Money and Monetary Policy The Functions of Money

- Slides: 49

Money and Monetary Policy

The Functions of Money

Money as a Medium of Exchange

Money is an intermediary and acts as a medium of exchange. This is unique to and defines money. Money: anything that is generally accepted as payment for goods and services or that is accepted in settlement of debt.

Money as a unit of account Unit of account: an agreed measure for stating the prices of goods and services. Prices expressed in monetary terms. Common measure of cost allows decisions on how best to spend our income. Could you measure GDP in a barter economy? ? ? Accounting unit – when prices increase, nominal values adjusted for price increases to obtain real values; only possible with money.

Money as a store of value Wealth can be held property, shares etc. BUT, money is liquid When inflation is high money loses purchasing power and is not a good store of value. Money can serves as a standard of deferred payment – credit can be granted.

Money is not… Income Natural resources, labour, capital and entrepreneurship = rent, wages and salaries, interest and profit. Wealth Includes ALL assets

Different kinds of money

Earliest forms of money were commodities. Suitability depended on… • Uniformity • Durability • Divisibility • Portability

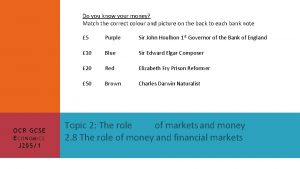

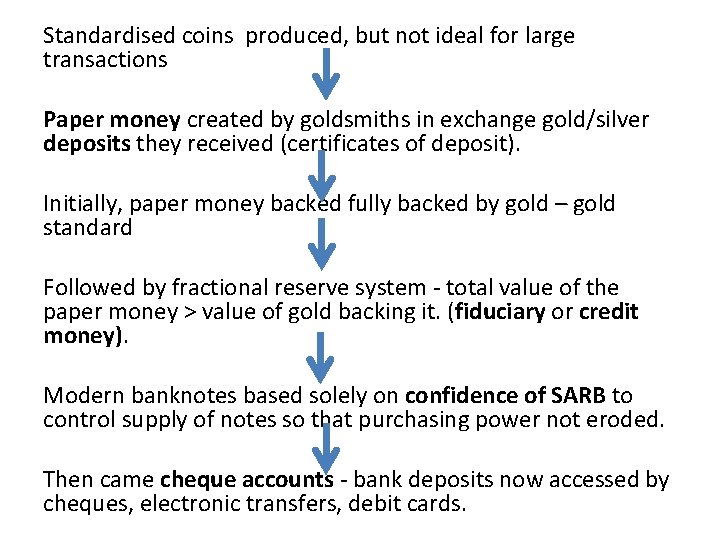

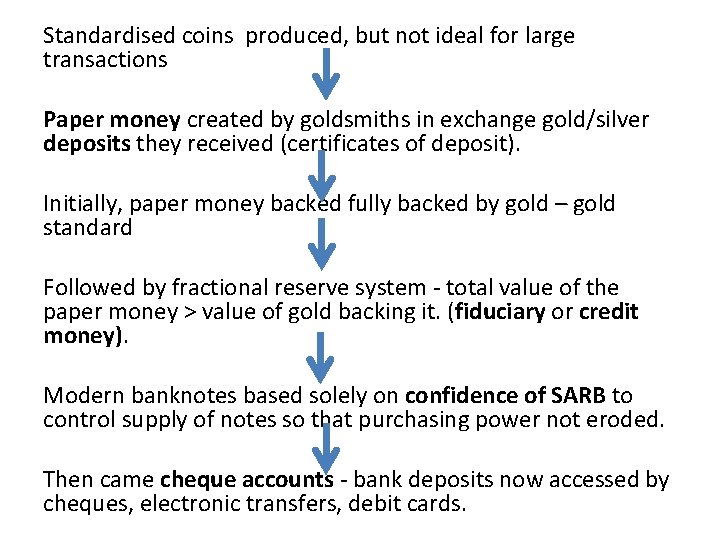

Standardised coins produced, but not ideal for large transactions Paper money created by goldsmiths in exchange gold/silver deposits they received (certificates of deposit). Initially, paper money backed fully backed by gold – gold standard Followed by fractional reserve system - total value of the paper money > value of gold backing it. (fiduciary or credit money). Modern banknotes based solely on confidence of SARB to control supply of notes so that purchasing power not eroded. Then came cheque accounts - bank deposits now accessed by cheques, electronic transfers, debit cards.

