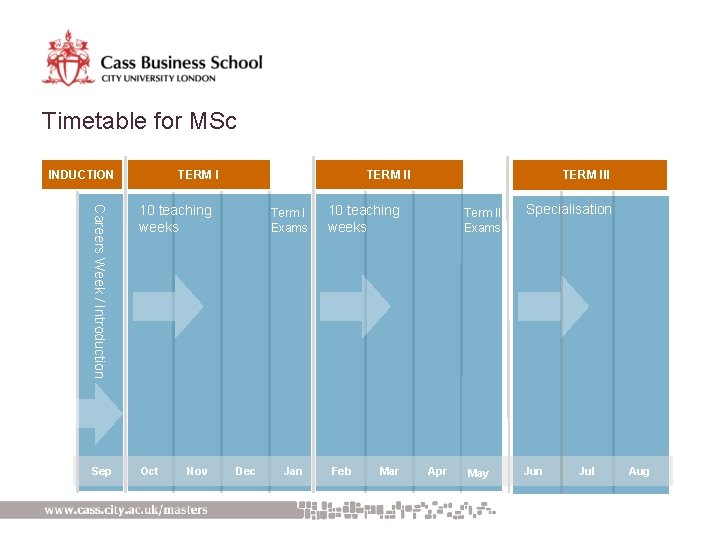

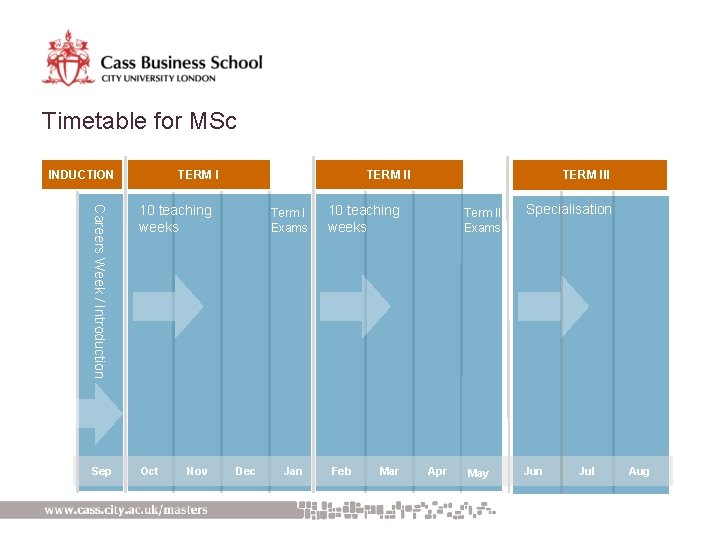

Timetable for MSc INDUCTION TERM I Careers Week / Introduction 10 teaching weeks Sep Oct Nov TERM III TERM II Term I Exams Dec Jan 10 teaching weeks Feb Mar Term II Exams Apr May Specialisation Jul Aug

Term III – route 1 1. Take five short elective modules, for example: • Stochastic Asset Models for Actuarial Use • Introduction to Copula Modelling • Modelling and Data Analysis • Model Office Building in Life Insurance • Visual Basic in Finance • Behavioural Finance • Hedge Funds • Credit Risk Management Choice out of portfolio of more than 60 modules

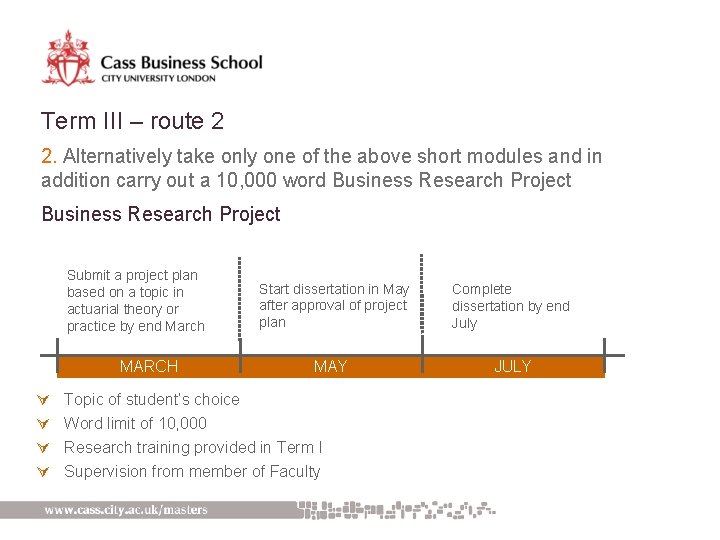

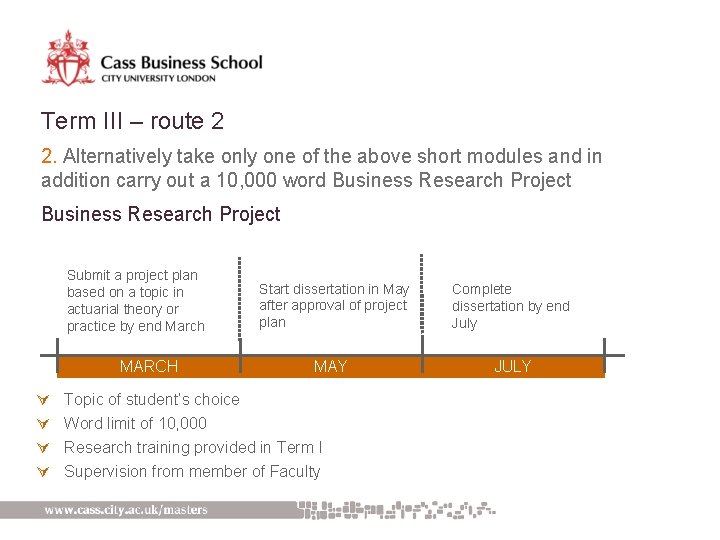

Term III – route 2 2. Alternatively take only one of the above short modules and in addition carry out a 10, 000 word Business Research Project Submit a project plan based on a topic in actuarial theory or practice by end March MARCH Ú Ú Start dissertation in May after approval of project plan Complete dissertation by end July MAY JULY Topic of student’s choice Word limit of 10, 000 Research training provided in Term I Supervision from member of Faculty

