Money and monetary policy 1 What is money

- Slides: 32

Money and monetary policy

1. What is money? 2. Demand for money and money supply 3. Money market 4. Monetary policy and its goals 5. Tools of monetary policy 9/30/2020 2

What Money Is, and Why It’s Important ─ Without money, trade would require barter, the exchange of one good or service for another. ─ Every transaction would require a double coincidence of wants – the unlikely occurrence that two people each have a good the other wants. ─ Most people would have to spend time searching for others to trade with – a huge waste of resources. This searching is unnecessary with money, the set of assets that people regularly use to buy g&s from other people.

Example ─ I’m an economics professor, but I’m a consumer, too. Suppose I want to go out for a beer. Under a barter system, I would have to search for a bartender that was willing to give me a beer in exchange for a lecture on economics. As you might imagine, I would have to spend a LOT of time searching. (On the plus side, this would prevent me from becoming an alcholic. ) ─ But thanks to money, I can go directly to my favorite pub and get a cold beer; the bartender doesn’t have to want to hear my lecture, he only has to want my money. 9/30/2020 4

Money: What it Is? Money = everything used as a tool for exchange

Gold standard – when gold was money… ─ Up until quite recently, gold was money. ─ 1933 - the United States went off the domestic gold standard. Gold was stored in government vaults, and in it's place people were issued paper money which was "backed" by gold or silver on a one for one basis. ─ 1973 - the U. S. left off the international gold standard. ─ This meant that gold and silver no longer had any monetary role whatever. They became (and remain) „normal” industrial commodities.

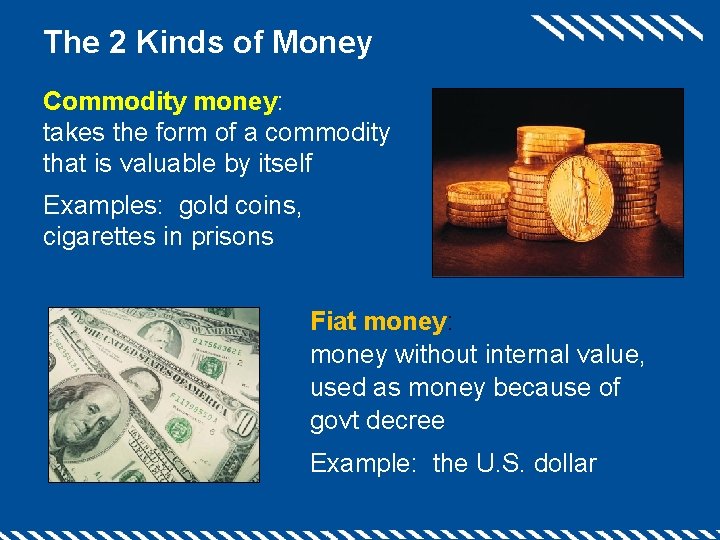

The 2 Kinds of Money Commodity money: takes the form of a commodity that is valuable by itself Examples: gold coins, cigarettes in prisons Fiat money: money without internal value, used as money because of govt decree Example: the U. S. dollar

The 3 Functions of Money ─ Medium of exchange: an item buyers give to sellers when they want to purchase g&s ─ Unit of account: the yardstick people use to post prices and record debts ─ Store of value: an item people can use to transfer purchasing power from the present to the future CHAPTER 21 THE MONETARY SYSTEM

1. What is money? 2. Demand for money and money supply 3. Money market 4. Monetary policy and its goals 5. Tools of monetary policy 9/30/2020 9

Demand for money ─ The demand for money is related with peoples intensions to hold (save) or spend the money. In other words they want to use money (or hold their assets in the form of money) ─ There are three reasons why people wish to save/spend: ─ Transactions demand: demand for day-to-day money by firms and households for buying goods and services. ─ Precautionary demand: demand for money by firms and households caused by the wish to save money in case of unexpected. ─ Speculative demand: this is demand for money as financial asset for investment opportunities.