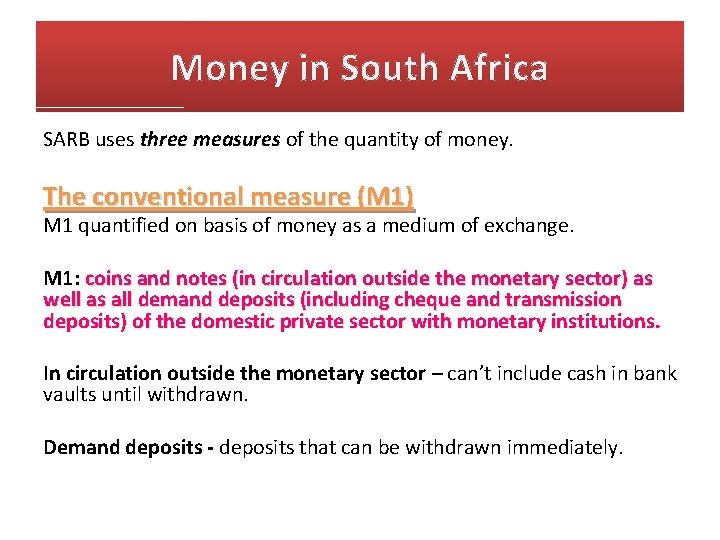

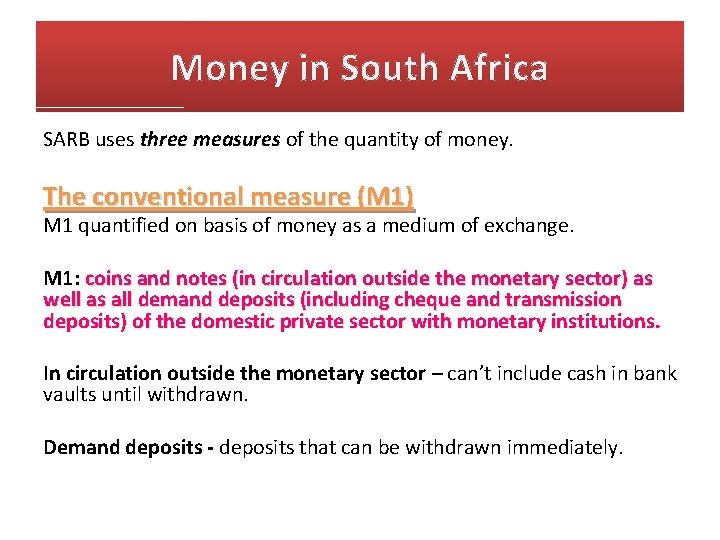

Money in South Africa SARB uses three measures of the quantity of money. The conventional measure (M 1) M 1 quantified on basis of money as a medium of exchange. M 1: coins and notes (in circulation outside the monetary sector) as well as all demand deposits (including cheque and transmission deposits) of the domestic private sector with monetary institutions. In circulation outside the monetary sector – can’t include cash in bank vaults until withdrawn. Demand deposits - deposits that can be withdrawn immediately.

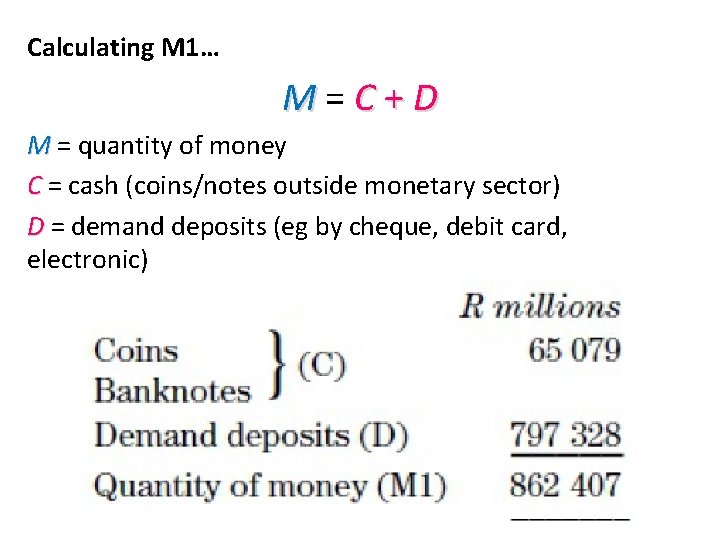

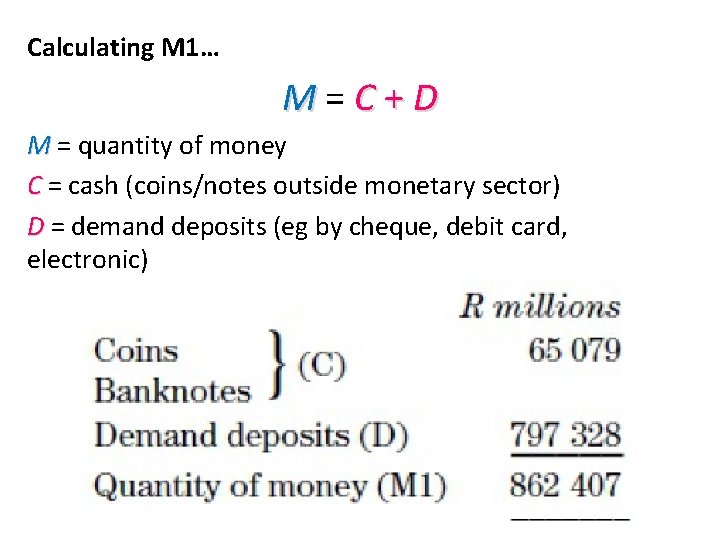

Calculating M 1… M=C+D M = quantity of money C = cash (coins/notes outside monetary sector) D = demand deposits (eg by cheque, debit card, electronic)

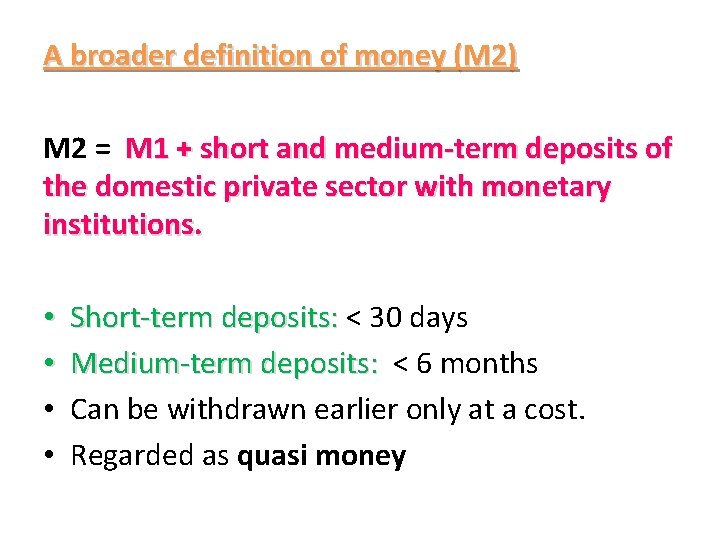

A broader definition of money (M 2) M 2 = M 1 + short and medium-term deposits of the domestic private sector with monetary institutions. • • Short-term deposits: < 30 days Medium-term deposits: < 6 months Can be withdrawn earlier only at a cost. Regarded as quasi money

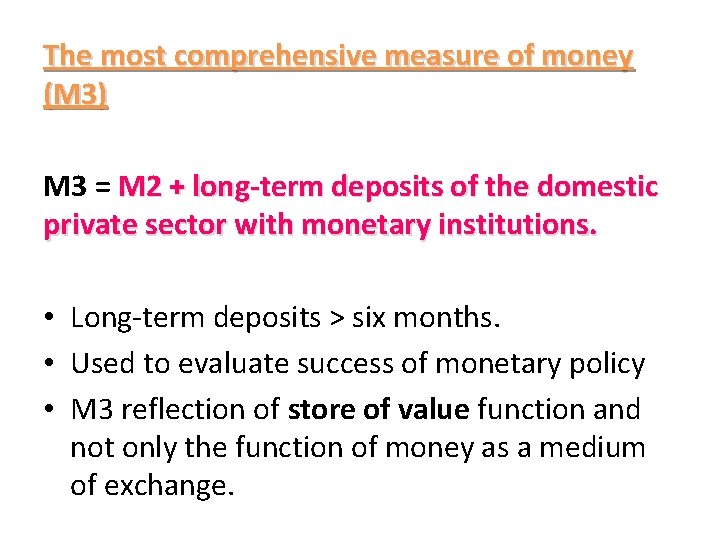

The most comprehensive measure of money (M 3) M 3 = M 2 + long-term deposits of the domestic private sector with monetary institutions. • Long-term deposits > six months. • Used to evaluate success of monetary policy • M 3 reflection of store of value function and not only the function of money as a medium of exchange.