A brief selection of employers of Actuarial Science graduates

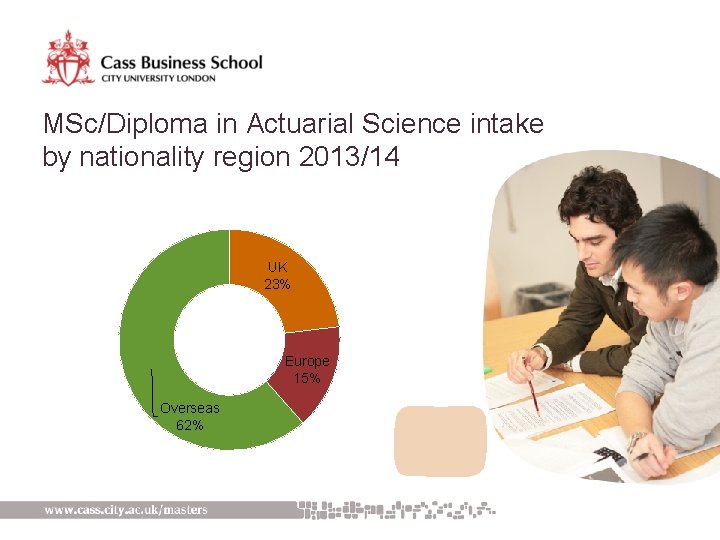

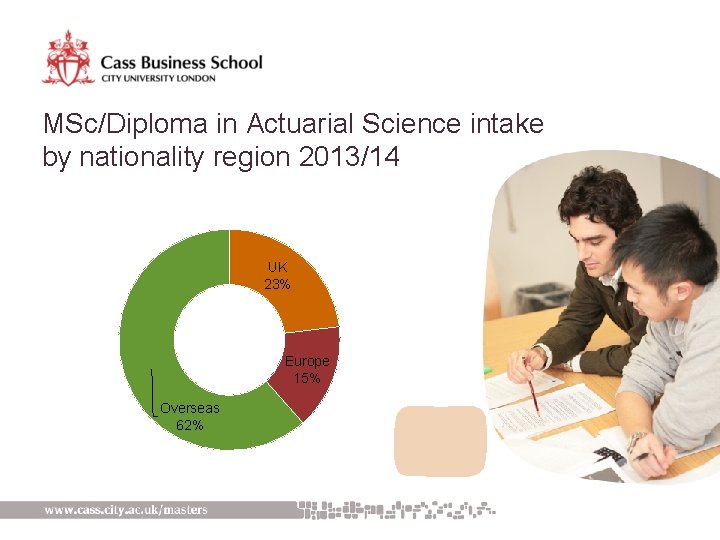

MSc/Diploma in Actuarial Science intake by nationality region 2013/14 UK 23% Europe 15% Overseas 62%

Applying Ú Online application Ú Minimum 2: 1 Honours degree in a mathematical subject and B grade in A-Level Maths (or equivalent) Ú English language proficiency (TOEFL/IELTS) Ú Two references (at least one academic) Ú Original transcripts Ú CV and Personal Statement Ú Conditional/unconditional decisions normally within 4 -6 weeks on a rolling basis

Key people Eva Matiaskova, Admissions Officer Ú email: eva. matiaskova. 1@city. ac. uk Dr Iqbal Owadally, Course Director and Admissions Tutor See website at Ú www. cass. city. ac. uk/actscience Ú Course brochure and application form available online

MSc in Actuarial Management Dr Douglas Wright, Course Director Eva Matiaskova, Admissions Officer

Who should apply MSc Actuarial Management (AM) is suitable for: Ú Experienced actuarial trainees, accomplished in most of the core technical subjects Ú Graduates with actuarial degrees Ú Students who wish to complete the intermediate and specialist stages (CA and ST subjects) of actuarial education

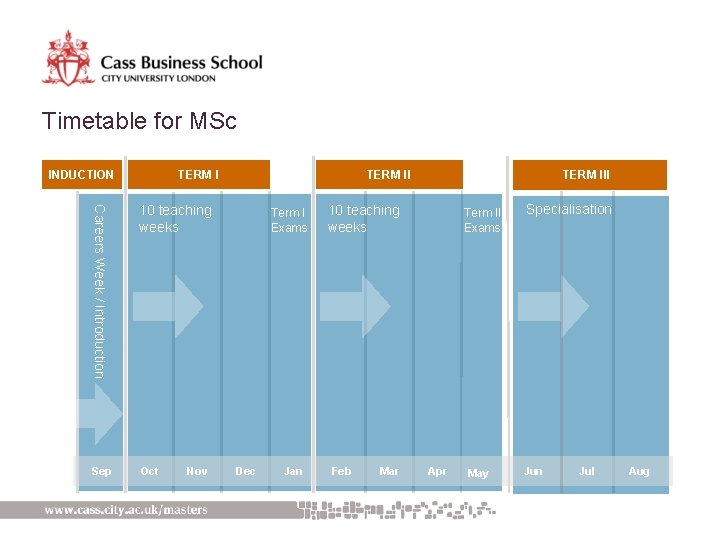

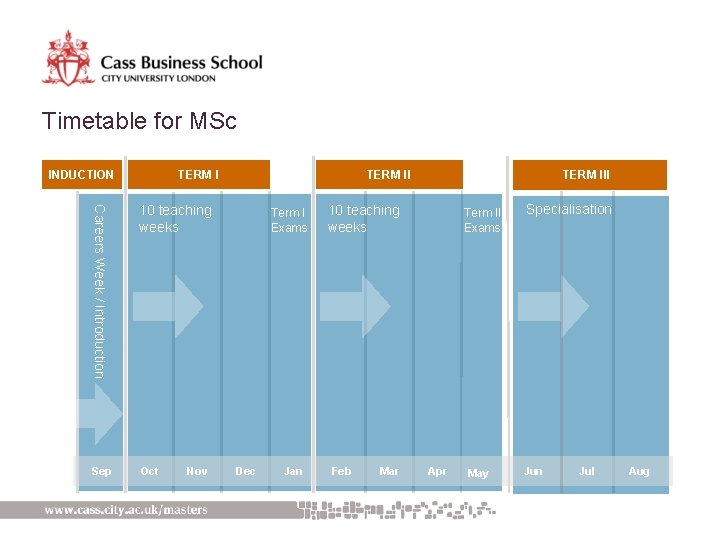

Timetable for MSc INDUCTION TERM I Careers Week / Introduction 10 teaching weeks Sep Oct Nov TERM III TERM II Term I Exams Dec Jan 10 teaching weeks Feb Mar Term II Exams Apr May Specialisation Jul Aug