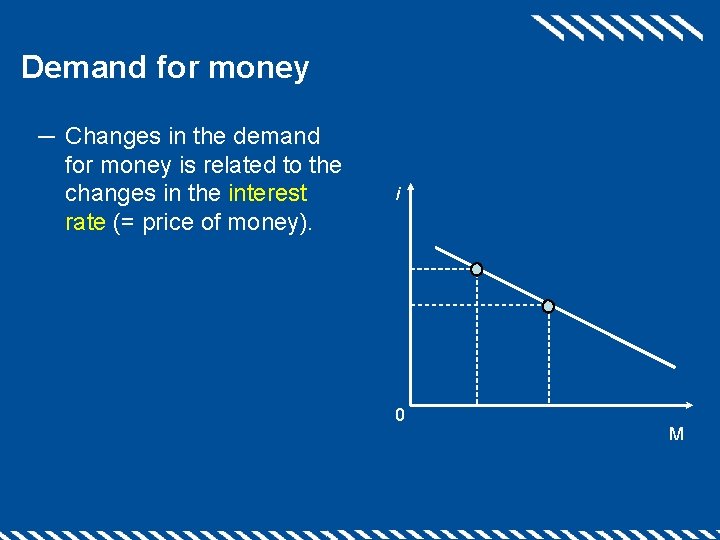

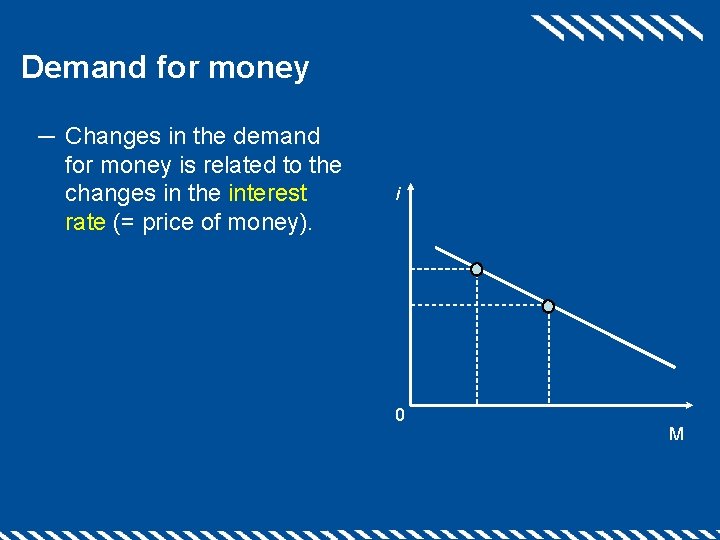

Demand for money ─ Changes in the demand for money is related to the changes in the interest rate (= price of money). i 0 M

The Money Supply ─ The money supply (or money stock): the quantity of money available in the economy ─ What assets should be considered part of the money supply? Here are two candidates: ─ Currency: the paper bills and coins in the hands of the (non-bank) public ─ Demand deposits: balances in bank accounts that depositors can access on demand by writing a check CHAPTER 21 THE MONETARY SYSTEM

1. What is money? 2. Demand for money and money supply 3. Money market 4. Monetary policy and its goals 5. Tools of monetary policy 9/30/2020 13

Money demand x supply ─ Who demands money? All subjects that need money for transactions and for other reasons. ─ Who supplies money? Subjects (mainly central banks) that offer money to be used in economy. ─ Money demand is the amount of money we want use, while money supply is the amount of money we can use. ─ When the amount of money we can use is different from the amount we want use, then there are troubles in economy…