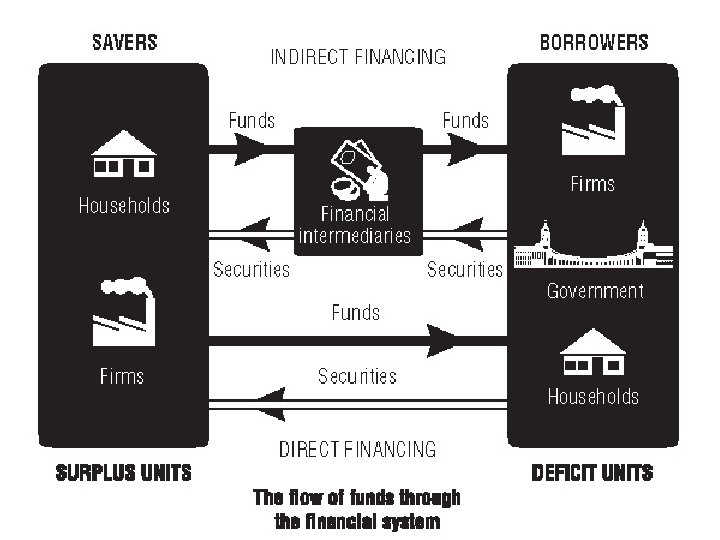

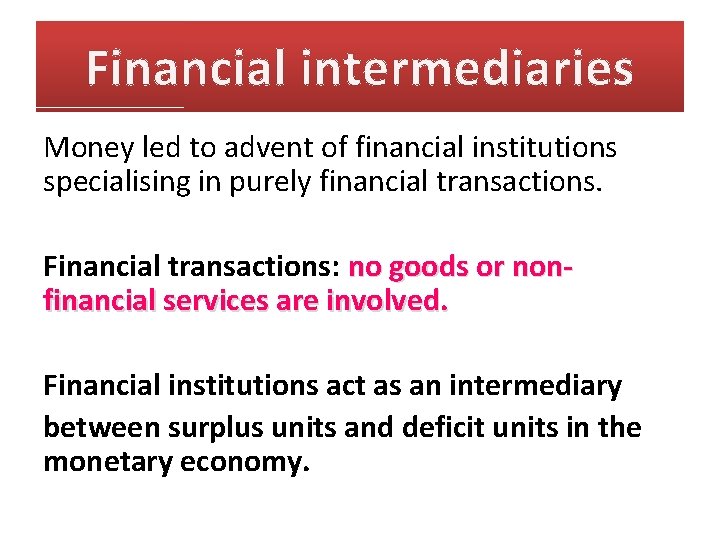

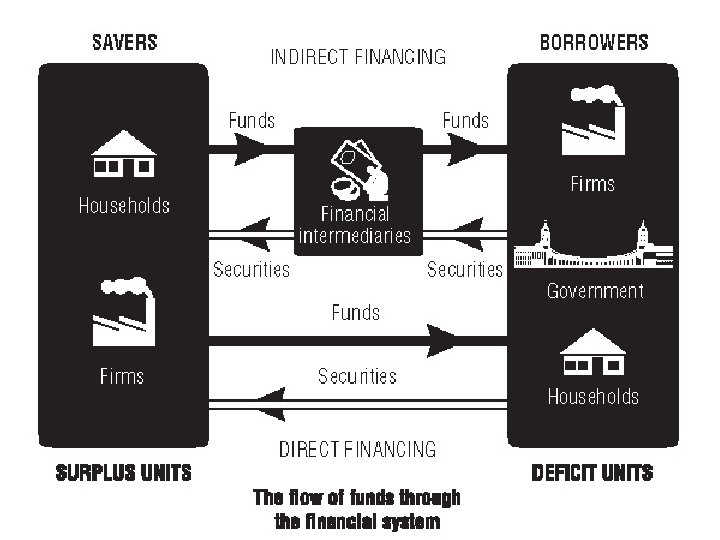

Financial intermediaries Money led to advent of financial institutions specialising in purely financial transactions. Financial transactions: no goods or nonfinancial services are involved. Financial institutions act as an intermediary between surplus units and deficit units in the monetary economy.

Lesetja Kganyago

Watch this video on the functions of the SARB https: //www. youtube. com/watch? v=Scz_DE 0 So 14