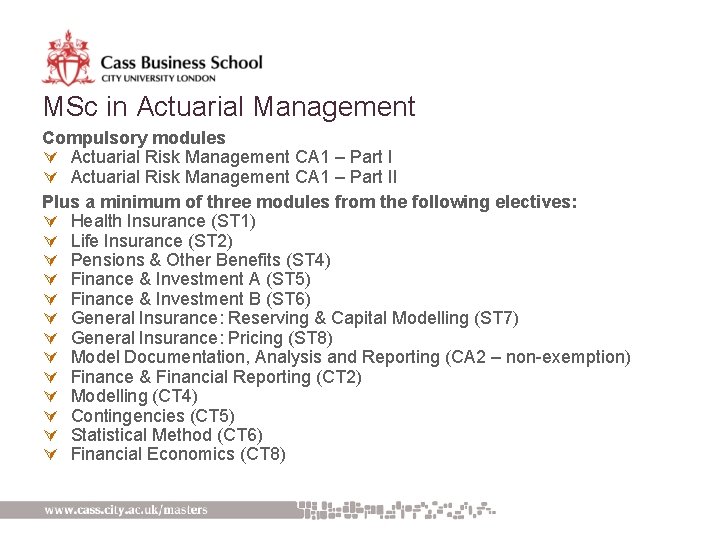

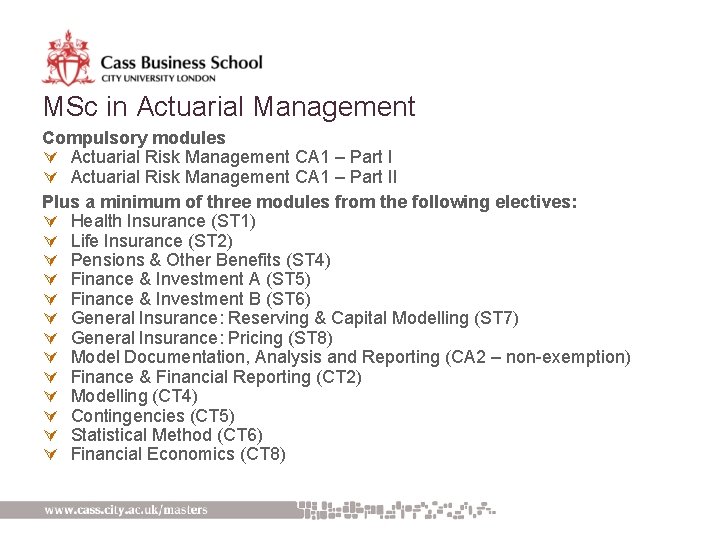

MSc in Actuarial Management Compulsory modules Ú Actuarial Risk Management CA 1 – Part II Plus a minimum of three modules from the following electives: Ú Health Insurance (ST 1) Ú Life Insurance (ST 2) Ú Pensions & Other Benefits (ST 4) Ú Finance & Investment A (ST 5) Ú Finance & Investment B (ST 6) Ú General Insurance: Reserving & Capital Modelling (ST 7) Ú General Insurance: Pricing (ST 8) Ú Model Documentation, Analysis and Reporting (CA 2 – non-exemption) Ú Finance & Financial Reporting (CT 2) Ú Modelling (CT 4) Ú Contingencies (CT 5) Ú Statistical Method (CT 6) Ú Financial Economics (CT 8)

Professional exemptions Ú Course is accredited by the UK Institute and Faculty of Actuaries Ú Students scoring at least 62% as an average in their actuarial subjects are eligible for exemptions from that group of subjects Ú Exemptions are also awarded on a subject by subject basis for students not meeting the accreditation requirements

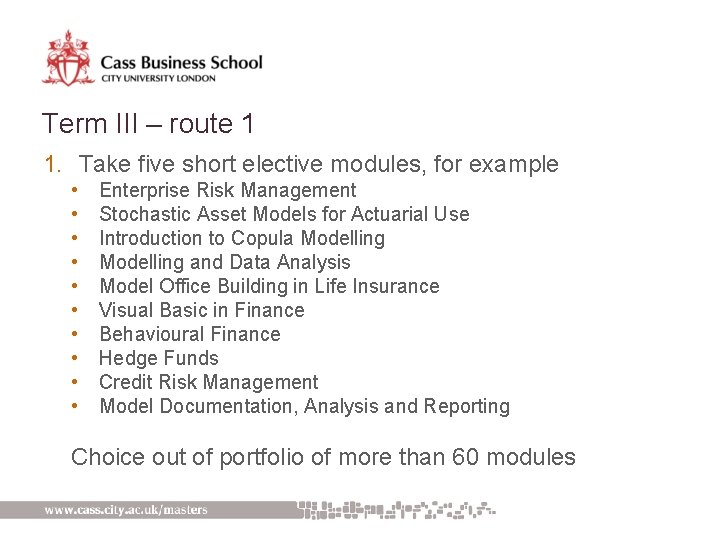

Term III – route 1 1. Take five short elective modules, for example • • • Enterprise Risk Management Stochastic Asset Models for Actuarial Use Introduction to Copula Modelling and Data Analysis Model Office Building in Life Insurance Visual Basic in Finance Behavioural Finance Hedge Funds Credit Risk Management Model Documentation, Analysis and Reporting Choice out of portfolio of more than 60 modules

