Money Banking 2 Cheques Current account holders can

Money & Banking 2

Cheques • Current account holders can use it to make payments. • Written permission to a bank to pay someone a certain amount of money. • Safe • Record (Stubb)

Cheque Guarantee Card • Given to creditworthy customers. • Guarantees payment of cheque up to € 130 • Identity card.

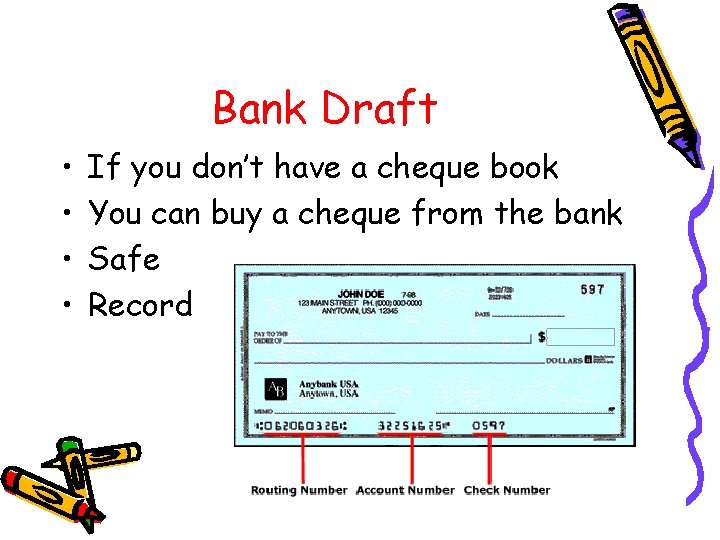

Bank Draft • • If you don’t have a cheque book You can buy a cheque from the bank Safe Record

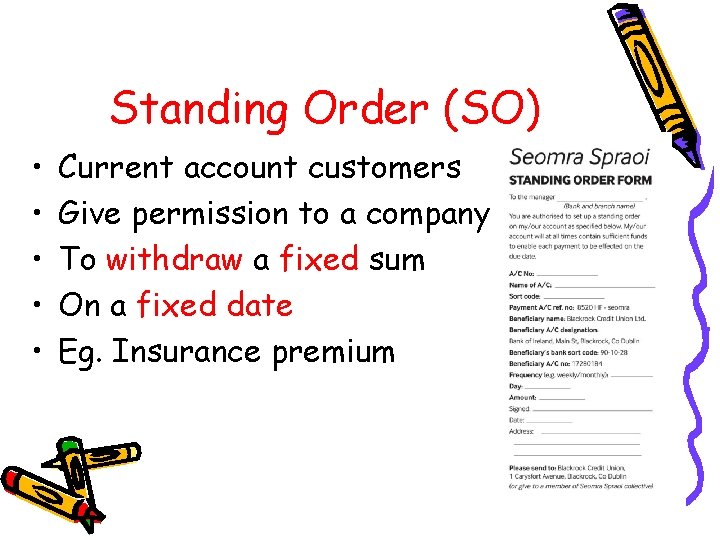

Standing Order (SO) • • • Current account customers Give permission to a company To withdraw a fixed sum On a fixed date Eg. Insurance premium

Direct Debit (DD) • Current account holder • Instructs the bank • To pay a variable amount to a company. • Time may vary also • Eg. ESB bill

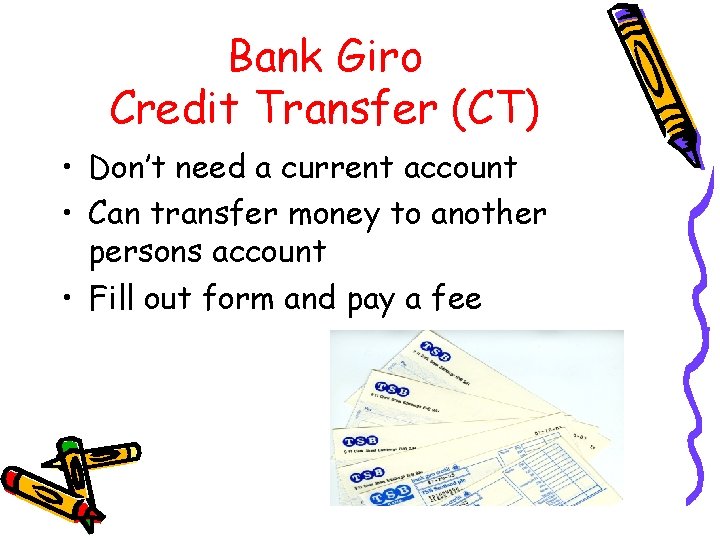

Bank Giro Credit Transfer (CT) • Don’t need a current account • Can transfer money to another persons account • Fill out form and pay a fee

Paypath • Paying wages directly into an employees bank account • Safer • Quicker • Reduces impulse buying

Plastic Cards • Make payment without using cash or cheques • Visa, Access, Master Card, ATM, Smart Card

Postal/Money Order • A written statement from one post office to another asking it to pay a certain sum to a named person • Pay a small fee • Safe

Registered Letter • Pay post office a small fee • Letter will only be given to person to whom it is addressed • That person must sign for letter • Very safe

How might you pay the following? • • Telephone bill Birthday present to USA Cash payment by post Life assurance premium College fees Weekly shopping Petrol

- Slides: 12