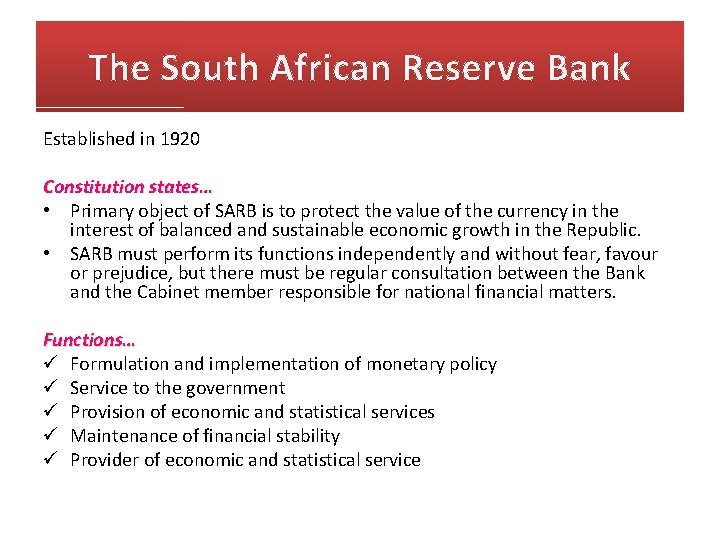

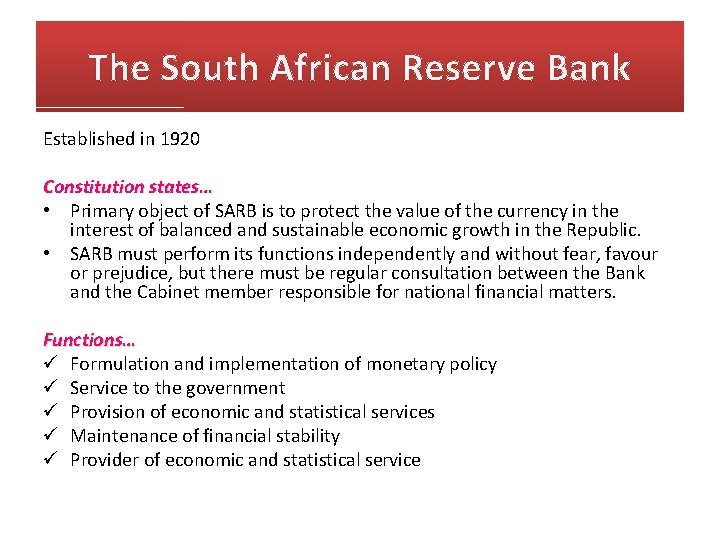

The South African Reserve Bank Established in 1920 Constitution states… • Primary object of SARB is to protect the value of the currency in the interest of balanced and sustainable economic growth in the Republic. • SARB must perform its functions independently and without fear, favour or prejudice, but there must be regular consultation between the Bank and the Cabinet member responsible for national financial matters. Functions… ü Formulation and implementation of monetary policy ü Service to the government ü Provision of economic and statistical services ü Maintenance of financial stability ü Provider of economic and statistical service

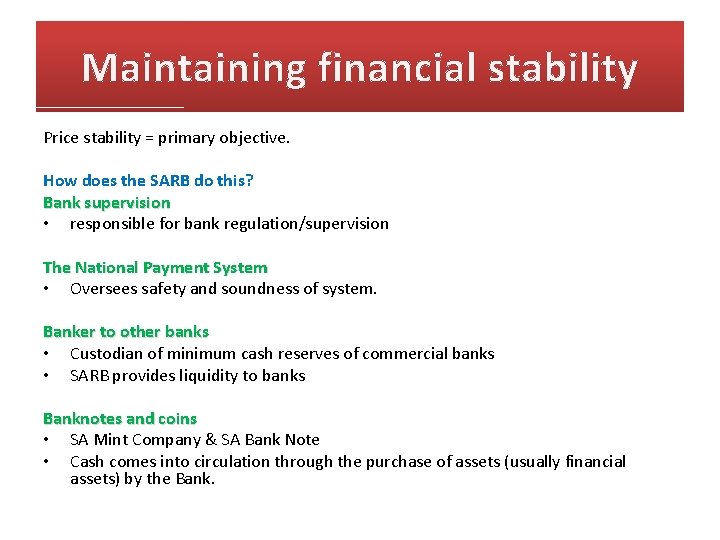

Maintaining financial stability Price stability = primary objective. How does the SARB do this? Bank supervision • responsible for bank regulation/supervision The National Payment System • Oversees safety and soundness of system. Banker to other banks • Custodian of minimum cash reserves of commercial banks • SARB provides liquidity to banks Banknotes and coins • SA Mint Company & SA Bank Note • Cash comes into circulation through the purchase of assets (usually financial assets) by the Bank.

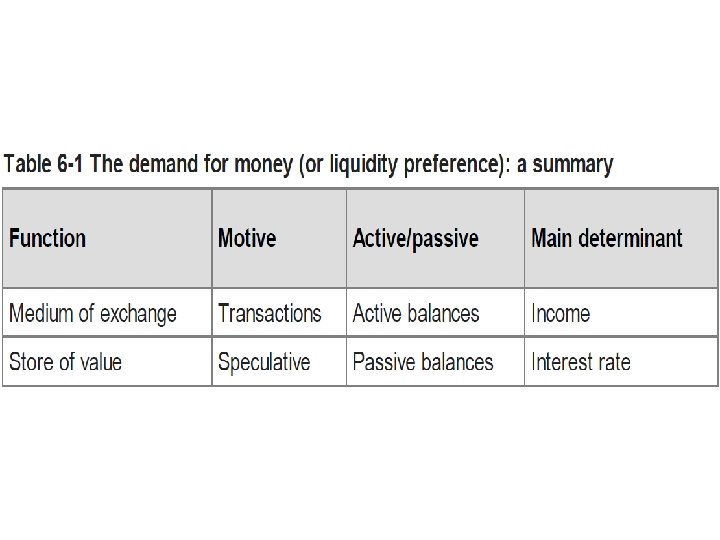

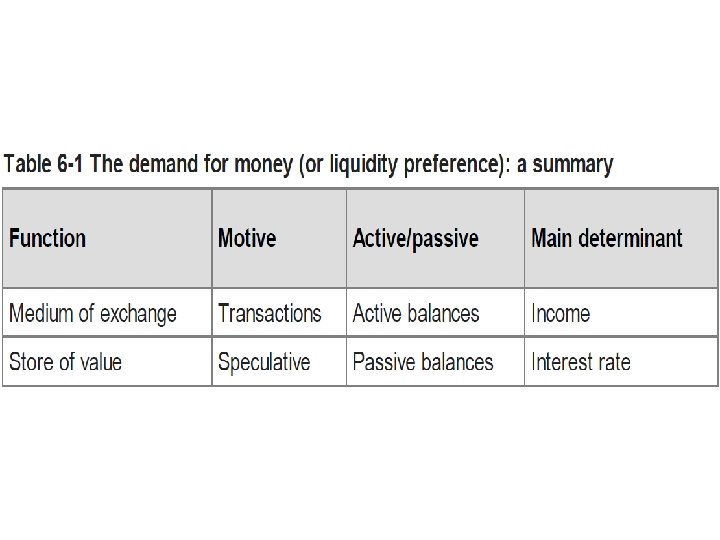

The demand for money Demand for money: amount that participants in the economy plan to hold in the form of money balances (i. e. cash or bank deposits). Opportunity cost of holding money? • Interest that could have been earned from bonds. Money held if it provides a service as good as opportunity cost of holding it. 2 basic components of demand for money… • The transactions demand for money which arises from the medium of exchange function • The demand for money as an asset which arises from the store of value function

Motives for holding money 2 main motives identified by JMK (liquidity preference) 1. Transactions motive • Participants hold money as a medium of exchange needed to enter into transactions. • Money held to buy goods/services between paydays. • How much money is needed depends on the level of income. At macro level - transactions demand for money is a function of the total income in the economy. > level of economic activity = > demand for bank loans.