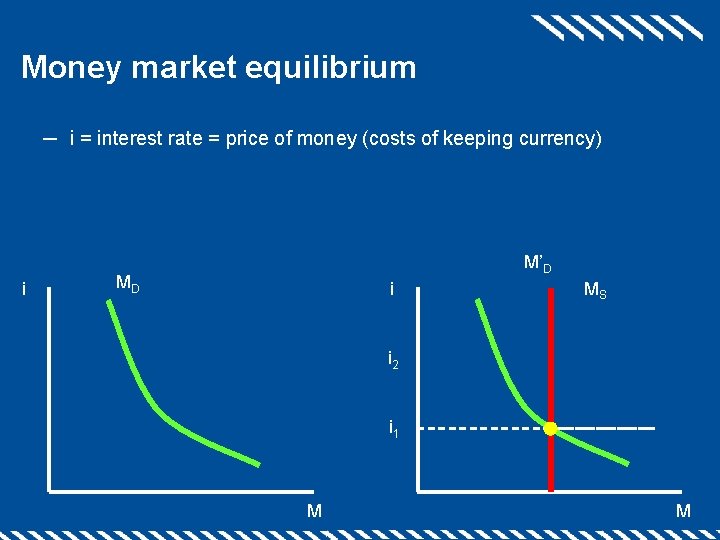

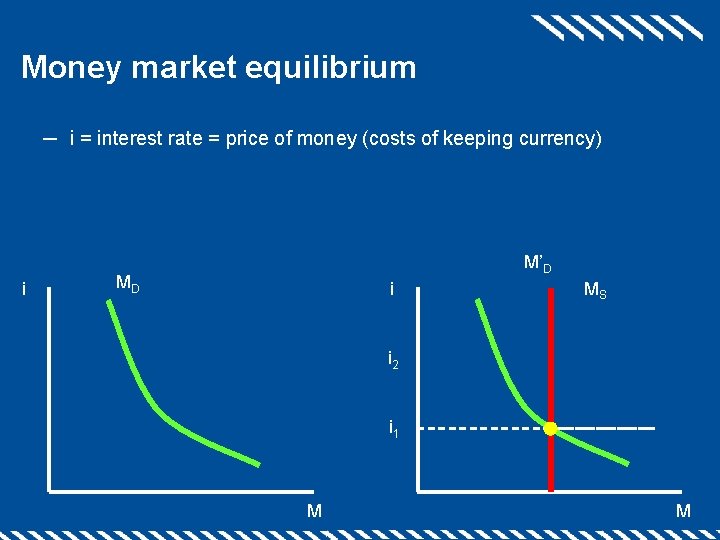

Money market equilibrium ─ i = interest rate = price of money (costs of keeping currency) i M’D MD i MS i 2 i 1 M M

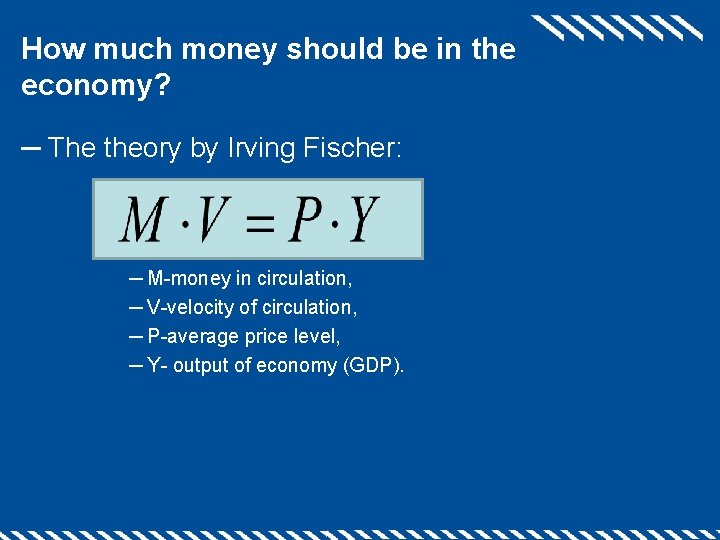

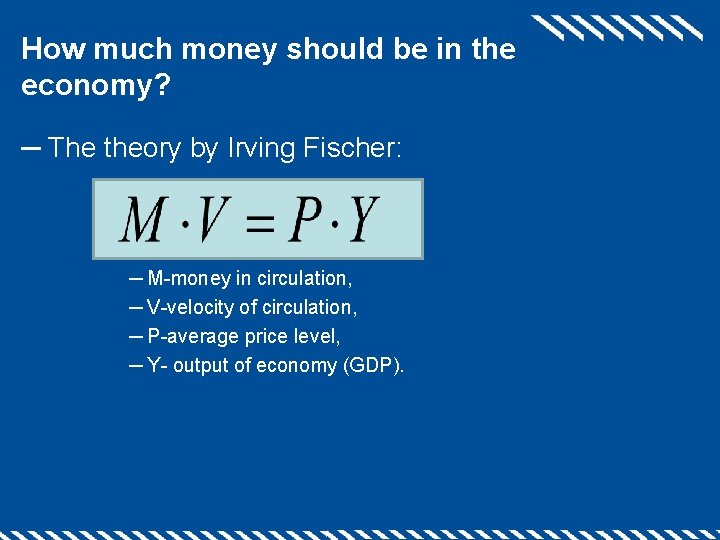

How much money should be in the economy? ─ The theory by Irving Fischer: ─ M-money in circulation, ─ V-velocity of circulation, ─ P-average price level, ─ Y- output of economy (GDP).