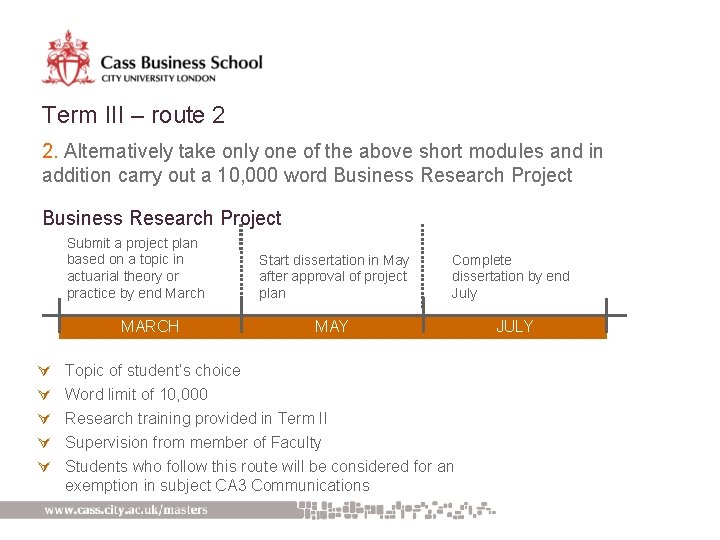

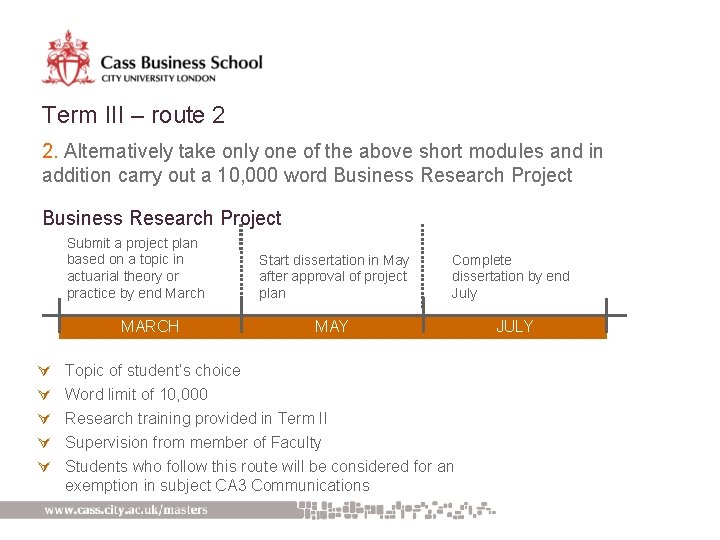

Term III – route 2 2. Alternatively take only one of the above short modules and in addition carry out a 10, 000 word Business Research Project Submit a project plan based on a topic in actuarial theory or practice by end March MARCH Ú Ú Ú Start dissertation in May after approval of project plan Complete dissertation by end July MAY JULY Topic of student’s choice Word limit of 10, 000 Research training provided in Term II Supervision from member of Faculty Students who follow this route will be considered for an exemption in subject CA 3 Communications

A brief selection of employers of Actuarial Management graduates

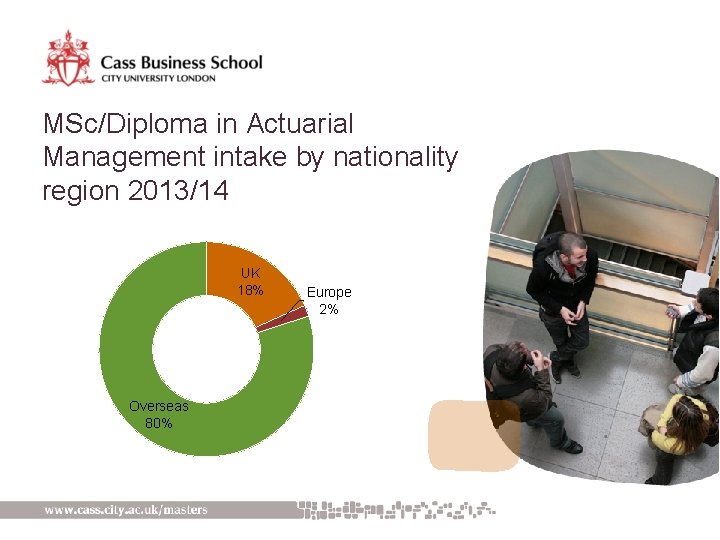

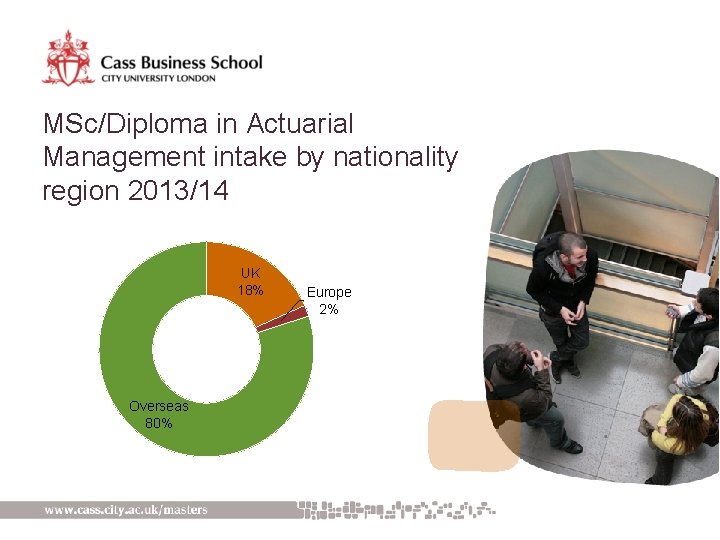

MSc/Diploma in Actuarial Management intake by nationality region 2013/14 UK 18% Overseas 80% Europe 2%

Admissions information Ú Students should have completed at least five of the CT subjects of the Institute and Faculty of Actuaries, either by previous exemption or by private study, including Subjects CT 1, CT 3 and CT 7 Ú English language proficiency (TOEFL/IELTS) Ú Two references (at least one academic) Ú CV and Personal Statement

Key people Eva Matiaskova, Admissions Officer Ú Email: eva. matiaskova. 1@city. ac. uk Dr Douglas Wright, Course Director and Admissions Tutor See website at Ú www. cass. city. ac. uk/actman Ú Course brochure and application form available online

MSc in Insurance & Risk Management Dr Cherie Chen, Course Director Sharron Charles, Course Officer Eva Matiaskova, Admissions Officer

Why Insurance & Risk Management? Ú One year full time or two years part time Ú Exemption route for ACII holders Ú International emphasis Ú Practical orientation Ú Broad scope Ú Strong global alumni network Ú Professional exemptions. . .