2. Speculative motive • Demand for money as an asset. • Money as a store of value. • Holding money (little or no interest) VS. holding bonds (which earn interest)? ? ? – Depends on interest rate

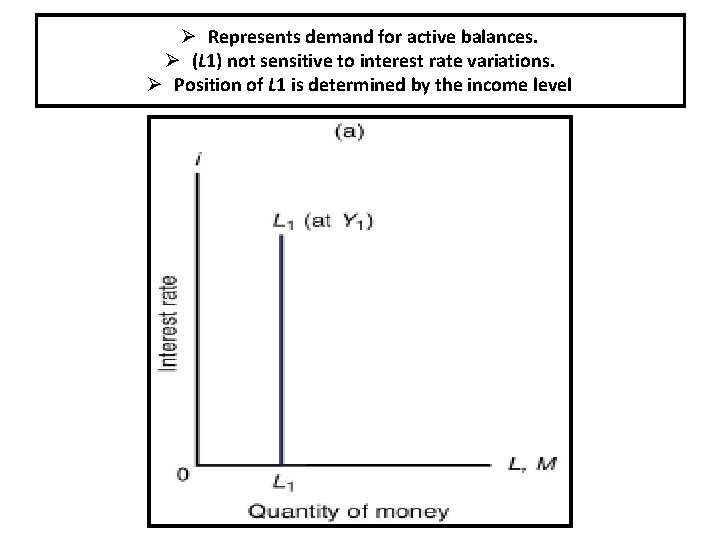

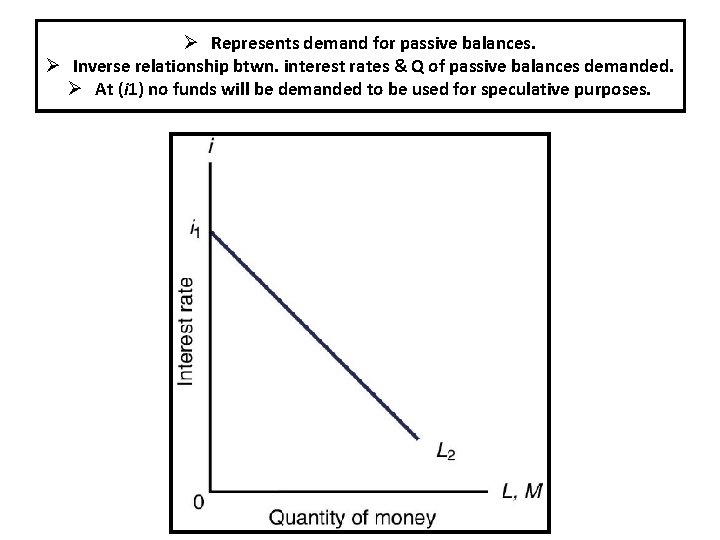

Transactions demand - purpose is to spend the money. Known as active balances. Speculative demand - purpose to hold money passively as a store of value. Known as passive balances (idle balances).

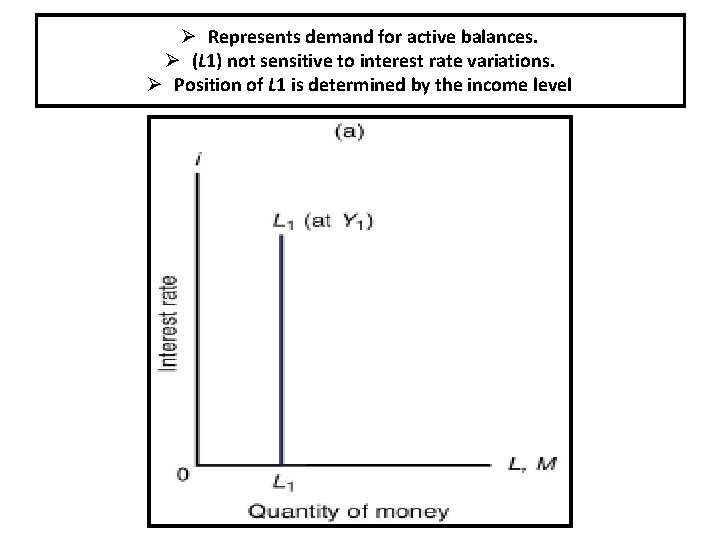

Ø Represents demand for active balances. The quantity of money demanded for transactions purposes depends on the For a given level of income (Y 1) there is thus a given quantity of money not sensitive to interest rate variations. of the interest level of incomeØin (L 1) the economy (Y) and is largely independent demanded (L 1). Ø Position of L 1 is determined by the income level rate.

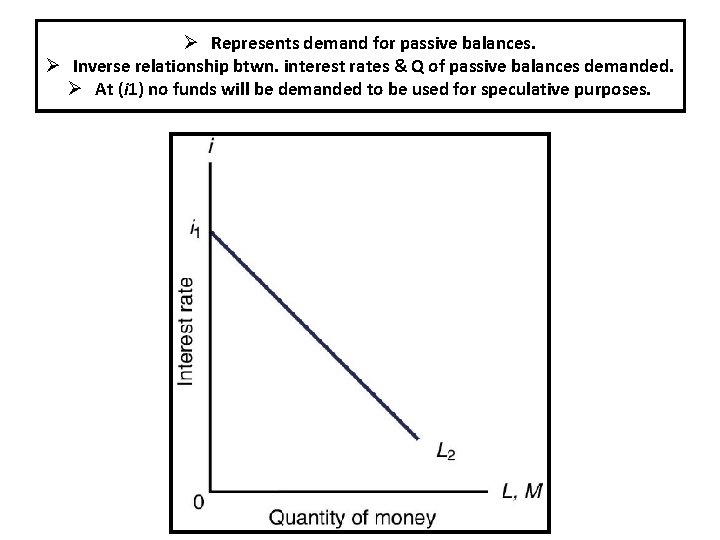

Ø Represents demand for passive balances. Negative (inverse) Quantity relationship of money between demanded quantity for speculative of money for Quantity of money demanded for speculative purposes low demanded when interest Ø Inverse relationship btwn. interest rates & Q of passive balances demanded. purposes higher speculative when interest purposes rate&lower levelof (opportunity ofmoney the interest cost rate. of money low). is high also high) Ø At (i 1) rate no funds will(opportunity be demandedcost to be used forisspeculative purposes.