1. What is money? 2. Demand for money and money supply 3. Money market 4. Monetary policy and its goals 5. Tools of monetary policy 9/30/2020 17

Monetary Policy Monetary policy is the process of managing a nation's money supply to achieve specific goals. Main participant: Central Bank (Czech National Bank, Federal Reserve Bank, the Bank of Canada, State Bank of Namibia…. )

Monetary Policy Goals ─ ─ Steady economic growth: Goal of steady economic growth closely related to high employment goal, as firms will invest more when unemployment is low. Price stability: Price stability increasingly viewed as the most important goal of monetary policy. Inflation (increasing price level) creates uncertainty in an economy and leads to slowdowns in economic growth. Interest rate stability: Fluctuations in interest rates can create uncertainty in the economy, making it harder to plan for future (for households or firms). Stability of financial markets: financial crisis causes recessions. ─ Financial crises decreasing investment opportunities, therefore decreasing real GDP, ─ Stability of financial markets also support by interest rate stability… as interest rate uncertainty is a main concern for financial institutions. ─ Stability of foreign exchange: value of CZK (Euro, US dollar) affects competitiveness of Czech (European, US) goods and services in the international economy. ─ Value of the CZK relative to other currencies is also a major consideration for the Czech National Bank. ─ Rise in value of CZK makes Czech firms less competitive. ─ Decline in value of CZK stimulates inflation in the CR.

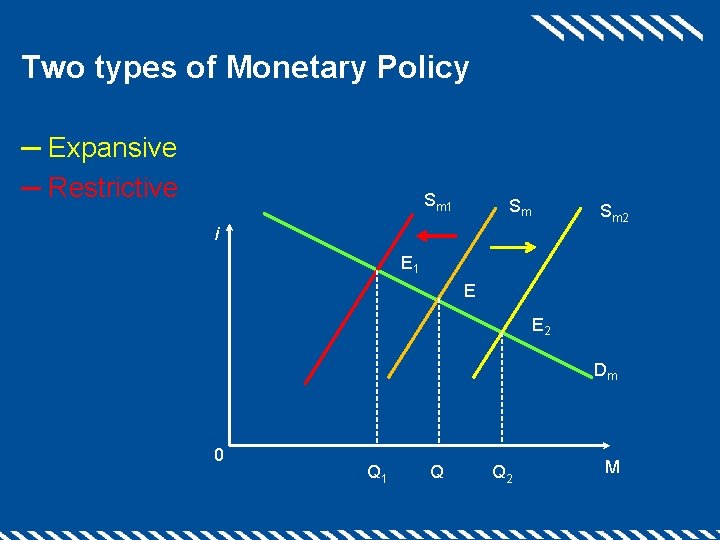

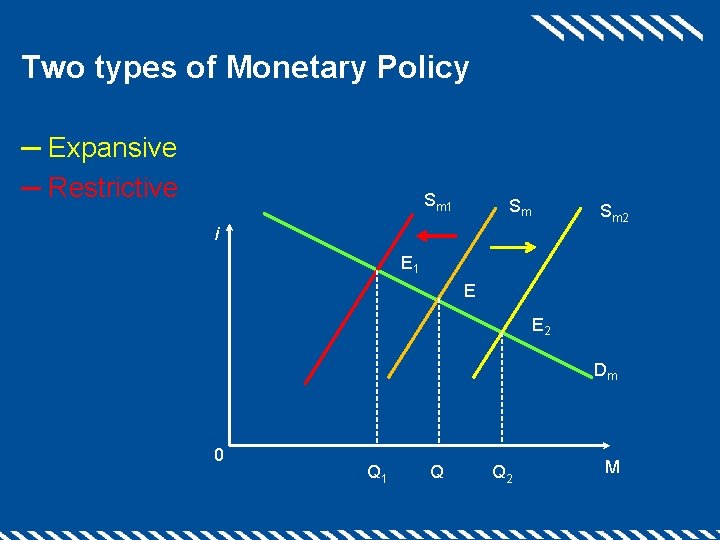

Two types of Monetary Policy ─ Expansive ─ Restrictive Sm 1 Sm Sm 2 i E 1 E E 2 Dm 0 Q 1 Q Q 2 M

Central Banks & Monetary Policy ─ Central bank: an institution that oversees the banking system and regulates the money supply ─ Monetary policy: the setting of the money supply by policymakers in the central bank CHAPTER 21 THE MONETARY SYSTEM

Central Bank – “Bank of banks” Functions: ─ Fights against inflation. ─ Promotes the efficiency of finance system. ─ Ensures financial system stability. Main Central Bank’s clients: ─ Commercial banks: ─ Transaction execution between banks. ─ Control of their assets and their performance. ─ The government: ─ Keeps it’s accounts. ─ Accumulates tax-income. ─ Other central banks.