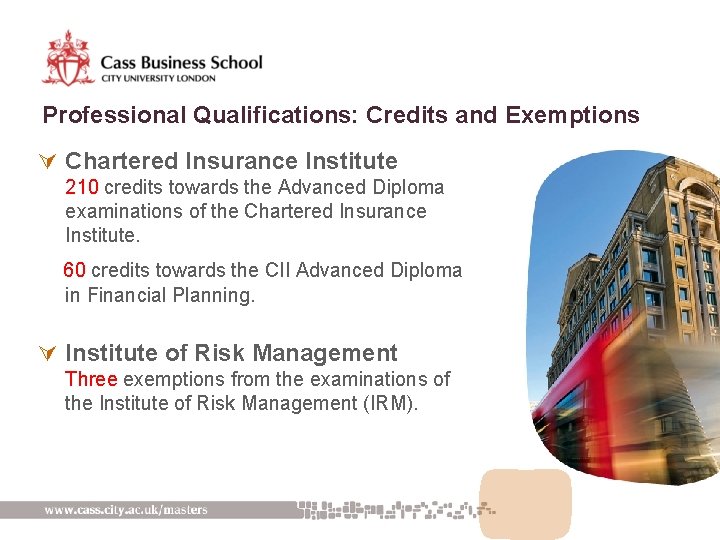

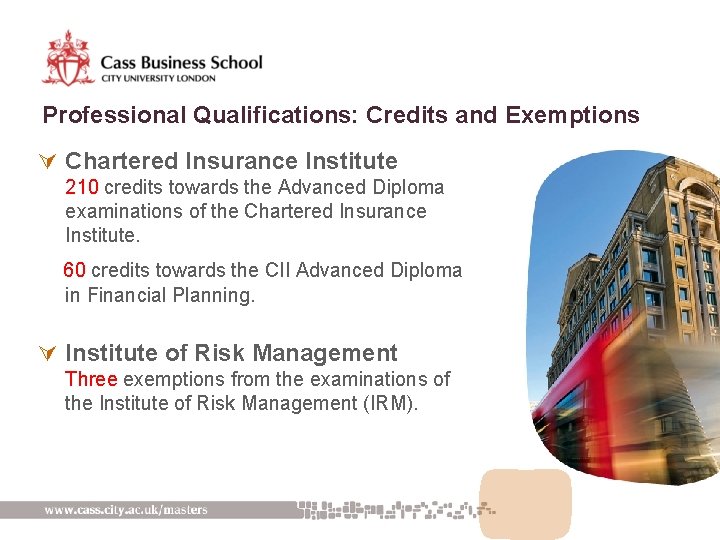

Professional Qualifications: Credits and Exemptions Ú Chartered Insurance Institute 210 credits towards the Advanced Diploma examinations of the Chartered Insurance Institute. 60 credits towards the CII Advanced Diploma in Financial Planning. Ú Institute of Risk Management Three exemptions from the examinations of the Institute of Risk Management (IRM).

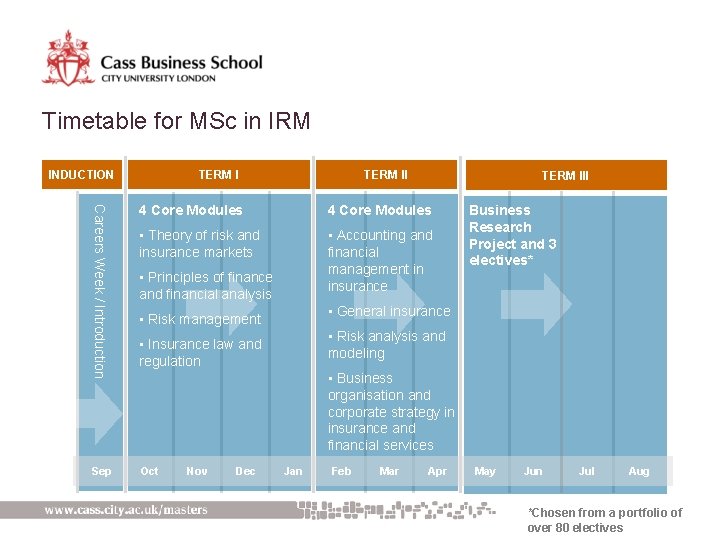

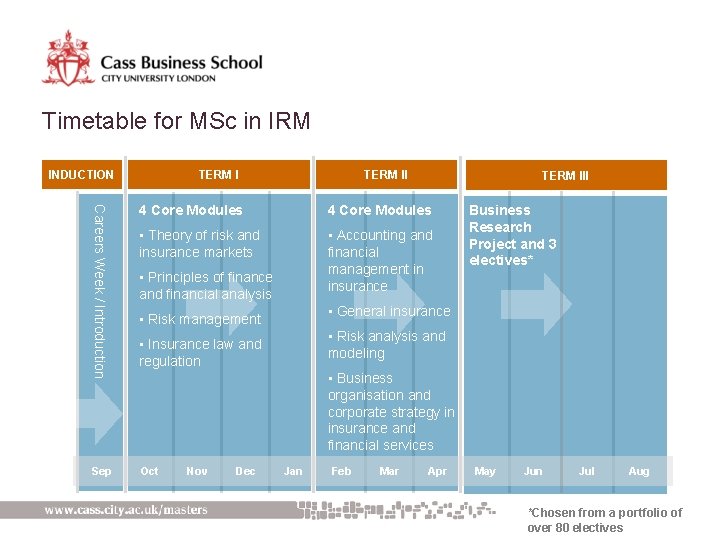

Timetable for MSc in IRM INDUCTION TERM III Careers Week / Introduction 4 Core Modules • Theory of risk and insurance markets • Accounting and financial management in insurance Sep Oct • Principles of finance and financial analysis Business Research Project and 3 electives* • General insurance • Risk management • Risk analysis and modeling • Insurance law and regulation • Business organisation and corporate strategy in insurance and financial services Nov Dec Jan Feb Mar Apr May Jun Jul Aug *Chosen from a portfolio of over 80 electives