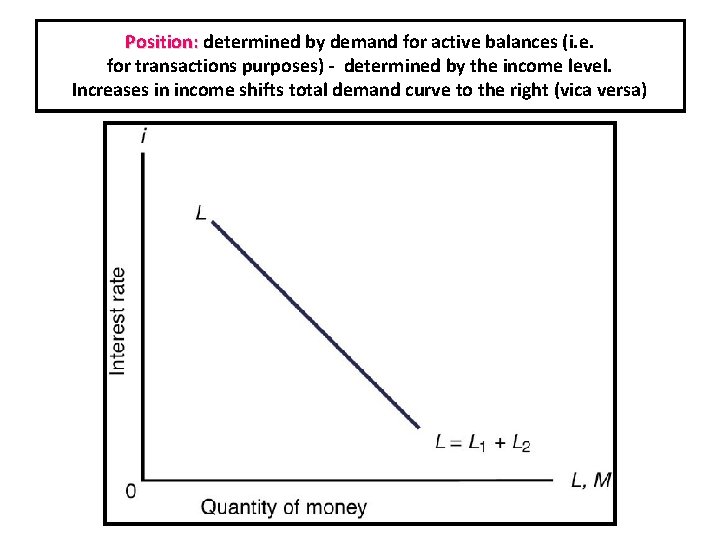

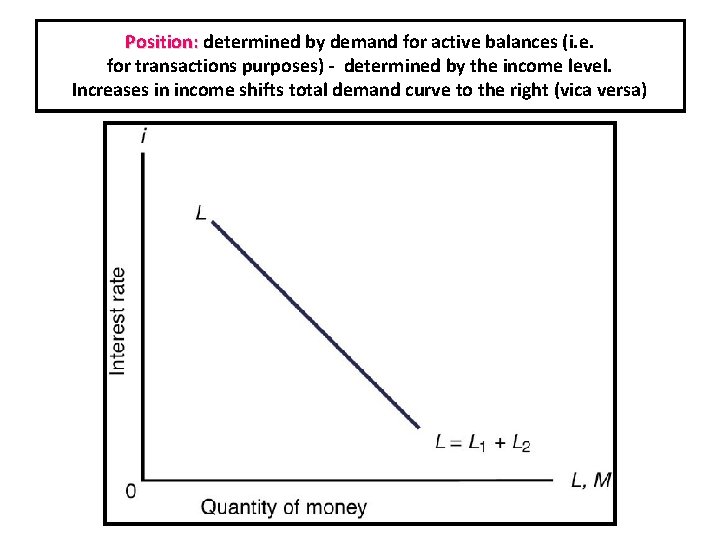

Position: determined by demand for active balances (i. e. Negative relationship rate(LL). level & Total slope: moneyinverse demand curve/totalbetween liquidityinterest preference for transactions purposes) - determined by the income level. Q of money demanded for speculative purposes (i. e. (Las Add demand for active and passive balances 1 +an L 2)asset). Increases in income shifts total demand curve to the right (vica versa)

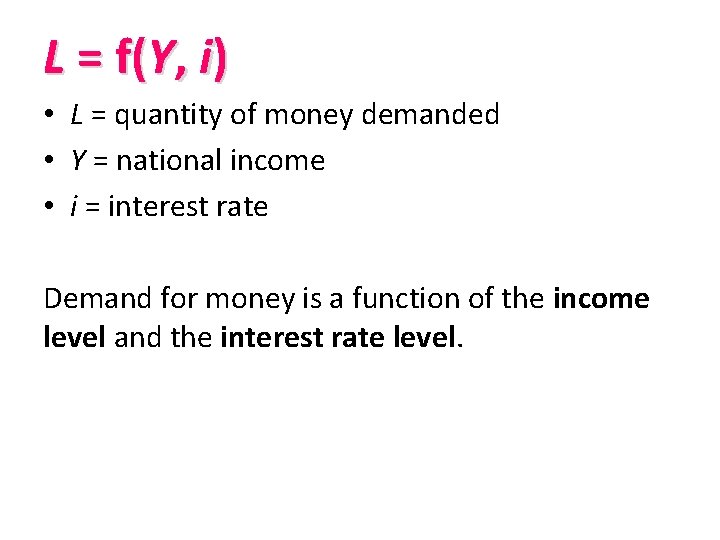

L = f(Y, i) • L = quantity of money demanded • Y = national income • i = interest rate Demand for money is a function of the income level and the interest rate level.

The stock of money: how is money created? Demand deposits constitute >90% of quantity of money. What determines the size of these deposits?

Money is created largely by banks and not by a mint or printing press. How do they do it? Banks create deposits by making loans. Watch this short video that explains how money is created. https: //youtu. be/p. ZRvja 7 Mvrw

How many loans can banks create? • Banks can create loans only if demand from creditworthy borrowers exists. • Quantity of loans demanded depends on interest rate. • Quantity of money demanded inversely related to interest rate.

• Instability of banking system necessitates central bank. • Growing economy requires growing money stock. • BUT… excessive money = inflation. • SO… SARB regulates money creation process. Sounds great – how do they do this? ? ?

• Interest rates influence the rate at which new money is created. • Affects demand for loans via the price of loans, i. e. , the interest rate. • This is the essence of monetary policy.