1. What is money? 2. Demand for money and money supply 3. Money market 4. Monetary policy and its goals 5. Tools of monetary policy 9/30/2020 23

Tools of the monetary policy ─ Direct and Indirect tools ─ Long-term and Short-term tools ─ Current and Exceptional tools ─ etc.

A. Direct (administrative) tools = tools limiting and influencing market banking sector market. These tools are used as exceptional and short term: ─ Mandatory structure of assets and liability for commercial banks. ─ Credits, loans limits. One of the most tough direct tool. ─ Obligatory deposits – obligation for state institutions to have account at the central bank (for example revenues authorities, ministries, etc. ). ─ Gentleman's agreements between central bank commercial banks

B. Indirect tools of the Central Bank Tools are influencing all participants of financial market; they could be used without time limitation. Basic tools: ─ Setting the Discount Rate ─ Reserve Requirements ─ Open Market Operations ─ Foreign exchange market operations

Discount Rate ─ This is the interest rate the CB charges to banks that borrow funds from the CB (bank rate). Serves as a signal to the public about its intentions over monetary policy. ─ ↑ discount rate > raise price of money > commercial banks are lending lower amount of money > money are „suck out“ from economy > money circulation slow down – (antiinflation) restrictive monetary policy; ─ ↓ discount rate > reduce price of money > commercial banks are lending higher amount of money > money are „suck in“ economy > money circulation speed up – expansive monetary policy

Required Reserves (RR) ─ This is the ratio of reserves to deposits required by law. RR is very powerful and affects all banks equally (as small change results in a large change in money supply). So, cannot be used for fine tuning (small changes in MS – money supply). ─ ↑ RR > raise price of money > money are „suck out“ from economy > money circulation slow down – (anti-inflation) restrictive monetary policy; ─ ↓ RR > reduce price of money > money are „suck in“ economy > money circulation speed up – expansive monetary policy

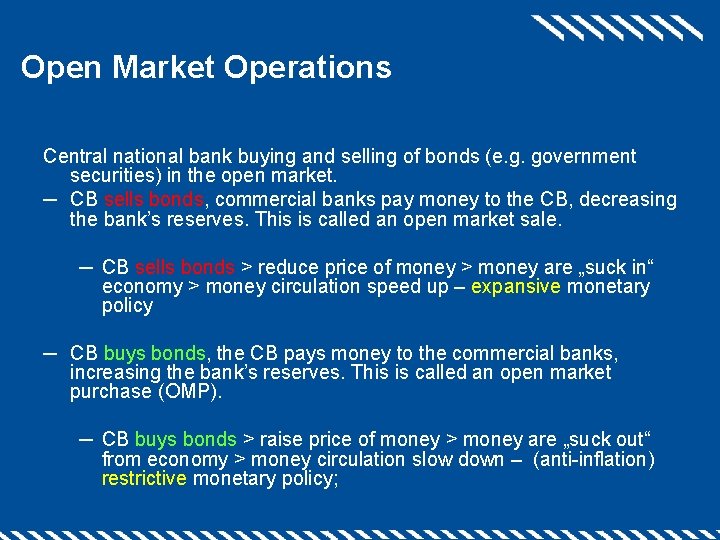

Open Market Operations Central national bank buying and selling of bonds (e. g. government securities) in the open market. ─ CB sells bonds, commercial banks pay money to the CB, decreasing the bank’s reserves. This is called an open market sale. ─ CB sells bonds > reduce price of money > money are „suck in“ economy > money circulation speed up – expansive monetary policy ─ CB buys bonds, the CB pays money to the commercial banks, increasing the bank’s reserves. This is called an open market purchase (OMP). ─ CB buys bonds > raise price of money > money are „suck out“ from economy > money circulation slow down – (anti-inflation) restrictive monetary policy;

Foreign exchange market operations ─ National Bank influences the national currency exchange rate by using the direct market interventions. ─ When the market experiences the lack of foreign currency > the exchange rate tend to rise > the national currency becomes cheaper > the CB enters the market and sells it’s foreign currency reserves therefore supporting the exchange rate. 1, 4 $ 1 € 0, 833 € 1 $ 1, 2 $ 1 € 0, 714 € 1 $