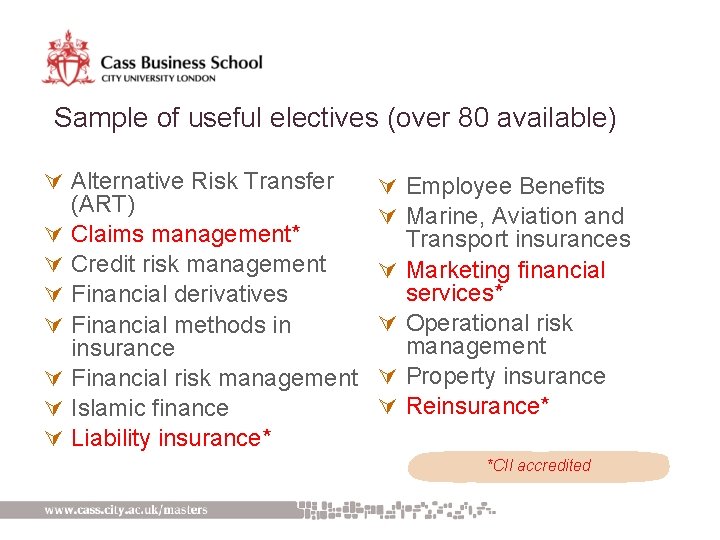

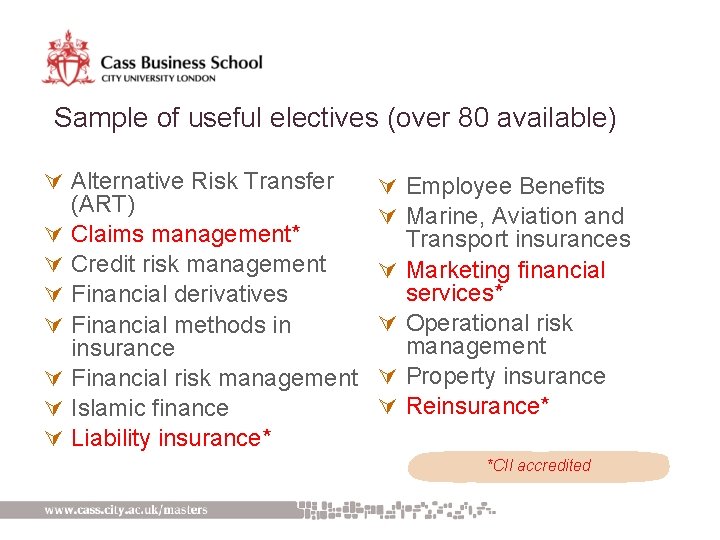

Sample of useful electives (over 80 available) Ú Alternative Risk Transfer (ART) Ú Claims management* Ú Credit risk management Ú Financial derivatives Ú Financial methods in insurance Ú Financial risk management Ú Islamic finance Ú Liability insurance* Ú Employee Benefits Ú Marine, Aviation and Transport insurances Ú Marketing financial services* Ú Operational risk management Ú Property insurance Ú Reinsurance* *CII accredited

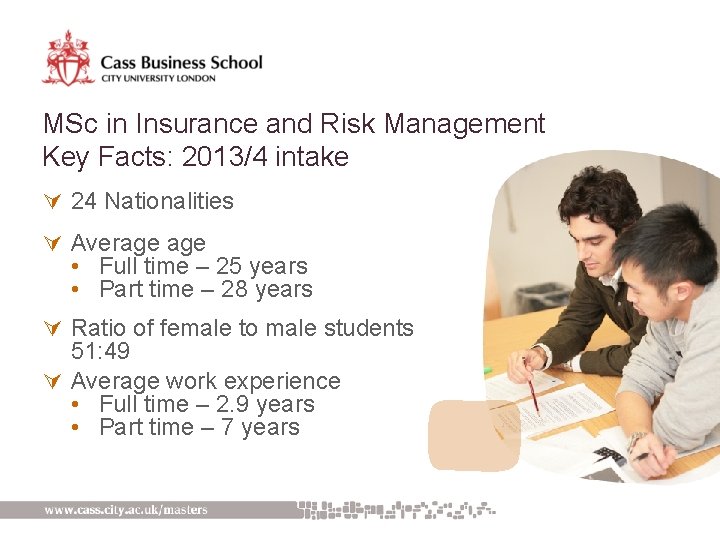

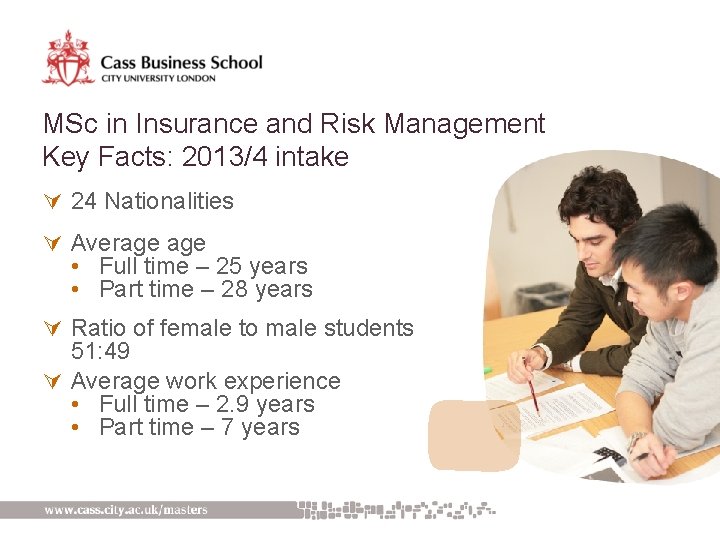

MSc in Insurance and Risk Management Key Facts: 2013/4 intake Ú 24 Nationalities Ú Average • Full time – 25 years • Part time – 28 years Ú Ratio of female to male students 51: 49 Ú Average work experience • Full time – 2. 9 years • Part time – 7 years