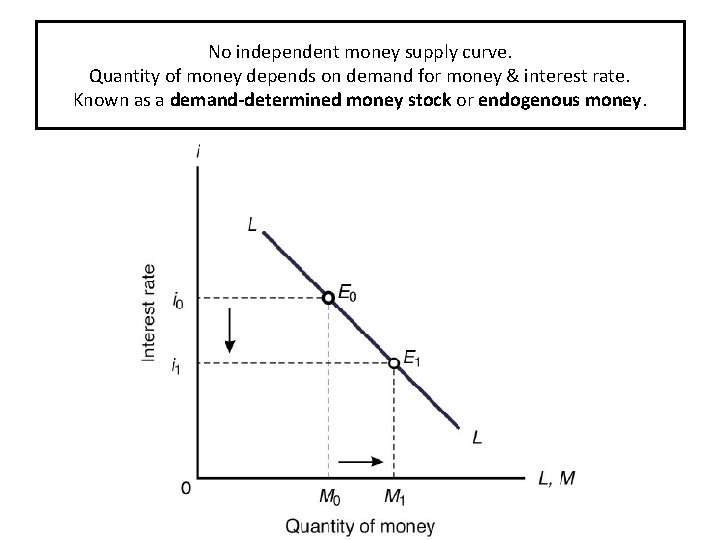

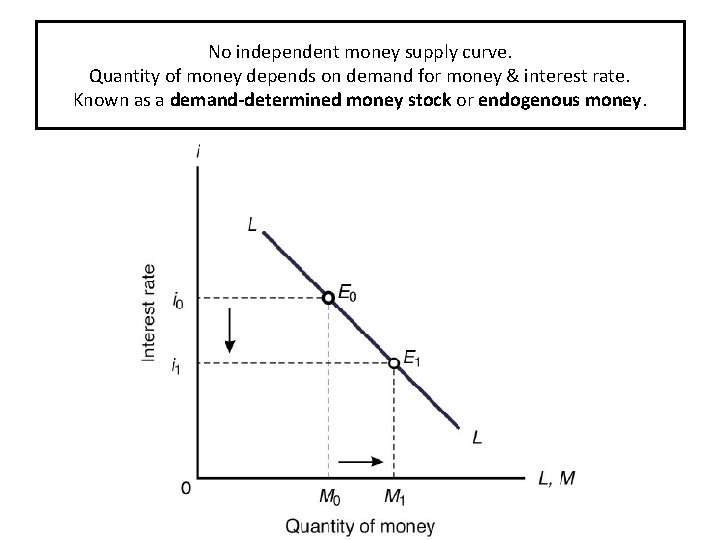

No independent money supply curve. Quantity of money depends on demand for money & interest rate. Known as a demand-determined money stock or endogenous money.

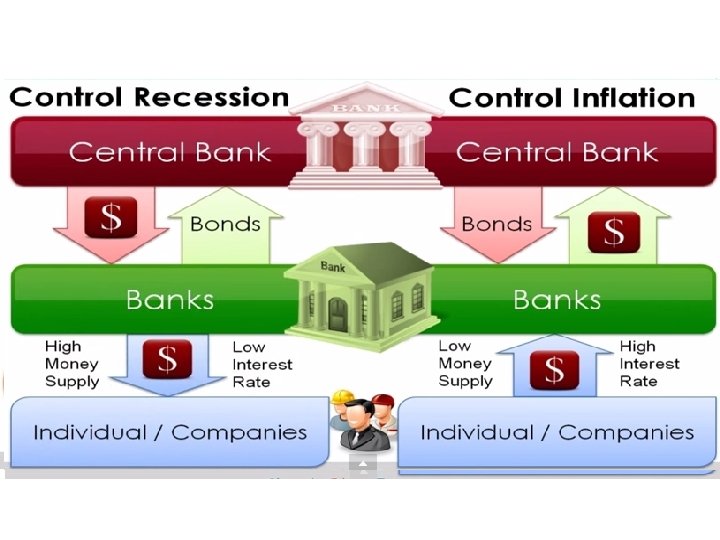

Monetary policy: measures taken to influence quantity of money or the rate of interest with a view to achieving stable prices, full employment and economic growth. Formulated and implemented by SARB’s Monetary Policy Committee

The monetary policy framework in SA Primary objective of the SARB to protect value of R in the interest of balanced and sustainable economic growth.

HISTORY! 1960’s - 70’s: direct intervention limits to extension of bank credit) 1970’s – 80’s: more market-oriented policy approach through creation of incentives for financial institutions to react in the desired manner. 1986 onwards: explicit monetary growth targets for M 3 announced annually. pursued by changes in Bank rate. March 1998: informal inflation target of 1 - 5 % set. 23 February 2000: formal inflation target 3 – 6% set by Minister of Finance

Main features of SA monetary policy framework • Ultimate objective: balanced and sustainable economic growth. • Intermediate objective: pre-announced inflation target. • Operational variable: short-term interest rates, governed by changes in repo rate. • Monetary control system: is a classical cash reserve system.

The instruments of monetary policy The key instruments include… • accommodation policy (refinancing of the liquidity requirement) • open-market policy

• Classical cash reserve system - banks obliged to hold 2, 5% of their total liabilities with Reserve Bank. • Shortage of cash reserves? Change financial assets into cash or borrow funds. • Borrow from overnight interbank market borrow from other banks with excess funds. • If all banks experience liquidity shortage, Reserve Bank, acts as lender of last resort • Banks obtain funds by means of the repo system. • Fixed rate determined SARB represents interest rate that banks pay for reserves they need.

Read Box 6. 7 on page 150

Changes in repo rate regulate quantity of money through variations in cost of credit. Changes in the repo rate → changes in interest rates at commercial banks ∴ cost of credit directly linked to the repo rate.

Open-market transactions: sale/purchase of domestic financial assets (eg. Treasury bills/ government bonds) by SARB to influence interest rates & quantity of money, via influence on cash reserve of the banks.