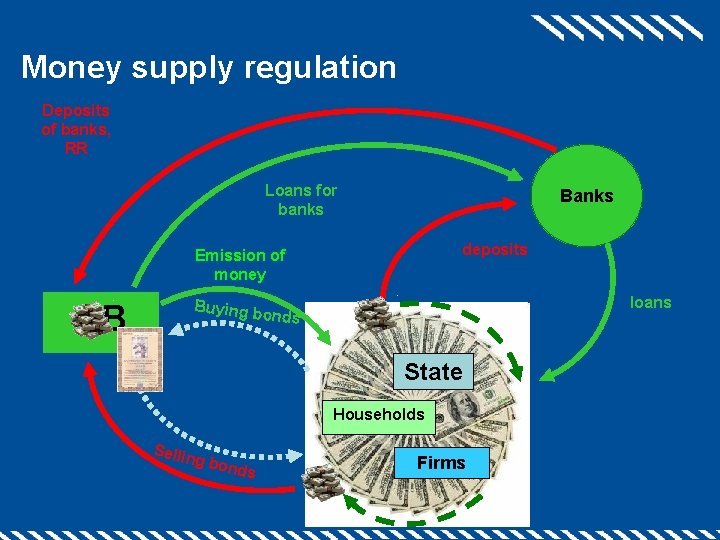

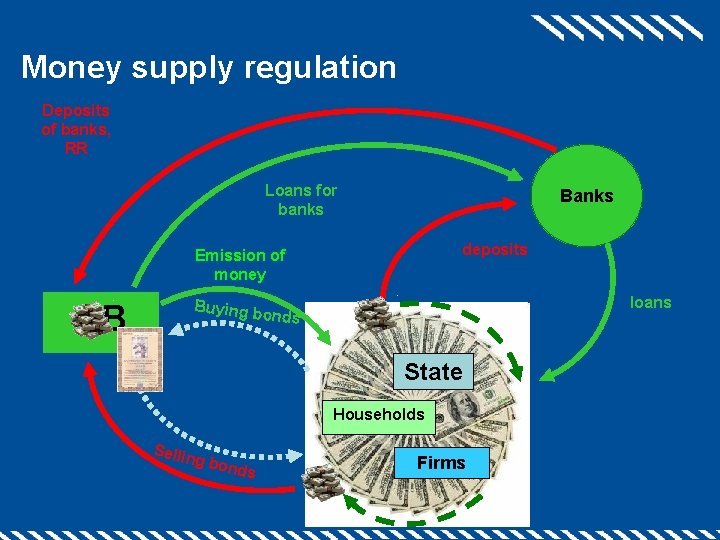

Money supply regulation Deposits of banks, RR Loans for banks Banks deposits Emission of money CB Buying b loans onds State Households Sellin g bond s Firms

Thank you for your attention 9/30/2020 32

Unit 4 money banking and monetary policy

Unit 4 money banking and monetary policy Unit 4 money banking and monetary policy

Unit 4 money banking and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Unit 4 money and monetary policy

Unit 4 money and monetary policy Expansionary monetary policy effects

Expansionary monetary policy effects Contractionary monetary policy graph

Contractionary monetary policy graph Transmission of monetary policy

Transmission of monetary policy Lesson quiz 16-1 monetary policy

Lesson quiz 16-1 monetary policy What are the objectives of monetary policy

What are the objectives of monetary policy Monetary policy meaning

Monetary policy meaning Types of monetary policy

Types of monetary policy What are the objectives of monetary policy

What are the objectives of monetary policy What are the objectives of monetary policy

What are the objectives of monetary policy Policy tools

Policy tools Monetary policy summary

Monetary policy summary Fiscal vs monetary policy

Fiscal vs monetary policy Monetary policy simulation game

Monetary policy simulation game Monetary policy types

Monetary policy types Instruments of monetary policy

Instruments of monetary policy Demand pull inflation

Demand pull inflation Moral suasion in monetary policy

Moral suasion in monetary policy Monetary policy

Monetary policy Tools of monetary policy ppt

Tools of monetary policy ppt Instruments of monetary policy

Instruments of monetary policy Expansionary monetary policy flow chart

Expansionary monetary policy flow chart Expansionary policy

Expansionary policy Monetary policy

Monetary policy Example of medium of exchange

Example of medium of exchange Conclusion of monetary policy

Conclusion of monetary policy Ecb unconventional monetary policy

Ecb unconventional monetary policy Monetary policy baseline

Monetary policy baseline Money money money team

Money money money team