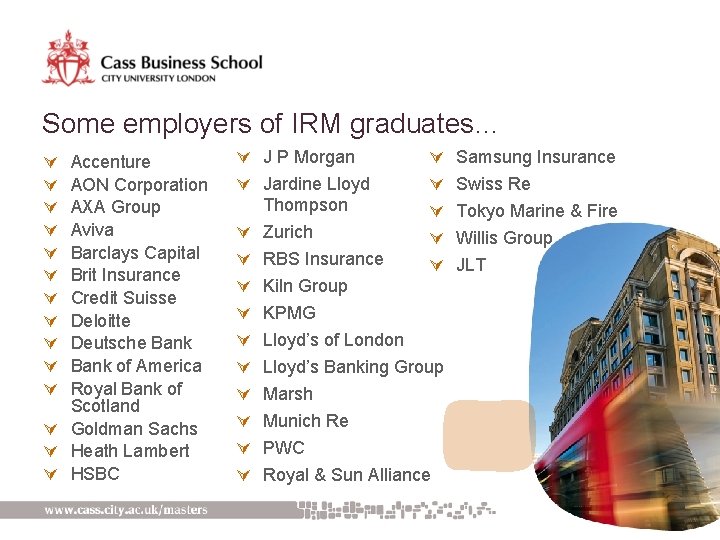

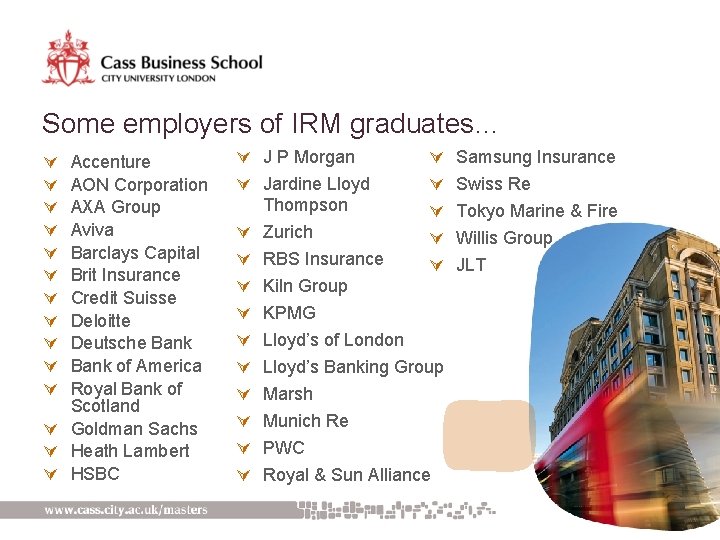

Some employers of IRM graduates… Ú Ú Ú Accenture AON Corporation AXA Group Aviva Barclays Capital Brit Insurance Credit Suisse Deloitte Deutsche Bank of America Royal Bank of Scotland Ú Goldman Sachs Ú Heath Lambert Ú HSBC Ú J P Morgan Ú Ú Jardine Lloyd Ú Thompson Ú Ú Zurich Ú Ú RBS Insurance Ú Ú Kiln Group Ú KPMG Ú Lloyd’s of London Ú Lloyd’s Banking Group Ú Marsh Ú Munich Re Ú PWC Ú Royal & Sun Alliance Samsung Insurance Swiss Re Tokyo Marine & Fire Willis Group JLT

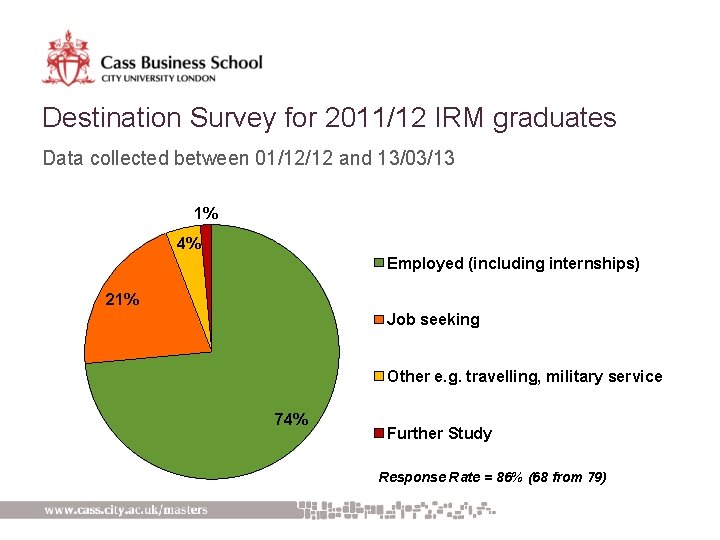

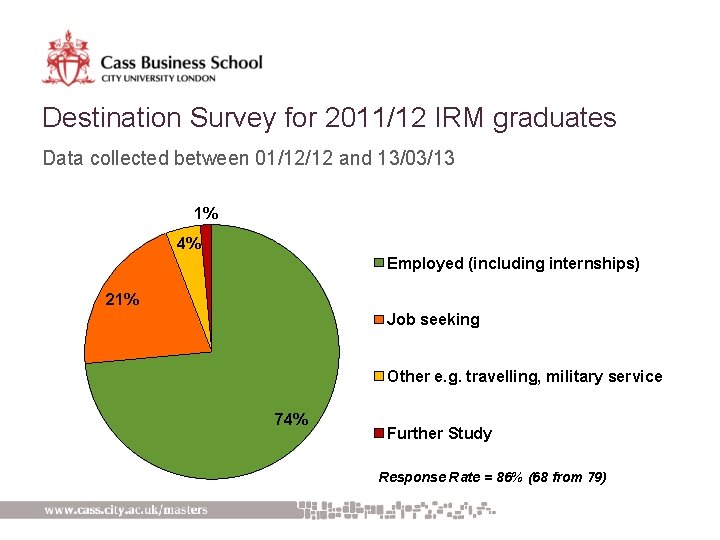

Destination Survey for 2011/12 IRM graduates Data collected between 01/12/12 and 13/03/13 1% 4% Employed (including internships) 21% Job seeking Other e. g. travelling, military service 74% Further Study Response Rate = 86% (68 from 79)