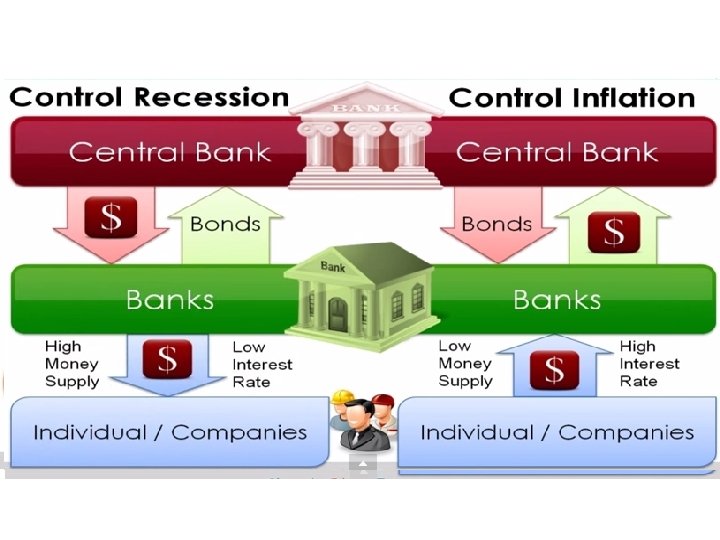

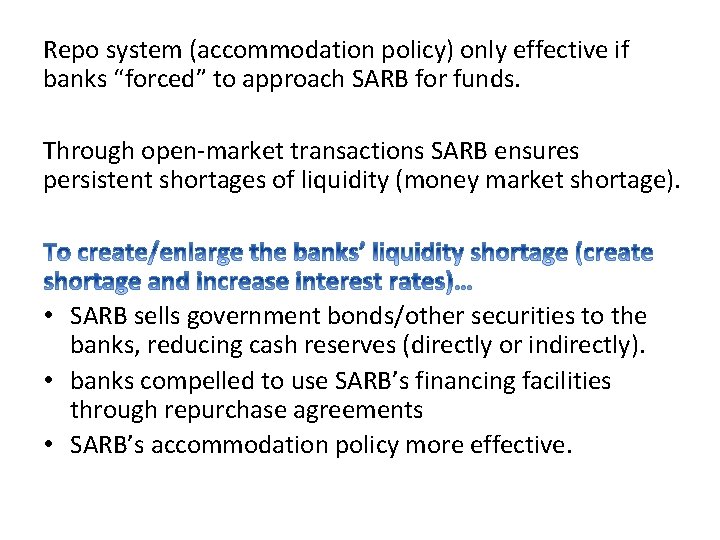

Repo system (accommodation policy) only effective if banks “forced” to approach SARB for funds. Through open-market transactions SARB ensures persistent shortages of liquidity (money market shortage). • SARB sells government bonds/other securities to the banks, reducing cash reserves (directly or indirectly). • banks compelled to use SARB’s financing facilities through repurchase agreements • SARB’s accommodation policy more effective.

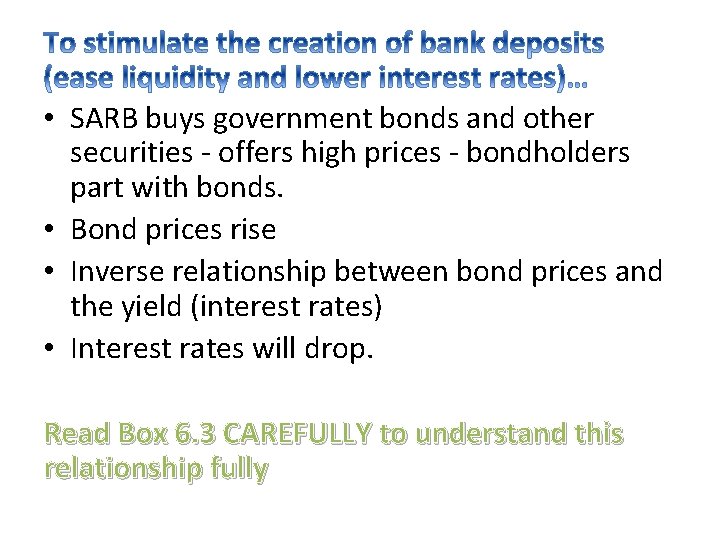

• SARB buys government bonds and other securities - offers high prices - bondholders part with bonds. • Bond prices rise • Inverse relationship between bond prices and the yield (interest rates) • Interest rates will drop. Read Box 6. 3 CAREFULLY to understand this relationship fully

Unit 4 money banking and monetary policy

Unit 4 money banking and monetary policy Unit 4 money banking and monetary policy

Unit 4 money banking and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Contractionary money policy

Contractionary money policy Money market graph expansionary monetary policy

Money market graph expansionary monetary policy Transmission mechanism

Transmission mechanism Lesson quiz 16-1 monetary policy

Lesson quiz 16-1 monetary policy Meaning of monetary

Meaning of monetary Monetary policy

Monetary policy Monetary policy types

Monetary policy types What are the objectives of monetary policy

What are the objectives of monetary policy What are the objectives of monetary policy

What are the objectives of monetary policy Three tools of monetary policy

Three tools of monetary policy Monetary policy summary

Monetary policy summary Fiscal vs monetary policy

Fiscal vs monetary policy Monetary policy simulation game

Monetary policy simulation game Types of monetary policy

Types of monetary policy Instruments of monetary policy

Instruments of monetary policy Demand pull inflation

Demand pull inflation Moral suasion by central bank

Moral suasion by central bank Monetary policy

Monetary policy Sama exchange rate

Sama exchange rate Instruments of monetary policy

Instruments of monetary policy Expansionary monetary policy flow chart

Expansionary monetary policy flow chart Expansionary monetary policy

Expansionary monetary policy Monetary policy

Monetary policy Example of medium of exchange

Example of medium of exchange Features of fiscal policy ppt

Features of fiscal policy ppt Ecb unconventional monetary policy

Ecb unconventional monetary policy Monetary policy baseline

Monetary policy baseline Money money money team

Money money money team Monetray base

Monetray base Functions of royal monetary authority of bhutan

Functions of royal monetary authority of bhutan Ano ang tight money policy

Ano ang tight money policy 075 lic plan

075 lic plan International monetary and financial environment

International monetary and financial environment International financial environment

International financial environment Mus sampling

Mus sampling Bill market scheme 1970

Bill market scheme 1970 What is unit of account example

What is unit of account example Nature and functions of money

Nature and functions of money Nature and functions of money

Nature and functions of money Characteristics of money

Characteristics of money Motifs in the great gatsby

Motifs in the great gatsby Money smart money match

Money smart money match Money on money multiple

Money on money multiple Context of great gatsby

Context of great gatsby Context of the great gatsby

Context of the great gatsby