Applying Ú Online application Ú University degree with 2. 1 or higher, or non-UK equivalent Ú Provisional or full degree transcript Ú Two references academic and / or professional Ú GMAT (only if requested by Course Director) Ú English proficiency (TOEFL / IELTS) Ú CV and Personal Statement Ú Conditional / Unconditional decisions are rendered on a rolling basis within 4 -6 weeks after receipt of the required documents

Course Director & Admissions Officer Eva Matiaskova, Admissions Officer Ú Email: eva. matiaskova. 1@city. ac. uk Dr Cherie Chen, Course Director and Admissions Tutor See website at Ú www. cass. city. ac. uk/irm Ú Course brochure and application form available online

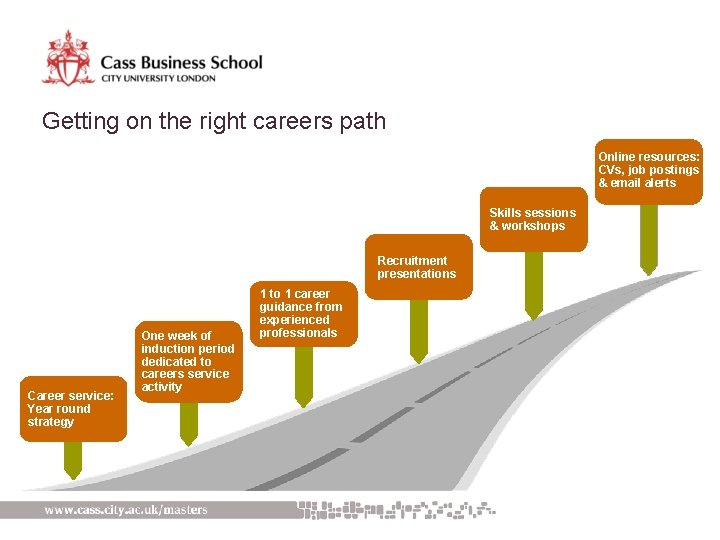

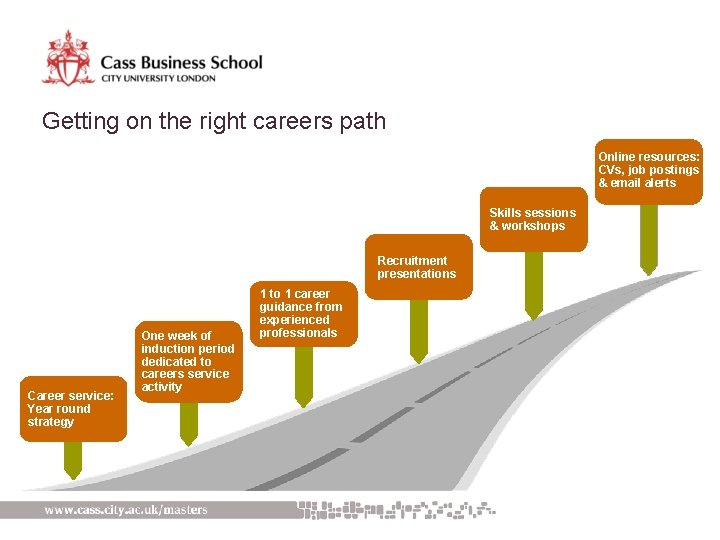

Getting on the right careers path Online resources: CVs, job postings & email alerts Skills sessions & workshops Recruitment presentations Career service: Year round strategy One week of induction period dedicated to careers service activity 1 to 1 career guidance from experienced professionals

Getting on the right career path skills sessions & workshops Ú Ú Ú Ú Ú Careers Fairs Interview Skills CVs and Applications Networking Personal Impact Job Search Strategies Presentation Skills Working with Recruitment Agencies Assessment Centres Personal Branding

Get involved Ú 20 -30 clubs are organised each year Ú Sporting clubs e. g. – basketball, adventure sports, badminton, golf, cricket, ski/snowboarding, squash Ú Business related clubs – investments, trading floor, emerging markets, actuarial society Ú Others include – dance, film, food and wine and country specific interest clubs

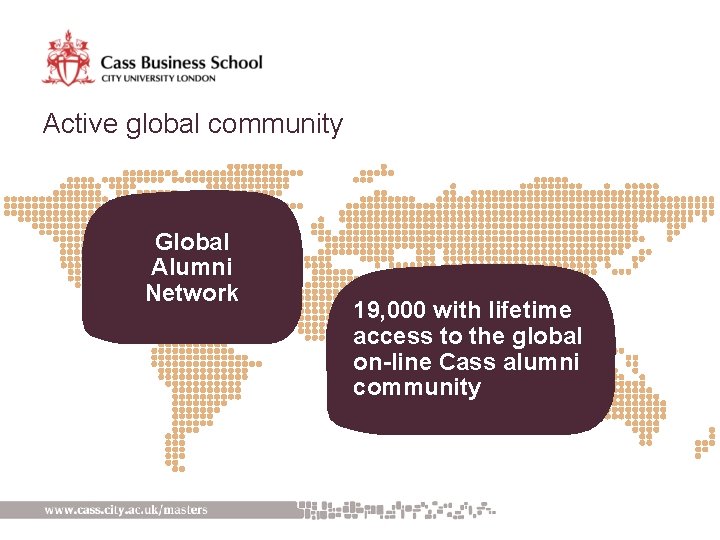

Active global community Global Alumni Network 19, 000 with lifetime access to the global on-line Cass alumni community

Active global community Alumni Ball London Cass Women in Business (CWIB) Speaker Series: e. g. , Women in Technology, Lehman Brothers Regular country reunions, events & Lord mayors receptions - Moscow, Kuala Lumpur, New Delhi & Warsaw 43 events worldwide Cass Entrepreneurs Network: e. g. , Trends in New Media, Christmas party Alumni receptions in cities including - Paris, Frankfurt, Shanghai, Hong Kong, Tokyo, Sao Paulo & New York

Contact Us